Toward a Unified Theory of Customer Continuance Model for Financial Technology Chatbots

Abstract

:1. Introduction

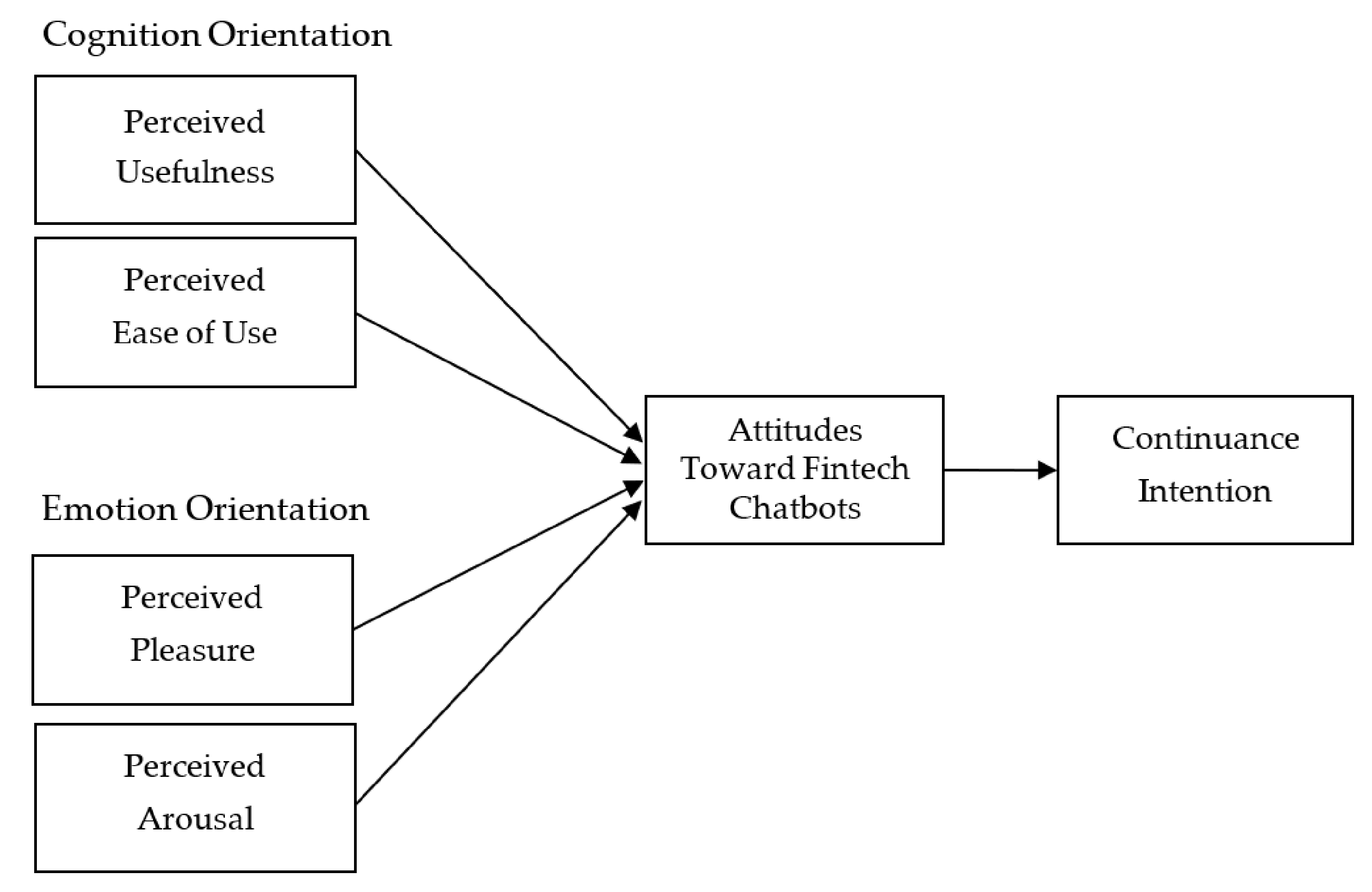

2. Hypothesis Development and Literature Review

Russell’s Affect Model and the TAM

3. Evaluation Procedure

3.1. Research Model and Hypotheses

3.2. Method

3.2.1. Research Population

3.2.2. Research Instruments

4. Analysis Results and Discussion

4.1. Model Validation

Model Measurement

4.2. Hypotheses Testing and Analysis Results

4.3. Findings and Discussion

5. Conclusions and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pakurár, M.; Haddad, H.; Nagy, J.; Popp, J.; Oláh, J. The Service Quality Dimensions that Affect Customer Satisfaction in the Jordanian Banking Sector. Sustainability 2019, 11, 1113. [Google Scholar] [CrossRef] [Green Version]

- Anastasiei, B.; Dospinescu, N.; Dospinescu, O. Understanding the Adoption of Incentivized Word-of-Mouth in the Online Environment. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 992–1007. [Google Scholar] [CrossRef]

- Dospinescu, O.; Dospinescu, N.; Agheorghiesei, D.-T. Fintech services and factors determining the expected benefits of users:Evidence in Romania for millennials and generation Z. EM Econ. Manag. 2021, 24, 101–118. [Google Scholar]

- Cheng, Y.; Jiang, H. Customer–Brand relationship in the era of artificial intelligence: Understanding the role of chatbot marketing efforts. J. Prod. Brand. Manag. 2021. [Google Scholar] [CrossRef]

- Nguyen, D.M.; Chiu, Y.-T.H.; Le, H.D. Determinants of Continuance Intention towards Banks’ Chatbot Services in Vietnam: A Necessity for Sustainable Development. Sustainability 2021, 13, 7625. [Google Scholar] [CrossRef]

- KPMG. The Pulse of Fintech 2018. KPMG. 2019. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2018/07/h1--2018-pulse-of-fintech.pdf (accessed on 1 March 2021).

- Montazemi, A.R.; Qahri-Saremi, H. Factors Affecting Adoption of Online Banking: A Meta-Analytic Structural Equation Modeling Study. Inf. Manag. 2015, 52, 210–226. [Google Scholar] [CrossRef]

- Ajzen, I. Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User acceptance of computer technology: A comparison of two theoretical models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef] [Green Version]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley Pub. Co.: Toronto, ON, Canada, 1975. [Google Scholar]

- Chen, S.-C.; Li, S.-H.; Liu, S.-C.; Yen, D.C.; Ruangkanjanases, A. Assessing Determinants of Continuance Intention towards Personal Cloud Services: Extending UTAUT2 with Technology Readiness. Symmetry 2021, 13, 467. [Google Scholar] [CrossRef]

- Jeng, M.-Y.; Yeh, T.-M.; Pai, F.-Y. The Continuous Intention of Older Adult in Virtual Reality Leisure Activities: Combining Sports Commitment Model and Theory of Planned Behavior. Appl. Sci. 2020, 10, 7509. [Google Scholar] [CrossRef]

- Wang, T.; Lin, C.-L.; Su, Y.-S. Continuance Intention of University Students and Online Learning during the COVID-19 Pandemic: A Modified Expectation Confirmation Model Perspective. Sustainability 2021, 13, 4586. [Google Scholar] [CrossRef]

- Russell, J.A. A circumplex model of affect. J. Pers. Soc. Psychol. 1980, 39, 1161–1178. [Google Scholar] [CrossRef]

- Patten, M.L.; Galvan, M.C. Proposing Empirical Research: A Guide to the Fundamentals; Routledge: London, UK, 2019. [Google Scholar]

- Seltman, H.J. Experimental Design and Analysis; Carnegie Mellon University: Pittsburgh, PA, USA, 2012. [Google Scholar]

- Duncan, T.E.; Duncan, S.C.; Strycker, L.A. An Introduction to Latent Variable Growth Curve Modeling: Concepts, Issues, and Applications; Erlbaum: Mahwah, NJ, USA, 2006. [Google Scholar]

- Huang, S.Y.B.; Lee, S.-C.; Lee, Y.-S. Constructing an Adoption Model of Proactive Environmental Strategy: A Novel Quantitative Method of the Multi-Level Growth Curve Model. Mathematics 2021, 9, 1962. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Li, M.-W.; Chang, T.-W. Transformational Leadership, Ethical Leadership, and Participative Leadership in Predicting Counterproductive Work Behaviors: Evidence from Financial Technology Firms. Front. Psychol. 2021, 12, 658727. [Google Scholar] [CrossRef]

- Chu, I.-H.; Wu, P.-T.; Wu, W.-L.; Yu, H.-C.; Yu, T.-C.; Chang, Y.-K. Affective Responses during High-Intensity Interval Exercise Compared with Moderate-Intensity Continuous Exercise in Inactive Women. Int. J. Environ. Res. Public Health 2021, 18, 5393. [Google Scholar] [CrossRef]

- Lo, J.-H.; Lai, Y.-F.; Hsu, T.-L. The Study of AR-Based Learning for Natural Science Inquiry Activities in Taiwan’s Elementary School from the Perspective of Sustainable Development. Sustainability 2021, 13, 6283. [Google Scholar] [CrossRef]

- Zulfiqar, S.; Al-reshidi, H.A.; Al Moteri, M.A.; Feroz, H.M.B.; Yahya, N.; Al-Rahmi, W.M. Understanding and Predicting Students’ Entrepreneurial Intention through Business Simulation Games: A Perspective of COVID-19. Sustainability 2021, 13, 1838. [Google Scholar] [CrossRef]

- Fernández-Guzmán, V.; Bravo, E.R. Understanding Continuance Usage of Natural Gas: A Theoretical Model and Empirical Evaluation. Energies 2018, 11, 2019. [Google Scholar] [CrossRef] [Green Version]

- Park, G.; Chen, F.; Cheng, L. A Study on the Millennials Usage Behavior of Social Network Services: Effects of Motivation, Density, and Centrality on Continuous Intention to Use. Sustainability 2021, 13, 2680. [Google Scholar] [CrossRef]

- Qasem, Y.A.M.; Abdullah, R.; Jusoh, Y.Y.; Atan, R.; Asadi, S. Analyzing Continuance of Cloud Computing in Higher Education Institutions: Should We Stay, or Should We Go? Sustainability 2021, 13, 4664. [Google Scholar] [CrossRef]

- Han, M.; Wu, J.; Wang, Y.; Hong, M. A Model and Empirical Study on the User’s Continuance Intention in Online China Brand Communities Based on Customer-Perceived Benefits. J. Open Innov. Technol. Mark. Complex. 2018, 4, 46. [Google Scholar] [CrossRef] [Green Version]

- Linares, M.; Gallego, M.D.; Bueno, S. Proposing a TAM-SDT-Based Model to Examine the User Acceptance of Massively Multiplayer Online Games. Int. J. Environ. Res. Public Health 2021, 18, 3687. [Google Scholar] [CrossRef]

- Suzianti, A.; Paramadini, S.A. Continuance Intention of E-Learning: The Condition and Its Connection with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 97. [Google Scholar] [CrossRef]

- Choi, Y.; Sun, L. Reuse Intention of Third-Party Online Payments: A Focus on the Sustainable Factors of Alipay. Sustainability 2016, 8, 147. [Google Scholar] [CrossRef] [Green Version]

- Castiblanco Jimenez, I.A.; Cepeda García, L.C.; Marcolin, F.; Violante, M.G.; Vezzetti, E. Validation of a TAM Extension in Agriculture: Exploring the Determinants of Acceptance of an e-Learning Platform. Appl. Sci. 2021, 11, 4672. [Google Scholar] [CrossRef]

- Álvarez-Marín, A.; Velázquez-Iturbide, J.Á.; Castillo-Vergara, M. Technology Acceptance of an Interactive Augmented Reality App on Resistive Circuits for Engineering Students. Electronics 2021, 10, 1286. [Google Scholar] [CrossRef]

- Trujillo-León, A.; de Guzmán-Manzano, A.; Velázquez, R.; Vidal-Verdú, F. Generation of Gait Events with a FSR Based Cane Handle. Sensors 2021, 21, 5632. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef] [Green Version]

- Jiang, J.; Feng, R.; Li, E.Y. Uncovering the Providers’ Continuance Intention of Participation in the Sharing Economy: A Moderated Mediation Model. Sustainability 2021, 13, 5095. [Google Scholar] [CrossRef]

- Mathew, A.O.; Jha, A.N.; Lingappa, A.K.; Sinha, P. Attitude towards Drone Food Delivery Services—Role of Innovativeness, Perceived Risk, and Green Image. J. Open Innov. Technol. Mark. Complex. 2021, 7, 144. [Google Scholar] [CrossRef]

- Sithipolvanichgul, J.; Chen, C.; Land, J.; Ractham, P. Enhancing User Experiences with Cloud Computing via Improving Utilitarian and Hedonic Factors. Energies 2021, 14, 1822. [Google Scholar] [CrossRef]

- Kulviwat, S.; Bruner, G.C., II; Neelankavil, J.P. Self-efficacy as an antecedent of cognition and affect in technology acceptance. J. Consum. Mark. 2014, 31, 190–199. [Google Scholar] [CrossRef]

- Loureiro, S.M.C. The role of website quality on PAD, attitude and intentions to visit and recommend island destination. Int. J. Hosp. Tour. Res. 2015, 17, 545–554. [Google Scholar] [CrossRef]

- Wang, Z.; Scheepers, H. Understanding the intrinsic motivations of user acceptance of hedonic information systems: Towards a unified research model. Commun. Assoc. Inf. Syst. 2012, 30, 255–274. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alshirah, M.H.; Alshira’h, A.F.; Abutaber, T.A.; Almarashdah, M.A. Digital Financial Inclusion Sustainability in Jordanian Context. Sustainability 2021, 13, 6312. [Google Scholar] [CrossRef]

- Yusoff, M.N.H.B.; Zainol, F.A.; Hafifi Ridzuan, R.; Ismail, M.; Afthanorhan, A. Psychological Traits and Intention to Use E-Commerce among Rural Micro-Entrepreneurs in Malaysia. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1827–1843. [Google Scholar] [CrossRef]

- Zardari, B.A.; Hussain, Z.; Arain, A.A.; Rizvi, W.H.; Vighio, M.S. Development and Validation of User Experience-Based E-Learning Acceptance Model for Sustainable Higher Education. Sustainability 2021, 13, 6201. [Google Scholar] [CrossRef]

- Cakirli Akyüz, N.; Theuvsen, L. The Impact of Behavioral Drivers on Adoption of Sustainable Agricultural Practices: The Case of Organic Farming in Turkey. Sustainability 2020, 12, 6875. [Google Scholar] [CrossRef]

- Lee, S.; Kim, B.G. The Impact of Individual Motivations and Social Capital on the Continuous Usage Intention of Mobile Social Apps. Sustainability 2020, 12, 8364. [Google Scholar] [CrossRef]

- Ali, S.; Poulova, P.; Akbar, A.; Javed, H.M.U.; Danish, M. Determining the Influencing Factors in the Adoption of Solar Photovoltaic Technology in Pakistan: A Decomposed Technology Acceptance Model Approach. Economies 2020, 8, 108. [Google Scholar] [CrossRef]

- Zhao, J.; Wang, J. Health Advertising on Short-Video Social Media: A Study on User Attitudes Based on the Extended Technology Acceptance Model. Int. J. Environ. Res. Public Health 2020, 17, 1501. [Google Scholar] [CrossRef] [Green Version]

- Liu, W.; Ji, R. Examining the Role of Online Reviews in Chinese Online Group Buying Context: The Moderating Effect of Promotional Marketing. Soc. Sci. 2018, 7, 141. [Google Scholar] [CrossRef] [Green Version]

- Ajzen, I. Nature and operation of attitudes. Annu. Rev. Psychol. 2001, 52, 27–58. [Google Scholar] [CrossRef] [Green Version]

- Han, H.; Ariza-Montes, A.; Tirado-Valencia, P.; Lee, S. Volunteering Attitude, Mental Well-Being, and Loyalty for the Non-Profit Religious Organization of Volunteer Tourism. Sustainability 2020, 12, 4618. [Google Scholar] [CrossRef]

- Han, H.; Moon, H.; Ariza-Montes, A.; Lee, S. Sensory/Health-Related and Convenience/Process Quality of Airline Meals and Traveler Loyalty. Sustainability 2020, 12, 857. [Google Scholar] [CrossRef] [Green Version]

- Huang, S.Y.B.; Fei, Y.-M.; Lee, Y.-S. Predicting Job Burnout and Its Antecedents: Evidence from Financial Information Technology Firms. Sustainability 2021, 13, 4680. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Ting, C.-W.; Li, M.-W. The Effects of Green Transformational Leadership on Adoption of Environmentally Proactive Strategies: The Mediating Role of Green Engagement. Sustainability 2021, 13, 3366. [Google Scholar] [CrossRef]

- Huang, S.Y.B.; Ting, C.-W.; Fei, Y.-M. A Multilevel Model of Environmentally Specific Social Identity in Predicting Envi-ronmental Strategies: Evidence from Technology Manufacturing Businesses. Sustainability 2021, 13, 4567. [Google Scholar] [CrossRef]

- Lee, C.-J.; Huang, S.Y.B. Double-edged effects of ethical leadership in the development of Greater China salespeople’s emotional exhaustion and long-term customer relationships. Chin. Manag. Stud. 2020, 14, 29–49. [Google Scholar] [CrossRef]

- Reynolds, N.; Diamantopoulos, A.; Schlegelmilch, B.B. Presting in questionnaire design: A review of the literature and suggestion for further research. J. Mark. Res. Soc. 1993, 35, 171–182. [Google Scholar]

- Lund, A.M. Measuring usability with the USE questionnaire. Usability Interface 2001, 8, 3–6. [Google Scholar]

- Moore, G.C.; Benbasat, I. Development of an instrument to measure the perceptions of adopting an information technology innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef] [Green Version]

- Chen, Q.; Wells, W.D. Attitude toward the site. J. Advert. Res. 1999, 39, 27–37. [Google Scholar]

- Bhattacherjee, A. Understand information systems continuance: An expectation-confirmation model. MIS Q. 2001, 16, 351–370. [Google Scholar] [CrossRef]

- Bin, P.; Vassallo, M. The Growth Path of Agricultural Labor Productivity in China: A Latent Growth Curve Model at the Prefectural Level. Economies 2016, 4, 13. [Google Scholar] [CrossRef] [Green Version]

- Coovert, M.D.; Miller, E.E.P.; Bennett, W., Jr. Assessing Trust and Effectiveness in Virtual Teams: Latent Growth Curve and Latent Change Score Models. Soc. Sci. 2017, 6, 87. [Google Scholar] [CrossRef] [Green Version]

- Preiser, B.; Assari, S. Psychological Predictors of Sexual Intimate Partner Violence against Black and Hispanic Women. Behav. Sci. 2018, 8, 3. [Google Scholar] [CrossRef] [Green Version]

- Hu, P.J.; Chau, P.Y.K.; Liu Sheng, O.R.; Yan Tam, K. Examining the technology acceptance model using physician acceptance of telemedicine technology. J. Manag. Inf. Syst. 1999, 16, 91–112. [Google Scholar] [CrossRef]

- Godin, G.; Kok, G. The theory of planned behavior: A review of its applications to health-related behaviors. Am. J. Health. Promot. 1996, 11, 87–98. [Google Scholar] [CrossRef]

- Sheeran, P.; Taylor, S. Predicting intentions to use condoms: A meta-analysis and comparison of the theories of reasoned action and planned behavior. J. Appl. Soc. Psychol. 1999, 29, 1624–1675. [Google Scholar] [CrossRef]

- Randall, D.M.; WolV, J.A. The time interval in the intention—Behaviour relationship: Meta-analysis. Br. J. Soc. Psychol. 1994, 33, 405–418. [Google Scholar] [CrossRef]

- Sheeran, P.; Orbell, S. Do intentions predict condom use? Meta-analysis and examination of six moderator variables. Br. J. Soc. Psychol. 1998, 37, 231–250. [Google Scholar] [CrossRef] [PubMed]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Chau, P.Y.K.; Hu, P. Information technology acceptance by individualprofessionals: A model comparison approach. Decis. Sci. 2001, 32, 699–719. [Google Scholar] [CrossRef]

- Alyoussef, I.Y. E-Learning Acceptance: The Role of Task–Technology Fit as Sustainability in Higher Education. Sustainability 2021, 13, 6450. [Google Scholar] [CrossRef]

- Qiao, P.; Zhu, X.; Guo, Y.; Sun, Y.; Qin, C. The Development and Adoption of Online Learning in Pre- and Post-COVID-19: Combination of Technological System Evolution Theory and Unified Theory of Acceptance and Use of Technology. J. Risk Financial Manag. 2021, 14, 162. [Google Scholar] [CrossRef]

| Measurement | Item | |

|---|---|---|

| Gender | Female | 40% |

| Male | 60% | |

| Use tenure | More than one year | 40% |

| Less than one year | 60% | |

| Education | College education or above | 89% |

| Less than a college education | 11% | |

| Frequency of using chatbots | Once everyone week | 30% |

| Once every two weeks | 60% | |

| Once every three weeks or above | 30% |

| Construct | Item | Factor Loading | Composite Reliability | Average Variance Extracted |

|---|---|---|---|---|

| Usefulness | U1 | 0.82 | 0.90 | 0.66 |

| U2 | 0.79 | |||

| U3 | 0.81 | |||

| U4 | 0.83 | |||

| U5 | 0.81 | |||

| Ease of use | E1 | 0.81 | 0.90 | 0.66 |

| E2 | 0.83 | |||

| E3 | 0.81 | |||

| E4 | 0.83 | |||

| E5 | 0.79 | |||

| Pleasure | P1 | 0.83 | 0.91 | 0.66 |

| P2 | 0.82 | |||

| P3 | 0.81 | |||

| P4 | 0.79 | |||

| P5 | 0.79 | |||

| P6 | 0.82 | |||

| Arousal | A1 | 0.79 | 0.92 | 0.66 |

| A2 | 0.82 | |||

| A3 | 0.81 | |||

| A4 | 0.83 | |||

| A5 | 0.84 | |||

| A6 | 0.82 | |||

| Attitudes toward fintech chatbots | AA1 | 0.83 | 0.89 | 0.67 |

| AA2 | 0.80 | |||

| AA3 | 0.82 | |||

| AA4 | 0.83 | |||

| Continuance intention | C1 | 0.82 | 0.86 | 0.67 |

| C2 | 0.81 | |||

| C3 | 0.83 |

| Hypothesis | Analysis Results | |

|---|---|---|

| H1 | Ease of use (phase 1 time) →Attitudes toward fintech chatbots | 0.31 ** |

| H2 | Usefulness (phase 1 time) →Attitudes toward fintech chatbots | 0.29 ** |

| H3 | Pleasure (phase 1 time) →Attitudes toward fintech chatbots | 0.27 ** |

| H4 | Arousal (phase 1 time) →Attitudes toward fintech chatbots | 0.25 ** |

| H5 | Attitudes toward fintech chatbots →Continuance intention | 0.35 ** |

| Empirical Model | Explanatory Power | References |

|---|---|---|

| TAM | 34% | [10] |

| TAM | 37% | [63] |

| TPB | 37% | [64] |

| TPB | 41% | [65] |

| TRA | 20% | [66] |

| TRA | 19% | [67] |

| UTAUT | 31% | [68] |

| UTAUT2 | 44% | [69] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, S.Y.B.; Lee, C.-J.; Lee, S.-C. Toward a Unified Theory of Customer Continuance Model for Financial Technology Chatbots. Sensors 2021, 21, 5687. https://doi.org/10.3390/s21175687

Huang SYB, Lee C-J, Lee S-C. Toward a Unified Theory of Customer Continuance Model for Financial Technology Chatbots. Sensors. 2021; 21(17):5687. https://doi.org/10.3390/s21175687

Chicago/Turabian StyleHuang, Stanley Y. B., Chih-Jen Lee, and Shih-Chin Lee. 2021. "Toward a Unified Theory of Customer Continuance Model for Financial Technology Chatbots" Sensors 21, no. 17: 5687. https://doi.org/10.3390/s21175687

APA StyleHuang, S. Y. B., Lee, C.-J., & Lee, S.-C. (2021). Toward a Unified Theory of Customer Continuance Model for Financial Technology Chatbots. Sensors, 21(17), 5687. https://doi.org/10.3390/s21175687