Abstract

The European Union (EU) has positioned itself as a global leader in digital regulation, with landmark frameworks such as the Digital Services Act (DSA), the Digital Markets Act (DMA), and relevant AI Act. These initiatives reflect the EU’s ambition to balance technological innovation with consumer protection, market fairness, and digital sovereignty. Yet, a growing body of research suggests that the EU may be lagging its global competitors—namely the United States and China—when it comes to scaling high-growth digital enterprises and attracting investment in frontier technologies. This study investigates the paradox of regulation versus innovation in the EU by comparing key performance indicators such as R&D investment, venture capital availability, and digital innovation output with those of the U.S. and China. Drawing on datasets from WIPO, the OECD, IMF, and the World Bank, the paper incorporates both cross-sectional and longitudinal analysis to assess the EU’s digital trajectory. Findings suggest that while the EU excels in institutional frameworks and research output, structural barriers—such as regulatory fragmentation and underdeveloped capital markets—limit its global competitiveness. The article concludes by discussing policy implications and the need for adaptive governance to maintain Europe’s digital leadership.

1. Introduction

The landscape of global digital governance has been evolving, and the European Union (EU) has emerged as a frontrunner in establishing regulatory frameworks aimed at safeguarding user rights, promoting fair competition, and asserting digital sovereignty. The EU’s leadership is evidenced by a series of legislative milestones, notably the General Data Protection Regulation (GDPR), the Digital Services Act (DSA), the Digital Markets Act (DMA), and the recently approved Artificial Intelligence Act (AI Act). Together, these instruments represent a normative agenda that seeks to balance innovation with ethical oversight, social responsibility, and legal certainty [1,2,3,4]. In addition to these regulatory milestones, the EU has launched several flagship initiatives designed to strengthen its technological capacity. These include the Digital Europe Programme, the Chips Act aimed at reinforcing the semiconductor ecosystem, and the European Alliance for Industrial Data, Edge and Cloud [5,6,7]. Together with the Digital Compass 2030 and the deployment of European Digital Innovation Hubs (EDIHs) across Member States, these initiatives illustrate that the EU’s ambitions are not limited to rule-setting but also extend to concrete technological investment and infrastructure development [8,9].

This ambition aligns with what scholars have termed the Brussels Effect, a phenomenon whereby the EU’s regulatory choices transcend its borders and shape global markets by virtue of economic gravity and legal rigor [10]. However, the extent to which this regulatory assertiveness translates into global technological competitiveness remains subject to debate. While the EU is recognized for its leadership in setting standards, questions persist about its ability to produce and scale breakthrough digital innovations at a rate comparable to the United States and China [9].

These two competing blocs represent divergent models. The U.S. favors a market-driven approach with limited regulatory intervention, facilitating agile startups, high venture capital influx, and rapid scaling of digital firms [11]. China, in contrast, adopts a state-centric innovation strategy, marked by direct government investment, industrial policy coordination, and support for strategic technologies such as AI, 5G, and semiconductors [12]. In both cases, despite differing institutional traditions, these models appear to outperform the EU in terms of scaling digital enterprises and capturing global market share in frontier technologies.

Empirical data reinforce these concerns. The EU lags behind in key competitiveness indicators such as venture capital availability, startup density, and GDP growth in high-tech sectors [11,13,14]. Although countries like Germany, Sweden, and the Netherlands remain among the world’s innovation leaders in research and development output, the bloc as a whole has failed to convert this scientific potential into economically dominant digital champions [12,15].

Moreover, internal fragmentation and heterogeneous regulatory implementation across Member States exacerbate coordination problems. While the European Commission has made strides in harmonizing rules, national interpretations and enforcement mechanisms still vary widely, creating legal uncertainty and increased compliance costs for digital businesses operating transnationally [13,15,16]. This creates a paradox: the EU’s commitment to robust regulation—while normatively commendable—may be eroding its competitiveness in the global digital economy.

In light of these challenges, this study seeks to explore the broader implications of the EU’s regulatory approach to the digital economy. Specifically, it is guided by the following research questions:

- To what extent does the EU’s digital regulatory framework promote or hinder innovation and economic competitiveness?

- How does the EU’s performance compare to that of the United States and China across macroeconomic and innovation metrics?

- What structural, legal, and economic barriers prevent the EU from scaling globally competitive digital enterprises?

To answer these questions, the study employs a comparative and interdisciplinary methodology, drawing from quantitative data (e.g., Global Innovation Index, GDP growth, R&D investment) and qualitative analyses of legal texts and policy documents. The objective is not merely to contrast models, but to determine whether the EU’s regulatory path is enabling long-term technological leadership—or contributing to a relative decline in digital competitiveness.

In doing so, this paper contributes to the broader literature on innovation policy, digital regulation, and strategic autonomy. It seeks to clarify whether the EU’s governance model can reconcile ethical oversight with economic dynamism in the digital age, or whether structural reforms are required to prevent technological marginalization in a rapidly shifting global landscape [13,15,16,17].

2. Literature Review: Regulation, Innovation, and Global Competitiveness

Academic literature on innovation policy and regulatory governance highlights a persistent tension between fostering technological development and ensuring market fairness and ethical standards [13,15,17]. Building on this, Schumpeter’s theory of creative destruction posits that innovation thrives in dynamic and competitive markets, often requiring minimal interference [17]. However, in high-risk, data-intensive sectors such as artificial intelligence and platform economies, unregulated growth can result in monopolistic practices, systemic vulnerabilities, and potential infringements of fundamental rights [15,17,18,19,20].

The European Union has distinguished itself as a global leader in digital regulation, advancing comprehensive frameworks such as the General Data Protection Regulation (GDPR), the Digital Markets Act (DMA), and the AI Act. These initiatives are often celebrated for enhancing digital rights and setting global standards through the so-called Brussels Effect [1,3,4,10]. Yet, the effectiveness of these policies in supporting global competitiveness remains contested. Europe’s regulatory density impedes the scalability of digital startups, particularly when compared to the United States’ market-led model and China’s state-coordinated innovation ecosystem [15,21]. Recent high-level policy reports—notably by Draghi [22], Letta [23], and Niinistö [24]—reinforce these debates, highlighting capital market underdevelopment, regulatory fragmentation, and the need for resilience and deeper integration to sustain Europe’s long-term competitiveness [21,22]. These contributions provide a complementary perspective that links structural barriers to broader questions of sovereignty and integration. The U.S. benefits from low compliance costs and mature venture capital infrastructure, which foster faster commercialization [25], while China prioritizes industrial coordination, leveraging state resources to fast-track innovation goals [12]. Moreover, institutional fragmentation within the EU, where overlapping competences, national divergences, and bureaucratic inertia delay policy execution, affects Europe’s ability to respond to emergent technologies and scale cross-border ventures [11,21]. While initiatives such as the Digital Decade and the Capital Markets Union are designed to address these barriers, their implementation remains incomplete and uneven across Member States [8].

Empirical research has underscored Europe’s innovation gap in R&D commercialization, high-tech exports, and unicorn creation [26,27,28,29,30]. Even with high researcher density and research output [31], the EU lags in transforming academic knowledge into globally competitive products and services. Recent contributions suggest that regulatory design must evolve toward adaptive governance—balancing ex-ante protections with ex-post flexibility, particularly in AI and data-driven sectors [32,33,34]. Public–private partnerships [35], regulatory sandboxes, and mission-oriented innovation policies [34] are increasingly proposed as mechanisms to overcome Europe’s structural stagnation.

Taken together, the literature indicates that regulation, while necessary, is not sufficient on its own. Sustained competitiveness in the digital age demands a hybrid model—one that combines effective regulation with robust infrastructure, capital mobility, and strong incentives for entrepreneurship. This study examines whether the EU is progressing toward this equilibrium or instead lagging behind its global peers.

3. Methodology

This study employs a comparative mixed-methods design [36,37], integrating longitudinal quantitative analysis of innovation and economic performance indicators with qualitative policy review of major EU legislative frameworks. The primary aim is to evaluate whether the European Union’s regulatory approach [38] has fostered or hindered digital competitiveness, particularly in contrast with the market-driven model of the United States and the state-coordinated innovation strategy of China [13,25,26,27,28]. Quantitative data were sourced from reputable institutional databases including the World Intellectual Property Organization (WIPO), OECD, IMF, and the World Bank, covering the period from 2000 to 2024. Variables analyzed include the Global Innovation Index, GDP growth and per capita trends, R&D expenditure, patent filings, high-tech exports, ICT service exports, and researcher density.

The qualitative component involves the analysis of key EU policy instruments—such as the Digital Markets Act (DMA), Digital Services Act (DSA), and the proposed AI Act—drawing on legal texts, policy briefs, and secondary academic commentary. This triangulated approach enables a holistic understanding of how regulatory design interacts with structural economic factors and innovation ecosystems. To situate these instruments within the current policy context, the analysis incorporated recent EU documents, including the Commission Work Programme 2025 [39] and President von der Leyen’s 2025 State of the Union Address to the European Parliament [40]. In this speech, von der Leyen emphasized Europe’s “independence moment” and explicitly linked digital and clean technologies to the Union’s capacity to remain competitive. Key proposals included the creation of a multi-billion euro Scaleup Europe Fund to finance high-growth firms in AI, quantum, and biotechnology, the development of European AI “gigafactories” to strengthen technological sovereignty, and a roadmap to complete the Single Market by 2028, tackling barriers in capital, services, energy, and telecommunications. These initiatives highlight the Commission’s acknowledgment that fragmented markets and underdeveloped scale-up pathways are major structural barriers to Europe’s digital competitiveness.

Although the approach offers broad regional insights, it is limited by its reliance on secondary data and aggregated indicators, which may obscure intra-EU differences. Nevertheless, the methodological framework enables robust cross-national comparison and informed conclusions regarding the EU’s evolving position in the global digital economy.

3.1. Research Design

The research design follows the IMRaD (Introduction, Methodology, Results, and Discussion) structure and is informed by Creswell’s approach to mixed-methods inquiry [36]. The quantitative dimension is based on the extraction and analysis of secondary macroeconomic and innovation-related datasets from internationally recognized sources. The qualitative dimension relies on a thematic examination of the EU’s key digital regulatory instruments and their implications for innovation, entrepreneurship, and competitiveness.

Quantitative indicators such as GDP growth, GDP per capita, R&D expenditure, venture capital availability, startup density, and innovation rankings are central to this evaluation. These are complemented by institutional metrics from the IMD World Competitiveness Ranking and the World Bank Worldwide Governance Indicators (Regulatory Quality) to characterize the broader regulatory and investment climate within which innovation occurs. On the qualitative side, the research applies Baldwin, Cave, and Lodge’s framework for evaluating regulation [38]. This framework incorporates four core dimensions—effectiveness, efficiency, proportionality, and legitimacy—that are critical for assessing the trade-offs between robust regulation and the need for dynamic innovation ecosystems.

3.2. Data Collection

This study relies on secondary quantitative and documentary data sources to construct a longitudinal, comparative dataset focused on digital innovation performance. Data were collected exclusively from internationally recognized and methodologically consistent sources published between 2023 and 2024, ensuring both currency and credibility.

Quantitative indicators were drawn from the following databases and reports:

- World Intellectual Property Organization (WIPO)—Global Innovation Index 2024, providing multidimensional metrics on innovation inputs and outputs across countries [13].

- International Monetary Fund (IMF)—World Economic Outlook 2024, offering standardized data on GDP growth, macroeconomic trends, and investment capacity [26].

- World Bank—World Development Indicators and Worldwide Governance Indicators (Regulatory Quality), contextualizing macroeconomic and regulatory conditions [27].

- Organisation for Economic Co-operation and Development (OECD)—Science, Technology and Innovation Outlook 2024, used to track R&D intensity, human capital trends, and sectoral innovation [28].

- International Institute for Management Development (IMD)—World Competitiveness Yearbook 2023, providing composite indicators on economic performance and innovation ecosystems [41].

- UNESCO Institute for Statistics—offering harmonized metrics on R&D researchers per million inhabitants, enabling comparative assessments of human capital [31].

All data were reviewed to ensure consistency in definitions, units of measurement, and temporal coverage. Where necessary, indicators were normalized or expressed as growth rates, indexed scores, or percentages to facilitate cross-national comparability and longitudinal tracking [36,37,38]. The analysis focused on four cornerstone EU legislative instruments—the General Data Protection Regulation (GDPR) [1], the Digital Services Act (DSA) [2], the Digital Markets Act (DMA) [3], and the Artificial Intelligence Act (AI Act) [4]. Supplementary European Commission communications and white papers on digital sovereignty, innovation strategy, and cross-border integration were also included [8,9,38]. These materials were reviewed through thematic content analysis to trace regulatory intentions, institutional priorities, and implementation challenges relevant to digital competitiveness.

3.3. Analytical Framework

Analytical framework. The analytical framework combines longitudinal comparative analysis with qualitative thematic coding, allowing for the integration of structural economic indicators with interpretive insights from regulatory texts. Quantitative data spanning from 2000 to 2024 were examined through descriptive statistics, compound annual growth rates (CAGR), and trajectory analysis to identify performance patterns across countries. Where possible, indicators were normalized to enhance comparability across economic scales, and results were presented in line graphs and structured tables to facilitate pattern recognition. The comparative dimension relies on two benchmark cases—the United States, which exemplifies a liberal, venture-capital-driven market economy, and China, which represents a state-orchestrated innovation model. Both countries have consolidated their positions as global digital powers and thus serve as appropriate counterpoints to the European Union’s regulatory-centered trajectory [11,12].

Legal documents, policy briefings, and official EU legislative instruments were systematically coded to highlight recurring themes such as “innovation bottlenecks,” “scalability constraints,” and “regulatory burden.” These thematic clusters were subsequently cross-referenced with empirical indicators to evaluate the consistency between regulatory discourse and measurable performance outcomes, thereby strengthening the robustness of the mixed-methods approach.

3.4. Scope and Limitations

While this study draws on a robust dataset and high-quality regulatory sources, several limitations must be acknowledged. First, the reliance on secondary data is constrained by the availability and comparability of indicators across jurisdictions. Despite efforts to harmonize sources, variations in definitions and national reporting standards may affect absolute comparability [38]. Second, although the study employs a comparative model, it does not conduct firm-level econometric analysis or survey-based empirical fieldwork. As a result, micro-level insights into startup ecosystems or company-level regulatory compliance fall beyond the scope of this analysis [37,38]. Third, the qualitative component is restricted to regulatory texts and excludes interviews with policymakers, legal experts, or digital entrepreneurs, which could have provided additional interpretive depth. Despite these limitations, the triangulated methodology adopted—combining longitudinal quantitative data with qualitative policy review—ensures that the findings remain analytically robust and contribute meaningfully to debates on Europe’s digital competitiveness [17].

Despite these limitations, the triangulated methodology adopted—anchored in reputable international datasets, legal instruments, and scholarly frameworks—offers a comprehensive and academically rigorous basis for evaluating the European Union’s digital competitiveness in a global context. Although longitudinal trends in innovation and investment consistently highlight structural weaknesses in the EU’s competitiveness, alternative interpretations may emerge depending on the level of analysis. Firm-level data, for example, might reveal sectoral success stories that aggregated indicators obscure. Moreover, benchmarking indexes such as the Global Innovation Index embed methodological assumptions that may privilege certain innovation models over others [13]. Recognizing these constraints mitigates the risk of adopting pre-determined conclusions and ensures a more balanced and context-sensitive analysis.

4. Results and Analysis

This chapter presents the empirical findings of the study and interprets them through the lens of digital competitiveness, innovation policy, and global regulatory models. By triangulating multiple datasets—including the Global Innovation Index [13], GDP growth and per capita data [27,28], R&D expenditures [29], and venture capital investment trends [11]—this section provides a longitudinal and comparative view of the European Union’s digital and economic performance relative to the United States and China.

4.1. Global Innovation Index Performance (2000–2024)

The Global Innovation Index (GII) is a multidimensional tool developed under the auspices of the World Intellectual Property Organization (WIPO) to assess national innovation performance across seven pillars: institutions, human capital, infrastructure, market sophistication, business sophistication, knowledge and technology outputs, and creative outputs [13]. China’s rapid progression in the GII rankings demonstrates a strong policy orientation toward innovation as a strategic objective. As seen in Table 1, the U.S. remains dominant due to its advanced commercialization capabilities, university–industry linkages, and robust capital markets. The EU, while showing improvement, reveals systemic weaknesses in market sophistication and business scaling mechanisms.

Table 1.

Average Global Innovation Index Score (2000–2024).

4.2. GDP Growth and Economic Performance

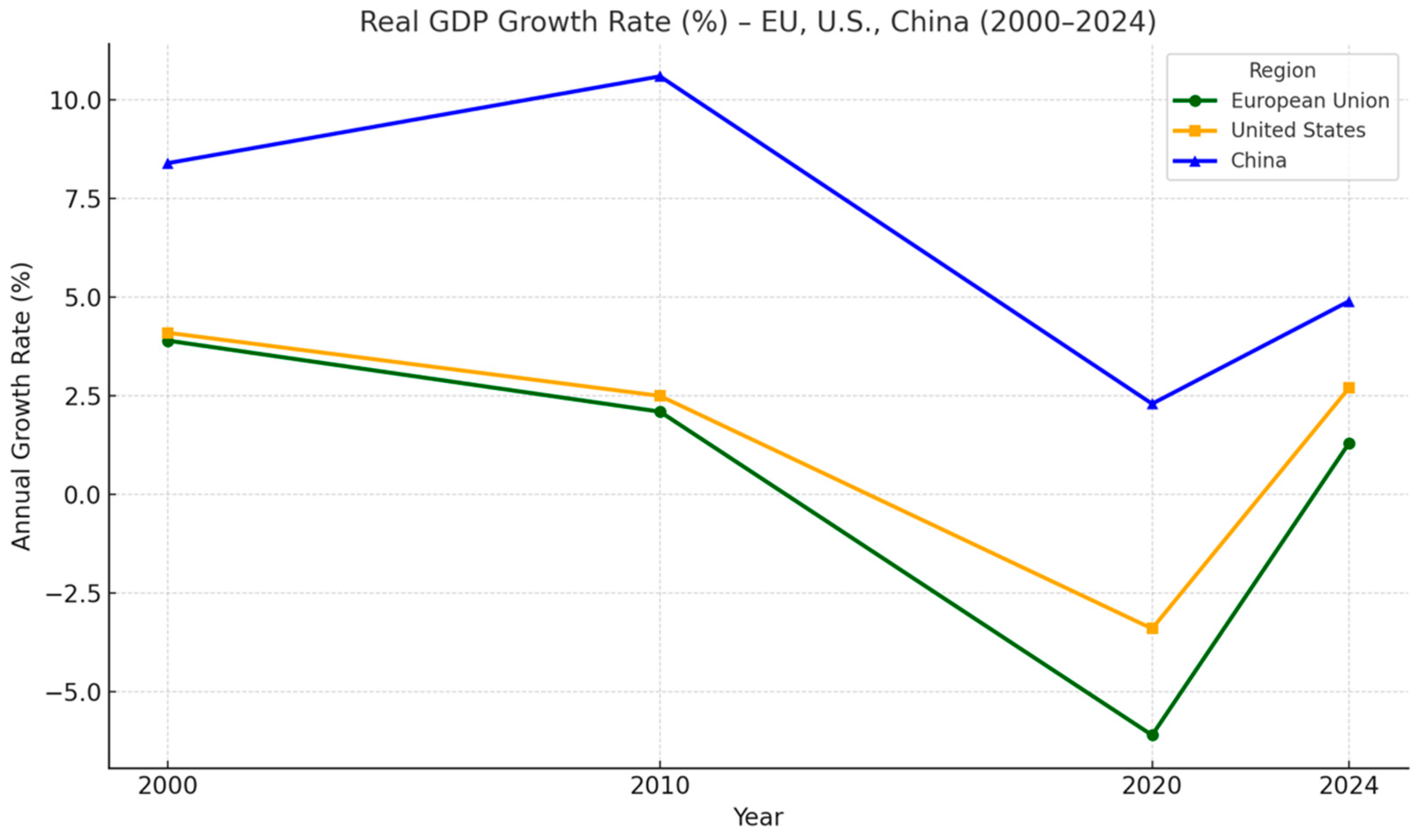

Real GDP growth reflects macroeconomic health and the availability of public and private resources for R&D and innovation. Sustained GDP growth supports the scaling of digital infrastructure and tech-intensive sectors [28]. As shown by Figure 1, the EU’s slower recovery from crises and lower average growth constrain innovation funding, affecting tech sector expansion and long-term productivity gains. China’s trajectory highlights the effectiveness of targeted industrial policy, while the U.S. benefits from dynamic private investment cycles.

Figure 1.

Real GDP Growth Rate (%). Sources: IMF (2024); World Bank (2024). Projections for 2024.

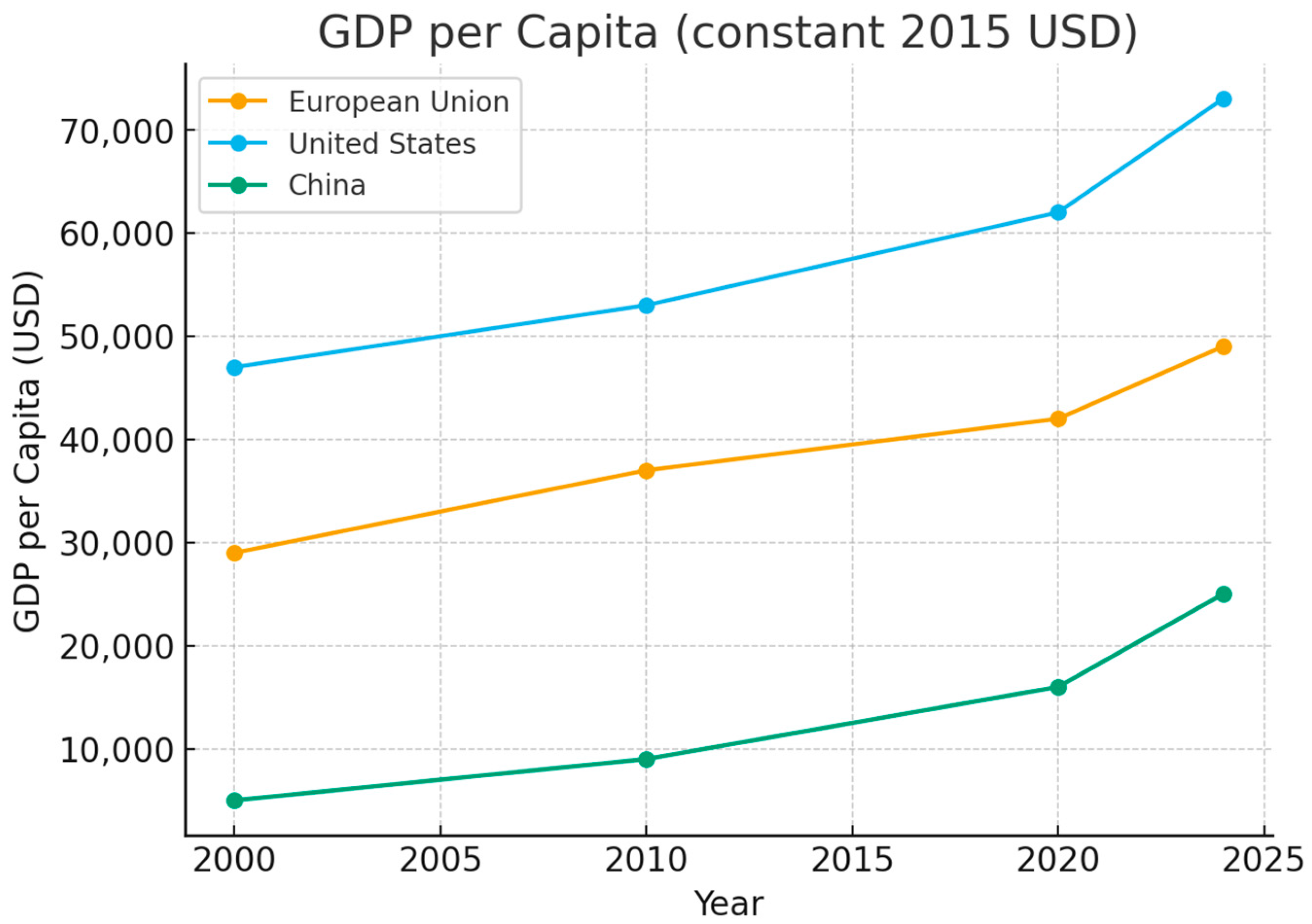

4.3. GDP per Capita Trends

GDP per capita is a widely used proxy for national wealth, labor productivity, and the capacity to absorb and scale innovation. Higher values generally indicate stronger infrastructure, better education systems, and more advanced digital readiness [27,28]. In this analysis (Figure 2), GDP per capita figures are expressed in constant 2015 U.S. dollars, which means they are adjusted for inflation using 2015 as the base year. This ensures comparability across time periods by isolating real growth from nominal price changes [28].

Figure 2.

GDP per capita evolution (comparison). Sources: OECD (2024); IMF (2024).

While the EU maintains high-income status, its growth is linear. The U.S. continues to widen the gap, and China’s accelerated convergence indicates a shift in the global economic power balance, partly driven by its prioritization of digital and green technologies.

4.4. Regulatory Environment and Ease of Doing Business

Regulatory environments influence business formation, foreign direct investment (FDI), and entrepreneurial agility. Composite benchmarks such as the IMD World Competitiveness Yearbook [41], the OECD Science, Technology and Innovation Outlook as a proxy for product market regulation [29], and the World Bank’s Worldwide Governance Indicators—Regulatory Quality [28] are used here as proxies for the regulatory and competitiveness context. The EU faces regulatory fragmentation, higher compliance complexity, and a preference for precautionary governance that can hinder the agility of digital startups. The United States benefits from stronger entrepreneurial support and deeper capital markets, while China compensates formal burdens with state coordination and industrial policy (Table 2).

Table 2.

Regulatory and Competitiveness Environment (indicative, 2024).

4.5. Sectoral Innovation and Startup Ecosystem

The presence of “unicorn” startups—tech firms valued at over $1 billion—serves as a proxy for the commercial viability of innovation ecosystems. A limited number of unicorns in the EU indicates barriers to scale, despite strong research outputs. In 2023, the United States led globally with 668 tech unicorns, followed by China with 316 and the European Union with 61 [11].

Despite Horizon Europe’s expanded focus on digital and green transitions [42] and increased investment commitments by the European Investment Bank [43], the EU continues to face structural barriers to scaling high-growth enterprises. Recent progress reports indicate that funding allocation remains fragmented and disproportionately concentrated in early-stage research, while late-stage scale-up financing is still insufficient to match the U.S. or China.

4.6. High-Tech Exports as a Percentage of Manufactured Exports

High-tech exports are used as a proxy for a country’s capacity to commercialize innovation in globally competitive sectors such as aerospace, pharmaceuticals, semiconductors, and telecommunications. Prior research indicates that higher proportions of high-tech exports reflect deeper integration into global value chains and greater technological sophistication [27,44,45]. The data (Table 3) reveal a relative stagnation in the EU’s high-tech manufacturing exports, which has implications for its competitiveness in advanced industrial sectors.

Table 3.

High-Tech Exports (% of Manufactured Exports).

4.7. Patent Applications Filed Under PCT per Million Inhabitants

Patent Cooperation Treaty (PCT) filings per million people measure knowledge intensity and international intellectual property activity. Prior research indicates that these filings reflect both inventive capacity and the commercial potential of innovations [46,47]. Although the EU continues to increase its patent filings, the growth trajectory is significantly flatter compared to China’s exponential gains (Table 4).

Table 4.

PCT Patent Applications per Million People.

4.8. ICT Service Exports (% of Total Service Exports)

ICT service exports are a measure of digital globalization. This metric captures the export capacity in software, cloud computing, IT consulting, and digital finance—key sectors in the digital economy [27]. While the EU shows gradual gains, its relative position in the digital services market remains behind the U.S., and China is narrowing the gap (Table 5).

Table 5.

ICT Service Exports (% of Total Services).

4.9. R&D Researchers per Million Inhabitants

This indicator reflects the density of research professionals, a key input in national innovation systems. It is positively correlated with absorptive capacity and long-term technological development [31,32]. The EU maintains a strong research base, although its rate of researcher growth is more moderate compared to China (Table 6).

Table 6.

R&D Researchers per Million People.

5. Discussion and Interpretation

This section interprets the empirical findings presented in Section 4, integrating them into a broader analytical framework focused on the European Union’s (EU) competitiveness in the global digital economy. Drawing on comparative metrics, academic literature, and recent institutional data, we discuss the implications of observed trends for innovation performance, regulatory frameworks, and strategic positioning.

5.1. Innovation Performance and Scaling Capacity

The Global Innovation Index (GII) scores indicate that the EU has maintained a strong innovation capacity over the past two decades. However, while countries such as Sweden, Germany, and the Netherlands perform well individually, the EU average remains behind the United States and is increasingly approached by China [13]. This reflects a structural divide between innovation input (e.g., R&D expenditure and researchers) and output (e.g., commercialization and global scale). High-tech export data [44,45] and PCT patent filings [46] show that Europe continues to be a relevant knowledge producer, yet struggles to translate this into globally competitive products and services. The decline in high-tech exports, despite a stable R&D intensity, may suggest inefficiencies in technology transfer or industrial fragmentation across member states [27,29].

5.2. Regulatory Environment and Market Fragmentation

The analysis confirms that the EU faces persistent structural issues related to regulatory fragmentation and compliance complexity. Regulatory burden remains high compared to both the U.S. and China. While EU regulations, such as the Digital Markets Act (DMA) and the AI Act, aim to promote fairness and user safety, they may inadvertently create entry barriers for startups [3,4,17]. China’s model—characterized by high state coordination despite formal regulatory hurdles—illustrates that flexible implementation can still yield rapid innovation scaling [27]. The U.S., in contrast, benefits from a lower regulatory burden and deeper venture capital markets, which support rapid scale-up of digital enterprises [41].

The Draghi Report [22] provides evidence that regulatory fragmentation not only increases compliance costs but also deters cross-border investment, limiting the attractiveness of EU capital markets. By contrast, the U.S. benefits from unified frameworks that enable the rapid emergence of billion-dollar venture capital funds. Without deeper integration of regulatory practices, Europe risks perpetuating a structural disadvantage in scale-up capacity.

5.3. Economic Foundations for Innovation

The EU’s lower GDP growth compared to the U.S. and China [26,27] constrains public investment in strategic technologies. Moreover, GDP per capita data suggests that while Europe retains high productivity, it is failing to achieve the same rate of convergence or economic dynamism seen in China. This economic context impacts the capacity of European firms to adopt and commercialize emerging technologies. Although the EU has a high concentration of R&D researchers, the slower growth in this domain relative to China is noteworthy [31]. Human capital remains a strength, but innovation ecosystems depend equally on institutional support, infrastructure, and investment liquidity.

Letta [23] argues that the future of the Single Market must rest on “speed, security, and solidarity.” This vision highlights that competitiveness requires not only efficiency and integration but also a capacity to rapidly adapt to technological and geopolitical shocks. By aligning capital markets with digital and green industrial strategies, the EU could better convert its research excellence into global economic influence. Echoing this view, Draghi [22] stresses that without deeper fiscal integration and investment in productivity-enhancing technologies, Europe will remain structurally disadvantaged in global competition.

5.4. Digital Economy Integration

ICT service export metrics further reinforce the EU’s lag in digital services globalization. Compared to the U.S. and China, Europe’s digital economy remains fragmented, with insufficient digital market integration across member states [25]. The Digital Decade targets set by the European Commission for 2030 may address this gap, but progress remains uneven. The presence of only 61 unicorns in the EU, versus 668 in the U.S. and 316 in China [12], reflects difficulties in scaling innovation. This can be attributed to fragmented capital markets and a lack of scale-oriented policy instruments.

5.5. Summary of Comparative Trends Analysis (2000–2024)

This trend-based comparison (Table 7) reveals clear strategic asymmetries among the EU, the United States, and China in innovation dynamics. A multi-dimensional assessment of the EU’s digital innovation capacity against the United States and China highlights five structural domains in which performance divergence is evident: innovation output, economic foundation, commercialization, digital integration, and human capital. Rather than focusing solely on absolute performance, this section emphasizes directional trends over the past two decades. Trends reported in Table 7 are based on longitudinal data from international sources, including the Global Innovation Index [13], GDP growth and GDP per capita from the IMF and World Bank [26,27], and OECD and UNESCO statistics on R&D intensity, researchers, and human capital [28,31]. For indicators where earlier data were unavailable or inconsistent across countries—such as PCT patent filings [44,45], R&D researchers [31], high-tech exports [27,29], and ICT services exports [27]—the analysis covers the period 2010 to 2023.

Table 7.

Trend-Based Comparison of Key Innovation and Economic Indicators.

Concrete initiatives such as the Chips Joint Undertaking and the European Digital Innovation Hubs (EDIHs) represent attempts to reduce fragmentation and build capacity at the implementation level [6,9]. However, their effectiveness depends on harmonized adoption across Member States. Without coherent deployment, these measures risk becoming isolated pockets of excellence rather than catalysts of systemic competitiveness.

5.6. Implications for Policy and Research

The findings of this study reveal a fundamental tension between the European Union’s regulatory leadership and its lagging digital competitiveness. Although regulatory instruments such as the Digital Markets Act (DMA) and the Artificial Intelligence Act (AI Act) showcase global normative ambition [3,4,17], they are often implemented in an ecosystem lacking scale, financial integration, and risk-taking incentives [22,42]. This contradiction necessitates a multidimensional policy shift that balances ethical oversight with industrial acceleration. From a research perspective, our results underscore the need for longitudinal, multi-country studies that empirically assess the links between regulatory structure, venture ecosystems, and innovation output. While the “Brussels Effect” has elevated the EU as a global standard-setter [10], it may also contribute to regulatory overreach, especially if not accompanied by targeted support mechanisms for digital enterprises [34]. While the EU’s regulatory leadership continues to exert normative influence globally [17], recent evidence suggests that without stronger industrial deployment—such as through the Chips Act, Digital Decade targets, and EDIHs—the EU risks consolidating a regulatory bias rather than fostering technological leadership [6,9,25]. A balanced strategy requires complementing rule-setting with concrete measures that enable firms to innovate and scale effectively.

5.6.1. Innovation Output and Global Reach

While the EU has shown consistent, albeit modest, improvements in innovation rankings such as the Global Innovation Index [13], its pace is eclipsed by China’s exponential gains in patent filings and industrial R&D [13,44,45]. The U.S., meanwhile, maintains innovation leadership due to its mature IP commercialization system and capital-intensive startup environment [15,29]. The disconnect between EU research inputs and global innovation impact raises concerns about absorptive capacity and international diffusion of innovation [31].

5.6.2. Economic Fundamentals and Fiscal Capacity

The EU’s slow real GDP growth and linear productivity expansion limit its fiscal margin for maneuver in tech-focused public investment [26,27]. According to Lall [29], structural industrial competitiveness depends not only on income levels but also on the composition and sophistication of production. China’s earlier growth model, built on export-driven industrial policy, has transitioned into a knowledge economy with an explicit digital strategy, while the EU struggles with the fragmentation of its industrial base and national R&D agendas [26,27].

5.6.3. Commercialization and Industrial Translation

Despite significant funding through Horizon Europe and national programs, the EU has not matched the United States or China in translating R&D into commercial scale [29,46]. The gap is visible in the number of tech unicorns and the share of high-tech exports. Scholars have emphasized the importance of technology transfer institutions and public–private collaboration in bridging this gap [29,35]. The EU’s relatively low rate of university spin-offs and limited scale-up pipelines suggest that innovation remains locked in academic and public-sector silos [17].

5.6.4. Digital Market Integration and Service Exports

ICT services have become a key marker of digital transformation, especially in software, cloud computing, and fintech sectors. While the EU has made progress through the Digital Single Market strategy, its digital integration remains incomplete [8,25]. Regulatory asymmetries and inconsistent enforcement mechanisms among member states reduce network effects and undermine digital cohesion [38]. In contrast, China has benefitted from centralized digital infrastructure investment [11], while the U.S. leverages its domestic scale and global platform dominance [40].

5.6.5. Human Capital and Innovation Inputs

The EU continues to produce a high density of researchers and STEM graduates [42,44], yet its growth in human capital intensity is not matched by gains in global innovation leadership. Absorptive capacity—the ability to recognize, assimilate, and apply external knowledge—is as important as raw research capacity [30]. China’s rise has been attributed to its aggressive investment in research institutions and international collaborations, leading to increased scientific output and talent retention [11]. Without policy mechanisms to align education, research, and commercialization, the EU risks stagnation even in areas of historical strength.

6. Conclusions and Policy Recommendations

This study critically examined the European Union’s (EU) position in the global digital economy, focusing on its capacity to balance regulatory governance with technological competitiveness. By analyzing longitudinal and comparative data from 2000 to 2024—including innovation indices, economic growth metrics, R&D performance, and digital integration, the research provides robust evidence that the EU, while maintaining excellence in regulatory leadership and research infrastructure, is increasingly challenged in the commercialization and global scaling of innovation.

6.1. Conclusions

The data presented throughout this report suggest that the EU is not keeping pace with the United States and China in several key areas of digital competitiveness. The Global Innovation Index (GII) shows that the EU has made only modest gains, while China has rapidly climbed the rankings and the U.S. maintains a dominant position [16]. GDP growth in the EU has stagnated, limiting public and private sector capacity to invest in strategic digital infrastructure [26,27]. Meanwhile, China’s economic rise and the U.S.’s post-crisis resilience have sustained their innovation ecosystems.

The EU’s high-tech exports and ICT service exports have shown weak growth relative to its global peers, indicating a gap in translating innovation into commercial output [28,44,45]. The European startup ecosystem is comparatively underdeveloped, with only 61 unicorns in 2023, reflecting barriers to capital, market access, and scalability [12]. While the EU boasts high R&D personnel density and stable research intensity, these inputs have not yielded equivalent global technological influence, especially in emerging fields like AI, quantum computing, and deep tech [29,30,43]. Overall, the EU appears to be falling behind in trend-based performance, not due to lack of innovation capacity, but because of institutional fragmentation, regulatory rigidity, and weak scale-up pathways. This highlights a structural misalignment between policy intent and economic outcomes.

6.2. Policy Recommendations and Current EU Initiatives

The empirical evidence suggests that the European Union must recalibrate its governance model from a compliance-centered orientation toward a more innovation-enabling framework. Current legislation, including the Digital Services Act (DSA) and the Digital Markets Act (DMA), imposes significant obligations on digital intermediaries, particularly dominant platforms, yet its rigid architecture often disincentivizes smaller firms from entering regulated sectors [2,3,17]. A proportionate approach that distinguishes between systemic risk and entrepreneurial agility is therefore essential. Complementary legal perspectives highlight the broader challenges of governing the digital economy and calibrating obligations for innovators [48]. On the infrastructure side, the EuroHPC Joint Undertaking and its flagship systems (e.g., LUMI and Leonardo) underscore Europe’s push for sovereign compute capacity [49,50,51]. In data governance, the International Data Spaces community advances usage-control architectures that operationalize trusted data sharing across domains [52,53,54,55]. Regulatory sandboxes, already applied in fintech and AI, should be institutionalized across all digital verticals, enabling adaptive oversight through iterative review cycles and stakeholder participation [56,57].

A second priority concerns the persistent commercialization gap that fragments Europe’s research-to-market ecosystem. Although the EU demonstrates strong research intensity and a growing volume of PCT patent filings, its relatively weak performance in unicorn creation, high-tech exports, and ICT services indicates that scientific excellence is not translating into scalable market outcomes [12,28,29]. To address this, Horizon Europe and the European Innovation Council should incorporate commercialization benchmarks, technology-transfer incentives, and innovation procurement tools. Establishing a structured EU-wide framework for academic spin-offs—comparable to the Bayh–Dole system in the U.S. or China’s state-funded incubators—would help reduce the structural disconnect between public R&D investment and market realization [33,35].

Capital market development also remains a cornerstone challenge. The underdevelopment of pan-European venture capital ecosystems continues to restrict the scaling of high-growth firms. While the Capital Markets Union (CMU) has made progress, regulatory divergence and institutional fragmentation still limit cross-border investment [23]. Accelerating CMU implementation, complemented by fiscal tools such as innovation bonds and public co-investment schemes, …could de-risk early-stage ventures and expand exit opportunities, for instance through a European Innovation Stock Exchange [47].

Finally, digital market integration must be deepened. Despite progress under the Digital Single Market, regulatory asymmetries and inconsistent enforcement mechanisms continue to reduce network effects and undermine cohesion [8]. A new generation of legislation—building on the enforceability model of the GDPR—should establish pan-European digital licensing, mutual recognition of certification regimes, and harmonized procurement of digital solutions.

Concrete initiatives already underway illustrate the operationalization of digital sovereignty. The European Search Perspective (EUSP), developed by Ecosia and Qwant, seeks to establish an independent European search index [58,59]. Privacy-oriented platforms such as EU Voice and EU Video, piloted by the European Data Protection Supervisor, represent attempts to create decentralized and trustworthy communication channels [53]. EuroHPC supercomputers like LUMI and Leonardo provide pre-exascale computing capacity to support AI, climate modeling, and other data-intensive domains [49,51]. “In parallel, the International Data Spaces (IDS) framework and usage-control mechanisms are being advanced as reference architectures for sovereign data governance [52,60].” While these projects highlight the EU’s capacity to translate regulatory ambition into infrastructural deployment [61], their long-term impact will depend on coherent adoption across Member States, avoiding the risk of fragmented pockets of excellence.

Taken together, these recommendations and initiatives underline that sustaining competitiveness requires the EU to move beyond regulatory leadership toward an integrated strategy that aligns industrial capacity, capital mobility, and digital market cohesion. By embedding resilience as a guiding principle, as emphasized in recent European Council conclusions [57,62], the Union may reconcile its normative ambitions with the structural conditions necessary for global technological leadership.

6.3. Directions for Future Research

The findings of this study highlight critical gaps in the understanding of how regulatory design, economic fundamentals, and innovation dynamics interact across geopolitical contexts. Future research should advance this agenda through more granular, interdisciplinary approaches. First, disaggregated analyses at the firm-level and regional-level are essential to capture intra-European variation in innovation output and regulatory burden [12,42]. Aggregate data may obscure divergent performances between Northern and Southern Europe or between small- and medium-sized enterprises and multinational corporations.

Second, sector-specific investigations, especially in artificial intelligence, green technologies, and digital financial services, would offer sharper insights into how regulatory frameworks such as the AI Act and GDPR shape innovation incentives and market entry behavior [13,37,47]. Such research could employ mixed-methods case studies to trace the evolution of compliance strategies and technology deployment.

Third, future empirical work should apply longitudinal econometric models and network analysis to examine the interplay between digital regulation, venture capital flows, and intellectual property formation [36,37]. This would clarify whether observed constraints in commercialization are temporary frictions or systemic failures.

Lastly, there is a pressing need to examine how innovation ecosystems respond to different governance models—market-driven, state-coordinated, and regulation-centered—across varying levels of technological maturity [16,27]. Such comparative designs can deepen theoretical understanding of innovation regimes in times of geopolitical fragmentation and accelerated digital transformation. By addressing these gaps, future research may contribute to a more evidence-based and context-sensitive approach to innovation policy, enabling the EU to evolve from a regulatory superpower into a globally competitive innovation actor. In this regard, the Chips Act [8,63] constitutes a critical case for empirical inquiry, as it seeks to reposition Europe’s semiconductor sector as a foundation for technological autonomy. Beyond reducing strategic dependencies, the initiative has the potential to generate spillovers into adjacent industries such as automotive, defence, and telecommunications, thereby linking regulatory ambition with industrial transformation.

Author Contributions

Conceptualization, F.P.; methodology, F.P. and M.J.V.; software, not applicable; validation, F.P. and M.J.V.; formal analysis, F.P.; investigation, not applicable; resources, not applicable; data curation, F.P.; writing—original draft preparation, F.P.; review and editing, M.J.V.; visualization, not applicable; supervision, not applicable; project administration, not applicable; funding acquisition, not applicable. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

All data analyzed in this study are derived from publicly available sources cited throughout the manuscript. These include WIPO’s Global Innovation Index (https://www.wipo.int/global_innovation_index), the IMF World Economic Outlook (https://www.imf.org/en/Publications/WEO), the World Bank World Development Indicators (https://databank.worldbank.org/source/world-development-indicators), OECD datasets and reports (https://www.oecd-ilibrary.org/), the UNESCO Institute for Statistics (https://uis.unesco.org/), WTO statistics (https://www.wto.org/english/res_e/statis_e/statis_e.htm), the IMD World Competitiveness Yearbook (https://www.imd.org/centers/world-competitiveness-center/), the European Investment Bank (https://www.eib.org), and European Commission programmes and reports (e.g., Digital Europe, Chips Act, Digital Decade: https://digital-strategy.ec.europa.eu/). All links accessed on 15 August 2025. No new datasets were generated by the authors; all tables and figures presented in the article are based on the processing and consolidation of these publicly accessible sources, as described in the Methodology, Section 3.

Acknowledgments

During the preparation of this manuscript, the authors used ChatGPT (GPT-5, OpenAI) and Scispace.com for drafting, editing suggestions, and formatting assistance; Mendeley for reference management; and Google Sheets, Google Docs, and Microsoft Word (Office 365 educational license) for data organization and manuscript preparation. The authors have reviewed and edited all outputs generated with these tools and take full responsibility for the final content of this publication.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- European Union. Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the Protection of Natural Persons with Regard to the Processing of Personal Data and on the Free Movement of Such Data (General Data Protection Regulation—GDPR). Off. J. Eur. Union 2016, L119, 1–88. Available online: https://eur-lex.europa.eu/eli/reg/2016/679/oj (accessed on 10 June 2025).

- European Union. Regulation (EU) 2022/1925 of the European Parliament and of the Council of 14 September 2022 on Contestable and Fair Markets in the Digital Sector (Digital Markets Act). Off. J. Eur. Union 2022, L265, 1–66. Available online: https://eur-lex.europa.eu/eli/reg/2022/1925/oj (accessed on 11 June 2025).

- European Union. Regulation (EU) 2022/2065 of the European Parliament and of the Council of 19 October 2022 on a Single Market for Digital Services and Amending Directive 2000/31/EC (Digital Services Act). Off. J. Eur. Union 2022, L277, 1–102. Available online: https://eur-lex.europa.eu/eli/reg/2022/2065/oj (accessed on 11 June 2025).

- European Union. Regulation (EU) 2024/1689 of the European Parliament and of the Council of 13 June 2024 Laying Down Harmonised Rules on Artificial Intelligence (Artificial Intelligence Act). Off. J. Eur. Union 2024, L168, 1–93. Available online: https://eur-lex.europa.eu/eli/reg/2024/1689/oj (accessed on 12 June 2025).

- European Commission. The EU’s 2021–2027 Long-Term Budget and NextGenerationEU—Facts and Figures; Directorate-General for Budget, Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- European Commission. Chips Act: Strengthening Europe’s Semiconductor Ecosystem; European Commission: Brussels, Belgium, 2024; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2023.229.01.0001.01.ENG (accessed on 13 May 2025).

- European Commission. European Alliance for Industrial Data, Edge and Cloud: Annual Report; European Commission: Brussels, Belgium, 2024; Available online: https://digital-strategy.ec.europa.eu/en/policies/cloud-alliance (accessed on 13 May 2025).

- European Commission. 2030 Digital Compass: The European Way for the Digital Decade; Communication from the Commission COM (2021) 118 Final; European Commission: Brussels, Belgium, 2021; Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021DC0118 (accessed on 18 June 2025).

- European Commission. European Digital Innovation Hubs (EDIHs); European Commission: Brussels, Belgium, 2024; Available online: https://digital-strategy.ec.europa.eu/en/activities/edihs (accessed on 20 June 2025).

- Bradford, A. The Brussels Effect: How the European Union Rules the World; Oxford University Press: Oxford, UK, 2023. [Google Scholar]

- CB Insights. The Global Unicorn Club. 2023. Available online: https://www.cbinsights.com/research-unicorn-companies (accessed on 3 June 2025).

- Zhu, K.; Zhang, F.; Wu, F.; Feng, Y. Governing innovation-driven development under state entrepreneurialism in China. Cities 2024, 152, 105194. [Google Scholar] [CrossRef]

- Dutta, S.; Lanvin, B.; Wunsch-Vincent, S. The Global Innovation Index 2024: Innovation in the Face of Uncertainty; World Intellectual Property Organization: Geneva, Switzerland, 2024; Available online: https://www.wipo.int/global_innovation_index/en/ (accessed on 19 June 2025).

- Organisation for Economic Co-Operation and Development. OECD Patent Database 2024; OECD Publishing: Paris, France, 2024; Available online: https://data-explorer.oecd.org/vis?lc=en&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_PATENTS%40DF_PATENTS_WIPO&df[ag]=OECD.STI.PIE&df[vs]=1.0&dq=.A...PRIORITY...INVENTOR.._T.&pd=2020%2C2021&to[TIME_PERIOD]=false (accessed on 12 June 2025).

- Ambrosio, F.; Brasili, A.; Niakaros, K. European Scale-Up Gap—Too Few Good Companies or Too Few Good Investors? Directorate-General for Research and Innovation, Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Caruana, M.M.; Borg, R.M. Regulating artificial intelligence in the European Union: Challenges and strategic responses. Eur. J. Risk Regul. 2024, 15, 41–63. [Google Scholar] [CrossRef]

- Blind, K. The impact of regulation on innovation. Camb. J. Econ. 2016, 40, 327–350. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Díaz-Rodríguez, N.; Del Ser, J.; Coeckelbergh, M.; de Prado, M.L.; Herrera-Viedma, E.; Herrera, F. Connecting the dots in trustworthy Artificial Intelligence: From AI principles, ethics, and key requirements to responsible AI systems and regulation. Inf. Fusion 2023, 99, 101896. [Google Scholar] [CrossRef]

- Slavković, V. Legal regulation of artificial intelligence: Between innovation and fundamental rights. Leg. Sci. Rev. 2024, 21, 15–32. [Google Scholar]

- Bauer, M.; Erixon, F. EU Digital Policy: Between Regulatory Ambition and Global Competitiveness; European Centre for International Political Economy: Brussels, Belgium, 2021. [Google Scholar]

- Draghi, M. The Future of European Competitiveness: In-Depth Analysis and Recommendations; European Commission: Brussels, Belgium, 2024; Available online: https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en (accessed on 19 June 2025).

- Letta, E. Much More Than a Market: Speed, Security, Solidarity; European Commission: Brussels, Belgium, 2024; Available online: https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf (accessed on 20 June 2025).

- Niinistö, S. A Strategy for European Resilience; European Council: Brussels, Belgium, 2025; Available online: https://www.consilium.europa.eu/en/documents-publications (accessed on 22 June 2025).

- European Commission. State of the Digital Decade Report 2023; European Commission: Brussels, Belgium, 2023; Available online: https://digital-strategy.ec.europa.eu/en/library/2023-report-state-digital-decade (accessed on 17 April 2025).

- International Monetary Fund. World Economic Outlook: April 2024; IMF: Washington, DC, USA, 2024; Available online: https://www.imf.org/en/Publications/WEO (accessed on 13 June 2025).

- World Bank. World Development Indicators 2024; World Bank: Washington, DC, USA, 2024; Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 12 April 2025).

- Organisation for Economic Co-Operation and Development. Science, Technology and Innovation Outlook 2024; OECD Publishing: Paris, France, 2024; Available online: https://www.oecd-ilibrary.org/science-and-technology/oecd-science-technology-and-innovation-outlook-2024 (accessed on 19 April 2025).

- Lall, S. The technological structure and performance of developing country manufactured exports, 1985–98. Oxf. Dev. Stud. 2000, 28, 337–369. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- UNESCO. R&D and Researchers Dataset 2024; UNESCO Institute for Statistics: Montreal, QC, Canada, 2024; Available online: https://uis.unesco.org/en/topic/research-and-development (accessed on 4 April 2025).

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Jessen, S.; Giacometti, A. An Introduction to Mission-Oriented Approaches to Innovation Policy; Nordregio Report 2024:17; Nordregio: Stockholm, Sweden, 2024. [Google Scholar]

- Mazzucato, M. Mission-Oriented Research & Innovation in the European Union: A Problem-Solving Approach to Fuel Innovation-Led Growth; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Organisation for Economic Co-Operation and Development. Fostering Innovation Through Public–Private Partnerships; OECD Publishing: Paris, France, 2022; Available online: https://www.oecd.org/sti/fostering-innovation-through-ppps.htm (accessed on 20 June 2025).

- Creswell, J.W. Research Design: Qualitative, Quantitative, and Mixed Methods Approaches, 5th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Hantrais, L. International Comparative Research: Theory, Methods and Practice; Palgrave Macmillan: London, UK, 2009. [Google Scholar]

- Baldwin, R.; Cave, M.; Lodge, M. Understanding Regulation: Theory, Strategy, and Practice, 2nd ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- European Commission. Commission Work Programme 2025; European Commission: Brussels, Belgium, 2025; Available online: https://commission.europa.eu/publications/commission-work-programme-2025_en (accessed on 11 June 2025).

- European Commission. 2025 State of the Union Address by President von der Leyen; European Commission: Strasbourg, France, 2025; Available online: https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_25_2053 (accessed on 12 September 2025).

- IMD. World Competitiveness Yearbook 2023; International Institute for Management Development: Lausanne, Switzerland, 2023; Available online: https://www.imd.org/centers/world-competitiveness-center/rankings/world-competitiveness/ (accessed on 18 May 2025).

- European Investment Bank. EIB Investment Report 2024/2025: Unlocking Europe’s Competitiveness; EIB: Luxembourg, 2024; Available online: https://www.eib.org/attachments/lucalli/20240354_investment_report_2024_en.pdf (accessed on 7 June 2025).

- European Commission. Horizon Europe Strategic Plan 2025–2027; European Commission: Brussels, Belgium, 2024; Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_24_1572 (accessed on 21 May 2025).

- Eurostat. High-Tech Exports by Manufacturing Industries (Percentage of Total Exports). Eurostat Database. 2023. Available online: https://ec.europa.eu/eurostat/documents/4187653/18051234/international-trade-high-tech-2023.xlsx/817eb1fb-82e1-878b-8302-466b64aeb917?t=1727351573779 (accessed on 15 June 2025).

- World Trade Organization. World Trade Statistical Review 2023; WTO: Geneva, Switzerland, 2023; Available online: https://www.wto.org/english/res_e/booksp_e/wtsr_2023_e.pdf (accessed on 19 June 2025).

- Griliches, Z. Patent statistics as economic indicators: A survey. J. Econ. Lit. 1990, 28, 1661–1707. Available online: https://www.jstor.org/stable/2727442 (accessed on 26 April 2025).

- World Intellectual Property Organization. WIPO IP Statistics Data Center—Patent Cooperation Treaty (PCT) Applications; WIPO: Geneva, Switzerland, 2024; Available online: https://www3.wipo.int/ipstats (accessed on 12 June 2025).

- Musch, S.; Borrelli, M.; Kerrigan, C. Bridging compliance and innovation: A comparative analysis of the EU AI Act and GDPR for enhanced organizational strategy. J. Data Prot. Priv. 2024, 7, 49–65. Available online: https://www.henrystewartpublications.com/jdpp (accessed on 2 May 2025). [CrossRef]

- EuroHPC Joint Undertaking. Lumi & Leonardo Among the World’s Five Most Powerful Supercomputers. EuroHPC News, 14 November 2022. Available online: https://www.eurohpc-ju.europa.eu/lumi-leonardo-among-worlds-five-most-powerful-supercomputers-2022-11-14_en (accessed on 7 June 2025).

- Erixon, F.; Guinea, O.; Lamprecht, P.; Sisto, E.; van der Marel, E. The Economic Dividend of Competitiveness; ECIPE Policy Brief No. 02/2023; European Centre for International Political Economy: Brussels, Belgium, 2023; Available online: https://ecipe.org/publications/economic-dividend-of-competitiveness/ (accessed on 10 April 2025).

- EuroHPC Joint Undertaking. Our Supercomputers. EuroHPC Portal. 2025. Available online: https://www.eurohpc-ju.europa.eu/supercomputers/our-supercomputers_en (accessed on 7 June 2025).

- Data Spaces Support Centre (DSSC). Access & Usage Policies Enforcement—Blueprint v2.0. 2015. Available online: https://dssc.eu/space/BVE/357075567/Access+&+Usage+Policies+Enforcement (accessed on 16 May 2025).

- European Data Protection Supervisor (EDPS). EDPS Launches Pilot Phase of Two Social Media Platforms: EU Voice and EU Video. EDPS Press Release, 28 April 2022. Available online: https://www.edps.europa.eu/press-publications/press-news/press-releases/2022/edps-launches-pilot-phase-two-social-media_en (accessed on 5 April 2025).

- European Data Protection Supervisor (EDPS). Opinion 3/2020 on the European Strategy for Data. EDPS Opinions, 16 June 2020. Available online: https://www.edps.europa.eu/sites/default/files/publication/20-06-16_opinion_data_strategy_en.pdf (accessed on 15 June 2025).

- Del Re, E. Technologies of data protection and institutional decisions for data sovereignty. Information 2024, 15, 444. [Google Scholar] [CrossRef]

- Zetzsche, D.A.; Buckley, R.P.; Arner, D.W.; Barberis, J.N. Regulating a Revolution: From Regulatory Sandboxes to Smart Regulation. Fordham J. Corp. Financ. Law 2017, 23, 31–103. Available online: https://ir.lawnet.fordham.edu/jcfl/vol23/iss1/2 (accessed on 21 May 2025). [CrossRef]

- European Council. European Council Conclusions on Competitiveness, European Defence and Security and Migration, 20 March 2025; European Council: Brussels, Belgium, 2025; Available online: https://www.consilium.europa.eu/en/press/press-releases/2025/03/20/european-council-conclusions-on-competitiveness-european-defence-and-security-and-migration (accessed on 18 June 2025).

- Ecosia. The Internet Just Got Better: Our European Search Index Goes Live. Ecosia Blog, 7 August 2025. Available online: https://blog.ecosia.org/launching-our-european-search-index/ (accessed on 15 August 2025).

- Qwant. Ecosia and Qwant Join Forces to Develop European Search Index (EUSP). Qwant Blog, 8 November 2024. Available online: https://betterweb.qwant.com/en/2024/11/08/ecosia-and-qwant-join-forces-to-develop-european-search-index/ (accessed on 6 June 2025).

- Eitel, A.; Jung, C.; Brandstädter, R.; Hosseinzadeh, A.; Bader, S.; Kühnle, C.; Birnstill, P.; Brost, G.; Gall, M.; Bruckner, F.; et al. Usage Control in the International Data Spaces; International Data Spaces Association: Dortmund, Germany, 2021. [Google Scholar] [CrossRef]

- Dalipi, L.; Zuzaku, A. Navigating legal frontiers: Addressing challenges in regulating the digital economy. Access Justice East. Eur. 2024, 4, 71–95. Available online: https://ajee-journal.com/upload/attaches/att_1714541271.pdf (accessed on 17 May 2025). [CrossRef]

- European Council. Conclusions—A New European Innovation Agenda; Council of the European Union: Brussels, Belgium, 2022; Available online: https://data.consilium.europa.eu/doc/document/ST-14705-2022-INIT/en/pdf (accessed on 22 June 2025).

- Chips Joint Undertaking. Annual Work Programme 2024; European Commission: Brussels, Belgium, 2024; Available online: https://chips-ju.europa.eu/ (accessed on 20 June 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).