Impact of the Global Fear Index (COVID-19 Panic) on the S&P Global Indices Associated with Natural Resources, Agribusiness, Energy, Metals, and Mining: Granger Causality and Shannon and Rényi Transfer Entropy

Abstract

:1. Introduction

2. Materials and Methods

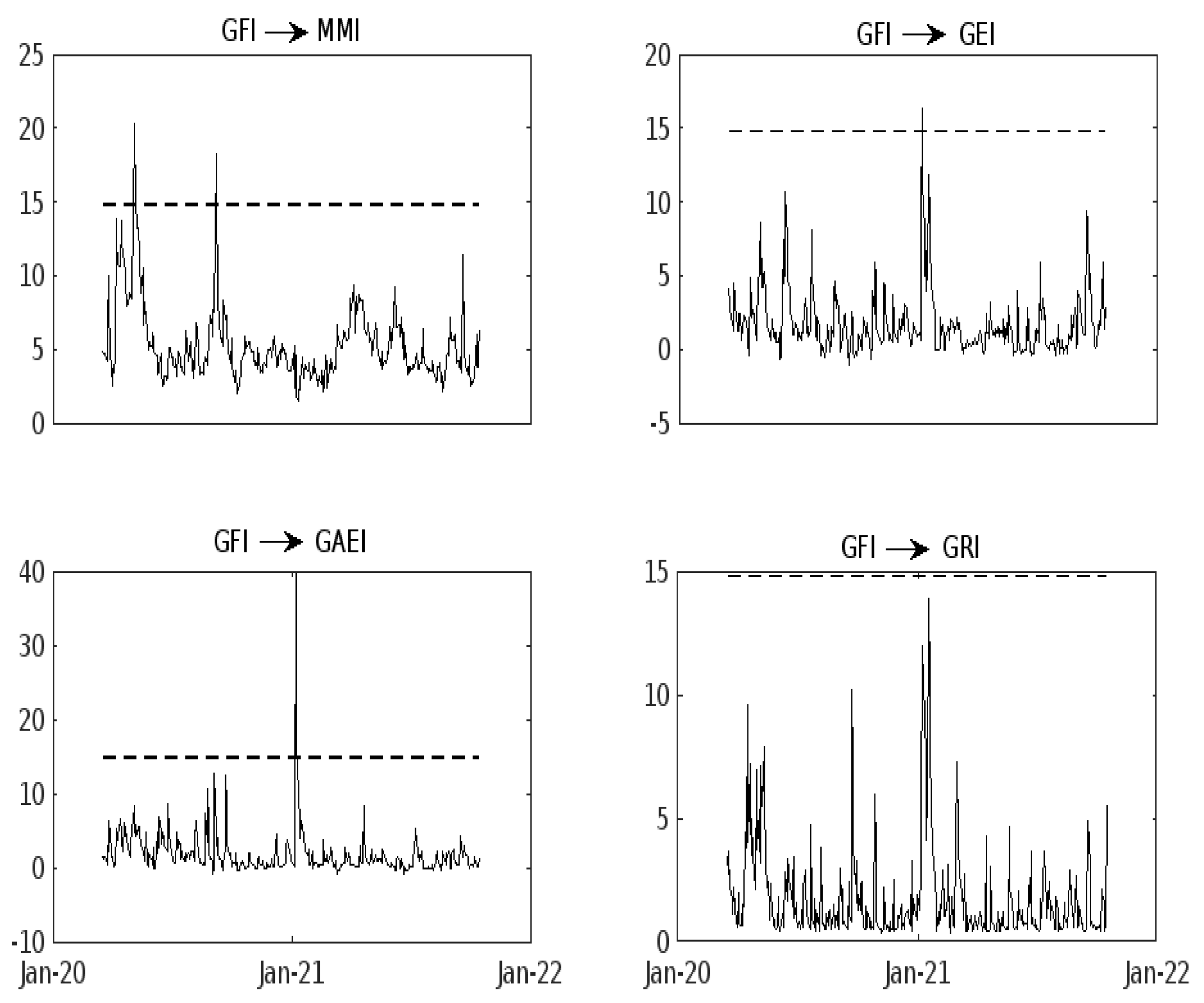

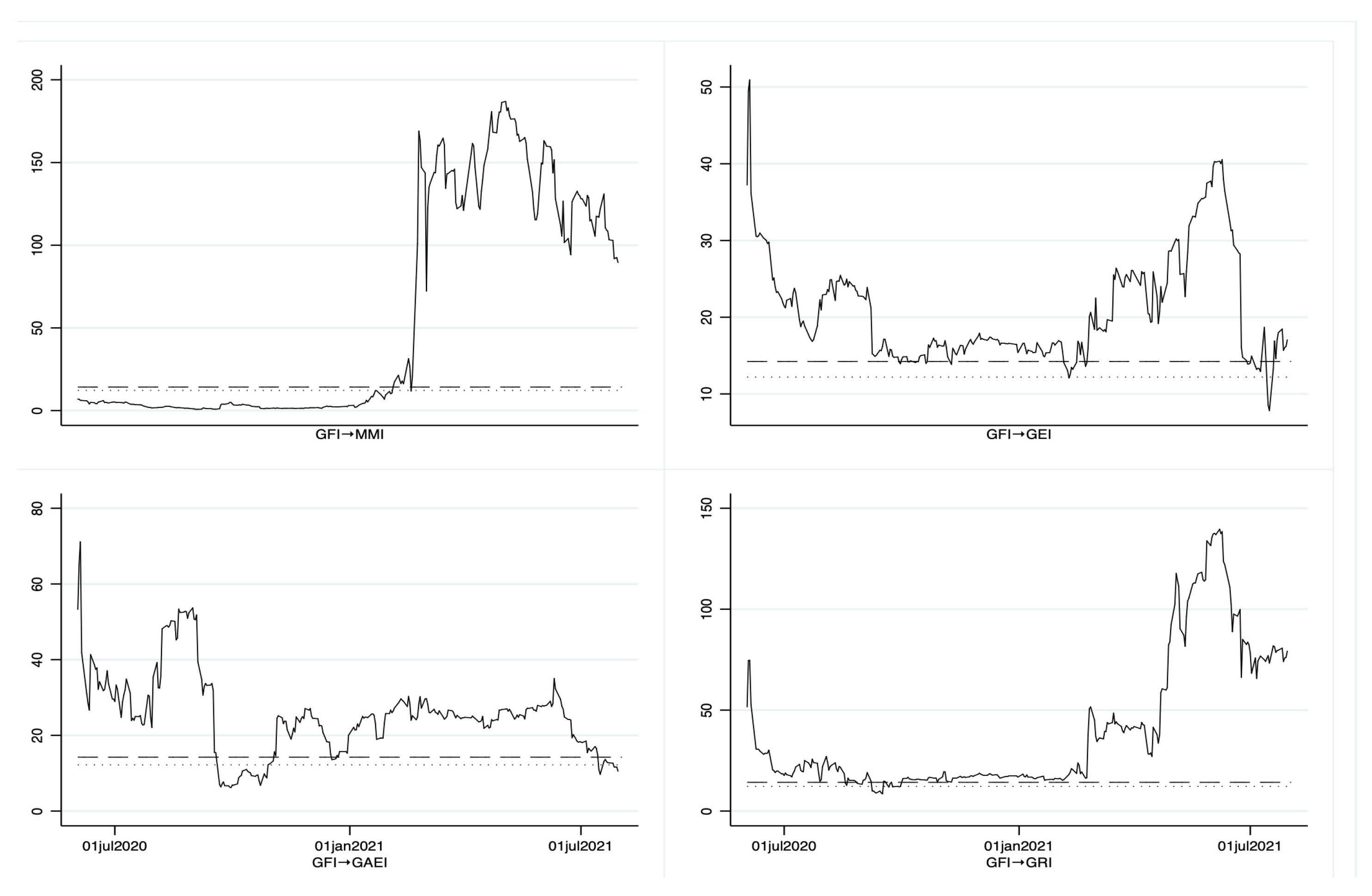

3. Empirical Results from Classical Time Series Analysis

4. Robustness Check with an Information-Theoretic Analysis (Shannon and Rényi Entropy)

5. General Discussion of the Empirical Results Obtained

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- World Health Organization Rolling Updates on Coronavirus Disease (COVID-19). Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/events-as-they-happen (accessed on 30 December 2022).

- Ashraf, B.N. Stock Markets’ Reaction to COVID-19: Cases or Fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Hu, M.; Ji, Q. Financial Markets under the Global Pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The Unprecedented Stock Market Reaction to COVID-19. Rev. Asset Pricing Stud. 2020, 10, 742–758. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, R. COVID-19 Impact on Commodity Futures Volatilities. Financ. Res. Lett. 2022, 47, 102624. [Google Scholar] [CrossRef]

- Bouri, E.; Demirer, R.; Gupta, R.; Pierdzioch, C. Infectious Diseases, Market Uncertainty and Oil Market Volatility. Energies 2020, 13, 4090. [Google Scholar] [CrossRef]

- Scherf, M.; Matschke, X.; Rieger, M.O. Stock Market Reactions to COVID-19 Lockdown: A Global Analysis. Financ. Res. Lett. 2022, 45, 102245. [Google Scholar] [CrossRef]

- Ganie, I.R.; Wani, T.A.; Yadav, M.P. Impact of COVID-19 Outbreak on the Stock Market: An Evidence from Select Economies. Bus. Perspect. Res. 2022, 1–15. [Google Scholar] [CrossRef]

- Mazur, M.; Dang, M.; Vega, M. COVID-19 and the March 2020 Stock Market Crash. Evidence from S&P1500. Financ. Res. Lett. 2021, 38, 101690. [Google Scholar] [CrossRef]

- Shapoval, V.; Hägglund, P.; Pizam, A.; Abraham, V.; Carlbäck, M.; Nygren, T.; Smith, R.M. The COVID-19 Pandemic Effects on the Hospitality Industry Using Social Systems Theory: A Multi-Country Comparison. Int. J. Hosp. Manag. 2021, 94, 102813. [Google Scholar] [CrossRef]

- Muche, M.; Yemata, G.; Molla, E.; Muasya, A.M.; Tsegay, B.A. COVID-19 Lockdown and Natural Resources: A Global Assessment on the Challenges, Opportunities, and the Way Forward. Bull. Natl. Res. Cent. 2022, 46, 20. [Google Scholar] [CrossRef]

- Rajput, H.; Changotra, R.; Rajput, P.; Gautam, S.; Gollakota, A.R.K.; Arora, A.S. A Shock like No Other: Coronavirus Rattles Commodity Markets. Environ. Dev. Sustain. 2021, 23, 6564–6575. [Google Scholar] [CrossRef]

- Ramelli, S.; Wagner, A.F. Feverish Stock Price Reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, 9, 622–655. [Google Scholar] [CrossRef]

- Sibley, C.G.; Greaves, L.M.; Satherley, N.; Wilson, M.S.; Overall, N.C.; Lee, C.H.J.; Milojev, P.; Bulbulia, J.; Osborne, D.; Milfont, T.L.; et al. Effects of the COVID-19 Pandemic and Nationwide Lockdown on Trust, Attitudes toward Government, and Well-Being. Am. Psychol. 2020, 75, 618–630. [Google Scholar] [CrossRef]

- Narayan, P.K.; Iyke, B.N.; Sharma, S.S. New Measures of the COVID-19 Pandemic: A New Time-Series Dataset. Asian Econ. Lett. 2021, 2, 1–13. [Google Scholar] [CrossRef]

- Amewu, G.; Owusu Junior, P.; Amenyitor, E.A. Co-Movement between Equity Index and Exchange Rate: Fresh Evidence from COVID-19 Era. Sci. Afr. 2022, 16, e01146. [Google Scholar] [CrossRef]

- Sazzad Jeris, S.; Deb Nath, R. COVID-19, Oil Price and UK Economic Policy Uncertainty: Evidence from the ARDL Approach. Quant. Financ. Econ. 2020, 4, 503–514. [Google Scholar] [CrossRef]

- Chiang, T.C. Evidence of Economic Policy Uncertainty and COVID-19 Pandemic on Global Stock Returns. J. Risk Financ. Manag. 2022, 15, 28. [Google Scholar] [CrossRef]

- Udeaja, E.A.; Isah, K.O. Stock Markets’ Reaction to COVID-19: Analyses of Countries with High Incidence of Cases/Deaths in Africa. Sci. Afr. 2022, 15, e01076. [Google Scholar] [CrossRef]

- Abu, N.; Gamal, A.A.M.; Sakanko, M.A.; Mateen, A.; Joseph, D.; Amaechi, B.O.O. How Have COVID-19 Confirmed Cases and Deaths Affected Stock Markets? Evidence from Nigeria. Contemp. Econ. 2021, 15, 76–99. [Google Scholar] [CrossRef]

- Al-Awadhi, A.M.; Alsaifi, K.; Al-Awadhi, A.; Alhammadi, S. Death and Contagious Infectious Diseases: Impact of the COVID-19 Virus on Stock Market Returns. J. Behav. Exp. Financ. 2020, 27, 100326. [Google Scholar] [CrossRef]

- Mishra, P.K.; Mishra, S.K. Corona Pandemic and Stock Market Behaviour: Empirical Insights from Selected Asian Countries. Millenn. Asia 2020, 11, 341–365. [Google Scholar] [CrossRef]

- Onali, E. COVID-19 and Stock Market Volatility. SSRN Electron. J. 2020, 1–24. [Google Scholar] [CrossRef]

- Corbet, S.; Larkin, C.; Lucey, B. The Contagion Effects of the COVID-19 Pandemic: Evidence from Gold and Cryptocurrencies. Financ. Res. Lett. 2020, 35, 101554. [Google Scholar] [CrossRef]

- Li, Y.; Liang, C.; Ma, F.; Wang, J. The Role of the IDEMV in Predicting European Stock Market Volatility during the COVID-19 Pandemic. Financ. Res. Lett. 2020, 36, 101749. [Google Scholar] [CrossRef] [PubMed]

- Coronado, S.; Martinez, J.N.; Romero-Meza, R. Time-Varying Multivariate Causality among Infectious Disease Pandemic and Emerging Financial Markets: The Case of the Latin American Stock and Exchange Markets. Appl. Econ. 2021, 54, 3924–3932. [Google Scholar] [CrossRef]

- Romero-Meza, R.; Coronado, S.; Ibañez-Veizaga, F. COVID-19 y Causalidad en la volatilidad del mercado accionario chileno. Estud. Gerenc. 2021, 37, 242–250. [Google Scholar] [CrossRef]

- Bouri, E.; Gkillas, K.; Gupta, R.; Pierdzioch, C. Forecasting Power of Infectious Diseases-Related Uncertainty for Gold Realized Variance. Financ. Res. Lett. 2021, 42, 101936. [Google Scholar] [CrossRef]

- Gupta, R.; Subramaniam, S.; Bouri, E.; Ji, Q. Infectious Disease-Related Uncertainty and the Safe-Haven Characteristic of US Treasury Securities. Int. Rev. Econ. Financ. 2021, 71, 289–298. [Google Scholar] [CrossRef]

- Salisu, A.A.; Akanni, L.O. Constructing a Global Fear Index for the COVID-19 Pandemic. Emerg. Mark. Financ. Trade 2020, 56, 2310–2331. [Google Scholar] [CrossRef]

- Li, W.; Chien, F.; Kamran, H.W.; Aldeehani, T.M.; Sadiq, M.; Nguyen, V.C.; Taghizadeh-Hesary, F. The Nexus between COVID-19 Fear and Stock Market Volatility. Econ. Res. Ekon. Istraživanja 2022, 35, 1765–1785. [Google Scholar] [CrossRef]

- Tao, R.; Su, C.W.; Yaqoob, T.; Hammal, M. Do Financial and Non-Financial Stocks Hedge against Lockdown in COVID-19? An Event Study Analysis. Econ. Res. Ekon. Istraz. 2021, 35, 2405–2426. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Orden-Cruz, C.; Escamilla-Solano, S. Influence of COVID-Induced Fear on Sovereign Bond Yield. Econ. Res. Ekon. Istraz. 2021, 35, 2173–2190. [Google Scholar] [CrossRef]

- Lu, F.; Hong, Y.; Wang, S.; Lai, K.; Liu, J. Time-Varying Granger Causality Tests for Applications in Global Crude Oil Markets. Energy Econ. 2014, 42, 289–298. [Google Scholar] [CrossRef]

- Caporin, M.; Costola, M. Time-Varying Granger Causality Tests in the Energy Markets: A Study on the DCC-MGARCH Hong Test. Energy Econ. 2022, 111, 106088. [Google Scholar] [CrossRef]

- Cevik, E.I.; Atukeren, E.; Korkmaz, T. Oil Prices and Global Stock Markets: A Time-Varying Causality-in-Mean and Causality-in-Variance Analysis. Energies 2018, 11, 2848. [Google Scholar] [CrossRef]

- Gupta, R.; Kanda, P.; Wohar, M.E. Predicting Stock Market Movements in the United States: The Role of Presidential Approval Ratings. Int. Rev. Financ. 2021, 21, 324–335. [Google Scholar] [CrossRef]

- Coronado, S.; Gupta, R.; Hkiri, B.; Rojas, O. Time-Varying Spillovers between Currency and Stock Markets in the USA: Historical Evidence from More than Two Centuries. Adv. Decis. Sci. 2020, 24, 1–33. [Google Scholar]

- Kanda, P.; Burke, M.; Gupta, R. Time-Varying Causality between Equity and Currency Returns in the United Kingdom: Evidence from over Two Centuries of Data. Physical A Stat. Mech. Its Appl. 2018, 506, 1060–1080. [Google Scholar] [CrossRef]

- Jammazi, R.; Ferrer, R.; Jareño, F.; Shahzad, S.J.H. Time-Varying Causality between Crude Oil and Stock Markets: What Can We Learn from a Multiscale Perspective? Int. Rev. Econ. Financ. 2017, 49, 453–483. [Google Scholar] [CrossRef]

- Bera, A.K.; Jarque, C.M. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Econ. Lett. 1981, 7, 313–318. [Google Scholar] [CrossRef]

- Meng, M.; Lee, J.; Payne, J.E. RALS-LM Unit Root Test with Trend Breaks and Non-Normal Errors: Application to the Prebisch-Singer Hypothesis. Stud. Nonlinear Dyn. Econom. 2017, 21, 31–45. [Google Scholar] [CrossRef]

- Sadiq, M.; Hsu, C.-C.; Zhang, Y.; Chien, F. COVID-19 Fear and Volatility Index Movements: Empirical Insights from ASEAN Stock Markets. Environ. Sci. Pollut. Res. 2021, 28, 67167–67184. [Google Scholar] [CrossRef] [PubMed]

- Ayyildiz, M. Asymmetrical Relationship between COVID-19 Global Fear Index and Agricultural Commodity Prices. Emir. J. Food Agric. 2022, 34, 239–247. [Google Scholar] [CrossRef]

- Dogan, E.; Majeed, M.T.; Luni, T. Analyzing the Nexus of COVID-19 and Natural Resources and Commodities: Evidence from Time-Varying Causality. Resour. Policy 2022, 77, 102694. [Google Scholar] [CrossRef]

- Zaremba, A.; Kizys, R.; Aharon, D.Y.; Demir, E. Infected Markets: Novel Coronavirus, Government Interventions, and Stock Return Volatility around the Globe. Financ. Res. Lett. 2020, 35, 101597. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 Pandemic, Oil Prices, Stock Market, Geopolitical Risk and Policy Uncertainty Nexus in the US Economy: Fresh Evidence from the Wavelet-Based Approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Lyócsa, Š.; Baumöhl, E.; Výrost, T.; Molnár, P. Fear of the Coronavirus and the Stock Markets. Financ. Res. Lett. 2020, 36, 101735. [Google Scholar] [CrossRef]

- Naseem, S.; Mohsin, M.; Hui, W.; Liyan, G.; Penglai, K. The Investor Psychology and Stock Market Behavior during the Initial Era of COVID-19: A Study of China, Japan, and the United States. Front. Psychol. 2021, 12, 1–10. [Google Scholar] [CrossRef]

- Xiang, Y.-T.; Yang, Y.; Li, W.; Zhang, L.; Zhang, Q.; Cheung, T.; Ng, C.H. Timely Mental Health Care for the 2019 Novel Coronavirus Outbreak Is Urgently Needed. Lancet Psychiatry 2020, 7, 228–229. [Google Scholar] [CrossRef]

- Jawadi, F.; Namouri, H.; Ftiti, Z. An Analysis of the Effect of Investor Sentiment in a Heterogeneous Switching Transition Model for G7 Stock Markets. J. Econ. Dyn. Control 2018, 91, 469–484. [Google Scholar] [CrossRef]

- Dash, S.R.; Maitra, D. The COVID-19 Pandemic Uncertainty, Investor Sentiment, and Global Equity Markets: Evidence from the Time-Frequency Co-Movements. N. Am. J. Econ. Financ. 2022, 62, 101712. [Google Scholar] [CrossRef]

- Zhang, H.; Ding, Y.; Li, J. Impact of the COVID-19 Pandemic on Economic Sentiment: A Cross-Country Study. Emerg. Mark. Financ. Trade 2021, 57, 1603–1612. [Google Scholar] [CrossRef]

- Su, Z.; Liu, P.; Fang, T. Pandemic-Induced Fear and Stock Market Returns: Evidence from China. Glob. Financ. J. 2021, 54, 100644. [Google Scholar] [CrossRef]

- Haroon, O.; Rizvi, S.A.R. COVID-19: Media Coverage and Financial Markets Behavior—A Sectoral Inquiry. J. Behav. Exp. Financ. 2020, 27, 100343. [Google Scholar] [CrossRef]

- Schell, D.; Wang, M.; Huynh, T.L.D. This Time Is Indeed Different: A Study on Global Market Reactions to Public Health Crisis. J. Behav. Exp. Financ. 2020, 27, 100349. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Foglia, M.; Nasir, M.A.; Angelini, E. Feverish Sentiment and Global Equity Markets during the COVID-19 Pandemic. J. Econ. Behav. Organ. 2021, 188, 1088–1108. [Google Scholar] [CrossRef]

- Rossi, B.; Wang, Y. Vector Autoregressive-Based Granger Causality Test in the Presence of Instabilities. Stata J. 2019, 19, 883–899. [Google Scholar] [CrossRef]

- Shi, S.; Phillips, P.C.B.; Hurn, S. Change Detection and the Causal Impact of the Yield Curve. J. Time Ser. Anal. 2018, 39, 966–987. [Google Scholar] [CrossRef]

- Coronado, S.; Gupta, R.; Nazlioglu, S.; Rojas, O. Time-varying causality between Bond and Oil Markets of the United States: Evidence from over One and Half Centuries of Data. Int. J. Financ. Econ. 2021, 1–9. [Google Scholar] [CrossRef]

- Aggarwal, S.; Nawn, S.; Dugar, A. What Caused Global Stock Market Meltdown during the COVID Pandemic–Lockdown Stringency or Investor Panic? Financ. Res. Lett. 2021, 38, 101827. [Google Scholar] [CrossRef]

- Mishra, R.; Sharma, R.; Karedla, Y.; Patel, N. Impact of COVID-19 Cases, Deaths, Stringency and Vaccinations on the US Stock Market. Vis. J. Bus. Perspect. 2022. [Google Scholar] [CrossRef]

- Jizba, P.; Lavicka, H.; Tabachová, Z. Causal Inference in Time Series in Terms of Rényi Transfer Entropy. Entropy 2022, 24, 855. [Google Scholar] [CrossRef] [PubMed]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423, 623–656. [Google Scholar] [CrossRef] [Green Version]

- Rényi, A. On measures of entropy and information. In Proceedings of the Fourth Berkeley Symposium on Mathematical Statistics and Probability, Davis, CA, USA, 20 June–30 July 1960; Volume 1, p. 547. [Google Scholar]

| MMI | GEI | GAEI | GRI | GFI | |

|---|---|---|---|---|---|

| Mean | 0.02 | 0.00 | 0.06 | 0.05 | 0.04 |

| Median | 0.07 | −0.04 | 0.10 | 0.14 | −0.35 |

| Min | −10.36 | −21.34 | −10.31 | −12.91 | −25.76 |

| Max | 9.95 | 15.52 | 6.69 | 11.69 | 28.06 |

| Variance | 3.71 | 7.69 | 2.46 | 3.56 | 42.9 |

| SD | 1.93 | 2.77 | 1.57 | 1.89 | 6.55 |

| Skewness | −0.31 | −1.3 | −1.3 | −1.41 | 0.18 |

| Kurtosis | 7.51 | 17.09 | 12.02 | 16.6 | 6.75 |

| JB | 369.54 *** | 3681.0 *** | 1683.10 *** | 3667.70 *** | 2018.80 *** |

| RALS-LM | −26.06 *** | −15.13 *** | −11.07 *** | −11.11 *** | −7.00 *** |

| 26 August 2021 01 August 2021 | 25 January 2021 23 February 2021 | 05 August 2020 19 August 2020 | 26 October 2020 25 February 2021 | 24 July 2020 03 December 2021 |

| GFI MMI | GFI GEI | GFI GAEI |

|---|---|---|

| 05 April 2020 05 May 2020 05 June 2020 05 July 2020 09 July 2020 | 01 July 2021 | 01 July 2021 01 August 2021 |

| Bivariate Series | Statistics | |||

|---|---|---|---|---|

| ExpW | MeanW | Nyblom | SupLR | |

| GFI MMI | 88.53 *** | 55.34 *** | 2.23 * | 186.94 *** |

| GFI GEI | 20.21 *** | 21.11 *** | 1.76 | 50.94 *** |

| GFI GAEI | 29.94 *** | 25.53 *** | 2.06 | 71.14 *** |

| GFI GRI | 65.23 *** | 40.21 *** | 1.90 | 139.60 *** |

| PANEL A | ||||||||

| Shannon Transfer Entropy | Bootstrapped TE Quantiles | |||||||

| Direction | TE | Eff. TE | Direction | 0% | 25% | 50% | 75% | 100% |

| GFI MMI | 2.5343 *** | 0.06 | GFI MMI | 1.88 | 2.03 | 2.07 | 2.11 | 2.23 |

| GFI GEI | 2.2945 *** | 0.06 | GFI GEI | 1.75 | 1.87 | 1.91 | 1.95 | 2.11 |

| GFI GAEI | 2.4526 *** | 0.07 | GFI GAEI | 1.83 | 1.98 | 2.01 | 2.05 | 2.17 |

| GFI GRI | 2.6126 *** | 0.09 | GFI GRI | 1.94 | 2.14 | 2.19 | 2.23 | 2.38 |

| PANEL B | ||||||||

| Rényi Transfer Entropy | Bootstrapped TE Quantiles | |||||||

| Direction | TE | Eff. TE | Direction | 0% | 25% | 50% | 75% | 100% |

| GFI MMI | 1.8436 *** | 0.05 | GFI MMI | 1.36 | 1.48 | 1.53 | 1.57 | 1.80 |

| GFI GEI | 1.7925 *** | 0.05 | GFI GEI | 1.33 | 1.46 | 1.50 | 1.54 | 1.70 |

| GFI GAEI | 1.921 *** | 0.06 | GFI GAEI | 1.43 | 1.52 | 1.56 | 1.61 | 1.74 |

| GFI GRI | 2.0353 *** | 0.07 | GFI GRI | 1.46 | 1.68 | 1.74 | 1.80 | 1.98 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Celso-Arellano, P.; Gualajara, V.; Coronado, S.; Martinez, J.N.; Venegas-Martínez, F. Impact of the Global Fear Index (COVID-19 Panic) on the S&P Global Indices Associated with Natural Resources, Agribusiness, Energy, Metals, and Mining: Granger Causality and Shannon and Rényi Transfer Entropy. Entropy 2023, 25, 313. https://doi.org/10.3390/e25020313

Celso-Arellano P, Gualajara V, Coronado S, Martinez JN, Venegas-Martínez F. Impact of the Global Fear Index (COVID-19 Panic) on the S&P Global Indices Associated with Natural Resources, Agribusiness, Energy, Metals, and Mining: Granger Causality and Shannon and Rényi Transfer Entropy. Entropy. 2023; 25(2):313. https://doi.org/10.3390/e25020313

Chicago/Turabian StyleCelso-Arellano, Pedro, Victor Gualajara, Semei Coronado, Jose N. Martinez, and Francisco Venegas-Martínez. 2023. "Impact of the Global Fear Index (COVID-19 Panic) on the S&P Global Indices Associated with Natural Resources, Agribusiness, Energy, Metals, and Mining: Granger Causality and Shannon and Rényi Transfer Entropy" Entropy 25, no. 2: 313. https://doi.org/10.3390/e25020313

APA StyleCelso-Arellano, P., Gualajara, V., Coronado, S., Martinez, J. N., & Venegas-Martínez, F. (2023). Impact of the Global Fear Index (COVID-19 Panic) on the S&P Global Indices Associated with Natural Resources, Agribusiness, Energy, Metals, and Mining: Granger Causality and Shannon and Rényi Transfer Entropy. Entropy, 25(2), 313. https://doi.org/10.3390/e25020313