Risk Analysis on the Implementation and Operation of Green Hydrogen and Its Derivatives in the Spanish Port System

Abstract

1. Introduction

2. State of the Art

2.1. Green Hydrogen and Its Role in the Port Sector

2.2. Risk Factors and Methodologies for Risk Assessment

2.3. Risk Analysis in Ports and Practical Applications

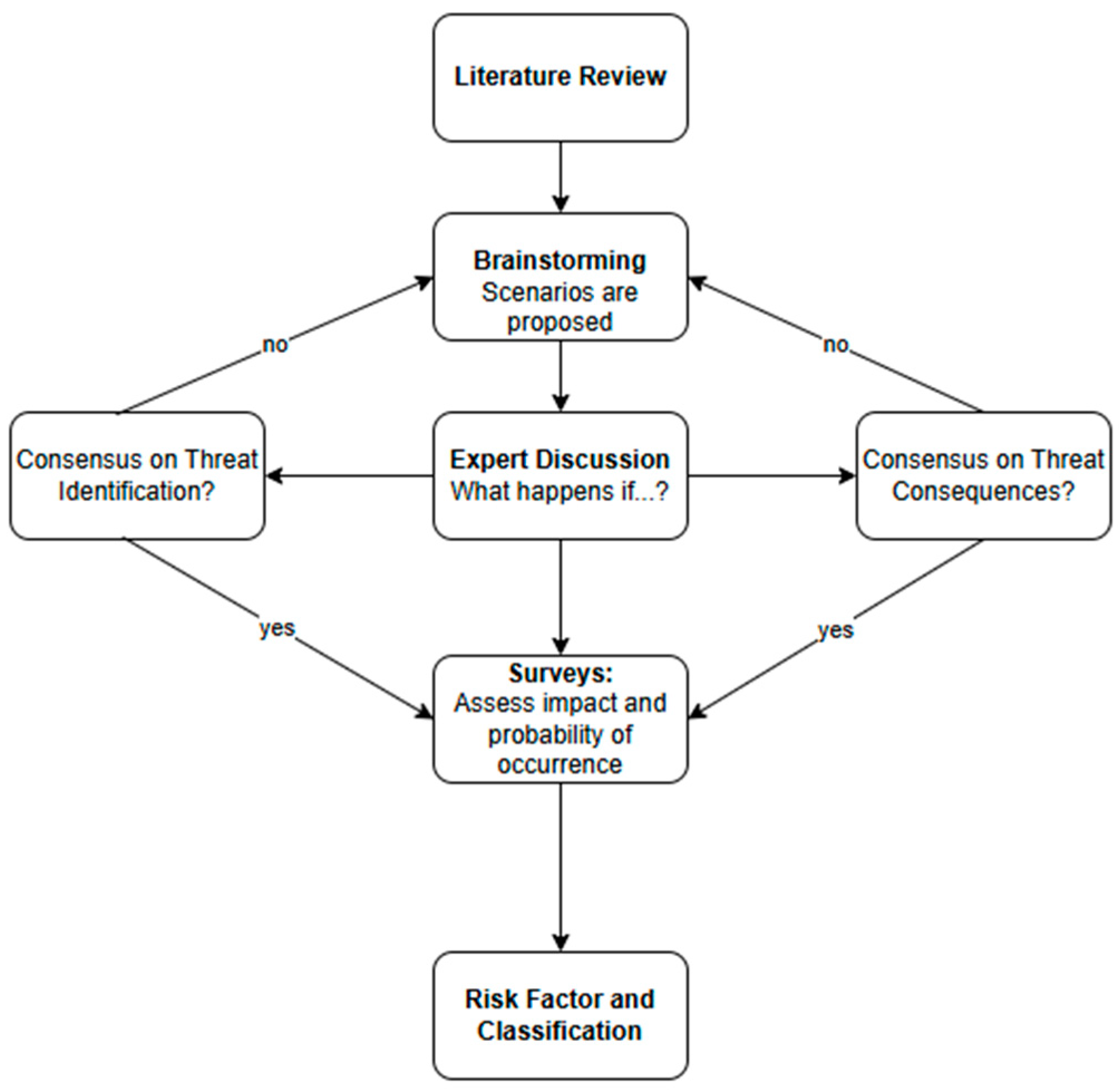

3. Methodology

- (a)

- Before beginning the study, the coordinator prepares a list of words or phrases of indication that can be based on a standardized set or can be created to allow for a complete review of threats or risks;

- (b)

- In the working meeting, the external and internal context of the system and the field of application of the study are discussed and agreed;

- (c)

- The coordinator asks questions to the participants to provoke and discuss known risks and dangers; previous experiences and incidents; known and existing controls and protections; regulatory requirements and restrictions;

- (d)

- Debate is encouraged by asking a question that uses the phrase “what if...?” and a word or point of indication. The phrases “what if...?” are “what if...?”, “what if...?”, “could something or someone...?”, “does someone or something about...?”. The aim is to encourage the study group to explore possible scenarios, as well as their causes, consequences, impacts and probabilities of occurrence;

- (e)

- A summary of the risks is made, along with their causes, consequences, impacts, and probabilities of occurrence;

- (f)

- The work team confirms and records the description of the risk, its causes, consequences, etc;

- (g)

- The task force considers risk management measures and defines possible measures;

- (h)

- During this discussion, additional questions such as “what if...?” are asked to identify other risks, if any;

- (i)

- The coordinator uses the list of prompts to monitor the discussion and to suggest additional issues and scenarios for the working group to discuss;

- (j)

- It is normal to apply a qualitative or semi-quantitative method of risk assessment to classify the actions created in terms of priority. In this case, fuzzy numbers are used.

4. Results and Discussion

- Class I (negligible)—risks with very low probability and impact, requiring minimal intervention;

- Class II (acceptable)—risks that pose a moderate impact but do not significantly disrupt port operations or hydrogen adoption strategies;

- Class III (not acceptable)—risks that demand active mitigation measures due to their potential to impact economic viability, infrastructure, or safety;

- Class IV (intolerable)—risks that pose severe consequences and require immediate mitigation strategies to ensure project feasibility and operational safety.

- In the first group and with the highest risk factor, there are “5. Financial viability and long-term profitability” and “26. Water scarcity.” Both as class IV.

- In the second place, “1. High Capital Investment”, “20. Substitute product”, “27. Manufacture of fertilizers”, and “30. Lack of international support.” Classified in class III.

- In third place, there are “2. Fluctuation in unit costs of electricity” and “10. Lack of sufficient capacity.” Classified in class III.

- Then, “3. High operating and maintenance costs”, “8. Failure of suppliers”, “11. Integration of renewable energies”, “22. Qualified human resources”, “23. Acceptance of H2 by consumers”, and “28. Government incentives, policy development and regulations”. Classified in class III.

- Then, “7. Intermittency of the electrical network”, “12. Rapid technological development”, and “18. Climate change”. Classified in class II.

- In sixth place, “4. Changes in the economy”, “14. Failures in infrastructure”, “19. Fluctuating demand”, “21. Bargaining power of customers”, and “29. Political instability.” Classified in class II.

- Subsequently, “6. Inadequate location of facilities”, “13. Information and Communication Technology”, “15. Inability to implement clean technology”, “17. Soil, water and air pollution”, and “24. Safety and health”. Closing category II.

- Then, we have “31. Terrorism and war”. Classified in class I.

- Finally, “9. Collaboration and transparency”, “16. Natural disasters and disease outbreaks”, and “25. Labor strike” are the remaining risks that close category I.

- “5. Financial viability and long-term profitability”: class IV. Hydrogen, and green hydrogen in particular, is not profitable mainly due to market demand and high production costs. Currently, the energy market is very well established, although it has changed in recent years. Renewable energies have been introduced into the electricity mix, which has been seen to increase the price of renewable energies. Electric cars have also been introduced, although they are in the minority. In the case of hydrogen, what is wanted to be achieved is a change in the energy paradigm with the combination of it and renewable energies [40]. That requires changes at a global level in an infrastructure that is difficult to change. However, improvements in renewable energy production technologies and electrolysis are expected in the future. On the other hand, grid-connected electrolyzers may be subject to taxes and fees, which make up a considerable proportion of the final price of electricity, resulting in a much higher operating cost that is added to the final cost of green hydrogen. However, there are already countries, such as Germany, that are proposing to exempt electrolyzers from all taxes and fees, such as the electricity tax and the surcharge for renewable energies, allowing hydrogen to be produced at a considerably lower cost [25]. Other feasible measures are to study the location of renewable sources for optimal efficiency, to promote technological progress with public–private investments and to establish a clear and favorable regulatory framework for these technologies.

- “26. Water scarcity”: class IV. In a country like Spain, which is vulnerable to droughts, competition for water resources between different sectors, such as agriculture, industry, and human consumption, would intensify. In this case, water would have many priorities before being used in hydrogen production. However, in a production system close to the port and the sea, desalinated seawater can be used as long as the appropriate procedures are used to treat it and as long as the energy used is renewable, since, if it is not performed in this way, it would no longer be considered green hydrogen. Another recommendation is to implement the technology in places where it is known that there are sufficient resources for its production.

- “1. High capital investment”: class III. It is a reality that the infrastructure to produce, store, and transport hydrogen has a high cost as has been seen in this project. However, the European Union’s plans and projects will develop viable projects for investment, fostering cooperation between public and private actors, and providing public support to attract greater investments. Regulations, plans, and policies that are drafted and put in place in favor of this technology will be an opportunity to mitigate this risk [7].

- “20. Substitute product”: class III. Nowadays, there is great energy competition, being a market that is mainly governed from an economic point of view, although there are also social and environmental implications. To mitigate this risk, green hydrogen must be mainly socially profitable, i.e., it must be economical and beneficial to society [23]. This requires advances in technology to lower costs and make it more efficient, requiring investments in research and development. Also, through policies, green hydrogen can be favored, reducing the taxes applied to it and promoting its development with investments.

- “27. Manufacture of fertilizers”: class III. In a world with a growing population, if the demand for hydrogen for fertilizer production increases significantly, there could be pressures to use less expensive hydrogen production methods [23]. However, an opportunity also arises for green hydrogen if the localization of renewable energies (wind, photovoltaic, etc.) is propitious, and it can become a cheaper option than other types of hydrogen. This would also be favored, as mentioned above, through policies that favor green hydrogen, reducing the taxes applied to it and promoting its development with investments.

- “30. Lack of international support”: class III. We live in a world where Europe is the region of greatest climate concern and, therefore, in developing this type of “clean” technologies. However, the global market is governed by what is most economically profitable and there is little European policies can do to influence the global market. However, it is the lowering of production costs that can make this technology be placed on the market so that it can be developed globally, favoring technological progress and cost reduction. This will be achieved with technological advances in renewable energy, electrolysers, etc. Therefore, a good measure is to support research into new materials and production systems.

- “2. Fluctuation in unit costs of electricity”: class III. Electricity costs directly influence the price of green hydrogen. To mitigate this risk, isolated gas production systems can be created using renewable energy systems connected directly to electrolysers. In this way, the price will not depend on the price of energy in the country but will depend on the good choice and study of a project of this technology.

- “10. Lack of sufficient capacity of electrolyzers, etc.”: class III. The reality is that there is still a long way to go technologically for the necessary components in the green hydrogen supply chain to be massively manufactured. This requires a demand for green hydrogen that does not yet exist. Therefore, new projects will have delays due to this lack of supply in terms of electrolyzers, technologies to store them, fuel cells, etc. Public policies and investments, along with technological advancement, are the ways forward to mitigate this risk.

- “3. High operating and maintenance costs”: class III. The processes involved in the production of green hydrogen are labor-intensive, contributing to high operating and maintenance costs [25]. In addition, governments and policymakers can allocate more budget in order to mitigate this risk.

- “8. Failure of suppliers”: class III. This risk is associated with the halt of the production chain due to lack of components or the slowness of new projects. That is why policymakers must ensure support for the expansion of electrolyzer manufacturing in the private sector. Therefore, a robust supplier selection process could be implemented to choose and manage a few qualified suppliers for critical materials and components [41].

- “11. Integration of renewable energies”: class III. This risk relates to the various design aspects required to integrate any renewable energy source into the existing energy grid. There is a risk associated with the integration of electrolyzers and the electricity grid, as this connection could consume renewable energy at the expense of other electricity uses due to increased demand. When there is excessive demand, it is normally covered by a marginal plant, which is often fossil fuel plants [42]. On the other hand, the integration of this technology into the global energy system will depend on the positive advances that are progressively made, so research and development must first be advanced at this early stage of the technology.

- “22. Qualified human resources”: class III. As mentioned, the processes involved in the production of green hydrogen are labor intensive [25]. As it is an immature technology, we find ourselves with the problem that there are no qualified personnel. However, to mitigate this fact, the training of personnel in the projects financed by the European Union or in which they participate in some way must be encouraged, since, by doing so jointly with private companies, it will favor feedback in all projects carried out in the European community, improving training and lowering training costs.

- “23. Acceptance of H2 by consumers”: class III. As mentioned, hydrogen is a very volatile and explosive gas. In addition, compared to other conventional and renewable fuels, green hydrogen may not be as competitive in price. This implies a possible reluctance of customers to adopt it [7]. The EU’s strategy to increase demand for green hydrogen also includes incentives and allocations for the use of green hydrogen in certain sectors [43].

- “28. Government incentives, policy development and regulations”: class III. The risk of inadequate development of incentives, policies, and regulations could hinder the development of the green hydrogen supply chain. To mitigate this risk, various market mechanisms could be used, such as carbon tax systems and contracts for carbon differences [43]. Taxing gray or blue hydrogen will help make green hydrogen cost-competitive. Developing policies that offer fees for producing green hydrogen instead of gray hydrogen could also reduce the cost gap. Equivalently, offering aid with public–private investment in green hydrogen projects is an attractive policy [7].

- “7. Intermittency of the electricity grid”: class II. Acceptable. It is an intrinsic problem of renewable energies, very difficult to change. As we have seen, electrolyzers that work well with this intermittency are being investigated.

- “12. Rapid technological development”: class II. Acceptable. While it may be difficult to keep pace with technological development economically for existing green hydrogen facilities, new developments also present an opportunity for this technology and for new investments.

- “18. Climate change”: class II. Acceptable. There is a lot of uncertainty about whether or not this risk will be unfavorable. However, a good study of the locations of renewable sources, taking into account the possible causes of climate change, is a good measure to mitigate this risk.

- “4. Changes in the economy”: class II. Acceptable. The economy is subject to continuous change by its very nature, affecting different sectors. It may also be an opportunity for green hydrogen if something similar to the oil crisis in the 1970s were to happen.

- “14. Infrastructure failures”: class II. Acceptable. Standardized safety controls must be in place both in parts factories and in production, storage, and transportation companies. Thus, ensuring proper operation.

- “19. Fluctuating demand”: class II. Acceptable. To reduce the risk associated with demand, green hydrogen must be an attractive market. To do this, it is sought to be as profitable as possible using the measures seen above.

- “21. Bargaining power of customers”: class II. Acceptable. The greater the supply of green hydrogen, the more negotiating power customers will have, being able to opt for cheaper options. However, this competition favors technological advances.

- “29. Political instability”: class II. Acceptable. It is an intrinsic problem of society and politics. It is difficult to mitigate, as ports and projects are subject to political changes. However, the European Union is a region with a certain stability.

- “6. Inadequate location of facilities”: class II. Acceptable. This is mitigated with a good prior study of the project related to this technology and the port.

- “13. Information and communication technology”: class II. Acceptable. You need to ensure that there are no failures by employing conventional security methods in industries, such as proper anti-malware, and having qualified personnel with the right tools.

- “15. Inability to implement clean technology”: class II. Acceptable. If any of the parties is unable to use clean technology, another supplier must be negotiated or found that does have that capacity.

- “17. Soil, water and air pollution”: class II. Acceptable. As we have seen, it is a much less polluting technology than other conventional energy technologies. It would be mitigated if the appropriate safety protocols are applied to prevent leaks, etc.

- “24. Health and safety”: class II. Acceptable. The production of green hydrogen involves several risk factors for workers. In addition, transporting green hydrogen is dangerous for the general population, as it is explosive and corrosive. However, the high levels of manual labor currently required to produce green hydrogen are expected to reduce over time, as rapid technological advances are made, too, the modernization of gas pipelines and other necessary infrastructure should ensure that these methods are suitable and do not pose a danger to the population in any given area [7].“31. Terrorism and war”: class I. Despicable. Although the impact could be very severe, the probability of occurrence has been considered very low. However, conventional security measures in strategic facilities such as energy or water resources could prevent terrorist attacks or vandalism.

- “9. Collaboration and transparency”: class I. Despicable. If any of the parties is unable to cooperate or places certain impediments, another supplier must be negotiated or found that does have that capacity.

- “16. Natural disasters and disease outbreaks”: class I. Despicable. Although the impact may be very high, the probability of occurrence is very low.

- “25. Labor strike”: class I. Despicable. Maintaining good working conditions is an appropriate measure to avoid this problem.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sanahuja Perales, J.A. El Pacto Verde, NextGenerationEU y la Nueva Europa geopolítica; Fundación Carolina: Madrid, Spain, 2022; Available online: https://hdl.handle.net/20.500.14352/4292 (accessed on 8 July 2024).

- Bouanan Pacheco, T. Análisis Económico de los Cinco Principales Puertos del Mediterráneo en el Tráfico de Contenedores. Bachelor’s Thesis, Universidad de Sevilla, Sevilla, Spain, 2019. Available online: https://idus.us.es/handle/11441/104184 (accessed on 8 July 2024).

- Armaroli, N.; Balzani, V. The Hydrogen Issue. ChemSusChem 2011, 4, 21–36. [Google Scholar] [CrossRef] [PubMed]

- IEA. The Future of Hydrogen—Analysis, IEA. Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 30 March 2024).

- Ajanovic, A.; Sayer, M.; Haas, R. The economics and the environmental benignity of different colors of hydrogen. Int. J. Hydrogen Energy 2022, 47, 24136–24154. [Google Scholar] [CrossRef]

- Penner, S.S. Steps toward the hydrogen economy. Energy 2006, 31, 33–43. [Google Scholar] [CrossRef]

- Azadnia, A.H.; McDaid, C.; Andwari, A.M.; Hosseini, S.E. Green hydrogen supply chain risk analysis: A european hard-to-abate sectors perspective. Renew. Sustain. Energy Rev. 2023, 182, 113371. [Google Scholar] [CrossRef]

- Cheng, W.; Lee, S. How green are the national hydrogen strategies? Sustainability 2022, 14, 1930. [Google Scholar] [CrossRef]

- Plan Nacional Integrado de Energía y Clima (PNIEC) 2021–2030, Ministerio para la Transición Ecológica y el Reto Demográfico. Available online: https://www.miteco.gob.es/es/prensa/pniec.html (accessed on 27 September 2024).

- Vivanco-Martín, B.; Iranzo, A. Analysis of the European Strategy for Hydrogen: A Comprehensive Review. Energies 2023, 16, 3866. [Google Scholar] [CrossRef]

- Zeng, K.; Zhang, D. Recent progress in alkaline water electrolysis for hydrogen production and applications. Prog. Energy Combust. Sci. 2010, 36, 307–326. [Google Scholar] [CrossRef]

- Al-Qahtani, A.; Parkinson, B.; Hellgardt, K.; Shah, N.; Guillen-Gosalbez, G. Uncovering the true cost of hydrogen production routes using life cycle monetisation. Appl. Energy 2021, 281, 115958. [Google Scholar] [CrossRef]

- UNE-EN ISO 22301:2020; Seguridad y resiliencia. Sistema de Gestión de la Continuidad del Negocio—Requisitos. UNE: Madrid, Spain, 2020. Available online: https://tienda.aenor.com/norma-une-en-iso-22301-2020-n0063818 (accessed on 27 September 2024).

- Dirzka, C. Port-centric Supply Chains as Catalysts for the Clean Energy Transition. In Ports as Energy Transition Hubs: An Exploratory Study; CBS Maritime: Copenhagen, Denmark, 2024; pp. 43–54. Available online: https://research.cbs.dk/en/publications/port-centric-supply-chains-as-catalysts-for-the-clean-energy-tran (accessed on 17 February 2025).

- Webmaster Potential of Hydrogen as Fuel for Shipping. Available online: https://www.emsa.europa.eu/publications/reports/item/5062-potential-of-hydrogen-as-fuel-for-shipping.html/?utm_source=eshidrogeno/ (accessed on 10 March 2025).

- Cruells Maristany, P. Exploring the Sociotechnical Imaginaries of Hydrogen Valleys: Case Studies from Northern Netherlands and Spain. Master’s Thesis, Universitat Politècnica de Catalunya, Barcelona, Spain, 2024. Available online: https://upcommons.upc.edu/handle/2117/417004 (accessed on 17 February 2025).

- Markmann, C.; Darkow, I.-L.; Von Der Gracht, H. A Delphi-based risk analysis—Identifying and assessing future challenges for supply chain security in a multi-stakeholder environment. Technol. Forecast. Soc. Change 2013, 80, 1815–1833. [Google Scholar]

- Hassan, N.S.; Jalil, A.A.; Rajendran, S.; Khusnun, N.F.; Bahari, M.B.; Johari, A.; Kamaruddin, M.J.; Ismail, M. Recent review and evaluation of green hydrogen production via water electrolysis for a sustainable and clean energy society. Int. J. Hydrogen Energy 2024, 52, 420–441. [Google Scholar]

- Graczyk, A.; Brusiło, P.; Graczyk, A.M. Hydrogen as a Renewable Fuel of Non-Biological Origins in the European Union—The Emerging Market and Regulatory Framework; IGEM House: Derby, UK, 2025; Available online: https://www.h2knowledgecentre.com/content/journal6794 (accessed on 17 February 2025).

- Ghadimi, P.; Donnelly, O.; Sar, K.; Wang, C.; Azadnia, A.H. The successful implementation of industry 4.0 in manufacturing: An analysis and prioritization of risks in Irish industry. Technol. Forecast. Soc. Change 2022, 175, 121394. [Google Scholar]

- Daneshmandi, M.; Sahebi, H.; Ashayeri, J. The incorporated environmental policies and regulations into bioenergy supply chain management: A literature review. Sci. Total Environ. 2022, 820, 153202. [Google Scholar]

- Li, H.; Cao, X.; Liu, Y.; Shao, Y.; Nan, Z.; Teng, L.; Peng, W.; Bian, J. Safety of hydrogen storage and transportation: An overview on mechanisms, techniques, and challenges. Energy Rep. 2022, 8, 6258–6269. [Google Scholar]

- Furfari, S. The Hydrogen Illusion; Independently Published. 2022. Available online: https://www.amazon.co.uk/hydrogen-illusion-Samuel-Furfari-ebook/dp/B08YM4NPYR# (accessed on 27 September 2024).

- Chae, M.J.; Kim, J.H.; Moon, B.; Park, S.; Lee, Y.S. The present condition and outlook for hydrogen-natural gas blending technology. Korean J. Chem. Eng. 2022, 39, 251–262. [Google Scholar]

- Bianco, E.; Blanco, H. Green Hydrogen: A Guide to Policy Making; IGEM House: Derby, UK, 2020; Available online: https://www.h2knowledgecentre.com/content/researchpaper1616 (accessed on 27 September 2024).

- Mokhtari, K.; Ren, J.; Roberts, C.; Wang, J. Application of a generic bow-tie based risk analysis framework on risk management of sea ports and offshore terminals. J. Hazard. Mater. 2011, 192, 465–475. [Google Scholar] [CrossRef]

- Koliousis, I. A conceptual framework that monitors port facility access through integrated Port Community Systems and improves port and terminal security performance. Int. J. Shipp. Transp. Logist. 2020, 12, 251. [Google Scholar] [CrossRef]

- Landoll, D. The Security Risk Assessment Handbook: A Complete Guide for Performing Security Risk Assessments; CRC Press: Boca Raton, FL, USA, 2021; Available online: https://www.taylorfrancis.com/books/mono/10.1201/9781003090441/security-risk-assessment-handbook-douglas-landoll (accessed on 27 September 2024).

- Delikhoon, M.; Zarei, E.; Banda, O.V.; Faridan, M.; Habibi, E. Systems thinking accident analysis models: A systematic review for sustainable safety management. Sustainability 2022, 14, 5869. [Google Scholar] [CrossRef]

- Lau, M.Y.; Liu, Y.; Kaber, D.B. Consequence severity-probability importance measure for fault tree analysis. Int. J. Syst. Assur. Eng. Manag. 2024, 15, 854–870. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy Logic. In Granular, Fuzzy, and Soft Computing; Lin, T.-Y., Liau, C.-J., Kacprzyk, J., Eds.; Encyclopedia of Complexity and Systems Science Series; Springer: New York, NY, USA, 2009; pp. 19–49. ISBN 978-1-0716-2627-6. [Google Scholar]

- John, A.; Paraskevadakis, D.; Bury, A.; Yang, Z.; Riahi, R.; Wang, J. An integrated fuzzy risk assessment for seaport operations. Saf. Sci. 2014, 68, 180–194. [Google Scholar]

- Fuentes Peris, P. Análisis de Riesgos de una Instalación de Suministro de Combustible para Embarcaciones en el Puerto de Valencia. Proyecto/Trabajo fin de carrera/grado, Universitat Politècnica de València, Valencia, Spain. 2022. Available online: https://riunet.upv.es/handle/10251/189562 (accessed on 17 February 2025).

- Pallis, A.A. The Common EU Maritime Transport Policy: Policy Europeanisation in the 1990s; Routledge: London, UK, 2017; Available online: https://www.taylorfrancis.com/books/mono/10.4324/9781315240596/common-eu-maritime-transport-policy-athanasios-pallis (accessed on 27 September 2024).

- Leimeister, M.; Kolios, A. A review of reliability-based methods for risk analysis and their application in the offshore wind industry. Renew. Sustain. Energy Rev. 2018, 91, 1065–1076. [Google Scholar]

- Maldonado, E.; Casas, J.; Canas, J. Aplicación de los conjuntos difusos en la evaluación de los parámetros de la vulnerabilidad sísmica de puentes. Rev. Int. Métod. Numér. Para Cálculo Diseño En Ing. 2002, 18, 2. [Google Scholar]

- World Bank. Recomendaciones de Desarrollo de Regulación de Seguridad para Habilitar el Uso de Hidrógeno Verde en Minería a Rajo Abierto, World Bank. Available online: https://documents.worldbank.org/pt/publication/documents-reports/documentdetail/en/099072723121019646 (accessed on 17 February 2025).

- Rodríguez, F.; Ibiett, M. El Método Delphi Como Método de Investigación en la Gestión de Riesgos Contra Atentados Terroristas. In Proceedings of the XIV International Congress on Project Engineering, Madrid, Spain, 30 June–2 July 2010. [Google Scholar]

- EN IEC 31010:2019; Risk management—Risk Assessment Techniques. ISO: Geneva, Switzerland, 2019. Available online: https://tienda.aenor.com/norma-cenelec-en-iec-31010-2019-63199 (accessed on 10 March 2025).

- Dincer, I.; Aydin, M.I. New paradigms in sustainable energy systems with hydrogen. Energy Convers. Manag. 2023, 283, 116950. [Google Scholar]

- Scita, R.; Raimondi, P.P.; Noussan, M. Green Hydrogen: The Holy Grail of Decarbonisation? An Analysis of the Technical and Geopolitical Implications of the Future Hydrogen Economy 2020. In Fondazione Eni Enrico Mattei Working Papers; FEEM: Milan, Italy, 2020. [Google Scholar] [CrossRef]

- Lahane, S.; Kant, R. Evaluation and ranking of solutions to mitigate circular supply chain risks. Sustain. Prod. Consum. 2021, 27, 753–773. [Google Scholar] [CrossRef]

- Barnes, A.; Yafimava, K. EU Hydrogen Vision: Regulatory Opportunities and Challenges; IGEM House: Derby, UK, 2020; Available online: https://www.h2knowledgecentre.com/content/policypaper1431 (accessed on 22 May 2024).

| Threat | Risk Factor | Risk Classification | Priority | |

|---|---|---|---|---|

| Number | Name | |||

| 5 | Financial viability and long-term profitability | 0.71 | IV | 1 |

| 26 | Water scarcity | 0.71 | IV | 1 |

| 1 | High capital investment for green hydrogen production and delivery technology compared to other energy sources | 0.60 | III | 2 |

| 20 | Substitute product | 0.60 | III | 2 |

| 27 | Fertilizer manufacturing | 0.60 | III | 2 |

| 30 | Lack of international support | 0.60 | III | 2 |

| 2 | Fluctuation in unit costs of electricity | 0.48 | III | 3 |

| 10 | Lack of sufficient capacity for electrolyzers, H2 storage, transportation, delivery, and conversion | 0.48 | III | 3 |

| 3 | High operating and maintenance costs | 0.42 | III | 4 |

| 8 | Supplier failure | 0.42 | III | 4 |

| 11 | Integration of renewable energies | 0.42 | III | 4 |

| 22 | Qualified human resources | 0.42 | III | 4 |

| 23 | Consumer acceptance of H2 | 0.42 | III | 4 |

| 28 | Government incentives, policy development and regulations | 0.42 | III | 4 |

| 7 | Grid intermittency | 0.29 | II | 5 |

| 12 | Rapid technological development and uncertainty in H2 production | 0.29 | II | 5 |

| 18 | Climate change and availability of renewable energy sources | 0.29 | II | 5 |

| 4 | Changes in the economy | 0.23 | II | 6 |

| 14 | Infrastructure failures | 0.23 | II | 6 |

| 19 | Fluctuating demand | 0.23 | II | 6 |

| 21 | Clients’ bargaining power | 0.23 | II | 6 |

| 29 | Political instability | 0.23 | II | 6 |

| 6 | Improper location of facilities | 0.17 | II | 7 |

| 13 | Information and communication technology | 0.17 | II | 7 |

| 15 | Inability to implement clean technology | 0.17 | II | 7 |

| 17 | Soil, water and air pollution | 0.17 | II | 7 |

| 24 | Health and safety | 0.17 | II | 7 |

| 31 | Terrorism and war | 0.06 | I | 8 |

| 9 | Collaboration and transparency | 0.04 | I | 9 |

| 16 | Natural disasters and disease outbreaks | 0.04 | I | 9 |

| 25 | Labor strike | 0.04 | I | 9 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García Nielsen, D.; Camarero-Orive, A.; Vaca-Cabrero, J.; González-Cancelas, N. Risk Analysis on the Implementation and Operation of Green Hydrogen and Its Derivatives in the Spanish Port System. Future Transp. 2025, 5, 37. https://doi.org/10.3390/futuretransp5020037

García Nielsen D, Camarero-Orive A, Vaca-Cabrero J, González-Cancelas N. Risk Analysis on the Implementation and Operation of Green Hydrogen and Its Derivatives in the Spanish Port System. Future Transportation. 2025; 5(2):37. https://doi.org/10.3390/futuretransp5020037

Chicago/Turabian StyleGarcía Nielsen, Daniel, Alberto Camarero-Orive, Javier Vaca-Cabrero, and Nicoletta González-Cancelas. 2025. "Risk Analysis on the Implementation and Operation of Green Hydrogen and Its Derivatives in the Spanish Port System" Future Transportation 5, no. 2: 37. https://doi.org/10.3390/futuretransp5020037

APA StyleGarcía Nielsen, D., Camarero-Orive, A., Vaca-Cabrero, J., & González-Cancelas, N. (2025). Risk Analysis on the Implementation and Operation of Green Hydrogen and Its Derivatives in the Spanish Port System. Future Transportation, 5(2), 37. https://doi.org/10.3390/futuretransp5020037