Algorithmic Approaches for Assessing Multiscale Irreversibility in Time Series: Review and Comparison

Abstract

1. Introduction

2. Methods

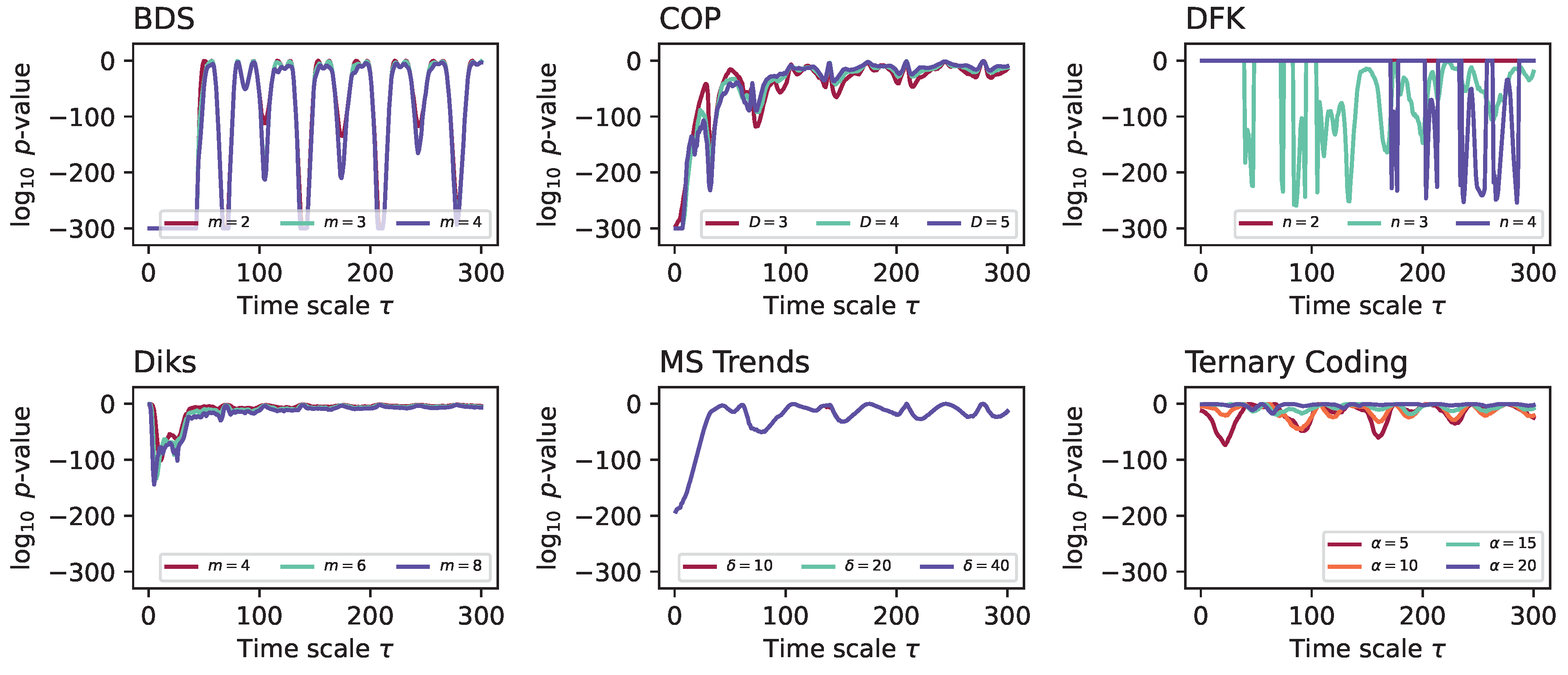

2.1. Irreversibility Tests

- BDS. Brock, Dechert and Scheinkman [40,41,42] proposed a test for low-dimensional chaos based on the calculation of the statistics:with being a time series of T observations, is the sample correlation integral at embedding dimension m and scaling parameter r, and is the estimated standard deviation of the statistic under the null hypothesis of independent data. Under such hypothesis, is distributed asymptotically as . Note that this null hypothesis implies both the absence of low-dimensional chaos, and, relevant for this work, of time asymmetrical dynamics.

- COP. Continuous Ordinal Patterns [43] (COPs in short) are an evolution of permutation patterns (which will be described below) that allow the seamless integration of the amplitude of the time series into the analysis, hence addressing one of the main limitations of the latter ones [44,45]. Given a COP and a sub-window of the time series, a distance between both is calculated. When this process is repeated over the whole time series, the distributions of for the original and time-reversed time series are expected to be the same in the case of time reversible processes; hence, irreversibility can be tested, e.g., through Kolmogorov–Smirnov two-samples test on the two distributions.

- Costa Index. This test was originally proposed as a description of heartbeat dynamics, but later found general applicability [46]. It is based on the comparison of the number of instances in which the time series increases or decreases, i.e., vs. , which are expected to be similar in a time series that is time-reversible. A p-value is obtained by comparing the difference in the number of such instances with that expected in surrogate versions of the original time series.

- DFK. This test, introduced by Daw, Finney, and Kennel (hence the acronym) [47], is based on partitioning the time series in n equiprobable regions, with each one represented by a symbol, for then mapping each time series’ value into one of them. Next, groups of L consecutive symbols are merged together to create “words”. Irreversibility is finally assessed by comparing the probability of appearance of each word in the original and time-reversed time series, normally using a test.

- Diks. The Diks’ irreversibility test is based on evaluating whether two sets of vectors, extracted from the original and time-reversed time series, correspond to the same multi-dimensional probability distribution [48]. Specifically, vectors representing subsets of the original time series are extracted, usually non-overlapping sub-windows of embedding dimension m and with an embedding delay ; afterwards, the distance between these and their time-reversed counterpart is evaluated. As a final step, the resulting distances are compared with an unbiased estimator under the null hypothesis of independence.

- Local CC. Along with the Visibility Graph method (see below), this test is based on representing time series as complex networks [49], i.e., graphs composed of nodes that correspond to individual data points, pairwise connected when the underlying values fulfil some geometrical rules [50]. In the simplest case, links can be created whenever the line connecting the values corresponding to two nodes is not obstructed by another intermediate point; in other words, when values “can see each other”. The result is called directed Horizontal Visibility Graph (dHVG) [50]. Once such a network is created, it can be analysed in several ways. As proposed in Ref. [51], a possibility is to compare the retarded and advanced local clustering coefficients, i.e., the propensity of the network to form triangles, respectively, backward and forward in time. These two sets of values are then transformed into a p-value using a Kolmogorov–Smirnov two-samples test.

- MS Trends. This test is based on micro-scale trends, i.e., the slopes of linear fits (or the highest-degree coefficients in polynomial fits) obtained for small overlapping sub-windows of the original time series [52]. As reversing the arrow of time of a series results in a change in the sign in the slope, i.e., from to , a sufficient requirement for time irreversibility is to observe a probability distribution of the slopes not symmetrical with respect to zero. This can easily be tested through a Kolmogorov–Smirnov test. The parameters of the analysis are the length of the sub-windows, and the degree d of the polynomial fit.

- Permutation patterns. Family of tests based on the symbolisation of a time series using permutation patterns, i.e., the rank sequences corresponding to short sub-windows of size D of the original series [53,54,55]. The resulting symbol frequencies are then analysed to detect time asymmetries, or deviations with respect to what is observed in the surrogate time series. Many similar tests have been proposed, mostly varying in the way the statistical significance is calculated [56,57,58,59,60]. We here specifically consider what is proposed in Ref. [56], involving the calculation of the difference in the frequencies of each pattern and of its time-reversed version, and the evaluation of the statistical significance of such a difference through a binomial test.

- Pomeau. One of the first tests proposed to detect irreversibility in a time series (see also [17,61]) was introduced by Yves Pomeau in 1982 [1]. It is based on calculating a time-asymmetric function on the data, defined as follows:with being a lag constant here, set to 1. The obtained value of is then compared to what was obtained in a large set of surrogate time series, in order to obtain an approximated p-value.

- Ramsey. James B. Ramsey and Philip Rothman proposed a test for irreversibility based on the comparison of the method-of-moments estimators of two sample bicovariances [62], respectively, given by the following:Here, T is the total length of the time series, and k is a parameter defining the lag— i.e., not dissimilar from the in the Pomeau’s test. When the time series under analysis is time-reversible, the difference between and tends to zero; hence irreversibility can be evaluated using a t-test.

- Skewness. This test, initially proposed by Demetris Koutsoyiannis in Ref. [63] and subsequently extended in Ref. [64], is based on considering the original time series and its differenced version . The skewness (i.e., the degree of asymmetry in the distribution) of these two time series is calculated, respectively denoted as and ; finally, a time-irreversibility index is defined as . As discussed by the authors, a large positive value of a denotes a large time asymmetry. This index is further compared to what obtained with a large set of surrogate time series to obtain a p-value.

- Ternary Coding. Conceptually similar to several other tests here discussed, most notably the Permutation Patterns’ one, this test is based on symbolising the values of the time series, for then evaluating the difference in their frequency under a time-reversal operation [30]. Specifically, a time series is differentiated as , and transformed according to:Note that here is calculated from the data distribution through its percentile; hence, a value of implies that the largest values are encoded with a 1 symbol. The full test is performed by splitting the original time series into D non-overlapping segments, and by evaluating if the frequency of the 1 and symbols is statistically different across them.

- TP Length. This test leverages the idea of trend patterns [65], i.e., sequences of consecutive values in the time series with a monotonous trend—either increasing or decreasing. Given a time series, this can be divided in trend patterns, and subsequently their length can be encoded in a probability distribution. As a final step, the length distribution of the original and time-reversed time series are compared, as these should be equal in a time reversible dynamics.

- Visibility Graph. Original irreversibility test [66] based on the analysis of the directed Horizontal Visibility Graph (dHVG) [50]—see the description for the local CC. In this case, a time series is classified as irreversible if the distributions of the number of links arriving at and departing from nodes (known, respectively, as the in- and out-degrees) are different in a statistically significant way, e.g., according to a Epps–Singleton test [67].

- Zumbach. In the original Ref. [68], Gilles Zumbach proposed several tests to detect time irreversibility in a financial time series; in spite of the very field-specific initial definition, they have been found useful outside their initial scope. The one considered here starts by transforming the original time series into a time series of returns, i.e., . Next, at each time t, two volatilities are calculated: a first one, called historical, with over all values between and t; and a second one, called realised, in the future data from ( being called the granularity) to . The volatility is simply defined as the sum of the square of values in the considered time window. Note that, from the point of view of a value at time point t, these correspond to the past and future volatilities, and should therefore be equal under a time-reversal operation. Such equality, for all values of t, is finally tested using a two-sample Kolmogorov–Smirnov test.

| Test Name | Reference | Parameters |

|---|---|---|

| BDS | [40,41] | , |

| COP | [43] | |

| Costa Index | [46] | - |

| DFK | [47] | , |

| Diks | [48] | , |

| Local CC | [51] | - |

| MS Trends | [52] | , |

| Permutation patterns | [56] | |

| Pomeau | [1] | |

| Ramsey | [62] | |

| Skewness | [63] | - |

| Ternaty Coding | [30] | |

| TP Length | [65] | - |

| Visibility Graph | [66] | - |

| Zumbach | [68] | , |

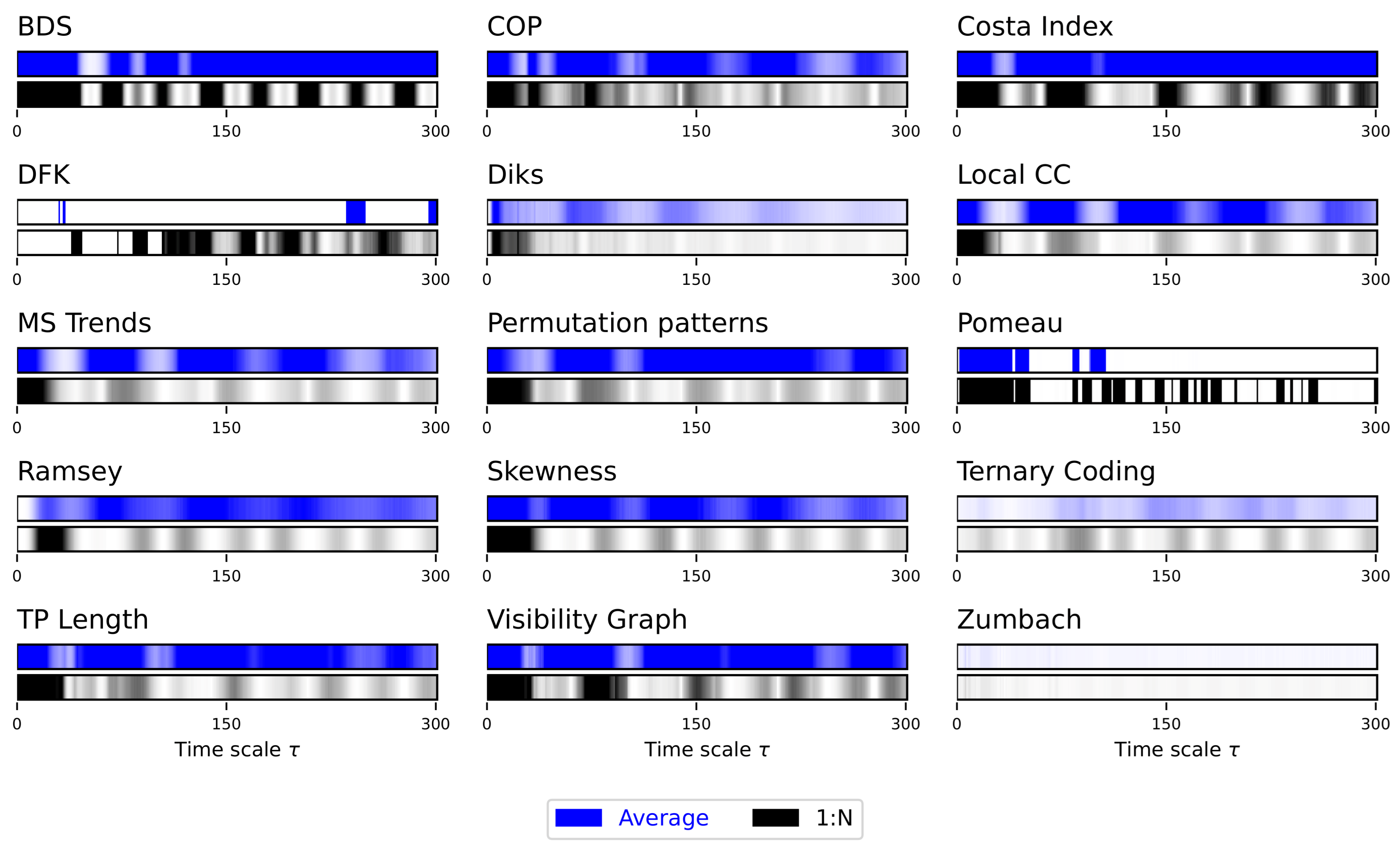

2.2. Downsampling Algorithms

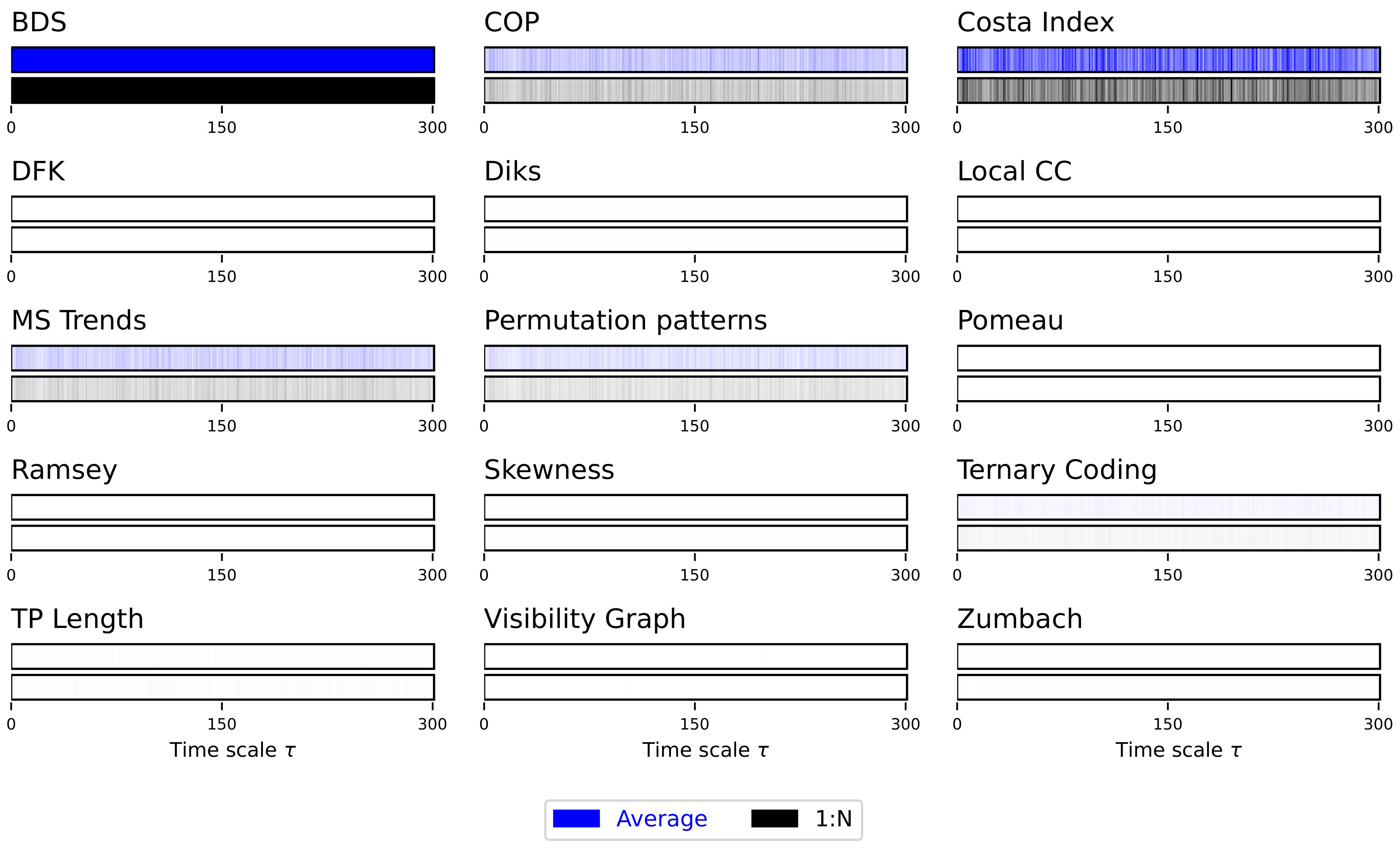

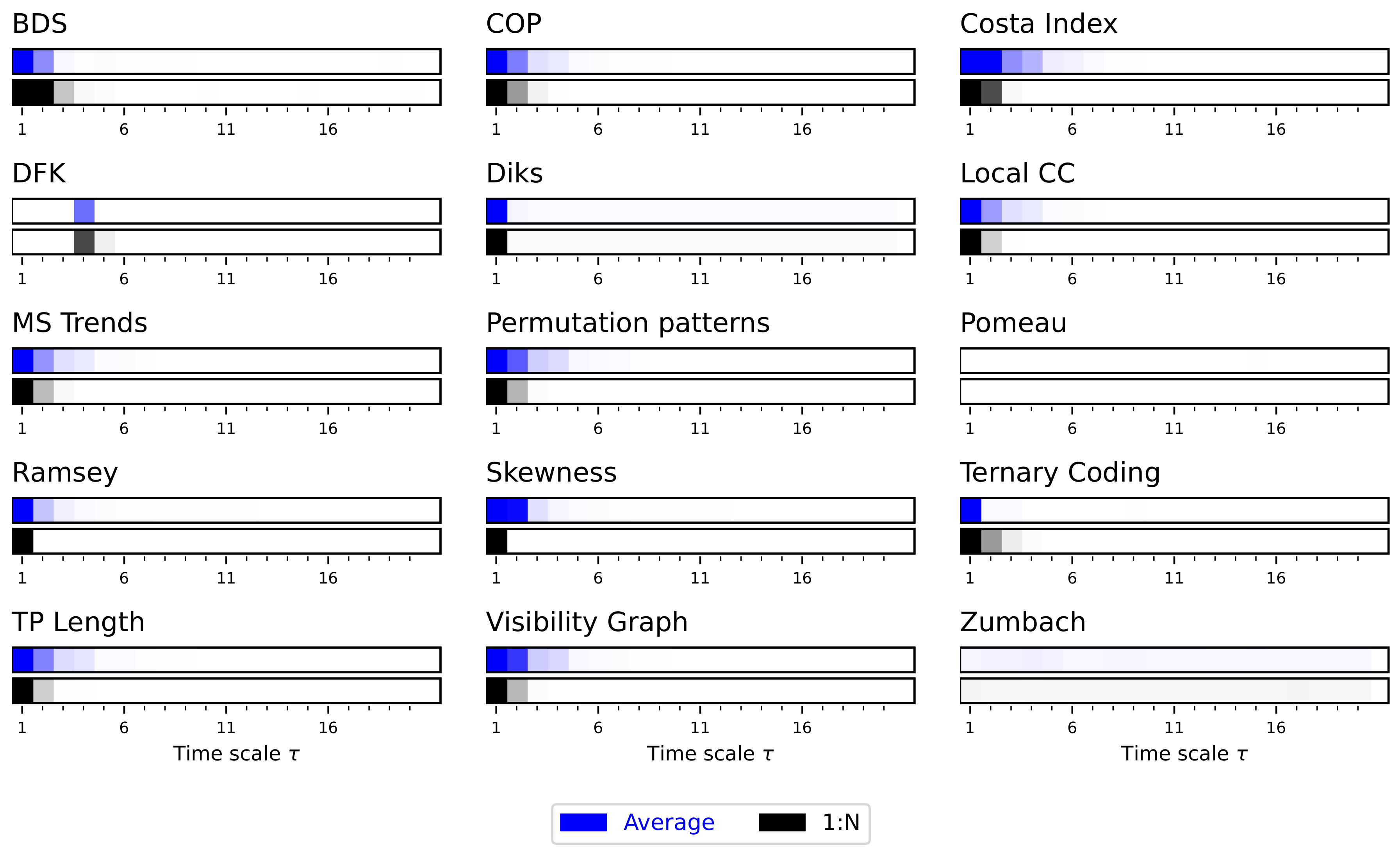

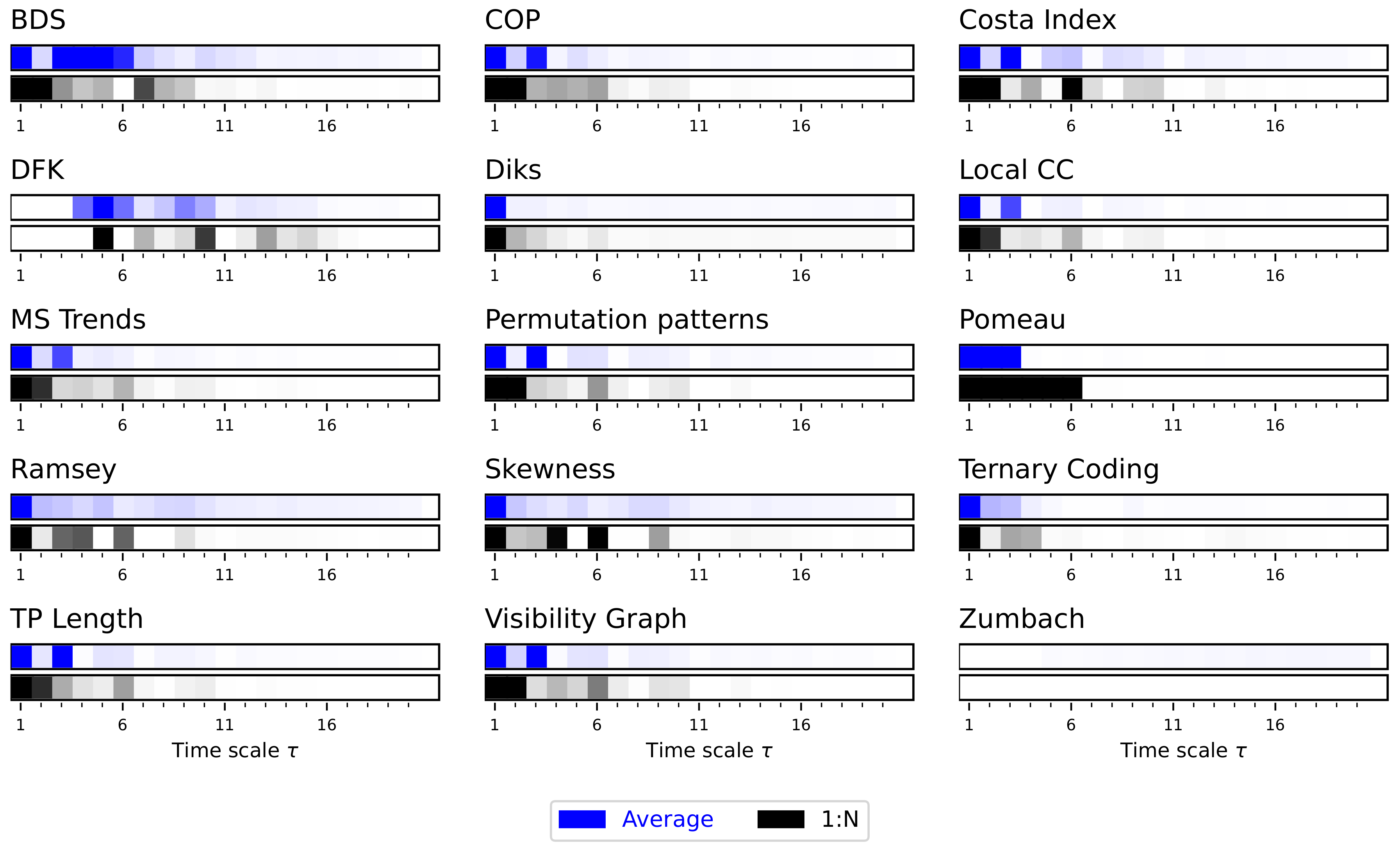

- 1:N downsampling: , i.e., one every elements are retained.

- Average downsampling: . As the name implies, the new values correspond to the average of non-overlapping windows of size of the original time series.

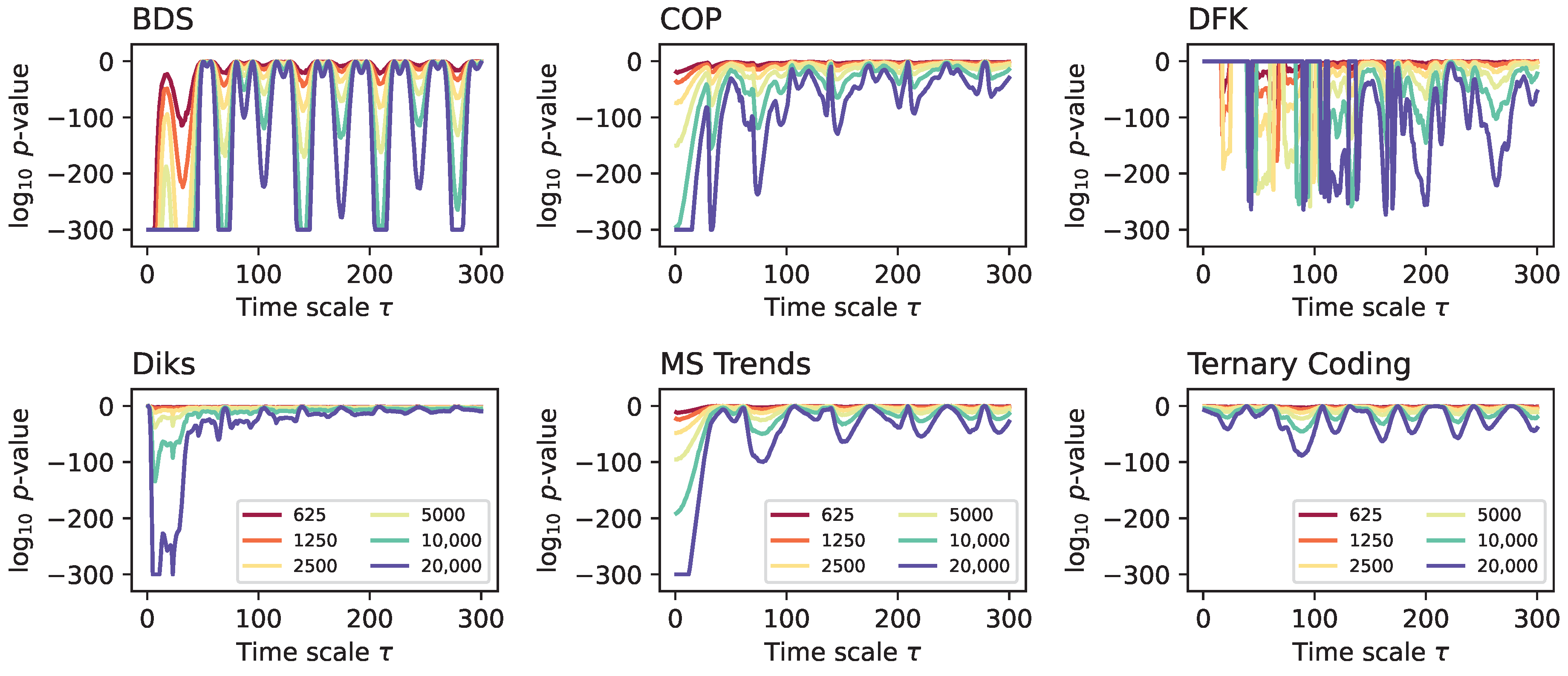

2.3. Evaluating Statistical Significance

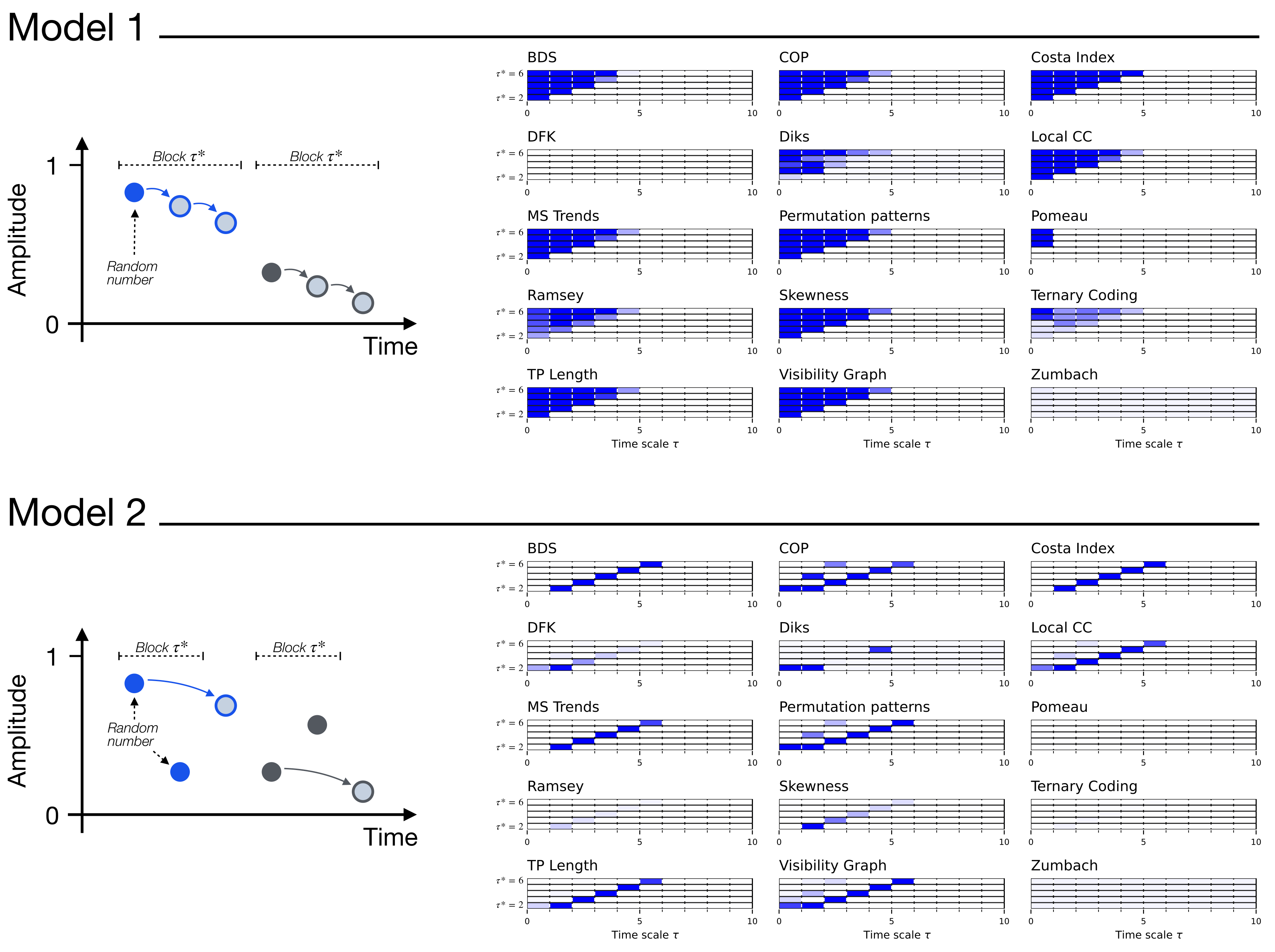

3. A Synthetic Model for Multiscale Irreversibility

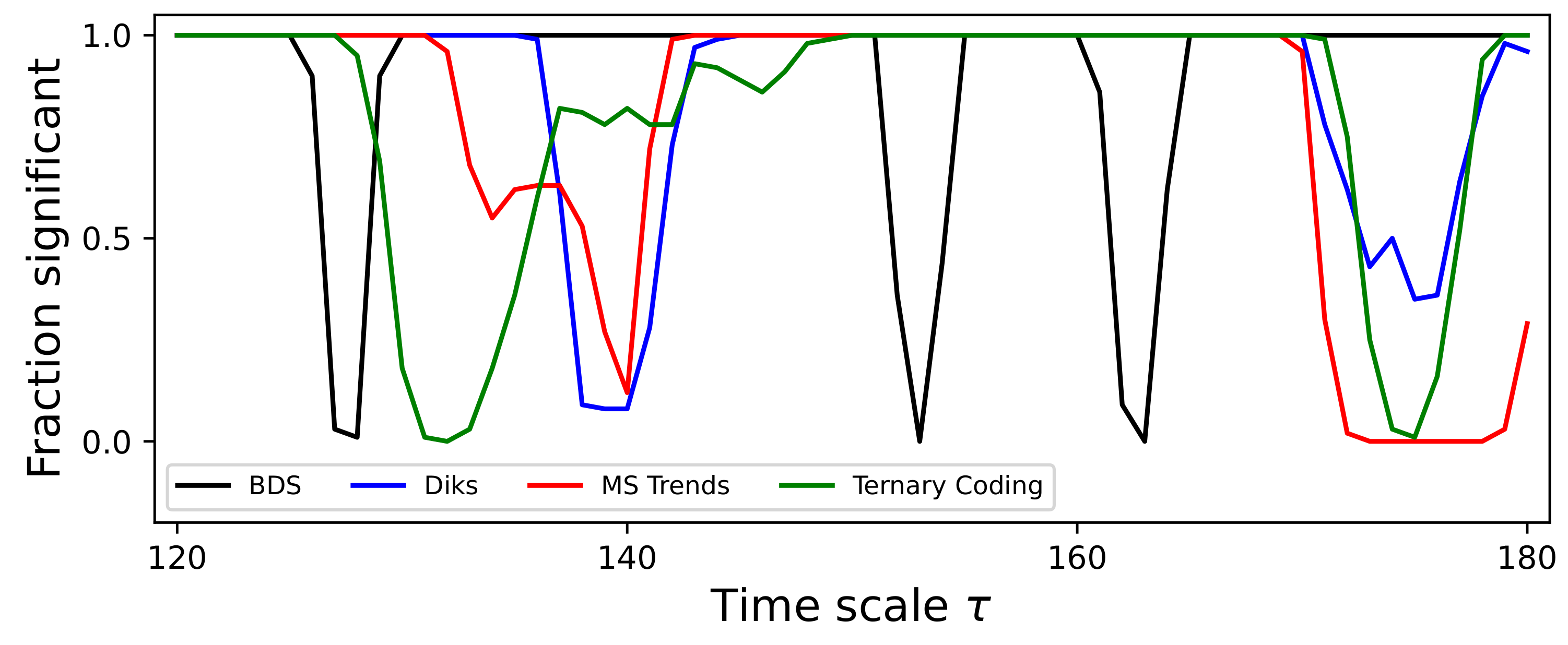

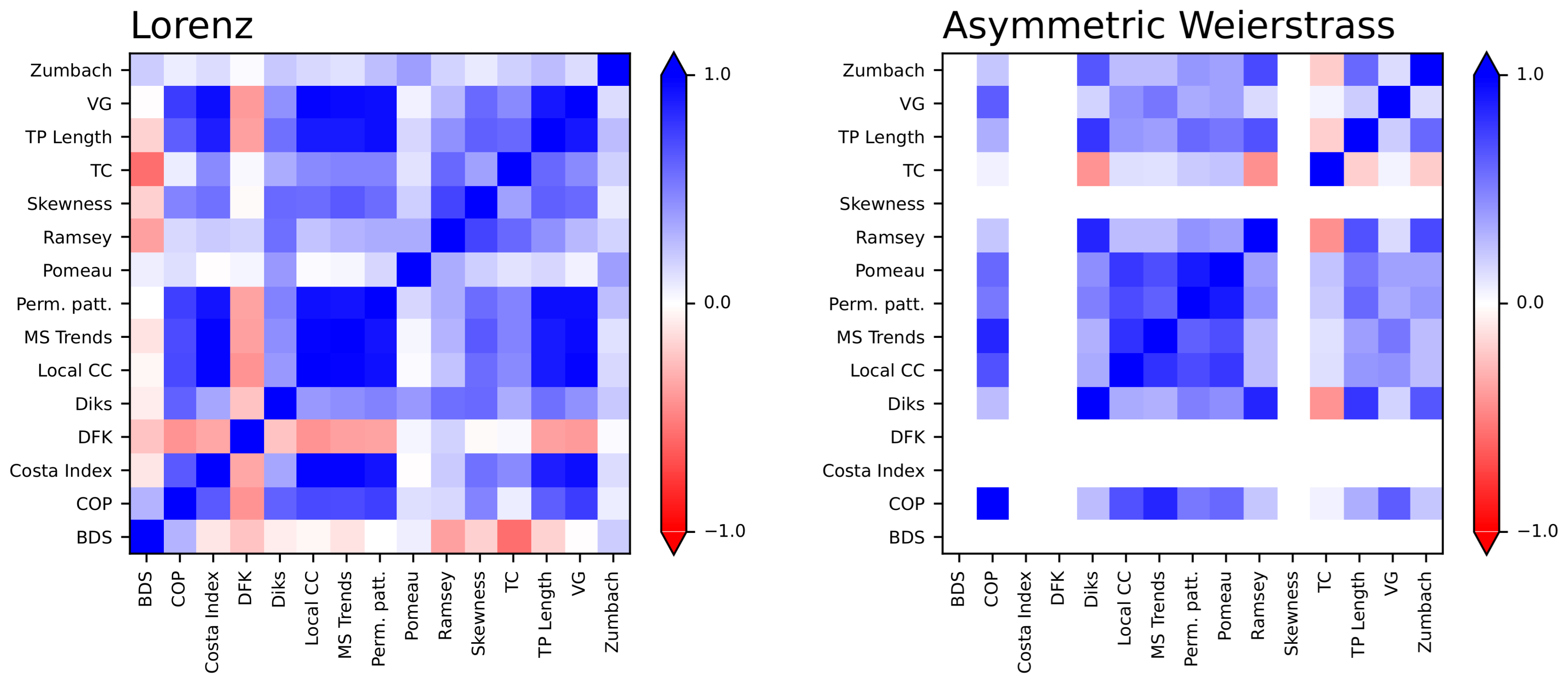

4. The Lorenz Dynamical System

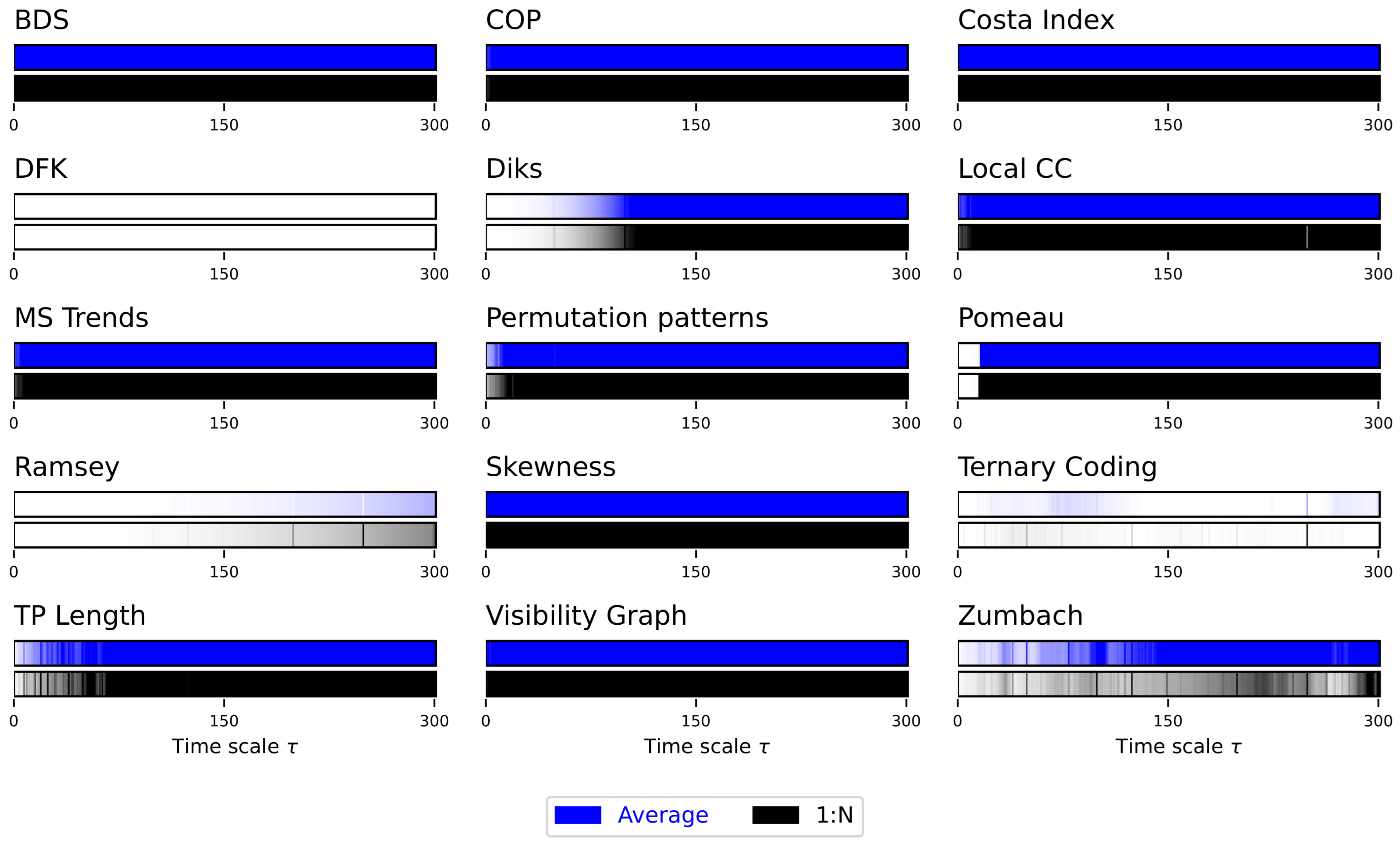

5. The Asymmetric Weierstrass Function

6. Brownian Motion Models

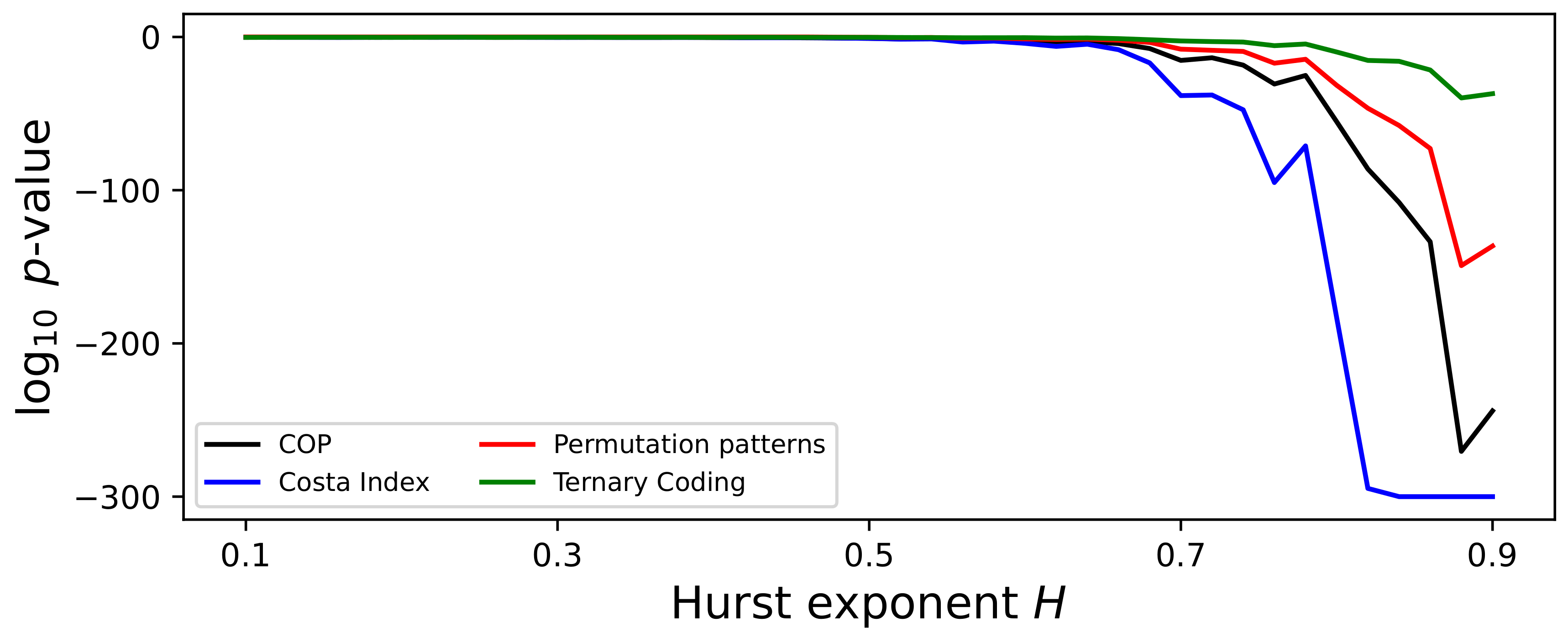

6.1. Fractional Brownian Motion

6.2. Geometric Brownian Motion with Stochastic Resetting

7. Chaotic Discrete Maps

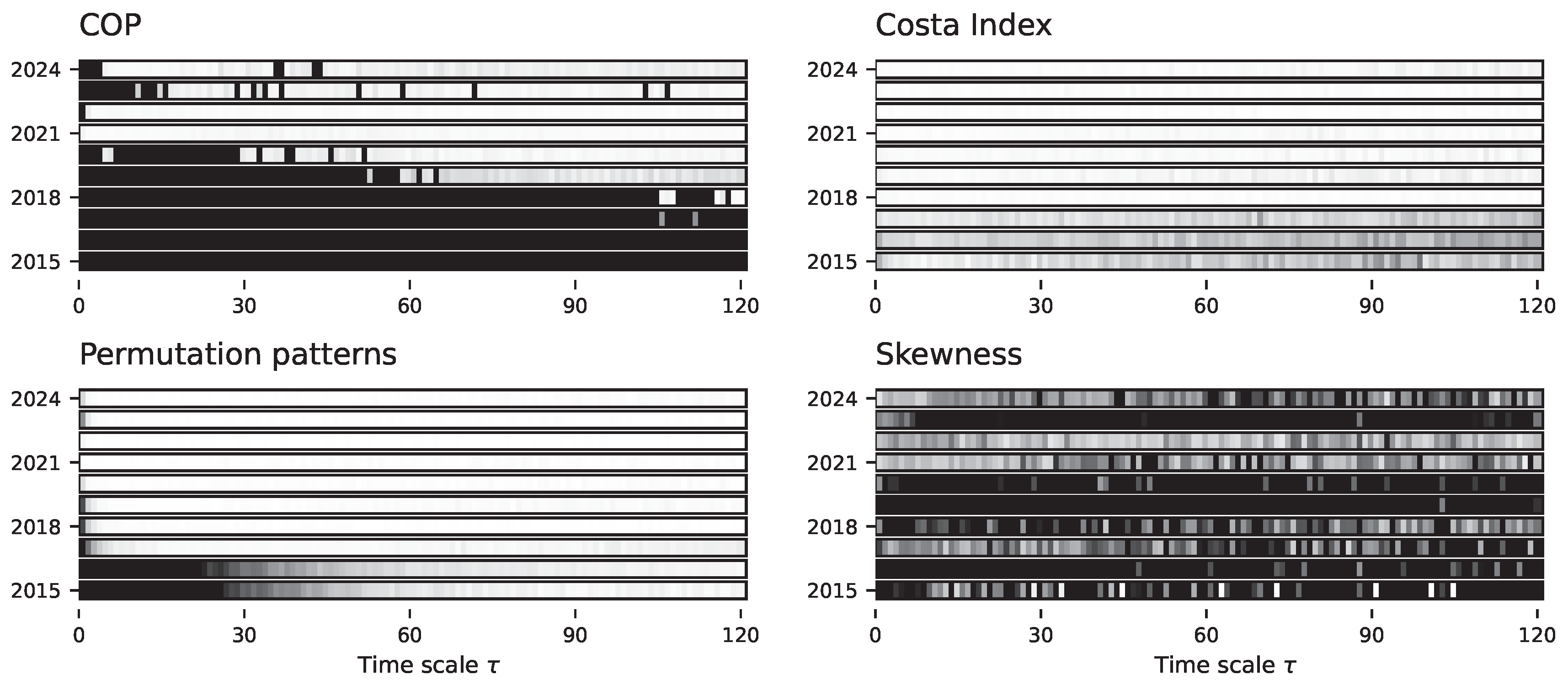

8. Real-World Data: Bitcoin Price Evolution

9. Discussion and Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BDS | Brock, Dechert, and Scheinkman |

| CC | Clustering Coefficient |

| COPs | Continuous Ordinal Patterns |

| DFK | Daw, Finney and Kennel |

| dHVG | Directed Horizontal Visibility Graph |

| fBM | Fractional Brownian Motion |

| MS Trends | Micro-scale Trends |

| O.-U. | Ornstein–Uhlenbeck |

| srGBM | Geometric Brownian Motion with stochastic resetting |

| TP Length | Trend Patterns Length |

References

- Pomeau, Y. Symétrie des fluctuations dans le renversement du temps. J. De Phys. 1982, 43, 859–867. [Google Scholar] [CrossRef]

- Gnesotto, F.S.; Mura, F.; Gladrow, J.; Broedersz, C.P. Broken detailed balance and non-equilibrium dynamics in living systems: A review. Rep. Prog. Phys. 2018, 81, 066601. [Google Scholar] [CrossRef] [PubMed]

- Needleman, D.; Dogic, Z. Active matter at the interface between materials science and cell biology. Nat. Rev. Mater. 2017, 2, 17048. [Google Scholar] [CrossRef]

- Gaspard, P. Time-reversed dynamical entropy and irreversibility in Markovian random processes. J. Stat. Phys. 2004, 117, 599–615. [Google Scholar] [CrossRef]

- Parrondo, J.M.; Van den Broeck, C.; Kawai, R. Entropy production and the arrow of time. New J. Phys. 2009, 11, 073008. [Google Scholar] [CrossRef]

- Gaspard, P. Brownian motion, dynamical randomness and irreversibility. New J. Phys. 2005, 7, 77. [Google Scholar] [CrossRef]

- Fodor, É.; Nardini, C.; Cates, M.E.; Tailleur, J.; Visco, P.; Van Wijland, F. How far from equilibrium is active matter? Phys. Rev. Lett. 2016, 117, 038103. [Google Scholar] [CrossRef]

- Kubo, R. The fluctuation-dissipation theorem. Rep. Prog. Phys. 1966, 29, 255. [Google Scholar] [CrossRef]

- Papo, D. Time scales in cognitive neuroscience. Front. Physiol. 2013, 4, 86. [Google Scholar] [CrossRef]

- Papo, D. Measuring brain temperature without a thermometer. Front. Physiol. 2014, 5, 124. [Google Scholar] [CrossRef][Green Version]

- Sarracino, A.; Arviv, O.; Shriki, O.; De Arcangelis, L. Predicting brain evoked response to external stimuli from temporal correlations of spontaneous activity. Phys. Rev. Res. 2020, 2, 033355. [Google Scholar] [CrossRef]

- Lindner, B. Fluctuation-dissipation relations for spiking neurons. Phys. Rev. Lett. 2022, 129, 198101. [Google Scholar] [CrossRef] [PubMed]

- Deco, G.; Lynn, C.W.; Sanz Perl, Y.; Kringelbach, M.L. Violations of the fluctuation-dissipation theorem reveal distinct nonequilibrium dynamics of brain states. Phys. Rev. E 2023, 108, 064410. [Google Scholar] [CrossRef] [PubMed]

- Battle, C.; Broedersz, C.P.; Fakhri, N.; Geyer, V.F.; Howard, J.; Schmidt, C.F.; MacKintosh, F.C. Broken detailed balance at mesoscopic scales in active biological systems. Science 2016, 352, 604–607. [Google Scholar] [CrossRef]

- Martínez, I.A.; Bisker, G.; Horowitz, J.M.; Parrondo, J.M. Inferring broken detailed balance in the absence of observable currents. Nat. Commun. 2019, 10, 3542. [Google Scholar] [CrossRef]

- Lynn, C.W.; Cornblath, E.J.; Papadopoulos, L.; Bertolero, M.A.; Bassett, D.S. Broken detailed balance and entropy production in the human brain. Proc. Natl. Acad. Sci. USA 2021, 118, e2109889118. [Google Scholar] [CrossRef]

- Weiss, G. Time-reversibility of linear stochastic processes. J. Appl. Probab. 1975, 12, 831–836. [Google Scholar] [CrossRef]

- Lawrance, A. Directionality and reversibility in time series. Int. Stat. Rev. Int. Stat. 1991, 59, 67–79. [Google Scholar] [CrossRef]

- Stone, L.; Landan, G.; May, R.M. Detecting time’s arrow: A method for identifying nonlinearity and deterministic chaos in time-series data. Proc. R. Soc. Lond. Ser. B Biol. Sci. 1996, 263, 1509–1513. [Google Scholar]

- Zanin, M.; Papo, D. Algorithmic approaches for assessing irreversibility in time series: Review and comparison. Entropy 2021, 23, 1474. [Google Scholar] [CrossRef]

- Puglisi, A.; Villamaina, D. Irreversible effects of memory. Europhys. Lett. 2009, 88, 30004. [Google Scholar] [CrossRef]

- Gallavotti, G. Fluctuation relation, fluctuation theorem, thermostats and entropy creation in nonequilibrium statistical physics. Comptes Rendus Phys. 2007, 8, 486–494. [Google Scholar] [CrossRef]

- Cugliandolo, L.F.; Dean, D.S.; Kurchan, J. Fluctuation-dissipation theorems and entropy production in relaxational systems. Phys. Rev. Lett. 1997, 79, 2168. [Google Scholar] [CrossRef]

- Egolf, D.A. Equilibrium regained: From nonequilibrium chaos to statistical mechanics. Science 2000, 287, 101–104. [Google Scholar] [CrossRef]

- Tan, T.H.; Watson, G.A.; Chao, Y.C.; Li, J.; Gingrich, T.R.; Horowitz, J.M.; Fakhri, N. Scale-dependent irreversibility in living matter. arXiv 2021, arXiv:2107.05701. [Google Scholar]

- Bernardi, D.; Shannahoff-Khalsa, D.; Sale, J.; Wright, J.A.; Fadiga, L.; Papo, D. The time scales of irreversibility in spontaneous brain activity are altered in obsessive compulsive disorder. Front. Psychiatry 2023, 14, 1158404. [Google Scholar] [CrossRef]

- Zanin, M.; Güntekin, B.; Aktürk, T.; Hanoğlu, L.; Papo, D. Time irreversibility of resting-state activity in the healthy brain and pathology. Front. Physiol. 2020, 10, 1619. [Google Scholar] [CrossRef]

- Costa, M.D.; Peng, C.K.; Goldberger, A.L. Multiscale analysis of heart rate dynamics: Entropy and time irreversibility measures. Cardiovasc. Eng. 2008, 8, 88–93. [Google Scholar] [CrossRef]

- Burykin, A.; Costa, M.D.; Peng, C.K.; Goldberger, A.L.; Buchman, T.G. Generating signals with multiscale time irreversibility: The asymmetric weierstrass function. Complexity 2011, 16, 29–38. [Google Scholar] [CrossRef][Green Version]

- Cammarota, C.; Rogora, E. Time reversal, symbolic series and irreversibility of human heartbeat. Chaos Solitons Fractals 2007, 32, 1649–1654. [Google Scholar] [CrossRef]

- Hou, F.; Zhuang, J.; Bian, C.; Tong, T.; Chen, Y.; Yin, J.; Qiu, X.; Ning, X. Analysis of heartbeat asymmetry based on multi-scale time irreversibility test. Phys. A Stat. Mech. Its Appl. 2010, 389, 754–760. [Google Scholar] [CrossRef]

- Hou, F.Z.; Ning, X.B.; Zhuang, J.J.; Huang, X.L.; Fu, M.J.; Bian, C.H. High-dimensional time irreversibility analysis of human interbeat intervals. Med Eng. Phys. 2011, 33, 633–637. [Google Scholar] [CrossRef] [PubMed]

- Chladekova, L.; Czippelova, B.; Turianikova, Z.; Tonhajzerova, I.; Calkovska, A.; Baumert, M.; Javorka, M. Multiscale time irreversibility of heart rate and blood pressure variability during orthostasis. Physiol. Meas. 2012, 33, 1747. [Google Scholar] [CrossRef]

- Wu, X.; Yang, Q.; Li, J.; Hou, F. Investigation on the Prediction of Cardiovascular Events Based on Multi-Scale Time Irreversibility Analysis. Symmetry 2021, 13, 2424. [Google Scholar] [CrossRef]

- Xia, J.; Shang, P.; Wang, J.; Shi, W. Classifying of financial time series based on multiscale entropy and multiscale time irreversibility. Phys. A Stat. Mech. Its Appl. 2014, 400, 151–158. [Google Scholar] [CrossRef]

- Xu, M.; Shang, P. Multiscale time irreversibility analysis of financial time series based on segmentation. Nonlinear Dyn. 2018, 94, 1603–1618. [Google Scholar] [CrossRef]

- Xie, B.; Kong, D.; Kong, L.; Kong, W.; Li, L. Analysis of vertical upward oil-gas-water three-phase flow based on multi-scale time irreversibility. Flow Meas. Instrum. 2018, 62, 9–18. [Google Scholar] [CrossRef]

- Iacobello, G.; Chowdhuri, S.; Ridolfi, L.; Rondoni, L.; Scarsoglio, S. Coherent structures at the origin of time irreversibility in wall turbulence. Commun. Phys. 2023, 6, 91. [Google Scholar] [CrossRef]

- Huang, Y.; Yang, D.; Wang, L.; Wang, K. Classifying of welding time series based on multi-scale time irreversibility analysis and extreme learning machine. Chaos Solitons Fractals 2020, 139, 110040. [Google Scholar] [CrossRef]

- Brock, W.A.; Hsieh, D.A.; LeBaron, B.D. Nonlinear Dynamics, Chaos, and Instability: Statistical Theory and Economic Evidence; MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Rothman, P. The comparative power of the TR test against simple threshold models. J. Appl. Econom. 1992, 7, S187–S195. [Google Scholar] [CrossRef]

- Brock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Zanin, M. Continuous ordinal patterns: Creating a bridge between ordinal analysis and deep learning. Chaos Interdiscip. J. Nonlinear Sci. 2023, 33. [Google Scholar] [CrossRef] [PubMed]

- Azami, H.; Escudero, J. Amplitude-aware permutation entropy: Illustration in spike detection and signal segmentation. Comput. Methods Programs Biomed. 2016, 128, 40–51. [Google Scholar] [CrossRef]

- Cuesta Frau, D. Permutation entropy: Influence of amplitude information on time series classification performance. Math. Biosci. Eng. 2019, 16, 6842–6857. [Google Scholar] [CrossRef]

- Costa, M.; Goldberger, A.L.; Peng, C.K. Broken asymmetry of the human heartbeat: Loss of time irreversibility in aging and disease. Phys. Rev. Lett. 2005, 95, 198102. [Google Scholar] [CrossRef]

- Daw, C.; Finney, C.; Kennel, M. Symbolic approach for measuring temporal “irreversibility”. Phys. Rev. E 2000, 62, 1912. [Google Scholar] [CrossRef]

- Diks, C.; Van Houwelingen, J.; Takens, F.; DeGoede, J. Reversibility as a criterion for discriminating time series. Phys. Lett. A 1995, 201, 221–228. [Google Scholar] [CrossRef]

- Strogatz, S.H. Exploring complex networks. Nature 2001, 410, 268–276. [Google Scholar] [CrossRef]

- Lacasa, L.; Luque, B.; Ballesteros, F.; Luque, J.; Nuno, J.C. From time series to complex networks: The visibility graph. Proc. Natl. Acad. Sci. USA 2008, 105, 4972–4975. [Google Scholar] [CrossRef]

- Donges, J.F.; Donner, R.V.; Kurths, J. Testing time series irreversibility using complex network methods. Europhys. Lett. 2013, 102, 10004. [Google Scholar] [CrossRef]

- Zanin, M. Assessing time series irreversibility through micro-scale trends. Chaos Interdiscip. J. Nonlinear Sci. 2021, 31. [Google Scholar] [CrossRef]

- Bandt, C.; Pompe, B. Permutation entropy: A natural complexity measure for time series. Phys. Rev. Lett. 2002, 88, 174102. [Google Scholar] [CrossRef] [PubMed]

- Zanin, M.; Zunino, L.; Rosso, O.A.; Papo, D. Permutation entropy and its main biomedical and econophysics applications: A review. Entropy 2012, 14, 1553–1577. [Google Scholar] [CrossRef]

- Leyva, I.; Martínez, J.H.; Masoller, C.; Rosso, O.A.; Zanin, M. 20 years of ordinal patterns: Perspectives and challenges. Europhys. Lett. 2022, 138, 31001. [Google Scholar] [CrossRef]

- Zanin, M.; Rodríguez-González, A.; Menasalvas Ruiz, E.; Papo, D. Assessing time series reversibility through permutation patterns. Entropy 2018, 20, 665. [Google Scholar] [CrossRef]

- Martínez, J.H.; Herrera-Diestra, J.L.; Chavez, M. Detection of time reversibility in time series by ordinal patterns analysis. Chaos Interdiscip. J. Nonlinear Sci. 2018, 28, 123111. [Google Scholar] [CrossRef]

- Yao, W.; Yao, W.; Wang, J.; Dai, J. Quantifying time irreversibility using probabilistic differences between symmetric permutations. Phys. Lett. A 2019, 383, 738–743. [Google Scholar] [CrossRef]

- Li, J.; Shang, P.; Zhang, X. Time series irreversibility analysis using Jensen–Shannon divergence calculated by permutation pattern. Nonlinear Dyn. 2019, 96, 2637–2652. [Google Scholar] [CrossRef]

- Zunino, L.; Olivares, F.; Ribeiro, H.V.; Rosso, O.A. Permutation Jensen-Shannon distance: A versatile and fast symbolic tool for complex time-series analysis. Phys. Rev. E 2022, 105, 045310. [Google Scholar] [CrossRef]

- Cox, D.R.; Gudmundsson, G.; Lindgren, G.; Bondesson, L.; Harsaae, E.; Laake, P.; Juselius, K.; Lauritzen, S.L. Statistical analysis of time series: Some recent developments [with discussion and reply]. Scand. J. Stat. 1981, 8, 93–115. [Google Scholar]

- Ramsey, J.B.; Rothman, P. Time irreversibility and business cycle asymmetry. J. Money Credit Bank. 1996, 28, 1–21. [Google Scholar] [CrossRef]

- Koutsoyiannis, D. Time’s arrow in stochastic characterization and simulation of atmospheric and hydrological processes. Hydrol. Sci. J. 2019, 64, 1013–1037. [Google Scholar] [CrossRef]

- Vavoulogiannis, S.; Iliopoulou, T.; Dimitriadis, P.; Koutsoyiannis, D. Multiscale temporal irreversibility of streamflow and its stochastic modelling. Hydrology 2021, 8, 63. [Google Scholar] [CrossRef]

- Morales Herrera, J.; Salgado-García, R. Measuring irreversibility via trend pattern lengths. AIP Adv. 2024, 14, 035226. [Google Scholar] [CrossRef]

- Lacasa, L.; Nunez, A.; Roldán, É.; Parrondo, J.M.; Luque, B. Time series irreversibility: A visibility graph approach. Eur. Phys. J. B 2012, 85, 1–11. [Google Scholar] [CrossRef]

- Epps, T.; Singleton, K.J. An omnibus test for the two-sample problem using the empirical characteristic function. J. Stat. Comput. Simul. 1986, 26, 177–203. [Google Scholar] [CrossRef]

- Zumbach, G. Time reversal invariance in finance. Quant. Financ. 2009, 9, 505–515. [Google Scholar] [CrossRef]

- Lorenz, E.N. Deterministic nonperiodic flow. J. Atmos. Sci. 1963, 20, 130–141. [Google Scholar] [CrossRef]

- Cocciaglia, N.; Lucente, D. Detecting time-irreversibility in multiscale systems: Correlation and response functions in the Lorenz96 model. arXiv 2024, arXiv:2411.07005. [Google Scholar]

- Weierstrass, K. On continuous functions of a real argument that do not have a well-defined differential quotient. In Classics on Fractals; CRC Press: Boca Raton, FL, USA, 2019; pp. 2–9. [Google Scholar]

- Davies, R.B.; Harte, D.S. Tests for Hurst effect. Biometrika 1987, 74, 95–101. [Google Scholar] [CrossRef]

- Stojkoski, V.; Sandev, T.; Kocarev, L.; Pal, A. Geometric Brownian motion under stochastic resetting: A stationary yet nonergodic process. Phys. Rev. E 2021, 104, 014121. [Google Scholar] [CrossRef] [PubMed]

- Zanin, M.; Trajanovski, P.; Jolakoski, P.; Sandev, T.; Kocarev, L. Evaluating Time Irreversibility Tests Using Geometric Brownian Motions with Stochastic Resetting. Symmetry 2024, 16, 1445. [Google Scholar] [CrossRef]

- Katsiampa, P. Volatility estimation for Bitcoin: A comparison of GARCH models. Econ. Lett. 2017, 158, 3–6. [Google Scholar] [CrossRef]

- Klein, T.; Thu, H.P.; Walther, T. Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. Int. Rev. Financ. Anal. 2018, 59, 105–116. [Google Scholar] [CrossRef]

- Jakub, B. Does Bitcoin follow the hypothesis of efficient market. Int. J. Econ. Sci. 2015, 4, 10–23. [Google Scholar]

- Sensoy, A. The inefficiency of Bitcoin revisited: A high-frequency analysis with alternative currencies. Financ. Res. Lett. 2019, 28, 68–73. [Google Scholar] [CrossRef]

- Martínez, J.H.; Ramasco, J.J.; Zanin, M. On the complementarity of ordinal patterns-based entropy and time asymmetry metrics. Chaos Interdiscip. J. Nonlinear Sci. 2023, 33, 033138. [Google Scholar] [CrossRef]

- Herrera, J.M.; Salgado-García, R. Trend patterns statistics for assessing irreversibility in cryptocurrencies: Time-asymmetry versus inefficiency. arXiv 2023, arXiv:2307.08612. [Google Scholar]

- Ante, L. The non-fungible token (NFT) market and its relationship with Bitcoin and Ethereum. FinTech 2022, 1, 216–224. [Google Scholar] [CrossRef]

- Seifert, U. From stochastic thermodynamics to thermodynamic inference. Annu. Rev. Condens. Matter Phys. 2019, 10, 171–192. [Google Scholar] [CrossRef]

- Gomez-Marin, A.; Parrondo, J.M.; Van den Broeck, C. Lower bounds on dissipation upon coarse graining. Phys. Rev. E—Stat. Nonlinear Soft Matter Phys. 2008, 78, 011107. [Google Scholar] [CrossRef] [PubMed]

- Esposito, M. Stochastic thermodynamics under coarse graining. Phys. Rev. E—Sta. Nonlinear Soft Matter Phys. 2012, 85, 041125. [Google Scholar] [CrossRef] [PubMed]

- Lucente, D.; Baldassarri, A.; Puglisi, A.; Vulpiani, A.; Viale, M. Inference of time irreversibility from incomplete information: Linear systems and its pitfalls. Phys. Rev. Res. 2022, 4, 043103. [Google Scholar] [CrossRef]

- Guzik, P.; Piskorski, J.; Krauze, T.; Wykretowicz, A.; Wysocki, H. Heart rate asymmetry by Poincaré plots of RR intervals. Biomed. Eng./Biomed. Tech. 2006, 51, 272–275. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zanin, M.; Papo, D. Algorithmic Approaches for Assessing Multiscale Irreversibility in Time Series: Review and Comparison. Entropy 2025, 27, 126. https://doi.org/10.3390/e27020126

Zanin M, Papo D. Algorithmic Approaches for Assessing Multiscale Irreversibility in Time Series: Review and Comparison. Entropy. 2025; 27(2):126. https://doi.org/10.3390/e27020126

Chicago/Turabian StyleZanin, Massimiliano, and David Papo. 2025. "Algorithmic Approaches for Assessing Multiscale Irreversibility in Time Series: Review and Comparison" Entropy 27, no. 2: 126. https://doi.org/10.3390/e27020126

APA StyleZanin, M., & Papo, D. (2025). Algorithmic Approaches for Assessing Multiscale Irreversibility in Time Series: Review and Comparison. Entropy, 27(2), 126. https://doi.org/10.3390/e27020126