2. Global Demand and Supply

The potential of lithium has long been known, and during these years, a lot of technology has been developed in its favor. The difference nowadays is that, the price of oil and its transport are at levels that are not environmentally friendly, there is pressure from climate targets that need to be achieved, and there is immense state support and interest from private lenders (banks that have immense resources parked in the ECB waiting for “mobilizing” projects) to start moving on lithium projects, all of which goes through huge mining and mineral purification operations.

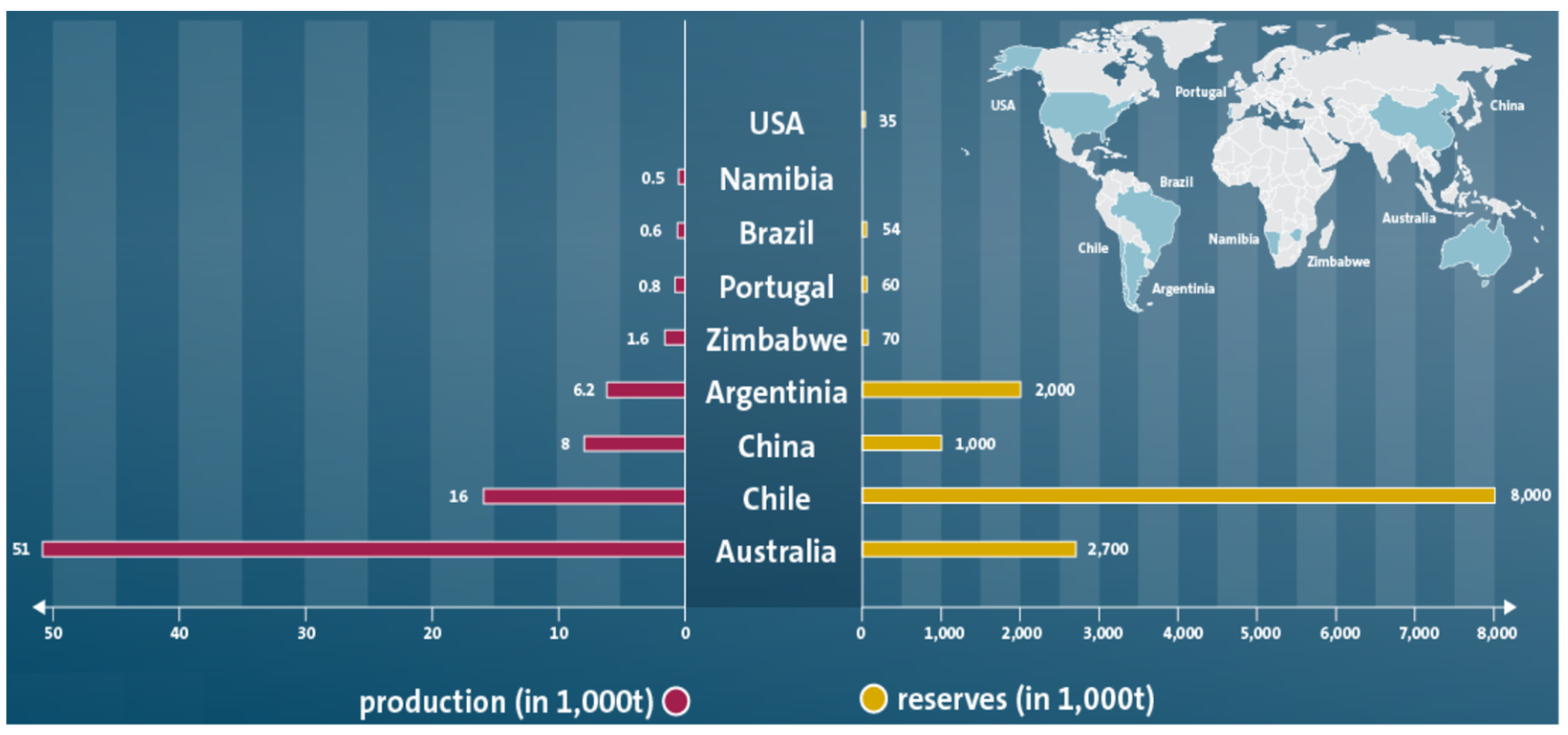

Following Australia, Chile, China, Argentina, Brazil and Zimbabwe, Portugal is 7th in the world with regard to lithium reserves.

Figure 1 illustrates the major countries for worldwide lithium mine production in 2021 (in metric tons) [

2].

Lithium from Australia comes from ore mining, while in Chile and Argentina, lithium comes from salt deserts, so-called salars. The extraction of raw materials from salars functions as follows: lithium-containing saltwater from underground lakes is brought to the surface and evaporates in large basins. The remaining saline solution is further processed in several stages until the lithium is suitable for use in batteries. Chile became a major producer due to the large size of the Salar de Atacama of Northern Chile and the high quality of the lithium brines, which resulted in Chile producing 23% of the world’s lithium in 2019. [

3] review several studies to better understand Chile’s remarkable current and future situation regarding lithium brine production, reserves, resources and exploration. In Bolivia and Chile, tons of lithium in the salt flats gave way to huge fields. The evaporation pools for mineral extraction fill the landscapes with striking colors.

It is possible to observe in

Figure 1 that Brazil, Zimbabwe and Portugal have similar reserve values when compared to the remaining countries. Portugal has been a stable country for decades, far from wars and conflicts. Additionally, Portugal is a European Union country that increases the confidence of other countries to make deals and agreements. These factors increase the role of Portugal and put it in the top three key countries for lithium mining. Some companies proceed with requests to dominate large areas between

Alentejo and

Minho/Trás os Montes, both high mountains in the interior of the country and hills on the coast. After the oil exploration problems in Portugal, the Algarve has been left out of interest from any company.

Lithium is the visible face of the desired change in the energy paradigm, namely, the hope of new profit for companies that find themselves increasingly limited in terms of the sustainability of oil-based mobility. This means large-scale investments and new jobs, of course, and also, once again, a huge financial boost.

Several recent studies have used different methods to estimate whether the lithium production can meet an increasing demand, especially from the transport sector, where lithium-ion batteries are the most likely technology for electric cars. The reserve and resource estimates of lithium vary greatly between different studies, and the question of whether the annual production rates of lithium can meet a growing demand is seldom adequately explained. Hanna Vikström et al. [

4] present a review and compilation of recent estimates of quantities of lithium available for exploitation, and they discuss the uncertainty and differences between these estimates. Additionally, mathematical curve-fitting models are used to estimate possible future annual production rates. This estimation of possible production rates is compared to a potential increased demand for lithium if the International Energy Agency’s Blue Map Scenarios are fulfilled regarding electrification of the car fleet. The study found that the availability of lithium could in fact be a problem for fulfilling this scenario if lithium-ion batteries are to be used. This indicates that other battery technologies might have to be implemented for enabling the electrification of road transport [

4].

With declining ore grades and increasing waste volumes, lithium-ion battery wastes (LIB) are increasingly considered valuable for urban mining for metal recovery and re-use. Although manual sorting and dismantling of LIB waste occurs onshore, in Australia, the valuable components are shipped overseas for processing due to limited onshore capacity to recover the inherent metal values. K. J. Schulz et al. [

1] review LIB recycling in Australia, considering the projections of LIB waste generation, identification of future trends, opportunities and potential for innovation.

Jamie Speirs et al. [

5] examine literature in this area, highlighting the levels of future lithium demand previously considered, pointing to the variables that give rise to the range of outcomes in these assessments and then investigate the ways in which lithium availability is calculated in the literature. The study is based on both lithium demand from electric vehicles and lithium supply from both brines and ore. On the demand side, these variables include the future market size of electric vehicles, their average battery capacity and the material intensity of the batteries. The key supply variables include global reserve and resource estimates, forecast production and recyclability. Jamie Speirs et al. [

5] found that the literature informing assumptions regarding the key variables is characterized by significant uncertainty. This uncertainty gives rise to a wide range of estimates for the future demand for lithium, based on scenarios consistent with a 50% reduction in global emissions by 2050, at between 184,000 and 989,000 t of lithium per year in 2050. However, lithium production is forecast to grow to between 75,000 and 110,000 t per year by 2020. Under this rate of production growth, it is plausible that lithium supply will meet increasing lithium demand over the coming decades to 2050.

Figure 2 [

6] illustrates the major lithium production and reserves in 2019. There are over 39 million tons of lithium resources worldwide. Of this resource, the USGS estimates there to be approximately 13 million tons of current economically recoverable lithium reserves. To help predict where future lithium supplies might be located, USGS scientists study how and where identified resources are concentrated in the Earth’s crust, and they use that knowledge to assess the likelihood that undiscovered resources also exist [

7].

China is a major supplier of rechargeable lithium batteries for the world’s consumer electronics (CE) and electric vehicles (EV). Consequently, China’s domestic lithium resources are being rapidly depleted, and the development of the CE and EV industries will be vulnerable to the carrying capacity of China’s lithium reserves. Xianlai Zeng et al. [

8] find that lithium demand in China will increase significantly due to the continuing growth of demand for CE and the briskly emerging market for EV, resulting in a short carrying duration of lithium, even with full recycling of end-of-life lithium products. With these applications increasing at an annual rate of 7%, the carrying duration of lithium reserves will oblige the end-of-life products recycling with a 90% rate.

There are different types of lithium which exist, and these are:

- -

Brine deposits in which the lithium grade is about 0.1% Li2O;

- -

Hard-rock deposits in which the lithium grade varies from 0.6 to 1.0% Li2O in various Li-bearing minerals.

The brine deposits are recent Li-rich lacustrine evaporates. Arid to hyper-arid climates and high evaporation rates contributed to their formation. The lithium source and enrichment processes are specific to each brine. Geochemistry attributes weathering of felsic rocks and local hydrothermal activity to their formation. North America, western USA, South America, northern Argentina, northern Chile, western Bolivia and China have brine deposits. Hard-rock deposits have different lithium mineralization in magmatic or sedimentary rocks. It is related to endogenous and exogenous processes. Lithium-bearing minerals include micas, pyroxenes, silicates, phosphates, clay, and borosilicate. Spodumene-bearing lithium–cesium–tantalum (LCT) pegmatites are unique to Australia [

9].

3. Research Methods: Prospecting and Exploring Damages and Risks

Geological prospecting is always the first step in the creation and development of any mining project, providing the basis for all decision making with a view to the correct assessment of a mining decision, also including the most common and likely decision, which is its non-viability, whether due to geological, technical, economic, environmental or social factors. It is against all this information that the state, characterized in various aspects, will be able to grant concessions, i.e., to know the details of all mining, processing of ores, environmental impacts, and economic details and to take possession of a mine closure plan, properly supported, which indicates how the territory will be after the completion of exploration.

Despite the damage that can occur in the exploration phase, there are some reasons for prospecting, such as [

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20]:

- -

The country deserves to know your potential mineral resources and primary energy to give them the best use;

- -

The requirement of many jobs and unskilled work, the use of local human resources, and the creation of employment;

- -

Exploitation is economically profitable in Portugal and is critical to the goal of carbon neutrality, according to the Ministry of Environment and Energy of the XXI Transition Government of Portugal;

- -

It has a very positive impact on the quality of life of the people and on the local development of the regions concerned, according to the various local social associations.

There are some risks of prospecting, such as [

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20]:

- -

Endangers the health of populations: thinning dust can cause silicosis, lung cancer and various respiratory diseases, up to several kilometers away;

- -

Consumes large amounts of drinking water per day, in addition to the risk of intoxicating rivers, streams and water supplies used in agriculture; the water supply and the water table will be contaminated, endangering public health many kilometers from farms;

- -

Endangers biodiversity: there are concerned holdings in protected areas such as the World Agricultural Reserve (FAO), Transboundary Biosphere Reserve, the Natura 2000 network, and several National Parks;

- -

Endangers the heritage: there are areas that correspond to the existence of cultural heritage, whether archaeological, historical, architectural, natural, or artistic;

- -

Destroys the water, the mountains and ecosystems;

- -

Destroys existing paths, preventing the mobility of locals and nature lovers;

- -

Brings up minerals and radioactive dust, which cause respiratory problems;

- -

Requires a lot of water per day on the farm;

- -

The social impacts and the local economy of the primary sector, tourism and other services;

- -

The impact on flora and fauna;

- -

The expropriation of land and compensation/income to low values;

- -

Makes noise, due to large explosions and heavy machinery traffic;

- -

Releases sulfides, phosphates and other toxic, going to the water lines;

- -

Causes deforestation, destroying the few trees that still remain in some of these places;

- -

Destroys landscapes;

- -

Promotes alternatives such as the circular economy, accelerates the time at which products move (e.g., to “pay one takes 2” from “is cheaper to buy than repair)," promotes the use of public transport, and stops incentives for the purchase of individual cars (especially electric cars);

- -

Uses natural resources by compromising future generations;

- -

There is no guarantee that there will be any mitigation of impacts generated. Mining companies are likely to go bankrupt or leave the territory, leaving a shivering and unrecoverable environmental liability;

- -

It is changing the quality of rivers sources, causing acidification of waters, accompanied by the dissolution of heavy metals that affect the fish;

- -

Has an impact on the river ecosystem. There are few detailed studies, but some indicate that because of mining activities, rivers were devoid of micro invertebrates and fish after two discharges from abandoned mines. In addition, vertebrates such as the blackbird and least weasel in the Iberian or Mexican desert rivers were severely damaged.

- -

It is not economically profitable in Portugal, and the impact of CO2 emissions from lithium mining undermines the objective of carbon neutrality, according to the environmental association Quercus;

- -

Has a very negative impact on the population’s quality of life and local development in the regions concerned, according to the various local social associations;

- -

Resorts to low-paid labor.

In addition to lithium mining, possible influencing factors include copper mining, tourism, agriculture and climate change. The survey and geological prospecting are always the first step in the creation and development of any mining project, providing the basis for all decision making, with a view to the correct assessment of a mining decision, also including the most common and likely decision, which is its non-viability, whether due to geological, technical, economic, environmental or social factors. The environmental impact study is performed at this stage, after the conclusion of the exploration contract. The environmental impact study is performed by the applicant company and then submitted to various public entities. If the environmental impact study is not approved, the project cannot move forward.

To sustain the lithium industry, one approach would be to develop the collection system and recycling technology of lithium-containing waste for closed-loop lithium recycling, and other future endeavors should include developing the low-lithium battery and lithium optimization industrial structure.

On the other hand, there is the well-founded fear that lithium exploration will destroy the territories, contaminate waterways, burst mountains, leave mines in the open, directly destroy the environment and put an end to sustainable tourism, with unrecoverable hazards [

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25]. On the other hand, recent well-proved positive experiences such as those in Western Australia, where hard-rock lithium mining can be performed in a responsible manner, raises doubt why it cannot be performed in Portugal and other countries.

The experience in Chile still has points to be reviewed and improved. There are always critical reports on the extraction of lithium from salars: in some areas, locals complain about increasing droughts, which, for example, threatens livestock farming or leads to vegetation drying out. It is still unclear to what extent the drought is actually related to lithium mining. It is undisputed that no drinking water is needed for the lithium production itself. What is disputed, on the other hand, is the extent to which the extraction of saltwater leads to an influx of fresh water and thus influences the groundwater at the edge of the salars. To assess this, the underground water flows in the Atacama Desert in Chile, for example, have not yet been sufficiently researched. For the present paper, this discussion about Chile is less relevant because this country uses a completely different mining method than that in the given scope.

Projects in Western Australia are important and use a mining method that can be used in Portugal and in hard-rock mining countries. One of the largest known hard-rock lithium deposits in the world is Wodgina Lithium Project, which commenced operations in April 2017 and, in 2018, commenced an expansion to enable the production of spodumene concentrate and, potentially, lithium hydroxide. On 1st November 2019, Mineral Resources completed the transaction with Albemarle for the partial sale of the Wodgina Lithium Project and established the MARBL joint venture, with Mineral Resources holding a 40% interest and Albemarle holding a 60% interest. As part of the transaction, Mineral Resources received a 40% interest in two 25ktpa lithium hydroxide modules in Kemerton, Western Australia, which are currently under construction [

26]. To cater for the increased production capability, several key non-process infrastructure items have been developed. This includes the installation of long-term water security solutions, an upgrade of the main road intersection, an expansion of the LNG-fired power station and improvements to mine-site communications. A current upgrade project is underway to increase production to 900,000 tons of mixed-grade spodumene concentrate per annum by December 2022. Completed construction includes the expansion of the accommodation village, bulk explosives facility and dry tailings load-out facility [

27]. At the southern tip of Western Australia, around 250 kilometers south of Perth, lies the Greenbushes lithium mine, the world’s largest project to extract the increasingly critical mineral driving the clean energy transition. The operation is owned by Talison Lithium, a joint venture between China’s Tianqi Lithium and US chemicals firm Albemarle. The Greenbushes lithium mine has an estimated 40-year project life, and it stands to provide key energy markets with the resources they need to innovate. The Greenbushes pegmatite deposit intrudes along a major northwest regional fault zone. It is approximately 2525 million years old. The pegmatite consists of a large main zone over 3 kms long and up to 300m wide, with numerous smaller pegmatite dykes and pods flanking the main body. The Greenbushes pegmatites are mineralogical zoned in a lenticular interfingering style along strike and down dip. The lithium zone is over 2 km long and enriched with the lithium-bearing mineral spodumene, which often makes up 50 percent of the rock. The Greenbushes pegmatite has unique features that distinguish it from many other rare-metal pegmatites [

28].

Lithium mining generates inhalable and respirable dust particles. Transportation, stockpiling, grinding, and ore processing which involves crushing and screening generate dust. Effective dust control management plans focus on the elimination of dust at its source. Dust generated during crushing and screening exposes lithium mine workers to silica. Inhaled silica can settle in the alveolar region of the lungs. This triggers conditions such as silicosis and lung cancer in the long term. The onus lies on the mining company to extend its duty of care. It is important to factor in dust suppression measures that have a no-compromise approach to air quality. Stockpile dust control at the port ensures non-exposure of nearby water bodies to the lithium dust which might end up disturbing the marine ecosystem. Haul mine roads are the backbone of daily mining operations, and haul road dust suppression is critical for service delivery to meet business targets related to operational objectives of lithium mines in Australia.

4. Impact analyses in Portugal and legislation evolution

The desirable long-term profit in a new energy source that either replaces the paradigm of carbon and fossil fuels, following the pandemic, with a huge wave of public incentives within the so-called mobilizing agendas of the Recovery and Resilience Plan. The importance of reserves and the geopolitical stability puts Portugal in the spotlight worldwide.

The high investments associated with the installation of a mine requires the careful management of risks associated with the business [

25]. This includes careful geological exploration research, detailed analysis, the review and modeling of technical data on the indicated resources, and the study of alternative mining scenarios to exploit such resources in order to prove it as a reserve. An example of the process of “resource-to-reserve definition” can be found in [

29]:

- -

Reserves are based on a scheduled resource, ensuring that the planning discipline is integral to the process;

- -

Appropriate mine design and layouts are applied to the resource areas, as dictated by current mining methods and mine design criteria, to derive a mineable resource;

- -

The mineable resource is scheduled according to production requirements to develop a scheduled resource;

- -

Only current operations (level 1), approved projects in execution (level 1e) and projects in the feasibility study (level 2a) included in the business plan are defined as reserves (in Proved and Probable categories according to SAMREC);

- -

The remaining scheduled area of the Life of Mine (LOM) plan is termed scheduled exclusive resource and includes projects from Level 2b, 2c, and Level 3, with the objective of optimally extracting the available resources.

- -

Resource categories have been increased to cater for exclusions and confidence levels (e.g., mineral resources above the geothermal gradient cut-off are moved to mineral inventory);

- -

The introduction of mining losses pertaining to resources left in pillars; the mineable resource excludes material locked up in mine-design-related pillars;

- -

Uneconomic production plan ‘tails’ revert to mineral resource or mineral inventory (depending on position in plan) through a ‘tail management’ process;

- -

The scheduled reserves are multi-discipline, peer reviewed and signed off by the competent person(s).

The application of modifying factors (technical, mining, geotechnical, processing and recovery, legal, market, and social/government factors) is implemented in three distinct phases:

- -

Mine design and scheduling: those modifying factors that impact on dilution of the resource (i.e., stope width versus resource width, tertiary development and other waste mining performed on the reef horizon, etc.) and modifying factors that define mining losses (i.e., non-mineable pillars and RIH/RIF mining inefficiencies, etc.) are applied to the criteria included in establishing the mine design and scheduling;

- -

Processing: those modifying factors that influence the efficiency of processing and recovery are applied to the scheduled resource, and the result is a mineable reserve;

- -

Economic: the subsequent application of modifying factors that influence the economic aspects of the mining operation results in the tail management requirement.

All of this process is required for the disclosure of mining projects and is mandatory to adhere to reference standards such as the Australian JORC [

30], the South African SAMREC [

31], or the Canadian NI 43-101 (2011) [

32]. Nevertheless, all this initial preparation work is highly costly. While being largely diffused in a standardized manner in large-scale mining, with large investments applied and state-of-the-art technologies employed, when dealing with small-scale mining (SSM), the exploratory and modeling phases are generally neglected due to a lack of capital [

33].

The opinions are divided, and the actual studies in Portugal are few, leaving the reasons and risks of exploration only theoretical but expected to be more are listed before. Despite concerns of irreversible environmental damage, licenses to search for lithium in other parts of the country have already been granted. With the conclusion of the environmental assessment for the areas of inclusion and the initiative to judge through the assessment, the Portuguese government researched and published a set of documents that rejected two regions for prospecting and authorized six regions: Environmental Declaration [

34], Non-Technical Summary [

35], Lithium Prospecting and Research Program [

36], Sheets of the 6 areas of Lithium PP [

37], Environmental Report [

38] and Environmental Report Annexes [

39].

Around the world, there are some experiences that allow us to say that the damage of lithium minning is similar to that of quarrying. Across Portugal, some lithium exploration was allowed until 2018. From this date on, the entire process of lithium mining in Portugal was subject to a new mining law that started to be presented in 2015. The new legal framework for the activities of revealing and exploiting existing geological resources in the national territory, a 2015 legislation that was only regulated in May 2021 after a long process of public consultation and subsequent approval by the Council of Ministers, was amended eight months later, as a result of the parliamentary review held in November last year. The changes to the rules of the mining sector come, above all, to reinforce the environmental protection of the explored areas, introducing more conditions to the attribution of rights and preventing the attribution of prospecting rights when unfavorable opinions are issued. It becomes mandatory, for example, to carry out an environmental impact study with a favorable opinion so that the exploitation rights are attributed, even when the project in question occupies an area below the limit provided for in the environmental impact assessment legislation. In addition to the environmental impact, the promoter will also have to present a social impact assessment to analyze local communities’ perspectives, anticipate points of conflict, clarify public benefits and identify strategies for involvement and collaboration. On the other hand, protected areas, namely, those that are part of the Natura 2000 Network or the National Network of Protected Areas, among others, are now definitively excluded from the proposals for areas to be submitted to a public tender procedure that are presented by the Directorate-General for Energy and Geology (DGEG). The law formulated by the government only defined that the DGEG should, whenever possible, exclude these areas from its proposals. As already provided for in the approved law, the municipalities and all entities with territorial competences whose territory is covered by mining operations will be consulted before proceeding with any project, having to issue opinions on the initiatives in question. However, there were consequences of a negative opinion change: in the law elaborated by the government, it was foreseen that in the face of a negative opinion, the DGEG could reject the exploration request, change the area object of the request or proceed with the procedure, maintaining the area initially proposed by the interested party, regardless of the negative opinion. This last possibility was revoked, so that, with a negative opinion from the local authorities or other competent entities, a mining exploration project can no longer proceed. The obligation to draw up an energy efficiency plan for the operation aimed at minimizing consumption is also established, as well as the integration of renewable electricity production technologies and measures to mitigate greenhouse gas emissions. Another of the changes to the law approved by the government concerns the destination of the revenues collected from the fines for violating the Mines Law. The initial diploma provided that the proceeds of the fines imposed for the practice of administrative offenses would be allocated as follows: 60% to the state coffers, 10% to the taxing entity and 30% to the DGEG. In the amended law, the distribution is more balanced: 25% for the state coffers, 25% for the municipalities where the infractions occur, 25% for the DGEG, 20% for the Geological Resources Fund and 5% for the entity court. In the case of very serious offences, the fines vary between EUR 1500 and 3500, in the case of natural persons, and between EUR 15,000 and 44,000, in the case of legal persons. In the case of serious offences, fines vary between EUR 1000 and 3000 for natural persons and between EUR 10,000 and 30,000 for legal persons.

In summary, the mineral deposit legislation is: [

40]

- -

Law nº 54/2015, of 22 June: Basic law of the legal regime for the disclosure and use of geological resources existing in the national territory, including those located in the national maritime space.

- -

New Decree-Law No. 30/2021, of 7 May: Regulates Law No. 54/2015, of 22 June, with regard to mineral deposits.

- -

Decree-Law nº 162/90, of 16 March: General Regulation on Safety and Hygiene at Work in Mines and Quarries.

- -

Ordinance No. 198/96, of 4th June: Regulates the minimum safety and health requirements in the places and jobs of the extractive industry in the open or underground.

- -

Decree-Law nº 376/84, of 30 November: Establishes the regulation on the licensing of establishments for the manufacture and storage of explosive products.

There is also supplementary legislation: [

40]

- -

Without prejudice to the existence of other legislation in force, there are some of the most relevant diplomas, connected with the activity of mineral resources.

- -

Decree-Law No. 198-A/2001, of 6 July: Establishes the legal regime for granting the exercise of the activity of environmental recovery of degraded mining areas.

- -

Decree-Law no. 152-B/2017, of 11 December: Legal framework for environmental impact assessment (EIA).

- -

Decree-Law no. 31/2013, of 22 February: Makes the first amendment to Decree-Law no. 10/10, 4 February: Legal regime to which the management of waste from mineral deposits and mineral masses is subject.

- -

Decree-Law nº 80/2015, of 14 May: Legal Regime of Territorial Management Instruments.

- -

Regulatory Decree 15/2015, of 19 August: Establishes the criteria for classifying and reclassifying the soil, as well as the qualification criteria and the categories of rustic and urban soil according to the dominant use, applicable to the entire National territory.

In Europe and Asia, regulations or policies to enforce or encourage product stewardship are lacking, with small recycling schemes targeting only consumer behavior, and voluntary actions of manufacturers and distributors. It is against all this information that the state will be in a position to grant concessions, i.e., to know the details of all mining, processing of ores, environmental impacts, and economic details and take possession of a mine closure plan, properly supported and that indicates how the territory will be after the completion of exploration. The next chapter presents the reasons and risks of exploration that more are listed. Interestingly, the last three of each of them are contradictory [

41].

5. Projects and Licenses in Portugal

Portugal is a member of the European Union. The European Union’s commitment to green energy for a sustainable, decarbonized and fully integrated EU energy system is well understood by their Priorities for 2019–2024 in the energy sector [

42] and National energy and climate plans [

43]. Additionally, the transition to electric vehicles for road transport, reducing CO

2 emissions from vehicles, is related to the increased need for lithium. Passenger cars and vans (‘light commercial vehicles’) are responsible for around 12% and 2.5% of total EU emissions of carbon dioxide (CO

2), respectively, which is the main greenhouse gas. On 1 January 2020, Regulation 2019/631 [

44] entered into force, setting CO

2 emission performance standards for new passenger cars and vans. It replaced and repealed the former Regulations (EC) 443/2009 [

45] (for cars) and (EU) 510/2011 [

44] (for vans).

The regulation sets EU fleet-wide CO

2 emission targets applying from 2020, 2025 and 2030 and includes a mechanism to incentivize the uptake of zero- and low-emission vehicles. As the new target started applying in 2020, the average CO

2 emissions from new passenger cars registered in Europe have decreased by 12% compared to the previous year, and the share of electric cars has tripled [

46].

On 14 July 2021, the European Commission adopted a series of legislative proposals setting out how it intends to achieve climate neutrality in the EU by 2050 [

47], including the intermediate target of at least a 55% net reduction in greenhouse gas emissions by 2030 [

47]. The package proposes to revise several pieces of EU climate legislation, including the EU ETS, Effort Sharing Regulation, and transport and land-use legislation, setting out in real terms the ways in which the Commission intends to reach EU climate targets under the European Green Deal.

A European lithium-ion battery industry is another major focus of the European Union [

48,

49,

50,

51,

52,

53,

54,

55,

56].

With the potential to have the largest reserves in Europe, less lithium arrived in Portugal, where there were two dozen prospecting requests this year, although mining companies are still awaiting the competition promised by the government. In addition to the urban spaces and municipal ecological structures, the polygynous prospecting and proposed research overlaps very relevant areas of other natural resources, such as agriculture, national agricultural reserve, forestry, agroforestry, water, national nature reserve, but also areas of asset protection heritage listed and inventoried and areas with very significant tourism potential. Estimates suggest that domestic lithium reserves stand at around the 60,000 metric tons, while the actual number is unknown, although not all the areas where you can find this metal have been studied, namely, those concentrated in the center and north of the country. If confirmed, Portugal would be among the countries with the most deposits in the world, though far removed from the five giants, Bolivia, Chile, China, Australia and Argentina, where reserves are counted in millions of metric tons [

57].

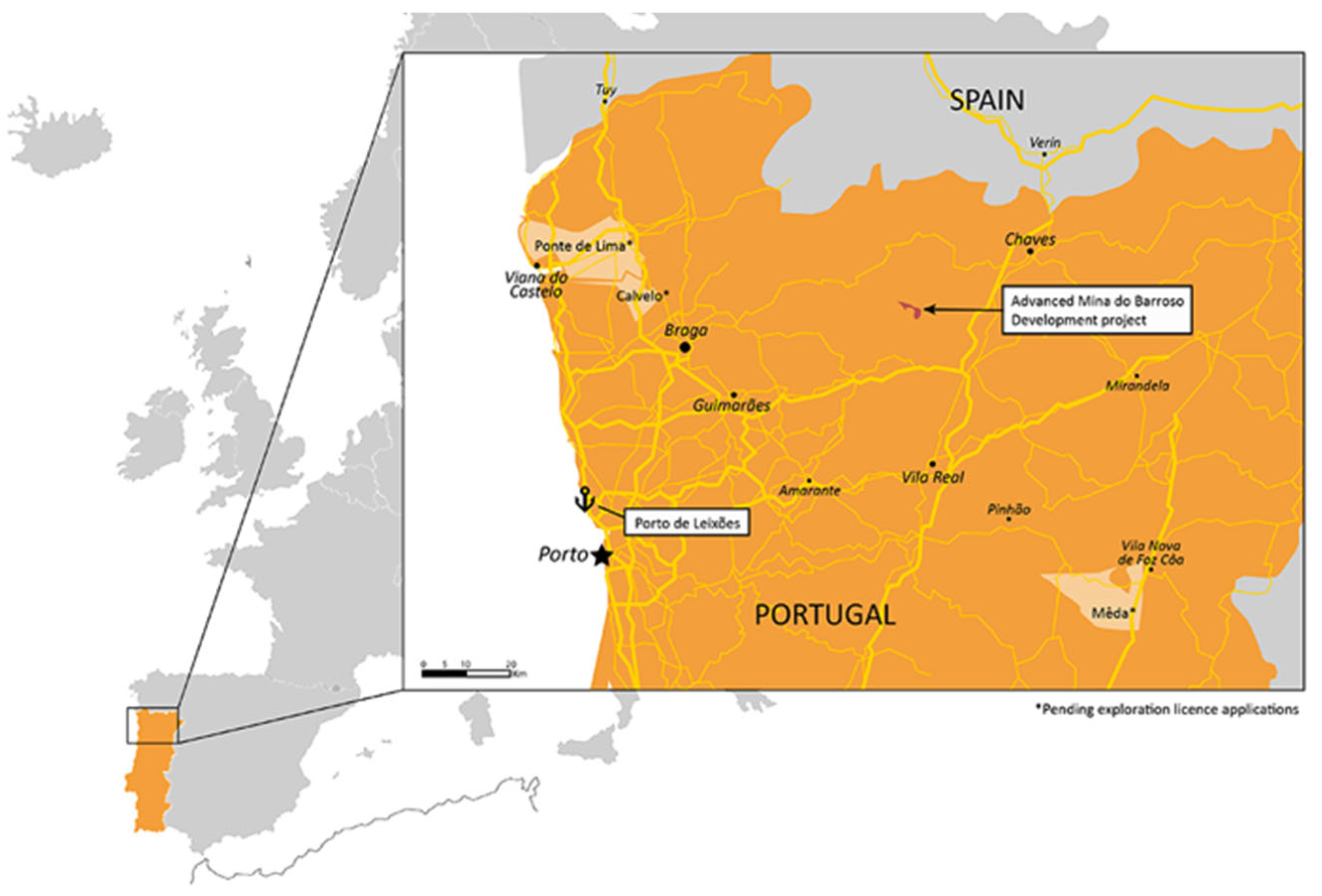

Portugal already produces lithium, which is for now only for the ceramics industry, and has active mines which do not produce enough volume to supply the factories producing batteries. The price of the raw material for ceramics is relatively low, so there will come a time when it is no longer economical to depend on farms. However, its use for electric mobility could give a twist to the sector in Portugal. At this moment, several Environmental Impact Assessments (EIA) are being prepared, which should be completed by the end of the year, and it was added that the intention of the company is to start operating in late 2020. The legal procedures are well advanced. The most advanced is the Barroso mine in the north, where the British Savannah Resources said they have found the largest lithium reserves in Western Europe. Plans are in place to invest about 500 million and start production at the end of 2020. However, because Portugal is positioned strongly in the lithium market, is necessary to conduct more surveys, which is something in the Portuguese Socialist government’s agenda. In January 2018, the Executive approved a strategy to streamline public tenders for the allocation of prospecting and research licenses, as well as for the respective operation. However, a year and a half later, they still have not been released. Eight prospecting competitions are expected to be opened in areas where reserves have been identified. However, the Ministry of Environment and Energy Transition, which has oversight over these concessions, gave no details on the expected date. In addition to the Savannah Resources, several foreign companies have shown great interest in the Portuguese lithium, as the Australian Fortescue, which this year presented two dozen prospecting requests, or Dakota Minerals, which has even decided to adapt its name from the Portuguese and exchange it to "New Lithium". As farms must wait for the prospecting procedures, the licensing process can take up to a decade. However, the application for prospecting presented for a location in the Peneda-Soajo, outside the National Park, but right next to its limit, was withdrawn. There is already an operating contract in Montalegre, the Mina Roman/Sepeda, whose contract belongs to Lusorecursos. The Savannah Lithium company presented in

Covas do Barroso, Boticas, a mining project that provides an initial investment of EUR 100 million and 300 direct jobs, where the company wants to proceed with an open pit mine to extract spodumene (mineral), where lithium is removed. On-site prospections revealed a reserve of 27 million tons of spodumene, with an average grade of 1.06% lithium per ton. Currently, for existing reserves, the investment is about EUR 100 million. For exploration, the company plans to build an alternative road to reduce the impact on the population by the passage of machinery and trucks, and also explained that they will transport the ore to the port of

Leixões, where it will be exported at an early stage to China. Together with the government, the construction of a refinery is being considered which, if implemented, should be installed in the area of Oporto. The company plans to create 300 direct and 600 indirect jobs, and will pay over EUR 258 M in ‘royalties’ to the state in taxes and charges generated by the project, part of which may also revert to the municipality. The Savannah Lithium company, Portugal, wants to start trading via countervailing measures [

57,

58,

59].

The Barroso mine [

57] will contribute to revitalize the Barroso region through:

- -

Creation of 300 direct and 500–600 indirect jobs;

- -

Payment of taxes and royalties, at local and national level;

- -

Supporting community development projects;

- -

Corporate social responsibility actions.

In [

59], the study declares that it is a megalomaniac project that does not fall under this region, classified as World Agricultural Heritage Site in 2017, and that the quality of life is more important than money. For the time being, they want to go ahead with mining along the Zêzere river where the dam of Castelo do Bode is located, which serves all of great Lisbon with piped water. It will affect millions of people, including the author of this paper, who drink and wash with tap water and do not want to drink only plastic-bottled water (no less ecological and sustainable) as has become the case in many places in Latin America where mining has contaminated the waters: water comes in tanks from other remote regions. Additionally, when the lithium runs out, only the ecological problems will be left. DL 54/2015 defines the prospecting areas, and companies can request exploration of whatever they wish within the area. There are no legal limits as long as the EIA is approved.

Figure 3 [

57] shows the Mina do Barroso and surroundings.

Figure 4 is adapted from [

58], showing the potential designated by Mapa do Minério, from 2013 until 2019.

The

Mapa do Minério in Figure 4 shows the areas pulled from the

Diário da República (DR), where requests and concessions of the Portuguese mining sector are circulated to the public. Also displayed are the zones recommended for prospection and eventual future exploration by the Lithium Working Group in their report published 3/2017 (please see the note below). Considering the areas published in [

44,

45], all types (requests for prospection, concession contracts, etc.) and minerals (from arsenic to zinc, including lithium, but also more common substances such as clay or sand) have been included.

- -

CHANGELOG, 6th version, 12 July 2019, German language.

- -

5th version, 24 June 2019, DR publications between 1/2013 and 24 June 2019. English edition. Inclusion of the C-100 concession (CC-DM-032) "Barroso Mine", published in 7 October 2006 RD 131/2006.

- -

4th version, 6 July 2019, DR publications between 1/2013 and 6 July 2019. Correct representation of the ‘exclusion zones’ in the polygons. Optional mode for satellite imagery and minor UI tweaks.

- -

3rd version, 24 May 2019, DR publications between 1/2013 and 24 May 2019. Added polygon surface in km2 (calculated independent from the value published in the DR).

- -

2nd version, 13 May 2019, DR publications between 1/2016 and 5/2019.

- -

Release version, 13 May 2019, DR publications between 1/2017 and 5/2019.

The defined roadmap adds [

44,

45] publications of the period between 2006 and 2012 and includes protected areas, the reserved spaces ‘Geological Resources Spaces’ defined in the NPCs (Municipal Director Plans), interactive filters and time line to select certain periods, the name of the submitting company, administrative region and minerals, and a PDF generator to allow print extracts of a certain district or municipality. At this time (for the vast areas in central and northern Portugal, above), areas for P & P, assigned or permitted through application by the companies (Fortescue, etc.) or by public tender, have still not started. The DGEG defines areas of exploitation, companies solicit the surveys, and businesses are demanding farms (for which they have to submit an EIA) [

57]. Most prospecting and exploration orders delivered in 2018/19 are pending. It has to do with various constraints such as:

- -

Areas that are interfering with areas intended for the public tender for prospecting and research (already announced for 2018 and not yet launched);

- -

It is still being heard that DGEG is asking the chambers to comment (yes, the favorable opinion or not of the CMs has an important weight in the process);

- -

PDMs that have not yet been updated to mention safeguard areas for geological resources.

In [

58], it is shown that what is at stake at this time (for the vast areas in central and northern Portugal, above) are areas for P & P, assigned or permitted through application by the companies (Fortescue, etc.) or by public tender, which have still not started. One can see both on the map in

http://mapadominerio.auportugal.eu/ (accessed on 31 August 2022) (requirements for P & P in blue, areas for the public tender in yellow) that grants, red on the map, are few at present, and there are even less for lithium (e.g., farms for the ceramic industry

Gonzalo/Guarda or Barroso Savannah Resources Lithium Project in Barroso).

A thorough analysis of all requests for mineral deposit prospection and exploration rights that have been made over the past three and a half years has demonstrated a complete and actual existence of a "race to lithium" in Portugal, which in most cases is accompanied by other minerals (gold, silver, zinc, copper, and others). A total of 93 requests were analyzed, and it was concluded that in 19.3% of the land area of Portugal, there are applications for prospecting and mineral research (17,797, 92 km

2), and only in the first half of 2019, a total area of 8 848.4 km2 was required, about 49.7% of the last three and a half years. Lithium and gold are the most required mineral, according to a total of 50 applications analyzed each year [

58].

With regard to lithium, in 2019, in just six months, 22 applications were submitted for a single company,

Fortescue Portugal, Unipessoal, Lda, totaling for exploration area of 6926 km

2, 74.4% of the total of the last three and a half years. In total, 130 municipalities in continental Portugal (46.8%) are under threat of exploitation of minerals, of which 79 have lithium requirements (25.7% of municipalities) [

57]. Municipalities with more lithium prospecting requirements are

Guarda and

Figueira de Castlo Rodrigo, with seven different requirements in total. The result of the analysis also made the following regions targets of these ore-prospecting applications:

Minho, Trás-os-Montes and Alto Douro and

Beira Interior. Faced with this evidence, the report [

56] considers that there is clearly pressure on the part of many investors of these mining projects, especially those relating to lithium, advancing across the country, and recommends to the Portuguese government to adopt a very precautionary attitude, looking more closely to environmental concerns and the affected populations [

58].

The theme of desertification and abandonment of the interior region has been repeatedly referred to as one of the problems in the domestic environment, and various approaches have been proposed as possible solutions: the most recent was designed to fit the so-called "fever of lithium", it being a lifeline for the economy and demography of the most forgotten regions. Additionally, a promise of jobs should not be neglected: once, the driving force of a mine was human hands, but today, machines have replaced humans without considerable investment in staff; still, direct and indirect jobs, which will vary according to the needs of the holding, are expected. The lifespan of a mine is about two decades and will certainly require the hiring of senior staff from abroad who will promote and fund research in universities and will bring machines and experience.

The European Union (EU) has played an important role in combating the COVID-19 pandemic and the subsequent economic recession. Since March 2020, several measures have been adopted at European level to respond to the pandemic crisis, the most emblematic being the agreement on the Recovery Plan for Europe, reached after a long process of negotiations. At the European Council meeting in December 2020, a global package of EUR 1824.3 billion was approved, available from 2021 and executable until 2029. This package also aims to respond to future challenges (resilience, digital and climate transition), combining two strands that will work together:

- -

The EU’s Multiannual Financial Framework 2021–2027, with an overall amount of EUR 1074.3 billion to be implemented by the end of 2029, of which EUR 29.8 billion is for Portugal, mostly within the scope of cohesion policy;

- -

The NextGenerationEU is a temporary instrument worth EUR 750,000 (of which EUR 390,000 in non-repayable grants and EUR 360,000 in loans), which will boost available EU resources between 2021 and 2026, with the aim of supporting primarily the recovery and resilience of Member States’ economies, but also research and innovation. The financing of this instrument will be fully ensured through an unprecedented issuance of debt by the European Commission on the capital markets, on behalf of the European Union.

The main instrument under NextGenerationEU is the Recovery and Resilience Mechanism, which will absorb around 90% of total funding. This mechanism—to be implemented between 2021 and 2026, with commitments having to be made by 2023—has EUR 672.5 billion, of which EUR 360 billion comes in the form of loans and EUR 312.5 billion in the form of grants. For Portugal, EUR 13.2 billion in grants and up to EUR 14.8 billion in loans are planned, at 2018 prices.

NextGenerationEU will also reinforce some European programs and funds with the following funds:

- -

Fund for the Just Transition Mechanism (created within the scope of the European Ecological Pact): EUR 10 billion, of which EUR EUR 116 M€ is for Portugal;

- -

European Rural Development Fund: EUR 7.5 billion, of which EUR 329 million is for Portugal;

- -

InvestEU (a program that aggregates several lines of support for investment that were dispersed): EUR 5.6 billion;

- -

Horizon (investment program in research and innovation): EUR 5 billion;

- -

RescEU (which is part of the EU civil protection mechanism): EUR 1.9 billion.

Thus, considering the funding provided for Portugal under the

NextGenerationEU (EUR 15.6 billion in grants) and the Multiannual Financial Framework (EUR 29.8 billion), to which Portugal’s funds were added in 2020, and which have not yet been implemented and may still be implemented until 2023 (EUR 12.8 thousand M), Portugal may receive a global amount of around EUR 58 thousand M to be executed until 2029, without counting the support available under the form of loans [

56]. Given that Portugal receives significant benefits from membership in the EU, part of it for climate transition, this raises the question of whether Portugal does not have some obligation to develop lithium mines, since it has the largest reserves in Europe and is in the top 10 in the world.

6. Conclusions

Lithium is an alternative energy source to fossil fuels such as oil or natural gas. Batteries for mobile phones, portable computers and electric cars are just some new examples where lithium is used, which are added to previous uses in ceramics, medicine, electronics, electric bicycles, vehicles, aerospace alloys, wind turbines and composites with glass. However, the lithium exploration and a range of materials is not peaceful, with residents afraid of the negative and perpetual environmental and social impacts that have been seen around the world in recent decades.

Social associations warn that lithium exploration causes some fears to mortgage the lives of residents, particularly if it will run the risk of people contracting disease, accelerate desertification and destroy the places where people live, as well as the main activities of agriculture, grazing, ecotourism and crafts. The lifespan of a mine is about two decades and will require human force, knowledge and machinery. More than bringing new people to desert places, and in risk of desertification of places, more local jobs are required, and the local economy will blossom. Additionally, due to the specifics of the exploration, the hiring of senior staff from abroad will promote and fund research in universities and will bring machines and experience.

Environmental associations warn of problems and environmental impacts that mining entails, and they do not consider it acceptable to support lithium extraction in the context of electric mobility as a unique and optimal solution energy storage, given all the context in which the extraction of the mineral takes place. Lithium mining generates inhalable and respirable dust particles. Transportation, stockpiling, grinding, and ore processing which involves crushing and screening generate dust. Effective dust control management plans focus on the elimination of dust at its source. These critical problems related to mining operations have been mitigated, and there are good examples that can be replicated in Portugal and in hard-rock mining countries, such as those that take place in lithium mines in Australia.

If there is a matter in which the government holds all the decision-making power, it is mining. In fact, when local authorities are called to mediate, its role is to issue a mere opinion which is indicative but without any binding force. In Portugal, the prospecting work has already begun: over 250 holes were open, some major, other smaller ones, in the middle of the valley close to the other houses. Each hole is 150 meters deep, 550 meters wide and 650 meters long.

Given that Portugal receives significant benefits from membership in the EU, some of the goals that require lithium, such as clean mobility, economy decarbonization and digital technologies, the question remains as to whether Portugal does not have some obligation to develop lithium mines, since it has the largest reserves in Europe. Some sustain that it may be one of the reasons that the national government of Portugal is determined to develop an expanded lithium mining sector. If lithium is not explored in Portugal, it will have to be imported from other countries. Thus, these social and environmental manifestations are not due to the NIMBY effect. The author’s opinion is that if environmental and social concerns are resolved, mining is a good opportunity for Portugal as a country and for the local population at risk from the desertification of areas.