Causal Hierarchy in the Financial Market Network—Uncovered by the Helmholtz–Hodge–Kodaira Decomposition

Abstract

1. Introduction

2. Materials and Methods

2.1. Data

2.2. Granger Causality

Details on the Estimation

2.3. Helmholtz–Hodge–Kodaira Decomposition

2.3.1. Mathematical Formulation of the Unidirectional HHKD

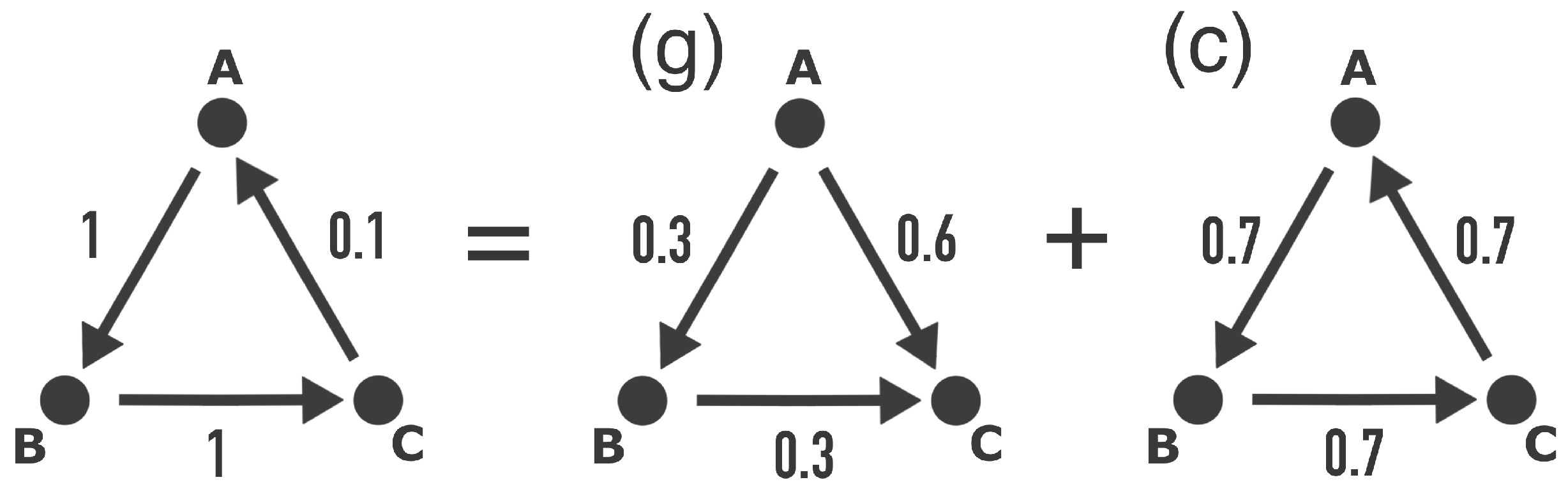

2.3.2. Bidirectional Flows

2.3.3. Circularity and Hierarchy

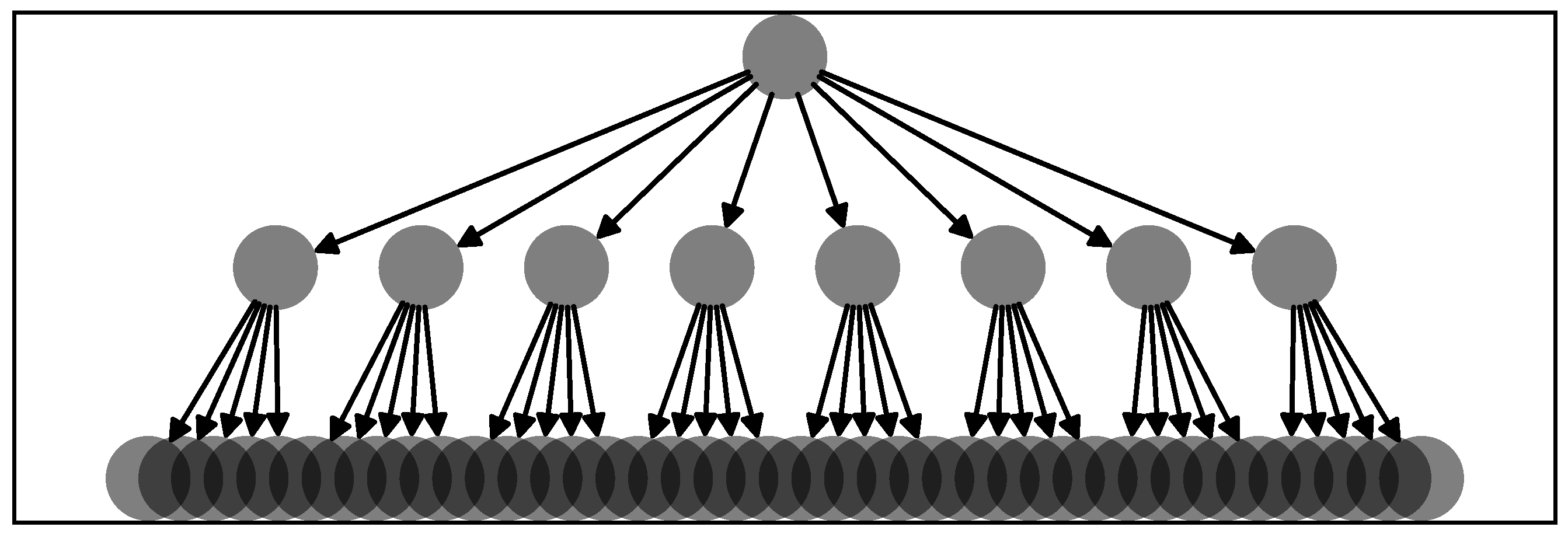

2.4. Test on Synthetic Data

3. Results

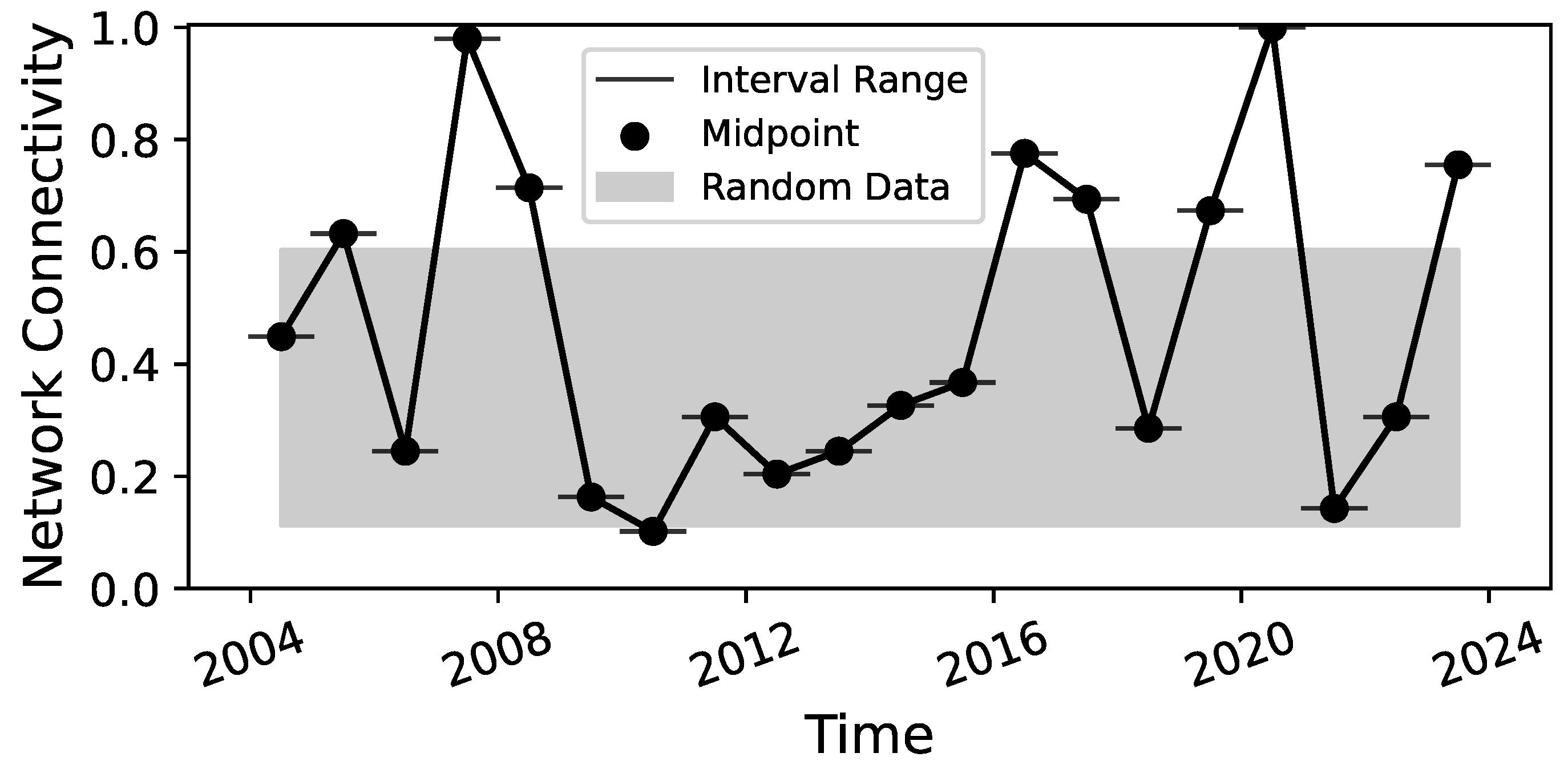

3.1. Year by Year

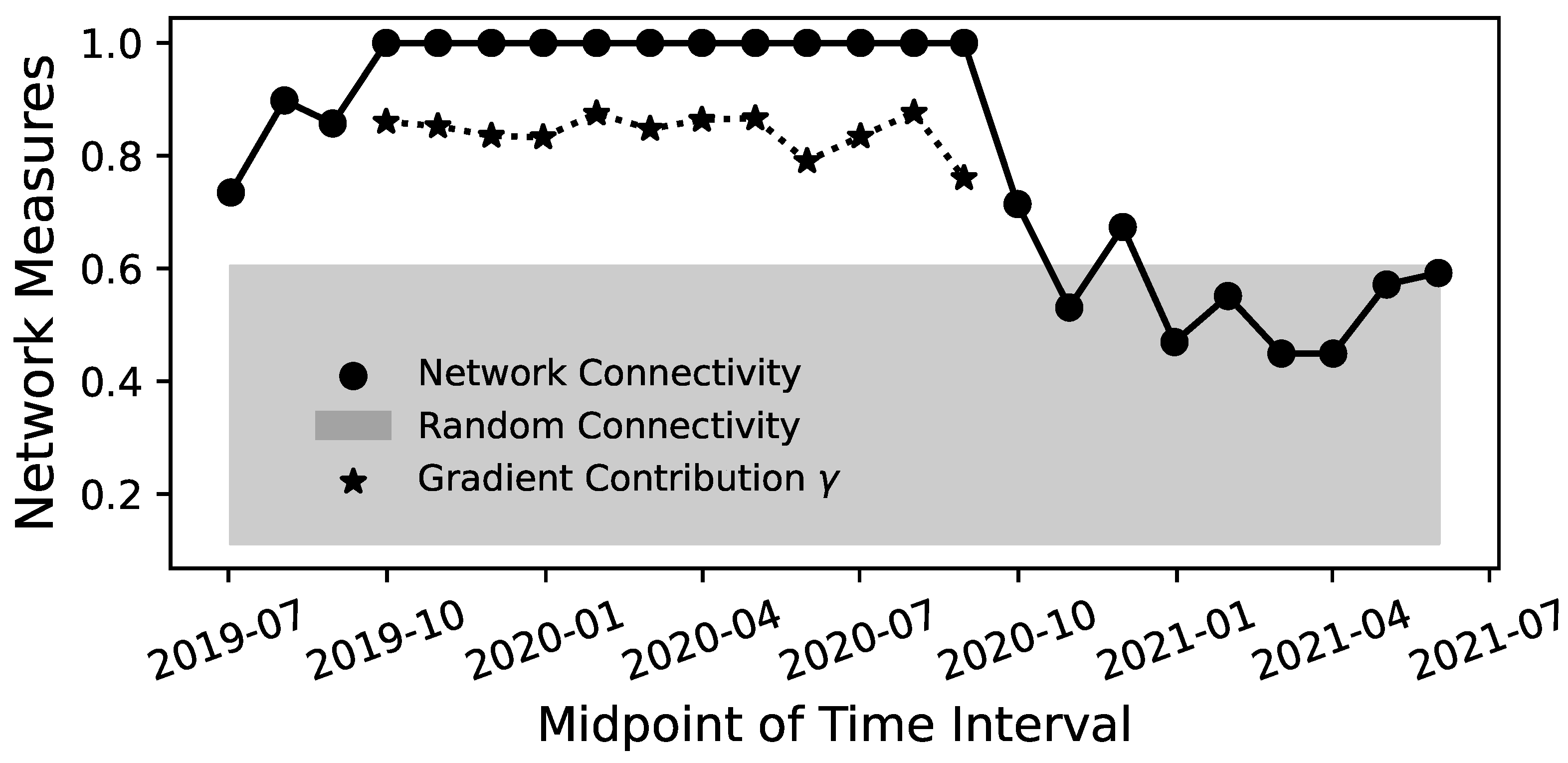

3.2. Complete Graphs during the 2020 COVID Pandemic

3.3. The 2007 Financial Crisis

4. Discussion

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BIC | Bayesian Information Criterion |

| CI | Confidence Interval |

| DAG | Directed Acyclic Graph |

| HHKD | Helmholtz–Hodge–Kodaira Decomposition |

| KDE | Kernel Density Estimation |

| PCA | Principal Component Analysis |

| RCGCI | Restricted Conditional Granger Causality Index |

| Aero | Aircraft |

| BldMt | Construction Materials |

| Cnstr | Construction |

| Drugs | Pharmaceutical Products |

| FabPr | Fabricated Products |

| Gold | Precious Metals |

| Hshld | Consumer Goods |

| Mach | Machinery |

| Meals | Restaurants, Hotels, and Motels |

| MedEq | Medical Equipment |

| PerSv | Personal Services |

| RlEst | Real Estate |

| Rubbr | Rubber and Plastic Products |

| Softw | Computer Software |

| Trans | Transportation |

| Toys | Recreation |

References

- Aldrich, J. Correlations Genuine and Spurious in Pearson and Yule. Stat. Sci. 1995, 10, 364–376. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Pearl, J.; Glymour, M.; Jewell, N.P. Causal Inference in Statistics: A Primer; Wiley: Hoboken, NJ, USA, 2016. [Google Scholar]

- Quiroga, R.Q.; Arnhold, J.; Grassberger, P. Learning driver-response relationships from synchronization patterns. Phys. Rev. E 2000, 61, 5142–5148. [Google Scholar] [CrossRef] [PubMed]

- Sugihara, G.; May, R.; Ye, H.; Hsieh, C.H.; Deyle, E.; Fogarty, M.; Munch, S. Detecting Causality in Complex Ecosystems. Science 2012, 338, 496–500. [Google Scholar] [CrossRef] [PubMed]

- Sun, J.; Taylor, D.; Bollt, E.M. Causal Network Inference by Optimal Causation Entropy. SIAM J. Appl. Dyn. Syst. 2015, 14, 73–106. [Google Scholar] [CrossRef]

- Aste, T.; Di Matteo, T. Sparse Causality Network Retrieval from Short Time Series. Complexity 2017, 2017, 4518429. [Google Scholar] [CrossRef]

- Siggiridou, E.; Kugiumtzis, D. Granger Causality in Multivariate Time Series Using a Time-Ordered Restricted Vector Autoregressive Model. IEEE Trans. Signal Process. 2016, 64, 1759–1773. [Google Scholar] [CrossRef]

- Siggiridou, E.; Koutlis, C.; Tsimpiris, A.; Kugiumtzis, D. Evaluation of Granger Causality Measures for Constructing Networks from Multivariate Time Series. Entropy 2019, 21, 1080. [Google Scholar] [CrossRef]

- Iskrzyński, M.; Janssen, F.; Picciolo, F.; Fath, B.; Ruzzenenti, F. Cycling and reciprocity in weighted food webs and economic networks. J. Ind. Ecol. 2021, 26, 838–849. [Google Scholar] [CrossRef]

- Johnson, J.L.; Goldring, T. Discrete Hodge Theory on Graphs: A Tutorial. Comput. Sci. Eng. 2013, 15, 42–55. [Google Scholar] [CrossRef]

- Strang, A. Applications of the Helmholtz-Hodge Decomposition to Networks and Random Processes. Ph.D. Thesis, Case Western Reserve University, Cleveland, OH, USA, 2020. Available online: https://case.edu/math/thomas/Strang-Alexander-2020-PhD-thesis-final.pdf (accessed on 24 January 2024).

- Mantegna, R.; Stanley, H. An Introduction to Econophysics; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Fujiwara, Y.; Islam, R. Bitcoin’s Crypto Flow Network. J. Phys. Soc. Jpn. 2021, 36, 011002. [Google Scholar] [CrossRef]

- Kichikawa, Y.; Iyetomi, H.; Ikeda, Y. Who Possesses Whom in Terms of the Global Ownership Network. In Big Data Analysis on Global Community Formation and Isolation: Sustainability and Flow of Commodities, Money, and Humans; Ikeda, Y., Iyetomi, H., Mizuno, T., Eds.; Springer: Singapore, 2021; pp. 143–190. [Google Scholar] [CrossRef]

- Serrano, M.A.; Boguñá, M. Topology of the world trade web. Phys. Rev. E 2003, 68, 015101. [Google Scholar] [CrossRef] [PubMed]

- Bornholdt, S.; Schuster, H.G. (Eds.) Handbook of Graphs and Networks; Wiley-VCH: Weinheim, Germany, 2005. [Google Scholar]

- Caldarelli, G.; Vespignani, A. (Eds.) Large Scale Structure and Dynamics of Complex Networks; World Scientific Publishing: Singapore, 2007. [Google Scholar]

- Sandoval, L. Structure of a Global Network of Financial Companies Based on Transfer Entropy. Entropy 2014, 16, 4443–4482. [Google Scholar] [CrossRef]

- Papana, A.; Kyrtsou, C.; Kugiumtzis, D.; Diks, C. Financial networks based on Granger causality: A case study. Phys. A Stat. Mech. Its Appl. 2017, 482, 65–73. [Google Scholar] [CrossRef]

- Stavroglou, S.K.; Pantelous, A.A.; Stanley, H.E.; Zuev, K.M. Hidden interactions in financial markets. Proc. Natl. Acad. Sci. USA 2019, 116, 10646–10651. [Google Scholar] [CrossRef]

- Ken French. US Research Returns Data. 49 Industry Portfolios [Daily]. Continuously Updated. Available online: https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html (accessed on 4 July 2024).

- Mackinnon, J. Approximate Asymptotic Distribution Functions for Unit-Root and Cointegration Tests. J. Bus. Econ. Stat. 1994, 12, 167–176. [Google Scholar] [CrossRef]

- Seabold, S.; Perktold, J. statsmodels: Econometric and statistical modeling with python. In Proceedings of the 9th Python in Science Conference, Austin, TX, USA, 28 June–3 July 2010. [Google Scholar]

- Fama, E.F.; French, K.R. Production of U.S. SMB and HML in the Fama-French Data Library. SSRN Electron. J. 2023, 2023, 4629613. [Google Scholar] [CrossRef]

- Chan, L.K.; Lakonishok, J.; Swaminathan, B. Industry Classifications and Return Comovement. Financ. Anal. J. 2007, 63, 56–70. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Industry costs of equity. J. Financ. Econ. 1997, 43, 153–193. [Google Scholar] [CrossRef]

- Babyak, M. What You See May Not Be What You Get: A Brief, Nontechnical Introduction to Overfitting in Regression-Type Models. Psychosom. Med. 2004, 66, 411–421. [Google Scholar]

- Schwarz, G. Estimating the Dimension of a Model. Ann. Stat. 1978, 6, 1176344136. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Nunes Amaral, L.A.; Stanley, H.E. Universal and Nonuniversal Properties of Cross Correlations in Financial Time Series. Phys. Rev. Lett. 1999, 83, 1471–1474. [Google Scholar] [CrossRef]

- Laloux, L.; Cizeau, P.; Bouchaud, J.P.; Potters, M. Noise Dressing of Financial Correlation Matrices. Phys. Rev. Lett. 1999, 83, 1467–1470. [Google Scholar] [CrossRef]

- Strang, A.; Abbott, K.C.; Thomas, P.J. The Network HHD: Quantifying Cyclic Competition in Trait-Performance Models of Tournaments. SIAM Rev. 2022, 64, 360–391. [Google Scholar] [CrossRef]

- Haruna, T.; Fujiki, Y. Hodge Decomposition of Information Flow on Small-World Networks. Front. Neural Circuits 2016, 10, 77. [Google Scholar] [CrossRef] [PubMed]

- Fujiki, Y.; Haruna, T. Hodge Decomposition of Information Flow on Complex Networks. In Proceedings of the 8th International Conference on Bio-inspired Information and Communications Technologies (Formerly BIONETICS), Boston, MA, USA, 1–3 December 2014. [Google Scholar] [CrossRef]

- Hagberg, A.; Swart, P.; Chult, D.S. Exploring Network Structure, Dynamics, and Function Using NetworkX; Technical Report; Los Alamos National Lab. (LANL): Los Alamos, NM, USA, 2008. [Google Scholar]

- Scott, D.W. Multivariate Density Estimation—Theory, Practice, and Visualization; John Wiley & Sons: New York, NY, USA, 2015. [Google Scholar]

- Zimmerman, G. Construction Materials Prices Increase More Than 20 Percent. 2022. Available online: https://www.facilitiesnet.com/designconstruction/tip/Construction-Materials-Prices-Increase-More-Than-20-Percent–49437 (accessed on 24 July 2024).

- Heßler, M.; Wand, T.; Kamps, O. Efficient Multi-Change Point Analysis to decode Economic Crisis Information from the S&P500 Mean Market Correlation. Entropy 2023, 25, 1265. [Google Scholar] [CrossRef]

- Ozili, P.K. Causes and Consequences of the 2023 Banking Crisis. SSRN Electron. J. 2023, 2023, 4407221. [Google Scholar] [CrossRef]

- Diaconaşu, D.; Mehdian, S.; Stoica, O. The Global Stock Market Reactions to the 2016 U.S. Presidential Election. Sage Open 2023, 13, 21582440231181352. [Google Scholar] [CrossRef]

- Münnix, M.C.; Shimada, T.; Schäfer, R.; Leyvraz, F.; Seligman, T.H.; Guhr, T.; Stanley, H.E. Identifying States of a Financial Market. Sci. Rep. 2012, 2, 644. [Google Scholar] [CrossRef]

- Stepanov, Y.; Rinn, P.; Guhr, T.; Peinke, J.; Schäfer, R. Stability and hierarchy of quasi-stationary states: Financial markets as an example. J. Stat. Mech. Theory Exp. 2015, 2015, P08011. [Google Scholar] [CrossRef]

- Rinn, P.; Stepanov, Y.; Peinke, J.; Guhr, T.; Schäfer, R. Dynamics of quasi-stationary systems: Finance as an example. EPL (Europhys. Lett.) 2015, 110, 68003. [Google Scholar] [CrossRef]

- Marsili, M. Dissecting financial markets: Sectors and states. Quant. Financ. 2002, 2, 297–302. [Google Scholar] [CrossRef]

- MacKay, R.S.; Johnson, S.; Sansom, B. How directed is a directed network? R. Soc. Open Sci. 2020, 7, 201138. [Google Scholar] [CrossRef] [PubMed]

- Ma, H.; Prosperino, D.; Haluszczynski, A.; Räth, C. Linear and nonlinear causality in financial markets. arXiv 2023, arXiv:2312.16185. [Google Scholar] [CrossRef]

- Maziarz, M. A review of the Granger-causality fallacy. J. Philos. Econ. 2015, 8, 10676. [Google Scholar] [CrossRef]

- Stokes, P.A.; Purdon, P.L. A study of problems encountered in Granger causality analysis from a neuroscience perspective. Proc. Natl. Acad. Sci. USA 2017, 114, E7063–E7072. [Google Scholar] [CrossRef]

- Iyetomi, H. Collective Phenomena in Economic Systems. In Evolutionary Economics and Social Complexity Science; Springer: Singapore, 2020; pp. 177–201. [Google Scholar] [CrossRef]

- Souma, W. Characteristics of Principal Components in Stock Price Correlation. Front. Phys. 2021, 9, 602944. [Google Scholar] [CrossRef]

- Kustepeli, A. On the Helmholtz Theorem and Its Generalization for Multi-Layers. Electromagnetics 2016, 36, 135–148. [Google Scholar] [CrossRef]

- Wand, T. Helmholtz-Hodge-Kodaira Decomposition on Financial Data by Ken French. Zenodo, 19 August 2024. Available online: https://zenodo.org/records/13340981 (accessed on 22 August 2024). [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wand, T.; Kamps, O.; Iyetomi, H. Causal Hierarchy in the Financial Market Network—Uncovered by the Helmholtz–Hodge–Kodaira Decomposition. Entropy 2024, 26, 858. https://doi.org/10.3390/e26100858

Wand T, Kamps O, Iyetomi H. Causal Hierarchy in the Financial Market Network—Uncovered by the Helmholtz–Hodge–Kodaira Decomposition. Entropy. 2024; 26(10):858. https://doi.org/10.3390/e26100858

Chicago/Turabian StyleWand, Tobias, Oliver Kamps, and Hiroshi Iyetomi. 2024. "Causal Hierarchy in the Financial Market Network—Uncovered by the Helmholtz–Hodge–Kodaira Decomposition" Entropy 26, no. 10: 858. https://doi.org/10.3390/e26100858

APA StyleWand, T., Kamps, O., & Iyetomi, H. (2024). Causal Hierarchy in the Financial Market Network—Uncovered by the Helmholtz–Hodge–Kodaira Decomposition. Entropy, 26(10), 858. https://doi.org/10.3390/e26100858