1. Introduction

Reducing the use of synthetic agricultural inputs is a goal shared by commodity farming sectors worldwide due to the harmful consequences agrochemicals have on human health and the environment. The use of bio-inputs is one of the alternatives to agrochemicals whenever innovations provide solutions to replace synthetic fertilizers, pesticides, and herbicides [

1].

Agricultural bio-inputs are biological products developed primarily from microorganisms such as fungi and bacteria that are intended for biological control, nutrition, and alleviation of biotic and abiotic stress in plants [

2]. Bio-inputs have become a fundamental industrial sector underpinning agricultural commodity markets by potentially improving the productivity, quality, and sustainability of crops [

3,

4].

The bio-inputs segment is an ideal indicator for assessing the potential growth of agro-industrial sectors in countries with large agricultural commodity production, such as Brazil. As a proxy for Brazil’s neo-industrialization potential, the bio-inputs segment can reveal the local entrepreneur’s capacity to identify existing opportunities, raise domestic and foreign funds, create alliances with public research centers to license innovations, and invest to compete in the local market.

For decades, Brazil has been enduring a process of deindustrialization and increasing economic dependence on the export of agricultural and mineral commodities [

5]. The industrialization achieved in Brazil in the past has deteriorated over time due to the absence of industrial policies and the combination of high interest rates, lack of investment, overvalued exchange rates, and excessive trade liberalization [

6]. Brazil’s deindustrialization is premature and undesirable for technology-intensive manufacturing subsectors, jeopardizing the country’s scientific and technological development [

7].

With the relative loss of industrial participation in Brazil’s Gross Domestic Product (GDP), commodity agriculture has become one of the main drivers of the economy and fundamental to the country’s trade balance [

8]. In 2024, agribusiness as a whole (including inputs, industry, services, and agricultural production) accounted for 23.2% of Brazil’s GDP, while farming alone (the primary agricultural sector) accounted for approximately 6.6% of the national GDP [

9].

The economic importance of agribusiness stimulates debates on how its growth can create areas of opportunities for Brazil’s development [

8,

10], overcoming the current expansion of commodity production to new agricultural frontiers with high social and environmental costs [

11]. The current situation of a liberal business environment in which Brazil is embedded results in the need for a new vision of development based on opportunities created by dynamic sectors such as agribusiness [

12]. Such a new development approach is even more important in the current global scenario of trade barriers imposed by the United States during the second Trump administration.

To reverse Brazil’s deindustrialization, academic, governmental, and private sector efforts are underway, aiming to establish new development paradigms in which Brazil interacts with the global world through more sophisticated economic sectors that better remunerate capital and labor [

13,

14]. Industrial development requires building capabilities [

15] to produce and export more complex products [

16], taking advantage of existing windows of opportunity [

17]. Countries that have transformed their basic production systems into high-value-added activities have benefited from strategic industrial policies [

18].

Brazil’s new industrial policy, named Nova Indústria Brasil (NIB), was launched in 2023 to pave the road for industrial development by 2033, focusing on neo-industrialization with an emphasis on green and sustainable industry [

19]. The NIB policy includes investments in agro-independent technology to support sustainable agro-industrial supply chains for food, nutritional, and energy safety.

The Brazilian private industrial sector has also invested in innovation to increase productivity [

20]. According to representatives of the Brazilian Agribusiness Association (ABAG), Brazil has the potential to be a leading player in bioeconomy sectors such as agricultural bio-inputs focused on sustainable food production as a means to recover from decades of stagnation in industrial development [

21].

However, existing opportunities for investment in industrial sectors of Brazilian agribusiness are unclear. A crucial challenge is to promote investments by domestic groups in the industrial agricultural inputs segments as a means to overcome the growing hegemony of foreign multinationals in the sector [

22,

23]. Agro-industrial segments tend to remunerate capital and labor better than commodity production on farms, since the industrial sector offers more opportunities for economies of scale and the spillover effects are greater than in agriculture [

24].

This paper aims to assess the opportunities for domestic investments in industrial sectors of the bioeconomy that have local competitive advantages and relatively low entry barriers and can attract both domestic and foreign investments. The overall objective is to analyze how domestic and foreign investments in industrial sectors of agribusiness, particularly in the agricultural bio-inputs segment, represent an area of opportunity for Brazil’s neo-industrialization by meeting the demands of Brazilian farmers for agricultural inputs. Specifically, this study aims to assess:

2. Theoretical Framework

This framework provides the basis for analyzing opportunities for the development of the Brazilian agricultural bio-inputs industry in three subsections: 1. Industrial development theories applied to developing countries that reveal opportunities for neo-industrialization; 2. Characteristics of the Brazilian agribusiness segments with the greatest opportunities for domestic companies investing in industrial sectors; and 3. Opportunities in sectors of the bioeconomy for developing countries like Brazil, particularly in the agricultural bio-inputs segment.

2.1. Development Theories

Development is generally conceived in terms of national or collective projects of structural and social transformation in contexts of subordination to globalized capitalism [

25]. Social scientists from developing countries have played a crucial role in promoting developmental theories, including Development Economics [

26], the Theory of Associated Dependent Development [

27], New Developmentalism [

13], and Neoindustrialization [

19].

Development Economics focused on growth based on protections for domestic industry, which would enable industrialization through import substitution. In Latin America, debates on development economics thrived under the term “Latin American Structuralism,” emphasizing the need to transform economic structures [

28]. Development Economics was the dominant theory of economic development in Brazil between the 1940s and 1960s, remaining influential until the 1980s.

The main criticism towards Development Economics was that it resulted in sectors being privileged by subsidies and state protection, leading to a loss of competitiveness [

29]. Government financial incentives to specific sectors ultimately benefit large companies and elites, with the risk of maintaining businesses that should have already been replaced by innovative ideas. In this sense, the main detrimental flaw of direct government subsidies to specific sectors is that they undermine innovation and creative destruction—the foundations of capitalism [

30].

As an alternative to Development Economics, the Theory of Associated Dependent Development is based on the idea that developing countries, by partnering with developed countries, can benefit from foreign investment to develop. This theory assumes a reconciliation of domestic and foreign interests and a link between development and external dependence, becoming very influential in Brazil from 1980 onward [

31]. Associated dependent development presupposes opening to international markets as a way to attract foreign capital. As a result of this approach, the neoliberalism implemented in Brazil since 1990 was anchored in free markets, trade liberalization, reduced government intervention, and fiscal discipline [

32].

Opening to international markets can attract foreign direct investment, which contributes directly to economic growth through capital and technological accumulation and indirectly through the transfer of technology and knowledge to the host economy [

33]. However, empirical evidence has also shown that the effects of foreign investment are heterogeneous and influenced by factors such as the type of investment, the economic sector, and the capacity of the host economy to benefit from it [

34]. The decisions made by domestic or foreign investors depend on the infrastructural conditions and the political and economic stability of the country receiving the investments [

35].

As an alternative to Associated Dependent Development, the so-called New Developmentalism presupposes a development model based on the export of manufactured goods supported by a competitive exchange rate [

29]. A structural shift toward a more sophisticated industrial base is considered a

sine qua non for an emerging economy to converge with developed economies [

36]. Therefore, New Developmentalism includes creating opportunities for domestic groups to increase their participation in industrial sectors based on long-term policies.

Experiences with New Developmentalism reveal the potential of industrial policies without the need to break with liberal macroeconomic policies [

29]. The government can support entrepreneurs in finding new innovative activities by focusing on activities with the potential to generate positive economic externalities [

36].

The development of an entrepreneurial ecosystem as part of a global value chain requires existing conditions that allow companies to improve their processes and products [

37]. National industrial clusters can benefit from government support for private ventures to enhance technological transformation [

38]. Policies can help to distribute the effects of bio-based innovation among supply chain members and prevent market concentration [

39]. Such an approach matches Brazil’s new industrial policy, Nova Indústria Brasil.

2.2. Characteristics of Sectors with Potential for Investment in Agribusiness

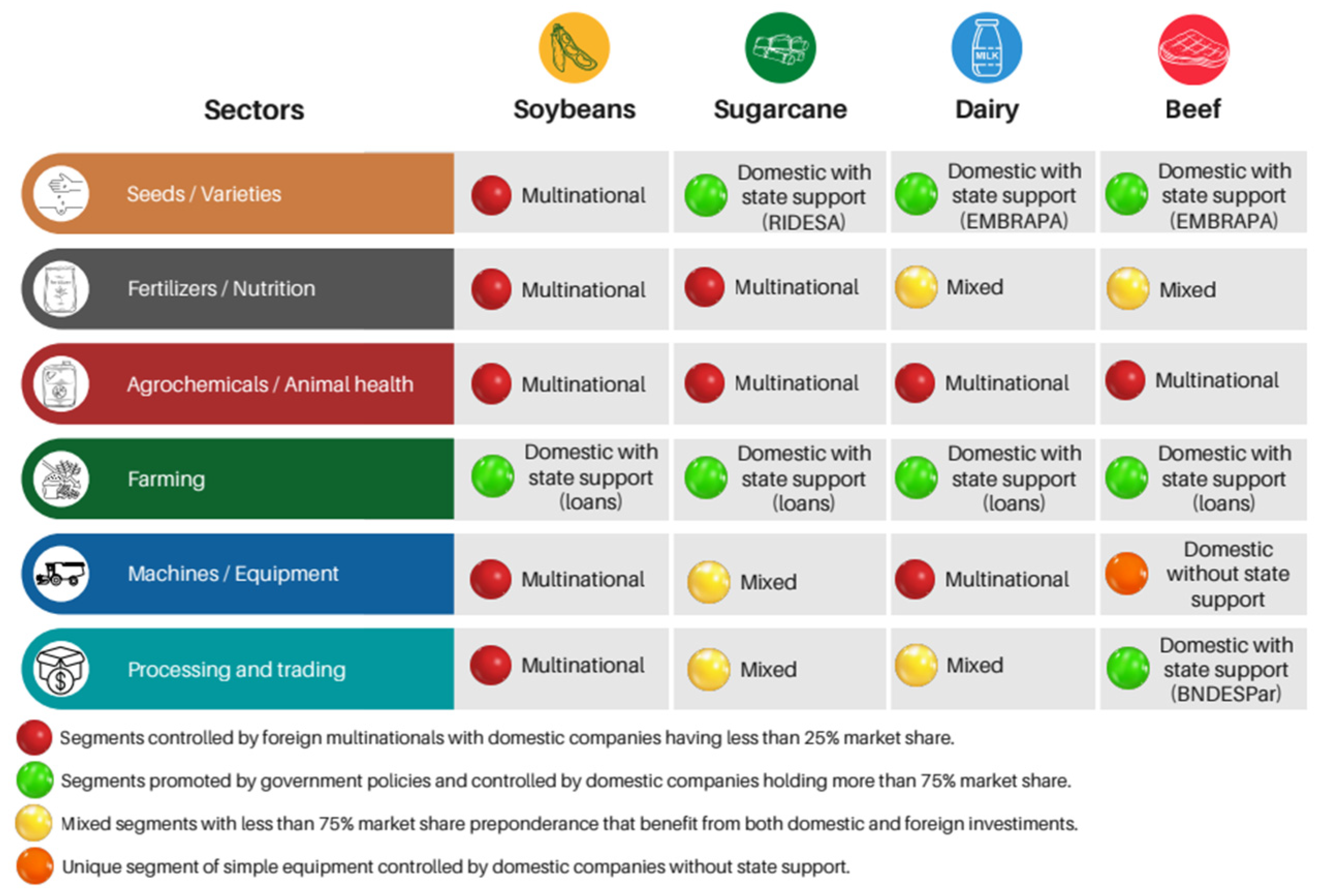

A study of the four main agribusiness supply chains in Brazil (

Figure 1) reveals three main market arrangements in terms of domestic participation: (1) segments with a predominant participation of foreign multinationals, where domestic groups have less than 25% market share (in red in the figure); (2) segments in which Brazilian entrepreneurs hold more than 75% market share, often supported by Brazilian state policies (in green in the figure); and (3) segments that benefit from domestic and foreign investments without domestic or multinational predominance and without significant state intervention (in yellow in the figure) [

40]. Furthermore, there is the case of the equipment segment in the beef supply chain (beige), a segment based on the use of simple technologies with a low entry barrier, which is led by domestic companies without state support.

The segments dominated by foreign corporations encompass the entire soybean chain, except for the farming sector, as well as specific segments of the sugarcane (fertilizers and pesticides), dairy (animal health and machinery), and beef cattle (animal health) supply chains [

40]. The segments with the greatest domestic participation are found in the sugarcane (cane variety development), dairy (pasture seed improvement), and livestock (seeds, processing, and marketing) supply chains, as well as in the farming segment across all supply chains. State investments have been made in technology development (for example, through the Ridesa University Network and the public company Embrapa for the development of sugarcane varieties and pasture seeds, respectively) and in capital for Brazilian companies (for example, through BNDESPar for the meat processing and marketing segment).

In mixed segments, domestic companies compete successfully with foreign companies, often without direct government support. Mixed segments include sugarcane machinery and mills, animal nutrition and milk processing, and beef cattle nutrition. The sugarcane ethanol segment has relatively high levels of government support and a high domestic market share but also a significant foreign presence. These mixed segments meet expectations of attracting foreign investment and, therefore, represent a win-win scenario. Investments in research and development can benefit the supply chain as a whole, not just specific sectors previously directly subsidized by the government.

2.3. Opportunities in the Bioeconomy—Agricultural Bio-Inputs

Industrial development theories reveal opportunities for neo-industrialization based on locally existing opportunities [

15]. In the Brazilian case, the agricultural bio-inputs segment is particularly noteworthy as a potential alternative to the use of synthetic inputs such as chemical fertilizers and pesticides [

41].

Growing market demand for agricultural bio-inputs led to significant technological developments in this area. The global biopesticide market was estimated at USD 6.51 billion in 2022, with an estimated growth of 15.7% through 2029 [

42]. The biofertilizer market in 2022 represented USD 2.02 billion, with an estimated growth of 12.1% through 2029, while the biostimulant market in 2022 represented USD 3.14 billion, with an estimated growth of 11.4% through 2029 [

42].

After product development processes in public research centers and private companies, bio-inputs are becoming widely available to farmers [

1]. Inoculants were the first generation of bio-inputs to have a large-scale market, especially for soybeans in the 1990s [

43]. Particularly since 2015, a new generation of commercial products such as biological fertilizers and biological fungicides has become available on the market, resulting in the current growth of the bio-input segment [

44]. The next generation of bio-inputs is expected to result from the growing market demand for bioherbicides [

45] and developments in biotechnology [

46]. This recent market growth for commodity crops has occurred alongside the increasing demand for organic farming, where synthetic inputs are not allowed [

47].

Brazilian companies and public research centers play an important role in these technological developments, as official records show that both foreign multinationals and domestic private companies lead the way in the number of products registered in Brazil [

48]. Innovation in agricultural bio-inputs represents an opportunity for sustainable development in countries like Brazil, which have a high demand for agricultural inputs [

49]. The country already has agricultural input industries, support from public innovation centers, and policies dedicated to promoting the bio-inputs segment [

50].

3. Methodology

Data published by the Ministry of Agriculture and Livestock (MAPA) were used to identify companies with registered biological products in Brazil. Data on inoculants and biofertilizers were obtained from the Integrated System of Agricultural Products and Establishments (Sipeagro) website (

https://mapa-indicadores.agricultura.gov.br/publico/extensions/Fertilizantes/Fertilizantes.html, accessed on 30 December 2024). In the Reports/Products section, the inoculants and biofertilizers option was selected, generating a list of companies and the number of registered products.

Data for biological control products were obtained from the AgroFit website (

https://www.gov.br/agricultura/pt-br/assuntos/insumos-agropecuarios/insumos-agricolas/agrotoxicos/agrofit, accessed on 30 December 2024). In the “Formulated Products” option, all classes listed as biological were selected, generating a list with the names of the products registered for biological control, their active ingredients, and the companies that registered them. The lists of inoculants/fertilizers and biological control products were combined for analysis purposes.

Companies with registered products and whose email, phone, and/or WhatsApp information was available on their websites were requested to be interviewed for this study. Out of the companies that responded to the survey, representatives of nine Brazilian companies with industrial production of bio-inputs were interviewed.

The interviews with companies’ representatives were conducted between July 2023 and July 2024, either in person or remotely, and lasted for one hour on average. Interviewees were informed that the interviews would not be recorded and their names would not be disclosed. The interview protocol covered information about the companies’ constitution and three main topics: 1. Innovations in biological products, 2. Market information, and 3. Registered commercial products.

To assess the market demand for agricultural bio-inputs in Brazil, interviews were conducted with soybean farmers from the Federal District and surrounding areas and from the municipality of Cristalina, in the state of Goiás. These regions have relatively large-scale farmers (with areas generally larger than 500 hectares), who adopt modern agricultural practices such as soil fertilization and pest and plant disease control, use mechanized systems, and often use irrigation systems [

51]. Considering a 90% confidence level and a 10% error, 72 farmers were sampled from the 1579 crop farmers in Brasília and Cristalina, according to the 2017 Agricultural Census [

52]. The interviews with farmers focused on the adoption of products for plant nutrition and for biological control of nematodes. In the case of plant nutrition, the focus of this study was on the adoption of phosphorus biosolubilizers because they have a greater number of commercial products than other biosolubilizers or plant activators. In the case of nematode control, the focus on the adoption of bionematicides was due to the possibility of replacing chemical nematicides with biological products.

Qualitatively, it is estimated that the two regions studied have farmers with technology adoption rates above the Brazilian average. Therefore, the results allow us to infer the potential for agricultural bio-input adoption by farmers in other regions who may expand their technology levels in the future.

4. Results

4.1. Market Share of Brazilian Companies in the Bio-Inputs Segment

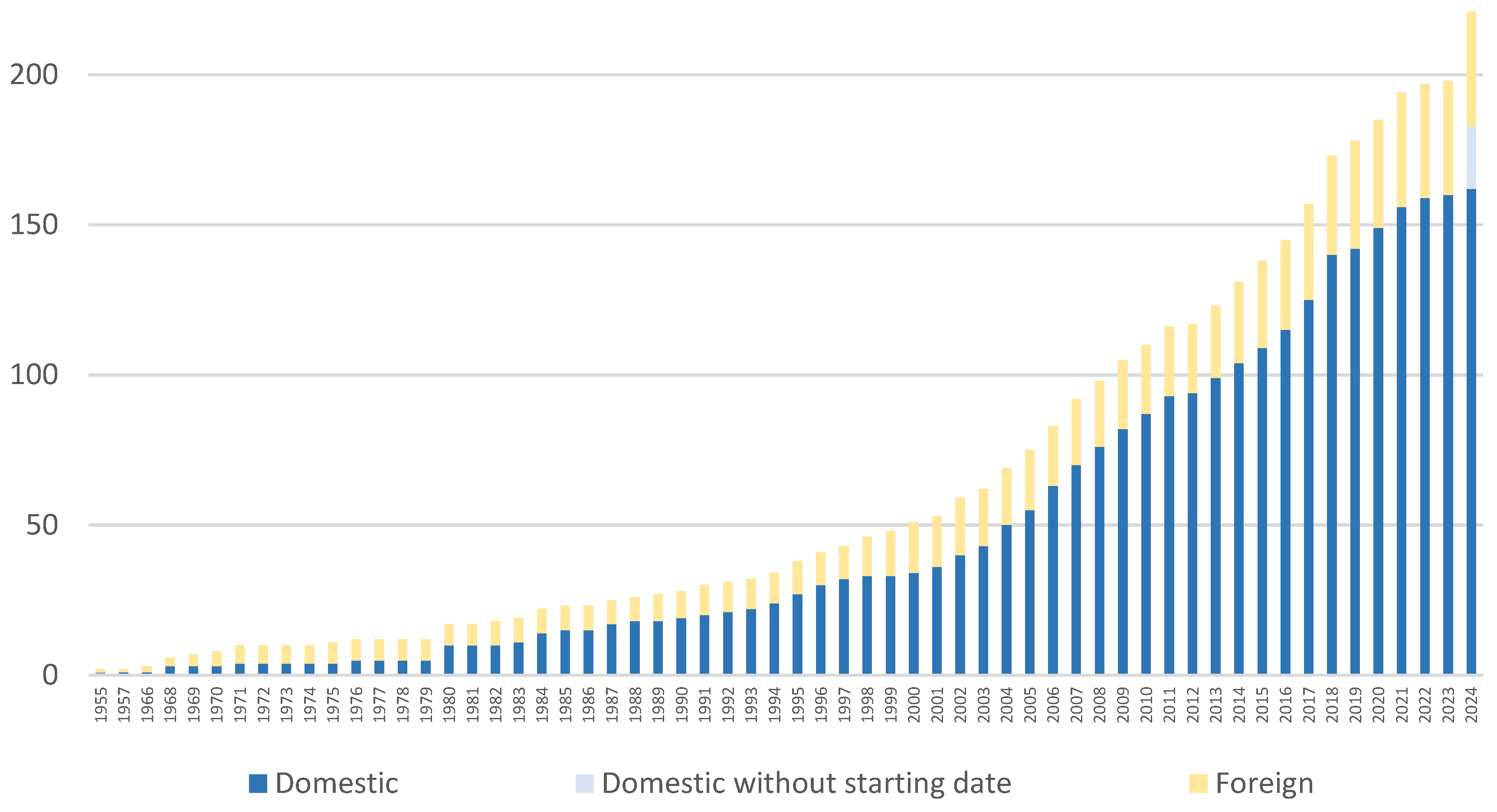

A total of 221 companies had registered 1325 biological products in Brazil by December 2024. Out of the 221 companies with products registered, 183 companies (82.8%) had Brazilian capital in 2024, meaning their owners and investors were primarily Brazilian, and 38 (17.2%) were foreign (

Figure 2). As for the number of products registered by 2024, Brazilian companies had 1020 products (76.9% of the total), while foreign companies had 305 products (23.1% of the total).

In the inoculant/biofertilizer segment, the Brazilian companies Biossíntese, Simbiose, and Vittia stand out with 54, 51, and 50 registered inoculants/biofertilizers, respectively. In biological control products, the Brazilian companies Biotrop/Total (now part of the Belgian company Biobest) stand out with 45 products, Simbiose with 34 products, Vittia with 25 products, Ballagro with 21 products, and VitalForce/Vital Brasil with 17 registered products. Among the foreign companies, Koppert stands out with 51 registered products for biological control. There are new bio-input companies in Brazil that do not yet have registered products, since the registration of products for biological control takes about three years to complete due to the field tests required to prove efficacy.

The company representatives interviewed reported that the first bio-input companies in Brazil focused on inoculants and grew alongside the expansion of soybean plantations in the country. Afterwards, the number of companies producing biofertilizers and biological control products grew. The development of the bio-input market for large-scale crops occurred in parallel with the growing and steady demand for bio-inputs for organic farming.

4.2. Conditions for Establishing Domestic Businesses

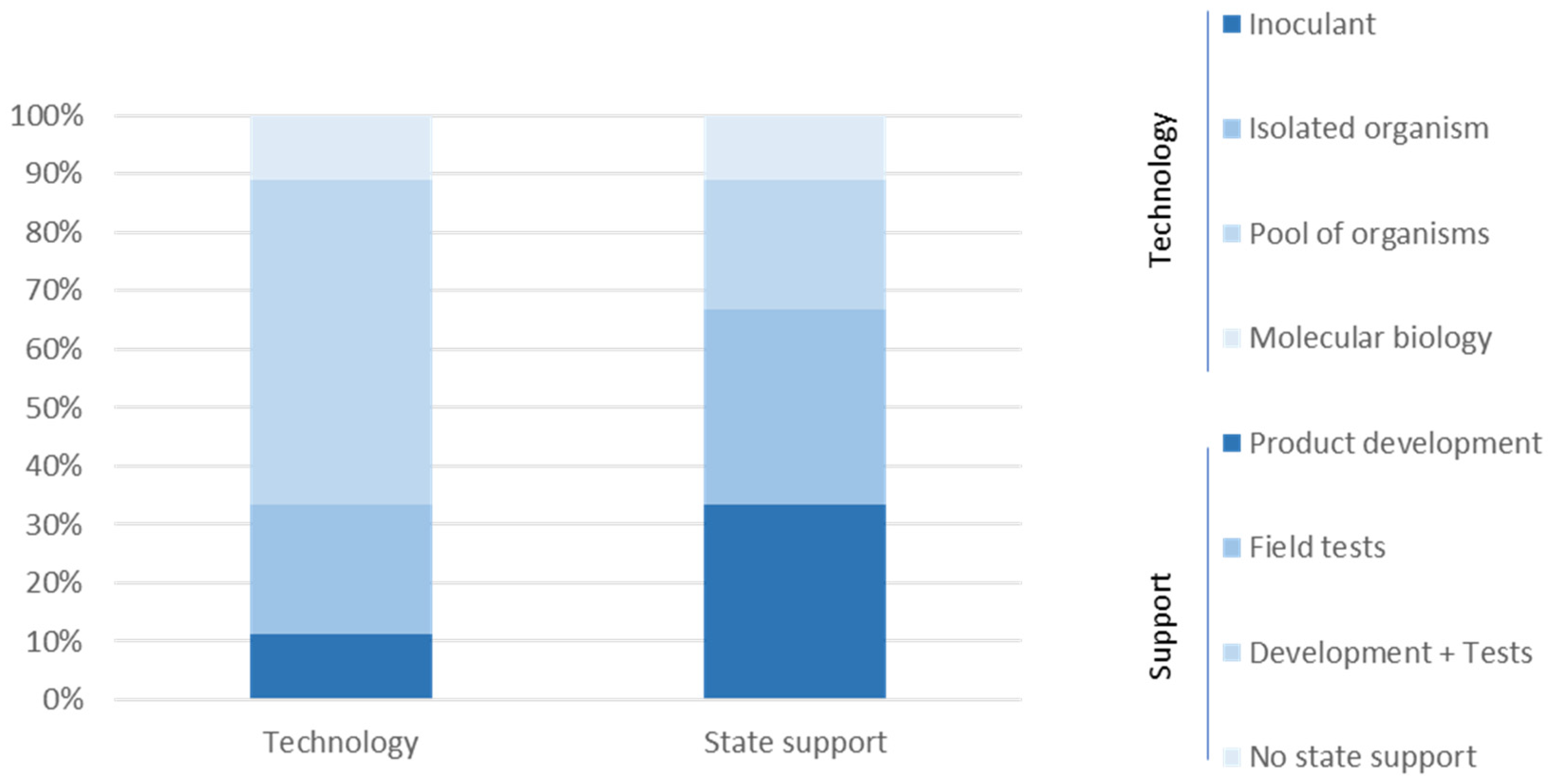

The companies analyzed presented different technological developments for their products, with formulations ranging from inoculants with a single isolated microorganism to biofungicides based on a mixture of selected, isolated, and combined bacteria and fungi (

Figure 3). Some companies also mentioned having products based on nanotechnology, amino acids, proteins extracted from bacteria, and livestock products. Ongoing developments reported by the companies include freeze-drying processes to prepare dehydrated bioproducts and investments in molecular biology to produce recombinant proteins. None of the interviewed companies reported to be working with genetically modified or edited organisms by the year 2024.

The interviews revealed that some characteristics of biological products offer competitive advantages for domestic production. Most companies use bacteria and fungi isolated locally by themselves or national research centers. The relatively short storage period and relatively small scale of sales limit large-volume production, which is of greater interest to large companies. The availability of local inputs for culture media reduces costs with imported raw materials. Equipment such as bioreactors is also available in the local market, often manufactured by Brazilian companies. Patents may be held for the final products and production processes, but not for the live microorganisms, which reduces entry barriers for new companies in the sector with products based on live microorganisms.

While private investment was crucial to the development of commercial products at all companies participating in this study, most of the companies surveyed have, at some point, received support from public innovation centers, whether at universities or research agencies such as Embrapa. Public centers also conducted field trials crucial to product validation, both for registration and commercial purposes. The partnership with public centers is publicized as a commercial strategy since approval by independent public research centers reassures the quality of the products.

While 89% of companies reported some direct support from public research centers for product development, field validation, or development and validation, only one company indicated having completed all of its product development with its own resources (

Figure 3). Support for co-development and field efficacy testing of products was reported by companies as effective contributions from public research institutions. The companies interviewed did not report other forms of support, such as subsidized credit lines.

4.3. Potential Demand from the Domestic Consumer Market

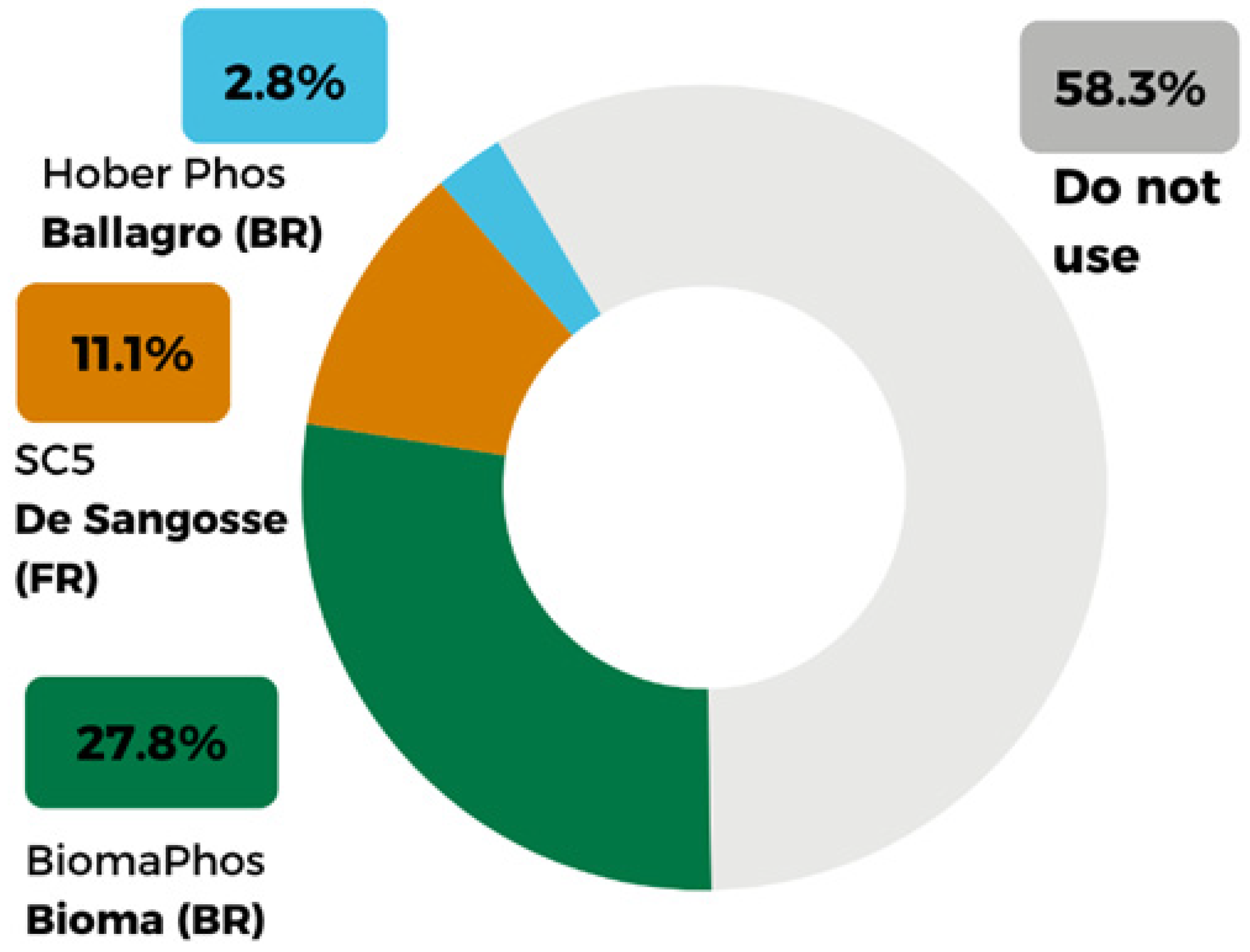

4.3.1. Plant Nutrition—Phosphorus Biosolubilizers

Biosolubilizers are microorganisms that promote the solubilization and mobilization of nutrients from the soil, making phosphorus and other essential elements bioavailable to plants. The results of the field interviews revealed that 41.7% of the interviewed farmers used phosphorus solubilizers and 58.3% did not. The vast majority of farmers used BiomaPhos (from the Brazilian company Bioma), while some farmers reported using SC5 (from the French company DeSangosse) and HoberPhos (from the Brazilian company Ballagro) (

Figure 4). Among the farmers who reported not using biosolubilizers, 11.1% mentioned that they had previously tested but stopped using them, and 88.9% had never used the product.

Among farmers who adopted phosphorus biosolubilizers, the investment ranged from BRL 40.00 to BRL 205.00 per hectare per year. Regarding the degree of satisfaction with the use of biological phosphorus solubilizers, 63% of farmers expressed satisfaction, while 25% were neither satisfied nor dissatisfied, and 12% expressed dissatisfaction. The most prominent factors influencing satisfaction were increased productivity and ease of application. The reported dissatisfaction was due to farmers not seeing results in the field and the perceived high cost. The lack of adequate equipment for applying biosolubilizers was cited as an obstacle to adoption by farmers who did not yet have equipment for targeted spraying of liquid solutions.

4.3.2. Nematode Control

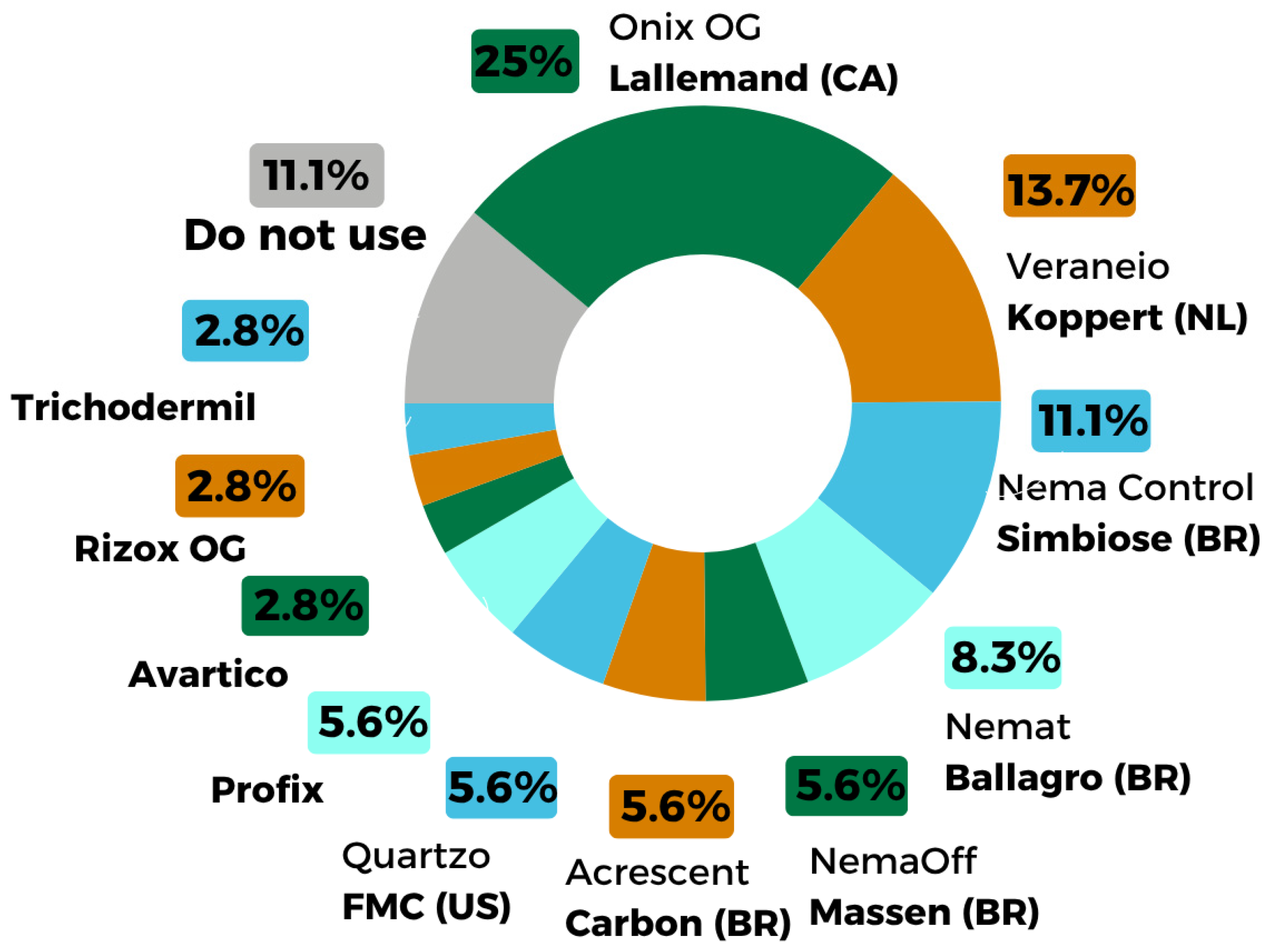

Nematodes are microscopic roundworms found in soil that can be harmful agricultural pests since plant-parasitic nematodes damage roots and stems, causing substantial crop loss. The results revealed that 88.9% of the farmers surveyed used bionematicides, while 11.1% did not (

Figure 5). There is no clear market leader in this segment, and this was the category with the largest number of products competing for market share in the studied areas, with 11 products identified in the survey. Half of the identified products belong to foreign companies and half to Brazilian companies.

Among the farmers who reported not using bionematicides, none had ever tested biological nematode control, and there were no cases of farmers who indicated they had used bionematicides before but then stopped using them.

Farmers’ costs with bionematicides ranged from BRL 25.00 to BRL 115.00 per hectare per year, with one application in all cases where biological products were adopted. Bionematicides are the only segment, besides inoculants, for which farmers reported using biological products instead of chemical ones, particularly in preventative applications, given the ability of biological products to control the population of juveniles and eggs. In cases of already identified infestation, farmers reported that nematode control is often achieved by combining biological and chemical products.

4.4. Bio-Inputs Used as Alternatives to Agrochemicals in Commodity Farming

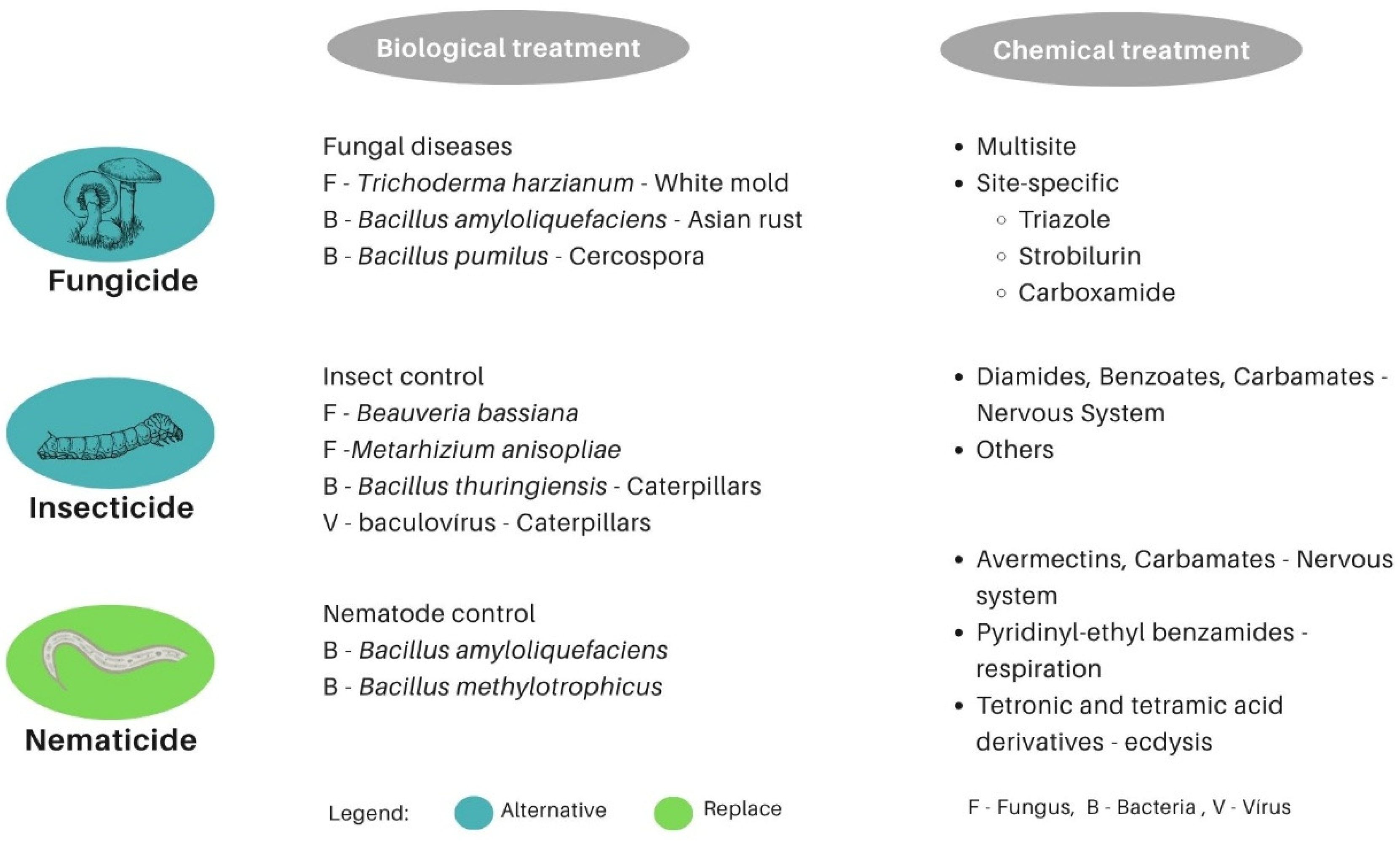

Figure 6 summarizes the biological technologies employed by the interviewed farmers for pest and disease control. Some biological products are used as alternatives to synthetic products, such as biofungicides and bioinsecticides. In these cases, biological products are used to prevent attacks by fungus and insect pests such as caterpillars, allowing the alternation of synthetic and biological applications, with the benefit of reducing the number of synthetic product applications.

Some biological products are used by the interviewed farmers as substitutes to replace chemical inputs. This is the case of bionematicides used to prevent nematode attacks. While biological products can help control juvenile and egg nematode populations, chemical products control juvenile individuals. For this reason, biological products are used to prevent nematode attacks, while chemical products are applied curatively, with little residual effect, and, therefore, are unable to prevent new infestations. Among the farmers interviewed, bionematicides have been used to replace synthetic products in preventing nematode attacks.

Inoculants based on nitrogen-fixing bacteria traditionally replace nitrogen fertilization in most of the soybean plantations made in Brazil. Other biological products are used by the interviewed farmers in addition to chemicals, such as plant activators and nutrient biosolubilizers (biofertilizers), which are applied with the recommendation to maintain chemical fertilization.

5. Discussion

Industrial development in Brazil is being promoted by the New Industry Brazil policy, which is influenced by development theories such as New Developmentalism [

13]. Despite the focus of the New Industry Brazil policy on green and sustainable industry, with emphasis on bioeconomy, the existing opportunities for directing industrial investments in the Brazilian industrial sectors are still unclear.

Innovations in bio-inputs represent an opportunity for bioeconomy-based development [

53] in countries like Brazil that have a high demand for agricultural inputs [

50]. This study revealed that the large market share held by domestic companies in the Brazilian bio-inputs segment was due to the use of technologies accessible to local investors developed in collaboration with public innovation centers.

This first result suggests that fostering neo-industrialization should begin by identifying the sectors most capable of absorbing the benefits of domestic and foreign investments [

17]. These sectors use locally available technologies and have low barriers to entry, such as patent protection, as in the case of bio-inputs based on microorganisms from Brazilian biodiversity. There is also potential in sectors counting on research and development (R&D) carried out by public innovation centers.

In Brazil, the adoption of agricultural bio-inputs by farmers has created an important local market, with adoption rates ranging from 41.7% for biosolubilizers to 88.9% for bionematicides in the studied region. Biological commercial products rely on technologies based on living microorganisms, but ongoing developments such as gene editing, phytovaccines, and nanotechnology may lead to new products that are expected to increase the efficacy, coverage, and adoption of biological alternatives [

1].

A new frontier has recently opened in the Brazilian bio-inputs market on edited organisms and their components. Several strains of edited bacteria with increased nitrogen fixation efficiency are being evaluated for commercial release. Double-stranded RNA (dsRNA) molecules, biosynthesized on a large scale by edited bacteria and yeast, are also being evaluated for their biosafety and efficacy in controlling insect pests, nematodes, and plant pathogens, in a clear effort to reduce plant production costs and the intensive use of pesticides [

54].

Another important point related to the use of gene editing technologies to obtain new bio-inputs is the acceleration of the process for obtaining elite genetically engineered organisms (those that exhibit the desired phenotypes) [

54]. Such technology reduces in vitro production time and production costs and, depending on the editing approach, simplifies regulatory evaluation steps (the most expensive part of the process), significantly shortening the development pipeline for new technologies. One of the most important consequences of this scenario is the proliferation of small and medium-sized development companies that act as developers of new bio-inputs, in addition to the major players [

54].

This second result shows that bio-inputs already represent an important domestic market in Brazil and a key sector for the bioeconomy in developing countries with strong agricultural sectors. These results shed light on opportunities for domestic investments in industrial agribusiness sectors as a proxy for the potential for neo-industrialization in bioeconomy sectors.

However, the survey with farmers was conducted in regions where the level of technology adoption tends to be higher than the national average. Therefore, the results tend to reveal more about the potential adoption than the current adoption levels countrywide. Additionally, for some cases, such as biosolubilizers, the results show that 11.1% of farmers give up after the trial, indicating that the market acceptance is not stable and may vary over time.

As limitations, this study was based on a limited sample of companies and farmers, since the survey was conducted with nine Brazilian bio-inputs companies and 72 farmers in the regions of Brasilia and Goiás. The results reveal that more than 80% of the companies are domestic, but foreign enterprises such as Koppert are ahead in the number of product registrations in the field of biocontrol. Therefore, ongoing market developments and investments may result in important changes in terms of market share in the near future.

6. Conclusions

Bio-inputs have emerged as a key industrial sector in commodity agriculture by potentially improving the sustainability of crops such as soybeans. As a proxy for Brazil’s neo-industrialization potential, the bio-inputs segment reveals local entrepreneurs’ willingness to identify existing opportunities to invest, raise domestic and foreign funds, and establish companies to compete in the local market.

This study revealed that domestic companies hold a large market share in the Brazilian agricultural bio-inputs industrial segment, an achievement that may inform the country’s neo-industrialization policy. By December 2024, 82.8% of companies with bio-inputs registered for commercial use in Brazil were majority-owned by Brazilian entrepreneurs. As an example of an emerging industry, the agricultural bio-inputs segment has some characteristics favorable to greater participation by domestic companies that contribute to Brazilian industrial development:

This study also revealed that the growing domestic market generated by the adoption of bio-inputs by Brazilian farmers enables the growth of the agricultural bio-inputs segment as part of more sustainable commodity supply chains. Brazil already has biological solutions for various farming practices, with adoption rates ranging from 41.7% for biosolubilizers to 88.9% for biological control of nematodes in the studied areas. These results reveal the potential for the adoption of agricultural bio-inputs in other regions that tend to increase the use of technologies over time.

These results reveal that bioeconomy sectors such as agricultural bio-inputs, which leverage local competitive advantages in industrial and technological segments with lower entry barriers (such as capital, technology, and patents) and rely on domestic and foreign investment, represent an area of opportunity for Brazilian neo-industrialization. In the agricultural bio-inputs industrial segment, developing countries with a strong agriculture sector can leverage the domestic consumer market and scientific, technological, and business capabilities to become technology developers and exporters.