User Acceptance of Blockchain Technology in Financial Applications: Information Security, Technology Awareness and Privacy Aspects

Abstract

1. Introduction

2. Literature Review

2.1. Blockchain Technology’s Application in the Financial Field

2.2. Opportunities and Challenges Faced by Blockchain Technology

2.3. Consumers’ Adoption Intention for Blockchain Technology in E-Commerce

2.4. Introduction of Basic Models

3. Methodology

3.1. Research Purposes and Significance

3.2. Research Framework and Method

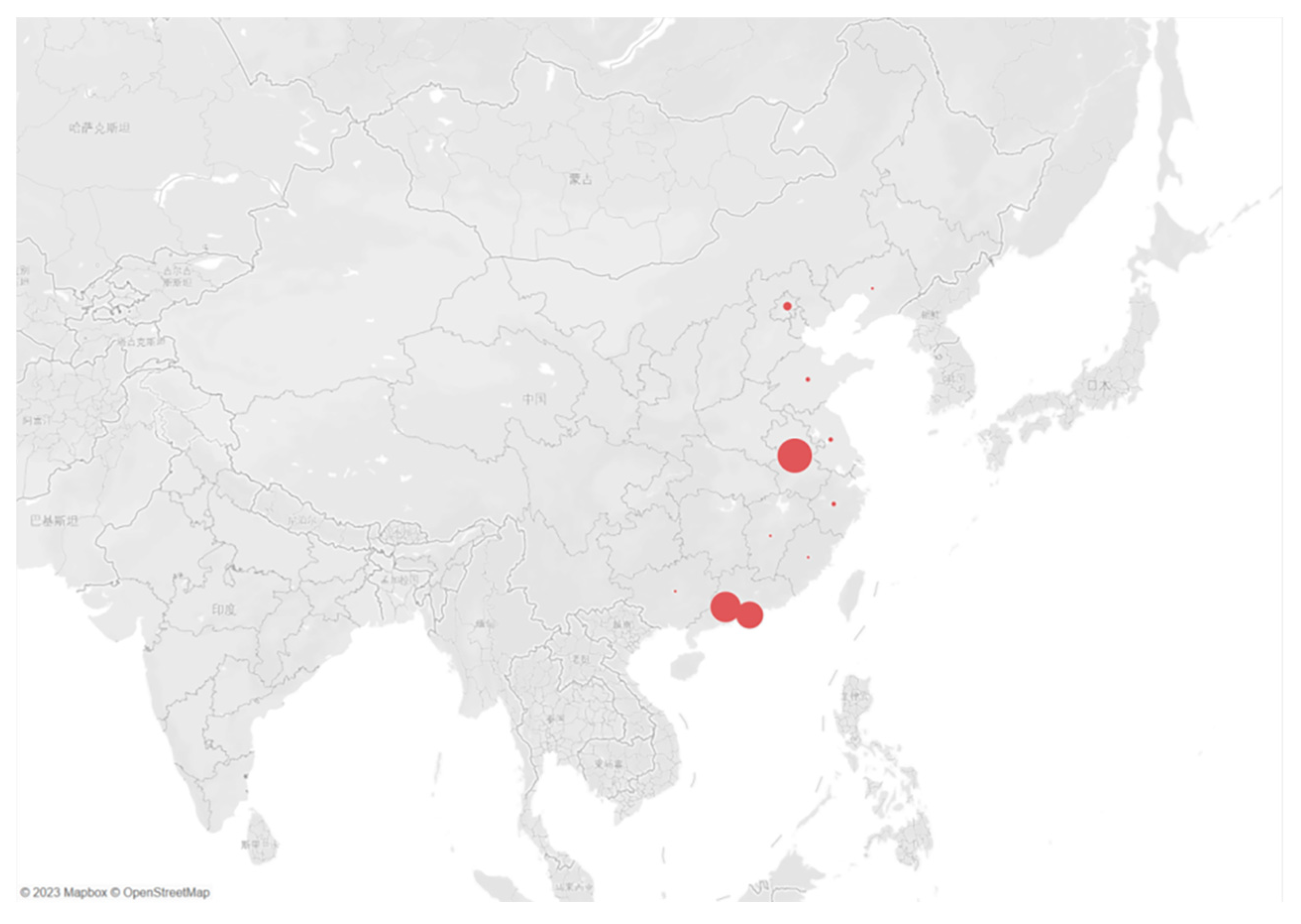

3.2.1. Survey Method

3.2.2. Empirical Approach

3.2.3. Functional Analysis

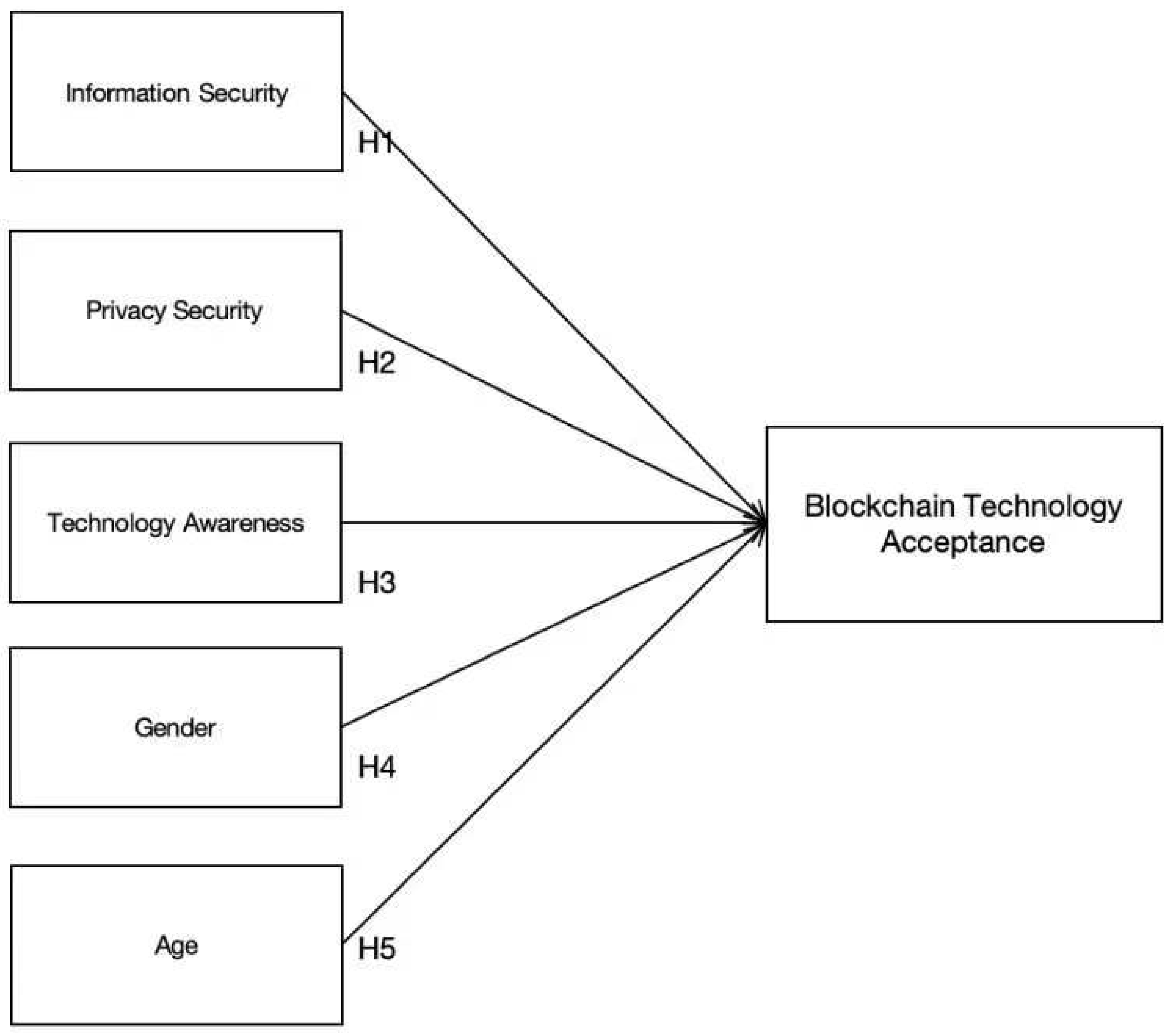

3.2.4. Empirical Analysis—Research Model and Hypotheses Building

4. Questionnaire Analysis

4.1. Questionnaire Design

4.2. Reliability and Validity Testing

4.3. Descriptive Statistical Analysis

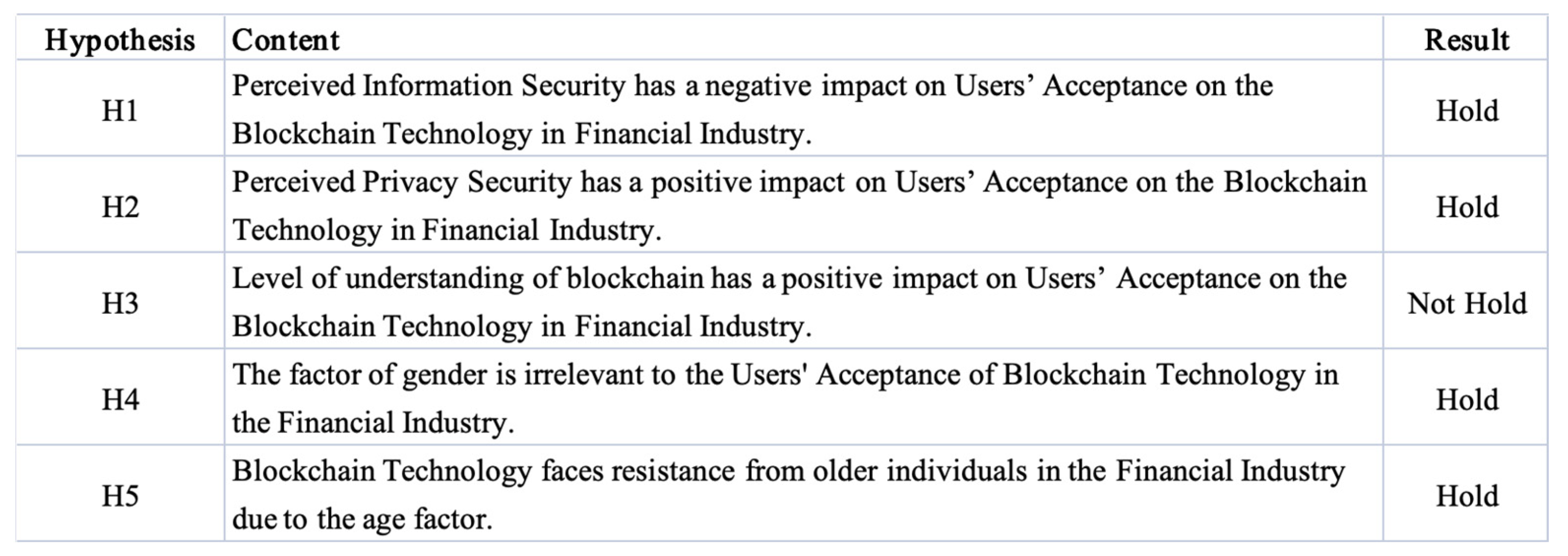

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Li, Y.; Juma’h, A.H. The Effect of Technological and Task Considerations on Auditors’ Acceptance of Blockchain Technology. J. Inf. Syst. 2022, 36, 129–151. [Google Scholar] [CrossRef]

- Jing, S.; Zheng, X.; Chen, Z. Review and Investigation of Merkle Tree’s Technical Principles and Related Application Fields. In Proceedings of the 2021 International Conference on Artificial Intelligence, Big Data and Algorithms (CAIBDA), Xi’an, China, 28–30 May 2021. [Google Scholar]

- Valadares, D.; Perkusich, A.; Martins, A.; Kamel, M.; Seline, C. Privacy-Preserving Blockchain Technologies. Sensors 2023, 23, 7172. [Google Scholar] [CrossRef]

- Nikolic, F. Blockstream Appoints Hashcash Inventor Dr. Adam Back as CEO; PR Newswire Association LLC: New York, NY, USA, 2016. [Google Scholar]

- Sherman, A.T.; Javani, F.; Zhang, H.; Golaszewski, E. On the Origins and Variations of Blockchain Technologies. IEEE Secur. Priv. 2019, 17, 72–77. [Google Scholar] [CrossRef]

- Haber, S.; Stornetta, W.S. How to Time-Stamp a Digital Document; Springer: Berlin/Heidelberg, Germany, 1991; Volume 3. [Google Scholar]

- Arvind, N. Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Yaga, D.; Mell, P.; Roby, N.; Scarfone, K. Blockchain Technology Overview; National Institute of Standards and Technology: Gaithersburg, MD, USA, 2018; Volume 1.

- Wen, B.; Wang, Y.; Ding, Y.; Zheng, H.; Qin, B.; Yang, C. Security and privacy protection technologies in securing blockchain applications. Inf. Sci. 2023, 645, 119322. [Google Scholar] [CrossRef]

- Zhang, L.; Xie, Y.; Zheng, Y.; Xue, W.; Zheng, X.; Xu, X. The challenges and countermeasures of blockchain in finance and economics. Syst. Res. Behav. Sci. 2020, 37, 691–698. [Google Scholar] [CrossRef]

- Li, Y.; Yang, G.; Susilo, W.; Yu, Y.; Au, M.H.; Liu, D. Traceable Monero: Anonymous Cryptocurrency with Enhanced Accountability. IEEE Trans. Dependable Secur. Comput. 2021, 18, 679–691. [Google Scholar] [CrossRef]

- Illing, G.; Peitz, M. Understanding the Digital Economy: Facts and Theory Introduction. CESifo Econ. Stud. 2005, 51, 187–188. [Google Scholar] [CrossRef]

- Chen, F. A probe into the dialectical relationship between money and freedom—From the perspective of Marxist Economic Philosophy. Nanjing Soc. Sci. 2017, 8, 75–81. [Google Scholar]

- Marcel, B.; Orġan, T.; Otgon, C. Information asymmetry theory in corporate governance systems. Ann. Univ. Oradea Econ. Sci. Ser. 2010, 19, 516–522. [Google Scholar]

- Alfandi, O.; Khanji, S.; Ahmad, L.; Khattak, A. A survey on boosting IoT security and privacy through blockchain. Clust. Comput. 2020, 24, 37–55. [Google Scholar] [CrossRef]

- Picone, M.; Cirani, S.; Veltri, L. Blockchain Security and Privacy for the Internet of Things. Sensors 2021, 21, 892. [Google Scholar] [CrossRef] [PubMed]

- Nærland, K.; Müller-Bloch, C.; Beck, R.; Palmund, S. Blockchain to Rule the Waves—Nascent Design Principles for Reducing Risk and Uncertainty in Decentralized Environments. In Proceedings of the International Conference on Information Systems (ICIS), Seoul, Republic of Korea, 10–13 December 2017. [Google Scholar]

- Kaur, G.; Bansal, M.; Kaur, T. Prospects of Blockchain Technology in Finance Sustainability. In Perspectives on Blockchain Technology and Responsible Investing; IGI Global: Hershey, PA, USA, 2023; pp. 177–189. Available online: https://www.igi-global.com/chapter/prospects-of-blockchain-technology-in-finance-sustainability/323026 (accessed on 7 October 2023).

- Son, B.; Jang, H. Economics of blockchain-based securities settlement. Res. Int. Bus. Financ. 2023, 64, 101842. [Google Scholar] [CrossRef]

- Zhang, R.; Xue, R.; Liu, L. Security and Privacy on Blockchain. ACM Comput. Surv. 2019, 52, 1–34. [Google Scholar] [CrossRef]

- Zaghloul, E.; Li, T.; Mutka, M.W.; Ren, J. Bitcoin and Blockchain: Security and Privacy. IEEE Internet Things J. 2020, 7, 10288–10313. [Google Scholar] [CrossRef]

- Kumar, B.A.; Garg, A.; Gajpal, Y. Determinants of Blockchain Technology Adoption in Supply Chains by Small and Medium Enterprises (SMEs) in India. Math. Probl. Eng. 2021, 2021, 5537395. [Google Scholar]

- Clohessy, T.; Acton, T. Investigating the influence of organizational factors on blockchain adoption. Ind. Manag. Data Syst. 2019, 119, 1457–1491. [Google Scholar] [CrossRef]

- Miyazakik, A.; Fernandez, A. Consumer Perceptions of Privacy and Security Risks for Online Shopping. J. Consum. Aff. 2001, 35, 27–44. [Google Scholar] [CrossRef]

- Felin, T.; Lakhani, K. What Problems Will You Solve with Blockchain? Massachusetts Institute of Technology: Cambridge, MA, USA, 2018.

- Aboobucker, I.; Bao, Y. What obstruct customer acceptance of internet banking? Security and privacy, risk, trust and website usability and the role of moderators. J. High Technol. Manag. Res. 2018, 29, 109–123. [Google Scholar] [CrossRef]

- Grover, P.; Kar, A.K.; Janssen, M.; Ilavarasan, V. Perceived usefulness, ease of use and user acceptance of blockchain technology for digital transactions—Insights from user-generated content on Twitter. Enterp. Inf. Syst. 2019, 13, 771–800. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Heilbroner, R.L.; Ajzen, I.; Fishbein, M.; Thurow, L.C. Understanding Attitudes and Predicting Social Behavior; Prentice-Hall: Hoboken, NJ, USA, 1980; Available online: https://books.google.com.hk/books/about/Understanding_Attitudes_and_Predicting_S.html?id=AnNqAAAAMAAJ&redir_esc=y (accessed on 17 November 2023).

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Venkatesh, V. Determinants of Perceived Ease of Use: Integrating Control, Intrinsic Motivation, and Emotion into the Technology Acceptance Model. Inf. Syst. Res. 2000, 11, 342–365. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Technology Acceptance Model 3 and a Research Agenda on Interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.; Suman, R.; Khan, S. A review of Blockchain Technology applications for financial services. BenchCouncil Trans. Benchmarks Stand. Eval. 2022, 2, 100073. [Google Scholar] [CrossRef]

- Trivedi, S.; Mehta, K.; Sharma, R. Systematic Literature Review on Application of Blockchain Technology in E-Finance and Financial Services. J. Technol. Manag. Innov. 2021, 16, 89–102. [Google Scholar] [CrossRef]

- Gad, A.G.; Mosa, D.T.; Abualigah, L.; Abohany, A.A. Emerging Trends in Blockchain Technology and Applications: A Review and Outlook. J. King Saud Univ. Comput. Inf. Sci. 2022, 34, 6719–6742. [Google Scholar] [CrossRef]

- Yi, Y.J.; You, S.; Bae, B.J. The influence of smartphones on academic performance: The development of the technology-to-performance chain model. Libr. Hi Tech 2016, 34, 480–499. [Google Scholar] [CrossRef]

- Garg, P.; Gupta, B.; Chauhan, A.K.; Sivarajah, U.; Gupta, S.; Modgil, S. Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technol. Forecast. Soc. Chang. 2021, 163, 120407. [Google Scholar] [CrossRef]

- Albayati, H.; Kim, S.K.; Rho, J.J. Accepting financial transactions using blockchain technology and cryptocurrency: A customer perspective approach. Technol. Soc. 2020, 62, 101320. [Google Scholar] [CrossRef]

- Sagheer, N.; Khan, K.L.; Fahd, S.; Mahmood, S.; Rashid, T.; Jamil, H. Factors Affecting Adaptability of Cryptocurrency: An Application of Technology Acceptance Model. Front. Psychol. 2022, 13, 903473. [Google Scholar] [CrossRef] [PubMed]

- Kumari, V.; Bala, P.K.; Chakraborty, S. An Empirical Study of User Adoption of Cryptocurrency Using Blockchain Technology: Analysing Role of Success Factors like Technology Awareness and Financial Literacy. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1580–1600. [Google Scholar] [CrossRef]

- Kliestik, T.; Valaskova, K.; Lazaroiu, G.; Kovacova, M.; Vrbka, J. Remaining Financially Healthy and Competitive: The Role of Financial Predictors. J. Compet. 2020, 12, 74–92. [Google Scholar] [CrossRef]

| Age | Gender | Know | School | Internet | Friend | Agree | m_info_security 0 | m_info_privacy 0 | m_block_know 0 | Willing | Province |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 3 | 1 | 0 | 0 | 1 | 2 | 2 | 2 | 4 | HongKong |

| 1 | 0 | 5 | 1 | 1 | 0 | 1 | 2 | 2 | 3 | 5 | HongKong |

| 1 | 1 | 2 | 1 | 1 | 0 | 1 | 3 | 3 | 3 | 4 | GuangDong |

| 1 | 0 | 3 | 1 | 0 | 1 | 1 | 3 | 3 | 3 | 5 | HongKong |

| 1 | 1 | 3 | 0 | 1 | 0 | 1 | 3 | 3 | 2 | 4 | GuangDong |

| 1 | 0 | 1 | 1 | 1 | 1 | 1 | 4 | GuangDong |

| Male | Female | |

|---|---|---|

| 35 years old and below | 74 | 88 |

| Over 35 years old | 101 | 160 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tse, W.K.; Dai, X.; Lee, Y.M.; Lu, D. User Acceptance of Blockchain Technology in Financial Applications: Information Security, Technology Awareness and Privacy Aspects. Blockchains 2024, 2, 299-311. https://doi.org/10.3390/blockchains2030014

Tse WK, Dai X, Lee YM, Lu D. User Acceptance of Blockchain Technology in Financial Applications: Information Security, Technology Awareness and Privacy Aspects. Blockchains. 2024; 2(3):299-311. https://doi.org/10.3390/blockchains2030014

Chicago/Turabian StyleTse, Woon Kwan, Xuechen Dai, Yat Ming Lee, and Danqi Lu. 2024. "User Acceptance of Blockchain Technology in Financial Applications: Information Security, Technology Awareness and Privacy Aspects" Blockchains 2, no. 3: 299-311. https://doi.org/10.3390/blockchains2030014

APA StyleTse, W. K., Dai, X., Lee, Y. M., & Lu, D. (2024). User Acceptance of Blockchain Technology in Financial Applications: Information Security, Technology Awareness and Privacy Aspects. Blockchains, 2(3), 299-311. https://doi.org/10.3390/blockchains2030014