United States Solar Investment: A Feasibility Study of Solar Farms in Kentucky

Abstract

:1. Introduction

2. Materials and Methods

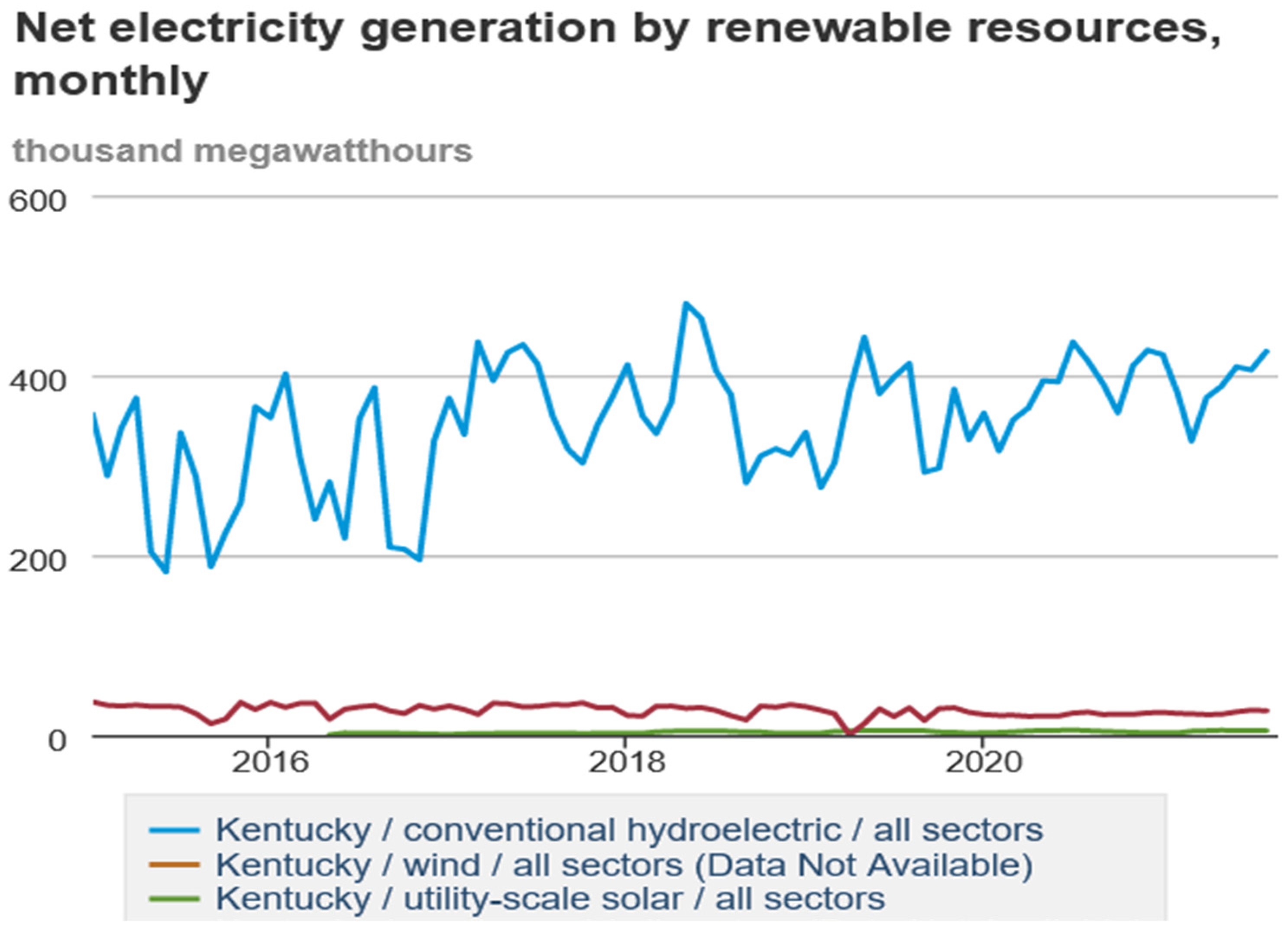

2.1. Analysis of Solar PV Potential in Kentucky

2.1.1. The Current of Solar in the KY State

Cooperative Solar

Corporate Solar

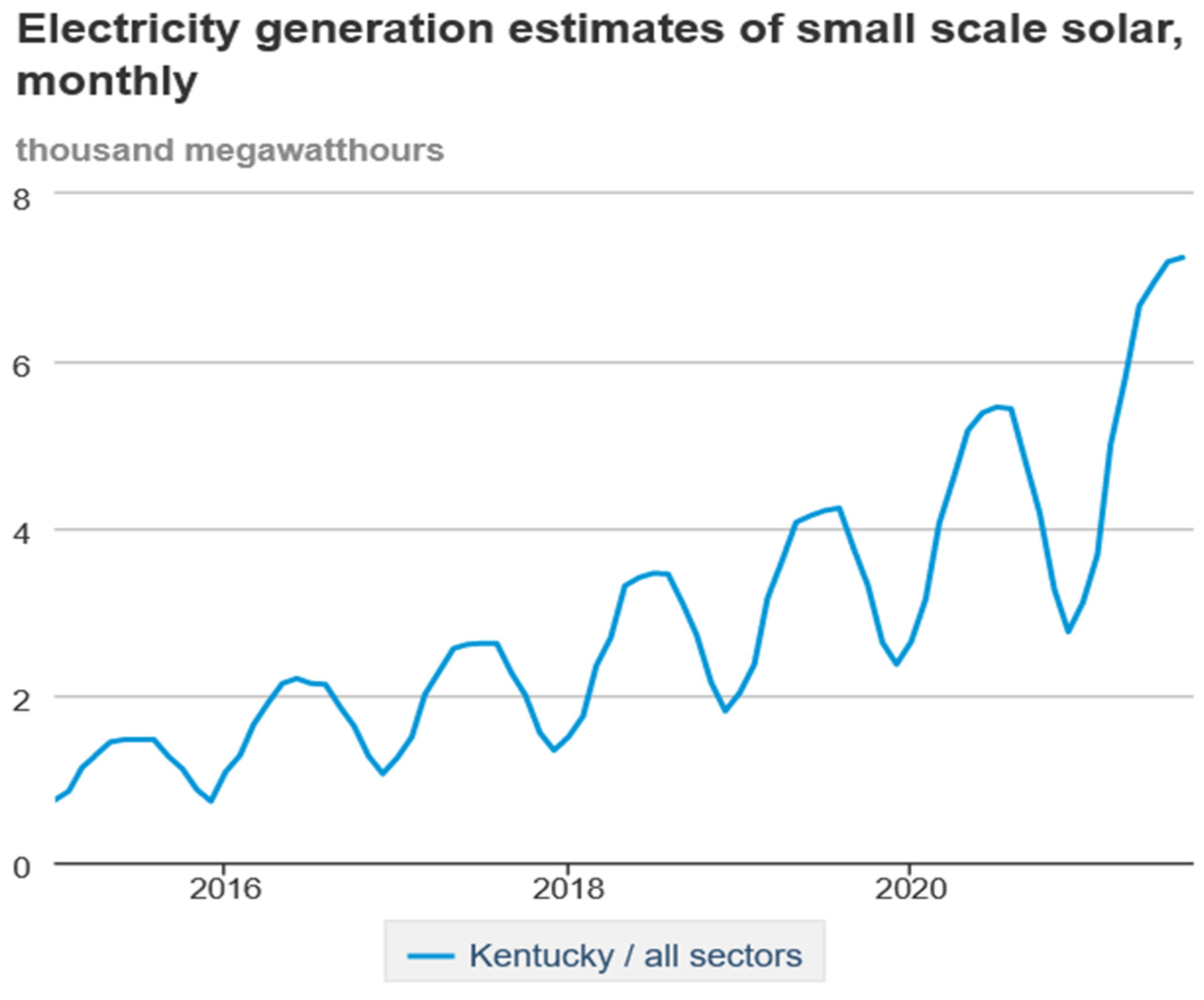

Small Scale Solar

2.1.2. The Future of Solar in the KY State

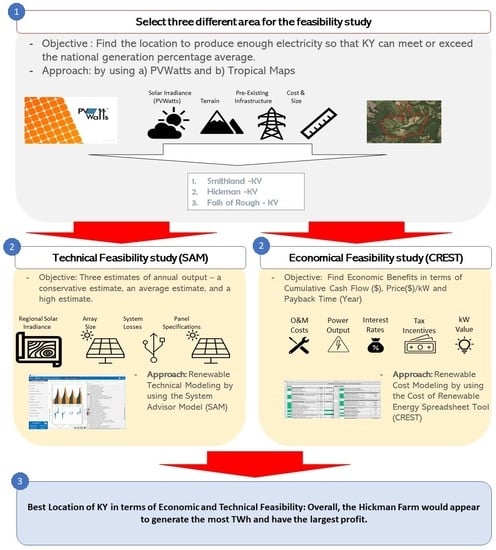

2.2. Approach

- (1)

- Terrain

- (2)

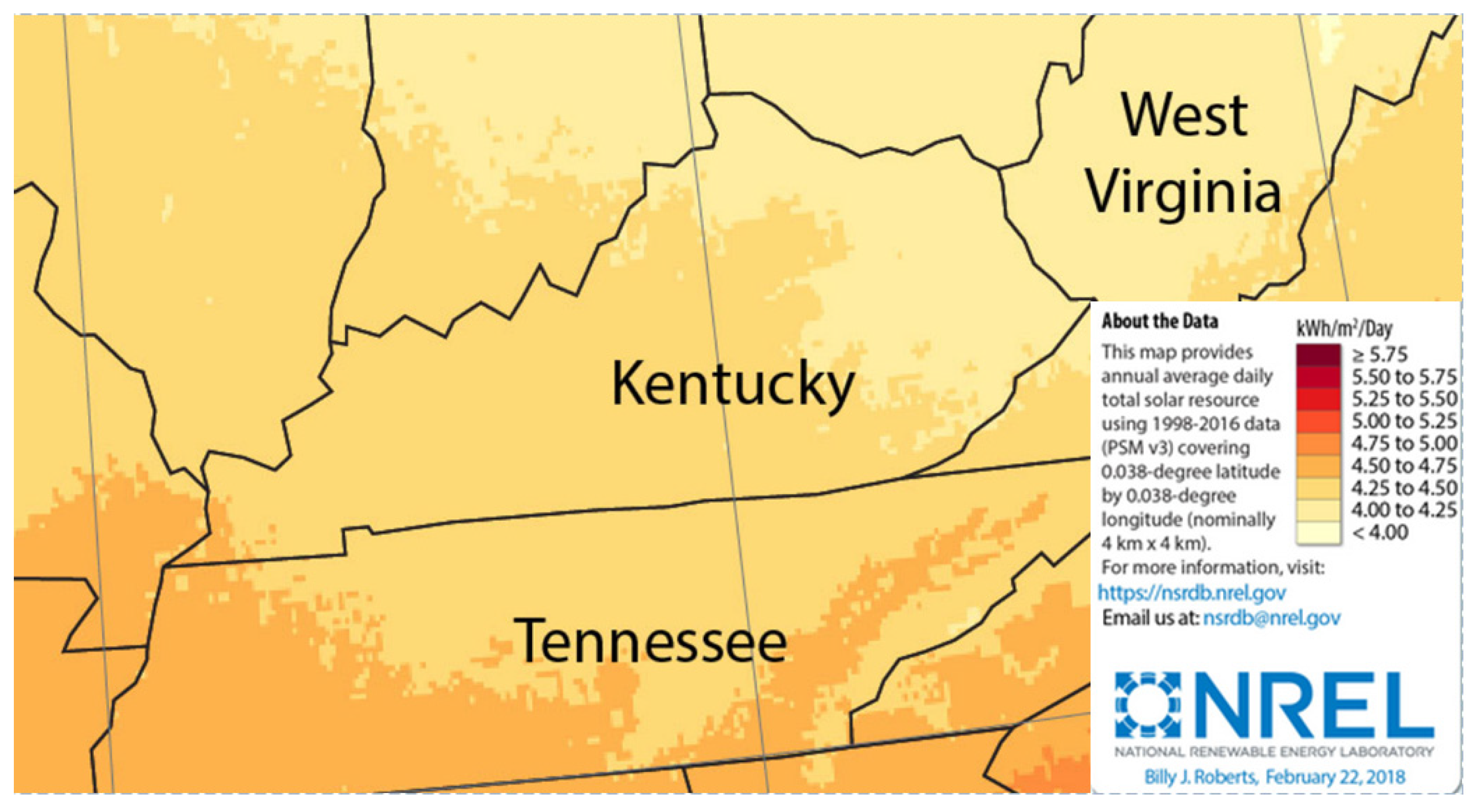

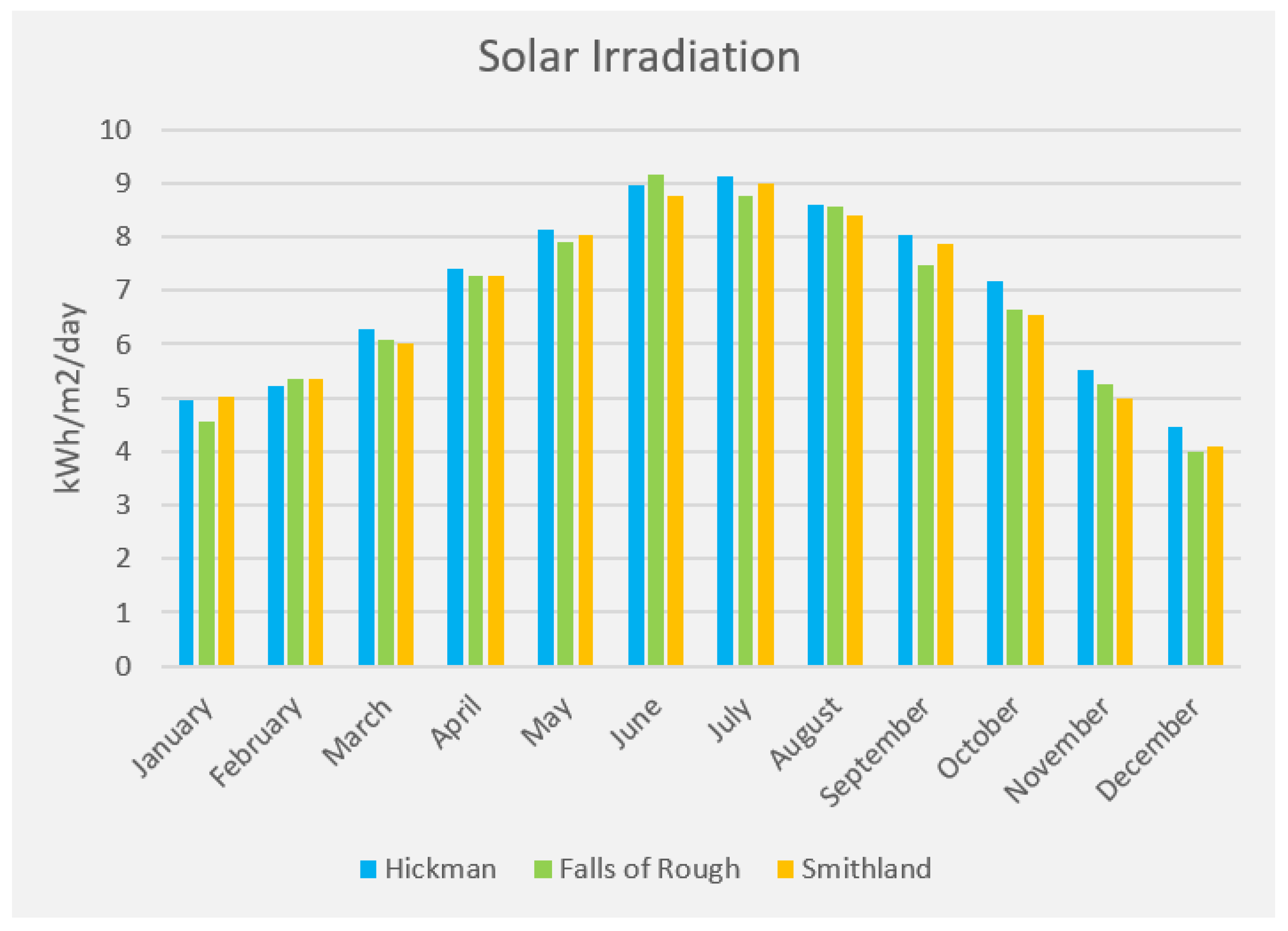

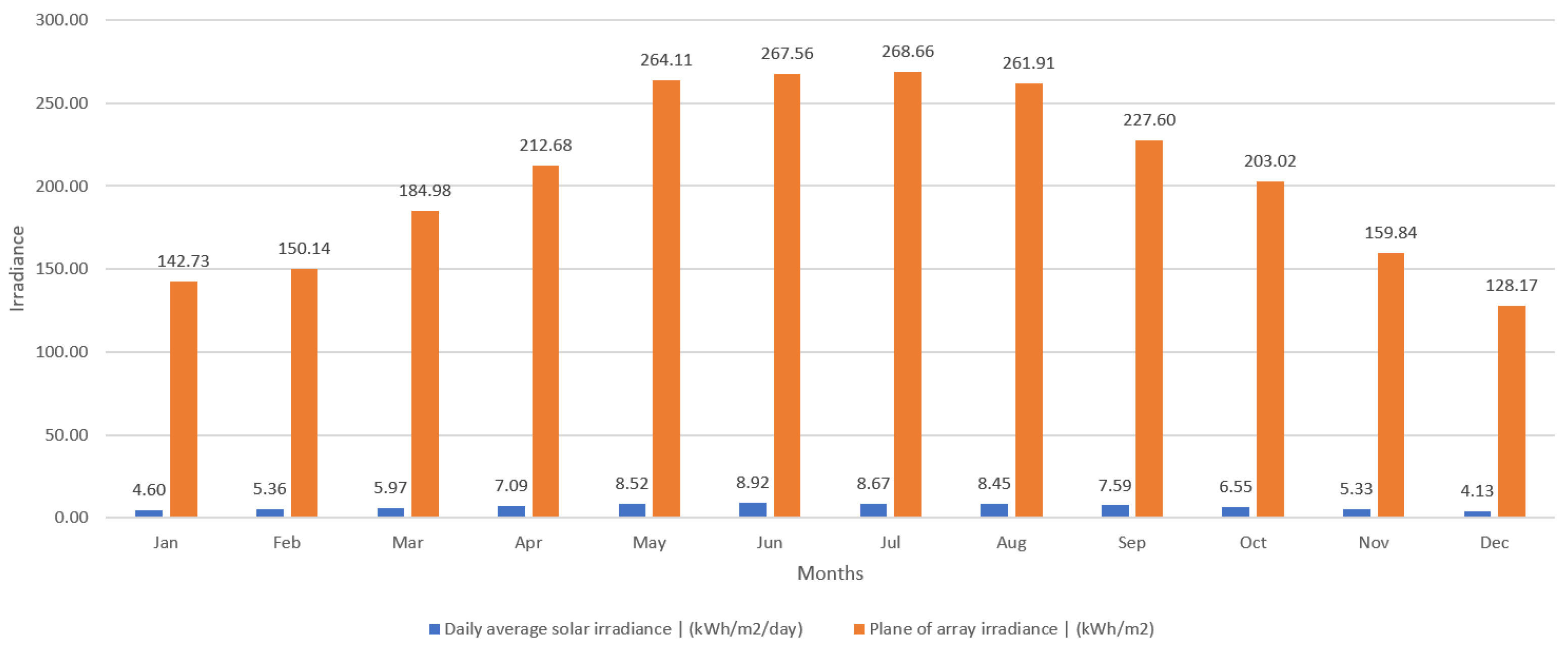

- Solar Irradiance

- (3)

- Cost and Size

- (4)

- Proximity to pre-existing infrastructure.

2.3. Modeling

2.3.1. System Advisor Model (SAM) and Cost of Renewable Energy Spreadsheet Tool (CREST)

2.3.2. SAM Parameters

2.3.3. CREST Parameters

3. Results

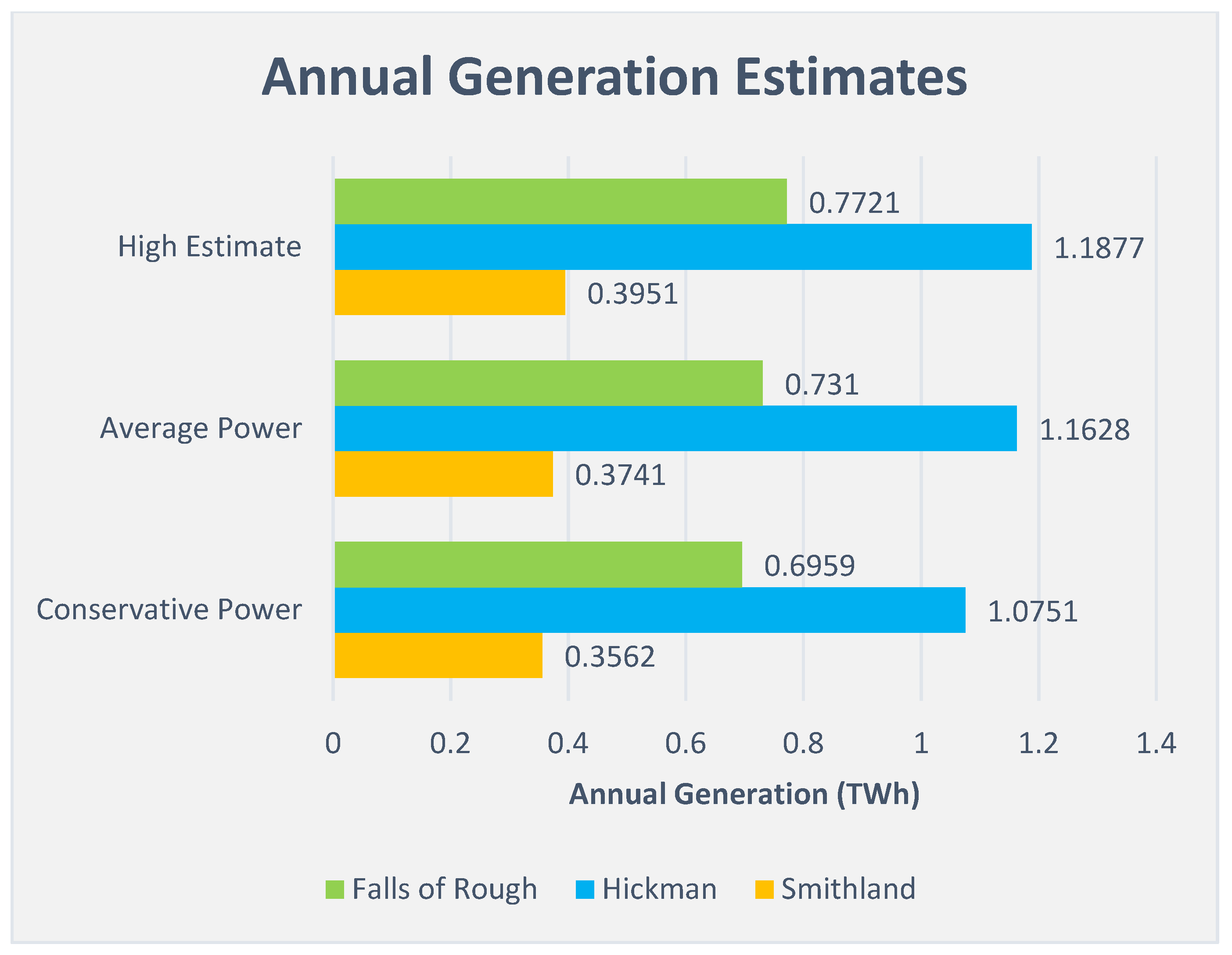

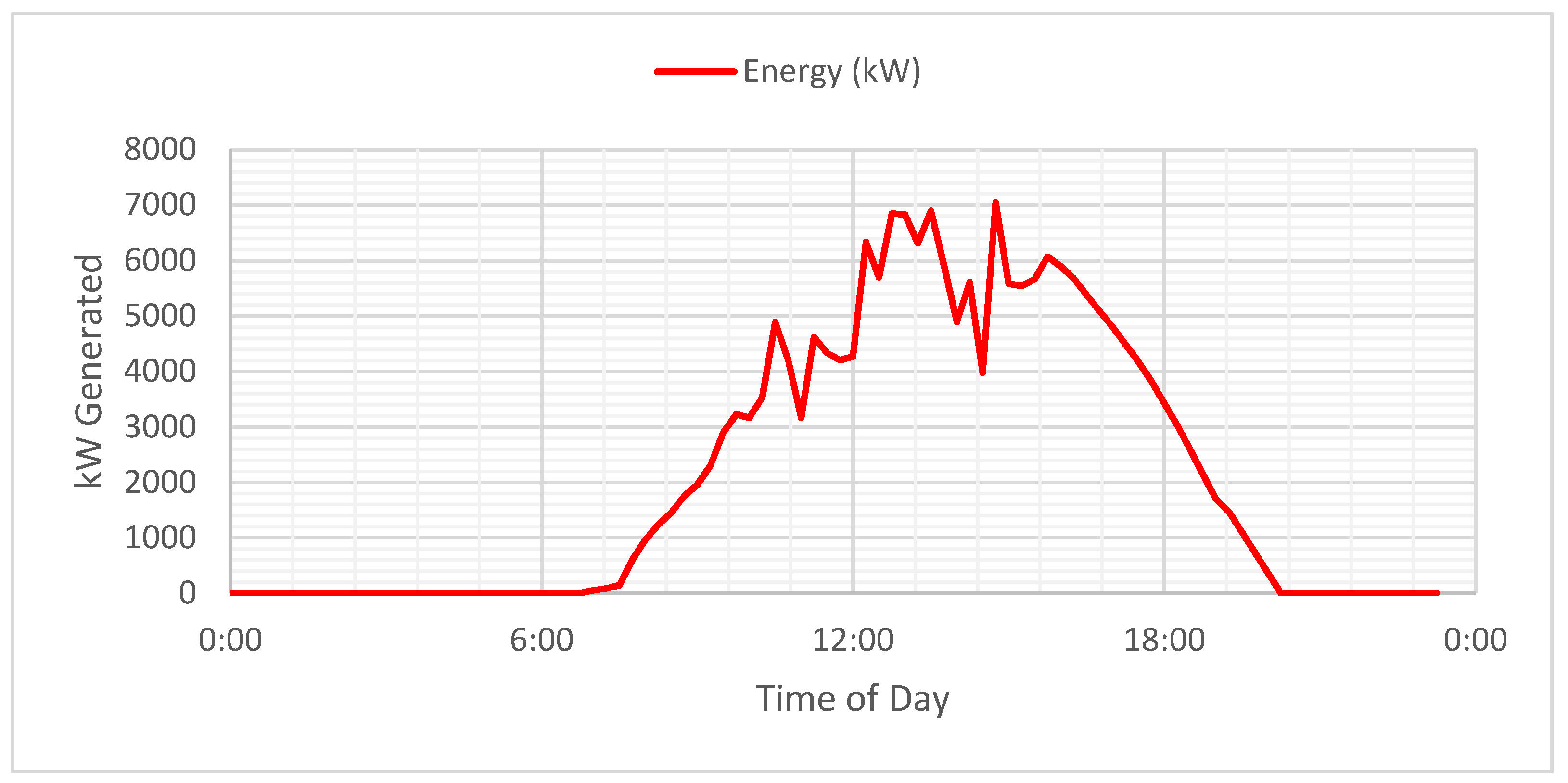

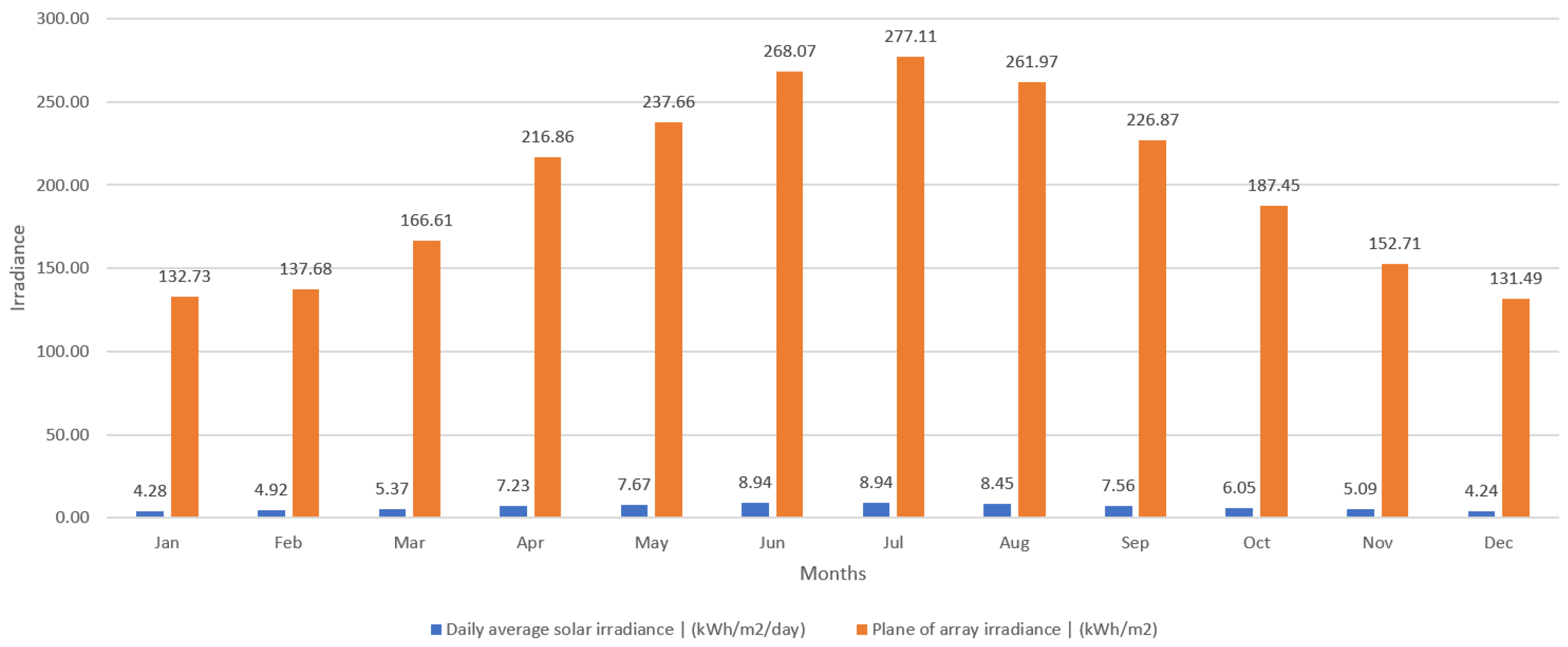

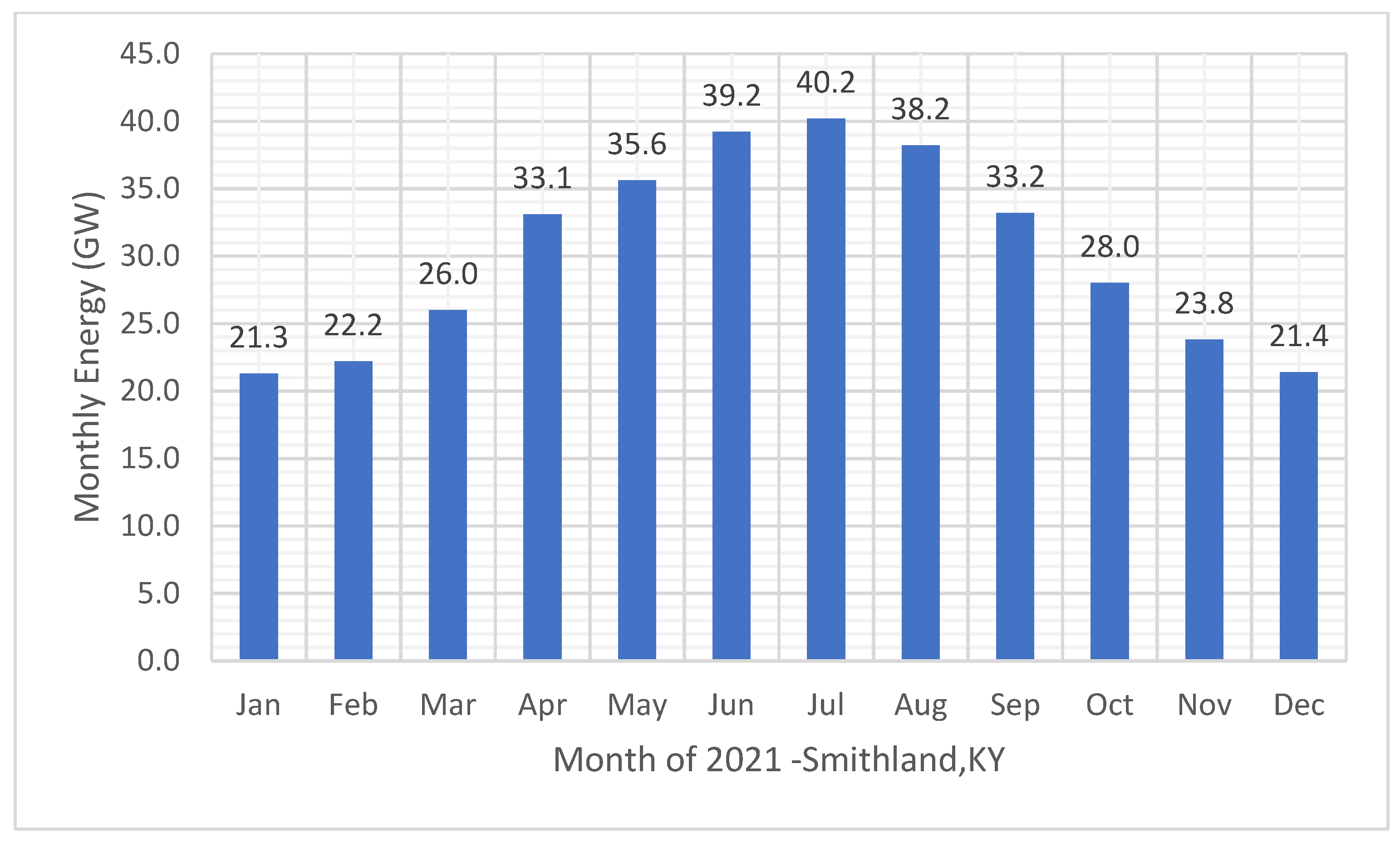

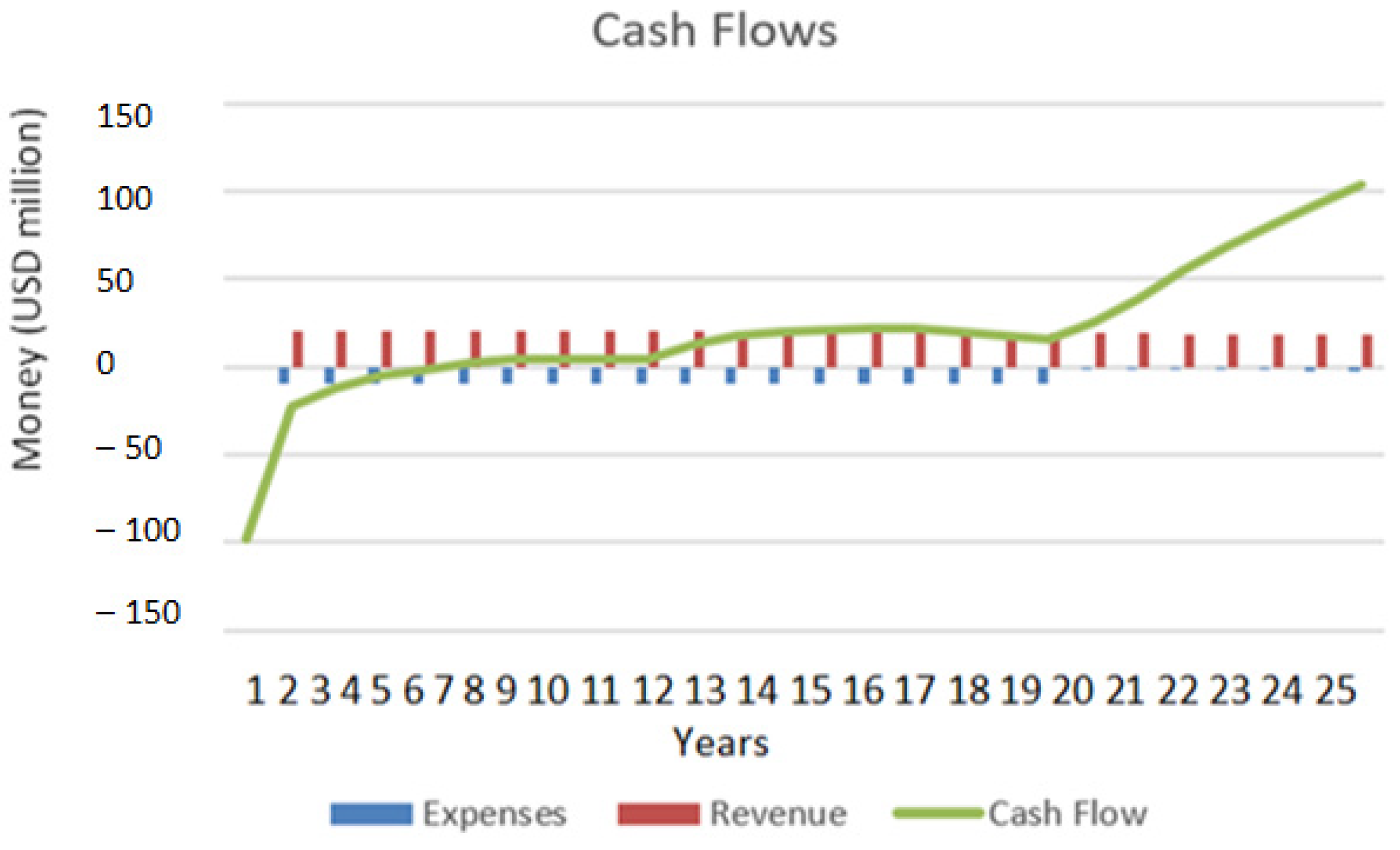

3.1. Solar Farms by Location—Smithland, KY

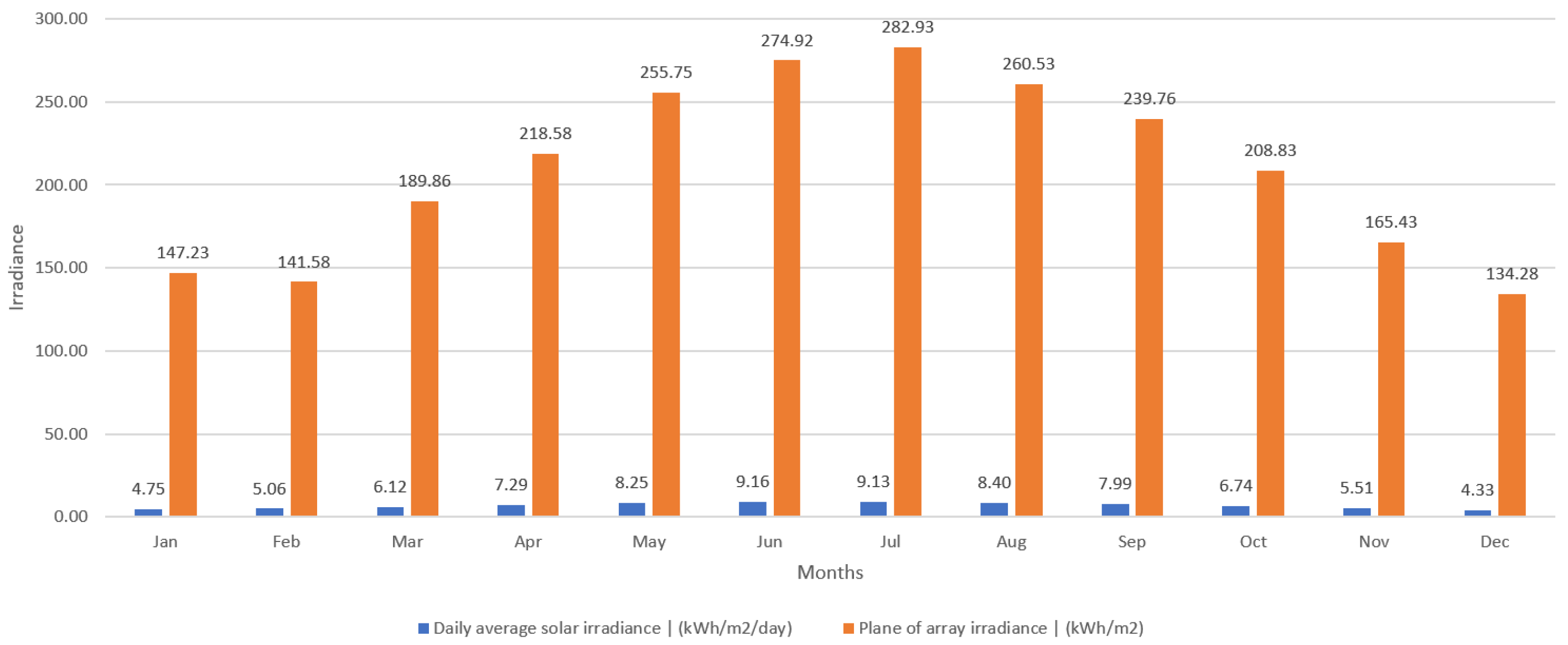

3.2. Solar Farms by Location—Hickman, KY

3.3. Solar Farms by Location—Falls of Rough, KY

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Category | Input | Description |

|---|---|---|

| Technology | Photovoltaic | Type of solar technology being used |

| Generator Nameplate Capacity | Varies on Location | Assumed system capacity |

| Net Capacity Factor | State Average | the options here are to enter a custom factor or to select State Average |

| State | KY | If State Average is chosen, enter the state here |

| Annual Production Degradation | 0.50% | Annual percentage the system has degraded. The value used was based on typical degradation for the panels used |

| Project Useful Life | 25 | How long the panels are expected to last before needing replacement |

| Total Installed Cost | Varies on Location | Total costs for standard operation, maintenance, etc. in $(USD)/Watt DC. This was based on averages for solar farms of similar size in areas with similar income |

| Fixed O & M Expense, Yr 1 | $6.50/kW-yr dc | Total expected fixed costs |

| O & M Cost Inflation, Initial Period | 1.60% | Inflation rate 1 will last over a set initial period |

| Initial Period Ends Last Day Of: | 10 | The time period over which inflation rate 1 lasts |

| O & M Cost Inflation, thereafter | 1.60% | Inflation Rate after the initial period ends |

| % Debt | 45% | Theoretical amount of funds borrowed |

| Debt Term | 18 | number of years for debt repayment |

| Interest Rate on Term Debt | 7% | interest rate set by lender |

| Lender’s Fee | 3% | one-time fee collected by the lender |

| DSCR | 1.2–1.45% | Debt Service Coverage Ratio is yearly cash flow/(annual principal + interest) |

| Target After-Tax Equity IRR | 12% | minimum rate of return |

| Other Closing Costs | 0% | any additional costs |

| Is the owner a taxable entity? | Yes | |

| Federal Income Tax Rate | 35% | |

| Federal Tax Benefits used as generated or carried forward? | Generated | determines whether deprecation is monetized as it occurs or after the project has sufficient tax liability |

| State Income Tax Rate | 0% | |

| State Tax Benefits used as generated or carried forward? | Generated | determines whether deprecation is monetized as it occurs or after the project has sufficient tax liability |

| Payment Duration for Cost-Based Tariff | FIT Contract length—determined by policymakers | |

| % Of Year 1 Tariff Escalated | portion of tariff that can be escalated | |

| Cost-Based Tariff Escalation Rate | used to account for levelized nominal tariff rate | |

| Federal Incentives | Cost-Based | |

| Investment Tax Credit (ITC) or Cash Grant? | ITC | |

| ITC Amount | 22% | |

| ITC Utilization Factor | 100% | How much of the project expenses the ITC can be applied to |

| Additional Federal Grants | 0 | |

| Federal Grants Treated as Taxable Income? | No | |

| State Rebates/Grants | No | |

| $ Cap on State Rebates/Grants | $500,000 | Maximum amount of state grants or rebates a project can legally accept |

| State Grants Treated as Taxable Income? | No | |

| 1st Equipment Replacement | 10 | Year equipment will need maintenance/replacement |

| 1st Replacement Cost ($ in year replaced) | $0.24 | |

| 2nd Equipment Replacement | 20 | Year equipment will need 2nd maintenance/replacement |

| 2nd Replacement Cost ($ in year replaced) | $0.24 | |

| Number of months of Debt Service | 6 | lenders often require a debt service amount set aside equal to x amount of months’ repayment |

| Number of months of O&M Expense | 6 | how many months of O & M should be set aside in a reserve account |

| Interest on All Reserves | 2% |

| Project Size and Performance | Units | Input Value |

|---|---|---|

| Generator Nameplate Capacity | kW dc | 400,000 |

| Net Capacity Factor: Select “State Average” or “Custom” → | State Average | |

| Net C.F.: If “State Average” method, then select state → | KY | |

| Net Capacity Factor, Yr 1 | 14.0% | |

| Production, Yr 1 | kWh | 490,669,792 |

| Annual Production Degradation | % | 0.5% |

| Project Useful Life | years | 25 |

| Capital Costs | Units | Input Value |

| Select Cost Level of Detail | Simple | |

| Total Installed Cost | $/Watt dc | $0.89 |

| Total Installed Cost (before rebates/grants, if any) | $ | $356,000,000 |

| Total Installed Cost (before rebates/grants, if any) | $/Watt dc | $0.89 |

| Operations & Maintenance | Units | Input Value |

| Select Cost Level of Detail | Simple | |

| Fixed O&M Expense, Yr 1 | $/kW-yr dc | $6.50 |

| Variable O&M Expense, Yr 1 | ¢/kWh | 0.00 |

| O&M Cost Inflation, initial period | % | 1.6% |

| Initial Period ends last day of: | year | 10 |

| O&M Cost Inflation, thereafter | % | 1.6% |

| Permanent Financing | Units | Input Value |

| % Debt (% of hard costs) (mortgage-style amort.) | % | 45% |

| Debt Term | years | 18 |

| Interest Rate on Term Debt | % | 7.00% |

| Lender’s Fee (% of total borrowing) | % | 3.0% |

| Required Minimum Annual DSCR | 1.20 | |

| Actual Minimum DSCR, occurs in → | Year 18 | 1.60 |

| Minimum DSCR Check Cell (If “Fail”, read note ==>) | Pass/Fail | Pass |

| Required Average DSCR | 1.45 | |

| Actual Average DSCR | 1.73 | |

| Average DSCR Check Cell (If “Fail”, read note ==>) | Pass/Fail | Pass |

| % Equity (% hard costs) (soft costs also equity funded) | % | 55% |

| Target After-Tax Equity IRR | % | 12.00% |

| Weighted Average Cost of Capital (WACC) | % | 8.47% |

| Other Closing Costs | $ | $0 |

| Summary of Sources of Funding for Total Installed Cost | ||

| Senior Debt (funds portion of hard costs) | 45% | $160,200,000 |

| Equity (funds balance of hard costs + all soft costs) | 55% | $195,800,000 |

| Total Value of Grants (excl. pmt in lieu of ITC, if applicable) | 0% | $0 |

| Total Installed Cost | $ | $356,000,000 |

| Tax | Units | Input Value |

| Is owner a taxable entity? | Yes | |

| Federal Income Tax Rate | % | 35.0% |

| Federal Tax Benefits used as generated or carried forward? | As Generated | |

| State Income Tax Rate | % | 8.5% |

| State Tax Benefits used as generated or carried forward? | As Generated | |

| Effective Income Tax Rate | % | 40.53% |

| Depreciation Allocation | see table ==> | |

| Cost-Based Tariff Rate Structure | Units | Input Value |

| Payment Duration for Cost-Based Tariff | years | 25 |

| % of Year-One Tariff Rate Escalated | % | 0.0% |

| Cost-Based Tariff Escalation Rate | % | 0.0% |

| Forecasted Market Value of Production; applies after Incentive Expiration | ||

| Select Market Value Forecast Methodology | Year One | |

| Value of energy, capacity & RECs, Yr 1 | ¢/kWh | 5.00 |

| Market Value Escalation Rate | % | 3.0% |

| Federal Incentives | Units | Input Value |

| Select Form of Federal Incentive | Cost-Based | |

| Investment Tax Credit (ITC) or Cash Grant? | ITC | |

| ITC or Cash Grant Amount | % | 22% |

| ITC utilization factor, if applicable | % | 100% |

| ITC or Cash Grant | $ | $73,620,800 |

| Is PBI Tax-Based (PTC) or Cash-Based (REPI)? | Tax Credit | |

| PBI Rate | ¢/kWh | 2.30 |

| PBI Utilization or Availability Factor, if applicable | % | 100.0% |

| PBI Duration | yrs | 10 |

| PBI Escalation Rate | % | 2.0% |

| Additional Federal Grants (Other than Section 1603) | $ | $0 |

| Federal Grants Treated as Taxable Income? | No | |

| State Rebates, Tax Credits and/or REC Revenue | Units | Input Value |

| Select Form of State Incentive | Neither | |

| ITC Amount | % | 30% |

| Utilization Factor, if applicable | % | 100% |

| State ITC realization period | yrs | 5 |

| Total State ITC, over realization period | $ | $0 |

| Is Performance-Based Incentive Tax Credit or Cash Pmt? | Cash | |

| Annual $ Cap on Performance-Based Incentive | $ | $0 |

| If cash, is state PBI or REC taxable? | Yes | |

| PBI or REC Rate | ¢/kWh | 1.50 |

| PBI Utilization Factor, if applicable | % | 100.0% |

| PBI or REC Payment Duration | yrs | 10 |

| PBI or REC Escalation Rate (pos. or neg.) | % | 2.0% |

| Additional State Rebates/Grants | $/Watt | $0.00 |

| Total $ Cap on State Rebates/Grants | $ | $500,000 |

| State Rebates/Grants Treated as Taxable Income? | No | |

| Capital Expenditures During Operations: Inverter Replacement | Input Value | |

| 1st Equipment Replacement | year | 10 |

| 1st Replacement Cost ($ in year replaced) | $/Watt dc | $0.235 |

| 2nd Equipment Replacement | year | 20 |

| 2nd Replacement Cost ($ in year replaced) | $/Watt dc | $0.235 |

| Reserves Funded from Operations | Units | Input Value |

| Decommissioning Reserve | ||

| Fund from Operations or Salvage Value? | Operations | |

| Reserve Requirement | $ | $0 |

| Initial Funding of Reserve Accounts | Units | Input Value |

| Debt Service Reserve | ||

| # of months of Debt Service | months | 6 |

| Initial Debt Service Reserve | $ | $7,962,949 |

| O&M Reserve/Working Capital | ||

| # of months of O&M Expense | months | 6 |

| Initial O&M and WC Reserve | $ | $1,583,103 |

| Interest on All Reserves | % | 2.0% |

| Depreciation Allocation | Input Values | |

| Bonus Depreciation | Yes | |

| % of Bonus Depreciation applied in Year 1 | 50% | |

| Allocation of Costs | 5-year MACRS | 7-year MACRS |

| Total Installed Cost | 94.0% | 0.0% |

References

- NREL. Solar Resource Data, Tools, and Maps. NREL.gov. Available online: https://www.nrel.gov/gis/solar.html (accessed on 15 December 2021).

- McDonald, A.; Bills, J. Appalachia-Science in the Public Interest and the Kentucky Solar Partnership. In The Kentucky Solar Energy Guide; 2005. [Google Scholar]

- Johnson, J.A. Analysis of Photovoltaic Energy in the Eastern Kentucky Region and the Residential Financial Feasibility. Ph.D. Thesis, Morehead State University, Morehead, KY, USA, 2018. [Google Scholar]

- Michaud, G. Perspectives on community solar policy adoption across the United States. Renew. Energy Focus 2020, 33, 1–15. [Google Scholar] [CrossRef]

- Gagnon, P.; Das, P. Projections of Distributed Photovoltaic Adoption in Kentucky through 2040 (No. NREL/PR-6A20-68656); National Renewable Energy Lab. (NREL): Golden, CO, USA, 2017. [Google Scholar] [CrossRef]

- Solar Energy Industries Association. Kentucky Solar. Available online: https://www.seia.org/state-solar-policy/kentucky-solar (accessed on 20 June 2022).

- Hale, B.; Kramer, S.W. Installation of Solar Panels in a Residential Setting: A Feasibility Study for a Southern US City. Available online: https://2015.creative-construction-conference.com/CCC2015_proceedings/CCC2015_69_Hale.pdf (accessed on 20 June 2022).

- EIA. U.S. Energy Information Administration-EIA-Independent Statistics and Analysis. Kentucky-State Energy Profile Analysis-U.S. Energy Information Administration (EIA). 15 July 2022. Available online: https://www.eia.gov/state/analysis.php?sid=KY#89 (accessed on 22 October 2021).

- Kentucky Office of Energy Policy and Kentucky Geological Survey. Kentucky Energy Infrastructure. 14 December 2021. Available online: https://kgs.uky.edu/kgsmap/kyenergy/viewer.asp (accessed on 15 December 2021).

- Amburgey, B.H. The Politics of Unionization: The Impact of Politics on the Strength of Kentucky Coal Miners’ Unions. 2020. Available online: https://ir.library.louisville.edu/honors/210/ (accessed on 20 June 2022).

- Net Metering. DSIRE. Available online: https://programs.dsireusa.org/system/program/detail/1081 (accessed on 31 May 2021).

- Noll, D.; Dawes, C.; Rai, V. Solar community organizations and active peer effects in the adoption of residential PV. Energy Policy 2014, 67, 330–343. [Google Scholar] [CrossRef]

- Kentucky Touchstone’s Energy Cooperative. Green Benefits. Envirowatts. 12 March 2021. Available online: https://www.envirowattsky.com/green-benefits/ (accessed on 31 May 2020).

- NC Clean Energy Technology Center. Programs. DSIRE. 27 August 2021. Available online: https://programs.dsireusa.org/system/program/ky/solar (accessed on 15 December 2021).

- East Kentucky Power Corporation. About Cooperative Solar. Cooperative Solar. Available online: https://www.cooperativesolar.com/about (accessed on 22 October 2021).

- Energy, D. Duke Energy unveils plans for its first solar power plants in Kentucky. Duke Energy | News Center. 14 July 2017. Available online: https://news.duke-energy.com/releases/duke-energy-unveils-plans-for-its-first-solar-power-plants-in-kentucky (accessed on 15 December 2021).

- Mayhew, C. Duke Energy Opens Solar Power Farms Near Walton. The Enquirer. 27 April 2018. Available online: https://www.cincinnati.com/story/news/local/kentoncounty/2018/04/24/duke-energy-opens-kentucky-solar-power-plant/546589002/ (accessed on 15 December 2021).

- EIA. EIA electricity Data Now Include Estimated Small-Scale Solar PV Capacity and Generation. Homepage-U.S. Energy Information Administration (EIA). Available online: https://www.eia.gov/todayinenergy/detail.php?id=23972 (accessed on 31 May 2022).

- Hiatt, R.S.; Parker, B.F. Solar Energy for Heating Farm Structures in Kentucky. 1979. Available online: https://uknowledge.uky.edu/aeu_reports/71/ (accessed on 20 June 2022).

- Duke, H. Encouraging rooftop solar: What policy is right for Kentucky? N. Ky. L. Rev. 2020, 47, 155. [Google Scholar]

- Kentucky Solar Energy Society. Solar Stories Map. 2020. Available online: https://www.kyses.org/SolarStories-Map (accessed on 20 June 2022).

- Savion Energy. Martin County Solar Project to Advance–Savion’s First Solar Project on a Reclaimed Coal Mine. SavionEnergy. 9 December 2021. Available online: https://savionenergy.com/martin-county-solar-project-to-advance-savions-first-solar-project-on-a-reclaimed-coal-mine/ (accessed on 28 September 2022).

- Salasovich, J.; Geiger, J.; Mosey, G.; Healey, V. Feasibility Study of Economics and Performance of Solar Photovoltaics at the Price Landfill Site in Pleasantville, New Jersey. A Study Prepared in Partnership with the Environmental Protection Agency for the RE-Powering America’s Land Initiative: Siting Renewable Energy on Potentially Contaminated Land and Mine Sites (No. NREL/TP-7A40-58480); National Renewable Energy Lab. (NREL): Golden, CO, USA, 2013. [Google Scholar]

- Jo, J.H.; Ilves, K.; Barth, T.; Leszczynski, E. Implementation of a large-scale solar photovoltaic system at a higher education institution in Illinois, USA. AIMS Energy 2017, 51, 54–62. [Google Scholar] [CrossRef]

- EIA. U.S. Energy Information Administration-EIA-Independent Statistics and Analysis. Electricity in the U.S.-U.S. Energy Information Administration (EIA). 18 March 2021. Available online: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php (accessed on 22 October 2021).

- WorldAtlas. Kentucky Maps & Facts. WorldAtlas. 9 January 2022. Available online: https://www.worldatlas.com/maps/united-states/kentucky (accessed on 30 June 2022).

- PVWatts [Computer Software]. 2022. Available online: https://pvwatts.nrel.gov/version_6_3.php (accessed on 20 June 2022).

- CREST: Cost of Renewable Energy Spreadsheet Tool [Computer Software]. 2010. Available online: https://www.nrel.gov/analysis/crest.html (accessed on 20 June 2022).

- SAM: System Advisor Model. [Computer Software]. 2021. Available online: https://sam.nrel.gov/download.html (accessed on 20 June 2022).

- Kentucky Land for Sale over 500 Acres. LandWatch. (n.d.). Available online: https://www.landwatch.com/kentucky-land-for-sale/acres-over-500 (accessed on 15 December 2021).

- Gauli, U. Feasibility Study on A Large Scale Solar PV System. 2016. Available online: https://www.theseus.fi/bitstream/handle/10024/112804/Gauli_Umesh.pdf?sequence=1 (accessed on 20 June 2022).

- NREL, 2018; Global Horizontal Solar Irradiance: National Solar Irradiation Database Physical Solar Model. NREL: Solar Resource Maps. Available online: https://www.nrel.gov/gis/assets/images/solar-annual-ghi-2018-usa-scale-01.jpg (accessed on 28 September 2022).

- Gilman, P.; Dobos, A.; DiOrio, N.; Freeman, J.; Janzou, S.; Ryberg, D. SAM Photovoltaic Model Technical Reference Update; NREL: Golden, CO, USA, 2018.

- Google Maps. 2021. Available online: https://www.google.com/maps (accessed on 20 June 2022).

| Kentucky | 2014 | 2016 | 2018 | 2020 | 2022 | 2024 | 2026 | 2028 | 2030 | 2032 | 2034 | 2036 | 2038 | 2040 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Low Cost | 12.0 | 15.6 | 30.2 | 54.6 | 90.2 | 149.1 | 242.9 | 390.3 | 610.6 | 932.0 | 1362.5 | 1907.1 | 2523.3 | 3160 |

| Mid Cost | 12.0 | 15.6 | 27.3 | 46.9 | 62.0 | 90.1 | 139.2 | 220.8 | 347.9 | 539.5 | 805.3 | 1166.9 | 1613.4 | 2124.2 |

| High Cost | 12.0 | 15.6 | 23.5 | 35.7 | 37.7 | 40.5 | 44.9 | 52.0 | 63.3 | 77.3 | 95.0 | 116.2 | 140.3 | 162.0 |

| Areas | Parameter Definition |

|---|---|

| Terrain | This parameter takes geographical features relevant to the construction of a solar farm into consideration (i.e., Elevation, mountains, flood plains, etc.) |

| Solar Irradiance | This is the kWh produced per square meter of paneling in a given day. The larger the solar irradiance, the more potential power output there is. |

| Cost and Size | Average property costs, state and county taxes, upfront costs, etc. are all important considerations. |

| Infrastructure | This parameter considers pre-existing infrastructure including coal powered plants, hydroelectric dams, transmission lines, etc. The more pre-existing infrastructure there is, the less new construction must be done. Furthermore, more reliable forms of power could compensate for the variable solar output. |

| Type | Annual Power Output (GWh) | Annual Percentage |

|---|---|---|

| Conserve Estimate | 356.2 | 0.39978% |

| Median Estimate | 374.1 | 0.41987% |

| High Estimate | 395.1 | 0.44340% |

| Type | Annual Power Output (GWh) | Annual Percentage |

|---|---|---|

| Conserve Estimate | 1075.1 | 1.20662% |

| Median Estimate | 1162.8 | 1.30505% |

| High Estimate | 1187.7 | 1.33300% |

| Type | Annual Power Output (TWh) | Annual Percentage |

|---|---|---|

| Conserve Estimate | 0.6959 | 0.78103% |

| Median Estimate | 0.7310 | 0.82042% |

| High Estimate | 0.7721 | 0.86655% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, Y.; Skaggs, A.; Ferrell, J. United States Solar Investment: A Feasibility Study of Solar Farms in Kentucky. Solar 2022, 2, 469-494. https://doi.org/10.3390/solar2040028

Kim Y, Skaggs A, Ferrell J. United States Solar Investment: A Feasibility Study of Solar Farms in Kentucky. Solar. 2022; 2(4):469-494. https://doi.org/10.3390/solar2040028

Chicago/Turabian StyleKim, Youngil, Allie Skaggs, and James Ferrell. 2022. "United States Solar Investment: A Feasibility Study of Solar Farms in Kentucky" Solar 2, no. 4: 469-494. https://doi.org/10.3390/solar2040028

APA StyleKim, Y., Skaggs, A., & Ferrell, J. (2022). United States Solar Investment: A Feasibility Study of Solar Farms in Kentucky. Solar, 2(4), 469-494. https://doi.org/10.3390/solar2040028