Abstract

Live streaming sales rely heavily on streamers, with both genuine and AI-generated virtual streamers gaining popularity. However, these streamer types possess contrasting capabilities. Genuine streamers are superior at building trust and reducing product valuation uncertainty but have limited reach, while virtual streamers excel at broad audience engagement but are less effective at mitigating uncertainty, often leading to higher product return rates. This trade-off creates a critical strategic gap; that is, brand firms lack clear guidance on whether to invest in genuine or virtual streamers or adopt a hybrid approach for their live channels. This study addresses this gap by developing a theoretical analytical model to determine a monopolistic brand firm’s optimal streamer strategy among three options: using only a genuine streamer, only a virtual streamer, or a combination of the two (hybrid approach). The researchers model consumer utility, factoring in uncertainty and the streamers’ differential impact on reach, to derive optimal decisions on pricing and streamer selection. The analysis yields several key findings with direct managerial implications. First, while a hybrid strategy leverages the complementary strengths of both streamer types, its success depends on employing high-quality streamers; in other words, this strategy does not justify settling for inferior talent of either type. Second, employing a virtual streamer requires a moderate price reduction to compensate for higher consumer uncertainty and prevent high profit-eroding return rates. Third, a pure strategy (only genuine or only virtual) is optimal only when that streamer type has a significant cost advantage. Otherwise, the hybrid strategy tends to be the most profitable. Moreover, higher product return costs directly diminish the viability of virtual streamers, making a genuine or hybrid strategy more attractive for products with expensive return processes. The results provide a clear framework for brand firms—that is, the choice of streamer is a strategic decision intertwined with pricing and product return costs. Firms should pursue a hybrid strategy not as a compromise but as a premium approach, use targeted pricing to mitigate the risk of virtual streamers, and avoid virtual options altogether for products with high return costs.

1. Introduction

Currently, it is undeniable that live streaming has become a popular form of engagement in many regions around the world, widely embraced by both practitioners and consumers [1]. The live streaming industry has witnessed exponential growth in 2025, driven by technological advancements and evolving consumer behaviors. According to Technavio’s 2025 market report, the global live streaming market is projected to grow by USD 20.64 billion between 2025 and 2029, with a compound annual growth rate (CAGR) of 16.6% [2]. This growth is particularly pronounced in China, where the live streaming market reached RMB 212.64 billion in 2024 and, as of the end of May 2025, the cumulative number of live streamer accounts has reached nearly 193 million [3]. Streamers play a pivotal role in this ecosystem. For instance, in China nearly 22,000 streamers achieved 100%-plus GMV growth during Kuaishou’s 2025 Chinese New Year, with the top performers generating over RMB 10 million in sales [4]. International streamers have also made a significant impact. For example, IShowSpeed’s (Darren Watkins Jr.) live streaming from Chongqing gained more than 450,000 views within 15 h on YouTube [5].

In the early stages of live streaming, many brand firms collaborated with prominent third-party streamers; however, they are now increasingly realizing that building their own branded live streaming channels offers a sustainable path forward [6]. Establishing one’s own live streaming channel enables brand firms to take control of key factors, such as pricing, consumers, and quality, and it also helps to avoid some expensive cooperation costs. Brand firms often seek the influence of well-known third-party streamers only when there is a need to promote a new product or for short-term exposure. A survey showed that store live streaming accounted for 52% of China’s total live commerce sales in 2024, and the number of brand firms participating in store live streaming in Douyin alone has risen by 113% over the past year [7]. Store live streaming has become a mainstream daily live streaming format for brand firms with live streaming channels. To ensure the smooth operation of store live streaming, the primary issue facing brand firms is what kind of streamers to hire to efficiently complete live sales of their products.

Regarding the issue of streamer selection, firstly it should be known that brand firms do not usually recruit well-known streamers for daily live streaming activities [8]. This is because if a streamer gains a significant reputation, the long-term value growth resulting from live streaming activities will often be linked to the streamer’s personal reputation rather than to the firm’s brand or product reputation, which is not conducive to the firm’s sustainable development and brand appreciation. For example, the value of Oriental Selection in live commerce was largely attributed to its well-known streamer Dong Yuhui, and it suffered a heavy blow (i.e., a halving of its market value) following Dong’s resignation [9]. The most common practice for many well-known brands (such as Uniqlo) is to select suitable candidates from the firm’s own contracted employees to serve as streamers for the brand’s live streaming shop to conduct live sales activities. The advantage of this approach is that the firm’s own employees are highly familiar with its products and brand value (or brand story), and they can interact efficiently with fans and convey brand value during live broadcasts. This can greatly eliminate the various uncertainties that fans have before purchasing the firm’s products and can also significantly maintain a low return rate. However, due to the considerable labor costs and the limitations imposed by human biological functions, firms using genuine people as streamers for live sales activities often choose specific time periods rather than having them online all the time. This can lead to some fans being unable to participate in live activities, due to inconvenient timing, decreasing the scale of fans reached by these activities. On the other hand, with the maturation of artificial intelligence and related technologies, some brand firms have also begun to experiment with using intelligent digital virtual humans as streamers for their shops to conduct non-stop, 24 h live streaming activities. For instance, JD’s AI-powered virtual streamers have promoted more than 4000 brands, contributing to a 30 percent increase in order-conversion rates during off-peak hours and helping firms to reduce live streaming costs, enhance operational efficiency, and optimize user experience [10]. However, although these AI-generated virtual streamers possess a certain level of intelligence and can conduct non-stop, 24 h live streaming to meet the needs of fans in different time zones, their limited intelligence and lack of understanding of the brand’s products mean that they still fail to eliminate the uncertainty that some fans have when shopping during live streaming activities. For virtual streamers, the lack of meticulous interactivity and repetitive dialogues often makes fans watching the live broadcast feel uneasy and lose trust, thus failing to eliminate uncertainty through interaction in the way that genuine streamers can [11].

Previous research on live streaming has predominantly focused on the impacts of streamers on fans’ purchasing intentions and the connection mechanisms and interactive logic between streamers and various stakeholders along the live streaming chain (such as brand firms, unions, and live streaming platforms). However, discussions on streamer selection—especially the choice between genuine and AI-generated virtual streamers—are scarce. Therefore, taking the above considerations into account, this study attempts to explore the issue of streamer selection by a brand firm for its own live streaming channel within a monopolistic framework, with a particular focus on the trade-offs between genuine and virtual streamers. The specific problems are as follows:

- (1)

- What is the performance of different types of streamers (i.e., genuine and virtual) in live streaming sales activities?

- (2)

- Under what conditions does a monopolistic brand firm prefer a pure strategy (using only a genuine or only a virtual streamer) over a hybrid strategy, and vice versa?

- (3)

- How do key factors, such as coverage (or informed) level acquisition efficiency and return cost, influence the streamer selection strategies of a monopolistic brand firm?

To address the aforementioned questions, an analytical model is developed to capture the streamer selection strategy of a brand firm. Specifically, similar to [12], a monopolistic brand firm and a live streaming channel are considered. The firm can choose from two types of streamers: genuine and virtual. The firm can choose one of them or select both to conduct live streaming sales activities. The genuine streamer can completely eliminate the pre-purchase uncertainty of fans in the live streaming room but, due to the limited live streaming duration, not all fans can participate in the live streaming activities. The virtual streamer has the opposite effect of the genuine streamer. This assumption is consistent with the results of some previous studies. For instance, the study of [13] revealed that real-time product live streaming demonstrations by genuine streamers significantly reduce perceived value uncertainty through visual verification and interactive Q&A with both streamers and other customers in live rooms. However, virtual streamers are less effective endorsers than genuine streamers, due to a perception of lower authenticity, so customers tend to view them skeptically [14]. This skepticism means that information conveyed by virtual streamers fails to eliminate product value uncertainty. As a result, the perceived value uncertainty is still a significant issue. In terms of live streaming duration, according to a survey by the China Performance Industry Association’s Network Performance (Live Streaming) Branch, nearly 80% of genuine streamers live stream for 1 to 12 h per day, while half of them live stream for 3 to 8 h per day [15]. Correspondingly, virtual streamers can easily live stream uninterrupted for 24 h every day [16]. Next, based on the model, the optimal results in different streamer selection strategy scenarios are discussed, and the corresponding comparative analysis is presented.

The main findings reveal that, compared with using only a genuine streamer or only a virtual streamer, employing both of them to conduct live streaming sales activities can indeed achieve a certain degree of functional complementarity. This, in turn, reduces the need to employ genuine streamers and/or virtual streamers (e.g., lower coverage level or informed level). This reflects reality to some extent. For instance, for firms (especially small and medium firms) who employ genuine streamers, introducing virtual streamers can extend the long-tail hours for the live streaming business (such as from late night to early morning), thereby reducing the shifts of genuine streamer teams (i.e., reflected in this study as a reduction in coverage level), while also covering the long-tail market that is difficult for genuine streamers to reach [17]. On the other hand, there is no doubt that, compared to the hybrid model, using only virtual streamers requires a higher intelligence level (reflected in this study as an increase in the informed level) to conduct live streaming activities. This is mainly because they need to cater to a large influx of users during peak times and engage in more complex and frequent content interactions. However, sometimes the practice of choosing both types of streamers can actually stimulate a greater requirement for one type of streamer. Usually, this situation occurs under conditions of high relevant costs or low efficiency. In this case, the complementary benefits provided by the hybrid mode can help firms to offset certain costs, thereby stimulating the pursuit of higher standards for both genuine and virtual streamers. Moreover, the disadvantages of the virtual streamer in raising uncertainty and causing product returns mean that whenever the virtual streamer is used the firm has to lower the selling price, to some extent, to reduce the return rate, especially when the firm’s return cost is high. This somewhat corroborates the conclusion obtained in [18]; that is, “aligning virtual streamers with promotional products” (i.e., those with lower prices). In terms of streamer selection, as long as the cost efficiency of hiring one type of streamer is sufficiently high the firm will be more willing to conduct live streaming sales activities using only that type of streamer. Otherwise, it is more profitable to employ a combination of the two different streamer types. This shift is primarily due to the firm’s transition in streamer selection from pursuing cost efficiency to seeking functional complementarity. At the current development stage, the skill training of both genuine streamers and the (AI) technological iterations behind virtual streamers is progressing rapidly, indicating a trend of simultaneous advancement that is still further developing. Meanwhile, due to the rapid development of logistics technology and the significant improvement in efficiency, the return costs for firms are becoming increasingly low. As a result, the hybrid model is more likely to become a trend. In fact, iMedia Research predicted that in China by 2025 over 60% of brands will adopt a dual-track live streaming model of “genuine and virtual humans” [19].

In addition, unlike empirical studies, this study does not focus on discussing the impact of one or several key factors on customers’ (or fans’) purchase intentions (or purchase decisions). This is because the focus of this study lies in comparing the relative advantages and disadvantages of different streamer selection models when brand firms choose between genuine streamers, virtual streamers, or a combination of both, rather than conducting an in-depth analysis of the customer side under a specific model. Therefore, in terms of modeling, only the heterogeneity of customers (or fans) in a generalized product valuation is considered, and their purchase decisions are mainly influenced by the product’s selling price. There is no doubt that lower prices always generate greater appeal, thereby prompting more customers to switch from not purchasing to making a purchase. Meanwhile, different models determine whether the product valuation performed by customers (or fans) when making purchase decisions is accurate or an estimated average. This gives rise to customer surplus and possible return behavior. Moreover, the coverage level also determines which individuals (or how many people) can actually enter the live room of a genuine streamer; this serves as a prerequisite for customers to decide whether to buy by judging whether the price is reasonable when a genuine streamer is involved. Although this study does not discuss factors that directly act on customers and influence their purchase decisions (such as streamers’ traits, the environment of live rooms, the quality of interactions, and customers’ subjective preferences), the results of this study may still reflect some indirect impacts of certain supply side factors on customers’ purchase decisions. For instance, the coverage level acquisition efficiency regulates the difficulty in entering genuine streamers’ live rooms by influencing the coverage level, thereby indirectly affecting customers’ purchase decisions. The higher this efficiency, the lower the entry threshold, and the more customers who will have the opportunity to make purchase decisions. However, the informed level acquisition efficiency positively affects both the informed level and the selling price. This means that improving this efficiency not only decreases product valuation uncertainty and the number of returns but may also reduce the customer surplus by lowering the price. This is a result of balancing pre- and post-sales “benefits.” Of course, at this point the selling price also reflects the return rate. Therefore, firms appropriately adjust the selling price based on the magnitude of this efficiency to balance the return losses and the extent to which customer surplus is extracted, thereby influencing customers’ purchase decisions. Finally, firms’ return costs influence customers’ purchase decisions via an underlying mechanism similar to that of the informed-level acquisition efficiency.

The contributions of this study are twofold. First, this study is the first to depict the characteristics of genuine and virtual streamers from the two dimensions of fans’ coverage level and informed level in live streaming activities and to explore the choice of streamer type by brand firms. Previous related studies (e.g., [20,21,22,23,24,25]) have overlooked these two important factors and have not considered the scenario where both types of streamers are chosen simultaneously. This study, however, brings this topic closer to reality. Second, by discussing the two important dimensions mentioned above and exploring the scenario where both types of streamers are used simultaneously this study further uncovers the functional complementarity between genuine and virtual streamers, the effectiveness of this complementarity, and its attractiveness to brand firms, which have not been revealed in previous related studies (e.g., [26,27]).

The remainder of this article is organized as follows. The literature review and the research gap are presented in Section 2. Then, Section 3 discusses the problem description and notations. Subsequently, in Section 4 the optimal results and comparative analysis are discussed. Finally, Section 5 concludes and provides managerial implications and limitations. In addition, the proofs of all the propositions are presented in Appendix A.

2. Literature Review

This study is closely connected to the body of work on live streaming sales. As a result, the following section provides a comprehensive review of the pertinent studies. Subsequently, the distinctions between this study and the reviewed literature are highlighted.

2.1. Reviews

Live streaming can be defined as the simultaneous recording and broadcast of audio–visual content to an audience over the internet in real time. It has two key components that differentiate it from pre-recorded media, that is, real-time broadcast and interactivity. The former refers to the technological infrastructure that enables low-latency transmission, which is fundamental to the sense of “liveness” and authenticity. The latter refers to the features that enable bidirectional communication between the streamer and the viewer, such as live chats, polls, and reactions. This component transforms a broadcast into a social experience [28]. In the field of live streaming commerce, a common objective of related research is to explore factor influences in live streaming scenarios [29,30,31,32], using empirical methods. This type of study mainly analyzes the impacts of various factors in live streaming scenarios from the perspective of empirical data. For instance, it was found that AI-oriented live streaming commerce can lead to information failure and service breakdowns, with consumer disappointment and emotional exhaustion playing mediating roles [33]. To improve service quality and encourage consumers to make purchases, the level of intelligence plays a crucial role for virtual streamers (especially virtual idols) [34].

In related studies based on theoretical methods, researchers have identified several widely acknowledged characteristics for describing live streaming, including the capacity to expand market scale, the ability to increase the value of consumers’ purchases, and the ability to resolve product mismatches. Based on these, a great many related studies have focused on the question of whether and when to adopt live streaming in various structures and environments. For example, some studies have examined whether traditional centralized sellers should implement live streaming sales. These studies, however, have been conducted within different settings, such as a traditional single e-channel environment [20,21,22,23,24,25], a traditional multichannel environment [35], a traditional omnichannel environment [36], a multi-period environment [37,38], and mixed decision-making environments that combine live streaming with other strategies (e.g., showrooming [39], buy-online-and-return-in-store (BORS) [40], and blockchain [41]). Their research reveals that when specific conditions are satisfied—such as when the costs borne by sellers (e.g., fixed fees, commission fees) are relatively low, the costs borne by consumers (e.g., the hassle costs of returning products) are relatively high, the traditional market size is not overly large, and product quality is relatively low—traditional centralized sellers may utilize live stream sales with streamers’ assistance. Nevertheless, it is also shown that introducing live streaming might not always be beneficial to the sellers that adopt it or their cooperating streamers. Additionally, live streaming may encourage the adoption of BORS services, suppress showrooming, or substitute or complement blockchain technology.

Studies have also examined the question of whether to adopt live streaming sales within a decentralized system. A typical structure here is a two-tier setup, comprising one upstream supplier (or manufacturer/brand owner) and one downstream retailer (or e-tailer/e-platform). Within this framework, related studies mainly center on three dimensions: live streaming strategies of upstream entities (e.g., suppliers, manufacturers, brand owners), downstream entities (e.g., retailers, e-tailers, e-platforms), or both upstream and downstream parties. For instance, when focusing solely on upstream entities’ live stream strategies, relevant researches (e.g., [42,43,44,45,46]) have found that upstream adoption of live streaming depends on the levels of associated costs (e.g., fixed fees, operational expenses) and related effects (e.g., network externality, free-riding). Clearly, lower costs and stronger effects will drive the adoption of live streaming. Additionally, these studies note that upstream parties offering live streaming does not always harm downstream entities. At the same time, upstream entities often find it more suitable to partner with less influential streamers to launch live stream channels—though this finding may not hold in overseas contexts. In contrast, when focusing exclusively on downstream entities’ live stream strategies, relevant researches (e.g., [47,48]) indicate that downstream parties are more likely to gain from live streaming and opt to open this channel as long as setup costs are not excessively high. Meanwhile, downstream adoption of live streaming does not always benefit upstream entities, yet there is potential for a win–win scenario. Regarding live stream strategies involving both upstream and downstream parties, studies have shown that live streaming may be a dominant strategy for both when the hassle cost is low and the procurement cost is high [49], or under a dynamic pricing scheme [50]. However, inconsistencies in live stream choices between upstream and downstream parties can also arise [51]. Upstream adoption does not always hurt downstream entities, and vice versa, meaning a conditional win–win situation is always possible [52]. Moreover, some studies have explored live streaming strategies among two horizontally competing retailers (e-tailers, brand owners, or firms). These researches reveal that live streaming may become a dominant strategy for competing retailers (e-tailers, brand owners, or firms) if the mismatch cost is moderately high [53], the commission rate is moderate [54], or the entertainment value is substantial [55]. Furthermore, high-quality decision-makers tend to adopt live streaming when the quality-adjusted cost is low [55], and retailers may prefer their competitors to refrain from adopting it [56].

Beyond investigating whether to adopt live streaming, certain studies have also centered on other matters in the live streaming context. For example, some research has explored mode-related questions when adopting live streaming, primarily examining whether to host live streaming independently or via third-party streamers (influencers or KOLs). The relevant results indicate that using third-party streamers (influencers or KOLs) for live streaming may be more favorable when consumers are less sensitive to the service [57] or when the expected level of random yield is high [58]; otherwise, a self-operated broadcasting model can be adopted. When opting to collaborate with streamers (influencers or KOLs), some studies have conducted further in-depth analyses of matters such as one-time versus long-term cooperation [59,60], partnering with top streamers or ordinary ones [61,62], adopting a re-sale mode or an agency mode for live streaming channels [63,64], using AI or not [26,27], employing blockchain technology or not [65], offering a discount pre-announcement strategy [66], providing an exclusive promotion strategy [67], implementing a selective sales strategy [68], using a product bundling strategy [69], adopting a product assortment strategy [70], establishing a live streaming cooperation strategy [71], designing cooperation contracts [72], and return policies [73]. Additionally, the impact of fairness within the live streaming context has also been explored [74].

2.2. Research Gap

It should be noted that the vast majority of the studies reviewed above (especially those conducted using theoretical methods) overlooked the discussion of AI-generated virtual streamers, particularly the exploration of the mechanisms by which virtual streamers differ from real streamers in live streaming sales activities and the choices that brand firms make between them. This is precisely the goal of this study, and it is consistent with the current topics of interest to brand firms in the live streaming field. Furthermore, this study is highly relevant to the studies reported in [26,27]. However, there are significant differences between those studies and this one. In [26], the authors mainly explored the performance of AI-generated virtual streamers and genuine KOL streamers in the context of cross-border live streaming e-commerce. However, they assumed that the emergence of AI-generated virtual streamers would alleviate only consumers’ distrust in online shopping, rather than the uncertainty in product value and subsequent product returns. That study focused on examining the additional emotional value of the two types of streamers and did not discuss a scenario where both types are used simultaneously. Product returns and the joint use of both streamer types are factors that distinguish this study from [26]. As for [27], although it took into account consumers’ uncertainty about product value and product returns in live streaming shopping, its consideration of AI usage focused on assisting genuine streamers in providing functions similar to virtual fitting rooms to alleviate (or eliminate) this uncertainty and return issues. In other words, it did not consider the issue of AI-generated virtual streamers and brand firms’ choices between genuine and virtual streamers. This is the biggest difference between [27] and this study.

3. Problem Description

Consider a brand firm (“firm” for short) that intends to open a live room to sell its product. This is very common in current mainstream business activities. For example, brand giants such as Uniqlo and Walmart have their own live streaming channels. The selling price of the product is p. All production and acquisition costs are ignored. After setting up the channel, the main question is which type of streamer to hire. Usually, the firm has three options:

- (i)

- Pure Genuine Streamer Option. First, the firm can hire a genuine streamer for live streaming product sales. Note that a genuine streamer can only reach some of the firm’s fans during live sales. One reason for this is that genuine streamers cannot be online 24/7 for these activities. Another reason is that not all fans have time to watch live sales and buy products during the stream. Thus, for genuine streamers it is assumed that the fraction of fans watching live shows is (“coverage level” for short), which is between 0 and 1. The firm must pay a quadratic fee to reach this , and the larger the the higher the fee. For example, to obtain a large the firm may raise the streamer’s salary (to extend their hours) or hire more temporary genuine streamers; shows how efficient it is to obtain . The smaller the the higher the efficiency (e.g., a competitive and low-cost labor market). In addition, it is assumed that all fans who watch the live shows can figure out the actual product valuation before buying by interacting with the genuine streamer. These fans are often called the “informed type”.

- (ii)

- Pure Virtual Streamer Option. Alternatively, the firm can hire a virtual streamer for live streaming product sales. Unlike genuine streamers, they can be online 24/7 for live sales. They can interact with fans who want to buy products and answer their questions immediately. As a result, a virtual streamer can reach all the firm’s fans during live sales—they have no time limits. However, even with some intelligence, virtual streamers cannot properly interact with each fan or give accurate answers the way that genuine ones can. Thus, some fans cannot figure out their true valuation of the product after interacting with a virtual streamer. Specifically, for virtual streamers it is assumed that the fraction of fans informed of the product valuation before buying is (“informed level” for short), which is between 0 and 1. Similarly to the previous case, the firm must pay a quadratic fee to reach this , and the larger the the higher the fee. For example, to obtain a large the firm must spend heavily on customized and high-intelligence digital humans; shows how efficient it is to achieve . The smaller the the higher the efficiency (e.g., more mature AI tech and related markets).

- (iii)

- Hybrid Streamer Option. Finally, the firm can hire both genuine and virtual streamers simultaneously. In this situation, the main role of the virtual streamer is to carry out live streaming sales activities when the genuine streamer is resting. This combination is mainly aimed at covering all fans and enabling efficient interactions during live sales. However, at the same time, the firm has to bear the corresponding costs of both types of streamers.

On the market side, the firm’s fan count is normalized to one. This can also be seen as market size or potential customers. Each individual fan only buys one unit at most. These fans’ actual product valuations are denoted by v, which is uniformly distributed between 0 and 1. That is, different fans have different product valuations. For simplicity, G and g represent the CDF and pdf of v. In addition, it is assumed that none of the fans know their actual v before interacting with the streamer or receiving the product. However, they fully understand it after interacting with a genuine streamer, but they may not after interacting with a virtual streamer. Furthermore, if fans do not know their v but still buy then they may find the product unsuitable and return it. It is assumed that the firm gives a full refund for each returned product and that other return-related hassle costs for fans are ignored. However, the firm incurs a unit return cost h to handle returned products (e.g., recycling, repackaging, redistribution, re-marketing). Moreover, it is also assumed that h cannot exceed the maximum product valuation (i.e., 1); otherwise, the firm will stop handling returned products. All the parameters mentioned in this paper are presented in Table 1.

Table 1.

Summary of notations.

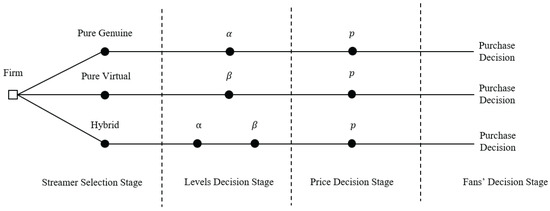

The decision tree is shown in Figure 1. Specifically, the firm first decides what type of streamer to hire (i.e., only genuine, only virtual, or hybrid). Then, based on this choice, the firm decides on the coverage level and/or informed level . These two levels indirectly reflect the capability of the hired streamers. Subsequently, the firm decides on the selling price of the product on the live streaming channel. Finally, fans who enter the live room make their purchase decisions based on the observed information. In the following sections, the optimal results from the three scenarios described above will be provided sequentially, and then a comparative analysis will be presented to explore the firm’s decision on its streamer selection strategy.

Figure 1.

Decision tree.

4. Optimal Results and Analysis

4.1. Pure Genuine Streamer Scenario

First, the pure genuine streamer scenario is discussed. The superscript “G” represents this scenario. In this case, the actual market size is equal to , i.e., the number of fans who are able to watch live shows. Here, all fans are informed by interacting with the genuine streamer and can know their actual v. An individual fan’s purchase utility is . By letting , it is easy to deduce that those with will ultimately buy products and that others will leave without buying anything. Thus, the demand conversion rate is , and the resulting actual demand is . For each sold product, the firm receives unit revenue p. However, in order to ensure the normal operation of the live streaming sales, the cost is needed. Therefore, the firm’s profit in this scenario is as follows:

In the decision sequence (see Figure 1), the firm first determines the coverage level that it wants to reach and then decides on the selling price p. Based on Equation (1), the optimal results in this scenario are obtained and shown in Proposition 1.

Proposition 1.

In the pure genuine streamer scenario, the optimal results are as follows:

- (i)

- if then

- (ii)

- if then

From Proposition 1, it is found that when the coverage level acquisition efficiency is high (e.g., ) the firm prefers to adopt measures to achieve full coverage (i.e., ). Otherwise, it is more appropriate for the firm to serve some fans in the live streaming channel. On the other hand, regardless of whether the firm aims to reach all or some fans with the help of the genuine streamer, the selling price remains unchanged (i.e., is always equal to ). Moreover, it is obvious that as the coverage level acquisition efficiency decreases (i.e., increases) the firm’s profit is reduced.

4.2. Pure Virtual Streamer Scenario

Next, the pure virtual streamer scenario is discussed. The superscript “V” represents this scenario. In this case, the actual market size is equal to one, since the virtual streamer can reach all fans by working all the time. However, only a fraction of fans can receive accurate feedback information and realize their actual v by interacting with the virtual streamer. Then, an individual informed fan’s purchase utility is , and the actual demand is . Meanwhile, in serving these informed fans the firm receives unit revenue p from each sold product. On the other hand, the fraction of fans are “uninformed” and do not know their actual v before receiving products, even after interaction. Their purchase decisions depend on the expected purchase utility. That is, for an individual uninformed fan, his (or her) expected purchase utility is . This means that all uninformed fans will buy products first, since their expected purchase utilities are non-negative. As a result, the actual demand of uninformed fans is . Then, after receiving their products these fans will check them at home. If the products meet their expectations (i.e., is larger) then they will keep them, and the firm receives unit revenue p for each sold product; otherwise, they will return the products and receive a full refund because their expectations are not met (i.e., is larger), and the firm receives unit revenue for each returned product. Moreover, among uninformed fans is the keeping rate while is the return rate. Therefore, the expected unit revenue of the firm for selling products to uninformed fans is . Additionally, in order to ensure normal operations the cost is needed. Therefore, the firm’s profit in this scenario is as below:

In the decision sequence (see Figure 1), the firm first determines the informed level that it wants to reach and then decides on the selling price p. Based on Equation (4), the optimal results in this scenario are obtained and shown in Proposition 2.

Proposition 2.

In the pure virtual streamer scenario, the optimal results are as follows:

- (i)

- if then

- (ii)

- if then

From Proposition 2, it is found that when the informed level acquisition efficiency is high (e.g., ) the firm prefers to choose a virtual streamer that has as much intelligence as genuine streamers to achieve “all informed” status (i.e., ). Otherwise, it may be appropriate for the firm to maintain some uninformed fans, even though they may lead to returns. Furthermore, in terms of selling price, surprisingly, when returns exist (e.g., ) the firm does not increase the selling price to compensate for the losses caused by returns. Instead, it tends to lower the selling price so that it is less expensive than before (e.g., when ). This is because the lower the selling price the lower the return rate. Additionally, it is obvious that as the informed level acquisition efficiency decreases (i.e., as increases) or as the return cost h increases the firm’s profit is reduced.

4.3. Hybrid Streamer Scenario

Finally, a hybrid streamer scenario is discussed. In this case, the firm hires both a genuine streamer and a virtual streamer to collaborate on carrying out live streaming sales. The superscript “H” represents this scenario. Specifically, the firm initially utilizes the genuine streamer to conduct live streaming sales for serving the fraction of fans. Similarly to the pure genuine streamer scenario, the corresponding actual demand is and the corresponding unit revenue is p. Then, when the genuine streamer takes a break the virtual streamer is dispatched to carry out live streaming sales to serve the fraction of fans. Similarly to the pure virtual streamer scenario, the fraction of these fans are informed, so the corresponding actual demand is and the corresponding unit revenue is p. Meanwhile, the fraction of these fans are uninformed, so the corresponding actual demand is and the corresponding expected unit revenue is . Additionally, in order to ensure normal operations, costs and are needed. Therefore, the firm’s profit in this scenario is as below:

In the decision sequence (see Figure 1), the firm first determines the coverage level that it wants to reach. Then, the firm determines the informed level it wants to reach. Finally, the selling price p is determined. Based on Equation (7), the optimal results in this scenario are obtained and shown in Proposition 3.

Proposition 3.

In the hybrid streamer scenario, the optimal results are as follows:

- (i)

- if and then

- (ii)

- if and then

- (iii)

- if and thenwhere is the real root of the equation .

From Proposition 3, it is found that when both genuine and virtual streamers are involved the firm does not always combine the two to carry out live streaming sales. In particular, if one party (i.e., the genuine streamer or virtual streamer) brings a relatively large acquisition efficiency (e.g., and or and ) then the firm is more inclined to adopt a single streamer type to cover all fans. In this event, the result will revert to the outcome in each of the previous two scenarios (i.e., pure genuine or pure virtual). On the contrary, when the coverage and informed level acquisition efficiencies are not too high (e.g., ) the firm may consider hiring both to carry out live streaming sales in collaboration. In addition, the possibility of jointly using both types of streamers decreases when the return cost (i.e., h) increases. This is because a higher return cost weakens the profitability of the virtual streamer, widens the gap between the two streamers, and leads the firm to typically prefer a single type.

4.4. Comparative Analysis

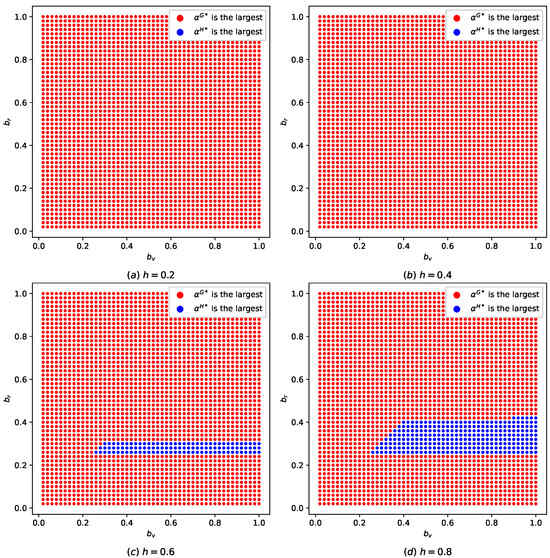

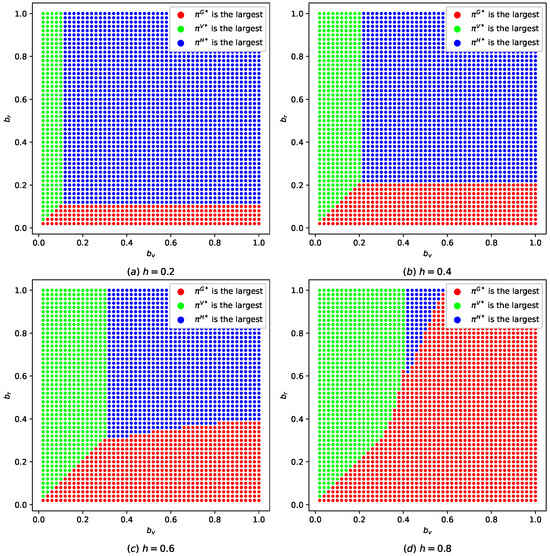

Next, the optimal results from the three scenarios (i.e., pure genuine, pure virtual, and hybrid) are compared to explore the performance of each streamer selection strategy and the firm’s best option. Given the complexity of the results in Proposition 3, a numerical analysis is adopted. Specifically, before analysis let . Then, for each value of h explore the impact of on , and by comparing them in the three scenarios, where and vary in the interval . The first comparison shows the optimal coverage levels in the three scenarios (i.e., and ), and the results are shown in Observation 1 and Figure 2.

Figure 2.

Comparison for the optimal coverage levels in different scenarios.

Observation 1.

The comparison results for the optimal coverage levels in different scenarios (i.e., ) are as follows:

- (i)

- if h is relatively small then for all properly possible , may be the largest;

- (ii)

- if h is relatively large then may be the largest if is relatively small or if is relatively large but is relatively not medium; otherwise, may be the largest.

From Observation 1 and Figure 2 (note that colors are used in this and subsequent figures to illustrate the comparison results and display the maximum value) it is found that in most conditions the complementary combination of the two streamers will reduce the coverage compared with the level obtained when only hiring the genuine streamer (e.g., ). This is because the virtual streamer can achieve full coverage of the remaining fans with lower costs (e.g., relatively small ) and less trouble (e.g., relatively small h). As a result, the firm is incentivized to appropriately reduce the relatively high costs brought by the genuine streamer in order to reach more fans. However, when introducing a virtual streamer is not relatively cost-efficient (e.g., relatively large at or ) and if the coverage level acquisition efficiency is relatively moderate (e.g., varies between and ) then pairing a genuine streamer with a virtual streamer will actually increase the coverage level (e.g., ). This is because one of the firm’s goals when hiring both streamers is to reach all fans. The relatively high return cost and the increased returns with the virtual streamer compel the firm to prioritize expanding the coverage level, in order to avoid returns and keep the cost as low as possible. In fact, surprisingly, this result indicates that seeking “virtual” partners for genuine streamers does not always shorten their working hours (or work intensity). Instead, due to the change in their primary and secondary positions in the firm’s mind (mainly caused by the seriousness of return loss) the firm may add additional work for genuine streamers. Obviously, in this case genuine streamers would not welcome the addition of virtual streamers. The second comparison shows the optimal informed levels in the three scenarios (i.e., and ), and the results are shown in Observation 2 and Figure 3.

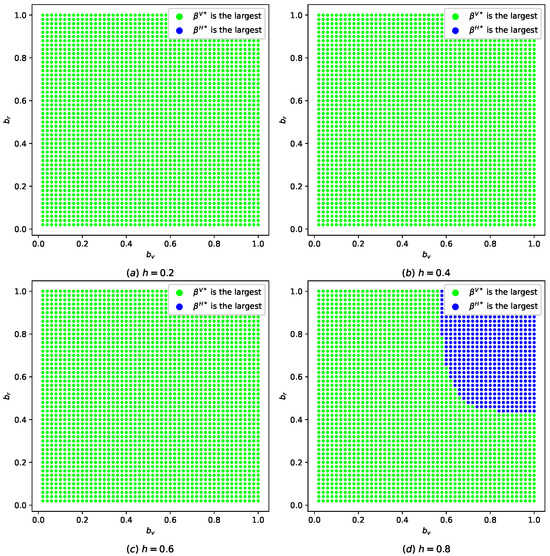

Figure 3.

Comparison for the optimal informed levels in different scenarios.

Observation 2.

The comparison results for the optimal informed levels in different scenarios (i.e., ) are as follows:

- (i)

- if h is not too large then for all properly possible may be the largest;

- (ii)

- if h is too large then may be the largest if is relatively small or if is relatively large but is relatively small; otherwise, may be the largest.

From Observation 2 and Figure 3 it is found that in most conditions the complementary combination of the two streamers will lower the informed level of fans served by the virtual streamer compared with the level obtained when only hiring the virtual streamer (e.g., ). This is because introducing the genuine streamer alleviates the disadvantage of the virtual streamer in addressing fans’ product valuation uncertainty and provides the firm with some control over returns. However, when the coverage and informed level acquisition efficiencies are low (e.g., vary between and 1) and the return cost is high (e.g., ) introducing the genuine streamer will force the virtual streamer to achieve a higher informed level than before (e.g., ). This is because the informed level achieved by the genuine streamer is relatively expensive and the threat of return loss is extremely high. As a result, the virtual streamer has to achieve a higher informed level to avoid more returns. In fact, surprisingly, this result indicates that the introduction of “genuine” partners does not always mean that firms can choose relatively foolish virtual streamers. Instead, in an adverse return environment an expensive genuine streamer often requires a more intelligent virtual partner. The third comparison shows the optimal selling prices in the three scenarios (i.e., , and ), and the results are shown in Observation 3 and Figure 4.

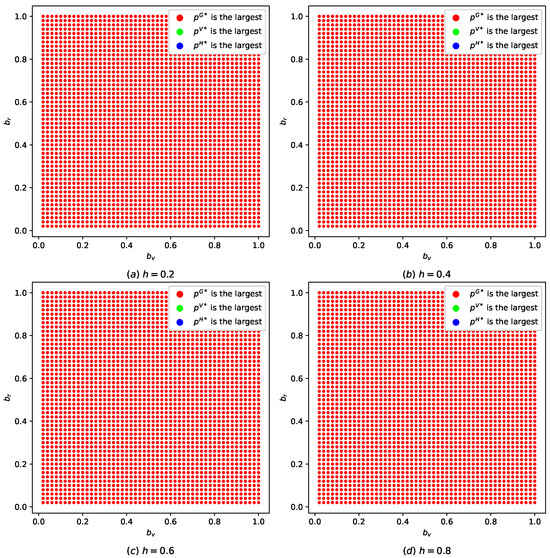

Figure 4.

Comparison for the optimal selling prices in different scenarios.

Observation 3.

The comparison results for the optimal selling prices in different scenarios (i.e., , and ) show that for all possible , is the largest.

From Observation 3 and Figure 4 it is found that when only hiring a genuine streamer the selling price is greater than that when using only a virtual streamer or both types of streamers. This is because as long as the virtual streamer is involved uninformed fans will exist and products will be returned. As a result, in order to avoid massive losses caused by excessive returns the firm has to reduce the selling price to lower the return rate. The final comparison shows the firm’s optimal profits in the three scenarios (i.e., , and ), and the results are shown in Observation 4 and Figure 5.

Figure 5.

Comparison for the optimal firm’s profits in different scenarios.

Observation 4.

The comparison results for the firm’s optimal profits in different scenarios (i.e., , and ) are as follows:

- (i)

- if h is not too large then (a) if is sufficiently small and is not too small then is the largest and, thus, the firm prefers to hire a pure genuine streamer, (b) if is sufficiently small and is not too small then is the largest and, thus, the firm prefers to hire a pure virtual streamer, (c) if and are not too small simultaneously then is the largest and, thus, the firm prefers to hire both types of streamers;

- (ii)

- if h is too large then the only difference from the result in (i) is that is the largest and both types of streamers are adopted only if is large and is relatively medium.

From Observation 4 and Figure 5 it is found that when the return cost is not too large the firm prefers to hire only a genuine (or virtual) streamer if its relative acquisition efficiency is sufficiently attractive (e.g., or is sufficiently small). This means that the main purpose of the firm is to enjoy the ultra-preferential cost, and the unique characteristics of the two types of streamers in sales are not the focus of the firm’s attention. On the contrary, when the coverage and informed level acquisition efficiencies are not good the firm is more inclined to use both types of streamers in order to reach all fans and minimize return loss. This is due to the complementary functions of the two types of streamers. On the other hand, when the return cost is too large the firm will become more cautious in the use of the virtual streamer, especially when the informed level acquisition efficiency is too poor. The firm often chooses not to combine the virtual streamer with the genuine streamer. As a result, the situation where both types of streamers are adopted is less likely to occur.

5. Conclusions

5.1. Main Findings

This study examines the streamer selection strategy of a monopolistic brand firm. Specifically, the firm can choose either a single streamer type (i.e., pure genuine or pure virtual) or both of them to carry out live streaming sales activities. Two key factors are taken into account in the model: one is the extent to which the live streaming activities cover fans (referred to as the coverage level), and the other is the notification degree of fans resulting from the interaction (referred to as the informed level). The virtual streamer is good at handling the former but often does poorly in the latter, while the opposite is true for the genuine streamer. Thus, using both types of streamers may lead to functional complementarity. Additionally, product returns are also considered. Thus, the firm can choose from three scenarios for its streamer selection strategy: pure genuine, pure virtual, and hybrid. By deriving the optimal results in different scenarios and comparing them, the firm’s streamer selection strategy and the impact of some key factors on this decision are discussed.

The main findings show that for a low return cost the coverage and informed levels are significantly lower when both streamer types are used simultaneously compared to the use of only one type. This indicates that the functional complementarity of the two streamers weakens the firm’s recruitment requirements for each streamer. However, for a high return cost the opposite result may occur if the coverage and informed level acquisition efficiencies are not sufficiently high. This is because in order to achieve full coverage and a sufficiently high informed level the firm has to increase its recruitment requirements for both types of streamers when using them together. In addition, the results reveal that when only a genuine streamer is chosen the selling price is the highest and is not affected by the coverage level acquisition efficiency. However, the inclusion of the virtual streamer raises the issues of uninformed fans and product returns. In response, the firm has to adjust the selling price. Surprisingly, in such cases the firm often lowers this price to pursue a lower return rate rather than raising this price to compensate for the return loss. This is quite different from previous findings on product returns in traditional scenarios.

In terms of the firm’s streamer selection strategy, it is obvious that when the coverage and informed level acquisition efficiencies are sufficiently high the firm will unhesitatingly choose the streamer type with the higher acquisition efficiency. Conversely, when the relevant efficiencies are quite low the firm is likely to employ both types of streamers simultaneously. This fully reflects the firm’s shift in streamer selection from pursuing low cost to pursuing high functional complementarity. However, note that the attractiveness of the virtual streamer gradually decreases as the return cost increases, and the difference in effectiveness between the two types of streamers increases. This makes the firm less likely to use both types of streamers simultaneously. In particular, when the coverage level acquisition efficiency is not too bad, as the informed level acquisition efficiency decreases, the firm is more likely to directly shift from hiring only a virtual streamer to only a genuine streamer, rather than go through a transitional phase in which both are adopted.

Moreover, the coverage level acquisition efficiency affects the difficulty in accessing genuine streamers’ live rooms by shaping overall coverage, indirectly influencing customers’ purchase decisions. Higher efficiency lowers entry barriers, providing more customers with the chance to make purchase decisions. In contrast, the informed level acquisition efficiency positively affects the informed level and selling price. Improved efficiency reduces product valuation uncertainty and returns while potentially shrinking customer surplus by lowering prices. This balances pre- and post-sales benefits. Notably, selling prices also reflect return rates. Firms thus adjust prices based on this efficiency to balance return losses and customer surplus extraction, which, in turn, impacts purchase decisions. Finally, firms’ return costs influence customers’ purchase decisions via an underlying mechanism similar to that of the informed level acquisition efficiency.

5.2. Managerial Implications

The findings of this study provide a robust and actionable decision-making framework for brand managers, live streaming channel operators, and strategic planners. The choice between genuine, virtual, and hybrid streamer is not merely a tactical decision but a core strategic one that directly impacts profitability, brand equity, and operational efficiency. The following implications are provided to translate the analytical results into clear, practical guidance.

First, prioritize the product return cost as the primary strategic filter. The most significant factor determining the viability of a virtual or hybrid strategy is the unit cost associated with product returns. Managers must first categorize their products based on this criterion. For products with high return costs (e.g., high-end electronics, custom furniture, specialized equipment) the financial risk of returns is substantial. In this context, the superior ability of genuine streamers to reduce uncertainty through authentic interaction is not just valuable—it is cost-effective. The model clearly shows that the higher investment in a genuine streamer is justified to avoid the profit-eroding impact of returns. A pure genuine streamer strategy is strongly recommended. Investing in a virtual streamer for these products is advisable only if the firm has access to a highly intelligent virtual agent (one that achieves a high informed level) at a remarkably low cost—a scenario that remains uncommon in current markets. For products with low return costs (e.g., fast-moving consumer goods, apparel, standard cosmetics), the potential downside of higher return rates is manageable. This liberates the firm to capitalize on the virtual streamer’s core advantage; that is, its expansive and continuous reach. For these products, a hybrid or even a pure virtual strategy becomes not only viable but often optimal. The gains from accessing a larger audience across all time zones far outweigh the modest costs associated with processing returns.

Second, reconceptualize the hybrid strategy as a premium, high-investment model. A critical and counter-intuitive finding is that the hybrid model does not allow firms to compromise on streamer quality. Success requires high performance from both streamer types. The implication for resource allocation is that firms should not view the hybrid approach as a way to cut costs by pairing a low-paid, inexperienced genuine streamer with a rudimentary AI avatar. This combination will likely underperform both pure strategies. Instead, a successful hybrid strategy requires investment in a knowledgeable, engaging genuine streamer and a sophisticated, high-intelligence virtual streamer. This makes it a premium strategy, suited for brand firms with the resources to invest in top-tier talent on both fronts. Consider a mid-sized skincare brand tempted by the cost savings of a basic AI streamer for overnight broadcasts. The researchers’ model suggests that if the AI cannot adequately answer complex, nuanced questions about ingredients and skin compatibility (i.e., it has a low informed level) then it will lead to customer disappointment and returns. For this brand, a more profitable—and brand-safe—strategy might be to use its highly trained aestheticians as genuine streamers who operate during peak hours and simply go offline overnight, rather than risking brand trust with a subpar virtual experience. The hybrid model is only superior if the virtual partner is sufficiently intelligent.

Third, implement strategic price reduction to mitigate virtual-streamer risk. Conventional wisdom might suggest increasing prices to offset losses from returns. The presented model unequivocally demonstrates that this is a suboptimal strategy. The new pricing logic is that when a virtual streamer is employed (in either a pure or hybrid model) the firm must integrate its pricing and return management strategies. A moderate, strategic price reduction is the most effective tool to reduce the return rate itself. A lower price point decreases the likelihood of post-purchase disappointment and minimizes the financial impact of each return that does occur, leading to higher net profitability. However, this does not mean engaging in massive discounting that devalues the brand. The price adjustment should be deliberate and framed appropriately. For instance, it could be positioned as an “always-on digital convenience price” or a “value offered by our virtual ambassador.” This framing allows the firm to leverage the price–return linkage mechanism identified in this study while protecting brand prestige.

Four, continuously monitor the external streamer talent and technology markets. The optimal strategy is not static. It evolves with advancements in AI technology and fluctuations in the labor market for live streaming talent. Managers must treat the cost efficiency parameters (i.e., coverage and informed level acquisition efficiencies) as dynamic variables. One of them assesses the genuine streamer market: is the cost of hiring and retaining effective genuine streamers increasing due to competition, or is a growing talent pool making it more cost-efficient? Another assesses the virtual streamer market: is AI and digital human technology advancing rapidly, making highly intelligent and interactive avatars more affordable? A breakthrough that significantly lowers informed level acquisition efficiency could quickly make virtual and hybrid strategies optimal for a much wider range of products, including those with higher return costs. An actionable insight is that firms should conduct periodic reviews of their streamer strategy, treating it as a dynamic capability. A strategy that is suboptimal today (e.g., pure genuine) may become optimal tomorrow based on technological disruption, and vice versa.

In conclusion, this framework empowers managers to move beyond anecdotal evidence and make decisions about their live streaming investments. By rigorously evaluating product return costs, investing appropriately in streamer quality, adopting strategic pricing, and remaining agile to market changes, brand firms can effectively navigate the complex trade-offs between genuine and virtual streamers to maximize their long-term profitability and brand health.

5.3. Limitations and Future Study

Although this study focuses on depicting several characteristics of different types of streamers and exploring brand firms’ streamer selection strategies, there are some limitations that could be further explored. First, this study considers the streamer selection strategy for a monopolistic brand firm’s own live streaming room, ignoring the exploration of a competitive environment. However, in reality, when firms hire streamers they may also regard it as a competitive tool, and their streamer selection strategy may echo the actions of their competitors. Therefore, exploring this issue from a competitive perspective is a possible research direction.

Second, this study does not explore other technical-level interactive decisions extending from the issue of firms’ streamer selection strategies, such as the pricing of MCN agencies (or AI-tech companies) that cultivate and provide genuine (or virtual) streamers, the level of open policy of live streaming platforms regarding the use of AI, and consumers’ heterogeneous preferences for human beings and virtual digital beings. These factors may also have a significant impact on the streamer selection decisions of brand firms. Therefore, it would also be worth exploring these issues within the context of the live streaming supply chain.

Third, exploring the streamer selection strategies of brand firms in a multichannel or omnichannel environment (e.g., both online and offline) is also a valuable topic. In particular, key factors include the cross-interaction between the online live streaming channel and the offline physical store channel, as well as the resulting cross-channel (or omnichannel) effects. This is also something that has not been discussed in this study and deserves to be explored further.

Fourth, in this study the use of PRISMA or other methods for purposive sampling—aimed at specifying how reviewed articles are selected and how data are analyzed—is not considered. However, this work is highly likely to play a crucial role in comprehensively and systematically grasping the relevant research context, enabling an in-depth positioning of this study and providing guidance for the data analysis involved. Therefore, it constitutes a key direction for future research.

Finally, the conclusions lack support from empirical evidence from actual respondents. This may lead to a gap between the theoretical conclusions and practical scenarios, resulting in potential bias in the applicability of the model. The lack of data from firm respondents also makes it impossible to confirm whether the “profit maximization” goal emphasized in the model is consistent with the actual decision-making needs of firms. This further limits the ability of this study’s conclusions to guide practical operations. This issue should be resolved in future research.

Funding

This research was supported by the Humanities and Social Science Fund of the Ministry of Education of China (Grant No. 21YJCZH053) and by the National Natural Science Foundation of China (Grant No. 72201111).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Proof of Proposition 1.

First, given , solve p. At this point, the objective is

Because , this indicates that there exists a p that can maximize . So, without constraint, let and obtain an interior solution . Furthermore, check this interior solution and find that it always satisfies the constraint . Thus, the best response functions are

Then, solve with the firm’s profit function obtained above . At this point, the objective is

Similarly, indicates that there exists an that can maximize . So, without constraint, let and obtain an interior solution . Furthermore, check this interior solution and find that it satisfies the constraint only if . Otherwise, the upper boundary value (i.e., 1) is adopted because in this condition . To summarize the above results, we find that if or if . Then, substitute into the best response function and and obtain the corresponding optimal selling price and profit. □

Proof of Proposition 2.

First, given , solve p. At this point, the objective is

Because , this indicates that there exists a p that can maximize . So, without constraint, let and obtain an interior solution . Furthermore, check this interior solution and find that it always satisfies the constraint , since and . Thus, the best response functions are

Then, solve with the firm’s profit function obtained above . At this point, the objective is

Note that and . Then, if , , which indicates that is non-decreasing in . As a result, , which indicates that is increasing in . Thus, the upper boundary value (i.e., 1) is adopted. In contrast, if , , which indicates that is decreasing in . As a result, . Furthermore, if then , which indicates that is increasing in . Thus, the upper boundary value (i.e., 1) is adopted; otherwise, if , as increases from 0 to 1, is first positive and then negative, which indicates that there exists an interior solution that can maximize . Let , and obtain the interior solution . To summarize the above results, we find that if or if . Then, substitute into the best response function and and obtain the corresponding optimal selling price and profit. □

Proof of Proposition 3.

First, given , solve p. At this point, the objective is

Because , this indicates that there exists a p that can maximize . So, without constraint, let and obtain an interior solution . Furthermore, check this interior solution and find that it always satisfies the constraint , since and . Thus, the best response functions are

Then, given , solve with the firm’s profit function obtained above . At this point, the objective is

Note that and . Then, if , , which indicates that is non-decreasing in . As a result, , which indicates that is increasing in . Thus, the upper boundary value (i.e., 1) is adopted. In contrast, if , , which indicates that is decreasing in . As a result, . Furthermore, if then , which indicates that is increasing in . Thus, the upper boundary value (i.e., 1) is adopted; otherwise, if , as increases from 0 to 1, is first positive and then negative, which indicates that there exists an interior solution that can maximize . Let and obtain the interior solution . Summarize the above results and obtain the best response functions, as shown below:

which is equivalent to the following functions by rewriting the conditions formats:

Finally, solve with the firm’s profit function obtained above . At this point, the objective is

which can be divided into two sub-objectives. Specifically, the first sub-objective is

It is easy to deduce that is decreasing in . Thus, the lower boundary value (i.e., 0) is adopted and the results are obtained, as shown below:

It is clear that the above results degenerate into those of the pure virtual streamer scenario, where genuine streamers are never considered for employment by the firm. On the other hand, the second sub-objective is

Note that and . Then,

(1) if , , which indicates that is non-decreasing in . Furthermore, the following holds true: (1a) If and , , where and , this indicates that is first decreasing and then increasing in . The optimal solution must be located at boundary points. Then, by comparing and , it is found that if further (note that if ), ; this means that the upper boundary value (i.e., 1) is adopted; otherwise, if further then and there is no feasible solution, since the lower boundary value is not feasible. (1b) If and , , , where and , this indicates that is always decreasing in and, thus, there is no feasible solution, since the lower boundary value is not feasible. (1c) If and , , where and , this indicates that is always increasing in and, thus, the upper boundary value (i.e., 1) is adopted. (1d) If and , , where and . Obviously, this situation will not happen under the condition .

(2) If , , which indicates that is decreasing in . (2a) Furthermore, if and , , where and . Obviously, this situation will not happen under the condition . (2b) If and , , where and , this indicates that is always decreasing in and, thus, there is no feasible solution, since the lower boundary value is not feasible. (2c) If and , , where and , this indicates that is always increasing in and, thus, the upper boundary value (i.e., 1) is adopted. (2d) If and , , where and , this indicates that is first increasing and then decreasing in . There exists an interior solution that must be the optimal result. This interior solution satisfies .

To summarize the above results, the optimal results of the second sub-objective are

where is the real root of .

Compare the above results of the two sub-objectives and find that (a) if then and , where it is greater than only if . Here, when ; (b) if and , due to the optimality of , being greater than ; (c) under other conditions, since , so the result of the first sub-objective is better and is adopted. To summarize the above results, we can ascertain that

Then, substitute into the best response function , and , and obtain the corresponding optimal informed level, selling price, and profit. □

References

- The Global Rise of Livestream e-Commerce: Trends, Challenges, and Opportunities. Available online: https://insights.made-in-china.com/The-Global-Rise-of-Livestream-E-Commerce-Trends-Challenges-and-Opportunities_pTYfOrwZXmHy.html (accessed on 12 March 2025).

- Live Streaming Market to Grow by USD 20.64 Billion (2025–2029), Driven by Smartphone Penetration and Easy Internet Access, AI-Powered Market Evolution-Technavio. Available online: https://www.prnewswire.com/news-releases/live-streaming-market-to-grow-by-usd-20-64-billion-2025-2029-driven-by-smartphone-penetration-and-easy-internet-access-ai-powered-market-evolution---technavio-302360418.html (accessed on 27 January 2025).

- Report: As of the End of May, the Cumulative Number of Live Streaming and Short-Video Streamer Accounts Opened Reached Nearly 193 Million. Available online: https://m.toutiao.com/group/7520132387204874767/?upstream_biz=doubao (accessed on 26 June 2025).

- 2025 Kuaishou Chinese New Year’s Goods Festival: Nearly 22000 Streamers Achieved over 100% Growth in GMV in Their Live Rooms. Available online: https://www.zhitongcaijing.com/content/detail/1237237.html (accessed on 14 January 2025).

- IShowSpeed’s China Livestreams Take Global Social Media by Storm. Available online: https://news.cgtn.com/news/2025-04-03/IShowSpeed-s-China-livestreams-take-global-social-media-by-storm-1CgPEA5vzJS/index.html (accessed on 3 April 2025).

- Luo, F.; Chen, S.H.; Xu, T.T.; Lqbal, M. Self-broadcasting or cooperating with an anchor? Strategy and dynamic system research on different sales modes in live commerce supply chain. Electron. Commer. Res. 2025, 1–40. [Google Scholar] [CrossRef]

- Climbing to the Third Place in the e-Commerce Market? Douyin’s “Latecomer Advantage” Is Not Due to Influencers, but to Store Live-Streaming. Available online: https://www.toutiao.com/article/7475885045757002251/?upstream_biz=doubao&source=m_redirect (accessed on 27 February 2025).

- How Brands Are Taking Back Ownership of Livestreaming in China. Available online: https://www.campaignasia.com/article/how-brands-are-taking-back-ownership-of-livestreaming-in-china/488024 (accessed on 21 August 2023).

- The Market Value Has Been Halved! After Dong Yuhui’s Departure, What Is the Value of Oriental Selection Now? Available online: https://36kr.com/p/3137894302669320 (accessed on 26 January 2025).

- Virtual Humans Helping Spur e-Commerce. Available online: https://www.chinadaily.com.cn/a/202405/07/WS66398723a31082fc043c5a10_1.html (accessed on 7 May 2024).

- Digital Humans|The Future Face of Live Commerce. Available online: https://www.ntu.edu.sg/docs/nanyangcmtlibraries/default-document-library/ncmt_002_digital_humans_compressed.pdf?sfvrsn=879c4380_3 (accessed on 18 June 2024).

- Xia, L.J.; Zhang, M.M.; Wang, J.; Hou, P.W. Platform traffic support strategies under dual live-streaming channels. Transp. Res. Part E Logist. Transp. Rev. 2025, 203, 104349. [Google Scholar] [CrossRef]

- Hwang, J.; Youn, S.Y. From brick-and-mortar to livestream shopping: Product information acquisition from the uncertainty reduction perspective. Fash. Text. 2023, 10, 7. [Google Scholar] [CrossRef]

- Liu, F.J.; Lee, Y.H. Virtually authentic: Examining the match-up hypothesis between human vs virtual influencers and product types. J. Prod. Brand. Manag. 2024, 33, 287–299. [Google Scholar] [CrossRef]

- New Career Development Report for Online Network Streamers. Available online: https://cdn.vidchina.cn/upload/files/724189d51096d38aa557b9dec980a154.pdf (accessed on 7 November 2024).

- Wu, R.J.; Liu, J.J.; Chen, S.; Tong, X. The effect of e-commerce virtual live streamer socialness on consumers’ experiential value: An empirical study based on Chinese e-commerce live streaming studios. J. Res. Interact. Mark. 2023, 17, 714–733. [Google Scholar] [CrossRef]

- Goodbye to Real Hosts! The AI Live Streaming System Clones Millions of Li Jiaqi, Reducing Costs by 90%, a Revolution in the Industry. Available online: https://baijiahao.baidu.com/s?id=1834415173473639948&wfr=spider&for=pc (accessed on 9 June 2025).

- Chang, Y.P.; Wang, H.; Guo, Z.J. Artificial intelligence in live streaming: How can virtual streamers bring more sales? J. Retail. Consum. Serv. 2025, 84, 104247. [Google Scholar] [CrossRef]

- Virtual Streamer Penetration Rate Exceeds 40%: The Breakthrough Battle for Genuine Streamers’ Smart Sales in 2025! Available online: https://www.sohu.com/a/887027111_121942895 (accessed on 21 April 2025).

- Zhang, W.; Yu, L.L.; Wang, Z.Z. Live-streaming selling modes on a retail platform. Transp. Res. Part E Logist. Transp. Rev. 2023, 173, 103096. [Google Scholar] [CrossRef]

- Duan, Y.R.; Song, J. The adoption of live streaming channel considering impulse buying and product returns. Int. J. Prod. Econ. 2024, 274, 109295. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, H.R.; Zhang, X.M.; Gajpal, Y.; Zhang, Z.C. Optimal channel strategy for an e-seller: Whether and when to introduce live streaming? Electron. Commer. Res. Appl. 2024, 63, 101348. [Google Scholar] [CrossRef]

- Zhang, T.; Tian, Y.; Cheng, T.C.E. Online retailing with key opinion leaders and product returns. Int. J. Prod. Econ. 2024, 279, 109458. [Google Scholar] [CrossRef]

- Zhang, Y.F.; Xu, Q. Consumer engagement in live streaming commerce: Value co-creation and incentive mechanisms. J. Retail. Consum. Serv. 2024, 81, 103987. [Google Scholar] [CrossRef]

- Li, K.L.; Yao, S.; Li, Y.J.; Tang, F.C.; Wang, Z.B. Deliberate shortage in live-streaming commerce. Omega 2025, 131, 103201. [Google Scholar] [CrossRef]

- Niu, B.Z.; Yu, X.H.; Dong, J. Could AI livestream perform better than KOL in cross-border operations? Transp. Res. Part E Logist. Transp. Rev. 2023, 174, 103130. [Google Scholar] [CrossRef]

- Xu, X.P.; Wang, Y.T.; Cheng, T.C.E.; Choi, T.M. Should live broadcasting platforms adopt artificial intelligence? A sales effort perspective. Eur. J. Oper. Res. 2024, 318, 979–999. [Google Scholar] [CrossRef]

- Bai, X.H.; Aw, E.C.; Tan, G.W.H.; Ooi, K.B. Livestreaming as the next frontier of e-commerce: A bibliometric analysis and future research agenda. Electron. Commer. Res. Appl. 2024, 65, 101390. [Google Scholar] [CrossRef]

- Liu, Z.L.; Li, J.N.; Wang, X.Q.; Guo, Y.R. How search and evaluation cues influence consumers’ continuous watching and purchase intentions: An investigation of live-stream shopping from an information foraging perspective. J. Bus. Res. 2023, 168, 114233. [Google Scholar] [CrossRef]

- Ma, X.Y.; Chen, H.Z.; Lang, X.P.; Li, T.S.; Wu, N.W.; Duong, B. Research on the impact of streamers’ linguistic emotional valence on live streaming performance in live streaming shopping environments. J. Retail. Consum. Serv. 2024, 81, 104040. [Google Scholar] [CrossRef]

- Tian, Y.; Frank, B. Optimizing live streaming features to enhance customer immersion and engagement: A comparative study of live streaming genres in China. J. Retail. Consum. Serv. 2024, 81, 103974. [Google Scholar] [CrossRef]

- Choi, Y.S.; Wu, Q.Q.; Lee, J.Y. Can you tolerate influencer marketing? An empirical investigation of live streaming viewership reduction related to influencer marketing. J. Bus. Res. 2025, 188, 115094. [Google Scholar] [CrossRef]

- Peng, Y.H.; Wang, Y.D.; Li, J.P.; Yang, Q. Impact of AI-oriented live-streaming e-commerce service failures on consumer disengagement–empirical evidence from China. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1580–1598. [Google Scholar] [CrossRef]

- Li, H.L.; Li, W.S.; Ma, T.L. Exploring the mechanism of AI-powered virtual idols’ intelligence level on digital natives’ impulsive buying intention in e-commerce live streaming: A perspective of psychological distance. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 173. [Google Scholar] [CrossRef]

- Zhang, T.; Tang, Z.J. Should manufacturers open live streaming shopping channels? J. Retail. Consum. Serv. 2023, 71, 103229. [Google Scholar] [CrossRef]

- Li, Y.R.; Li, B.; Wang, M.X.; Liu, Y. Optimal sales strategies for an omni-channel manufacturer in livestreaming demonstration trends. Transp. Res. Part E Logist. Transp. Rev. 2023, 180, 103222. [Google Scholar] [CrossRef]

- Wang, X.T.; Han, X.H.; Chen, Y. Optimal manufacturer strategy for live-stream selling and product quality. Electron. Commer. Res. Appl. 2024, 64, 101372. [Google Scholar] [CrossRef]

- Zhao, Q.L.; Fan, Z.P. Two-period pricing of an e-tailer: Is using a top influencer to promote new products a bane or a boon? Electron. Commer. Res. Appl. 2024, 63, 101345. [Google Scholar] [CrossRef]

- Gong, H.Y.; Zhao, M.; Ren, J.L.; Hao, Z.H. Live streaming strategy under multi-channel sales of the online retailer. Electron. Commer. Res. Appl. 2022, 55, 101184. [Google Scholar] [CrossRef]

- Xu, Q.Y.; Shao, Z.; Zhang, L.; He, Y. Optimal livestream selling strategy with buy-online-and-return-in-store. Electron. Commer. Res. Appl. 2023, 61, 101307. [Google Scholar] [CrossRef]

- Liu, X.F.; Zhou, Z.B.; Hu, M.H.; Zhong, F.M. How retailers can gain more profitability driven by digital technology: Live streaming promotion and blockchain technology traceability? Electron. Commer. Res. Appl. 2024, 68, 101445. [Google Scholar] [CrossRef]

- Fan, X.J.; Zhang, L.; Guo, X.; Zhao, W.Y. The impact of live-streaming interactivity on live-streaming sales mode based on game-theoretic analysis. J. Retail. Consum. Serv. 2024, 81, 103981. [Google Scholar] [CrossRef]

- Lu, W.; Ji, X.; Wu, J. Retailer’s information sharing and manufacturer’s channel expansion in the live-streaming e-commerce era. Eur. J. Oper. Res. 2025, 320, 527–543. [Google Scholar] [CrossRef]

- Niu, B.Z.; Yu, X.H.; Li, Q.Y.; Wang, Y.L. Gains and losses of key opinion leaders’ product promotion in livestream e-commerce. Omega 2023, 117, 102846. [Google Scholar] [CrossRef]

- Zhang, T.; Tang, Z.J.; Han, Z.Y. Optimal online channel structure for multinational firms considering live streaming shopping. Electron. Commer. Res. Appl. 2022, 56, 101198. [Google Scholar] [CrossRef]

- Zhang, Y.F.; Xu, Q. Whether and how to adopt live streaming selling: A perspective on interaction value creation. Electron. Commer. Res. Appl. 2024, 68, 101464. [Google Scholar] [CrossRef]

- Chen, Q.Y.; Yan, X.; Zhao, Y.; Bian, Y.W. Live streaming channel strategy of an online retailer in a supply chain. Electron. Commer. Res. Appl. 2023, 62, 101321. [Google Scholar] [CrossRef]