Evolution of Cohesion between USA Financial Sector Companies before, during, and Post-Economic Crisis: Complex Networks Approach

Abstract

1. Introduction

2. Related Work

2.1. Time Series Processing

2.2. Obtaining Network from Correlation Matrix

2.3. Crisis Examined Using Quantitative Methodologies

3. Materials and Methods

3.1. Data

3.2. Methodology

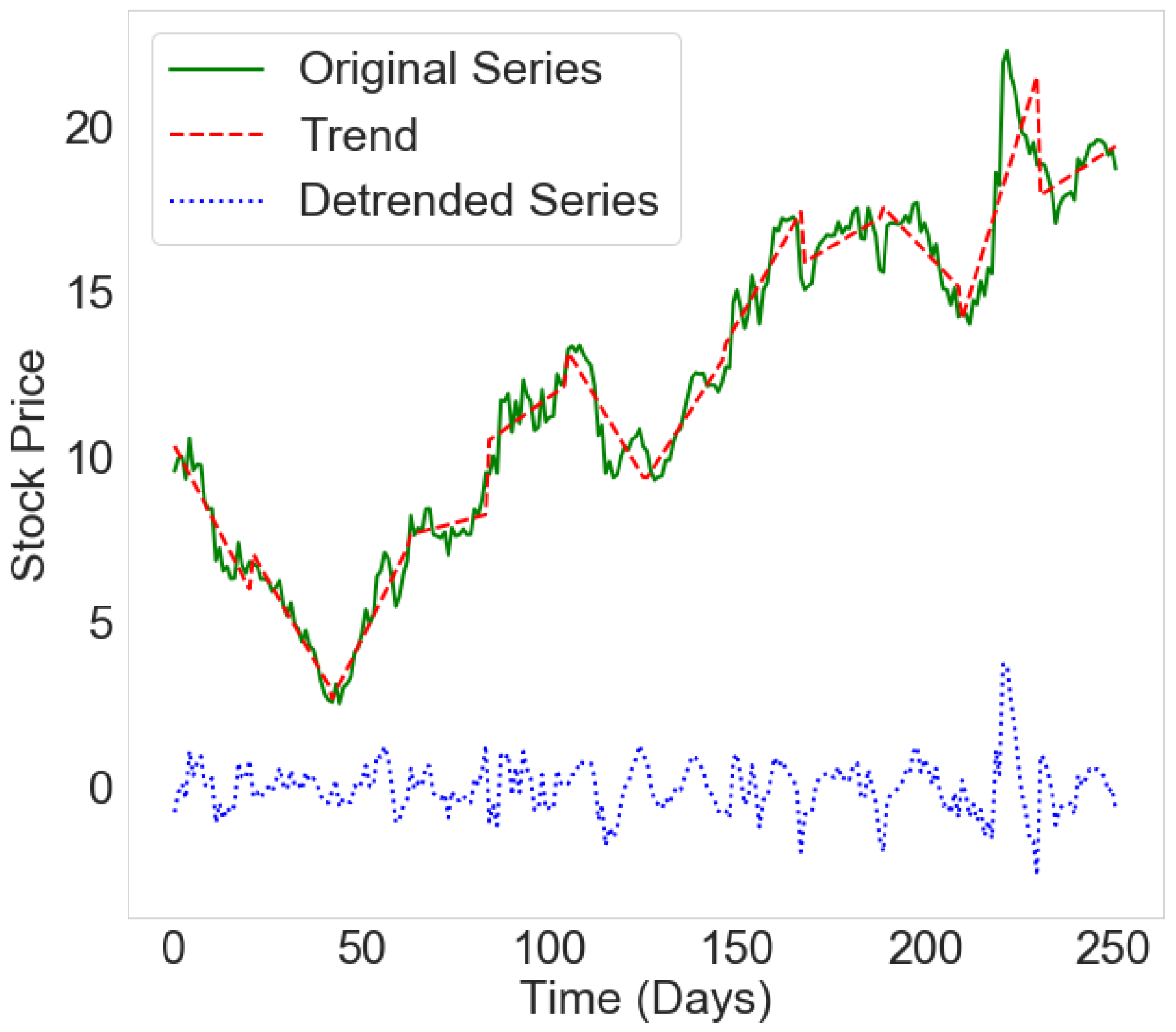

3.2.1. Time Series of Prices for Obtaining Network

3.2.2. Measuring the Intra- and Inter-Community Connectivity

4. Results

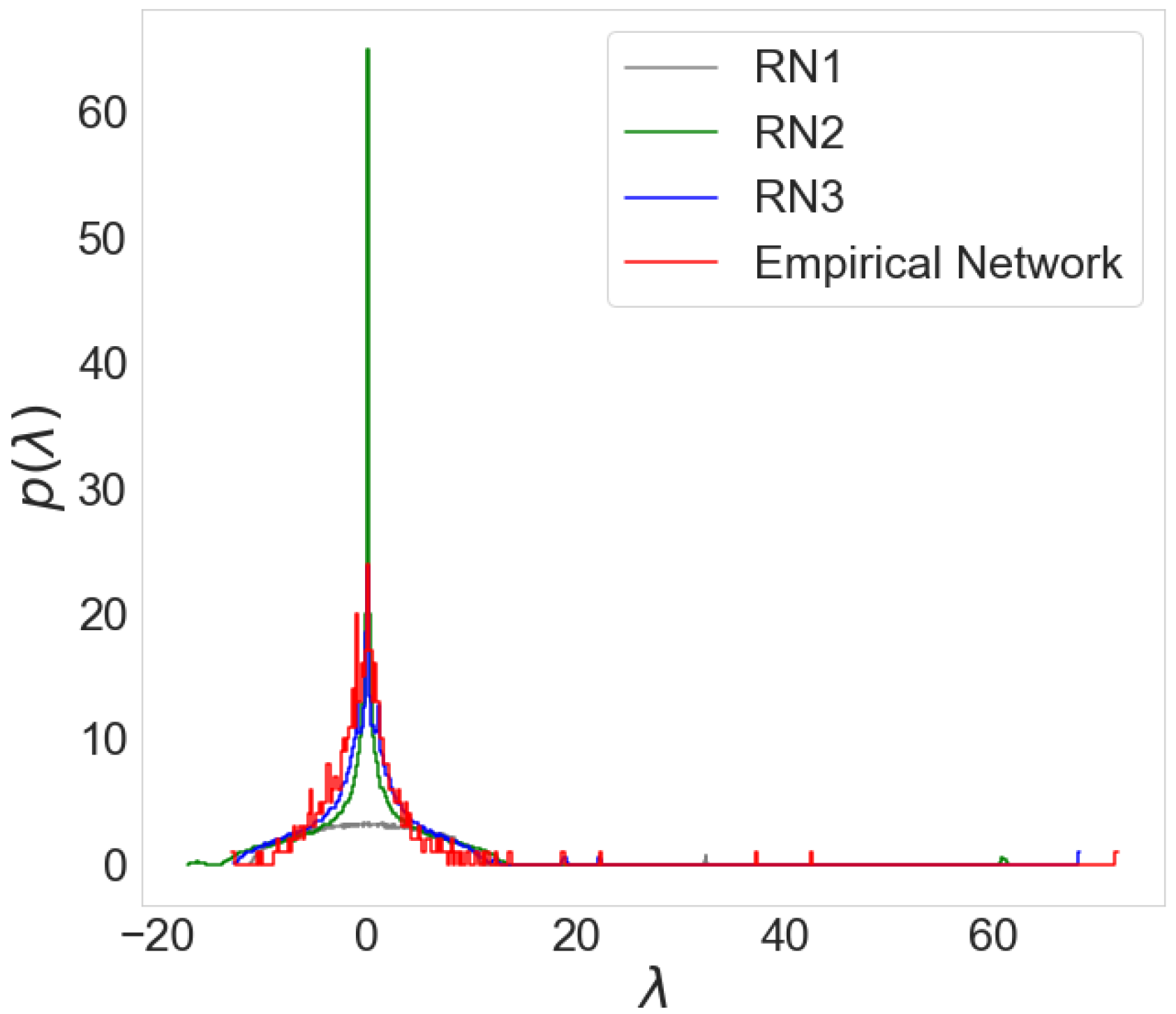

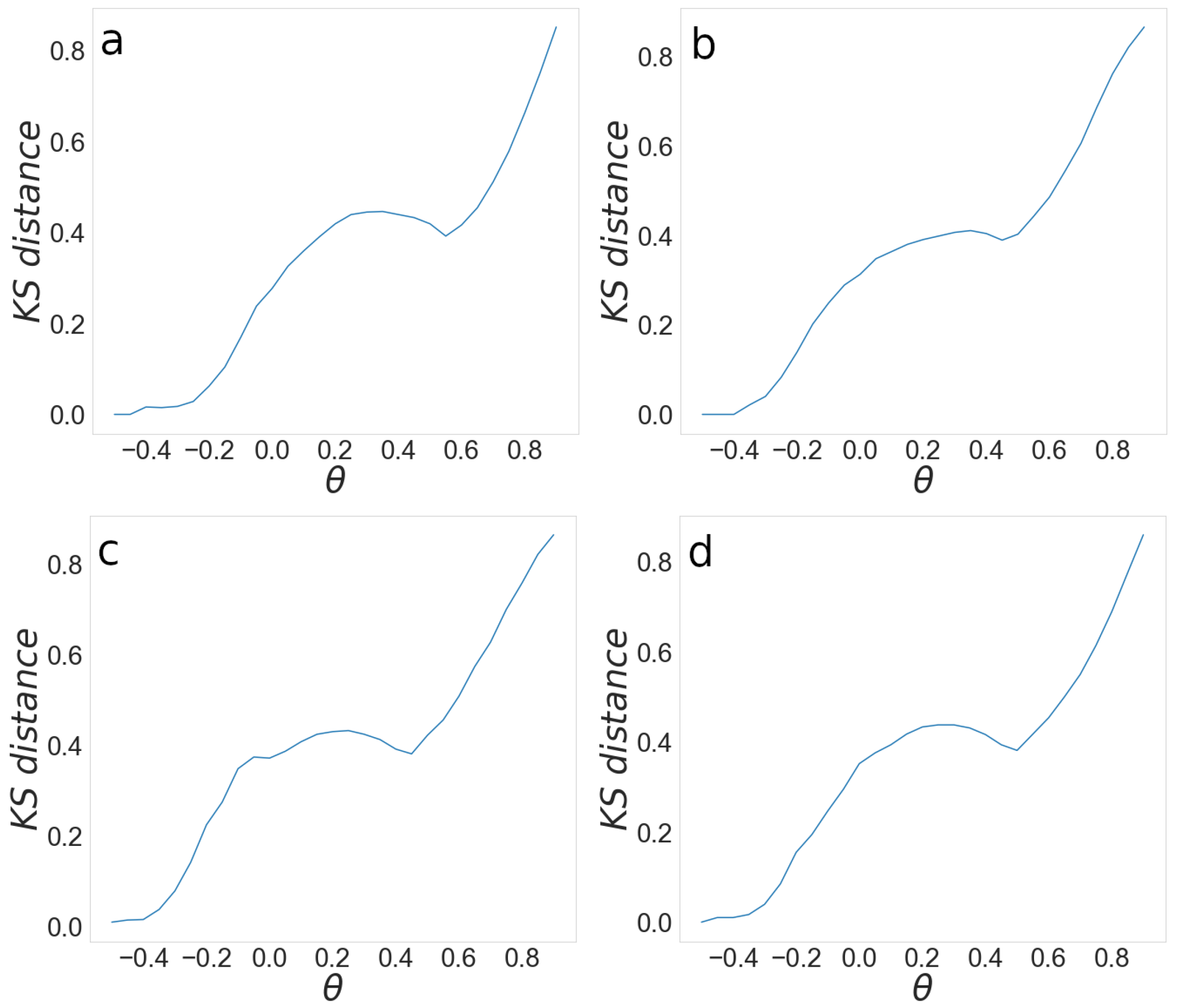

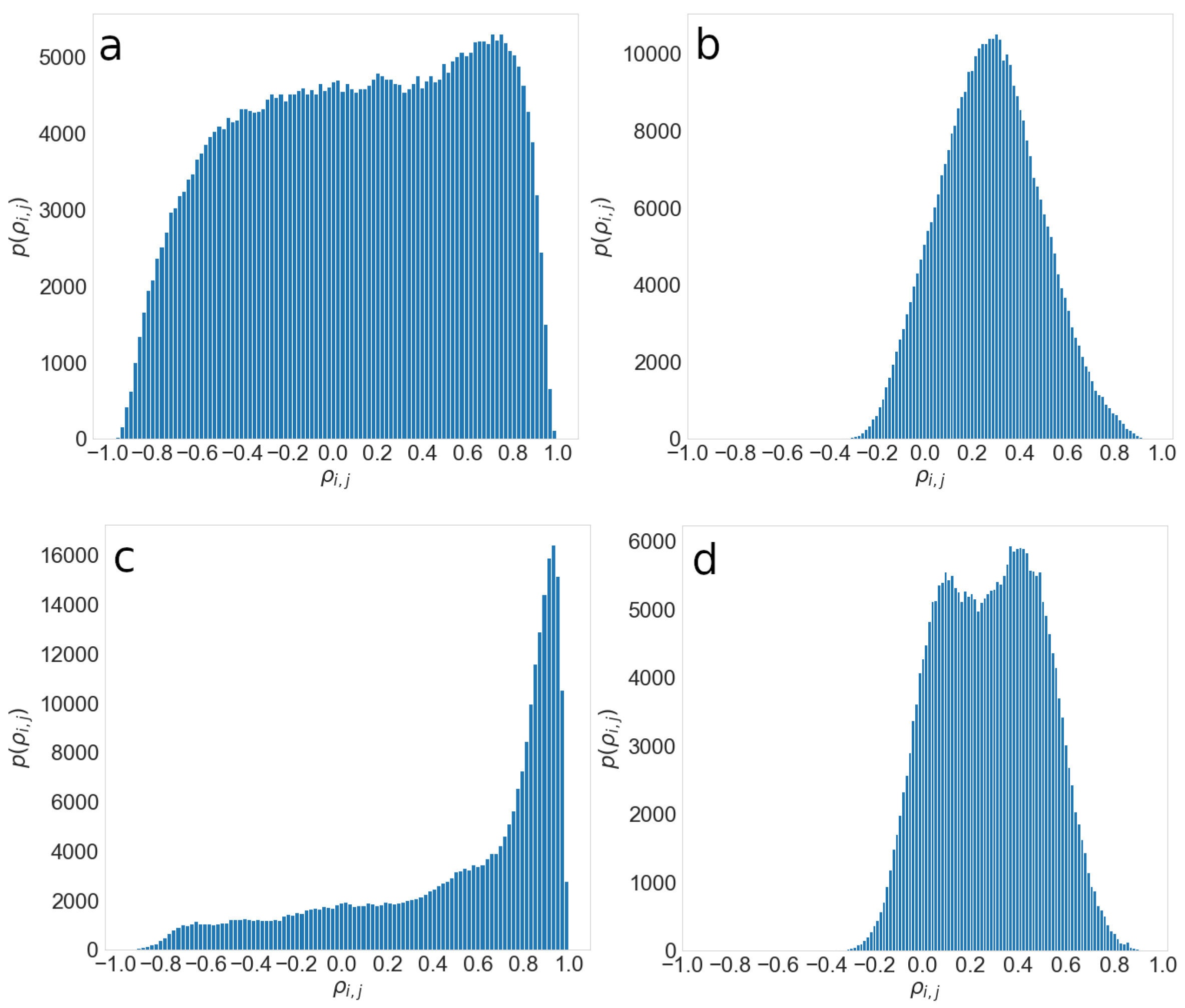

4.1. Characteristics of the Correlation Matrix and Obtained Network

4.2. Relation between Inter and Intra-Connectivity of Communities and Its Evolution

Effect of Regulation on Structure and Behavior

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Stiglitz, J.E. Freefall: America, Free Markets, and the Sinking of the World Economy; WW Norton & Company: New York, NY, USA, 2010. [Google Scholar]

- Krugman, P. The profession and the crisis. East. Econ. J. 2011, 37, 307–312. [Google Scholar] [CrossRef]

- Junior, L.S.; Franca, I.D.P. Correlation of financial markets in times of crisis. Phys. A 2012, 391, 187–208. [Google Scholar]

- Petersen, A.M.; Wang, F.; Havlin, S.; Stanley, H.E. Market dynamics immediately before and after financial shocks: Quantifying the Omori, productivity, and Bath laws. Phys. Rev. E 2010, 82, 036114. [Google Scholar] [CrossRef] [PubMed]

- Filimonov, V.; Sornette, D. Quantifying reflexivity in financial markets: Toward a prediction of flash crashes. Phys. Rev. E 2012, 85, 056108. [Google Scholar] [CrossRef] [PubMed]

- Zhao, L.; Li, W.; Cai, X. Structure and dynamics of stock market in times of crisis. Phys. Lett. A 2016, 380, 654–666. [Google Scholar] [CrossRef]

- Fenn, D.J.; Porter, M.A.; Williams, S.; McDonald, M.; Johnson, N.F.; Jones, N.S. Temporal evolution of financial-market correlations. Phys. Rev. E 2011, 84, 026109. [Google Scholar] [CrossRef]

- Yang, L.; Rea, W.; Rea, A. Impending doom: The loss of diversification before a crisis. J. Financ. Stud. 2017, 5, 29. [Google Scholar] [CrossRef]

- Meng, H.; Xie, W.J.; Jiang, Z.Q.; Podobnik, B.; Zhou, W.X.; Stanley, H.E. Systemic risk and spatiotemporal dynamics of the US housing market. Sci. Rep. 2014, 4, 3655. [Google Scholar] [CrossRef]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D. Complex networks: Structure and dynamics. Phys. Rep. 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Barabási, A. Network Science; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Barzel, B.; Barabási, A. Universality in network dynamics. Nat. Phys. 2013, 9, 673–681. [Google Scholar] [CrossRef]

- Caldarelli, G. Scale-Free Networks: Complex Webs in Nature and Technology; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Zhao, L.; Li, W.; Fenu, A.; Podobnik, B.; Wang, Y.; Stanley, H.E. The q-dependent detrended cross-correlation analysis of stock market. J. Stat. Mech. Theory Exp. 2018, 2018, 023402. [Google Scholar] [CrossRef]

- Squartini, T.; Van Lelyveld, I.; Garlaschelli, D. Early-warning signals of topological collapse in interbank networks. Sci. Rep. 2013, 3, 3357. [Google Scholar] [CrossRef] [PubMed]

- Ross, G.J. Dynamic multifactor clustering of financial networks. Phys. Rev. E 2014, 89, 022809. [Google Scholar] [CrossRef] [PubMed]

- Huang, W.Q.; Zhuang, X.T.; Yao, S.; Uryasev, S. A financial network perspective of financial institutions’ systemic risk contributions. Phys. A 2016, 456, 183–196. [Google Scholar] [CrossRef]

- Guo, X.; Zhang, H.; Jiang, F.; Tian, T. Development of stock correlation network models using maximum likelihood method and stock big data. In Proceedings of the 2018 IEEE International Conference on Big Data and Smart Computing (BigComp), Shanghai, China, 15–17 January 2018; pp. 455–461. [Google Scholar]

- Fortunato, S. Community detection in graphs. Phys. Rep. 2010, 486, 75–174. [Google Scholar] [CrossRef]

- Onnela, J.; Kaski, K.; Kertész, J. Clustering and information in correlation based financial networks. Eur. Phys. J. B 2004, 38, 353–362. [Google Scholar] [CrossRef]

- Kumar, S.; Deo, N. Correlation and network analysis of global financial indices. Phys. Rev. E 2012, 86, 026101. [Google Scholar] [CrossRef]

- Nobi, A.; Lee, S.; Kim, D.H.; Lee, J.W. Correlation and network topologies in global and local stock indices. Phys. Lett. A 2014, 378, 2482–2489. [Google Scholar] [CrossRef]

- Xia, L.; You, D.; Jiang, X.; Guo, Q. Comparison between global financial crisis and local stock disaster on top of Chinese stock network. Phys. A 2018, 490, 222–230. [Google Scholar] [CrossRef]

- Nobi, A.; Maeng, S.E.; Ha, G.G.; Lee, J.W. Effects of global financial crisis on network structure in a local stock market. Phys. A 2014, 407, 135–143. [Google Scholar] [CrossRef]

- Zhao, L.; Wang, G.J.; Wang, M.; Bao, W.; Li, W.; Stanley, H.E. Stock market as temporal network. Phys. A 2018, 506, 1104–1112. [Google Scholar] [CrossRef]

- Namaki, A.; Shirazi, A.; Raei, R.; Jafari, G. Network analysis of a financial market based on genuine correlation and threshold method. Phys. A 2011, 390, 3835–3841. [Google Scholar] [CrossRef]

- Musmeci, N.; Aste, T.; Di Matteo, T. Risk diversification: A study of persistence with a filtered correlation-network approach. Ournal Netw. Theory Financ. 2014, 1, 77–98. [Google Scholar] [CrossRef]

- Cao, X.; Shi, Y.; Wang, P.; Chen, L.; Wang, Y. The evolution of network topology structure of Chinese stock market. In Proceedings of the 2018 IEEE 3rd International Conference on Big Data Analysis (ICBDA), Shanghai, China, 9–12 March 2018; pp. 329–333. [Google Scholar]

- Peng, C.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685. [Google Scholar] [CrossRef] [PubMed]

- Lyócsa, Š.; Vỳrost, T.; Baumöhl, E. Stock market networks: The dynamic conditional correlation approach. Phys. A 2012, 391, 4147–4158. [Google Scholar] [CrossRef]

- Coelho, R.; Hutzler, S.; Repetowicz, P.; Richmond, P. Sector analysis for a FTSE portfolio of stocks. Phys. A 2007, 373, 615–626. [Google Scholar] [CrossRef]

- Eom, C.; Oh, G.; Jung, W.S.; Jeong, H.; Kim, S. Topological properties of stock networks based on minimal spanning tree and random matrix theory in financial time series. Phys. A 2009, 388, 900–906. [Google Scholar] [CrossRef]

- Song, D.M.; Tumminello, M.; Zhou, W.X.; Mantegna, R.N. Evolution of worldwide stock markets, correlation structure, and correlation-based graphs. Phys. Rev. E 2011, 84, 026108. [Google Scholar] [CrossRef]

- Yang, L.; Zhao, L.; Wang, C. Portfolio optimization based on empirical mode decomposition. Phys. A 2019, 531, 121813. [Google Scholar] [CrossRef]

- Orsini, C.; Dankulov Mitrović, M.; Colomer-de Simón, P.; Jamakovic, A.; Mahadevan, P.; Vahdat, A.; Bassler, K.E.; Toroczkai, Z.; Boguná, M.; Caldarelli, G.; et al. Quantifying randomness in real networks. Nat. Commun. 2015, 6, 1–10. [Google Scholar] [CrossRef]

- Oh, G.; Kim, H.Y.; Ahn, S.W.; Kwak, W. Analyzing the financial crisis using the entropy density function. Phys. A 2015, 419, 464–469. [Google Scholar] [CrossRef]

- Yim, K.; Oh, G.; Kim, S. An analysis of the financial crisis in the KOSPI market using Hurst exponents. Phys. A Stat. Mech. Its Appl. 2014, 410, 327–334. [Google Scholar] [CrossRef]

- Wiliński, M.; Sienkiewicz, A.; Gubiec, T.; Kutner, R.; Struzik, Z.R. Structural and topological phase transitions on the German Stock Exchange. Phys. A 2013, 392, 5963–5973. [Google Scholar] [CrossRef]

- Živković, J.; Tadić, B.; Wick, N.; Thurner, S. Statistical indicators of collective behavior and functional clusters in gene networks of yeast. Eur. Phys. J. B 2006, 50, 255–258. [Google Scholar] [CrossRef][Green Version]

- Van Mieghem, P. Graph Spectra for Complex Networks; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Mitrović, M.; Tadić, B. Spectral and dynamical properties in classes of sparse networks with mesoscopic inhomogeneities. Phys. Rev. E 2009, 80, 026123. [Google Scholar] [CrossRef]

- Farkas, I.J.; Derényi, I.; Barabási, A.; Vicsek, T. Spectra of “real-world” graphs: Beyond the semicircle law. Phys. Rev. E 2001, 64, 026704. [Google Scholar] [CrossRef]

- Blondel, V.D.; Guillaume, J.L.; Lambiotte, R.; Lefebvre, E. Fast unfolding of communities in large networks. J. Stat. Mech. Theory Exp. 2008, 2008, P10008. [Google Scholar] [CrossRef]

- Sherman, M. A short history of financial deregulation in the United States. Cent. Econ. Policy Res. 2009, 7, 1–17. [Google Scholar]

- Coffee, J.C., Jr. What went wrong? An initial inquiry into the causes of the 2008 financial crisis. J. Corp. Law Stud. 2009, 9, 1–22. [Google Scholar] [CrossRef]

- Baily, M.N.; Klein, A.; Schardin, J. The impact of the Dodd-Frank Act on financial stability and economic growth. RSF Russell Sage Found. J. Soc. Sci. 2017, 3, 20–47. [Google Scholar]

- Akhigbe, A.; Martin, A.D.; Whyte, A.M. Dodd–Frank and risk in the financial services industry. Rev. Quant. Financ. Account. 2016, 47, 395–415. [Google Scholar] [CrossRef]

- Barth, J.R.; Prabha, A.P.; Wihlborg, C. The Dodd-Frank act: Key features, implementation progress, and, financial system impact. In The First Great Financial Crisis of the 21st Century: A Retrospective; World Scientific: Singapore, 2016; pp. 337–376. [Google Scholar]

| T | T | ||

|---|---|---|---|

| 2002 | 518 | 2010 | 762 |

| 2003 | 558 | 2011 | 786 |

| 2004 | 609 | 2012 | 804 |

| 2005 | 653 | 2013 | 825 |

| 2006 | 695 | 2014 | 855 |

| 2007 | 711 | 2015 | 884 |

| 2008 | 740 | 2016 | 892 |

| 2009 | 748 | 2017 | 888 |

| Year | Year | ||

|---|---|---|---|

| 2002 | 0.35 | 2010 | 0.525 |

| 2003 | 0.325 | 2011 | 0.55 |

| 2004 | 0.425 | 2012 | 0.475 |

| 2005 | 0.35 | 2013 | 0.475 |

| 2006 | 0.35 | 2014 | 0.45 |

| 2007 | 0.475 | 2015 | 0.5 |

| 2008 | 0.55 | 2016 | 0.55 |

| 2009 | 0.475 | 2017 | 0.375 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stević, V.; Rašajski, M.; Mitrović Dankulov, M. Evolution of Cohesion between USA Financial Sector Companies before, during, and Post-Economic Crisis: Complex Networks Approach. Entropy 2022, 24, 1005. https://doi.org/10.3390/e24071005

Stević V, Rašajski M, Mitrović Dankulov M. Evolution of Cohesion between USA Financial Sector Companies before, during, and Post-Economic Crisis: Complex Networks Approach. Entropy. 2022; 24(7):1005. https://doi.org/10.3390/e24071005

Chicago/Turabian StyleStević, Vojin, Marija Rašajski, and Marija Mitrović Dankulov. 2022. "Evolution of Cohesion between USA Financial Sector Companies before, during, and Post-Economic Crisis: Complex Networks Approach" Entropy 24, no. 7: 1005. https://doi.org/10.3390/e24071005

APA StyleStević, V., Rašajski, M., & Mitrović Dankulov, M. (2022). Evolution of Cohesion between USA Financial Sector Companies before, during, and Post-Economic Crisis: Complex Networks Approach. Entropy, 24(7), 1005. https://doi.org/10.3390/e24071005