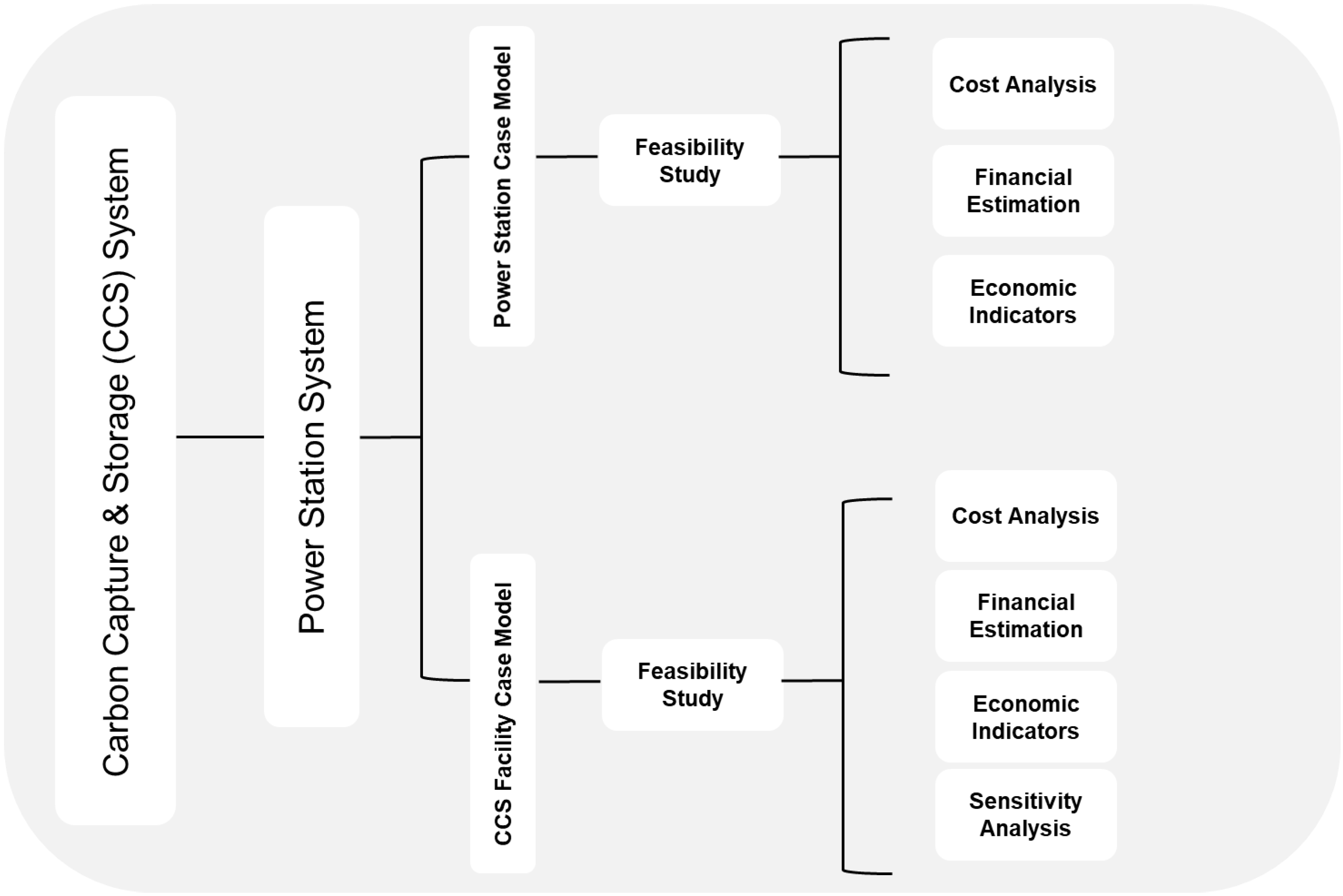

In this section, we present the results of the CSM related to the power station and the CCSF. The selection process for the PSCM and the CCSM is based on the calculations performed using the SAMLCAT and the AC. An adjustment is also performed by replacing the PSIC in the FLS to fit the case at hand for the State of Kuwait. Moreover, the fuel source in FLS is replaced with the Kuwaiti heavy oil (HO) fuel source (

Table S7). Furthermore, the consumption capacity is changed, depending on the selected Kuwait’s PS-HO consumption capacity, leading to a change in the annual fuel cost variable. The IGGC-PS is the most compatible technology for the sustainability of the CCSF, based on the available information allocated from MEW and the reviewed literature. Moreover, the calculated AC amount from the applied statistical method is around USD 2.5 billion, based on the results depicted in detail within

Tables S9–S18. According to the study conducted by the NETL [

48], the cost is within the average of CSM for such a project. Hence, to accommodate the largest plant with potential carbon stream appropriate for CCS, we select the Al-Zour station with an installed capacity of 5805.80 MW annually so that the integrated plant can consider its facility. Additionally, the selected fuel source for this FLS is HO, with an average price of USD 34 per barrel, which is very similar to MEW cost (

Table S20). Moreover, the selected LCOE price considered is USD/MW 175, and the T and S cost is 5% from TC [

48].

3.3. Financial Estimation

The pre-production cost is assessed to accommodate the cost requirements of the administration buildings. The total amount that is required to construct and operate the headquarters is around USD 53 million, as per the calculated categories depicted in

Table S16. The initial investment is estimated as USD 840 million, and the pre-production and the working capital costs amount to USD 420 and USD 53 million, respectively. Therefore, the total amount of this financial group is around USD 1.3 billion. The revenues from the power station are estimated with a LCOE of 175 USD/MW. The feasibility study associated with the power station yields USD 1 billion; an annual breakdown is given in

Table S22. The LCOE is sensitive to various variables, such as the plant capacity, capital investment, and fuel cost [

49]. These are investigated and discussed in the sensitivity analysis section, whilst the capacity is kept fixed to accommodate the carbon captured in the considered station (e.g., Al-Zour). Additionally, in the first few years of operations, the NCF project is worth around USD 135 million (

Table S21). Furthermore, the NCF increases slightly over the years to reach an amount of USD 144 million. Moreover, the NCF in year twelve stabilizes at USD 187 million for the remaining production year. As for the economic indicators related to the constructed CCS project working on an amine absorption principle,

Table 6 summarizes the feasibility study results for the project. Therefore, the COE of the CCSF is around 168 USD/MW. Furthermore, in comparing the feasibilities both COEs, it is realized that the COE-PS is much lower than COE-CCSF; in fact, it is even lower than the LCOE selected for this feasibility. Moreover, one of the reasons for difference in the COE values is due to the PSIC in both FSs.

As for the economic indicators for the CCS project, the IRR is estimated to be 7%, presenting a lucrative ratio for such projects. This can be attributed to the fuel prices in Kuwait and, moreover, the government subsidies for such projects, which are considered in this work, such as elimination construction tax, supporting labor salaries. The NPV is also estimated as USD 47,928 million, and the PBP is estimated as 13 years and 1 month with an ROI equaling at 20%.

3.4. Sensitivity Analysis for CCS Project

The sensitivity analysis presented in this section is aimed at showing the reliance of this project against changes anticipated within the work and the local market. A baseline scenario is chosen for the LCEO at 175 USD/MW, PSIC at 2541 MW, and HO (Kuwaiti crude), with a price of USD 20 per barrel representing the lower end of the price spectrum when compared with average oil prices.

Table 7 illustrates seven hypothetical calculated cost adjustment scenarios for the CCSF-FS. Additionally, the first scenario in the middle is the base study which displays the economic indicators aforementioned. Moreover, the remaining six scenarios are divided into two segments—three with an increase in operational cost and three with a decrease in the same category, which represents the group that could be most influenced by changes in the market. Therefore, in the first scenario, for the above, the operational cost is in the decreasing segment, reaching 1% over the life span of the project. Accordingly, the IRR shows a profitable ratio at 9%, and NPV at USD 104,085 million, which signifies a valuable approach for such projects in Kuwait. Furthermore, the PBP is 12 years and the ROI is 44%, demonstrating a beneficial financial outcome as well. Consequently, in the second and third scenarios of the operational costs, the reduced ratios are 2% and 3%, respectively, leading to an IRR of 10% and 11, correspondingly. Likewise, the NPV of both scenarios is USD 152,327 million and USD 193,945 million, respectively, while the PBP for both scenarios is 11 years. Therefore, the above operational cost reduction scenarios show a favorable financial outcome. Additionally, in the second segment of the scenarios, the operational costs are increased to show a different outcome. However, in the first scenario, the operational cost is increased by 1%, which leads to a significant decrease in the economic indicators. Moreover, in the first indicator, the IRR is reduced to 5%, and the NPV is also decreased, reaching USD 17,713 million. Additionally, the PBP is 15 years and the ROI is −7%; therefore, this scenario economic indicators all display the unfeasibility of the project (highlighted in

Table 7). Furthermore, in the second scenario, the operational cost increases by 2%, leading to a 1% decrease in the IRR, thus indicating an unfeasible project. In addition, the NPV, PBP, and ROI are all reduced to reach negative USD 94,738 million across 19 years, i.e., a −40% decrease, respectively. Correspondingly, in the third scenario, the operational cost increases by 3%, which results in a negative IRR, thus indicating unfeasible outcomes of the projects. Moreover, the remaining economic indicators of this scenario present an unfeasible result concerning the project. Therefore, any increase in the operational cost for the base study scenario can lead to a significant decrease in the project’s profitability outcome.

Table 8 illustrates the price adjustment scenarios in the HO for the CCSF-FS, containing three base study scenarios (business as usual baseline), including A-15 and A-25. In the A-15 scenario, the price of HO is decreased to USD 15 per barrel, while the price of HO increases to USD 25 per barrel in the A-25 scenario. In addition, in the A-15 scenario, the IRR is 41%, the NPV is USD 1164 billion, and the PBP is 2 years, while the ROI is a very high ratio of 487%, indicating a highly feasible project, as shown in

Table 8. Additionally, in the second scenario, the price of HO increases up to 25 USD/barrel, which is very similar to its cost in MEW. Therefore, by applying this price, an increase in HO in this scenario can result in adverse economic outcomes. The first economic indicator is IRR, showing a negative 10%; likewise, the NPV shows a negative value of USD 590,409 million. Additionally, the PBP displays a period over 30 years, and the ROI has an unfavorable ratio of −447%. Therefore, any increase in the HO prices beyond the baseline can result in an unfeasible project, as demonstrated. It should be noted that the results may demonstrate a certain tendency to showcase a non-feasible project with any increase expected in the local market for crude oil prices (fuel derivatives), which might lead to neglecting CCS projects in an economy, such as Kuwait. However, the background must be discussed and considered here in detail to deliver a realistic viewpoint. There is a key limitation in conducting sensitivity scenarios for such work, where the focus is on constructing and operating a CCS plant devoted for the power sector as a standalone carbon emitter in Kuwait. In reality, the assumption that the CCS can withstand Al-Zour’s plant carbon emission and can also accommodate additional carbon streams from nearby refineries, namely the new refinery project in the same area [

19]. Conducting sensitivity analysis on HO prices can exclusively neglect other impacts on various sectors in Kuwait which contribute to carbon sources. The exclusion of energy-saving measures and carbon crediting is also another limitation here and is also indicated in other previous studies [

8]. In order to avoid an increase in COE and alterations in IRR with the HO process, carbon crediting schemes can take effect in Kuwait when implemented by governmental bodies, such as the Kuwait Environment Public Authority (KEPA). An allowance proved to be highly useful in the previous study of Bellotti et al. [

50], in order to avoid COE increases.

As previously pointed, the bulk of carbon emissions in Kuwait are associated with the power sector essentially yielded from combusting fossil fuels. The commonly used fuel types in MEW P&D plants are gas oil, lean gas, fuel gas, and crude, depending on type of turbines. This might be of concern for future mitigation plans, where lesser carbon intense sources should be considered as turbines relying on natural gas rather than HO. The four most applicable technologies for CO

2 capture from P&D plants include post-combustion, pre-combustion, oxy-fuel combustion, and chemical looping, which are also reviewed for the benefit of this study. Post-combustion is chosen as a mature choice in the market; however, the study might be extended to assess the feasibility of operating more than one choice in the future or more than one station to overcome logistical issues in storage and transport. Futuristic scenarios of direct extraction from air are also a possibility, namely for integration purposes with a CCS project in Kuwait, such as those presented in this study. This is essential in order to overcome the impracticality of extracting ambient CO

2 concentrations (i.e., ~400 ppm), which are not feasible and require additional operating expenses [

51].

From a macro point of view considering the region as a whole, the majority of the power generation in Middle East utilizes oil-fired power and desalination plants. Sixty percent of the world desalination capacity exists in the Middle East, particularly in the Gulf Cooperation Council (GCC) countries [

52]. In the GCC countries, about 58% of the energy consumption is attributed to air conditioning and water desalination [

23]. In Kuwait, over 80% of the blend of fossil-fuel-based primary energy is consumed via thermal conversion processes. Around total 62% of this amount is consumed by both electricity and water generation (≈52% for electricity production) and about (≈10%) for desalination freshwater production. This poses a direct question of possibility and practicality of having a carbon network with neighboring countries where other oil-driven economies, such as Saudi and Iraq, can utilize a CCS-based mega infrastructure in Kuwait. The choice of Kuwait is also logical due to being a mid-point between both countries and can initiate a trading scheme in oil derivatives with both countries. It should be noted herein that there is a policy gap in terms of most effective CCS technology and implementation policy in Kuwait, where no clear and published targets are put in place to accommodate the country’s status. It is quite common in developed nations to tax fossil fuel energy sources as one of the most common policy options to mitigate and control carbon emissions [

53]. However, in Kuwait, where the sole means of energy is fossil-fuel-based, this seems to be a hindering step that requires proper infrastructure for renewables (e.g., waste to energy, solar, wind, etc.) and such projects are yet still not in their right stature to produce what is expected of them for the national grid. Therefore, this stage of country’s development requires more incentives for energy projects that can utilize renewable sources in order to reduce carbon emissions. Furthermore, judging from the baseline scenario (IRR of 7%), the right choice of CCS technology can be a lucrative option that can become economically self-sustaining with time. The emission issue can be solved with time and can be reduced as the project takes place in other parts of the world, as described by Duan et al. [

53]. An internal policy of governmental based carbon taxing seems to be a viable step as well, especially on the oil and power sectors where such a policy implementation can definitely set a true course for action for commissioning CCS plants. KEPA is a regulatory body within the state similar to other parts of the world where a governmental body is responsible for monitoring the emissions of various sectors. With time, large-scale CCS may require policy implementation to accommodate large-scale plants, as well as initiatives to foster entrepreneurial activity and market formation, which can also extend to neighboring countries as well based on our study [

54]. Such policies should also accommodate a no cap policy for storage in a similar fashion to the

Q45 policy for carbon credits [

55]. This is used to accommodate the case of oil-driven economies such as Kuwait at initial stages of technology implementation. There are also a number of conclusions that can be drawn based on the empirical analysis conducted in this work, namely a comparative assessment with other Middle Eastern countries. As of the year 2022, the Middle East is in the lowest region in terms of CCS projects [

56]. This should not be confused with the shear amount of carbon captured, as the region has 11 CCS operational projects located in Saudi, Qatar, and the Emirates, which are responsible for 10% of global CO

2 captured annually (capacity extending 3.8 Mt per annum in some cases), i.e., double that of Europe. The focus of these projects is associated with gas processing plants (≈26% captured globally, 42.6 Mt per annum). Compared to Kuwait, which has no CCS plants as of yet, a good start may be to concentrate efforts on associated gas plants with the oil sector, as described elsewhere [

19,

20]. However, the power sector remains the largest in Kuwait as a prime emitter of carbo, as depicted earlier in this work (41.636 Mt per annum, 41.6%), which can also provide a good start for such CCS future plans. This is especially true when considering capital scaling and electrical power subsidies provided in the Middle East region, as previously depicted by Paltsev et al. [

57]. Currently, the Emirates are ranked first in CCS projects in the region [

58]. A carbon network can also offer a good start in Gulf countries between Kuwait, Saudi, and the Emirates.

During the years 2020–2021, the global COVID-19 pandemic has drastically altered energy policies around the world. This was due to a number of factors, namely general lockdowns which, on the other hand, reduced transportation and demand on fuels following boarder closures between countries. Daily carbon emissions reduced by 17%, as of early April 2020, when compared to the average of 2019 [

59]. It should be noted that the drop in CO

2 emissions had no detectable impact on atmospheric CO

2 or climate change [

60]. Therefore, it is estimated that CCS projects and future plans can recover as the Russian–Ukrainian conflict drives oil markets to new highs and the original demand shows to gain strength similar to before the pandemic. As of late, the issue of air quality, namely over the past three years, has been a focus of many health agencies where relevant. This is due to proven health effects of major pollutants on the general wellbeing of populations around the globe. Based on the transport sector data, Huang et al. [

61] proposed a novel nonlinear multivariate grey model (ENGM (1,4)) based on an environmental Kuznets curve. This new tool was validated against the results from the US, Japan, and China, and during the years 2019–2025, an average increase in carbon emissions from the transport sector in China and the USA was 2.837% and 2.394%, respectively. The results of Japan show a downward trend with an average decline rate of 1.2231%. Therefore, the transport sector in mega populated cities (with largely dense countries) could benefit from such models to estimate and subsequently monitor their carbon emissions. The same principle could also be applied on different sectors and could be transferred to oil-driven economies, such as Kuwait. These sectors can also include industry [

62], new emerging transport technologies [

63], and pollution during the past pandemic [

64].