Factors Affecting the Readiness of User-Pay Public–Private Partnership Procurement for Infrastructure Projects: A Comparison between Developed and Emerging Economies

Abstract

1. Introduction

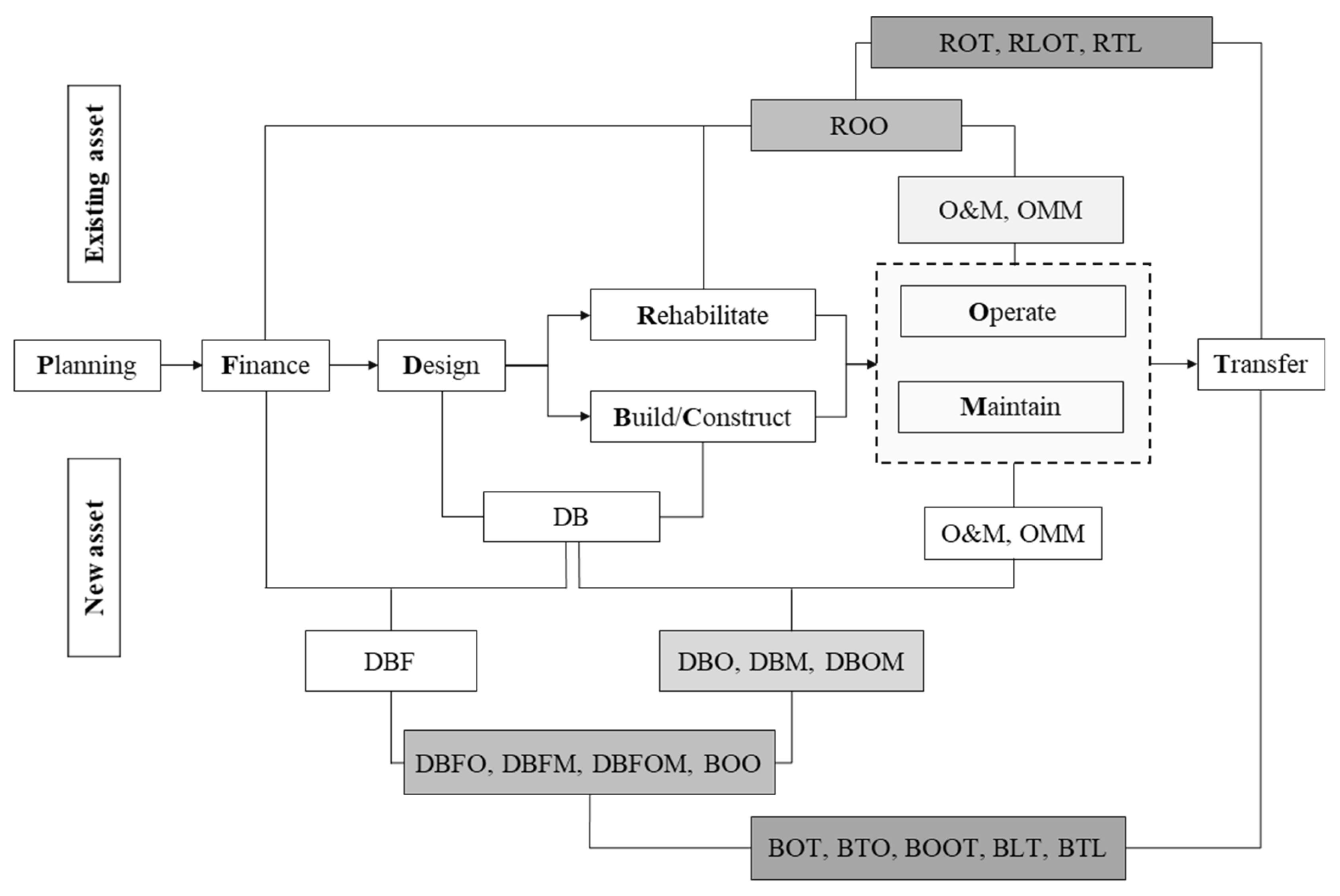

2. Background

3. Factors Affecting PPP Scheme Readiness

4. Research Methodology

4.1. Pilot Study

4.2. Questionnaire Survey

5. Results and Discussions

5.1. Reliability Test

5.2. Kendall’s Coefficient of Concordance (Wa)

5.3. Mean Score Ranking of 25 Factors for Selecting PPP Schemes

5.4. Significant Differences in the Rankings of PPP Selection Factors

6. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kim, J. Rationale and Institution for Public–Private Partnerships; Asian Development Bank Economics Working Paper Series. Asian Development Bank: Manila, Philippines, 2018. [Google Scholar]

- Jomo, K.S.; Chowdhury, A.; Sharma, K.; Platz, D. Public-Private Partnerships and the 2030 Agenda for Sustainable Development: Fit for Purpose? Department of Economic and Social Affairs, United Nations: New York, NY, USA, 2016. [Google Scholar]

- El-Sayegh, S.M. Significant Factors Affecting the Selection of the Approporiate Project Delivery Method. In Proceedings of the Fifth LACCEI International Latin American and Caribbean Conference for Engineering and Technology (LACCEI’2007) “Developing Entrepreneurial Engineers for the Sustainable Growth of Latin America and the Caribbean: Education, Innovation, Technology and Practice”, Tampico, Mexico, 29 May–1 June 2007. [Google Scholar]

- Mahdi, I.M.; Alreshaid, K. Decision support system for selecting the proper project delivery method using analytical hierarchy process (AHP). Int. J. Proj. Manag. 2005, 23, 564–572. [Google Scholar] [CrossRef]

- Tariq, S.; Zhang, X. Critical Failure Drivers in International Water PPP Projects. J. Infrastruct. Syst. 2020, 26, 04020038. [Google Scholar] [CrossRef]

- Luk, E. New Grouping Wins Rights to Kai Tak Cruise Terminal 2012. Available online: http://www.thestandard.com.hk/sections-news_print.php?id=120511 (accessed on 1 June 2019).

- Zwalf, S. From turnpikes to toll-roads: A short history of government policy for privately financed public infrastructure in Australia. J. Econ. Policy Reform 2022, 25, 103–120. [Google Scholar] [CrossRef]

- Soomro, M.A.; Zhang, X. Evaluation of the Functions of Public Sector Partners in Transportation Public-Private Partnerships Failures. J. Manag. Eng. 2016, 32, 04015027. [Google Scholar] [CrossRef]

- Cheung, E.; Chan, A.P. Is BOT the best financing model to procure infrastructure projects? A case study of the Hong Kong-Zhuhai-Macau Bridge. J. Prop. Invest Financ. 2009, 27, 290–302. [Google Scholar] [CrossRef]

- Bovaird, T. A brief intellectual history of the public–private partnership movement. In International Handbook on Public-Private Partnerships; Hodge, G.A., Greve, C., Boardman, A.E., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2010. [Google Scholar]

- Atalia, G.; Malik, R.; Banks, B.; Grimsey, D.; Carlton-Jones, B.; Clayton, T.; Hiscock-Croft, R. Public-Private Partnerships and the Global Infrastructure Challenge: How PPPs Can Help Governments Close the “Gap” Amid Financial Limitations; Ernst & Young Global Limited. 2015. Available online: http://www.fa.ru/org/chair/gchp/Documents/biblio/EY-public-private-partnerships-and-the-global.pdf (accessed on 3 June 2019).

- Wang, H.; Xiong, W.; Wu, G.; Zhu, D. Public–private partnership in Public Administration discipline: A literature review. Public Manag. Rev. 2018, 20, 293–316. [Google Scholar] [CrossRef]

- Ng, A.; Loosemore, M. Risk allocation in the private provision of public infrastructure. Int. J. Proj. Manag. 2007, 25, 66–76. [Google Scholar] [CrossRef]

- Abdel Aziz, A.M. Successful Delivery of Public-Private Partnerships for Infrastructure Development. J. Constr. Eng. Manag. 2007, 133, 918–931. [Google Scholar] [CrossRef]

- European Commision. Guidelines for Sucessful Public-Private Partnerships; European Commision: Brussels, Belgium, 2003. [Google Scholar]

- Vu, H.; Zhang, G.; Sandanayake, M.; Yang, L. Perspectives on Criteria for Selection of Public-Financed Schemes of Public-Private Partnerships Infrastructure Projects; Springer: Singapore, 2021. [Google Scholar]

- Pakkala, P. Innovative Project Delivery Methods for Infrastructure; Finnish Road Enterprise: Helsinki, Finland, 2002; p. 19. [Google Scholar]

- World Bank Group. Public-Private Partnerships Reference Guide Version 3; International Bank for Reconstruction and Development, The World Bank: Washington, DC, USA, 2017; p. 20433. [Google Scholar]

- Zhang, X. Paving the Way for Public–Private Partnerships in Infrastructure Development. J. Constr. Eng. Manag. 2005, 131, 71–80. [Google Scholar] [CrossRef]

- Australian Government. National Public Private Partnership Guidelines Vol.1: Procurement Options Analysis; Department of Infrastructure and Regional Development, Australian Government: Canberra, Australia, 2008. [Google Scholar]

- Verweij, S.; van Meerkerk, I. Do public–private partnerships achieve better time and cost performance than regular contracts? Public Money Manag. 2021, 41, 286–295. [Google Scholar] [CrossRef]

- Regan, M.; Smith, J.; Love, P.E. Impact of the Capital Market Collapse on Public-Private Partnership Infrastructure Projects. J. Constr. Eng. Manag. 2011, 137, 6–16. [Google Scholar] [CrossRef]

- Boardman, A.; Hellowell, M. A comparative analysis and evaluation of specialist PPP units’ methodologies for conducting value for money appraisals. J. Comp. Policy Anal. Res. Pract. 2017, 19, 191–206. [Google Scholar] [CrossRef]

- Spackman, M. Public–private partnerships: Lessons from the British approach. Econ. Syst. 2002, 26, 283–301. [Google Scholar] [CrossRef]

- Durdyev, S.; Ismail, S. The build-operate-transfer model as an infrastructure privatisation strategy for Turkmenistan. Util. Policy 2017, 48, 195–200. [Google Scholar] [CrossRef]

- Cheung, E.; Chan, A.P.; Kajewski, S. Factors contributing to successful public private partnership projects: Comparing Hong Kong with Australia and the United Kingdom. J. Facil. Manag. 2012, 10, 45–58. [Google Scholar] [CrossRef]

- Wang, H.; Liu, Y.; Xiong, W.; Song, J. The moderating role of governance environment on the relationship between risk allocation and private investment in PPP markets: Evidence from developing countries. Int. J. Proj. Manag. 2019, 37, 117–130. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P. Developing a Project Success Index for Public–Private Partnership Projects in Developing Countries. J. Infrastruct. Syst. 2017, 23, 04017028. [Google Scholar] [CrossRef]

- Love, P.E.; Skitmore, M.; Earl, G. Selecting a suitable procurement method for a building project. Constr. Manag. Econ. 1998, 16, 221–233. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. Factors influencing the success of PPP at feasibility stage—A tripartite comparison study in Hong Kong. Habitat Int. 2012, 36, 423–432. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Critical Success Factors for PPPs in Infrastructure Developments: Chinese Perspective. J. Constr. Eng. Manag. 2010, 136, 484–494. [Google Scholar] [CrossRef]

- Qiao, L.; Wang, S.Q.; Tiong, R.L.; Chan, T.-S. Framework for Critical Success Factors of BOT Projects in China. J. Struct. Finance 2001, 7, 53–61. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Critical success factors for PPP/PFI projects in the UK construction industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar] [CrossRef]

- Salman, A.F.M.; Skibniewski, M.J.; Basha, I. BOT Viability Model for Large-Scale Infrastructure Projects. J. Constr. Eng. Manag. 2007, 133, 50–63. [Google Scholar] [CrossRef]

- Zhang, X. Concession period determination for PPP infrastructure projects in Hong Kong. In Policy, Management and Finance of Public-Private Partnerships; Akintoye, A., Beck, M., Eds.; Wiley-Blackwell: London, UK, 2009; pp. 436–456. [Google Scholar]

- El-Gohary, N.M.; Osman, H.; El-Diraby, T.E. Stakeholder management for public private partnerships. Int. J. Proj. Manag. 2006, 24, 595–604. [Google Scholar] [CrossRef]

- Trangkanont, S.; Charoenngam, C. Critical failure factors of public-private partnership low-cost housing program in Thailand. Eng. Constr. Arch. Manag. 2014, 21, 421–443. [Google Scholar] [CrossRef]

- Jefferies, M.; Gameson, R.; Rowlinson, S. Critical success factors of the BOOT procurement system: Reflections from the Stadium Australia case study. Eng. Constr. Archit. Manag. 2002, 9, 352–361. [Google Scholar] [CrossRef]

- Cuttaree, V.; Humphreys, M.; Muzira, S. Private Participation in the Transport Sector: Lessons from Recent Experience in Europe and Central Asia; The World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Zhang, X. Critical Success Factors for Public–Private Partnerships in Infrastructure Development. J. Constr. Eng. Manag. 2005, 131, 3–14. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Flexible contracts to cope with uncertainty in public–private partnerships. Int. J. Proj. Manag. 2013, 31, 473–483. [Google Scholar] [CrossRef]

- Nguyen, A.; Mollik, A.; Chih, Y.-Y. Managing Critical Risks Affecting the Financial Viability of Public–Private Partnership Projects: Case Study of Toll Road Projects in Vietnam. J. Constr. Eng. Manag. 2018, 144, 05018014. [Google Scholar] [CrossRef]

- Cabrera, M.; Suárez-Alemán, A.; Trujillo, L. Public-private partnerships in Spanish Ports: Current status and future prospects. Util. Policy 2015, 32, 1–11. [Google Scholar] [CrossRef]

- Soomro, M.A.; Zhang, X. Roles of Private-Sector Partners in Transportation Public-Private Partnership Failures. J. Manag. Eng. 2015, 31, 04014056. [Google Scholar] [CrossRef]

- Tam, C. Build-operate-transfer model for infrastructure developments in Asia: Reasons for successes and failures. Int. J. Proj. Manag. 1999, 17, 377–382. [Google Scholar] [CrossRef]

- Jefferies, M. Critical success factors of public private sector partnerships: A case study of the Sydney SuperDome. Eng. Constr. Archit. Manag. 2006, 13, 451–462. [Google Scholar] [CrossRef]

- Tiong, R.L. CSFs in competitive tendering and negotiation model for BOT projects. J. Constr. Eng. Manag. 1996, 122, 205–211. [Google Scholar] [CrossRef]

- Johnston, F. Innovations in procuring highways management and maintenance. In Proceedings of the Safer Highways, Proven and Innovation Technologies, Hong Kong, 12 June 2004; Institution of Highways & Transportation, Hong Kong Branch: Hong Kong. [Google Scholar]

- Carbonara, N.; Pellegrino, R. Fostering innovation in public procurement through public private partnerships. J. Public Procure. 2018, 18, 257–280. [Google Scholar] [CrossRef]

- Babatunde, S.O.; Opawole, A.; Akinsiku, O.E. Critical success factors in public-private partnership (PPP) on infrastructure delivery in Nigeria. J. Facil. Manag. 2012, 10, 212–225. [Google Scholar] [CrossRef]

- Dikmen, I.; Birgonul, M.T.; Atasoy, G. Best Value Procurement in Build Operate Transfer Projects: The Turkish Experience. In Policy, Finance & Management for Public-Private Partnerships; Akintoye, A., Beck, M., Eds.; Wiley-Blackwell: London, UK, 2009; p. 363. [Google Scholar]

- Skitmore, M.; Marsden, D. Which procurement system? Towards a universal procurement selection technique. Constr. Manag. Econ. 1988, 6, 71–89. [Google Scholar]

- Babatunde, S.O.; Perera, S.; Zhou, L.; Udeaja, C. Barriers to public private partnership projects in developing countries: A case of Nigeria. Eng. Constr. Archit. Manag. 2015, 22, 669–691. [Google Scholar] [CrossRef]

- Liu, T.; Wang, Y.; Wilkinson, S. Identifying critical factors affecting the effectiveness and efficiency of tendering processes in Public–Private Partnerships (PPPs): A comparative analysis of Australia and China. Int. J. Proj. Manag. 2016, 34, 701–716. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P. Implementing public–private partnership (PPP) policy for public construction projects in Ghana: Critical success factors and policy implications. Int. J. Constr. Manag. 2016, 17, 113–123. [Google Scholar] [CrossRef]

- George, D.; Mallery, M. Using SPSS for Windows Step by Step: A Simple Guide and Reference; Allyn & Bacon: Boston, CA, USA, 2003. [Google Scholar]

- Nunnally, J.C.; Bernstein, I.H. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1994; Volume 2. [Google Scholar]

- DeVellis, R.F. Scale Development: Theory and Applications; Sage Publications: Saunders Oaks, CA, USA, 2012. [Google Scholar]

- Siegel, S.; Castellan, N. Nonparametric Statistics for the Behavioral Sciences; McGraw-Hill: New York, NY, USA, 1988. [Google Scholar]

- Chileshe, N.; Kikwasi, G.J. Risk assessment and management practices (RAMP) within the Tanzania construction industry: Implementation barriers and advocated solutions. Int. J. Constr. Manag. 2014, 14, 239–254. [Google Scholar]

- Yalegama, S.; Chileshe, N.; Ma, T. Critical success factors for community-driven development projects: A Sri Lankan community perspective. Int. J. Proj. Manag. 2016, 34, 643–659. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P. Implementation constraints in public-private partnership: Empirical comparison between developing and developed economies/countries. J. Facil. Manag. 2017, 15, 90–106. [Google Scholar] [CrossRef]

- Johnston, J.; Gudergan, S.P. Governance of public—Private partnerships: Lessons learnt from an Australian case? Int. Rev. Adm. Sci. 2007, 73, 569–582. [Google Scholar] [CrossRef]

- Koppenjan, J.F.; Enserink, B. Public–private partnerships in urban infrastructures: Reconciling private sector participation and sustainability. Public Adm. Rev. 2009, 69, 284–296. [Google Scholar] [CrossRef]

- Hyun, S.; Park, D.; Tian, S. Determinants of Public–Private Partnerships in Infrastructure in Asia: Implications for Capital Market Development. In ADB Economics Working Paper Series; Asian Development Bank: Manila, Philippines, 2018. [Google Scholar]

- Ehrlich, M.; Tiong, R. Improving the Assessment of Economic Foreign Exchange Exposure in PublicaPrivate Partnership Infrastructure Projects. J. Infrastruct. Syst. 2012, 18, 57–67. [Google Scholar] [CrossRef]

- Zou, P.X.; Zhang, G.; Wang, J.-Y. Identifying key risks in construction projects: Life cycle and stakeholder perspectives. In Proceedings of the Pacific Rim Real Estate Society Conference, Auckland, New Zealand, 22–25 January 2006. [Google Scholar]

- Medda, F. A game theory approach for the allocation of risks in transport public private partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Assaf, S.A.; Al-Hejji, S. Causes of delay in large construction projects. Int. J. Proj. Manag. 2006, 24, 349–357. [Google Scholar] [CrossRef]

- van den Hurk, M.; Verhoest, K. The governance of public–private partnerships in sports infrastructure: Interfering complexities in Belgium. Int. J. Proj. Manag. 2015, 33, 201–211. [Google Scholar] [CrossRef]

| Code | PPP Selection Factors | References |

|---|---|---|

| F01 | Stable politics and government system | [30,31] |

| F02 | Stable macroeconomics during the project life cycle (stable economic growth, low and stable inflation rate, low unemployment, etc.) | [30] |

| F03 | Supportive political climate for PPP projects | [32,33] |

| F04 | Community/public support to PPP projects | [34,35,36] |

| F05 | Mature legal system required to support PPP procurements | [33,37,38] |

| F06 | Government experience in operation and maintenance (O&M) | [30,39] |

| F07 | Government experience in project management | |

| F08 | The project scale and the amount of total investment | Interview |

| F09 | Financial attraction of the project to investors | [30,32,39,40] |

| F10 | Financial viability based on NPV and risk-adjusted PV | |

| F11 | Technical risk due to engineering and design failures | [13,21,41,42,43,45] |

| F12 | Construction risk due to faulty construction techniques and cost escalation and delays in the construction stage | |

| F13 | Operating risk due to higher operating costs and maintenance costs | |

| F14 | Financial risks arise due to inaccurate forecasts or failure to extract resources, the volatility in prices, and demand for products and services sold, which can lead to revenue deficiency | |

| F15 | Financial risks arising from exchange rate volatility, transaction costs, and financing costs | |

| F16 | Regulatory/political risks due to legal changes and unsupportive government policies | |

| F17 | Innovation in technology | [46,47,48,49] |

| F18 | Innovation in management | |

| F19 | Innovation in operation | |

| F20 | Government provides guarantees against financial risks, political/legal risks | [33,50,51] |

| F21 | Project design and construction complexity | [20,52] |

| F22 | The complexity of the operation and or maintenance stage | |

| F23 | Alternative solutions that may affect the demand for the PPP project | Interview |

| F24 | Type of asset: Economic infrastructure | Interview |

| F25 | Type of asset: Social infrastructure |

| Characteristic | Developed Economies | Emerging Economies | Total | |||

|---|---|---|---|---|---|---|

| Freq. | % | Freq. | % | Freq. | % | |

| By sector | ||||||

| Public sector | 33 | 34.7% | 47 | 27.3% | 80 | 30.0% |

| Private sector | 51 | 53.7% | 101 | 58.7% | 152 | 56.9% |

| Research, policy maker and others | 11 | 11.6% | 24 | 14.0% | 35 | 13.1% |

| Total | 95 | 35.6% | 172 | 64.4% | 267 | 100% |

| By number of years of experience in PPP | ||||||

| 0–5 years | 24 | 27.9% | 103 | 62.8% | 127 | 50.8% |

| 5–10 years | 38 | 44.2% | 39 | 23.8% | 77 | 30.8% |

| 10–20 years | 20 | 23.3% | 20 | 12.2% | 40 | 16.0% |

| >20 years | 4 | 4.6% | 2 | 1.2% | 6 | 2.4% |

| Total | 86 | 34.4% | 164 | 65.6% | 250 | 100% |

| Characteristics | Developed Economies | Emerging Economies | All Respondents |

|---|---|---|---|

| Number of survey response | 86 | 164 | 250 |

| Kendall’s Coefficient of Concordance | 0.186 | 0.128 | 0.141 |

| Chi-square value | 383.812 | 503.222 | 843.908 |

| Critical value of Chi-square | 36.415 | 36.415 | 36.415 |

| Degree of freedom | 24 | 24 | 24 |

| Asymptotic significance | 0.000 | 0.000 | 0.000 |

| Developed Economies | Emerging Economies | Total | Mann–Whitney U Test | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. | Rank | Mean | Std. | Rank | Mean | Std. | Rank | Developed Economies Mean Rank | Emerging Economies Mean Rank | U Statistic | Z | p-Value | |

| 01—Stable politics and government system | 4.349 | 0.930 | 4 | 4.159 | 1.074 | 4 | 4.224 | 1.029 | 3 | 133.06 | 121.53 | 6401.5 | −1.313 | 0.189 |

| 02—Stable macro-economics during the project life cycle | 4.233 | 0.836 | 6 | 4.110 | 0.907 | 6 | 4.152 | 0.883 | 6 | 131.28 | 122.47 | 6554.5 | −0.983 | 0.326 |

| 03—Supportive political climate for PPP projects | 4.337 | 0.889 | 5 | 4.140 | 1.002 | 5 | 4.208 | 0.968 | 4 | 134.08 | 121.00 | 6314.0 | −1.475 | 0.140 |

| 04—Community/public support to PPP projects | 4.035 | 0.999 | 10 | 3.970 | 1.024 | 7 | 3.992 | 1.014 | 9 | 128.40 | 123.98 | 6802.5 | −0.484 | 0.628 |

| 05—Mature legal system required to support PPP procurements | 4.186 | 1.000 | 9 | 4.195 | 0.978 | 3 | 4.192 | 0.983 | 5 | 125.63 | 125.43 | 7040.5 | −0.023 | 0.982 |

| 06—Government experience in O&M | 3.151 | 1.057 | 25 | 3.209 | 1.059 | 25 | 3.189 | 1.057 | 25 | 121.96 | 127.36 | 6747.5 | −0.585 | 0.558 |

| 07—Government experience in project management | 3.267 | 1.078 | 24 | 3.311 | 1.127 | 24 | 3.296 | 1.109 | 24 | 120.81 | 127.96 | 6649.0 | −0.771 | 0.441 |

| 08—The project scale and the amount of total investment | 4.198 | 0.931 | 8 | 3.768 | 0.976 | 10 | 3.916 | 0.980 | 10 | 147.15 | 114.15 | 5190.0 | −3.604 | 0.000 * |

| 09—Financial attraction of the project to investors | 4.628 | 0.687 | 1 | 4.238 | 0.946 | 1 | 4.372 | 0.884 | 1 | 144.58 | 115.49 | 5411.0 | −3.415 | 0.001 * |

| 10—Financial viability based on NPV and risk-adjusted PV | 4.419 | 0.711 | 2 | 4.232 | 0.904 | 2 | 4.296 | 0.846 | 2 | 133.08 | 121.52 | 6400.0 | −1.314 | 0.189 |

| 11—Technical risk due to engineering and design failures | 3.884 | 0.832 | 17 | 3.634 | 0.991 | 15 | 3.720 | 0.945 | 17 | 135.16 | 120.44 | 6221.5 | −1.627 | 0.104 |

| 12—Construction risk due to faulty construction techniques and cost escalation and delays in construction | 4.012 | 0.759 | 11 | 3.689 | 0.963 | 13 | 3.800 | 0.910 | 12 | 139.99 | 117.90 | 5806.0 | −2.445 | 0.014 * |

| 13—Operating risk due to higher operating costs and maintenance costs | 3.988 | 0.833 | 12 | 3.610 | 0.982 | 16 | 3.740 | 0.949 | 15 | 143.55 | 116.03 | 5499.5 | −3.035 | 0.002 * |

| 14—Financial risks arising from inaccurate forecasts or failure to extract resources, the volatility of prices, and demand | 4.221 | 0.860 | 7 | 3.933 | 0.934 | 9 | 4.032 | 0.918 | 8 | 140.08 | 117.85 | 5798.0 | −2.463 | 0.014 * |

| 15—Financial risks arising from exchange rate volatility, transaction costs, and financing costs | 3.942 | 0.860 | 16 | 3.707 | 0.940 | 12 | 3.788 | 0.918 | 13 | 136.72 | 119.62 | 6087.5 | −1.889 | 0.059 |

| 16—Regulatory/political risks due to legal changes and unsupportive government policies | 4.349 | 0.891 | 3 | 3.951 | 1.056 | 8 | 4.088 | 1.018 | 7 | 143.84 | 115.88 | 5474.5 | −3.097 | 0.002 * |

| 17—Innovation in technology | 3.570 | 0.875 | 21 | 3.598 | 0.989 | 18 | 3.588 | 0.950 | 18 | 123.81 | 126.38 | 6907.0 | −0.282 | 0.778 |

| 18—Innovation in management | 3.442 | 0.989 | 23 | 3.555 | 1.005 | 19 | 3.516 | 0.999 | 21 | 119.88 | 128.45 | 6568.5 | −0.936 | 0.349 |

| 19—Innovation in operation | 3.581 | 0.874 | 20 | 3.473 | 0.993 | 21 | 3.510 | 0.953 | 22 | 130.27 | 123.00 | 6642.0 | −0.797 | 0.425 |

| 20—Government provides guarantees against financial, political/legal risks | 3.953 | 1.084 | 15 | 3.732 | 1.130 | 11 | 3.808 | 1.117 | 11 | 134.70 | 120.67 | 6260.5 | −1.518 | 0.129 |

| 21—Project design and construction complexity | 3.767 | 0.877 | 18 | 3.421 | 0.984 | 23 | 3.540 | 0.961 | 20 | 141.30 | 117.21 | 5693.0 | −2.638 | 0.008 * |

| 22—The complexity of the operation and/or maintenance stage | 3.686 | 0.871 | 19 | 3.482 | 0.937 | 20 | 3.552 | 0.918 | 19 | 135.45 | 120.28 | 6196.5 | −1.671 | 0.095 |

| 23—Alternative solutions that may affect the demand for the PPP project | 3.988 | 1.023 | 13 | 3.640 | 0.971 | 14 | 3.760 | 1.001 | 14 | 142.35 | 116.66 | 5603.0 | −2.791 | 0.005 * |

| 24—Type of asset: Economic infrastructure | 3.962 | 1.153 | 14 | 3.610 | 1.077 | 17 | 3.731 | 1.114 | 16 | 141.64 | 117.04 | 5664.0 | −2.658 | 0.008 * |

| 25—Type of asset: Social infrastructure | 3.506 | 1.013 | 22 | 3.448 | 1.058 | 22 | 3.468 | 1.041 | 23 | 127.15 | 124.63 | 6910.0 | −0.272 | 0.785 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vu, H.; Sandanayake, M.; Zhang, G. Factors Affecting the Readiness of User-Pay Public–Private Partnership Procurement for Infrastructure Projects: A Comparison between Developed and Emerging Economies. Knowledge 2023, 3, 384-400. https://doi.org/10.3390/knowledge3030026

Vu H, Sandanayake M, Zhang G. Factors Affecting the Readiness of User-Pay Public–Private Partnership Procurement for Infrastructure Projects: A Comparison between Developed and Emerging Economies. Knowledge. 2023; 3(3):384-400. https://doi.org/10.3390/knowledge3030026

Chicago/Turabian StyleVu, Hang, Malindu Sandanayake, and Guomin Zhang. 2023. "Factors Affecting the Readiness of User-Pay Public–Private Partnership Procurement for Infrastructure Projects: A Comparison between Developed and Emerging Economies" Knowledge 3, no. 3: 384-400. https://doi.org/10.3390/knowledge3030026

APA StyleVu, H., Sandanayake, M., & Zhang, G. (2023). Factors Affecting the Readiness of User-Pay Public–Private Partnership Procurement for Infrastructure Projects: A Comparison between Developed and Emerging Economies. Knowledge, 3(3), 384-400. https://doi.org/10.3390/knowledge3030026

_Zhang.png)