Resource Recovery and the Sherwood Plot

Abstract

1. Introduction

2. Materials and Methods

2.1. Physical Foundations of the Sherwood Plot

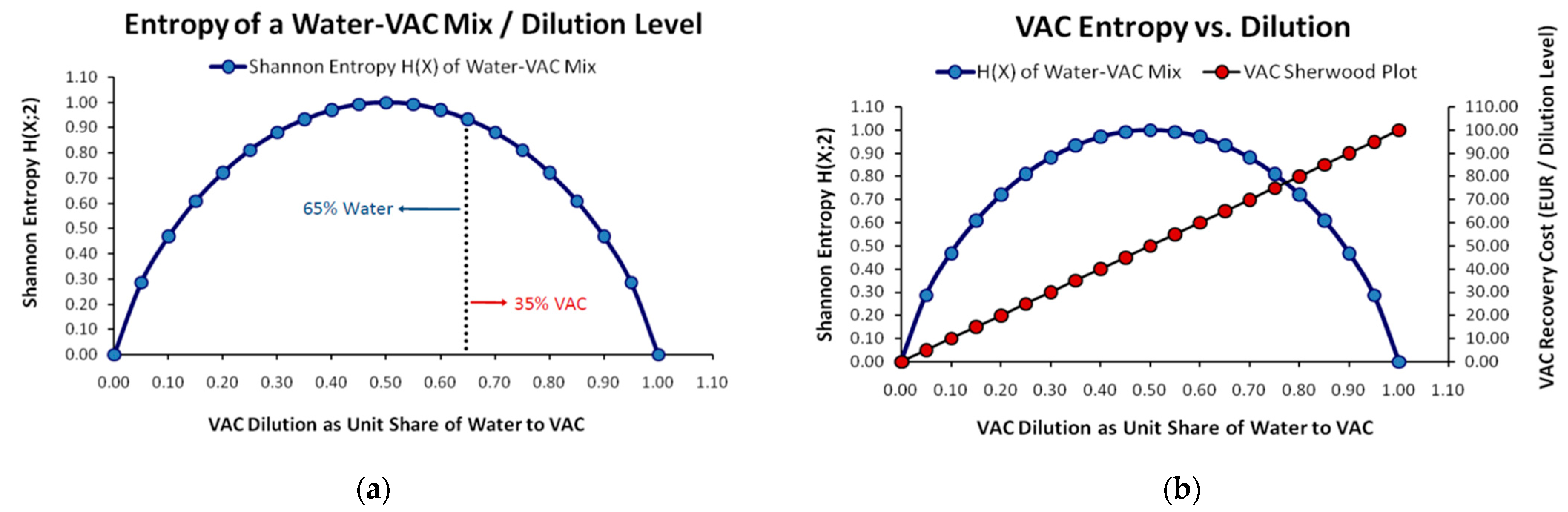

2.1.1. Entropy, Dilution and the Sherwood Plot

2.1.2. Process Engineering and the Sherwood Plot

2.2. Institutional Shifts and the Sherwood Plot

2.3. Economic Foundations of the Sherwood Plot

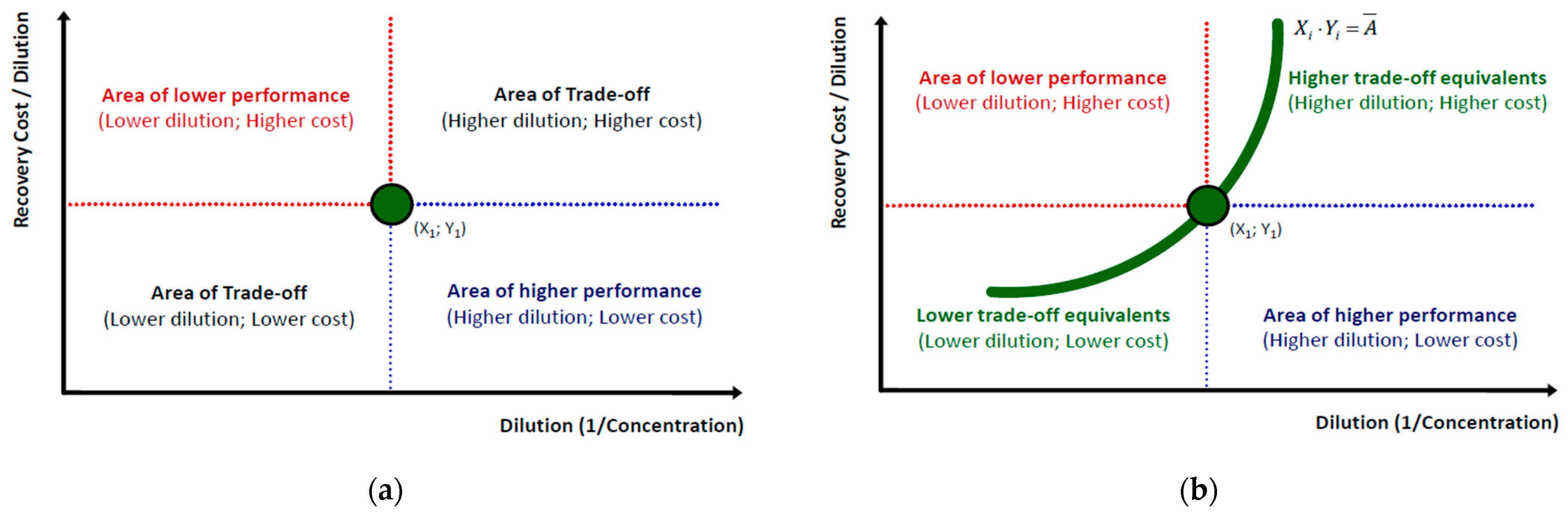

2.3.1. Microeconomic Foundations

2.3.2. Macroeconomic Foundations

2.3.3. The Recovery Cost vs. the Required Market Price Approach

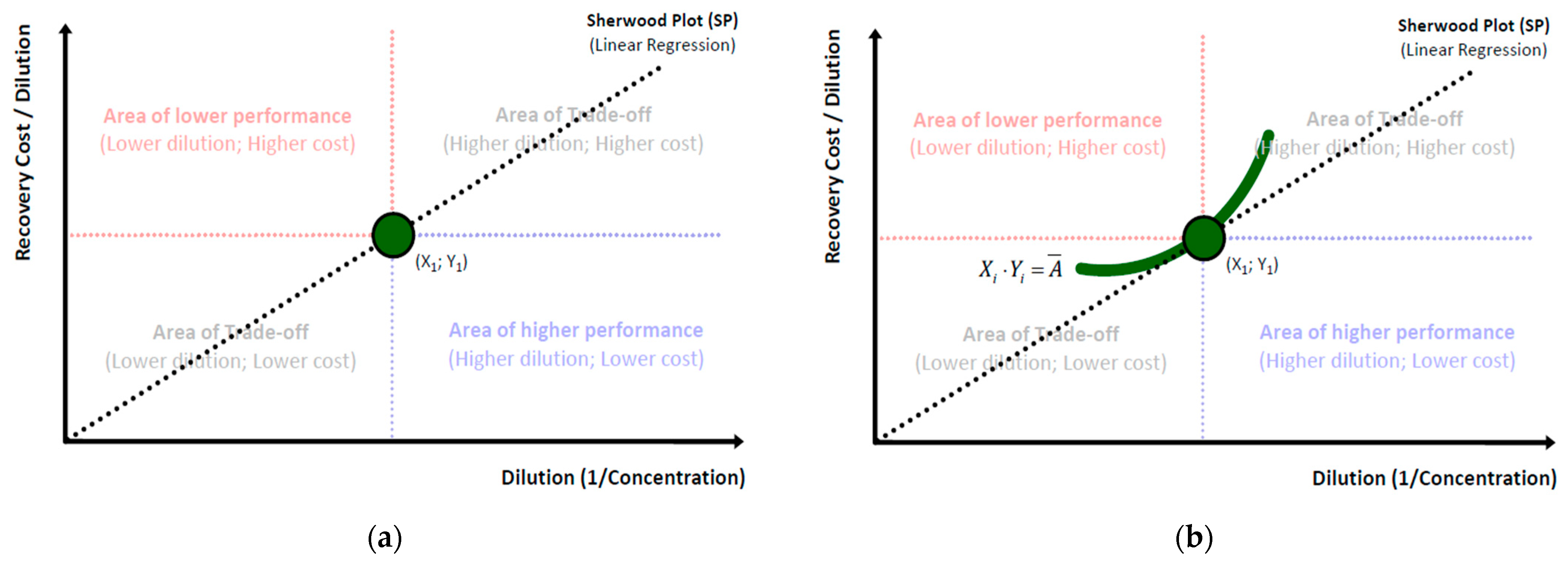

2.4. Mathematical Formulation of the Sherwood Plot

2.4.1. Generalized Theoretical Formulation

2.4.2. Prevalent Empirical Formulation

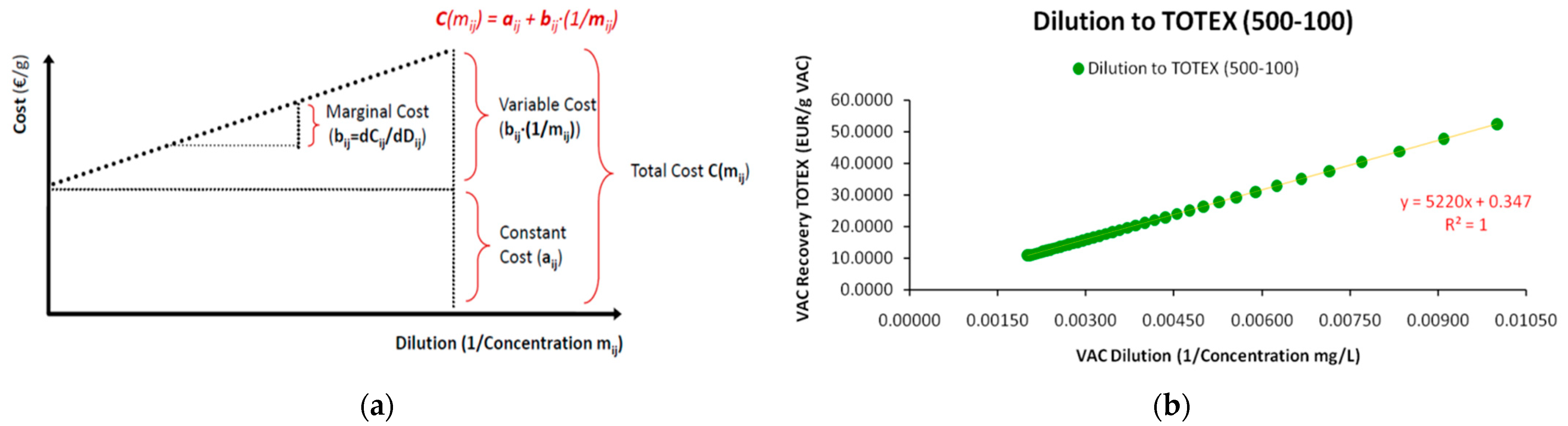

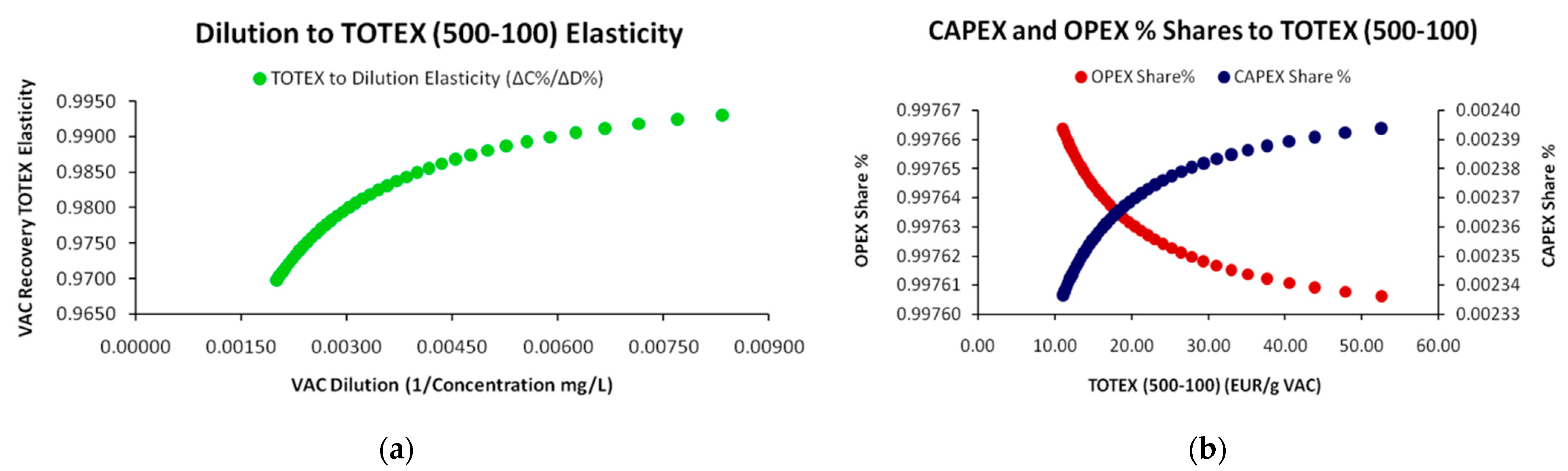

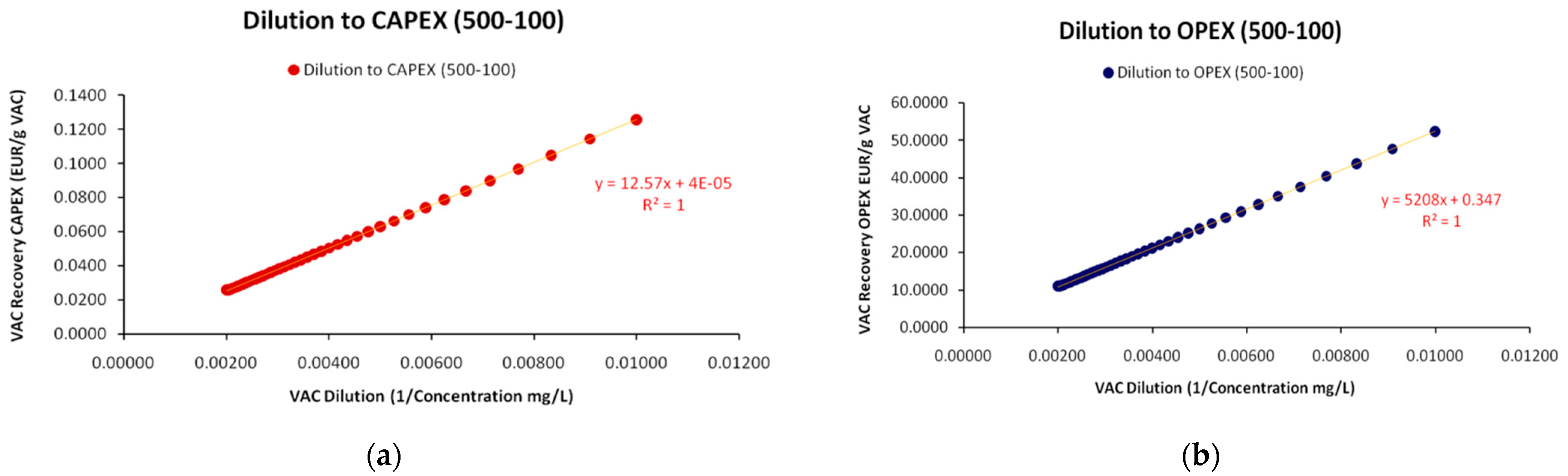

2.4.3. Cost Structure Analytics

3. Results

3.1. Empirical Formulation of the Sherwood Plot

3.1.1. Sherwood Plot with Deterministic Data

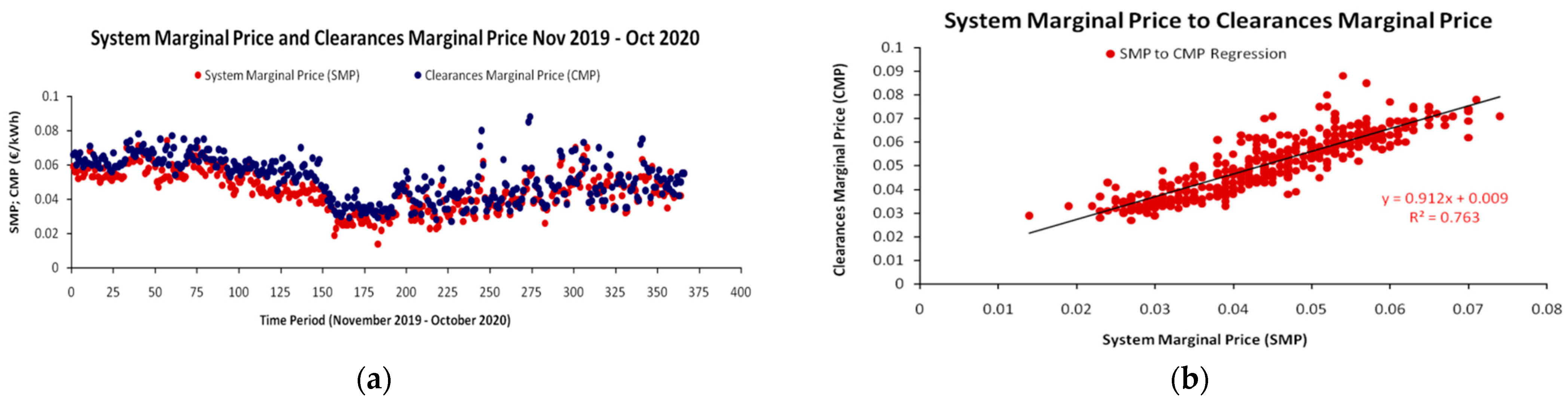

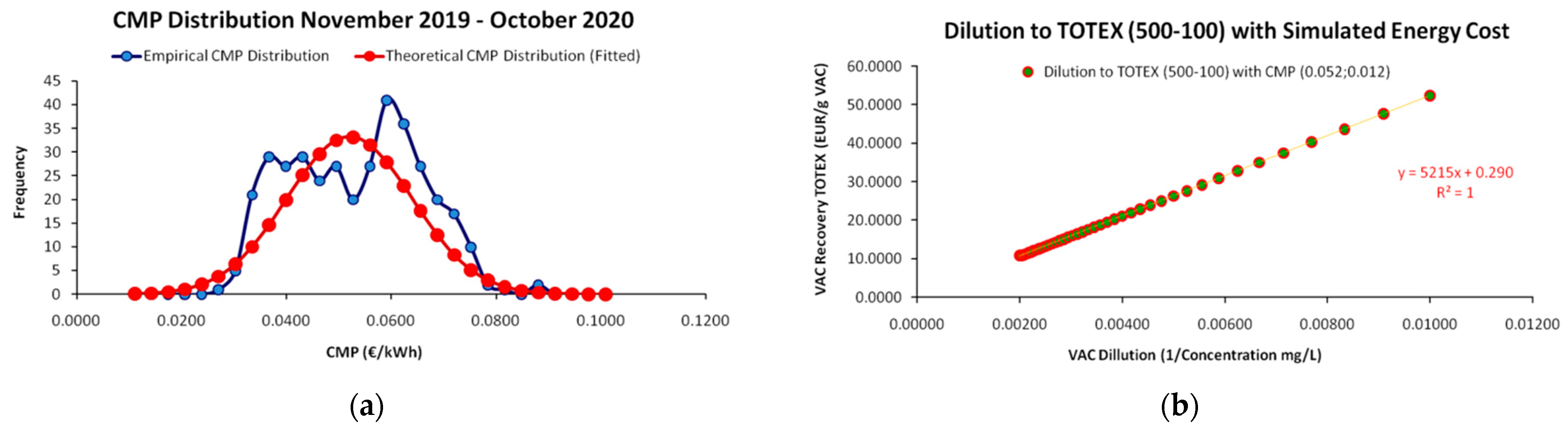

3.1.2. Sherwood Plot with Stochastic Data

3.2. The Sherwood Plot and Circular Economy Finance (CEF)

3.3. Market Structure and the Sherwood Plot

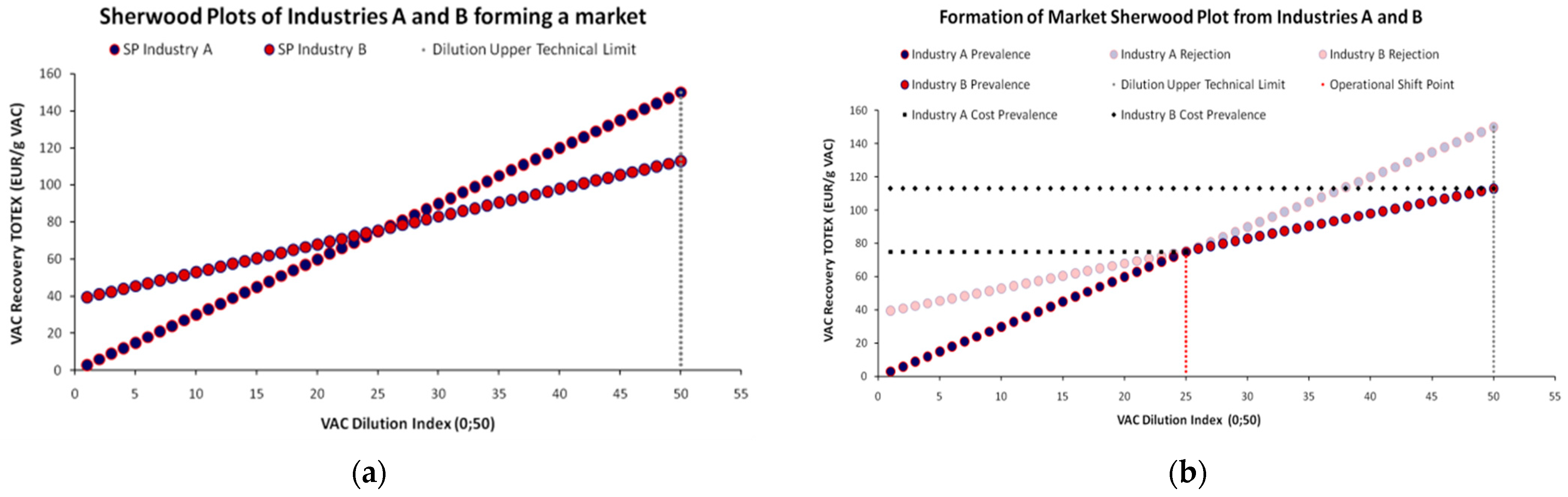

3.3.1. Market Formation Process

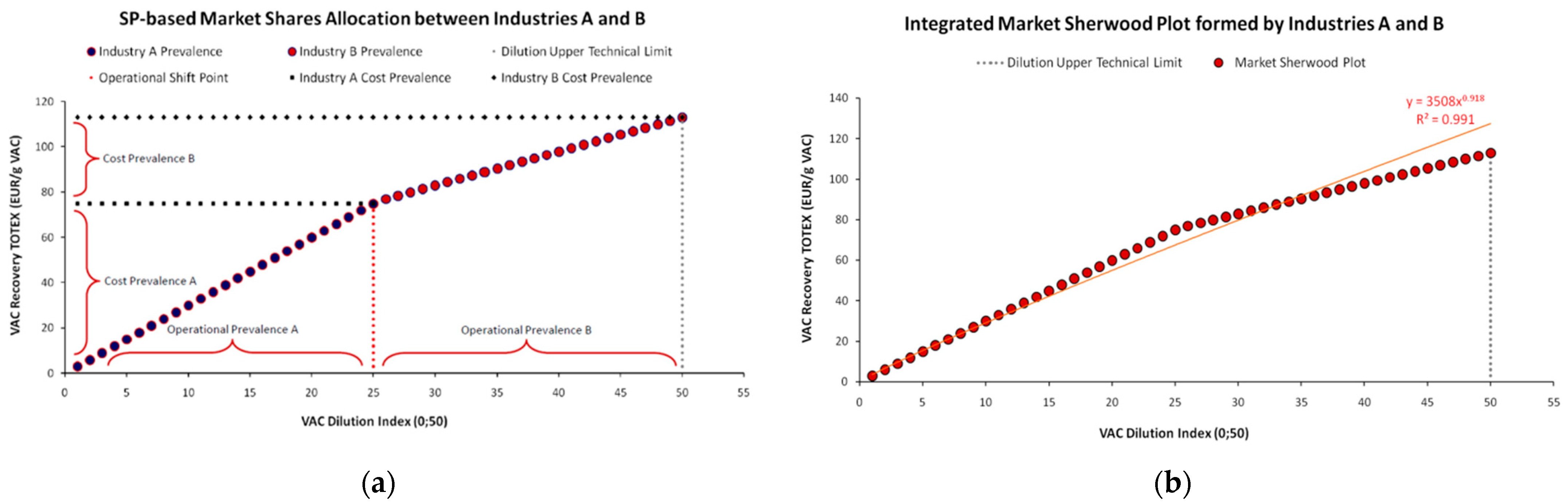

3.3.2. Market Allocation and Optimization

3.3.3. Market Structure Diagnostics (MSDs)

4. Discussion and Extensions

4.1. Market Ontologies

4.2. Research Extensions of the Sherwood Plot

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sherwood, T.K.; Woertz, B.B. Mass Transfer between Phases. Ind. Eng. Chem. 1939, 31, 1034–1041. [Google Scholar] [CrossRef]

- Sherwood, T.K. Mass Transfer between Phases; Priestley Lecture, Phi Lambda Upsilon; Penn State University: University Park, PA, USA, 1959. [Google Scholar]

- Deng, S.; Zhou, X.; Huang, A.; Yih, Y.; Sutherland, J.W. Evaluating economic opportunities for product recycling via the Sherwood principle and machine learning. Resour. Conserv. Recycl. 2021, 167, 105232. [Google Scholar] [CrossRef]

- Makropoulos, C.; Rozos, E.; Tsoukalas, I.; Plevri, A.; Karakatsanis, G.; Karagiannidis, L.; Makri, E.; Lioumis, C.; Noutsopoulos, C.; Mamais, D. Sewer-mining: A water reuse option supporting circular economy, public service provision and entrepreneurship. J. Environ. Manag. 2017, 216, 285–298. [Google Scholar] [CrossRef] [PubMed]

- Liakopoulou, A.; Makropoulos, C.; Nikolopoulos, D.; Monokrousou, K.; Karakatsanis, G. An Urban Water Simulation Model for the Design, Testing and Economic Viability Assessment of Distributed Water Management Systems for a Circular Economy. Environ. Sci. Proc. 2020, 2, 14. [Google Scholar] [CrossRef]

- Hotelling, H. The Economics of Exhaustible Resources. J. Political Econ. 1931, 39, 137–175. [Google Scholar] [CrossRef]

- United Nations (UN). System of Environmental Economic Accounting (SEEA) 2012: Central Framework. New York, USA, 2014, ISBN (UN): 987-92-1-161563-0. Available online: https://unstats.un.org/unsd/envaccounting/seearev/seea_cf_final_en.pdf (accessed on 25 November 2022).

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Official Journal of the European Communities. Directive 2000/60/EC of the European Parliament and of the Council of October 2000; Establishing A Framework for Community Action in the Field of Water Policy, L 327/1, Document 32000L0060. 2000. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32000L0060 (accessed on 17 December 2022).

- Dahmus, J.B.; Gutowski, T.J. What gets recycled: An information theory based model for product recycling. Environ. Sci. Technol. 2007, 41, 7543–7550. [Google Scholar] [CrossRef]

- Gutowski, T.G.; Wolf, M.I.; Dahmus, J.B.; Albino, D.K. Analysis of Recycling Systems. In Proceedings of the 2008 NSF Engineering Research and Innovation Conference, Knoxville, TE, USA, 7–10 January 2008. Available online: http://web.mit.edu/ebm/www/Publications/NSFJan08.pdf (accessed on 25 November 2022).

- House, K.Z.; Baclig, A.C.; Ranjan, M.; van Nierop, E.A.; Wilcox, J.; Herzog, H.J. Economic and energetic analysis of capturing CO2 from ambient air. Proc. Natl. Acad. Sci. USA 2011, 108, 20428–20433. [Google Scholar] [CrossRef]

- National Academy of Engineering. The Greening of Industrial Ecosystems; The National Academies Press: Washington, DC, USA, 1994. [Google Scholar] [CrossRef]

- Helmenstine, A.M. Learn about STP in Chemistry. ThoughtCo. 2021. Available online: thoughtco.com/stp-in-chemistry-607533 (accessed on 25 November 2022).

- International Union of Pure and Applied Chemistry (IUPAC). Quantities, Units and Symbols in Physical Chemistry, 3rd ed.; prepared by Cohen et al for the IUPAC Physical and Biophysical Chemistry Division; RSC Publishing: Zurich, Switzerland, 2007. [Google Scholar]

- International Union of Pure and Applied Chemistry (IUPAC). Quantities, Units and Symbols in Physical Chemistry, 2nd ed.; Prepared by Mills et al. for the IUPAC Physical Chemistry Division; Blackwell Science: Oxford, UK, 1993; ISBN 0-632-03583-8. [Google Scholar]

- Lehmann, H.P.; Fuentes-Arderiu, X.; Bertello, L.F. Glossary of Terms in Quantities and Units in Clinical Chemistry (IUPAC-IFCC Recommendations 1996). Pure Appl. Chem. 1996, 68, 957–1000. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Baez, J.C. Renyi Entropy and Free Energy (v4). Quantum Physics (quant-ph). arXiv 2011, arXiv:1102.2098v4. [Google Scholar]

- Karakatsanis, G.; Mamassis, N.; Koutsoyiannis, D.; Efstratiadis, A. Entropy and reliability of water use via a statistical approach of scarcity. In Proceedings of the Facets of Uncertainty: 5th EGU Leonardo Conference—Hydrofractals 2013–STAHY 2013, EGU, IAHS and IUGG, Kos, Greece; 2013. [Google Scholar] [CrossRef]

- Bailey, R.; Allen, J.K.; Bras, B. Applying ecological input-output flow analysis to material flows in industrial systems: Part I: Tracing flows. J. Ind. Ecol. 1992, 8, 69–91. [Google Scholar] [CrossRef]

- Bolton, R. Integrating Economic and Environmental Models: Some Preliminary Considerations. Socio-Econ. Plan. Sci. 1989, 23, 25–37. [Google Scholar] [CrossRef]

- Capros, P. Integrated Economy/Energy/Environment Models; International Atomic Energy Agency (IAEA), International Nuclear Information System (INIS): Vienna, Austria, 1996; Volume 28, p. 343. [Google Scholar]

- Climis, A.D. A pollution theory of value. Socio-Econ. Plan. Sci. 1979, 13, 303–312. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas. 2022. Available online: https://iea.blob.core.windows.net/assets/1af70a5f-9059-47b4-a2dd-1b479918f3cb/A10-PointPlantoReducetheEuropeanUnionsRelianceonRussianNaturalGas.pdf (accessed on 25 November 2022).

- Couder, J.; Verbruggen, A. Towards an Integrated Performance Indicator for (Energy) Benchmarking Covenants with Industry. In The Handbook of Environmental Voluntary Agreements; Croci, E., Ed.; Environment & Policy; Springer: Dordrecht, The Netherlands, 2005; Volume 43. [Google Scholar] [CrossRef]

- Karakatsanis, G.; Roussis, D.; Moustakis, Y.; Gournari, P.; Parara, I.; Dimitriadis, P.; Koutsoyiannis, D. Energy, variability and weather finance engineering. Energy Procedia 2017, 125, 389–397. [Google Scholar] [CrossRef]

- Karakatsanis, G.; Mamassis, N.; Koutsoyiannis, D.; Efstratiadis, A. Entropy, Pricing and Macroeconomics of Pumped-Storage Systems; European Geosciences Union (EGU) General Assembly: Vienna, Austria, 2014. [Google Scholar] [CrossRef]

- Gilding, P.; Murray, H.; Rick, H. Safe Companies: An Alternative Approach to Operationalizing Sustainability. Corp. Environ. Strategy 2002, 9, 390–397. [Google Scholar] [CrossRef]

- Sehnem, S.; Queiroz, A.A.F.S.L.; Pereira, S.C.F.; Correia, G.S.; Kuzma, E. Circular economy and innovation: A look from the perspective of organizational capabilities. Bus. Strategy Environ. 2021, 31, 1–15. [Google Scholar] [CrossRef]

- Grübler, A. Technology and Global Change; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar] [CrossRef]

- Phillips, W.; Edwards, D. Metal prices as a function of ore grade. Resource Policy 1976, 2, 167–178. [Google Scholar] [CrossRef]

- Trainer, F.E. A Critical Examination of the Ultimate Resource and the Resourceful Earth. Technol. Forecast. Soc. Change 1986, 30, 19–37. [Google Scholar] [CrossRef]

- National Academies of Sciences, Engineering and Medicine. Separation and Purification: Critical Needs and Opportunities; The National Academies Press: Washington, DC, USA, 1987. [Google Scholar] [CrossRef]

- Domenech, T.; Doranova, A.; Roman, L.; Smith, M.; Artola, I. Cooperation Fostering Industrial Symbiosis: Market Potential, Good Practice and Policy Actions: Final Report; Publications Office: Luxembourg, 2018. [Google Scholar]

- European Commission. Accelerating the Transition to the Circular Economy: Improving Access to Finance for Circular Economy Projects; Publications Office: Luxenburg, 2019; ISBN 978-92-79-99324-4. [Google Scholar] [CrossRef]

- European Investment Bank (EIB). Circular Economy Overview 2021. 2021. Available online: https://www.eib.org/attachments/thematic/circular_economy_overview_2021_en.pdf (accessed on 25 November 2022).

- European Commission. Financing a Sustainable European Economy. Final Report by the EU High-Level Expert Group on Sustainable Finance. 2018. Available online: https://ec.europa.eu/info/sites/default/files/180131-sustainable-finance-final-report_en.pdf (accessed on 25 November 2022).

- European Commission. Circular Economy Action Plan for a Cleaner and More Competitive Europe. 2020. Available online: https://ec.europa.eu/environment/pdf/circular-economy/new_circular_economy_action_plan.pdf (accessed on 25 November 2022).

- European Commission. Report on Critical Raw Materials in the Circular Economy; Publications Office: Luxenburg, 2018; ISBN 978-92-79-94626-4. [Google Scholar] [CrossRef]

- Krajnc, D.; Peter, G. How to compare companies on relevant dimensions of sustainability. Ecol. Econ. 2005, 55, 551–563. [Google Scholar] [CrossRef]

- Popp, J.; Hoag, D.; Hyatt, D. Sustainability indices with multiple objectives. Ecol. Indic. 2001, 1, 37–47. [Google Scholar] [CrossRef]

- Spangenberg, J.H.; Femia, A.; Hinterberger, F.; Schütz, H.; Bringezu, S.; Liedtke, C.; Schmidt-Bleek, F. Material Flow-based Indicators in Environmental Reporting; In Environmental Issues Series; European Environment Agency (EEA): Copenhagen, Denmark, 1998. [Google Scholar]

- European Commission. Final Report of the High-Level Panel of the European Decarbonisation Pathways Initiative; Publications Office: Luxenburg, 2018; ISBN 978-92-79-96827-3. [Google Scholar] [CrossRef]

- Morilla, C.R.; Díaz-Salazar, G.L.; Cardenete, M.A. Economic and environmental efficiency using a social accounting matrix. Ecol. Econ. 2006, 60, 774–786. [Google Scholar] [CrossRef]

- Krajnc, D.; Glavič, P. A model for integrated assessment of sustainable development. Resour. Conserv. Recycl. 2005, 43, 189–208. [Google Scholar] [CrossRef]

- Organization of Economic Co-operation and Development (OECD). Measuring Sustainable Development: Integrated Economic, Environmental and Social Frameworks; OECD Publishing: Paris, France, 2004. [Google Scholar] [CrossRef]

- Martin, W. Environmental multipliers from a system of physical resource accounting. Struct. Chang. Econ. Dyn. 1991, 2, 297–313. [Google Scholar] [CrossRef]

- Roussis, D.; Karakatsanis, G.; Makropoulos, C. A macroeconomic model of water capital conservation. In Proceedings of the 4th International Conference of Water Economics, Statistics and Finance, Livorno, Italy, 4–5 April 2017. [Google Scholar] [CrossRef]

- Walter, N.; Snyder, C. Microeconomic Theory: Basic Principles and Extensions, 10th ed.; Thomson South-Western: Mason, OH, USA, 2007; ISBN 13: 978-0-324-42162-0. [Google Scholar]

- Georgescu-Roegen, N. The Entropy Law and the Economic Process; Harvard University Press: Cambridge, MA, USA, 1971; ISBN 9780674281653. [Google Scholar] [CrossRef]

- Midilli, A.; Dincer, I.; Ay, M. Green energy strategies for sustainable development. Energy Policy 2006, 34, 3623–3633. [Google Scholar] [CrossRef]

- Dasgupta, P.; Mäler, K.-G. Environmental and Resource Economics: Some Recent Developments. 2007. Available online: https://www.econ.cam.ac.uk/people-files/emeritus/pd10000/publications/survey.pdf (accessed on 25 November 2022).

- Reed, M.; Fraser, E.D.G.; Morse, S.; Dougill, A.J. Integrating Methods for Developing Sustainability Indicators to Facilitate Learning and Action. Ecol. Soc. 2005, 10, 1. [Google Scholar] [CrossRef]

- Hottel, C.H. Thomas Kilgore Sherwood 1903–1976: A Bibliographical Memoir; National Academy of Sciences: Washington DC, USA, 1994; Available online: https://cart.nap.edu/resource/biomems/tsherwood.pdf (accessed on 25 November 2022).

- Conrad, K. Computable General Equilibrium Models in Environmental and Resource Economics; Discussion Papers 601; Institut für Volkswirtschaftslehre und Statistik, Abteilung für Volkswirtschaftslehre, University of Manheim: Mannheim, Germany, 2001. [Google Scholar]

- Qi, F.; Li, W.-H.; Yu, S.-B.; Du, X.-Y.; Guo, B.-N. A Ratio of Many Gamma Functions and its Properties with Applications (v1). Classical Analysis and ODEs (math.CA). arXiv 2019, arXiv:1911.05883v1. [Google Scholar]

- Weisstein, E.W. Binomial Coefficient. From MathWorld—A Wolfram Web Resource. Available online: https://mathworld.wolfram.com/BinomialCoefficient.html (accessed on 25 November 2022).

- Uzawa, H. Production Functions with Constant Elasticities of Substitution. Rev. Econ. Stud. 1962, 29, 291–299. [Google Scholar] [CrossRef]

- Karakatsanis, G. Exergy and the economic process. Energy Procedia 2016, 97, 51–58. [Google Scholar] [CrossRef][Green Version]

- Independent Power Transmission Operator (IPTO). System Marginal Price (SMP) vs. Clearances Marginal Price (CMP) Data, November 2019—October 2020. Available online: https://www.admie.gr/en/market/market-statistics/key-data/sip-vs-smp (accessed on 25 November 2022).

- Kontarakis, E.; Karakatsanis, G.; Dimitriadis, P.; Iliopoulou, T.; Koutsoyiannis, D. Hydroclimate and Agricultural Output in Developing Countries; European Geosciences Union (EGU) General Assembly: Vienna, Austria, 2018. [Google Scholar] [CrossRef]

- Ausubel, J.H. Industrial ecology: Reflections on a colloquium. Proc. Natl. Acad. Sci. USA 1992, 89, 879–884. [Google Scholar] [CrossRef]

- Lowe, E.A.; Evans, L.K. Industrial ecology and industrial ecosystems. J. Clean. Prod. 1995, 3, 47–53. [Google Scholar] [CrossRef]

- Harper, E.; Graedel, T.E. Industrial ecology: A teenager’s progress. Technol. Soc. 2004, 26, 433–445. [Google Scholar] [CrossRef]

- O’Rourke, D.; Connelly, L.; Koshland, K. Industrial Ecology: A Critical Review. Int. J. Environ. Pollut. 1996, 6, 89–112. [Google Scholar] [CrossRef]

- Brad, A. The ontologies of industrial ecology? Prog. Ind. Ecol. Int. J. 2006, 3, 28–40. [Google Scholar] [CrossRef]

- Jouni, K. Industrial Ecology for Sustainable Development: Six Controversies in Theory Building. Environ. Values 2005, 14, 83–112. [Google Scholar] [CrossRef]

- Karakatsanis, G.; Mamassis, N.; Koutsoyiannis, A.; Efstratiadis, A. Entropy, Recycling and Macroeconomics of Water Resources; European Geosciences Union (EGU) General Assembly: Vienna, Austria, 2014. [Google Scholar] [CrossRef]

- Jungermann, A.H. Entropy and the Shelf Model: A Quantum Physical Approach to a Physical Property. J. Chem. Educ. 2006, 83, 1686. [Google Scholar] [CrossRef]

- Rene, K. Technology and the Transition to Environmental Sustainability: The problem of technological regime shifts. Futures 1994, 26, 1023–1046. [Google Scholar] [CrossRef]

- Wagner, M. Achieving Environmental-Economic Sustainability through Corporate Environmental Strategies: Empirical Evidence on Environmental Shareholder Value. In Sustainability Accounting and Reporting; Schaltegger, S., Bennett, M., Burritt, R., Eds.; Springer: Dordrecht, The Netherlands, 2006; Volume 21. [Google Scholar] [CrossRef]

- Frank, M.; Karavezyris, V.; Blum, C. Chemical leasing in the context of sustainable chemistry. Environ. Sci. Pollut. Res. 2014, 22, 9. [Google Scholar] [CrossRef]

- Granger, C.W.J.; Newbold, P. Spurious Regressions in Econometrics. J. Econom. 1974, 2, 111–120. [Google Scholar] [CrossRef]

| Cost Category/Class | CAPEX | OPEX |

|---|---|---|

| Constant | Infrastructure investment, indirectly related to production volume and recurrent at constant size and periodicity: Purchase of land, infrastructure (e.g., facilities, machinery) via long-term loans (5–10 years duration) at fixed discount rate or long-term leasing; legal contracts (e.g., company foundation and constitution); product certifications; intellectual property (IP) and patents; equipment insurance. | Necessary supplies and services for operations, indirectly related to production volume and recurrent at constant size and/or periodicity: Personnel of strategic hard skills (e.g., R&D, administration) with long-term employment contracts and non-disclosure agreements that is difficult to substitute; resources (e.g., chemicals, fuels, electricity) supplied with forward contracts at fixed prices (e.g., futures); periodical (at fixed dates) equipment maintenance with company personnel or long-term outsourcing contracts. |

| Variable | Infrastructure investment, directly related to production volume and non-recurrent at variable size and/or periodicity: Transportation means (e.g., vans, trucks) via variable discount rate loans or cash; marketing and promotion; ad-hoc long-term training programs and certification seminars for strategic personnel. | Necessary supplies and services for operations, directly related to production volume and non-recurrent at variable size and/or periodicity: Temporary contractor/outsourced personnel (high or low skilled) of rolling durations that is easy to substitute; ad-hoc personnel short trainings; consumables (e.g., paper, printers); travel costs; ad-hoc equipment maintenance by external personnel at current market prices. |

| Cost Category/Class | CAPEX | OPEX | TOTEX |

|---|---|---|---|

| Constant Costs Coefficient a | 0.0269 | 0.347 | 0.347 |

| Variable Costs Coefficient b | 12.570 | 5208.000 | 5220.570 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karakatsanis, G.; Makropoulos, C. Resource Recovery and the Sherwood Plot. Entropy 2023, 25, 4. https://doi.org/10.3390/e25010004

Karakatsanis G, Makropoulos C. Resource Recovery and the Sherwood Plot. Entropy. 2023; 25(1):4. https://doi.org/10.3390/e25010004

Chicago/Turabian StyleKarakatsanis, Georgios, and Christos Makropoulos. 2023. "Resource Recovery and the Sherwood Plot" Entropy 25, no. 1: 4. https://doi.org/10.3390/e25010004

APA StyleKarakatsanis, G., & Makropoulos, C. (2023). Resource Recovery and the Sherwood Plot. Entropy, 25(1), 4. https://doi.org/10.3390/e25010004