Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China

Abstract

:1. Introduction

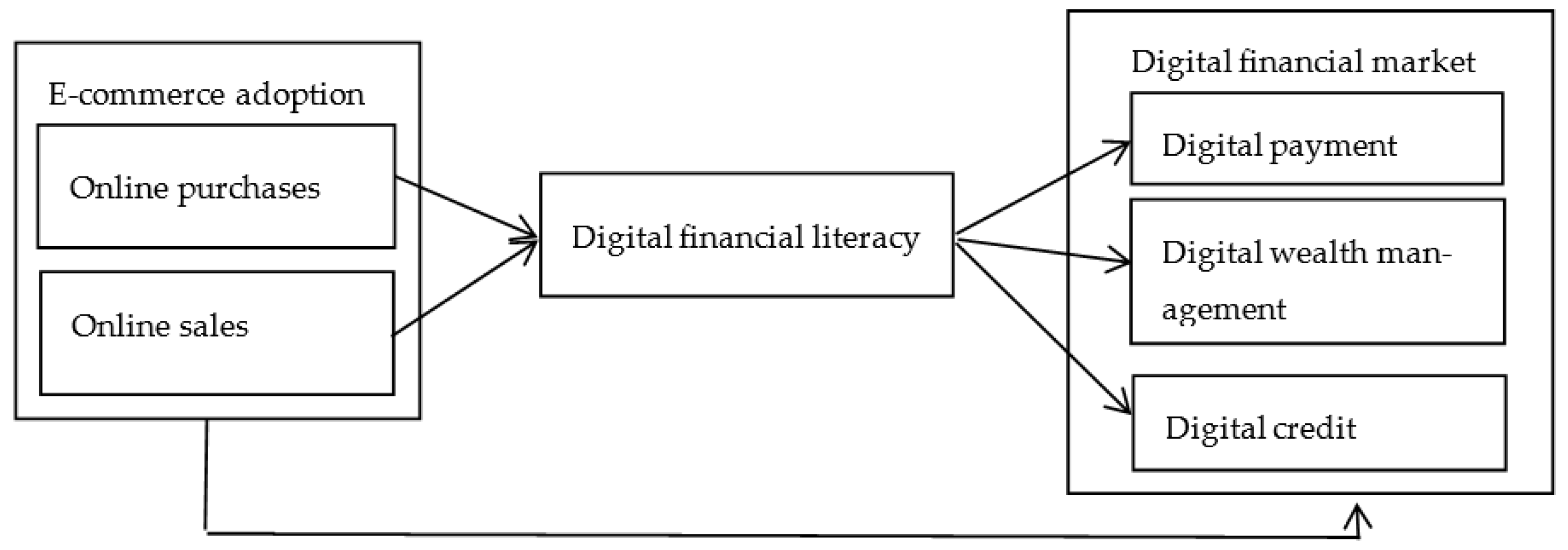

2. Literature Review and Hypothesis

2.1. Development of the Definition of Digital Finance

2.2. Nexus between Online Purchases and Participation in the Digital Financial Market

2.3. Nexus between Online Sales and Participation in the Digital Financial Market

3. Model Specification

3.1. Modelling the Adoption Decision of E-Commerce

3.2. Modelling the Impacts of E-Commerce Adoption on Engaging in Digital Financial Market

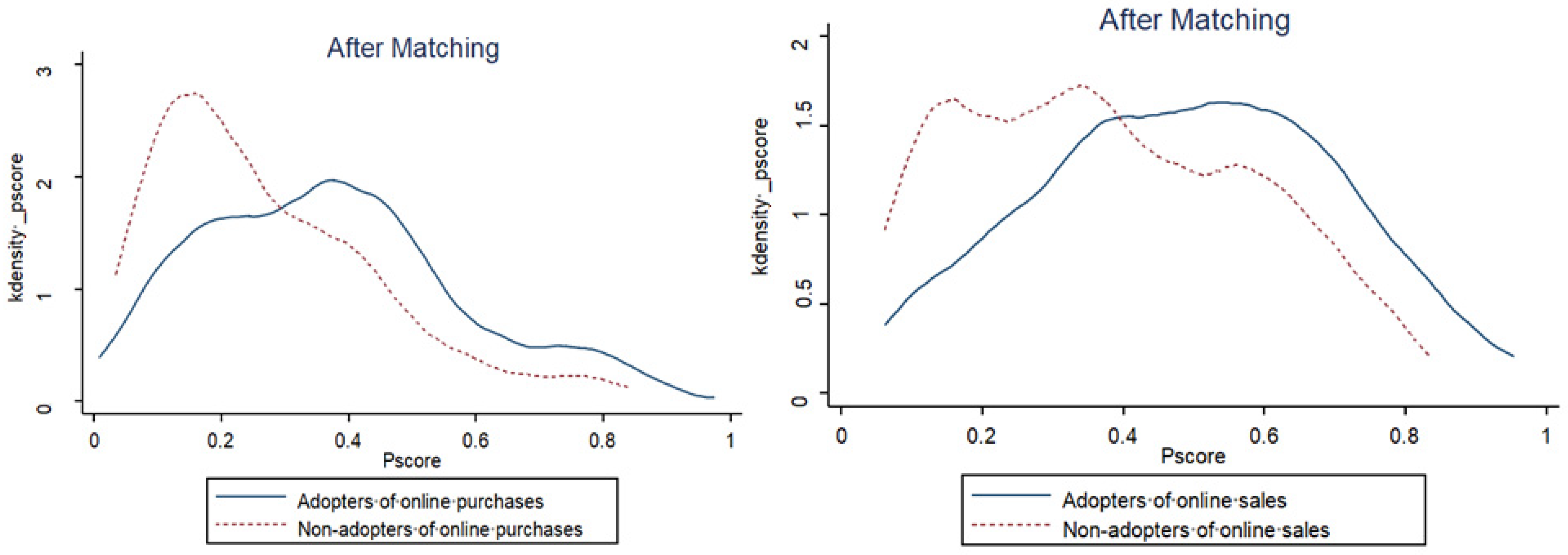

3.3. PSM Method

3.4. Instrument Variable Estimation

3.5. Mediation Model

4. Data and Variables

4.1. Data Source and Descriptive Statistics

4.2. Dependent Variable

4.3. Treatment Variables

4.4. Channel Variable

4.5. Control Variables

5. Empirical Results and Discussion

5.1. Determinants of the Adoption of Online Purchases and Sales

5.2. Impact of E-Commerce Adoption on Usage of Digital Finance

5.2.1. The PSM Estimation Results

5.2.2. The IV Estimation Results

5.3. Robustness Checks

5.3.1. Rosenbaum Bound Sensitivity Analysis

5.3.2. Superposition Effect

5.4. Potential Impact Pathways

5.5. Heterogeneous Treatment Effects

6. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Online Purchases | Online Sales | ||||

|---|---|---|---|---|---|---|

| Treatment | Control | T-Test | Treatment | Control | T-Test | |

| Digital payments | 0.90 (0.30) | 0.71 (0.45) | 0.19 *** | 0.91 (0.28) | 0.66 (0.47) | 0.25 *** |

| Digital wealth management | 0.41 (0.49) | 0.17 (0.38) | 0.24 *** | 0.38 (0.48) | 0.14 (0.35) | 0.24 *** |

| Digital credit | 0.19 (0.40) | 0.08 (0.26) | 0.11 *** | 0.17 (0.37) | 0.07 (0.25) | 0.10 *** |

| Digital financial literacy | 3.49 (0.13) | 2.11 (0.08) | 1.38 *** | 3.20 (0.11) | 2.02 (0.08) | 1.18 *** |

| Gender | 0.86 (0.35) | 0.75 (0.43) | 0.11 *** | 0.81 (0.39) | 0.76 (0.43) | 0.05 * |

| Age | 42.04 (9.01) | 45.24 (9.15) | −3.20 *** | 41.97 (8.89) | 45.87 (9.10) | 3.90 *** |

| Education | 10.43 (3.18) | 8.48 (3.25) | 1.95 *** | 9.92 (3.30) | 8.40 (3.24) | 1.52 *** |

| Risk propensity | 2.62 (1.08) | 2.44 (1.09) | 0.18 ** | 2.67 (1.10) | 2.38 (1.07) | 0.29 *** |

| Internet learning ability | 3.89 (1.15) | 3.19 (1.37) | 0.70 *** | 3.86 (1.15) | 3.07 (1.38) | 0.79 *** |

| Skills training experience | 0.69 (0.46) | 0.48 (0.50) | 0.21 *** | 0.63 (0.48) | 0.48 (0.50) | 0.15 *** |

| Information access | 0.73 (0.45) | 0.53 (0.50) | 0.20 *** | 0.78 (0.42) | 0.46 (0.50) | 0.32 *** |

| Time online | 19.79 (15.82) | 12.92 (12.56) | 6.87 *** | 19.44 (16.54) | 11.82 (10.96) | 7.62 *** |

| Annual network fee | 9.59 (9.05) | 6.57 (8.22) | 302.05 *** | 9.60 (8.64) | 6.00 (7.22) | 359.64 *** |

| Number of WeChat friends | 1.21 (2.13) | 0.52 (1.89) | 68.94 *** | 1.11 (2.50) | 0.45 (2.51) | 66.62 *** |

| Financial network | 0.23 (0.42) | 0.16 (0.37) | 0.07 ** | 0.23 (0.42) | 0.15 (0.36) | 0.08 *** |

| New agricultural operation entities | 0.47 (0.50) | 0.28 (0.45) | 0.19 *** | 0.42 (0.49) | 0.27 (0.44) | 0.15 *** |

| Entrepreneurship industry | 0.51 (0.50) | 0.36 (0.48) | 0.15 *** | 0.50 (0.50) | 0.33 (0.47) | 0.17 *** |

| Distance to town | 4.84 (3.58) | 5.76 (6.48) | −0.92 ** | 5.02 (3.58) | 5.12 (5.69) | −0.10 |

| Formal financial institution status | 2.18 (1.12) | 2.13 (1.15) | 0.05 | 2.10 (2.10) | 2.16 (1.19) | −0.06 |

| Taobao shops | 0.29 (0.45) | 0.26 (0.44) | 0.03 | 0.34 (0.47) | 0.26 (0.44) | 0.08 * |

| Shaanxi | 0.44 (0.50) | 0.36 (0.48) | 0.08 * | 0.43 (0.50) | 0.35 (0.48) | 0.08 ** |

| Ningxia | 0.29 (0.46) | 0.38 (0.49) | −0.09 ** | 0.30 (0.46) | 0.40 (0.49) | −0.10 *** |

| Observations | 195 | 637 | 295 | 537 | ||

| Variables | Online Purchases | Online Sales |

|---|---|---|

| Gender | 0.4443 *** (0.1441) | 0.2190 * (0.1279) |

| Age | −0.0048 (0.0063) | −0.0081 (0.0059) |

| Education | 0.0570 *** (0.0185) | 0.0141 (0.0170) |

| Risk propensity | −0.0045 (0.0502) | 0.0756 * (0.0458) |

| Internet learning ability | 0.0786 * (0.0469) | 0.0970 ** (0.0436) |

| Skills training experience | 0.3054 *** (0.1187) | 0.2566 ** (0.1103) |

| Information access | 0.1199 (0.1200) | 0.5131 *** (0.1109) |

| Online time per week | 0.0134 *** (0.0040) | 0.0141 *** (0.0042) |

| Annual network fee | 0.0001 (0.0001) | 0.0002 ** (0.0001) |

| Number of WeChat friends | 0.0003 (0.0002) | 0.0003 (0.0002) |

| Financial network | 0.0529 (0.1341) | 0.0949 (0.1286) |

| New agricultural operation entities | 0.2581 ** (0.1260) | 0.2138 * (0.1183) |

| Entrepreneurship industry | 0.4153 *** (0.1143) | 0.3930 *** (0.1080) |

| Distance to the nearest town | −0.0337 ** (0.0151) | 0.0048 (0.0116) |

| Formal financial institution status | 0.0364 (0.0482) | 0.0028 (0.0450) |

| Taobao shops | −0.1260 (0.1313) | 0.2867 ** (0.1213) |

| Shaanxi | 0.0370 (0.1534) | 0.1051 (0.1429) |

| Ningxia | −0.0570 (0.1603) | 0.0588 (0.1477) |

| Observations | 832 | 832 |

| LR X2 | 143.30 *** | 191.17 *** |

| Methods | Treated | Controls | ATT | Average ATTs | |

|---|---|---|---|---|---|

| Digital payments | NNM | 0.9357 | 0.8378 | 0.0980 *** (0.0350) | 0.0776 |

| CM | 0.9328 | 0.8571 | 0.0757 ** (0.0353) | ||

| NNMC | 0.9328 | 0.8535 | 0.0793 ** (0.0343) | ||

| KM | 0.9357 | 0.8697 | 0.0660 * (0.0383) | ||

| SM | 0.9362 | 0.8675 | 0.0687 ** (0.0316) | ||

| MM | 0.9362 | 0.8582 | 0.0780 * (0.0387) | ||

| Digital wealth management | NNM | 0.4286 | 0.3378 | 0.0908 * (0.0531) | 0.0890 |

| CM | 0.4254 | 0.3423 | 0.0831 * (0.0499) | ||

| NNMC | 0.4254 | 0.3345 | 0.0909 * (0.0525) | ||

| KM | 0.4286 | 0.3455 | 0.0831 * (0.0502) | ||

| SM | 0.4255 | 0.3429 | 0.0826 * (0.0498) | ||

| MM | 0.4256 | 0.3221 | 0.1035 ** (0.0547) | ||

| Digital credit | NNM | 0.2000 | 0.1153 | 0.0847 ** (0.0411) | 0.0712 |

| CM | 0.1940 | 0.1278 | 0.0662 * (0.0388) | ||

| NNMC | 0.1940 | 0.1218 | 0.0722 * (0.0405) | ||

| KM | 0.2000 | 0.1291 | 0.0709 * (0.0340) | ||

| SM | 0.1986 | 0.1319 | 0.0667 * (0.0390) | ||

| MM | 0.1986 | 0.1324 | 0.0662 * (0.0344) |

References

- Liao, G.K.; Yao, D.Q.; Hu, Z.H. The spatial effect of the efficiency of regional financial resource allocation from the perspective of internet finance: Evidence from Chinese provinces. Emerg. Mark. Financ. Trade 2020, 56, 1–13. [Google Scholar] [CrossRef]

- Lei, Y. Policy Discussion of Internet Finance in China. BOFIT Policy Brief, Institute for Economies in Transition, Bank of Finland. 25 November 2014. Available online: https://helda.helsinki.fi/bof/bitstream/handle/123456789/13462/bpb1314%5b1%5d.pdf?sequence=1&isAllowed=y (accessed on 20 April 2021).

- Ren, B.Y.; Li, L.Y.; Zhao, H.M.; Zhou, Y.B. The financial exclusion in the development of digital finance: A study based on survey data in the JingJinJi rural area. Singap. Econ. Rev. 2018, 63, 65–82. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef] [Green Version]

- Lenka, S.K.; Barik, R. Has expansion of mobile phone and internet use spurred financial inclusion in the SAARC countries? Financ. Innov. 2018, 4, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Turvey, C.G.; Xiong, X. Financial inclusion, financial education, and e-commerce in rural China. Agribusiness 2017, 33, 279–285. [Google Scholar] [CrossRef]

- Zhang, Q.; Posso, A. Thinking inside the Box: A closer look at financial inclusion and household income. J. Dev. Stud. 2019, 55, 1616–1631. [Google Scholar] [CrossRef]

- Hojjati, S.N.; Rabi, A.R. Effects of Iranian online behavior on the acceptance of internet banking. J. Asian Bus. Stud. 2013, 7, 123–139. [Google Scholar] [CrossRef]

- Mu, H.L.; Lee, Y.C. Examining the influencing factors of third-party mobile payment adoption: A comparative study of Alipay and WeChat pay. J. Inform. Syst. 2017, 26, 257–294. [Google Scholar]

- Ren, J.Z.; Sun, H. Acceptance behavior of internet wealth management based on user risk perception: The case of Alibaba’s Yuebao. In Proceedings of the 2017 International Conference on Management Engineering, Software Engineering and Service Sciences, Wuhan, China, 14–16 January 2017. [Google Scholar]

- Lele, U.; Goswami, S. The fourth industrial revolution, agricultural and rural innovation, and implications for public policy and investments: A case of India. Agric. Econ. 2017, 48, 87–100. [Google Scholar] [CrossRef]

- Qi, J.Q.; Zheng, X.Y.; Guo, H.D. The formation of Taobao villages in China. China Econ. Rev. 2019, 53, 106–127. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, Q.; Gao, S.; Huang, J.K. The spatial aggregation of rural e-commerce in China: An empirical investigation into Taobao Villages. J. Rural Stud. 2020, 80, 403–417. [Google Scholar] [CrossRef]

- Chitura, T.; Mupemhi, S.; Dube, T.; Bolongkikit, J. Barriers to electronic commerce adoption in small and medium enterprises: A critical literature review. J. Int. Bank. Commer. 2008, 13, 1–13. [Google Scholar]

- Malhotra, R.; Malhotra, D.K. The impact of internet and e-commerce on the evolving business models in the financial services industry. Int. J. Electron. Bus. 2006, 4, 56–82. [Google Scholar] [CrossRef]

- Patel, V.B.; Asthana, A.K.; Patel, K.J.; Patel, K.M. A study on adoption of e-commerce practices among the Indian farmers with specific reference to north Gujarat region. Inter. J. Commer. Bus. Manag. 2016, 9, 1–7. [Google Scholar] [CrossRef]

- Chiu, Y.P.; Lo, S.K.; Hsieh, A.Y.; Hwang, Y.J. Exploring why people spend more time shopping online than in offline stores. Comput. Hum. Behav. 2019, 95, 24–30. [Google Scholar] [CrossRef]

- Wu, L.Y.; Chen, K.Y.; Chen, P.Y.; Cheng, S.L. Perceived value, transaction cost, and repurchase-intention in online shopping: A relational exchange perspective. J. Bus. Res. 2014, 67, 2768–2776. [Google Scholar] [CrossRef]

- Baourakis, G.; Kourgiantakis, M.; Migdalas, A. The impact of e-commerce on agro-food marketing: The case of agricultural cooperatives, firms and consumers in Crete. Br. Food J. 2002, 104, 580–590. [Google Scholar] [CrossRef]

- Treiblmaier, H.; Pinterits, A.; Floh, A. Success factors of internet payment systems. Inter. J. Electron. Bus. 2008, 6, 369–385. [Google Scholar] [CrossRef]

- Xu, N.N.; Shi, J.Y.; Rong, Z.; Yuan, Y. Financial literacy and formal credit accessibility: Evidence from informal businesses in China. Financ. Res. Lett. 2020, 36, 101327. [Google Scholar] [CrossRef]

- Lee, S. Evaluation of mobile application in user’s perspective: Case of P2P lending apps in fintech industry. KSII Trans. Internet Inf. Syst. 2017, 11, 1105–1117. [Google Scholar]

- Lam, L.T.; Lam, M.K. The association between financial literacy and problematic internet shopping in a multinational sample. Addict. Behav. Rep. 2017, 6, 123–127. [Google Scholar] [CrossRef] [PubMed]

- Navickas, M.; Gudaitis, T.; Krajnakova, E. Influence of financial literacy on management of personal finances in a young household. Bus. Theory Pract. 2014, 15, 32–40. [Google Scholar] [CrossRef]

- Kolodinsky, J.M.; Hogarth, J.M.; Hilgert, M.A. The adoption of electronic banking technologies by US consumers. Inter. J. Bank Mark. 2004, 22, 238–259. [Google Scholar] [CrossRef]

- Xie, P.; Zou, C.W. Studies on the mode of internet finance. J. Financ. Res. 2012, 12, 11–22. [Google Scholar]

- Wu, X.Q. Internet finance: The logic of growth. Financ. Trade Econ. 2015, 2, 5–15. [Google Scholar]

- Tufano, P. Consumer finance. Annu. Rev. Financ. Econ. 2009, 1, 227–247. [Google Scholar] [CrossRef]

- Lo, S.K.; Hsieh, A.Y.; Chiu, Y.P. Why expect lower prices online? Empirical examination in online and store-based retailers. Inter. J. Electron. Commer. Stud. 2014, 5, 27–37. [Google Scholar] [CrossRef]

- Patnaik, B.C.M.; Sethy, P.K. An empirical study on NPAs in working capital loan of Gramya banks. TRANS Asian J. Mark. Manag. Res. 2013, 2, 1–13. [Google Scholar]

- Lee, E.; Lee, B. Herding behavior in online P2P lending: An empirical investigation. Electron. Commer. Res. Appl. 2012, 11, 495–503. [Google Scholar] [CrossRef] [Green Version]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef] [Green Version]

- Yang, S.; Chen, S.X.; Li, B. The role of business and friendships on WeChat business: An emerging business model in China. J. Glob. Mark. 2016, 29, 174–187. [Google Scholar] [CrossRef]

- Lv, Z.P.; Jin, Y.; Huang, J.H. How do sellers use live chat to influence consumer purchase decisions in China? Electron. Commer. Res. Appl. 2018, 28, 102–113. [Google Scholar] [CrossRef]

- Bai, B.; Law, R.; Wen, I. The impact of website quality on customer satisfaction and purchase intentions: Evidence from Chinese online visitors. Int. J. Hosp. Manag. 2008, 27, 391–402. [Google Scholar] [CrossRef]

- Rahimnia, F.; Hassanzadeh, J.F. The impact of website content dimension and e-trust on e-marketing effectiveness: The case of Iranian commercial saffron corporations. Inf. Manag. 2013, 50, 240–247. [Google Scholar] [CrossRef]

- Panda, A. The status of working capital and its relationship with sales. Int. J. Commer. Manag. 2012, 22, 36–52. [Google Scholar] [CrossRef]

- Hu, L.; Lopez, R.A.; Zeng, Y. The impact of credit constraints on the performance of Chinese agricultural wholesalers. Appl. Econ. 2019, 51, 3864–3875. [Google Scholar] [CrossRef]

- Miller, M.; Godfrey, N.; Lévesque, B.; Stark, E. The Case for Financial Literacy in Developing Countries: Promoting Access to Finance by Empowering Consumers; World Bank, DFID, OECD and CGAP Joint Note: Washington, DC, USA, 2009. [Google Scholar]

- Becerril, J.; Abdulai, A. The impact of improved maize varieties on poverty in Mexico: A propensity score-matching approach. World Dev. 2010, 38, 1024–1035. [Google Scholar] [CrossRef]

- Morgan, P.J.; Long, T.Q. Financial literacy, financial inclusion, and savings behavior in Laos. J. Asian Econ. 2020, 68, 101197. [Google Scholar] [CrossRef]

- Staiger, D.; Stock, J.H. Instrumental Variables Regression with Weak Instruments. Econometrica 1997, 65, 557–586. [Google Scholar] [CrossRef]

- Heckman, J.J.; Vytlacil, E.J. Econometric evaluation of social programs, part II: Using the marginal treatment effect to organize alternative econometric estimators to evaluate social programs, and to forecast their effects in new environments. In Handbook of Econometrics; Elsevier: Amsterdam, The Netherlands, 2007; pp. 4875–5143. [Google Scholar]

- Rosenbaum, P.R.; Rubin, D.B. Constructing a control group using multivariate matched sampling methods that incorporate the propensity score. Am. Stat. 1985, 39, 33–38. [Google Scholar]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Rodgers, S.; Harris, M.A. Gender and e-commerce: An exploratory study. J. Advert. Res. 2003, 43, 322–329. [Google Scholar] [CrossRef]

- Kim, J.B. An empirical study on consumer first purchase intention in online shopping: Integrating initial trust and TAM. Electron. Commer. Res. 2012, 12, 125–150. [Google Scholar] [CrossRef]

- Li, X.L.; Troutt, M.D.; Brandyberry, A.A.; Wang, T. Decision factors for the adoption and continued use of online direct sales channels among SMEs. J. Assoc. Inf. Syst. 2011, 12, 1–31. [Google Scholar] [CrossRef] [Green Version]

- Modigliani, F.; Cao, S.L. The Chinese saving puzzle and the life-cycle hypothesis. J. Econ. Lit. 2004, 42, 145–170. [Google Scholar] [CrossRef] [Green Version]

- Bucher-Koenen, T.; Lusardi, A. Financial Literacy and Retirement Planning in Germany. J. Pension Econ. Financ. 2011, 10, 565–584. [Google Scholar] [CrossRef] [Green Version]

- Poon, W.C.; Yong, G.F.D.; Lam, W.H.P. An insight into the attributes influencing the acceptance of internet banking: The consumers’ perspective. Int. J. Serv. Stand. 2009, 5, 81–94. [Google Scholar] [CrossRef]

- Sekyi, S.; Abu, B.M.; Nkegbe, P.K. Effects of farm credit access on agricultural commercialization in Ghana: Empirical evidence from the northern Savannah ecological zone. Afr. Dev. Rev. 2020, 32, 150–162. [Google Scholar] [CrossRef]

- Huang, J.K. Impacts of COVID-19 on agriculture and rural poverty in China. J. Integr. Agr. 2020, 19, 2849–2853. [Google Scholar] [CrossRef]

| Variables | Definition | Full Sample | |

|---|---|---|---|

| Mean | S.D. | ||

| Digital payments | =1 if the respondent used it; =0 otherwise | 0.75 | 0.43 |

| Digital wealth management | =1 if the respondent used it; =0 otherwise | 0.23 | 0.42 |

| Digital credit | =1 if the respondent used it; =0 otherwise | 0.10 | 0.31 |

| Online purchases | =1 if the respondent purchased raw materials, machinery, and other means of production online; =0 otherwise | 0.23 | 0.42 |

| Online sales | =1 if the respondent sold products online; =0 otherwise | 0.36 | 0.48 |

| Digital financial literacy | The total score of each respondent for the six measurement items related to digital finance | 2.43 | 1.72 |

| Gender | =1 if the respondent is male; =0 otherwise | 0.78 | 0.42 |

| Age | Age of respondent (unit: year) | 44.49 | 9.22 |

| Education | Respondent years of education (unit: year) | 8.94 | 3.34 |

| Risk propensity | =1 extremely unpreferred; =2 relatively unpreferred; =3 neutral; =4 relatively preferred; =5 extremely preferred | 2.48 | 1.09 |

| Internet learning ability | =1 very bad; =2 relatively bad; =3 neutral; =4 relatively good; =5 very good | 3.35 | 1.36 |

| Skills training | =1 if the respondent participated in training related to business skills (e.g., internet usage); =0 otherwise | 0.53 | 0.49 |

| Information access | =1 if the respondent often obtains information from their circle of friends via social platforms; =0 otherwise | 0.57 | 0.49 |

| Online time per week | The average time spent online per week (unit: hour) | 14.53 | 13.70 |

| Annual network fee | The average network fee per year (unit: hundred RMB) | 7.28 | 8.51 |

| Number of WeChat friends | The number of WeChat friends in frequent contact with the respondent (unit: hundred people) | 0.68 | 1.53 |

| Financial network | =1 if relatives or friends worked at banks or credit cooperatives; =0 otherwise | 0.18 | 0.38 |

| New agricultural operation entities | =1 if engaging in family farms, professional cooperatives, agricultural enterprises, etc.; =0 otherwise | 0.32 | 0.47 |

| Entrepreneurship industry | =1 if the respondent was engaged in non-agricultural entrepreneurship; =0 otherwise | 0.39 | 0.49 |

| Distance to the nearest town | Distance from village to the nearest town (unit: km) | 5.06 | 4.45 |

| Formal financial institution status | Number of formal financial institutions near the village in the same town | 2.14 | 1.14 |

| Taobao shops | =1 if there were Taobao shops in the village; =0 otherwise | 0.29 | 0.45 |

| Shaanxi | =1 if from Shaanxi province; =0 otherwise | 0.38 | 0.49 |

| Ningxia | =1 if from Ningxia province; =0 otherwise | 0.36 | 0.48 |

| Matching Methods | Online Purchases | Online Sales | |||

|---|---|---|---|---|---|

| ATT | Average ATTs | ATT | Average ATTs | ||

| Digital payments | NNM | 0.0573 * (0.0344) | 0.0716 | 0.0892 *** (0.0331) | 0.0928 |

| CM | 0.0902 ** (0.0391) | 0.0918 *** (0.0335) | |||

| NNMC | 0.0895 *** (0.0374) | 0.0877 *** (0.0332) | |||

| KM | 0.0689 * (0.0370) | 0.0995 *** (0.0328) | |||

| SM | 0.0568 * (0.0304) | 0.0900 *** (0.0309) | |||

| MM | 0.0670 * (0.0365) | 0.0986 *** (0.0352) | |||

| Digital wealth management | NNM | 0.0875 * (0.0451) | 0.0897 | 0.1090 *** (0.0382) | 0.1059 |

| CM | 0.0982 ** (0.0453) | 0.1007 *** (0.0373) | |||

| NNMC | 0.0875 * (0.0474) | 0.0997 *** (0.0382) | |||

| KM | 0.0821 * (0.0436) | 0.1035 *** (0.0368) | |||

| SM | 0.0789 * (0.0468) | 0.1034 ** (0.0449) | |||

| MM | 0.1040 ** (0.0443) | 0.1196 *** (0.0432) | |||

| Digital credit | NNM | 0.0677 * (0.0349) | 0.0667 | 0.0498 * (0.0288) | 0.0530 |

| CM | 0.0710 ** (0.0350) | 0.0526 * (0.0279) | |||

| NNMC | 0.0737 ** (0.0366) | 0.0494 * (0.0288) | |||

| KM | 0.0611 * (0.0338) | 0.0509 * (0.0276) | |||

| SM | 0.0650 * (0.0354) | 0.0574 * (0.0293) | |||

| MM | 0.0618 * (0.0350) | 0.0578 * (0.0314) | |||

| Variables | Digital Payments | Digital Wealth Management | Digital Credit |

|---|---|---|---|

| (1) | (2) | (3) | |

| Online purchases | 0.0763 * (0.0462) | 0.0983 *** (0.0208) | 0.0585 ** (0.0289) |

| Control variables fixed | Yes | Yes | Yes |

| Wald X2 | 151.44 *** | 162.35 *** | 145.54 *** |

| F-value of first stage | 27.27 *** | 27.27 *** | 27.27 *** |

| t value of IV | 5.22 *** | 5.22 *** | 5.22 *** |

| DWH endogenous test | 3.58 * | 4.22 * | 5.38 ** |

| Observations | 832 | 832 | 832 |

| Online sales | 0.0789 *** (0.0137) | 0.1029 *** (0.0268) | 0.0534 * (0.0323) |

| Control variables fixed | Yes | Yes | Yes |

| Wald X2 | 164.02 *** | 177.28 *** | 163.06 *** |

| F-value of first stage | 46.60 *** | 46.60 *** | 46.60 *** |

| t value of IV | 6.83 *** | 6.83 *** | 6.83 *** |

| DWH endogenous test | 3.10 * | 3.29 * | 5.17 ** |

| Observations | 832 | 832 | 832 |

| Variables | Digital Payments | Digital Wealth Management | Digital Credit | Digital Financial Literacy | Digital Payments | Digital Wealth Management | Digital Credit |

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Online purchases | 0.0822 * (0.0426) | 0.0910 *** (0.0322) | 0.0485 ** (0.0209) | 0.4987 *** (0.1422) | 0.0738 * (0.0435) | 0.0531 ** (0.0213) | 0.0337 * (0.0181) |

| Digital financial literacy | 0.0581 *** (0.0098) | 0.0726 *** (0.0093) | 0.0422 *** (0.0078) | ||||

| Control variables fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| LR X2/F/Wald X2 | 359.17 *** | 205.28 *** | 148.22 *** | 22.41 *** | 252.02 *** | 205.56 *** | 158.12 *** |

| Pseduo R2/R2 | 0.50 | 0.23 | 0.27 | 0.39 | |||

| F-value of first stage | 35.11 *** | 35.11 *** | 35.11 *** | ||||

| t value of IV | 6.35 *** | 6.35 *** | 6.35 *** | ||||

| DWH endogenous test | 12.12 *** | 10.56 *** | 9.86 *** | ||||

| Online sales | 0.1028 *** (0.0302) | 0.1151 *** (0.0268) | 0.0634 * (0.0346) | 0.4264 *** (0.1289) | 0.0912 *** (0.0350) | 0.0665 ** (0.0285) | 0.0342 * (0.0201) |

| Digital financial literacy | 0.0426 *** (0.0084) | 0.0731 *** (0.0091) | 0.0415 *** (0.0076) | ||||

| Control variables fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| LR X2/F/Wald X2 | 312.63 *** | 206.72 *** | 144.50 *** | 21.18 *** | 258.43 *** | 208.01 *** | 159.24 *** |

| Pseudo R2/R2 | 0.33 | 0.23 | 0.26 | 0.38 | |||

| F-value of first stage | 35.11 *** | 35.11 *** | 35.11 *** | ||||

| t value of IV | 6.35 *** | 6.35 *** | 6.35 *** | ||||

| DWH endogenous test | 14.02 *** | 12.55 *** | 10.37 *** | ||||

| Observations | 832 | 832 | 832 | 832 | 832 | 832 | 832 |

| Treatment Variables | Dependent Variables | Education Levels | Skills Training Experience | New Agricultural Operation Entities | Entrepreneurship Industry | ||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | ||

| Low | High | No | Yes | No | Yes | Non-Agriculture | Agriculture | ||

| Online purchases | Digital payments | 0.0163 (0.0564) | 0.0812 * (0.0444) | 0.0367 (0.0614) | 0.0551 (0.0432) | 0.0732 (0.0462) | 0.0371 (0.0520) | 0.0440 (0.0470) | 0.0732 * (0.0432) |

| Digital wealth management | 0.0824 (0.0561) | 0.0867 * (0.0511) | 0.0947 (0.0678) | 0.1113 ** (0.0562) | 0.0681 (0.0746) | 0.1216 ** (0.0545) | 0.0218 (0.0716) | 0.1747 *** (0.0587) | |

| Digital credit | 0.0507 (0.0398) | 0.1007 * (0.0590) | 0.0309 (0.0526) | 0.0687 * (0.0414) | 0.0261 (0.0446) | 0.1124 ** (0.0511) | 0.0212 (0.0556) | 0.0847 * (0.0470) | |

| Online sales | Digital payments | 0.0842 * (0.0454) | 0.1123 * (0.0606) | 0.0388 (0.0552) | 0.0989 * (0.0515) | 0.0730 * (0.0431) | 0.1239 * (0.0645) | 0.0620 (0.0658) | 0.1331 *** (0.0464) |

| Digital wealth management | 0.0984 (0.0790) | 0.1322 *** (0.0443) | 0.0443 (0.0566) | 0.1693 *** (0.0571) | 0.0724 (0.0756) | 0.1715 *** (0.0454) | 0.0405 (0.0893) | 0.0856 ** (0.0410) | |

| Digital credit | 0.0595 (0.0627) | 0.0505 * (0.0299) | 0.0105 (0.0420) | 0.0571 (0.0397) | 0.0184 (0.0463) | 0.0473 (0.0368) | 0.1005 (0.0663) | 0.0856 ** (0.0410) | |

| Observations | 566 | 266 | 391 | 441 | 566 | 266 | 324 | 508 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, L.; Peng, Y.; Kong, R.; Chen, Q. Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1434-1457. https://doi.org/10.3390/jtaer16050081

Su L, Peng Y, Kong R, Chen Q. Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China. Journal of Theoretical and Applied Electronic Commerce Research. 2021; 16(5):1434-1457. https://doi.org/10.3390/jtaer16050081

Chicago/Turabian StyleSu, Lanlan, Yanling Peng, Rong Kong, and Qiu Chen. 2021. "Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China" Journal of Theoretical and Applied Electronic Commerce Research 16, no. 5: 1434-1457. https://doi.org/10.3390/jtaer16050081

APA StyleSu, L., Peng, Y., Kong, R., & Chen, Q. (2021). Impact of E-Commerce Adoption on Farmers’ Participation in the Digital Financial Market: Evidence from Rural China. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1434-1457. https://doi.org/10.3390/jtaer16050081