Sustainable Knowledge Creation and Corporate Outcomes: Does Corporate Data Governance Matter?

Abstract

:1. Introduction

2. Literature Review and Hypotheses

3. Methods and Materials

3.1. Sample and Procedures

3.2. Instruments

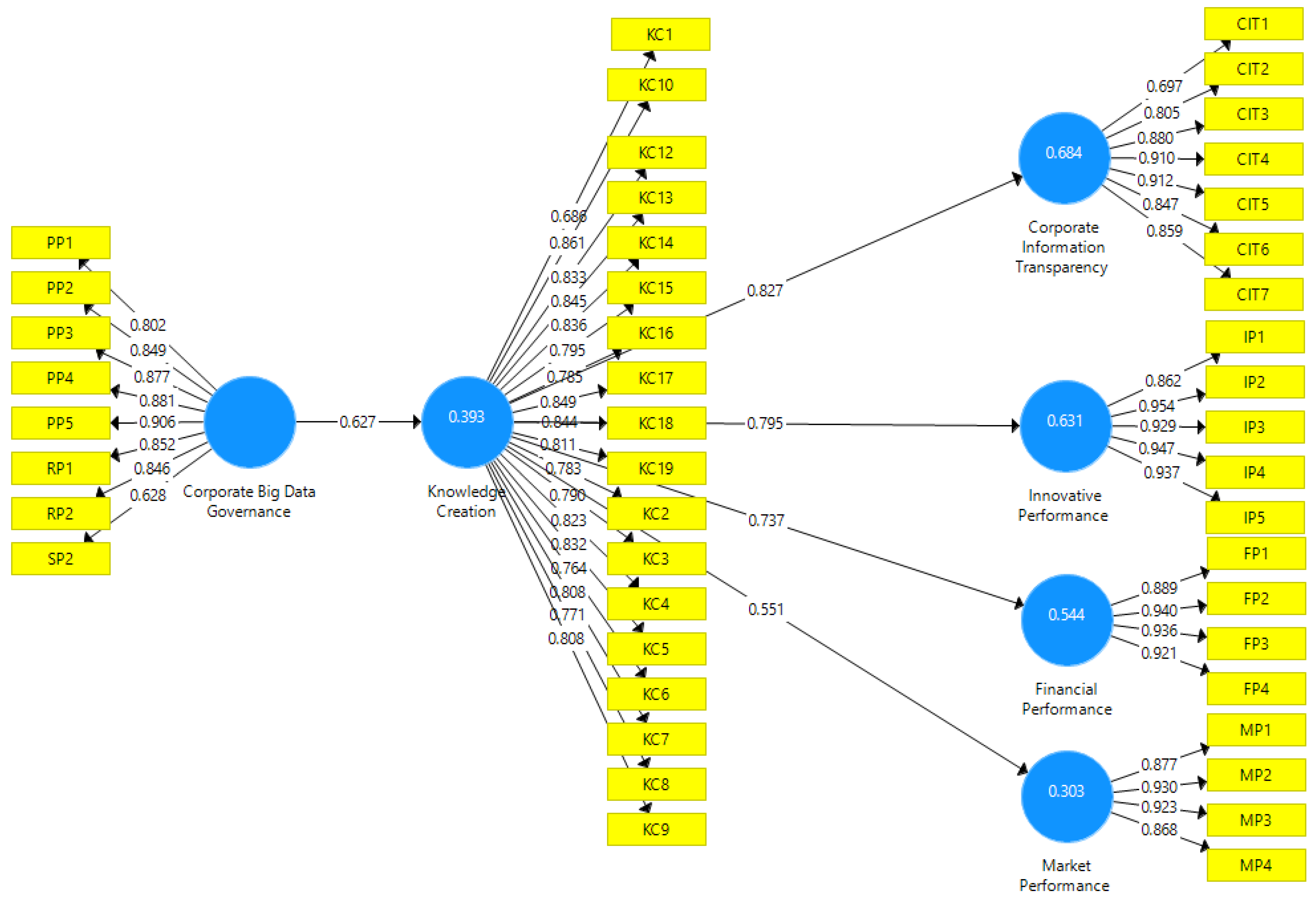

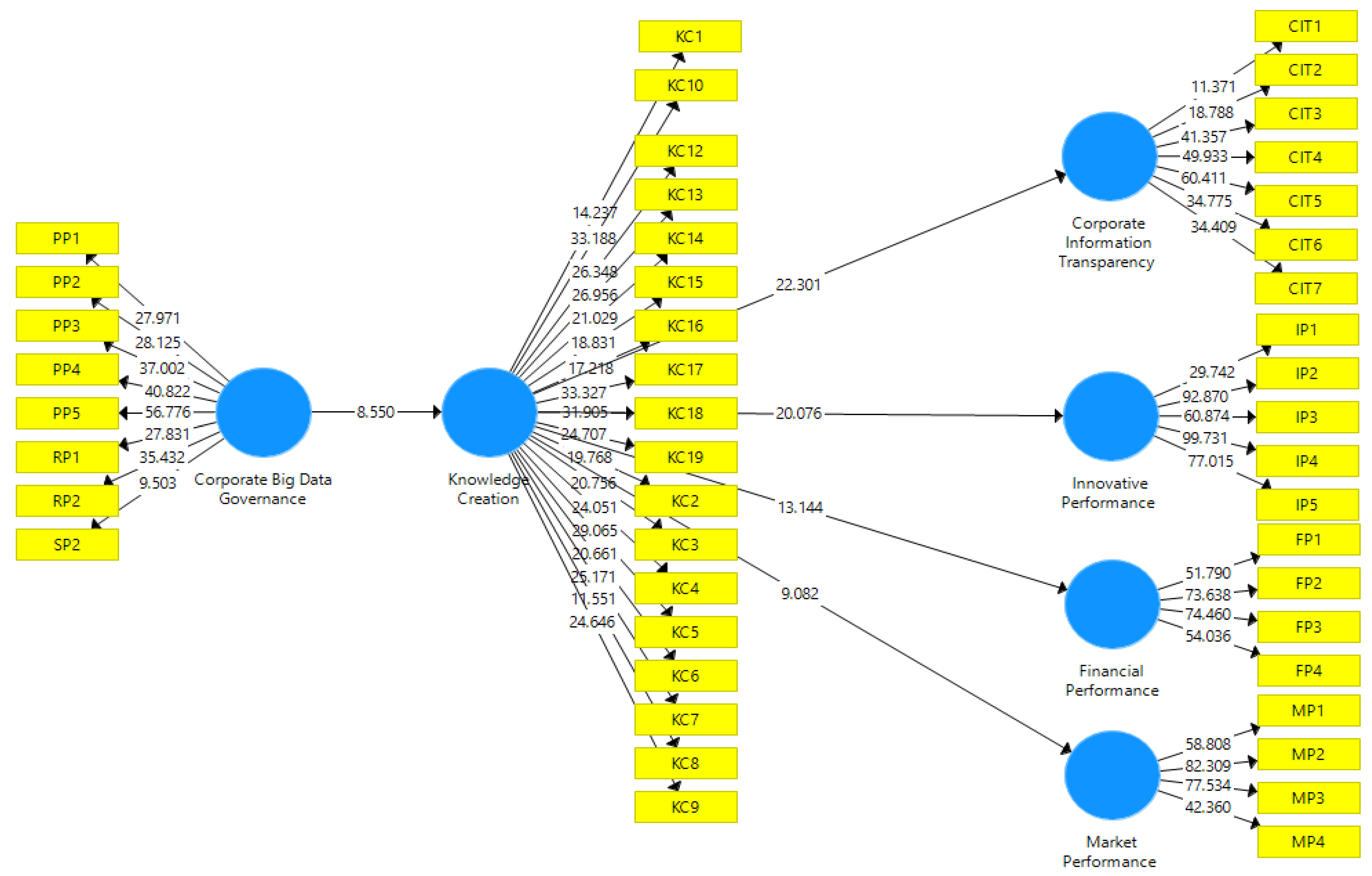

3.3. Data Analysis and Results

4. Discussion

- Corporate data governance emerged as a strong predictor of sustainable knowledge creation. By abstracting corporate data governance from a financial perspective and showing how it improves sustainable knowledge creation, this article answers the call for greater scholarly attention to antecedents for knowledge creation and its consequences [8,15]. Past work only showed the beneficial effects of data governance, IT management, and sustainable knowledge creation for firms without empirical evidence [3,10,11,17,23]. Even the studies that provided empirical evidence acknowledged incoherency by recommending future investigation [18]. Capitalizing on this line of reasoning, this study observed an incremental change in sustainable knowledge creation when corporate data governance was leveraged. Simply, corporate data governance can contribute to knowledge creation and enhance decision-making as it provides a framework for decision rights and accountabilities as part of corporate-wide strategy.

- Our expectation about the role of sustainable knowledge creation emerging as a predictor for corporate information transparency was supported. The outcome demonstrates that sustainable knowledge creation has the tendency to increase perceived corporate information transparency. This is consistent with the general KM literature’s conclusion that an individual’s involvement and participation in decision processes allows them to have an insight on what is going on within the corporation [42,43]. For example, the free flow of information and access to information ensures that individuals can access, use, update, and share knowledge with colleagues, superiors, and external stakeholders within the boundary of corporate regulations.

- The results of this study help address two needs in KM and performance research streams, more specifically, sustainable knowledge creation and three types of corporate performance. One, the mechanisms that link sustainable knowledge creation to firm performance have remained largely in a black box [15]. Two, KM researches mostly combined and considered performance as a single entity [48] and paid little attention to which corporate performance dimension benefited more from sustainable knowledge creation. Third, sustainable knowledge creation emerged as a strong predictor for corporate innovative performance. Our study also advances the corporate innovative performance literature, as prior studies focused on how shared knowledge can boost innovative performance [51]. In addition, prior work showed that explicit knowledge (organized) has more impact on innovation and financial performance, while tacit knowledge has more impact on operational performance. Our findings are in line with past empirical outcomes, sustainable knowledge creation impacted innovative performance the most. Our study extends these concepts to the domain of created knowledge through corporate data governance.

- Sustainable knowledge creation emerged as strong predictor for corporate financial performance. Prior work also found that KM initiatives have a positive influence on financial performance [47]. This study narrowed down the argument by specifically highlighting the incremental impact of sustainable knowledge creation on corporate financial performance. Contrariwise to our finding, Zack et al.’s [12] study among North American and Australian firms found that KM practices do not exert any effect on financial performance. Our results show that corporate financial performance was second in terms of effect size, however, prior work argued that KM practices in Spanish firms exerted more effect on financial performance compared to innovative and market performance [47]. The present outcome shows variation, and a plausible explanation for this might be in the geographic, economic, cultural, and country’s context. Similar arguments were echoed by [12]. Nonetheless, managers could rely on these findings to negotiate with and convince stakeholders concerning the importance of corporate data governance and sustainable knowledge creation in determining greater financial performance.

- Sustainable knowledge creation emerged as strong predictor for corporate market performance. Past research found that KM practices can enhance financial and market performance [13]. However, this paper argues that conceptualizing financial and market performance as one construct is misleading. Other field work revealed that the association between knowledge creation and performance was mediated by organizational learning [49]. In this study, we theorize that knowledge creation is itself a kind of learning. Using a Chinese sample Chen [50] revealed that KM practices amplified operational performance. In short, our result helps to clarify the role of knowledge creation in amplifying market performance, an area that has receive scant attention, mixed results, and inconsistent conceptualization.

- Sustainable knowledge creation assumes the role of a mediator in the association between the exogenous variable and endogenous variables. Our mediation results offer novel insights into the mechanistic processes in which corporate data governance drives sustainable knowledge creation, and subsequently results in corporate information transparency and innovative, financial, and market performance. Prior studies have examined the varying mechanisms underlying knowledge generation and its subsequent outcomes. For example, organizational and environmental factors [29], information cultures [31], and distributed leadership [32]. However, no study explores the interplay of corporate data governance with sustainable knowledge creation and their effects on corporate information transparency and innovative, financial, and market performance. In short, previous researches failed to acknowledge the chained relationships between the variables under investigation. Thus, our post hoc mediation analyses add insights into the potential effects of corporate data governance in a broader sense.

5. Practical and Theoretical Implications

6. Limitations and Future Research Direction

Author Contributions

Funding

Conflicts of Interest

References

- Mikalef, P.; Krogstie, J. Big Data Governance and Dynamic Capabilities: The Moderating Effect of Environmental Uncertainty. In Proceedings of the Twenty-Second Pacific Asia Conference on Information Systems, Yokohama, Japan, 26–30 June 2018. [Google Scholar]

- Raymond, L.; Bergeron, F.; Croteau, A.M.; Uwizeyemungu, S. Determinants and Outcomes of IT Governance in Manufacturing SMEs: A strategic IT management perspective. Int. J. Account. Inf. Syst. 2019, in press. [Google Scholar] [CrossRef]

- Otto, B. Organizing data governance: Findings from the telecommunications industry and consequences for large service providers. Commun. Assoc. Inf. Syst. 2011, 29, 45–66. [Google Scholar] [CrossRef]

- Alhassan, I.; Sammon, D.; Daly, M. Data Governance Activities: An Analysis of the Literature. J. Decis. Syst. 2016, 25, 64–75. [Google Scholar] [CrossRef]

- Tallon, P.P.; Ramirez, R.V.; Short, J.E. The Information Artifact in IT Governance: Toward a Theory of Information Governance. J. Manag. Inf. Syst. 2013, 30, 141–178. [Google Scholar] [CrossRef]

- Loebbecke, C.; Picot, A. Reflections on Societal and Business Model Transformation Arising From Digitization and Big Data Analytics: A Research Agenda. J. Strateg. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Nonaka, I. A Dynamic Theory of Organizational Knowledge Creation. Org. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Lee, H.; Choi, B. Knowledge Management Enablers, Processes and Organizational Performance: An Integrative View and Empirical Examination. J. Manag. Inf. Syst. 2003, 20, 20–179. [Google Scholar]

- Nonaka, I.; Von Krogh, G. Perspective—Tacit Knowledge and Knowledge Conversion: Controversy and Advancement in Organizational Knowledge Creation Theory. Org. Sci. 2009, 20, 635–652. [Google Scholar] [CrossRef]

- Nonaka, I.; Toyama, R. The Knowledge-Creating Theory Revisited: Knowledge Creation as a Synthesizing Process. In The Essentials of Knowledge Management; Edwards, J.S., Ed.; Palgrave Macmillan: London, UK, 2015. [Google Scholar]

- Mao, H.; Liu, S.; Zhang, J.; Deng, Z. Information Technology Resource, Knowledge Management Capability and Competitive Advantage: The Moderating Role of Resource Commitment. Int. J. Inf. Manag. 2016, 36, 1062–1074. [Google Scholar] [CrossRef]

- Zack, M.; McKeen, J.; Singh, S. Knowledge Management and Organizational Performance: An Exploratory Analysis. J. Knowl. Manag. 2009, 13, 392–409. [Google Scholar] [CrossRef]

- Cohen, J.F.; Olsen, K. Knowledge Management Capabilities and Firm Performance: A Test of Universalistic, Contingency and Complementarity Perspectives. Expert. Syst. Appl. 2015, 42, 1178–1188. [Google Scholar] [CrossRef]

- Inkinen, H. Review of Empirical Research on Knowledge Management Practices and Firm Performance. J. Knowl. Manag. 2016, 20, 230–257. [Google Scholar] [CrossRef]

- Abubakar, A.M.; Elrehail, H.; Alatailat, M.A.; Elçi, A. Knowledge Management, Decision-Making Style and Organizational Performance. J. Innov. Knowl. 2017, 4, 104–114. [Google Scholar] [CrossRef]

- Al Ahbabi, S.A.; Singh, S.K.; Balasubramanian, S.; Gaur, S.S. Employee Perception of Impact of Knowledge Management Processes on Public Sector Performance. J. Knowl. Manag. 2019, 23, 351–373. [Google Scholar] [CrossRef]

- Daily, C.M.; Dalton, D.R.; Cannella, A.A., Jr. Corporate Governance: Decades of Dialogue and Data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar] [CrossRef]

- Kamioka, T.; Luo, X.; Tapanainen, T. An Empirical Investigation of Data Governance: The Role of Accountabilities. In Proceedings of the Pacific Asia Conference on Information Systems, Chiayi, Taiwan, 27 June–1 July 2016. [Google Scholar]

- Leiblein, M.J.; Reuer, J.J.; Dalsace, F. Do Make or Buy Decisions Matter? The Influence of Organizational Governance on Technological Performance. Strategic. Manag. J. 2002, 23, 817–833. [Google Scholar] [CrossRef]

- Rossi, M.; Lombardi, R.; Siggia, D.; Oliva, N. The Impact of Corporate Characteristics on the Financial Decisions of Companies: Evidence on Funding Decisions by Italian SMEs. J. Innov. Entrep. 2015, 5. [Google Scholar] [CrossRef]

- Widyaningsih, I.U.; Gunardi, A.; Rossi, M.; Rahmawati, R. Expropriation by the Controlling Shareholders on Firm Value in the Context of Indonesia: Corporate Governance as Moderating Variable. Int. J. Manag. Finan. Acct. 2017, 9, 322–337. [Google Scholar] [CrossRef]

- Rouf, M.A. Firm-Specific Characteristics, Corporate Governance and Voluntary Disclosure in Annual Reports of Listed Companies in Bangladesh. Int. J. Manag. Finan. Acct. 2017, 9, 263–282. [Google Scholar]

- Weber, K.; Otto, B.; Österle, H. One Size does not fit all: A Contingency Approach to Data Governance. ACM J. Data Inf. Qual. 2009, 1, 4. [Google Scholar] [CrossRef]

- Kooper, M.N.; Maes, R.; Lindgreen, E.R. On the Governance of Information: Introducing a New Concept of Governance to Support the Management of Information. Int. J. Inf. Manag. 2011, 31, 195–200. [Google Scholar] [CrossRef]

- De Haes, S.; Van Grembergen, W.; Debreceny, R.S. COBIT 5 and Enterprise Governance of Information Technology: Building Blocks and Research Opportunities. J. Inf. Syst. 2013, 27, 307–324. [Google Scholar] [CrossRef]

- Wu, S.P.J.; Straub, D.W.; Liang, T.P. How Information Technology Governance Mechanisms and Strategic Alignment Influence Organizational Performance: Insights from a Matched Survey of Business and IT Managers. Mis Q. 2015, 39, 497–518. [Google Scholar] [CrossRef]

- Kathuria, A.; Saldanha, T.J.V.; Khuntia, J.; Andrade Rojas, M.G. How Information Management Capability Affects Innovation Capability and Firm Performance Under Turbulence: Evidence from India. In Proceedings of the International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016. [Google Scholar]

- Murdoch, T.B.; Detsky, A.S. The Inevitable Application of Big Data to Health Care. JAMA 2013, 309, 1351–1352. [Google Scholar] [CrossRef] [PubMed]

- Little, T.A.; Deokar, A.V. Understanding Knowledge Creation in the Context of Knowledge-Intensive Business Processes. J. Knowl. Manag. 2016, 20, 858–879. [Google Scholar] [CrossRef]

- Nonaka, I.; Takeuchi, H. The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Vick, T.E.; Nagano, M.S.; Popadiuk, S. Information Culture and its Influences in Knowledge Creation: Evidence from University Teams Engaged in Collaborative Innovation Projects. Int. J. Inf. Manag. 2015, 35, 292–298. [Google Scholar] [CrossRef]

- Cannatelli, B.; Smith, B.; Giudici, A.; Jones, J.; Conger, M. An Expanded Model of Distributed Leadership in Organizational Knowledge Creation. Long Range Plann. 2017, 50, 582–602. [Google Scholar] [CrossRef]

- Smith, K.; Collins, C.; Clark, K. Existing Knowledge, Knowledge Creation Capability and the Rate of New Product Introduction in High-Technology Firms. Acad. Manag. J. 2005, 48, 346–357. [Google Scholar] [CrossRef]

- Gupta, M.; George, J.F. Toward the Development of a Big Data Analytics Capability. Inf. Manag. 2016, 53, 1049–1064. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big Data Analytics and Firm Performance: Findings from a Mixed-Method Approach. J. Bus. Res. 2019, 98, 261–276. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the Relationship Between Big Data Analytics Capability and Competitive Performance: The Mediating Roles of Dynamic and Operational Capabilities. Inf. Manag. 2019, in press. [Google Scholar] [CrossRef]

- Pappas, I.O.; Mikalef, P.; Giannakos, M.N.; Krogstie, J.; Lekakos, G. Big Data and Business Analytics Ecosystems: Paving the Way Towards Digital Transformation and Sustainable Societies. Inf. Syst. e-Business Manag. 2018, 16, 479–491. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- McManus, T.; Holtzman, Y.; Lazarus, H.; Anderberg, J.; Lazarus, H. Transparency Guru: An Interview with Tom McManus. J. Manag. Devel. 2006, 25, 923–936. [Google Scholar] [CrossRef]

- Simon, C. Corporate Information Transparency: The Synthesis of Internal and External Information Streams. J. Manag. Devel. 2006, 25, 1029–1031. [Google Scholar] [CrossRef]

- Bushman, R.M.; Piotroski, J.D.; Smith, A.J. What Determines Corporate Transparency? J. Account. Res. 2004, 42, 207–252. [Google Scholar] [CrossRef]

- Alavi, M.; Leidner, D.E. Knowledge Management and Knowledge Management Systems: Conceptual Foundations and Research Issues. Mis Q. 2001, 25, 107–136. [Google Scholar] [CrossRef]

- Al-Jabri, I.M.; Roztocki, N. Adoption of ERP systems: Does Information Transparency Matter? Telemat. Inform. 2015, 32, 300–310. [Google Scholar] [CrossRef]

- Bonsón, E.; Royo, S.; Ratkai, M. Citizens’ Engagement on Local Governments’ Facebook sites. An Empirical Analysis: The Impact of Different Media and Content Types in Western Europe. Gov. Inf. Q. 2015, 32, 52–62. [Google Scholar]

- Venkatesh, V.; Thong, J.Y.; Chan, F.K.; Hu, P.J. Managing Citizens’ Uncertainty in e-Government Services: The Mediating and Moderating Roles of Transparency and Trust. Inf. Syst. Res. 2016, 27, 87–111. [Google Scholar] [CrossRef]

- Bertot, J.C.; Jaeger, P.T.; Grimes, J.M. Using ICTs to Create a Culture of Transparency: E-government and Social Media as Openness and Anti-Corruption Tools for Societies. Gov. Inf. Q. 2010, 27, 264–271. [Google Scholar] [CrossRef]

- López-Nicolás, C.; Meroño-Cerdán, Á.L. Strategic Knowledge Management, Innovation and Performance. Int. J. Inf. Manag. 2011, 31, 502–509. [Google Scholar]

- Saenz, J.; Aramburu, N.; Blanco, C.E. Knowledge Sharing and Innovation in Spanish and Colombian High-Tech Firms. J. Knowl. Manag. 2012, 16, 919–933. [Google Scholar] [CrossRef]

- Ramírez, A.M.; Morales, V.J.G.; Rojas, R.M. Knowledge Creation, Organizational Learning and Their Effects on Organizational Performance. Engin. Econ. 2011, 22, 309–318. [Google Scholar] [CrossRef]

- Chen, J.L. Effects of Knowledge Management on the Operational Performance of the B & B Industry. Int. J. Markt. Stud. 2016, 8, 67–76. [Google Scholar]

- Tan, L.P.; Wong, K.Y. Linkage Between Knowledge Management and Manufacturing Performance: A Structural Equation Modeling Approach. J. Knowl. Manag. 2015, 19, 814–835. [Google Scholar] [CrossRef]

- Iyer, D.N.; Sharp, B.M.; Brush, T.H. Knowledge Creation and Innovation Performance: An Exploration of Competing Perspectives on Organizational Systems. Univ. J. Manag. 2017, 5, 261–270. [Google Scholar] [CrossRef] [Green Version]

- Aliani, K.; Mhamid, I.; Rossi, M. Does CEO Overconfidence Influence Tax Planning? Evidence from Tunisian Context. Int. J Manag. Finan. Acct. 2016, 8, 197–208. [Google Scholar] [CrossRef]

- Jahmani, K.; Fadiya, S.O.; Abubakar, A.M.; Elrehail, H. Knowledge Content Quality, Perceived Usefulness, KMS Use for Sharing and Retrieval: A Flock Leadership Application. VINE J. Inf. Knowl. Manag. Syst. 2018, 48, 470–490. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Podsakoff, N.P. Sources of Method Bias in Social Science Research and Recommendations on How to Control it. Annu. Rev. Psychol. 2012, 63, 539–569. [Google Scholar] [CrossRef]

- Alpkan, L.; Bulut, C.; Gunday, G.; Ulusoy, G.; Kilic, K. Organizational Support for Intrapreneurship and its Interaction with Human Capital to Enhance Innovative Performance. Manag. Dec. 2010, 48, 732–755. [Google Scholar] [CrossRef]

- Drew, S.A. From Knowledge to Action: The Impact of Benchmarking on Organizational Performance. Long Range Plann. 1997, 30, 427–441. [Google Scholar] [CrossRef]

- Vorhies, D.W.; Morgan, N.A. Benchmarking Marketing Capabilities for Sustainable Competitive Advantage. J. Mark. 2005, 69, 80–94. [Google Scholar] [CrossRef]

- Abubakar, A.M. Linking Work-Family Interference, Workplace Incivility, Gender and Psychological Distress. J. Manag. Devel. 2018, 37, 226–242. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The Use of Partial Least Squares Path Modelling in International Marketing. In New Challenges to International Marketing; Emerald Group Publishing: Bingley, UK, 2009. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson: London, UK, 2014. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models With Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Behravesh, E.; Tanova, C.; Abubakar, A.M. Do High-Performance Work Systems Always Help to Retain Employees or is there a Dark Side? Serv. Ind. J. 2019, 1–21. [Google Scholar] [CrossRef]

- Abubakar, A.M.; Behravesh, E.; Rezapouraghdam, H.; Yildiz, S.B. Applying Artificial Intelligence Technique to Predict Knowledge Hiding Behavior. Int. J. Inf. Manag. 2019, 49, 45–57. [Google Scholar] [CrossRef]

- Fiss, P.C. Building Better Causal Theories: A Fuzzy Set Approach to Typologies in Organization Research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

| Instruments | 1 | 2 | 3 | 4 | 5 | 6 | α | CR | AVE | R2 |

|---|---|---|---|---|---|---|---|---|---|---|

| Corporate data governance | 0.83 | 0.94 | 0.95 | 0.70 | ||||||

| Sustainable knowledge creation | 0.63 | 0.81 | 0.97 | 0.97 | 0.65 | 0.39 | ||||

| Corporate information transparency | 0.56 | 0.83 | 0.85 | 0.93 | 0.95 | 0.72 | 0.68 | |||

| Innovative performance | 0.46 | 0.80 | 0.72 | 0.93 | 0.96 | 0.97 | 0.86 | 0.63 | ||

| Financial performance | 0.41 | 0.74 | 0.71 | 0.82 | 0.92 | 0.94 | 0.96 | 0.85 | 0.54 | |

| Market performance | 0.54 | 0.55 | 0.48 | 0.49 | 0.55 | 0.90 | 0.92 | 0.94 | 0.81 | 0.30 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abueed, R.A.I.; Aga, M. Sustainable Knowledge Creation and Corporate Outcomes: Does Corporate Data Governance Matter? Sustainability 2019, 11, 5575. https://doi.org/10.3390/su11205575

Abueed RAI, Aga M. Sustainable Knowledge Creation and Corporate Outcomes: Does Corporate Data Governance Matter? Sustainability. 2019; 11(20):5575. https://doi.org/10.3390/su11205575

Chicago/Turabian StyleAbueed, Raed A.I., and Mehmet Aga. 2019. "Sustainable Knowledge Creation and Corporate Outcomes: Does Corporate Data Governance Matter?" Sustainability 11, no. 20: 5575. https://doi.org/10.3390/su11205575