1. Introduction

Since Markowitz (1952) [

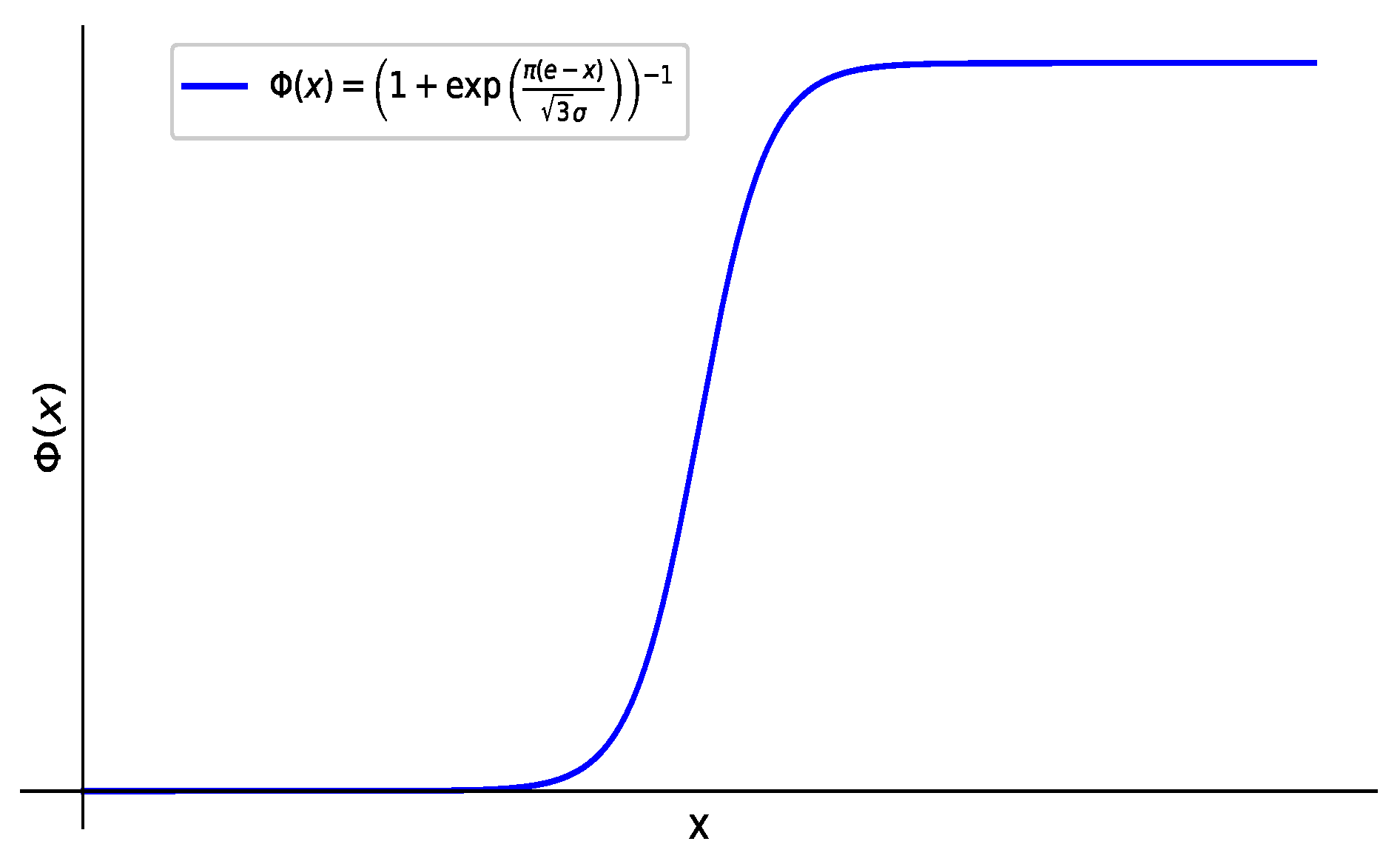

1], the mean-variance model was introduced, and portfolio theory has become central to finance. This model provides a framework for balancing returns and risks in asset allocation. However, practical applications [

2] reveal challenges: Michaud (1989) [

3] highlighted its sensitivity to input parameters, while Kanaparthi (2024) [

4] demonstrated how uncertainty affects its out-of-sample performance. Recent studies have integrated fuzzy and uncertainty theories to improve the model. For example, Gong et al. (2022) [

5] proposed a multi-period model using consistent fuzzy numbers, but these models often overlook investor preference complexity. Zadeh’s fuzzy set theory (1965) [

6] addresses uncertainty but struggles with multi-objective decision making. Liu and Liu’s (2010) [

7] uncertainty theory offers tools for linguistic fuzziness, providing insights into portfolio optimization.

The main challenge of existing models is the insufficient characterization of investor preference uncertainty [

8,

9,

10]. These models typically assume definite or fuzzy preferences, whereas real-world investor preferences are often uncertain, especially in complex market environments. Tversky and Kahneman’s heuristic method (1974) [

11] reveals systematic biases in judgment under uncertainty, and their prospect theory (1979) [

12] highlights differences in risk preferences when facing gains versus losses. Secondly, the complexity of multi-objective decision making increases the difficulty of model design. In multiobjective portfolio selection, how to balance goals such as mean, variance, skewness, and liquidity remains a challenge. Although the multi-objective portfolio selection model based on the cloud model proposed by Gong et al. (2021) provides flexibility, it still has deficiencies in dealing with complex preference relations [

13]. Finally, the consistency problem in group decision making has not been effectively solved. Although the group decision-making method based on additive consistency and sequential consistency proposed by Chen et al. (2014) improves the defects of the Lee method, it still has limitations in dealing with uncertain preference relations [

14].

In order to address the above challenges, it is necessary to establish a new portfolio model, particularly one that considers the normal uncertain preference relation of investors. The normal uncertain preference relation reflects investor decision making under uncertainty, especially in complex market environments. It accurately characterizes risk preferences and expected returns, enhancing model practicability and robustness. For instance, Guo et al. (2024) [

15] combined fuzzy preference relations with portfolio theory, proposing a model that demonstrates high robustness to distance thresholds and consistency indices. Additionally, new models require efficient consistency measurement methods for multi-objective and group decision making to ensure reliability and accuracy.

Wang and Xu (2015) [

16] introduced extended hesitant fuzzy linguistic preference relations for visual consistency interpretation, while Liu et al. (2015) [

17] developed a multiplicative consistency test method for hesitant fuzzy preference relations, improving accuracy and reliability. These studies [

18,

19] provide valuable references for handling complex preference relations, but further research is needed on integrating the normal uncertain preference relation into multiobjective portfolio models.

In existing studies, the portfolio optimization model based on uncertain yield proposed by Li et al. (2022) [

20] combines prospect theory with the perspective of expected utility maximization and designs an improved gray wolf optimization algorithm (GWO), verifying its superiority in solving complex non-smooth and non-concave problems. However, these models [

21,

22,

23] still rely on traditional fuzzy theory when dealing with investor preference relations, failing to fully depict the uncertainty of these relations. Furthermore, the portfolio selection model based on Z-number theory and fuzzy neural networks proposed by Ghahtarani (2021) [

24] performs better than traditional models under bubble conditions, but its application in multi-objective decision making and group decision making still requires expansion. The portfolio selection model based on the difference between the fundamental value and the market value of assets proposed by Lv et al. (2024) [

25] integrates the Z-number theory to handle uncertainty of the data, offering solutions closer to the actual market conditions. Its consistency measurement method in group decision making requires improvement. While existing models have progressed in handling uncertainty and multiobjective decision making, they still struggle to accurately depict investors’ normal uncertain preference relations.

By introducing the normal uncertain preference relation, the new portfolio model effectively reflects investor behavior under uncertainty, particularly in complex markets. Consider multiple objectives such as mean, variance, skewness, and liquidity, while providing flexibility through compromise programming. An improved consistency measurement method addresses individual preference inconsistencies, improving the reliability of the decision. For example, Gong et al. (2020) [

26] introduced linear uncertain preference relations (LUPRs) to address global complementarity and consistency challenges. Fuzzy interval preference relations (IFPRs) play a crucial role in improving group decision-making processes. Future research could explore normal uncertain preference relations in financial decisions and improve model accuracy with machine learning. Nozarpour et al. (2023) [

27] developed a multi-period stock portfolio model that considers transaction costs and correction time periods, better reflecting real market conditions. Furthermore, Avramov et al. (2022) [

28] examined the impact of uncertainty about ESG on asset pricing, offering new research directions. These studies contribute to a more comprehensive portfolio model and provide practical tools for investors.

This paper proposes a new portfolio model with normal uncertain preference relations to more accurately describe investors’ decision-making behavior under uncertainty. Compared with existing models, this model handles uncertain preference relations and multiobjective decision-making problems more effectively, improves group decision-making reliability and accuracy through an enhanced consistency measurement method, and provides a practical tool for investors to make scientific decisions in complex market environments. Future research can explore the application of normal uncertain preference relations in other financial decisions.

The paper is structured as follows.

Section 2 introduces uncertainty theory and defines preference relations.

Section 3 formulates uncertain preference relations and their additive consistency.

Section 4 develops a weight derivation model for the NUPR.

Section 5 demonstrates the methodology with an empirical case of China’s SSE 50 index.

Section 6 concludes and outlines future research directions.

5. Empirical Analysis

In this section, the effectiveness and efficiency of the proposed model were tested by selecting different numbers of stocks from various industries included in the SSE 50 Index.

5.1. Data Preprocessing

In this section, the core objective of the data preprocessing stage is to screen and optimize stock samples according to the goals of the investment portfolio, ensuring that the selected stocks can effectively verify the applicability and reliability of the model. During the preliminary analysis phase (as shown in

Section 5.2 and

Section 5.3), we selected four stocks for the experiment. 600028 represents the refining and chemical industry, 600089 represents power transmission and transformation equipment, 601398 represents large state-owned banks, and 601628 represents insurance. The main reasons for this selection are to simplify the model and enhance the feasibility of the experiment. Firstly, a smaller-scale stock portfolio facilitates in-depth analysis. Especially in the initial research stage, the selection of four stocks makes the model’s calculation and analysis more concise and clear. Secondly, this selection takes into account industry representativeness, ensuring that it covers the characteristics of different industries. This enables the research to compare the performance of stocks across industries and further verify the risk and return relationships of the model among different securities.

After completing the preliminary experiments on four stocks, in order to further verify the effectiveness of the model and enhance the universality of the experimental results, we decided to expand the sample to 16 stocks (as shown in

Section 5.4). This decision was based on two main factors. Firstly, expanding the sample size can provide richer experimental data, which helps to improve the robustness of the model results. Secondly, the increased stock samples can cover a wider range of industries and market backgrounds, thereby enhancing the exploration of the risk-return relationship of different securities. During the data preprocessing process, we first screened the constituent stocks of the SSE 50 Index. Since some companies had situations such as mergers, suspensions of trading, or delistings, which made it impossible to obtain complete historical data, we excluded these stocks. Then, considering the goal of maximizing the return of the investment portfolio, we removed the stocks with negative expected returns. Finally, 20 stocks remained. To further optimize the industry representativeness and risk-return characteristics of the sample, we selected a representative single stock from each industry to ensure that stocks with higher returns were chosen at the same risk level. Eventually, 16 stocks that met the research objectives were obtained, as shown in

Table 1.

5.2. Background Description and Parametric Assumptions

This section presupposes that an individual is ready to allocate funds into a portfolio consisting of four securities. To facilitate the process, we have opted for four stocks from diverse sectors within the SSE 50 index as potential investment options. The securities codes are Sinopec (600028), TBEA (600089), ICBC (601398), and China Life Insurance (601628). Labeled (i.e., ), the weekly closing prices of these four securities from April 2021 to March 2024 are obtained, and their expected returns are calculated.

We calculated the expected rate of return of securities for four

, as well as the matrix

that represents the relationship between them.

In behavioral finance, investor preferences are influenced not only by rational economics, such as Markowitz’s mean-variance theory, but also by psychological factors and behavioral biases. By considering factors in behavioral finance like investor risk aversion, loss aversion, and expected return, we can construct a matrix of potential uncertain preference relations for investors. For instance, when faced with uncertainty, investors tend to rely on familiar stocks within their own industry or those they have previously purchased.

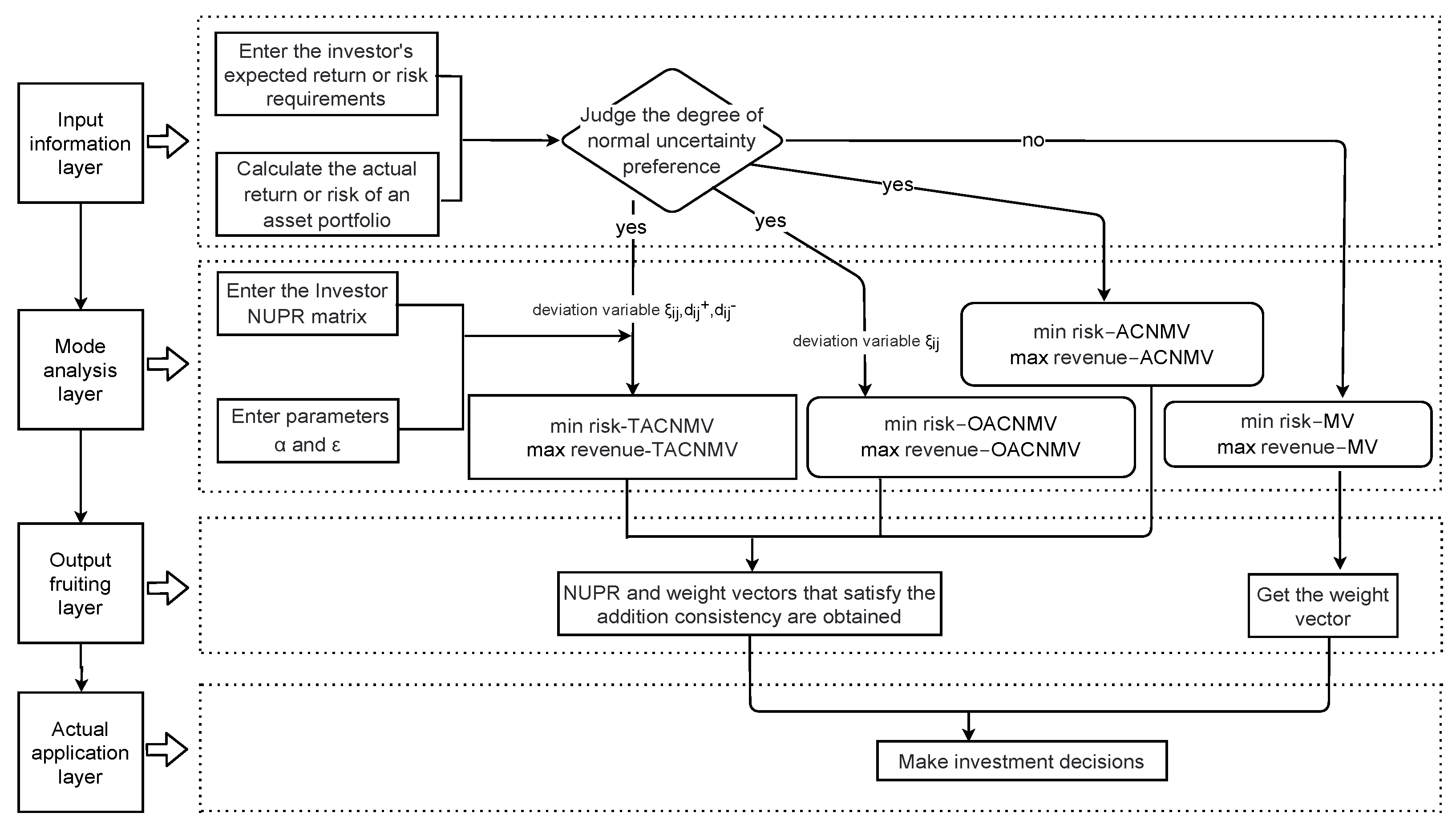

5.3. Comparison of Results and Sensitivity Analysis—Using the Risk Minimization Model as an Example

The paper proposes the ACNMV model as shown in Equation (

53), the OACNMV model as given in Equation (

55), and the TACNMV model as presented in Equation (

57) for the classical MV portfolio model, aiming to minimize investment risk while ensuring a constant return rate or a minimum threshold. However, the OACNMV model incorporates chance constraints for the NUPR

Z that satisfy additive consistency, whereas the TACNMV model introduces subdivision bias variables as an enhancement over the OACNMV model. A comparative analysis of these three models is conducted. With

and

set,

Table 2 presents the results obtained from these models.

The weight vectors adopted in the example (

Section 5.2) are derived from the optimization frameworks of the MV, ACNMV, OACNMV, and TACNMV models, each minimizing portfolio risk under distinct constraints. For the MV model, weights are determined by solving a quadratic program with expected return and budget constraints. The ACNMV model extends this by enforcing additive consistency on the NUPR matrix

Z, while the OACNMV and TACNMV models further incorporate chance constraints and subdivision bias variables, respectively. The consistency of these weights is validated by: (a) ensuring numerical stability via symmetric covariance matrices (e.g.,

); (b) verifying feasibility of the target return

within the range of asset returns; and (c) confirming non-negativity and unit-sum constraints. The results in

Table 2 reflect these rigorous computations, with risk values (

) demonstrating the trade-offs between model complexity and risk minimization.

Table 2 demonstrates significant disparities in asset weight allocation and portfolio risk across various portfolio optimization strategies. Firstly, the minimum variance portfolio (MV) represents a classical approach aimed at minimizing overall portfolio risk by appropriately distributing asset weights. In this strategy, the weight of asset

is zero, indicating that without any additional constraints,

does not significantly contribute to the optimal combination of risks or may be excluded due to its risk characteristics. However, with the implementation of constrained optimization portfolios (such as ACNMV, OACNMV, TACNMV), the weight of

notably increases to 0.1456. This adjustment can be interpreted as a result of introducing specific constraints such as tail risk management, liquidity requirements, or individual asset limits into the portfolio optimization model, which prompts a reassessment of

’s importance. The weights assigned to other assets like

, and

are also slightly modified in order to meet new optimization conditions and achieve an enhanced balance between risk and return.

The introduction of the constraint reduces the overall portfolio risk from 0.0006 to 0.0005, and although this change may seem marginal, it has a positive impact on long-term cumulative returns in large portfolios due to its magnitude of risk reduction. This phenomenon highlights the essential role that optimization constraints play in risk management. By integrating more advanced optimization methods, our enhanced strategy provides better risk control than traditional MV portfolios while improving adaptability and stability across various market conditions.

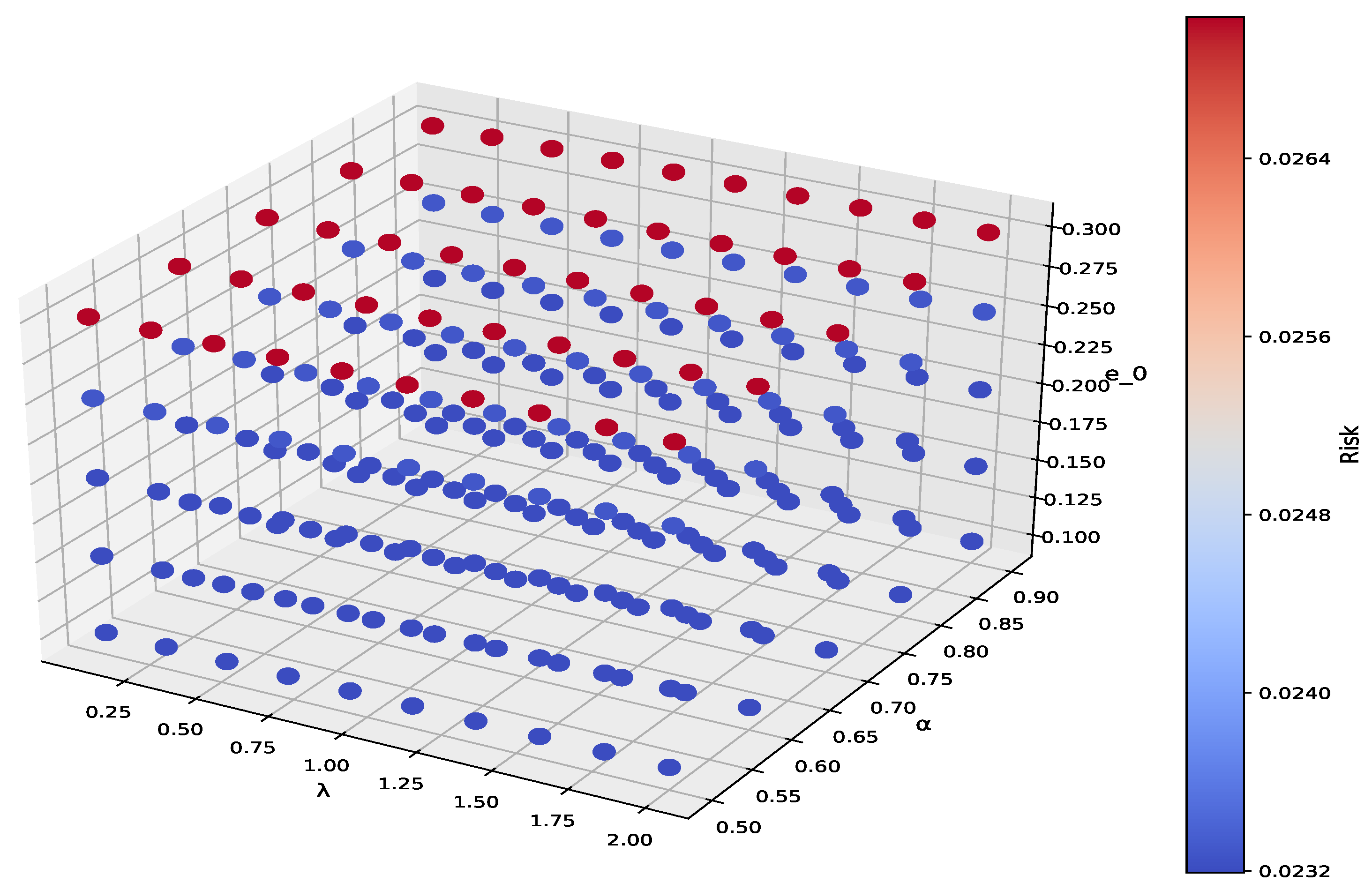

Figure 4 demonstrates a sensitivity analysis of our proposed model.

The findings are applicable to

,

, and

. The models ACNMV, OACNMV, and TACNMV represent the primary models proposed in this paper and incorporate all three parameters. Consequently, they are now subjected to a sensitivity analysis. In relation to this matter,

Figure 4 demonstrates the minimum risk values across various

and

.

The sensitivity analysis of this code demonstrates the volatility of portfolio risk under different parameter conditions. In the study, key parameters like risk aversion coefficient , reliability level , and target return threshold were adjusted to analyze their effects on portfolio risk. Results show that lower risk aversion and higher return targets increase volatility, while higher risk aversion and lower reliability reduce risk. Investors should adjust these parameters based on their risk tolerance and return goals to optimize their strategy. Balancing risks and benefits improves decision making.

5.4. Out-of-Sample Validation and Model Expansion

This section assumes that investors are ready to allocate funds to an investment portfolio consisting of 16 securities. As shown in the method of selecting out-of-sample data in

Section 5.1, we selected 16 stocks from different sectors of the SSE 50 Index as potential investment options. The security codes are 600028, 600050, 600089, 600111, 600150, 600406, 600690, 600809, 600900, 601225, 601398, 601628, 601668, 601669, 601899, and 601919. These 16 securities are labeled as

,

, …,

(i.e.,

). We obtained their weekly closing prices from April 2021 to March 2024 and calculated their expected returns.

To verify the out-of-sample data stability of the ACNMV model, OACNMV model, and TACNMV model proposed in this paper, the experimental parameter settings are kept consistent with those in

Section 5.2. The aim is to minimize the investment risk while ensuring a constant rate of return or reaching the minimum threshold.

Table 3 presents the results obtained from these models, and a comparative analysis of these three models is carried out.

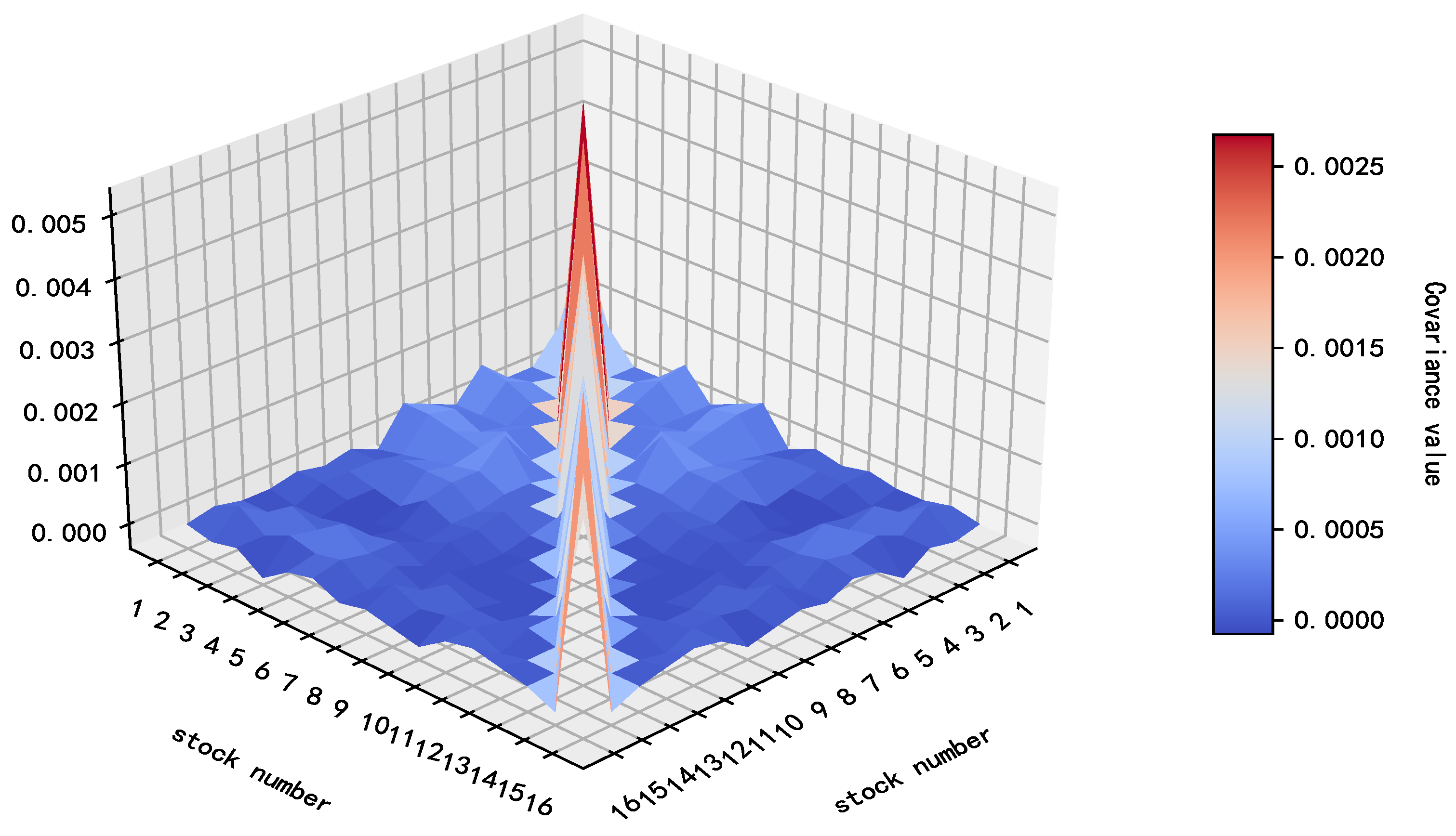

The expected returns of 16 securities are

, and the matrix representing the relationships among them (as shown in

Figure 5) is

.

Based on the out-of-sample analysis in

Table 3, this study examines asset allocation and risk performance under various portfolio optimization strategies. The results show that adding constraints alters the asset weight distribution and improves the portfolio risk structure. Specifically, in the traditional mean-variance portfolio (MV), the weight of asset

is zero, indicating its low contribution to risk minimization without constraints. However, in constrained strategies (ACNMV, OACNMV, TACNMV),

’s weight increases to 0.0285–0.0286, highlighting the significant impact of constraints on asset selection. These strategies incorporate non-traditional factors such as tail risk and liquidity, allowing assets excluded by MV to gain meaningful weights.

Further analysis shows that the constrained optimization strategy adjusts asset weights differently. High-risk asset , already weighted at 0.1483 in the MV strategy, increases to 0.1891 in the constrained strategy, a 27.5% rise. Conversely, asset decreases from 0.0198 in the MV strategy to zero in the constrained strategy. This asymmetry confirms that constrained optimization involves more than simple weight redistribution. Notably, all constrained strategies (ACNMV, OACNMV, TACNMV) yield nearly identical weight configurations (with differences under 0.0001), demonstrating stability in asset selection under various constraints.

From the perspective of risk indicators, the constrained strategy offers significant advantages. The total portfolio risk decreases from 0.000263 under mean-variance (MV) to 0.000191–0.000192 under the constrained strategy, a relative reduction of 27.2%. In financial practice, this is equivalent to an annualized risk reduction of approximately ¥272,000 for a ¥1 billion portfolio. Risk reduction occurs primarily through two mechanisms: excluding extreme risk assets and optimizing the covariance structure among assets. Out-of-sample tests confirm that the constrained optimization strategy reduces risk levels while maintaining portfolio stability, providing empirical support for institutional investors in complex market environments.