Characterizing Complexity Changes in Chinese Stock Markets by Permutation Entropy

Abstract

1. Introduction

2. Data and Method

2.1. Data

2.2. PE for Detecting Dynamical Changes in a Time Series

2.3. Detrending Method

3. Results

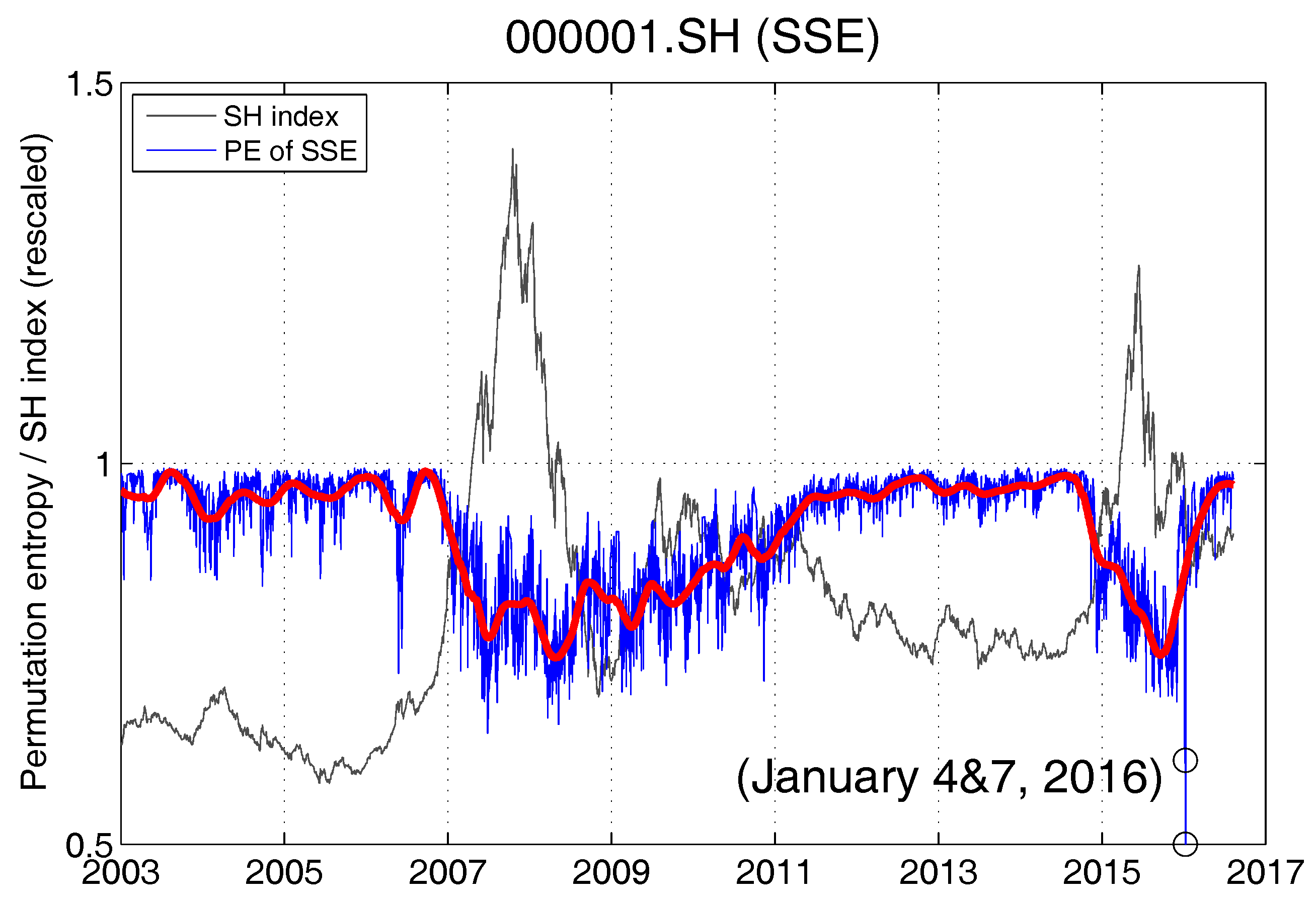

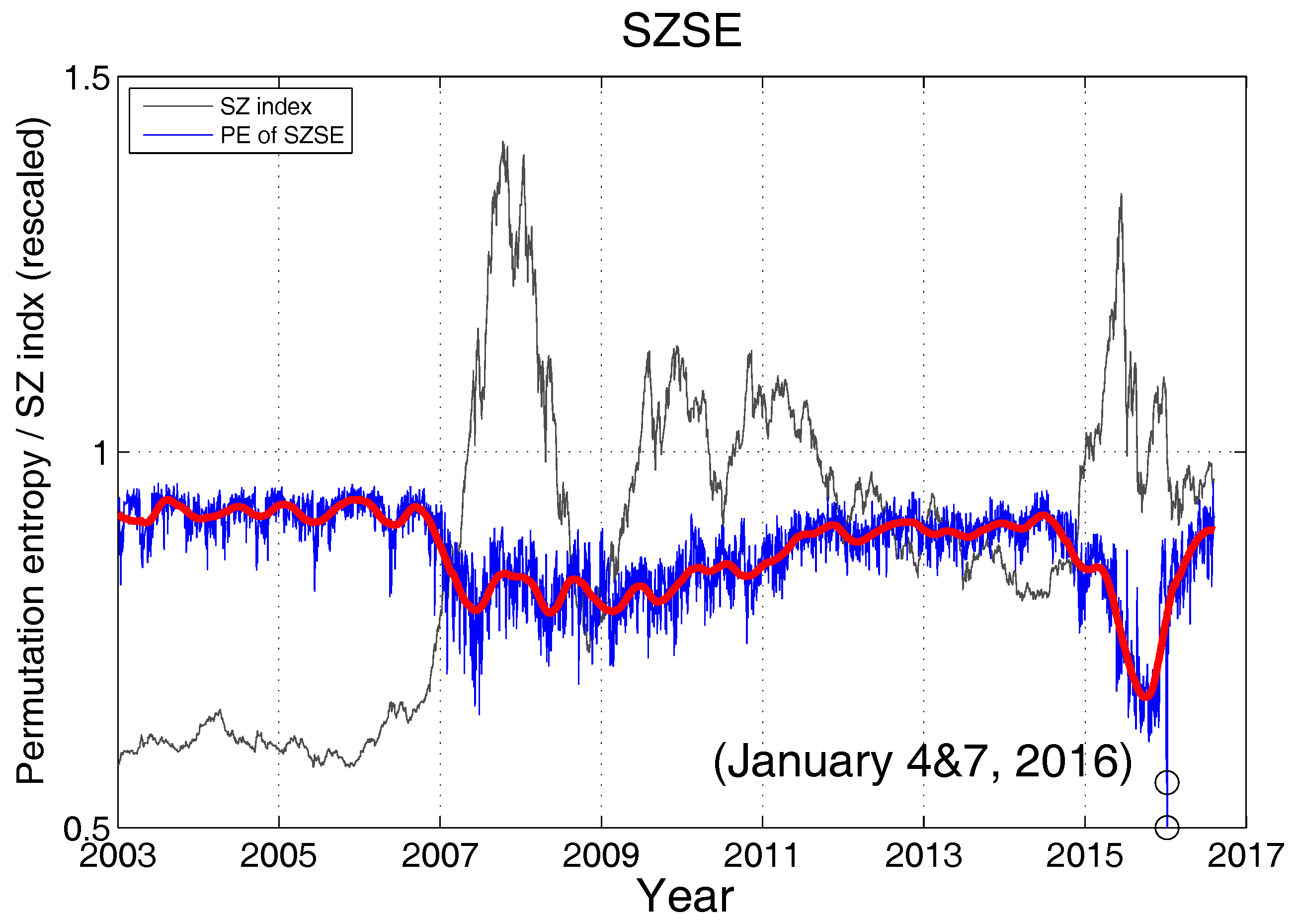

3.1. Dynamic Changes of Markets’ Complexity

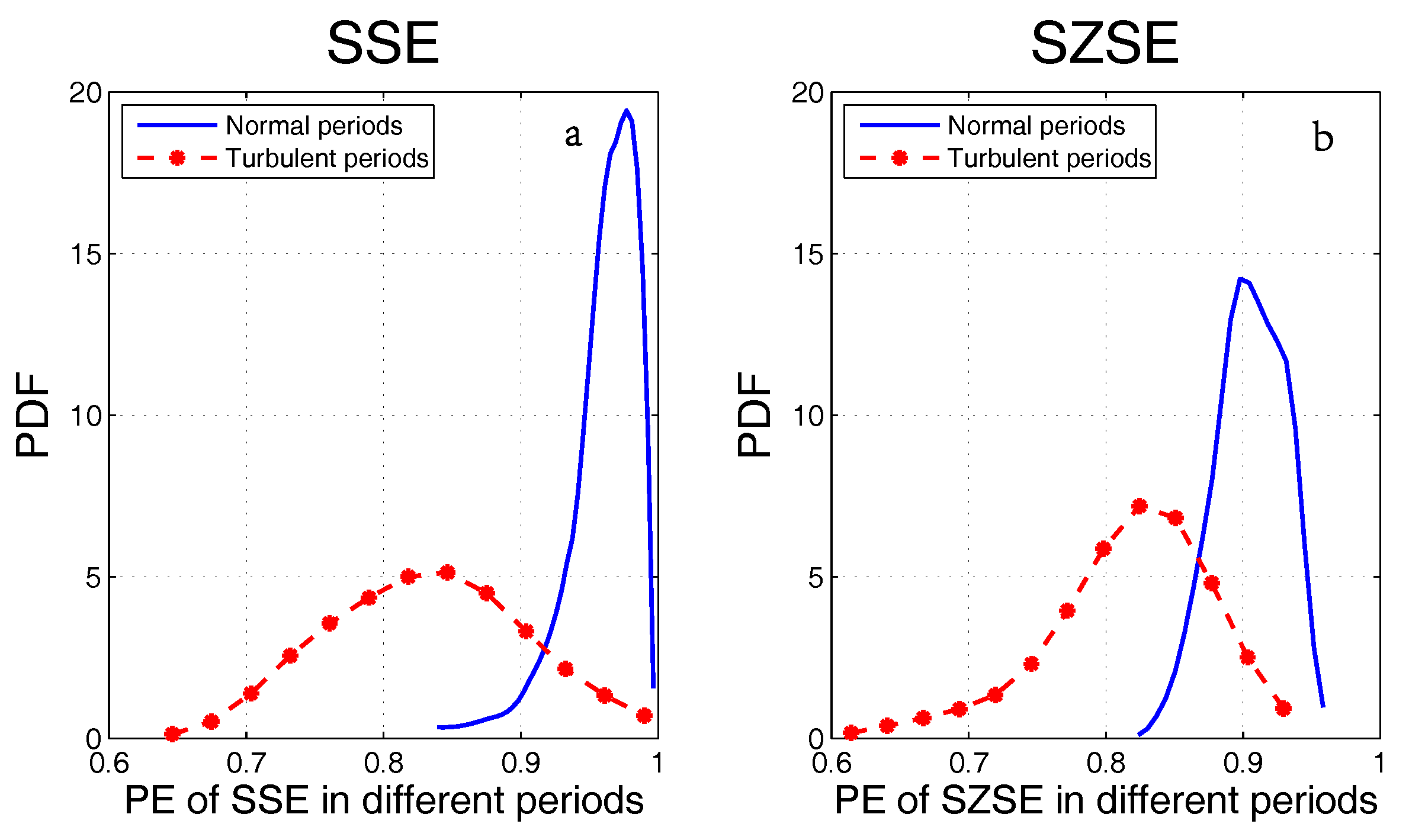

3.2. Shenzhen vs. Shanghai Market

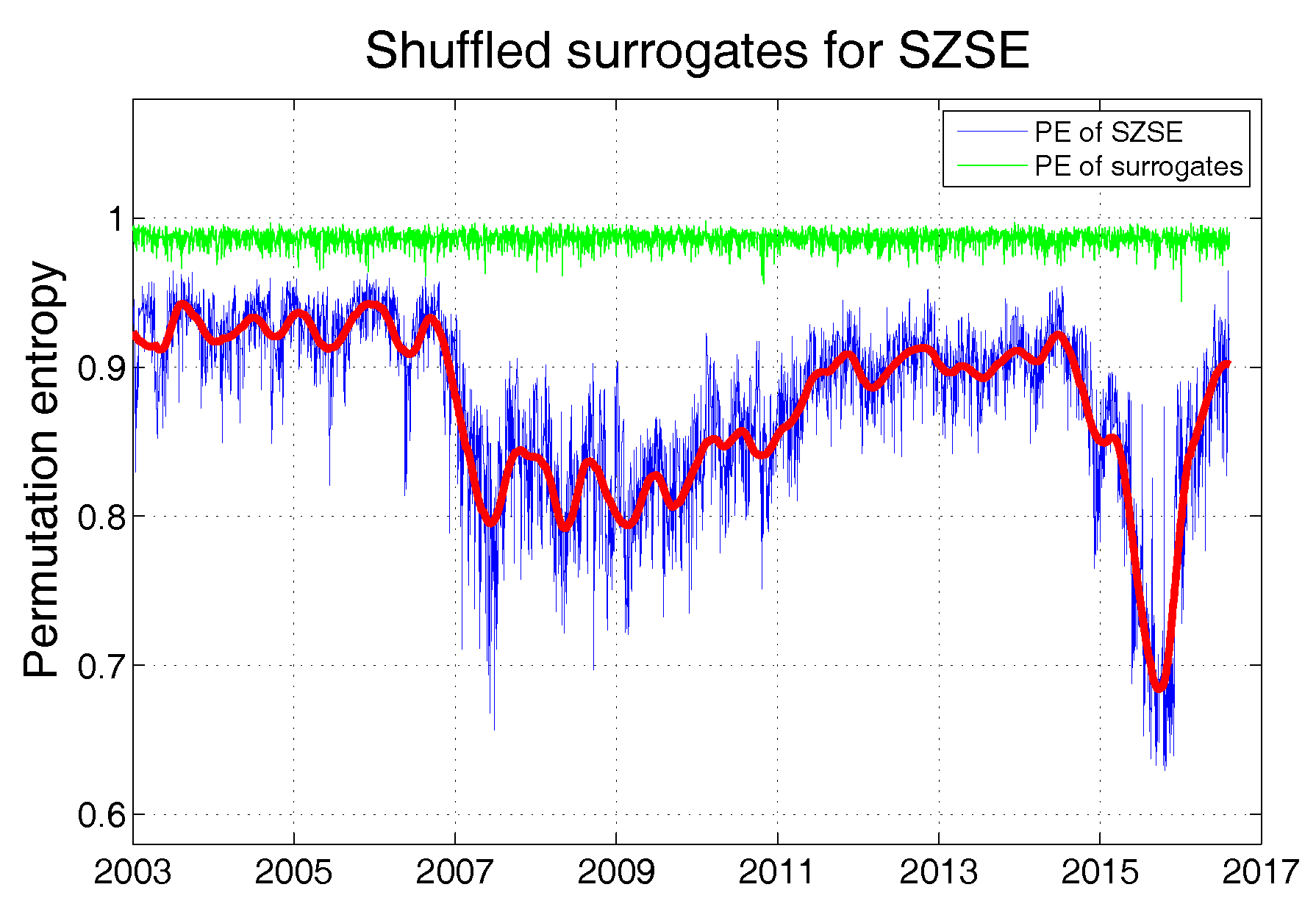

3.3. Surrogate Data Analysis

4. Concluding Discussions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Fama, E.F. Effcient Capital Markets: A Review of Theory and Empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Burton, G.M. The Efficient Market Hypothesis and Its Critics. J. Econ. Perspect. 2003, 17, 59–82. [Google Scholar]

- William, H.B. Market Efficiency. Accunting Rev. 1981, 1, 23–37. [Google Scholar]

- Fama, E.F. Market efficiency, long-term returns, and behavioral finance. J. Financ. Econ. 1998, 49, 283–306. [Google Scholar] [CrossRef]

- French, K.R. Crash-testing the efficient market hypothesis. NBER Macroecon. Annu. 1988, 3, 277–285. [Google Scholar] [CrossRef]

- Fama, E.F. The Behavior of Stock-Market Prices. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef]

- Bachelier, L. Théorie de la Spéculation; Gauthier-Villars: Paris, France, 1900. [Google Scholar]

- Mandelbrot, B.B. The Variation of Certain Speculative Prices. J. Bus. 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Clark, P.K. A Subordinated Stochastic Process Model with Finite Variance for Speculative Prices. Econometrica 1973, 41, 135–155. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. Scaling Behaviour in the Dynamics of an Economic Index. Nature 1995, 376, 46–49. [Google Scholar] [CrossRef]

- Tsallis, C.; Anteneodo, C.; Borland, L.; Osorio, R. Nonextensive Statistical Mechanics and Economic. Physica A 2003, 324, 89–100. [Google Scholar] [CrossRef]

- Lehar, A. Measuring Systemic Risk: A Risk Management Approach. J. Bank. Financ. 2005, 29, 2577–2603. [Google Scholar] [CrossRef]

- Perignon, C.; Deng, Z.; Wang, Z. Do Banks Overstate Their Value-at-Risk. J. Bank. Financ. 2008, 32, 783–794. [Google Scholar] [CrossRef]

- Bhansali, V.; Gingrich, R.M.; Longstaff, F.A. Systemic Credit Risk: What Is the Market Telling Us. Financ. Anal. J. 2008, 64, 16–24. [Google Scholar] [CrossRef]

- Gorton, G. Banking Panics and Business Cycles. Oxf. Econ. Pap. 1988, 40, 751–781. [Google Scholar] [CrossRef]

- Kaminsky, G.L.; Reinhart, C.M. The Twin Crises: The Causes of Banking and Balance-of-Payments Problems. Am. Econ. Rev. 1999, 89, 473–500. [Google Scholar] [CrossRef]

- Getmansky, M.; Lo, A.W.; Makarov, I. An Econometric Model of Serial Correlation and Illiquidity in Hedge Fund Returns. J. Financ. Econ. 2004, 74, 529–609. [Google Scholar] [CrossRef]

- Gao, J.B.; Hu, J.; Mao, X.; Zhou, M.; Gurbaxani, B.; Lin, J.W.-B. Entropies of negative incomes, Pareto-distributed loss, and financial crises. PLoS ONE 2011, 6, e25053. [Google Scholar] [CrossRef] [PubMed]

- Zheng, Z.; Podobnik, B.; Feng, L.; Li, B. Changes in Cross-Correlations as an Indicator for Systemic Risk. Sci. Rep. 2012, 2, 888. [Google Scholar] [CrossRef] [PubMed]

- Kenett, D.Y.; Shapira, Y.; Madi, A.; Bransburg-Zabary, S.; Gur-Gershgoren, G.; Ben-Jacob, E. Index Cohesive Force Analysis Reveals that the US Market Became Prone to Systemic Collapses since 2002. PLoS ONE 2011, 6, e19378. [Google Scholar] [CrossRef] [PubMed]

- Sandoval, L.; Franca, I.D.P. Correlation of financial markets in times of crisis. Physica A 2012, 391, 187–208. [Google Scholar] [CrossRef]

- Caraiani, P. The predictive power of singular value decomposition entropy for stock market dynamics. Physica A 2014, 391, 0378–4371. [Google Scholar] [CrossRef]

- Gao, J.B.; Hu, J. Financial crisis, Omori’s law, and negative entropy flow. Int. Rev. Financ. Anal. 2014, 33, 79–86. [Google Scholar] [CrossRef]

- Fan, F.L.; Gao, J.B.; Liang, S.H. Crisis-like behavior in China’s stock market and its interpretation. PLoS ONE 2015, 10, e0117209. [Google Scholar] [CrossRef] [PubMed]

- Wilinski, M.; Sienkiewicz, A.; Gubiec, T.; Kutner, R.; Struzik, Z.R. Structural and topological phase transitions on the German Stock Exchange. Physica A 2013, 392, 5963–5973. [Google Scholar] [CrossRef]

- Sandoval, L. Structure of a global network of financial companies based on transfer entropy. Entropy 2014, 16, 4443–4482. [Google Scholar] [CrossRef]

- Fiedor, P. Networks in financial markets based on the mutual information rate. Phys. Rev. E 2014, 89, 052801. [Google Scholar] [CrossRef] [PubMed]

- Fiedor, P. Mutual Information-Based Hierarchies on Warsaw Stock Exchange. Acta Phys. Pol. A 2015, 127, A33–A37. [Google Scholar] [CrossRef]

- Wen, X.; Li, K.; Liang, L. A weak-form Efficienct Testing of China’s Stock Markets. In Proceedings of the 2010 Third International Jonint Conference on Computational Science and Optimization, Huangshan, Anhui, China, 28–31 May 2010; pp. 514–517. [Google Scholar]

- Borges, M.R. Efficient market hypothesis in European stock markets. Eur. J. Financ. 2010, 7, 711–726. [Google Scholar] [CrossRef]

- Hamid, K.; Suleman, M.T.; Ali Shah, S.Z.; Akash, I.; Shahid, R. Testing the weak form of efficient market hypothesis: Empirical evidence from Asia-Pacific markets. Int. Res. J. Financ. Econ. 2010, 58, 1450–2887. [Google Scholar] [CrossRef]

- Nisar, S.; Hanif, M. Testing weak form of efficient market hypothesis: Empirical evidence from South-Asia. World Appl. Sci. J. 2012, 17, 414–427. [Google Scholar]

- John, M.G.; Patrick, J.K.; Federico, N. Do Market Efficiency Measures Yield Correct Inferences? A Comparison of Developed and Emerging Markets. Rev. Financ. Stud. 2015, 23, 3225–3277. [Google Scholar]

- Kolmogorov, A.N. Three approaches to the quantitative definition of information. Probl. Inf. Transm. 1965, 1, 1–7. [Google Scholar] [CrossRef]

- Gao, J.B.; Cao, Y.H.; Tung, W.W.; Hu, J. Multiscale Analysis of Complex Time Series: Integration of Chaos and Random Fractal Theory, and Beyond; Wiley: Hoboken, NJ, USA, 2007. [Google Scholar]

- Gao, J.B.; Liu, F.Y.; Zhang, J.F.; Hu, J.; Cao, Y.H. Information entropy as a basic building block of complexity theory. Entropy 2013, 15, 3396–3418. [Google Scholar] [CrossRef]

- Fideor, P. Frequency Effects on Predictability of Stock Returns. In Proceedings of the 2014 IEEE Conference on Computational Intelligence for Financial Engineering & Economics, London, UK, 27–28 March 2014; pp. 247–254. [Google Scholar]

- Nicolas, N.; Shu-Heng, C. On Predictability and Profitability: Would GP Induced Trading Rules be Sensitive to the Observed Entropy of Time Series? In Natural Computing in Computational Finance; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Gao, J.B.; Tung, W.W.; Hu, J.; Cao, Y.H.; Sarshar, N.; Roychowdhury, V.P. Assessment of long range correlation in time series: How to avoid pitfalls. Phys. Rev. E 2006, 73, 016117. [Google Scholar] [CrossRef] [PubMed]

- Cajueiro, D.O.; Tabak, B.M. Evidence of long range dependence in Asian equity markets: The role of liquidity and market restriction. Physica A 2004, 342, 654–664. [Google Scholar] [CrossRef]

- Cajueiro, D.O.; Tabak, B.M. The Hurst exponent over time: Testing the assertion that emerging markets are becoming more efficient. Physica A 2004, 336, 521–537. [Google Scholar] [CrossRef]

- Grech, D.; Mazur, Z. Can one make any crash prediction in finance using the local Hurst exponent idea? Physica A 2004, 336, 133–145. [Google Scholar] [CrossRef]

- Di Matteo, T.; Aste, T.; Dacorogna, M.M. Long-term memories of developed and emerging markets: Using the scaling analysis to characterize their stage of development. J. Bank. Financ. 2005, 29, 827–851. [Google Scholar] [CrossRef]

- Eom, C.; Choi, S.; Oh, G.; Jung, W.S. Hurst exponent and prediction based on weak-form efficient market hypothesis of stock market. Physica A 2008, 387, 4630–4636. [Google Scholar] [CrossRef]

- Eom, C.; Choi, S.; Oh, G.; Jung, W.S. Relationship between efficiency and predictability in stock change. Physica A 2008, 387, 5511–5517. [Google Scholar] [CrossRef]

- Wang, Y.D.; Liu, L.; Gu, R.B. Analysis of Efeficiency for Shenzhen Stock Market based on multifractal detrended fluctuation analysis. Int. Rev. Financ. Anal. 2009, 18, 271–276. [Google Scholar] [CrossRef]

- Wang, Y.D.; Liu, L.; Gu, R.; Cao, J.; Wang, H. Analysis of market efficiency for the Shanghai Stock Market over time. Physica A 2010, 389, 1635–1642. [Google Scholar] [CrossRef]

- Zhou, W.J.; Dang, Y.G.; Gu, R.B. Efficiency and multifractality analysis of CSI 300 based on multifractal detrending moving average algorithm. Physica A 2013, 392, 1429–1438. [Google Scholar] [CrossRef]

- Giglio, R.; Matsushita, R.; Figueiredo, A.; Gleria, I.; Da Silva, S. Algorithmic complexity theory and the relative efficiency of financial markets. Europhys. Lett. 2008, 84, 48005. [Google Scholar] [CrossRef]

- Giglio, R.; Da Silva, S. Ranking the stocks listed on Bovespa according to their relative efficiency. Appl. Math. Sci. 2009, 3, 2133–2142. [Google Scholar]

- Zunino, L.; Zanin, M.; Tabak, B.M.; Pérez, D.G.; Rosso, O.A. Forbidden patterns, permutation entropy and stock market inefficiency. Physica A 2009, 388, 2854–2864. [Google Scholar] [CrossRef]

- Zunino, L.; Zanin, M.; Tabak, B.M.; Pérez, D.G.; Rosso, O.A. Complexity-entropy causality plane: A useful approach to quantify the stock market inefficiency. Physica A 2010, 389, 1891–1901. [Google Scholar] [CrossRef]

- Zunino, L.; Bariviera, A.F.; Guercio, M.B.; Martinez, L.B.; Rosso, O.A. On the efficiency of sovereign bond markets. Physica A 2012, 391, 4342–4349. [Google Scholar] [CrossRef]

- Bandt, C.; Pompe, B. Permutation entropy: A natural complexity measure for time series. Phys. Rev. Lett. 2002, 88, 0031–9007. [Google Scholar] [CrossRef] [PubMed]

- Joshua, G.; Ryan, J.; Elizabeth, B. Model-free quantification of time-series predictability. Phys. Rev. E 2014, 90, 052910. [Google Scholar]

- Bariviera, A.F.; Zunino, L.; Guercio, M.B.; Martinez, L.B.; Rosso, O.A. Revisiting the European sovereign bonds with a permutationinformation-theory approach. Eur. Phys. J. B 2013, 86, 509. [Google Scholar] [CrossRef]

- Rosso, O.A.; Larrondo, H.A.; Martin, M.T.; Plastino, A.; Fuentes, M.A. Distinguishing noise from chaos. Phys. Rev. Lett. 2007, 99, 154102. [Google Scholar] [CrossRef] [PubMed]

- Cao, Y.H.; Tung, W.W.; Gao, J.B.; Protopopescu, V.A.; Hively, L.M. Detecting dynamical changes in time series using the permutation entropy. Phys. Rev. E 2004, 70, 1539–3755. [Google Scholar] [CrossRef] [PubMed]

- Zunino, L.; Pérez, D.G.; Martín, M.T.; Garavaglia, M.; Plastino, A.; Rosso, O.A. Permutation entropy of fractional Brownian motion and fractional Gaussian noise. Phys. Lett. A 2008, 372, 4768–4774. [Google Scholar] [CrossRef]

- Zunino, L.; Soriano, M.C.; Fischer, I.; Rosso, O.A.; Mirasso, C.R. Permutation-information-theory approach to unveil delay dynamics from time-series analysis. Phys. Rev. E 2010, 82, 046212. [Google Scholar] [CrossRef] [PubMed]

- Riedl, M.; Müller, A.; Wessel, N. Practical considerations of permutation entropy. Eur. Phys. J. Spec. Top. 2013, 222, 249–262. [Google Scholar] [CrossRef]

- Zanin, M.; Zunino, L.; Rosso, O.A.; Papo, D. Permutation entropy and its main biomedical and econophysics applications: A review. Entropy 2012, 14, 1553–1577. [Google Scholar] [CrossRef]

- Bruzzo, A.; Gesierich, B.; Santi, M.; Tassinari, C.A.; Birbaumer, N.; Rubboli, G. Permutation entropy to detect vigilance changes and preictal states from scalp EEG in epileptic patients. A preliminary study. Neurol. Sci. 2008, 29, 3–9. [Google Scholar] [CrossRef] [PubMed]

- Nicolaou, N.; Georgiou, J. Detection of epileptic electroencephalogram based on permutation entropy and support vector machines. Expert Syst. Appl. 2012, 39, 202–209. [Google Scholar] [CrossRef]

- Wendling, F.; Chauvel, P.; Biraben, A.; Bartolomei, F. From intracerebral EEG signals to brain connectivity: identification of epileptogenic networks in partial epilepsy. Front. Syst. Neurosci. 2010, 4, 154. [Google Scholar] [CrossRef] [PubMed]

- Olofsen, E.; Sleigh, J.W.; Dahan, A. Permutation entropy of the electroencephalogram: a measure of anaesthetic drug effect. Br. J. Anaesth. 2008, 101, 810–821. [Google Scholar] [CrossRef] [PubMed]

- Li, D.; Li, X.; Liang, Z.; Voss, L.J.; Sleigh, J.W. Multiscale permutation entropy analysis of EEG recordings during sevoflurane anesthesia. J. Neural Eng. 2010, 7, 046010. [Google Scholar] [CrossRef] [PubMed]

- Schinkel, S.; Marwan, N.; Kurths, J. Order patterns recurrence plots in the analysis of ERP data. Cognit. Neurodyn. 2007, 1, 317–325. [Google Scholar] [CrossRef] [PubMed]

- Nicolaou, N.; Georgiou, J. Permutation entropy: A new feature for brain-computer interfaces. In Proceedings of the Biomedical Circuits and Systems Conference (BioCAS), Paphos, Cyprus, 3–5 November 2010; pp. 49–52. [Google Scholar]

- Bian, C.; Qin, C.; Ma, Q.D.; Shen, Q. Modified permutation-entropy analysis of heartbeat dynamics. Phys. Rev. E 2012, 85, 021906. [Google Scholar] [CrossRef] [PubMed]

- Bahraminasab, A.; Ghasemi, F.; Stefanovska, A.; McClintock, P.V.; Kantz, H. Direction of coupling from phases of interacting oscillators: A permutation information approach. Phys. Rev. Lett. 2008, 100, 084101. [Google Scholar] [CrossRef] [PubMed]

- Frank, B.; Pompe, B.; Schneider, U.; Hoyer, D. Permutation entropy improves fetal behavioural state classification based on heart rate analysis from biomagnetic recordings in near term fetuses. Med. Biol. Eng. Comput. 2006, 44, 179. [Google Scholar] [CrossRef] [PubMed]

- Hu, J.; Gao, J.B.; Wang, X. Multifractal analysis of sunspot time series: The effects of the 11-year cycle and fourier truncation. J. Stat. Mech. 2009, 2, P02066. [Google Scholar] [CrossRef]

- Tung, W.W.; Gao, J.; Hu, J.; Yang, L. Recovering chaotic signals in heavy noise environments. Phys. Rev. E 2011, 83, 046210. [Google Scholar] [CrossRef] [PubMed]

- Gao, J.B.; Sultan, H.; Hu, J.; Tung, W.W. Denoising nonlinear time series by adaptive filtering and wavelet shrinkage: A comparison. IEEE Signal Process. Lett. 2010, 17, 237–240. [Google Scholar]

- Gao, J.B.; Hu, J.; Tung, W.W. Facilitating joint chaos and fractal analysis of biosignals through nonlinear adaptive filtering. PLoS ONE 2011, 6, e24331. [Google Scholar] [CrossRef] [PubMed]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hou, Y.; Liu, F.; Gao, J.; Cheng, C.; Song, C. Characterizing Complexity Changes in Chinese Stock Markets by Permutation Entropy. Entropy 2017, 19, 514. https://doi.org/10.3390/e19100514

Hou Y, Liu F, Gao J, Cheng C, Song C. Characterizing Complexity Changes in Chinese Stock Markets by Permutation Entropy. Entropy. 2017; 19(10):514. https://doi.org/10.3390/e19100514

Chicago/Turabian StyleHou, Yunfei, Feiyan Liu, Jianbo Gao, Changxiu Cheng, and Changqing Song. 2017. "Characterizing Complexity Changes in Chinese Stock Markets by Permutation Entropy" Entropy 19, no. 10: 514. https://doi.org/10.3390/e19100514

APA StyleHou, Y., Liu, F., Gao, J., Cheng, C., & Song, C. (2017). Characterizing Complexity Changes in Chinese Stock Markets by Permutation Entropy. Entropy, 19(10), 514. https://doi.org/10.3390/e19100514