Abstract

As new digitalization strategies storm the banking industry, banks which are behind the technological curve may struggle to keep pace. This is a well-known challenge in the Islamic banking sector in particular; however, this research shows that little is being done in order to achieve unified digitalization in operations. The 2020 Global Islamic Bankers Survey (GIBS) from CIBAFI sought opinions and data from 101 Islamic banks, which outlined both their institutions’ adoption of financial technology and their awareness of existing technologies. In addition, several technology trends—such as AI, machine learning, DLTs, and P2P lending—were analyzed separately in order to understand how they may be implemented within Islamic banking. This paper performed different statistical procedures to answer these research questions via correlation analysis and one-way ANOVA. The data were compiled and analyzed using SPSS software. In doing so, this study clarified the perspective of Islamic banks on digital transformation and answered whether Islamic banks are taking the right direction in terms of their digitalization strategies. Interestingly, most newly developing technologies have a low implementation level in Islamic banking operations globally, with the exception of mobile banking, which already has a vast global infrastructure. The results may serve as a warning to Islamic banks to invest more capital and energy in the developing fields of financial technologies in order to keep abreast of their conventional banking counterparts.

Keywords:

Islamic banking; digitalization; digital transformation; digital awareness; Fintech; banking technologies JEL Codes:

G21; G28; M21

1. Introduction

Starting from the spread of ATMs and credit cards, the banking industry has experienced several digital transformations. Especially in the last decade, technology became and remained the core of banking, transforming nearly all of its services online in a phenomenon known as the “Bank 4.0” concept [1]. Digital transformation quickly shifted from being an advantage to becoming a necessity for all banks to survive amidst other financial institutions, tech giants, start-ups, and media-telecommunication companies.

As more institutions join the competition in the banking and finance industry, the scope of digital transformation is changing rapidly. For example, even just ten years ago, a bank with more ATM locations and more credit card services was considered sufficiently digitalized. However, with the emergence of the Bank 4.0 era, banks need more autonomous systems in which artificial intelligence is actively used, more machine-learning skills to analyze the tremendous amount of data, and a more open-minded attitude to deal with the vast opportunities of blockchain and other Distributed Ledger Technology (DLT) based innovations. While keeping up with these new concepts, banks must also strive to keep the customer service experience streamlined and comfortable.

Considering the rapid change in the finance industry and the emergence of new players such as Fintech companies, tech giants, and media-telecommunication companies, it is more apparent that banks need to change their competitive strategies. Today’s customers are more precise about what they want, making it challenging for financial institutions to serve them. Already-established financial institutions or banks have a hard time restructuring their operations to meet emerging needs, unlike start-ups and Fintechs who have the benefit of a blank slate.

The digitalization of banking is deeply related to widespread internet technologies, as these technologies help banks go online and beyond merely a physical location. This may prove difficult for institutions which have rooted themselves with a strong physical presence but have not built the necessary framework for a strong virtual presence as well. The scope of digital transformation in a bank encompasses three main tasks: adopting digital technology, redesigning processes for downsizing service costs dominating the financial aspects with digital services, and restructuring corporate bodies [2] As is evident from these steps, a healthy digital transformation process requires a top-to-bottom change in a bank’s structures and operations. However, one main challenge is completing this restructuring while keeping the bank profitable, up-to-date, and in tune with customer needs. Finance start-ups and Fintechs can build their structure to be compatible with the requirements of a digitalized service from the very beginning. Hence, today, even micro-scale Fintechs could be perceived as a threat to multi-billion-dollar banks, depending on their business model [3].

The shifting technological landscape may prove to be a more significant challenge for larger banks, as they are less flexible in changing their operational structure [4]. Consequently, it could be hypothesized that small-scale or younger banks have a greater advantage in digital transformations than large-scale banks. Keeping in mind that Islamic banking is much younger than conventional banking, the current literature establishes a consensus about Islamic banking being more advantageous than its conventional counterparts in terms of digitalization and Fintech adoption. This theory is supported by Islamic finance’s more flexible operational structure and its principal doctrines, which encourage digitalization and Fintech adoption [5].

The new concepts of digital transformation that came with Bank 4.0 seem like game-changers for financial institutions. While most Islamic banks are interested in adopting digital technologies, the focus on their different concepts varies widely from bank to bank. This raises the question: which technology trends do Islamic banks focus more on in their digitalization race? And what is the maturity level of this technology adoption? In this light, this paper aims to understand the level of technology adoption within Islamic banks and the position of digital transformation in the core business activities of Islamic banks globally by focusing on one main research objective: To observe the maturity level of digital transformation within Islamic banks, and to understand what Islamic bankers’ knowledge is on the topic.

The main research question of this article analyzes seven technological trends’ significance regarding the digital transformation of Islamic banks: Artificial Intelligence (AI), Machine Learning (ML) and Big Data, Peer to Peer (P2P) Finance, Open Banking, Mobile Banking/Payments, Cryptocurrencies, Other uses of Blockchain or other Distributed Ledger Technologies (DLT), and Robo-advisory. This question examines Islamic banks’ understanding of these technologies, and whether they are taking sufficient steps to incorporate them into their institutions’ infrastructure.

In order to assess responses to the research questions, the following hypotheses are identified:

Hypothesis 1:

There is a significant awareness level among Islamic banks regarding the importance of these digital technologies as key growth drivers.

Hypothesis 2:

Islamic banks which claim to have the most awareness of such technologies are the institutions who are frontrunners in the more advanced aspects of digital transformation.

Hypothesis 3:

Some factors, such as geographical location, have a statistically significant impact on the technologies adopted by Islamic banks.

The paper’s main findings show a significant level of awareness globally in the Islamic banking sector regarding the importance of digitalization for the survival of this sector and how more-digitalized small-scale businesses can threaten banking operations. However, the research highlights that very little is being done in the adoption of critical technologies in banking operations. This central finding urges Islamic banks to increase awareness and speed up their digital adoption processes.

From this point of view, the literature includes many studies about the digital transformation of conventional or Islamic banking, and about how this transformation affects banking business and operations [6,7]. In addition, another body of studies focuses on which technology trends impact the banking business. However, to the best of our knowledge currently, no study signifies the conflict of awareness versus the lack of action in Islamic banking statistically and on a global scale.

2. Digital Transformation in the Making

An early definition of digital transformation is the use of digital technologies to facilitate institutions’ day-to-day operations. Nowadays, the concept has become much broader, and it has a profound impact on financial institutions’ entire business models [6]. Digital transformation is now more broadly defined as the use of advanced technology to improve and upgrade the performance and efficiency of enterprises [8].

According to Tanguy Catlin et al. [9], if fully adopted, digital transformation provides organizations with the power to rethink and change all their operational aspects. Thus, digital transformation is a process where organizations identify strategic responses to adopt new paths for value creation while mitigating the challenges of such technologies [10].

The internet has fundamentally impacted society with the advent of its related innovative new technologies [11]. Digital developments mold systematic change in internal processes, business models, and competencies to deliver intelligent and interactive values to customers [6,12]. A holistic view of the definition of digital transformation consists of looking at both the operational aspect, by emphasizing on the use of technologies in the processes to upscale the operations, and the strategical aspect, in which transformative actions are applied on different levels, including the organization’s culture, the business model, value creation, and the processes [13].

Various pieces of literature discuss the disruptive effect of the digitalization of finance, questioning the existence of banks in the fully digitalized future world. Classical banking business models and related value chains are no longer effective, and Fintech collaboration and the adoption of digital innovations have become crucial in order for banks to stay in the race [14,15]. According to Cziesla [16], the majority of traditional business models in the financial sector are challenged by digitalization, leading to the disintermediation of traditional financial institutions.

A related KPMG survey [17] showed that almost 90% of banks perceive Fintech as a threat to their businesses. Fintech increases the competition in digital banking services, open banking, and data analytics; it also provides a smoother customer experience [18].

Among the trending digital platform models, social-media-inspired platform designs appear to have the most significant attraction for customers, owing to their smooth and easy-to-use structure for banking operations [19]. However, when diving into the underlying systems of these digital platforms, Arner et al. [20] argued that blockchain, together with Fintech, has a similar disruptive effect on the banking business. Similarly, Aysan et al. [21] discussed, in their study, the fact that among these technologies, blockchain-based solutions have a crucial role in achieving a resilient system. They focused on SDG achievement as a benchmark, and continued the paper by measuring the possibility of SDG achievement through blockchain-based methods. According to the authors, these methods are vital for achieving a greener and more inclusive banking system.

In terms of customer relationships, the use of technology has an impact on customer service performance, and leads to customer centricity. However, banks are adopting a cautious approach toward customer centricity [16]. Abuhasan and Moreb [12] analyzed the impact of digital transformation on customer experience. Their research focused on the relationship between the customers and Islamic banks of Palestine, and how this relationship is affected based on the digitalization processes of the banks. Widharto et al. [2] performed a similar study on Indonesian banks. They argued that IT systems have the most rejuvenating effect on the digital transformation of the Indonesian banks, yet they are not enough for a bank to be defined as a “digital bank”. Traditional financial institutions are confronted with strategic and operational barriers in their digital transformation journey, which indicates the absence of a comprehensive understanding of digitalization [22].

Furthermore, Abedifar et al. [23] explained that a financial ecosystem in which Islamic banks are fully-fledged and technological opportunities are used more efficiently will perform better than an ecosystem with Islamic windows and more outdated infrastructures. The study proved that a dual banking system with fully-fledged Islamic banks will perform better in a systematic shock. Similarly, Dosso and Aysan [24] demonstrated that a more technological financial system will perform better than a more outdated ecosystem, whether Islamic or conventional.

Zouari and Abdelhedi [25] questioned the statistical impact of digitalization on customer satisfaction by focusing on Tunisian Islamic banks. They found out that there is a direct relationship between customer satisfaction and service quality and the digitalization process of the bank. Tiutiunyk et al. [26] examined how banks’ digital transformation improves their competitive positions in advanced economies, and the risks and benefits involved. The results show a direct relationship between the banks’ performance and their digitalization level. Unlike most literature about financial digitalization, this paper is critical in showing, through a market study, that digital transformation is seen differently among Islamic banks, and that there may be discrepancies in the comprehensive understanding of the elements leading to a perfect implementation of digitalization. Additionally, Aysan and Unal [3] discussed the fact that, especially, the global Islamic financial system evolves into fintech and blockchain-based user interface for a smoother customer experience and a more competitive position in the market.

Similarly, Tsindeliani et al. [7] focused on financial digitalization from a legal perspective, and how deregulating the finance industry helps to improve flexibility mechanisms and stability amidst economic crises. The paper’s results underlined the important impact of the internationalization and harmonization of legislation on financial performance in the industry. Sekhar and Gudimetla [27] demonstrated with their study that the performance of a country at both the micro and macro levels increases with a higher level of digitalization activity. The results showed that a higher level of digitalization eases the production of high added-value products and increases the GDP. Besides this, the production, transmission, storage, and processing of information and knowledge help an economy make more concise and quick decisions, improving its ability to absorb significant shocks. A similar study by Apergis et al. [28] focused on the effects of macro-prudential policies in systemic risks over a financial system. The authors proved that capital strength, managerial quality and other institutional qualities are the main basis for a positive policy effect on a financial ecosystem.

As evidenced by the literature, the digitization of Islamic/conventional banking and its disruptive and restructuring effects on the banking industry is a hot topic among experts worldwide. However, the understanding of digital transformation and its impact on the level of adoption and the type of technologies adopted by Islamic banks is limited in its global sample size. Most of the studies directly focus on the finance industry as a whole, or on a specific group of countries, lacking a snapshot of Islamic banks globally in the literature. Therefore, this paper aims to fill this gap by focusing on the relationship between the understanding of the digitalization process and its level of adoption by Islamic banks in a sample of numerous countries.

3. Data and Methodology

This study is based on a unique dataset, and employs a quantitative research method. The data were obtained from the Global Islamic Bankers’ Survey conducted by the General Council for Islamic Banks and Financial Institutions (CIBAFI) in 2020. The survey covered the topic of digitalization and customer experience in the Islamic banking sector by surveying 101 Islamic Banks worldwide. Based on the research questions of this study, the dataset was derived from specific questions of the CIBAFI questionnaire, namely the Global Islamic Banks Survey (GIBS). The GIBS survey was conducted from November 2019 to February 2020 [29].

GIBS is an annual survey carried out by CIBAFI among Islamic banks’ top managers around the globe in order to understand the current situation of the industry and its future direction. The survey is crucial for the direct observation of the management goals and motivations of the decision-makers, and for the use of this knowledge in quantitative testing.

The survey consists of around 35 countries and 101 Islamic banks per year. These countries are categorized into seven groups in order to extrapolate geographical trends. The table below summarizes the country classification for the 2020 data. CIBAFI announces survey reports and executive summaries in which major global Islamic banking industry highlights are listed every year. From a research perspective, GIBS is a valuable resource for the collection of diverse data on Islamic financial institutions around the globe. Table 1 shows the details of the surveyed countries ad groups.

Table 1.

2020 GIBS survey country and group details.

Returning to the test, we performed different statistical procedures to answer the research questions: correlation analysis and one-way ANOVA. The data were compiled and analyzed using the Statistical Package for Social Sciences (SPSS) software (IBM, Armonk, NY, USA). Descriptive statistics were also applied to extract insights into the importance of Fintech for the Islamic banks, the most important technology trends that are being implemented, and the importance of customer experiences for Islamic banks. Furthermore, a correlation was conducted to check the relationship between different technological trends and how banks utilized Fintech in their core business activities. Finally, we also carried out analysis of variance (ANOVA) to investigate significant statistical differences between the banks’ adoption levels.

4. Results

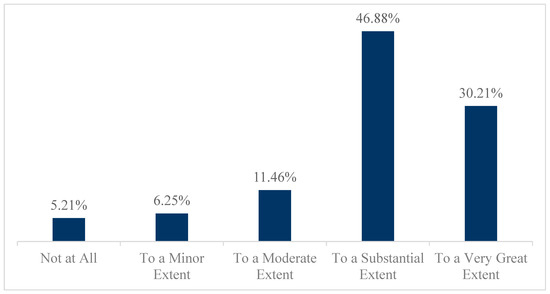

The descriptive statistics of the data show that most banks are putting technology at the center of their core business activities. In response to the survey question “To what extent does your institution put technology at the core of its activities?” more than 70 percent of the respondents reported more than a moderate interest in technology. This supports the first hypothesis of this paper. Figure 1 shows the answer percentages to the related question of the survey.

Figure 1.

Answer to the survey question: To what extent does your institution put technology at the core of its activities?

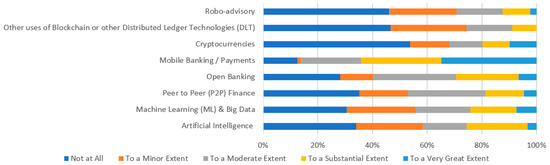

Figure 2 shows that mobile banking/payments are the most-implemented technology by Islamic banks. In contrast, controversial trends such as cryptocurrencies, other uses of distributed ledger technology (DLT), and robo-advisory have lower implementation levels. Relative implementation is associated with P2P and open-banking trends, indicating the potential of these trends within the Islamic banking sector [30].

Figure 2.

The correlation between the level of adoption of technology for the core business activities of Islamic banks and the implementation of trends and technologies.

The correlation between different technological trends and digital transformation supports the above analysis of the implemented technologies. The most substantial relationship is between mobile banking/payments and digital transformation, followed by the relationship between machine learning (ML) and big data and digital technology. The third strongest correlation is between P2P and digital transformation. This shows that the implementation level of new technologies is low even for the most advanced Islamic banks in terms of digital transformation. This indicates that the second hypothesis is true only for some technologies that are well established. Table 2 shows the correlation between different technological trends and digital transformation.

Table 2.

The correlation between different technological trends and digital transformation.

The one-way ANOVA test shows that for AI, ML and big data, P2P, and other uses of blockchain or other DLT, overall, there are significant differences based on the criteria of geographical location regarding the implementation of these technologies by Islamic banks, which supports the third hypothesis of this paper. The significance of F for these technologies is less than 0.05. Meanwhile, with the other technologies, the one-way ANOVA does not show any significant difference in terms of implementation in different regions.

Mobile banking is one of the trends in which the difference in the implementation based on the geographical location is not significant, as the one-way ANOVA shows. This could be explained by the current usage of smartphones globally, as the infrastructure for this technology already exists widely. However, other trends which require new infrastructure and R&D—such as AI or DLT-based technologies—are not as popular, which explains the significant difference in the implementation from one region to another. Table 3 shows the one-way ANOVA test result shows the significance of technological trends.

Table 3.

The one-way ANOVA test result shows the significance of technological trends.

5. Discussions and Conclusions

The impact of technology on the financial system is exceptionally high. With more financial institutions embarking on the digital transformation journey, the industry is witnessing increased innovation and burgeoning market competitiveness. The trend of adopting and implementing technology in the core business activities of financial institutions is valid for both the conventional and the Islamic financial sectors.

The tests conducted on the data collected through a survey by CIBAFI showed the great interest from Islamic banks in digital transformation. However, the analysis of the implemented trends and how these trends are connected to digital transformation showed that, overall, Islamic banks relate digital transformation with basic and well-established trends and technologies. This means that there is more work to be done regarding new trends and advanced technologies.

One of the main conclusions of this analysis shows that Islamic banks are well aware of the globe’s technological transformation, and are willing to adapt within it. However, the test results show that most Islamic bankers’ digital transformation is limited to mobile banking and big data. This raises the question of the awareness and accuracy of Islamic banks’ visions of digitalization.

One hypothesis explains this situation through the ease of implementing these technologies. Mobile banking is based on mobile phones and the internet, which are both very mature technologies. Therefore, implementing mobile banking into a bank’s operations requires less investment, likely only consisting of a mobile application and related optimizations. However, the other mentioned technologies in this study are much younger in terms of maturity, and therefore they are more challenging and costly to implement. Although technologies such as AI, machine learning, and big data are mature enough to be used in banking, others, such as DLT technologies or crypto assets, have an implementation level near zero globally. Therefore, in a highly competitive business such as banking, high R&D investments and long-term return profiles are embraced less often.

Lastly, the size and the level of technological development in the regions in which they operate pose two challenges for Islamic banks in their digital transformation journey. Islamic banks must overcome these challenges, understand the urgency of technology adoption as a business growth driver, and master the emerging technologies in order to become future-ready financial institutions and continue growing in a competitive environment. Moreover, Islamic banks must widen their digital transformation perspective and actively use novel technologies. This implementation does not necessarily have to originate from the bank itself; it could also be in acquisition or partnership with the existing Fintechs using these technologies [31]. This method would pose less risk and less cost for the banks, while offering faster implementation due to decreased operational flexibility concerns. Islamic banks would increase their competitive advantage by rising to the forefront of the digitalization race, and more research on the strategy development of technology implementation in Islamic banking operations would accelerate this process.

The paper’s main findings are that Islamic banks globally are aware of the importance of digitalization for their survival and how more digitalized small-scale businesses can threaten banking operations. However, more must be done to adopt critical technologies in banking operations. This central finding urges Islamic banks to increase awareness and speed up their digital adoption processes. In the competitive environment of banking, the definition of digital transformation is not limited to mobile and online banking anymore. Banks are challenged to adapt to the astonishing restructuring requirements of the different technologies mentioned in this paper. Further study should focus on how Islamic banks globally could adopt these technology trends systematically, and how they could be an advantage in the Islamic banking industry as we progress into a future of technological innovation.

Author Contributions

Conceptualization, I.M.U.; Data curation, R.E.; Formal analysis, I.M.U.; Investigation, I.M.U.; Methodology, I.M.U. and R.E.; Resources, I.M.U. and A.B.; Supervision, A.F.A.; Writing—original draft, I.M.U. and R.E.; Writing—review & editing, A.F.A., I.M.U., R.E. and A.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research receives no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data includes Annual CIBAFI GIBS Survey Results.

Conflicts of Interest

The authors declare no conflict of interest.

References

- King, B. Bank 4.0: Banking Everywhere, Never at a Bank; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Widharto, P.; Pandesenda, A.I.; Yahya, A.N.; Sukma, E.A.; Shihab, M.R.; Ranti, B. Digital Transformation of Indonesia Banking Institution: Case Study of PT. BRI Syariah. In Proceedings of the 2020 International Conference on Information Technology Systems and Innovation (ICITSI), Bandung, Indonesia, 19–23 October 2020; IEEE: New York, NY, USA, 2020; pp. 44–50. [Google Scholar]

- Aysan, A.; Unal, I.M. Is Islamic Finance Evolving into Fintech and Blockchain: A Bibliometric Analysis. Efil J. Econ. Res. 2021; in press. [Google Scholar]

- Sibanda, W.; Ndiweni, E.; Boulkeroua, M.; Echchabi, A.; Ndlovu, T. Digital technology disruption on bank business models. Int. J. Bus. Perform. Manag. 2020, 21, 184–213. [Google Scholar] [CrossRef]

- Yunita, P. The Digital Banking Profitability Challenges: Are They Different Between Conventional And Islamic Banks? J. Akunt. Dan Keuang. Indones. 2021, 18, 4. [Google Scholar] [CrossRef]

- Khanboubi, F.; Boulmakoul, A. Digital transformation in the banking sector: Surveys exploration and analytics. Int. J. Inf. Syst. Change Manag. 2019, 11, 93–127. [Google Scholar] [CrossRef]

- Tsindeliani, I.A.; Proshunin, M.M.; Sadovskaya, T.D.; Popkova, Z.G.; Davydova, M.A.; Babayan, O.A. Digital transformation of the banking system in the context of sustainable development. J. Money Laund. Control 2021, 25, 165–180. [Google Scholar] [CrossRef]

- Consulting, C.G.; Sloan, M. Digital Transformation: A Roadmap for Billion-Dollar Organizations. Available online: https://www.capgemini.com/wp-content/uploads/2017/07/Digital_Transformation__A_Road-Map_for_Billion-Dollar_Organizations.pdf (accessed on 31 October 2019).

- Catlin, T.; Lorenz, J.-T.; Sternfels, B.; Willmott, P. A Roadmap for a Digital Transformation. McKinsey, 2017. Available online: https://www.mckinsey.com/industries/financial-services/our-insights/a-roadmap-for-a-digital-transformation (accessed on 24 December 2021).

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- El-Darwiche, B.; Herzog, M.; Singh, M.; Maalouf, R. Understanding Digital Content and Services Ecosystems: The Role of Content and Services in Boosting Internet Adoption; PwC Network: New York, NY, USA, 2016. [Google Scholar]

- Abuhasan, F.; Moreb, M. The Impact of the Digital Transformation on Customer Experience in Palestine Banks. In Proceedings of the 2021 International Conference on Information Technology (ICIT), Amman, Jordan, 14–15 July 2021; IEEE: New York, NY, USA, 2021; pp. 43–48. [Google Scholar]

- Yu, H.; Fletcher, M.; Buck, T. Managing digital transformation during re-internationalization: Trajectories and implications for performance. J. Int. Manag. 2022, 28, 100947. [Google Scholar] [CrossRef]

- Omarini, A.E. The digital transformation in banking and the role of FinTechs in the new financial intermediation scenario. Int. J. Financ. Econ. Trade 2017, 1, 1–6. [Google Scholar]

- PwC (PricewaterhouseCoopers). A Decade of Digital Keeping Pace with Transformation. 2017 Global Digital IQ® Survey: 10th Anniversary Edition. pp. 1–30. Available online: https://www.pwc.com/ee/et/publications/pub/pwc-digital-iq-report.pdf (accessed on 23 May 2018).

- Cziesla, T. A Literature Review on Digital Transformation in the Financial Service Industry. In Proceedings of the BLED 2014 Proceedings, Bled, Slovenia, 1–5 June 2014. [Google Scholar]

- KPMG. Technologies Unlocking Massive Market Opportunity Part 2: Innovation Convergence Unlocks New Paradigms. Available online: https://assets.kpmg/content/dam/kpmg/lv/pdf/disruptive-tech-2017-part2.pdf (accessed on 23 March 2019).

- Omarini, A.E. Banks and Fintechs: How to develop a digital open banking approach for the bank’s future. Int. Bus. Res. Can. Cent. Sci. Educ. 2018, 11, 23–36. [Google Scholar] [CrossRef]

- Chishti, S.; Barberis, J. The Fintech Book: The Financial Technology Handbook for Investors, Entrepreneurs, and Visionaries; John Wiley & Sons: Hoboken, NJ, USA, 2016. [Google Scholar]

- Arner, D.W.; Barberis, J.; Buckey, R.P. FinTech, RegTech, and the reconceptualization of financial regulation. Northwest. J. Int. Law Bus. 2016, 37, 371. [Google Scholar]

- Aysan, A.F.; Bergigui, F.; Disli, M. Blockchain-based solutions in achieving SDGs after COVID-19. J. Open Innov. Technol. Mark. Complex. 2021, 7, 151. [Google Scholar] [CrossRef]

- Diener, F.; Špaček, M. Digital Transformation in Banking: A Managerial Perspective on Barriers to Change. Sustainability 2021, 13, 2032. [Google Scholar] [CrossRef]

- Abedifar, P.; Giudici, P.; Hashem, S.Q. Heterogeneous market structure and systemic risk: Evidence from dual banking systems. J. Financ. Stab. 2017, 33, 96–119. [Google Scholar] [CrossRef] [Green Version]

- Dosso, M.; Aysan, A.F. The Technological Impact in Finance: A Bibliometric Study of Fintech Research. In Eurasian Business and Economics Perspectives; Springer: Cham, Switzerland, 2022; pp. 193–209. [Google Scholar]

- Zouari, G.; Abdelhedi, M. Customer satisfaction in the digital era: Evidence from Islamic banking. J. Innov. Entrep. 2021, 10, 9. [Google Scholar] [CrossRef]

- Tiutiunyk, I.; Drabek, J.; Antoniuk, N.; Navickas, V.; Rubanov, P. The impact of digital transformation on macroeconomic performance: Evidence from EU countries. J. Int. Stud. 2021, 14, 220–234. [Google Scholar] [CrossRef]

- Sekhar, S.; Gudimetla, V. Theorems and theories of financial innovation: Models and mechanism perspective. Financ. Quant. Anal. 2013, 1, 26–29. [Google Scholar] [CrossRef]

- Apergis, N.; Aysan, A.F.; Bakkar, Y. How do institutional settings condition the effect of macroprudential policies on bank systemic risk? Econ. Lett. 2021, 209, 110123. [Google Scholar] [CrossRef]

- CIBAFI (General Council for Islamic Banks and Financial Institutions, Bahrain). 2020. Available online: https://islamicmarkets.com/publications/cibafi-global-islamic-bankers-survey-june-2020 (accessed on 24 May 2021).

- Nanaeva, Z.; Aysan, A.F.; Shirazi, N.S. Open banking in Europe: The effect of the Revised Payment Services Directive on Solarisbank and Insha. J. Paym. Strategy Syst. 2021, 15, 432–444. [Google Scholar]

- Abumughli, A.; Aysan, A. The ascent of digital banks in the Gulf region: Prospects and challenges. J. Digit. Bank. 2022, 6, 277–286. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).