Managing Service-Level Returns in E-Commerce: Joint Pricing, Delivery Time, and Handling Strategy Decisions

Abstract

1. Introduction

- How do product returns influence the equilibrium pricing, PDL, and wholesale price decisions in a decentralized supply chain?

- Under what conditions should a manufacturer agree to buy back service-level returns, and how does the e-tailer’s ability to extract value from these returns (defined as the reselling ratio) shape the optimal handling strategy?

- How does the balance of power within the supply chain—specifically, a Manufacturer-Stackelberg (MS) versus a Retailer-Stackelberg (RS) structure—alter these strategic decisions and their financial outcomes?

2. Literature Review

2.1. Promised Delivery Lead Time and Pricing Strategies

2.2. Product Return Handling Strategies

3. The Basic Model

- The manufacturer decides the product returns handling strategy ( or );

- If the disposal option is , the e-tailer chooses whether to return product returns back to the manufacturer or not; otherwise, the e-tailer would take the responsibility to salvage product returns;

- The manufacturer determines the wholesale price (w);

- Price (p) and PDL (T) decisions are made simultaneously by the e-tailer before the selling season.

- All the parameters are non-negative (i.e., ). Moreover, the maximum return rate and the reselling ratio , where refers to the minimum reselling ratio that the e-tailer can hardly extract any value from the returned units. Since , we have ;

- The return rate sensitivity to PDL satisfies that , to exclude the trivial cases where the return rate is non-positive when [31].

4. Equilibrium Analysis in the MS Supply Chain

4.1. The MS Stackelberg Game Under Strategy

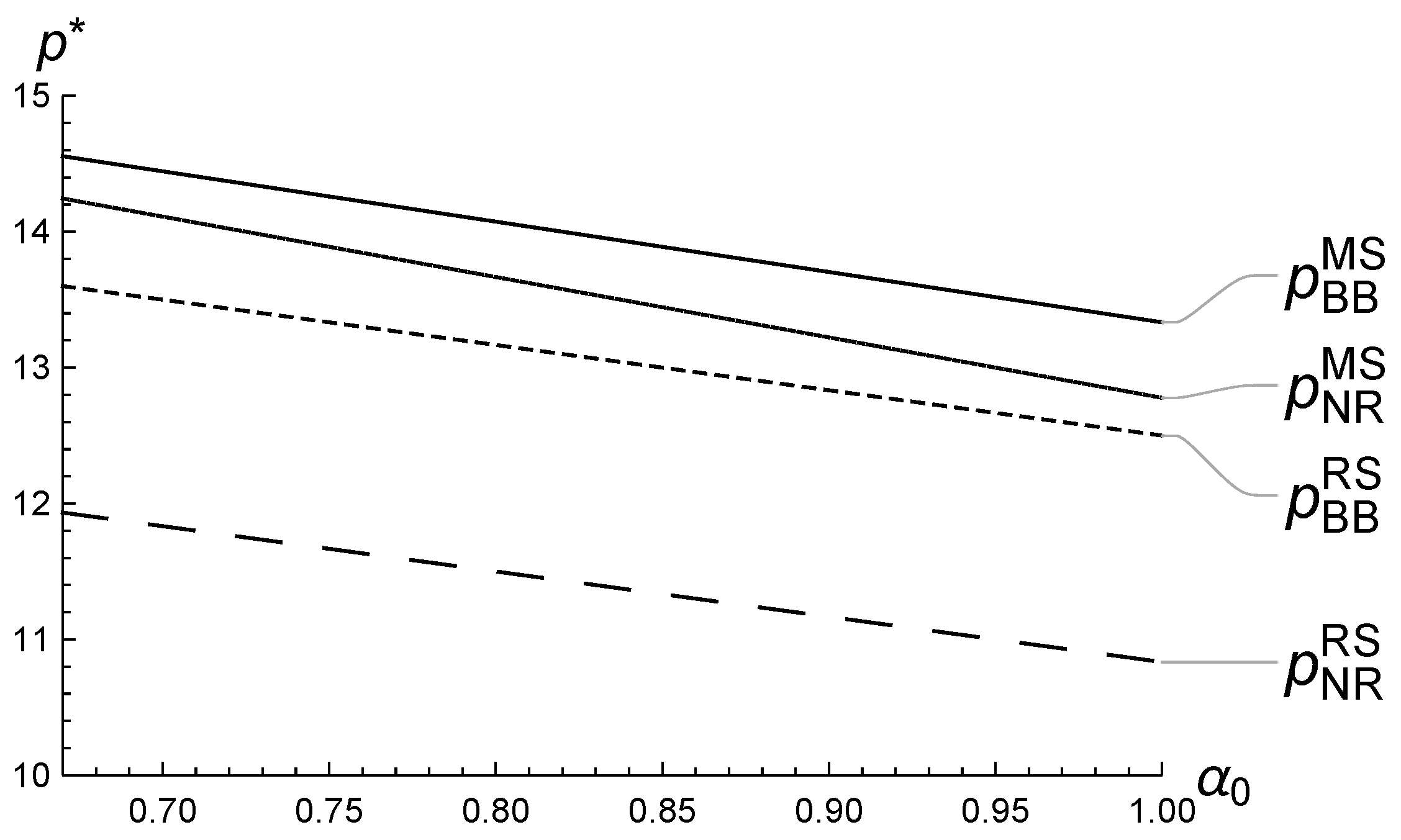

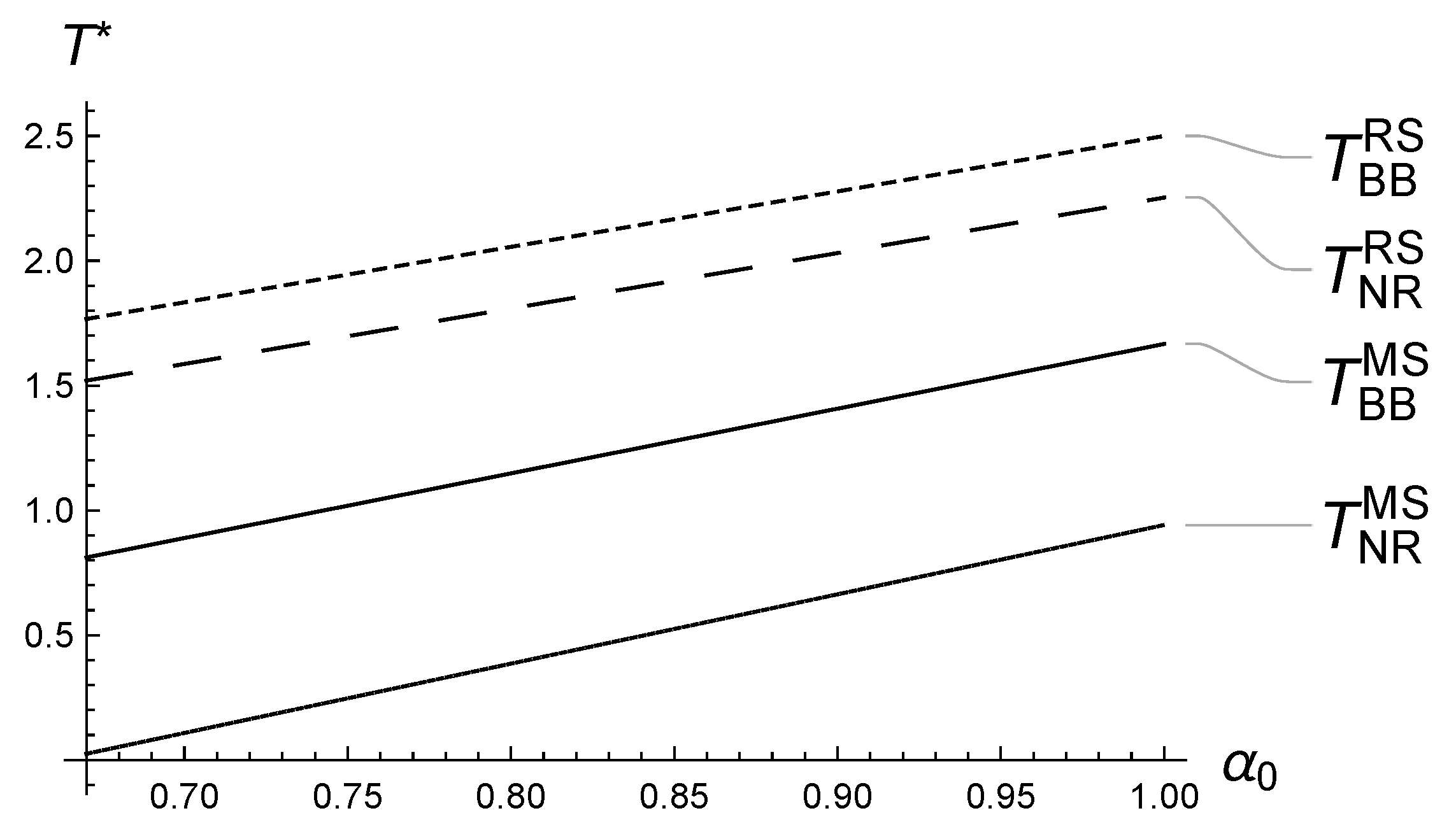

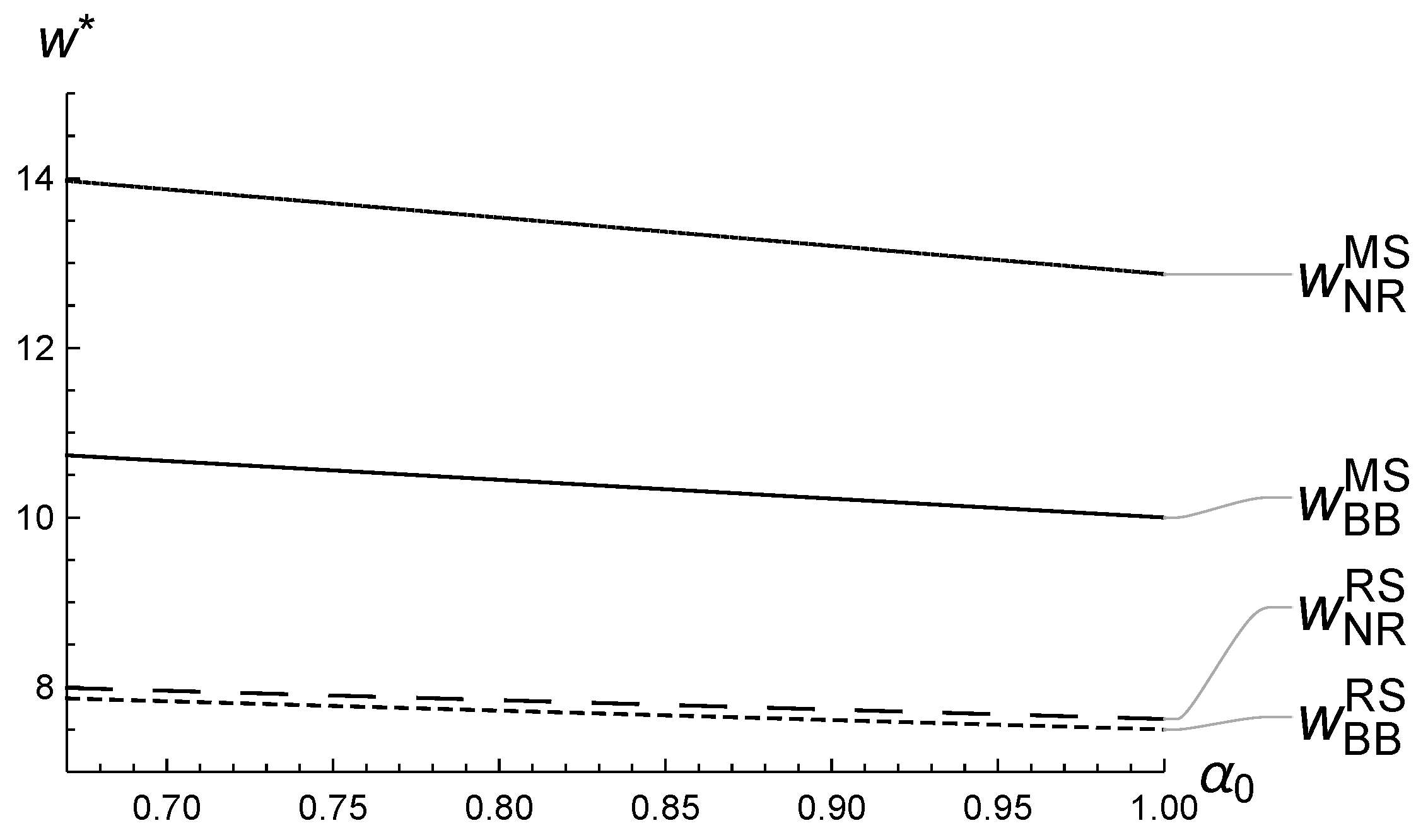

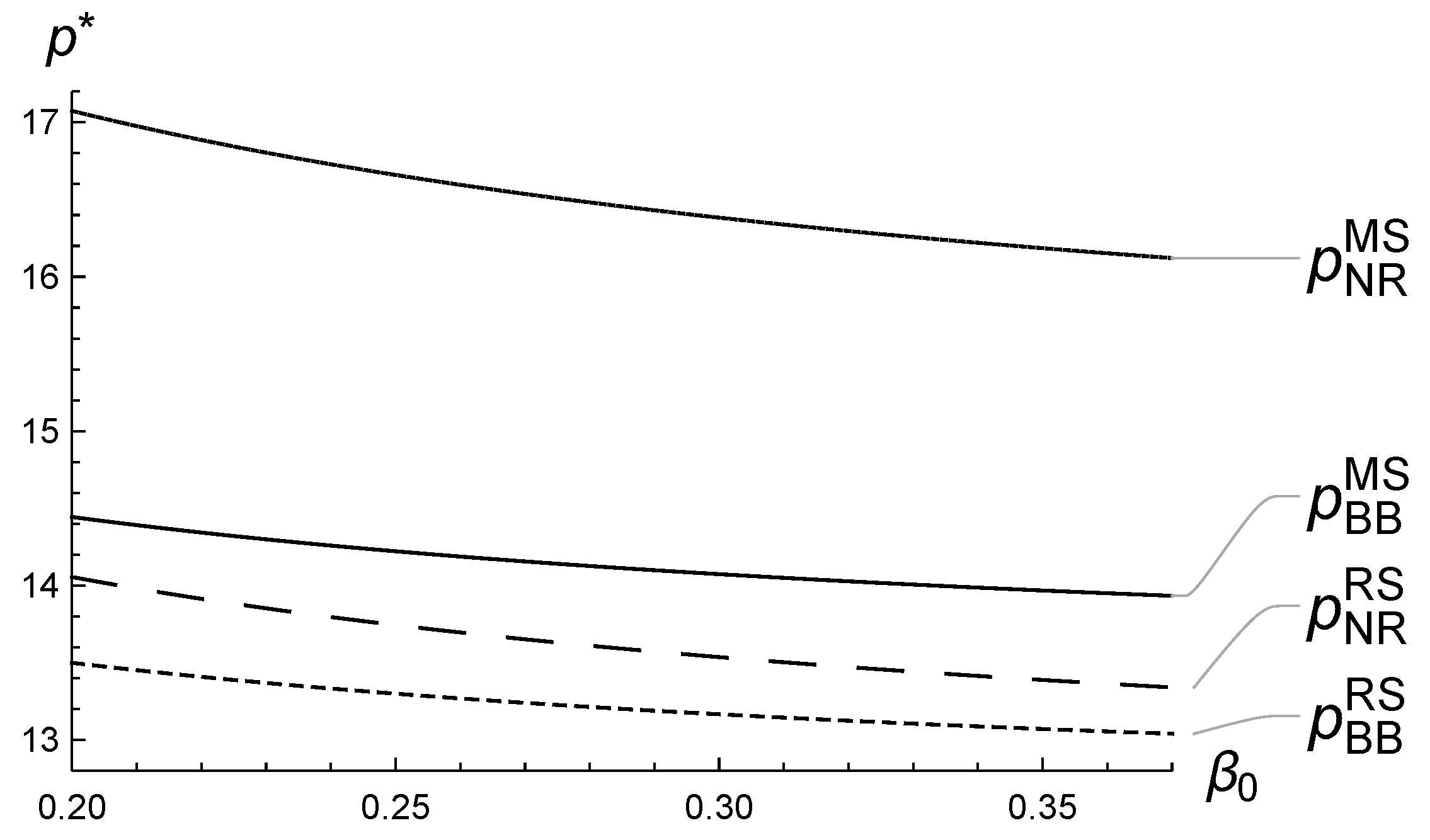

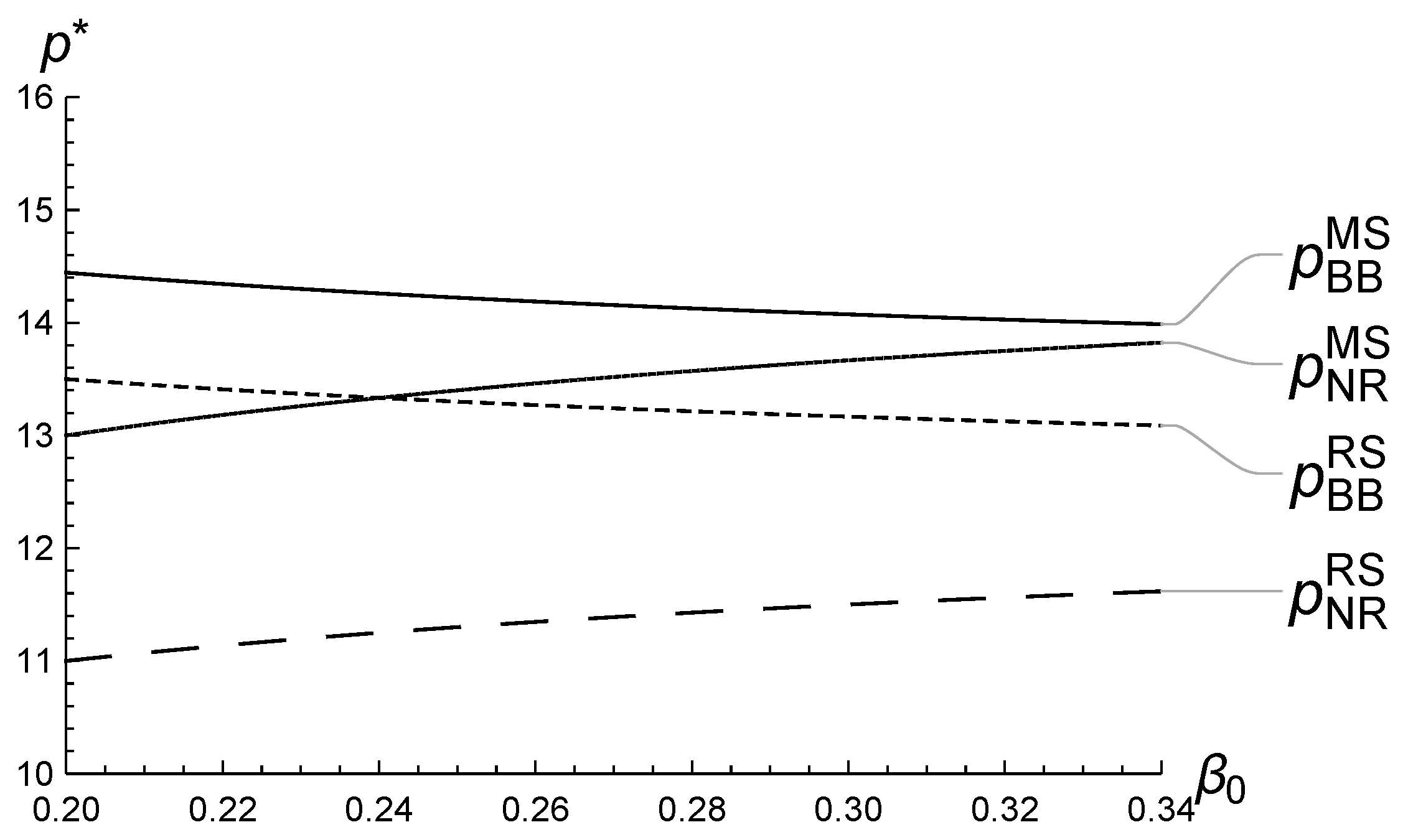

- the equilibrium price, , monotonically decreases in ;

- the equilibrium PDL, , monotonically increases in ;

- the equilibrium wholesale price, , monotonically decreases in .

4.2. The MS Stackelberg Game Under Strategy

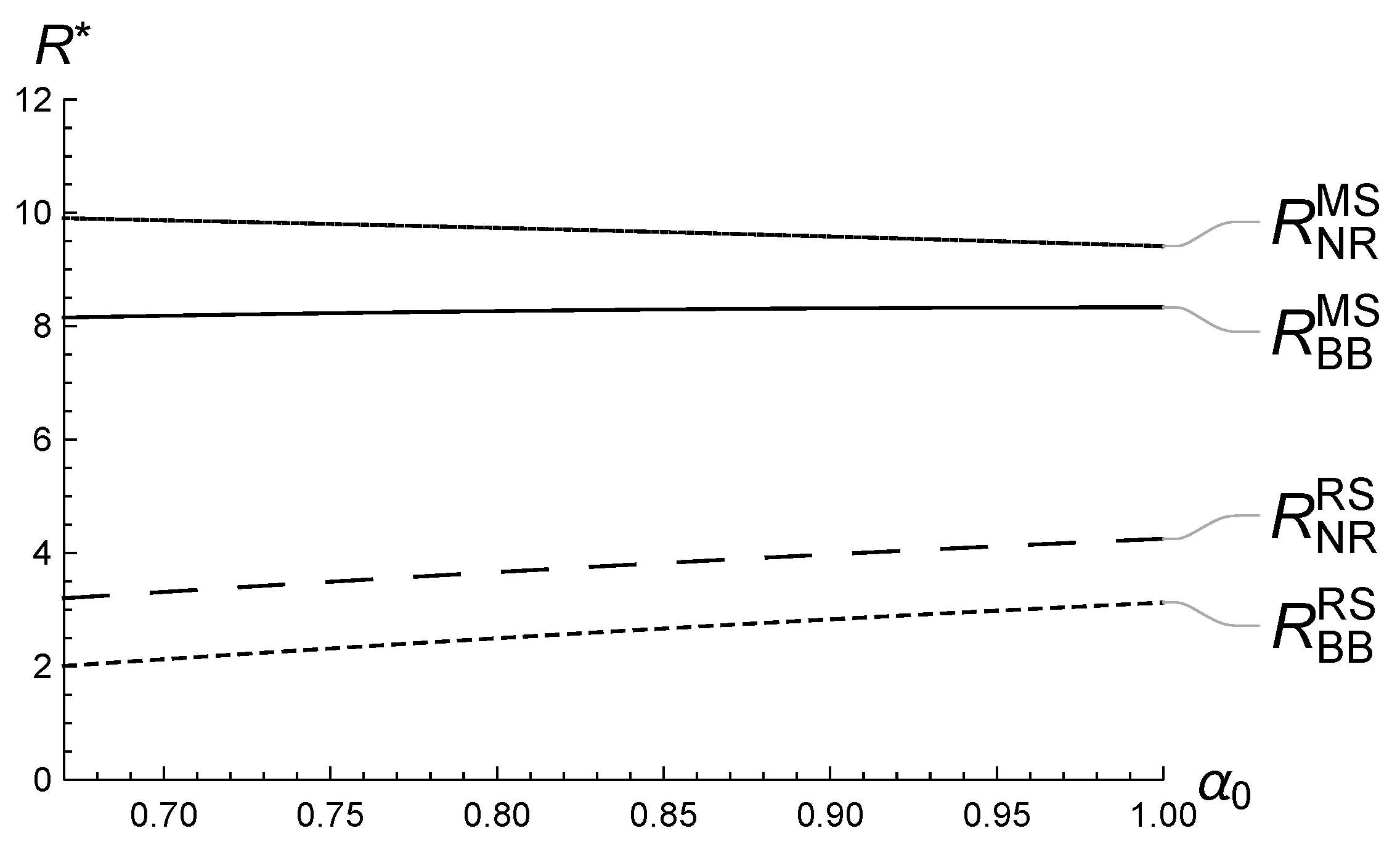

- both and decrease in , while increases in ;

- the relationships between the equilibrium solutions of the supply chain and are non-monotonic: if , and increase in , while decreases in ; Otherwise, and decrease in and increases in ;

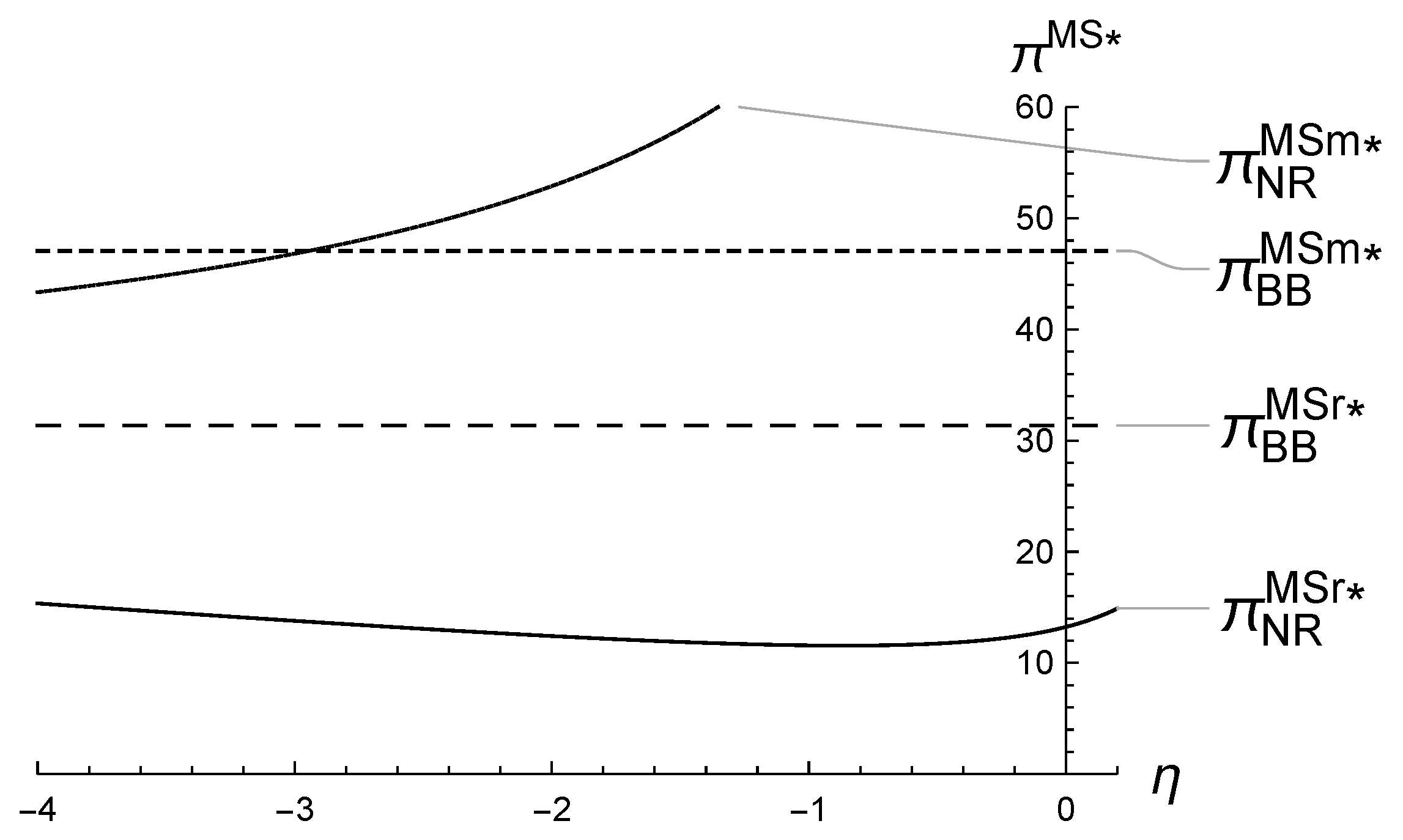

- both and increase in η, while decreases in η.

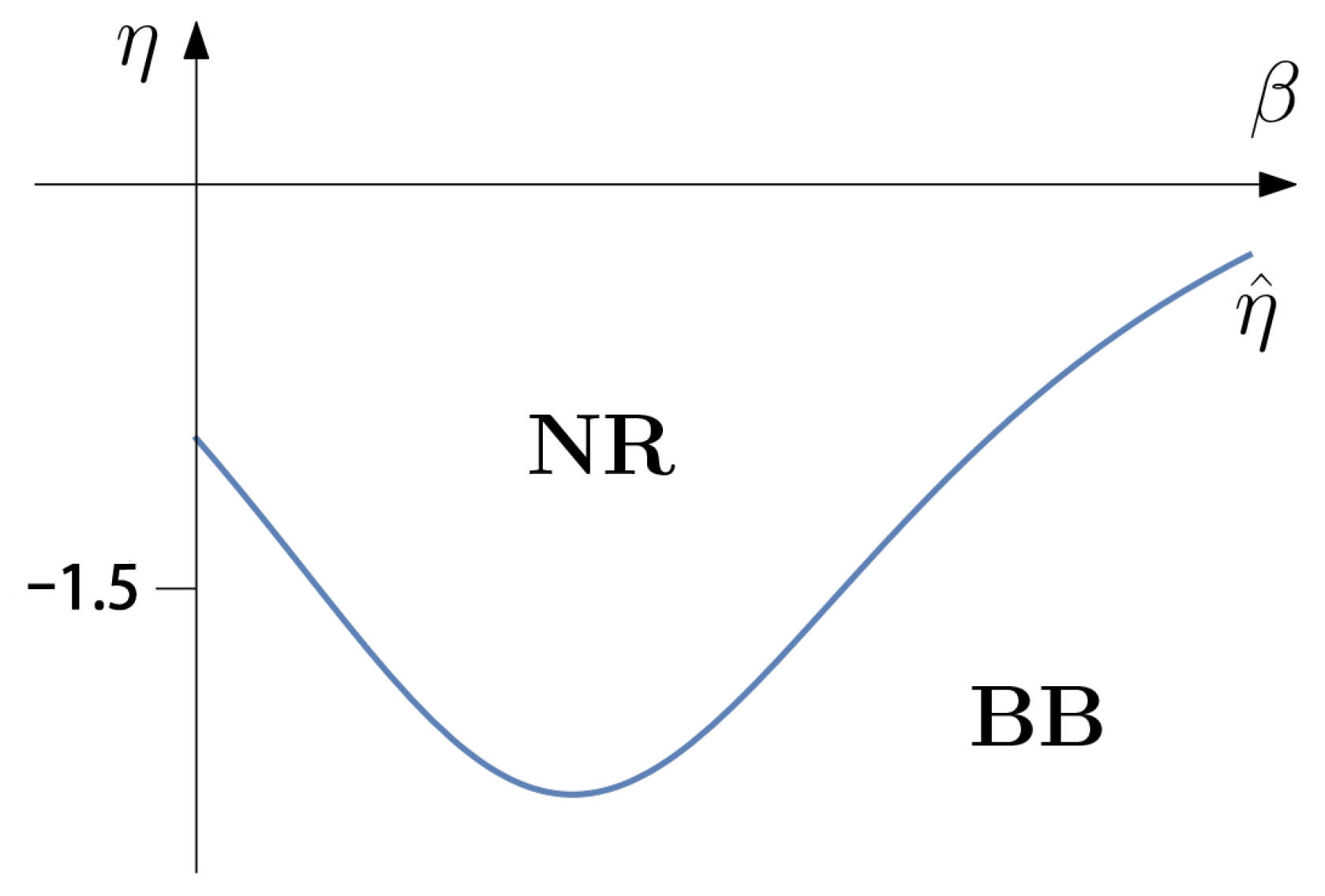

4.3. The Equilibrium Handling Strategy of Product Returns in the MS Supply Chain

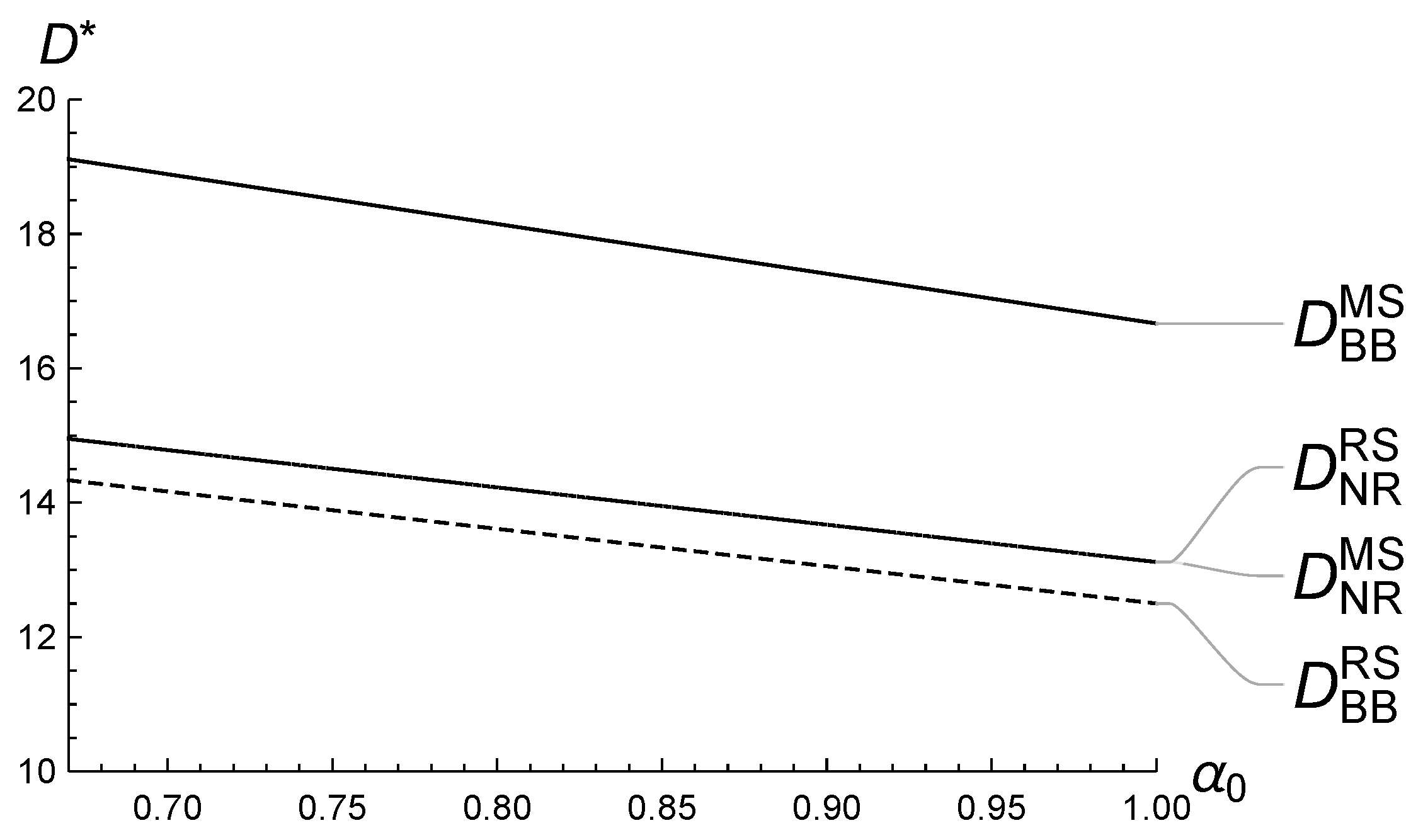

- decreases in the maximum return rate ;

- increases in the return rate sensitivity to PDL ;

- is affected by the reselling ratio under strategy non-monotonically: ifincreases in η; Otherwise, decreases in η.

- decreases in the maximum return rate ;

- increases in the return rate sensitivity to PDL under strategy; is affected by in two ways under strategy: If , increases in . Otherwise, decreases in ;

- increases in η under strategy.

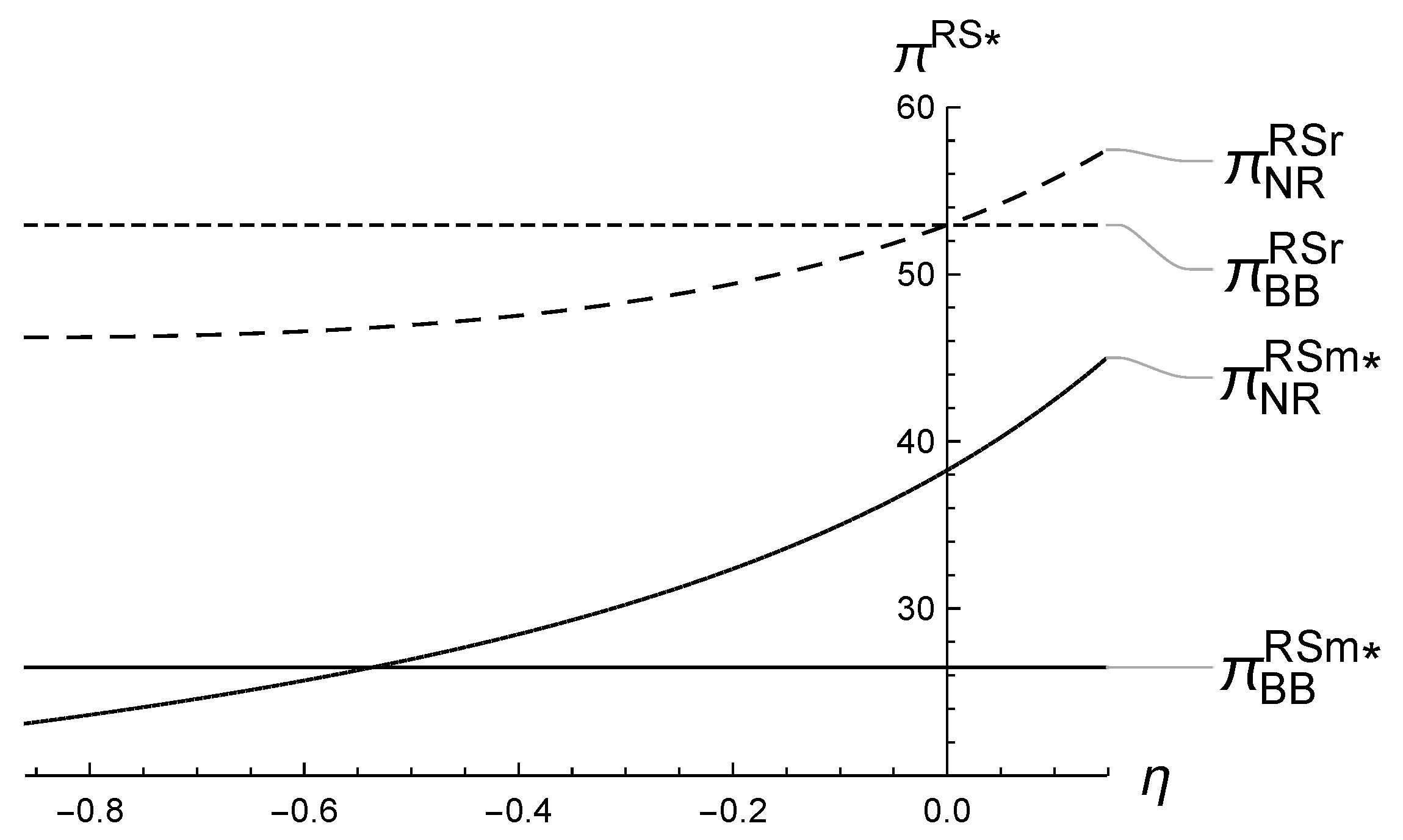

5. Equilibrium Analysis Under the RS Supply Chain

- The e-tailer decides the product returns handling strategy ( or );

- The profit margin (m) and PDL (T) decisions are made simultaneously by the e-tailer;

- The manufacturer determines the wholesale price (w) before the selling season.

- monotonically decreases in the maximum return rate ;

- monotonically increases in the return rate sensitivity to PDL ;

- increases in the reselling ratio η under strategy.

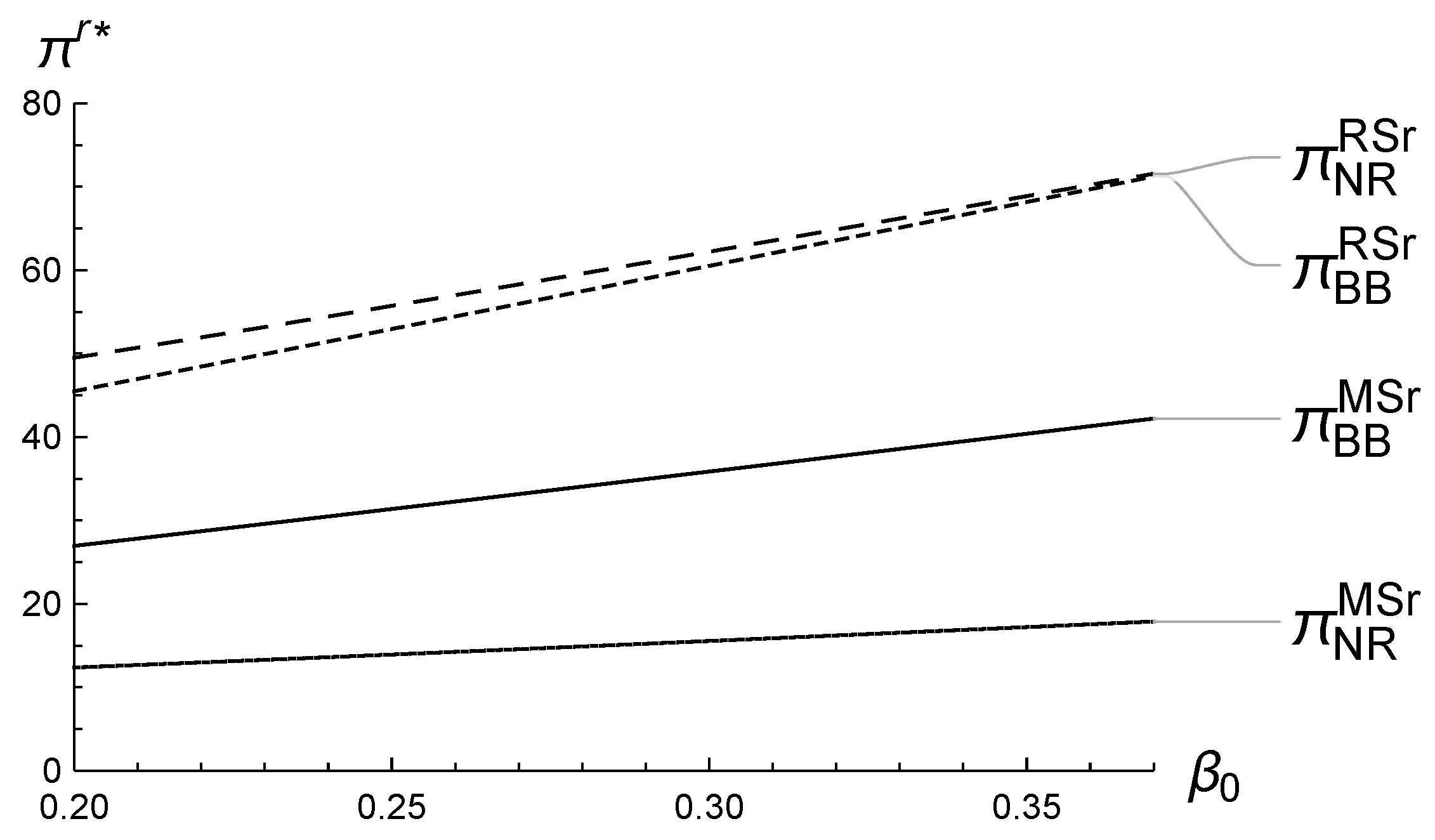

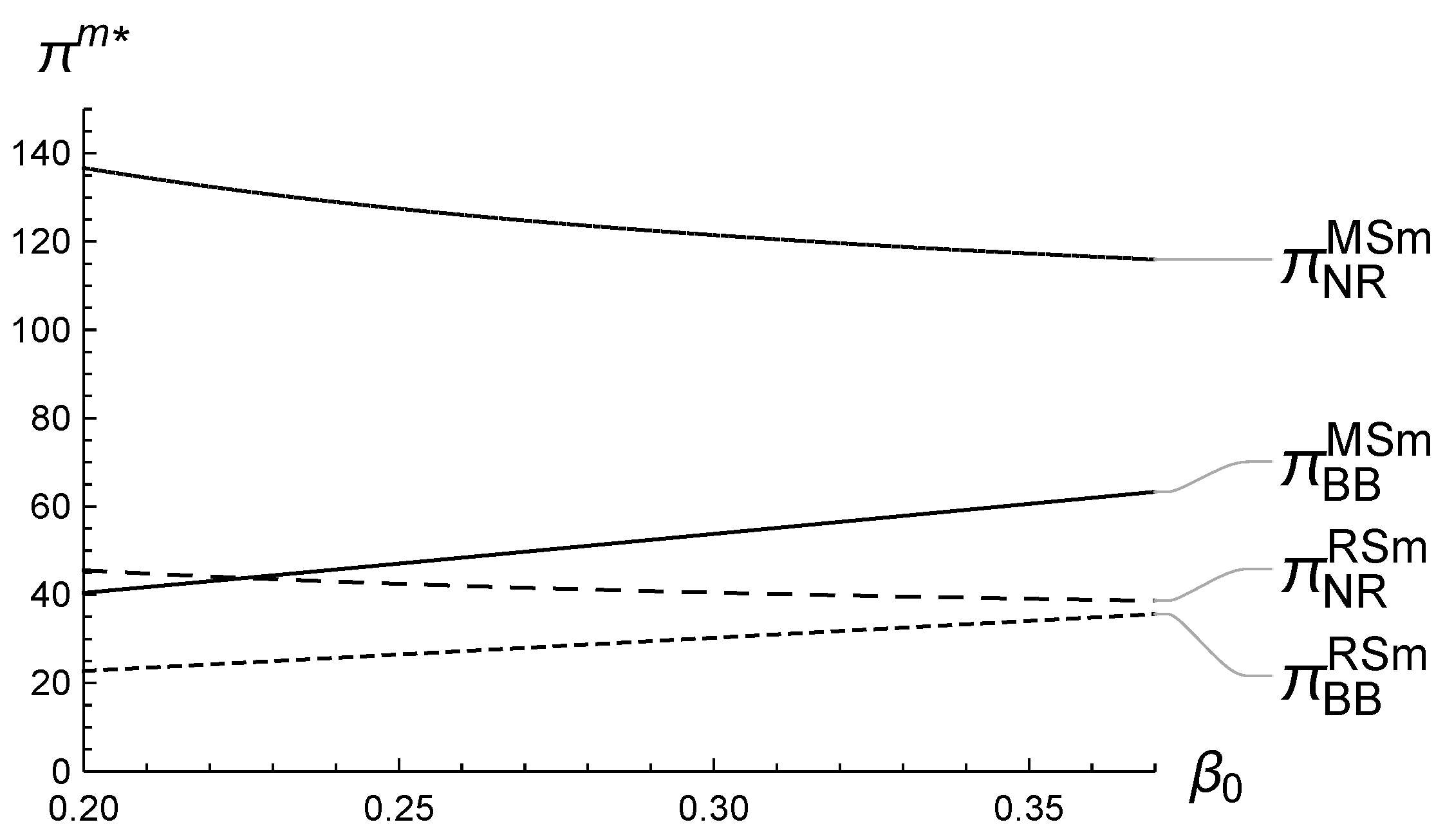

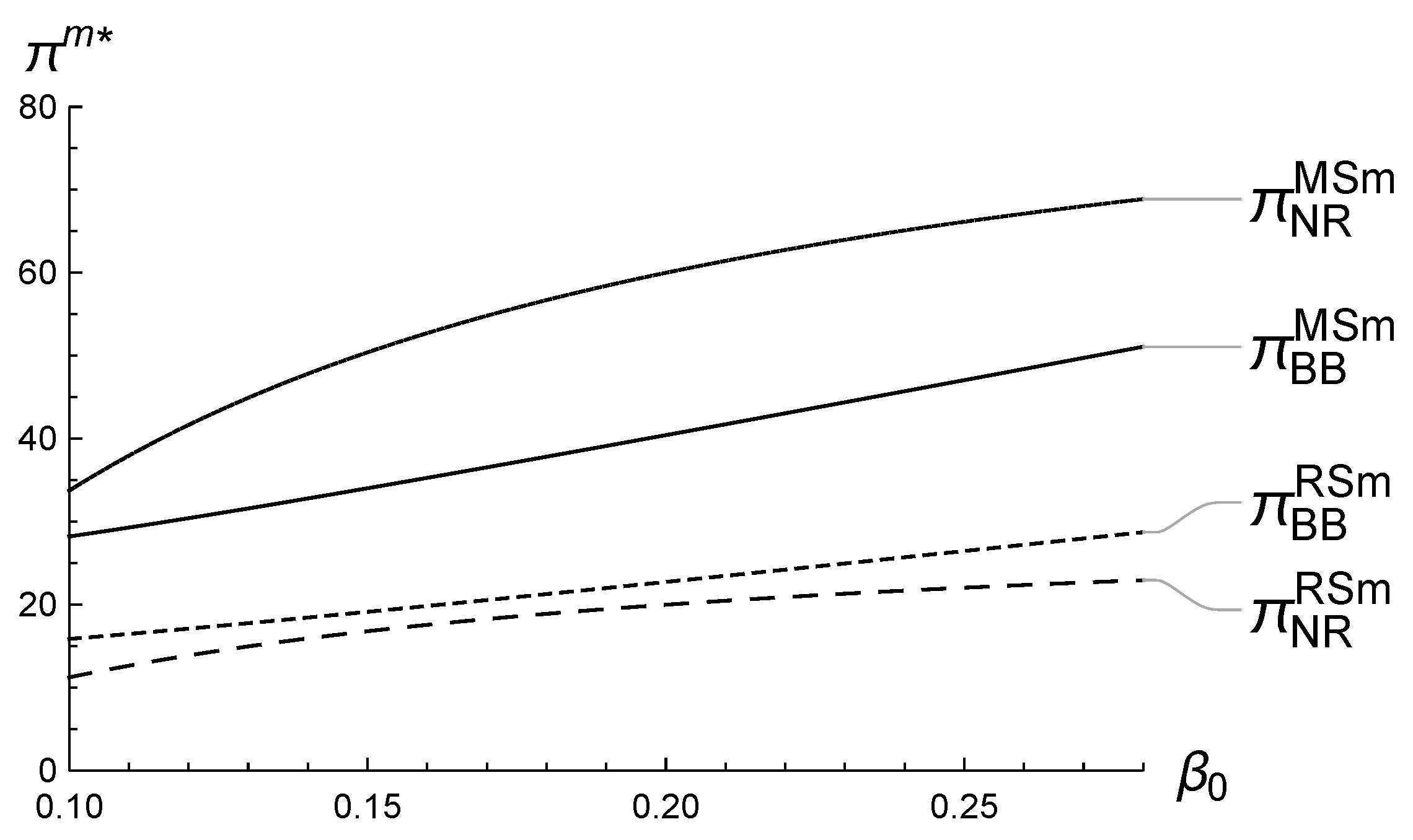

5.1. Numerical Analysis of ’s Impact on the Equilibrium

5.2. Numerical Analysis of ’s Impact on the Equilibrium

5.3. Numerical Analysis of ’s Impact on the Equilibrium

6. Discussion and Managerial Implications

7. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Postponed Proofs

Appendix A.1. Proof of Proposition 1

- ;

- ;

- ;

- .

Appendix A.2. Proof of Proposition 2

- ;

- ;

- ;

- .

Appendix A.3. Proof of Proposition 3

Appendix A.4. Proof of Corollary 8

References

- Tapia, J.; Fariña, P.; Urbina, I.; Dujovne, D. Examining the retail delivery choice behavior in a technology-aware market. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1392–1410. [Google Scholar] [CrossRef]

- Niu, B.; Liu, J.; Zhang, J.; Chen, K. Promised-delivery-time-driven reselling facing global platform’s private label competition: Game analysis and data validation. Omega 2024, 123, 102990. [Google Scholar] [CrossRef]

- Hu, L.; Zhou, X.; Choi, T.M.; Du, S. Making Delivery Platform Drivers Safer: Platform Responsibility Versus Consumer Empowerment. Prod. Oper. Manag. 2025, 34, 2104–2123. [Google Scholar] [CrossRef]

- Chung, W.; Talluri, S.; Kovács, G. Investigating the effects of lead-time uncertainties and safety stocks on logistical performance in a border-crossing JIT supply chain. Comput. Ind. Eng. 2018, 118, 440–450. [Google Scholar] [CrossRef]

- Rao, S.; Rabinovich, E.; Raju, D. The role of physical distribution services as determinants of product returns in Internet retailing. J. Oper. Manag. 2014, 32, 295–312. [Google Scholar] [CrossRef]

- Cui, R.; Lu, Z.; Sun, T.; Golden, J.M. Sooner or later? Promising delivery speed in online retail. Manuf. Serv. Oper. Manag. 2024, 26, 233–251. [Google Scholar] [CrossRef]

- Li, Z.; Chen, X.; Li, S. Delivery timeliness disclosure strategy in platform-based instant retail industries: Understanding the effect of consumer loss aversion. Transp. Res. Part E Logist. Transp. Rev. 2025, 201, 104288. [Google Scholar] [CrossRef]

- Shulman, J.D.; Coughlan, A.T.; Savaskan, R.C. Optimal reverse channel structure for consumer product returns. Mark. Sci. 2010, 29, 1071–1085. [Google Scholar] [CrossRef]

- Chen, J.; Chen, B. Competing with customer returns policies. Int. J. Prod. Res. 2016, 54, 2093–2107. [Google Scholar] [CrossRef]

- Yi, L. Research on B2C cross-border electronic commerce return logistics model selection based on estimated return rate. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1034–1059. [Google Scholar]

- Altug, M.S.; Aydinliyim, T.; Jain, A. Managing opportunistic consumer returns in retail operations. Manag. Sci. 2021, 67, 5660–5678. [Google Scholar] [CrossRef]

- Pekgün, P.; Griffin, P.M.; Keskinocak, P. Centralized versus decentralized competition for price and lead-time sensitive demand. Decis. Sci. 2017, 48, 1198–1227. [Google Scholar] [CrossRef]

- Zhang, Y.; Yu, P.; Feng, T. Full Quantity or Full Credit? Choosing the Right Buyback Policy for a Behavioral Retailer. Manuf. Serv. Oper. Manag. 2024, 26, 2212–2230. [Google Scholar] [CrossRef]

- Crocker, K.J.; Letizia, P. Optimal policies for recovering the value of consumer returns. Prod. Oper. Manag. 2014, 23, 1667–1680. [Google Scholar] [CrossRef]

- Frei, R.; Jack, L.; Brown, S. Product returns: A growing problem for business, society and environment. Int. J. Oper. Prod. Manag. 2020, 40, 1613–1621. [Google Scholar] [CrossRef]

- Yang, L.; Li, X.; Xia, Y.; Aneja, Y. Returns operations in omnichannel retailing with buy-online-and-return-to-store. Omega 2023, 119, 102874. [Google Scholar] [CrossRef]

- Huang, X.; Gu, J.W.; Ching, W.K.; Siu, T.K. Impact of secondary market on consumer return policies and supply chain coordination. Omega 2014, 45, 57–70. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, J.; Li, Y. Pricing decisions for complementary products with firms’ different market powers. Eur. J. Oper. Res. 2013, 224, 507–519. [Google Scholar] [CrossRef]

- El-Ansary, A.I.; Stern, L.W. Power measurement in the distribution channel. J. Mark. Res. 1972, 9, 47–52. [Google Scholar] [CrossRef]

- Pan, K.; Lai, K.K.; Leung, S.C.; Xiao, D. Revenue-sharing versus wholesale price mechanisms under different channel power structures. Eur. J. Oper. Res. 2010, 203, 532–538. [Google Scholar] [CrossRef]

- So, K.C.; Song, J.S. Price, delivery time guarantees and capacity selection. Eur. J. Oper. Res. 1998, 111, 28–49. [Google Scholar] [CrossRef]

- Li, Y.; Lin, Q.; Ye, F. Pricing and promised delivery lead time decisions with a risk-averse agent. Int. J. Prod. Res. 2014, 52, 3518–3537. [Google Scholar] [CrossRef]

- Albana, A.S.; Frein, Y.; Hammami, R. Effect of a lead time-dependent cost on lead time quotation, pricing, and capacity decisions in a stochastic make-to-order system with endogenous demand. Int. J. Prod. Econ. 2018, 203, 83–95. [Google Scholar] [CrossRef]

- Zhai, Y.; Cheng, T. Lead-time quotation and hedging coordination in make-to-order supply chain. Eur. J. Oper. Res. 2022, 300, 449–460. [Google Scholar] [CrossRef]

- Zhai, Y.; Hua, G.; Cheng, M.; Cheng, T. Production lead-time hedging and order allocation in an MTO supply chain. Eur. J. Oper. Res. 2023, 311, 887–905. [Google Scholar] [CrossRef]

- Yang, Z.; Zheng, Y.; Li, J.; Zhu, S.X.; Yang, C. Delivery service for a service-oriented manufacturing supply chain with procurement and delivery time decisions. Int. J. Prod. Res. 2024, 62, 7581–7597. [Google Scholar] [CrossRef]

- So, K.C. Price and Time Competition for Service Delivery. Manuf. Serv. Oper. Manag. 2000, 2, 392–409. [Google Scholar] [CrossRef]

- Niu, B.; Dai, Z.; Zhuo, X. Co-opetition effect of promised-delivery-time sensitive demand on air cargo carriers’ big data investment and demand signal sharing decisions. Transp. Res. Part E Logist. Transp. Rev. 2019, 123, 29–44. [Google Scholar] [CrossRef]

- Ye, F.; Xie, Z.; Tong, Y.; Li, Y. Promised delivery time: Implications for retailer’s optimal sales channel strategy. Comput. Ind. Eng. 2020, 144, 106474. [Google Scholar] [CrossRef]

- Gong, C.; Song, H.; Chen, D.; Day, S.J.; Ignatius, J. Logistics sourcing of e-commerce firms considering promised delivery time and environmental sustainability. Eur. J. Oper. Res. 2024, 317, 60–75. [Google Scholar] [CrossRef]

- Zhao, S.; Wu, F.; Jia, T.; Shu, L. The impact of product returns on price and delivery time competition in online retailing. Comput. Ind. Eng. 2018, 125, 658–667. [Google Scholar] [CrossRef]

- Ahmed, A.; Deokar, A.; Lee, H.C.B.; Summerfield, N. The role of commitment in online reputation systems: An empirical study of express delivery promise in an E-commerce platform. Decis. Support Syst. 2024, 176, 114061. [Google Scholar] [CrossRef]

- Wagner, L.; Calvo, E.; Amorim, P. Better Together! The Consumer Implications of Delivery Consolidation. Manuf. Serv. Oper. Manag. 2023, 25, 903–920. [Google Scholar] [CrossRef]

- Zhao, W.; Yan, X.; Yu, Y. Product price and delivery-time commitment decisions with reference effects. Transp. Res. Part E Logist. Transp. Rev. 2025, 197, 104093. [Google Scholar] [CrossRef]

- Gayon, J.P.; Vercraene, S.; Flapper, S.D.P. Optimal control of a production-inventory system with product returns and two disposal options. Eur. J. Oper. Res. 2017, 262, 499–508. [Google Scholar] [CrossRef]

- Rouhani, S.; Wardley, L.J.; Amin, S.H. A comprehensive survey into reverse logistics and Closed-Loop Supply Chain aspects to provide analyses and insights for implementation. J. Clean. Prod. 2025, 490, 144743. [Google Scholar] [CrossRef]

- Ma, S.; Jemai, Z.; Sahin, E.; Dallery, Y. The news-vendor problem with drop-shipping and resalable returns. Int. J. Prod. Res. 2017, 55, 6547–6571. [Google Scholar] [CrossRef]

- Zhao, L.; Guo, W.; Fang, S.C.; An, Q. Enhancing supply chain coordination through transparency initiatives to mitigate product returns. J. Retail. Consum. Serv. 2024, 78, 103756. [Google Scholar] [CrossRef]

- Hwang, S.O.; Üster, H.; Savaskan-Ebert, R.C. Reverse channel selection for commercial product returns under time-to-market and product value considerations. Ann. Oper. Res. 2025, 349, 1403–1440. [Google Scholar] [CrossRef]

- Yu, L.; Xiao, T.; Xu, P. Collection responsibility and freight insurance strategies for an e-tailing supply chain in the presence of managerial optimism. Int. Trans. Oper. Res. 2025, 32, 2360–2397. [Google Scholar] [CrossRef]

- Ye, T.; Sun, H.; Li, Z. Coordination of pricing and leadtime quotation under leadtime uncertainty. Comput. Ind. Eng. 2016, 102, 147–159. [Google Scholar] [CrossRef]

- Liu, L.; Parlar, M.; Zhu, S.X. Pricing and lead time decisions in decentralized supply chains. Manag. Sci. 2007, 53, 713–725. [Google Scholar] [CrossRef]

- Zhu, S.X. Integration of capacity, pricing, and lead-time decisions in a decentralized supply chain. Int. J. Prod. Econ. 2015, 164, 14–23. [Google Scholar] [CrossRef]

- Xiao, T.; Qi, X. A two-stage supply chain with demand sensitive to price, delivery time, and reliability of delivery. Ann. Oper. Res. 2016, 241, 475–496. [Google Scholar] [CrossRef]

- Pi, Z.; Fang, W.; Zhao, Q.; Zhang, B. On the introduction of return window to supply chains with online channel. Comput. Ind. Eng. 2022, 172, 108623. [Google Scholar] [CrossRef]

- Gao, Z.; Huang, G.; Huang, T.; Liu, Y.; Yu, Y. A Novel Return Policy: Negotiating Refunds Without Returns. SSRN Electronic Journal. 2023. Available online: https://ssrn.com/abstract=4834337 (accessed on 29 September 2025).

- Li, R.; Liao, C.; Shi, D. Online Retailing with Instant Return Credit. SSRN Electronic Journal. 2024. Available online: https://ssrn.com/abstract=4975151 (accessed on 29 September 2025).

- Hervas-Drane, A.; Shelegia, S. Retailer-Led Marketplaces. Manag. Sci. 2025. [Google Scholar] [CrossRef]

| Decision Variables | |

| p | Unit price |

| m | Profit margin |

| T | Promised delivery lead time (PDL) |

| w | Unit wholesale price |

| D | Demand function |

| R | Product returns function |

| Profit function | |

| Parameters | |

| Market base | |

| , | Demand sensitivity to price and PDL, respectively |

| The maximum return rate | |

| Return rate sensitivity to PDL | |

| Reselling ratio, which equals the margin of the reselling returned units scaled by the magin of the regular selling units | |

| c | Unit cost |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, S. Managing Service-Level Returns in E-Commerce: Joint Pricing, Delivery Time, and Handling Strategy Decisions. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 282. https://doi.org/10.3390/jtaer20040282

Zhao S. Managing Service-Level Returns in E-Commerce: Joint Pricing, Delivery Time, and Handling Strategy Decisions. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(4):282. https://doi.org/10.3390/jtaer20040282

Chicago/Turabian StyleZhao, Sisi. 2025. "Managing Service-Level Returns in E-Commerce: Joint Pricing, Delivery Time, and Handling Strategy Decisions" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 4: 282. https://doi.org/10.3390/jtaer20040282

APA StyleZhao, S. (2025). Managing Service-Level Returns in E-Commerce: Joint Pricing, Delivery Time, and Handling Strategy Decisions. Journal of Theoretical and Applied Electronic Commerce Research, 20(4), 282. https://doi.org/10.3390/jtaer20040282