The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China

Abstract

:1. Introduction

2. Literature Review and Theoretical Hypothesis

2.1. Literature Review

2.2. Theoretical Hypothess

2.2.1. Green Credit Policy and Green Innovation Level

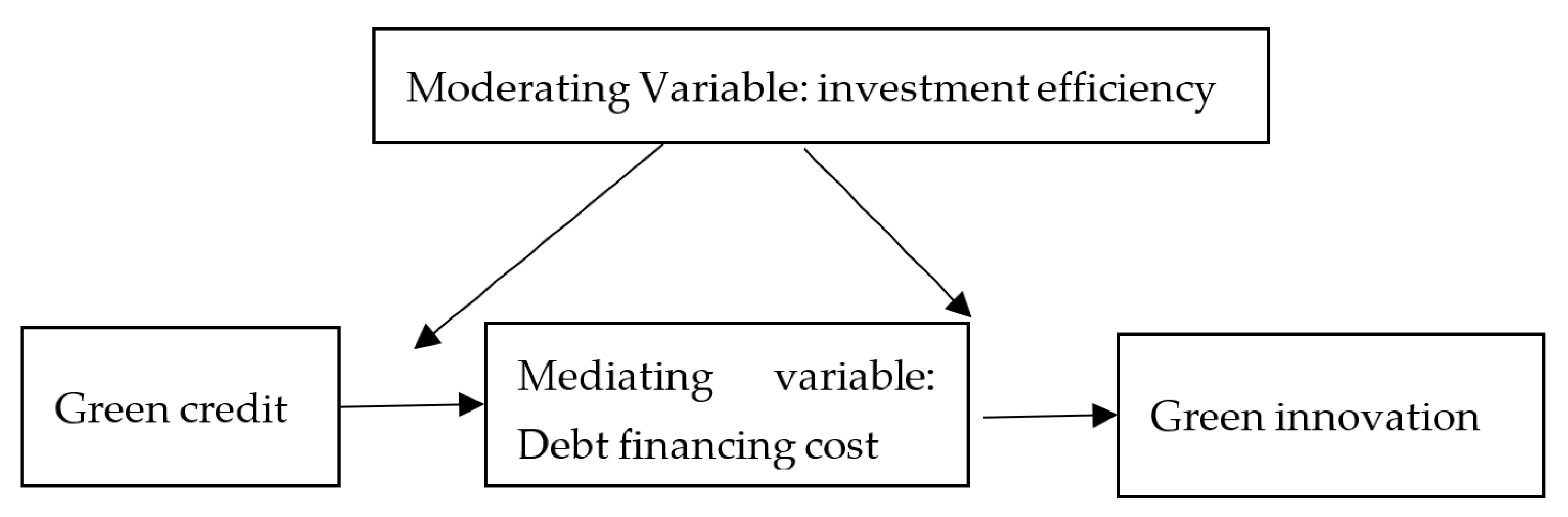

2.2.2. The Moderating Effect of Enterprise Investment Efficiency

2.2.3. Green Credit, Corporate Debt Financing Costs and Corporate Green Innovation Capabilities

3. Data and Methods

3.1. Data and Variables

3.2. Methods

4. Results

4.1. Basic Regression

4.2. Robustness Test

4.2.1. Parallel Trend Test

4.2.2. Placebo Test

4.3. Analysis of Heterogeneity

4.4. Mechanism Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Leichenko, R.; O’Brien, K. Environmental Change and Globalization: Double Exposures; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Schiederig, T.; Tietze, F.; Herstatt, C. Green innovation in technology and innovation management—An exploratory literature review. Rd Manag. 2012, 42, 180–192. [Google Scholar] [CrossRef]

- Azzone, G.; Bertelè, U.; Noci, G. At last we are creating environmental strategies which work. Long Range Plan. 1997, 30, 478–571. [Google Scholar] [CrossRef]

- Wu, H.G.; Wang, S.H. Do bond market participants pay attention to corporate environmental information?—Empirical evidence from China’s heavily polluting listed companies. Account. Res. 2016, 9, 68–74. [Google Scholar]

- Wang, K.; Zhang, X. The effect of media coverage on disciplining firms’ pollution behaviors: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 2021, 280, 123035. [Google Scholar] [CrossRef]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Andersen, D.C. Do credit constraints favor dirty production? Theory and plant-level evidence. J. Environ. Econ. Manag. 2017, 84, 189–208. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Liao, G.; Albitar, K. Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Bus. Strategy Environ. 2020, 29, 1045–1055. [Google Scholar] [CrossRef]

- Palmer, K.; Oates, W.E.; Portney, P.R. Tightening Environmental Standards: The Benefit-Cost or the No-Cost Paradigm? J. Econ. Perspect. 1995, 9, 119–132. [Google Scholar] [CrossRef]

- Caragnano, A.; Mariani, M.; Pizzutilo, F.; Zito, M. Is it worth reducing GHG emissions? Exploring the effect on the cost of debt financing. J. Environ. Manag. 2020, 270, 110860. [Google Scholar] [CrossRef]

- Ling, S.; Han, G.; An, D.; Hunter, W.C.; Li, H. The impact of green credit policy on corporate green innovation. Stud. Sci. Sci. 2021, 18, 1–23. [Google Scholar]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- He, D.; Zhang, X. Thoughts on several issues in the promotion of green credit by Chinese commercial banks. Shanghai Financ. 2007, 12, 4–9. [Google Scholar]

- Guo, P. Financial policy innovation for social change: A case study of China’s green credit policy. Int. Rev. Sociol. 2014, 24, 69–76. [Google Scholar] [CrossRef]

- Xu, L. On the evaluation of performance system incorporating “green credit” policies in China’s financial industry. J. Financ. Risk Manag. 2013, 2, 33–37. [Google Scholar] [CrossRef] [Green Version]

- Zhang, K.; Li, Y.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 113445. [Google Scholar] [CrossRef] [PubMed]

- Lei, X.; Wang, Y.; Zhao, D.; Chen, Q. The local-neighborhood effect of green credit on green economy: A spatial econometric investigation. Environ. Sci. Pollut. Res. 2021, 28, 65776–65790. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Wang, M.; Liao, G.; Li, Y. The relationship between environmental regulation, pollution and corporate environmental responsibility. Int. J. Environ. Res. Public Health 2021, 18, 8018. [Google Scholar] [CrossRef] [PubMed]

- Oosterhaven, J.; Broersma, L. Sector structure and cluster economies: A decomposition of regional labour productivity. Reg. Stud. 2007, 41, 639–659. [Google Scholar] [CrossRef]

- Xu, S.; Zhao, X.; Yao, S. Analysis of the effect of green credit on the upgrading of industrial structure. J. Shanghai Univ. Financ. Econ. 2018, 20, 59–72. [Google Scholar]

- Shao, C.; Wei, J.; Liu, C. Empirical analysis of the influence of green credit on the industrial structure: A case study of China. Sustainability 2021, 13, 5997. [Google Scholar] [CrossRef]

- He, L.; Wu, C.; Zhong, Z.; Zhu, J. Green credit, internal and external policies, and commercial bank competitiveness: Based on an empirical study of 9 listed commercial banks. Financ. Econ. Res. 2018, 33, 91–103. [Google Scholar]

- King, R.G.; Levine, R. Finance and growth: Schumpeter might be right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Luo, S.; Yu, S.; Zhou, G. Does green credit improve the core competence of commercial banks? Based on quasi-natural experiments in China. Energy Econ. 2021, 100, 105335. [Google Scholar] [CrossRef]

- Yin, X. Research on the impact of green credit on the financial performance of commercial banks. Financ. Mark. 2021, 6, 71. [Google Scholar] [CrossRef]

- Liu, J.-Y.; Xia, Y.; Fan, Y.; Lin, S.-M.; Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 2017, 163, 293–302. [Google Scholar] [CrossRef]

- Lemmon, M.; Roberts, M.R. The response of corporate financing and investment to changes in the supply of credit. J. Financ. Quant. Anal. 2010, 45, 555–587. [Google Scholar] [CrossRef]

- Li, W.; Cui, G.; Zheng, M. Does green credit policy affect corporate debt financing? Evidence from China. Environ. Sci. Pollut. Res. 2021, 1–10. [Google Scholar] [CrossRef] [PubMed]

- Peng, B.; Yan, W.; Elahi, E.; Wan, A. Does the green credit policy affect the scale of corporate debt financing? Evidence from listed companies in heavy pollution industries in China. Environ. Sci. Pollut. Res. 2021, 29, 755–767. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Y.; Huang, Z. Do the green credit guidelines affect renewable energy investment? Empirical research from China. Sustainability 2021, 13, 9331. [Google Scholar] [CrossRef]

- Yang, Z.; Fang, H. Research on green productivity of chinese real estate companies—Based on SBM-DEA and TOBIT models. Sustainability 2020, 12, 3122. [Google Scholar] [CrossRef] [Green Version]

- Zhang, M.; Xu, H.; Feng, T. Business environment, relational lending and technological innovation of small and medium-sized enterprises. J. Shanxi Univ. Financ. Econ. 2019, 41, 35–49. [Google Scholar]

- Lai, X.; Yue, S.; Chen, H. Can green credit increase firm value? Evidence from Chinese listed new energy companies. Environ. Sci. Pollut. Res. 2021, 1–19. [Google Scholar] [CrossRef]

- Yao, S.; Pan, Y.; Sensoy, A.; Uddin, G.S.; Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Ling, S.; Han, G.; An, D.; Hunter, W.C.; Li, H. The impact of green credit policy on technological innovation of firms in pollution-intensive industries: Evidence from China. Sustainability 2020, 12, 4493. [Google Scholar] [CrossRef]

- Hao, F.; Xie, Y.; Liu, X. The impact of green credit guidelines on the technological innovation of heavily polluting enterprises: A quasi-natural experiment from China. Math. Probl. Eng. 2020, 2020, 8670368. [Google Scholar] [CrossRef]

- Hong, M.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar]

- Liu, S.; Xu, R.; Chen, X. Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ. Sci. Pollut. Res. 2021, 28, 65265–65277. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Guo, Q.; Zhou, M.; Liu, N.; Wang, Y. Spatial effects of environmental regulation and green credits on green technology innovation under low-carbon economy background conditions. Int. J. Environ. Res. Public Health 2019, 16, 3027. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef] [Green Version]

- Whaller, N.; Whitehead, B. It’s not easy being green. Harv. Bus. Rev. 1994, 72, 46–52. [Google Scholar]

- Leonard, H.J. Pollution and the Struggle for the World Product: Multinational Corporations, Environment, and International Comparative Advantage; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Yuan, B.; Xiang, Q. Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean Prod. 2018, 176, 895–908. [Google Scholar] [CrossRef]

- Kneller, R.; Manderson, E. Environmental regulations and innovation activity in UK manufacturing industries. Resour. Energy Econ. 2012, 34, 211–235. [Google Scholar] [CrossRef]

- Shi, B.; Feng, C.; Qiu, M.; Ekeland, A. Innovation suppression and migration effect: The unintentional consequences of environmental regulation. China Econ. Rev. 2018, 49, 1–23. [Google Scholar] [CrossRef]

- Feng, T.; Zhang, M. Business environment, financial development and enterprise technological innovation. Technol. Prog. Countermeas. 2020, 37, 147–153. [Google Scholar]

- Zadeh, M.H.; Magnan, M.; Cormier, D.; Hammami, A. Environmental and social transparency and investment efficiency: The mediating effect of analysts’ monitoring. J. Clean. Prod. 2021, 322, 128991. [Google Scholar] [CrossRef]

- Chava, S.; Oettl, A.; Subramanian, A.; Subramanian, K.V. Banking deregulation and innovation. J. Financ. Econ. 2013, 109, 759–774. [Google Scholar] [CrossRef]

- Arrow, K.J.; Hurwicz, L. Competitive stability under weak gross substitutability: Nonlinear price adjustment and adaptive expectations. Int. Econ. Rev. 1962, 3, 233–255. [Google Scholar] [CrossRef]

- Faulkender, M.; Petersen, M.A. Does the source of capital affect capital structure? Rev. Financ. Stud. 2006, 19, 45–79. [Google Scholar] [CrossRef] [Green Version]

- Randall, A. Market solutions to externality problems: Theory and practice. Am. J. Agric. Econ. 1972, 54, 175–183. [Google Scholar] [CrossRef]

- Meade, J.E. The Theory of Economic Externalities: The Control of Environmental Pollution and Similar Social Costs; Brill Book Archive: Leiden, The Netherlands, 1973; Volume 2. [Google Scholar]

- Dong, Q. The impact of technological finance on the total factor productivity of city commercial banks—Based on the perspective of moderating effect and mediating effect. Financ. Theory Pract. 2018, 9, 38–44. [Google Scholar]

- Qi, S.; Lin, S.; Cui, J. Can the environmental rights trading market induce green innovation?—Evidence based on green patent data of Chinese listed companies. Econ. Res. 2018, 53, 129–143. [Google Scholar]

- Shen, H.; Ma, Z. Regional economic development pressure, corporate environmental performance and debt financing. Financ. Res. 2014, 2, 153–166. [Google Scholar]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Yang, X.; Yao, Y. Environmental compliance and firm performance: Evidence from China. Oxf. Bull. Econ. Stat. 2012, 74, 397–424. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Antonakis, J.; Bendahan, S.; Jacquart, P.; Lalive, R. On making causal claims: A review and recommendations. Leadersh. Q. 2010, 21, 1086–1120. [Google Scholar] [CrossRef] [Green Version]

- Baron, R.M.; Kemmy, D.A. The moderator mediator variable distinction in social psychological research. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Li, C.; Lu, N.; Li, D.; Wang, X. Corporate green innovation: Government regulation, information disclosure and investment strategy evolution. Stud. Sci. Sci. 2021, 39, 180–192. [Google Scholar]

- Wang, Y.L.; Lei, X.D.; Long, R.Y. Can green credit policy promote the corporate investment efficiency? China Popul. Resour. Environ. 2021, 31, 123–133. [Google Scholar]

- Singh, S.K.; Del Giudice, M.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Yu, B. How Green Credit Policy Affects Technological Innovation of Heavy-polluting Enterprises? Econ. Manag. 2021, 11, 35–51. [Google Scholar]

- Chen, X.; Shi, Y.; Song, X. Green credit constraints, commercial credit and corporate environmental governance. Int. Financ. Stud. 2019, 12, 13–22. [Google Scholar]

- Li, R.; Liu, L. Green finance and green innovation of enterprises. J. Wuhan Univ. Philos. Soc. Sci. 2021, 74, 126–140. [Google Scholar]

| Variable | Statistic | Description |

|---|---|---|

| Green innovation level | lngp | Ln (1 + Number of green patent applications) |

| Group dummy variable | treated | Heavy polluting enterprise = 1; Non-heavy polluting enterprises = 0 |

| Event dummy variable | post | The value for 2012 and later is 1. Otherwise, the value is 0 |

| Investment efficiency | inveffi | Measured by Richardson’s (2006) model |

| Debt financing cost | debt | Total financial expenses/liabilities |

| Company size | size | The natural log of total assets at year end |

| Leverage | lev | Asset-liability ratio |

| Company age | age | The number of years the company has been listed |

| Return on assets | roa | Net profit/Total average assets |

| Proportion of tangible assets | tar | (Owners’ equity − Intangible Assets − Deferred Assets)/Total assets amount |

| Cash holding ratio | cash | Cash and cash equivalents ending balance/current liabilities |

| Ownership concentration | equity | Shareholding ratio of the company’s largest shareholder |

| Social responsibility | public | Public social responsibility report = 1; Non-disclosure of social responsibility report = 0 |

| Earning volatility | std | Standard deviation of return on assets in years t−3 to T |

| Tobin’s Q | tq | (Market value of tradable shares + par value of non-tradable shares)/(Total Assets − net intangible assets − net goodwill) |

| Return on stock | ret | Annual return on individual shares |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| lngp | 12,378 | 0.2871725 | 0.7132743 | 0 | 6.590301 |

| po | 12,420 | 0.5273752 | 0.4992701 | 0 | 1 |

| after | 12,420 | 0.8 | 0.4000161 | 0 | 1 |

| size | 12,419 | 22.24249 | 1.331667 | 14.75859 | 28.63649 |

| lev | 12,419 | 0.4632725 | 0.6146905 | 0.0070799 | 29.69759 |

| age | 12,420 | 2.793565 | 0.397153 | 0.6931472 | 3.688879 |

| roa | 12,419 | 0.0506745 | 0.3824283 | −28.94023 | 22.00289 |

| tar | 12,419 | 0.9304783 | 0.079834 | 0.317304 | 1 |

| cash | 12,419 | 0.1745579 | 0.1345231 | 0.0001508 | 0.9147874 |

| equity | 12,420 | 34.32527 | 15.02518 | 0.2863 | 89.9858 |

| public | 12,368 | 0.3036061 | 0.4598331 | 0 | 1 |

| std | 12,420 | 0.0949768 | 4.084318 | 0.0006314 | 453.1186 |

| tq | 12,048 | 2.164018 | 2.746482 | 0.683714 | 122.1895 |

| ret | 12,410 | 435.1414 | 39555.46 | −353.706 | 4324004 |

| inveffi | 11,014 | 0.0412461 | 0.0512885 | 4.69 × 10−6 | 0.4645226 |

| debt | 12,420 | 0.0111637 | 0.1502056 | −2.454517 | 14.79254 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| did | −0.188 *** | −0.028 | −0.002 | −0.070 *** |

| [0.013] | [0.017] | [0.017] | [0.027] | |

| size | 0.203 *** | 0.128 *** | 0.079 *** | 0.062 *** |

| [0.010] | [0.016] | [0.017] | [0.017] | |

| lev | −0.01 | 0.007 | 0.006 | 0.017 |

| [0.014] | [0.010] | [0.010] | [0.011] | |

| age | −0.076 *** | 0.068 ** | 0.173 *** | −0.113 |

| [0.016] | [0.032] | [0.044] | [0.082] | |

| roa | −0.011 | 0.009 | 0.008 | 0.016 |

| [0.015] | [0.007] | [0.007] | [0.010] | |

| tar | 0.229 *** | 0.213 ** | 0.155 | 0.147 |

| [0.069] | [0.099] | [0.100] | [0.100] | |

| cash | 0.325 *** | 0.041 | 0.034 | 0.026 |

| [0.052] | [0.056] | [0.057] | [0.058] | |

| equity | −0.004 *** | −0.001 | 0 | 0 |

| [0.001] | [0.001] | [0.001] | [0.001] | |

| public | 0.093 *** | 0.047 ** | 0.022 | 0.015 |

| [0.015] | [0.023] | [0.026] | [0.026] | |

| std | −0.008 | 0.008 | 0.008 | 0.007 |

| [0.010] | [0.015] | [0.014] | [0.013] | |

| tq | 0.015 *** | 0.007 *** | 0.004 ** | 0.003 |

| [0.003] | [0.003] | [0.002] | [0.002] | |

| ret | 0 | 0 | 0 | 0 |

| [0.000] | [0.000] | [0.000] | [0.000] | |

| _cons | −4.149 *** | −2.936 *** | −2.102 *** | −0.888 ** |

| [0.233] | [0.375] | [0.385] | [0.441] | |

| Year-fixed effect | Control | Control | Control | Control |

| Firm-fixed effect | Control | Control | Control | Control |

| N | 12048 | 12048 | 12048 | 12048 |

| R-squared | 0.136 | 0.107 | 0.703 | 0.705 |

| (5) | (6) | (7) | (8) | |

|---|---|---|---|---|

| State-Owned | Non-State-Owned | Large Firms | Small Firms | |

| did | −0.0599 | −0.0867 ** | −0.167 | −0.0384 |

| (−1.32) | (−2.67) | (−1.94) | (−1.72) | |

| size | 0.0388 | 0.0842 *** | 0.206 ** | 0.0580 *** |

| −1.44 | −3.62 | −3.21 | −3.47 | |

| lev | 0.0763 | 0.0204 | −0.0623 | 0.0104 |

| −1.1 | −1.9 | (−0.50) | −1 | |

| age | −0.237 | −0.0262 | −0.38 | 0.007 |

| (−0.78) | (−0.34) | (−1.25) | −0.11 | |

| roa | 0.0628 | 0.0183 | 0.285 | −0.0048 |

| −1.44 | −1.45 | −1.47 | (−0.59) | |

| tar | −0.0126 | 0.166 | −0.133 | 0.0231 |

| (−0.05) | −1.42 | (−0.38) | −0.28 | |

| cash | −0.14 | 0.0276 | −0.0376 | 0.0418 |

| (−1.20) | −0.44 | (−0.20) | −0.77 | |

| equity | −0.00117 | −0.00098 | −0.00066 | −9.2 × 10−5 |

| (−0.72) | (−0.86) | (−0.35) | (−0.10) | |

| public | 0.00318 | 0.0128 | −0.0509 | 0.0445 |

| −0.09 | −0.36 | (−1.30) | −1.52 | |

| std | 0.0384 | −0.0003 | 0.0361 | −0.03 |

| −1.63 | (−0.07) | −1.61 | (−1.84) | |

| tq | −0.00073 | 0.00538 * | 0.0372 | 0.00196 |

| (−0.17) | −2.03 | −1.59 | −1.28 | |

| ret | −7.35× 10−8 *** | 0.000000591 *** | 0.000139 | −3.62 × 10−8 |

| (−11.23) | −22.11 | −0.91 | (−1.21) | |

| _cons | 0.218 | −1.663 ** | −3.052 | −1.120 ** |

| −0.18 | (−3.12) | (−1.77) | (−2.60) | |

| Year-fixed effect | Control | Control | Control | Control |

| Firm-fixed effect | Control | Control | Control | Control |

| N | 5483 | 6153 | 5094 | 6861 |

| R-squared | 0.1405 | 0.1356 | 0.1963 | 0.1357 |

| (9) | (10) | (11) | (12) | |

|---|---|---|---|---|

| Regulating Effect | Mediating Effect | |||

| did | −0.206 *** | −0.188 *** | 0.00237 * | −0.188 *** |

| (−13.58) | (−14.71) | (−2.26) | (−14.69) | |

| did_inveffi | 0.321 | |||

| −1.83 | ||||

| debt | −0.144 ** | |||

| (−3.49) | ||||

| size | 0.224 *** | 0.203 *** | 0.00125 | 0.204 *** |

| −18.79 | −20.42 | −1.89 | −20.44 | |

| lev | −0.115 ** | −0.01 | 0.0244 *** | −0.00651 |

| (−2.72) | (−0.69) | −3.33 | (−0.46) | |

| age | −0.114 *** | −0.0757 *** | 0.00196 | −0.0754 *** |

| (−6.02) | (−4.77) | −1.19 | (−4.75) | |

| roa | −0.436 *** | −0.0109 | 0.00913 | −0.00963 |

| (−5.62) | (−0.75) | −1.09 | (−0.68) | |

| tar | 0.320 *** | 0.229 *** | 0.00712 | 0.230 *** |

| −4.2 | −3.33 | −1.16 | −3.34 | |

| cash | 0.452 *** | 0.325 *** | −0.176 *** | 0.300 *** |

| −6.14 | −6.23 | (−14.87) | −5.43 | |

| equity | −0.00347 *** | −0.00359 *** | −0.0000696 * | −0.00360 *** |

| (−6.30) | (−7.07) | (−2.22) | (−7.09) | |

| public | 0.0844 *** | 0.0929 *** | −0.00258 * | 0.0925 *** |

| −5.31 | −6.12 | (−2.20) | −6.09 | |

| std | −0.337 *** | −0.00774 | −0.00256 | −0.00811 |

| (−4.88) | (−0.76) | (−0.67) | (−0.81) | |

| tq | 0.0257 *** | 0.0154 *** | −0.000323 | 0.0154 *** |

| −7.11 | −5.19 | (−1.14) | −5.2 | |

| ret | 1.62 × 10−8 | 8.47 × 10−9 | 1.36 × 10−9 | 8.67 × 10−9 |

| −0.89 | −0.39 | −1.23 | −0.4 | |

| _cons | −4.543 *** | −4.149 *** | −0.00839 | −4.151 *** |

| (−16.61) | (−17.82) | (−0.48) | (−17.83) | |

| Year-fixed effect | Control | Control | Control | Control |

| Firm-fixed effect | Control | Control | Control | Control |

| N | 10770 | 12048 | 12048 | 12048 |

| R-squared | 0.1405 | 0.1356 | 0.1963 | 0.1357 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. https://doi.org/10.3390/ijerph19020650

Zhang Z, Duan H, Shan S, Liu Q, Geng W. The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China. International Journal of Environmental Research and Public Health. 2022; 19(2):650. https://doi.org/10.3390/ijerph19020650

Chicago/Turabian StyleZhang, Zhifeng, Hongyan Duan, Shuangshuang Shan, Qingzhi Liu, and Wenhui Geng. 2022. "The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China" International Journal of Environmental Research and Public Health 19, no. 2: 650. https://doi.org/10.3390/ijerph19020650

APA StyleZhang, Z., Duan, H., Shan, S., Liu, Q., & Geng, W. (2022). The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China. International Journal of Environmental Research and Public Health, 19(2), 650. https://doi.org/10.3390/ijerph19020650