Transactional Interpretation for the Principle of Minimum Fisher Information

Abstract

:1. Introduction

2. Fisher Information

3. Schrödinger-like Equation from the Principle of Minimum Fisher Information (MFI)

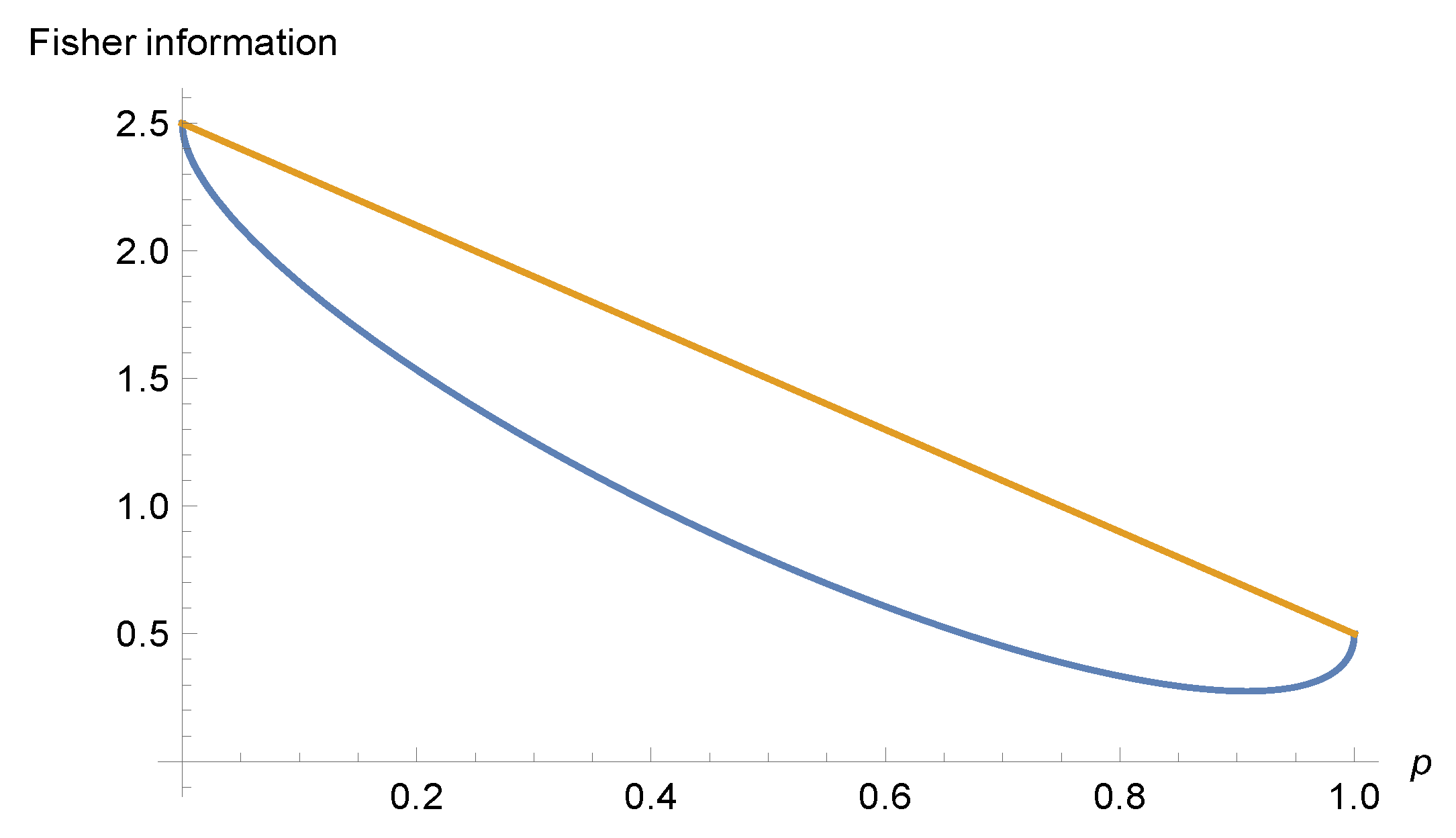

4. Fisher Information of Pure Oscillator State

5. Fisher Information of Superposition of States with Locally Minimal

6. The Pure States of Harmonic Oscillator Randomized by Gibbs Distribution

7. Physical Order vs. Transactional Order for Fisher Information

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Blaug, M. Economic Theory in Retrospect; Cambridge University Press: Cambridge, UK, 1985. [Google Scholar]

- Piotrowski, E.W.; Sładkowski, J.; Syska, J. Subjective modelling of supply and demand—The minimum of Fisher information solution. Physica A 2010, 389, 4904–4912. [Google Scholar] [CrossRef]

- Piotrowski, E.W.; Sładkowski, J. A subjective supply-demand model: The maximum Boltzmann/Shannon entropy solution. J. Stat. Mech. Theory Exp. 2009, 2009, 03035. [Google Scholar] [CrossRef]

- Makowski, M.; Piotrowski, E.W.; Sładkowski, J.; Syska, J. Profit intensity and cases of non-compliance with the law of demand/supply. Physica A 2017, 473, 53–59. [Google Scholar] [CrossRef]

- Makowski, M.; Piotrowski, E.W.; Sładkowski, J. Schrödinger type equation for subjective identification of supply and demand. Physica A 2019, 521, 131–137. [Google Scholar] [CrossRef] [Green Version]

- Frieden, B.R. Physics from Fisher Information; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Frieden, B.R. Science from Fisher Information: A Unification; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Streater, R.F. Lost Causes in and beyond Physics; Springer: Berlin/Heidelberg, Germany, 2007; p. 69. [Google Scholar]

- Ziemann, I.; Sandberg, H. Resource Constrained Sensor Attacks by Minimizing Fisher Information. In Proceedings of the 2021 American Control Conference (ACC), New Orleans, LA, USA, 25–28 May 2021; pp. 4580–4585. [Google Scholar]

- Bercher, J.F.; Vignat, C. On minimum Fisher information distributions with restricted support and fixed variance. Inf. Sci. 2009, 179, 3832–3842. [Google Scholar] [CrossRef]

- Frieden, F.; Gatenby, R.A. Exploratory Data Analysis Using Fisher Information; Springer: London, UK, 2007. [Google Scholar]

- Ponomarenko, S.A. Quantum harmonic oscillator revisited: A Fourier transform approach. Am. J. Phys. 2004, 72, 1259–1260. [Google Scholar] [CrossRef]

- Piotrowski, E.W.; Sładkowski, J. Quantum auctions: Facts and myths. Physica A 2008, 387, 3949–3953. [Google Scholar] [CrossRef] [Green Version]

- Scharfenaker, E.; Foley, D.K. Quantal Response Statistical Equilibrium in Economic Interactions: Theory and Estimation. Entropy 2017, 19, 444. [Google Scholar] [CrossRef]

- Erdélyi, A.; Magnus, W.; Oberhettinger, F.; Tricomi, F.G. Higher Transcendental Functions, Vol. III; Robert, E., Ed.; Krieger Publishing Co., Inc.: Melbourne, FL, USA, 1981; Based on Notes Left by Harry Bateman. Reprint of the 1955 original. [Google Scholar]

- Cramer, J.G. Transactional Interpretation of Quantum Mechanics. In Compendium of Quantum Physics; Greenberger, D., Hentschel, K., Weinert, F., Eds.; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Piotrowski, E.W.; Sładkowski, J. Geometry of financial markets—Towards information theory model of markets. Physica A 2007, 382, 228–234. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Makowski, M.; Piotrowski, E.W.; Frąckiewicz, P.; Szopa, M. Transactional Interpretation for the Principle of Minimum Fisher Information. Entropy 2021, 23, 1464. https://doi.org/10.3390/e23111464

Makowski M, Piotrowski EW, Frąckiewicz P, Szopa M. Transactional Interpretation for the Principle of Minimum Fisher Information. Entropy. 2021; 23(11):1464. https://doi.org/10.3390/e23111464

Chicago/Turabian StyleMakowski, Marcin, Edward W. Piotrowski, Piotr Frąckiewicz, and Marek Szopa. 2021. "Transactional Interpretation for the Principle of Minimum Fisher Information" Entropy 23, no. 11: 1464. https://doi.org/10.3390/e23111464

APA StyleMakowski, M., Piotrowski, E. W., Frąckiewicz, P., & Szopa, M. (2021). Transactional Interpretation for the Principle of Minimum Fisher Information. Entropy, 23(11), 1464. https://doi.org/10.3390/e23111464