Forecasting Commodity Market Synchronization with Commodity Currencies: A Network-Based Approach

Abstract

1. Introduction

- i.

- Synchronization is crucial for systemic risk and financial stability in economic and financial crises. When synchronization in the financial market increases, it reduces the benefits of diversification and increases the probability of contagion.

- ii.

- As the benefits of international diversification diminish, risk management strategies based on investing abroad and combining multiple financial asset classes with commodities require a proper redesign to include this risk factor in the decision-making criteria.

- iii.

- The emergence of synchronization risk imposes on global investors the task of properly managing this element. Accordingly, global financial agents, such as investment banks, pension funds, mutual funds, and hedge funds, must innovate and develop new financial engineering products that properly help market participants manage this risk.

- iv.

- From a broad perspective, our results show the relevance of financial stability within global markets. Well-functioning and stable capital markets are necessary to fulfil the prominent roles of financial markets. Consequently, practioners and portfolio managers ought to incorporate these new perspectives and insights to improve the coordination of the markets before new global shocks again jeopardize the stability of capital markets.

2. Materials and Methods

2.1. Data

2.2. Network Method—The Minimum Spanning Tree Length (MSTL)

2.3. Forecasting Methods

2.4. Out-of-Sample Test

2.4.1. Encompassing Test ENCNEW

2.4.2. Mean Directional Accuracy

3. Empirical Findings and Discussion

3.1. Descriptive Analysis

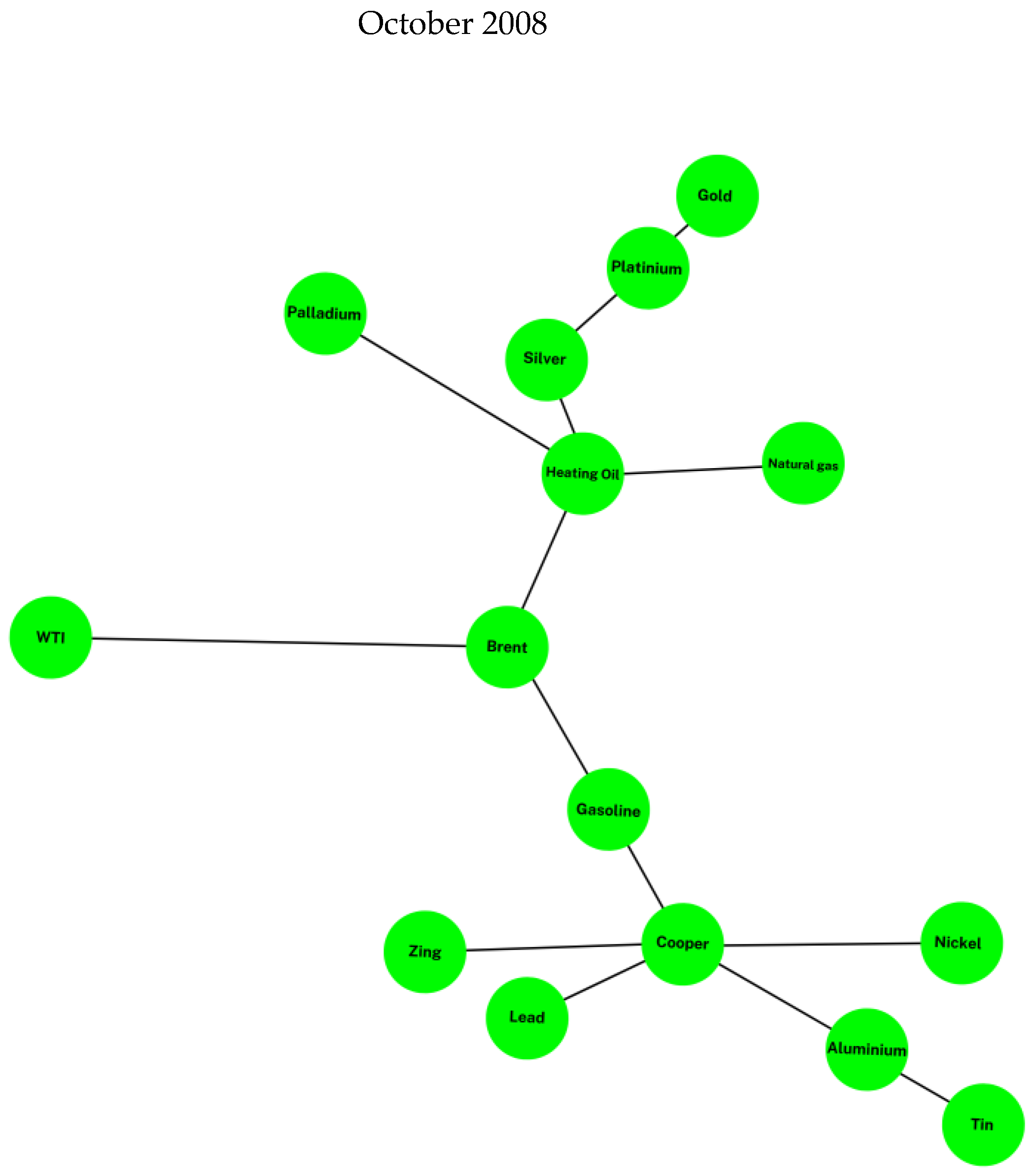

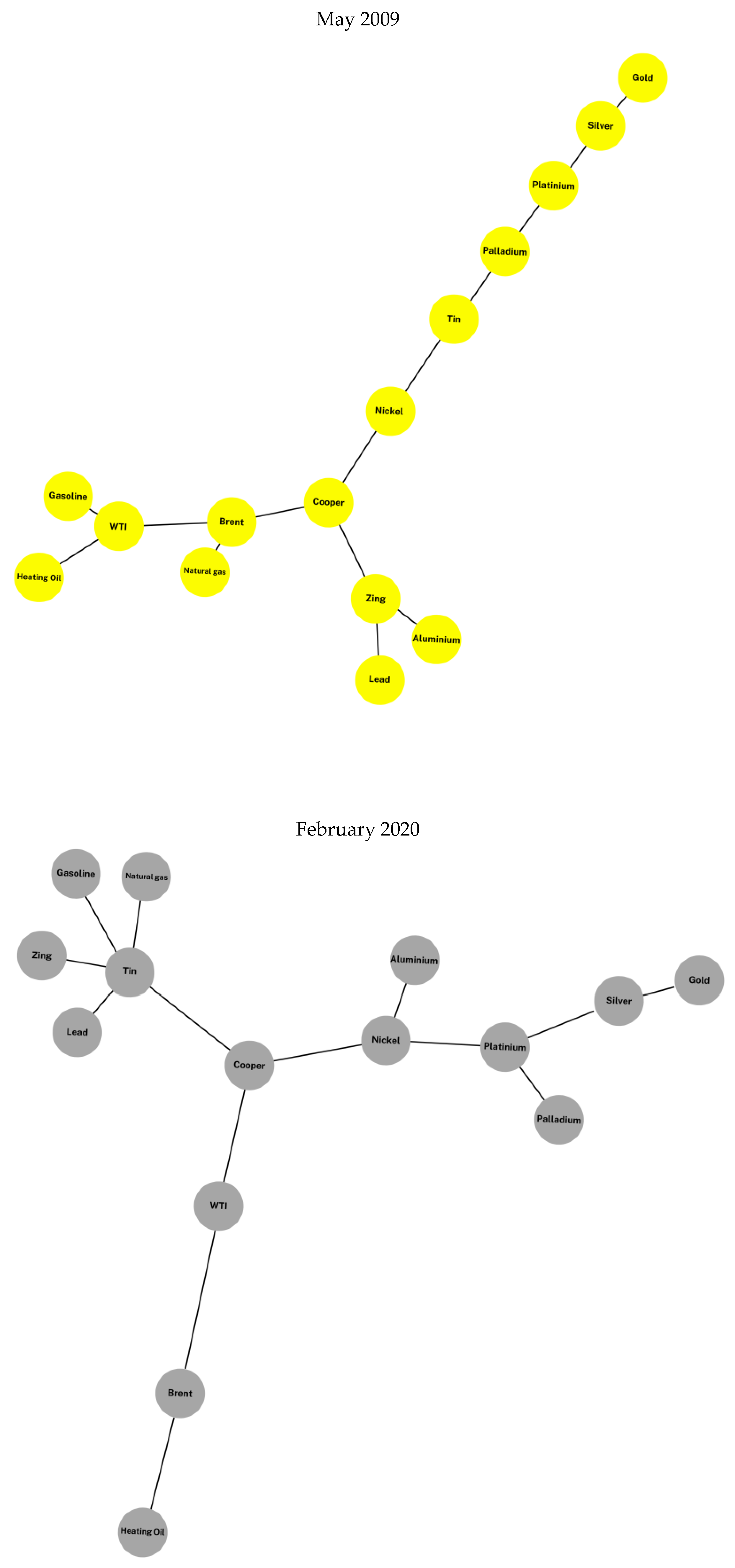

3.1.1. Minimum Spanning Tree and Commodity Market Synchronization

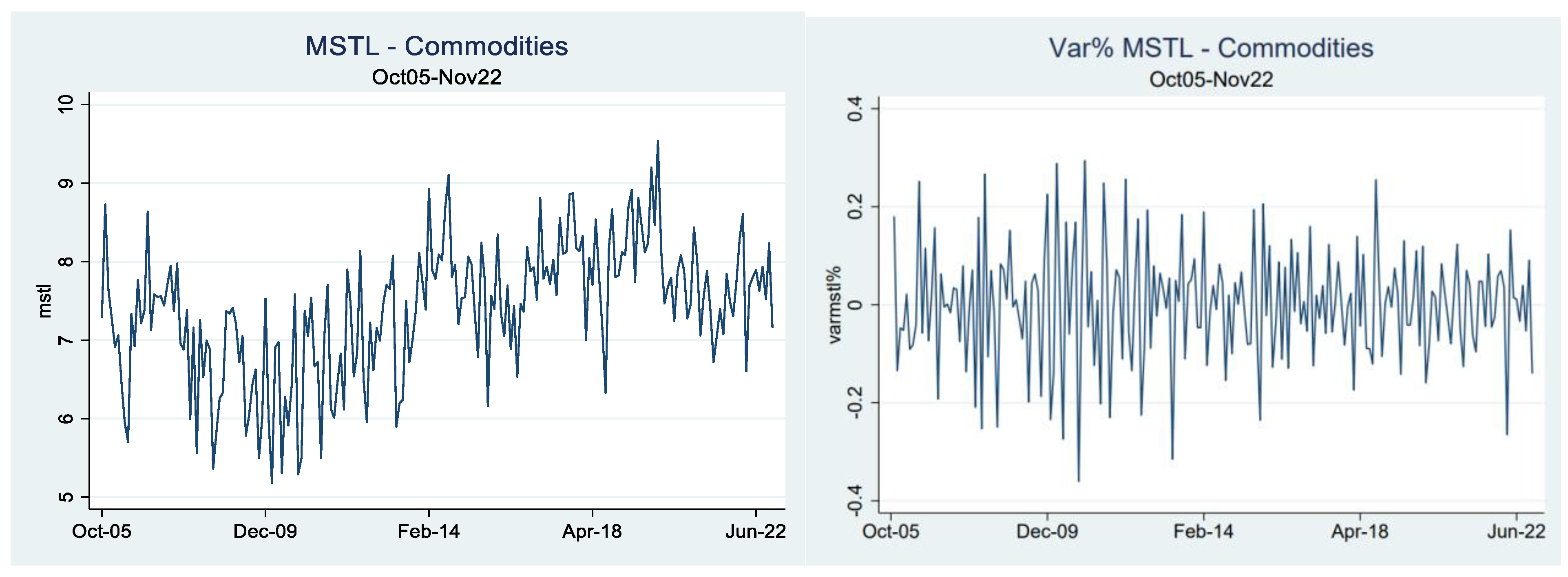

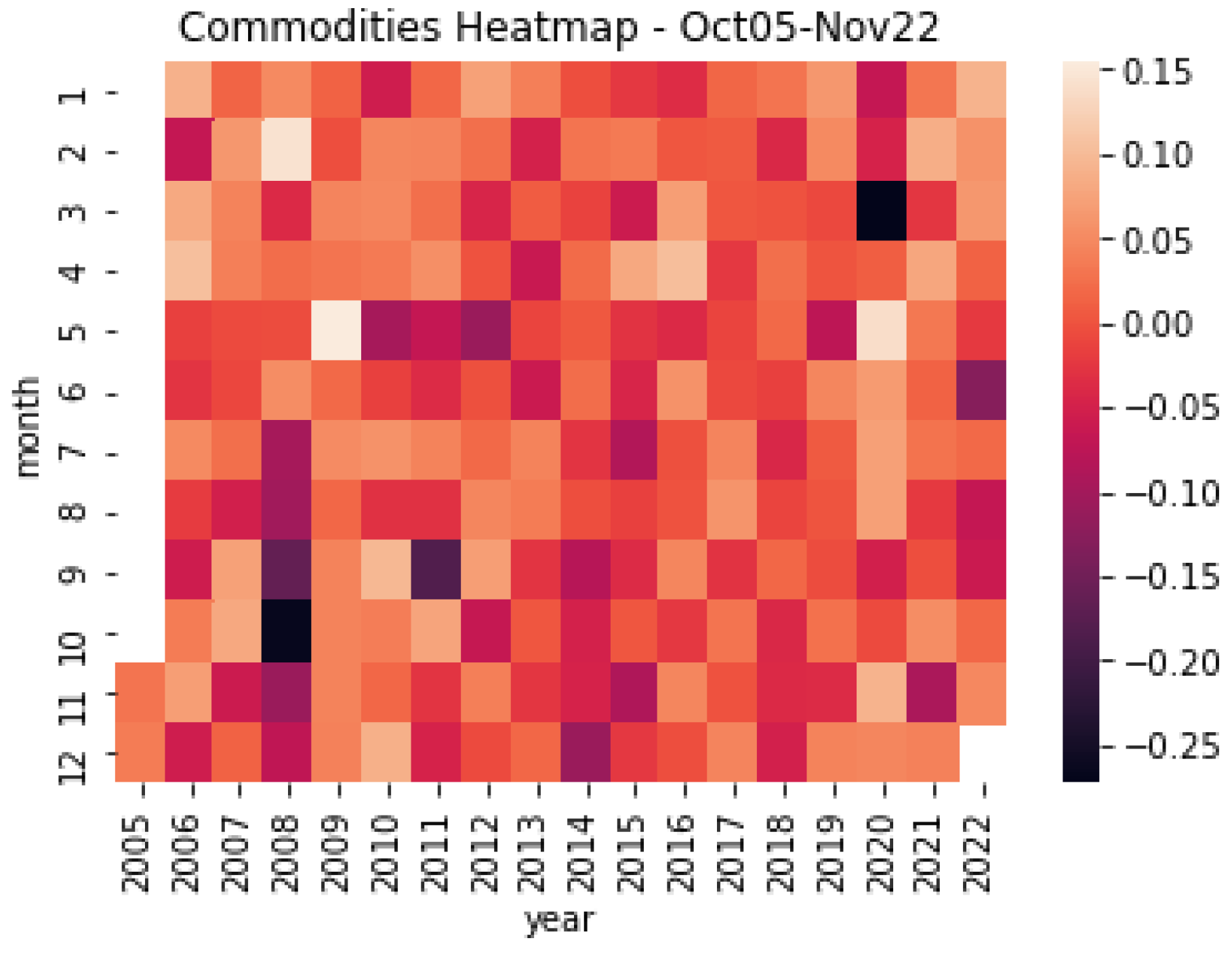

3.1.2. Dynamic Behavior of Commodity Market Synchronization

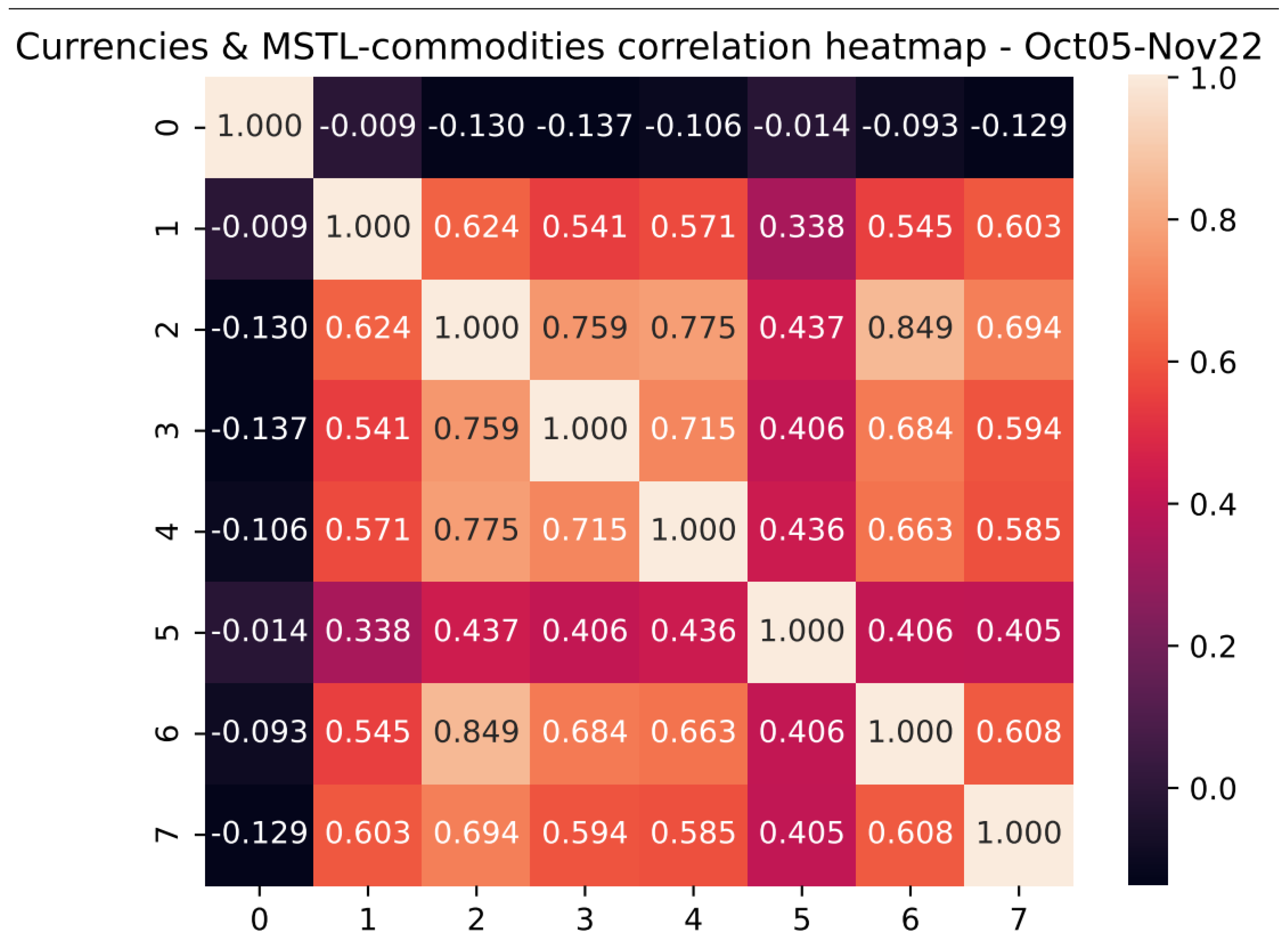

3.1.3. Commodity Currencies and Commodity Market Synchronization

- (a)

- There was a positive correlation among the sample of currencies, indicating that they tended to move in the same direction during the analysis period.

- (b)

- There was a wide range of correlations among the currencies for the period 2005–2022, with a maximum level equal to 0.85 and a minimum equal to 0.34, indicating heterogeneous reactions to market conditions among the baskets of currencies.

- (c)

- The correlation between the variation in the MSTL that groups the sample of commodities and the currencies was negative, suggesting the existence of a negative relationship between the synchronization of the commodities and the variations of the currencies against the USD.

3.2. In-Sample Analysis

3.3. Out-of-Sample Analysis

Mean Directional Accuracy

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Billio, M.; Getmansky, M.; Lo, A.W.; Pelizzon, L. Econometric Measures of Connectedness and Systemic Risk in the Finance and Insurance Sectors. J. Financ. Econ. 2012, 104, 535–559. [Google Scholar] [CrossRef]

- Gai, P.; Haldane, A.; Kapadia, S. Complexity, Concentration and Contagion. J. Monet. Econ. 2011, 58, 453–470. [Google Scholar] [CrossRef]

- Haldane, A.G. Rethinking the Financial Network. In Fragile Stabilität—Stabile Fragilität; Springer VS: Wiesbaden, Germany, 2013; pp. 243–278. ISBN 978-3-658-02247-1/978-3-658-02248-8. [Google Scholar]

- Lavin, J.F.; Valle, M.A.; Magner, N.S. A Network-Based Approach to Study Returns Synchronization of Stocks: The Case of Global Equity Markets. Complexity 2021, 2021, 7676457. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic Co-Movements of Stock Market Returns, Implied Volatility and Policy Uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Benoit, S.; Colliard, J.-E.; Hurlin, C.; Pérignon, C. Where the Risks Lie: A Survey on Systemic Risk. Rev Financ 2017, 21, 109–152. [Google Scholar] [CrossRef]

- Magner, N.S.; Lavin, J.F.; Valle, M.A.; Hardy, N. The Volatility Forecasting Power of Financial Network Analysis. Complexity 2020, 2020, 7051402. [Google Scholar] [CrossRef]

- Raddant, M.; Kenett, D.Y. Interconnectedness in the Global Financial Market. J. Int. Money Financ. 2021, 110, 102280. [Google Scholar] [CrossRef]

- Cheng, H.; Xiong, W. The Financialization of Commodity Markets; Princeton University: Princeton, NJ, USA, 2013. [Google Scholar]

- Zhang, D.; Broadstock, D.C. Global Financial Crisis and Rising Connectedness in the International Commodity Markets. Int. Rev. Financ. Anal. 2020, 68, 101239. [Google Scholar] [CrossRef]

- Lahrech, A.; Sylwester, K.U.S. and Latin American Stock Market Linkages. J. Int. Money Financ. 2011, 30, 1341–1357. [Google Scholar] [CrossRef]

- Pincheira, P.; Hardy, N. Forecasting Base Metal Prices with the Chilean Exchange Rate. Resour. Policy 2019, 62, 256–281. [Google Scholar] [CrossRef]

- West, K.D.; Wong, K.-F. A Factor Model for Co-Movements of Commodity Prices. J. Int. Money Financ. 2014, 42, 289–309. [Google Scholar] [CrossRef]

- Chen, Y.-C.; Rogoff, K.S.; Rossi, B. Can Exchange Rates Forecast Commodity Prices? Q. J. Econ. 2010, 125, 1145–1194. [Google Scholar] [CrossRef]

- Chen, Y.; Rogoff, K.; Rossi, B. Predicting agri-commodity prices: An asset pricing approach. In Global Uncertainty and the Volatility of Agricultural Commodities Prices, Munier, B., Ed.; IOS Press: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Campbell, J.; Shiller, R. Cointegration and Tests of Present Value Models. J. Political Econ. 1987, 95, 1062–1088. [Google Scholar] [CrossRef]

- Engel, C.; West, K.D. Exchange Rates and Fundamentals. J. Political Econ. 2005, 113, 485–517. [Google Scholar] [CrossRef]

- Gargano, A.; Timmermann, A. Forecasting Commodity Price Indexes Using Macroeconomic and Financial Predictors. Int. J. Forecast 2014, 30, 825–843. [Google Scholar] [CrossRef]

- Pincheira, P.M.; Hardy, N. The Predictive Relationship between Exchange Rate Expectations and Base Metal Prices. 2018. Available online: https://ssrn.com/abstract=3263709 (accessed on 9 August 2018).

- Pincheira, P.; Hardy, N.; Bentancor, A. A Simple Out-of-Sample Test of Predictability against the Random Walk Benchmark. Mathematics 2022, 10, 228. [Google Scholar] [CrossRef]

- Groen, J.J.J.; Pesenti, P.A. Commodity prices, commodity currencies, and global economic developments. In Commodity Prices and Markets, East Asia Seminar on Economics; University of Chicago Press: Chicago, IL, USA, 2011; Volume 20, pp. 15–42. [Google Scholar]

- Bork, L.; Kaltwasser, P.R.; Sercu, P. Commodity Index Construction and the Predictive Power of Exchange Rates. J. Bank Financ. 2019, 1, issn 0378-4266. [Google Scholar]

- Lof, M.; Nyberg, H. Noncausality and the Commodity Currency Hypothesis. Energy Econ. 2017, 65, 424–433. [Google Scholar] [CrossRef]

- Mantegna, R.N. Hierarchical Structure in Financial Markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Ferraro, D.; Rogoff, K.; Rossi, B. Can oil prices forecast exchange rates? An empirical analysis of the relationship between commodity prices and exchange rates. J. Int. Money Financ. 2015, 54, 116–141. [Google Scholar] [CrossRef]

- Pincheira, P.; Hardy, N. Forecasting Aluminum Prices with Commodity Currencies. Resour. Policy 2021, 73, 102066. [Google Scholar] [CrossRef]

- Magner, N.; Lavin, J.F.; Valle, M.; Hardy, N. The Predictive Power of Stock Market’s Expectations Volatility: A Financial Synchronization Phenomenon. PLoS ONE 2021, 16, e0250846. [Google Scholar] [CrossRef] [PubMed]

- Magner, N.; Lavín, J.F.; Valle, M.A. Modeling synchronization risk among sustainable exchange trade funds: A statistical and network analysis approach. Mathematics 2022, 10, 3598. [Google Scholar] [CrossRef]

- Timmermann, A. Elusive Return Predictability. Int. J. Forecast 2008, 24, 1–18. [Google Scholar] [CrossRef]

- Conlon, T.; Cotter, J.; Eyiah-Donkor, E. The Illusion of Oil Return Predictability: The Choice of Data Matters! J. Bank Financ. 2022, 134, 106331. [Google Scholar] [CrossRef]

- Pincheira-Brown, P.; Bentancor, A.; Hardy, N.; Jarsun, N. Forecasting fuel prices with the Chilean exchange rate: Going beyond the commodity currency hypothesis. Energy Econ. 2022, 106, 105802. [Google Scholar] [CrossRef]

- Pulgar, N.M.; Esteban, J.A.T.S.; Muñoz, V.A.G. Stock Market Synchronization and Stock Volatility: The Case of an Emerging Market. Rev. Mex. De Econ. Y Finanz. Nueva Época REMEF 2022, 17, 747. [Google Scholar]

- Yan, X.-G.; Xie, C.; Wang, G.-J. Stock Market Network’s Topological Stability: Evidence from Planar Maximally Filtered Graph and Minimal Spanning Tree. Int. J. Mod. Phys. B 2015, 29, 1550161. [Google Scholar] [CrossRef]

- Wen, F.; Yuan, Y.; Zhou, W. Cross-shareholding Networks and Stock Price Synchronicity: Evidence from China. Int. J. Financ. Econ. 2021, 26, 914–948. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertész, J.; Kanto, A. Dynamics of Market Correlations: Taxonomy and Portfolio Analysis. Phys. Rev. E Stat. Phys. Plasmas Fluids Relat. Interdiscip. Top. 2003, 68, 056110. [Google Scholar] [CrossRef]

- Wang, H. VIX and Volatility Forecasting: A New Insight. Phys. A Stat. Mech. Its Appl. 2019, 533, 121951. [Google Scholar] [CrossRef]

- Andersen, T.G.; Bollerslev, T.; Diebold, F.X.; Labys, P. Modeling and Forecasting Realized Volatility. Econometrica 2003, 71, 579–625. [Google Scholar] [CrossRef]

- Newey, W.K.; West, K.D. Hypothesis Testing with Efficient Method of Moments Estimation. Int. Econ. Rev. 1987, 28, 777–787. [Google Scholar] [CrossRef]

- Newey, W.K.; West, K.D. Automatic Lag Selection in Covariance Matrix Estimation. Rev. Econ. Stud. 1994, 61, 631–653. [Google Scholar] [CrossRef]

- Rossi, B.; Inoue, A. Out-of-Sample Forecast Tests Robust to the Choice of Window Size. J. Bus. Econ. Stat. 2012, 30, 432–453. [Google Scholar] [CrossRef]

- Clark, T.E.; McCracken, M.W. Tests of Equal Forecast Accuracy and Encompassing for Nested Models. J. Econom. 2001, 105, 85–110. [Google Scholar] [CrossRef]

- Pincheira-Brown, P.; Neumann, F. Can We Beat the Random Walk? The Case of Survey-Based Exchange Rate Forecasts in Chile. Financ. Res. Lett. 2020, 37, 101380. [Google Scholar] [CrossRef]

- Pincheira, P.; Hardy, N.; Muñoz, F. “Go Wild for a While!”: A New Test for Forecast Evaluation in Nested Models. Mathematics 2021, 9, 2254. [Google Scholar] [CrossRef]

- Clark, T.E.; McCracken, M.W. Tests of Equal Forecast Accuracy for Overlapping Models. J. Appl. Econ. 2014, 29, 415–430. [Google Scholar] [CrossRef]

- Cheung, Y.-W.; Chinn, M.D.; Pascual, A.G. Empirical Exchange Rate Models of the Nineties: Are Any Fit to Survive? J. Int. Money Financ. 2005, 24, 1150–1175. [Google Scholar] [CrossRef]

- Ciner, C. Predicting White Metal Prices by a Commodity Sensitive Exchange Rate. Int. Rev. Financ. Anal. 2017, 52, 309–315. [Google Scholar] [CrossRef]

- Fernandez, V. A Historical Perspective of the Informational Content of Commodity Futures. Resour. Policy 2017, 51, 135–150. [Google Scholar] [CrossRef]

- Fernandez, V. Commodity Price Excess Co-Movement from a Historical Perspective: 1900–2010. Energy Econ. 2015, 49, 698–710. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 1995, 20, 134–144. [Google Scholar] [CrossRef]

- West, K.D. Asymptotic Inference about Predictive Ability. Econometrica 1996, 64, 1067–1084. [Google Scholar] [CrossRef]

| Panel A: In-the-sample core model | |

| (3) | |

| Panel B: out-of-sample core models | |

| (4) | |

| (5) | |

| Panel C: Out-of-sample benchmark models | |

| (6) | |

| (7) | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|

| Lag | MSTL | Chilean Peso | Icelandic Krona | Norwegian Krone | South African Rand | Australian Dollar | Canadian Dollar | New Zealand Dollar |

| Panel A: Ret(−1) | ||||||||

| 0 | −0.009 | −0.014 | −0.106 | −0.129 | −0.130 | −0.137 | −0.093 | |

| 1 | −0.401 | 0.096 | 0.133 | 0.248 | 0.175 | 0.233 | 0.196 | 0.222 |

| 2 | −0.142 | 0.034 | −0.090 | −0.060 | 0.063 | −0.050 | −0.045 | −0.105 |

| 3 | 0.053 | −0.031 | 0.075 | −0.007 | −0.018 | 0.001 | 0.019 | −0.013 |

| 4 | 0.067 | 0.032 | −0.009 | 0.028 | 0.039 | 0.048 | −0.050 | 0.025 |

| 5 | −0.050 | 0.008 | 0.006 | −0.020 | −0.029 | −0.026 | 0.064 | 0.047 |

| 6 | −0.039 | 0.029 | 0.046 | 0.013 | 0.017 | 0.040 | 0.039 | 0.005 |

| 7 | 0.062 | −0.005 | −0.179 | −0.036 | −0.017 | −0.032 | −0.068 | −0.042 |

| 8 | −0.118 | 0.060 | 0.113 | 0.071 | 0.019 | 0.037 | 0.020 | 0.053 |

| 9 | 0.071 | −0.141 | 0.028 | −0.089 | −0.094 | −0.077 | −0.015 | −0.063 |

| 10 | 0.063 | −0.023 | −0.026 | −0.065 | 0.037 | −0.025 | −0.023 | −0.036 |

| 11 | −0.045 | 0.061 | −0.020 | 0.104 | 0.030 | 0.066 | 0.005 | 0.103 |

| 12 | −0.028 | −0.047 | −0.006 | −0.056 | −0.018 | −0.068 | −0.015 | −0.182 |

| Panel B: Ret(−1)+Ret(−2)+Ret(−3) | ||||||||

| 0 | 0.055 | 0.066 | 0.109 | 0.125 | 0.108 | 0.102 | 0.064 | |

| 1 | −0.401 | 0.019 | −0.012 | −0.021 | 0.047 | −0.001 | −0.049 | −0.058 |

| 2 | −0.142 | 0.004 | 0.040 | 0.002 | −0.005 | 0.015 | 0.019 | 0.036 |

| 3 | 0.053 | 0.042 | 0.023 | 0.012 | 0.015 | 0.035 | 0.031 | 0.049 |

| 4 | 0.067 | 0.015 | −0.067 | −0.023 | −0.021 | −0.011 | 0.019 | 0.006 |

| 5 | −0.050 | 0.048 | −0.009 | 0.030 | 0.008 | 0.026 | −0.007 | 0.010 |

| 6 | −0.039 | −0.051 | −0.021 | −0.032 | −0.049 | −0.039 | −0.036 | −0.035 |

| 7 | 0.062 | −0.055 | 0.058 | −0.054 | −0.019 | −0.041 | −0.009 | −0.027 |

| 8 | −0.118 | −0.064 | −0.009 | −0.029 | −0.015 | −0.019 | −0.019 | 0.001 |

| 9 | 0.071 | −0.002 | −0.030 | −0.012 | 0.029 | −0.017 | −0.020 | −0.071 |

| 10 | 0.063 | 0.022 | −0.005 | 0.055 | 0.002 | 0.026 | 0.042 | −0.010 |

| 11 | −0.045 | −0.020 | 0.027 | 0.003 | 0.035 | 0.045 | 0.034 | 0.039 |

| 12 | −0.028 | 0.009 | 0.004 | −0.003 | 0.003 | 0.014 | −0.007 | 0.081 |

| Australia | Canada | Chile | Iceland | Norway | New Zealand | South Africa | |

|---|---|---|---|---|---|---|---|

| ER(−1) + ER(−2) + ER(−3) | 0.233 *** | 0.344 * | 0.189 ** | 0.156 *** | 0.233 ** | 0.174 | 0.190 * |

| (0.085) | (0.184) | (0.073) | (0.057) | (0.126) | (0.130) | (0.107) | |

| IVOL Aluminum (−1) | −0.045 ** | −0.046 ** | −0.042 ** | −0.042 ** | −0.043 | −0.044 ** | −0.045 ** |

| (0.018) | (0.019) | (0.017) | (0.018) | (0.018) | (0.017) | (0.018) | |

| Obs | 189 | 189 | 189 | 189 | 189 | 189 | 189 |

| R2 | 0.356 | 0.357 | 0.349 | 0.349 | 0.356 | 0.348 | 0.355 |

| ER(−1) + ER(−2) + ER(−3) | 0.277 *** | 0.409 ** | 0.236 *** | 0.130 | 0.297 ** | 0.161 | 0.262 ** |

| (0.103) | (0.174) | (0.078) | (0.084) | (0.117) | (0.147) | (0.103) | |

| IVOL Cooper (−1) | −0.124 *** | −0.118 *** | −0.112 *** | −0.107 ** | −0.115 | −0.110 ** | −0.120 *** |

| (0.045) | (0.041) | (0.041) | (0.042) | (0.042) | (0.045) | (0.045) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.346 | 0.347 | 0.338 | 0.331 | 0.347 | 0.331 | 0.353 |

| ER(−1) + ER(−2) + ER(−3) | 0.214 ** | 0.337 ** | 0.186 *** | 0.090 | 0.255 ** | 0.102 | 0.223 ** |

| (0.090) | (0.169) | (0.071) | (0.095) | (0.116) | (0.151) | (0.095) | |

| IVOL Crude Oil (−1) | −0.004 ** | −0.003 | 0.001 | 0.007 | −0.006 | 0.003 | −0.003 |

| (0.031) | (0.029) | (0.031) | (0.032) | (0.032) | (0.034) | (0.031) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.324 | 0.326 | 0.319 | 0.314 | 0.327 | 0.313 | 0.332 |

| ER(−1) + ER(−2) + ER(−3) | 0.293 | 0.396 ** | 0.231 *** | 0.136 * | 0.301 ** | 0.171 | 0.262 *** |

| (0.085) | (0.164) | (0.070) | (0.081) | (0.117) | (0.130) | (0.099) | |

| IVOL Gold (−1) | −0.180 *** | −0.165 *** | −0.161 *** | −0.161 *** | −0.167 *** | −0.165 *** | −0.170 *** |

| (0.054) | (0.057) | (0.057) | (0.059) | (0.057) | (0.052) | (0.057) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.362 | 0.36 | 0.352 | 0.345 | 0.362 | 0.346 | 0.367 |

| ER(−1) + ER(−2) + ER(−3) | 0.303 *** | 0.393 ** | 0.218 *** | 0.135 | 0.302 ** | 0.179 | 0.256 ** |

| (0.101) | (0.178) | (0.074) | (0.086) | (0.121) | (0.139) | (0.104) | |

| IVOL Silver (−1) | −0.186 *** | −0.166 *** | −0.159 *** | −0.162 *** | −0.169 *** | −0.169 ** | −0.168 *** |

| (0.055) | (0.050) | (0.050) | (0.051) | (0.053) | (0.050) | (0.049) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.365 | 0.336 | 0.351 | 0.346 | 0.362 | 0.347 | 0.367 |

| ER(−1) + ER(−2) + ER(−3) | 0.236 ** | 0.351 ** | 0.206 *** | 0.098 | 0.267 ** | 0.115 | 0.232 ** |

| (0.096) | (0.175) | (0.072) | (0.090) | (0.122) | (0.146) | (0.100) | |

| VIX(−1) | −0.031 | −0.024 | −0.026 | −0.019 | −0.027 | −0.020 | −0.026 |

| (0.030) | (0.029) | (0.029) | (0.028) | (0.030) | (0.029) | (0.029) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.327 | 0.329 | 0.322 | 0.315 | 0.33 | 0.315 | 0.334 |

| ER(−1) + ER(−2) + ER(−3) | 0.211 *** | 0.334 ** | 0.187 *** | 0.092 | 0.251 ** | 0.104 | 0.222 ** |

| (0.088) | (0.166) | (0.070) | (0.091) | (0.114) | (0.141) | (0.095) | |

| Obs | 202 | 202 | 202 | 202 | 202 | 202 | 202 |

| R2 | 0.324 | 0.326 | 0.319 | 0.313 | 0.327 | 0.313 | 0.332 |

| ENCNEW | Australia | Canada | Chile | Iceland | Norway | New Zealand | South Africa |

|---|---|---|---|---|---|---|---|

| P/R: 0.2 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.261 | 0.857 ** | 0.365 | −0.025 | 1.276 ** | 0.233 | 0.287 |

| AR(3) + IVOLCCop(−1) | 0.563 * | 1.275 ** | 0.822 ** | 0.100 | 1.926 *** | 0.465 | 0.720 * |

| AR(3) + IVOLCrudOil(−1) | 0.303 | 0.900 ** | 0.344 | −0.012 | 1.340 ** | 0.274 | 0.291 |

| AR(3) + IVOLGold(−1) | 0.653 * | 1.294 ** | 0.685 * | 0.178 | 2.006 *** | 0.565 * | 0.969 ** |

| AR(3) + IVOLSilver(−1) | −0.490 | 0.752 ** | 0.233 | −0.300 | 0.959 ** | −0.107 | 0.438 |

| AR(3) + VIX(−1) | 0.443 | 0.932 ** | 0.574 * | 0.026 | 1.501 *** | 0.289 | 0.435 |

| AR(3) | 0.144 | 0.743 * | 0.320 | −0.019 | 1.194 ** | 0.176 | 0.254 |

| P/R: 0.4 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.992 * | 0.982 | 0.795 | 0.104 | 1.656 | 0.492 | 1.695 |

| AR(3) + IVOLCCop(−1) | 1.658 ** | 1.427 ** | 1.332 ** | 0.363 | 2.432 ** | 0.959 | 2.293 *** |

| AR(3) + IVOLCrudOil(−1) | 0.892 * | 0.865 * | 0.676 | 0.039 | 1.585 ** | 0.405 | 1.431 ** |

| AR(3) + IVOLGold(−1) | 1.472 ** | 1.210 ** | 1.155 ** | 0.386 | 2.272 *** | 0.882 | 2.352 *** |

| AR(3) + IVOLSilver(−1) | 0.737 * | 0.781 * | 0.653 | 0.104 | 1.650 ** | 0.504 | 1.935 ** |

| AR(3) + VIX(−1) | 1.153 ** | 0.997 * | 0.947 * | 0.120 | 1.812 ** | 0.505 | 1.682 ** |

| AR(3) | 0.923 * | 0.896 * | 0.744 * | 0.091 | 1.634 ** | 0.424 | 1.541 ** |

| P/R: 0.6 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.538 | 0.475 | 0.433 | −0.165 | 1.062 * | 0.209 | 0.761 |

| AR(3) + IVOLCCop(−1) | 0.385 | 0.274 | 0.316 | −0.291 | 1.146 * | 0.158 | 0.368 |

| AR(3) + IVOLCrudOil(−1) | 0.385 | 0.333 | 0.310 | −0.259 | 0.930 * | 0.072 | 0.449 |

| AR(3) + IVOLGold(−1) | 0.650 | 0.379 | 0.612 | 0.056 | 1.299 * | 0.215 | 1.243 * |

| AR(3) + IVOLSilver(−1) | −0.215 | 0.089 | 0.122 | −0.357 | 0.818 * | −0.308 | 0.811 * |

| AR(3) + VIX(−1) | 1.024 * | 0.726 | 0.784 | −0.101 | 1.507 ** | 0.298 | 1.006 * |

| AR(3) | 0.523 | 0.459 | 0.416 | −0.201 | 1.092 * | 0.149 | 0.642 |

| Hit Rate | Australia | Canada | Chile | Iceland | Norway | New Zealand | South Africa |

|---|---|---|---|---|---|---|---|

| P/R: 0.2 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.765 *** | 0.794 *** | 0.765 *** | 0.735 *** | 0.765 *** | 0.735 *** | 0.794 *** |

| AR(3) + IVOLCCop(−1) | 0.765 *** | 0.794 *** | 0.735 *** | 0.735 *** | 0.824 *** | 0.765 *** | 0.794 *** |

| AR(3) + IVOLCrudOil(−1) | 0.765 *** | 0.794 *** | 0.765 *** | 0.765 *** | 0.794 *** | 0.765 *** | 0.794 *** |

| AR(3) + IVOLGold(−1) | 0.765 *** | 0.765 *** | 0.765 *** | 0.735 *** | 0.794 *** | 0.765 *** | 0.794 *** |

| AR(3) + IVOLSilver(−1) | 0.765 *** | 0.765 *** | 0.735 *** | 0.706 *** | 0.765 *** | 0.765 *** | 0.735 *** |

| AR(3) + VIX(−1) | 0.794 *** | 0.824 *** | 0.765 *** | 0.765 *** | 0.824 *** | 0.765 *** | 0.794 *** |

| AR(3) | 0.794 *** | 0.794 *** | 0.794 *** | 0.765 *** | 0.794 *** | 0.765 *** | 0.794 *** |

| P/R: 0.4 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.746 *** | 0.746 *** | 0.746 *** | 0.729 *** | 0.729 *** | 0.729 *** | 0.712 *** |

| AR(3) + IVOLCCop(−1) | 0.763 *** | 0.729 *** | 0.712 *** | 0.695 *** | 0.780 *** | 0.746 *** | 0.746 *** |

| AR(3) + IVOLCrudOil(−1) | 0.729 *** | 0.763 *** | 0.746 *** | 0.746 *** | 0.763 *** | 0.712 *** | 0.763 *** |

| AR(3) + IVOLGold(−1) | 0.695 *** | 0.729 *** | 0.712 *** | 0.695 *** | 0.763 *** | 0.695 *** | 0.729 *** |

| AR(3) + IVOLSilver(−1) | 0.712 *** | 0.712 *** | 0.678 *** | 0.695 *** | 0.729 *** | 0.712 *** | 0.729 *** |

| AR(3) + VIX(−1) | 0.746 *** | 0.746 *** | 0.763 *** | 0.729 *** | 0.780 *** | 0.746 *** | 0.763 *** |

| AR(3) | 0.746 *** | 0.763 *** | 0.746 *** | 0.729 *** | 0.746 *** | 0.729 *** | 0.763 *** |

| P/R: 0.6 | |||||||

| AR(3) + IVOLAluminum(−1) | 0.711 *** | 0.684 *** | 0.711 *** | 0.697 *** | 0.697 *** | 0.697 *** | 0.697 *** |

| AR(3) + IVOLCCop(−1) | 0.697 *** | 0.658 *** | 0.658 *** | 0.658 *** | 0.724 *** | 0.684 *** | 0.711 *** |

| AR(3) + IVOLCrudOil(−1) | 0.697 *** | 0.697 *** | 0.711 *** | 0.724 *** | 0.724 *** | 0.697 *** | 0.737 *** |

| AR(3) + IVOLGold(−1) | 0.658 *** | 0.697 *** | 0.671 *** | 0.671 *** | 0.711 *** | 0.658 *** | 0.697 *** |

| AR(3) + IVOLSilver(−1) | 0.684 *** | 0.671 *** | 0.658 *** | 0.684 *** | 0.697 *** | 0.684 *** | 0.711 *** |

| AR(3) + VIX(−1) | 0.711 *** | 0.684 *** | 0.724 *** | 0.711 *** | 0.724 *** | 0.724 *** | 0.737 *** |

| AR(3) | 0.711 *** | 0.697 *** | 0.711 *** | 0.711 *** | 0.711 *** | 0.711 *** | 0.737 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Magner, N.S.; Hardy, N.; Lavin, J.; Ferreira, T. Forecasting Commodity Market Synchronization with Commodity Currencies: A Network-Based Approach. Entropy 2023, 25, 562. https://doi.org/10.3390/e25040562

Magner NS, Hardy N, Lavin J, Ferreira T. Forecasting Commodity Market Synchronization with Commodity Currencies: A Network-Based Approach. Entropy. 2023; 25(4):562. https://doi.org/10.3390/e25040562

Chicago/Turabian StyleMagner, Nicolas S., Nicolás Hardy, Jaime Lavin, and Tiago Ferreira. 2023. "Forecasting Commodity Market Synchronization with Commodity Currencies: A Network-Based Approach" Entropy 25, no. 4: 562. https://doi.org/10.3390/e25040562

APA StyleMagner, N. S., Hardy, N., Lavin, J., & Ferreira, T. (2023). Forecasting Commodity Market Synchronization with Commodity Currencies: A Network-Based Approach. Entropy, 25(4), 562. https://doi.org/10.3390/e25040562