The Role of Perceived Value and Risk in Shaping Purchase Intentions in Live-Streaming Commerce: Evidence from Indonesia

Abstract

1. Introduction

RQ1. How do credibility, interactivity, and media richness shape consumers’ perceived value and perceived risk in live-streaming commerce?RQ2. How do perceived value and perceived risk influence users’ purchase intentions?

2. Literature Review

2.1. Live-Streaming Commerce (LSC)

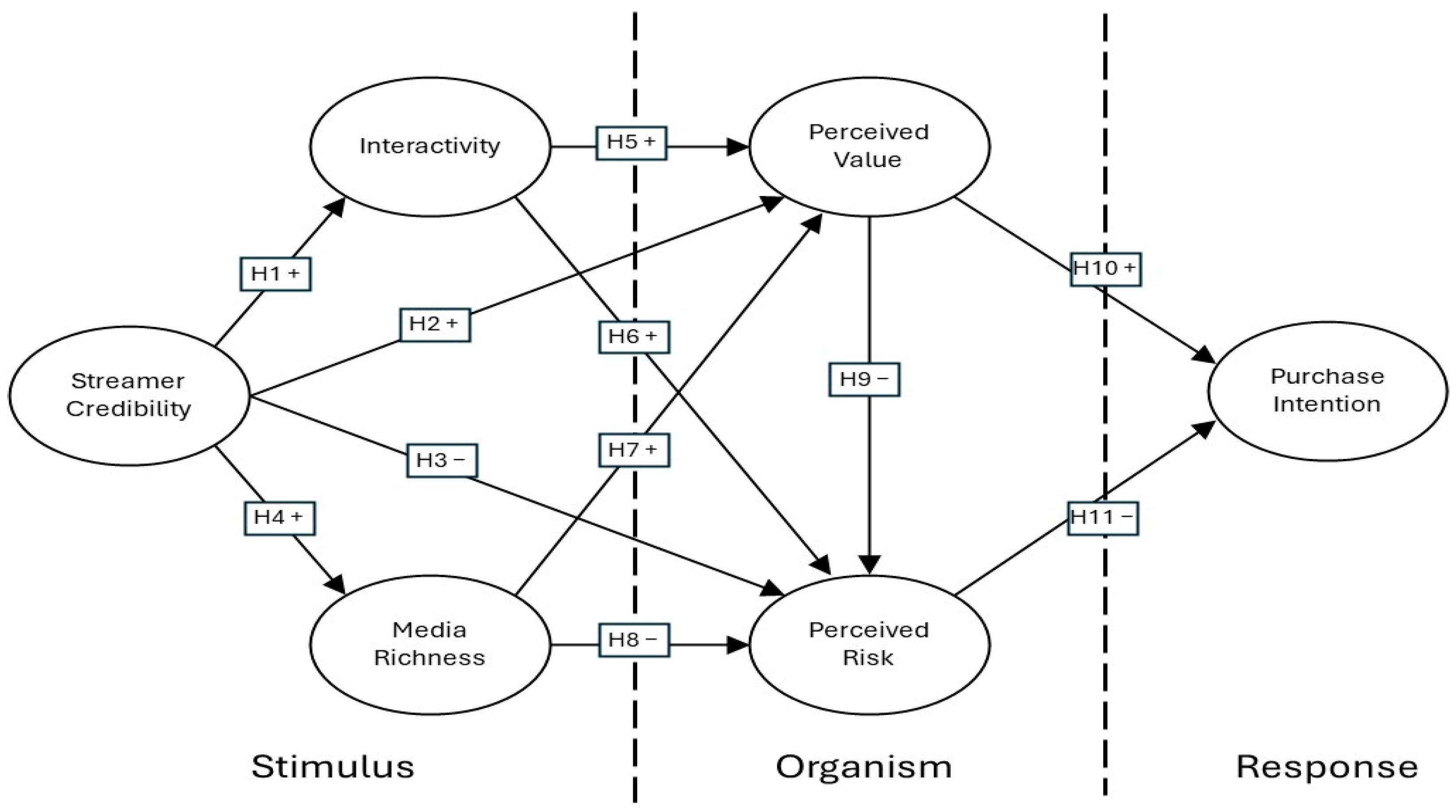

2.2. Stimulus–Organism–Response (SOR) Theory

2.3. Concept Framework and Hypotheses Development

2.3.1. Streamer Credibility (SC) as Stimuli

2.3.2. Interactivity (IT) as Stimuli

2.3.3. Media Richness (MR) as Stimuli

2.3.4. Organismic Appraisals: Perceived Value (PV) and Perceived Risk (PR)

3. Methodology

3.1. Respondent & Data Collection

3.2. Instrument Development

3.3. Data Quality Screening and Cleaning

4. Results

4.1. Common Method Bias (CMB)

4.2. Measurement Model Assessment

4.3. Structural Model Evaluation

4.4. Robustness Check

5. Discussion

5.1. Effect of Streamer Credibility in Interactivity and Media Richness

5.2. Interactivity and Media Richness Effect

5.3. Perceived Value and Perceived Risk

5.4. Theoretical and Practical Implications

6. Conclusions, Limitations, and Recommendations

6.1. Conclusions

6.2. Limitations and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dong, X.; Liu, X.; Xiao, X. Understanding the influencing mechanism of users’ participation in live streaming shopping: A socio-technical perspective. Front. Psychol. 2023, 13, 1082981. [Google Scholar] [CrossRef]

- Zhang, S.; Huang, C.; Li, X.; Ren, A. Characteristics and roles of streamers in e-commerce live streaming. Serv. Ind. J. 2022, 42, 1001–1029. [Google Scholar] [CrossRef]

- Wu, D.; Wang, X.; Ye, H. Transparentizing the “Black Box” of Live Streaming: Impacts of Live Interactivity on Viewers’ Experience and Purchase. IEEE Trans. Eng. Manag. 2024, 71, 3820–3831. [Google Scholar] [CrossRef]

- Sokolova, K.; Kefi, H. Instagram and YouTube bloggers promote it, why should I buy? How credibility and parasocial interaction influence purchase intentions. J. Retail. Consum. Serv. 2020, 53, 101742. [Google Scholar] [CrossRef]

- Ali, B.J. Impact of COVID-19 on consumer buying behavior toward online shopping in Iraq. Ali, BJ (2020). Impact of COVID-19 on consumer buying behavior toward online shopping in Iraq. Econ. Stud. J. 2020, 18, 267–280. [Google Scholar]

- Statista.com. E-Commerce Market Volume in Southeast Asia from 2022 to 2024, with Forecasts to 2030, by Country. Available online: https://www.statista.com/statistics/647645/southeast-asia-ecommerce-market-size-country/ (accessed on 30 October 2024).

- Vero-Asean.com. Insights: Despite TikTok Shop Closure, Live Shopping Trend in Indonesia Is Here to Stay. Available online: https://vero-asean.com/live-shopping-trend-in-indonesia-is-here-to-stay/ (accessed on 5 September 2025).

- Ahmadi, F.; Hudrasyah, H. Factors influencing product purchase intention in TikTok live streaming shopping. Int. J. Account. Financ. Bus. (IJAFB) 2022, 7, 571–586. [Google Scholar]

- Hsu, C.-L.; Lin, J.C.-C.; Miao, Y.-F. Why are people loyal to live stream channels? The perspectives of uses and gratifications and media richness theories. Cyberpsychology Behav. Soc. Netw. 2020, 23, 351–356. [Google Scholar] [CrossRef]

- Tang, X.; Hao, Z.; Li, X. The influence of streamers’ physical attractiveness on consumer response behavior: Based on eye-tracking experiments. Front. Psychol. 2024, 14, 1297369. [Google Scholar]

- Zhang, L.; Chen, M.; Zamil, A.M. Live stream marketing and consumers’ purchase intention: An IT affordance perspective using the SOR paradigm. Front. Psychol. 2023, 14, 1069050. [Google Scholar] [CrossRef]

- Song, C.; Liu, Y.-l. The effect of live-streaming shopping on the consumer’s perceived risk and purchase intention in China. In Proceedings of the 23rd Biennial Conference of the International Telecommunications Society (ITS), Gothenburg, Sweden, 21–23 June 2021. [Google Scholar]

- Phamthi, V.A.; Nagy, Á.; Ngo, T.M. The influence of perceived risk on purchase intention in e-commerce—Systematic review and research agenda. Int. J. Consum. Stud. 2024, 48, e13067. [Google Scholar] [CrossRef]

- Zhou, R.; Baskaran, A. Influencing mechanisms of live streaming influencer characteristics on purchase intention: The mediating role of emotional trust. PLoS ONE 2025, 20, e0322294. [Google Scholar] [CrossRef]

- Utami, A.F.; Ekaputra, I.A.; Japutra, A.; Van Doorn, S. The role of interactivity on customer engagement in mobile e-commerce applications. Int. J. Mark. Res. 2022, 64, 269–291. [Google Scholar] [CrossRef]

- Ali, A.; Bhasin, J. Understanding customer repurchase intention in e-commerce: Role of perceived price, delivery quality, and perceived value. Jindal J. Bus. Res. 2019, 8, 142–157. [Google Scholar] [CrossRef]

- Syamsuar, D.; Darren, C. Integrating Trust and Risk Perception into UTAUT: Study About Consumers’ Purchase Intentions in Social Media. In Proceedings of the 2023 International Conference on Informatics, Multimedia, Cyber and Informations System (ICIMCIS), Jakarta, Indonesia, 7–8 November 2023; pp. 55–60. [Google Scholar]

- Yan, M.; Kwok, A.P.K.; Chan, A.H.S.; Zhuang, Y.S.; Wen, K.; Zhang, K.C. An empirical investigation of the impact of influencer live-streaming ads in e-commerce platforms on consumers’ buying impulse. Internet Res. 2023, 33, 1633–1663. [Google Scholar] [CrossRef]

- Jin, M.; Xu, H.; Peng, H. The Moderating Role of Age in the Mechanism of the Impact of Social Presence on Purchase Intention in Live-Streaming Shopping. Int. J. Hum. Comput. Interact. 2025, 41, 3443–3454. [Google Scholar] [CrossRef]

- Haenlein, M.; Anadol, E.; Farnsworth, T.; Hugo, H.; Hunichen, J.; Welte, D. Navigating the new era of influencer marketing: How to be successful on Instagram, TikTok, & Co. Calif. Manag. Rev. 2020, 63, 5–25. [Google Scholar]

- Soares, R.; Liu, J.; Zhang, T.; Lu, C.; Zhong, Y. How Does Credibility Matter? Proposing and Validating a Framework for the Credibility of Live Streamers in the Gaming Industry. Serv. Mark. Q. 2024, 45, 83–104. [Google Scholar] [CrossRef]

- Sesar, V.; Martinčević, I.; Boguszewicz-Kreft, M. Relationship between advertising disclosure, influencer credibility and purchase intention. J. Risk Financ. Manag. 2022, 15, 276. [Google Scholar] [CrossRef]

- Mehrabian, A. An Approach to Environmental Psychology; Massachusetts Institute of Technology: Cambridge, MA, USA, 1974. [Google Scholar]

- Huang, T. Using SOR framework to explore the driving factors of older adults smartphone use behavior. Humanit. Soc. Sci. Commun. 2023, 10, 1–16. [Google Scholar] [CrossRef]

- Liu, Y.; Cai, L.; Ma, F.; Wang, X. Revenge buying after the lockdown: Based on the SOR framework and TPB model. J. Retail. Consum. Serv. 2023, 72, 103263. [Google Scholar] [CrossRef]

- Hew, J.-J.; Lee, V.-H.; T’ng, S.-T.; Tan, G.W.-H.; Ooi, K.-B.; Dwivedi, Y.K. Are online mobile gamers really happy? On the suppressor role of online game addiction. Inf. Syst. Front. 2024, 26, 217–249. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Z.; Wang, X.; Zhao, Y. Assessing word-of-mouth reputation of influencers on B2C live streaming platforms: The role of the characteristics of information source. Asia Pac. J. Mark. Logist. 2022, 34, 1544–1570. [Google Scholar] [CrossRef]

- Cabeza-Ramírez, L.J.; Sánchez-Cañizares, S.M.; Santos-Roldán, L.M.; Fuentes-García, F.J. Impact of the perceived risk in influencers’ product recommendations on their followers’ purchase attitudes and intention. Technol. Forecast. Soc. Change 2022, 184, 121997. [Google Scholar] [CrossRef]

- Shaputra, R.I.; Fitriani, W.R.; Hidayanto, A.N.; Kumaralalita, L.; Purwandari, B. How Media Richness and Interactivity in Hotel Visualization Affect Hotel Booking Intention in Online Travel Agency Applications? Hum. Behav. Emerg. Technol. 2023, 2023, 5087488. [Google Scholar] [CrossRef]

- Chen, L.; Rashidin, M.S.; Song, F.; Wang, Y.; Javed, S.; Wang, J. Determinants of consumer’s purchase intention on fresh e-commerce platform: Perspective of UTAUT model. SAGE Open 2021, 11, 21582440211027875. [Google Scholar] [CrossRef]

- Kang, K.; Lu, J.; Guo, L.; Li, W. The dynamic effect of interactivity on customer engagement behavior through tie strength: Evidence from live streaming commerce platforms. Int. J. Inf. Manag. 2021, 56, 102251. [Google Scholar] [CrossRef]

- Kim, K.; Chung, T.-L.D.; Fiore, A.M. The role of interactivity from Instagram advertisements in shaping young female fashion consumers’ perceived value and behavioral intentions. J. Retail. Consum. Serv. 2023, 70, 103159. [Google Scholar] [CrossRef]

- Ferry, D.L.; Kydd, C.T.; Sawyer, J.E. Measuring facts of media richness. J. Comput. Inf. Syst. 2001, 41, 69–78. [Google Scholar] [CrossRef]

- Tseng, C.-H.; Wei, L.-F. The efficiency of mobile media richness across different stages of online consumer behavior. Int. J. Inf. Manag. 2020, 50, 353–364. [Google Scholar] [CrossRef]

- Şen Küpeli, T.; Özer, L. Assessing perceived risk and perceived value in the hotel industry: An integrated approach. Anatolia 2020, 31, 111–130. [Google Scholar] [CrossRef]

- Qing, C.; Jin, S. What drives consumer purchasing intention in live streaming e-commerce? Front. Psychol. 2022, 13, 938726. [Google Scholar] [CrossRef]

- Tao, Q.; Wang, X.; Zhao, Y.; Li, M.; Liu, L. A Benefit-Cost Perspective on Consumers’ Purchase of Online Content. In Proceedings of the HCI International 2021-Posters: 23rd HCI International Conference, HCII 2021, Virtual Event, 24–29 July 2021; pp. 447–455. [Google Scholar]

- Barton, B.; Zlatevska, N.; Oppewal, H. Scarcity tactics in marketing: A meta-analysis of product scarcity effects on consumer purchase intentions. J. Retail. 2022, 98, 741–758. [Google Scholar] [CrossRef]

- Sun, B.; Zhang, Y.; Zheng, L. Relationship between time pressure and consumers’ impulsive buying—Role of perceived value and emotions. Heliyon 2023, 9, e23185. [Google Scholar] [CrossRef]

- Neuman, W.L. Social Research Methods: Qualitative and Quantitative Approaches, 7th ed.; Allyn and Bacon: Boston, MA, USA, 2011. [Google Scholar]

- Memon, M.A.; Ting, H.; Cheah, J.-H.; Thurasamy, R.; Chuah, F.; Cham, T.H. Sample size for survey research: Review and recommendations. J. Appl. Struct. Equ. Model. 2020, 4, i–xx. [Google Scholar] [CrossRef] [PubMed]

- Evermann, J.; Rönkkö, M. Recent developments in PLS. Commun. Assoc. Inf. Syst. 2023, 52, 663–667. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 8th ed.; Cengage Learning EMEA: Southbank, Australia, 2018. [Google Scholar]

- Giner-Sorolla, R.; Montoya, A.K.; Reifman, A.; Carpenter, T.; Lewis Jr, N.A.; Aberson, C.L.; Bostyn, D.H.; Conrique, B.G.; Ng, B.W.; Schoemann, A.M. Power to detect what? Considerations for planning and evaluating sample size. Personal. Soc. Psychol. Rev. 2024, 28, 276–301. [Google Scholar] [CrossRef]

- Zhang, H.; Zheng, S.; Zhu, P. Why are Indonesian consumers buying on live streaming platforms? Research on consumer perceived value theory. Heliyon 2024, 10, e33518. [Google Scholar] [CrossRef] [PubMed]

- Koo, M.; Yang, S.-W. Likert-Type Scale. Encyclopedia 2025, 5, 18. [Google Scholar] [CrossRef]

- Sawmong, S. Examining the Key Factors that Drives Live Stream Shopping Behavior. Emerg. Sci. J. 2022, 6, 1394–1408. [Google Scholar] [CrossRef]

- Singh, S.; Singh, N.; Kalinić, Z.; Liébana-Cabanillas, F.J. Assessing determinants influencing continued use of live streaming services: An extended perceived value theory of streaming addiction. Expert Syst. Appl. 2021, 168, 114241. [Google Scholar] [CrossRef]

- Zhao, H.; Yao, X.; Liu, Z.; Yang, Q. Impact of pricing and product information on consumer buying behavior with customer satisfaction in a mediating role. Front. Psychol. 2021, 12, 720151. [Google Scholar] [CrossRef]

- Chen, C.-C.; Lin, Y.-C. What drives live-stream usage intention? The perspectives of flow, entertainment, social interaction, and endorsement. Telemat. Inform. 2018, 35, 293–303. [Google Scholar] [CrossRef]

- Aljukhadar, M.; Senecal, S. Communicating online information via streaming video: The role of user goal. Online Inf. Rev. 2017, 41, 378–397. [Google Scholar] [CrossRef]

- Hair, J.; Risher, J.; Sarstedt, M.; Ringle, C. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Al-Dhaafri, H.; Alosani, M. Integration of TQM and ERP to enhance organizational performance and excellence: Empirical evidence from public sector using SEM. World J. Entrep. Manag. Sustain. Dev. 2021, 17, 822–845. [Google Scholar] [CrossRef]

- Sarstedt, M.; Hair Jr, J.F.; Ringle, C.M. “PLS-SEM: Indeed a silver bullet”–retrospective observations and recent advances. J. Mark. Theory Pract. 2023, 31, 261–275. [Google Scholar] [CrossRef]

- Vaithilingam, S.; Ong, C.S.; Moisescu, O.I.; Nair, M.S. Robustness checks in PLS-SEM: A review of recent practices and recommendations for future applications in business research. J. Bus. Res. 2024, 173, 114465. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Podsakoff, N.P.; Williams, L.J.; Huang, C.; Yang, J. Common method bias: It’s bad, it’s complex, it’s widespread, and it’s not easy to fix. Annu. Rev. Organ. Psychol. Organ. Behav. 2024, 11, 17–61. [Google Scholar] [CrossRef]

- Hair, J.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2022. [Google Scholar]

- Chin, W.W.; Thatcher, J.B.; Wright, R.T. Assessing Common Method Bias: Problems With The ULMC Technique. MIS Q. 2012, 36, 1003–1019. [Google Scholar] [CrossRef]

- Kock, N.; Lynn, G. Lateral Collinearity and Misleading Results in Variance-Based SEM: An Illustration and Recommendations. J. Assoc. Inf. Syst. 2012, 13, 546–580. [Google Scholar] [CrossRef]

- Kock, N. Common method bias in PLS-SEM: A full collinearity assessment approach. Int. J. E-Collab. (Ijec) 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Creswell, J. Educational Research: Planning, Conducting and Evaluating Quantitative and Qualitative Research, 4th ed.; Pearson Education: Boston, MA, USA, 2012. [Google Scholar]

- Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 655–690. [Google Scholar]

- Li, Y.; García-de-Frutos, N.; Ortega-Egea, J.M. Impulse buying in live streaming e-commerce: A systematic literature review and future research agenda. Comput. Hum. Behav. Rep. 2025, 19, 100676. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarste, M. A New Criterion for Assessing Discriminant Validity in Variance-based Structural Equation Modeling. JAMS 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hair, J.; Sarstedt, M.; Ringle, C.M.; Gudergan, S.P. Advanced Issues in Partial Least Squares Structural Equation Modeling; SAGE Publications: London, UK, 2023. [Google Scholar]

- Aguirre-Urreta, M.; Rönkkö, M. Statistical Inference with PLSc Using Bootstrap Confidence Intervals. MIS Q. 2017, 42, 1001–1020. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Erlbaum Associates: New York, NY, USA, 2013. [Google Scholar]

- Zhao, X.; Lynch, J.G., Jr.; Chen, Q. Reconsidering Baron and Kenny: Myths and Truths about Mediation Analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Ghasemy, M.; Teeroovengadum, V.; Becker, J.-M.; Ringle, C.M. This fast car can move faster: A review of PLS-SEM application in higher education research. High. Educ. 2020, 80, 1121–1152. [Google Scholar] [CrossRef]

- Shmueli, G.; Sarstedt, M.; Hair, J.F.; Cheah, J.-H.; Ting, H.; Vaithilingam, S.; Ringle, C.M. Predictive model assessment in PLS-SEM: Guidelines for using PLSpredict. Eur. J. Mark. 2019, 53, 2322–2347. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Cheah, J.-H.; Ting, H.; Moisescu, O.I.; Radomir, L. Structural model robustness checks in PLS-SEM. Tour. Econ. 2020, 26, 531–554. [Google Scholar] [CrossRef]

- Wang, J.; Shahzad, F.; Ahmad, Z.; Abdullah, M.; Hassan, N.M. Trust and consumers’ purchase intention in a social commerce platform: A meta-analytic approach. Sage Open 2022, 12, 21582440221091262. [Google Scholar] [CrossRef]

- Yu, T.; Ping, T.; Bian, Q.; Liao, J.; Wang, C. What Drives Purchase Intention in Live Streaming E-Commerce? The Perspectives of Virtual Streamers. Int. J. Hum.-Comput. Interact. 2025, 1–20. [Google Scholar] [CrossRef]

| Measures | Description | Frequency (n) | Percentage (%) |

|---|---|---|---|

| Gender | Female | 178 | 80.5 |

| Male | 43 | 19.5 | |

| Age | <18 years | 17 | 7.7 |

| 18–22 years | 103 | 46.6 | |

| 23–29 years | 78 | 35.3 | |

| >30 years | 23 | 10.4 | |

| Education | Senior High School | 122 | 55.2 |

| Diploma 3 | 11 | 11.7 | |

| Bachelor | 79 | 35.7 | |

| S2/S3 | 1 | 0.5 | |

| Other | 8 | 2.7 | |

| Income | <3,000,000 | 160 | 72.4 |

| 3,000,001–6,000,000 | 43 | 19 | |

| 6,000,001–10,000,000 | 14 | 6.3 | |

| >15,000,000 | 5 | 2.3 |

| Constructs/Indicators | Sources | Kurtosis | Skewness | |

|---|---|---|---|---|

| Purchase Intention (PI) | ||||

| PI1 | I am willing to buy a product or service from a live-stream seller | [17,47] | 0.654 | −0.927 |

| PI2 | I will buy products/services from live streaming | −0.023 | −0.576 | |

| PI3 | I plan to shop online using live streaming. | 0.029 | −0.545 | |

| PI4 | I would recommend online purchasing through live streaming | 0.664 | −0.849 | |

| PI5 | I predict that I will shop online using live streaming in the next 3 months. | −0.139 | −0.740 | |

| Perceived Value (PV) | ||||

| PV1 | Product purchase live-streaming shopping is reliable in quality | [48,49] | −0.115 | −0.651 |

| PV2 | I feel much better after using streaming services. | −0.029 | −0.516 | |

| PV3 | Products purchased through live-stream shopping are value for money. | 0.731 | −0.988 | |

| PV4 | This discount makes the product more affordable | 2.507 | −1.618 | |

| PV5 | I enjoy live-streaming shopping via social media. | 1.250 | −1.101 | |

| Perceived Risk (PR) | ||||

| PR1 | I might get overcharged if I shop online through a live stream | [12,17] | −0.974 | 0.512 |

| PR2 | I might not get what I ordered through a live stream | −0.905 | 0.425 | |

| PR3 | Delivery may be sent to the wrong place. | −0.736 | 0.452 | |

| PR4 | Finding the right product online can take some time | −1.301 | −0.071 | |

| PR5 | I am afraid that the after-sales service is not good. | −0.714 | 0.039 | |

| Streamer Credibility (SC) | ||||

| SC1 | The streamer is trustworthy | [12,50] | −0.156 | −0.330 |

| SC2 | The streamer gives viewers information about the product/service. | 0.247 | −0.557 | |

| SC3 | I think the streamer has an appealing appearance | 0.542 | −0.747 | |

| SC4 | Streamers have extensive experience and are experts in reviewing products and services. | −0.319 | −0.544 | |

| SC5 | Watching a live stream is entertaining. | 0.040 | −0.668 | |

| Media Richness (MR) | ||||

| MR1 | During live-streaming shopping, I can see detailed pictures of the product | [1,9] | 1.792 | −1.308 |

| MR2 | I can use a variety of media (text, pictures, video) to share the information I get from live-streaming shopping. | 1.229 | −0.940 | |

| MR3 | The streamer responded quickly to my questions. | 0.019 | −0.667 | |

| MR4 | Streamer provides clear guidelines for shopping | 0.768 | −0.989 | |

| MR5 | I can provide opinions in a variety of languages | 0.798 | −0.909 | |

| Interactivity (IT) | ||||

| IT1 | The streamer is willing to communicate with me | [12,51] | −0.416 | −0.385 |

| IT2 | The streamer can respond to my specific questions quickly and efficiently. | 0.746 | −0.858 | |

| IT3 | The information that streamers offer in real-time may affect the quality of the stream. | −0.170 | −0.722 | |

| IT4 | When watching a live stream, I feel closer to the streamer. | −0.274 | −0.553 | |

| IT5 | I can get a lot of good advice from the streamer. | 0.203 | −0.636 | |

| Constructs | Items | Loadings | CA | CR | AVE |

|---|---|---|---|---|---|

| Interactivity (IT) | IT1 | 0.822 | 0.852 | 0.895 | 0.630 |

| IT2 | 0.717 | ||||

| IT3 | 0.783 | ||||

| IT4 | 0.796 | ||||

| IT5 | 0.845 | ||||

| Media Richness (MR) | MR1 | 0.789 | 0.790 | 0.865 | 0.616 |

| MR2 | 0.706 | ||||

| MR3 | 0.751 | ||||

| MR4 | 0.884 | ||||

| Purchase Intention (PI) | PI1 | 0.835 | 0.868 | 0.904 | 0.654 |

| PI2 | 0.835 | ||||

| PI3 | 0.846 | ||||

| PI4 | 0.753 | ||||

| PI5 | 0.771 | ||||

| Perceived Risk (PR) | PR1 | 0.827 | 0.822 | 0.871 | 0.629 |

| PR2 | 0.765 | ||||

| PR3 | 0.864 | ||||

| PR5 | 0.685 | ||||

| Perceived Value (PV) | PV1 | 0.785 | 0.822 | 0.871 | 0.629 |

| PV2 | 0.786 | ||||

| PV3 | 0.845 | ||||

| PV4 | 0.776 | ||||

| PV5 | 0.853 | ||||

| Streamer Credibility (SC) | SC1 | 0.813 | 0.840 | 0.887 | 0.611 |

| SC2 | 0.838 | ||||

| SC3 | 0.777 | ||||

| SC4 | 0.754 | ||||

| SC5 | 0.720 |

| IT | MR | PI | PR | PV | SC | |

|---|---|---|---|---|---|---|

| Heterotrait-Monotrait Ratio (HTMT) | ||||||

| IT | ||||||

| MR | 0.883 | |||||

| PI | 0.740 | 0.721 | ||||

| PR | 0.092 | 0.183 | 0.099 | |||

| PV | 0.806 | 0.896 | 0.866 | 0.152 | ||

| SC | 0.852 | 0.817 | 0.680 | 0.106 | 00.774 | |

| Fornell-Larcker Criterion | ||||||

| IT | 0.825 | |||||

| MR | 0.714 | 0.822 | ||||

| PI | 0.633 | 0.591 | 0.809 | |||

| PR | −0.055 | −0.190 | −0.058 | 0.758 | ||

| PV | 0.692 | 0.736 | 0.759 | −0.174 | 0.810 | |

| SC | 0.718 | 0.658 | 0.586 | −0.069 | 0.663 | 0.781 |

| IT | MR | PI | PR | PV | SC | |

|---|---|---|---|---|---|---|

| IT1 | 0.812 | 0.64 | 0.554 | −0.065 | 0.6 | 0.566 |

| IT3 | 0.805 | 0.611 | 0.513 | −0.084 | 0.583 | 0.557 |

| IT4 | 0.818 | 0.474 | 0.493 | 0.043 | 0.512 | 0.603 |

| IT5 | 0.865 | 0.626 | 0.529 | −0.08 | 0.588 | 0.642 |

| MR1 | 0.570 | 0.835 | 0.470 | −0.157 | 0.654 | 0.500 |

| MR2 | 0.518 | 0.752 | 0.454 | −0.043 | 0.489 | 0.485 |

| MR4 | 0.662 | 0.874 | 0.532 | −0.252 | 0.657 | 0.626 |

| PI1 | 0.462 | 0.507 | 0.835 | −0.145 | 0.624 | 0.467 |

| PI2 | 0.522 | 0.527 | 0.835 | 0.003 | 0.645 | 0.487 |

| PI3 | 0.554 | 0.531 | 0.846 | −0.046 | 0.69 | 0.534 |

| PI4 | 0.469 | 0.366 | 0.754 | −0.109 | 0.535 | 0.433 |

| PI5 | 0.553 | 0.441 | 0.771 | 0.049 | 0.559 | 0.438 |

| PR1 | −0.0076 | −0.186 | −0.056 | 0.831 | −0.178 | −0.073 |

| PR2 | 0.020 | −0.095 | 0.015 | 0.780 | −0.052 | −0.026 |

| PR3 | −0.066 | −0.19 | −0.09 | 0.851 | −0.197 | −0.079 |

| PR5 | 0.007 | −0.056 | 0.028 | 0.701 | 0.010 | 0.031 |

| PV1 | 0.541 | 0.526 | 0.519 | −0.121 | 0.784 | 0.563 |

| PV2 | 0.565 | 0.542 | 0.656 | −0.065 | 0.786 | 0.538 |

| PV3 | 0.569 | 0.624 | 0.646 | −0.140 | 0.845 | 0.536 |

| PV4 | 0.488 | 0.642 | 0.544 | −0.275 | 0.777 | 0.471 |

| PV5 | 0.631 | 0.642 | 0.691 | −0.130 | 0.853 | 0.579 |

| SC1 | 0.594 | 0.537 | 0.506 | −0.034 | 0.563 | 0.814 |

| SC2 | 0.578 | 0.536 | 0.514 | −0.041 | 0.579 | 0.838 |

| SC3 | 0.532 | 0.491 | 0.367 | −0.037 | 0.429 | 0.778 |

| SC4 | 0.511 | 0.53 | 0.404 | −0.205 | 0.484 | 0.752 |

| SC5 | 0.584 | 0.471 | 0.484 | 0.034 | 0.523 | 0.720 |

| Construct | CA | CR | AVE | Items Kept | |||

|---|---|---|---|---|---|---|---|

| Before | After | Before | After | Before | After | ||

| IT | 0.852 | 0.844 | 0.895 | 0.895 | 0.630 | 0.681 | IT1, IT3, IT4, IT5 |

| MR | 0.790 | 0.760 | 0.865 | 0.862 | 0.616 | 0.676 | MR1, MR2, MR4 |

| Hypothesis Relationship | β | t | p | 95% CI | Sig. | Supported? | f2 | VIF | |

|---|---|---|---|---|---|---|---|---|---|

| LL | UL | ||||||||

| H1. SC → IT | 0.718 | 19.046 | 0.000 | 0.648 | 0.774 | *** | Yes | 1.063 | 1.000 |

| H2. SC → PV | 0.215 | 1.979 | 0.024 | 0.038 | 0.400 | * | No | 0.054 | 2.264 |

| H3. SC → PR | 0.074 | 0.664 | 0.253 | −0.119 | 0.245 | NS | Yes | 0.002 | 2.385 |

| H4. SC → MR | 0.658 | 14.890 | 0.000 | 0.575 | 0.722 | *** | Yes | 0.762 | 1.000 |

| H5. IT → PV | 0.230 | 2.507 | 0.006 | 0.080 | 0.385 | ** | Yes | 0.053 | 2.620 |

| H6. IT → PR | 0.187 | 1.692 | 0.045 | −0.019 | 0.348 | * | Yes | 0.014 | 2.759 |

| H7. MR → PV | 0.431 | 4.827 | 0.000 | 0.277 | 0.573 | *** | Yes | 0.218 | 2.237 |

| H8. MR → PR | −0.249 | 2.504 | 0.006 | −0.381 | −0.044 | ** | Yes | 0.024 | 2.725 |

| H9. PV → PR | −0.174 | 1.455 | 0.073 | −0.355 | 0.022 | NS | No | 0.012 | 2.626 |

| H1. PV → PI | 0.773 | 22.873 | 0.000 | 0.711 | 0.823 | *** | Yes | 1.385 | 1.033 |

| H11. PR → PI | 0.079 | 2.118 | 0.017 | 0.019 | 0.140 | ** | No | 0.014 | 1.033 |

| From | Via | Indirect β | 5.0% | 95.0% | Sig. | Mediation Type |

|---|---|---|---|---|---|---|

| SC | PV → PR | −0.003 | −0.014 | −0.000 | No | No mediation |

| SC | PR | 0.006 | −0.005 | 0.027 | No | No mediation |

| SC | MR → PV → PR | −0.004 | −0.014 | −0.000 | No | No mediation |

| SC | MR → PV | 0.219 | 0.137 | 0.303 | Yes | Indirect-only |

| SC | MR → PV | 0.283 | 0.178 | 0.389 | Yes | Complementary |

| SC | MR → PR | −0.013 | −0.031 | −0.002 | No | No mediation |

| SC | IT → PV → PR | −0.002 | −0.009 | −0.000 | No | No mediation |

| SC | IT → PV | 0.128 | 0.044 | 0.216 | Yes | Indirect-only |

| SC | IT → PV | 0.165 | 0.057 | 0.277 | Yes | Complementary |

| SC | IT → PR | 0.011 | 0.000 | 0.031 | No | No mediation |

| IT | PV → PR | −0.003 | −0.013 | −0.000 | No | No mediation |

| IT | PV | 0.178 | 0.061 | 0.300 | Yes | Indirect-only |

| IT | PR | 0.015 | 0.001 | 0.042 | No | No mediation |

| MR | PV → PR | −0.006 | −0.020 | −0.000 | No | No mediation |

| MR | PV | 0.333 | 0.212 | 0.446 | Yes | Indirect-only |

| MR | PR | −0.020 | −0.046 | −0.002 | No | No mediation |

| MR | PV → PR | −0.006 | −0.020 | −0.000 | No | No mediation |

| MR | PV | 0.333 | 0.212 | 0.446 | Yes | Indirect-only |

| MR | PR | −0.020 | −0.046 | −0.002 | No | No mediation |

| PV | PR | −0.014 | −0.042 | −0.001 | No | No mediation |

| From (Predictor) | Indirect Sum (β) | Total Effect to PI (β) | VAF (=Indirect/Total) | Mediation Type |

|---|---|---|---|---|

| IT → PI | 0.178 | 0.190 | 0.94 | Indirect-only via PV |

| MR → PI | 0.307 | 0.308 | 1.00 | Indirect-only via PV |

| SC → PI | 0.346 | 0.507 | 0.68 | Partial (complementary) |

| PV → PI | −0.014 | 0.760 | 0.00 | No mediation |

| PR → PI | 0.00 | 0.079 | 0.00 | No mediation |

| Indicator Items | Q2 Predict | PLS | LM | RMSEPLS − RMSELM | MAEPLS − MAELM | ||

|---|---|---|---|---|---|---|---|

| RMSE | MAE | RMSE | MAE | ||||

| PI1 | 0.208 | 0.755 | 0.581 | 0.769 | 0.588 | −0.014 | −0.007 |

| PI2 | 0.224 | 0.745 | 0.584 | 0.761 | 0.592 | −0.016 | −0.008 |

| PI3 | 0.264 | 0.721 | 0.576 | 0.719 | 0.564 | 0.002 | 0.012 |

| PI4 | 0.178 | 0.791 | 0.608 | 0.797 | 0.614 | −0.006 | −0.006 |

| PI5 | 0.184 | 0.954 | 0.756 | 0.963 | 0.759 | −0.009 | −0.003 |

| Nonlinear Effect | β | t-Values | p Values | PCI | Sig? |

|---|---|---|---|---|---|

| QE (SC) → IT | 0.074 | 1.180 | 0.238 | [−0.061–0.173] | No |

| QE (SC) → MR | 0.011 | 0.185 | 0.854 | [−0.111–0.104] | No |

| QE (SC) → PR | −0.101 | 1.566 | 0.117 | [−0.221–0.036] | No |

| QE (SC) → PV | 0.047 | 0.656 | 0.512 | [−0.113–0.156] | No |

| QE (MR) → PR | −0.073 | 1.199 | 0.230 | [−0.184–0.132] | No |

| QE (MR) → PV | 0.027 | 0.508 | 0.612 | [−0.082–0.184] | No |

| QE (IT) → PR | 0.042 | 0.551 | 0.581 | [−0.116–0.184] | No |

| QE (IT) → PV | −0.036 | 0.558 | 0.577 | [−0.175–0.084] | No |

| QE (PV) → PI | 0.038 | 1.152 | 0.249 | [−0.022–0.107] | No |

| QE (PV) → PR | 0.033 | 0.498 | 0.618 | [−0.084–0.182] | No |

| QE (PR) → PI | 0.048 | 1.345 | 0.179 | [−0.022–0.119] | No |

| Criteria | Segment | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| AIC (Akaike’s information criterion) | 2.34.884 | 2.223.753 | 2.211.754 | 2.101.249 |

| AIC3 (modified AIC with Factor 3) | 2.356.884 | 2.256.753 | 2.261.754 | 2.168.249 |

| AIC4 (modified AIC with Factor 4) | 2.372.884 | 2.289.753 | 2.311.754 | 2.235.249 |

| BIC (Bayesian information criterion) | 2.394.437 | 2.334.208 | 2.379.109 | 2.325.505 |

| CAIC (consistent AIC) | 2.41.437 | 2.367.208 | 2.429.109 | 2.392.505 |

| MDL5 (minimum description length with factor 5) | 2.736.652 | 3.04.026 | 3.448.531 | 3.758.530 |

| EN (normed entropy statistic) | 0.000 | 0.573 | 0.578 | 0.779 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Syamsuar, D.; Witarsyah, D. The Role of Perceived Value and Risk in Shaping Purchase Intentions in Live-Streaming Commerce: Evidence from Indonesia. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 298. https://doi.org/10.3390/jtaer20040298

Syamsuar D, Witarsyah D. The Role of Perceived Value and Risk in Shaping Purchase Intentions in Live-Streaming Commerce: Evidence from Indonesia. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(4):298. https://doi.org/10.3390/jtaer20040298

Chicago/Turabian StyleSyamsuar, Dedy, and Deden Witarsyah. 2025. "The Role of Perceived Value and Risk in Shaping Purchase Intentions in Live-Streaming Commerce: Evidence from Indonesia" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 4: 298. https://doi.org/10.3390/jtaer20040298

APA StyleSyamsuar, D., & Witarsyah, D. (2025). The Role of Perceived Value and Risk in Shaping Purchase Intentions in Live-Streaming Commerce: Evidence from Indonesia. Journal of Theoretical and Applied Electronic Commerce Research, 20(4), 298. https://doi.org/10.3390/jtaer20040298