Fear of Missing Out: Constrained Trial of Blockchain in Supply Chain

Abstract

1. Introduction

2. Blockchain and Its Envisioned Use in Supply Chain and Logistics

2.1. How Blockchain Works

2.2. Blockchain in Supply Chain and Logistics

3. Use Cases around Supply Chain

3.1. Case 1: Certificate Dissemination for Verified Producers

- (1)

- Authenticity: A certificate for a given entity can only be issued and revoked by the certifier.

- (2)

- Revocability: Buyers cannot be convinced by a certificate after it is revoked.

- (3)

- Transparency: Buyers and sellers can find out when a certificate is issued or revoked.

- (4)

- Non-repudiation: The certifier cannot deny issuing or revoking a given certificate.

3.1.1. A Blockchain-Based Solution

3.1.2. Alternative Solutions

3.1.3. Analysis

3.2. Case 2: Damage Attribution of Conditioned Goods

3.2.1. A Blockchain-Based Solution

3.2.2. Alternative Solutions

3.2.3. Analysis

3.3. Case 3: Electronic Bill of Ladings

3.3.1. Blockchain-Based Solution

3.3.2. Alternative Solutions

3.3.3. Analysis

4. Evaluation

4.1. Company and Interviewee Background

4.2. Position on Digitalization and Blockchain

4.3. Challenges and Opportunities of Using Blockchain for Supply Chain Logistics

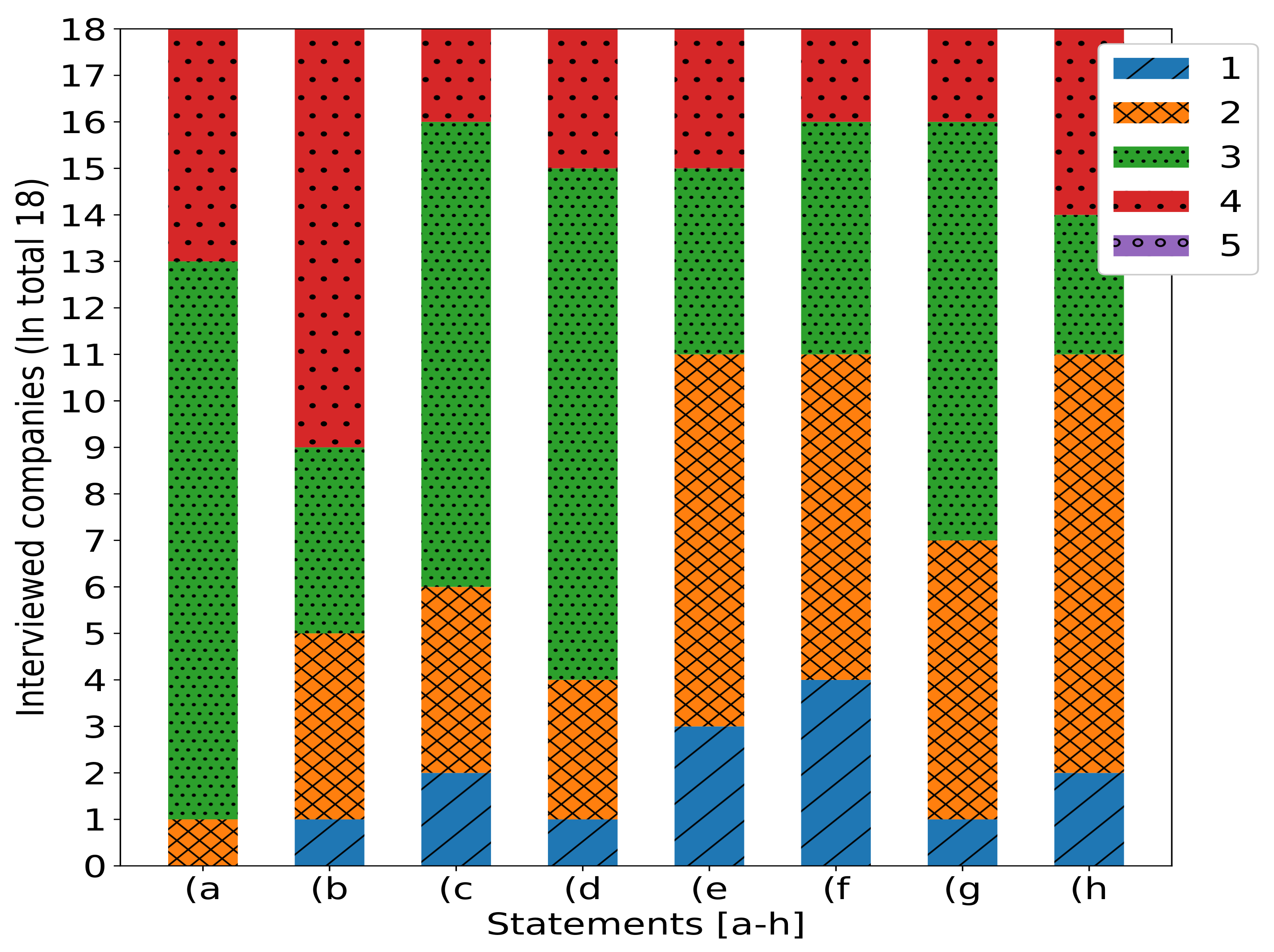

- (a)

- New revenue sources from blockchain and/or digital asset solutions will be seen in our sector.

- (b)

- If my company does not implement blockchain technologies, we will miss the potential for a competitive advantage.

- (c)

- Blockchain and/or digital assets solutions or strategies are being discussed by our business partners, suppliers, customers, and/or competitors.

- (d)

- There exists a compelling business for utilizing blockchain technology and/or digital assets in my organization.

- (e)

- Blockchain technology is broadly scalable and has achieved mainstream adoption.

- (f)

- Our executive team believes blockchain and/or digital assets are overhyped.

- (g)

- Blockchain solutions are being discussed or developed by suppliers, customers, and/or competitors to address problems in the value chain.

- (h)

- The industry will be disrupted by blockchain technology.

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire

| ID | Question |

|---|---|

| Q1 | What is the name of the company for which you work? |

| Q2 | Where is your company located? |

| Q3 | Would you like the answers to this form to remain anonymous? |

| Q4 | What is your age group? (21–30; 31–40; 41–50; 51–60) |

| Q5 | In which of the following industries does the organization you work for primarily operate? (Construction; Nautical; Food; Transport/Logistics; Agriculture; Manufacturing; Defence; Pharmaceutical; Software development) |

| Q6 | Which of the following best describes your current job role/title? (Founder-R&D; Supply Chain mgr.; Business Analyst; Project mgr.; Vacation Job; Operations mgr.; Director of Operations; Financial mgr.; CFO; General mgr.; Supply Planner; Demand Planning mgr.; Logistics Analyst; Transportation Planner; Sourcing Specialist) |

| Q7 | What is the amount of workers in the company you work for? |

| Q8 | Which of the following roles in the supply chain best describes the organization for which you work? (Producer/Manufacturer/Processor; Technology provider; Inspection; Farmer/raw material extractor; Transporter/3PL(Third-Party Logistics)/LSP(Logistic Service Providers); Fund manager & Structurer; Military; Retailer) |

| Q9 | Which one of the following best describes your organization’s technology stage? (Data sharing (Sharing data with customer and/or supplier via various connector tools); Digital basic (Internal digital strategy & process improvement); Disruptions (Using digitization to transform and disrupt markets and to create a new one)) |

| Q10 | How would you rate your company on the ability to use data and analytics to improve or transform the business? (1: Not at all, 10: Data analytics expert, 0: No idea) |

| Q11 | In your current role, what do you use data for? |

| Q12 | Which of the following best describes the interactions you have with data in your work? (Editor (change data in the system, interacts with it); Viewer/User (visualise and use system data); Admin (in charge of the system and its good functioning)) |

| Q13 | Which of the following technologies is the organization for which you work currently using? (multiple-choice) (Clouds systems (Online storage); ERP,WMS,TMS,EDI *; API **; Connected sensors & IoT (Devices to measure and collect data); AI (Artificial intelligence); Blockchain) |

| Q14 | How do you process data for analysis? |

| Q15 | Who do you share your information about the supply chain process with? (multiple-choice) (Customers; Other parties of the supply chain; Only limited business partners; Co-workers-sales/marketing/finance; Mostly internal; Sales) |

| Q16 | How do you share information among your partners? |

| Q17 | How do you store the data? |

| Q18 | What is the importance of data that is stored? (1: Nothing will happen if the data leak happens, 10: Data leak causes high damage to the company (Financial and Reputational), 0: No Idea) |

| Q19 | Are you using a common database (have access to the same database) with other parties of your supply chain? |

| Q20 | Which of the following parties in the supply chain receives information from your databases on a regular basis (at least once a month)? (multiple-choice) (Manufacturers; Raw Material Suppliers; Distributors; Wholesalers; End User; Registrars; Transporters; Not applicable; Certifiers; Retailers; None) |

| ID | Question |

|---|---|

| Q21 | Which of the following parties in the supply chain sends you information that will impact your database? (multiple-choice) (Standards Organizations; Retailers; Commercial; Manufacturers; Distributors; Wholesalers; Raw Material Suppliers; End User; Registrars; None; Not applicable; Certifiers) |

| Q22 | How many data-related mistakes were made at your company in the last 12 months? |

| Q23 | How costly were those data-related mistakes (in % of your yearly turnover)? |

| Q24 | How do you ensure the execution of an agreement that you made with other parties in the supply chain? |

| Q25 | What is your level of expertise regarding blockchain? (0: Not at all, 10: Expert) |

| Q26 | Have you ever developed a project around blockchain before? |

| Q27 | Which of the following did you already know about blockchain can provide your business? (multiple-choice) (Transparency for product or service flow; Traceable data; Connecting all parties of the supply chain within the same network; Single source of truth; Secure business agreement via Smart contracts; Security; Payments; Immutable data; Decentralized verification; Shared or equal data ownership; Inbuilt resilience and fault tolerance) |

| Q28 | Which of the following disadvantages of blockchaindid you already know? (multiple-choice) (Transparency ruins business cases; Slower through consensus methods; Requires a trust problem (Trust exists; blockchain becomes inefficient); Not one size fits all (No generalization, specific solutions for each case); Distributed solution; Need active participation; Energy consumption; Centralized approach (Distributed network updated by centralized tools); Lack of understanding and implementation; Requires a cost-carrying party; Sunk Cost fallacy; Finite (Limitation on flexibility and errors)) |

| Q29 | What do you think is the biggest opportunity for using blockchain in your company? (multiple-choice) (Transparency for product or service flow; Security; Connecting all parties of supply chain within the same network; Secure business agreement via Smart contracts; Payments; Single source of truth; Immutable data; Traceable data; Decentralized verification) |

| Q30 | What are your organization’s barriers, if any, to greater investment in blockchain technology? (multiple-choice) (Implementation/replacement of other systems; Ambiguous return on investment; Low priority for current business; Regulatory issues; Insufficient in-house knowledge or expertise; Concerns over sensitivity of competitive information; Broad adoption; The technology is new and controversial) |

| Q31 | Which of the following best describes how your organization currently views the relevance of blockchain to your organization? (Important; Relevant; Unsure; No idea) |

| Q32 | Is your organization investing in exploring blockchain-based applications to support current or new business models now or in the future? (Yes, now; Yes in the future <2 years; Yes in the future <5–10 years; No idea; No, not in the future) |

| Q33 | Which blockchain model are you focusing your activities on? (Permissioned (with your supply chain partners); Private blockchain (internal to the company); Public blockchain (global, open networks); No idea; None are in sight; No interest in blockchain) |

| Q34 | Which of the following blockchain use cases is your company working on? (multiple-choice) (Secure information transfer; Digital currency; Asset management and monitoring; Digital identification; Regulation observance; Traceability of financial flow; Digitization of data or document; Credentials and licensing; Track and trace of the product supply chain; Contracts management; None yet; No interest in blockchain; Regulation observance) |

| Q35 | Where is your company in its blockchain journey? (Action (pilot under development or live already); Interest (exploring potential); Desire (preparing development); Awareness; Not sure; Not interested/compatible) |

| Q36 | How does your organization’s current adoption of blockchain compare to that of your direct competitors? (Leading; On par; Not interested/compatible) |

| Q37 | What % of your yearly turnover is made available for tech investment? (<5%; 5–10%; 10–25%; 25–50%; >50%; Unknown) |

| Q38 | What % of your yearly turnover is made available for blockchain investment? |

| Q39 | What is your company’s current position on creating or being a participant of a blockchain consortium with other companies? (Already participated in one; Considering joining one; Unsure; No interest in participating) |

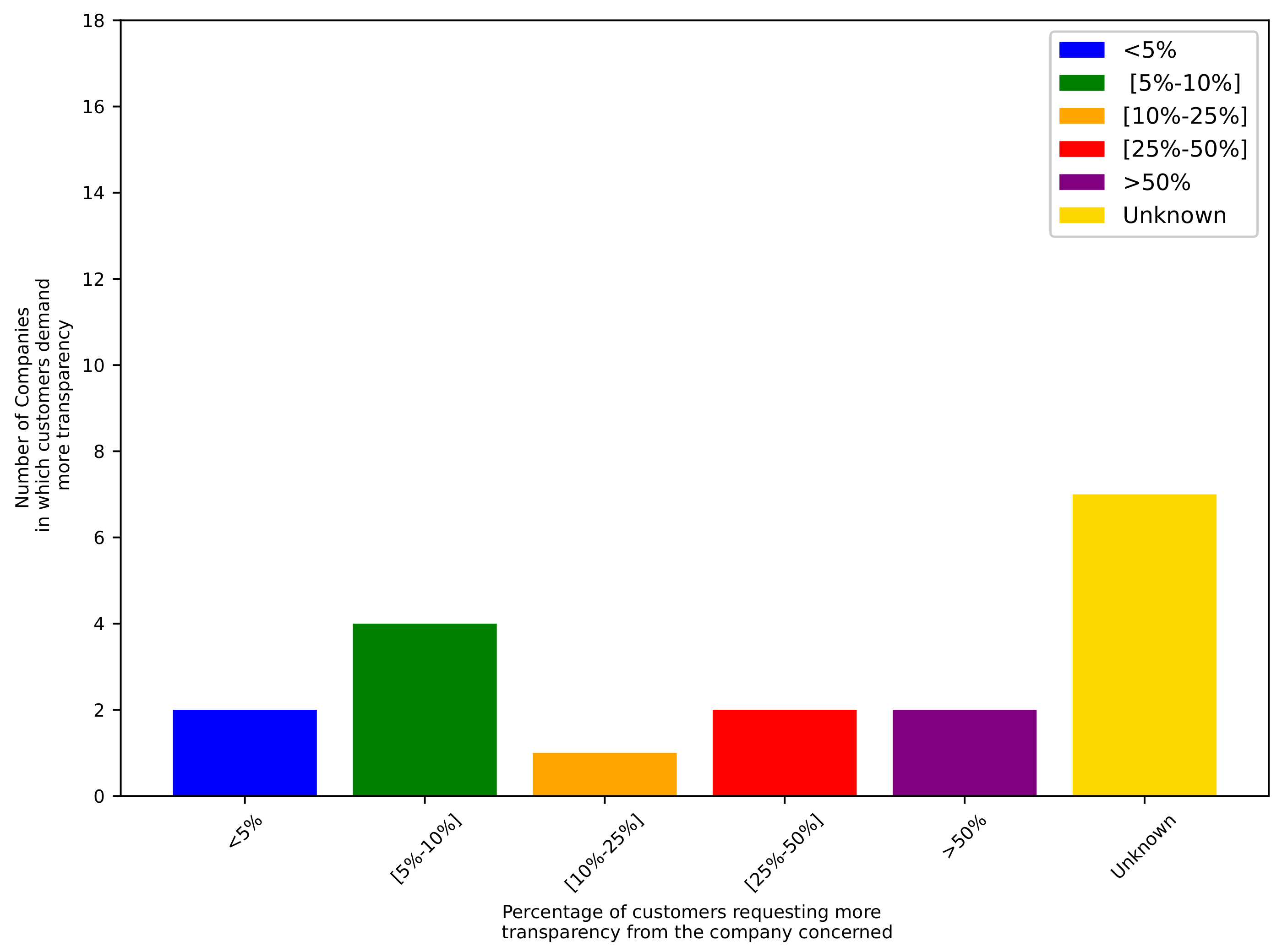

| Q40 | What is the scale of customers or parties that demand more transparency in your supply chain? (More than 50%; Between 25% and 50%; Between 10% and 25%; Between 5% and 10%; Less than 5%; No idea) |

| Q41 | What is your opinion about the security level of blockchain-based systems compared to the current system? (Blockchain-based more secure; Don’t know; Blockchain-based less secure) |

| Q42 | Do you have any last comments? |

| ID | What is Your Level of Agreement or Disagreement with Each of the Following Statements? (0–10) |

|---|---|

| Q43 | New revenue sources from blockchain and/or digital asset solutions will be seen in our sector |

| Q44 | If my company does not implement blockchain technologies, we will miss a potential for a competitive advantage |

| Q45 | Blockchain and/or digital assets solutions or strategies are being discussed by our business partners, suppliers, customers, and/or competitors |

| Q46 | There exists a compelling business for utilizing blockchain technology and/or digital assets in my organization |

| Q47 | Blockchain technology is broadly scalable and has achieved mainstream adoption |

| Q48 | Our executive team believes blockchain and/or digital assets are overhyped |

| Q49 | Blockchain solutions are being discussed or developed by suppliers, customers, and/or competitors to address problems in the value chain |

| Q50 | The industry will be disrupted by blockchain technology |

References

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- GlobeNewswire. Global Supply Chain Management Market Size 2020–2026; Statista: New York, NY, USA, 2021. [Google Scholar]

- Placek, M. Supply Chain Challenges in 2021; Statista: New York, NY, USA, 2022. [Google Scholar]

- Placek, M. Top Strategic Visibility Focus for Suppliers in Global Supply Chains in 2017; Statista: New York, NY, USA, 2022. [Google Scholar]

- Johnsen, L.C.; Voigt, G.; Weimann, J. The Effect of Communication Media on Information Sharing in Supply Chains. Prod. Oper. Manag. 2020, 29, 705–724. [Google Scholar] [CrossRef]

- Bigliardi, B.; Filippelli, S.; Petroni, A.; Tagliente, L. The digitalization of supply chain: A review. In Proceedings of the 3rd International Conference on Industry 4.0 and Smart Manufacturing (ISM 2022), Virtual, 17–19 November 2021; Volume 200, pp. 1806–1815. [Google Scholar] [CrossRef]

- Boffey, D. Contaminated eggs: Netherlands failed to sound alarm, says Belgium, 2016. The Guardian, 9 August 2017. [Google Scholar]

- Wüst, K.; Gervais, A. Do you Need a Blockchain? In Proceedings of the 2018 Crypto Valley Conference on Blockchain Technology (CVCBT), Zug, Switzerland, 20–22 June 2018; pp. 45–54. [Google Scholar] [CrossRef]

- Elsden, C.; Manohar, A.; Briggs, J.; Harding, M.; Speed, C.; Vines, J. Making Sense of Blockchain Applications: A Typology for HCI. In Proceedings of the 2018 CHI Conference on Human Factors in Computing Systems, New York, NY, USA, 27 April–2 May 2018; pp. 1–14. [Google Scholar] [CrossRef]

- Allessie, D.; Sobolewski, M.; Vaccari, L. Blockchain for Digital Government: An Assessment of Pioneering Implementations in Public Services; JRC Research Reports JRC115049; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Nascimento, F.D.; Sousa, L.J.; Pólvora, A. Blockchain4EU: Blockchain for Industrial Transformations; Scientific Analysis or Review, Policy Assessment, Anticipation and Foresight KJ-NA-29215-EN-N; European Union Office: Luxembourg, 2018. [Google Scholar] [CrossRef]

- Consortium, Dutch Research Council. Spark! Living Lab Project, 2020–2024; Dutch Research Council (NWO): The Hague, The Netherlands, 2022. [Google Scholar]

- Kjærgaard-Winther, C. Maersk and IBM to Discontinue TradeLens, a Blockchain-Enabled Global Trade Platform. 2023. Available online: https://www.maersk.com/news/articles/2022/11/29/maersk-and-ibm-to-discontinue-tradelens (accessed on 9 September 2023).

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Bamakan, S.M.H.; Motavali, A.; Babaei Bondarti, A. A survey of blockchain consensus algorithms performance evaluation criteria. Expert Syst. Appl. 2020, 154, 113385. [Google Scholar] [CrossRef]

- Xu, J.; Wang, C.; Jia, X. A Survey of Blockchain Consensus Protocols. ACM Comput. Surv. 2023, 55, 1–35. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System; United States Sentencing Commission: Washington, DC, USA, 2008.

- Garay, J.A.; Kiayias, A.; Shen, Y. Proof-of-Work-Based Consensus in Expected-Constant Time. IACR Cryptol. ePrint Arch. 2023, 1663. [Google Scholar] [CrossRef]

- Xu, J.; Cheng, Y.; Wang, C.; Jia, X. Occam: A Secure and Adaptive Scaling Scheme for Permissionless Blockchain. In Proceedings of the 41st IEEE International Conference on Distributed Computing Systems, ICDCS 2021, Washington, DC, USA, 7–10 July 2021; pp. 618–628. [Google Scholar] [CrossRef]

- Yu, H.; Nikolic, I.; Hou, R.; Saxena, P. OHIE: Blockchain Scaling Made Simple. In Proceedings of the 2020 IEEE Symposium on Security and Privacy, SP 2020, San Francisco, CA, USA, 18–21 May 2020; pp. 90–105. [Google Scholar] [CrossRef]

- Li, C.; Li, P.; Zhou, D.; Yang, Z.; Wu, M.; Yang, G.; Xu, W.; Long, F.; Yao, A.C. A Decentralized Blockchain with High Throughput and Fast Confirmation. In Proceedings of the 2020 USENIX Annual Technical Conference, USENIX ATC 2020, Boston, MA, USA, 15–17 July 2020; pp. 515–528. [Google Scholar]

- Szalachowski, P.; Reijsbergen, D.; Homoliak, I.; Sun, S. StrongChain: Transparent and Collaborative Proof-of-Work Consensus. In Proceedings of the 28th USENIX Security Symposium, USENIX Security 2019, Santa Clara, CA, USA, 14–16 August 2019; pp. 819–836. [Google Scholar]

- Bissias, G.; Levine, B.N. Bobtail: Improved Blockchain Security with Low-Variance Mining. In Proceedings of the 27th Annual Network and Distributed System Security Symposium, NDSS 2020, San Diego, CA, USA, 23–26 February 2020. [Google Scholar]

- Reijsbergen, D.; Szalachowski, P.; Ke, J.; Li, Z.; Zhou, J. LaKSA: A Probabilistic Proof-of-Stake Protocol. In Proceedings of the 28th Annual Network and Distributed System Security Symposium, NDSS 2021, Virtual, 21–25 February 2021. [Google Scholar]

- Kerber, T.; Kiayias, A.; Kohlweiss, M.; Zikas, V. Ouroboros Crypsinous: Privacy-Preserving Proof-of-Stake. In Proceedings of the 2019 IEEE Symposium on Security and Privacy, SP 2019, San Francisco, CA, USA, 19–23 May 2019; pp. 157–174. [Google Scholar] [CrossRef]

- Badertscher, C.; Gazi, P.; Kiayias, A.; Russell, A.; Zikas, V. Ouroboros Genesis: Composable Proof-of-Stake Blockchains with Dynamic Availability. In Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security, CCS 2018, Toronto, ON, Canada, 15–19 October 2018; pp. 913–930. [Google Scholar] [CrossRef]

- David, B.; Gazi, P.; Kiayias, A.; Russell, A. Ouroboros Praos: An Adaptively-Secure, Semi-synchronous Proof-of-Stake Blockchain. In Proceedings of the Advances in Cryptology—EUROCRYPT 2018—37th Annual International Conference on the Theory and Applications of Cryptographic Techniques, Tel Aviv, Israel, 29 April–3 May 2018; Volume 10821, pp. 66–98. [Google Scholar] [CrossRef]

- Miller, A.; Juels, A.; Shi, E.; Parno, B.; Katz, J. Permacoin: Repurposing Bitcoin Work for Data Preservation. In Proceedings of the 2014 IEEE Symposium on Security and Privacy, SP 2014, Berkeley, CA, USA, 18–21 May 2014; pp. 475–490. [Google Scholar] [CrossRef]

- Park, S.; Kwon, A.; Fuchsbauer, G.; Gazi, P.; Alwen, J.; Pietrzak, K. SpaceMint: A Cryptocurrency Based on Proofs of Space. In Proceedings of the Financial Cryptography and Data Security—22nd International Conference, FC 2018, Nieuwpoort, Curaçao, 26 February–2 March 2018; Volume 10957, pp. 480–499. [Google Scholar] [CrossRef]

- Zhang, Y.; Setty, S.T.V.; Chen, Q.; Zhou, L.; Alvisi, L. Byzantine Ordered Consensus without Byzantine Oligarchy. In Proceedings of the 14th USENIX Symposium on Operating Systems Design and Implementation, OSDI 2020, Virtual, 4–6 November 2020; pp. 633–649. [Google Scholar]

- Zhai, D.; Wang, J.; Liu, J.; Liu, T.; Niu, W. Efficient-HotStuff: A BFT Blockchain Consensus with Higher Efficiency and Stronger Robustness. In Proceedings of the 28th IEEE International Conference on Parallel and Distributed Systems, ICPADS 2022, Nanjing, China, 10–12 January 2023; pp. 217–225. [Google Scholar] [CrossRef]

- Liu, Y.; Xing, X.; Cheng, H.; Li, D.; Guan, Z.; Liu, J.; Wu, Q. A Flexible Sharding Blockchain Protocol Based on Cross-Shard Byzantine Fault Tolerance. IEEE Trans. Inf. Forensics Secur. 2023, 18, 2276–2291. [Google Scholar] [CrossRef]

- Kelkar, M.; Zhang, F.; Goldfeder, S.; Juels, A. Order-Fairness for Byzantine Consensus. In Proceedings of the Advances in Cryptology—CRYPTO 2020—40th Annual International Cryptology Conference, CRYPTO 2020, Santa Barbara, CA, USA, 17–21 August 2020; Volume 12172, pp. 451–480. [Google Scholar] [CrossRef]

- Abraham, I.; Malkhi, D.; Nayak, K.; Ren, L.; Yin, M. Sync HotStuff: Simple and Practical Synchronous State Machine Replication. In Proceedings of the 2020 IEEE Symposium on Security and Privacy, SP 2020, San Francisco, CA, USA, 18–21 May 2020; pp. 106–118. [Google Scholar] [CrossRef]

- Guo, B.; Lu, Z.; Tang, Q.; Xu, J.; Zhang, Z. Dumbo: Faster Asynchronous BFT Protocols. In Proceedings of the CCS ’20: 2020 ACM SIGSAC Conference on Computer and Communications Security, Virtual, 9–13 November 2020; pp. 803–818. [Google Scholar] [CrossRef]

- Duan, S.; Zhang, H.; Zhao, B. WaterBear: Information-Theoretic Asynchronous BFT Made Practical. IACR Cryptol. ePrint Arch. 2022, 21. [Google Scholar]

- Wood, G. Ethereum: A Secure Decentralised Generalised Transaction Ledger; Ethereum Project Yellow Paper; Parity Technologies: London, UK, 2014; Volume 151, pp. 1–32. [Google Scholar]

- Szabo, N. Formalizing and Securing Relationships on Public Networks. First Monday 1997, 2, 9. [Google Scholar] [CrossRef]

- Taherdoost, H. Smart Contracts in Blockchain Technology: A Critical Review. Information 2023, 14, 117. [Google Scholar] [CrossRef]

- Monrat, A.A.; Schelén, O.; Andersson, K. A Survey of Blockchain From the Perspectives of Applications, Challenges, and Opportunities. IEEE Access 2019, 7, 117134–117151. [Google Scholar] [CrossRef]

- Androulaki, E. Hyperledger Fabric: A Distributed Operating System for Permissioned Blockchains. In Proceedings of the Thirteenth EuroSys Conference, New York, NY, USA, 23–26 April 2018; pp. 1–15. [Google Scholar] [CrossRef]

- Dutta, P.; Choi, T.M.; Somani, S.; Butala, R. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transp. Res. Part Logist. Transp. Rev. 2020, 142, 102067. [Google Scholar] [CrossRef] [PubMed]

- Lim, M.K.; Li, Y.; Wang, C.; Tseng, M.L. A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Comput. Ind. Eng. 2021, 154, 107133. [Google Scholar] [CrossRef]

- Li, T.; Vos, J.; Erkin, Z. Decentralized Private Freight Declaration & Tracking with Data Validation. In Proceedings of the 2022 IEEE International Conference on Pervasive Computing and Communications Workshops and other Affiliated Events, PerCom 2022 Workshops, Pisa, Italy, 21–25 March 2022; pp. 267–272. [Google Scholar] [CrossRef]

- Moosavi, J.; Naeni, L.M.; Fathollahi-Fard, A.M.; Fiore, U. Blockchain in supply chain management: A review, bibliometric, and network analysis. Environ. Sci. Pollut. Res. 2021, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Zhu, Q.; Bai, C.; Sarkis, J. Blockchain technology and supply chains: The paradox of the atheoretical research discourse. Transp. Res. Part Logist. Transp. Rev. 2022, 164, 102824. [Google Scholar] [CrossRef]

- Graser, S. BMW Group Uses Blockchain to Drive Supply Chain Transparency. 2020. BMW Group Website. Available online: https://www.press.bmwgroup.com/global/article/detail/T0307164EN/bmw-group-uses-blockchain-to-drive-supply-chain-transparency?language=en (accessed on 9 September 2023).

- Luckow, A. The BMW Group Navigates a Blockchain-Driven Future. Wall Str. J. 2022. Available online: https://deloitte.wsj.com/cio/the-bmw-group-navigates-a-blockchain-driven-future-01650045838 (accessed on 9 September 2023).

- Goldman, S. The Ethical Supply Chain: Definition, Examples, Stats. The Future of Commerce. 2021. Available online: https://www.the-future-of-commerce.com/2020/01/22/ethical-supply-chain-definition-stats/ (accessed on 9 September 2023).

- Xie, R.; Wang, Y.; Tan, M.; Zhu, W.; Yang, Z.; Wu, J.; Jeon, G. Ethereum-Blockchain-Based Technology of Decentralized Smart Contract Certificate System. IEEE Internet Things Mag. 2020, 3, 44–50. [Google Scholar] [CrossRef]

- Chang, P.Y.; Hwang, M.S.; Yang, C.C. A Blockchain-Based Traceable Certification System. In Security with Intelligent Computing and Big-Data Services; Peng, S.L., Wang, S.J., Balas, V.E., Zhao, M., Eds.; Springer: Cham, Switzerland, 2018; pp. 363–369. [Google Scholar]

- Laurie, B.; Kasper, E. Revocation Transparency—Google Research. 2012. Available online: https://github.com/google/trillian/tree/master/docs/papers (accessed on 9 September 2023).

- Eijdenberg, A.; Laurie, B.; Cutter, A. Verifiable data structures. In Data Privacy Management, Cryptocurrencies and Blockchain Technology: Proceedings of the ESORICS 2018 International Workshops, DPM 2018 and CBT 2018, Barcelona, Spain, 6–7 September 2018; Springer: Berlin, Germany, 2018. [Google Scholar]

- SAI. Sustainable Agriculture for a Better World; SAI: Brussels, Belgium, 2023. [Google Scholar]

- Warmmarkt Time/Temperature Indicator Tags; LabelMaster: Chicago, IL, USA, 2023.

- Sabt, M.; Achemlal, M.; Bouabdallah, A. Trusted execution environment: What it is, and what it is not. In Proceedings of the 2015 IEEE Trustcom/BigDataSE/Ispa, Helsinki, Finland, 20–22 August 2015; Volume 1, pp. 57–64. [Google Scholar]

- Erhan, L.; Ndubuaku, M.; Di Mauro, M.; Song, W.; Chen, M.; Fortino, G.; Bagdasar, O.; Liotta, A. Smart anomaly detection in sensor systems: A multi-perspective review. Inf. Fusion 2021, 67, 64–79. [Google Scholar] [CrossRef]

- Naviporta. Naviporta: Quay Connect. 2021. Available online: https://naviporta.com/quay-connect/ (accessed on 9 September 2023).

- Pschetz, L.; Tallyn, E.; Gianni, R.; Speed, C. Bitbarista: Exploring Perceptions of Data Transactions in the Internet of Things. In Proceedings of the 2017 CHI Conference on Human Factors in Computing Systems, New York, NY, USA, 6–11 May 2017; pp. 2964–2975. [Google Scholar] [CrossRef]

- Murray-Rust, D.; Elsden, C.; Nissen, B.; Tallyn, E.; Pschetz, L.; Speed, C. Blockchain and Beyond: Understanding Blockchains Through Prototypes and Public Engagement. ACM Trans. Comput. Hum. Interact. 2023, 29, 41. [Google Scholar] [CrossRef]

- Upadhyay, A.; Mukhuty, S.; Kumar, V.; Kazancoglu, Y. Blockchain technology and the circular economy: Implications for sustainability and social responsibility. J. Clean. Prod. 2021, 293, 126130. [Google Scholar] [CrossRef]

| Use Cases | Trust on | Blockchain Provides | Highlights |

|---|---|---|---|

| UC1 | CA | A data-sharing platform | Presence of an existing solution stops deployment |

| UC2 | Sensors | A data-sharing platform | Unclear benefits for using blockchain |

| UC3 | Official documents | Transparency and trust | Clear benefits, the solution is being tested |

| ID | Age Range | Job Title | Level of BC Expertise (1–10) | Industrial Field | Company Size | Country |

|---|---|---|---|---|---|---|

| P1 | 31–40 | Founder-R&D | 7 | Construction | Small | NL |

| P2 | 51–60 | Supply Chain mgr. | 1 | Nautical | Medium | FR |

| P3 | 31–40 | Business Analyst | 8 | Food | Small | NL |

| P4 | 51–60 | Project mgr. | 3 | Transport/Logistics | Large | NL |

| P5 | 21–30 | Vacation Job | 3 | Construction | Medium | NL |

| P6 | 51–60 | Operations mgr. | 3 | Agriculture | Small | NL |

| P7 | 51–60 | Director of Operations | 3 | Transport/Logistics | Small | NL |

| P8 | 31–40 | Financial mgr. | 6 | Agriculture | Medium | NL |

| P9 | 31–40 | General mgr. | 6 | Food | Small | NL |

| P10 | 41–50 | CFO | 4 | Manufacturing | Medium | NL |

| P11 | 41–50 | Supply Chain mgr. | 7 | Defence | Large | UK |

| P12 | 41–50 | Business Analyst | 9 | Food | Large | NL |

| P13 | 21–30 | Supply Planner | 4 | Manufacturing | Medium | NL |

| P14 | 21–30 | Demand Planning mgr. | 1 | Pharmaceutical | Medium | DK |

| P15 | 31–40 | Logistics Analyst | 7 | Agriculture | Small | NL |

| P16 | 21–30 | Transportation Planner | 6 | Transport/Logistics | Large | NL |

| P17 | 21–30 | Sourcing Specialist | 3 | Manufacturing | Large | NL |

| P18 | 21–30 | Project mgr. | 10 | Software Dev. | Small | NL |

| Reason the Data are Used for, in the Company | Number of Companies Using the Corresponding Data | Result in % |

|---|---|---|

| Recording activities of process/tasks | 15 | 83% |

| Informing relevant parties of the status of an activity on the supply chain | 11 | 61% |

| Making decisions | 9 | 50% |

| Tracking progress | 1 | 6% |

| Justifying cost | 1 | 6% |

| Stakeholders in the Information Sharing | Number of Companies Sharing Data with the Corresponding Stakeholders | Result in % |

|---|---|---|

| Customers | 9 | 50% |

| Other parties of the supply chain | 9 | 50% |

| Only limited business partners | 8 | 44% |

| Co-workers (sales/marketing/finance) | 1 | 6% |

| Mostly internal | 1 | 6% |

| Sales | 1 | 6% |

| Stakeholders in the Information Sharing | % of Company’s Information Sharing Action | |

|---|---|---|

| Sending | Receiving | |

| Manufacturers | 22% | 33% |

| Raw Material Suppliers | 11% | 28% |

| Distributors | 44% | 56% |

| Wholesalers | 28% | 28% |

| End User | 33% | 28% |

| Registrars | 11% | 6% |

| Transporters | 44% | N/A |

| Certifiers | 17% | 22% |

| Retailers | 17% | 22% |

| Not applicable | 17% | 28% |

| Companies’ Current Adaptation State of Blockchain Compared to Their Direct Competitors | Portion of Companies |

|---|---|

| On a par | 38.9% |

| Leading | 27.8% |

| Not started/No activity | 33.3% |

| Companies’ Current or Future Relationship with a Blockchain Models | Number of Companies | Result in % |

|---|---|---|

| Permissioned (with supply chain partners) | 3 | 17% |

| Public blockchain (global, open networks) | 4 | 22% |

| Private blockchain (internal to the company) | 1 | 6% |

| No idea | 2 | 14% |

| None are in sight | 5 | 28% |

| No interest in blockchain | 3 | 17% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kromes, R.; Li, T.; Bouillon, M.; Güler, T.E.; van der Hulst, V.; Erkin, Z. Fear of Missing Out: Constrained Trial of Blockchain in Supply Chain. Sensors 2024, 24, 986. https://doi.org/10.3390/s24030986

Kromes R, Li T, Bouillon M, Güler TE, van der Hulst V, Erkin Z. Fear of Missing Out: Constrained Trial of Blockchain in Supply Chain. Sensors. 2024; 24(3):986. https://doi.org/10.3390/s24030986

Chicago/Turabian StyleKromes, Roland, Tianyu Li, Maxime Bouillon, Talha Enes Güler, Victor van der Hulst, and Zekeriya Erkin. 2024. "Fear of Missing Out: Constrained Trial of Blockchain in Supply Chain" Sensors 24, no. 3: 986. https://doi.org/10.3390/s24030986

APA StyleKromes, R., Li, T., Bouillon, M., Güler, T. E., van der Hulst, V., & Erkin, Z. (2024). Fear of Missing Out: Constrained Trial of Blockchain in Supply Chain. Sensors, 24(3), 986. https://doi.org/10.3390/s24030986