Customer Experience in Fintech

Abstract

1. Introduction

2. Theoretical Framework

2.1. Customer Experience

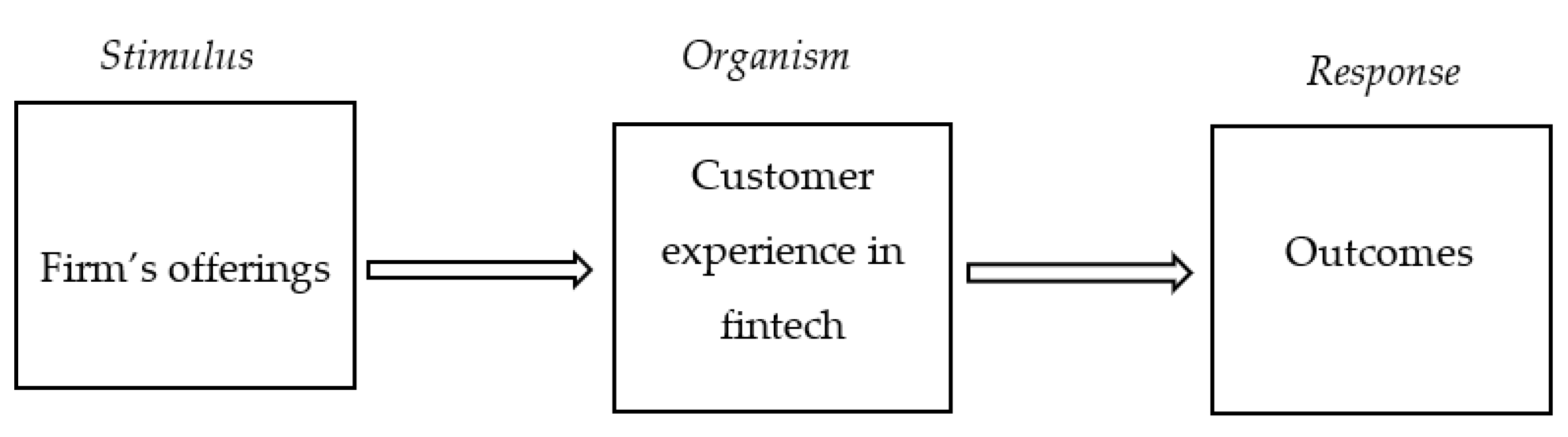

2.2. The S-O-R Approach

2.3. Customer Experience in Fintech

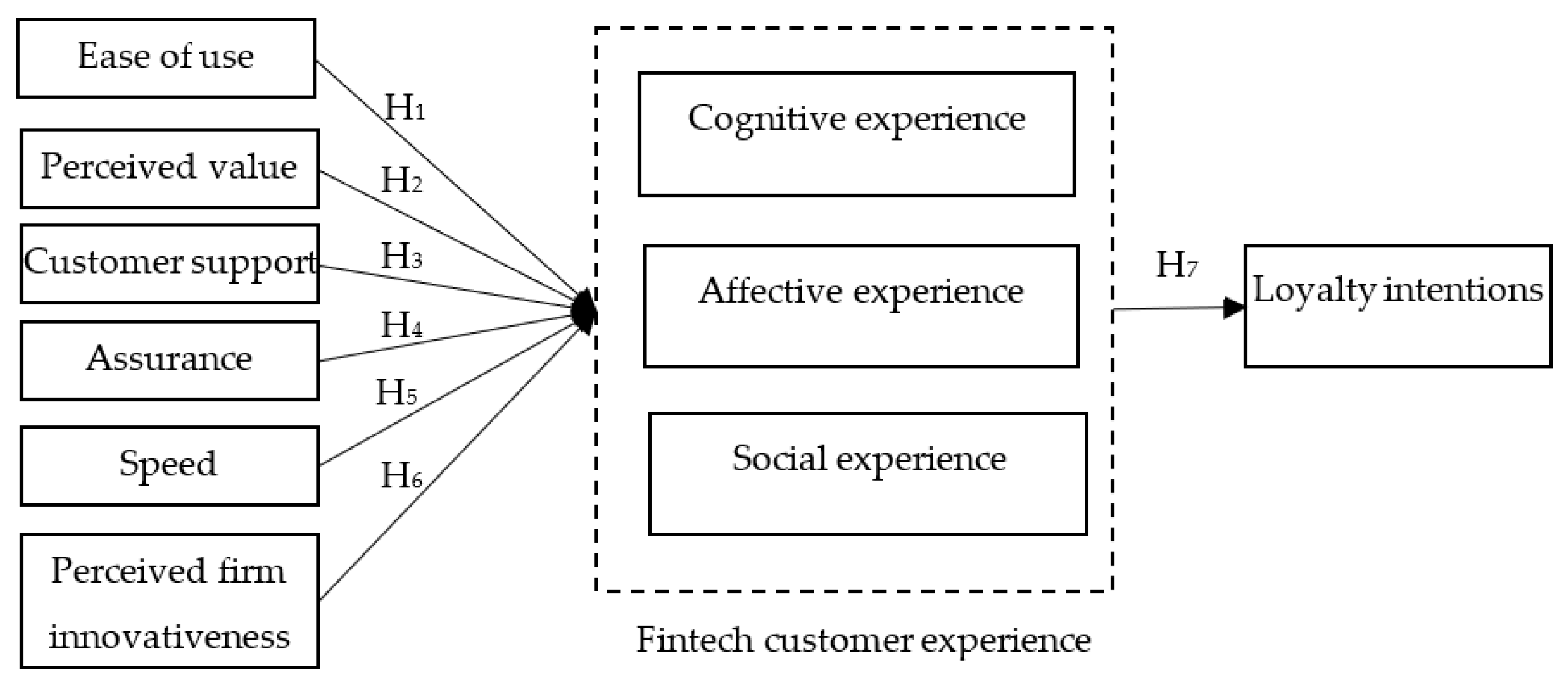

3. Conceptual Model and Hypotheses Development

4. Research Methodology

4.1. Sampling and Data Collection

4.2. Measures

5. Findings

6. Discussions and Implications

7. Conclusions

7.1. Theoretical Contributions

7.2. Managerial Implications

7.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abad-Segura, E.; González-Zamar, M.-D.; López-Meneses, E.; Vázquez-Cano, E. Financial Technology: Review of Trends, Approaches and Management. Mathematics 2020, 8, 951. [Google Scholar] [CrossRef]

- Nicoletti, B. The Future of FinTech: Integrating Finance and Technology in Financial Services; Palgrave Macmillan: Cham, Switzerland, 2017. [Google Scholar]

- Mansilla-Fernández, J.M. Institutions. Eur. Econ. 2017, 3, 41–50. [Google Scholar]

- Nitescu, D.C.; Murgu, V. The Economic Growth Catalyzers at the European Level, in the Context of the 2008 Financial Crisis. Amfiteatru Econ. 2019, 21, 241–257. [Google Scholar] [CrossRef]

- Knight, E.; Wójcik, D. FinTech, economy and space: Introduction to the special issue. Environ. Plan. A Econ. Space 2020, 52, 1490–1497. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Nistor, C.S.; Êtefģnescu, C.A.; Zanellato, G. Encompassing Non-Financial Reporting in A Coercive Framework for Enhancing Social Responsibility: Romanian Listed Companies’ Case. Amfiteatru Econ. 2019, 21, 590–606. [Google Scholar] [CrossRef]

- Gatto, A.; Polselli, N.; Bloom, G. Empowering Gender Equality through Rural Development: Rural Markets and Micro-Finance in Kyrgyzstan. In L’Europa e la Comunità Internazionale Difronte alle Sfide dello Sviluppo; Matteo, L., Pace, M., Eds.; Giannini Editore: Napoli, Italy, 2016. [Google Scholar]

- Gatto, A. Historical Roots of Microcredit and Usury: The Role ofMonti di Pietàin Italy and in the Kingdom of Naples in XV-XX Centuries. J. Int. Dev. 2018, 30, 911–914. [Google Scholar] [CrossRef]

- Lim, S.H.; Kim, D.J.; Hur, Y.; Park, K. An Empirical Study of the Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services. Int. J. Hum. Comput. Interact. 2019, 35, 886–898. [Google Scholar] [CrossRef]

- Nakashima, T. Creating credit by making use of mobility with FinTech and IoT. IATSS Res. 2018, 42, 61–66. [Google Scholar] [CrossRef]

- Suseendran, G.; Chandrasekaran, E.; Akila, D.; Kumar, A.S. Banking and FinTech (Financial Technology) Embraced with IoT Device. In Advances in Human Factors, Business Management, Training and Education; Metzler, J.B., Ed.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 197–211. [Google Scholar]

- Weichert, M. The Future of Payments: How FinTech Players Are Accelerating Customer-Driven Innovation in Financial Services; Henry Stewart Publication: London, UK, 2017; Volume 11, pp. 23–33. [Google Scholar]

- KPMG. Pulse of Fintech H1 2020. 2020. Available online: https://assets.kpmg/content/dam/kpmg/tw/pdf/2020/09/pulse-of-fintech-h1-2020.pdf (accessed on 14 December 2020).

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Alt, R.; Beck, R.; Smits, M.T. FinTech and the transformation of the financial industry. Electron. Mark. 2018, 28, 235–243. [Google Scholar] [CrossRef]

- Baber, H. Financial inclusion and FinTech. Qual. Res. Financ. Mark. 2019, 12, 24–42. [Google Scholar] [CrossRef]

- Nangin, M.A.; Barus, I.R.G.; Wahyoedi, S. The Effects of Perceived Ease of Use, Security, and Promotion on Trust and Its Implications on Fintech Adoption. J. Consum. Sci. 2020, 5, 124–138. [Google Scholar] [CrossRef]

- Meyliana, F.; Surjandy, E. The Influence of Perceived Risk and Trust in Adoption of FinTech Services in Indonesia. CommIT Commun. Inf. Technol. J. 2019, 13, 31–37. [Google Scholar] [CrossRef]

- Saksonova, S.; Kuzmina-Merlino, I. Fintech as Financial Innovation-The Possibilities and Problems of Implementation. Eur. Res. Stud. J. 2017, 30, 961–973. [Google Scholar] [CrossRef]

- Romānova, I.; Kudinska, M. Banking and Fintech: A Challenge or Opportunity? Contemp. Issues Public Sect. Account. Audit. 2016, 98, 21–35. [Google Scholar]

- Dorfleitner, G.; Hornuf, L.; Schmitt, M.; Weber, M. Definition of FinTech and Description of the FinTech Industry. In FinTech in Germany; Dorfleitner, G., Hornuf, L., Schmitt, M., Weber, M., Eds.; Springer: Cham, Swizerland, 2017; pp. 5–10. [Google Scholar] [CrossRef]

- Sloboda, L.Y.; Lviv Educational and Scientific Institute of SHEI “Banking University”; Demianyk, O.M.; Ua, L.B.F.I. Prospects and Risks of the Fintech Initiatives in a Global Banking Industry. Probl. Econ. 2020, 1, 275–282. [Google Scholar] [CrossRef]

- Boratyńska, K. Impact of Digital Transformation on Value Creation in Fintech Services: An Innovative Approach. J. Promot. Manag. 2019, 25, 631–639. [Google Scholar] [CrossRef]

- Hoyer, W.D.; Kroschke, M.; Schmitt, B.; Kraume, K.; Shankar, V. Transforming the Customer Experience Through New Technologies. J. Interact. Mark. 2020, 51, 57–71. [Google Scholar] [CrossRef]

- Libai, B.; Bart, Y.; Gensler, S.; Hofacker, C.F.; Kaplan, A.; Kötterheinrich, K.; Kroll, E.B. Brave New World? On AI and the Management of Customer Relationships. J. Interact. Mark. 2020, 51, 44–56. [Google Scholar] [CrossRef]

- Rangaswamy, A.; Moch, N.; Felten, C.; van Bruggen, G.; Wieringa, J.E.; Wirtz, J. The Role of Marketing in Digital Business Platforms. J. Interact. Mark. 2020, 51, 72–90. [Google Scholar] [CrossRef]

- Ieva, M.; Ziliani, C. The role of customer experience touchpoints in driving loyalty intentions in services. TQM J. 2018, 30, 444–457. [Google Scholar] [CrossRef]

- Herhausen, D.; Kleinlercher, K.; Verhoef, P.C.; Emrich, O.; Rudolph, T. Loyalty Formation for Different Customer Journey Segments. J. Retail. 2019, 95, 9–29. [Google Scholar] [CrossRef]

- Chylinski, M.; Heller, J.; Hilken, T.; Keeling, D.I.; Mahr, D.; de Ruyter, K. Augmented Reality Marketing: A Technology-Enabled Approach to Situated Customer Experience. Australas. Mark. J. 2020, 28, 374–384. [Google Scholar] [CrossRef]

- Jung, S.H.; Chung, B.G. Influential Factors of Digital Customer Experiences on Purchase in the 4th Industrial Revolution Era. J. Ventur. Innov. 2020, 3, 101–115. [Google Scholar] [CrossRef]

- Holbrook, M.B.; Hirschman, E.C. The Experiential Aspects of Consumption: Consumer Fantasies, Feelings, and Fun. J. Consum. Res. 1982, 9, 132–140. [Google Scholar] [CrossRef]

- Holt, D.B. How Consumers Consume: A Typology of Consumption Practices. J. Consum. Res. 1995, 22, 1–16. [Google Scholar] [CrossRef]

- Rose, S.; Clark, M.; Samouel, P.; Hair, N. Online Customer Experience in e-Retailing: An empirical model of Antecedents and Outcomes. J. Retail. 2012, 88, 308–322. [Google Scholar] [CrossRef]

- Waqas, M.; Hamzah, Z.L.B.; Salleh, N.A.M. Customer experience: A systematic literature review and consumer culture theory-based conceptualisation. Manag. Rev. Q. 2021, 71, 135–176. [Google Scholar] [CrossRef]

- Pine II, B.J.; Gilmore, J.H. Welcome to the Experience Economy; Harvard Business Review: Brighton, MA, USA, 1998; pp. 97–105. [Google Scholar]

- Kranzbühler, A.-M.; Kleijnen, M.H.; Morgan, R.E.; Teerling, M. The Multilevel Nature of Customer Experience Research: An Integrative Review and Research Agenda. Int. J. Manag. Rev. 2017, 20, 433–456. [Google Scholar] [CrossRef]

- Pecorari, P.M.; Lima, C.R.C. Correlation of customer experience with the acceptance of product-service systems and circular economy. J. Clean. Prod. 2021, 281, 125275. [Google Scholar] [CrossRef]

- Kornberger, M. Brand Society: How Brands Transform Management and Lifestyle; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Becker, L.; Jaakkola, E. Customer experience: Fundamental premises and implications for research. J. Acad. Mark. Sci. 2020, 48, 630–648. [Google Scholar] [CrossRef]

- Lemon, K.N.; Verhoef, P.C. Understanding Customer Experience Throughout the Customer Journey. J. Mark. 2016, 80, 69–96. [Google Scholar] [CrossRef]

- Brakus, J.J.; Schmitt, B.H.; Zarantonello, L. Brand Experience: What Is It? How Is It Measured? Does It Affect Loyalty? J. Mark. 2009, 73, 52–68. [Google Scholar] [CrossRef]

- De Keyser, A.; Lemon, K.N.; Klaus, P.; Keiningham, T.L. A framework for understanding and managing the customer experience. Mark. Sci. Inst. Work. Pap. Ser. 2015, 85, 15–121. [Google Scholar]

- Keiningham, T.L.; Ball, J.; Moeller, S.B.; Née Bruce, H.L.; Buoye, A.; Dzenkovska, J.; Nasr, L.; Ou, Y.-C.; Zaki, M. The interplay of customer experience and commitment. J. Serv. Mark. 2017, 31, 148–160. [Google Scholar] [CrossRef]

- Ameen, N.; Tarhini, A.; Reppel, A.; Anand, A. Customer experiences in the age of artificial intelligence. Comput. Hum. Behav. 2021, 114, 106548. [Google Scholar] [CrossRef]

- De Keyser, A.; Verleye, K.; Lemon, K.N.; Keiningham, T.L.; Klaus, P. Moving the Customer Experience Field Forward: Introducing the Touchpoints, Context, Qualities (TCQ) Nomenclature. J. Serv. Res. 2020, 23, 433–455. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Lemon, K.N.; Parasuraman, A.; Roggeveen, A.; Tsiros, M.; Schlesinger, L.A. Customer Experience Creation: Determinants, Dynamics and Management Strategies. J. Retail. 2009, 85, 31–41. [Google Scholar] [CrossRef]

- McColl-Kennedy, J.R.; Gustafsson, A.; Jaakkola, J.; Klaus, P.; Radnor, Z.J.; Perks, H.; Friman, M. Fresh perspectives on customer experience. J. Serv. Mark. 2015, 29, 430–435. [Google Scholar] [CrossRef]

- Chaney, D.; Lunardo, R.; Mencarelli, R. Consumption experience: Past, present and future. Qual. Mark. Res. Int. J. 2018, 21, 402–420. [Google Scholar] [CrossRef]

- Bolton, R.N.; McColl-Kennedy, J.R.; Cheung, L.; Gallan, A.; Orsingher, C.; Witell, L.; Zaki, M. Customer experience challenges: Bringing together digital, physical and social realms. J. Serv. Manag. 2018, 29, 776–808. [Google Scholar] [CrossRef]

- Mehrabian, A.; Russell, J.A. An Approach to Environmental Psychology; MIT Press: Cambridge, MA, USA, 1974. [Google Scholar]

- Mosteller, J.; Donthu, N.; Eroglu, S. The fluent online shopping experience. J. Bus. Res. 2014, 67, 2486–2493. [Google Scholar] [CrossRef]

- Lin, J.; Lin, S.; Turel, O.; Xu, F. The buffering effect of flow experience on the relationship between overload and social media users’ discontinuance intentions. Telemat. Inform. 2020, 49, 101374. [Google Scholar] [CrossRef]

- Chopdar, P.K.; Balakrishnan, J. Consumers response towards mobile commerce applications: S-O-R approach. Int. J. Inf. Manag. 2020, 53, 102106. [Google Scholar] [CrossRef]

- Chahal, H.; Wirtz, J.; Verma, A. Social media brand engagement: Dimensions, drivers and consequences. J. Consum. Mark. 2019, 37, 191–204. [Google Scholar] [CrossRef]

- Kamboj, S.; Sarmah, B.; Gupta, S.; Dwivedi, Y. Examining branding co-creation in brand communities on social media: Applying the paradigm of Stimulus-Organism-Response. Int. J. Inf. Manag. 2018, 39, 169–185. [Google Scholar] [CrossRef]

- Hollebeek, L.D. Demystifying customer brand engagement: Exploring the loyalty nexus. J. Mark. Manag. 2011, 27, 785–807. [Google Scholar] [CrossRef]

- Iyer, P.; Davari, A.; Mukherjee, A. Investigating the effectiveness of retailers’ mobile applications in determining customer satisfaction and repatronage intentions? A congruency perspective. J. Retail. Consum. Serv. 2018, 44, 235–243. [Google Scholar] [CrossRef]

- Følstad, A.; Kvale, K. Customer journeys: A systematic literature review. J. Serv. Theory Pr. 2018, 28, 196–227. [Google Scholar] [CrossRef]

- Capgemini. World Fintech Report. 2020. Available online: https://fintechworldreport.com/resources/world-fintech-report-2020/ (accessed on 19 January 2021).

- Mbama, C.I.; Ezepue, P.O. Digital banking, customer experience and bank financial performance. Int. J. Bank Mark. 2018, 36, 230–255. [Google Scholar] [CrossRef]

- Palomo, R.; Fernández, Y.; Gutiérrez, M. Banca cooperativa y transformación digital: Hacia un nuevo modelo de relación con sus socios y clientes. Rev. De Estud. Coop. 2018, 129, 161–182. [Google Scholar] [CrossRef]

- Maedche, A.; Morana, S.; Schacht, S.; Werth, D.; Krumeich, J. Advanced User Assistance Systems. Bus. Inf. Syst. Eng. 2016, 58, 367–370. [Google Scholar] [CrossRef]

- Jung, D.; Dorner, V.; Glaser, F.; Morana, S. Robo-Advisory. Bus. Inf. Syst. Eng. 2018, 60, 81–86. [Google Scholar] [CrossRef]

- Jung, D.; Dorner, V.; Weinhardt, C.; Pusmaz, H. Designing a robo-advisor for risk-averse, low-budget consumers. Electron. Mark. 2017, 28, 367–380. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Buckley, R.P.; Webster, S. Fintech in developing countries: Charting new customer journeys. J. Financ. Transform. 2016, 44, 151–159. [Google Scholar]

- Riemer, K.; Hafermalz, E.; Roosen, A.; Boussand, N.; El Aoufi, H.; Mo, D.; Kosheliev, A. The Fintech Advantage: Harnessing Digital Technology to Keep the Customer in Focus. 2017. Available online: https://ses.library.usyd.edu.au/bitstream/handle/2123/16259/Fintech_Report_Final_Web.pdf?sequence=4&isAllowed=y (accessed on 11 January 2021).

- Baber, H. FinTech, Crowdfunding and Customer Retention in Islamic Banks. Vision: J. Bus. Perspect. 2019, 24, 260–268. [Google Scholar] [CrossRef]

- Vasiljeva, T.; Lukanova, K. Commercial banks and fintech companies in the Digital transformation: Challenges for the future. J. Bus. Manag. 2016, 11, 25–33. [Google Scholar]

- Imerman, M.B.; Fabozzi, F.J. Cashing in on innovation: A taxonomy of FinTech. J. Asset Manag. 2020, 21, 1–11. [Google Scholar] [CrossRef]

- Van Thiel, D.; Van Raaij, F. Explaining Customer Experience of Digital Financial Advice. Econ. World 2017, 5, 69–84. [Google Scholar] [CrossRef][Green Version]

- Bleier, A.; Harmeling, C.M.; Palmatier, R.W. Creating Effective Online Customer Experiences. J. Mark. 2018, 83, 98–119. [Google Scholar] [CrossRef]

- Verleye, K. The co-creation experience from the customer perspective: Its measurement and determinants. J. Serv. Manag. 2015, 26, 321–342. [Google Scholar] [CrossRef]

- Lee, M.-C. Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electron. Commer. Res. Appl. 2009, 8, 130–141. [Google Scholar] [CrossRef]

- Parasuraman, A.; Gremler, D.D.; Gwinner, K.P. Technology Readiness Index (Tri). J. Serv. Res. 2000, 2, 307–320. [Google Scholar] [CrossRef]

- Fernández-Cruz, F.-J.; Fernández-Díaz, M.-J. Generation Z’s teachers and their digital skills. Comun. Media Educ. Res. J. 2016, 24, 97–105. [Google Scholar] [CrossRef]

- Dabija, D.-C.; Bejan, B.M.; Tipi, N. Generation X versus Millennials communication behaviour on social media when purchasing food versus tourist services. E+M Èkon. A Manag. 2018, 21, 191–205. [Google Scholar] [CrossRef]

- Gefen, D. TAM or Just Plain Habit. J. Organ. End User Comput. 2003, 15, 1–13. [Google Scholar] [CrossRef]

- Kim, Y.; Park, Y.-J.; Choi, J.; Yeon, J. An Empirical Study on the Adoption of “Fintech” Service: Focused on Mobile Payment Services. Business 2015, 114, 136–140. [Google Scholar] [CrossRef]

- Chuang, L.M.; Liu, C.C.; Kao, H.K. The adoption of fintech service: TAM perspective. Int. J. Manag. Ad Minist. Sci. 2016, 3, 1–15. [Google Scholar]

- Ryu, H.-S.; Ko, K. Sustainable Development of Fintech: Focused on Uncertainty and Perceived Quality Issues. Sustainability 2020, 12, 7669. [Google Scholar] [CrossRef]

- Tan, T.; Zhang, Y.; Heng, C.S.; Ge, C. Empowerment of Grassroots Consumers: A Revelatory Case of a Chinese FinTech Innovation. J. Assoc. Inf. Syst. 2020. Forthcoming. Available online: https://ssrn.com/abstract=3563373 (accessed on 15 January 2021).

- Fornell, C.; Johnson, M.D.; Anderson, E.W.; Cha, J.; Bryant, B.E. The American Customer Satisfaction Index: Nature, Purpose, and Findings. J. Mark. 1996, 60, 7–18. [Google Scholar] [CrossRef]

- Agarwal, S.; Teas, R.K. Perceived Value: Mediating Role of Perceived Risk. J. Mark. Theory Pr. 2001, 9, 1–14. [Google Scholar] [CrossRef]

- Agarwal, S.; Zhang, J. FinTech, Lending and Payment Innovation: A Review. Asia Pac. J. Financ. Stud. 2020, 49, 353–367. [Google Scholar] [CrossRef]

- Garg, R.; Rahman, Z.; Qureshi, M. Measuring customer experience in banks: Scale development and validation. J. Model. Manag. 2014, 9, 87–117. [Google Scholar] [CrossRef]

- Prodanova, J.; Ciunova-Shuleska, A.; Palamidovska-Sterjadovska, N. Enriching m-banking perceived value to achieve reuse intention. Mark. Intell. Plan. 2019, 37, 617–630. [Google Scholar] [CrossRef]

- Shiau, W.-L.; Yuan, Y.; Pu, X.; Ray, S.; Chen, C.C. Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Ind. Manag. Data Syst. 2020, 120, 1659–1689. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Malhotra, A. E-S-QUAL. J. Serv. Res. 2005, 7, 213–233. [Google Scholar] [CrossRef]

- Kotarba, M. New Factors Inducing Changes in the Retail Banking Customer Relationship Management (CRM) and Their Exploration by the Fintech Industry. Found. Manag. 2016, 8, 69–78. [Google Scholar] [CrossRef]

- Muthukannan, P.; Tan, B.; Gozman, D.; Johnson, L. The emergence of a Fintech Ecosystem: A case study of the Vizag Fintech Valley in India. Inf. Manag. 2020, 57, 103385. [Google Scholar] [CrossRef]

- Lee, D.K.; Teo, E.G.S. Emergence of Fintech and the Lasic Principles. SSRN Electron. J. 2015, 3, 24–36. [Google Scholar] [CrossRef]

- Swaid, S.I.; Wigand, R.T. Measuring the quality of e-service: Scale development and initial validation. J. Electron. Commer. Res. 2009, 10, 13–28. [Google Scholar]

- Zhou, T. An empirical examination of continuance intention of mobile payment services. Decis. Support Syst. 2013, 54, 1085–1091. [Google Scholar] [CrossRef]

- Yang, Q.; Pang, C.; Liu, L.; Yen, D.C.; Tarn, J.M. Exploring consumer perceived risk and trust for online payments: An empirical study in China’s younger generation. Comput. Hum. Behav. 2015, 50, 9–24. [Google Scholar] [CrossRef]

- Mehrban, S.; Khan, M.A.; Nadeem, M.W.; Hussain, M.; Ahmed, M.M.; Hakeem, O.; Saqib, S.; Kiah, M.L.M.; Abbas, F.; Hassan, M. Towards Secure FinTech: A Survey, Taxonomy, and Open Research Challenges. IEEE Access 2020, 8, 23391–23406. [Google Scholar] [CrossRef]

- Tachiciu, L.; Fulop, M.T.; Marin-Pantelescu, A.; Oncioiu, I.; Topor, D.I. Non-Financial Reporting and Reputational Risk in the Romanian Financial Sector. Amfiteatru Econ. 2020, 22, 668–691. [Google Scholar] [CrossRef]

- Jünger, M.; Mietzner, M. Banking goes digital: The adoption of FinTech services by German households. Financ. Res. Lett. 2020, 34, 101260. [Google Scholar] [CrossRef]

- Tripathy, A.K.; Jain, A. FinTech adoption: Strategy for customer retention. Strat. Dir. 2020, 36, 47–49. [Google Scholar] [CrossRef]

- Teo, A.-C.; Tan, G.W.-H.; Ooi, K.-B.; Hew, T.-S.; Yew, K.-T. The effects of convenience and speed in m-payment. Ind. Manag. Data Syst. 2015, 115, 311–331. [Google Scholar] [CrossRef]

- Kunz, W.; Schmitt, B.; Meyer, A. How does perceived firm innovativeness affect the consumer? J. Bus. Res. 2011, 64, 816–822. [Google Scholar] [CrossRef]

- Berman, A.; Cano-Kollmann, M.; Mudambi, R. Innovation and entrepreneurial ecosystems: Fintech in the financial services industry. Rev. Manag. Sci. 2021, 1–20. [Google Scholar] [CrossRef]

- Henard, D.H.; Dacin, P.A. Reputation for Product Innovation: Its Impact on Consumers. J. Prod. Innov. Manag. 2010, 27, 321–335. [Google Scholar] [CrossRef]

- Shams, R.; Alpert, F.; Brown, M. Consumer perceived brand innovativeness. Eur. J. Mark. 2015, 49, 1589–1615. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. The emergence of the global fintech market: Economic and technological determinants. Small Bus. Econ. 2019, 53, 81–105. [Google Scholar] [CrossRef]

- Khan, I.; Fatma, M.; Kumar, V.; Amoroso, S. Do experience and engagement matter to millennial consumers? Mark. Intell. Plan. 2020, 39, 329–341. [Google Scholar] [CrossRef]

- Molinillo, S.; Navarro-García, A.; Anaya-Sánchez, R.; Japutra, A. The impact of affective and cognitive app experiences on loyalty towards retailers. J. Retail. Consum. Serv. 2020, 54, 101948. [Google Scholar] [CrossRef]

- Dospinescu, O.; Anastasiei, B.; Dospinescu, N. Key Factors Determining the Expected Benefit of Customers When Using Bank Cards: An Analysis on Millennials and Generation Z in Romania. Symmetry 2019, 11, 1449. [Google Scholar] [CrossRef]

- Dabija, D.C.; Bejan, B.; Dinu, V. How Sustainability Oriented is Generation Z in Retail? A Literature Review. Transform. Bus. Econ. 2019, 18, 140–155. [Google Scholar]

- Abu Daqar, M.A.M.; Arqawi, S.; Abu Karsh, S. Fintech in the eyes of Millennials and Generation Z (the financial behavior and Fintech perception). Banks Bank Syst. 2020, 15, 20–28. [Google Scholar] [CrossRef]

- Sangwan, V.; Harshita, H.; Prakash, P.; Singh, S. Financial technology: A review of extant literature. Stud. Econ. Financ. 2019, 37, 71–88. [Google Scholar] [CrossRef]

- Dabija, D.-C.; Postelnicu, C.; Dinu, V. Cross-Generational Investigation of Ethics and Sustainability. Insights from Romanian Retailing; Metzler, J.B., Ed.; Springer: Gewerbesrasse, Swizerland, 2018; pp. 141–163. [Google Scholar]

- Jiwasiddi, A.; Adhikara, C.; Adam, M.; Triana, I. Attitude toward using Fintech among Millennials. In Proceedings of the 1st Workshop Multimedia Education, Learning, Assessment and Its Implementation in Game and Gamification, Medan, Indonesia, 26–28 January 2019. [Google Scholar]

- Omarini, A.E. Fintech and the Future of the Payment Landscape: The Mobile Wallet Ecosystem-A Challenge for Retail Banks? Int. J. Financ. Res. 2018, 9, 97. [Google Scholar] [CrossRef]

- Carlin, B.; Olafsson, A.; Pagel, M. FinTech Adoption Across Generations: Financial Fitness in the Information Age; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Techcrunch.com. Available online: www.techcrunch.com/2020/02/24/revolut-raises-500-million-at-5-5-billion-valuation (accessed on 12 December 2020).

- Financialintelligence.ro. Available online: www.financialintelligence.ro/revolut-ofera-iban-uri-locale-celor-peste-125-milioane-de-utilizatori-romani-in-parteneriat-cu-libra-internet-bank (accessed on 12 December 2020).

- Gurău, C. A life-stage analysis of consumer loyalty profile: Comparing Generation X and Millennial consumers. J. Consum. Mark. 2012, 29, 103–113. [Google Scholar] [CrossRef]

- Dabija, D.-C.; Băbuț, R. Enhancing Apparel Store Patronage through Retailers’ Attributes and Sustainability. A Generational Approach. Sustainability 2019, 11, 4532. [Google Scholar] [CrossRef]

- Brislin, R.W. Back-Translation for Cross-Cultural Research. J. Cross Cult. Psychol. 1970, 1, 185–216. [Google Scholar] [CrossRef]

- Hair, J.F.; Howard, M.C.; Nitzl, C. Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Henseler, J.; Sarstedt, M. Goodness-of-fit indices for partial least squares path modeling. Comput. Stat. 2013, 28, 565–580. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Prentice Hall: Englewood Cliffs, NJ, USA, 2010. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Siguaw, J.A. Formative Versus Reflective Indicators in Organizational Measure Development: A Comparison and Empirical Illustration. Br. J. Manag. 2006, 17, 263–282. [Google Scholar] [CrossRef]

- Kuo, Y.-F.; Wu, C.-M.; Deng, W.-J. The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Comput. Hum. Behav. 2009, 25, 887–896. [Google Scholar] [CrossRef]

- Parise, S.; Guinan, P.J.; Kafka, R. Solving the crisis of immediacy: How digital technology can transform the customer experience. Bus. Horiz. 2016, 59, 411–420. [Google Scholar] [CrossRef]

- Bhattacherjee, A. Understanding Information Systems Continuance: An Expectation-Confirmation Model. MIS Q. 2001, 25, 351–370. [Google Scholar] [CrossRef]

- Bank for International Settlements (BIS). Fast Payments: Enhancing the Speed and Availability of Retail Payments; Committee on Pay-ments and Market Infrastructures: Basel, Switzerland, 2016. [Google Scholar]

- Razzaque, A.; Cummings, R.T.; Karolak, M.; Hamdan, A. The Propensity to Use FinTech: Input from Bankers in the Kingdom of Bahrain. J. Inf. Knowl. Manag. 2020, 19, 2040025. [Google Scholar] [CrossRef]

- Chen, M.A.; Wu, Q.; Yang, B. How Valuable Is FinTech Innovation? Rev. Financial Stud. 2019, 32, 2062–2106. [Google Scholar] [CrossRef]

- Mascarenhas, O.A.; Kesavan, R.; Bernacchi, M. Lasting customer loyalty: A total customer experience approach. J. Consum. Mark. 2006, 23, 397–405. [Google Scholar] [CrossRef]

- Larsson, A.; Viitaoja, Y. Building customer loyalty in digital banking. Int. J. Bank Mark. 2017, 35, 858–877. [Google Scholar] [CrossRef]

- Baber, H. Impact of FinTech on customer retention in Islamic banks of Malaysia. Int. J. Bus. Syst. Res. 2020, 14, 217. [Google Scholar] [CrossRef]

- Hoffman, D.L.; Novak, T.P. Flow Online: Lessons Learned and Future Prospects. J. Interact. Mark. 2009, 23, 23–34. [Google Scholar] [CrossRef]

- Pleyers, G.; Poncin, I. Non-immersive virtual reality technologies in real estate: How customer experience drives attitudes toward properties and the service provider. J. Retail. Consum. Serv. 2020, 57, 102175. [Google Scholar] [CrossRef]

- Lyons, N.; Lăzăroiu, G. Addressing the COVID-19 Crisis by Harnessing Internet of Things Sensors and Machine Learning Algorithms in Data-driven Smart Sustainable Cities. Geopolit. Hist. Int. Relat. 2020, 12, 65. [Google Scholar] [CrossRef]

| Variable | Specification | N | % |

|---|---|---|---|

| Gender | Female | 138 | 55.87% |

| Male | 109 | 44.13% | |

| Generation | Generation Z | 135 | 54.66% |

| Generation Y/Millennials | 112 | 45.34% | |

| Highest degree of education | High school | 77 | 31.17% |

| Bachelor degree | 81 | 32.80% | |

| Master degree | 89 | 36.03% |

| Construct/ Coding | Items and Source | Factor Loadings |

|---|---|---|

| Ease of use Adapted from Rose et al. (2012); Gefen (2003) | ||

| EU1 | The use of [Firm] is user-friendly. | 0.854 |

| EU2 | [Firm] is simple to use. | 0.815 |

| EU3 | The use of [Firm] is intuitive. | 0.844 |

| Perceived valueAdapted from Fornell et al. (1996); Agarwal and Teas (2001) | ||

| PV1 | I save money using [Firm]. | 0.791 |

| PV2 | For the given price, I rate the [Firm] offer as good. | 0.825 |

| PV3 | I consider [Firm] to be a good buy. | 0.860 |

| Customer supportAdapted from Parasuraman et al. (2005) | ||

| CS1 | The company promptly responds to requests. | 0.858 |

| CS2 | The company solves the problems right the first time. | 0.840 |

| CS3 | The company has a proactive approach. | 0.811 |

| Assurance Adapted from Swaid and Wigand (2009) | ||

| A1 | [Firm] is a reliable company. | 0.843 |

| A2 | Financial operations with [Firm] are safe. | 0.860 |

| A3 | Data sharing with [Firm] is safe. | 0.893 |

| Speed Adapted from Garg et al. (2014) | ||

| S1 | [Firm] services are fast. | 0.827 |

| S2 | [Firm] services can be accessed at any time. | 0.705 |

| S3 | I save time using [Firm]. | 0.849 |

| Perceived firm innovativenessAdapted from Kunz et al. (2011) | ||

| PFI1 | [Firm] is a dynamic company. | 0.832 |

| PFI2 | [Firm] is an innovative company. | 0.876 |

| PFI3 | [Firm] is a creative company. | 0.856 |

| Cognitive experienceAdapted from Bleier et al. (2019) | ||

| CCX1 | The information obtained from [Firm] is useful. | 0.804 |

| CCX 2 | I learned a lot from using [Firm]. | 0.808 |

| CCX 3 | The information obtained from [Firm] brings interesting ideas to mind. | 0.856 |

| Affective experienceAdapted from Rose et al. (2012) | ||

| ACX1 | Using [Firm] makes me feel good. | 0.869 |

| ACX 2 | Using [Firm] makes me feel optimistic. | 0.878 |

| ACX 3 | Using [Firm] makes me feel enthusiastic. | 0.835 |

| Social experienceAdapted from Verleye (2015) | ||

| SCX1 | I ask the opinions of other [Firm] customers. | 0.675 |

| SCX 2 | I advise other people about [Firm]. | 0.883 |

| SCX 3 | I consider myself a member of the community of [Firm] users. | 0.873 |

| Loyalty intentionsAdapted from Parasuraman et al. (2005) | ||

| LI1 | I will say positive things about [Firm] to other people. | 0.908 |

| LI2 | I will recommend [Firm] to other people. | 0.902 |

| LI3 | I will continue to use [Firm]. | 0.842 |

| Construct | Cronbach’s Alpha | CR | AVE |

|---|---|---|---|

| Ease of use (EU) | 0.787 | 0.876 | 0.702 |

| Perceived value (PV) | 0.767 | 0.865 | 0.682 |

| Customer support (CS) | 0.786 | 0.875 | 0.700 |

| Assurance (A) | 0.832 | 0.899 | 0.749 |

| Speed (S) | 0.711 | 0.838 | 0.634 |

| Perceived firm innovativeness (PFI) | 0.816 | 0.890 | 0.731 |

| Cognitive experience (CCX) | 0.762 | 0.863 | 0.677 |

| Affective experience (ACX) | 0.825 | 0.895 | 0.741 |

| Social experience (SCX) | 0.743 | 0.855 | 0.665 |

| Loyalty intentions (LI) | 0.860 | 0.915 | 0.782 |

| EU | PV | CS | A | S | PFI | CCX | ACX | SCX | LI | |

|---|---|---|---|---|---|---|---|---|---|---|

| EU | 0.838 | |||||||||

| PV | 0.657 | 0.826 | ||||||||

| CS | 0.579 | 0.632 | 0.836 | |||||||

| A | 0.609 | 0.557 | 0.642 | 0.865 | ||||||

| S | 0.589 | 0.515 | 0.656 | 0.659 | 0.796 | |||||

| PFI | 0.613 | 0.606 | 0.559 | 0.568 | 0.652 | 0.855 | ||||

| CCX | 0.457 | 0.560 | 0.565 | 0.590 | 0.583 | 0.574 | 0.823 | |||

| ACX | 0.544 | 0.557 | 0.574 | 0.591 | 0.587 | 0.530 | 0.727 | 0.861 | ||

| SCX | 0.455 | 0.532 | 0.562 | 0.517 | 0.523 | 0.518 | 0.622 | 0.728 | 0.816 | |

| LI | 0.576 | 0.600 | 0.552 | 0.657 | 0.572 | 0.575 | 0.608 | 0.702 | 0.710 | 0.884 |

| Effects/Paths | Path Co-efficient (β) | t-Value (Bootstrap) | p-Value | Hypotheses |

|---|---|---|---|---|

| Ease of use → Customer experience | −0.028 | 0.341 | 0.73 | H1: Not supported |

| Perceived value → Customer experience | 0.221 | 2.938 | 0.003 | H2: Supported |

| Customer support → Customer experience | 0.165 | 2.608 | 0.009 | H3: Supported |

| Assurance → Customer experience | 0.215 | 2.714 | 0.007 | H4: Supported |

| Speed → Customer experience | 0.189 | 2.851 | 0.005 | H5: Supported |

| Perceived firm innovativeness → Customer experience | 0.153 | 2.135 | 0.033 | H6: Supported |

| Customer experience → Loyalty intentions | 0.758 | 20.109 | <0.001 | H7: Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barbu, C.M.; Florea, D.L.; Dabija, D.-C.; Barbu, M.C.R. Customer Experience in Fintech. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1415-1433. https://doi.org/10.3390/jtaer16050080

Barbu CM, Florea DL, Dabija D-C, Barbu MCR. Customer Experience in Fintech. Journal of Theoretical and Applied Electronic Commerce Research. 2021; 16(5):1415-1433. https://doi.org/10.3390/jtaer16050080

Chicago/Turabian StyleBarbu, Cătălin Mihail, Dorian Laurenţiu Florea, Dan-Cristian Dabija, and Mihai Constantin Răzvan Barbu. 2021. "Customer Experience in Fintech" Journal of Theoretical and Applied Electronic Commerce Research 16, no. 5: 1415-1433. https://doi.org/10.3390/jtaer16050080

APA StyleBarbu, C. M., Florea, D. L., Dabija, D.-C., & Barbu, M. C. R. (2021). Customer Experience in Fintech. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1415-1433. https://doi.org/10.3390/jtaer16050080