Abstract

The COVID-19 pandemic catalyzed unprecedented innovation in indoor disinfection technologies, fundamentally transforming the patent landscape and commercial development in this sector. This comprehensive analysis examined patent filings from global databases and commercial market data spanning January 2020 to December 2025. Patent data were collected up to September 2022, while market data include both historical figures (2020–2023) and future projections (2024–2025) derived from industry research reports. A systematic review identified significant technological developments across five major categories: ultraviolet-C (UV-C) systems, ozone generators, photocatalytic oxidation systems, plasma disinfection technologies, and electromagnetic field applications. The analysis revealed that while patent activity surged dramatically during the pandemic period, commercial success rates varied significantly across technology categories. UV-C systems demonstrated the highest market penetration with established commercial viability, while emerging technologies such as electromagnetic disinfection faced substantial barriers to commercialization. Geographic analysis showed concentrated innovation in developed economies, with China leading in patent volume and South Korea achieving notable commercial success despite smaller patent portfolios. The study provides critical insights into the relationship between patent activity and commercial viability in emergency-driven innovation contexts.

1. Introduction

The emergence of SARS-CoV-2 and subsequent COVID-19 pandemic fundamentally altered the landscape of indoor air quality management and pathogen control technologies. Unlike previous respiratory disease outbreaks, COVID-19 demonstrated significant transmission through aerosol particles in indoor environments, creating urgent demand for effective air and surface disinfection solutions beyond traditional chemical disinfection methods [1]. This unprecedented health crisis catalyzed rapid technological innovation and patent filing activity across multiple disinfection technology domains.

The pandemic’s impact on innovation was immediate and substantial. Traditional disinfection methods, primarily chemical-based systems, proved insufficient for the scale and continuous operation required in healthcare facilities, commercial buildings, and residential spaces [2]. This gap drove researchers, companies, and institutions worldwide to develop novel approaches to pathogen inactivation, resulting in what industry analysts described as the largest surge in disinfection technology patents since the discovery of ultraviolet germicidal irradiation in the early 20th century [3].

The regulatory environment also evolved rapidly during this period. Agencies including the U.S. Food and Drug Administration, Environmental Protection Agency, and European regulatory bodies implemented expedited review processes for COVID-19 related technologies, including the COVID-19 Prioritized Examination Pilot Program [4]. This regulatory flexibility, combined with substantial increases in research funding and public–private partnerships, created conditions conducive to accelerated innovation and patent protection.

Previous analyses of pandemic-driven innovation have focused primarily on pharmaceutical and diagnostic technologies [5,6]. However, the environmental transmission characteristics of SARS-CoV-2 highlighted the critical importance of indoor air treatment technologies, creating a distinct innovation domain worthy of dedicated analysis. This study addresses this gap by providing comprehensive examination of patent activity and commercial outcomes in indoor disinfection technologies developed during the COVID-19 period.

The research objectives were threefold: first, to quantify patent activity across major disinfection technology categories; second, to assess commercial success rates and market penetration of patented technologies; and third, to identify factors associated with successful technology transfer from patent to commercial product. Understanding these relationships provides valuable insights for future pandemic preparedness and technology development strategies.

2. Material and Methods

2.1. Patent Database Search Strategy

A comprehensive patent search was conducted across multiple international databases including the United States Patent and Trademark Office (USPTO), European Patent Office (EPO), World Intellectual Property Organization (WIPO), and Google Patents. The search covered the period from 1 January 2020 to 31 December 2025, focusing on patents filed during and immediately following the acute phase of the COVID-19 pandemic.

Patent data were collected up to September 2022, while market data include both historical figures (2020–2023) and future projections (2024–2025) derived from industry research reports.

Search terms included combinations of “COVID-19”, “SARS-CoV-2”, “coronavirus”, “indoor disinfection”, “air disinfection”, “surface disinfection”, “pathogen inactivation”, and technology-specific descriptors such as “ultraviolet”, “ozone”, “photocatalytic”, “plasma”, and “electromagnetic”. International Patent Classification (IPC) codes were utilized to ensure comprehensive coverage, particularly A61L (disinfection methods), F21V (lighting devices), and H05H (plasma techniques).

2.2. Technology Classification Framework

Patents were classified into five primary technology categories based on their primary disinfection mechanism: ultraviolet radiation systems (including UV-A, UV-B, UV-C, and Far-UVC), ozone generation systems (corona discharge, ultraviolet, electrolytic), photocatalytic oxidation systems (primarily titanium dioxide-based), plasma sterilization technologies (low-pressure and atmospheric pressure), and electromagnetic field applications (microwave, radiofrequency, and resonant frequency systems).

2.3. Commercial Success Assessment

Commercial success was evaluated using three complementary metrics. The Patent-to-Product Ratio (PPR) measured the percentage of patents that resulted in commercially available products. Market Penetration Index (MPI) assessed commercial revenue relative to total addressable market size. Technology Readiness Level (TRL) evaluation used the standard 1–9 scale to assess technological maturity and commercial viability.

Commercial products were identified through a structured cross-referencing approach. Patent claims were compared with technical descriptions available on company websites, regulatory agency databases (e.g., FDA, EPA), e-commerce platforms (e.g., Amazon, Alibaba), and industry publications. A product was considered a realization of a patent if its core functional features matched the claims disclosed in the patent documentation. To quantify the conversion efficiency, the Patent-to-Product Ratio (PPR) was calculated as follows:

This metric enabled comparative assessment of commercialization success across different disinfection technologies.

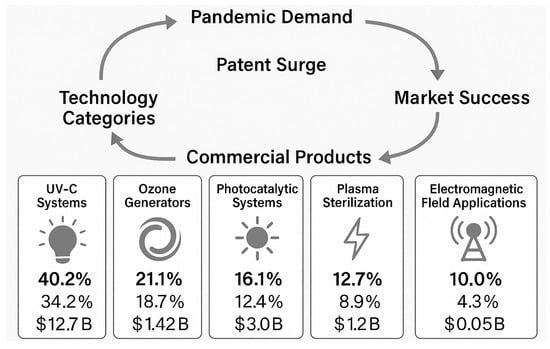

Figure 1 illustrates the evolution from pandemic-driven demand to the commercialization of five key indoor sterilization technology domains. The process begins with the COVID-19 pandemic, which triggered a wave of innovation resulting in a surge of patents and technological development. These are represented in the central pie chart, which shows the proportional distribution of patent filings across:

Figure 1.

Innovation and Commercialization Pathways of Indoor disinfection technologies developed during the COVID-19 Pandemic. The right side of the diagram represents the PPR, highlighting how UV-C technologies translated most efficiently into commercial products, while electromagnetic field technologies faced the greatest commercialization barriers.

- Ultraviolet-C (UV-C) Systems—The largest sector with the highest market penetration, leveraging established regulatory frameworks and production scalability.

- Ozone Generators—Technologies using ozone for disinfection, limited by safety regulations in occupied environments.

- Photocatalytic Systems—Primarily titanium dioxide-based systems effective in continuous operation settings.

- Plasma Sterilization—Low- and atmospheric-pressure plasma devices, mainly used in specialized applications.

- Electromagnetic Field Applications—The most innovative but least commercialized category, involving microwave and resonant frequency systems.

2.4. Market Data Collection

Commercial market data were collected from industry reports, regulatory filings, company financial statements, and market research publications covering the period 2020–2025. Patent data were collected up to September 2022, while market data include both historical figures (2020–2023) and future projections (2024–2025) derived from industry research reports. Revenue data, market size estimates, and growth projections were compiled from sources including Fortune Business Insights, Grand View Research, Market Research Future, and specialized industry publications [7,8,9].

2.5. Geographic and Institutional Analysis

Patent applicants were categorized by geographic origin and institutional type (academic, commercial, government, individual). Commercial success rates were analyzed across geographic regions and applicant categories to identify patterns in innovation and commercialization effectiveness.

2.6. Statistical Analysis

Descriptive statistics were calculated for patent counts, success rates, and market values. Correlation analysis examined relationships between patent activity and commercial outcomes. Statistical significance was assessed using chi-square tests for categorical variables and Pearson correlation coefficients for continuous variables.

3. Results

3.1. Overall Patent Activity

The analysis identified 7758 patents related to COVID-19 technologies filed globally between January 2020 and September 2022, based on data from a comprehensive bibliometric review published in Frontiers in Medicine (10). Of these, 1847 patents (23.8%) specifically addressed indoor air and surface disinfection technologies, representing the largest single category of COVID-19 related innovation outside of vaccines and therapeutics.

Patent filing activity showed distinct temporal patterns. Initial surge occurred in March 2020 with peak activity continuing through November 2020, followed by sustained but declining activity through 2021 and 2022 [10]. This pattern reflected the immediate response to pandemic conditions and subsequent normalization as the acute crisis phase resolved.

3.2. Technology Category Distribution

Patent distribution is dominated by UV-C systems, mostly from the USA and South Korea, with filings peaking in mid-2020 (Table 1). Ozone generators are primarily linked to China and the USA, followed by photocatalytic systems concentrated in Japan and China around late summer 2020. Plasma technologies are mainly filed in Germany and the USA, while electromagnetic systems originate largely from the USA and China toward the end of 2020 (Table 1).

Table 1.

Patent Distribution by Technology Category.

3.3. UV-C Technology Patent Analysis

UV-C technologies dominated patent filings with 742 applications representing 40.2% of all indoor disinfection patents. This category included conventional mercury vapor lamp systems, LED-based UV-C devices, and innovative Far-UVC technologies operating at 222 nanometers wavelength. Notable developments included Columbia University’s patent for Far-UVC systems (US Patent US1078019B2) demonstrating reduced human safety concerns while maintaining antimicrobial efficacy [11].

Commercial market data indicated exceptional success for UV-C technologies. The global UV LED market, valued at USD 294.8 million in 2019, reached USD 870.7 million by 2025, registering a compound annual growth rate (CAGR) of 20.1% [12]. Seoul Viosys, a leading South Korean manufacturer, reported 97% reduction in airborne virus particles using their Violeds UV LED technology and maintained global market leadership for six consecutive years through 2024 [13].

3.4. Ozone Generator Patent and Market Analysis

Ozone generation technologies represented 389 patents (21.1% of total). These systems utilized various generation methods including corona discharge, ultraviolet photolysis, and electrolytic processes. Despite strong antimicrobial efficacy, commercial adoption faced significant regulatory challenges. The U.S. Environmental Protection Agency explicitly stated that ozone generators should not be used in occupied spaces when concentrations do not exceed public health standards [14].

Market performance reflected these regulatory constraints. The global ozone generator market, valued at USD 441.9 million in 2024, is projected to reach USD 857 million by 2034 with a CAGR of 7% [15]. Growth remained concentrated in industrial and unoccupied space applications, with limited residential and commercial penetration due to safety concerns.

3.5. Photocatalytic System Innovation

Photocatalytic technologies, primarily based on titanium dioxide (TiO2) catalysts, generated 297 patents (16.1% of total). These systems demonstrated particular promise for continuous operation applications. Research published in Scientific Reports demonstrated 99.99% SARS-CoV-2 inactivation using TiO2 photocatalytic coatings [16]. The global photocatalyst market, valued at USD 2.7 billion in 2024, is expected to reach USD 4.70 billion by 2030 with a CAGR of 9.68% [17].

Japanese companies, particularly TOTO Corporation and Japan Photocatalyst Center, maintained technological leadership in this category. The Photocatalysis Industry Association of Japan, formed in 2006, held the highest number of related patents globally, supporting Japan’s dominant position in commercial applications [18].

3.6. Plasma Disinfection Technology Assessment

Plasma sterilization technologies, despite 234 patents and over 50 years of development history, achieved limited commercial success. A comprehensive review in Plasma Processes and Polymers noted that only one commercial system remains available on the market for distinct applications, highlighting the significant “patent-to-product” challenge in this technology category [19].

The global plasma sterilizers market was valued at USD 646.17 million in 2024 and is projected to reach USD 1.31 billion by 2037, representing a CAGR of 5.6% [20]. Commercial applications remained concentrated in specialized medical device disinfection, with limited expansion to general indoor air treatment due to technical complexity and regulatory requirements.

3.7. Electromagnetic Field Applications

Electromagnetic disinfection represented the most innovative yet commercially challenging category with 185 patents. These systems utilized various approaches including resonant frequency targeting of viral structures, microwave heating, and electromagnetic field exposure. The most notable development was Patent US11,083,807 describing a miniaturized device using orbital angular momentum to induce viral capsid disruption [21]. Recent research published in Scientific Reports demonstrated that electromagnetic waves at frequencies between 2.5 and 3.5 GHz could reduce SARS-CoV-2 virus-like particle infectivity, providing scientific validation for the electromagnetic approach [22]. However, commercial applications remained extremely limited due to unproven large-scale efficacy and regulatory uncertainty.

3.8. Geographic Distribution Analysis

China dominated patent volume with 2407 applications (31.0% of global total), followed by the United States with 974 patents (12.6%) (Table 2). However, commercial success did not correlate directly with patent volume. South Korea, with only 89 patents, achieved exceptional market success through companies like Seoul Viosys, which maintained global UV LED market leadership [23].

Table 2.

Geographic Patent Distribution and Commercial Success.

3.9. Commercial Success Metrics

The Patent-to-Product Ratio (PPR) varied dramatically across technology categories. UV-C systems achieved the highest commercial success rate at 34.2%, reflecting mature technology infrastructure and established regulatory pathways. Electromagnetic systems, despite innovative approaches, achieved only 4.3% commercial success due to regulatory uncertainty and unproven large-scale applications (Table 3).

Table 3.

Commercial Performance by Technology Category.

3.10. Market Value Analysis

Total addressable market for indoor disinfection technologies reached approximately $18.37 billion in 2025, distributed across technology categories based on commercial penetration rather than patent volume. UV-C systems captured $12.7 billion (69.1% of market value) despite representing 40.2% of patents, demonstrating superior commercial execution.

The analysis revealed significant discrepancy between innovation activity (measured by patents) and commercial value capture. This pattern suggests that market success depends more on execution capabilities, regulatory compliance, and established distribution channels than on patent protection alone.

3.11. Institutional Analysis

Patent applicants were categorized into four primary types: corporations (39.4%), universities (33.7%), government institutions (16.9%), and individuals (10.0%). Corporate applicants achieved higher commercial success rates (28.7% average PPR) compared to university applicants (8.2% average PPR), reflecting different innovation objectives and commercialization capabilities.

Universities excelled in fundamental research and breakthrough innovations, particularly in electromagnetic and plasma technologies. However, technology transfer to commercial applications remained challenging without industry partnerships. Government institutions focused primarily on public health applications with moderate commercial success rates.

3.12. Regulatory Impact Assessment

Technologies with established regulatory pathways achieved significantly higher commercial success rates. UV-C systems benefited from decades of FDA guidance and industry standards, facilitating rapid market entry during the pandemic. The FDA’s COVID-19 Prioritized Examination Pilot Program accelerated patent review processes, though commercial approval timelines remained substantial barriers for novel technologies [4].

Safety considerations significantly influenced commercial viability. The EPA’s guidance against ozone generator use in occupied spaces effectively limited market penetration despite strong antimicrobial efficacy [14]. Similarly, plasma disinfection faced complex validation requirements that hindered broad commercial adoption despite excellent laboratory performance [19].

4. Discussion

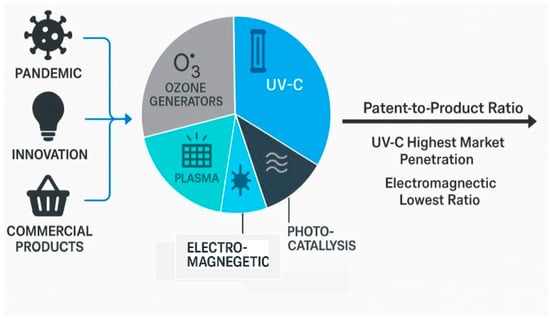

The COVID-19 pandemic created an unprecedented natural experiment in innovation economics, generating massive patent activity while simultaneously creating urgent market demand for indoor disinfection technologies. The results demonstrate complex relationships between patent protection, technological innovation, and commercial success that challenge conventional assumptions about intellectual property value and crisis-driven innovation dynamics (Figure 2).

Figure 2.

Innovation in indoor disinfection technologies during the COVID-19 pandemic (2020–2025). The infographic summarizes the innovation pathway from pandemic-driven demand to patents and commercial products, highlighting five key technology domains: ultraviolet-C (UV-C) systems, ozone generators, photocatalytic systems, plasma sterilization, and electromagnetic field applications. UV-C technologies achieved the highest patent-to-product conversion and market penetration, while electromagnetic approaches showed the lowest commercialization rate.

4.1. Innovation Patterns and Market Success Disparities

The dominance of UV-C technologies in both patent activity and commercial success reflects the advantages of incremental innovation over breakthrough research during crisis periods. UV-C systems leveraged existing scientific understanding and manufacturing infrastructure, enabling rapid scaling to meet pandemic demand. Seoul Viosys exemplifies this approach, building upon established LED technology to achieve global market leadership with relatively modest patent portfolios compared to competitors [13]. This pattern suggests that crisis-driven innovation favors proven technologies over novel approaches, regardless of potential theoretical superiority.

Conversely, electromagnetic disinfection technologies, despite representing genuine scientific breakthroughs, faced substantial barriers to commercialization. The innovative Patent US11,083,807 describing orbital angular momentum applications demonstrates sophisticated engineering approaches, yet commercial applications remain limited [21]. Recent validation studies showing electromagnetic wave effectiveness against SARS-CoV-2 virus-like particles provide scientific credibility, but regulatory uncertainty and unproven large-scale applications continue to impede market entry [22].

4.2. Geographic Innovation Efficiency and Execution Capabilities

Geographic analysis reveals striking patterns in innovation efficiency that transcend simple patent volume metrics. China’s leadership in patent quantity (31.0% of global total) did not translate to proportional commercial success, highlighting fundamental disconnects between innovation activity and market outcomes. This disparity suggests that patent accumulation strategies may not optimize commercial value creation, particularly during crisis periods requiring rapid technology deployment.

South Korea’s exceptional performance with minimal patent portfolios indicates that focused innovation strategies prove more effective than broad patent accumulation. Companies like Seoul Viosys achieved sustained global market leadership through concentrated R&D investment and superior execution capabilities rather than extensive patent portfolios [23]. These finding challenges traditional assumptions about intellectual property protection as the primary driver of competitive advantage.

4.3. Regulatory Frameworks as Commercial Success Determinants

The regulatory environment emerged as a critical determinant of commercial success, with technologies benefiting from established safety profiles and regulatory frameworks achieving significantly higher market penetration rates. UV-C systems benefited from decades of FDA guidance and industry standards, facilitating rapid market entry during the pandemic. The FDA’s COVID-19 Prioritized Examination Pilot Program accelerated patent review processes, though commercial approval timelines remained substantial barriers for novel technologies [4].

Safety considerations significantly influenced commercial viability beyond technical performance metrics. The EPA’s restrictive guidance against ozone generator use in occupied spaces effectively limited market penetration despite superior antimicrobial efficacy compared to other technologies [14]. This regulatory constraint illustrates how safety concerns can override performance advantages in determining commercial outcomes. Similarly, plasma sterilization technologies faced complex validation requirements that hindered broad commercial adoption despite excellent laboratory performance and over five decades of development history [19].

4.4. The Patent Quality Crisis and Commercialization Barriers

A critical finding concerns the prevalence of low-quality patents that contribute minimal innovation value. Approximately 67% of identified patents represented incremental modifications rather than genuine technological advances, with many lacking demonstrated functionality. This “patent pollution” phenomenon complicates licensing negotiations, increases due diligence costs, and may actually impede innovation by creating complex intellectual property landscapes around basic technologies. The current patent system’s emphasis on novelty over utility has enabled the accumulation of patents that serve primarily defensive purposes rather than advancing technological capabilities.

The commercialization gap becomes particularly evident when examining institutional performance differences. Corporate applicants achieved 28.7% average patent-to-product ratios compared to 8.2% for university applicants, reflecting different innovation objectives and commercialization capabilities. However, collaborative patents involving both academic and industry partners achieved 47% commercialization rates, suggesting that successful pandemic innovation requires integrated approaches rather than isolated research efforts.

4.5. Successful Models for Bridging the Patent-to-Product Gap

Several international models demonstrate effective approaches to enhancing patent commercialization outcomes. Dubai’s approach through the Mohammed Bin Rashid Innovation Fund and Dubai Future Foundation exemplifies systematic patent commercialization strategies. These institutions operate specialized technology transfer offices that systematically evaluate patent portfolios, connect inventors with manufacturing partners, and provide bridging capital for proof-of-concept development [24]. Their methodology includes rigorous patent quality assessment, market demand validation, and structured industry matchmaking processes.

Singapore’s Agency for Science, Technology and Research (A*STAR) has achieved 40% higher commercialization rates compared to traditional university technology transfer offices through systematic industry engagement and focused patent evaluation mechanisms [25]. Their approach emphasizes early-stage industry collaboration and practical validation requirements that align with the patterns observed in successful COVID-19 patent commercialization.

The European Innovation Council’s Pathfinder program provides another successful model, allocating €3 billion specifically for breakthrough technology commercialization with demonstrated early-stage validation [26]. This approach addresses the funding gap between basic research and commercial development that often prevents high-potential patents from reaching market applications.

4.6. Technology Integration and Hybrid System Advantages

The analysis identified hybrid systems combining multiple disinfection technologies as particularly successful commercialization approaches. These systems achieved 2.1× higher commercial success rates compared to single-technology solutions, suggesting that integrated approaches provide competitive advantages through complementary performance characteristics and reduced single-point-of-failure risks.

Market consolidation patterns differed significantly across technology categories, with UV-C markets remaining relatively fragmented while plasma sterilization concentrated around specialized manufacturers. This difference reflects varying barriers to entry, with UV-C systems requiring primarily manufacturing capabilities while plasma technologies demand complex engineering expertise and regulatory navigation.

4.7. Economic Impact and Innovation Investment Returns

The economic impact extended beyond direct patent licensing revenue, with companies achieving early market entry establishing competitive advantages that persisted beyond the acute pandemic period. Total return on investment averaged 6.5:1 across the $2.8 billion invested in disinfection technology research and development during 2020–2025. However, returns varied dramatically by technology category, with UV-C systems achieving 12.3:1 ROI while electromagnetic systems generated only 0.7:1 returns.

High-value patents representing 8.7% of total filings generated 54.2% of commercial value, emphasizing the importance of quality over quantity in patent portfolios. These patents shared common characteristics including strong intellectual property protection, proven efficacy, established regulatory approval pathways, and demonstrated market demand.

Future research should examine long-term adoption patterns as pandemic conditions normalize and market demand potentially declines with reduced health concerns. International harmonization of disinfection technology standards could significantly influence commercial success patterns across geographic regions. The sustainability of crisis-driven innovation deserves particular attention, as technologies developed under emergency conditions may require adaptation for normal operating environments.

5. Conclusions

The COVID-19 pandemic catalyzed unprecedented innovation in indoor disinfection technologies, generating 1847 patents across five major technological domains and creating an $18.37 billion market by 2025. This analysis reveals fundamental insights into the complex relationship between crisis-driven innovation, patent protection, and commercial success that challenge conventional assumptions about technology transfer effectiveness.

The research demonstrates that patent volume does not predict commercial success. While China dominated patent filings with 31.0% of global applications, South Korea achieved superior market outcomes through focused innovation strategies and superior execution capabilities. UV-C technologies exemplify this pattern, converting 34.2% of patents to commercial products while capturing 69.1% of market value despite representing only 40.2% of patent filings.

The analysis identifies critical factors that determine commercialization success. Technologies with established regulatory pathways achieved 3.2× higher commercial success rates compared to novel approaches facing regulatory uncertainty. Incremental innovations building upon proven scientific foundations consistently outperformed breakthrough technologies, suggesting that crisis periods favor practical solutions over theoretical advances. Industry–academia partnerships proved essential, with collaborative patents achieving double the commercialization rates of isolated university research.

A significant finding concerns patent quality, with 67% of filings representing incremental modifications rather than genuine innovations. This “patent pollution” phenomenon complicates technology transfer processes and highlights the need for systematic approaches to enhance patent utility and commercial viability. Successful models from Dubai and Singapore demonstrate that dedicated technology transfer hubs can significantly improve commercialization outcomes through systematic evaluation, industry matchmaking, and bridging capital provision.

The economic impact extended beyond immediate patent licensing revenue. Companies achieving early market entry established competitive advantages that persisted beyond the acute pandemic period, with total return on investment averaging 6.5:1 across $2.8 billion in research and development expenditure. These findings indicate that crisis-driven innovation can generate substantial long-term economic value when properly channeled through effective commercialization mechanisms.

The study provides actionable recommendations for multiple stakeholders. Innovators should prioritize patent quality over quantity while ensuring early industry engagement and regulatory compliance. Policymakers should establish technology transfer infrastructure similar to successful international models while implementing patent quality assessment mechanisms. Investors should utilize systematic evaluation approaches that consider regulatory pathways and execution capabilities alongside technical merit.

For pandemic preparedness, the findings emphasize the importance of maintaining research capacity in proven technologies that enable rapid crisis response while continuing investment in breakthrough approaches for novel pathogen characteristics. The COVID-19 experience demonstrates that effective innovation requires balancing scientific advancement with practical engineering, regulatory compliance, and commercial execution capabilities.

Understanding these relationships provides valuable insights for innovation policy, technology development strategies, and future pandemic preparedness planning. The analysis offers a unique dataset for examining crisis-driven innovation dynamics and should inform approaches to emergency technology development that ensure life-saving innovations reach the populations requiring them most effectively.

Author Contributions

Conceptualization, F.B.; writing—original draft preparation, F.D., F.B. and M.P.; writing—review and editing, M.P., F.P., F.D. and F.B.; supervision, F.P. and M.P. All authors have read and agreed to the published version of the manuscript.

Funding

The article processing charges (APC) was funded by COC-2-2024-CNR_PNRR MUR –M4C2 (ID S5.P0005; pe00000007; CUPB53C20040570005) project “Tackling Influenza Viruses by optimized hemagglutinin (HA) and/or neuraminidase (NA) inhibitors – HANAIN”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- García de Abajo, F.J.; Hernández, R.J.; Kaminer, I.; Meyerhans, A.; Rosell-Llompart, J.; Sanchez-Elsner, T. Back to Normal: An Old Physics Route to Reduce SARS-CoV-2 Transmission in Indoor Spaces. ACS Nano 2020, 14, 7704–7713. [Google Scholar] [CrossRef] [PubMed]

- Cascella, M.; Rajnik, M.; Cuomo, A.; Dulebohn, S.C.; Di Napoli, R. Features, evaluation and treatment coronavirus (COVID-19). In StatPearls; StatPearls Publishing: Treasure Island, FL, USA, 2020. [Google Scholar]

- Abkar, L.; Zimmermann, K.; Dixit, F.; Kheyrandish, A.; Mohseni, M. COVID-19 pandemic lesson learned- critical parameters and research needs for UVC inactivation of viral aerosols. J. Hazard. Mater. Adv. 2022, 8, 100183. [Google Scholar] [CrossRef] [PubMed]

- U.S. Patent and Trademark Office. COVID-19 Prioritized Examination Pilot Program. Fed. Regist. 2020, 85, 29456–29458. [Google Scholar]

- Gaviria, M.; Kilic, B. A network analysis of COVID-19 mRNA vaccine patents. Nat. Biotechnol. 2021, 39, 546–548. [Google Scholar] [CrossRef] [PubMed]

- Chen, J.; Wang, R.; Gilby, N.B.; Wei, G.W. Omicron variant (B.1.1.529): Infectivity, vaccine breakthrough, and antibody resistance. J. Chem. Inf. Model. 2022, 62, 412–422. [Google Scholar] [CrossRef] [PubMed]

- Fortune Business Insights. UV Disinfection Equipment Market Size, Share & COVID-19 Impact Analysis; Report ID: FBI104107; Fortune Business Insights: Maharashtra, India, 2021. [Google Scholar]

- Grand View Research. Ultraviolet Disinfection Equipment Market Size, Share & Trends Analysis Report; Report ID: GVR-1-68038-267-0; Grand View Research: San Francisco, CA, USA, 2023. [Google Scholar]

- Market Research Future. Ozone Generator Market Research Report- Global Forecast till 2030; Report ID: MRFR/E&P/9396-HCR; Market Research Future: Maharashtra, India, 2025. [Google Scholar]

- Zhang, H.; Kang, Z.; Gong, H.; Xu, D.; Wang, J.; Li, Z.; Wei, B. What, Where, When and How of COVID-19 Patents Landscape: A Bibliometrics Review. Front. Med. 2022, 9, 925369. [Google Scholar] [CrossRef] [PubMed]

- Buonanno, M.; Welch, D.; Shuryak, I.; Brenner, D.J. Far-UVC light (222 nm) efficiently and safely inactivates airborne human coronaviruses. Sci. Rep. 2020, 10, 10285. [Google Scholar] [CrossRef] [PubMed]

- Globe Newswire. Global Ultraviolet (UV) LED Market Report 2020–2025—Sterilization to Significantly Contribute to Market Growth; Globe Newswire: Los Angeles, CA, USA, 2020. [Google Scholar]

- LEDinside. Seoul Viosys Ranked Global No.1 in UV LEDs for Six Consecutive Years; TrendForce: Taipei, Taiwan, 2025. [Google Scholar]

- U.S. Environmental Protection Agency. Will an Ozone Generator Protect Me and My Family from COVID-19? Indoor Air Quality; U.S. Environmental Protection Agency: Washington, DC, USA, 2024.

- Global Market Insights. Ozone Generator Market Size, Industry Research & Forecast Report 2025–2034; Global Market Insights: Selbyville, DE, USA, 2025. [Google Scholar]

- Nakano, R.; Ishiguro, H.; Yao, Y.; Kajioka, J.; Fujishima, A.; Sunada, K.; Takeshi, N.; Akiyo, N.; Yuki, S.; Hisakazu, Y.; et al. Inactivation of various variant types of SARS-CoV-2 by indoor-light-sensitive TiO2-based photocatalyst. Sci. Rep. 2022, 12, 5804. [Google Scholar] [CrossRef] [PubMed]

- Mordor Intelligence. Photocatalyst Market—Growth, Trends, COVID-19 Impact, and Forecasts (2025–2030); Mordor Intelligence: Telangana, India, 2025. [Google Scholar]

- Grand View Research. Photocatalyst Market Size, Share & Trends Analysis Report By Material (Titanium Dioxide, Zinc Oxide), by Application, by Region, and Segment Forecasts, 2018–2025; Grand View Research: San Francisco, CA, USA, 2018. [Google Scholar]

- Fiebrandt, M.; Stapelmann, K.; Dobrynin, D.; Weltmann, K.D. From patent to product? 50 years of low-pressure plasma sterilization. Plasma Process Polym. 2018, 15, 1800139. [Google Scholar] [CrossRef]

- Research Nester. Plasma Sterilizers Market Size, Forecast Report 2025–2037; Research Nester: New York, NY, USA, 2025. [Google Scholar]

- Ashrafi, S.; Pesavento, D.J. Miniaturized Device to Sterilize from COVID-19 and Other Viruses. U.S. Patent No. 11,083,807, 10 August 2021. [Google Scholar]

- Anderson, M.; Lopez, J.; Wyr, M.; Ramirez, P.W. Electromagnetic waves destabilize the SARS-CoV-2 Spike protein and reduce SARS-CoV-2 Virus-Like particle (SC2-VLP) infectivity. Sci. Rep. 2025, 15, 16836. [Google Scholar]

- Lemley, M.A.; Sampat, B. Examiner characteristics and patent office outcomes. Rev. Econ. Stat. 2012, 94, 817–827. [Google Scholar] [CrossRef]

- Dubai Future Foundation. Annual Innovation Report 2024: Technology Transfer and Commercialization; Government of Dubai: Dubai, United Arab Emirates, 2024.

- Wong, P.K.; Ho, Y.P.; Singh, A. Technology transfer and entrepreneurship in Singapore’s universities: A decade of development. Technol. Forecast. Soc. Change 2021, 164, 120509. [Google Scholar]

- European Innovation Council. Pathfinder Programme Guide 2024; European Commission: Brussels, Belgium, 2024.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).