1. Introduction

The rapid development of e-commerce has provided consumers with numerous conveniences, leading more and more consumers to choose to shop through online retail platforms [

1,

2]. According to data from the National Bureau of Statistics, China’s online retail sales reached 15.52 trillion yuan in 2024, marking a 7.2% increase compared to 2023 and accounting for 31.82% of the total retail sales. The exponential growth of online sales has brought unprecedented attention to the e-commerce platform supply chain [

3,

4,

5]. This phenomenon not only reflects consumers’ growing preference for online shopping but also highlights the increasing complexity of the e-commerce platform supply chain (EPSC).

Compared to physical stores, online retail still has some notable shortcomings in terms of consumer experience. Firstly, consumers cannot directly touch or inspect products when shopping online, and concerns about product quality often affect their purchasing decisions [

6,

7]. Secondly, some platforms suffer from delays in online customer service responses [

8]. When consumers need to inquire about product details, after-sales policies, or other information, communication inefficiencies can directly diminish their shopping experience and may even lead to lost orders. Additionally, long delivery times remain a significant factor discouraging consumers from choosing online shopping [

9,

10]. This is particularly true for product categories with high urgency, such as perishable goods and emergency supplies, where extended logistics cycles undermine the convenience advantage of online shopping and drive consumers toward offline instant consumption scenarios.

The advancement of artificial intelligence (AI) technology offers a potential solution to these challenges. Driven by AI, the EPSC is undergoing a profound digital transformation, infusing new vitality and growth potential into supply chain management [

11,

12,

13]. Notably, AI has been empirically proven to significantly enhance the online shopping experience [

14,

15]. In practice, many leading manufacturers and e-commerce platforms have pioneered the application of AI technologies in online shopping scenarios to create more immersive experiences for consumers [

16,

17]. In the manufacturing process, AI helps manufacturers detect quality issues earlier and respond more swiftly [

18]. For example, Toyota has adopted an AI-based quality control system to strengthen the inspection of automotive components. During the sales process, platforms can use AI to provide consumers with virtual showrooms, AI-based chatbots, and personalised recommendation systems, reducing consumers’ uncertainty about product suitability and thereby improving their shopping experience [

19]. For example, Amazon has innovatively introduced virtual showrooms features in its shopping applications, using AI to offer consumers a more intuitive product experience. Similarly, Tmall’s deployment of intelligent customer service robots enables real-time and efficient responses to consumer inquiries, significantly optimizing customer service experiences. Furthermore, AI is driving transformation in the logistics industry. Within highly complex operational environments, AI empowers logistics providers to substantially improve delivery efficiency and optimize distribution networks [

20,

21,

22].

Investments in AI technology by supply chain members inevitably incur corresponding costs, which not only increase the operational expenses of each member but also exert certain pressure on their short-term profits [

23,

24,

25]. It is worth noting that each member of the supply chain is a rational economic subject, and its decision to invest in AI technology is necessarily driven by the goal of maximizing its own interests [

26]. Against this backdrop, establishing an effective supply chain coordination mechanism becomes particularly important. By designing a scientific and reasonable contract mechanism, the responsibilities and obligations of each participant can be clearly defined. Such a contractual framework can not only incentivize supply chain members to actively engage in the research and application of AI technology but also promote in-depth cooperation among members, ensuring that the benefits of technological innovation are distributed fairly. Ultimately, this type of contractual mechanism will help maximize the overall benefits of the supply chain.

Therefore, this paper models the role of AI in the EPSC and investigates the joint decision-making of supply chain members regarding pricing and effort under different supply chain structures. Specifically, we address the following research questions:

- (1)

How do supply chain members make joint decisions on pricing and AI investment efforts under different decision-making scenarios?

- (2)

Which decision-making model is more beneficial for the overall supply chain and its members?

- (3)

How does the cost-sharing contract affect the optimal effort in AI investment and the profitability of supply chain members?

To address the above questions, this study constructs a three-tier EPSC model containing a manufacturer, an e-commerce platform, and a logistics provider, in which each member invests in AI technology. The key decision variables include the wholesale price, logistics price, retail price, and the efforts of AI investment by each member. First, based on Stackelberg game theory, supply chain models are established under three structures, i.e., centralized decision-making, partially decentralized decision-making, and fully decentralized decision-making. Second, a cost-sharing contract mechanism is designed to incentivize the logistics provider to improve service quality. Finally, the validity of the models and the coordinating effect of the contract are verified through numerical simulation experiments.

This study makes significant contributions to the existing literature in several key ways. Firstly, while most current supply chain research focuses on AI investment within individual firms or bilateral relationships, this paper innovatively incorporates three members, i.e., the manufacturer, e-commerce platform, and logistics provider, into the analytical framework at the same time to explore the synergistic impact of their AI investments on supply chain demand. By quantifying the marginal contributions of the three members, this study reveals the interactions among their technology investments and the mechanisms through which such investments enhance overall efficiency. Secondly, within the context of AI investment, this paper provides the first systematic comparison of the performance differences among four supply chain structures: centralized, partially decentralized, fully decentralized, and coordinated. By constructing game-theoretic models, this study clarifies the game equilibria of member decisions under different structures and reveals how supply chain structures influence AI investment efforts, profit distribution, and overall supply chain effectiveness. Thirdly, to address the issue of double marginalization in a fully decentralized structure, a novel AI cost-sharing contract mechanism is proposed. Through mathematical proofs and numerical analyses, it is verified that the contract can align the interests of the three members, achieve Pareto improvement, and provide an operable solution for AI investment cooperation among supply chain members in practice.

The rest of this paper is organized as follows.

Section 2 provides a literature review, which reviews the relevant literature.

Section 3 describes the problem and gives assumptions about models.

Section 4 establishes game models and obtains optimal results under the centralized structure, partially decentralized structure, fully decentralized structure, and coordinated structure. In

Section 5, the optimal results under different decision modes are compared and analyzed theoretically. In

Section 6, numerical experiments are conducted, and the results are discussed. We discuss an extension in

Section 7, and present our concluding remarks and outline potential directions for future research in

Section 8.

2. Literature Review

2.1. The Use of AI Technology in Supply Chain

In recent years, AI has attracted considerable attention from scholars specializing in operations management and supply chain domains [

27,

28,

29]. Jackson et al. (2024) [

30] examined the impact of AI on thirteen distinct decision domains in supply chain and operations management, providing a practical framework for both practitioners and researchers. Fatorachian et al. (2025) [

31] focused on the enabling role of AI and blockchain technology in emission tracking for cold chain logistics, with the core being the enhancement of efficiency by improving data security and digital monitoring standards.

With the rapid growth of the e-commerce industry, a number of researchers have begun to study AI in this field. In particular, De Giovanni (2021) [

32] investigated the use of AI by the manufacturer to mitigate the negative impact of error terms in operations management. Niu et al. (2023) [

33] studied whether the global brand in a cross-border supply chain should adopt AI livestream and how to determine the investment level of the AI. Yang et al. (2021) [

34] pointed out that there was great potential for applying AI in practice to better manage fresh produce, and social planners should incentivise retailers to utilise AI methods. Li and li (2022) [

35] discussed whether the retailer with regretful behaviour should adopt AI to eliminate decision bias. Zhao et al. (2022) [

36] examined the service decision-making problem of online retailers regarding human and non-human online shopping consultation services under the online duopoly market. Wang et al. (2024) [

19] explored whether the retail platform should adopt AI technology to remove online consumer uncertainty regarding product fitness, and showed that the platform preferred to adopt AI in cases where consumers were allowed to return products. Yao et al. (2024) [

37] investigated the impact of AI on the financing preferences of e-commerce supply chain members and found that the impact of AI on the profitability of the platform was dual-sided. Xu et al. (2024) [

26] analyzed whether the live streaming platform should adopt AI to provide virtual services to consumers to reduce the unfit probability. He et al. (2024) [

8] explored whether the AI service of the e-commerce platform outperforms manual service and its impact on the choice of selling mode within the e-commerce platform supply chain. Zhao and Wu (2025) [

38] studied the online retailer’s choice of human customer service and AI customer service strategies, and the impact of different strategies on the online retailer and consumers. Yang et al. (2025) [

39] explored AI adoption strategies of the retailer in a two-tier green supply chain. The study showed that regardless of whether the retailer underestimates or overestimates the consumers’ green preference without AI, the greater the estimation bias, the more inclined the retailer is to adopt AI.

While the above literature focuses on the impact of AI application on optimal decisions by a single member of the supply chain, i.e., manufacturer or platform (retailer), some scholars have further expanded the scope of the research by exploring the decision-making context when AI is adopted simultaneously by both upstream and downstream parties in the supply chain. For example, Xu et al. (2023) [

40] investigated whether the manufacturer and platform should adopt AI in a supply chain consisting of a manufacturer and platform. They found that the use of AI allows the manufacturer’s optimal profit to always increase with platform power in both marketplace and reselling modes. Wang et al. (2025) [

22] examined the impact of AI adoption by the manufacturer and retailer on the front-end and back-end service models of the supply chain. The results indicated that the implementation of AI typically reduces product pricing, while its impact on market demand exhibits a non-linear characteristic.

In addition, it has been noted that AI can significantly enhance decision-making in highly complex operational environments. By leveraging big data analytics, AI can optimize logistics operations through cost reduction (Choi et al. 2022 [

41], De Oliveira Neto et al. 2025 [

42]). Therefore, this study simultaneously examines the AI investment strategies of the three main members, i.e., the manufacturer (production side), e-commerce platform (sales side), and logistics service provider (delivery side). This whole-chain perspective not only systematically assesses the enabling effect of AI technology on each link of the supply chain but also reveals the synergistic effect generated by cross-body AI investment and its enhancement mechanism on the overall supply chain efficiency.

2.2. Coordination Contracts of the Online Channel

Supply chain contracts, as a key mechanism for coordinating and incentivizing supply chain members, have long received extensive academic attention. By designing reasonable cooperation and profit-sharing rules, they can effectively alleviate issues such as double marginalization and information asymmetry, thereby enhancing the overall efficiency and stability of the supply chain.

The major concern of this subsection is the contractual papers in the online channel. Li et al. (2022) [

43] combined option strategy and pricing strategy to explore the coordination mechanism of the supply chain, and the results showed that the business risks of both the retailers and suppliers are reduced through the risk-sharing mechanism of an option contract. Nouri-Harzvili et al. (2022) [

44] proposed a combined two-part tariff contract to simultaneously optimize competitive green service and pricing decisions in the dual-channel supply chain. Das et al. (2025) [

45] found that the two-part tariff contract can effectively coordinate the closed-loop dual-channel supply chain. Ren and Hu (2025) [

46] proposed the “cost–benefit sharing” contract for the decentralized structure, and found that this contract can increase the profits of the online store and TPL and improve the freshness of fresh food. He et al. (2022) [

47] studied the effects of the manufacturer’s channel encroachment and logistics integration of the e-commerce platform, proposing the transfer payment contract and revenue-sharing contract to achieve a win-win-win scenario. Xu et al. (2024) [

26] explored coordination in a live broadcasting supply chain and found that both commission rate contracts in the agency model and wholesale price contracts in the resale model enable coordination between two firms. Biswas et al. (2023) [

48] discussed the impact of contract sequence on profit distribution among supply chain members in a decentralized multi-level supply chain. Chen et al. (2025) [

49] designed three fee contracts to improve information disclosure strategies in the supply chain and showed that under certain conditions, the retailer can facilitate information cooperation with a geographical indication fresh produce supplier or a local fresh produce supplier through contracts involving specific fees. Qiu et al. (2025) [

50] compared the fixed-fee and revenue-sharing contracts and found that the revenue-sharing contract prominently improves the efficiency of the supply chain.

Shen et al. (2019) [

51] demonstrated that the cost-sharing contract can coordinate the global supply chain and achieve centralized optimal performance. Hong and Guo (2019) [

52] studied several cooperation contracts and investigated their environmental performance. The results found that cooperation may not always benefit all members. Zhang et al. (2024) [

53] explored the retailer sharing the cost of the manufacturer’s digital technology investment in order to incentivise the manufacturer to invest in digital technology. The results indicated that the designed cost-sharing contract improves the digital technology level of the manufacturer and results in a win-win situation for the supply chain participants. Wang et al. (2023) [

54] analyzed the impact of consumers’ fairness concern behaviour on the decision-making of e-commerce closed-loop supply chains and designed a “dual-revenue and service-cost sharing” contract to coordinate the supply chain for the decentralized model. The results demonstrated that the newly proposed contract could effectively mitigate the efficiency loss inherent in the two decentralized models. Liu et al. (2023) [

55] examined how contracts can be designed to incentivise the logistics service provider’s effort to retain product freshness during transport, and the results showed that a flexible revenue-sharing contract increases consistency in the goal of delivering fresh products. Zhao et al. (2024) [

56] investigated the optimal price and effort decisions of supply chain members and proposed a revenue-cost-sharing contract to coordinate the supply chain. They found that the contract could achieve a win-win outcome under certain conditions.

Existing literature demonstrates that the coordination mechanism of online channels has become an important research topic in the field of supply chain management and has gained extensive attention from the academic community. Different from the existing studies focusing on a single link, this paper innovatively proposes a theoretical framework in which the manufacturer, e-commerce platform, and logistics service provider work together to promote market demand with a collaborative AI investment strategy. By constructing the Stackelberg game model, this study systematically examines the equilibrium strategies of the EPSC in different decision-making situations. After combing through the literature, it is found that no study has yet examined the collaborative AI investment mechanism of the three members in the supply chain within a unified analytical framework, and the research work in this paper effectively bridges this theoretical gap.

2.3. Research Gap

The literature review indicates that while significant progress has been made in the application of AI and coordination contracts in supply chain management, certain research gaps remain. Existing research has predominantly focused on AI application strategies involving one or two members within a two-tier supply chain context, whereas research on AI investment decisions jointly made by three parties—such as the manufacturer, the e-commerce platform, and the logistics provider—in a three-tier supply chain framework remains relatively scarce. This paper aims to address this gap by analyzing the decision-making behaviors of the manufacturer, the e-commerce platform, and the logistics service provider in AI investment. Furthermore, although prior research has explored pricing and AI investment strategies of supply chain members under decentralized decision-making settings, limited attention has been paid to the impact of different supply chain structures on such decisions. Grounded in real-world contexts, this study incorporates three distinct supply chain structures and develops corresponding game-theoretic models for each decision scenario to better reflect the diversity present in practical operations. Regarding coordination mechanisms, existing literature frequently employs two-part tariff contracts and revenue-sharing contracts to incentivize AI investment efforts, with a minority of studies adopting exogenously given cost-sharing contracts. In contrast, this paper designs a cost-sharing contract from the perspective of the e-commerce platform to motivate the logistics provider to enhance its effort in the delivery process. Notably, the cost-sharing ratio in this contract is treated as an endogenous decision variable. This approach enhances the model’s practical applicability and theoretical depth, thereby highlighting the distinctive contribution of this study compared to existing works.

To more clearly highlight the differences between this research and the existing literature in terms of theoretical framework and innovative value, we systematically compare this research with the relevant studies listed in

Table 1. By comparing the similarities and differences in research context, model construction, decision-making entities, contract formats, and conclusion contributions, this comparison not only clarifies the positioning of our research but also helps illustrate its unique value in theoretical extension and practical application.

3. Model Description

The research object is a three-tier EPSC composed of a manufacturer (denoted as M), an e-commerce platform (denoted as R), and a logistics provider (denoted as L). The manufacturer produces products and wholesales them to the platform at a price . The platform then sells the products to consumers at a price and entrusts the logistics provider to deliver the products to consumers, with the logistics price recorded as . The unit production cost of the product is denoted as , which is borne by the manufacturer, while the unit logistics cost is denoted as , which is borne by the logistics provider.

In this paper, we consider four structures of the EPSC, i.e., the centralized structure, partially decentralized structure, fully decentralized structure, and coordinated structure. Under the centralized structure (denoted as mode ), the manufacturer, platform, and logistics provider form a community of interest and make decisions with the goal of maximizing the overall benefit of the supply chain. Under the partially decentralized structure (denoted as mode ), the platform and logistics provider form an alliance, which then engages in a game with the manufacturer. Under the fully decentralized structure (denoted as mode ), the manufacturer, platform, and logistics provider make decisions individually, each aiming to maximize their own profits. Under the coordinated structure (denoted as mode ), the platform incentivizes the logistics provider to invest in an AI-driven effort in the logistics delivery process by sharing a portion of the effort cost. Let denotes the cost-sharing rate of the platform, where .

All three members of the supply chain invest in AI to enhance operational efficiency and stimulate end-demand. For the manufacturer, AI investment is primarily focused on smart production and quality control. By adopting AI technologies, the manufacturer achieves intelligent equipment diagnosis, fault prediction, and elimination, as well as production process optimization. AI enables precise quality management, thereby improving product reliability and consistency. These enhancements strengthen product competitiveness and effectively stimulate market demand. For the platform, AI investment aims to enhance consumer experience and operational performance, thereby driving sales growth. Specific applications include the construction of virtual showrooms to provide immersive shopping experiences, the deployment of AI-powered customer service for efficient and intelligent query handling, and the use of personalized recommendation engines that leverage user behavioral data to deliver precise product suggestions. The logistics provider concentrates its AI investment on optimizing the entire logistics chain. Employing AI algorithms enables intelligent planning and dynamic adjustment in areas such as warehouse layout, transportation routing, and delivery scheduling. This improves logistical efficiency and delivery timeliness, enhancing service appeal and indirectly contributing to demand growth.

We assume that the AI investment costs of the manufacturer, platform and logistics provider are quadratic functions of their respective investment efforts, i.e.,

, where

denotes the cost coefficient of AI investment effort and

denotes AI investment effort of the supply chain member,

. This consideration aligns with that in the existing study (He et al. 2024 [

8]). From a practical perspective, AI investment exhibits the characteristic of “increasing marginal cost”, that is, in the initial stage, enterprises can cut in at low cost using mature tools; in the later stage, to achieve customization, more research and development and talent resources need to be invested, leading to an accelerated cost growth. The quadratic function can accurately depict this process. From a theoretical perspective, the strict convexity of the quadratic function ensures the existence of a unique equilibrium solution in game models while simplifying mathematical derivation. Additionally, its parameters are easy to calibrate with enterprises’ actual data, balancing theoretical rigor and empirical feasibility. A framework diagram of the interaction between the manufacturer, platform, and logistics provider is shown in

Figure 1.

Building upon extensive prior research (Niu et al. 2023 [

33]; He et al. 2024 [

8]), we use a linear demand function that declines with the retail price, increasing with AI investment efforts. Specifically, the demand function is expressed as:

where

represents the market size,

represents the sensitivity of market demand to the retail price, and

measures the sensitivity of market demand to the supply chain member’s AI investment efforts,

. Without loss of generality, we assume that

,

,

. Supply chain members are rational and risk-neutral, implying that

.

For the sake of simplicity, superscripts of

denote the centralized structure, partially decentralized structure, fully decentralized structure, coordinated structure. Subscripts of

represent the manufacturer, the platform, and the logistics provider, respectively.

Table 2 summarizes the notations used in this paper.

4. Model Development and Analysis

4.1. Mode

Under the centralized structure, the manufacturer, platform, and logistics provider form a whole to determine retail price

, and AI investment efforts

to maximize profit. Therefore, the profit function of the whole is:

By backward induction, we derive the equilibrium results of the whole shown in Proposition 1. Please see

Appendix A for the detailed certification process.

Proposition 1. In mode

, the optimal AI investment efforts of supply chain members are given by , , . The optimal retail price is given by . The optimal market demand and profit are given by and , where , , , = , , .

It is straightforward to note that an increase in the sensitivity of market demand to the manufacturer’s AI investment effort leads to an increase in the equilibrium AI investment effort of the manufacturer. The sensitivity of market demand to the platform’s AI investment effort has had a positive effect on the platform’s AI investment effort. The sensitivity of market demand to the logistics provider’s AI investment effort positively affects the platform’s AI investment effort. These results can be attributed to the fact that when the corresponding marginal impact coefficient is relatively larger, each additional unit of AI investment effort by a supply chain member leads to a more substantial increase in market demand. From the perspective of cost-benefit analysis in economics and the profit-maximizing nature of firms, supply chain decision-makers naturally prioritize allocating more resources to initiatives with higher returns.

Therefore, when the return on AI investment is significantly positively correlated with the marginal demand impact coefficient, especially when the coefficient is at a high level, supply chain members become keenly aware of the substantial demand-stimulating effect of AI technology investment on market demand. This perception will stimulate an inherent motivation for supply chain members to continually increase their investment in AI technologies, as they anticipate achieving more notable market share growth and more profitable returns through AI-driven demand expansion.

4.2. Mode

Under the partially decentralized structure, the manufacturer determines the wholesale price

and AI investment effort

. Then, the coalition determines the retail price

and AI investment efforts

. Therefore, the profit function of the manufacturer is:

The profit function of the coalition is:

By backward induction, we derive the equilibrium results of the manufacturer and coalition shown in Proposition 2. Please see

Appendix A for the detailed certification process.

Proposition 2. In mode DC, the optimal AI investment efforts of supply chain members are given by , , . The optimal retail price and wholesale price are given by , . The optimal market demand and profits are given by , , , where .

Proposition 2 indicates that supply chain members’ AI investment efforts are increasing with respect to the sensitivity of market demand to supply chain members’ AI investment efforts . They decrease with the cost parameters of . That is, an increase in the sensitivity of market demand to efforts motivates supply chain members to increase efforts, while an increase in the cost of effort discourages efforts. It can also be observed that , , and have a positive impact on and . The reason is that an increase in cost parameters of supply chain members significantly dampens their willingness to invest in AI technology. To mitigate this challenge, the manufacturer tends to adopt a strategy of lowering the wholesale price to enhance its attractiveness to the downstream platform. In turn, the decline in the wholesale price prompts the platform to lower the retail price.

4.3. Mode

Under the fully decentralized structure, the manufacturer determines the wholesale price

and AI investment effort

. Then, the logistics provider determines the logistics price

and AI investment effort

. Finally, the platform determines the retail price

and AI investment effort

to maximize its profit. Therefore, the profit function of the manufacturer is:

The profit function of the platform is:

The profit function of the logistics provider is:

The optimal results can be obtained by inverse solving and are shown in Proposition 3. Please see

Appendix A for the detailed certification process.

Proposition 3. In mode DT, the optimal AI investment efforts of supply chain members are given by

, , . The optimal retail price, wholesale price, and logistics price are given by , , . The optimal market demand and profits are given by , , , = , where .

For , it can be seen that has a positive impact on . Thus, the more sensitive market demand is to the manufacturer’s AI investment effort, the more willing the manufacturer is to invest in AI. For , it can be seen that has a positive impact on . Hence, the more sensitive market demand is to the platform’s AI investment effort, the more willing the platform is to invest in AI. For + , it can be seen that has a positive impact on , that is, an increase in the sensitivity of market demand to logistics provider’s effort motivates the logistics provider to increase effort. For , it can be seen that positively affect , that is, the greater the marginal impact of the manufacturer’s AI investment effort on demand, the higher the wholesale price. For = , it can be seen that positively affects . The greater the marginal impact of the platform’s AI investment effort on demand, the higher the retail price. For , it can be seen that exerts a positive impact on , that is, an increase in the sensitivity of market demand to logistics provider’s effort raises the logistics price.

The rationale behind these results is that the more sensitive market demand is to the manufacturer’s AI investment effort, the more willing the manufacturer becomes to increase investment in AI technology, thereby raising the wholesale price. Similarly, heightened sensitivity of market demand to the logistics provider’s AI investment effort motivates the logistics provider to enhance its AI technology investment, leading to an increase in logistics price. To maintain profitability, the platform responds by correspondingly raising the retail price.

4.4. Mode

Under the coordinated structure, in order to encourage the logistics provider to exert more efforts in AI technology in the delivery process, the platform may consider sharing the AI investment effort cost of the logistics provider. This section investigates supply chain coordination based on the cost-sharing contract. The supply chain is coordinated by a contract when the profits of supply chain members are increased [

57,

58]. Let

represents the cost-sharing rate by the platform,

. The manufacturer determines the wholesale price

and AI investment effort

. The logistics provider determines the logistics price

and AI investment effort

. The platform determines the retail price

, AI investment effort

, and cost-sharing rate

to maximize its profit. Therefore, the profit function of the manufacturer is:

The profit function of the platform is:

The profit function of the logistics provider is:

The optimal results can be obtained by inverse solving and are shown in proposition 4. Please see

Appendix A for the detail certification process.

Proposition 4. In mode

, the optimal AI investment efforts of supply chain members are given by , , . The optimal wholesale price, retail price, and logistics price are given by , + , . The optimal cost-sharing rate by the platform is given by . The optimal market demand and profits are given by , , , , where , , , .

We can observe from Proposition 4 that the manufacturer’s AI investment effort is positively affected by the the efficiency of the manufacturer’s AI investment effort. That is, the greater the marginal impact of AI investment effort on demand, the more willing the manufacturer is to invest in AI investment effort. For , it can be seen that has a positive impact on . Thus, the greater the marginal impact of AI investment effort on demand, the more willing the logistics provider is to invest in AI investment effort. For , it can be seen that has a positive impact on , that is, the greater the marginal impact of AI investment effort on demand, the more willing the platform is to invest in AI investment effort. It can be seen that an increase in the sensitivity of market demand to supply chain members’ AI investment efforts motivates supply chain members to invest in AI.

For , it can be seen that the sensitivity of market demand to the manufacturer’s AI investment effort has a positive effect on the wholesale price . That is, the greater the marginal impact of the manufacturer’s AI investment effort on demand, the higher the wholesale price. For = − , it can be seen that has a positive impact on . The greater the marginal impact of AI investment effort on demand, the higher the retail price. For , it can be seen that has bring positive effect on . That is, the greater the sensitivity of market demand to the logistics provider’s AI investment effort, the higher the equilibrium logistics price.

For , it can be seen that has a positive impact on . The more significant the marginal impact of logistics providers’ AI investment on market demand, the higher the cost-sharing factor of the platform. Specifically, when the logistics provider’s AI investment has a stronger marginal contribution to demand growth, the platform is more inclined to increase the proportion of cost-sharing to incentivise the logistics provider to increase its AI investment so as to optimise the overall supply chain efficiency. This mechanism suggests a positive moderating relationship between the cost-sharing strategy of the platform firm and the demand elasticity of logistics providers’ AI investment.

5. Comparison and Analysis of Results

To intuitively show the optimal results, we list all effort decisions and price decisions of the manufacturer, logistics provider and platform, and profits of suppy chain members under centralized structure, partially decentralized structure, fully decentralized structure, and coordinated structure in

Table 3. The following corollary can be drawn, where

,

,

,

,

,

,

,

,

,

,

,

.

Corollary 1. In modes

, and , the proportional relationships between AI investment efforts of the manufacturer, logistics provider and platform are , , . In mode , the proportional relationship between AI investment efforts of the manufacturer and platform is still , but the proportional relationship between the AI investment effort of the logistics provider and that of the manufacturer and platform are and , respectively.

Corollary 1 indicates that under the three supply chain structures of centralized, partially decentralized, and fully decentralized, AI investment efforts of the manufacturer, platform, and logistics provider always maintain a fixed proportional relationship. Specifically, when the manufacturer increases AI investment effort, the platform and logistics provider will simultaneously raise AI investment in corresponding proportions. It is worth noting that under the coordinated structure, while the proportional relationship between the logistics provider’s investment and that of the manufacturer and platform changes significantly. Under this mode, when the manufacturer or platform increases its AI investment, the logistics provider demonstrates a stronger willingness to invest, and the increase in its AI investment is more significant than that under the non-coordinated structure.

Corollary 2. In modes

, and , there is always , .

Corollary 2 reveals the variation patterns of AI investment efforts under different supply chain structures, i.e., the centralized structure achieves the highest level of AI investment effort, followed by the partially decentralized structure, while the fully decentralized structure yields the lowest. The intrinsic mechanism of this phenomenon lies in the fact that the manufacturer, platform, and logistics provider need to determine their AI investment efforts independently in both partially decentralized and fully decentralized structures compared to the centralized structure. Due to their individual profit-maximizing objectives, each decision-maker expects other parties to increase their investments to enhance their own returns. This strategic behaviour ultimately leads to a gradual decrease in the overall AI investment effort within the system.

Corollary 3. In modes

and , AI investment efforts of the manufacturer, logistics provider and platform satisfy , . When , there is .

Corollary 3 shows the differential impact of the cost-sharing contract on AI investment behaviour. First, the contract is consistently effective in enhancing the AI investment efforts of both the manufacturer and platform. For the logistics provider, a threshold effect is observed: when the AI investment cost coefficient is below a certain threshold, the investment effort under the cost-sharing contract is significantly higher than that under the fully decentralized structure; conversely, when the cost coefficient exceeds the threshold, even with the cost-sharing, the logistics provider still lacks sufficient incentive to enhance its investment effort. The economic explanation for this phenomenon lies in the fact that moderate cost-sharing can effectively reduce the marginal investment cost of the logistics provider, thus stimulating its willingness to invest. However, when the inherent cost is too high, even if the platform shares a portion of the cost, the remaining expense still exceeds the logistics provider’s acceptable threshold, resulting in incentive failure.

Corollary 4. In modes

, and , the wholesale price satisfies .

Corollary 4 suggests the impact mechanism of different decision-making structures on the pricing strategies of supply chain members, i.e., the partially decentralized structure leads to the highest wholesale price, followed by the coordinated structure, while the fully decentralized structure results in the lowest wholesale price. This price gradient phenomenon stems from the strategic interactions among decision makers, that is, under a fully decentralized structure, independent decision-making by each decision-maker. Under the fully decentralized structure, each member makes independent decisions based on self-interest, leading to a contraction in market demand. In response, the manufacturer proactively reduces the wholesale price to incentivize the platform to lower the retail price, thereby stimulating a rebound in end-market demand and creating a virtuous price transmission mechanism.

Corollary 5. In modes CC, DC, , and , when + , the retail price satisfies .

Corollary 5 demonstrates the critical role of the effort cost coefficient of the logistics provider in shaping retail price relationships across the four structures. Specifically, when the cost coefficient of the logistics provider’s AI investment effort is below a certain threshold, the fully decentralized structure yields the highest retail price, while the centralized structure results in the lowest. Notably, the retail price under the coordinated structure remains lower than that under the fully decentralized structure. Compared to the fully decentralized structure, the cost-sharing contract effectively reduces the retail price, demonstrating its ability to meet consumers’ demand for lower price and thereby helping secure a competitive price advantage in the market.

Corollary 6. In modes CC, DC, , and , market demand satisfies .

Corollary 6 clearly demonstrates significant differences in market demand across decision-making structures. The centralized structure achieves the highest market demand, followed by the partially decentralized structure, then the coordinated structure, while the fully decentralized structure yields the lowest market demand. Of particular interest is that the introduction of the cost-sharing contract proves effective in stimulating market demand growth compared to the fully decentralized structure. The findings indicate that the cost-sharing contract can break the low market demand dilemma inherent under the fully decentralized structure, optimize the allocation of market resources, and provide new insights and approaches for enhancing product market share and revitalizing market dynamics.

Corollary 7. In modes

, and , the profit of the manufacturer satisfies .

Corollary 7 reveals that the partially decentralized structure can create maximum profit margin for the manufacturer, followed by the coordinated structure, while the fully decentralized structure results in the lowest manufacturer profitability. This disparity arises from the double marginalization effect between the platform and logistics provider under the fully decentralized structure, where each party prioritizes its own profit maximization. This behavior leads to multiple price markups throughout the circulation process, driving up the final market price, which in turn dampens market demand and significantly reduces the manufacturer’s profits. In contrast, when the platform participates in sharing the AI effort cost of the logistics provider, the efficiency of the logistics process improves, enhancing the product’s market competitiveness and stimulating greater market demand. Driven by this increased demand, the manufacturer’s profitability is substantially enhanced.

6. Numerical Analysis

In the previous section, we provided a comprehensive analysis of the equilibrium outcomes under four different decision-making scenarios. In this section, we explore the impact of two key parameters, the logistics provider’s AI effort cost coefficient and the sensitivity of market demand to the logistics provider’s AI investment effort on the equilibrium AI investment efforts, cost-sharing rate, market demand, and profits of supply chain members. The corresponding results are shown in

Figure 2,

Figure 3,

Figure 4,

Figure 5,

Figure 6,

Figure 7,

Figure 8,

Figure 9,

Figure 10,

Figure 11,

Figure 12 and

Figure 13.

6.1. Effects of on Supply Chain Performance

This subsection analyzes the effect of the logistics provider’s AI investment effort cost coefficient

on optimal results under different structures. According to the model assumptions, we set the relevant parameters and assign them the following values:

,

,

,

,

,

,

,

,

,

. The results are shown in

Figure 2,

Figure 3,

Figure 4,

Figure 5,

Figure 6 and

Figure 7.

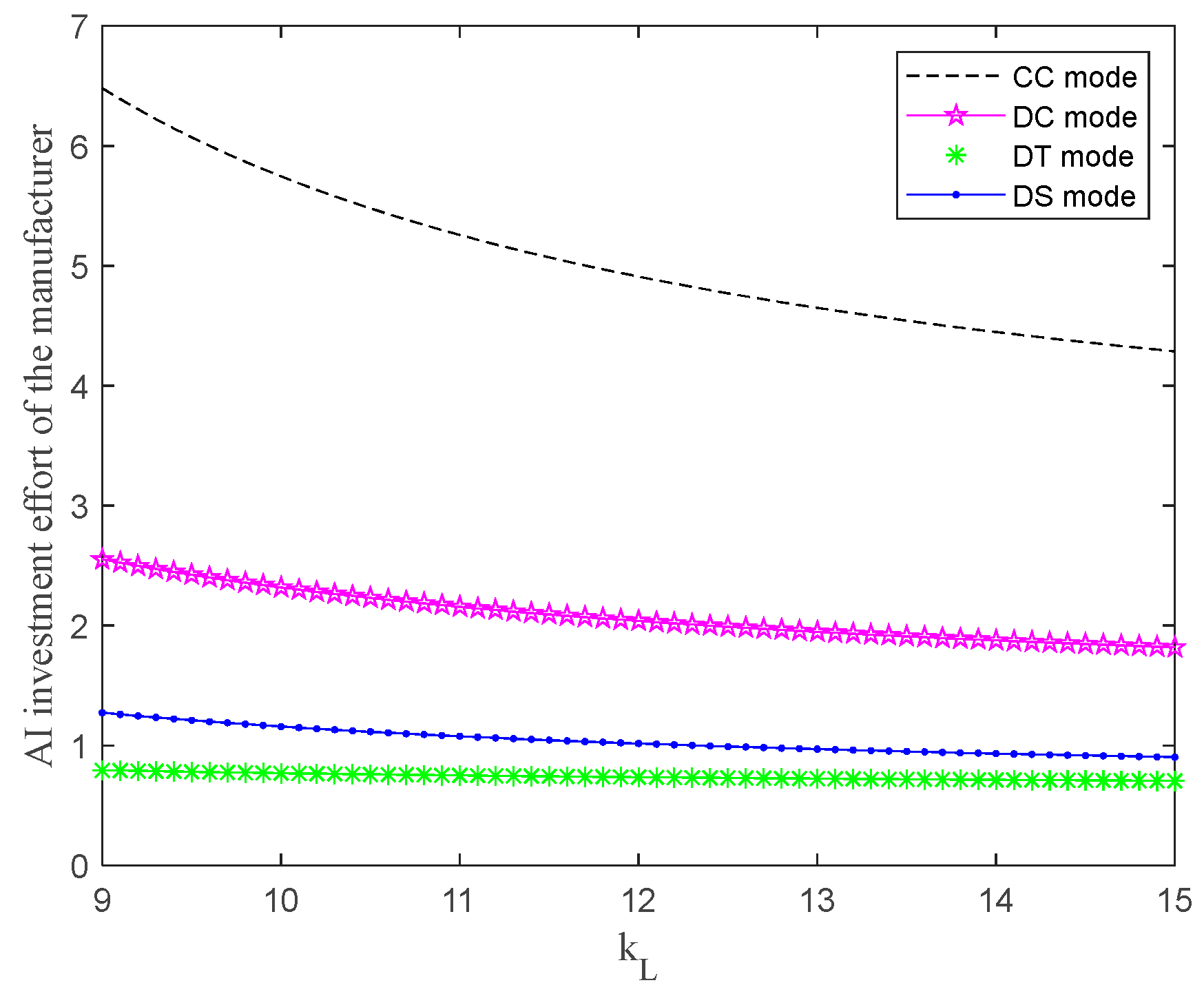

Figure 2.

Effect of cost coefficient on the manufacturer’s AI investment effort.

Figure 2.

Effect of cost coefficient on the manufacturer’s AI investment effort.

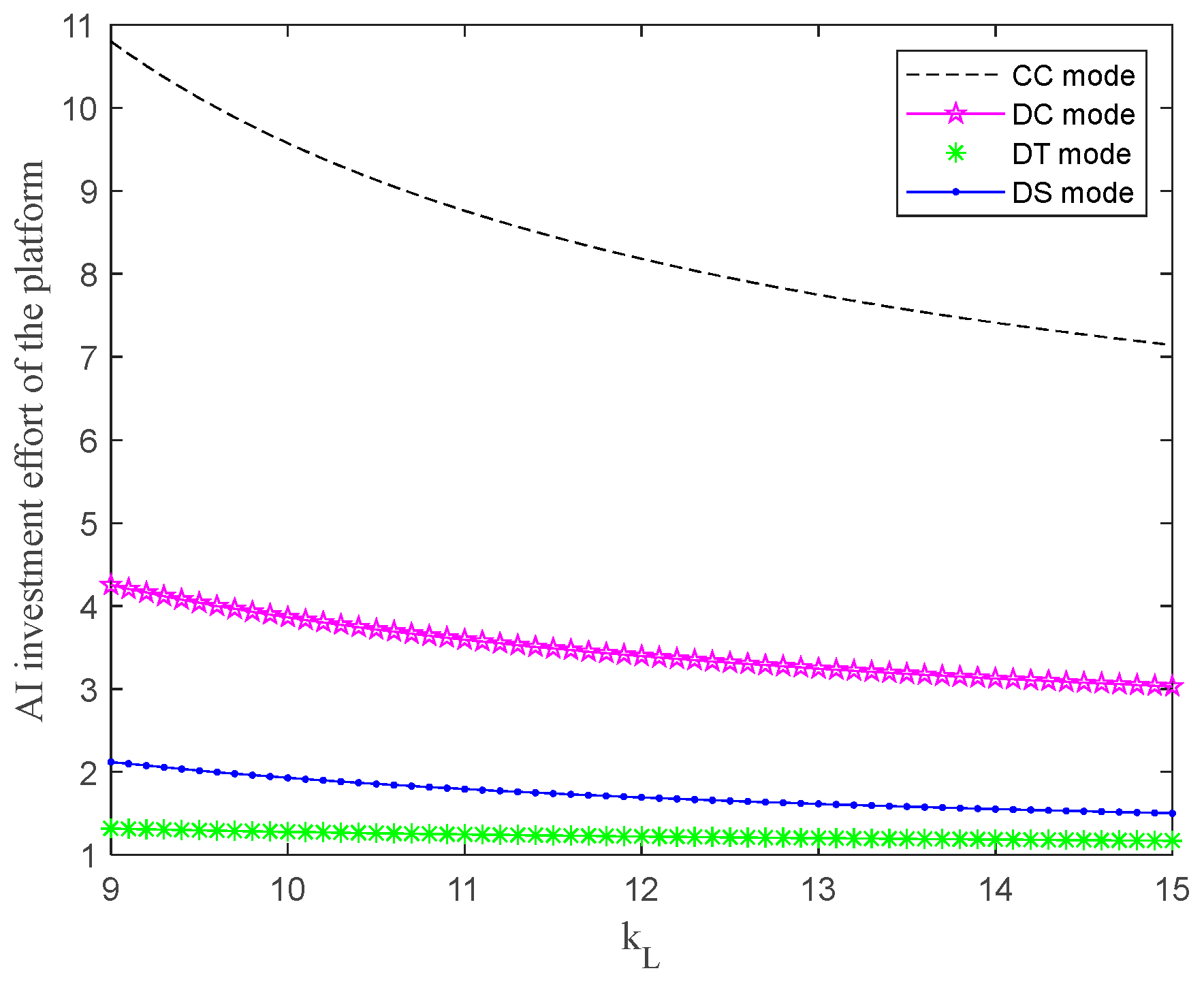

Figure 3.

Effect of cost coefficient on the platform’s AI investment effort.

Figure 3.

Effect of cost coefficient on the platform’s AI investment effort.

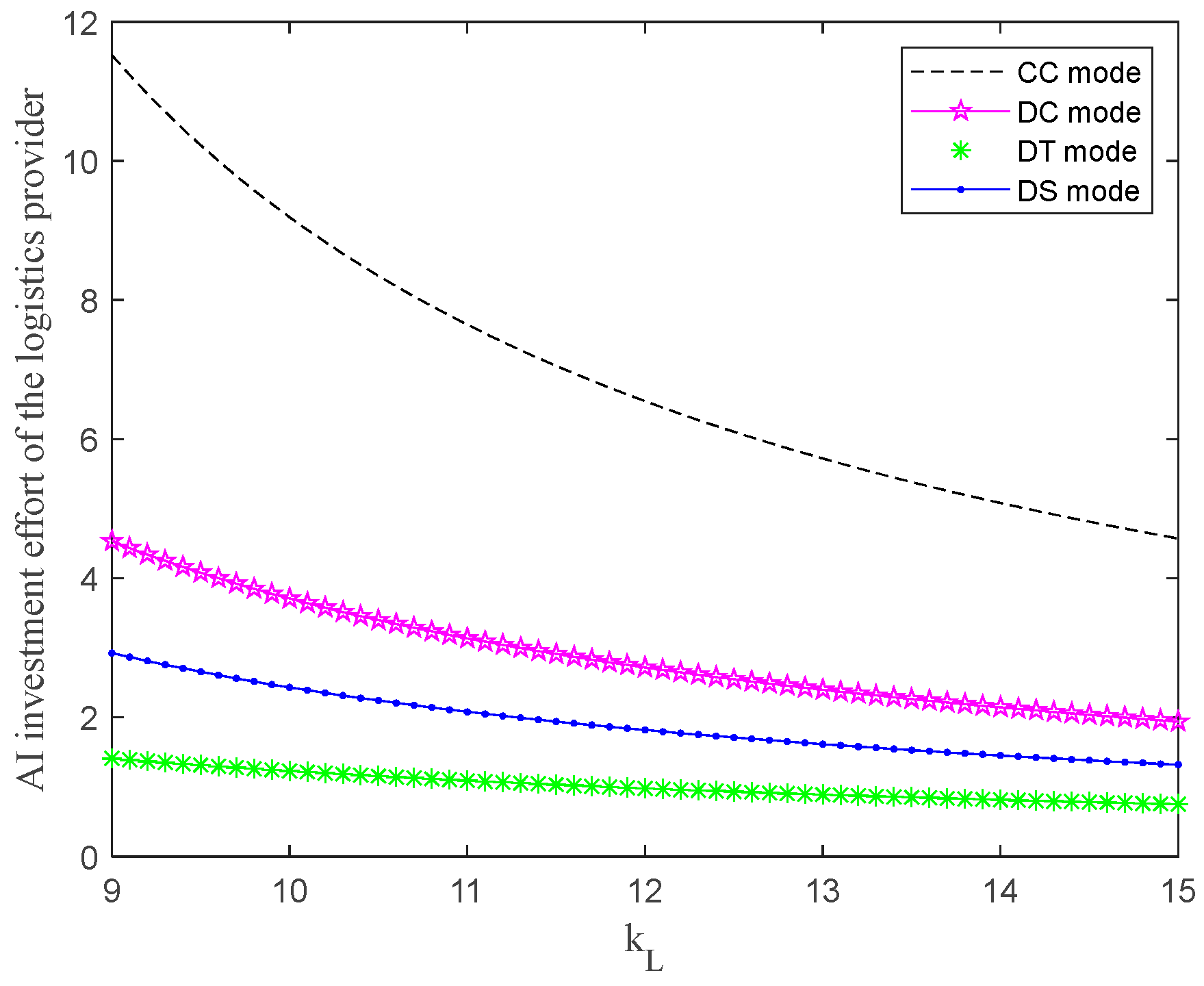

Figure 4.

Effect of cost coefficient on the logistics provider’s AI investment effort.

Figure 4.

Effect of cost coefficient on the logistics provider’s AI investment effort.

As shown in the dynamic evolutionary trends from

Figure 2,

Figure 3 and

Figure 4, an increase in the parameter

leads to a significant decline in AI investment by the manufacturer, platform, and logistics provider. This phenomenon intuitively reflects a clear negative correlation between AI investment cost and the willingness of supply chain members to invest; that is, a higher cost corresponds to lower motivation for active investment across all members. A further comparison of investment performance across the four decision-making scenarios reveals that the level of AI investment effort decreases in the following order: centralized structure, partially decentralized structure, coordinated structure, and fully decentralized structure. Compared to the fully decentralized structure, under the cost-sharing contract framework, the manufacturer, platform, and logistics provider all exhibit a stronger willingness to invest in AI, indicating that a reasonable cost-sharing mechanism can effectively stimulate the investment motivation of supply chain members.

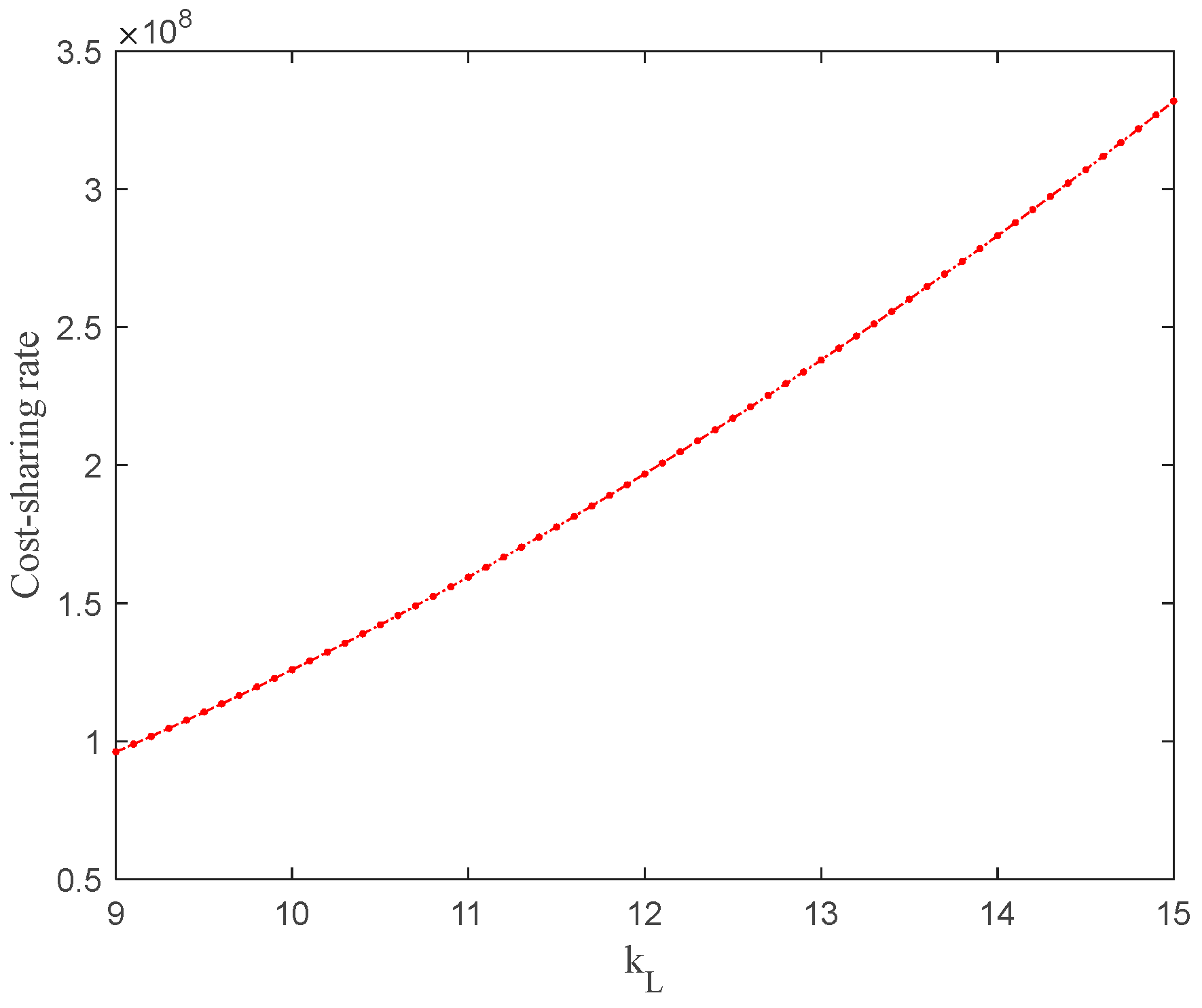

Figure 5.

Effect of cost coefficient on cost-sharing rate.

Figure 5.

Effect of cost coefficient on cost-sharing rate.

The trend in

Figure 5 shows that as the parameter

increases, the cost-sharing rate also increases in the same direction. This indicates that the higher the logistics provider’s AI investment cost, the more inclined the platform is to share the effort cost. When the logistics cost is high, the logistics provider tends to reduce its willingness to invest in AI due to cost pressure, leading to a contraction in market demand. To mitigate this situation and stimulate market demand growth, the platform incentivizes the logistics provider to increase its investment effort by sharing a portion of the cost, thereby maintaining the overall effectiveness of the supply chain.

Figure 6.

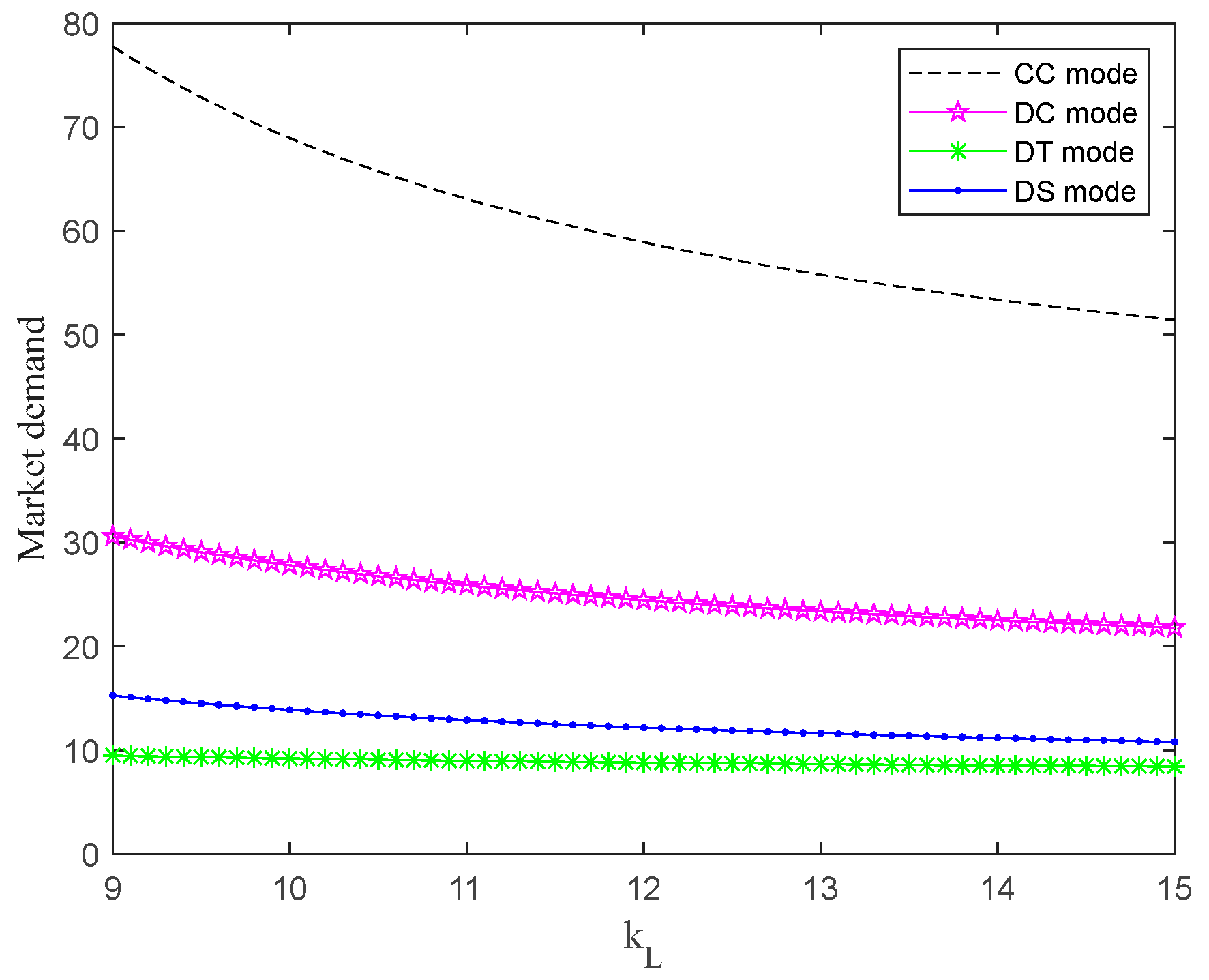

Effect of cost coefficient on market demand.

Figure 6.

Effect of cost coefficient on market demand.

Figure 6 clearly indicates that market demand decreases as the value of the parameter

increases. This trend suggests that a higher AI investment cost makes the logistics provider more cautious in its effort allocation, consequently resulting in reduced market demand. Among the four decision-making modes, the centralized mode achieves the highest market demand, whereas the fully decentralized mode yields the lowest. Notably, the cost-sharing contract mode leads to higher market demand compared to the fully decentralized mode, demonstrating the effectiveness of the cost-sharing mechanism in stimulating demand.

Figure 7.

Effect of cost coefficient on profits of supply chain members.

Figure 7.

Effect of cost coefficient on profits of supply chain members.

According to the simulation results in

Figure 7, the profits of the manufacturer, platform, and logistics provider all decrease as the parameter

increases. This suggests that excessively high AI investment costs inhibit the logistics provider’s willingness to invest in AI, which subsequently reduces market demand and ultimately negatively affects the profitability of supply chain members. It is worth noting that under the cost-sharing contract mechanism, the profits of supply chain members are significantly higher than those under the fully decentralized decision-making mode. This result strongly demonstrates the effectiveness of the cost-sharing contract in enhancing the performance of supply chain members.

6.2. Effects of on Supply Chain Performance

This subsection analyzes the effect of the sensitivity of market demand to the logistics provider’s AI investment effort on optimal results. The parameter setting is the same as that in

Section 6.1, where

. The results are shown in

Figure 8,

Figure 9,

Figure 10,

Figure 11,

Figure 12 and

Figure 13.

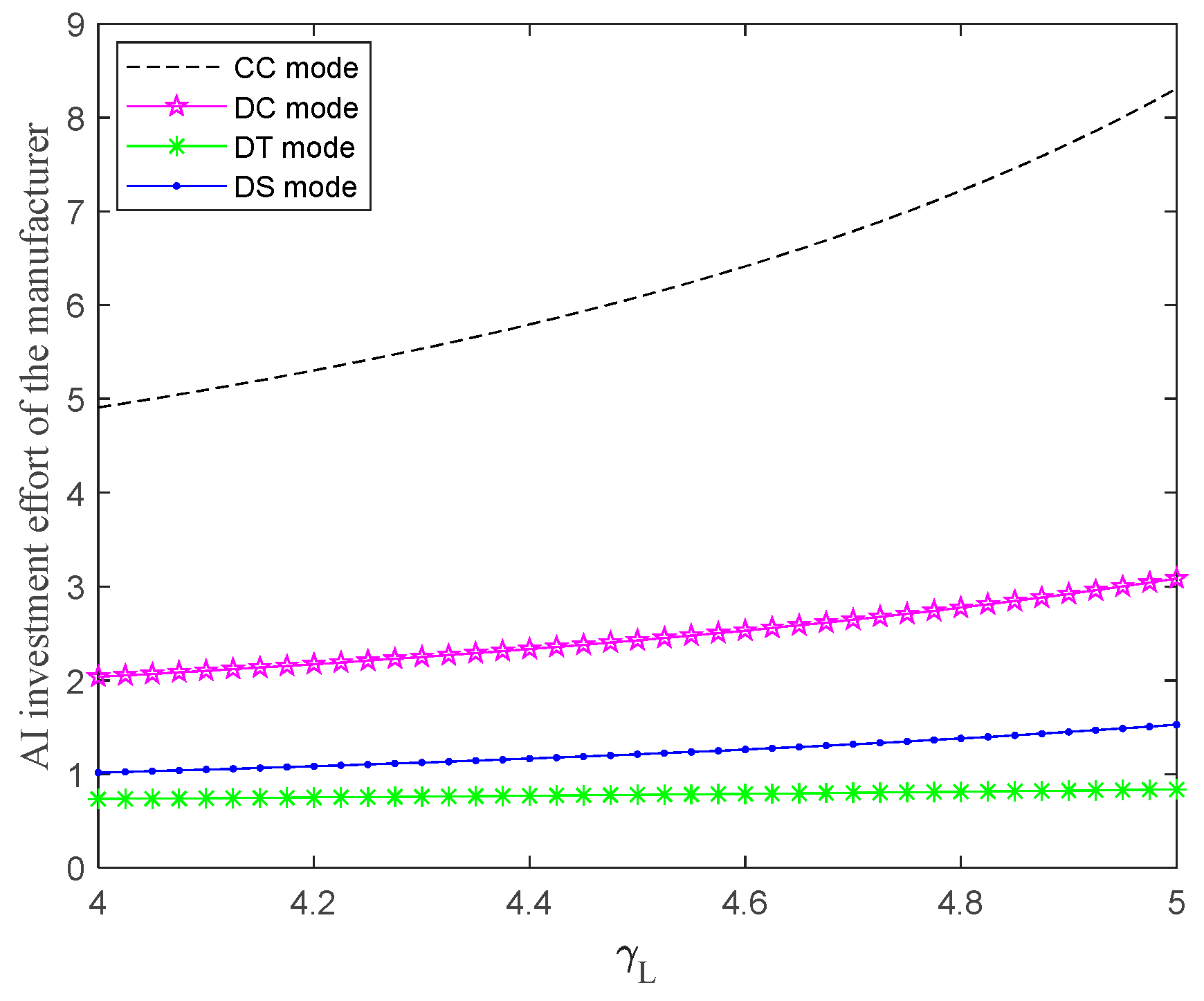

Figure 8.

Effect of sensitivity coefficient on the manufacturer’s AI investment effort.

Figure 8.

Effect of sensitivity coefficient on the manufacturer’s AI investment effort.

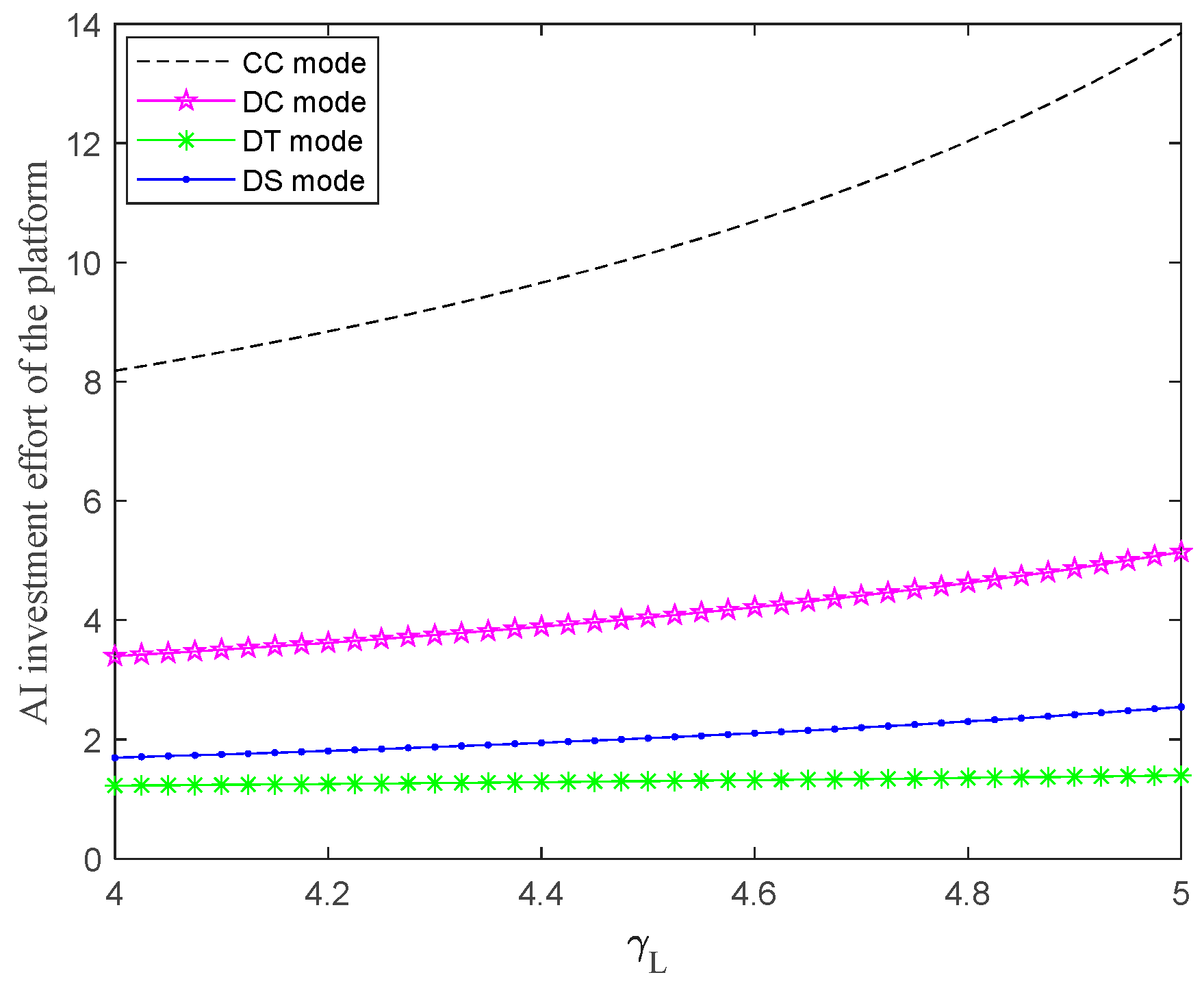

Figure 9.

Effect of sensitivity coefficient on the platform’s AI investment effort.

Figure 9.

Effect of sensitivity coefficient on the platform’s AI investment effort.

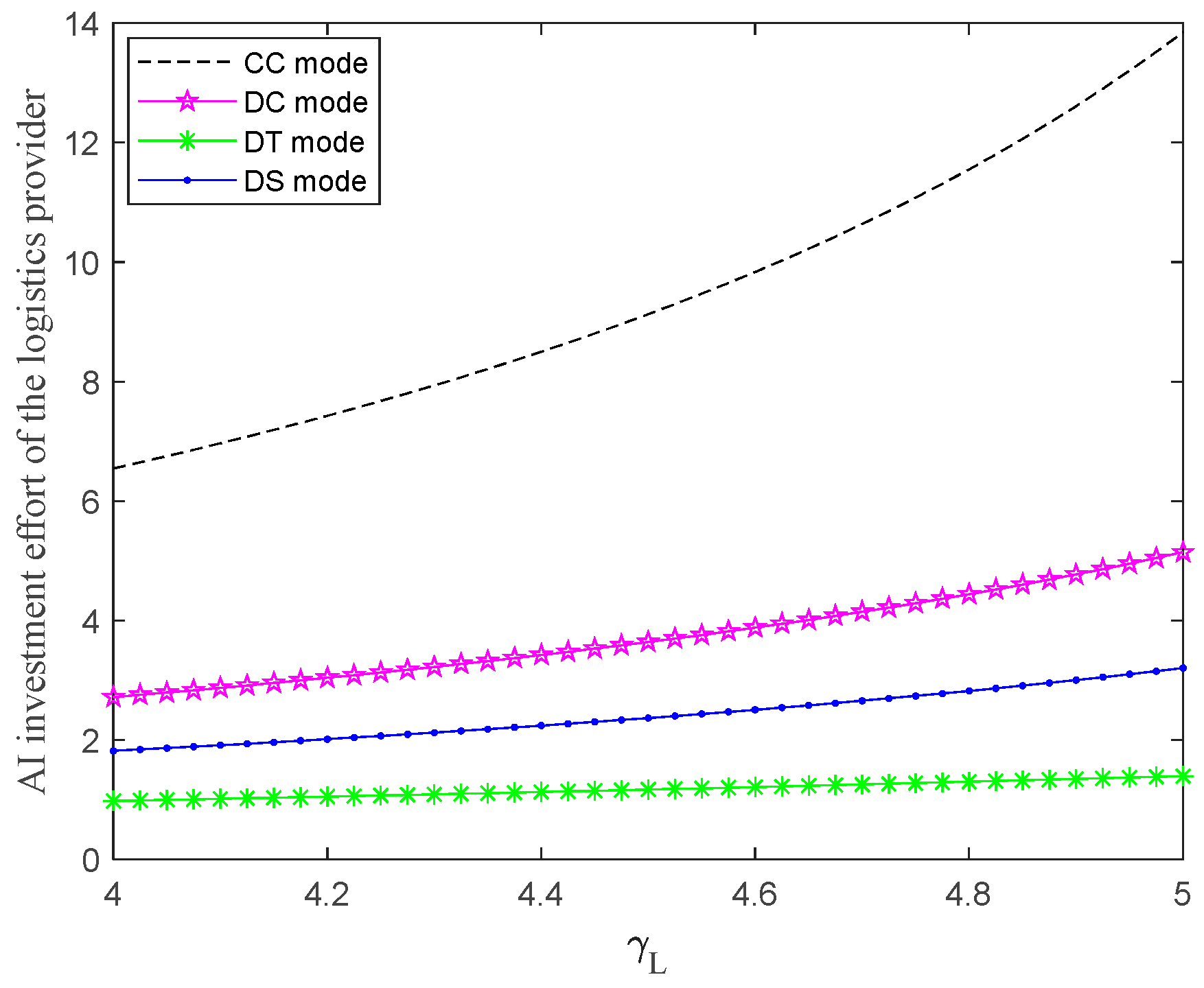

Figure 10.

Effect of sensitivity coefficient on the logistics provider’s AI investment effort.

Figure 10.

Effect of sensitivity coefficient on the logistics provider’s AI investment effort.

As can be seen from the dynamic evolution trends in

Figure 8,

Figure 9 and

Figure 10, with the increase in

, the manufacturer, platform, and logistics provider have shown an upward trend in their investment intensity in the field of AI. This phenomenon intuitively reveals that the sensitivity of market demand to the logistics provider’s AI investment effort has a positive driving effect on the AI investment willingness of supply chain members. Specifically, the higher the sensitivity of market demand to the logistics provider’s AI investment effort, the greater the investment enthusiasm and input level of supply chain members. It is worth noting that the rising trend of centralized decision-making structure is significantly faster than that of the other three structures, which shows that it has outstanding advantages in supply chain resource integration, investment planning, and decision-making efficiency. By unifying objectives, this model can reduce the interest bias of decentralized decision-making, rely on centralized risk-taking and resource allocation ability, respond to market demand changes more quickly, and promote the acceleration of AI investment.

A further horizontal comparison of the investment effort under the four decision-making scenarios shows that the AI investment efforts of the three members, from highest to lowest, are in the order of: centralized structure, partially decentralized structure, coordinated structure, and fully decentralized structure. Compared with the fully decentralized structure, the manufacturer, platform, and logistics provider all show a stronger tendency to invest in AI under the framework of the cost-sharing contract mechanism. This result indicates that a reasonably designed cost-sharing contract can effectively reduce the investment cost pressure on supply chain members, thereby significantly stimulating their investment motivation in the AI field and providing impetus for the digital transformation of the supply chain.

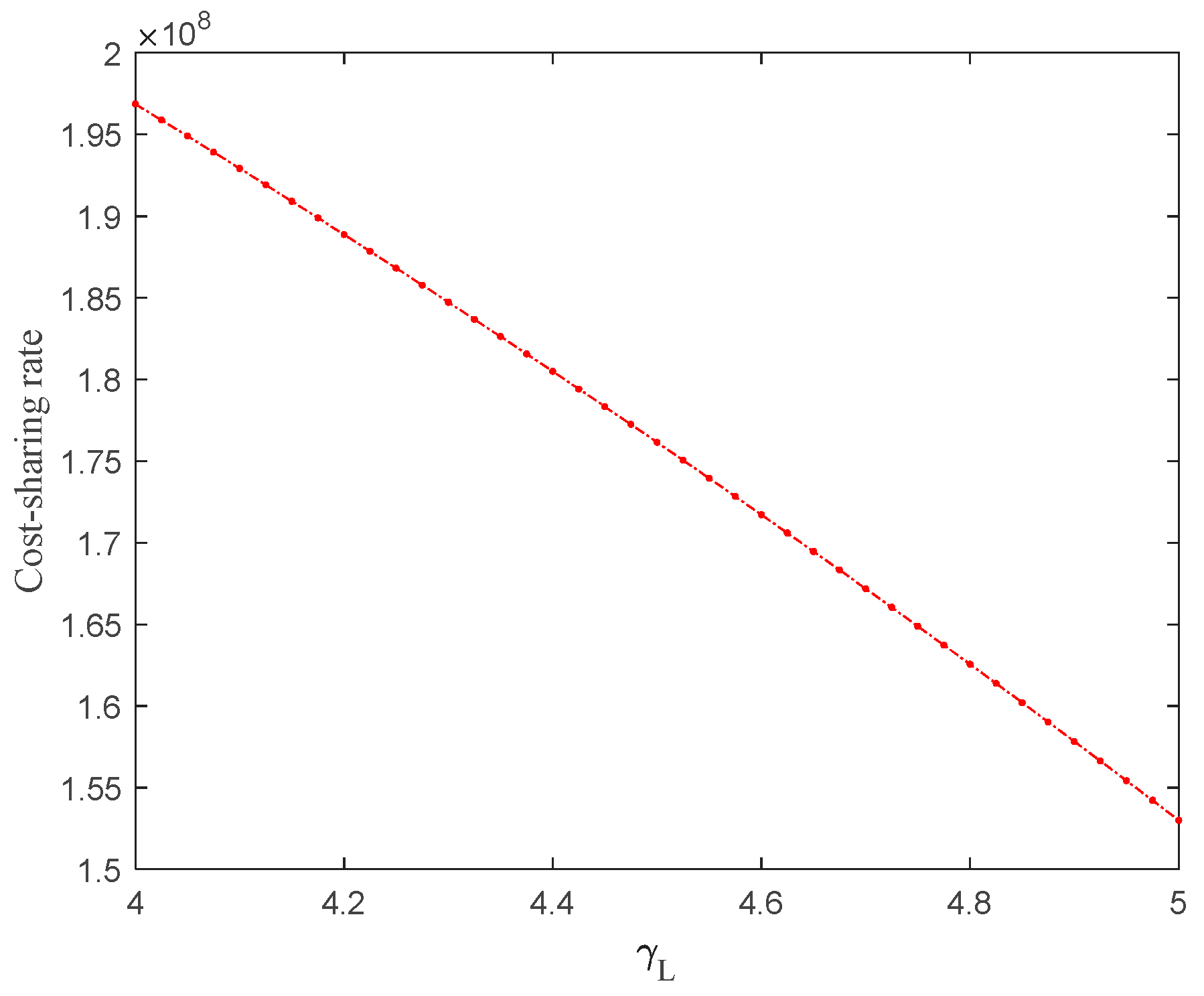

Figure 11.

Effect of sensitivity coefficient on cost-sharing rate.

Figure 11.

Effect of sensitivity coefficient on cost-sharing rate.

As can be seen from

Figure 11, the sensitivity of market demand to the logistics provider’s AI investment effort exerts a negative impact on the cost-sharing rate. This phenomenon stems from the dynamic matching of cost and benefit as well as the substitution effect of incentive mechanisms in the supply chain. When the sensitivity is low, the logistics provider’s AI investment has a limited driving effect on the overall supply chain benefit, with its value mostly confined to optimizing internal operations. If the platform does not share part of the effort cost, the logistics provider will lack investment motivation, and the platform may instead suffer indirect losses due to lagging logistics service. Thus, the platform needs to raise the cost-sharing rate to incentivize investment. When the sensitivity is high, the spillover effect of the logistics provider’s AI investment is significant: such investment not only brings core benefits like order growth and user retention to the platform but also enables the logistics provider itself to gain more profit through increased business volume. At this point, the logistics provider has inherent motivation to invest, allowing the platform to reduce the cost-sharing rate and redirect resources to value-added links such as its own AI marketing, thereby achieving optimal allocation of supply chain cost.

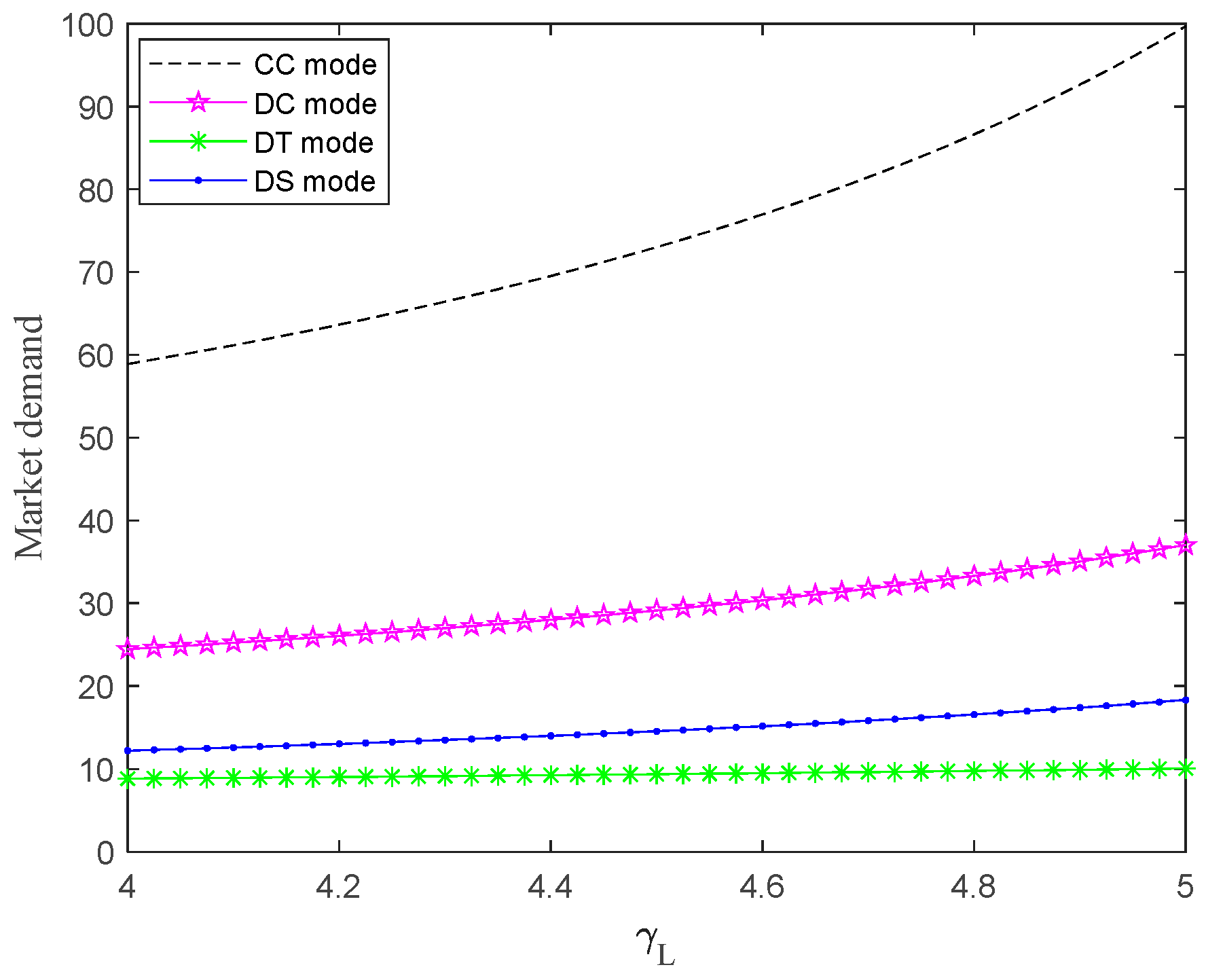

Figure 12.

Effect of sensitivity coefficient on market demand.

Figure 12.

Effect of sensitivity coefficient on market demand.

As can be clearly observed from

Figure 12, market demand shows a gradual growth trend as the sensitivity of market demand to the logistics provider’s AI investment effort increases. This result indicates that the higher the sensitivity of market demand to the logistics provider’s AI investment effort, the more effectively it can drive the growth of market demand. A further comparison of the four decision-making modes reveals that the scale of market demand is the largest under the centralized decision-making mode, while it is the smallest under the fully decentralized decision-making mode. Notably, the level of market demand under the cost-sharing contract mode is higher than that under the fully decentralized decision-making mode, which fully demonstrates the significant effectiveness of a reasonable cost-sharing contract in stimulating the growth of market demand.

Figure 13.

Effect of sensitivity coefficient on profits of supply chain members.

Figure 13.

Effect of sensitivity coefficient on profits of supply chain members.

As can be seen from

Figure 13, with the increase in the sensitivity of market demand to the logistics provider’s AI investment effort, the profits of the manufacturers, platform, and logistics provider all show an upward trend. This indicates that the enhanced sensitivity of market demand to the logistics provider’s AI investment effort can significantly boost the profits of the three members through the supply chain value transmission mechanism. Meanwhile, a comparative analysis shows that under the cost-sharing contract, the profit level of supply chain members is significantly higher than that under the fully decentralized decision-making mode. This result confirms the key role of a reasonable cost-sharing contract in optimizing resource allocation and reducing collaboration cost, thereby exerting a significant promotional effect on improving the overall performance of supply chain members.

7. Extension

In order to encourage the logistics provider to exert more effort in AI technology in the delivery process, the platform can also share part of its revenue with the logistics provider. This section investigates supply chain coordination based on the revenue-sharing contract. Let

represents the revenue-sharing rate by the platform

. The manufacturer determines the wholesale price

and AI investment effort

. The logistics provider determines the logistics price

and AI investment effort

. The platform determines the retail price

, AI investment effort

, and cost-sharing rate

to maximize its profit. Therefore, the profit function of the manufacturer is:

The profit function of the platform is:

The profit function of the logistics provider is:

The optimal results can be obtained by inverse solving and are shown in proposition 5. Please see

Appendix A for the detailed certification process.

Proposition 5. In mode

, the optimal AI investment efforts of supply chain members are given by , , . The optimal wholesale price, retail price, and logistics price are given by , − , . The optimal revenue-sharing rate by the platform is given by . The optimal market demand and profits are given by , , , − , where .

Proposition 5 indicates that the efficiency of the manufacturer’s AI investment effort can always bring a positive impact on the manufacturer’s AI investment effort. This demonstrates that an increase in efficiency of the manufacturer’s AI investment effort incentivises the manufacturer to be more inclined to make an effort. The impact of the platform’s AI investment effort efficiency on its AI investment effort follows the same pattern as that of the manufacturer, and the impact of the logistics’ AI investment effort efficiency on its AI investment effort also aligns with the pattern observed in the manufacturer. It can be seen that an increase in the sensitivity of market demand to supply chain members’ AI investment efforts motivates supply chain members to invest in AI.

With respect to , it is evident that the sensitivity of market demand to the manufacturer’s AI investment effort positively affects the wholesale price. Specifically, a higher sensitivity of market demand to the manufacturer’s AI investment effort incentivizes the manufacturer to raise the wholesale price. Correspondingly, for , the sensitivity of market demand to the platform’s AI investment effort also has a positive impact on the retail price. An increase in the sensitivity of market demand to the platform’s AI investment effort drives the platform to elevate the retail price. Similarly, regarding − , the sensitivity of market demand to the logistics provider’s AI investment effort exerts a positive effect on the equilibrium logistics price. That is, the greater the sensitivity of market demand to the logistics provider’s AI investment effort, the higher the equilibrium logistics price.

For , it is evident that the sensitivity of market demand to the logistics provider’s AI investment effort exerts a positive effect on the revenue-sharing rate. Specifically, when the logistics provider’s AI investment has a stronger marginal contribution to demand growth, the platform is more inclined to increase the proportion of revenue-sharing to incentivise the logistics provider to increase its AI investment so as to optimise the overall supply chain efficiency.

Now let’s compare the impact of a revenue-sharing contract and a cost-sharing contract on the investment decisions and profits of supply chain members. The results are shown in Corollary 8.

Corollary 8. Compared with the revenue-sharing contract, the cost-sharing contract increases the AI investment efforts of the manufacturer, platform, and logistics provider, as well as their profits.

Corollary 8 demonstrates that in the three-tier supply chain consisting of the manufacturer, e-commerce platform, and logistics provider, the cost-sharing contract is significantly superior to the revenue-sharing contract in incentivizing AI investment and boosting profits. The core difference between the two lies in their mechanism design logic; that is, the revenue-sharing contract is oriented towards “ex-post profit distribution”, requiring the three members to bear the upfront costs of AI investments independently. This “independent investment, shared returns” model tends to weaken their investment willingness due to uncertain returns. In contrast, the cost-sharing contract alleviates financial pressure and stimulates the three members’ initiative to increase AI investments through the “ex-ante cost-sharing” mechanism. This collaborative investment strengthens AI’s driving effect on market demand and optimizes overall supply chain operational efficiency, ultimately enabling the three members to achieve higher AI investment intensity and profits than under the revenue-sharing contract.

8. Conclusions and Future Directions

8.1. Conclusions

This study examines a three-tier EPSC consisting of a manufacturer, an e-commerce platform, and a logistics provider, in which market demand is simultaneously affected by the AI investment efforts of these three members and the retail price. Based on Stackelberg game theory, game models under centralized structure, partially decentralized structure, and fully decentralized structure are constructed, and a cost-sharing contract mechanism is designed to achieve the coordination of the supply chain. Through rigorous mathematical derivation and numerical simulation analysis, the following important research findings are obtained:

Firstly, the in-depth analysis of supply chain decision-making models reveals that the cost-sharing contract significantly enhances the motivation of both the manufacturer and the platform to invest in AI. The results demonstrate a distinct gradient in AI investment efforts across different decision-making structures: the centralized structure exhibits the highest investment effort, followed by the partially decentralized structure, with the cost-sharing contract model ranking intermediate, and the fully decentralized structure showing the lowest effort. It is noteworthy that, compared to the partially decentralized structure, the logistics provider demonstrates a greater tendency to increase AI investment under the centralized structure, reflecting a stronger willingness to invest and potential for collaboration.

Secondly, the study shows that under certain conditions, the cost-sharing contract can positively influence the effort input of the logistics provider. Under the fully decentralized structure, the correlation between the logistics provider’s effort and the cost-sharing contract primarily depends on the effort cost associated with AI investment. When the effort cost faced by the logistics provider falls within a reasonable range, the platform can effectively incentivize the logistics provider to increase its effort motivation and input by sharing a portion of the cost. However, if the effort cost is excessively high, even with cost-sharing support from the platform, the logistics provider lacks sufficient incentive to enhance its effort due to the imbalance between benefits and costs.

Thirdly, when the total cost efficiency of the three AI investments decision-makers is higher than the marginal effect of the retail price on market demand, the retail price and AI investment efforts exhibit an isotropic relationship. Furthermore, in comparisons across different structures, the wholesale price and manufacturer profit under the partially decentralized structure are significantly higher than those under the fully decentralized structure. This result indicates that the partially decentralized structure, by optimizing resource allocation and risk-sharing mechanisms, is more conducive to enhancing product pricing power and protecting manufacturer profit.

Moreover, this study introduces a revenue-sharing contract as a comparative mechanism in extended analyses to further validate the effectiveness of the proposed cost-sharing contract. The results show that under the cost-sharing contract, the AI investment efforts and profits of the manufacturer, platform, and logistics provider are significantly higher than those under the revenue-sharing contract. This finding further demonstrates that the cost-sharing contract designed in this study not only exhibits sound coordination properties in theory but also offers greater practicality and incentivizing effects in practice. It is particularly suitable for digital supply chain scenarios requiring high upfront technological investments, providing targeted management insights and contractual design references for promoting the adoption and application of artificial intelligence technology in the supply chain.

8.2. Managerial Implications

This study reveals the impact of pricing, supply chain structure, AI investment effort, and cost-sharing contract on the overall performance of the three-tier e-commerce supply chain. From the perspective of the e-commerce platform, these findings provide important management implications, emphasizing the core role of collaborative strategies, cost-sharing mechanisms, and structural optimization in improving supply chain efficiency, competitiveness, and sustainability.

Firstly, the platform should recognize the synergistic potential between retail price and AI investment efforts under isotropic conditions. When the total cost efficiency is high, increasing AI investment efforts does not necessarily lead to a higher retail price but may instead achieve a win-win outcome through demand expansion. The platform should leverage this characteristic to balance pricing and investment strategies, avoiding over-reliance on price competition and instead enhancing differentiated advantages through AI-driven value-added services.

Secondly, the platform should proactively promote the implementation of the cost-sharing contract to incentivize supply chain members to increase their AI investment efforts. This study shows that the cost-sharing contract can significantly enhance the investment motivation of three members, particularly under the fully decentralized structure. By sharing part of the cost, the platform can effectively alleviate the cost pressure on partners, thereby encouraging greater effort. For instance, the platform can design dynamic contract mechanisms that flexibly adjust the cost-sharing rate based on the marginal returns and cost efficiency of AI investment. This not only strengthens the willingness to cooperate among supply chain members but also facilitates deeper integration and application of AI technologies, ultimately boosting market demand and overall supply chain profits.

Thirdly, the platform needs to optimize the decision-making structure by prioritizing partially decentralized or centralized structures to maximize the benefits of AI investment. Research findings indicate that AI investment efforts are highest under the centralized structure, followed by the partially decentralized structure, and lowest under the fully decentralized structure. This suggests that the platform should strengthen collaborative integration with the manufacturer and logistics provider through information sharing, joint decision-making, and risk sharing to reduce double marginalization effects. For example, the platform can take the lead in establishing a supply chain collaboration platform, using data-driven tools to monitor demand fluctuations and investment outcomes in real time, thereby coordinating the efforts of three members.

Lastly, the platform should focus on the effort cost range of the logistics provider to ensure the effectiveness of cost-sharing contracts. The study points out that when the effort cost of the logistics provider is within a reasonable range, cost-sharing can positively influence their work input; however, if the cost is too high, even with support, the incentive effect may be limited. Therefore, the platform must evaluate the cost structure of the logistics provider and reduce its effort cost through technical assistance, process optimization, or economies of scale collaboration. For instance, the platform can invest in shared AI infrastructure to reduce the initial investment burden on the logistics provider.

The model of this study can be applied to many industries in reality, such as the fresh e-commerce industry, the 3C digital industry, and the fast-moving consumer goods industry. Taking Freshippo as an example, its supply chain includes the fresh produce base (manufacturer), Freshippo platform (e-commerce platform), and the enterprise responsible for cold chain delivery (logistics provider). The fresh produce base uses AI technology as the core to improve product quality and provide high-quality fresh food for the supply chain. The Freshippo platform relies on AI technology to push personalized products and marketing activities, and deploys intelligent customer service to handle inquiries and enhance user experience. The cold chain logistics provider uses AI temperature control systems to monitor delivery temperatures in real time and dynamic route planning algorithms to optimize delivery efficiency, thereby improving the on-time delivery rate. However, one of the core pain points of the fresh food supply chain is the control of fresh food loss and the improvement of delivery timeliness in the logistics link. AI technology (such as intelligent temperature control monitoring and dynamic route planning systems) is a key solution. Nevertheless, when the logistics provider bears the research and deployment costs of AI systems alone, its willingness to invest tends to decrease due to the long return cycle. At this point, based on the model proposed in this paper, the Freshippo platform can sign a cost-sharing contract with its cooperative cold chain logistics provider to directly incentivize it to increase effort in AI applications. Ultimately, a win-win situation is achieved where the platform’s order fulfillment rate is improved and the logistics provider’s operational efficiency is enhanced.

8.3. Limitations and Future Directions

This study still has several limitations that point to valuable directions for future research. First, we assume that all decision-makers are fully rational, whereas in reality, participants often exhibit bounded rationality. Therefore, subsequent research could adopt a bounded rationality framework to further explore the behavioral mechanisms of supply chain members in artificial intelligence investment, pricing, and effort decisions. Second, this paper assumes that market demand is deterministic; however, actual demand is often uncertain due to the multi-sided nature of the e-commerce platform. Therefore, future research may introduce a random variable into the demand function, for instance, , to better characterize demand uncertainty. Third, this paper treats demand as a static function of price and AI investment efforts. In future research, dynamic factors such as brand loyalty could be considered to examine their impact on demand, and differential games could be employed to explore pricing, effort decisions, and contract design in the three-tier supply chain.