1 Introduction

Merton’s problem of finding the optimal investment strategy in a continuous–time securities market was proposed by Merton in 1969 ([

18]). Using the technology of dynamic programming, he derived in [

18] and [

19] a non-linear PDE (Hamilton–Jacobi–Bellman equation) and produced explicit solutions for the cases of power, logarithmic and exponential utility function. Later on, the rich theory of martingales found its way into the problem, via the works of Harrison and Pliska [

9], Karatzas et al [

15] and Cox and Huang [

2]. In these works, the duality methodology of convex analysis combined with martingale technology to provide a powerful method to deal with this problem, e.g. [

10], [

15], [

3], [

16],[

20]. The main feature of the application of martingale technology to portfolio optimization is the derivation of the equivalent “dual problem”, a minimization problem over the set of martingale measures. This latter is similar to the problem of choosing the appropriate martingale measure that one faces in the problem of pricing derivative securities in incomplete markets. In fact, the intimate relation between these two problems was established by Davis [

4] by giving the investor an extremal objective in the form of a utility maximization problem. Indeed, Davis was the first to plug the derivative pricing problem for incomplete markets into a utility maximization framework to get a unique risk neutral measure (the “pricing measure”).

In recent years, there has been increased activity in extending this framework to include more general models of securities. Papers which address processes of independent increments [

8] and general semimartingales [

16],[

20] have all added to the framework.

In information theory (that part of probability theory which addresses the notion of distance between probability measures) there has been an upsurge of interest in the last decade in the concept of Hellinger processes and integrals. These processes arise from a dynamical approach to the Kakutani-Hellinger distance between two probability measures, see [

12] and [

17]. The application of Hellinger processes in mathematical finance started with the work of [

14]. Very recently, [

8] proposed the Hellinger martingale measure as an alternative to the minimal and optimal variance martingale measures for the case of processes with independent increments. In that paper, the pricing measure derived from a specific power–law utility (with exponent

p = −1) is shown to be identical to the equivalent martingale measure which is nearest to the physical measure (“real–world measure”) in the sense of the (

q = 1/2) Hellinger distance. Thus, the paper shows a link between information theory and portfolio theory for a single example of utility function.

In the present paper, we strengthen the link between information theory and portfolio theory by demonstrating that Grandits’ example can be extended to more general utility functions. Working in an exponential Lévy process market model, we show that for the most general power law utility, for the logarithmic utility, and for exponential utility, one can in each case define a process which possesses a number of properties similar to the Hellinger processes. Then the pricing measure in each case is shown to be identical to the equivalent martingale measure which minimizes the corresponding generalized Hellinger process. In the case of exponential utility, the corresponding pricing measure is the minimal entropy martingale measure which was introduced by Frittelli in [

5],[

6] (see also [

1] for related works).

The organization of the paper is as follows.

Section 2 introduces the exponential Lévy market model and provides some preliminary analysis. In

Section 3, we review Merton’s problem and its dual formulation and give an economic interpretation for the solution to this problem.

Section 4 reviews the definition of Hellinger processes and presents their defining properties. Our main contribution is in

section 5, where we define examples of generalized Hellinger processes corresponding to the three types of utility functions mentioned above, and demonstrate their relation to Merton’s problem and their desirable information theoretic properties.

2 The market model

We start with a filtered probability space

, a one–dimensional Brownian motion

W and a one–dimensional Poisson random measure

N (

dt, dy) with Lévy measure

ν(

dy). The filtration is supposed to satisfy the usual conditions by which we mean right continuity and completeness i.e.

and

where

is the set of

-measurable and

P–negligible events. We consider a financial market consisting of a risk-free asset (bank account)

B given by

where

r > 0 is a constant interest rate and a stock

S (risky asset). An ideal market is assumed in which transaction costs and liquidity effects are neglected and there are no limits on short-selling or borrowing.

The stock process

S is assumed to be governed by the following stochastic differential equation

Here

σ > 0

, b are constants and

is the compensated Poisson random measure given by

. We have denoted the indicator functions

I{y≤1},

I{y>1} by

I≤,

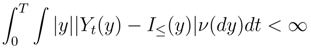

I>. We make two assumptions on the Lévy measure:

Note the first condition is a strengthening of the general condition that 1 ∧ |

y|

2 be integrable; the second condition is natural for a non–negative financial asset.

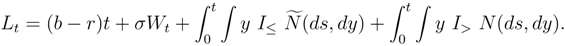

The discounted stock price

can be written as the Doléans–Dade exponential

B−1S =

S0𝜀(

L) of the following Lévy process (stationary process with independent increments)

Here 𝜀(

L) is the unique solution to the SDE

dK =

K_dL, K0 = 1. As shown in [

13],

B−1S can equivalently be expressed as the

ordinary exponential

S0 exp(

X) of a Lévy process with Lévy measure

ν′ with supp(

ν′) = (−∞, ∞).

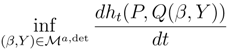

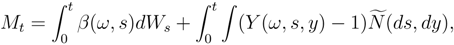

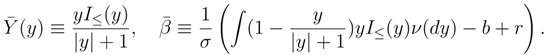

We denote by , and the spaces of all absolutely continuous local martingale measures, locally equivalent martingale measures and equivalent martingale measures respectively. The following proposition gives a representation of the density for the most general as the exponential of some (local) martingale with respect to the Brownian motion and the Poisson random measure.

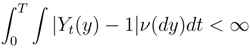

Proposition 2.1 Let Q be a probability measure absolutely continuous with respect to P with conditional density . Then- 1.

Z can be written 𝜀(

M)

for a (local) martingale of the formfor a predictable W-integrable process β and non-negative (

![Entropy 03 00150 i009]()

)

-measurable function Y (

ω, t, y)

(we will omit ω in the notation of β, Y and simply denote them by βt, Yt(

y)

; recall is the predictable σ–algebra) which satisfiesalmost surely for any T < ∞. - 2.

The following two conditions are equivalent:- (a)

- (b)

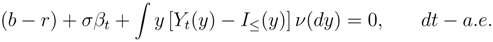

For any T < ∞, β and Y satisfy

In this paper we will focus on two restricted families of exponential martingales Z where “deterministic” martingales are defined by (2.6) with β = β(t), Y = Y (t, y) deterministic functions and “markovian” martingales are defined by (2.6) with β = β(t, Zt), Y = Y (t, y, Zt) deterministic functions.

The set

is not reduced to a singleton unless

ν is zero. Indeed, (2.9) admits an infinite number of solutions: one martingale measure can be described by

a second is given by

For each

α ∊ [0, 1], the couple

is also a solution. By the fundamental theorem of arbitrage pricing [

9] this implies that the market is incomplete and there exist payoffs (contingent claims) which cannot be perfectly replicated. One of the most important problems one faces in incomplete markets is which martingale measure to choose as pricing measure. Schweizer and Föllmer propose the minimal martingale measure [

7], others propose the variance–optimal martingale measure [

21]. In general, however, the correct approach is via utility theory, a typical problem of which is the Merton problem.

3 The Merton problem

Consider an investor who wants to invest in their wealth in this market in an optimal way over the period [0,

T]. Letting

πt, 1 −

πt be the fraction of wealth invested at time

t in the stock and bank respectively and making the usual self–financing requirement (meaning no money is withdrawn from or added to the portfolio), then the wealth process

which follows from an initial endowment

x =

X0 is given by

The investor’s tolerance of risk is quantified by a utility function

U (

x) which measures their pleasure experienced when the wealth is

x.

Definition 3.1 A utility function U is a strictly increasing, strictly concave and twice continuously differentiable real valued function defined on ![Entropy 03 00150 i009]() + such that

+ such that Remark. With the domain taken to be

![Entropy 03 00150 i010]() +

+ = [0, ∞) we have placed an extra restriction that the portfolio value may never become negative. In one example discussed in §5 we will consider a utility function supported on

![Entropy 03 00150 i010]()

.

The Merton problem for a given utility function

U and initial wealth

x is now to determine the strategy

π* to be implemented over the investment horizon [0,

T] which maximizes the expected utility of the terminal wealth

. Thus the Merton problem is to produce (if possible) the maximizer

π* amongst admissible strategies

(0

, x) for the problem

We have used the definition

Definition 3.2 A predictable process π is an “admissible trading strategy” over the period [t, T] if Xπ,x is positive –as. We denote the set of such processes by (t, x).

To study (3.11) it is useful to consider a dynamical version of the problem defined by

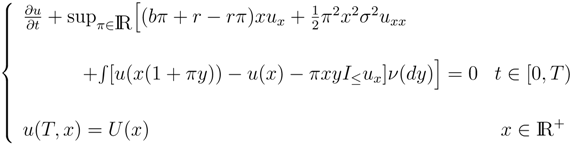

Then in the markovian setting as we have here, we are lead to study the HJB equation for

u(

t, x):

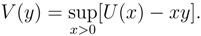

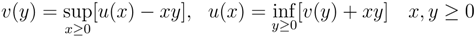

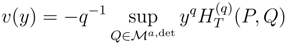

As is now well known, the so–called “primal” problem (3.11) can also be addressed by focusing on the Legendre transform

V of

U defined by

which is a strictly decreasing, strictly convex and twice differentiable function. Now one studies the “dual problem”

When a minimal

Z can be found for the dual problem, we can interpret it as the equivalent martingale measure (pricing measure) which captures the risk preferences coded into the utility function

U. Furthermore, as shown in [

16], the functions

u(

x) and

v(

y) can themselves be obtained from each other by using Legendre transform:

In this paper, we will treat the cases of exponential, power and logarithmic utility. The extension to general semimartingales for these utility functions will require a careful treatment using stochastic calculus. The extension to general utility function is also possible and will be the focus of our future work.

4 Hellinger processes and the dual problem

In this section, we review Hellinger processes and examine the role they can play in optimal problems in mathematical finance.

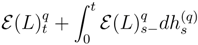

Theorem 4.1 For 0 < q < 1 and L a local martingale such that 1 + ∆

L > 0 P -almost surely, the following assertions hold.- 1.

The process 𝜀(L)q is a supermartingale;

- 2.

There exists a predictable increasing process h(q) such that andis a martingale.

Proof. The proof of this theorem is given in Theorem III.1.18 of [

12]. Note that statement (1) is a consequence of the concavity of the function

f(

y) =

yq /q and Jensen’s inequality. ☐

When Theorem 4.1 is applied to a martingale

Z of the form (2.6) for a pair

Q ≪

P, the resulting process

h(q)(

P,

Q) is called a

q–Hellinger process. The expectation

is called the

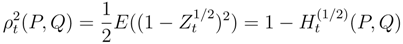

q–Hellinger integral. The particular case

q = 1/2 is related to the Kakutani–Hellinger distance

ρt between

P and

Q at time

t:

For

q ≠ 1/2,

H(q)(

P,Q) is not symmetric in

P,Q; nonetheless it can be thought of as measuring the degree of separation between measures.

In the markovian case

it can be shown that

h =

h(

t, Zt) for a bivariate deterministic function and in the completely deterministic case

h=h(

t) is a deterministic increasing function of

t alone. When

note that the Hellinger integral is given by

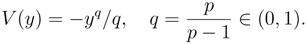

Now we consider the Merton problem for the power utility function

U (

x) =

xp/p with

p < 0. Its Legendre transform is given by

For this utility, the dual Merton problem (3.15) can be rewritten in terms of the

q–Hellinger integral:

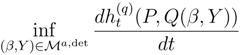

General theory implies that the optimizer for (4.20) in our Lévy market will be deterministic and thus can be found by solving

Theorem 4.2 In the Lévy market model described above with q ∈ (

0, 1)

, the pair (

β,Y)

solves (4.21) if and only if it solvesfor all t ∈ [0,

T].

Proof. From (4.18), it follows that

Ht = exp(−

ht). Then we derive

☐

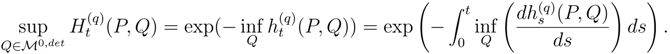

Remark. The problem of (4.22) is solved independently for each value of t and determines (β,Y) at that time. Thus we see that the optimal martingale measure is that which minimizes the relative rate of decrease of the Hellinger integral at every instant of time. Put another way, we see that the Hellinger process measures the rate that Q moves away from P, and the optimal martingale measure is that Q for which this rate is minimized at each instant of time.

A direct calculation using the generalized Ito formula [

11] leads to an explicit formula for the Hellinger process

5 Generalized Hellinger processes

We now show that much of the previous section remains true for more general concave functions of the density process

Zt defined by the pair

Q ≪

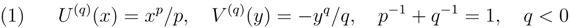

P. We consider the three important special cases of utility functions and their Legendre transforms:

Remark: The third is called the “‘entropy” case : Note that in this case the domain of

U is

![Entropy 03 00150 i010]()

, and

V is no longer a decreasing function.

We shall now define generalized Hellinger processes which correspond to these three utility functions. They are predictable increasing processes which can be written as the integral of a positive deterministic function when

. Furthermore, exactly as in the previous section they lead to the solution of the deterministic dual problem (3.15) defined by the given utility function.

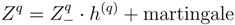

Case of

q < 0: Now we notice that

Zq is a positive sub–martingale which can be decomposed uniquely into

where

h(q) is an increasing predictable process we will call the

q–Hellinger process of order

q < 0. The explicit formula for

h(q) is

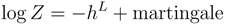

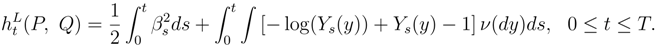

Logarithmic case: Here there is a unique increasing predictable process we will call the log–Hellinger process, or

hL, such that

It is given by

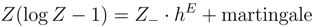

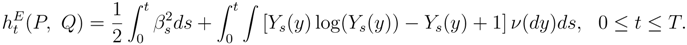

Entropy case: The entropy-Hellinger process

hE is defined by the decomposition

and is given explicitly by

With these new definitions, we see a clear relation with the Merton problem for the corresponding utility.

Theorem 5.1 In each of the three problems described above, the pair (

β,Y)

solves (3.15) if and only if it solvesfor all t ∈ [0,

T].

Proof. We need only reproduce the proof of Theorem 4.2 ☐

)-measurable function Y (ω, t, y) (we will omit ω in the notation of β, Y and simply denote them by βt, Yt(y); recall is the predictable σ–algebra) which satisfies

almost surely for any T < ∞.

+ such that

+ such that + = [0, ∞) we have placed an extra restriction that the portfolio value may never become negative. In one example discussed in §5 we will consider a utility function supported on

+ = [0, ∞) we have placed an extra restriction that the portfolio value may never become negative. In one example discussed in §5 we will consider a utility function supported on  .

.

, and V is no longer a decreasing function.

, and V is no longer a decreasing function.