Peak-Season Price Adjustments in Shared Accommodation: The Role of Platform-Certified Signals and User-Generated Signals

Abstract

1. Introduction

2. Literature Review

3. Theoretical Framework, Conceptual Model, and Hypotheses

3.1. Signaling Theory

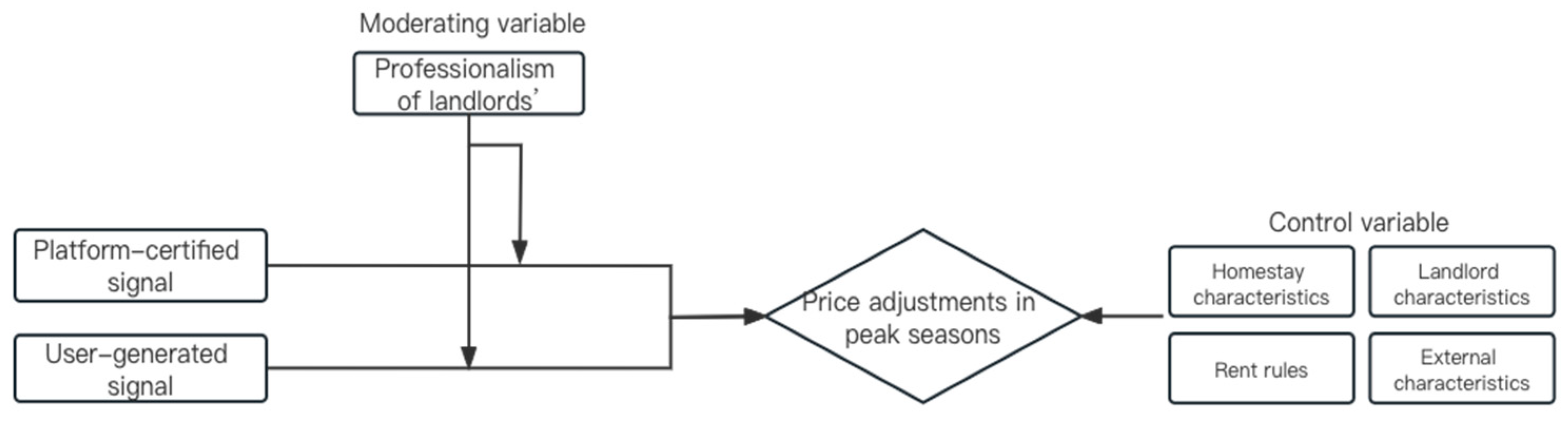

3.2. Conceptual Model

3.3. Research Hypothesis

4. Data Collection and Research Methodology

4.1. Variables

4.2. Data Collection

4.3. Research Model

5. Main Result

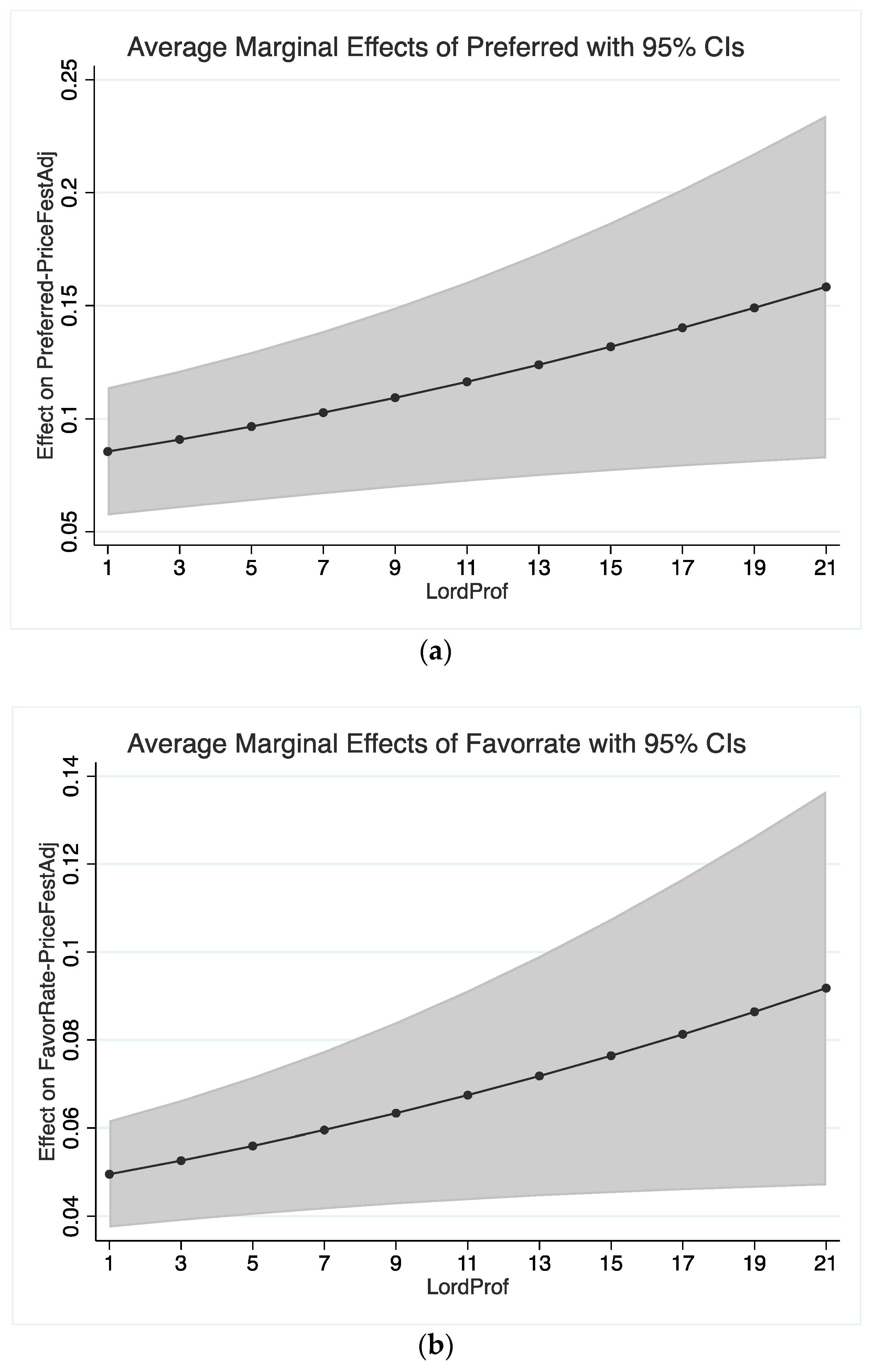

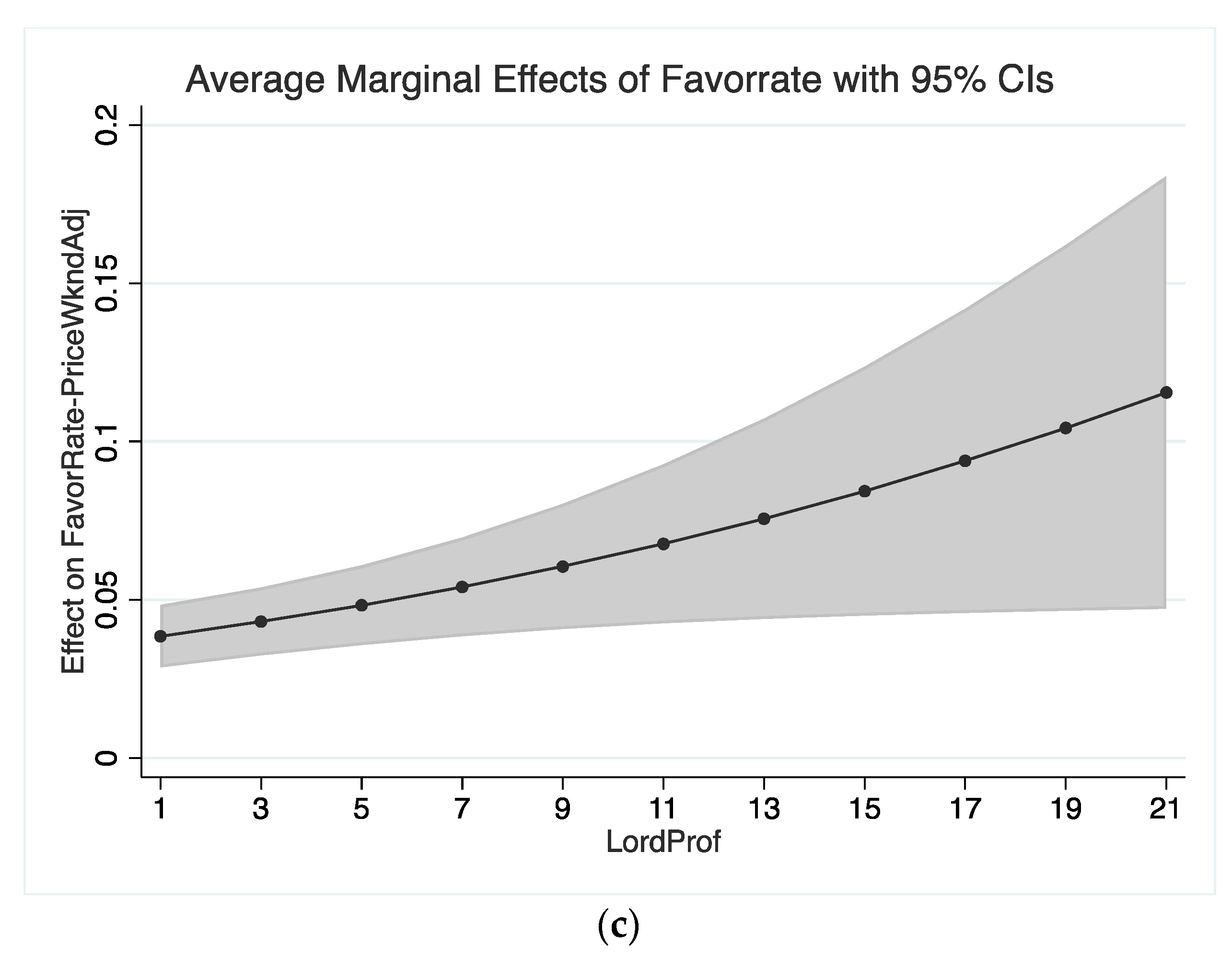

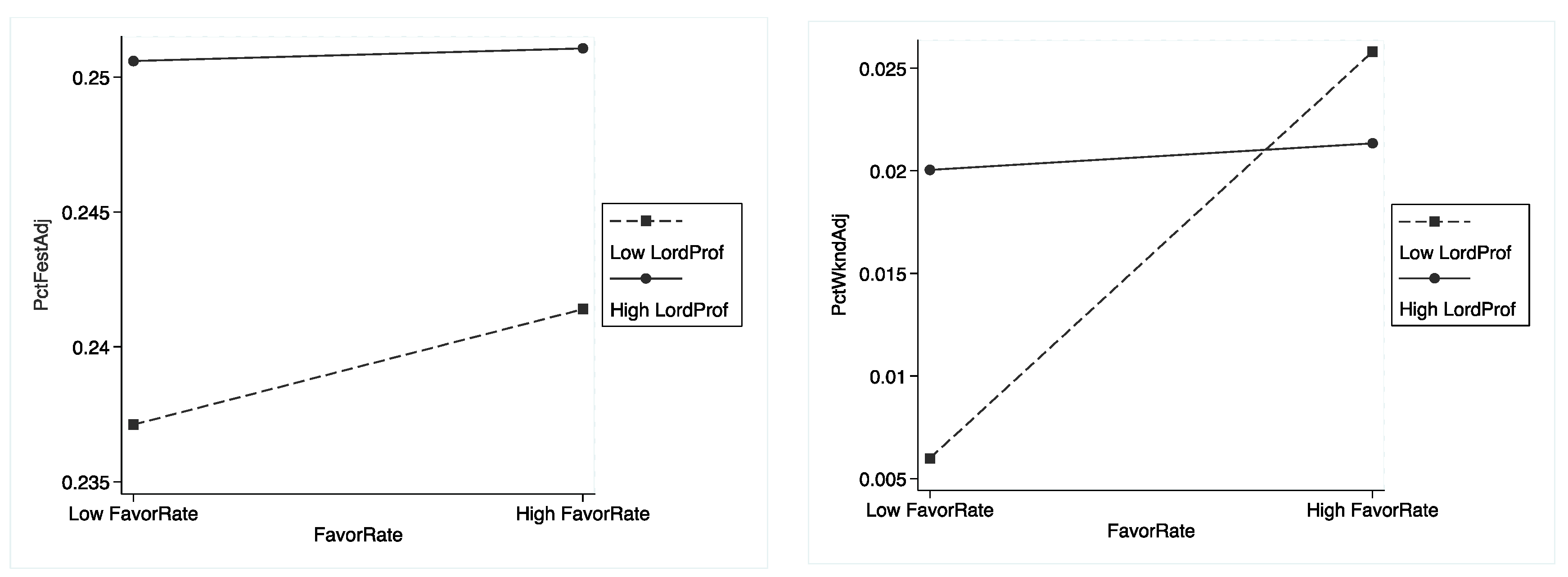

5.1. Impact of Signals on the Probability of Price Adjustments during Peak Seasons

5.2. Impact of Signals on the Percentage of Price Adjustments during Peak Seasons

5.3. Theoretical and Managerial Implications

6. Endogeneity Issue Discussion and Robustness Checks

6.1. Discussion of Endogeneity Issues

6.2. Discussion on the Robustness of Results

7. Conclusions and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Schlagwein, D.; Schoder, D.; Spindeldreher, K. Consolidated, systemic conceptualization, and definition of the “sharing economy”. J. Assoc. Inf. Sci. Technol. 2020, 71, 817–838. [Google Scholar] [CrossRef]

- Zervas, G.; Proserpio, D.; Byers, J.W. The Rise of the Sharing Economy: Estimating the Impact of Airbnb on the Hotel Industry. J. Mark. Res. 2017, 54, 687–705. [Google Scholar] [CrossRef]

- Chen, Y.Y.; Huang, Y.X.; Tan, C.H. Short-term rental and its regulations on the home-sharing platform. Inf. Manag. 2021, 58, 103322. [Google Scholar] [CrossRef]

- Yi, J.; Yuan, G.; Yoo, C. The effect of the perceived risk on the adoption of the sharing economy in the tourism industry: The case of Airbnb. Inf. Process. Manag. 2020, 57, 102108. [Google Scholar] [CrossRef]

- Guttentag, D. Airbnb: Disruptive innovation and the rise of an informal tourism accommodation sector. Curr. Issues Tour. 2015, 18, 1192–1217. [Google Scholar] [CrossRef]

- Tussyadiah, I.P. Factors of satisfaction and intention to use peer-to-peer accommodation. Int. J. Hosp. Manag. 2016, 55, 70–80. [Google Scholar] [CrossRef]

- Liang, L.J.; Choi, H.C.; Joppe, M. Exploring the relationship between satisfaction, trust and switching intention, repurchase intention in the context of Airbnb. Int. J. Hosp. Manag. 2018, 69, 41–48. [Google Scholar] [CrossRef]

- Li, Y.T.; Li, B.; Wang, G.; Yang, S. The effects of consumer animosity on demand for sharing-based accommodations: Evidence from Airbnb. Decis. Support Syst. 2021, 140, 113430. [Google Scholar] [CrossRef]

- Mahadevan, R. Examination of motivations and attitudes of peer-to-peer users in the accommodation sharing economy. J. Hosp. Mark. Manag. 2018, 27, 679–692. [Google Scholar] [CrossRef]

- Mudambi, S.M.; Schuff, D. What Makes a Helpful Online Review? A Study of Customer Reviews on Amazon.com. MIS Q. 2010, 34, 185–200. [Google Scholar] [CrossRef]

- Kuhzady, S.; Seyfi, S.; Beal, L. Peer-to-peer (P2P) accommodation in the sharing economy: A review. Curr. Issues Tour. 2022, 25, 3115–3130. [Google Scholar] [CrossRef]

- Taltavull de La Paz, P.; Norman Mora, E.; Su, Z.; Perez Sanchez, R.; Juarez Tarraga, F. Synchronisation among short-term rental markets, co-movements and cycles in 39 European cities. Cities 2023, 134, 104148. [Google Scholar] [CrossRef]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Morton, J.; Goodwill, A. Pricing in the sharing economy: A hedonic pricing model applied to Airbnb listings. J. Travel Tour. Mark. 2018, 35, 46–56. [Google Scholar] [CrossRef]

- Farmaki, A.; Stergiou, D.P.; Christou, P. Sharing economy: Peer-to-peer accommodation as a foucauldian heterotopia. Tour. Rev. 2021, 76, 570–578. [Google Scholar] [CrossRef]

- Ert, E.; Fleischer, A.; Magen, N. Trust and reputation in the sharing economy: The role of personal photos in Airbnb. Tour. Manag. 2016, 55, 62–73. [Google Scholar] [CrossRef]

- Liang, S.; Schuckert, M.; Law, R.; Chen, C.-C. Be a “Superhost”: The importance of badge systems for peer-to-peer rental accommodations. Tour. Manag. 2017, 60, 454–465. [Google Scholar] [CrossRef]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Yao, L.; Morton, J. Use of dynamic pricing strategies by Airbnb hosts. Int. J. Contemp. Hosp. Manag. 2018, 30, 2–20. [Google Scholar] [CrossRef]

- Kwok, L.; Xie, K.L. Pricing strategies on Airbnb: Are multi-unit hosts revenue pros? Int. J. Hosp. Manag. 2019, 82, 252–259. [Google Scholar] [CrossRef]

- Ye, P.; Qian, J.; Chen, J.; Wu, C.-H.; Zhou, Y.; De Mars, S.; Yang, F.; Zhang, L. Acm in Customized Regression Model for Airbnb Dynamic Pricing. In Proceedings of the 24th ACM SIGKDD Conference on Knowledge Discovery and Data Mining (KDD), London, UK, 19–23 August 2018; pp. 932–940. [Google Scholar]

- Ikkala, T.; Lampinen, A. Defining the price of hospitality: Networked hospitality exchange via Airbnb. In Proceedings of the Companion Publication of the 17th ACM Conference on Computer Supported Cooperative Work & Social Computing, Baltimore, MD, USA, 15–19 February 2014. [Google Scholar] [CrossRef]

- Wang, D.; Nicolau, J.L. Price determinants of sharing economy based accommodation rental: A study of listings from 33 cities on Airbnb.com. Int. J. Hosp. Manag. 2017, 62, 120–131. [Google Scholar] [CrossRef]

- Priporas, C.V.; Stylos, N.; Rahimi, R.; Vedanthachari, L.N. Unraveling the diverse nature of service quality in a sharing economy A social exchange theory perspective of Airbnb accommodation. Int. J. Contemp. Hosp. Manag. 2017, 29, 2279–2301. [Google Scholar] [CrossRef]

- Xie, K.L.; Chen, Y. Effects of host incentives on multiple listings in accommodation sharing. Int. J. Contemp. Hosp. Manag. 2019, 31, 1995–2013. [Google Scholar] [CrossRef]

- Benitez-Aurioles, B. Why are flexible booking policies priced negatively? Tour. Manag. 2018, 67, 312–325. [Google Scholar] [CrossRef]

- Kakar, V.; Voelz, J.; Wu, J.; Franco, J. The Visible Host: Does race guide Airbnb rental rates in San Francisco? J. Hous. Econ. 2018, 40, 25–40. [Google Scholar] [CrossRef]

- Mariani, M.; Predvoditeleva, M. How do online reviewers’ cultural traits and perceived experience influence hotel online ratings? An empirical analysis of the Muscovite hotel sector. Int. J. Contemp. Hosp. Manag. 2019, 31, 4543–4573. [Google Scholar] [CrossRef]

- Abrate, G.; Sainaghi, R.; Mauri, A.G. Dynamic pricing in Airbnb: Individual versus professional hosts. J. Bus. Res. 2022, 141, 191–199. [Google Scholar] [CrossRef]

- Boto-García, D. Heterogeneous price adjustments among Airbnb hosts amid COVID-19: Evidence from Barcelona. Int. J. Hosp. Manag. 2022, 102, 103169. [Google Scholar] [CrossRef] [PubMed]

- Deng, T.; Ma, M.; Nelson, J.D. Measuring the impacts of Bus Rapid Transit on residential property values: The Beijing case. Res. Transp. Econ. 2016, 60, 54–61. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Deboosere, R.; Kerrigan, D.J.; Wachsmuth, D.; El-Geneidy, A. Location, location and professionalization: A multilevel hedonic analysis of Airbnb listing prices and revenue. Reg. Stud. Reg. Sci. 2019, 6, 143–156. [Google Scholar] [CrossRef]

- Wang, X.; Sun, J.; Wen, H. Tourism seasonality, online user rating and hotel price: A quantitative approach based on the hedonic price model. Int. J. Hosp. Manag. 2019, 79, 140–147. [Google Scholar] [CrossRef]

- Zhao, C.F.; Wu, Y.L.; Chen, Y.F.; Chen, G.H. Multiscale Effects of Hedonic Attributes on Airbnb Listing Prices Based on MGWR: A Case Study of Beijing, China. Sustainability 2023, 15, 1703. [Google Scholar] [CrossRef]

- Spence, A.M. Market signaling: Informational transfer in hiring and related screening processes. ILR Rev. 1974, 29, 143. [Google Scholar]

- Rothschild, M.; Stiglitz, J. Equilibrium in Competitive Insurance Markets: An Essay on the Economics of Imperfect Information*. Q. J. Econ. 1976, 90, 629–649. [Google Scholar] [CrossRef]

- Spence, M. Job Market Signaling*. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Yao, B.; Qiu, R.T.R.; Fan, D.X.F.; Liu, A.; Buhalis, D. Standing out from the crowd—An exploration of signal attributes of Airbnb listings. Int. J. Contemp. Hosp. Manag. 2019, 31, 4520–4542. [Google Scholar] [CrossRef]

- Filieri, R.; Galati, F.; Raguseo, E. The Host Canceled My Reservation! Impact of Host Cancelations on Occupancy Rate in the P2P Context: A Signaling Theory Perspective. IEEE Trans. Eng. Manag. 2022, 71, 785–796. [Google Scholar] [CrossRef]

- Truong, Y.; Ackermann, C.-L.; Klink, R.R. The role of legitimacy and reputation judgments in users’ selection of service providers on sharing economy platforms. Inf. Manag. 2021, 58, 103529. [Google Scholar] [CrossRef]

- Zhang, L.; Yan, Q.; Zhang, L. A computational framework for understanding antecedents of guests’ perceived trust towards hosts on Airbnb. Decis. Support Syst. 2018, 115, 105–116. [Google Scholar] [CrossRef]

- Zhang, L.; Yan, Q.; Zhang, L. A text analytics framework for understanding the relationships among host self-description, trust perception and purchase behavior on Airbnb. Decis. Support Syst. 2020, 133, 113288. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Zamani, E.D.; Choudrie, J.; Katechos, G.; Yin, Y. Trust in the sharing economy: The AirBnB case. Ind. Manag. Data Syst. 2019, 119, 1947–1968. [Google Scholar] [CrossRef]

- Biswas, B.; Sengupta, P.; Chatterjee, D. Examining the determinants of the count of customer reviews in peer-to-peer home-sharing platforms using clustering and count regression techniques. Decis. Support Syst. 2020, 135, 113324. [Google Scholar] [CrossRef]

- Ert, E.; Fleischer, A. The evolution of trust in Airbnb: A case of home rental. Ann. Tour. Res. 2019, 75, 279–287. [Google Scholar] [CrossRef]

- Liang, T.-P.; Lin, Y.-L.; Hou, H.-C. What drives consumers to adopt a sharing platform: An integrated model of value-based and transaction cost theories. Inf. Manag. 2021, 58, 103471. [Google Scholar] [CrossRef]

- Ba, S.L.; Pavlou, P.A. Evidence of the effect of trust building technology in electronic markets: Price premiums and buyer behavior. Mis Q. 2002, 26, 243–268. [Google Scholar] [CrossRef]

- Zhao, J.L.; Wang, H.W.; Zhang, Y.; Huang, Y.X. Trust in sharing accommodation sector: An institution-based trust perspective. Internet Res. 2023, 33, 1399–1421. [Google Scholar] [CrossRef]

- Fleischer, A.; Ert, E.; Bar-Nahum, Z. The Role of Trust Indicators in a Digital Platform: A Differentiated Goods Approach in an Airbnb Market. J. Travel Res. 2022, 61, 1173–1186. [Google Scholar] [CrossRef]

- Cai, Y.; Ke, W.M.; Cui, E.; Yu, F. A deep recommendation model of cross-grained sentiments of user reviews and ratings. Inf. Process. Manag. 2022, 59, 102842. [Google Scholar] [CrossRef]

- Yacouel, N.; Fleischer, A. The Role of Cybermediaries in Reputation Building and Price Premiums in the Online Hotel Market. J. Travel Res. 2012, 51, 219–226. [Google Scholar] [CrossRef]

- Li, H.; Chen, Q.; Zhong, Z.M.; Gong, R.R.; Han, G.K. E-word of mouth sentiment analysis for user behavior studies. Inf. Process. Manag. 2022, 59, 102784. [Google Scholar] [CrossRef]

- Fang, J.M.; Wen, L.; Ren, H.Y.; Wen, C. The effect of technical and functional quality on online physician selection: Moderation effect of competition intensity. Inf. Process. Manag. 2022, 59, 102969. [Google Scholar] [CrossRef]

- Daugherty, T.; Eastin, M.S.; Bright, L. Exploring Consumer Motivations for Creating User-Generated Content. J. Interact. Advert. 2008, 8, 16–25. [Google Scholar] [CrossRef]

- Goh, K.Y.; Heng, C.S.; Lin, Z.J. Social Media Brand Community and Consumer Behavior: Quantifying the Relative Impact of User- and Marketer-Generated Content. Inf. Syst. Res. 2013, 24, 88–107. [Google Scholar] [CrossRef]

- Xiao, M.; Zhai, C. Research on Subsidy Strategy of Shared Accommodation Platform under the Background of Big Data Based on Evolutionary Game. Comput. Intell. Neurosci. 2022, 2022, 9066215. [Google Scholar] [CrossRef]

- Jia, R.; Wang, S. Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome. Sustainability 2021, 13, 12331. [Google Scholar] [CrossRef]

- Tsai, I.C. Price Rigidity and Vacancy Rates: The Framing Effect on Rental Housing Markets. J. Real Estate Financ. Econ. 2021, 63, 547–564. [Google Scholar] [CrossRef]

- Yang, Z.Y. Contract design in China’s rural land rental market: Contractual flexibility and rental payments. J. Econ. Behav. Organ. 2020, 178, 15–43. [Google Scholar] [CrossRef]

- Lawani, A.; Reed, M.R.; Mark, T.; Zheng, Y.Q. Reviews and price on online platforms: Evidence from sentiment analysis of Airbnb reviews in Boston. Reg. Sci. Urban Econ. 2019, 75, 22–34. [Google Scholar] [CrossRef]

- Zhao, J.; Peng, Z.X. Shared Short-Term Rentals for Sustainable Tourism in the Social-Network Age: The Impact of Online Reviews on Users’ Purchase Decisions. Sustainability 2019, 11, 4064. [Google Scholar] [CrossRef]

- Zhu, H.; Gumus, M.; Ray, S. Short-Term Housing Rentals and Corporatization of Platform Pricing. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Rao, A. Online Content Pricing: Purchase and Rental Markets. Mark. Sci. 2015, 34, 430–451. [Google Scholar] [CrossRef]

- Miao, R.; Qi, Z.; Shi, C.; Lin, L. Personalized Pricing with Invalid Instrumental Variables: Identification, Estimation, and Policy Learning. arXiv 2023, arXiv:2302.12670. Available online: https://ui.adsabs.harvard.edu/abs/2023arXiv230212670M (accessed on 1 February 2023).

- Burgess, S.; Small, D.S.; Thompson, S.G. A review of instrumental variable estimators for Mendelian randomization. Stat. Methods Med. Res. 2017, 26, 2333–2355. [Google Scholar] [CrossRef] [PubMed]

| Author | Price-Influencing Factors | Sample | Results |

|---|---|---|---|

| Ikkala et al. [21] | Landlord reputation | 11 Airbnb landlords with different levels of experience | Landlord reputation has a positive impact on listing prices |

| Wang et al. [22] | Landlord and accommodation characteristics, property amenities, rent rules, and reviews | 180,533 listings across 33 cities on Airbnb | All five factors have significant impacts on listing prices |

| Benítez-Aurioles [25] | Flexible cancellation policy | 497,509 listings across 44 cities globally | Flexible cancellation policies have a negative impact on listing prices |

| Kakar et al. [26] | Landlord ethnicity | 2772 Airbnb listings in San Francisco | Landlord ethnicity has a significant impact on listing prices |

| Gibbs et al. [14] | Landlord and accommodation characteristics | 15,716 Airbnb listings in Canada | Location and pictures have a positive impact on price while star ratings and review count have a negative impact |

| Abrate et al. [28] | Landlord professionalism | 1.2 million observation of Airbnb data from Milan and Rome | The average intensity of price variability tends to increase with the degree of professionalization (number of listings) |

| Boto-García [29] | Landlord professionalism | 24,000 Airbnb listings in Barcelona | Professional landlords show higher intertemporal price discrimination |

| Deboosere et al. [32] | Time variable, structural variable, host variable, and location and neighborhood variables | 386,153 Airbnb listings in NYC | Location and seasonality have a significant impact on the price of Airbnb listings |

| Zhao et al. [34] | Functional attributes, locational attributes, reputational attributes, and host status attributes | 1499 Airbnb listings in Beijing, China | Number of bedrooms, ratings, and transportation convenience have positive influences on listing prices, while reviews and the “Superhost” badge are negatively related to listing prices |

| Type | Variable | Definition |

|---|---|---|

| Dependent Variables | Price adjustments | |

| PriceFestAdj | =1 if prices are adjusted during festivals | |

| PctFestAdj | Percentage of festival price adjustment | |

| PriceWkndAdj | =1 if prices are adjusted during weekends | |

| PctWkndAdj | Percentage of weekend price adjustment | |

| Independent Variables | Platform-certified signal | |

| Preferred | Platform preferred/recommended houses | |

| User-generated signal | ||

| FavorRate | 100 × the ratio of positive comments (“positive comments” are defined as those reviews where guests have given a listing a rating that meets or exceeds a certain threshold indicative of satisfaction. Specifically, our dataset categorizes reviews with ratings of 4 or 5 stars on a 5-star scale as “positive”.) received by landlords | |

| Moderating Variable | Landlord professionalism | |

| LordProf | Number of properties listed (owned) by the landlord | |

| Interaction Terms | Platform-certified signal interaction term | |

| Preferred × LordProf | ||

| User-generated signal interaction term | ||

| FavorRate × LordProf | ||

| Control Variables | Accommodation characteristics | |

| Area | House area (size) | |

| DailyPrice | Single-day price for the rental home | |

| Headline | Length for headline of the listing (in words) | |

| PicNum | Number of pictures provided by the landlord | |

| Describe | Descriptive text length (in words) | |

| Landlord characteristics | ||

| SatisNum | Number of satisfactory ratings received by the landlord | |

| GoldLord | =1 if the landlord is certified as a gold landlord | |

| LordComment | Number of comments received by the landlord | |

| LordText | Comments text length (in words) | |

| Rent rules | ||

| RentWay | =1 if whole-house rental; =0 if share with others | |

| Cancel | =1 if there is flexible cancellation | |

| DepositFree | =1 if there is no deposit | |

| Discount | =1 if there is a renewal discount | |

| StartNum | Minimum lease days | |

| External characteristics | ||

| SalesAmount | Overall tourism revenue in the province | |

| Income | Total revenue of the shared accommodation industry in the province | |

| CPI | The consumer price index in the province | |

| HousePrice | Average sale price of pre-owned houses in the province | |

| Variable | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| PriceFestAdj | 11,795 | 0.1 | 0.31 | 0 | 1 |

| PriceWkndAdj | 11,795 | 0.06 | 0.24 | 0 | 1 |

| PctFestAdj | 11,795 | 0.23 | 1.55 | 0 | 49.5 |

| PctWkndAdj | 11,795 | 0.02 | 0.11 | 0 | 3.98 |

| Preferred | 11,795 | 0.06 | 0.23 | 0 | 1 |

| FavorRate | 11,795 | 35 | 47 | 0 | 100 |

| LordProf | 11,795 | 5.85 | 9.63 | 0 | 63 |

| Area | 11,795 | 56.58 | 77.35 | 1 | 4917 |

| DailyPrice | 11,795 | 175.88 | 413.04 | 10 | 15,000 |

| Headline | 11,795 | 14.17 | 7.72 | 0 | 50 |

| PicNum | 11,795 | 11.63 | 7.99 | 1 | 72 |

| Describe | 11,795 | 174.41 | 195.08 | 1 | 2079 |

| SatisNum | 11,795 | 27.9 | 83.3 | 0 | 999 |

| GoldLord | 11,795 | 0.08 | 0.28 | 0 | 1 |

| LordComment | 11,795 | 3.91 | 17.77 | 0 | 464 |

| LordText | 11,795 | 195.83 | 618.77 | 0 | 5370 |

| RentWay | 11,795 | 1.54 | 0.66 | 0 | 2 |

| Cancel | 11,795 | 0.78 | 0.42 | 0 | 1 |

| DepositFree | 11,795 | 0.46 | 0.5 | 0 | 1 |

| Discount | 11,795 | 0.28 | 0.45 | 0 | 1 |

| StartNum | 11,795 | 4.83 | 9 | 1 | 31 |

| SalesAmount | 11,795 | 131.99 | 109 | 6.5 | 427.1 |

| Income | 11,795 | 70.78 | 57.22 | 3.6 | 235.9 |

| CPI | 11,795 | 102.46 | 0.45 | 101.5 | 103.6 |

| HousePrice | 11,795 | 21,348.57 | 17,119.47 | 2939 | 1.20 × 105 |

| Model Dependent Variable | Logit1 PriceFestAdj (OddsRatio) | Logit2 PriceFestAdj (OddsRatio) | Logit3 PriceWkndAdj (OddsRatio) | Logit4 PriceWkndAdj (OddsRatio) |

|---|---|---|---|---|

| Preferred | 13.749 *** | 6.989 *** | 28.721 *** | 26.794 *** |

| FavorRate | 2.397 *** | 3.088 *** | 2.737 *** | 4.358 *** |

| LordProf | 1.022 *** | 1.054 ** | 0.983 *** | 1.088 *** |

| Area | 1.002 * | 1.002 * | 1 | 1 |

| DailyPrice | 0.999 *** | 0.999 *** | 0.999 ** | 0.999 ** |

| Headline | 1.052 *** | 1.054 *** | 1.014 * | 1.012 |

| PicNum | 1.032 *** | 1.032 *** | 1.015 * | 1.014 * |

| Describe | 1.001 *** | 1.001 *** | 1.001 * | 1.000 * |

| SatisNum | 1.006 *** | 1.006 *** | 0.991 * | 0.989 ** |

| GoldLord | 0.543 ** | 0.583 * | 0.719 | 0.76 |

| LordComment | 0.816 *** | 0.832 *** | 0.952 | 0.967 |

| LordText | 1.002 *** | 1.002 *** | 1.001 | 1.001 |

| RentWay | 2.590 *** | 2.573 *** | 3.488 *** | 3.505 *** |

| Cancel | 0.552 *** | 0.554 *** | 0.812 | 0.817 |

| DepositFree | 1.283 ** | 1.288 ** | 1.174 | 1.151 |

| Discount | 1.519 *** | 1.519 *** | 1.684 *** | 1.688 *** |

| StartNum | 0.957 *** | 0.957 *** | 0.962 *** | 0.961 *** |

| SalesAmount | 1.011 *** | 1.010 ** | 1.029 *** | 1.029 *** |

| Income | 0.980 ** | 0.981 ** | 0.947 *** | 0.946 *** |

| CPI | 0.656 *** | 0.672 *** | 1.263 | 1.279 |

| HousePrice | 1 | 1 | 1 | 1 |

| Preferred × LordProf | 1.056 *** | 1.033 | ||

| FavorRate × LordProf | 0.944 ** | 0.873 *** | ||

| N | 11,795 | 11,795 | 11,795 | 11,795 |

| Pseudo R2 | 0.4742 | 0.4762 | 0.4349 | 0.4384 |

| Model Dependent_Variable | Reg1 PctFestAdj (Coef.) | Reg2 PctFestAdj (Coef.) | Reg3 PctWkndAdj (Coef.) | Reg4 PctWkndAdj (Coef.) |

|---|---|---|---|---|

| Preferred | 3.003 *** | 3.121 *** | 0.088 *** | 0.102 *** |

| FavorRate | 0.043 * | 0.061 *** | 0.014 *** | 0.016 *** |

| LordProf | −0.001 | 0.007 ** | −0.000 * | 0.001 * |

| Area | 0 | 0 | −0.000 * | 0 |

| DailyPrice | −0.000 *** | −0.000 *** | 0 | 0 |

| Headline | −0.01 | −0.01 | 0 | 0 |

| PicNum | 0.011 ** | 0.011 ** | 0 | 0 |

| Describe | 0 | 0 | 0 | 0 |

| SatisNum | 0.000 *** | 0.000 *** | −0.000 *** | −0.000 *** |

| GoldLord | 0.006 | −0.003 | −0.005 * | −0.006 ** |

| LordComment | −0.001 * | −0.001 ** | 0.000 * | 0.000 ** |

| LordText | 0 | −0.000 * | 0 | 0 |

| RentWay | 0.045 *** | 0.045 *** | 0.006 *** | 0.006 *** |

| Cancel | −0.027 * | −0.025 * | −0.003 | −0.003 |

| DepositFree | 0.040 ** | 0.038 ** | 0.003 | 0.003 |

| Discount | 0.053 *** | 0.054 *** | 0.002 | 0.002 |

| StartNum | 0.007 ** | 0.007 ** | −0.000 * | −0.000 * |

| SalesAmount | −0.004 ** | −0.004 *** | 0.000 *** | 0.000 *** |

| Income | 0.009 *** | 0.009 *** | −0.001 *** | −0.001 *** |

| CPI | −0.130 *** | −0.130 *** | 0.003 | 0.003 |

| HousePrice | −0.000 *** | −0.000 *** | −0.000 * | −0.000 * |

| Preferred × LordProf | −0.004 | −0.001 | ||

| FavorRate × LordProf | −0.007 ** | −0.001 ** | ||

| _cons | 13.325 *** | 13.266 *** | −0.262 | −0.267 |

| N | 11,795 | 11,795 | 11,795 | 11,795 |

| adj. R2 | 0.2039 | 0.2055 | 0.0578 | 0.0584 |

| Hypothesis | Peak Season | Type of Signal | Probability of Price Adjustment | Percentage of Price Adjustment |

|---|---|---|---|---|

| H1a | Festival | Platform-certified | Positive (supported) | |

| H1b | Festival | Platform-certified | Positive (supported) | |

| H1c | Weekend | Platform-certified | Positive (supported) | |

| H1d | Weekend | Platform-certified | Positive (supported) | |

| H2a | Festival | User-generated | Positive (supported) | |

| H2b | Festival | User-generated | Positive (supported) | |

| H2c | Weekend | User-generated | Positive (supported) | |

| H2d | Weekend | User-generated | Positive (supported) | |

| Moderating Effect of Landlord Professionalism | ||||

| H3a | Festival | Platform-certified | Positive (supported) | |

| H3b | Weekend | Platform-certified | Positive (not supported) | |

| H3c | Festival | User-generated | Positive (supported) | |

| H3d | Weekend | User-generated | Positive (supported) | |

| H4a | Festival | Platform-certified | Negative (not supported) | |

| H4b | Weekend | Platform-certified | Negative (not supported) | |

| H4c | Festival | User-generated | Negative (supported) | |

| H4d | Weekend | User-generated | Negative (supported) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Liu, Y.; Li, S.; Wang, H. Peak-Season Price Adjustments in Shared Accommodation: The Role of Platform-Certified Signals and User-Generated Signals. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1164-1184. https://doi.org/10.3390/jtaer19020060

Wang X, Liu Y, Li S, Wang H. Peak-Season Price Adjustments in Shared Accommodation: The Role of Platform-Certified Signals and User-Generated Signals. Journal of Theoretical and Applied Electronic Commerce Research. 2024; 19(2):1164-1184. https://doi.org/10.3390/jtaer19020060

Chicago/Turabian StyleWang, Xiangyu, Yipeng Liu, Shengli Li, and Haoyu Wang. 2024. "Peak-Season Price Adjustments in Shared Accommodation: The Role of Platform-Certified Signals and User-Generated Signals" Journal of Theoretical and Applied Electronic Commerce Research 19, no. 2: 1164-1184. https://doi.org/10.3390/jtaer19020060

APA StyleWang, X., Liu, Y., Li, S., & Wang, H. (2024). Peak-Season Price Adjustments in Shared Accommodation: The Role of Platform-Certified Signals and User-Generated Signals. Journal of Theoretical and Applied Electronic Commerce Research, 19(2), 1164-1184. https://doi.org/10.3390/jtaer19020060