Global Market Perceptions of Cryptocurrency and the Use of Cryptocurrency by Consumers: A Pilot Study

Abstract

1. Introduction

- (a)

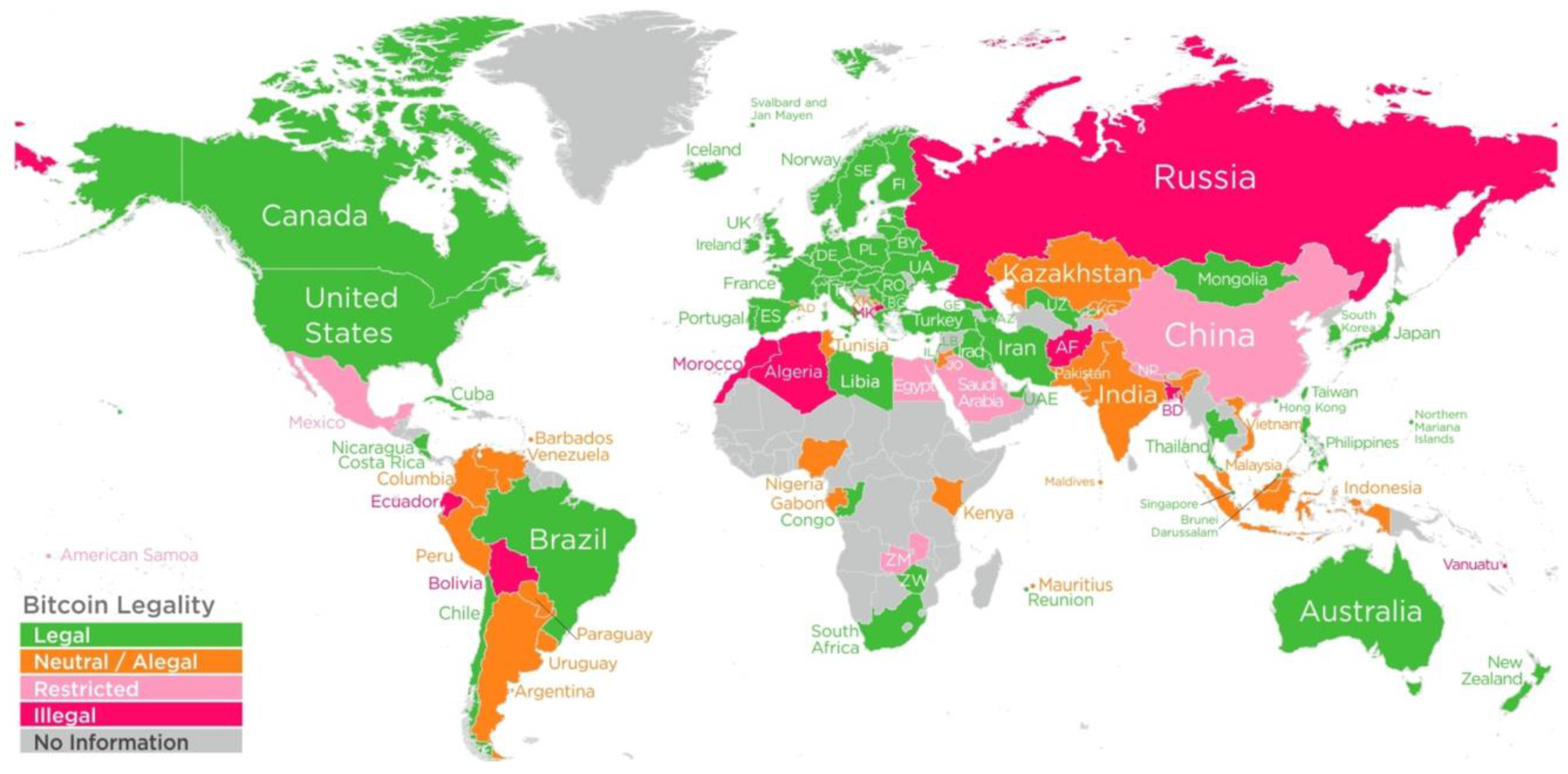

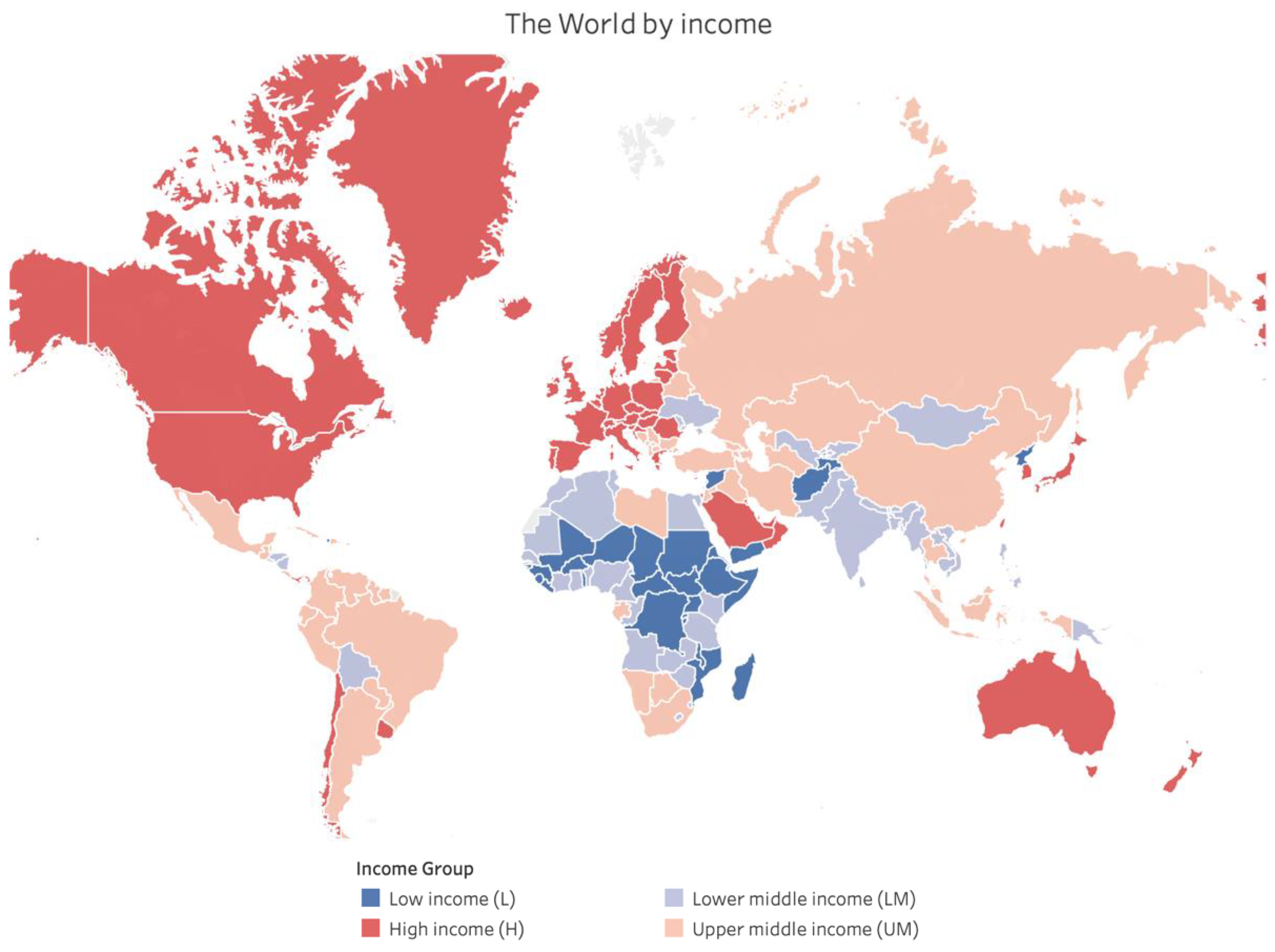

- In this study, we review and assess the consumer behavior and perceptions of cryptocurrency based on several factors: (i) the factors that influence cryptocurrency usage, (ii) consumer perception and behavioral factors associated with cryptocurrency use, (iii) case studies about the use and influence of cryptocurrencies in different countries, and (iv) the technological processes involved in handling cryptocurrencies.

- (b)

- Furthermore, it sheds some light on how this relatively new exchange medium is perceived around the world.

- (c)

- We also review the various processes involved in handling cryptocurrencies online, types of cryptocurrencies, common challenges, and security issues in managing cryptocurrencies, their effects on consumers, and their future directions.

- (d)

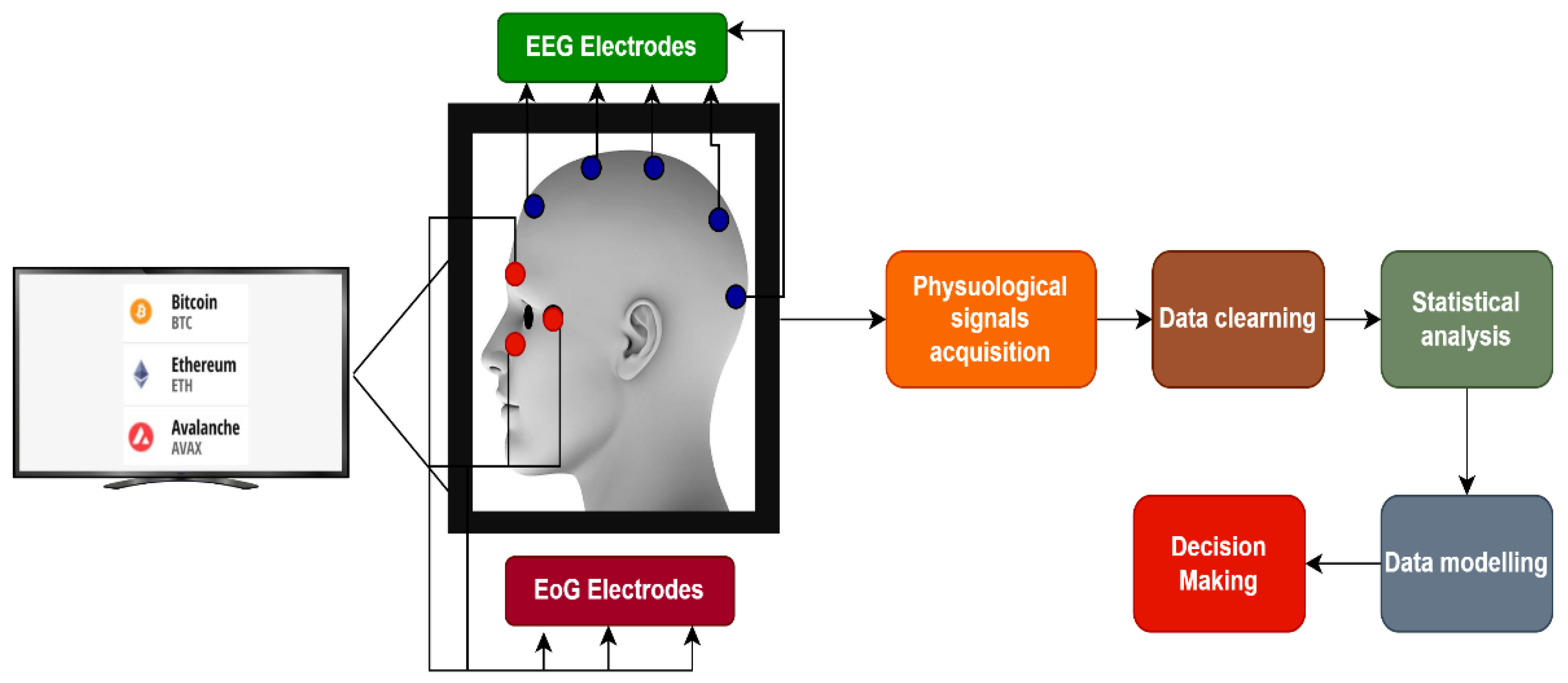

- We propose a physiological signals-based consumer perception assessment in cryptocurrency to understand consumer behavior more accurately.

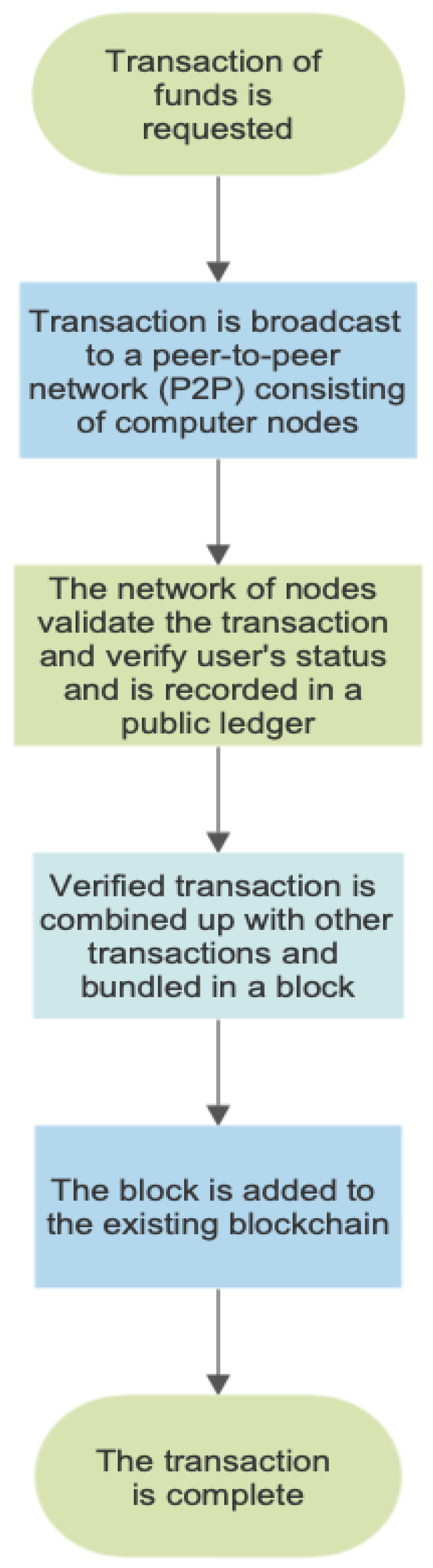

2. The Process Involved in Handling Cryptocurrencies

- a.

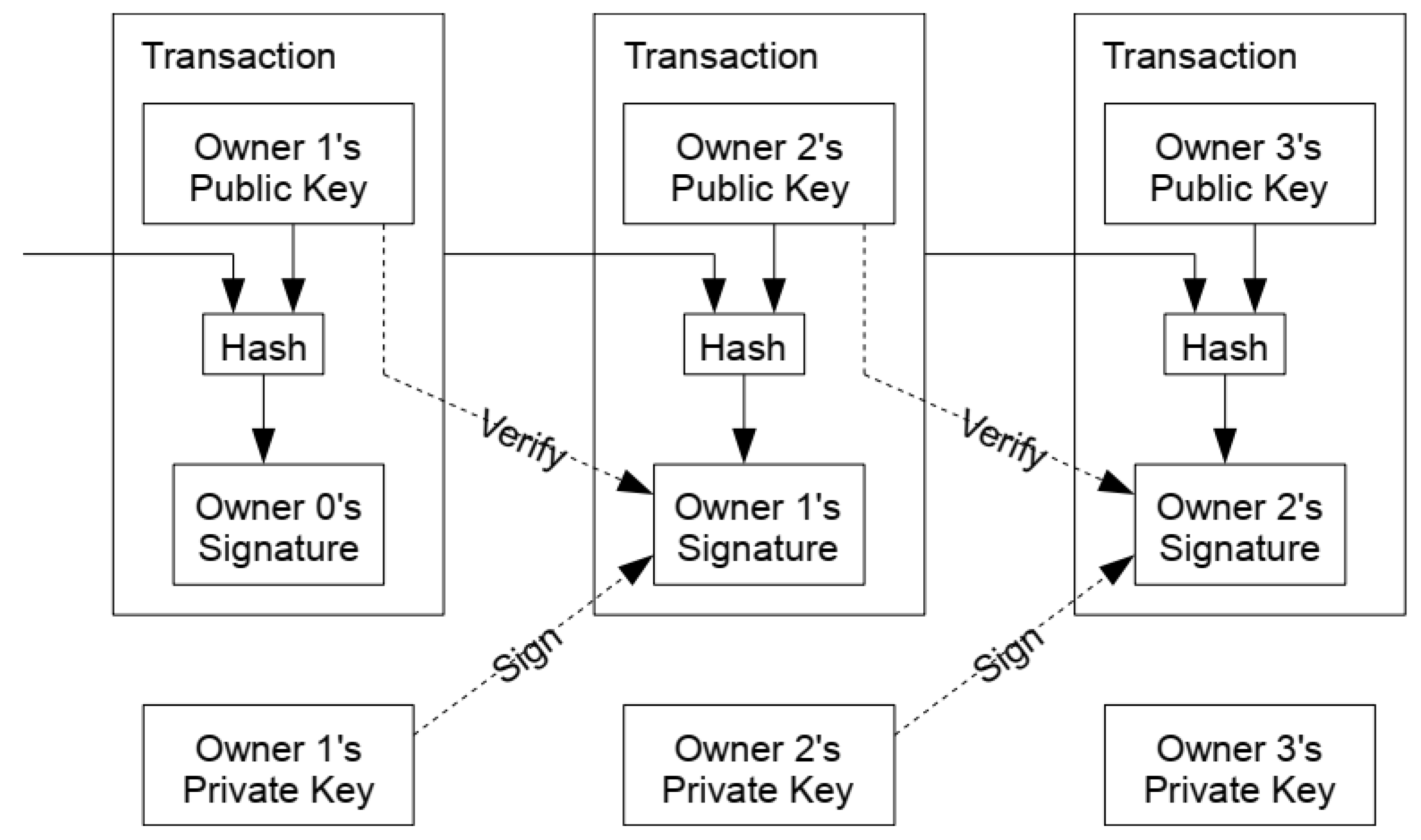

- Blockchain Technology: Blockchain technology and mining are the two fundamental elements involved in creating cryptocurrency. Blockchain is the backbone technology involved in cryptocurrency operations. It is a decentralized platform used for handling transactions and data processing without an intermediate agent [19]. It is a framework that enables transactions to be performed through a distributed chain of blocks that are stored on a secured ledger. This makes them permanent and anonymous [20]. Cryptocurrencies are stored in secure wallets and processed by the blockchain, in which each block is associated with a fixed time stamp and distributed through a decentralized ledger. All details regarding each transaction are saved in blocks from A to Z [21].

- b.

- Exchanges and Wallets: The common elements in a basic transaction are the number of bitcoins exchanged, the wallet address to whom the bitcoins must be transferred (the receiver of the bitcoins), and a private key (of the sender) used for verifying the transaction. This stands in stark contrast to regular transactions in any other form of currency as there is no central authority directly involved. However, similar to other currency markets, cryptocurrency value fluctuates and changes due to various factors in the economy. These factors include the cost of producing bitcoin through mining, the exchange it trades on, regulations regarding its sale, and other internal regulations.

- c.

- Cryptocurrency mining: The network is accessible to the public. Miners are individuals who work tirelessly to solve problems related to online transactions which require heavy computing equipment, specialized software, large amounts of bandwidth, and large amounts of electricity. Bitcoin’s system needs to be aggravated with cumulative computational control that supplements the mining’s substance. New bitcoins created by miners are usually paid off with bitcoins that can now be withdrawn from the currency. Bitcoins can also be made through other means besides mining. There is also free software available that allows people to convert their fiat currencies into bitcoins and vice versa [21].

3. Factors That Influence the Use of Cryptocurrency

4. Consumer Perception and Behavioral Factors Related to the Use of Cryptocurrency

4.1. Survey and Case Studies in Different Countries

4.2. Cryptocurrency Investors Market Analysis

5. Cryptocurrencies—Types, Exchanges, and Platforms

- d.

- Coinbase (https://www.coinbase.com/) (accessed on 20 January 2023): In more than 100 countries, this platform is one of the largest exchanges for trading BTC, BCH, ETH, ETC, LTC, and ERC-20 tokens. Both iOS and Android platforms are supported for instant and scheduled trading (daily, weekly, monthly).

- e.

- PrimeXBT (https://primexbt.com/) (accessed on 5 June 2023): Through this platform, consumers can sell and buy cryptocurrencies, stock indices, commodities, and Forex through a single account. This module allows users to copy the best trading activity from the covering module in order to create their trading strategy. Using the intuitive platform, users can manage and execute orders in real-time and analyze market data in real-time.

- f.

- Binance (https://www.binance.com/) (accessed on 20 July 2023): This online platform supports trading in more than 150 countries and is compatible with Web, iOS, and Android platforms. Approximately 2 billion transactions are executed per day with more than 1.4 million transactions per second. Binance has one of the highest transaction speeds among online trading platforms.

- g.

- Cex.io (https://cex.io/) (accessed on 20 July 2023): A consumer using this platform is protected from DDOS (Distributed Denial-of-Service) attacks with full data encryption during crypto transactions. A variety of coins, including Bitcoin, Ethereum, and XRP (Ripple), can be traded here. The system accepts MasterCard, Visa, or PayPal as payment methods.

- h.

- Cointree (https://www.cointree.com/) (accessed on 10 June 2023): Cryptocurrency exchange platform owned and operated by Australians, regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC). More than 130 cryptocurrencies are supported, as well as instant AUD deposits using PayID.

- i.

- Changelly (https://changelly.com/) (accessed on 30 June 2023): A platform offering secure and fast trading of 150+ cryptocurrencies is provided by this company. It provides flawless purchases, sales, swaps, and trading of cryptocurrencies through 350 API partners. The consumer can choose the crypto pair for exchange, then after confirmation, the exact amount will be sent to the address provided, and the crypto will be delivered to the wallet within minutes.

6. Discussion

- (a)

- Challenges and Issues in Cryptocurrency

- (b)

- Security issues in cryptocurrency

- (c)

- Physiological signals-based consumer perception assessment in cryptocurrency

- (d)

- Further scope of the study

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alqaryouti, O.; Siyam, N.; Alkashri, Z.; Shaalan, K. Users’ Knowledge and Motivation on Using Cryptocurrency. In Information Systems Lecture Notes in Business Information Processing; Springer: Cham, Switzerland, 2020; pp. 113–122. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System (August 21, 2008). Available online: https://ssrn.com/abstract=3440802 (accessed on 30 July 2022). [CrossRef]

- Understanding Cryptocurrency Market Cap. 2023. Available online: https://www.slickcharts.com/currency (accessed on 30 July 2023).

- Gao, X.; Clark, G.D.; Lindqvist, J. Of Two Minds, Multiple Addresses, and One Ledger. In Proceedings of the 2016 CHI Conference on Human Factors in Computing Systems, San Jose, CA, USA, 7–12 May 2016; pp. 1656–1668. [Google Scholar] [CrossRef]

- Cryptocurrency Market Size, Share, Growth & Forecast 2020–2027. Available online: https://www.fortunebusinessinsights.com/industry-reports/cryptocurrency-market-100149 (accessed on 24 February 2022).

- Karolla, R. The New Decentralised World—DAPPs, Smart Contracts on Blockchain. 2021. Available online: https://www.slideshare.net/ramkinavy/the-new-decentralised-world-dapps-smart-contracts-on-blockchain?hcb=1 (accessed on 3 June 2021).

- “#1 Bitcoin—Statistics”. CryptoCurrencyChart. 2021. Available online: https://www.cryptocurrencychart.com/coin/BTC (accessed on 6 May 2021).

- Which is the Largest Economy in the World? … It Depends! Medium. 2021. Available online: https://medium.com/world-of-opportunity/which-is-the-largest-economy-in-the-world-it-depends-50ccf0696c45 (accessed on 3 June 2021).

- Kim, M. A psychological approach to Bitcoin usage behavior in the era of COVID-19: Focusing on the role of attitudes toward money. J. Retail. Consum. Serv. 2021, 62, 102606. [Google Scholar] [CrossRef]

- Avcı, İ.; Özmen, E.; Ozhan, M. Research on Consumer Opinions on the Use of Cryptocurrency in Online Shopping. Uluslararası Yönetim İktisat Ve İşletme Derg. 2023, 19, 311–327. [Google Scholar] [CrossRef]

- Aytekïn, B.A.; Ulusoy, T.A. A netnography study examined consumer perception towards cryptocurrency investment during the COVID-19 pandemic. Bus. Manag. Stud. Int. J. 2022, 10, 1380–1396. [Google Scholar] [CrossRef]

- Swati, S.A. A Study on the Awareness and Perception of Cryptocurrency in Bangalore. A Indian J. Appl. Res. 2019, 9, 15–25. [Google Scholar]

- McMorrow, J.; Esfahani, M.S. An Exploration into People’s Perception and Intention on using Cryptocurrencies. HOLISTICA—J. Bus. Public Adm. 2021, 12, 109–144. [Google Scholar] [CrossRef]

- Wongsunopparat, S.; Nanjun, Z. Study of Factors Influencing Consumer to Adopt Cryptocurrency. Bus. Manag. Strat. 2023, 14, 1–18. [Google Scholar] [CrossRef]

- Osagwu, A.O.; Okafor, E.G. Understanding the Nexus Between Advertising and Purchase Intention of Cryptocurrency Among Young Adults in Nigeria. Eur. J. Bus. Innov. Res. 2022, 10, 34–70. [Google Scholar] [CrossRef]

- Mashatan, A.; Sangari, M.S.; Dehghani, M. How Perceptions of Information Privacy and Security Impact Consumer Trust in Crypto-Payment: An Empirical Study. IEEE Access 2022, 10, 69441–69454. [Google Scholar] [CrossRef]

- Arias-Oliva, M.; de Andrés-Sánchez, J.; Pelegrín-Borondo, J. Fuzzy Set Qualitative Comparative Analysis of Factors Influencing the Use of Cryptocurrencies in Spanish Households. Mathematics 2021, 9, 324. [Google Scholar] [CrossRef]

- Synoun, K.; Veerisa, C. The Perception of Cambodian Users Towards Cryptocurrency Exchange Application. J. ASEAN Plus Stud. 2023, 4, 46–60. [Google Scholar]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef] [PubMed]

- Alqaryouti, O.; Shallan, K. Trade Facilitation Framework for E-commerce Platforms using Blockchain. Int. J. Bus. Inf. Syst. 2020, 1, 1. [Google Scholar] [CrossRef]

- Gainsbury, S.M.; Blaszczynski, A. How Blockchain and Cryptocurrency Technology Could Revolutionize Online Gambling. Gaming Law Rev. 2017, 21, 482–492. [Google Scholar] [CrossRef]

- Hayes, A.S. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telemat. Inform. 2017, 34, 1308–1321. [Google Scholar] [CrossRef]

- Christopher, C. Why on earth do people use bitcoin? Bus. Bankruptcy Law J. 2014, 2, 1. [Google Scholar]

- Bohr, J.; Bashir, M. Who Uses Bitcoin? An exploration of the Bitcoin community. In Proceedings of the 2014 Twelfth Annual International Conference on Privacy, Security and Trust, Toronto, ON, Canada, 23–24 July 2014; pp. 94–101. [Google Scholar] [CrossRef]

- Khairuddin, I.E.; Sas, C.; Clinch, S.; Davies, N. Exploring Motivations for Bitcoin Technology Usage. In Proceedings of the 2016 CHI Conference Extended Abstracts on Human Factors in Computing Systems, San Jose, CA, USA, 7–12 May 2016; pp. 2872–2878. [Google Scholar] [CrossRef]

- Mian, G.M.; Sharma, P.; Gul, F.A. Investor sentiment and advertising expenditure. Int. J. Res. Mark. 2018, 35, 611–627. [Google Scholar] [CrossRef]

- Lo, A.W.; Repin, D.V.; Steenbarger, B.N. Fear and Greed in Financial Markets: A Clinical Study of Day-Traders. SSRN Electron. J. 2005, 95, 352–359. [Google Scholar]

- Shankar, V.; Grewal, D.; Sunder, S.; Fossen, B.; Peters, K.; Agarwal, A. Digital marketing communication in global marketplaces: A review of extant research, future directions, and potential approaches. Int. J. Res. Mark. 2022, 39, 541–565. [Google Scholar] [CrossRef]

- Sun, W.; Dedahanov, A.T.; Shin, H.Y.; Kim, K.S. Switching intention to crypto-currency market: Factors predisposing some individuals to risky investment. PLoS ONE 2020, 15, e0234155. [Google Scholar] [CrossRef]

- Straub, E.T. Understanding Technology Adoption: Theory and Future Directions for Informal Learning. Rev. Educ. Res. 2009, 79, 625–649. [Google Scholar] [CrossRef]

- Spenkelink, H. The Adoption Process of Cryptocurrencies—Identifying Factors That Influence the Adoption of Cryptocurrencies from a Multiple Stakeholder Perspectives. Master’s Thesis, University of Twente, Enschede, The Netherlands, 2004. [Google Scholar]

- Mahomed, N. Understanding Consumer Adoption of Cryptocurrencies. Ph.D. Thesis, University of Pretoria, Pretoria, South Africa, November 2017. [Google Scholar]

- Bensaou, M.; Venkatraman, N. Configurations of Interorganizational Relationships: A Comparison Between U.S. and Japanese Automakers. Manag. Sci. 1995, 41, 1471–1492. [Google Scholar] [CrossRef]

- Pavlou, P. Consumer Intentions to Adopt Electronic Commerce—Incorporating Trust and Risk in the Technology Acceptance Model. In DIGIT 2001 Proceedings; University of Southern California: Los Angeles, CA, USA, 2001; Volume 2. [Google Scholar]

- Kim, H.K.; Han, S.H.; Park, J. Identifying affect elements based on a conceptual model of affect: A case study on a smartphone. Int. J. Ind. Ergon. 2016, 53, 193–204. [Google Scholar] [CrossRef]

- Park, J.; Han, S.H. Defining user value: A case study of a smartphone. Int. J. Ind. Ergon. 2013, 43, 274–282. [Google Scholar] [CrossRef]

- Jung, S.; Park, J.; Wang, L.; Widyanti, A. Comparison of affective perception of bitcoin between Korea and China. ICIC Int. 2019, 13, 231–237. [Google Scholar]

- Maciejasz-Swiatkiewicz, M.; Poskart, R. Cryptocurrency Perception Within Countries: A Comparative Analysis. Eur. Res. Stud. J. 2020, 23, 186–203. [Google Scholar] [CrossRef][Green Version]

- Sagheer, N.; Khan, K.I.; Fahd, S.; Mahmood, S.; Rashid, T.; Jamil, H. Factors affecting adaptability of cryptocurrency: An application of technology acceptance model. Front. Psychol. 2022, 13, 903473. [Google Scholar] [CrossRef]

- Almajali, D.A.; Masa’deh, R.; Dahalin, Z.M.; Feng, G.C. Factors influencing the adoption of Cryptocurrency in Jordan: An application of the extended TRA model. Cogent Soc. Sci. 2022, 8, 2103901. [Google Scholar] [CrossRef]

- Sukumaran, S.; Bee, T.S.; Wasiuzzaman, S. Investment in cryptocurrencies: A study of its adoption among Malaysian investors. J. Decis. Syst. 2022, 1–29. [Google Scholar] [CrossRef]

- Quan, W.; Moon, H.; Kim, S.S.; Han, H. Mobile, traditional, and cryptocurrency payments influence consumer trust, attitude, and destination choice: Chinese versus Koreans. Int. J. Hosp. Manag. 2023, 108, 103363. [Google Scholar] [CrossRef]

- Arias-Oliva, M.; Pelegrín-Borondo, J.; Matías-Clavero, G. Variables influencing cryptocurrency use: A technology acceptance model in Spain. Front. Psychol. 2019, 10, 475. [Google Scholar] [CrossRef]

- Mazambani, L.; Mutambara, E. Predicting FinTech innovation adoption in South Africa: The case of cryptocurrency. Afr. J. Econ. Manag. Stud. 2020, 11, 30–50. [Google Scholar] [CrossRef]

- Cristofaro, M.; Giardino, P.L.; Misra, S.; Pham, Q.T.; Phan, H.H. Behavior or culture? Investigating the use of cryptocurrencies for electronic commerce across the USA and China. Manag. Res. Rev. 2022, 46, 340–368. [Google Scholar] [CrossRef]

- Rudkin, S.; Rudkin, W.; Dłotko, P. On the topology of cryptocurrency markets. Int. Rev. Financ. Anal. 2023, 89, 102759. [Google Scholar] [CrossRef]

- Griffith, T.; Clancey-Shang, D. Cryptocurrency regulation and market quality. J. Int. Financ. Mark. Inst. Money 2023, 84, 101744. [Google Scholar] [CrossRef]

- Fang, S.; Cao, G.; Egan, P. Forecasting and backtesting systemic risk in the cryptocurrency market. Financ. Res. Lett. 2023, 54, 103788. [Google Scholar] [CrossRef]

- Almeida, J.; Gonçalves, T.C. A systematic literature review of investor behavior in the cryptocurrency markets. J. Behav. Exp. Financ. 2023, 37, 100785. [Google Scholar] [CrossRef]

- Understanding the Different Types of Cryptocurrency. Available online: https://www.bitdegree.org/crypto/tutorials/types-of-cryptocurrency (accessed on 26 May 2021).

- Ante, L.; Fiedler, I.; Strehle, E. The influence of stablecoin issuances on cryptocurrency markets. Financ. Res. Lett. 2020, 41, 101867. [Google Scholar] [CrossRef]

- Cong, L.W.; Xiao, Y. Categories and Functions of Crypto-Tokens. In The Palgrave Handbook of FinTech and Blockchain; Pompella, M., Matousek, R., Eds.; Palgrave Macmillan: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- Cryptocurrency Comparison. IG. 2021. Available online: https://www.ig.com/en/cryptocurrency-trading/cryptocurrency-comparison (accessed on 27 May 2022).

- Fang, F.; Ventre, C.; Basios, M.; Kanthan, L.; Martinez-Rego, D.; Wu, F.; Li, L. Cryptocurrency Trading: A Comprehensive Survey. Financ. Innov. 2021, 8, 13. Available online: https://arxiv.org/pdf/2003.11352.pdf (accessed on 4 June 2022). [CrossRef]

- Top 15 BEST Crypto Exchanges & Trading Platforms in 2021. Guru99.com. 2021. Available online: https://www.guru99.com/best-cryptocurrency-exchanges.html (accessed on 30 May 2022).

- Kazerani, A.; Rosati, D.; Lesser, B. Determining the usability of bitcoin for beginners using change tip and coinbase. In Proceedings of the 35th ACM International Conference on the Design of Communication, Halifax, NS, Canada, 11–13 August 2017. [Google Scholar] [CrossRef]

- Peres, R.; Schreier, M.; Schweidel, D.A.; Sorescu, A. Blockchain meets marketing: Opportunities, threats, and avenues for future research. Int. J. Res. Mark. 2022, 40, 1–11. [Google Scholar] [CrossRef]

- Boshkov, T. Blockchain and Digital Currency in the World of Finance. In Blockchain and Cryptocurrencies; Asma, S., Muthanna, G., Abdul, R., Eds.; IntechOpen: London, UK, 2018. [Google Scholar] [CrossRef]

- Bouri, E.; Salisu, A.A.; Gupta, R. The predictive power of Bitcoin prices for the realized volatility of US stock sector returns. Financ. Innov. 2023, 9, 62. [Google Scholar] [CrossRef]

- Wątorek, M.; Kwapień, J.; Drożdż, S. Cryptocurrencies Are Becoming Part of the World Global Financial Market. Entropy 2023, 25, 377. [Google Scholar] [CrossRef] [PubMed]

- Prabhune, N.; Mahajan, A.; Mittal, M.P.; Kumar, R. Investigating the Dynamics of Cryptocurrencies with Financial Markets: Evidence from an ARDL Approach. Glob. Bus. Rev. 2023. [Google Scholar] [CrossRef]

- Fang, X.; Elie, B.; Oguzhan, C. Blockchain and crypto-exposed US companies and major cryptocurrencies: The role of jumps and co-jumps. Financ. Res. Lett. 2022, 50, 2022. [Google Scholar] [CrossRef]

- Grant, G.; Hogan, R. Bitcoin: Risks and Controls. J. Corp. Account. Financ. 2015, 26, 29–35. [Google Scholar] [CrossRef]

- Maurer, B.; Nelms, T.C.; Swartz, L. “When perhaps the real problem is money itself!”: The practical materiality of Bitcoin. Soc. Semiot. 2013, 23, 261–277. [Google Scholar] [CrossRef]

- Aiyar, Y.; Walton, M. Rights, accountability and citizenship: India’s emerging welfare state. In Governance in Developing Asia; Deolalikar, A.B., Jha, S., Quising, P.F., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2015; pp. 260–295. [Google Scholar] [CrossRef]

- Baur, D.G.; Hong, K.; Lee, A.D. Bitcoin: Medium of exchange or speculative assets? J. Int. Financ. Mark. Inst. Money 2018, 54, 177–189. [Google Scholar] [CrossRef]

- Cheah, E.; Fry, J. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ. Lett. 2015, 130, 32–36. [Google Scholar] [CrossRef]

- Hur, W.; Kim, B.; Park, S. The Relationship between Coworker Incivility, Emotional Exhaustion, and Organizational Outcomes: The Mediating Role of Emotional Exhaustion. Hum. Factors Ergon. Manuf. Serv. Ind. 2014, 25, 701–712. [Google Scholar] [CrossRef]

- Stein, J.C. Informational Externalities and Welfare-Reducing Speculation. J. Political Econ. 1987, 95, 1123–1145. [Google Scholar] [CrossRef]

- Zhang, Z.J. Cryptopricing: Whence comes the value for cryptocurrencies and NFTs? Int. J. Res. Mark. 2022, 40, 22–29. [Google Scholar] [CrossRef]

- Yu, J.; Yen, B. A Cryptocurrency Based Insurance Model. In Proceedings of the CEB 2018, Guilin, China, 2–6 December 2018; p. 55. [Google Scholar]

- Zamani, E.; He, Y.; Phillips, M. On the security risks of the blockchain. J. Comput. Inf. Syst. 2020, 60, 495–506. [Google Scholar] [CrossRef]

- Kizza, J.M. Blockchains, Cryptocurrency, and Smart Contracts Technology: Security Considerations. In Guide to Computer Network Security; Springer: Cham, Switzerland, 2020; pp. 533–558. [Google Scholar]

- Yet Another Crypto Exchange Has Fallen Victim to a Massive Hack. TechRadar, Techradar.com. 2021. Available online: https://www.techradar.com/in/news/yet-another-crypto-exchange-has-fallen-victim-to-a-massive-hack (accessed on 6 December 2021).

- A Comprehensive List of Cryptocurrency Exchange Hacks—SelfKey. SelfKey. 2021. Available online: https://selfkey.org/list-of-cryptocurrency-exchange-hacks/ (accessed on 6 December 2021).

- Lazarenko, A.; Avdoshin, S. Financial risks of the blockchain industry: A survey of cyberattacks. In Proceedings of the Future Technologies Conference, Vancouver, DC, Canada, 15–16 November 2018; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Grobys, K. When the blockchain does not block: On hackings and uncertainty in the cryptocurrency market. Quant. Financ. 2021, 21, 1267–1279. [Google Scholar] [CrossRef]

- Suga, Y.; Shimaoka, M.; Sato, M.; Nakajima, H. Securing Cryptocurrency Exchange: Building up Standard from Huge Failures. In Proceedings of the International Conference on Financial Cryptography and Data Security, Kota Kinabalu, Malaysia, 14 February 2020; Springer: Cham, Switzerland, 2020. [Google Scholar]

- Weforum (Ed.) The Global Competitiveness Report 2015–2016. 2016. Available online: http://www3.weforum.org/docs/gcr/2015-2016/Global_Competitiveness_Report_2015-2016.pdf (accessed on 4 January 2021).

- Businesswire (Ed.) Global Management Consulting Services Market Report 2017—Research and Markets. 2017. Available online: http://www.businesswire.com/news/home/20170505005432/en/Global-Management-Consulting-Services-Market-Report-2017 (accessed on 4 January 2021).

| Ref. No | Model | Factors | Country | Consumer Adoption |

|---|---|---|---|---|

| [39] | Technology Acceptance Model (TAM) | Usefulness, ease of use, risk | Pakistan | Technology awareness and behavioral intention will impact |

| [40] | Extended Theory of Reasoned Action (TRA) model | Risk, Usefulness, enjoyment, ease of use, trust | Jordan | Perceived risk may have a negative effect on attitude and intention to use. |

| [41] | SmartPLS Structural Equation Modelling | Compatibility, trialability, ease of use, observability | Malaysia | Factors influence the intention to invest in cryptocurrency |

| [42] | Technology Acceptance Model | Usefulness, ease of use, and security | Chinese and Korea | Perceived security and ease of use for Chinese; while ease of use and trust form the Korean consumers’ attitude. |

| [43] | Technology Acceptance Model | Performance expectancy, effort expectancy, social influence, use, risk | Spain | Performance expectancy is the determinant variable in the acceptance of cryptocurrency |

| [44] | Theory of planned behavior (TPB) | Behavioral intention | South Africa | Attitude and perceived behavioral control can make an impact. |

| [45] | Theory of planned behavior, financial behavior, and cultural | Attitude, perceived behavioral control and herding behavior | USA and China | Factors have a positive impact on the use of cryptocurrency, except financial literacy, which has no influence. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murugappan, M.; Nair, R.; Krishnan, S. Global Market Perceptions of Cryptocurrency and the Use of Cryptocurrency by Consumers: A Pilot Study. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1955-1970. https://doi.org/10.3390/jtaer18040098

Murugappan M, Nair R, Krishnan S. Global Market Perceptions of Cryptocurrency and the Use of Cryptocurrency by Consumers: A Pilot Study. Journal of Theoretical and Applied Electronic Commerce Research. 2023; 18(4):1955-1970. https://doi.org/10.3390/jtaer18040098

Chicago/Turabian StyleMurugappan, Murugappan, Rashmi Nair, and Saravanan Krishnan. 2023. "Global Market Perceptions of Cryptocurrency and the Use of Cryptocurrency by Consumers: A Pilot Study" Journal of Theoretical and Applied Electronic Commerce Research 18, no. 4: 1955-1970. https://doi.org/10.3390/jtaer18040098

APA StyleMurugappan, M., Nair, R., & Krishnan, S. (2023). Global Market Perceptions of Cryptocurrency and the Use of Cryptocurrency by Consumers: A Pilot Study. Journal of Theoretical and Applied Electronic Commerce Research, 18(4), 1955-1970. https://doi.org/10.3390/jtaer18040098