The Effect of Business Intelligence on Bank Operational Efficiency and Perceptions of Profitability

Abstract

1. Introduction

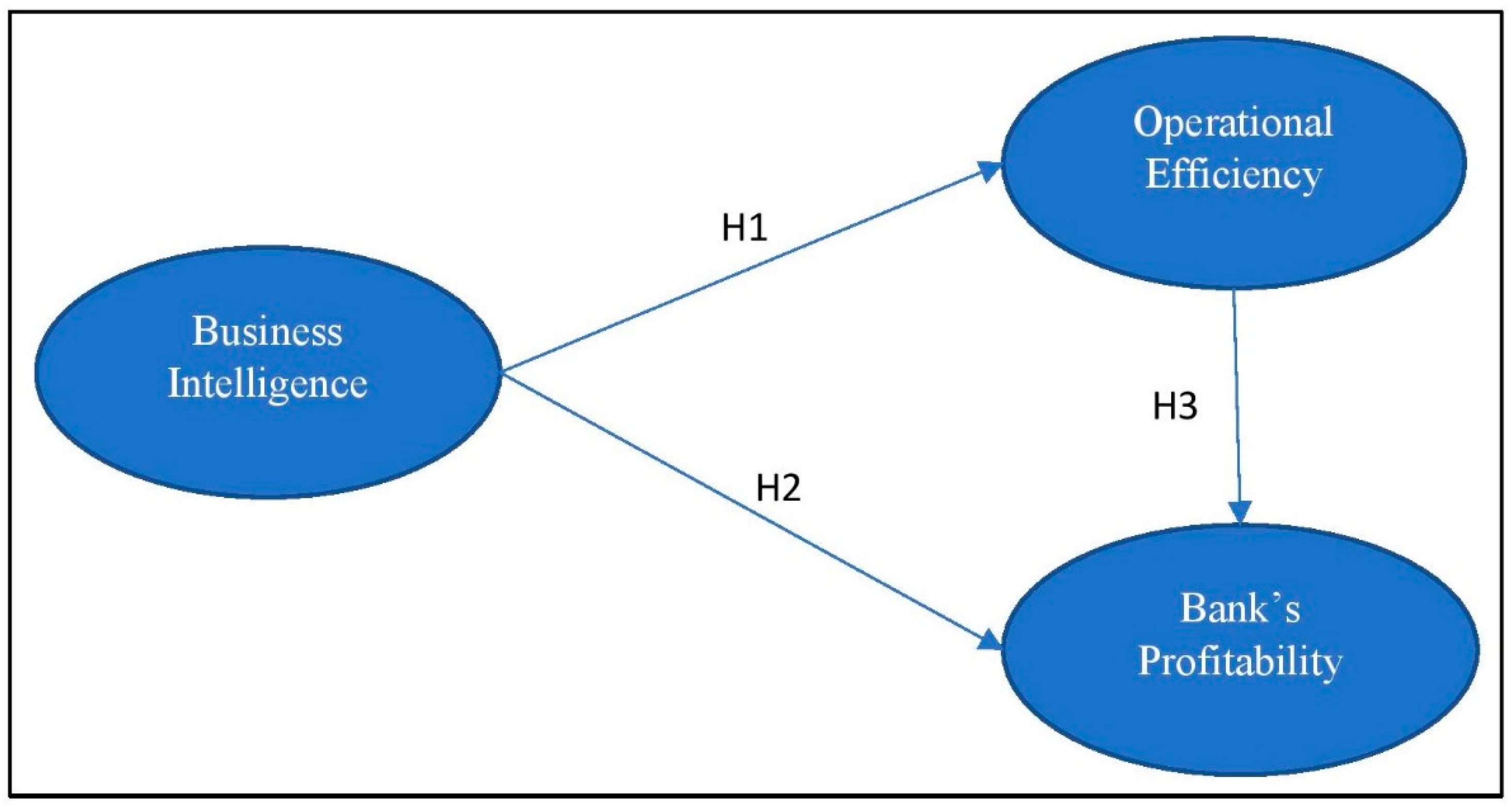

2. Literature Review and Hypothesis Development

2.1. Resource Based View of Business Intelligence

2.2. Business Intelligence and Operational Efficiency

2.3. Business Intelligence and Perceptions of Bank’s Profitability

2.4. Operational Efficiency and Perceptions of Bank’s Profitability

3. Research Methodology

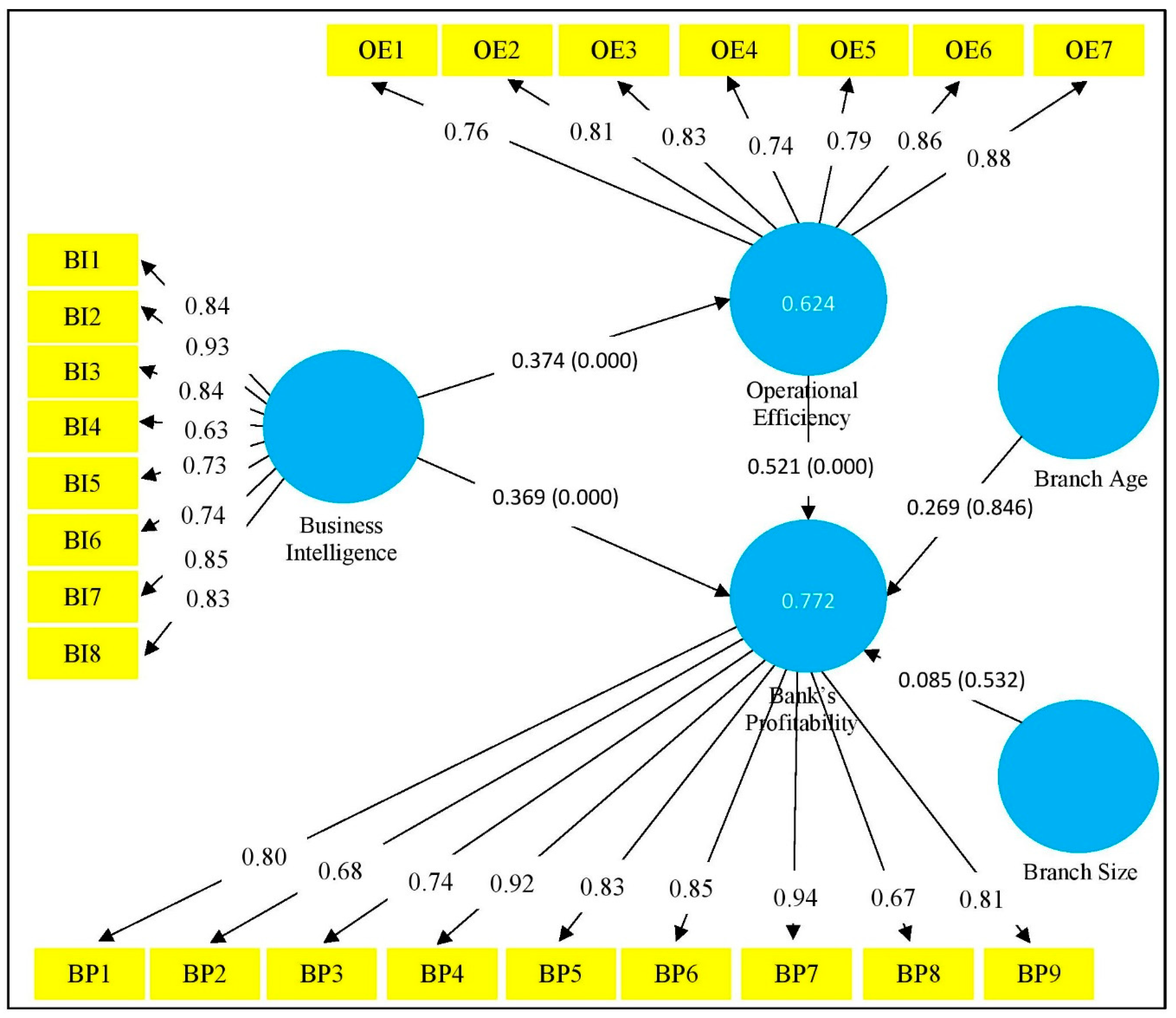

4. Analysis and Results

4.1. Measurement Model

4.2. Model Fitness Measures

4.3. Hypothesis Testing

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Authors | Title | Period | Model/Method | Findings |

|---|---|---|---|---|

| Arefin, Hoque [21] | The impact of business intelligence on organisation’s effectiveness: an empirical study | 2015 | PLS-SEM | BI improves organisational effectiveness. Banks with BI are more efficient than those without it. |

| Babu [12] | Artificial intelligence in Bangladesh, its applications in different sectors and relevant challenges for the government: an analysis | 2021 | Qualitative | Application of artificial intelligence maintain banks’ policy, information security, regulations, and operational effectiveness. |

| Bhatiasevi and Naglis [13] | Elucidating the determinants of business intelligence adoption and organisational performance | 2018 | SEM | BI is positively associated with bank’s performance and internal processing. |

| Elbashir, Collier [17] | Measuring the effects of business intelligence systems: The relationship between business process and organisational performance | 2008 | Qualitative | BI systems enhance business process and bank performance. |

| Fethi and Pasiouras [43] | Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey | 2010 | Qualitative | Bank efficiency and performance have positive associations with AI. |

| Nithya and Kiruthika [6] | Impact of Business Intelligence Adoption on performance of banks: a conceptual framework | 2021 | Literature | BI adoption has positive impact on bank’s performance. |

| Owusu [51] | Business intelligence systems and bank performance in Ghana: The balanced scorecard approach | 2017 | PLS-SEM | BI systems are not directly associated with bank performance but they have indirect impacts. |

| Richards, Yeoh [63] | Business Intelligence Effectiveness and Corporate Performance Management: An Empirical Analysis | 2019 | Mixed-method | BI has positive associations with corporate performance management. BI is strongly connected to planning but less so to measurement. |

| Rouhani, Ashrafi [8] | The impact model of business intelligence on decision support and organisational benefits | 2016 | PLS-SEM | BI has a strong positive impact on bank benefits. Banks with BI can lead effective decision support. |

| Wamba-Taguimdje, Fosso Wamba [10] | Influence of artificial intelligence on bank performance: the business value of AI-based transformation projects | 2020 | Qualitative | There is a positive association between artificial intelligence and bank performance. |

| Yiu, Yeung [31] | The impact of business intelligence systems on profitability and risks of banks | 2005–2014 | Qualitative | BI increases bank profitability and reduces risks. BI improves operational efficiency. |

| Kimble and Milolidakis [42] | Big Data and Business Intelligence: Debunking the Myths | 2015 | Qualitative | Big data and BI improve decision making effectiveness. |

| Varshney and Varshney [38] | Workforce agility and its links to emotional intelligence and workforce performance: A study of small entrepreneurial | 2020 | Qualitative | Emotional intelligence improves two performances, i.e., adaptive performance and contextual performance but does not impact task performance. |

References

- Abusweilem, M.; Abualoush, S. The impact of knowledge management process and business intelligence on organisational performance. Manag. Sci. Lett. 2019, 9, 2143–2156. [Google Scholar] [CrossRef]

- Ayadi, R.; Bongini, P.; Casu, B.; Cucinelli, D. Bank Business Model Migrations in Europe: Determinants and Effects. Br. J. Manag. 2021, 32, 1007–1026. [Google Scholar] [CrossRef]

- Liang, T.-P.; Liu, Y.-H. Research Landscape of Business Intelligence and Big Data analytics: A bibliometrics study. Expert Syst. Appl. 2018, 111, 2–10. [Google Scholar] [CrossRef]

- Côrte-Real, N.; Ruivo, P.; Oliveira, T. The Diffusion Stages of Business Intelligence & Analytics (BI&A): A Systematic Mapping Study. Procedia Technol. 2014, 16, 172–179. [Google Scholar] [CrossRef]

- Drake, B.M.; Walz, A. Evolving Business Intelligence and Data Analytics in Higher Education. New Dir. Inst. Res. 2018, 2018, 39–52. [Google Scholar] [CrossRef]

- Nithya, N.; Kiruthika, R. Impact of Business Intelligence Adoption on performance of banks: A conceptual framework. J. Ambient Intell. Humaniz. Comput. 2021, 12, 3139–3150. [Google Scholar] [CrossRef]

- Popovič, A.; Puklavec, B.; Oliveira, T. Justifying business intelligence systems adoption in SMEs. Ind. Manag. Data Syst. 2019, 119, 210–228. [Google Scholar] [CrossRef]

- Rouhani, S.; Ashrafi, A.; Zare Ravasan, A.; Afshari, S. The impact model of business intelligence on decision support and organisational benefits. J. Enterp. Inf. Manag. 2016, 29, 19–50. [Google Scholar] [CrossRef]

- Saura, J.R.; Bennett, D.R. A Three-Stage method for Data Text Mining: Using UGC in Business Intelligence Analysis. Symmetry 2019, 11, 519. [Google Scholar] [CrossRef]

- Wamba-Taguimdje, S.-L.; Fosso Wamba, S.; Kala Kamdjoug, J.R.; Tchatchouang Wanko, C.E. Influence of artificial intelligence (AI) on firm performance: The business value of AI-based transformation projects. Bus. Process Manag. J. 2020, 26, 1893–1924. [Google Scholar] [CrossRef]

- Pieket Weeserik, B.; Spruit, M. Improving Operational Risk Management Using Business Performance Management Technologies. Sustainability 2018, 10, 640. [Google Scholar] [CrossRef]

- Babu, K.-E.K. Artificial intelligence in Bangladesh, its applications in different sectors and relevant challenges for the government: An analysis. Int. J. Public Law Policy 2021, 7, 319–333. [Google Scholar] [CrossRef]

- Bhatiasevi, V.; Naglis, M. Elucidating the determinants of business intelligence adoption and organisational performance. Inf. Dev. 2018, 36, 78–96. [Google Scholar] [CrossRef]

- Ji, F.; Tia, A. The effect of blockchain on business intelligence efficiency of banks. Kybernetes 2022, 51, 2652–2668. [Google Scholar] [CrossRef]

- Bitar, M.; Pukthuanthong, K.; Walker, T. The effect of capital ratios on the risk, efficiency and profitability of banks: Evidence from OECD countries. J. Int. Financ. Mark. Inst. Money 2018, 53, 227–262. [Google Scholar] [CrossRef]

- Bordeleau, F.-E.; Mosconi, E.; de Santa-Eulalia, L.A. Business intelligence and analytics value creation in Industry 4.0: A multiple case study in manufacturing medium enterprises. Prod. Plan. Control 2020, 31, 173–185. [Google Scholar] [CrossRef]

- Elbashir, M.Z.; Collier, P.A.; Davern, M.J. Measuring the effects of business intelligence systems: The relationship between business process and organisational performance. Int. J. Account. Inf. Syst. 2008, 9, 135–153. [Google Scholar] [CrossRef]

- Lim, E.-P.; Chen, H.; Chen, G. Business Intelligence and Analytics: Research Directions. ACM Trans. Manag. Inf. Syst. 2013, 3, 1–10. [Google Scholar] [CrossRef]

- Moro, S.; Cortez, P.; Rita, P. Business intelligence in banking: A literature analysis from 2002 to 2013 using text mining and latent Dirichlet allocation. Expert Syst. Appl. 2015, 42, 1314–1324. [Google Scholar] [CrossRef]

- Tumpa, Z.N.; Saifuzzaman, M.; Rabby, S.F.; Crearie, L.; Stansfield, M. Understanding Business Intelligence in The Context of Mental Healthcare Sector of Bangladesh for Improving Health Services. In Proceedings of the 2020 IEEE 8th R10 Humanitarian Technology Conference (R10-HTC), Kuching, Malaysia, 1–3 December 2020. [Google Scholar]

- Arefin, M.S.; Hoque, M.R.; Bao, Y. The impact of business intelligence on organisation’s effectiveness: An empirical study. J. Syst. Inf. Technol. 2015, 17, 263–285. [Google Scholar] [CrossRef]

- Al-Hasan, M.; Aktar, M.R.; Al Seraj, M.S. An Economic and Modern Business Intelligence Solution for Textile Industries in Bangladesh. Glob. J. Comput. Sci. Technol. 2018, 18, 11. [Google Scholar]

- Nahar, N.; Naheen, I.T.; Hasan, S.J. Application of Artificial Intelligence in Claim Management & Fire Surveying in the context of Bangladesh. Bimaquest 2020, 20, 48–56. [Google Scholar]

- Biswas, M.; Rahman, M.S.; Ferdausy, F. Role of Emotional Intelligence in Solving Problems in the Private Commercial Banks of Bangladesh. Comilla Univ. J. Bus. Stud. 2017, 4, 51–66. [Google Scholar]

- Ranjan, J. Business justification with business intelligence. VINE 2008, 38, 461–475. [Google Scholar] [CrossRef]

- Sahay, B.S.; Ranjan, J. Real time business intelligence in supply chain analytics. Inf. Manag. Comput. Secur. 2008, 16, 28–48. [Google Scholar] [CrossRef]

- Nofal, M.I.; Yusof, Z.M. Integration of Business Intelligence and Enterprise Resource Planning within Organisations. Procedia Technol. 2013, 11, 658–665. [Google Scholar] [CrossRef]

- Işık, Ö.; Jones, M.C.; Sidorova, A. Business intelligence success: The roles of BI capabilities and decision environments. Inf. Manag. 2013, 50, 13–23. [Google Scholar] [CrossRef]

- Olszak, C.M. Toward Better Understanding and Use of Business Intelligence in Organisations. Inf. Syst. Manag. 2016, 33, 105–123. [Google Scholar] [CrossRef]

- Lawrence, D. Business intelligence: Now, more than ever, hospitals need to identify and track key performance metrics to improve operational efficiency. Heal. Inf. 2009, 25, 47–49. [Google Scholar]

- Yiu, L.M.D.; Yeung, A.C.L.; Cheng, T.C.E. The impact of business intelligence systems on profitability and risks of firms. Int. J. Prod. Res. 2021, 59, 3951–3974. [Google Scholar] [CrossRef]

- Tabassum, M.; Begum, N.; Rana, M.S.; Faruk, M.O.; Miah, M.M. Factors influencing Women’s empowerment in Bangladesh. Sci. Technol. Public Policy 2019, 3, 1–7. [Google Scholar] [CrossRef]

- Akhter, J.; Cheng, K. Sustainable Empowerment Initiatives among Rural Women through Microcredit Borrowings in Bangladesh. Sustainability 2020, 12, 2275. [Google Scholar] [CrossRef]

- Islam, N.; Ahmed, M. Factors influencing the development of women entrepreneurship in Bangladesh. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Lohani, M.; Aburaida, L. Women empowerment: A key to sustainable development. Soc. ION 2017, 6, 26–29. [Google Scholar] [CrossRef]

- Rahman, M.M.; Akhter, B. The impact of investment in human capital on bank performance: Evidence from Bangladesh. Future Bus. J. 2021, 7, 61. [Google Scholar] [CrossRef]

- Barney, J.B. Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view. J. Manag. 2001, 27, 643–650. [Google Scholar] [CrossRef]

- Varshney, D.; Varshney, N.K. Workforce agility and its links to emotional intelligence and workforce performance: A study of small entrepreneurial firms in India. Glob. Bus. Organ. Excell. 2020, 39, 35–45. [Google Scholar] [CrossRef]

- Yang, X. The Impact of Corporate Emotional Intelligence on Innovation: Observations from China. Glob. Bus. Organ. Excell. 2016, 36, 87–97. [Google Scholar] [CrossRef]

- Almaqtari, F.A.; Al-Homaidi, E.A.; Tabash, M.I.; Farhan, N.H. The determinants of profitability of Indian commercial banks: A panel data approach. Int. J. Financ. Econ. 2019, 24, 168–185. [Google Scholar] [CrossRef]

- Dillman, D.A.; Smyth, J.D.; Christian, L.M. Internet, Phone, Mail, and Mixed-Mode Surveys: The Tailored Design Method; John Wiley & Sons: Hoboken, NJ, USA, 2014. [Google Scholar]

- Kimble, C.; Milolidakis, G. Big Data and Business Intelligence: Debunking the Myths. Glob. Bus. Organ. Excell. 2015, 35, 23–34. [Google Scholar] [CrossRef]

- Fethi, M.D.; Pasiouras, F. Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. Eur. J. Oper. Res. 2010, 204, 189–198. [Google Scholar] [CrossRef]

- Abu-Alkheil, A.M.; Burghof, H.-p.; Khan, W.A. Islamic commercial banking in Europe: A cross-country and inter-bank analysis of efficiency performance. Int. Bus. Econ. Res. J. 2012, 11, 647–676. [Google Scholar] [CrossRef]

- Chandrasekhar, M.; Sonar, R.M. Impact of information technology on the efficiency and total factor productivity of Indian banks. South Asian J. Manag. 2008, 15, 74–99. [Google Scholar]

- Cook, W.D.; Hababou, M. Sales performance measurement in bank branches. Omega 2001, 29, 299–307. [Google Scholar] [CrossRef]

- Cohen, C. Business Intelligence: The Effectiveness of Strategic Intelligence and Its Impact on the Performance of Organisations; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Ubiparipović, B.; Đurković, E. Application of business intelligence in the banking industry. Manag. Inf. Syst. 2011, 6, 23–30. [Google Scholar]

- Vercellis, C. Business Intelligence: Data Mining and Optimization for Decision Making; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Negash, S.; Gray, P. Business intelligence. In Handbook on Decision Support Systems 2; Springer: Berlin/Heidelberg, Germany, 2008; pp. 175–193. [Google Scholar]

- Owusu, A. Business intelligence systems and bank performance in Ghana: The balanced scorecard approach. Cogent Bus. Manag. 2017, 4, 1364056. [Google Scholar] [CrossRef]

- Papadopoulos, T.; Kanellis, P. A path to the successful implementation of Business Intelligence: An example from the Hellenic Banking sector. OR Insight 2010, 23, 15–26. [Google Scholar] [CrossRef]

- Acharya, V.V.; Engle Iii, R.F.; Steffen, S. Why Did Bank Stocks Crash during COVID-19? National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar]

- Akhtaruzzaman, M.; Boubaker, S.; Sensoy, A. Financial contagion during COVID–19 crisis. Financ. Res. Lett. 2021, 38, 101604. [Google Scholar] [CrossRef]

- Elnahass, M.; Trinh, V.Q.; Li, T. Global banking stability in the shadow of COVID-19 outbreak. J. Int. Financ. Mark. Inst. Money 2021, 72, 101322. [Google Scholar] [CrossRef]

- Wu, D.D.; Olson, D.L. (Eds.) The Effect of COVID-19 on the Banking Sector. In Pandemic Risk Management in Operations and Finance: Modeling the Impact of COVID-19; Springer International Publishing: Cham, Switzerland, 2020; pp. 89–99. [Google Scholar] [CrossRef]

- Boubaker, S.; Le, T.D.Q.; Ngo, T. Managing bank performance under COVID-19: A novel inverse DEA efficiency approach. Int. Trans. Oper. Res. 2022. [Google Scholar] [CrossRef]

- Mirzaei, A.; Saad, M.; Emrouznejad, A. Bank stock performance during the COVID-19 crisis: Does efficiency explain why Islamic banks fared relatively better? Ann. Oper. Res. 2022. [Google Scholar] [CrossRef] [PubMed]

- Williams, S.; Williams, N. The Profit Impact of Business Intelligence; Elsevier: Amsterdam, The Netherlands, 2010. [Google Scholar]

- Puklavec, B.; Oliveira, T.; Popovič, A. Understanding the determinants of business intelligence system adoption stages. Ind. Manag. Data Syst. 2018, 118, 236–261. [Google Scholar] [CrossRef]

- Vieira, A.; Sehgal, A. How Banks Can Better Serve Their Customers Through Artificial Techniques. In Digital Marketplaces Unleashed; Linnhoff-Popien, C., Schneider, R., Zaddach, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; pp. 311–326. [Google Scholar] [CrossRef]

- Stylos, N.; Zwiegelaar, J. Big Data as a Game Changer: How Does It Shape Business Intelligence Within a Tourism and Hospitality Industry Context? In Big Data and Innovation in Tourism, Travel, and Hospitality: Managerial Approaches, Techniques, and Applications; Sigala, M., Rahimi, R., Thelwall, M., Eds.; Springer Singapore: Singapore, 2019; pp. 163–181. [Google Scholar] [CrossRef]

- Richards, G.; Yeoh, W.; Chong, A.Y.L.; Popovič, A. Business Intelligence Effectiveness and Corporate Performance Management: An Empirical Analysis. J. Comput. Inf. Syst. 2019, 59, 188–196. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2021. [Google Scholar]

- Alvarez, G.; Núñez-Cortés, R.; Solà, I.; Sitjà-Rabert, M.; Fort-Vanmeerhaeghe, A.; Fernández, C.; Bonfill, X.; Urrútia, G. Sample size, study length, and inadequate controls were the most common self-acknowledged limitations in manual therapy trials: A methodological review. J. Clin. Epidemiol. 2021, 130, 96–106. [Google Scholar] [CrossRef] [PubMed]

- Mokhtar, N.; Jusoh, R.; Zulkifli, N. Corporate characteristics and environmental management accounting (EMA) implementation: Evidence from Malaysian public listed companies (PLCs). J. Clean. Prod. 2016, 136, 111–122. [Google Scholar] [CrossRef]

- Hair, J.F.; Matthews, L.M.; Matthews, R.L.; Sarstedt, M. PLS-SEM or CB-SEM: Updated guidelines on which method to use. Int. J. Multivar. Data Anal. 2017, 1, 107–123. [Google Scholar] [CrossRef]

- Sarstedt, M.; Hair, J.F.; Cheah, J.-H.; Becker, J.-M.; Ringle, C.M. How to specify, estimate, and validate higher-order constructs in PLS-SEM. Australas. Mark. J. 2019, 27, 197–211. [Google Scholar] [CrossRef]

- Shmueli, G.; Sarstedt, M.; Hair, J.F.; Cheah, J.-H.; Ting, H.; Vaithilingam, S.; Ringle, C.M. Predictive model assessment in PLS-SEM: Guidelines for using PLSpredict. Eur. J. Mark. 2019, 53, 2322–2347. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modeling. Handb. Mark. Res. 2017, 26, 1–40. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson Education: London, UK, 2019. [Google Scholar]

- Sarstedt, M.; Ringle, C.M.; Smith, D.; Reams, R.; Hair Jr, J.F. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. J. Fam. Bus. Strategy 2014, 5, 105–115. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics; Sage Publications Sage CA: Los Angeles, CA, USA, 1981. [Google Scholar]

- Rahman, M.M.; Rahman, M.S.; Deb, B.C. Competitive Cost Advantage: An Application of Environmental Accounting and Management Approach with reference to Bangladesh. Cost Manag. 2021, 49, 47–59. [Google Scholar]

- Salehi, M.; Arianpoor, A. The relationship among financial and non-financial aspects of business sustainability performance: Evidence from Iranian panel data. TQM J. 2021, 33, 1447–1468. [Google Scholar] [CrossRef]

- Lyng, K.D.; Rathleff, M.S.; Dean, B.J.F.; Kluzek, S.; Holden, S. Current management strategies in Osgood Schlatter: A cross-sectional mixed-method study. Scand. J. Med. Sci. Sport. 2020, 30, 1985–1991. [Google Scholar] [CrossRef] [PubMed]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics and firm performance: Findings from a mixed-method approach. J. Bus. Res. 2019, 98, 261–276. [Google Scholar] [CrossRef]

- Thiel, A.; Diehl, K.; Giel, K.E.; Schnell, A.; Schubring, A.M.; Mayer, J.; Zipfel, S.; Schneider, S. The German Young Olympic Athletes’ Lifestyle and Health Management Study (GOAL Study): Design of a mixed-method study. BMC Public Health 2011, 11, 410. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. A survey of fintech research and policy discussion. Rev. Corp. Financ. 2021, 1, 259–339. [Google Scholar] [CrossRef]

| Categories | Variations | Freq. | % |

|---|---|---|---|

| Participants’ Profile (Total 259 Respondents) | |||

| Gender | Male | 168 | 64% |

| Female | 91 | 36% | |

| Total | 259 | 100% | |

| Age | Less than 30 years | 83 | 32% |

| 30–45 years | 148 | 57% | |

| More than 45 years | 28 | 11% | |

| Total | 259 | 100% | |

| Designation | General Manager | 25 | 10% |

| Senior officers | 74 | 29% | |

| General officers | 81 | 31% | |

| Employees | 79 | 30% | |

| Total | 259 | 100% | |

| Bank’s Profile (Total 27 Branches) | |||

| Operating years (Bank Age) | Less than 10 years | 6 | 22% |

| 10–20 years | 13 | 48% | |

| More than 20 years | 8 | 30% | |

| Total | 27 | 100% | |

| No. of Employees (Bank Size) | Less than 25 | 7 | 26% |

| 25–40 | 9 | 33% | |

| More than 40 | 11 | 41% | |

| Total | 27 | 100% | |

| Code | Constructs and Items | Mean | SD | FL * | α | rho | CR | AVE |

|---|---|---|---|---|---|---|---|---|

| BI | Business Intelligence | 4.418 | 1.035 | 0.82 | 0.82 | 0.87 | 0.55 | |

| BI1 | “Our bank effectively uses spreadsheets as a business intelligence to model and manipulate bank data” | 4.220 | 1.319 | 0.839 | ||||

| BI2 | “Our bank visually appeals graphical representations to quickly gain insights.” | 4.831 | 1.271 | 0.932 | ||||

| BI3 | “Our bank uses online platform to communicate clients” | 4.198 | 1.014 | 0.844 | ||||

| BI4 | “Our bank uses a dashboard of quick metrics designed to support better decisions” | 3.401 | 1.782 | 0.632 | ||||

| BI5 | “Our bank stores data of all departments in a data warehouse” | 5.108 | 1.281 | 0.732 | ||||

| BI6 | “Our bank uses big data in strategic and tactical decision-making processes” | 4.403 | 1.294 | 0.742 | ||||

| BI7 | “Our bank uses business intelligence for an analytical querying of the prepared data” | 4.173 | 1.290 | 0.848 | ||||

| BI8 | “Our bank uses business intelligence to prepare key performance indicators to the clients” | 5.319 | 1.371 | 0.826 | ||||

| OE | Operational Efficiency | 5.502 | 1.189 | 0.85 | 0.87 | 0.89 | 0.53 | |

| OE1 | “Our bank simplifies operations through business intelligence tools” | 4.948 | 1.014 | 0.758 | ||||

| OE2 | “Our bank enhances process consistency by business intelligence tools” | 4.482 | 1.734 | 0.812 | ||||

| OE3 | “Our bank assures timely, accurate, and relevant user information by business intelligence tools” | 5.264 | 1.290 | 0.825 | ||||

| OE4 | “Our bank assures customer satisfaction through efficient operational functions” | 4.037 | 1.017 | 0.738 | ||||

| OE5 | “Our bank is providing secured services by business intelligence” | 5.129 | 1.873 | 0.794 | ||||

| OE6 | “Our bank operates functions with lower costs” | 4.672 | 1.701 | 0.863 | ||||

| OE7 | “Our bank operates functions with reduced risks” | 5.112 | 1.939 | 0.882 | ||||

| BP | Bank’s Profitability | 5.016 | 1.004 | 0.86 | 0.86 | 0.91 | 0.70 | |

| BP1 | “Our bank makes more profit after adopting business intelligence” | 4.839 | 1.187 | 0.803 | ||||

| BP2 | “Our bank generates more customer margin through cross-selling strategy of business intelligence” | 5.851 | 1.871 | 0.684 | ||||

| BP3 | “Our bank improves net interest margin through business intelligence adoption” | 5.382 | 1.193 | 0.739 | ||||

| BP4 | “Our bank improves return on assets through business intelligence adoption” | 5.041 | 1.173 | 0.918 | ||||

| BP5 | “Our bank improves return on investment through business intelligence adoption” | 4.582 | 1.276 | 0.832 | ||||

| BP6 | “Our bank assures potential profitability by improving data analytical capabilities” | 4.423 | 1.103 | 0.851 | ||||

| BP7 | “Our bank improves return on equity through business intelligence adoption” | 5.146 | 1.126 | 0.943 | ||||

| BP8 | “Our bank improves profitability through reducing fraudulent activities” | 4.605 | 1.869 | 0.674 | ||||

| BP9 | “Our bank increases sales through business intelligence adoption” | 4.582 | 1.158 | 0.814 |

| BI | OE | BP | |

|---|---|---|---|

| BI | 0.742 | 0.541 | 0.440 |

| OE | 0.403 | 0.728 | 0.563 |

| BP | 0.528 | 0.462 | 0.836 |

| Diagonal values: “Square root of AVE”. Below the diagonal: Correlation matrix. Above the diagonal: HTMT values. | |||

| BI | OE | BP | |

|---|---|---|---|

| BI1 | 0.839 | 0.371 | 0.217 |

| BI2 | 0.932 | 0.469 | 0.362 |

| BI3 | 0.844 | 0.418 | 0.316 |

| BI4 | 0.632 | 0.416 | 0.303 |

| BI5 | 0.732 | 0.311 | 0.167 |

| BI6 | 0.742 | 0.429 | 0.250 |

| BI7 | 0.848 | 0.370 | 0.278 |

| BI8 | 0.826 | 0.417 | 0.278 |

| OE1 | 0.367 | 0.758 | 0.382 |

| OE2 | 0.275 | 0.812 | 0.386 |

| OE3 | 0.461 | 0.825 | 0.324 |

| OE4 | 0.382 | 0.738 | 0.276 |

| OE5 | 0.223 | 0.794 | 0.425 |

| OE6 | 0.268 | 0.863 | 0.424 |

| OE7 | 0.219 | 0.882 | 0.461 |

| BP1 | 0.204 | 0.217 | 0.803 |

| BP2 | 0.417 | 0.276 | 0.684 |

| BP3 | 0.273 | 0.305 | 0.739 |

| BP4 | 0.312 | 0.231 | 0.918 |

| BP5 | 0.427 | 0.412 | 0.832 |

| BP6 | 0.276 | 0.380 | 0.851 |

| BP7 | 0.317 | 0.423 | 0.943 |

| BP8 | 0.206 | 0.427 | 0.674 |

| BP9 | 0.349 | 0.322 | 0.814 |

| Variables | f Square | R Square | Adj. R Square | SRMR | NFI | RMSEA |

|---|---|---|---|---|---|---|

| BI | ||||||

| OE | 0.531 | 0.624 | 0.609 | 0.045 | 0.93 | 0.049 |

| BP | 0.428–0.583 | 0.772 | 0.764 | 0.045 | 0.93 | 0.049 |

| Relationship | Coeff. (β) | t-Value | p-Values | VIF | Decision |

|---|---|---|---|---|---|

| Direct Effect | |||||

| BI → OE | 0.374 | 15.165 | 0.000 *** | 1.114 | H1 supported |

| BI → BP | 0.369 | 12.486 | 0.000 *** | 1.217 | H2 supported |

| OE → BP | 0.521 | 27.328 | 0.000 *** | 1.125 | H3 supported |

| Mediating Effect | |||||

| BI → OE→ BP | 0.133 | 3.127 | 0.023 ** | 1.211 | Partial Mediation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, M.M. The Effect of Business Intelligence on Bank Operational Efficiency and Perceptions of Profitability. FinTech 2023, 2, 99-119. https://doi.org/10.3390/fintech2010008

Rahman MM. The Effect of Business Intelligence on Bank Operational Efficiency and Perceptions of Profitability. FinTech. 2023; 2(1):99-119. https://doi.org/10.3390/fintech2010008

Chicago/Turabian StyleRahman, Md. Mominur. 2023. "The Effect of Business Intelligence on Bank Operational Efficiency and Perceptions of Profitability" FinTech 2, no. 1: 99-119. https://doi.org/10.3390/fintech2010008

APA StyleRahman, M. M. (2023). The Effect of Business Intelligence on Bank Operational Efficiency and Perceptions of Profitability. FinTech, 2(1), 99-119. https://doi.org/10.3390/fintech2010008