1. Introduction

Well-being is crucial for social development, which not only reflects people’s attitudes towards their life but also is an important embodiment regarding the quality of economic development and public welfare in a country [

1,

2,

3,

4]. As stated in the resolution adopted by the 66th United Nations General Assembly on 28 June 2012, well-being is the universal goal and aspiration in people’s lives worldwide [

5]. Meanwhile, the resolution pointed out the need to adopt a more inclusive, equitable, and balanced approach to economic growth that promotes sustainable development, poverty eradication, and the well-being of all peoples.

Recently, with the wide application of Internet technology in financial systems, financial technology (fintech) has boomed worldwide and is considered to have tremendous potential in facilitating financial inclusion [

6,

7,

8,

9,

10,

11,

12]. There is growing evidence that increasing financial inclusion or enabling more vulnerable groups to access financial services is critical to a region’s economic growth, income distribution, and public well-being [

13,

14,

15,

16,

17,

18,

19]. In particular, mobile payment, as one aspect of financial technology, has become an effective and popular transacting tool in recent years, reshaping the business model and the way people use the Internet [

20]. According to GSMA Intelligence, the number of registered mobile money accounts worldwide reached 1.75 billion in 2023, processing USD 1.4 trillion in transactions per year [

21]. The rise of mobile payment not only promotes the demonetization and mobility of payment methods but also brings people a new lifestyle, such as a sharing economy. Against this backdrop, a growing number of studies are attempting to investigate the connection between mobile payments and the physical world, as well as their impacts on individual welfare. These studies mainly focus on the reasons why people use mobile payment [

20,

22,

23,

24,

25]; its differences from cash payment or credit card payment, such as the convenience of remote payment, the avoidance of queues, and being more convenient and cost-effective [

26,

27,

28]; and its impact on people’s consumption activities [

29,

30,

31,

32,

33].

Additionally, a few studies have directly explored the impact of mobile payment on individual well-being. For example, Zheng and Ma [

34] examined the correlation between mobile payment and subjective well-being (SWB). The study by Wu et al. [

35] investigated the effect of mobile payment adoption at the household level on the well-being of rural householders. However, the research on the association between mobile payment and individual well-being is still insufficient. Importantly, individual well-being is not only affected by economic and social factors (e.g., income status and consumption), but also determined by the natural environment. Although prior studies have identified several economic and social mechanisms by which mobile payment affects well-being [

35,

36], they have overlooked the role of how mobile payment alters the impact of the external environment on people’s well-being. In fact, the popularity of mobile payment has promoted the rise of the paperless money era, making people’s transaction activities break through the restrictions of time and space. In the pre-mobile payment era, many transactions needed to be conducted face-to-face offline, and people often spend a certain amount of time in a specific outdoor space. This makes it difficult to avoid exposure to harsh external environments during the transaction process, such as conducting transactions near construction sites or dirty selling areas. By comparison, with mobile payment technology, people do not necessarily have to use tangible paper money, nor do they have to engage in face-to-face trading activities offline. These contactless changes allow people to avoid the potential negative effects of a poor external environment (such as air pollution or noise pollution) on their well-being in many situations.

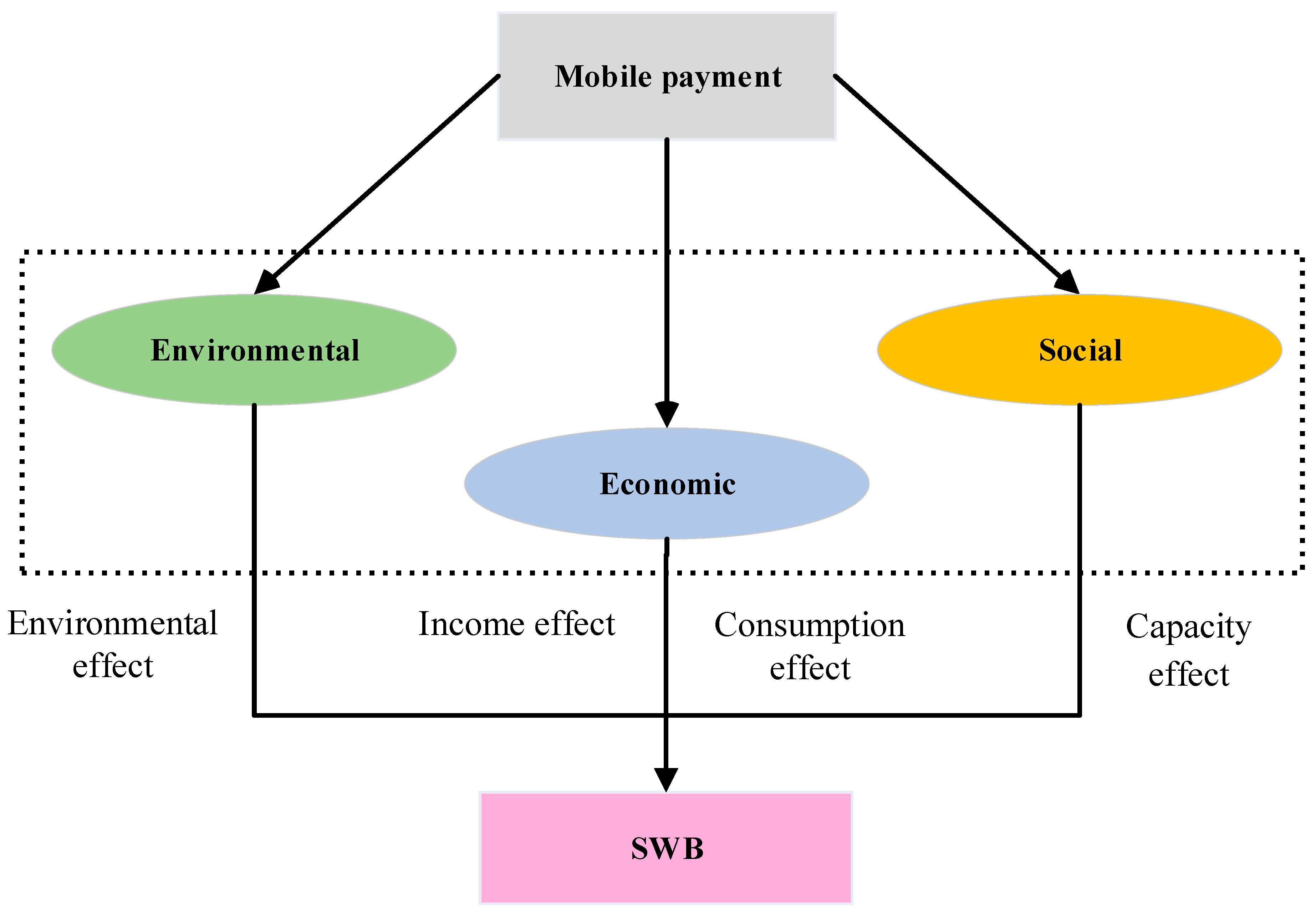

To fill the gap, this work attempts to contribute to the existing literature by exploring the influence of mobile payment on an individual’s SWB and the mechanisms by which this association appears from a more comprehensive and novel channel, namely, the economic–social–environmental perspective. Accordingly, we adopt data from the 2017 and 2018 waves of the Chinese General Social Survey (CGSS) and find a statistically significant and positive correlation between mobile payment and SWB. Furthermore, our study indicates that this positive association is attributable to the multifaceted influence of mobile payment across the economic, social, and environmental dimensions, jointly shaping individuals’ SWB.

Consequently, this study provides three novel contributions. Firstly, it complements the literature about the impact mechanism of mobile payment on SWB. This paper examines how mobile payment affects an individual’s SWB from the economic–social–environmental perspective by addressing both environmental conditions and the socioeconomic factors. Secondly, we extend the research on environmental quality and well-being. The environmental literature has a long history of exploring the link between external environmental quality and individual well-being. However, the related literature has not considered how the popularity of mobile payment changes and influences the relationship. Thirdly, the work provides several ideas for other developing countries to implement a people-oriented sustainable development strategy via digital technology. Our study gives new evidence for the non-economic effects of mobile payment, particularly in non-western contexts. Interestingly, China, the world’s largest developing country, is now the global leader in mobile payment applications, despite its low credit card ownership in the past. Data show that China’s mobile payment users exceeded 900 million in 2024 [

37], and mobile payment has become the most popular payment method for consumers. Therefore, the research based on China’s scenario can contribute compelling evidence of how the emergence of new payment methods affects people’s social welfare. Moreover, we also find that the promotion effect of mobile payment on individuals’ SWB is non-homogenous, which is more obvious for people from underdeveloped areas within the economic–social–environmental system. The conclusion provides some policy implications for enabling inclusive growth via digital technologies.

This paper is organized as follows: first, to prompt the empirical estimates, we give a brief literature review and propose the theoretical framework; second, the data source, model and variables selection, and descriptive analysis are presented; third, the empirical results and related discussions are shown; lastly, the conclusion and policy implications are discussed.

5. Conclusions and Discussion

This study introduces an economic–social–environmental perspective to explore the association between mobile payment and SWB. We extend the mobile payment–SWB literature by not only considering how mobile payment affects the economic and social determinants of SWB, but also analyzing how it alters the relationship between the external environment quality and SWB. Accordingly, using data from the CGSS2017 and CGSS2018, we find that mobile payment can significantly increase Chinese residents’ SWB. The results are still robust when adopting the substitution variable method and conducting IV estimation. The findings are in line with two categories of the literature. The first category is the research that emphasizes the positive effect of Internet use on personal well-being [

62,

64,

116], while the second category finds the importance of financial technology or Internet finance to improve public welfare [

117,

118,

119].

The results further prove that the positive association is a composite influence from multiple channels. Firstly, it shows that mobile payment can boost an individual’s income to improve their SWB and has a greater impact on the SWB of low-income groups. Moreover, as for the social aspect, we also find that the application of mobile payment is conducive to providing people with more equitable access to social resources. The results further support the finding in

Table 2, suggesting that the new transaction method of mobile payment brings opportunities to improve the welfare of vulnerable groups and help eliminate welfare inequality. The conclusion is also consistent with a growing body of literature underscoring the role of information technology in reducing poverty and inequality [

120,

121,

122]. However, our study shows that mobile payment can promote online consumption, but it does not lead to an increase in individuals’ SWB. As suggested by Ahn and Nam [

83], mobile payment may increase the risk of overconsumption and have a negative impact on consumers. Secondly, our study proves that the popularity of mobile payment is beneficial for reducing the negative impact of environmental pollution on individuals’ SWB. A growing body of research shows that environmental pollution exposure reduces people’s well-being [

123,

124]. Therefore, our findings provide some empirical evidence for how to reduce the negative impact of environmental pollution on individuals’ SWB via digital technology.

In addition, the disaggregated analysis demonstrates that mobile payment has a stronger positive impact on the SWB of people in areas that are relatively disadvantaged in the economic–socio–environmental system. The possible reason is that residents in these areas may face more serious resource constraints and environmental pollution problems, so mobile payment has a more positive role in improving their quality of life. Zhang et al. [

31], for instance, found that mobile payment has a greater positive impact on household consumption expenditure in central and western China than that in eastern China. They hold that the main reason for this is that households in eastern China face more developed financial and business services, and mobile payment is more of an alternative to traditional payment methods for them. In addition, Shao et al. [

125] suggested that people with better economic and social conditions have more ability to reduce the negative impact of environmental pollution on themselves. As the Brundtland Report asserted, “sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs” [

126]. Therefore, our conclusion proves that the adoption of mobile payment can contribute to sustainable development and a fairer and happier world.

6. Policy Implications and Limitations

Our work offers several implications for implementing people-oriented development policies. The goal of sustainable development requires achieving a dynamic balance between the economy, society, and the environment, thereby improving public well-being. The findings in our study underscore the potential of fintech to promote sustainable development by improving people’s economic and social conditions as well as coordinating the relationship between the natural environment and human activities. As the world’s largest developing country, China has witnessed the tremendous development and application of Internet technology during the past few decades. A series of information promotion policies has been promulgated and implemented to increase China’s digital technology penetration and its application. For instance, the Chinese government issued a white paper entitled “the State of the Internet in China” in 2010, which introduced the development of the Internet in China and elaborated the Chinese government’s policies on the Internet and its basic views on relevant issues. Subsequently, the State Council of the People’s Republic of China released the “guiding opinions” to promote the “Internet plus” action in 2015. The initiative aims to promote productivity and creativity in the economic and social system by deepening the integration of the Internet in various fields in China. Additionally, the Chinese government has also proposed the development strategies of “digital China” and the “digital village” in recent years, thus promoting its modernization process. Therefore, China’s experience indicates that taking effective measures to improve the application of digital technology can accelerate the modernization process in developing countries. These measures could involve increasing investments in information infrastructure, improving citizens’ information literacy, and promoting the integration of the Internet and social systems. At the same time, our study suggests that developing countries should take effective measures to amplify the positive impact of online consumption on public well-being and reduce its negative impact. For example, strengthening the quality supervision of online products and improving the logistics system and after-sales service guarantee all contribute to enhancing people’s good consumption experience. In addition, policymakers need to take more measures to analyze the deep-seated reasons that limit citizens’ use of mobile payment technology, especially the socially vulnerable population, thereby formulating more accurate information policies.

This paper is subject to several limitations. First, although we employ the IV estimator to address the endogeneity issue, the material used in our study is two years of cross-sectional data, not panel data. This makes it difficult to determine the long-term and dynamic impact of mobile payment on individual SWB. Furthermore, additional studies can select a more appropriate IV to identify causality. Second, although this paper offers an economic–social–environmental perspective to understand how mobile payment affects individual SWB, it does not further investigate how mobile payment specifically influences each pathway, for example, how mobile payment can reduce the negative impact of environmental pollution on people’s SWB. Is there heterogeneity for this? Moreover, the study does not discuss the potential confounding variables that may affect the relationship between mobile payment and SWB, such as an individual’s economic and social status and household endowment. Third, the mobile payment indicator used in this paper is a dummy variable, which does not allow for the observation of the influence of individual differences in mobile payment usage on SWB, such as mobile payment usage intensity or usage in different scenarios. Further work can adopt more specific data to capture that information. Fourth, as aforementioned, the experience of mobile payment in China in improving public welfare may offer several lessons for other developing countries. To address this issue, the research needs to further explore the institutional, cultural, and economic factors that promote the popularity of mobile payment in China. Meanwhile, analyzing the effect of mobile payment on the economic–social–environmental system of other countries, such as India and African countries, is also critical in order to conduct sustainable development. Finally, an over-reliance on digital technology may also increase people’s risk of social anxiety and obesity due to long hours indoors and a lack of exercise [

127]. Therefore, although mobile payment may reduce the negative impact of environmental pollution on people’s SWB, it may also have a negative impact on SWB due to the lack of connection with the external social environment, which is worth discussing in the future.