Abstract

Using quarterly data for the 2002–2022 period, we estimate the output and inflation effects of several commodity prices (agricultural raw materials, crude oil, and metals) for 8 Eastern European countries with different exchange rate regimes. The Kalman filter is used for estimating the time-varying parameters. Our main findings can be summarized in the following way: (i) higher crude oil prices are inflationary in most of the countries (except Slovakia), with a stronger price effect since 2020; (ii) crude oil prices are neutral with respect to output growth in 4 out of 8 countries, with an expansionary effect in Croatia, Slovenia, and Romania, as well as a contractionary effect in Slovakia, but the crude oil shock of 2021–2022 seems to be expansionary in almost all countries (except Slovakia), regardless of the exchange rate regime practiced; (iii) inflation and output effects of metals prices are quite heterogeneous across countries; (iv) agricultural raw material prices play a role in both inflation and output growth only in Bulgaria and Poland. Since 2021, a growing inflationary impact of crude oil prices suggests a stronger monetary policy reaction to the oil shock, especially in the presence of its favorable output effect.

1. Introduction

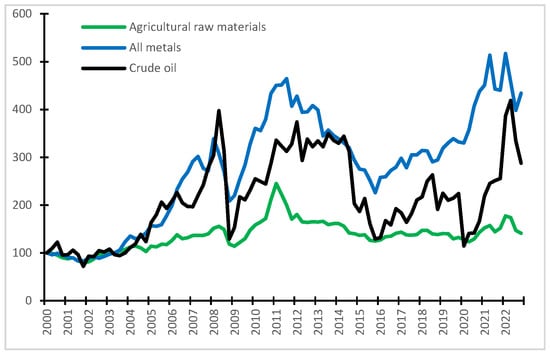

The recent surge in world commodity prices was once blamed for an increase in the inflation rate, with numerous concerns about simultaneous output slowdown (or stagflation) as shown in [1,2]. Although commodity prices have started to decline since the end of 2022 (Figure 1), their consumer price and output effects cannot but attract attention for at least two reasons. First of all, international prices for metals and crude oil remain at historically high levels. Secondly, a new roundabout of commodity price hikes is not ruled out, especially in the context of an increase in the commodity super-cycle. Such an outcome is of interest for the conduct of stabilization policies in the first place, with the macroeconomic effects of abrupt changes in the commodity prices being taken into account. While commodity price hikes of 2021–2022 are often compared with the 1970s oil shocks, the present economic environment is quite different, with alternative energy sources such as natural gas and renewables playing a larger role in electricity generation [3].

Figure 1.

The world commodity prices (index, 2000 = 100), 2000–2022. Source: International Monetary Fund.

Earlier studies demonstrate a strong link between commodity prices and economic growth [4,5], especially in the context of the financialization of commodity markets, which implies links between commodity prices and the stock markets through expectations of dividends and cash flows [6,7]. The world financial crisis of 2008–2009 had not weakened the link between commodity prices and output [8,9], with the phenomenon of financialization of commodity markets still in place [10]. However, there is evidence for the USA that since the middle of the 1980s, oil prices have been affecting the economy indirectly by inducing monetary policy responses [11]. As stressed by Enilov [12], commodity price effects are not confined to the reliance on oil; the proportion of energy-dependent countries and mineral-dependent countries was approximately one-third of all commodity-dependent economies, with the fraction of economies dependent on agricultural commodities declining to slightly above 30%. In the presence of structural breaks, the commodity–growth relationship is not stable over time. As commodity price effects are likely to be time-varying due to numerous factors, such as cleaner energy sources, structural shifts in favor of energy-efficient sectors, changes in the net foreign asset positions, or the policy framework, it implies potential benefits of the time-varying framework.

While it is quite natural to find a significant impact of commodity prices on the commodity-exporting countries, for example [13], although with the ambiguous effects in the long run [14,15], the causal links are not so clear in the case of commodity-importing countries, both in the short run and long run. Under certain circumstances, it cannot be ruled out that an increase in the prices of output-sensitive commodities such as oil is associated with economic growth [16,17], in contrast to other studies [18,19,20]. A mixed impact of oil prices on economic growth is found in 38 OECD countries over the period 2000–2020 [21]. As observed in another recent study, higher commodity prices erode global growth, as the modest growth boost for commodity exporters is only partly offset by the output losses of commodity importers, along with significant inflationary pressures to be born out [2]. The effects are expected to be strongest for food and energy prices.

It is common in the literature to explain commodity price effects by the nature of commodity price shock, structural features of the economy, institutional environment, economic policy framework, or valuation of investment assets. The example of oil shocks indicates that the effects are dependent on the underlying source of the price shift [16]. Also, the positive impact of commodity booms could be offset by the volatility of commodity prices [22]. However, more volatile commodity prices can lead to a significant increase in non-resource growth in democratic countries, with no significant increase in autocracies [23]. For the Central and Eastern European (CEE) countries, it has been found that the reaction to world commodity price shocks is related to the underlying economic structure and the credibility of the monetary policy [24]. In line with the development of the financial markets, capital inflows, and currency appreciation, it is likely that the valuation channel has gained importance in the CEE countries at the cost of the trade channel. There is evidence that oil price shocks have a short-lived impact on current accounts, while exerting a significant effect on net foreign asset positions [25]. As oil importers used to suffer from exchange rate depreciation resulting from the worsening of the trade balance and capital outflows, it exacerbates an output slowdown by a fall in the value of stocks and other assets.

As expected, the commodity prices exert a significant inflationary pressure [26]. Inflationary effects of commodity prices become stronger if individual commodity price factors are used. The application of a factor model with data on a set of 67 advanced and emerging countries for the period 1970–2014 indicates that commodity price shocks can explain between 26% and 38% of inflation fluctuations in the median country. However, the fraction of the inflation variance explained by world commodity shocks falls below 13% in the median country when a single world price is included in the model. In the case of oil prices, several studies find a direct relation to inflation for industrial countries [27], but no evidence of such causality is found in other studies for G20 countries [28] and G7 countries [17].

Although most of the past literature has focused on oil prices and their impact on the US economy, with a current commodity price research network centered on oil prices [29], studies on oil–growth relationships outside the US have been on the increase over the last few years [12]. Studies on the other commodity prices are rather scarce, especially for the CEE countries. Zyra and Shevchuk [30] prove that an increase in the world commodity price index, as provided by the IMF, is complementary to output growth in the Czech Republic and Hungary. For the euro area inflation, it has been found by Peersman [31] that without exogenous food commodity price shocks, inflation would have been 0.2–0.8% lower in the period 2009–2012 and 0.5–1.0% higher in the period 2014–2015. In a study by Borrallo, Cuadro-Sáez, and Pérez [32], empirical results reveal that a temporary increase in food commodity prices by 10% leads to a rise in euro area headline inflation (HICP) of around 0.3 percentage points after 12 months.

The aim of this study is an empirical estimation of several commodity prices (agricultural raw materials, crude oil, and metals) effects on output growth and inflation for 8 Eastern European countries with different exchange rate regimes. It is of interest as the recent increase in commodity prices in 2021–2022 (Figure 1) used to be associated with the inflation surge all over the industrial countries and fears of output slowdown, if not disastrous stagflation, as presented in [33,34]. As an increase in the commodity prices of 2021–2022 has similarities with temporary commodity shocks of 2007–2008 and 2010–2012 implying instability of causal links, it seems to be relevant to study commodity price effects on inflation and output with the use of time-varying parameters (TVP) approach.

Our main findings can be summarized in the following way: (i) higher crude oil prices are inflationary in most of the countries (except Slovakia), with a stronger price effect since 2020; (ii) crude oil prices are neutral with respect to output growth in 4 out of 8 countries, with an expansionary effect in Croatia, Slovenia, and Romania, as well as a contractionary effect in Slovakia, but the crude oil shock of 2021–2022 seems to be expansionary in almost all countries (except Slovakia), regardless of the exchange rate regime practiced; (iii) inflation and output effects of metals prices are quite heterogeneous across countries; (iv) agricultural raw material prices play a role in both inflation and output growth only in Bulgaria and Poland. The paper adds to the literature by presenting the time-varying nature of commodity price effects on inflation and output growth, thus providing some insights into a better understanding of the latest surge of inflation in 2021–2022. Our findings may be useful for the design of stabilization policies in the presence of dependence on commodity shocks.

The rest of the article is structured as follows. The most important theoretical arguments regarding inflation and the output effects of commodity prices are reviewed in Section 2. Data and statistical model are outlined in Section 3. Empirical results are presented in Section 4. A discussion of the results is provided in Section 5. The final Section 6 concludes the discussion.

2. Analytical Framework

Despite substantial skepticism on the causal relationship between commodity prices and output growth as implied by standard open economy models [35], analytical arguments on the link between commodity prices and industrial country inflation were raised as early as the end of the 1970s. Using an open economy model with flexible exchange rates, Van Duyne [36] demonstrated that bad harvests and commodity speculation initially affect prices through asset markets, with trade flows, capital flows, consumption, and the stock of real and financial assets. Since the beginning of the 1980s, analytical preferences shifted towards analysis of the relationship between oil prices and inflation. For example, Bosworth and Lawrence [37] and Beckerman and Jenkinson [38], among others, argued that an increase in the oil price led to a rise in the energy bill for consumers and an increase in unit costs for producers, with a decrease in aggregate demand and a drop in productivity, profits, and investments to follow.

Besides treating commodities as final consumer goods and industrial inputs, Boughton and Branson [39] emphasize the role of expectations in determining movements in commodity prices as a leading indicator of inflationary developments. Based on the equilibrium condition in the money market and the interest rate arbitrage, it is obtained that

where , , and are the logarithms of the price of the manufactured good, the price of commodities, and the supply of the industrial good, respectively, and i is the interest rate. The speed of price adjustment is dependent on the sensitivity of excess demand to commodity prices () and interest rate (), with anti-inflationary pressure provided by the supply of the industrial good. With gradual adjustment of industrial prices, commodities are treated as an inflation hedge. In anticipation of higher inflation, agents buy commodities or commodity futures contracts. These kinds of arguments could be used to explain a potentially destructive feature of the financialization of commodity markets.

However, it has been demonstrated recently by Arango, Chavarro, and González [40] that commodity price shocks are of minor importance if expectations are the main determinant of inflation during the inflation targeting regime. According to the model with an expectations-augmented Phillips curve and a monetary policy rule designed to minimize the costs of output and inflation variability, the inflation process is as follows:

where π is the inflation rate; is the expectations of inflation; is the inflation target; and are the components of commodity prices orthogonal to expectations mechanisms, namely, crude oil and food prices; and are the coefficients on and in the equations for output gap and inflation; θ and δ are the coefficients on output gap and real exchange rate (RER) gap in the Phillips curve; and are the coefficients on real interest rate and RER in the IS curve; and stand for cost-push and demand shocks. Parameter measures the reaction of inflation to the RER gap. As the parameter contains , , it means that the latter appears in the denominator of each coefficient.

Deviations of inflation from the target are caused by deviations of inflation expectations from the target, shocks to commodity prices, and demand and cost-push shocks. As expectations of inflation (), cost-push shocks (), and higher food prices () are unambiguously inflationary, in the case of shocks to oil prices () or structural demand (), the inflationary effect depends on whether the weight of deviations of the exchange rate from its long-run value in the loss function and the parameter linked to the marginal cost in the Phillips curve (βθ) is greater than the contribution to inflation of deviations of the exchange rate from its long-run value in the Phillips curve, the coefficient of RER in the IS equation, and the weights of the gap in the loss function (δαλ). If , higher oil prices or a demand shock could be deflationary.

As reviewed recently by Enilov [12], the commodity–growth relationship is explained by numerous theories that lay stress upon production costs and household welfare. With a focus on commodity-importing countries, the commodity wealth channel implies that higher commodity prices lead to a decline in consumption and, therefore, output slowdown in the economy.

DePratto, de Resende, and Maier [20] developed a semi-structural New-Keynesian model, in which oil price changes have temporary and persistent effects on output through the supply and demand sides of the economy. Temporary demand-side effects of oil prices are modeled with the IS curve, while inflationary effects are captured with the Phillips curve through the supply side. Finally, oil prices generate changes in the potential output, which have a persistent effect on the growth rate. Based on theoretical analysis and empirical results for the United States, Canada, and the United Kingdom, it is argued that energy prices affect the economy primarily through the supply side, with higher oil prices having temporary negative effects on both potential and actual output.

Similarly, Peersman and Van Robajs [16] distinguish between the origin of the oil shocks. If oil demand shocks are driven by global economic activity, a temporary increase in real GDP is expected for both oil exporters and importers following the oil price increase. However, oil-specific demand shocks are contractionary in the short run. On the other hand, adverse oil supply shocks are associated with a permanent fall in economic activity for net oil and energy-importing countries. Improvement in the net energy position over time is likely to bring about a weaker reaction to oil supply and oil-specific demand shocks.

For annual data of the 1970–2007 period, it was found by Cavalcanti, Mohaddes, and Raissi [22] that commodity terms of trade growth enhance real output per capita, with the opposite effect of the volatility of commodity prices. However, the volatility of commodity prices could be a complement to economic growth due to a large increase in net domestic savings [23]. Such a causality is much stronger in democratic countries, while it is not significant in autocracies.

Similar to commodity-producing countries, it is likely that nominal rigidities and financial frictions play a role. As argued by Céspedes and Velasco [13], the transmission of commodity price shocks depends on the exchange rate regime, the development of financial markets, international reserve accumulation, political stability, and the degree of capital account openness of the economy. The output response is smaller for more flexible exchange rate regimes and economies with more developed financial markets. Sufficient international reserves should be helpful in preventing exchange rate depreciation.

Holm-Hadulla and Hubrich [41] proposed a model for two regimes of economic policy, with a focus on the reaction to lower oil prices. In the normal regime, when real households’ income and firms’ profits increase, oil price shocks trigger only limited and short-lived adjustments in output and inflation. In the adverse regime, with the oil price slump becoming entrenched in inflation expectations, oil price shocks are followed by sizeable and sustained macroeconomic fluctuations, with inflation and economic activity moving in the same direction as the oil price. The model emphasizes the wage-price spirals as a dominant channel for the oil price effects. In the case of the euro area, it is argued that an alternative to the interest-rate channel, with falling inflation expectations exerting upward pressure on the long-term real rates, is much weaker.

To sum up, the relationship between commodity prices and macroeconomic variables such as inflation or output depends on the demand-side and supply-side channels, with expectations being an important factor as well. Macroeconomic effects of different commodity prices, such as crude oil or foodstuff, could be different. Under certain structural features, a deflationary effect of higher oil prices is not ruled out. Also, it is possible that commodity price effects for commodity-exporting and commodity-importing countries are not different, with the expansionary effect on output in the case of a price hike. Finally, commodity price effects on inflation and output can evolve over time, reflecting developments in technologies, changes in the institutional environment, monetary regimes, and expectations.

3. Data and Statistical Model

For the purpose of this study, time series for the 2002Q1:2022Q4 sample have been gathered from the IMF (https://data.imf.org/?sk=4c514d48-b6ba-49ed-8ab9-52b0c1a0179b, accessed on 3 August 2023) and FRED databases (https://fred.stlouisfed.org, accessed on 3 August 2023). The following variables are used: , , are the world prices of agricultural raw materials, metals, and crude oil (index, 2016 = 100), respectively; yt is the real gross domestic product (2010 = 100); cpit is the consumer price level (2010 = 100); neert is the nominal effective exchange rate (NEER) (2010 = 100). Consumer price indexes are index numbers that measure average changes in the prices of goods and services over a given quarter. The NEER is defined as domestic currency units per unit of foreign currencies, so that an increase in the value of et represents a depreciation for the home country. Among country-specific controls, several extra variables are used: usratet, the U.S. interest rate (%); investt, investments (% of GDP); opent, openness to foreign trade (% of GDP).

Our choice of controls is quite clear. For the Eastern European countries, consumer price and output effects of the NEER are well documented, for example [42,43,44,45,46,47,48]. For the CEE countries, a positive relationship between openness and inflation is reported by María-Dolores [49] and Shevchuk [48]. At the same time, no impact of openness on output is found in the latter study. As expected, investments contribute positively to output.

Among the Eastern European countries included in the study, the share of energy in total imports ranged from 9.4% in Czechia to as much as 25% in Croatia (Table 1). Imported oils, fuels, and distillation products are used for the production of energy exports, besides being inputs for other products. As expected, the share of energy exports is highest in Croatia, followed by Slovenia and Romania. On average, countries with a floating exchange rate are less dependent on energy imports. According to the World Bank data for the 2002–2014 period, the share of net energy imports as % of energy use fluctuated between 26% and 32% in Czechia, 56% and 60% in Hungary, 12% and 28% in Poland, 23% and 16% in Romania, 43% and 36% in Bulgaria, 64% and 61% in Slovakia, and 51% and 48% in Slovenia (no data are provided for Croatia). Export of metals exceeds import only in Czechia and Slovakia. However, the differences between the value of metals exports and imports are small enough as compared with energy. Except for Slovakia and Slovenia, there is a net surplus in the trade of agricultural goods in most of the countries, especially Bulgaria and Romania.

Table 1.

The share of commodity exports and imports in foreign trade (%), 2022.

Assuming a likely unstable relationship between the world commodity prices and domestic consumer price inflation or output growth, the choice of the state space model estimated with the Kalman filter is quite natural as it works with all available information, such as all the available measurements, knowledge of the system model, and the statistical description of its inaccuracies, noise, and errors. From a theoretical standpoint, the Kalman filter is an algorithm permitting exact inference in a linear dynamical system, where the state space of the latent variables is continuous and where all latent and observed variables have a Gaussian distribution [50]. The Kalman filter algorithm is based on two stages: prediction and measurement update.

Based on standard aggregate demand relationships, the signal equation of the state space model is as follows:

where is the state vector containing consumer prices (or output) at time t; is the vector of observed variables with fixed coefficients (); the matrix Φt−1 represents the state transition between the time periods t − 1 and t; is the vector of observed variables with time-varying coefficients (, , ); Γt is the matrix of coefficients for observed variables; is a white noise error vector; and is the covariance matrix of innovations. Equation (3) describes the dynamics of the system.

Measurements of the system are defined according to the model

where is the vector of measurements, and are the transformation matrixes that map the state vector parameters and the observed variables parameters into the measurement domain, is the vector containing the measurement noise terms for each observation in the measurement, and is the covariance matrix of the measurement errors.

The algorithm of the Kalman filter is recursive [51]. First, the parameters of the predictive distribution of given are calculated as follows (for simplicity, a shorter version of Equation (4) is used):

where is the predictor of state for t, is the signal variance, and is the variance of the state at time t.

Second, the parameters of the predictive distribution of are calculated given :

where is the forecast of the observation at time t, and is the process noise covariance matrix associated with noisy control inputs.

Third, the prediction error and the so-called Kalman gain are calculated as follows:

where is the Kalman gain.

Finally, the estimates for the prediction in t + 1 are derived:

As demonstrated by Equation (8), the predicted state for t + 1 is equal to a weighted average of the predicted state at t and the prediction error of t, with the weight given by the Kalman gain. The recursive nature of the algorithm implies a sequence of consecutive prediction and updation cycles, with the first estimate at t being based on information at t − 1 and the new observation being used to update and improve the prediction. Such a feature means that the Kalman filter utilizes all information contained in previous forecasts and information sets. Such a feature seems to be important for the analysis of commodity price shocks. Specifically, information content could be important in determination of either monetary policy reaction to changes in the world commodity prices or adjustments in the private sector.

For the purpose of our study, all variables are used after taking the first differences of natural logarithms, i.e., , where Δ is the operator of first differences. Time-varying coefficients for the lagged value of inflation (cpit) are modeled as driftless random walks, which can capture various time paths of the parameters. On the other hand, time-varying coefficients for the lagged value of output growth rate (yt) and all predetermined variables are modeled as recursive ones, which implies the relative stability of the relationships. Priors are obtained on the basis of the regression estimates for the 2000–2010 period. Moreover, the estimation started at the observation of 1998Q1, i.e., four years before the estimates are used, so that the estimates have time to converge, regardless of the influence of the priors. The EViews 10 statistical package was used for estimations.

4. Results

Inflationary effects of commodity prices are presented in Figure 2, Figure 3 and Figure 4, with output effects being presented in Figure 5, Figure 6 and Figure 7. Also, exchange rate effects on both inflation and output growth are presented in Figure 8 and Figure 9, along with a brief explanation of other results. As mentioned above, price and output effects of commodity prices are estimated within the time-varying framework of Equations (3) and (4), with a detailed algorithm presented in Equations (5)–(8), while controlling for several variables with fixed coefficients, such as the openness of the economy, investments as the share of GDP, and the U.S. interest rate.

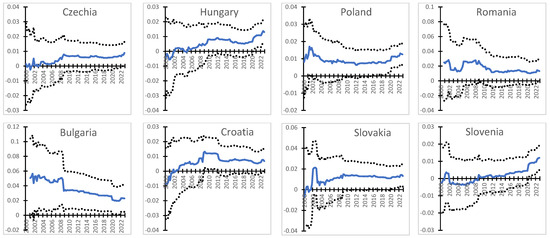

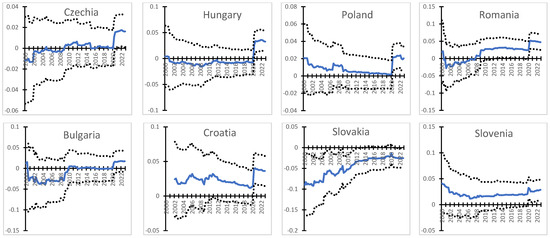

Figure 2.

Inflationary effects of crude oil prices. Note: here and hereafter point estimates are presented within the band of ±2 standard deviations.

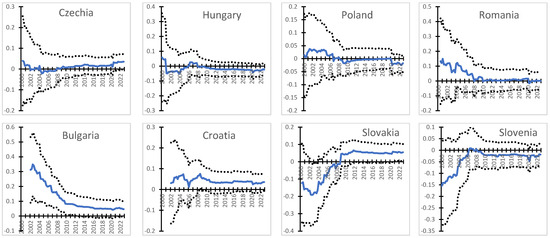

Figure 3.

Inflationary effects of the world metals prices.

Figure 4.

Inflationary effects of the agricultural raw materials prices.

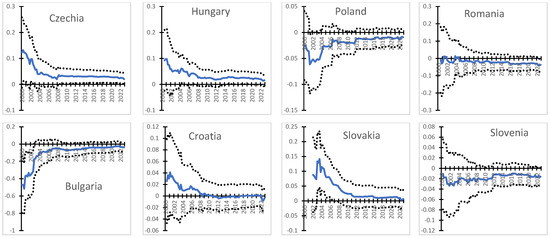

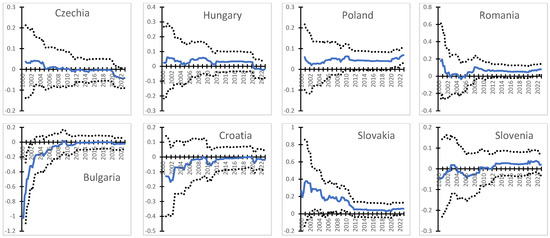

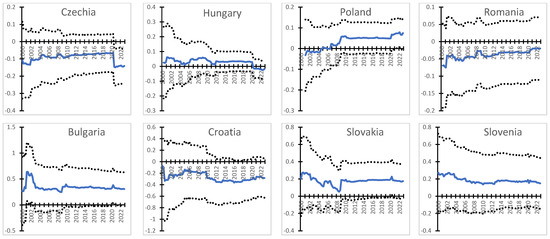

Figure 5.

Output growth effects of the crude oil prices.

Figure 6.

Output growth effects of the world metals prices.

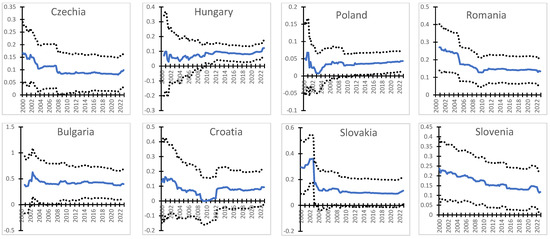

Figure 7.

Output growth effects of the agricultural raw materials prices.

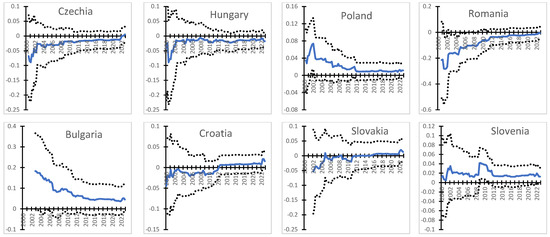

Figure 8.

Inflationary effects of the NEER depreciation.

Figure 9.

Output effects of the NEER depreciation.

4.1. Commodity Price Effects on Inflation

As seen in Figure 2, an increase in crude oil prices has been predominantly inflationary over the last two decades, especially in Bulgaria, Croatia, and Poland. Given its dependence on energy imports, the estimates for Croatia are intuitively appealing. However, Poland is among the countries with the lowest share of energy in total imports (Table 1). Since the middle of the 2000s, the inflationary effect of crude oil prices has become stronger in Czechia, Hungary, Croatia, and Slovakia, while it has been just the opposite in Romania and Bulgaria. For Poland, time-varying coefficients on have gained statistical significance since 2009. Slovenia is the only country that demonstrates neutrality of consumer prices with respect to crude oil prices over the 2002–2019 period, though with an upward trend in the time-varying coefficients on ; however, the effect of crude oil prices on inflation has become statistically significant since 2020. Similar developments have been observed over the 2020–2022 period in Hungary and Poland and on a smaller scale in other countries. It seems that the recent strengthening of the crude oil inflationary effects is not related to the dependence on energy imports. The same conclusion can be drawn with regard to the relationship between the crude oil impact on inflation and the monetary regime. Practicing a floating exchange rate regime does not guarantee insulation from fluctuations in crude oil prices (for example, Poland), while it is not ruled out that domestic prices are neutral with respect to crude oil changes under a fixed exchange rate regime (Slovenia before 2020). As it is shown below, results are not much different in the case of two other commodity shocks.

The inflationary impact of the world metals prices is quite heterogeneous across countries (Figure 3). A surge in the metals prices is unambiguously inflationary in Czechia and Hungary, with the causal link being stable since 2008. For Bulgaria and Poland, higher metals prices had exerted a strong downward pressure on inflation at the beginning of the 2000s, but the effect gradually weakened over time. An inverse relationship between the metals prices and inflation is a recent phenomenon in Slovenia and Romania, which are countries with the highest share of metals in both imports and exports (besides Slovakia).

In contrast to the world crude and metals prices, the inflationary effects of the agricultural raw materials prices are weak (if any) (Figure 4). Higher price for agricultural raw materials was a source of inflationary pressure at the beginning of the 2000s in Bulgaria and Poland, but the effect has been weakening since then in both countries. For Slovenia, there is a short-lived inflationary effect of around the 2008–2010 period. Romania is the only country where higher agricultural raw materials prices contributed to a decrease in inflation over the 2000–2008 period, with neutrality with respect to consumer prices to follow. No dependence of inflation on agricultural raw materials prices can be observed in Czechia, Hungary, Croatia, and Slovakia. There is no evidence that either the share of agricultural goods in foreign trade or the monetary regime plays a role in the transmission of agricultural raw materials price shocks into consumer price inflation.

4.2. Commodity Price Effects on Output

The crude oil prices had been neutral with respect to output growth in Czechia, Hungary, and Poland until 2021, with a strong expansionary effect since then (Figure 5). A similar expansionary effect of the 2021–2022 oil shock can be noticed in Romania, but against the backdrop of the previous expansionary effects established around 2010. Among countries with a fixed exchange rate regime, a similar strengthening of a positive link between crude oil prices and output growth since 2021 is seen in Croatia and Slovenia. For Bulgaria, it is likely that the previous neutrality of oil prices with respect to output growth is being transformed into an expansionary effect. Slovakia is the only Eastern European country where higher crude oil prices contribute to a slowdown in output growth.

Neutrality of output growth with respect to crude oil prices could be considered in favor of insulating property of flexible exchange rates in Czechia, Hungary, and Poland, but this kind of institutional feature has disappeared since 2020. As mentioned above, Romania serves as an example that a flexible exchange rate may not insulate a country from foreign price shocks. On the other hand, estimates for Bulgaria demonstrate that insulation from foreign price shocks could be observed under a fixed exchange rate regime. Also, it is worth mentioning that the directions of the crude oil price effects on output growth are different in other Eastern European countries with a fixed exchange rate.

Positive output effects of higher world metal prices are observed in Bulgaria, Croatia, and Slovakia (Figure 6), all countries with a fixed exchange rate regime. However, the time pattern of the relationship between and is different across the abovementioned countries. For Bulgaria, an expansionary effect of the metals prices was much stronger in the 2000s, gradually weakening by the end of the decade. As for Slovakia, it is just the opposite, i.e., higher metal prices were contractionary at the beginning of the 2000s but then became expansionary. Like the impact of oil prices, an expansionary effect of the metals prices has emerged since 2021 in Czechia, while the outcome has been just the opposite for Poland. There is weak evidence of an inverse relationship between and in Hungary, in continuation of the previous tendency for metals prices to depress output growth. Similar to the output effects of crude oil prices, there is no evidence of any generalizations based on the country-specific shares of metals in foreign trade or monetary regimes chosen.

As seen in Figure 7, higher prices of agricultural raw materials have a persistent stimulating effect on output growth in Poland and Romania (since 2010), with a stronger impact since 2021. In contrast, a negative impact of on has emerged recently in Czechia, with a similar (albeit weaker) tendency in Hungary. Among other countries, an increase in agricultural raw materials prices was detrimental to output growth at the beginning of the 2000s in Bulgaria, while having a significant expansionary impact over the 2001–2010 period in Slovakia (no effect is observed for Croatia and Slovenia). Again, it would be highly speculative to distinguish any specific features of the agricultural raw materials price effects on output growth in relation to different monetary regimes or the share of agricultural goods in exports and imports. For example, Bulgaria has the highest share of agricultural goods in total exports (Table 1), but its output does not react positively to higher agricultural raw materials prices, as is the case in Poland and Romania, both countries with a floating exchange rate regime.

4.3. Other Results

Finally, the NEER effects on inflation and output growth are presented in Figure 8 and Figure 9, respectively. A stable ERPT has been found for Czechia and Romania, but the estimates are low (Figure 8). For Hungary and Poland, the estimates of the ERPT are insignificant for the earlier pre-crisis period of 2000–2008, but it has been positive since then. The ERPT seems to be quite strong and stable in Bulgaria, implying that an exchange rate depreciation of 1% contributes to the acceleration of inflation by 0.4 percentage points. The ERPT of similar magnitude was observed in Slovakia over the 2000–2002 period, but it declined significantly in 2003, with relative stability at 0.1 since then and a slight increase in 2022 (like Hungary). For Slovenia, a downward trend in the ERPT is found throughout the 2000–2022 period, with local increases in 2010, 2014–2015, and again in 2020–2021. As of the end of 2022, the ERPT has decreased to a record low level. There is no evidence of the pass-through in Croatia till 2012. The relationship between exchange rate and inflation strengthened since then, but it is still statistically not significant.

If we consider control for a few commodity prices, the exchange rate depreciation turns out to be expansionary in Bulgaria and Slovakia (Figure 9). The exchange rate effect on output growth is stronger for the former, with a somewhat lower statistical significance in the 2003–2008 period. As of the latter, the impact of on had been on a decline throughout the 2002–2008 period, but the trend reversed on the euro area adoption in 2009. In contrast, Croatia demonstrates that a relatively stable inverse relationship between the exchange rate and output growth emerged around 2010, though with signs of weakening since 2020. No exchange rate effects on output growth are found in Slovenia, Hungary, and Romania. Similar neutrality of the exchange rate with respect to output growth was observed in Czechia till the middle of 2020, but the effect has been contractionary since then.

Among estimates of the fixed coefficients, openness is a factor behind higher inflation in Croatia and disinflation in Slovakia, while the output effects are unambiguously positive in Czechia, Hungary, Croatia, and Slovenia (results are available on request). An increase in the US long-term rate is inflationary in Romania, Bulgaria, Slovakia, and Slovenia. For Bulgaria, it is combined with an expansionary effect on output growth. A similar positive relationship between the US long-term rate and output growth is found in Czechia, with a negative link between and in Hungary (in both countries, estimated coefficients are statistically significant at the 10% level). Investments are complementary to economic growth in Poland and Bulgaria. Crisis developments of 2008–2009 and 2020–2021 have been deflationary in Czechia and Poland, with a contractionary impact on output growth in Hungary, Poland, Romania, and Slovakia.

5. Methods

Based on the quarterly data for the 2002–2022 period, we aimed at detection of the time-varying nature of the relationship between commodity prices and two main macroeconomic indicators, namely inflation and output growth, for 8 Eastern European countries with different exchange rate regimes. For this purpose, the Kalman filter estimates were used. In general, it is proven that commodity price effects on both inflation and output growth could be unstable, especially as it is observed in most of the countries since 2020, or gradually evolve over time, as it is the case in Bulgaria or Slovakia. However, the commodity price effects could be relatively stable for quite a long time span, as it is observed in Czechia or Romania.

6. Discussion

For the Eastern European countries, our findings confirm that the recent surge in commodity prices in 2021–2022 has exerted inflationary pressure, mainly in the context of crude oil prices, which is in line with other studies for industrial countries [27], even though there is evidence in favor of neutrality with respect to consumer prices [17,28]. However, there is no ground for fears of stagflation, as the oil price shock turns out to be expansionary in all countries (except Slovakia), regardless of the exchange rate regime practiced. Such results are in accordance with the study by Zyra and Shevchuk [30], which established a complementarity between higher commodity prices and output growth in Czechia and Hungary. In a wider context, our results are in support of other studies, which indicate a positive relationship between oil prices and economic growth [16,17]. As inflation, output, and the oil price move in the same direction, there is support for the model proposed by Holm-Hadulla and Hubrich [41] with two regimes of economic policy, which differ in the reactions of households and firms to the oil price shocks.

In the spirit of a model proposed by Boughton and Branson [39], a strong price effect of the commodity prices means higher sensitivity of excess demand to both commodity prices and interest rate in the presence of expectations in determining movements in commodity prices. On the other hand, theoretical arguments by Arango, Chavarro, and González [40] imply that commodity price shocks are of minor importance, if inflation is driven mainly by expectations. Although there is a possibility of deflationary impact by higher crude oil prices, in contrast to inflationary effects of other commodity prices, such a phenomenon is not supported by our findings. While it has been confirmed that agricultural raw materials prices could be inflationary in several countries (Bulgaria, Slovenia), similar to findings in the previous studies [31,32], there is no overwhelming support for a hypothesis that inflationary effects of agricultural prices (food) could be as strong as of energy prices [2]. Although non-energy commodities such as metals can be a source of substantial inflationary pressure (Czechia, Hungary), there is consumer price neutrality (Bulgaria, Croatia, Slovakia) or even anti-inflationary effects in other Central European countries (Slovenia, Romania).

Similar to other studies [8,9], it has been found that the world financial crisis of 2008–2009 did not weaken the link between commodity prices and output growth. Commodity price effects on inflation and output are less stable in the case of crude oil prices, while relative stability of the macroeconomic effects by international metals and agricultural raw materials prices has been observed in the post-crisis period since 2010.

As there are several cases of a positive link between commodity prices and output growth, it means that in Eastern European countries, commodity price shocks do not lead to a decline in investments or consumption, as it is customary in other industrial countries due to the negative wealth effect [12]. Higher savings could be another explanation behind the inverse relationship between commodity prices and output growth [22]. Based on the arguments by Peersman and Van Robajs [16], the latest combination of higher crude oil prices and output growth in 2021–2022 can be explained by the realities of oil demand shocks driven by global economic activity. Regarding the domestic economy supply-side effects [20], it is not ruled out that improvement in the net energy position of the Eastern European countries has been responsible for the lack of a standard inverse relationship between higher crude oil prices and output growth.

Our study does not provide enough support for arguments made by Céspedes and Velasco [13] that the output response to commodity prices is smaller for more flexible exchange rate regimes. Until 2020, neutrality of output growth with respect to crude oil prices had been observed for either countries with a fixed exchange rate regime (Czechia, Hungary, Poland), or countries with a fixed exchange rate regime (Bulgaria, Croatia, Slovenia), with an expansionary effect in Romania and a contractionary effect in Slovakia. Later, a uniform expansionary effect is observed in all countries (except Slovakia). The output response to metal prices is stronger under a fixed exchange rate regime, but the response to agricultural raw material prices is stronger for countries with a floating exchange rate regime.

In the presence of commodity price effects, our results confirm the findings of previous studies that the exchange rate depreciation is inflationary [42,43,47,48]. However, there is no evidence of a strong contractionary effect on output growth, contrary to several other studies [44,45,46,48]. In part, different results could be explained by potential differences between the short-term and long-term effects of exchange rates on output. For example, the inverse relationship between exchange rate and output is obtained by estimates in levels [48], which capture the long-term effects.

Directions for future studies are twofold. First, it is of interest to shed light on the transmission channels for commodity price shocks. In this respect, a sectoral analysis of commodity price effects on consumption, investments, exports, and imports, as well as on the stock market, is necessary. Macroeconomic effects could be sensitive to commodity price volatility, which is one of the constraints of the present study. Second, money policy reactions in situations where inflation and output move in the same direction as commodity prices are worth attention. A modeling framework for two regimes of the economic policy described by Holm-Hadulla and Hubrich [41] can be utilized for this purpose.

7. Conclusions

Our study suggests several conclusions which indicate that the macroeconomic effects of commodity prices in Eastern European countries are far from marginal, although with a certain country-specific flavor. First of all, our findings argue in favor of a significant link between crude oil prices and inflation across Eastern European countries (except Slovakia), which has become stronger since 2020. While the crude oil price effect on output growth is a country-specific phenomenon, the oil shock of 2021–2022 seems to be expansionary in almost all countries (except Slovakia), regardless of the exchange rate regime practiced. Second, both inflation and output responses to the agricultural raw materials and metals prices are weaker if compared with the impact of crude oil prices but not marginal. In contrast to the crude oil prices, inflation and output effects of metals prices are quite heterogeneous across countries. Dependence of inflation on the metal prices is observed in the majority of countries, with output effects somewhat weaker. In contrast, agricultural raw materials prices play a role in both inflation and output growth only in Bulgaria and Poland. Third, the inflationary effects of the exchange rate depreciation are similar in countries with floating and fixed exchange rate regimes. There is no evidence of uniform exchange rate effects on output growth.

The findings of the study have several implications for stabilization policies. As a floating exchange rate regime does not insulate from commodity price shocks, especially in the economic environment since 2020, it suggests the feasibility of including commodity prices implicitly into the monetary response function of the central bank. For countries which already are (or would become soon) members of the Eurozone, dependence on commodity prices cannot but imply a wider use of fiscal instruments. In turn, it requires sufficient fiscal space. An open question is whether implementation of the large-scale national energy-saving programs and wider initiatives like the EU Green Deal would bring about the desired insulation from commodity shocks, regardless of the monetary regime and fiscal conditions of the economy.

Author Contributions

Conceptualization, V.S.; methodology, V.S.; software, R.K.; validation, R.K.; formal analysis, R.K.; investigation, V.S.; resources, R.K.; data curation, R.K.; writing—original draft preparation, R.K.; writing—review and editing, V.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created as part of this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ha, J.; Kose, M.A.; Ohnsorge, F. Global stagflation. In Working Paper; Koç University-TÜSIAD Economic Research Forum (ERF): Istanbul, Turkey, 2022; p. 2204. [Google Scholar]

- Igan, D.; Kohlscheen, E.; Nodari, G.; Rees, D. Commodity market disruptions, growth and inflation. In BIS Bulletin; Bank of International Settlements: Basle, Switzerland, 2022; p. 54. [Google Scholar]

- Avalos, F.; Huang, W. Commodity markets: Shocks and spillovers. BIS Q. Rev. 2022, 23, 15–29. [Google Scholar]

- Hamilton, J.D. That is what happened to the oil price macroeconomy relation. J. Monet. Econ. 1996, 38, 215–220. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.V. Forecasting Output and Inflation: The Role of Asset Prices. J. Econ. Lit. 2003, 41, 788–829. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the stock markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Wray, L.R. The commodities market bubble: Money manager capitalism and the financialization of commodities. In Public Policy Brief; Levy Economics Institute of Bard College: Annandale-on-Hudson, NY, USA, 2008; p. 96A. [Google Scholar]

- Tahar, M.B.; Slimane, S.B.; Houfi, M.A. Commodity prices and economic growth in commodity-dependent countries: New evidence from nonlinear and asymmetric analysis. Resour. Policy 2021, 72, 102043. [Google Scholar] [CrossRef]

- Ge, Y.; Tang, K. Commodity Prices and GDP Growth. Int. Review Fin. Anal. 2020, 71, 101512. [Google Scholar] [CrossRef]

- Kang, W.; Tang, K.; Wang, N. Financialization of commodity markets ten years later. J. Commod. Mark. 2023, 30, 100313. [Google Scholar] [CrossRef]

- Hooker, M.A. Exploring the Robustness of the Oil Price-Macroeconomy Relationship. In Federal Reserve Board (FEDS) Working Paper; Federal Reserve Board: Washington, DC, USA, 1999; p. 43. [Google Scholar]

- Enilov, M. The predictive power of commodity prices for future economic growth: Evaluating the role of economic development. Int. J. Financ. Econ. 2023, in press. [Google Scholar] [CrossRef]

- Zyra, A.; Shevchuk, S. Commodity price volatility, output growth and exchange rate dynamics in the Central and Eastern European countries. Res. Pap. Wroclaw Univ. Econ. 2016, 509, 509–520. [Google Scholar] [CrossRef]

- Céspedes, L.F.; Velasco, A. Macroeconomic performance during commodity price booms and busts. In NBER Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 2012; p. 185569. [Google Scholar]

- Collier, P.; Goderis, B. Commodity Prices and Growth: An empirical investigation. Eur. Econ. Rev. 2012, 56, 1241–1260. [Google Scholar] [CrossRef]

- Emara, N.; Simutowe, A.; Jamison, T. Commodity Price Changes and Economic Growth in Developing Countries. In MPRA Paper; University Library of Munich: Munich, Germany, 2010; p. 68678. [Google Scholar]

- Peersman, G.; van Robajs, I. Cross-country differences in the effects of oil shocks. Energy Econ. 2012, 34, 1532–1547. [Google Scholar] [CrossRef]

- Yıldırım, E.; Öztürk, Z. Oil price and industrial production in G7 countries: Evidence from the asymmetric and non-asymmetric causality tests. Procedia Soc. Behav. Sci. 2014, 143, 1020–1024. [Google Scholar] [CrossRef]

- Berk, Y.; Hakan, Y. Energy prices and economic growth: Theory and evidence in the long run. In Working Papers in Economics; University of Economics: Izmir, Turkey, 2013; p. 3. [Google Scholar]

- De Michelis, A.; Ferreira, T.; Iacovello, M. Oil Prices and Consumption across Countries and U.S. States. Int. J. Cent. Bank. 2019, 16, 3–43. [Google Scholar] [CrossRef]

- DePratto, B.; de Resende, C.; Maier, P. How Changes in Oil Prices Affect the Macroeconomy. In Working Paper; Bank of Canada: Ottawa, Canada, 2009; p. 33. [Google Scholar]

- Deyshappriya, D.; Padmakanthi, D.; Rukshan, I.A. Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability 2023, 15, 4888. [Google Scholar] [CrossRef]

- Cavalcanti, T.; Mohaddes, K.; Raissi, M. Commodity Price Volatility and the Sources of Growth. In IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2011. [Google Scholar]

- Arezki, R.; Gylfason, T. Commodity price volatility, democracy and economic growth. In CESifo Working Paper Series; CESifo: Munich, Germany, 2011; p. 3619. [Google Scholar]

- Jiménez-Rodriguez, R.; Morales-Zumaquero, A.; Égert, B. The VARying Effect of Foreign Shocks in Central and Eastern Europe. In CESifo Working Paper Series; CESifo: Munich, Germany, 2010; p. 3080. [Google Scholar]

- International Monetary Fund. World Economic Outlook; International Monetary Fund: Washington, DC, USA, 2006. [Google Scholar]

- Drechsel, T.; Mcleary, M.; Tenreyro, S. Monetary Policy for Commodity Booms and Busts. In Proceedings of the Jackson Hole Economic Policy Symposium, Jackson Hole, WY, USA, 22–24 August 2019; pp. 337–419. [Google Scholar]

- Narayan, P.K.; Sharma, S.S.; Poon, W.C.; Westerlund, J. Do oil prices predict economic growth? New global evidence. Energy Econ. 2014, 41, 137–146. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Ghoshray, A. The dynamics of economic growth, oil prices, stock market depth, and other macroeconomic variables: Evidence from the G-20 countries. Int. Rev. Financ. Anal. 2015, 39, 84–95. [Google Scholar] [CrossRef]

- Zhang, Q.; Hu, Y.; Jiao, J.; Wang, S. Exploring the Trend of Commodity Prices: A Review and Bibliometric Analysis. Sustainability 2022, 14, 9536. [Google Scholar] [CrossRef]

- Peersman, G. International Food Commodity Prices and Missing (Dis)Inflation in the Euro Area. In Working Paper Research; National Bank of Belgium: Brussel, Belgium, 2018; p. 350. [Google Scholar]

- Borrallo, F.; Cuadro-Sáez Pérez, J.J. Rising food commodity prices and their pass-through to euro area consumer prices. Econ. Bull. 2022, 23, 22. [Google Scholar]

- Hofman, B.; Park, T.; Tejada, A.P. Commodity prices, the dollar and stagflation risk. BIS Q. Rev. 2023, 33–45. [Google Scholar]

- Wang, Z. The “Stagflation” Risk and Policy Control: Causes, Governance and Inspiration. China Financ. Econ. Rev. 2023, 12, 48–66. [Google Scholar]

- Diewert, W.E.; Morrison, C.J. Adjusting output and productivity indexes for changes in the terms of trade. Econ. J. 1986, 96, 659–679. [Google Scholar] [CrossRef]

- Van Duyne, C. The Macroeconomic effects of commodity market disruptions. J. Monet. Econ. 1979, 9, 559–582. [Google Scholar] [CrossRef]

- Bosworth, B.P.; Lawrence, R.Z. Commodity Prices and the New Inflation; Brookings Institution Press: Washington, DC, USA, 1982. [Google Scholar]

- Beckerman, W.; Jenkinson, T. What stopped the inflation? Unemployment or commodity prices? Econ. J. 1986, 96, 39–54. [Google Scholar] [CrossRef]

- Boughton, J.M.; Branson, W.H. The use of commodity prices to forecast inflation. In World Economic and Financial Surveys; International Monetary Fund: Washington, DC, USA, 1990; pp. 1–17. [Google Scholar] [CrossRef]

- Arango, L.E.; Chavarro, X.; González, E. Commodity Price Shocks and Inflation within an Optimal Monetary Policy Framework: The Case of Colombia. Monetaria 2015, 203–249. [Google Scholar]

- Holm-Hadulla, F.; Hubrich, K. Macroeconomic implications of oil price fluctuations: A regime-switching framework for the euro area. In Working Paper Series; European Central Bank: Frankfurt, Germany, 2015; p. 2119. [Google Scholar]

- Beckmann, E.; Fidrmuc, J. Exchange rate pass-through in CIS countries. Comp. Econ. Stud. 2013, 55, 705–720. [Google Scholar] [CrossRef]

- Haug, A.; Jędrzejowicz, T.; Sznajderska, A. Combining monetary and fiscal policy in an SVAR for a small open economy. In NBP Working Papers; National Bank of Poland: Warsaw, Poland, 2013; p. 168. [Google Scholar]

- Hsing, Y.; Krenn, M. Effects of fiscal policy and exchange rates on aggregate output in Bulgaria. Socio-Econ. Probl. State 2016, 14, 11–17. [Google Scholar] [CrossRef][Green Version]

- Hsing, Y. Is Real Depreciation Expansionary? The Case of the Slovak Republic. Appl. Econom. Int. Dev. 2016, 16, 55–62. [Google Scholar]

- Hsing, Y. Is real depreciation expansionary? The case of the Czech Republic. Theor. Appl. Econ. 2016, 23, 93–100. [Google Scholar]

- Jimborean, R. The exchange rate pass-through in the new EU member States. Econ. Syst. 2013, 37, 302–329. [Google Scholar] [CrossRef]

- Shevchuk, V. Price and output effects of long-term exchange rate changes: Central and Eastern European countries in 2002–2019. Entrep. Bus. Econ. Rev. 2022, 10, 31–44. [Google Scholar] [CrossRef]

- María-Dolores, R. Exchange Rate Pass-Through in Central and East European Countries. Do Inflation and Openness Matter? East. Eur. Econ. 2009, 47, 42–61. [Google Scholar] [CrossRef]

- Faragher, R. Understanding the Basis of the Kalman Filter Via a Simple and Intuitive Derivation. IEEE Signal Process. Mag. 2012, 29, 128–132. [Google Scholar] [CrossRef]

- Petris, G.; Petroni, S.; Campagnoli, P. Dynamic Linear Models with R; Springer: Berlin, Germany; New York, NY, USA; London, UK, 2009. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).