Abstract

Prior research has focused on the technical and institutional challenges of blockchain adoption. However, little is known about how blockchain ventures claim categorical space in the market and how such domain positioning influences their visibility and evaluation. This study investigates the relationship between strategic domain positioning and market recognition among blockchain-based ventures, with a particular focus on applications relevant to e-commerce, such as non-fungible tokens (NFTs) and decentralized finance (DeFi). Drawing on research on categorization, legitimacy, and the technology lifecycle, we propose a domain lifecycle perspective that accounts for the evolving expectations and legitimacy criteria across blockchain domains. Using BERTopic, a transformer-based topic modeling method, we classify 9665 blockchain ventures based on their textual business descriptions. We then test the impact of domain positioning on market recognition—proxied by Crunchbase rank—while examining the moderating effects of external validation signals such as funding events, media attention, and organizational age. Our findings reveal that clear domain positioning significantly enhances market recognition, but the strength and direction of this effect vary by domain. Specifically, NFT ventures experience stronger recognition when young and less institutionally validated, suggesting a novelty premium, while DeFi ventures benefit more from conventional legitimacy signals. These results advance our understanding of how categorical dynamics operate in emerging digital ecosystems and offer practical insights for e-commerce platforms, investors, and entrepreneurs navigating blockchain-enabled innovation.

1. Introduction

Blockchain technology, originally developed as the underlying infrastructure for Bitcoin, has undergone a significant transformation over the past decade. It has emerged as a general-purpose technology capable of reshaping industries far beyond its cryptocurrency origins [1,2]. A growing body of research highlights its application in diverse domains such as intellectual property protection [3], sustainability-oriented supply chains [4], internationalization strategies for SMEs [5], and collaborative value creation in co-innovation ecosystems [6]. These developments point to blockchain’s role not only as a distributed ledger but as an enabler of new business architectures built on decentralization, transparency, and programmable trust [7].

The growing diversity of blockchain use cases reflects an important evolution in the ecosystem. Where early ventures were primarily focused on cryptocurrency exchanges and token services, more recent entrants have targeted sectors including healthcare, finance, logistics, intellectual property, and digital content [1,8]. Patent-based and text-mining studies have also demonstrated the increasing complexity of the blockchain knowledge space, suggesting a movement toward industrial specialization and domain-specific innovation [9]. These trends align with broader observations in technology management research that emphasize how emerging technologies evolve through domain-specific differentiation and application layering [10]. Our analysis of over 4000 blockchain ventures between 2010 and 2021 reveals a clear shift in strategic focus—from enterprise-oriented solutions to consumer-facing domains such as non-fungible tokens (NFTs), metaverse platforms, and decentralized finance (DeFi).

Despite these advances, a core conceptual and empirical gap remains: the systematic understanding of how blockchain ventures position themselves—and how such domain choices shape market recognition—remains limited. Much of the existing literature focuses on the technical feasibility, innovation potential, or sectoral challenges associated with blockchain implementation [11,12]. Yet there is a limited understanding of how blockchain ventures strategically occupy and signal their position within a complex and emerging business ecosystem and how these positioning choices interact with other organizational characteristics, such as age and external validation signals.

This gap is significant given the importance of external validation and stakeholder recognition in emerging technologies [13,14]. In a decentralized and still ambiguous market like blockchain, a company’s ability to attract investment, gain media attention, or achieve public legitimacy may depend as much on how it defines and communicates its domain as on its technological novelty. As Moore (1993) and Adner (2017) argue, the “authority establishment” phase of a business ecosystem requires actors to assert domain leadership and coordinate meaning systems. Strategic positioning becomes a crucial pathway to legitimacy and visibility [15,16].

This positioning process is particularly complex in blockchain for three reasons. First, the technology itself spans both technical infrastructure and cultural innovations, creating diverse institutional logics that ventures must navigate. Second, many blockchain domains—particularly those related to NFTs and decentralized finance—embody ideological commitments to decentralization and disintermediation that may generate tensions with traditional legitimacy signals from institutional actors [17,18]. Third, the rapidly evolving nature of the ecosystem means that domains are at different lifecycle stages, potentially creating variation in how positioning affects recognition [19].

We argue that these dynamics create a unique context for studying how domain positioning, external validation, and temporal factors interact to shape market recognition. Building on Anderson and Tushman’s (1990) technology lifecycle framework, we propose a domain lifecycle theory of legitimacy that accounts for the differential effects of positioning, external validation, and organizational age across domains at different evolutionary stages [20]. This perspective suggests that emergent domains like NFTs may privilege different legitimacy signals than more established domains like DeFi, with important implications for how ventures gain recognition in each space.

This paper addresses three interrelated research questions. First, how can blockchain companies be systematically classified into strategic business domains using firm-level data? Second, how does domain positioning affect market recognition? Third, what role do external legitimacy signals—such as investment rounds and media exposure—play in this relationship, in conjunction with firm-level attributes such as age?

To answer these questions, we apply BERTopic, a transformer-based topic modeling method that leverages document embeddings and class-based TF-IDF to cluster unstructured business descriptions. We apply this method to a dataset of 9665 blockchain firms collected from Crunchbase, one of the largest global platforms for startup intelligence. This technique allows us to move beyond pre-assumed categories and derive strategic domains grounded in semantic patterns of how firms describe their value propositions. Compared to traditional approaches such as LDA, BERTopic offers better interpretability, contextual awareness, and practical utility in classifying heterogeneous business models [21,22].

We then test the relationship between domain positioning and market recognition—proxied by Crunchbase rank—using a multivariate regression model that controls for other explanatory factors that might affect market recognition. Most crucially, we examine interaction effects between domain positioning and three key factors: funding history, media attention, and organizational age. These interactions allow us to test our domain lifecycle theory by revealing how the relationship between positioning and recognition is contingent on external validation and temporal factors.

Our findings reveal several important insights. First, while domain positioning generally enhances market recognition, the strength of this effect varies significantly across domains. NFT and DeFi ventures show particularly strong recognition advantages. Second, and more importantly, we find evidence for domain-specific legitimacy dynamics: in the NFT domain, external validation through funding and media attention paradoxically weakens recognition benefits, while organizational age shows a similar negative interaction. In contrast, the DeFi domain shows weaker or non-significant interactions with these factors. These findings support our domain lifecycle theory by demonstrating that legitimacy mechanisms operate differently across domains based on their evolutionary stage and institutional characteristics.

These insights extend beyond the blockchain ecosystem to inform our understanding of digital platform evolution more broadly. Particularly for e-commerce research, our findings offer valuable implications as blockchain increasingly intersects with online marketplace dynamics. Blockchain technology holds the potential to address fundamental challenges in e-commerce—trust, intermediary dependence, transaction transparency, and digital asset ownership [23,24]. The two domains we examine in detail illustrate this potential: NFTs expand the scope of e-commerce by enabling scarcity, ownership, and resale of digital goods [25], while DeFi transforms traditional e-commerce infrastructure by decentralizing payment systems and consumer finance [26].

The positioning and legitimacy dynamics we uncover are especially relevant for understanding how these blockchain-based innovations might reshape e-commerce platforms. Similarly to established e-commerce marketplaces, blockchain-based ventures depend on network effects and multi-sided market dynamics [1,27] but face distinct challenges in establishing legitimacy. Our domain lifecycle theory helps explain why certain blockchain innovations gain traction while others struggle, providing insights into how e-commerce platforms might strategically incorporate these technologies and how new blockchain-based marketplaces might successfully position themselves against incumbents.

This study makes four contributions. First, it introduces a domain lifecycle perspective that explains how the relationship between positioning and recognition evolves across domains at different stages. Second, it provides a novel, scalable method for mapping the business domains of blockchain firms based on actual textual narratives. Third, it empirically demonstrates that domain positioning has significant effects on market recognition, with certain domains—such as NFT and DeFi—associated with greater but potentially volatile visibility. Fourth, it reveals the paradoxical effects of external validation signals in culturally charged domains, challenging the assumption that funding and media attention uniformly enhance recognition.

The remainder of the paper is structured as follows: Section 2 develops the theoretical framework and hypotheses. Section 3 describes the data, BER Topic modeling process, and empirical strategy. Section 4 presents the main results. Section 5 discusses theoretical and practical implications, and Section 6 concludes.

2. Theoretical Framework and Hypotheses

2.1. Domain Positioning and Market Recognition

Blockchain-based ventures do not operate in a domain-neutral environment. Rather, they actively construct and signal their domain identities to gain recognition from key stakeholders. The theoretical basis for understanding these positioning strategies draws on three interrelated studies: business ecosystems, market categorization, and legitimacy theory.

First, the business ecosystem perspective offers crucial insights into how organizational positioning shapes competitive dynamics in interconnected technology markets. Moore’s (1993) pioneering work on business ecosystems identified how firms must co-evolve with partners across industry boundaries, progressing through distinct lifecycle stages of birth, expansion, leadership, and renewal [15]. Each stage presents different positioning challenges, with early-stage ecosystems characterized by domain formation and boundary definition. Adner (2017) further developed this framework by conceptualizing ecosystems as the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize [16]. This definition highlights how ecosystem participants must establish their position within a complex web of complementary activities. In rapidly emerging ecosystems like blockchain, ventures face the dual challenge of defining their role within an evolving value structure while simultaneously differentiating themselves from competitors. Unlike mature markets with established category systems and industry standards, emergent ecosystems require ventures to actively contribute to the formation of new domains, while simultaneously competing for attention and resources within those emerging spaces [28].

Second, recent research in technology and innovation categories highlights how the construction and adoption of categorical identities are crucial to how emerging technologies are evaluated and legitimated. Rather than operating within pre-existing classification systems, ventures in nascent fields like blockchain often confront a lack of established categories, requiring them to participate actively in the process of category formation [29,30]. In such contexts, firms must not only articulate a compelling value proposition but also construct the very categorical frames that enable stakeholders to interpret and assess their innovation.

This process is inherently social and contested. Glynn and Navis (2013) emphasize that categorical identity is shaped through narratives that communicate a coherent organizational persona, especially in technologically novel or ambiguous spaces [31]. For ventures in emergent technological domains, domain positioning becomes a performative act that claims membership within a proto-category while also differentiating from other entrants. Firms that clearly signal alignment with recognizable, interpretable domains are more likely to be understood and legitimated by investors, media, and consumers [32]. Conversely, ambiguous or straddling positions may delay recognition, create confusion, or lead to discounting by evaluators.

The domain positioning dynamics we explore are particularly relevant to understanding blockchain’s transformative potential in e-commerce. NFTs and DeFi represent distinct but complementary pathways through which blockchain technology is reshaping digital commerce. Non-fungible tokens fundamentally alter e-commerce by enabling the verifiable scarcity and ownership of digital assets—creating new markets for digital goods that were previously difficult to monetize due to infinite reproducibility. Decentralized finance, meanwhile, reconfigures the financial infrastructure of e-commerce by enabling programmable, trustless transactions without traditional intermediaries, potentially reducing costs and friction in payments, financing, and settlement [17,18]. By examining how ventures position themselves within these domains and how such positioning affects recognition, we gain insight into the legitimacy mechanisms that may accelerate or constrain blockchain’s integration into mainstream e-commerce platforms.

In the blockchain space, where formal category systems are still fluid, domain positioning—especially through textual self-description—functions as a key mechanism of categorical construction. By aligning with or helping define emerging domains such as NFTs or DeFi, ventures make themselves legible within the broader ecosystem and enhance the interpretability of their innovation for key audiences. Non-fungible tokens (NFTs) refer to blockchain-based representations of unique digital assets—such as art, collectibles, or in-game items—that are often valued for their symbolic meaning, cultural relevance, and scarcity. In contrast, decentralized finance (DeFi) encompasses blockchain applications that replicate or replace traditional financial services like lending, staking, and trading, emphasizing transparency, disintermediation, and protocol-driven governance. These two domains differ not only in their technical focus but also in their stakeholder logics and legitimacy pathways.

Third, legitimacy acquisition in such contexts is also shaped by technological novelty and the socio-symbolic content of external signals. Prior research shows that signals like funding rounds and media attention play a crucial role in reducing uncertainty around emerging technologies [33,34]. However, Wry et al. (2011) suggest that the effectiveness of such signals depends on categorical clarity and cultural resonance [32]. In ideologically charged or symbolically contested domains—such as NFTs—these very signals may undermine perceived authenticity or provoke skepticism among evaluators. Thus, the legitimacy of blockchain ventures is not only a function of signal strength but also of categorical meaning and alignment.

Building on these foundations and incorporating insights from the technology lifecycle literature [15,20], we argue that blockchain domains evolve along distinct trajectories, each shaped by different mechanisms of legitimacy acquisition over time. Domains in early stages of emergence, such as NFTs, tend to privilege novelty, symbolic value, and cultural resonance, whereas more established domains like DeFi emphasize a balance between innovation, functional robustness, and compliance with institutional expectations. This temporal evolution leads to domain-specific variation in how external validation signals—such as funding and media coverage—influence market recognition.

Our first hypotheses reflect the core proposition that clear domain positioning enhances recognition by offering stakeholders cognitively accessible frames through which they can interpret and evaluate blockchain ventures. NFT and DeFi domains represent two of the most prominent and culturally salient applications of blockchain technology, each projecting distinct value propositions that resonate with different stakeholder audiences. While our study focuses primarily on NFT and DeFi domains as representative cases of culturally driven and infrastructure-oriented blockchain applications, respectively, we acknowledge the broader ecosystem encompasses numerous other domains, including supply chain management, digital identity, healthcare records, and governance applications. These domains likely exhibit their own positioning dynamics and legitimacy pathways. However, NFTs and DeFi represent particularly salient domains for understanding blockchain’s intersection with commercial applications and consumer markets, making them valuable focal points for theoretical development and hypothesis testing. Future research could extend our domain lifecycle framework to examine additional blockchain domains as they mature and differentiate. We develop the following hypotheses:

Hypothesis 1a (H1a).

Ventures operating in NFT-related domains will experience higher market recognition than those in other domains.

Hypothesis 1b (H1b).

Ventures operating in DeFi/Staking-related domains will experience higher market recognition than those in other domains.

2.2. The Moderating Role of Funding Events

The logic behind our next hypotheses stems from three key theoretical considerations on how external validation interacts with domain-specific identity construction and legitimation processes. First, Battilana and Dorado (2010) demonstrate that organizations face legitimacy trade-offs when attempting to integrate conflicting institutional logics [17]. In the NFT domain—where symbolic value, community autonomy, and cultural resistance are central—external funding from traditional investors may activate a commercial–institutional logic that contradicts these foundational identity claims. This creates a form of authenticity tension, wherein mainstream validation undermines perceived commitment to the core values of the domain. Such tensions are particularly salient in cultural fields, where symbolic boundaries between “insiders” and “outsiders” are strongly maintained and actively policed.

Second, Navis and Glynn (2010) argue that organizations in nascent fields establish legitimacy through identity narratives that convey coherent membership within a nascent category [30]. In the context of NFTs, identity claims often emphasize decentralization, creator empowerment, and resistance to hierarchical structures. Accumulating multiple rounds of institutional funding may be interpreted as compromising this identity, generating identity dissonance—a perceived misalignment between the venture’s projected self-definition and stakeholder expectations—particularly among community gatekeepers and early adopters.

Third, Kennedy and Fiss (2013) highlight that early-stage market categories are marked by fluid boundaries and less institutionalized identity criteria, making them especially vulnerable to symbolic contamination [35]. Given that the NFT domain remains in an earlier phase of institutionalization compared to DeFi, signals like external funding are more likely to be scrutinized for perceived authenticity violations. In contrast, the more mature DeFi domain—with its institutional logic oriented toward financial infrastructure and technical performance—may accommodate such signals more easily. Thus, we expect a weaker negative interaction effect in DeFi than in NFTs.

Hypothesis 2a (H2a).

Funding events negatively moderate the relationship between domain positioning and market recognition for ventures operating in the NFT domain.

Hypothesis 2b (H2b).

The negative moderating effect of funding events is stronger in the NFT domain than in the DeFi/Staking domain.

2.3. The Moderating Role of Media Attention

Our third set of hypotheses builds on three complementary mechanisms linking media attention to domain-specific legitimacy. First, Stern, Dukerich, and Zajac (2014) argue that a misalignment between a signal’s framing and the value system of its intended audience leads to signal incongruence, which may reduce rather than enhance recognition [36]. In the NFT domain, media coverage often emphasizes spectacular sales, celebrity involvement, or hype cycles—frames that misalign with community values of creative authenticity and autonomy.

Second, media legitimation theory emphasizes that framing—not just volume—shapes audience evaluation [34]. NFT coverage tends to adopt speculative or commercial frames, whereas DeFi media narratives often highlight protocol design or financial infrastructure—frames more congruent with technocratic expectations. Thus, media attention may function as a congruent signal for DeFi but a conflicting one for NFTs.

Third, Peterson (2005) shows that authenticity is threatened by perceived commercialization in symbolically charged cultural fields [37]. The NFT domain, grounded in artistic and symbolic production, is especially vulnerable to authenticity penalties when commercial frames dominate. In contrast, DeFi’s utilitarian logic insulates it from such threats.

Hypothesis 3a (H3a).

Media attention negatively moderates the relationship between domain positioning and market recognition for ventures operating in the NFT domain.

Hypothesis 3b (H3b).

The negative moderating effect of media attention is weaker in the DeFi/Staking domain than in the NFT domain.

2.4. The Moderating Role of Organizational Age

Our final hypotheses explore how organizational age shapes legitimacy outcomes across domain lifecycle stages. First, organizational imprinting theory suggests that founding conditions durably shape firm identity and routines [38,39]. In fast-evolving domains like NFTs, older firms may carry legacies from earlier blockchain paradigms, making them more prone to structural inertia and less adaptable to shifting domain norms [40].

Second, according to March’s (1991) exploration–exploitation framework, younger firms in novel domains often benefit from a novelty premium—that is, higher recognition due to perceptions of innovativeness and creative alignment [41]. The NFT domain, in its early-stage, culturally infused form, exemplifies this effect.

Third, legitimacy requirements evolve over time. Aldrich and Fiol (1994) suggest that early-stage domains emphasize identity-based legitimacy, while mature domains shift toward output and process legitimacy [13]. Fisher et al. (2017) provide empirical support for this temporal evolution. As such, NFT ventures are more sensitive to age-related penalties than DeFi ventures, which reward both novelty and accumulated expertise [19].

Hypothesis 4a (H4a).

Organizational age negatively moderates the relationship between domain positioning and market recognition for ventures operating in the NFT domain.

Hypothesis 4b (H4b).

The negative moderating effect of organizational age is weaker in the DeFi/Staking domain than in the NFT domain.

These hypotheses collectively advance a domain lifecycle theory of legitimacy, suggesting that the value of different positioning strategies and external signals varies systematically across domains and over time in the blockchain ecosystem.

3. Methodology

3.1. Sample Collection and Data Sources

Our primary dataset consists of blockchain-related companies listed in Crunchbase, a widely used platform that aggregates structured and unstructured data on startups, investors, and funding activities. We retrieved company records through a keyword search for “blockchain” in business descriptions, industry tags, and company overviews. After filtering for companies with sufficient text content and valid founding year and location information, we obtained a final sample of 9665 firms spanning from 1990 to June 2021.

From our initial sample of 9665 blockchain companies, our regression analysis included 8529 observations due to missing values in key variables such as Crunchbase rank, funding information, or geographical data, which necessitated the exclusion of approximately 12% of companies from the final analysis. This sample size reduction is consistent with similar studies utilizing commercial databases that contain some incomplete records, and our final sample remains sufficiently large for robust statistical analysis.

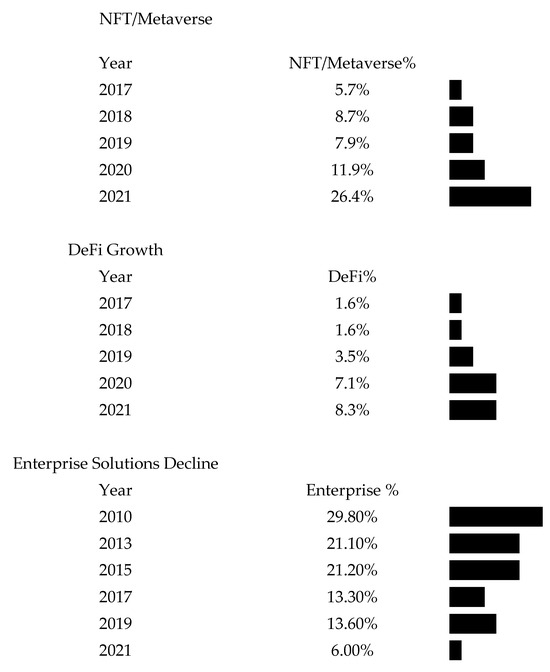

To provide context for our analysis of domain positioning, we conducted an exploratory investigation of how the blockchain ecosystem evolved over time. Using Structural Topic Modeling (STM) on company business descriptions, we identified clear structural shifts: enterprise-focused applications declined from 29.8% in 2010 to 6.0% in 2021, while consumer-facing domains expanded significantly. In particular, NFT/metaverse ventures grew from 7.0% to 26.4%, and DeFi applications rose from 0.9% in 2015 to 8.3% in 2021. These patterns provide theoretical grounding for our domain lifecycle perspective. Detailed results are presented in Appendix A.

This exploratory analysis established the context for our company-level analysis, highlighting how different domains emerged at different times and evolved at different rates—a pattern consistent with our domain lifecycle theory.

3.2. Variables

3.2.1. Dependent Variable

Market Recognition: Operationalized using Crunchbase rank (F_cb_rk_scaled), which reflects a company’s visibility and attention in the startup ecosystem. Crunchbase calculates this rank based on various signals including web traffic, social media mentions, news coverage, and profile completeness. Since lower numerical ranks indicate greater recognition, we reverse-coded and normalized the values to range from 0 to 1, with higher values representing greater recognition. This variable represents a snapshot of recognition at our data collection date (30 June 2021).

3.2.2. Independent Variables

Domain positioning is operationalized through the BERTopic results described above. For each company, we created a set of dummy variables (Topic_0 through topic_13) indicating its primary domain assignment. For companies in the undefined category (−1), we created a separate dummy variable (Topic_undefined). In our regression models, these domain indicators serve as the key independent variables to test the relationship between strategic positioning and market recognition.

To identify the strategic domains to which each company belongs, we implemented BERTopic, a transformer-based topic modeling framework developed by Grootendorst (2022). Unlike traditional approaches such as Latent Dirichlet Allocation (LDA), which rely on bag-of-words assumptions, BER Topic utilizes contextual embeddings to capture the semantic meaning of business descriptions. The process consisted of five steps:

- Text Preprocessing: All business descriptions were lowercased and stripped of stop words, symbols, and non-English characters. Missing values were handled using zero-padding with blank strings.

- Embedding Generation: Each document was converted into a dense vector representation using the all-MiniLM-L6-v2 Sentence Transformer, a BERT-based model optimized for sentence similarity. These embeddings capture contextual and semantic nuances beyond word frequency.

- Dimensionality Reduction: To facilitate clustering, we applied Uniform Manifold Approximation and Projection (UMAP) to reduce the high-dimensional embeddings into a 2D representation while preserving local structure.

- Clustering: Hierarchical Density-Based Spatial Clustering (HDBSCAN) was used to group documents into semantically coherent clusters. Unlike k-means, this method does not require the number of clusters to be pre-specified and can detect noise or outliers (assigned to a “−1” undefined group).

- Topic Labeling and Refinement: For each resulting topic, we extracted top n-grams using class-based TF-IDF. They were manually reviewed to generate interpretable topic names representing business domains.

Through iterative testing and model evaluation, we identified an optimal topic model comprising 14 topics that captured meaningful thematic distinctions within the blockchain ecosystem. Each firm was assigned to the topic with the highest probability score based on its business description. Several topics correspond well with recognizable blockchain subdomains, including NFT/digital art (Topic 3), gaming (Topic 2), energy applications (Topic 5), cannabis-related ventures (Topic 6), metaverse and virtual reality (Topic 7), and DeFi/staking-related applications (Topic 9).

However, a substantial portion of firms fell into two broadly defined categories that lack strong thematic coherence: an “unclassified” cluster (Topic 1), encompassing 44.08% of firms, and a “miscellaneous blockchain” category (Topic 0), comprising 39.34%. Topic 1 is primarily characterized by sparse or generic language in firm descriptions, often dominated by functional buzzwords such as “platform,” “token,” or “solution,” which offer limited insight into specific application domains. Topic 0, while somewhat more descriptive, still aggregates ventures that reference blockchain technologies without coalescing around a well-defined thematic focus.

The predominance of these two catch-all categories—together comprising over 83% of the sample—underscores a key limitation of the topic modeling approach. Specifically, the model’s capacity to differentiate firms by their strategic domain positioning is constrained by the nature of the input text, which often lacks the granularity or specificity needed to generate distinct thematic classifications. This limitation reflects not only the early-stage and heterogeneous character of many blockchain ventures but also the inherent challenges of categorizing firms based solely on brief and frequently ambiguous business descriptions.

It is also important to acknowledge that our focal domains of interest—NFT/digital art (Topic 3) and DeFi/staking protocols (Topic 9)—account for relatively small portions of the overall sample at 2.00% (193 firms) and 0.29% (28 firms), respectively. This distribution reflects both the emerging nature of these domains during our study period and the challenges of definitively categorizing firms in an evolving ecosystem. The relatively small number of identified DeFi companies in particular represents a limitation when interpreting results related to this domain. However, the statistical significance of our findings despite this sample size constraint suggests robust relationships worthy of investigation, though the results should be interpreted with appropriate caution.

Each firm was assigned two outputs from the topic model:

- A primary topic assignment, indicating the most representative domain.

- A vector of topic probabilities, reflecting the firm’s relative degree of affiliation across all 14 topics.

For our hypothesis testing, we concentrated on two focal domains: Topic 3 (NFT/digital art) and Topic 9 (DeFi/staking). These two domains represent distinct points along the industry lifecycle, with NFTs characterized by recent, explosive growth and DeFi by a relatively more mature, infrastructure-oriented trajectory.

Drawing on the temporal evolution patterns revealed by our Structural Topic Modeling analysis (see Appendix A), we conceptualize NFTs as an emergent and culturally driven domain and DeFi as a technically mature but still rapidly developing domain rooted in financial decentralization. This distinction forms the theoretical basis for examining how domain positioning interacts with other external validation mechanisms in shaping market recognition.

3.2.3. Moderating Variables

- Funding Events: Measured as the natural logarithm of the number of funding rounds (F_fn_num_ln) a company had received by 30 June 2021. This variable captures the accumulation of external financial validation.

- Media Attention: Operationalized as the natural logarithm of the number of news articles (F_art_num_ln) mentioning the company by 30 June 2021. This measures external media validation.

- Company Age: Calculated as the number of years since founding (age) as of 30 June 2021. For interaction terms, we also included squared and cubic terms to account for potential non-linear effects.

3.2.4. Control Variables

- Patent Activity: Measured as the natural logarithm of the number of patents (F_pat_c_ln) held by the company, controlling for technological capabilities.

- Headquarters Location: Represented by five dummy variables indicating the company’s headquarter region (F_hq_ctr_reg_id_dum_1 through F_hq_ctr_reg_id_dum_5), controlling for geographical variation in recognition patterns.

3.3. Statistical Model

We employed OLS regression with robust standard errors to test our hypotheses. The robust option addresses potential heteroskedasticity concerns. Our models progressively test the effects of domain positioning and moderating variables:

- Model 1: Tests the main effects of domain positioning on market recognition, controlling for firm characteristics.

- F_cb_rk_scaled = β0 + β1topic_0 + β2topic_1 + … + β14topic_13 + βxControls + ε.

- Models 2–3: Incorporate funding events and media attention as direct predictors.

- Models 4–5: Include all predictors with controls for potential non-linear age effects.

To test our interaction hypotheses, we estimated additional models with interaction terms between domain positioning (specifically Topic 3 and Topic 9) and each moderating variable:

F_cb_rk_scaled = β0 + β1topic_3 + β2f_fn_num_ln + β3(topic_3 × f_fn_num_ln) + … + βₓControls + ε

Similar models were estimated for interactions with media attention and age. These interaction terms allow us to test whether the relationship between domain positioning and market recognition is contingent on external validation signals and temporal factors, as predicted by our domain lifecycle theory.

4. Results

4.1. Firm-Level Domain Identification

As noted in our methodology section, the firm-level topic assignment revealed significant classification challenges inherent to an emerging technological ecosystem. The predominance of firms in the undefined topic cluster (Topic 1, 44.08%) and miscellaneous blockchain group (Topic 0, 39.34%) reflects both the early-stage nature of many blockchain ventures and the limited descriptive specificity in their business communications. Despite these classification limitations, our analysis of the more distinctly categorized firms provides valuable insights into domain-specific positioning effects, particularly for ventures with clearly articulated strategic identities.

Among companies with more distinct and thematically defined domain identities, several categories emerge. Table 1 shows that the most prevalent among them is general development and platform-building (Topic 1, 5.93%), followed by gaming and eSports (Topic 2, 2.20%), NFTs (Topic 3, 2.00%), digital art and creative content (Topic 4, 1.82%), and energy and cleantech applications (Topic 5, 1.68%). Additional, albeit smaller, segments include cannabis and regulated substances (Topic 6, 0.81%), metaverse and virtual reality (Topic 7, 0.72%), blockchain infrastructure (Topic 8, 0.46%), and DeFi and staking protocols (Topic 9, 0.29%). The remaining domains form a long tail of niche applications: peer-to-peer trading (Topic 10, 0.26%), voting and blockchain-based governance (Topic 11, 0.17%), financial trading platforms (Topic 12, 0.14%), and legal services (Topic 13, 0.11%).

Table 1.

Primary topic name using BERTopic.

4.2. Descriptive Statistics and Correlations

Table 2 presents descriptive statistics for our key variables. The dependent variable, market recognition (f_cb_rk_scaled), shows a mean of 0.78 with a standard deviation of 0.21, indicating substantial variation in recognition levels across companies. Among the independent variables, topic_0 (39%) and topic_undefined (44%) have the highest means, reflecting the large proportion of companies in these categories. The moderating variables show that companies have an average of 0.71 media mentions (logged) and 0.40 funding rounds (logged), with an average age of 5.67 years.

Table 2.

Descriptive statistics.

Table 3 presents the correlation matrix for all variables. Market recognition (F_cb_rk_scaled) shows positive correlations with media attention (0.39) and funding rounds (0.53), and a negative correlation with age (−0.12). Among domain variables, Topic_3 (NFT) has a small positive correlation (0.04) with market recognition, as does Topic_9 (DeFi/staking) with a correlation of 0.02. These correlations provide preliminary support for our hypotheses but require multivariate analysis to control for other factors.

Table 3.

Correlation matrix.

4.3. Hypothesis Test Results

Table 4 presents the results of our regression analysis examining the effects of domain positioning on market recognition. In line with Hypothesis 1a, we find that operating in the NFT domain (Topic 3) is positively associated with market recognition (β = 0.0459, p < 0.01). Similarly, supporting Hypothesis 1b, positioning in the DeFi/staking domain (Topic 9) shows a positive and significant relationship with market recognition (β = 0.0577, p < 0.01). These results confirm that clear domain positioning in these emerging areas enhances a venture’s market recognition.

Table 4.

OLS result (hypothesis testing).

The control variables in our model also reveal interesting patterns. Funding events (β = 0.150, p < 0.01) and media attention (β = 0.0342, p < 0.01) both have strong positive associations with market recognition. Firm age shows a non-linear relationship with recognition, as indicated by the significant coefficients for the linear (β = −0.0136, p < 0.01) and squared (β = 0.000371, p < 0.01).

To test our hypotheses regarding domain-specific legitimacy dynamics, we examined the interaction effects between domain positioning and three key factors: funding events, media attention, and firm age.

Model 2 examines the interaction between domain positioning and funding events. As predicted in Hypothesis 2a, we find a significant negative interaction between NFT domain positioning (Topic 3) and funding events (β = −0.0511, p < 0.01). This indicates that while NFT ventures generally enjoy higher market recognition (main effect β = 0.0719, p < 0.01), this advantage diminishes as they accumulate more funding rounds. In contrast, supporting Hypothesis 2b, the interaction between DeFi domain positioning (Topic 9) and funding events is negative but not statistically significant (β = −0.0111, p > 0.1), while the main effect remains positive (β = 0.0639, p < 0.01). This suggests that DeFi ventures do not experience the same legitimacy trade-offs from institutional funding as NFT ventures.

Model 3 tests the interaction between domain positioning and media attention. In line with Hypothesis 3a, we find a significant negative interaction between NFT domain positioning and media attention (β = −0.0228, p < 0.01). This supports our prediction that increased media coverage paradoxically weakens the recognition benefits of NFT positioning (main effect β = 0.0656, p < 0.01). Interestingly, and consistent with Hypothesis 3b, the interaction between DeFi domain positioning and media attention is positive, though not statistically significant (β = 0.0118, p > 0.1), with a positive main effect (β = 0.0497, p < 0.05). This contrasting pattern suggests that media coverage may have domain-specific effects on market recognition.

Our additional analysis in Model 4 examined the interaction between domain positioning and firm age. We found a significant negative interaction between NFT domain positioning and age (β = −0.00561, p < 0.05), supporting Hypothesis 4a. This indicates that younger firms benefit more from NFT domain positioning than older firms (main effect β = 0.0659, p < 0.01), consistent with our prediction of a “novelty premium” in this emergent domain. In contrast, the interaction between DeFi domain positioning and age was not statistically significant (β = −0.0032, p > 0.1), supporting Hypothesis 4b and suggesting that the value of DeFi positioning is less dependent on firm age.

5. Discussion

5.1. Summary of Key Findings

Our results provide strong support for our domain lifecycle theory of legitimacy. First, we find that domain positioning significantly influences market recognition, with NFT and DeFi domains showing particularly strong positive effects. Second, and more importantly, we uncover domain-specific legitimacy dynamics: in the NFT domain, external validation through funding and media attention paradoxically weakens recognition benefits, while organizational age shows a similar negative interaction. In contrast, the DeFi domain shows weaker or non-significant interactions with these factors.

These findings demonstrate that legitimacy mechanisms operate differently across domains based on their evolutionary stage and institutional characteristics. The NFT domain, which experienced explosive growth in 2021 and embodies strong cultural–creative values, shows clear evidence of legitimacy trade-offs where external validation from institutional actors may conflict with community-based authenticity. The DeFi domain, which underwent more gradual growth since 2019 and blends financial innovation with technical infrastructure, exhibits a more balanced relationship between external validation and domain authenticity.

Collectively, these results support our theoretical framework, which proposes that domains at different lifecycle stages privilege different legitimacy signals and face different tensions between external validation and domain-specific values. Our findings challenge the assumption that funding and media attention uniformly enhance market recognition, revealing instead a more nuanced relationship that varies significantly across blockchain domains.

5.2. Theoretical Implications

This study makes a key theoretical contribution by developing and empirically validating a domain lifecycle theory of legitimacy. Our findings demonstrate that blockchain domains at different stages of evolution—such as NFTs and DeFi—exhibit distinct patterns in how domain positioning influences market recognition, and how this relationship is moderated by external validation signals. These results advance existing theory in several important ways.

First, while prior work has explored technological lifecycles and industry evolution, our domain-level focus adds nuance by showing how sub-industries within an emerging ecosystem evolve at different rates, with domain-specific legitimacy logics. The contrast between NFTs and DeFi—two blockchain domains that emerged around the same time but have followed divergent trajectories—demonstrates that legitimacy is not determined solely by technology type or timing but by how domain identity is culturally and institutionally constructed.

Second, our study extends legitimacy theory by showing that the salience and effectiveness of legitimacy signals (e.g., funding, media attention) vary systematically across domain lifecycle stages. While previous research has distinguished among cognitive, moral, and pragmatic legitimacy, it has paid less attention to how the relative weight of these types shifts over time and across domains. Our results suggest that in nascent, culturally charged domains like NFTs, authenticity-based legitimacy plays a central role and may conflict with traditional institutional validation. In more established domains like DeFi, institutional validation aligns more closely with domain values, leading to fewer legitimacy trade-offs.

Third, we contribute to the market categorization literature by showing that the benefits and constraints of categorical positioning are not static but contingent on domain maturity. The strong positive effect of NFT positioning on recognition, coupled with its negative interaction with institutional validation, illustrates that categorical clarity may bring reputational advantages while simultaneously introducing tensions with legitimacy acquisition. This challenges universalistic accounts of category effects and emphasizes their temporal contingency.

Our finding that external validation (via funding and media) paradoxically dampens recognition in the NFT domain, but not in DeFi, offers empirical insight into how legitimacy dilemmas unfold in emerging fields. It supports the idea that external validation may backfire when it conflicts with a domain’s cultural logic. These dynamics suggest that legitimacy is not a linear function of exposure or endorsement, but one shaped by the alignment between external signals and domain norms.

Moreover, our results align with research on hybrid organizing, highlighting how domains themselves—not just organizations—may embody multiple, often conflicting institutional logics. The NFT domain blends cultural–creative and commercial logics, leading to acute tensions with institutional validation. DeFi, in contrast, reflects a blend of technical–financial and decentralization logics, allowing for a smoother integration of institutional support. The varying intensity of these tensions offers a novel domain-level perspective on hybrid complexity.

We also find that firm age interacts negatively with NFT positioning but not with DeFi positioning, suggesting that temporal factors shape legitimacy acquisition differently across domains. In fast-moving, culturally oriented domains like NFTs, newer firms may be better positioned to project authenticity and align with domain expectations. This finding adds a domain-contingent layer to imprinting theory by implying that the advantages of early or late entry are not uniform across domains.

Finally, our results connect to exploration–exploitation theory by suggesting that emergent domains favor exploration-driven capabilities (e.g., novelty, adaptability), while more mature domains reward a balance between exploration and exploitation. The “novelty premium” we observe in the NFT domain implies that learning and innovation strategies must be aligned with the domain’s evolutionary stage.

Together, these findings offer a richer, more dynamic account of how legitimacy operates in emerging industries. They highlight that a domain’s lifecycle stage is a key contingency in shaping the value of categorical identity, external validation, and organizational age—offering a theoretical framework for understanding legitimacy as both domain-specific and temporally situated.

5.3. Practical Implications

Our findings offer several important implications for entrepreneurs, investors, and platform managers navigating the evolving blockchain ecosystem.

For entrepreneurs, the results underscore the importance of strategic domain positioning as a core driver of market recognition. Affiliating with well-defined domains such as NFTs or DeFi can enhance visibility and legitimacy, but the effectiveness of domain signaling is contingent on the domain’s lifecycle stage. In nascent domains like NFTs, recognition is tightly coupled with authenticity and alignment with community norms, while conventional markers of institutional validation—such as formal funding rounds or extensive media exposure—can paradoxically undermine credibility. By contrast, in more mature domains like DeFi, firms benefit from demonstrating technical competence and institutional credibility, indicating a different set of legitimacy expectations.

Funding strategy must therefore be adapted to domain context. In the NFT space, our findings show that multiple funding rounds may erode recognition by signaling commercialization that conflicts with the domain’s authenticity norms. Entrepreneurs operating in these domains may consider alternative funding approaches—such as community token offerings, DAO-based models, or grassroots crowdfunding—that align more closely with cultural and ideological expectations. In contrast, DeFi ventures appear more resilient to institutional funding effects, allowing greater flexibility in engaging with traditional financing mechanisms.

Media strategy should also be tailored to domain-specific legitimacy dynamics. The negative interaction between media attention and recognition in the NFT domain suggests that indiscriminate publicity may dilute perceived authenticity. Ventures in this space may benefit from selective media engagement that emphasizes mission-driven narratives, creative vision, or community orientation, rather than commercial success metrics. For DeFi ventures, media strategies may place greater emphasis on technical innovation, reliability, and financial utility, which are more compatible with the domain’s legitimacy criteria.

For investors, our study suggests that due diligence should extend beyond technical feasibility or market potential to include an understanding of domain-specific legitimacy norms. Funding mechanisms that signal credibility in one domain may backfire in another. In domains like NFTs, where authenticity and community identity are central, conventional signals of venture “seriousness” may be interpreted as misalignment.

For platform managers, particularly those building blockchain marketplaces or multi-sided ecosystems, our findings highlight the value of domain-sensitive onboarding, branding, and governance structures. For instance, platforms aiming to host NFT-based applications may need to adopt community-driven governance or create sub-brand architectures that maintain separation from parent institutional identity. DeFi platforms may focus more on interoperability, security standards, and compliance, where institutional validation enhances platform credibility.

Taken together, these practical implications suggest that blockchain ventures cannot treat domain affiliation as a generic branding strategy. Instead, legitimacy must be cultivated in ways that reflect the evolving normative logics of the domain. Understanding where a domain lies in its lifecycle—and what legitimacy signals are valued or penalized at that stage—is critical for venture growth, platform design, and strategic decision-making.

5.4. Limitations

Our operationalization of market recognition relied exclusively on Crunchbase rank, which, while widely used as an industry metric, presents certain limitations. This single proxy measure lacks transparency in its calculation methodology and may not fully capture all dimensions of market recognition, particularly those related to technical adoption, ecosystem participation, or community legitimacy. Crunchbase rank may also exhibit particular biases toward ventures with stronger institutional ties or media presence, potentially undervaluing alternative pathways to recognition within blockchain domains. Future research could benefit from triangulating recognition using multiple metrics such as transaction volume, user adoption rates, developer activity, or specialized blockchain analytics that provide more domain-specific indicators of market attention and legitimacy.

The cross-sectional design of our study limits our ability to make strong causal claims about the relationship between domain positioning and market recognition. While our findings demonstrate significant associations between these variables, we cannot definitively establish the direction of causality. It is possible that ventures with higher recognition potential self-select into certain domains, rather than domain positioning directly causing enhanced recognition. Alternatively, unobserved variables might simultaneously influence both domain selection and recognition outcomes. Longitudinal research designs that track ventures’ domain positioning choices and recognition metrics over time would provide stronger evidence for causal relationships and potentially reveal how the domain lifecycle effects we identified evolve as the blockchain ecosystem matures. Future research could adopt longitudinal approaches to track how domain positioning and recognition evolve over time, employ multiple recognition metrics, and extend the domain lifecycle framework to additional blockchain applications and other emerging technology ecosystems. As blockchain continues to transform digital commerce and organizational structures, understanding the domain-specific legitimacy mechanisms that shape technology adoption will be increasingly valuable for theory development and strategic guidance.

Our detailed analysis focuses primarily on two blockchain domains—NFTs and DeFi—which represent important but limited segments of the broader blockchain ecosystem. While these domains offer valuable case studies in culturally driven and infrastructure-oriented applications, respectively, they may not capture dynamics present in other emerging domains such as supply chain management, healthcare applications, digital identity, or governance systems. Each domain likely has its own institutional context, legitimacy criteria, and stakeholder expectations that shape the relationship between positioning and recognition. The domain lifecycle theory we propose may require domain-specific adaptations to account for these contextual differences, and the interaction effects we identified between external validation signals and domain positioning may vary across other blockchain applications. Further research examining a wider array of domains would enhance the generalizability of our findings and refine our understanding of domain-specific legitimacy mechanisms.

5.5. Implications for E-Commerce Transformation

Our findings offer valuable insights into how blockchain technologies—particularly NFTs and DeFi—are transforming the architecture of e-commerce systems and platforms. By highlighting how domain-specific legitimacy patterns influence recognition and integration, we provide a theoretical lens for understanding the uneven adoption of blockchain innovations in digital commerce.

First, our domain lifecycle perspective helps explain why NFT-based innovations have largely emerged through specialized platforms (e.g., standalone NFT marketplaces) rather than being integrated into traditional e-commerce systems. The strong recognition benefits associated with NFT positioning, coupled with the negative interactions with institutional validation, suggest that ventures in this domain must cultivate authenticity and cultural alignment—values that may be difficult to sustain within the constraints of conventional e-commerce platforms. For established e-commerce companies, this suggests that NFT integration may require dedicated sub-platforms or brand extensions that maintain credible identity construction within the NFT ecosystem rather than simply adding NFT functionality to existing marketplaces.

Second, our findings indicate that DeFi technologies are more readily compatible with institutional e-commerce environments. The absence of significant negative interactions between DeFi positioning and external validation implies that ventures in this domain can integrate more easily with established infrastructure. This helps explain the faster adoption of cryptocurrency-based payment systems and decentralized financial services in e-commerce relative to NFT integration. E-commerce platforms seeking to incorporate blockchain-based financial innovations may find DeFi applications more aligned with their existing legitimacy structures, requiring fewer adaptations to their institutional positioning.

Third, blockchain technologies in both domains directly address fundamental challenges in e-commerce that traditional centralized architectures struggle to solve. NFTs enable the verifiable scarcity and ownership of digital goods, creating entirely new categories of tradable digital assets while addressing longstanding issues of piracy and reproduction. DeFi protocols reduce payment friction and settlement time while potentially lowering transaction costs by eliminating intermediaries—addressing key pain points in cross-border e-commerce. Both domains enable programmable business logic through smart contracts, allowing for automated escrow, conditional transactions, and novel loyalty programs that can transform customer relationships in digital commerce.

Fourth, domain positioning influences not only venture recognition but also adoption trajectories for blockchain innovations. E-commerce platforms must navigate domain-specific adoption patterns: NFT integration requires greater sensitivity to authenticity and community values, while DeFi adoption necessitates focus on security, compliance, and technical reliability. Our identification of domain-specific moderating effects suggests that e-commerce platforms should tailor their blockchain integration strategies to the specific legitimacy requirements of each domain rather than pursuing a uniform approach.

In sum, NFTs and DeFi are reshaping e-commerce architecture through distinct but complementary pathways. NFTs expand what can be meaningfully owned and traded in digital space, while DeFi transforms how transactions are structured, cleared, and settled. Our domain lifecycle theory provides a framework for anticipating how these innovations will continue to evolve and integrate with mainstream e-commerce, highlighting that successful adoption requires alignment with domain-specific legitimacy mechanisms rather than simply deploying blockchain technology as undifferentiated infrastructure.

6. Conclusions

This study examined how domain positioning shapes market recognition among blockchain ventures and how this relationship is moderated by external validation signals and organizational age. Drawing on a dataset of 8529 ventures and a machine learning-based domain classification approach, we proposed and empirically validated a domain lifecycle theory of legitimacy. Our theory posits that as blockchain domains evolve, the mechanisms by which firms acquire legitimacy—and the signals that confer recognition—vary systematically with the domain’s maturity and institutional character.

Our findings reveal that the blockchain ecosystem has shifted from enterprise-focused applications to consumer-oriented domains such as NFTs and DeFi. While positioning in both domains enhances market recognition, the underlying dynamics differ. In the NFT domain, external validation via funding or media attention paradoxically diminishes recognition benefits—suggesting an authenticity-based legitimacy logic where institutional signals may contradict community values. In contrast, the DeFi domain shows a more balanced relationship with external validation, reflecting its technical–financial orientation and greater compatibility with institutional legitimacy. These findings contribute to ecosystem and legitimacy theory by demonstrating that subdomains within an emerging technology field evolve at different rates and with distinct legitimacy requirements.

Author Contributions

Conceptualization, Y.-T.L. and E.-J.H.; methodology, E.-J.H.; validation, E.-J.H.; data curation, Y.-T.L. and E.-J.H.; writing—original draft preparation, E.-J.H. and Y.-T.L.; writing—review and editing, Y.-T.L.; supervision, E.-J.H.; project administration, Y.-T.L. and E.-J.H.; funding acquisition Y.-T.L. and E.-J.H. All authors have read and agreed to the published version of the manuscript.

Funding

We did not receive any funding specifically designated for this project.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Some portions of the data are available from the authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Evolution of Blockchain Domains: STM Analysis

This appendix presents the results of our exploratory Structural Topic Modeling (STM) analysis based on company-level business descriptions from 2010 to 2021. The STM analysis aimed to uncover major domain themes in the blockchain ecosystem and their temporal dynamics, thereby offering contextual background for our theoretical framing of domain lifecycles.

Appendix A.1. Dataset Summary and Word Frequencies

Our dataset included 9665 blockchain companies, with text descriptions averaging 534 characters in length. As shown in Table A1, the most frequent words in company descriptions highlight the technology-focused nature of the industry. “Blockchain” was the most frequent term (12,752 occurrences), followed by “technology” (4743), “digital” (4036), and “data” (3234). These frequencies reflect the industry’s technical foundations while also suggesting considerable heterogeneity in how companies describe their activities beyond these common terms.

Table A1.

Most frequent words in company descriptions.

Table A1.

Most frequent words in company descriptions.

| Rank | Word | Frequency |

|---|---|---|

| 1 | blockchain | 12,752 |

| 2 | technology | 4743 |

| 3 | digital | 4036 |

| 4 | data | 3234 |

| 5 | development | 3043 |

| 6 | services | 3007 |

| 7 | solutions | 2615 |

| 8 | crypto | 2181 |

| 9 | world | 2158 |

| 10 | cryptocurrency | 1993 |

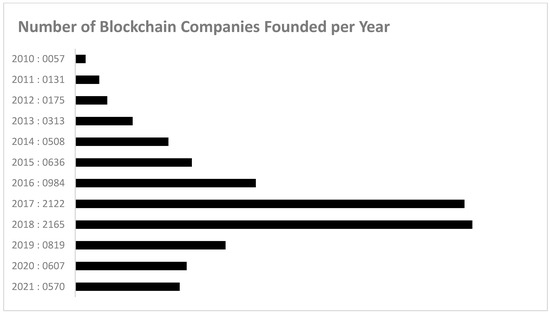

Figure A1 illustrates the distribution of company founding years, revealing a clear pattern of industry growth and evolution. The blockchain industry experienced modest growth from 2010 (57 companies) through 2016 (984 companies), followed by a dramatic surge in 2017–2018, when over 4200 companies were established (2122 and 2165, respectively). This peak coincided with the cryptocurrency market boom and initial coin offering (ICO) phenomenon. Following this period, we observed a substantial decline in new company formation, with 819 companies in 2019, 607 in 2020, and 570 in 2021.

Figure A1.

Company distribution by founding year.

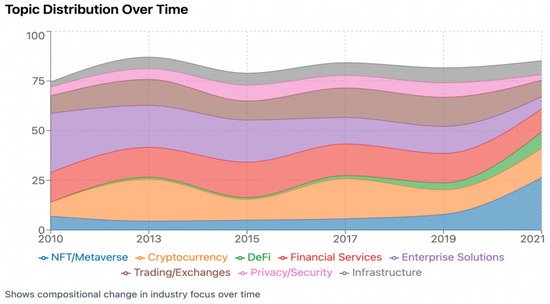

Appendix A.2. STM Results: Domain Shifts over Time

Table A2 presents the results of our Structural Topic Modeling analysis, revealing significant shifts in the blockchain ecosystem from 2010 to 2021. The industry has undergone a marked transition from enterprise-focused applications toward consumer-oriented domains. Enterprise solutions, which dominated the early blockchain landscape (29.8% of ventures in 2010), declined dramatically to just 6.0% by 2021. Concurrently, we observed substantial growth in consumer-facing domains. Most notably, NFT/Metaverse applications surged from 7.0% in 2010 to 26.4% in 2021, becoming the dominant domain category. Similarly, DeFi applications grew from a negligible 0.9% in 2015 to 8.3% in 2021.

Table A2.

Topic distribution by year (%).

Table A2.

Topic distribution by year (%).

| Topic | 2010 | 2013 | 2015 | 2017 | 2019 | 2021 |

|---|---|---|---|---|---|---|

| NFT/Metaverse | 7 | 4.5 | 5 | 5.7 | 7.9 | 26.4 |

| Cryptocurrency | 7 | 21.1 | 10.4 | 20.1 | 12.3 | 14.7 |

| DeFi | 0 | 1 | 0.9 | 1.6 | 3.5 | 8.3 |

| Financial Services | 14.9 | 15 | 17.8 | 15.9 | 14.8 | 11.6 |

| Enterprise Solutions | 29.8 | 21.1 | 21.2 | 13.3 | 13.6 | 6 |

| Trading/Exchanges | 8.8 | 13.1 | 9.6 | 14.9 | 14.7 | 8.4 |

| Privacy/Security | 4.4 | 5.4 | 8 | 6.3 | 7.2 | 2.8 |

| Infrastructure | 2.6 | 5.8 | 6 | 6.4 | 7.6 | 7 |

| Supply Chain | 3.5 | 1.6 | 3 | 2.5 | 3.4 | 1.8 |

| Smart Contracts | 0.9 | 0 | 2.8 | 2.8 | 1.2 | 1.4 |

| Other | 21.1 | 11.5 | 15.3 | 10.4 | 13.8 | 11.6 |

Figure A2 visually represents these domain shifts over time, showing the crossover patterns as different domains rose and fell in prominence. The visualization reveals how enterprise solutions and cryptocurrency initially dominated, while NFT/Metaverse and DeFi emerged as significant forces in recent years.

Figure A2.

Topic distribution over time.

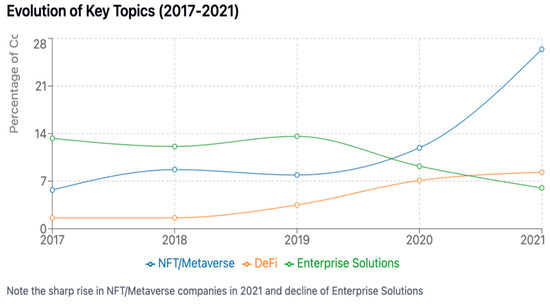

Figure A3 further depicts this domain evolution by highlighting the changing proportion of companies across major categorical groupings, showing the decline in enterprise solutions and the rise in consumer applications.

Figure A3.

Evolution of key topics.

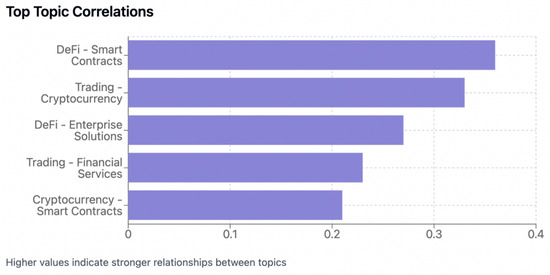

Appendix A.3. Topic Correlations and Overlaps

Table A3 presents topic correlations that indicate a significant degree of overlap among blockchain domains. These findings suggest that many companies do not confine themselves to a single domain but instead straddle multiple related areas, reflecting the inherently interconnected and multi-functional nature of blockchain technologies.

Table A3.

Top topic correlations (coefficient).

Table A3.

Top topic correlations (coefficient).

| Topic Pair | Correlation |

|---|---|

| DeFi—Smart Contracts | 0.36 |

| Trading/Exchanges—Cryptocurrency | 0.33 |

| DeFi—Enterprise Solutions | 0.27 |

| Trading/Exchanges—Financial Services | 0.23 |

| Cryptocurrency—Smart Contracts | 0.21 |

Figure A4 provides additional insight into the blockchain ecosystem’s structural evolution through topic correlations. As shown in Table A3, we found significant correlations between certain domain pairs, particularly DeFi and Smart Contracts (0.36), Trading/Exchanges and Cryptocurrency (0.33), and DeFi and Enterprise Solutions (0.27). These correlations suggest that many companies operate across multiple related domains rather than focusing exclusively on a single area, revealing the interconnected nature of blockchain applications.

Figure A4.

Top topic correlations.

Appendix A.4. Detailed Domain Trends

Figure A5 offers a more detailed visualization of three critical domain trends. The NFT/Metaverse domain showed modest presence between 2017 (5.7%) and 2019 (7.9%), before rapid growth to 11.9% in 2020 and an explosive expansion to 26.4% in 2021. The DeFi domain followed a more gradual growth trajectory, remaining at 1.6% in 2017–2018, then increasing to 3.5% in 2019, 7.1% in 2020, and 8.3% in 2021. In contrast, Enterprise Solutions steadily declined from 29.8% in 2010 to 6.0% in 2021, with the most dramatic drops occurring after 2017.

Figure A5.

NFT/Metaverse growth.

Table A4 summarizes these shifts by broader category, showing that Consumer Applications (including NFT/Metaverse and parts of Cryptocurrency) increased from 14.0% in 2010 to 41.1% in 2021 (+27.1%), while Enterprise Solutions declined from 29.8% to 6.0% (−23.8%). Financial Services showed moderate growth from 24.6% to 28.3% (+3.7%), and Technical Infrastructure increased from 7.9% to 14.0% (+6.1%).

Table A4.

Topic distribution change from 2010 to 2021.

Table A4.

Topic distribution change from 2010 to 2021.

| Topic Category | 2010 | 2021 | Change |

|---|---|---|---|

| Enterprise Solutions | 29.80% | 6.00% | −23.80% |

| Consumer Applications | 14.00% | 41.10% | 27.10% |

| Financial Services | 24.60% | 28.30% | 3.70% |

| Technical Infrastructure | 7.90% | 14.00% | 6.10% |

| Other | 23.70% | 10.60% | −13.10% |

Note: Consumer Applications includes NFT/Metaverse and parts of Cryptocurrency; Financial Services includes Trading/Exchanges, DeFi, and Financial Services categories.

Table A5 provides a year-by-year view of dominant, secondary, and emerging topics, illustrating the shifting priorities in the blockchain ecosystem. The progression from Enterprise Solutions (dominant in 2010) to Cryptocurrency (dominant in 2017) to NFT/Metaverse (dominant in 2021) traces the industry’s evolution from infrastructure-focused to consumer-oriented applications.

Table A5.

Year-by-Year Topic Progression.

Table A5.

Year-by-Year Topic Progression.

| Year | Dominant Topic | Secondary Topic | Emerging Topic |

|---|---|---|---|

| 2010 | Enterprise Solutions (29.8%) | Financial Services (14.9%) | Trading (8.8%) |

| 2013 | Enterprise/Crypto (21.1%) | Financial Services (15.0%) | Trading (13.1%) |

| 2015 | Enterprise Solutions (21.2%) | Financial Services (17.8%) | Cryptocurrency (10.4%) |

| 2017 | Cryptocurrency (20.1%) | Financial Services (15.9%) | Trading (14.9%) |

| 2019 | Financial Services (14.8%) | Trading (14.7%) | Enterprise (13.6%) |

| 2021 | NFT/Metaverse (26.4%) | Cryptocurrency (14.7%) | Financial Services (11.6%) |

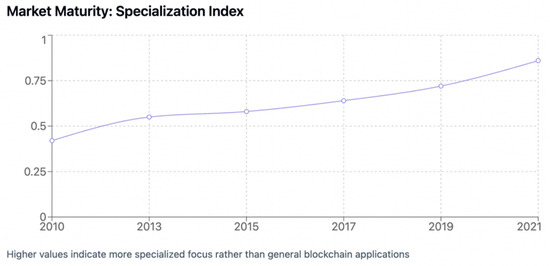

The blockchain ecosystem also showed increasing specialization over time. Our specialization index by year increased from 0.42 in 2010 to 0.86 in 2021. This trend, visualized in Figure A6, indicates a shift from general blockchain applications toward more focused domain positioning, supporting our domain lifecycle theory that suggests increasing differentiation as domains mature.

Figure A6.

Specialization index by year.

References

- Catalini, C.; Gans, J.S. Some simple economics of the blockchain. Commun. ACM 2020, 63, 80–90. [Google Scholar] [CrossRef]

- Yermack, D. Corporate governance and blockchains. Rev. Financ. 2017, 21, 7–31. [Google Scholar] [CrossRef]

- Nam, K.; Dutt, C.S.; Choi, P.; Cheng, M. Blockchain for intellectual property protection in the tourism and hospitality industry. J. Hosp. Tour. Manag. 2023, 54, 350–360. [Google Scholar]

- Dal Mas, F.; Dicuonzo, G.; Massaro, M.; Dell’Atti, V. Blockchain and sustainable supply chains: A systematic literature review. J. Bus. Res. 2023, 153, 113297. [Google Scholar]

- Singh, R.; Prasad, M. A cross-country analysis of blockchain technology adoption in internationalization of small and medium-sized enterprises. J. Glob. Inf. Manag. 2024, 32, 1–22. [Google Scholar]

- Kondrateva, G.; Ammi, C.; Baudier, P. Understanding the multiple roles of blockchain in collaborative innovation ecosystems: An integrative framework. Technol. Forecast. Soc. Chang. 2022, 174, 121279. [Google Scholar]

- Iansiti, M.; Lakhani, K.R. The truth about blockchain. Harv. Bus. Rev. 2017, 95, 118–127. [Google Scholar]

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World; Portfolio Penguin: London, UK, 2016. [Google Scholar]

- Wamba, S.F.; Kala Kamdjoug, J.R.; Epie Bawack, R.; Keogh, J.J. Blockchain technology in the smart city: A bibliometric review and avenues for future research. Inf. Syst. Front. 2020, 22, 1173–1196. [Google Scholar]

- Daim, T.U.; Rueda, G.R.; Martin, H. Technology forecasting using bibliometric analysis and system dynamics. Technol. Anal. Strateg. Manag. 2020, 32, 200–222. [Google Scholar]

- Chang, Y.; Iakovou, E.; Shi, W. Blockchain in global supply chains and cross border trade: A critical synthesis of the state-of-the-art, challenges and opportunities. Int. J. Prod. Res. 2020, 58, 2082–2099. [Google Scholar] [CrossRef]

- Garg, P.; Gupta, B.; Chauhan, A.; Bala, P. Blockchain adoption for E-government: A conceptual framework. Inf. Syst. Front. 2021, 23, 477–491. [Google Scholar]

- Aldrich, H.E.; Fiol, C.M. Fools rush in? The institutional context of industry creation. Acad. Manag. Rev. 1994, 19, 645–670. [Google Scholar] [CrossRef]

- Zimmerman, M.A.; Zeitz, G.J. Beyond survival: Achieving new venture growth by building legitimacy. Acad. Manag. Rev. 2002, 27, 414–431. [Google Scholar] [CrossRef]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–86. [Google Scholar]

- Adner, R. Ecosystem as structure: An actionable construct for strategy. J. Manag. 2017, 43, 39–58. [Google Scholar] [CrossRef]

- Behl, A.; Pereira, V.; Nigam, A.; Wamba, S.; Sindhwani, R. Knowledge development in non-fungible tokens (NFT): A scoping review. J. Knowl. Manag. 2024, 28, 232–267. [Google Scholar] [CrossRef]

- De Filippi, P.; Loveluck, B. The invisible politics of bitcoin: Governance crisis of a decentralized infrastructure. Internet Policy Rev. 2016, 5. [Google Scholar] [CrossRef]

- Fisher, G.; Kotha, S.; Lahiri, A. Changing with the times: An integrated view of identity, legitimacy, and new venture life cycles. Acad. Manag. Rev. 2017, 42, 525–551. [Google Scholar] [CrossRef]

- Anderson, P.; Tushman, M.L. Technological discontinuities and dominant designs: A cyclical model of technological change. Adm. Sci. Q. 1990, 35, 604–633. [Google Scholar] [CrossRef]

- Grootendorst, M. BERTopic: Neural topic modeling with class-based TF-IDF. arXiv 2022, arXiv:2203.05794. [Google Scholar] [CrossRef]

- Kim, B.T.S.; Hyun, E.J. Mapping the landscape of blockchain technology knowledge: A patent co-citation and semantic similarity approach. Systems 2023, 11, 111. [Google Scholar] [CrossRef]

- Subramanian, H. Decentralized blockchain-based electronic marketplaces. Commun. ACM 2018, 61, 78–84. [Google Scholar] [CrossRef]

- Zhao, J.L.; Fan, S.; Yan, J. Overview of business innovations and research opportunities in blockchain and introduction to the special issue. Financ. Innov. 2021, 7, 1–15. [Google Scholar] [CrossRef]

- Chalmers, D.; Fisch, C.O.; Matthews, R.C.T. Exploring the tokenization of intellectual property: The case of non-fungible tokens. Res. Policy 2022, 51, 104541. [Google Scholar]

- Chen, Y.; Bellavitis, C. Blockchain disruption and decentralized finance: The rise of decentralized business models. J. Bus. Ventur. Insights 2020, 13, e00151. [Google Scholar] [CrossRef]

- Parker, G.G.; Van Alstyne, M.W. Two-sided network effects: A theory of information product design. Manag. Sci. 2005, 51, 1494–1504. [Google Scholar] [CrossRef]

- Santos, F.M.; Eisenhardt, K.M. Constructing markets and shaping boundaries: Entrepreneurial power in nascent fields. Acad. Manag. J. 2009, 52, 643–671. [Google Scholar] [CrossRef]

- Kennedy, M.T. Getting counted: Markets, media, and reality. Am. Sociol. Rev. 2008, 73, 270–295. [Google Scholar] [CrossRef]

- Navis, C.; Glynn, M.A. Legitimate distinctiveness and the entrepreneurial identity: Influence on investor judgments of new venture plausibility. Acad. Manag. Rev. 2010, 35, 479–499. [Google Scholar]

- Glynn, M.A.; Navis, C. Categories, identities, and cultural classification: Moving beyond a model of categorical constraint. J. Manag. Stud. 2013, 50, 1124–1137. [Google Scholar] [CrossRef]

- Wry, T.; Lounsbury, M.; Glynn, M.A. Legitimating nascent collective identities: Coordinating cultural entrepreneurship. Organ. Sci. 2011, 22, 449–463. [Google Scholar] [CrossRef]

- Spence, M. Job market signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Pollock, T.G.; Rindova, V.P. Media legitimation effects in the market for initial public offerings. Acad. Manag. J. 2003, 46, 631–642. [Google Scholar] [CrossRef]

- Kennedy, M.T.; Fiss, P.C. An ontological turn in categories research: From standards of legitimacy to evidence of actuality. J. Manag. Stud. 2013, 50, 1138–1154. [Google Scholar] [CrossRef]

- Stern, S.E.; Dukerich, J.M.; Zajac, E.J. Unmixed signals: How reputation and legitimacy interact to shape organizational outcomes. Acad. Manag. J. 2014, 57, 872–896. [Google Scholar]

- Peterson, R.A. In search of authenticity. J. Manag. Stud. 2005, 42, 1083–1098. [Google Scholar] [CrossRef]

- Stinchcombe, A.L. Social structure and organizations. In Handbook of Organizations; March, J.G., Ed.; Rand McNally: Chicago, IL, USA, 1965; pp. 142–193. [Google Scholar]

- Johnson, V. Organizational imprinting and the early transformation of social movement fields: A case of U.S. recycling advocacy. Adm. Sci. Q. 2007, 52, 527–557. [Google Scholar]

- Hannan, M.T.; Freeman, J. Structural inertia and organizational change. Am. Sociol. Rev. 1984, 49, 149–164. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).