Market Power in the Context of Globalization

Definition

1. The Concept of Market Power

2. Assessment of Market Power Situations from a Law and Economics Perspective

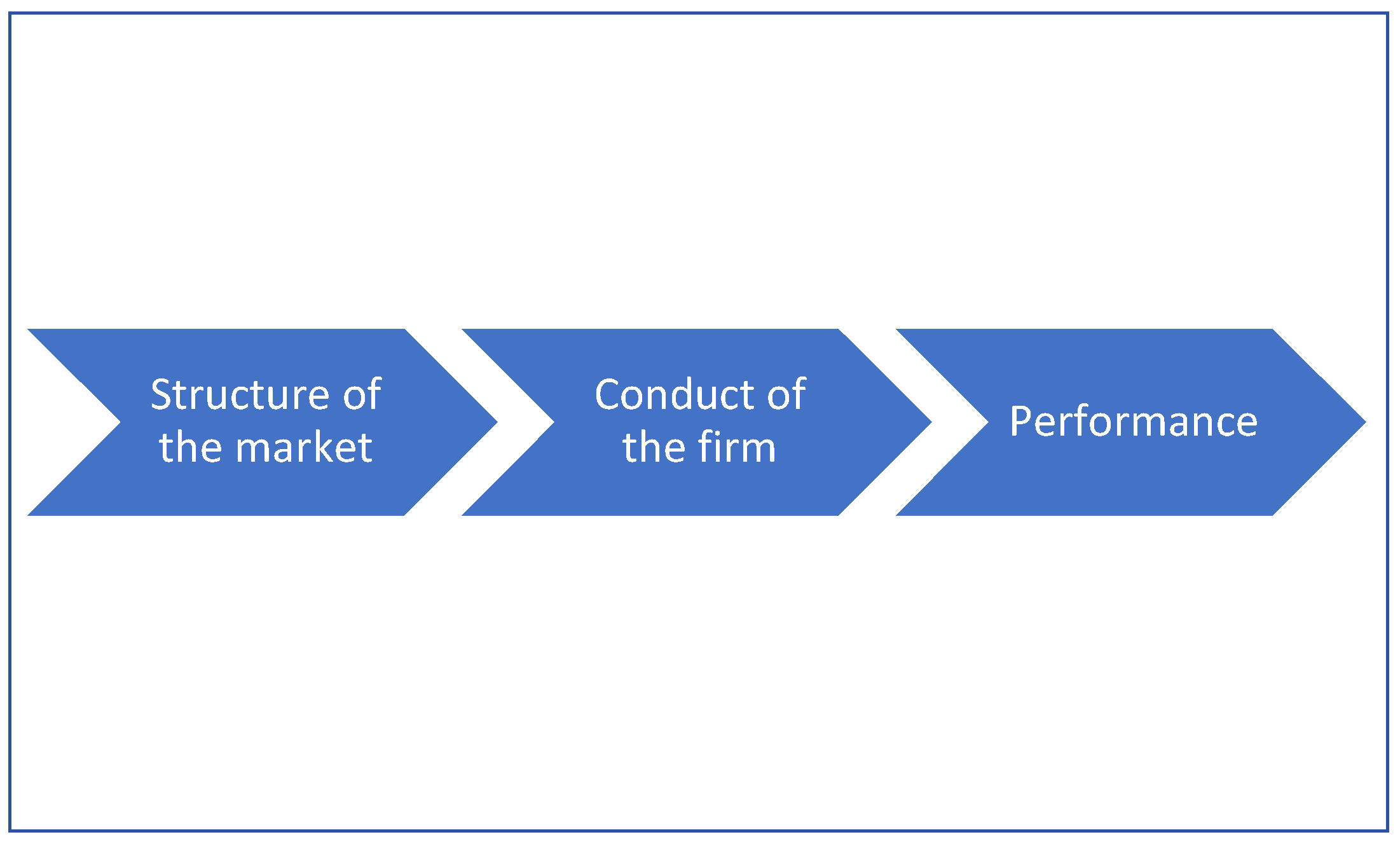

2.1. Models: Market Power—Law and Economics Paradigm, Change of Paradigm and New Approaches

2.2. Indicators of Market Power

2.3. New Trends Influencing Market Power Situations

3. Conclusions Regarding Market Power Situations in the Context of Globalization

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Koffi, S.L.Y.; Gahé, Z.S.Y.; Ping, Z.X. Globalization Effects on Sub-Saharan Africa: The Impact of International Trade on Poverty and Inequality. Int. J. Innov. Econ. Dev. 2018, 4, 41–48. [Google Scholar]

- Bishop, S.; Walker, M. The Economics of EC Competition Law: Concepts, Application and Measurement; Thomson Reuters (Legal) Limited, Trading as Sweet & Maxwell: London, UK, 2010. [Google Scholar]

- McNutt, P.A. Law, Economics and Antitrust Towards a New Perspective; Edward Elgar: Cheltenham, UK; Northhampton, MA, USA, 2005. [Google Scholar]

- Marciano, A.; Ramello, G.B. (Eds.) The Encyclopedia of Law and Economics; Springer: New York, NY, USA, 2019. [Google Scholar]

- Wu, T. Law & Economics of Information. In The Oxford Handbook of Law and Economics: Volume 2: Private and Commercial Law; Francesco, P., Ed.; Oxford University Press: Oxford, UK; New York, NY, USA, 2007. [Google Scholar]

- Carlton, D.; Perloff, J. Modern Industrial Organization; Harper Collins: USA, 2004. [Google Scholar]

- Stigler, G. The Organisation of Industry; Richard D. Irwin Inc.: Homewood, IL, USA, 1968. [Google Scholar]

- von Stackelberg, H. Market Structure and Equilibrium; Springer: Berlin/Heidelberg, Germany, 2011; Available online: https://link.springer.com/book/10.1007/978-3-642-12586-7 (accessed on 14 August 2022).

- Brown, D.V.; Chamberlin, E. The Economics of the Recovery Program; McGraw-Hill: New York, NY, USA, 1934. [Google Scholar]

- Liu, Y.; Zhou, W.; Wang, Q. Global dynamics of an oligopoly competition model with isoelastic demand and strategic delegation. Chaos Solitons Fractals 2022, 161, 112304. [Google Scholar] [CrossRef]

- Investopedia. Quantity Demanded Definition (investopedia.com). 2021. Available online: https://www.investopedia.com; https://www.investopedia.com/terms/q/quantitydemanded.asp (accessed on 15 August 2022).

- Chung, H.; Lee, E. Asymmetric relationships with symmetric suppliers: Strategic choice of supply chain price leadership in a competitive market. Eur. J. Oper. Res. 2017, 259, 564–575. [Google Scholar] [CrossRef]

- Frenz, W. Handbook of EU Competition Law; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Isoni, A.; Poulsen, A.; Sugden, R.; Tsutsui, K. Focal points and payoff information in tacit bargaining. Games Econ. Behav. 2019, 114, 193–214. [Google Scholar] [CrossRef]

- Kogiku, K.C. Microeconomic Models; Harper & Row: New York, NY, USA, 1971. [Google Scholar]

- Treaty on the Functioning of the EU. Consolidated Version of the Treaty on the Functioning of the EU. Off. J. Eur. Union 2012, C 326, 47–390. [Google Scholar]

- Ungureanu, D. Dreptul Uniunii Europene in Domeniul Concurentei. Jurisprudenta Recenta a Curtii de la Luxemburg; Beck, C.H., Ed.; C.H. Beck: Bucharest, Romania, 2010. [Google Scholar]

- Shepherd, W.G. Herfindahl Index. In The New Palgrave Dictionary of Economics; Palgrave Macmillan: London, UK, 2018. [Google Scholar]

- Cordonnier, T.; Kunstler, G. The Gini index brings asymmetric competition to light, Perspectives in Plant Ecology. Evol. Syst. 2015, 17, 107–115. [Google Scholar] [CrossRef]

- Fukuyama, H.; Matousek, R.; Tzeremes, N.G. Estimating the degree of firms’ input market power via data envelopment analysis: Evidence from the global biotechnology and pharmaceutical industry. Eur. J. Oper. Res. 2015, 17, 107–115. [Google Scholar] [CrossRef]

- de Almeida, L.; Esposito, F.; van Zeben, J. When indicators fail electricity policies: Pitfalls of the EU’s retail energy market Barrier Index. Energy Policy 2022, 165, 112892. [Google Scholar] [CrossRef]

- McHugh, C.; Coleman, S.C.; Kerr, D. Technical indicators for energy market trading. Mach. Learn. Appl. 2021, 6, 100182. [Google Scholar] [CrossRef]

- Cavalleri, M.C.; Eliet, A.; McAdam, P.; Petroulakis, F.; Soares, A.C.; Vansteenkiste, I. Concentration, Market Power and Dynamism in the Euro Area; ECB Working Paper No. 2253; Frankfurt, A.M., Ed.; European Central Bank (ECB): Frankfurt am Main, Germany, 2019; Available online: http://hdl.handle.net/10419/208287 (accessed on 14 August 2022).

- Case 27/76 United Brands Company and United Brands Continentaal BV v Commission of the European Communities. Chiquita Bananas, Judgment of the Court of 14 February 1978. In European Court Reports 1978-00207; ECLI Identifier: ECLI:EU:C:1978:22; European Union: Brussels, Belgium, 1978. [Google Scholar]

- Case 85/76 Hoffmann-La Roche & Co. AG v Commission of the European Communities. Dominant Position. Judgment of the Court of 13 February 1979. In European Court Reports 1979-00461; ECLI Identifier: ECLI:EU:C:1979:36; European Union: Brussels, Belgium, 1979. [Google Scholar]

- Case C-62/86 AKZO Chemie BV v Commission of the European Communities. Judgment of the Court (Fifth Chamber) of 3 July 1991. In European Court Reports 1991 I-03359; ECLI identifier: ECLI:EU:C:1991:286; European Union: Brussels, Belgium, 1991. [Google Scholar]

- European Commission. 2021. Available online: https://ec.europa.eu/competition-policy/system/files/2021-05/antitrust_procedures_102_en.pdf (accessed on 31 October 2021).

- European Commission Guidelines. Guidelines on Market Analysis and the Assessment of Significant Market Power under the EU Regulatory Framework for Electronic Communications Networks and Services. 2021. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52018XC0507(01)&rid=7 (accessed on 31 October 2021).

- European Commission Staff Working Document. 2021. Available online: https://ec.europa.eu/competition-policy/system/files/2021-07/evaluation_market-definition-notice_en.pdf (accessed on 31 October 2021).

- Gudbrandsdottir, I.Y.; Olafsdottir, G.; Oddsson, G.V.; Stefansson, H.; Bogason, S.G. Operationalization of Interorganizational Fairness in Food Systems: From a Social Construct to Quantitative Indicators. Agriculture 2021, 11, 36. [Google Scholar] [CrossRef]

- Murray, N.; Manrai, A.K.; Manrai, L.A. The financial services industry and society: The role of incentives/punishments, moral hazard, and conflicts of interests in the 2008 financial crisis. J. Econ. Financ. Adm. Sci. 2017, 22, 168–190. [Google Scholar] [CrossRef]

- Busato, F.; Coletta, C.M. A moral hazard perspective on financial crisis. Banks BankSyst. 2017, 12, 298–307. Available online: https://uaccess.univie.ac.at/login?url=https://www.proquest.com/scholarly-journals/moral-hazard-perspective-on-financial-crisis/docview/2221338652/se-2 (accessed on 14 July 2022). [CrossRef][Green Version]

- Dembe, A.; Boden, L. Moral hazard: A question of morality. New Solut. J. Environ. Occup. Health Policy 2000, 10, 257–279. [Google Scholar] [CrossRef] [PubMed]

- Krugman, P. The Return of Depression Economics and the Crisis of 2008; W.W. Norton Company Limited: New York, NY, USA, 2009. [Google Scholar]

- Basel Framework. 2021. Available online: https://www.bis.org/basel_framework/index.htm (accessed on 31 October 2021).

- Danisman, G.O.; Demirel, P. Bank risk-taking in developed countries: The influence of market power and bank regulations. J. Int. Financ. Mark. Inst. Money 2019, 59, 202–217. [Google Scholar] [CrossRef]

- Maudos, J.; Vives, X. Competition Policy in Banking in the European Union. Rev. Ind. Organ. 2019, 55, 27–46. [Google Scholar] [CrossRef]

- Yildirim, C.; Kasman, A. Market power evolution and convergence in European banking: An empirical note. Bull. Econ. Res. 2020, 73, 535–544. [Google Scholar] [CrossRef]

- World Bank. 2022. Available online: https://www.worldbank.org/en/research/commodity-markets (accessed on 19 August 2022).

- Machado, A.; Hack, A.; Sousa, J. Globalization: Intersection Between Communication, Innovation and Knowledge. J. Int. Bus. Res. Mark. 2019, 4, 22–27. [Google Scholar] [CrossRef]

- Harvard Business Review Report. Competing in 2020: Winners and Losers in the Digital Economy. A Harvard Business Review Analytic Services Report. Harvard Business School Publishing. 2017, pp. 1–20. Available online: https://docslib.org/doc/9461662/winners-and-losers-in-the-digital-economy (accessed on 14 July 2022).

- OECD. Abuse of Dominance in Digital Markets. 2020. Available online: www.oecd.org/daf/competition/abuse-of-dominance-in-digital-markets-2020.pdf (accessed on 31 October 2021).

- Xhindi, T.; Gjika, I. The Effect of Corruption on Economic Development: An Empirical Analysis of Western Balkans Countries. Int. J. Innov. Econ. Dev. 2022, 8, 27–38. [Google Scholar]

- Calvano, E.; Polo, M. Market power, competition and innovation in digital markets: A survey. Inf. Econ. Policy 2021, 54, 100853. [Google Scholar] [CrossRef]

- Vogelsang, M. Digitalization in Open Economies Theory and Policy Implications; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Van Reenen, J. Increasing Differences between Firms: Market Power and the Macro-Economy; CEP Discussion Papers (CEPDP1576); Centre for Economic Performance, London School of Economics and Political Science: London, UK, 2018. [Google Scholar]

- Weche, J.P.; Wambach, A. The Fall and Rise of Market Power in Europe. Jahrbücher Natl. Stat. 2021, 241, 555–575. [Google Scholar] [CrossRef]

- Kopp, T.; Sexton, R.J. Farmers, Traders and Processors: Buyer Market Power and Double Marginalization in Indonesia. Am. J. Agric. Econ. 2020, 103, 543–568. [Google Scholar] [CrossRef]

- Eeckhout, J.; Veldkamp, L. Data and Market Power; Working Paper 30022; National Bureau of Economic Research: Cambridge, MA, USA, 2022. [Google Scholar] [CrossRef]

- Dospinescu, O.; Dospinescu, N.; Agheorghiesei, D.-T. FinTech Services and Factors Determining the Expected Benefits of Users: Evidence in Romania for Millennials and Generation Z. EM Econ. Manag. 2021, 24, 101–118. [Google Scholar] [CrossRef]

- Su, R.; Obrenovic, B.; Du, J.; Godinic, D.; Khudaykulov, A. COVID-19 Pandemic Implications for Corporate Sustainability and Society: A Literature Review. Int. J. Environ. Res. Public Health 2022, 19, 1592. [Google Scholar] [CrossRef] [PubMed]

- Şanta, A.-M.I. Die Gestaltung eines Gemeinsamen Energiemarktes auf der Ebene der Europäischen Union; Springer: Wiesbaden, Germany, 2021; ISBN 978-3-658-33355-3. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Şanta, A.-M.I. Market Power in the Context of Globalization. Encyclopedia 2022, 2, 1688-1697. https://doi.org/10.3390/encyclopedia2040115

Şanta A-MI. Market Power in the Context of Globalization. Encyclopedia. 2022; 2(4):1688-1697. https://doi.org/10.3390/encyclopedia2040115

Chicago/Turabian StyleŞanta, Ana-Maria Iulia. 2022. "Market Power in the Context of Globalization" Encyclopedia 2, no. 4: 1688-1697. https://doi.org/10.3390/encyclopedia2040115

APA StyleŞanta, A.-M. I. (2022). Market Power in the Context of Globalization. Encyclopedia, 2(4), 1688-1697. https://doi.org/10.3390/encyclopedia2040115