Abstract

Sustainable tourism development has emerged as a strategic priority across ASEAN countries, yet the role of green innovation and environmentally responsible investment in shaping tourism outcomes remains underexplored. Existing studies often overlook the spatial interdependencies that characterize regional integration and cross-border environmental dynamics. This study investigates how green patents and green foreign direct investment (FDI) influence sustainable tourism development, both within and across ASEAN nations. Drawing on endogenous growth theory, ecological modernization, and FDI spillover frameworks, the analysis employs a Spatial Durbin Model (SDM) using panel data from 2000 to 2023. The findings reveal that green innovation and green FDI significantly enhance tourism development, with notable spatial spillover effects that benefit neighboring countries. These effects are most pronounced in leading ASEAN economies, where institutional capacity and absorptive readiness amplify the impact of green practices. The relationship is further shaped by economic growth, human capital, and political stability, while environmental degradation and inflation pose constraints. The study underscores the nonlinear and regionally heterogeneous nature of green tourism development, offering policy insights for fostering inclusive, resilient, and environmentally sustainable tourism strategies across ASEAN.

1. Introduction

Tourism has become a vital engine of economic growth and regional integration across the Association of Southeast Asian Nations (ASEAN), contributing significantly to employment, foreign exchange earnings, and infrastructure development. However, the rapid expansion of tourism has also intensified environmental pressures, including increased greenhouse gas emissions, biodiversity loss, and resource depletion [1,2]. These challenges have prompted a growing recognition of the need to transition toward sustainable tourism models that balance economic benefits with ecological preservation and social inclusivity. In this context, green innovation and environmentally responsible investment have emerged as critical pathways for aligning tourism development with the broader goals of sustainable development and climate resilience [3,4]. In addition to environmental degradation, overtourism—characterized by excessive tourist numbers that strain local infrastructure and ecosystems—has emerged as a critical challenge in popular ASEAN destinations such as Halong Bay, Bali, and Angkor Wat. Addressing overtourism through green innovation and investment is therefore essential for achieving long-term sustainability.

Green patents, which reflect technological advancements aimed at reducing environmental harm, and green foreign direct investment (FDI), which channels capital into environmentally sustainable sectors, are increasingly viewed as strategic tools for promoting sustainable tourism. Green technologies can enhance the environmental performance of tourism infrastructure, reduce energy consumption, and improve waste management systems, thereby increasing the attractiveness and competitiveness of destinations [5]. Similarly, green FDI brings not only financial capital but also knowledge spillovers, international best practices, and innovation networks that can accelerate the adoption of sustainable practices in the tourism sector [6]. For ASEAN countries—characterized by diverse levels of development, institutional capacity, and environmental vulnerability—understanding the role of green patents and green FDI in shaping tourism outcomes is both timely and policy-relevant.

Despite the increasing policy emphasis on green growth, empirical research on the nexus between green innovation, green investment, and sustainable tourism remains limited, particularly in spatially interconnected regions such as ASEAN. Most existing studies adopt a national or sectoral perspective, often overlooking the spatial spillover effects that may arise from regional integration, cross-border investment, and shared environmental challenges [7,8]. For instance, green innovation in one country may influence tourism development in neighboring countries through technology diffusion, regional branding, and collaborative infrastructure projects, while green FDI can generate positive externalities that transcend national borders, thereby strengthening the sustainability of tourism ecosystems across the region. These dynamics are especially salient in ASEAN, where economic cooperation and regional connectivity are central to development strategies [9]. Nevertheless, few studies have examined how green patents and green FDI jointly affect tourism development, particularly through regional spillover effects. To address this gap, the present study applies a spatial econometric approach to evaluate both the direct and indirect impacts of green economic activities on tourism sustainability.

To address these gaps, this study employs a spatial econometric framework to analyze the impact of green patents and green FDI on sustainable tourism development across ASEAN countries from 2005 to 2023. By applying the Spatial Durbin Model (SDM), the study captures both direct effects—how green innovation and investment influence tourism within a country—and indirect effects—how these factors affect tourism development in neighboring countries. This approach allows for a more nuanced understanding of the regional dynamics at play and provides robust empirical evidence to inform policy-making. The analysis is grounded in theories of endogenous growth [10], ecological modernization [11], and FDI spillovers [12], which collectively underscore the importance of innovation, investment, and institutional context in shaping sustainable development trajectories.

Guided by these theoretical foundations, the research sets out to (1) assess the level of sustainable tourism development across ASEAN, (2) examine the spatial effects of green patents and green FDI, and (3) propose policy strategies that leverage green technology and investment to enhance sustainability in the tourism sector. Three core research questions frame the inquiry: (1) How do green patents influence sustainable tourism development in ASEAN countries? (2) Does green FDI contribute to tourism growth, and are there spatial spillover effects across neighboring countries? (3) Does the interaction between green patents and green FDI generate a synergistic effect on sustainable tourism? By addressing these questions, the study contributes to the growing literature on green economic transformation and sustainable tourism. It offers actionable insights for policymakers, investors, and development practitioners seeking to align tourism growth with environmental sustainability in the ASEAN region. The findings are expected to inform regional strategies that leverage green innovation and investment to foster inclusive, resilient, and environmentally responsible tourism development.

2. Literature Review, Conceptual Frameworks, Materials and Methods

2.1. Literature Review and Conceptual Frameworks

The transition toward sustainable tourism in ASEAN countries is increasingly shaped by the interplay between green innovation, foreign direct investment (FDI), and regional economic integration. As tourism continues to be a major contributor to GDP, employment, and foreign exchange earnings in the region, its environmental consequences—ranging from carbon emissions to biodiversity loss—have prompted a shift toward more sustainable development models. In this context, green patents and green FDI have emerged as pivotal tools for aligning tourism growth with environmental and social sustainability.

2.1.1. Green Patents and Technological Innovation

Green patents refer to intellectual property rights granted for technologies that reduce environmental harm. Examples include solar panel innovations, energy-efficient building materials, low-emission transportation systems, and advanced waste recycling technologies. These patents serve as indicators of a country’s commitment to environmental innovation.

Green patents serve as a proxy for environmentally focused technological innovation [13]. They reflect a country’s capacity to develop and adopt technologies that reduce environmental harm, such as renewable energy systems, waste treatment technologies, and energy-efficient infrastructure [14]. These innovations are particularly relevant to the tourism sector, where environmental quality is a key determinant of destination attractiveness. Empirical studies have shown that green innovation enhances the competitiveness of tourism destinations by improving environmental performance, reducing operational costs, and meeting the growing demand for eco-conscious travel experiences [15,16,17].

In ASEAN countries, the distribution of green patents is uneven, often concentrated in more developed economies with stronger institutional frameworks and research ecosystems. Salgado & da Silva Franchi [18] emphasize that green patents not only stimulate technological advancement but also contribute to socioeconomic development by fostering innovation ecosystems that support sustainability. Moreover, the acceleration of green patent approvals through national programs—such as Brazil’s Green Patents Program—demonstrates how policy instruments can incentivize innovation in environmentally sensitive sectors.

2.1.2. Green FDI and Sustainable Development

Green FDI refers to investment flows directed toward environmentally sustainable sectors, including renewable energy, green infrastructure, and eco-tourism. It plays a dual role in sustainable tourism development: providing capital for green projects and facilitating the transfer of knowledge, technology, and international best practices [19]. Rodríguez-Chávez et al. [20,21] highlight that sustainable FDI contributes to all three pillars of sustainable development—economic, social, and environmental—when aligned with national development strategies and supported by robust governance.

In the ASEAN context, green FDI has been shown to enhance environmental quality and promote low-carbon development pathways. However, its effectiveness is contingent upon the absorptive capacity of host countries, including infrastructure readiness, regulatory quality, and human capital. Wang [21] finds that green FDI and green patents exhibit bidirectional causality with sustainable prosperity in emerging economies, suggesting that investment and innovation reinforce each other in driving sustainability outcomes.

2.1.3. Economic Growth, EKC Hypothesis, and Tourism

The Environmental Kuznets Curve (EKC) hypothesis posits that environmental degradation initially increases with economic growth but eventually declines as societies invest in cleaner technologies and adopt stricter environmental regulations [22]. This framework is particularly relevant for ASEAN countries, where rapid economic development has often come at the expense of environmental quality. Ketchoua et al. [16] demonstrate that technological innovation can moderate the negative environmental impacts of FDI, transforming it into a driver of green growth.

In the tourism sector, economic growth can enhance infrastructure and service quality, thereby attracting more visitors [23]. However, without green innovation and investment, such growth may exacerbate environmental pressures [24]. The integration of green technologies into tourism infrastructure—such as energy-efficient hotels, low-emission transport, and smart waste management—can mitigate these effects and support long-term sustainability.

2.1.4. Spatial Spillovers and Regional Integration

ASEAN’s regional integration and geographic proximity create fertile ground for spatial spillover effects. Green innovation and FDI in one country can influence tourism development in neighboring countries through shared infrastructure, regional branding, and policy diffusion. Spatial econometric models, such as the Spatial Durbin Model (SDM), have been employed to capture these interdependencies, revealing that green economic activities often transcend national borders [25,26,27].

For instance, green patents registered in Singapore may benefit tourism development in Malaysia or Indonesia through cross-border knowledge transfer and collaborative infrastructure projects [28]. Similarly, green FDI in Thailand’s eco-tourism sector may generate positive externalities for neighboring countries by raising regional environmental standards and fostering competitive innovation [29,30].

2.1.5. Institutional Quality, Human Capital, and Policy Synergies

The success of green innovation and FDI in fostering sustainable tourism is heavily influenced by institutional quality and human capital. Countries with stable governance, effective regulatory frameworks, and skilled labor forces are better positioned to attract green investment and implement eco-friendly technologies. Conversely, weak institutions and limited human capital can hinder the diffusion of green practices, particularly in less developed ASEAN economies [31,32,33,34].

Policy interventions that enhance education, support research and development, and improve governance are therefore essential for maximizing the benefits of green economic activities [35,36]. These measures not only strengthen domestic innovation ecosystems but also increase the attractiveness of countries to environmentally responsible investors. Moreover, regional cooperation—through ASEAN platforms—can facilitate knowledge sharing, harmonize environmental standards, and promote joint investment in sustainable tourism infrastructure [37,38,39].

2.1.6. Theoretical Foundations Supporting Green Innovation in Tourism

Rogers’ Diffusion of Innovation theory [40] provides a useful lens to understand how green technologies spread across regions, influencing tourism practices. The Triple Bottom Line framework [41,42] emphasizes the balance between economic, environmental, and social sustainability—an essential consideration for tourism development. Additionally, the Sustainable Tourism Development model [43] highlights the need for long-term planning, stakeholder engagement, and environmental stewardship. These frameworks collectively support the inclusion of green patents and green FDI as strategic levers for sustainable tourism.

2.1.7. Research Gaps and Contribution

Despite the growing body of literature on green innovation and sustainable development, significant gaps remain in understanding the integrated effects of green patents and green FDI on tourism development, particularly within spatially interconnected regions like ASEAN. Most existing studies tend to examine these variables in isolation or within single-country contexts, overlooking the complex spatial spillover effects that arise from regional integration, cross-border investment, and shared environmental challenges. Furthermore, while the Environmental Kuznets Curve (EKC) and endogenous growth theories have been widely applied to assess the environmental impacts of economic growth, few studies have incorporated spatial econometric models to capture the multidimensional and interregional dynamics of green innovation and tourism. This paper addresses these gaps by employing a Spatial Durbin Model (SDM) to analyze both direct and indirect effects of green patents and green FDI on sustainable tourism development across ASEAN countries. By integrating spatial analysis with a comprehensive set of economic, environmental, and institutional variables, the study offers novel insights into how green economic practices influence tourism outcomes regionally. It contributes to the literature by providing empirical evidence on the synergistic role of innovation and investment in promoting sustainability, and by proposing policy strategies tailored to the heterogeneous capacities of ASEAN member states.

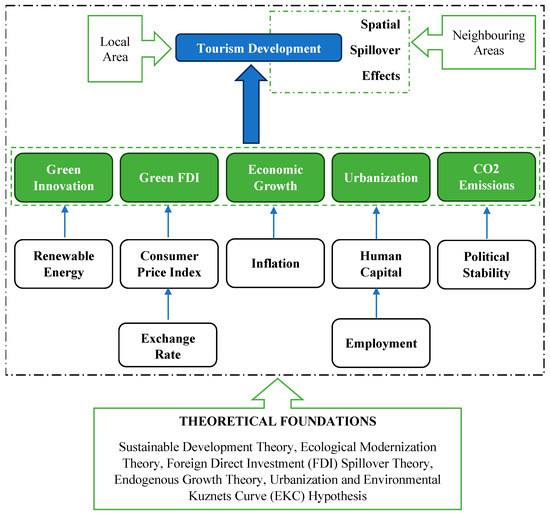

2.1.8. Conceptual Framework

Green patents represent technological innovations that reduce environmental harm, such as energy-efficient infrastructure and low-emission transport systems, which directly enhance tourism sustainability. Green FDI brings capital and knowledge transfer that supports eco-tourism projects and sustainable hospitality practices. These indicators are grounded in ecological modernization theory and FDI spillover theory, which posit that innovation and investment are key drivers of environmental and economic transformation.

Based on the insights derived from the literature review and the stated objectives of this study, we propose a conceptual framework that illustrates the hypothesized relationships among green patents, green FDI, economic growth, and sustainable tourism development in ASEAN countries. As shown in Figure 1, the framework integrates both direct and spatial spillover effects, capturing how green innovation and investment influence tourism outcomes within and across national borders. This model also incorporates key control variables such as urbanization, CO2 emissions, and institutional quality to reflect the multidimensional nature of sustainable tourism development in the region.

Figure 1.

Conceptual Framework. Source: Own elaboration.

2.2. Materials and Methods

2.2.1. Research Model

In the context of deepening globalization and regional integration, ASEAN countries are increasingly interconnected in terms of economy, investment, and technology. Green Foreign Direct Investment (Green FDI) and innovation through Green Patents not only influence sustainable tourism development within individual countries but also generate spillover effects across neighboring countries through regional value chains, technology transfers, and tourism cooperation. Consequently, the assumption of spatial independence among observational units is no longer appropriate. An analytical approach capable of accounting for spatial interdependencies is necessary to ensure the accuracy and validity of the empirical results.

The Spatial Durbin Model (SDM), a statistical tool that captures how changes in one region affect both itself and its neighbors, is particularly suitable for regional studies such as ASEAN—where countries are economically and geographically interconnected—and is chosen for this study due to its generality and superior ability to capture spatial effects in both dependent and independent variables. Unlike the Spatial Autoregressive Model (SAR), which only accounts for spatial dependence in the dependent variable, and the Spatial Error Model (SEM), which focuses on spatial correlation in the error term, the SDM simultaneously incorporates both. This enables the analysis of direct effects within each country as well as indirect (spillover) effects from neighboring countries. Such an approach is particularly relevant in this study, as the spillovers of Green FDI and Green Patents across ASEAN economies are theoretically grounded in the region’s interconnected investment and green technology networks. The SDM is therefore especially suitable for analyzing regional interdependencies, where green innovation and investment in one country may generate spillover effects influencing tourism development in others.

The core objective of this research is not only to explore the relationship between green investment, green innovation, and sustainable tourism within each country, but also to examine whether these factors in one country can influence sustainable tourism development in adjacent countries. The use of the Spatial Durbin Model enables a clear distinction between direct and indirect effects, thereby offering more robust empirical evidence to inform regional policy-making in the fields of green investment and sustainable tourism.

The data are structured as a spatial panel dataset comprising 10 ASEAN countries over the period from 2000 to 2023. This format enables the construction of a spatial weight matrix based on either geographical proximity or the degree of economic integration. The availability of detailed information on geographic location, investment flows, and regional cooperation facilitates the accurate application of the Spatial Durbin Model (SDM), while also ensuring the reliability of parameter estimates that capture spatial effects.

The general Spatial Durbin Model (SDM) is as follows:

Y is an N × 1 vector of the dependent variable for region i (i = 1, …, N) at time t (t = 1, …, T). X is an N × K matrix of explanatory variables, where K is the number of explanatory variables. ρ represents the spatial autocorrelation parameter corresponding to the spatially lagged dependent variable WY, capturing endogenous interaction effects (. W is an N × N spatial weight matrix that describes spatial relationships among units. θ denotes the exogenous interaction effects of neighboring regions’ explanatory variables WX, capturing exogenous spatial spillover effects (WXθ). β is a K × 1 vector of unknown parameters associated with the independent variables. λ represents spatial dependence among neighboring regions’ error terms, indicating spatial autocorrelation in the error structure (λWu). ε is a vector of normally distributed error terms with a mean of zero and standard deviation σ. μ and ν represent spatial and time fixed effects, respectively.

To capture both direct and indirect (spatial spillover) effects of green innovation, we have

where W is Spatial weight matrix, Xit is Vector of control variables, and ρ is Spatial autoregressive coefficient.

Several spatial econometric models consider three types of effects: direct effects, indirect effects, and total effects (see more in Table 1). Ref. [44] introduced a generalized framework for these effects, which can be rewritten as follows:

Table 1.

Variable details.

Taking the partial derivative of the expected value of y with respect to the k-th explanatory variable in X across observations 1, …, N1, we obtain

In this matrix, the diagonal elements represent direct effects, while indirect effects are captured by the off-diagonal elements (i.e., the rows and columns excluding the main diagonal). According to [7,8], the presence of a spatial weight matrix (W) enriches and complicates the marginal effects compared to traditional OLS models. For more complex models such as the Spatial Durbin Model (SDM), direct effects are the diagonal elements of W), while indirect effects are the off-diagonal elements of the same matrix. To compute these effects, [7] proposed the following series expansion:

2.2.2. Variable Selection and Justification

This study investigates the dynamic relationship between green innovation, foreign direct investment in environmentally sustainable sectors, and tourism development across ASEAN countries. The variable selection is grounded in both theoretical relevance and empirical precedents in sustainability and development economics.

Tourism development serves as the explained variable and reflects the economic and structural growth of the tourism sector in ASEAN countries [45]. It captures the outcome of both domestic and international tourism activities and is typically measured through indicators such as tourism revenue, tourist arrivals, or tourism’s contribution to GDP. Given the increasing prioritization of sustainable tourism in national strategies, this variable is critical for assessing how green policies and investments influence the sector’s expansion and long-term viability.

Several explanatory variables are employed to capture the multidimensional drivers of tourism development. First, green innovation, proxied by the number of green patents, represents technological advancement geared toward environmental sustainability. Green innovation is posited to enhance tourism attractiveness through cleaner infrastructure, eco-friendly services, and more sustainable resource use [46]. Second, Green Foreign Direct Investment (Green FDI) is included to assess how capital inflows targeting green sectors contribute to sustainable tourism infrastructure and services [6]. Green FDI may also bring knowledge spillovers and improve environmental standards, which are crucial for long-term tourism competitiveness. Third, economic growth, represented by GDP per capita, captures the level of economic development. A wealthier population and higher national income levels often coincide with improved infrastructure and services that support tourism [47]. Fourth, urbanization is introduced as a proxy for modernization and infrastructure expansion, which directly affects the accessibility and attractiveness of tourist destinations [48]. However, excessive urbanization may also present environmental challenges, making its inclusion essential for capturing both positive and negative spillovers. Lastly, CO2 emissions are included as both a proxy for environmental degradation and a test of whether tourism growth coexists with sustainable environmental practices [49].

Following Aransyah et al. [11], Gavrilović & Maksimović [50], and Jo et al. [46], and to isolate the effects of the key explanatory variables, the model incorporates a comprehensive set of control variables. Renewable energy consumption is included to reflect the extent to which countries transition toward clean energy, potentially mitigating environmental pressures from tourism activities. CO2 emissions are retained to capture environmental externalities not fully explained by green innovation or FDI. The Consumer Price Index (CPI) and inflation serve to control for macroeconomic stability, which can influence both tourist behavior and investment decisions. The Human Capital Index acts as a proxy for labor quality and education, which affect service quality and innovation capacity in the tourism sector. Political stability is essential for ensuring tourist safety and reducing investment risks—factors crucial to tourism performance. The exchange rate captures the relative cost of travel, which significantly affects international tourist flows. Lastly, employment levels in both the tourism sector and the broader economy are considered to reflect labor market dynamics that may simultaneously drive and result from tourism development. Collectively, this robust set of variables enables a nuanced analysis of the relationship between green economic practices and tourism development, while accounting for spatial interdependencies and temporal dynamics across ASEAN countries. Details of the variables are presented in Table 1.

2.2.3. Data Source and Processing

The data used in this study are compiled from multiple reputable international sources to ensure reliability and consistency. Green patent data are obtained from the World Intellectual Property Organization (WIPO) and the Organization for Economic Co-operation and Development (OECD), providing standardized measures of green innovation activity across countries. Green Foreign Direct Investment (FDI) figures are sourced from the United Nations Conference on Trade and Development (UNCTAD), which offers detailed records of environmentally sustainable investment flows. Key tourism indicators and macroeconomic variables—including GDP per capita, inflation, Consumer Price Index, exchange rates, and employment—are collected from the World Bank and ASEANstats, ensuring comprehensive regional coverage and compatibility. After excluding entries with substantial missing values, the study retained 210 valid observations covering the period from 2000 to 2021. To minimize the influence of outliers and stabilize variance, logarithmic transformations were applied to variables with large numerical ranges. Descriptive statistics for the main variables are presented in Table 2. All data are processed into a panel format for ASEAN countries over the study period, with necessary cleaning, harmonization, and interpolation performed to address missing values and ensure comparability across sources and time. This structured dataset allows for robust empirical analysis of the relationships among green innovation, green FDI, and sustainable tourism development in the ASEAN region.

Table 2.

Variable descriptive statistics.

2.2.4. Correlation Analysis

The correlation matrix in Table 3 highlights several significant relationships among green patents (GPAT), green FDI (GFDI), economic growth (GDPpC), and sustainable tourism development (TD) in ASEAN countries. Notably, TD is positively and significantly correlated with GFDI, GDPpC, and GPAT, suggesting that green economic activities and innovation are closely linked to tourism development. Additionally, GDPpC and GPAT show strong positive correlations with human capital (HCI) and political stability (POL), reinforcing the importance of institutional and social infrastructure. Conversely, renewable energy consumption (REC) is negatively correlated with most development indicators, possibly reflecting structural differences in energy use or development stages.

Table 3.

Correlation coefficients.

Although the correlation coefficient can indicate significance at various levels, the analysis does not account for the influence of other variables or spatial interaction effects, further spatial analysis is essential to understand how these relationships vary across regions. Spatial econometric models can capture geographic spillovers, regional clusters, and policy diffusion effects that traditional correlation analysis cannot. This would provide deeper insights into how proximity, regional cooperation, and localized policies influence the dynamics between green innovation, investment, and tourism, enabling more targeted and effective sustainable development strategies in the ASEAN region.

3. Results and Discussion

3.1. Spatial Correlation Analysis

Table 4 Moran’s I is a measure of spatial autocorrelation that indicates how similar or dissimilar values are distributed across geographic space. A positive Moran’s I (close to +1) suggests positive spatial autocorrelation, meaning similar values—either high or low—are geographically clustered, such as countries with high tourism receipts located near others with similarly high receipts. A negative Moran’s I (close to −1) indicates negative spatial autocorrelation, where high values are near low values, forming a dispersed or checkerboard-like pattern. When Moran’s I is near 0, it implies no spatial autocorrelation, and the values are randomly distributed across space without any clear geographic pattern [51].

Table 4.

Moran’s I index.

The Moran’s I values for Tourism Development and Green Patent from 2002 to 2021 indicate varying degrees of spatial autocorrelation across ASEAN countries. For tourism development, the values are consistently positive, ranging from around 0.12 to 0.41, with higher values in earlier years and a notable increase in 2020 and 2021 (0.29). This suggests a moderate to strong positive spatial autocorrelation, meaning countries with similar levels of tourism receipts tend to be geographically clustered [17,46]. The higher values in 2020–2021 may reflect shared regional impacts from global events like the COVID-19 pandemic. In contrast, green patent’s Moran I values are generally lower, fluctuating between weakly positive and slightly negative (e.g., 0.01 to 0.45). This indicates weaker spatial clustering, suggesting that green innovation is more unevenly distributed and less influenced by geographic proximity [52]. Overall, these patterns imply that tourism development is more regionally aligned, while green patent activity is more independently driven. Further spatial analysis could help uncover local clusters, regional influences, and others impacts shaping these trends.

3.2. Spatial Influences and Green Innovation’s Impact on Tourism

While correlation analysis offers preliminary insights, the main analytical approach employed is the Spatial Durbin Model (SDM), which allows for a nuanced understanding of how green innovation and investment influence tourism development both within and across countries. This model captures spatial dependencies and provides robust evidence of causal relationships, aligning with the study’s theoretical foundations.

Table 5 presents the results of the LM tests. The Z-statistics for both the robust LM (error) and robust LM (lag) tests were notably high—6.48 and 9.72, respectively—with corresponding p-values below 0.001. These results confirm the presence of spatial autocorrelation, suggesting that traditional SAR or SEMs alone are insufficient to fully explain the spatial structure in the dataset. Furthermore, the LR and Wald test statistics for the error term were 455.872 and 532.652, respectively, both strongly rejecting the null hypothesis that the Spatial Durbin Model (SDM) can be simplified to a Spatial Error Model (SEM) at the 1% level. Likewise, the LR and Wald test statistics for the lagged dependent variable were 100.523 and 112.798, respectively, significantly rejecting the reduction of SDM to a Spatial Autoregressive (SAR) model. As a result, the SDM was chosen as the appropriate spatial econometric model for this study.

Table 5.

Model Fitness Test.

The SDM regression results (Table 6) in both the two models show that green innovation, green FDI, and economic growth (GDPpC) have strong positive impacts on tourism development across ASEAN countries. In contrast, CO2 emissions and urbanization consistently show significant negative effects, suggesting that environmental degradation and over-urbanization may hinder tourism growth [53].

Table 6.

SDM regression results.

Both models demonstrate high statistical significance, with large t-statistics for key variables like GDPpC, GPAT, and CO2. This indicates robust model performance and reliable estimates. The consistency of signs and significance across models further supports the validity of the findings.

The spatial lag coefficient (ρ) is highly significant in both models (0.653 and 0.634), confirming strong spatial dependence. This means tourism development in one country is influenced by neighboring countries, highlighting the importance of regional dynamics and spatial spillover effects in tourism and green innovation policy planning. This finding confirms the regional tourism development in ASEAN countries [54].

We decomposed the Spatial Durbin Model into three components to better understand the impact of green innovation. The direct effect reflects how a region’s green innovation influences its own tourism development, while the indirect effect captures the influence on neighboring regions. The total effect combines both, offering a comprehensive view of green innovation’s role in promoting tourism across regions.

Table 7 displays the decomposed results of the Spatial Durbin Model, indicating that green innovation has a direct effect coefficient of 0.4521 on tourism development. This result underscores the importance of green innovation in shaping tourism development. Moreover, economic growth, employment, and human capital exhibit strong positive direct effects, indicating that regions with robust economies, job opportunities, and skilled labor are more attractive to tourists. These findings align with the theory that tourists are drawn to destinations offering quality infrastructure, services, and cultural experiences [54,55]. Green innovation and green FDI also show significant positive direct effects, suggesting that environmentally sustainable practices and investments enhance a region’s tourism appeal [56]. In contrast, inflation, CO2 emissions, and exchange rate volatility negatively impact tourism directly, likely due to increased costs and environmental degradation that reduce destination competitiveness.

Table 7.

Decomposition of SDM effects.

The indirect effects reveal how developments in neighboring regions influence local tourism, highlighting the spatial interdependence of regional economies. The indirect effect coefficient of green innovation on tourism development was 0.1876. Economic growth, employment, and human capital again show positive spillovers, suggesting that prosperity and skilled labor in adjacent areas can enhance tourism through shared infrastructure, regional branding, and cross-border travel. Urbanization and renewable energy consumption also contribute positively, indicating that sustainable urban development and clean energy adoption in nearby regions can elevate the broader region’s attractiveness [57]. However, inflation and CO2 emissions continue to exert negative spillover effects, reinforcing the idea that regional instability and environmental harm can ripple across borders and undermine tourism ecosystems [58]. These findings emphasize the need for coordinated regional strategies to foster sustainable tourism growth.

The findings confirm the relevance of ecological modernization and endogenous growth theories in explaining how green innovation and investment drive sustainable tourism. The positive spillover effects observed through the SDM analysis support the Diffusion of Innovation theory, indicating that regional collaboration can amplify sustainability outcomes. Practically, this suggests that ASEAN countries should prioritize cross-border green investment and technology sharing to enhance tourism resilience.

Green innovation, represented by green patents and green foreign direct investment, plays a pivotal role in promoting sustainable development in ASEAN countries. These economies, characterized by rapid urbanization and growing environmental challenges, benefit significantly from the adoption of eco-friendly technologies and sustainable investment practices [59]. Moreover, green innovation promotes optimizing and upgrading the local economic structure and development of low-carbon industries, and it further strengthens the region’s ability to tourism development [60]. The positive direct and indirect effects of GPAT and GFDI on tourism development suggest that green innovation not only enhances environmental quality but also boosts economic sectors like tourism that are sensitive to ecological conditions [61]. For ASEAN nations, integrating green technologies into infrastructure, transportation, and hospitality services can improve energy efficiency, reduce emissions, and create a more appealing image for international tourists.

Moreover, green FDI brings in not just capital but also knowledge transfer and international best practices, which are crucial for building long-term sustainability [62]. As ASEAN countries strive to meet global climate commitments and Sustainable Development Goals (SDGs), fostering green innovation becomes a strategic imperative. Policies that incentivize green patents, support clean energy startups, and attract environmentally responsible investors can create a virtuous cycle of innovation, sustainability, and economic growth [63]. In this context, tourism serves as both a beneficiary and a driver of green development, reinforcing the importance of aligning environmental and economic policies across the region.

3.3. Robustness Tests

The robustness tests (Table 8) were conducted using six different model specifications to ensure the consistency and reliability of the estimated effects of green innovation (GPAT), green FDI (GFDI), and other control variables on tourism development (TD). These specifications include the following: (1) pooled OLS, (2) SDM with random effects, (3) SDM with spatial fixed effects, (4) SDM with time fixed effects, (5) SDM with both spatial and time fixed effects, and (6) SDM without decomposition of effects. This comprehensive approach allows for testing the sensitivity of the results to different assumptions about unobserved heterogeneity and spatial dependence.

Table 8.

Robustness test.

Across all models, the coefficients for GPAT and GFDI remain positive and statistically significant in most specifications, confirming their robust contribution to tourism development. For instance, in the pooled OLS model, GPAT shows a strong positive effect (0.087, p < 0.01), and this effect remains significant in the spatial and time fixed effects model (0.082, p < 0.05). Similarly, GFDI maintains a positive and significant effect across models, particularly in the time fixed effects model (0.083, p < 0.05), suggesting that green investment consistently supports tourism growth. The spatial lag coefficient (ρ) is also significant in all SDMs, indicating strong spatial dependence and validating the use of spatial econometric techniques. The R2 values across models range from 0.029 to 0.683, with the highest explanatory power observed in the model with both spatial and time fixed effects. These findings confirm that the positive impacts of green innovation and green FDI on tourism development are not model-specific but hold across various estimation strategies, reinforcing the credibility of the study’s conclusions.

3.4. Regional Heterogeneity

Based on Tang [64], ASEAN countries are divided into two groups: the ASEAN-5 leading economies (Indonesia, Malaysia, Thailand, Singapore, and the Philippines) and the ASEAN non-leading 5 economies (Brunei, Cambodia, Laos, Vietnam, and Myanmar). However, due to Vietnam’s significant economic growth in recent years, it has become the fifth-largest economy among the ten ASEAN countries. A more recent study [65,66,67] considers Vietnam one of the ASEAN-6 leading economies. Therefore, this study will categorize the ten ASEAN countries into two groups: the leading six economies and the non-leading four economies.

Regional variations in the impact of green innovation on tourism indicate notable disparities across ASEAN countries’ landscape. Table 9 presents the leading six economies regions’ strongest performance. In the leading economies, green innovation (GPAT) and green FDI (GFDI) exhibit strong and statistically significant positive effects on tourism development, with a coefficient of 0.0421 (significant at 1%) and 0.3127 (significant at 1%), respectively. This suggests that these countries have more mature institutional frameworks, better infrastructure, and stronger absorptive capacities to translate green technologies and investments into sustainable tourism outcomes. These findings align with the Tourism-Led Economic Growth (TLEG) hypothesis, which posits that tourism can drive broader economic development when supported by innovation and investment [68]. Additionally, variables like GDP per capita, human capital, and political stability further reinforce tourism growth, indicating that these countries benefit from a synergistic relationship between economic development and sustainability.

Table 9.

Regional Heterogeneity in ASEAN.

In contrast, the non-leading economies show weaker but still positive effects of green innovation and FDI, with lower coefficients and t-statistics. This suggests that while green initiatives are beneficial, their impact is moderated by structural limitations such as weaker governance, limited infrastructure, and lower institutional capacity. These countries may face challenges in fully leveraging green innovation due to gaps in education, regulatory enforcement, and investment readiness. However, the positive direction of the coefficients indicates potential for growth if these barriers are addressed. This supports findings from [69], who emphasized that eco-efficiency and innovation in tourism require supportive policy environments and capacity-building efforts.

4. Conclusions and Future Research

4.1. Conclusion and Policy Implications

This study successfully addressed its three core research questions by demonstrating that green patents and green FDI significantly influence sustainable tourism development in ASEAN, both directly and through spatial spillovers. Employing the Spatial Durbin Model (SDM), the analysis provides robust empirical evidence that green innovation, measured through green patents (GPAT), and green foreign direct investment (GFDI) substantially contribute to tourism sustainability. The findings reveal not only country-level benefits but also positive spillover effects across neighboring regions, thereby validating the theoretical linkages between innovation, investment, and sustainability and filling a critical gap in the literature. Moreover, the results confirm that economic growth, human capital, and political stability further reinforce tourism development, whereas CO2 emissions, inflation, and exchange rate volatility remain significant challenges to sustainability.

The regional heterogeneity analysis highlights that leading ASEAN economies, such as Indonesia, Malaysia, Thailand, Singapore, Vietnam, and the Philippines, benefit more substantially from green innovation and investment due to stronger institutional frameworks and absorptive capacities. In contrast, non-leading economies—Brunei, Cambodia, Laos, and Myanmar—show positive but weaker effects, indicating the need for targeted support to overcome structural limitations.

To harness the full potential of green innovation and green foreign direct investment (FDI) for sustainable tourism development in ASEAN, governments and regional institutions must adopt a multi-pronged policy approach. First, strengthening national innovation ecosystems is essential. This includes increasing public investment in research and development, offering tax incentives for green patent applications, and supporting incubators and accelerators focused on eco-friendly technologies. By fostering a culture of innovation, ASEAN countries can generate homegrown solutions that enhance tourism sustainability and reduce environmental footprints.

Second, attracting and facilitating green FDI should be a strategic priority. Governments can establish clear regulatory frameworks that define green investment criteria, streamline approval processes for environmentally sustainable projects, and offer fiscal incentives such as tax holidays or reduced tariffs for green infrastructure development. Public–private partnerships can also be leveraged to co-finance eco-tourism projects, especially in areas with high ecological value but limited financial resources.

Third, regional cooperation and capacity building are crucial, particularly for non-leading ASEAN economies. ASEAN-wide initiatives such as shared green technology platforms, regional tourism branding, and joint training programs can help bridge institutional and infrastructural gaps. Technical assistance from leading economies within ASEAN can support policy harmonization and institutional strengthening in less developed member states, ensuring that green innovation benefits are equitably distributed.

Fourth, integrating sustainability into tourism planning and regulation is vital. Governments should enforce environmental standards for tourism operators, promote low-carbon transportation options, and encourage the use of renewable energy in hospitality services. National tourism strategies must align with climate goals and the Sustainable Development Goals (SDGs), ensuring that tourism growth does not come at the expense of environmental degradation.

Finally, monitoring and evaluation mechanisms should be established to track progress in green innovation, FDI inflows, and tourism sustainability. This includes developing indicators for eco-efficiency, carbon intensity, and innovation adoption in the tourism sector. Transparent data collection and reporting will enable evidence-based policy-making and allow for timely adjustments to strategies based on performance.

4.2. Contribution, Limitation, and Future Research

This study makes several important contributions to the literature on sustainable tourism and green economic development in ASEAN. First, it provides empirical evidence on the role of green innovation—measured through green patents—and green foreign direct investment (FDI) in promoting tourism development. By applying the Spatial Durbin Model (SDM), the study captures both direct and spatial spillover effects, offering a nuanced understanding of how green practices influence tourism across borders. Second, the study introduces a regional heterogeneity analysis, distinguishing between leading and non-leading ASEAN economies, which highlights disparities in absorptive capacity and institutional readiness. Third, the integration of economic, environmental, and institutional variables into the spatial framework enhances the robustness of the findings and provides actionable insights for policymakers.

Despite its strengths, this study has several limitations. The analysis relies on secondary data sources, which may contain inconsistencies or gaps, particularly in less developed ASEAN countries. The use of green patents as a proxy for innovation may not fully capture informal or non-patented practices that contribute to sustainability. Moreover, while the SDM accounts for spatial dependence, it does not explicitly model temporal dynamics or policy shocks that may influence tourism trends. The categorization of countries into leading and non-leading groups, although grounded in the recent literature, may oversimplify the complex and evolving nature of regional development. Finally, the use of national-level tourism indicators does not distinguish between urban, rural, or niche forms of tourism, such as cruises or eco-tourism.

Future research could address these limitations in several ways. Time-series models may be applied to capture the dynamic effects of green innovation and FDI over time. Researchers could also examine the role of digital transformation and smart tourism technologies in advancing sustainability. Comparative studies between ASEAN and other regional blocs may provide broader insights into the global applicability of green tourism strategies. Additionally, the use of more disaggregated data would enable exploration of how different forms of tourism interact with green innovation and environmental sustainability. Finally, qualitative case studies of successful green tourism initiatives within ASEAN could complement the quantitative findings, offering deeper contextual understanding of how green innovation is implemented and how local communities perceive and adapt to these changes.

Funding

This research received no external funding.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| SDM | Spatial Durbin Model |

| FDI | Foreign Direct Investment |

| ASEAN | Association of Southeast Asian Nations |

| EKC | Environmental Kuznets Curve |

References

- UNWTO. Sustainable Tourism Initiatives|UN Tourism. Available online: https://www.unwto.org/sustainable-development/tourism-initiatives (accessed on 18 July 2025).

- Sun, Y.Y.; Faturay, F.; Lenzen, M.; Gössling, S.; Higham, J. Drivers of global tourism carbon emissions. Nat. Commun. 2024, 15, 10384. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Karim, S. Green energy, green innovation, and political stability led to green growth in OECD nations. Energy Strategy Rev. 2024, 55, 101519. [Google Scholar] [CrossRef]

- Kwilinski, A.; Dacko-Pikiewicz, Z.; Szczepanska-Woszczyna, K.; Lyulyov, O.; Pimonenko, T. The role of innovation in the transition to a green economy: A path to sustainable growth. J. Open Innov. Technol. Mark. Complex. 2025, 11, 100530. [Google Scholar] [CrossRef]

- Vu, N.D. Patent Landscape on Green Technology in Vietnam. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Gopalan, S.; Khalid, U.; Okafor, L. Do greenfield FDI inflows promote international tourism? Curr. Issues Tour. 2023, 27, 4561–4578. [Google Scholar] [CrossRef]

- LeSage, J.; Pace, R.K. Introduction to Spatial Econometrics; Chapman and Hall/CRC: Boca Raton, FL, USA, 2009. [Google Scholar] [CrossRef]

- Vega, S.H.; Elhorst, J.P. The SLX Model. J. Reg. Sci. 2015, 55, 339–363. [Google Scholar] [CrossRef]

- Secretariat, T.A.S.A. ASEAN Tourism Strategic Plan 2016–2025. 2015. Available online: https://asean.org/book/asean-tourism-strategic-plan-2016-2025-2 (accessed on 18 July 2025).

- Howitt, P. Endogenous Growth Theory; Economic Growth; MIT press: Cambridge, MA, USA, 2010; pp. 68–73. [Google Scholar] [CrossRef]

- Aransyah, M.F.; Hermanto, B.; Muftiadi, A.; Oktadiana, H. Exploring sustainability oriented innovations in tourism: Insights from ecological modernization, diffusion of innovations, and the triple bottom line. Cogent Soc. Sci. 2025, 11, 2447396. [Google Scholar] [CrossRef]

- Mao, Z.E.; Yang, Y. FDI spillovers in the Chinese hotel industry: The role of geographic regions, star-rating classifications, ownership types, and foreign capital origins. Tour. Manag. 2016, 54, 1–12. [Google Scholar] [CrossRef]

- Favot, M.; Vesnic, L.; Priore, R.; Bincoletto, A.; Morea, F. Green patents and green codes: How different methodologies lead to different results. Resour. Conserv. Recycl. Adv. 2023, 18, 200132. [Google Scholar] [CrossRef]

- Rahman, S. The importance of green patents for CDS pricing: The role of environmental disclosures. Energy Econ. 2024, 139, 107905. [Google Scholar] [CrossRef]

- Inmor, S.; Na-Nan, K.; Phanniphong, K.; Jaturat, N.; Kůstka, M. The role of smart green tourism technologies in shaping tourist intentions: Balancing authenticity and sustainability in natural tourism. Environ. Chall. 2025, 19, 101171. [Google Scholar] [CrossRef]

- Ketchoua, G.S.; Arogundade, S.; Mduduzi, B. Revaluating the Sustainable Development Thesis: Exploring the moderating influence of Technological Innovation on the impact of Foreign Direct Investment (FDI) on Green Growth in the OECD Countries. Discov. Sustain. 2024, 5, 252. [Google Scholar] [CrossRef]

- Sun, Y.; Ding, W.; Yang, G. Green innovation efficiency of China’s tourism industry from the perspective of shared inputs: Dynamic evolution and combination improvement paths. Ecol. Indic. 2022, 138, 108824. [Google Scholar] [CrossRef]

- Salgado, E.G.; da Silva Franchi, R.A. Green Technologies: The Role of Green Patents for Innovation, Preservation and Sustainable Development. Rev. De Gestão-RGSA 2023, 17, e03331. [Google Scholar] [CrossRef]

- Cai, X.; Aljofan, A. Accessing the role of tourism, renewable energy, and green finance in shaping the sustainable future. Sci. Rep. 2025, 15, 14511. [Google Scholar] [CrossRef] [PubMed]

- Rodríguez-Chávez, C.A.; Oré-Evanán, L.M.; Zapata-Sánchez, G.G.; Toribio-Lopez, A.; Eguiguren-Eguigurem, G.R. Foreign Direct Investment and Sustainable Development in Asia: Bibliometric Analysis and Systematic Literature Review. Sustainability 2024, 16, 10718. [Google Scholar] [CrossRef]

- Wang, H. Green finance and foreign investment: Catalysts for sustainable prosperity in emerging economies. Front. Environ. Sci. 2025, 13, 1561838. [Google Scholar] [CrossRef]

- Bhattacharya, M. The Environmental Kuznets Curve. In Environmental Kuznets Curve (EKC): A Manual; Elsevier: Amsterdam, The Netherlands, 2019; pp. 9–14. [Google Scholar] [CrossRef]

- Liu, S.; Islam, H.; Ghosh, T.; Ali, M.S.E.; Afrin, K.H. Exploring the nexus between economic growth and tourism demand: The role of sustainable development goals. Humanit. Soc. Sci. Commun. 2025, 12, 441. [Google Scholar] [CrossRef]

- Van Trung, H.; Dao, D.Q.; Nguyet, L.T.A. Tourism, FDI, Renewable Energy, And Growth. Rev. Tur. Desenvolv. 2025, 48, 599–623. [Google Scholar] [CrossRef]

- Beer, C.; Riedl, A. Modelling spatial externalities in panel data: The Spatial Durbin model revisited. Pap. Reg. Sci. 2012, 91, 299–319. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, Y.; He, M. The Spatial Interaction Effect of Green Spaces on Urban Economic Growth: Empirical Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 10360. [Google Scholar] [CrossRef]

- Shi, W.; Lee, L. Spatial dynamic panel data models with interactive fixed effects. J. Econom. 2017, 197, 323–347. [Google Scholar] [CrossRef]

- Ministry of Foreign Affairs of Singapore. Towards a sustainable and resilient Singapore: Singapore’s Voluntary National Review Report to the 2018 UN High-Level Political Forum on Sustainable Development|Planipolis. 2018. Available online: https://planipolis.iiep.unesco.org/en/2018/towards-sustainable-and-resilient-singapore-singapore%E2%80%99s-voluntary-national-review-report-2018 (accessed on 19 July 2025).

- Yang, X. How Does Green Investment Influence on Tourism Development in Thailand? J. Environ. Manag. Tour. 2022, 13, 1047–1058. [Google Scholar] [CrossRef] [PubMed]

- Sangnak, D. Sustainable tourism development in Thailand: The role of agricultural tourism and government support for SMEs. Sustain. Futures 2025, 9, 100782. [Google Scholar] [CrossRef]

- Wang, R.; Qamruzzaman, M.; Karim, S. Unveiling the power of education, political stability and ICT in shaping technological innovation in BRI nations. Heliyon 2024, 10, e30142. [Google Scholar] [CrossRef]

- Ni, L.; Ahmad, S.F.; Alshammari, T.O.; Liang, H.; Alsanie, G.; Irshad, M.; Alyafi-AlZahri, R.; BinSaeed, R.H.; Al-Abyadh, M.H.A.; Bakir, S.M.D.M.A.; et al. The role of environmental regulation and green human capital towards sustainable development: The mediating role of green innovation and industry upgradation. J. Clean. Prod. 2023, 421, 138497. [Google Scholar] [CrossRef]

- Dam, M.M.; Durmaz, A.; Bekun, F.V.; Tiwari, A.K. The role of green growth and institutional quality on environmental sustainability: A comparison of CO2 emissions, ecological footprint and inverted load capacity factor for OECD countries. J. Environ. Manag. 2024, 365, 121551. [Google Scholar] [CrossRef]

- Teklie, D.K.; Yağmur, M.H. The Role of Green Innovation, Renewable Energy, and Institutional Quality in Promoting Green Growth: Evidence from African Countries. Sustainability 2024, 16, 6166. [Google Scholar] [CrossRef]

- Liu, C.; Padhan, H.; Rekha, V.; Gozgor, G. The path to green growth in OECD economies: The role of energy transition and education. Energy Econ. 2025, 145, 108419. [Google Scholar] [CrossRef]

- Naruetharadhol, P.; ConwayLenihan, A.; McGuirk, H. Assessing the role of public policy in fostering global eco-innovation. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100294. [Google Scholar] [CrossRef]

- Hussey, A. Regional development and cooperation through ASEAN. Geogr. Rev. 1991, 81, 87–98. [Google Scholar] [CrossRef]

- Berthet, M.; Corrado, R. ASEAN regional cooperation in the space sector: Current status, potential gaps, and future perspectives. Space Policy 2025, 72, 101666. [Google Scholar] [CrossRef]

- ADB. Asia’s Journey to Prosperity: Policy, Market, and Technology Over 50 Years. ADB. Asian-Pac. Econ. Lit. 2020, 34, 170. [Google Scholar] [CrossRef]

- Miller, R.L. Rogers’ Innovation Diffusion Theory (1962, 1995). In Information Seeking Behavior and Technology Adoption: Theories and Trends; IGI Global Scientific Publishing: Hershey, PA, USA, 2015; pp. 261–274. [Google Scholar] [CrossRef]

- Elkington, J. Enter the Triple Bottom Line; Routledge: Abingdon, UK, 2013; pp. 1–16. [Google Scholar] [CrossRef]

- Jeurissen, R. John Elkington, Cannibals With Forks: The Triple Bottom Line of 21st Century Business. J. Bus. Ethics 2000, 23, 229–231. [Google Scholar] [CrossRef]

- WTO. Making Tourism More Sustainable—A Guide for Policy Makers (English version); WTO: Geneva, Switzerland, 2005; p. 212. [Google Scholar] [CrossRef]

- Elhorst, J.P. Specification and Estimation of Spatial Panel Data Models. Int. Reg. Sci. Rev. 2003, 26, 244–268. [Google Scholar] [CrossRef]

- Walton, J. Tourism and economic development in ASEAN. In Tourism in South-East Asia; Routledge: Abingdon, UK, 1993; pp. 214–233. [Google Scholar]

- Jo, Y.; Kim, M.J.; Yoon, Y.-S.; Hall, C.M.; Michael, C. Tourism green growth through technological innovation. J. Sustain. Tour. 2025, in press. [Google Scholar] [CrossRef]

- Cárdenas-García, P.J.; Brida, J.G.; Segarra, V. Modeling the link between tourism and economic development: Evidence from homogeneous panels of countries. Humanit. Soc. Sci. Commun. 2024, 11, 308. [Google Scholar] [CrossRef]

- Tan, Y.; Jiang, G.; Merajuddin, S.S.; Zhao, F. Urbanization and tourism economic development. Financ. Res. Lett. 2025, 73, 106632. [Google Scholar] [CrossRef]

- Mancini, M.S.; Barioni, D.; Danelutti, C.; Barnias, A.; Bračanov, V.; Pisce, G.C.; Chappaz, G.; Đuković, B.; Guarneri, D.; Lang, M.; et al. Ecological Footprint and tourism: Development and sustainability monitoring of ecotourism packages in Mediterranean Protected Areas. J. Outdoor Recreat. Tour. 2022, 38, 100513. [Google Scholar] [CrossRef]

- Gavrilović, Z.; Maksimović, M. Green innovations in the tourism sector. Strateg. Manag. 2018, 23, 36–42. [Google Scholar] [CrossRef]

- Chen, Y. Spatial autocorrelation equation based on Moran’s index. Sci. Rep. 2023, 13, 19296. [Google Scholar] [CrossRef]

- Suki, N.M.; Suki, N.M.; Afshan, S.; Sharif, A.; Kasim, M.A.; Hanafi, S.R.M. How does green technology innovation affect green growth in ASEAN-6 countries? Evidence from advance panel estimations. Gondwana Res. 2022, 111, 165–173. [Google Scholar] [CrossRef]

- Teng, Y.; Cox, A.; Chatziantoniou, I. Environmental degradation, economic growth and tourism development in Chinese regions. Environ. Sci. Pollut. Res. 2021, 28, 33781–33793. [Google Scholar] [CrossRef] [PubMed]

- Mazumder, M.N.H.; Sultana, M.A.; Al-Mamun, A. Regional Tourism Development in Southeast Asia. Transnatl. Corp. Rev. 2013, 5, 60–76. [Google Scholar] [CrossRef]

- Wong, E.P.Y.; Mistilis, N.; Dwyer, L. A model of Asean collaboration in tourism. Ann. Tour. Res. 2011, 38, 882–899. [Google Scholar] [CrossRef]

- Van, T.H.; Lichang, L.; Quoc, T.D.T. Sustainable development in Southeast Asia: The nexus of tourism, finance, and environment. Heliyon 2024, 10, e40829. [Google Scholar] [CrossRef]

- Vo, D.H.; Vo, A.T.; Ho, C.M. Urbanization and renewable energy consumption in the emerging ASEAN markets: A comparison between short and long-run effects. Heliyon 2024, 10, e30243. [Google Scholar] [CrossRef]

- Hussain, S.; Ahmad, W.; Qamar, Y.; Akram, M.S. Impact of Inflation, CO2 Emissions and Foreign Investment on Economic Growth: A Case of Pakistan. Asian Dev. Policy Rev. 2019, 7, 307–317. [Google Scholar] [CrossRef]

- Nuryanto, U.W.; Basrowi; Quraysin, I.; Pratiwi, I. Harmonizing eco-control and eco-friendly technologies with green investment: Pioneering business innovation for corporate sustainability in the Indonesian context. Environ. Chall. 2024, 15, 100952. [Google Scholar] [CrossRef]

- Shi, B.; Li, N.; Gao, Q.; Li, G. Market incentives, carbon quota allocation and carbon emission reduction: Evidence from China’s carbon trading pilot policy. J. Environ. Manag. 2022, 319, 115650. [Google Scholar] [CrossRef]

- Li, X.J. Green Innovation Behavior Toward Sustainable Tourism Development: A Dual Mediation Model. Front. Psychol. 2022, 13, 930973. [Google Scholar] [CrossRef]

- Zhou, X.; Choi, C.H. Tourism Development, Foreign Direct Investment, and Environmental Sustainability: How Green Technology Innovations Make a Difference. SAGE Open 2025, 15. [Google Scholar] [CrossRef]

- Olsen, S.; Teoh, S.; Miyazawa, I. ASEAN Community and the Sustainable Development Goals: Positioning Sustainability at the Heart of Regional Integration; Institute for Global Environmental Strategies: Kanagawa, Japan, 2015; Available online: https://www.iges.or.jp/en/pub/asean-community-and-sustainable-development/en (accessed on 17 June 2025).

- Tang, K.-B. The precise form of uncovered interest parity: A heterogeneous panel application in ASEAN-5 countries. Econ. Model. 2010, 28, 568–573. [Google Scholar] [CrossRef]

- Nguyen, M.-L.T.; Bui, T.N. Trade Openness and Economic Growth: A Study on Asean-6. Economies 2021, 9, 113. Available online: https://ideas.repec.org/a/gam/jecomi/v9y2021i3p113-d614315.html (accessed on 17 June 2025). [CrossRef]

- Thach, N.N.; Kieu, V.T.T.; An, D.T.T. Impact of Financial Development on International Trade in ASEAN-6 Countries: A Bayesian Approach. Stud. Comput. Intell. 2022, 983, 169–184. [Google Scholar] [CrossRef]

- Le, T.H.; Nguyen, N.; Pham, M. The impacts of capital inflows on bank lending in the ASEAN-6 countries. Int. J. Emerg. Mark. 2023, 19, 4364–4382. [Google Scholar] [CrossRef]

- Zhang, H.; Liang, Q.; Li, Y.; Gao, P. Promoting eco-tourism for the green economic recovery in ASEAN. Econ. Change Restruct. 2023, 56, 2021–2036. [Google Scholar] [CrossRef]

- Robaina, M.; Madaleno, M. Resources: Eco-efficiency, Sustainability and Innovation in Tourism. In The Future of Tourism; Fayos-Solà, E., Cooper, C., Eds.; Springer: Cham, Switzerland, 2019; pp. 19–41. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).