Estimating the Value of Information Technology in the Productivity of the Transport Sector

Abstract

1. Introduction

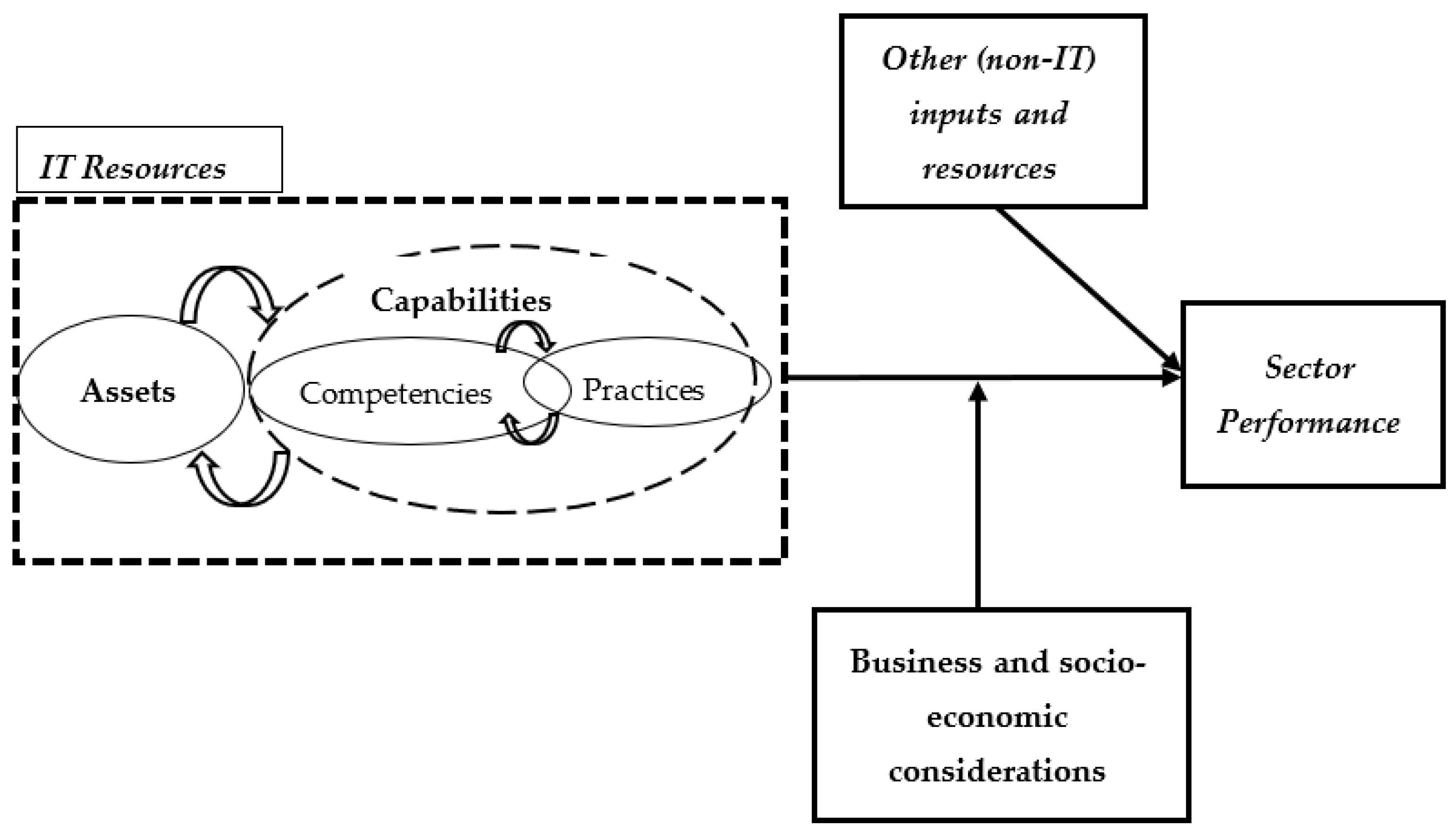

2. Literature Review

3. Materials and Methods (Methodological Formulation)

3.1. Basic Definitions

3.2. Model Formulation

- vit, which represents the deviation due to random error distributed according to a normal distribution, N (0. σv2);

- uit, which is the error term representing “inefficiency”. This “inefficiency” term is a very useful item for our analysis since its value can be used to calculate the productive efficiency of the sector (i) at a time (t) by use of the production theory relation:PEit = e−uit

3.3. Sources of Data

- ○

- Structural Business Statistics (SBS) database with metadata (Euro SDMX metadata Structure–ESMS).

- ○

- Annual detailed enterprise statistics for services (NACE Rev.2 H-N and S95).

- ○

- Cross-classification of fixed assets by industry and by asset.

- For Yit (“observed” output of the sector), the annual production value (in millions of Euros) of the transport and storage sector is available in Eurostat’s SBS database [37]. The “production value” is defined by Eurostat as the turnover, plus or minus the changes in stocks of finished products, work in progress, and goods and services purchased for resale, minus the purchases of goods and services for resale, plus capitalized production and other operating income (excluding subsidies) [37]. This value was considered a good measure of sector “output” as it is a result of the inner interactions and workings of the various businesses and economic sub-elements within the sector (which are expressed as the independent variables). The annual production value came under different configurations in the Eurostat database, and therefore, several of these configurations were tested (see Table 1).

- For Kit (non-IT capital), the non-IT capital for the transport sector is found in the cross-classification of fixed non-IT assets database of Eurostat, specified according to the statistical classification of economic activities in the European Community (NACE revision 2) [38]. These non-IT assets are given under the following cross-classification codes:

- N111—Dwellings;

- N112—Other buildings and structures;

- N1131—Transport equipment;

- N11O—Other machinery and equipment;

- N11O—intellectual property products;

- N1171—Research and Development.

- For Iit (IT-capital), the same as with the Ks database was used, but the IT-capital data are classified under the European System of Accounts—ESA 2010 (9/28) classification “ICT equipment” [38]. The figures include investments for the following classification codes:

- N11321—Computer hardware;

- N11322—Telecommunications equipment;

- N1173—Computer software and databases.

- For Lit (labor), it represents the total number of persons employed in the transport sector under different configurations (see Table 1) [39]. It is defined by Eurostat as the total number of persons who work in the sector’s firms both “internally”, i.e., working personnel inclusive of working proprietors, partners working regularly in the firms, and unpaid family workers, as well as “externally”, i.e., persons who work outside the firm but belong to it and are paid by it (e.g., sales representatives, delivery personnel, repair, and maintenance teams).

| Name of Variable [Sign Used] | Description | Source | Unit |

|---|---|---|---|

| Productivity 1 [PR1] | Annual turnover value of transport and storage sector | Eurostat, table SBS_NA_1A_SE_R2 [39] | Million Euros |

| Productivity 2 [PR 2] | Annual value added at factor cost of transport and storage sector | Eurostat, table SBS_NA_1A_SE_R2 [39] | Million Euros |

| Productivity 3 [PR 3] | Annual index of turnover in services of transport and storage sector | Eurostat, table STS_SETU [40] | Index of turnover, 2015 = 100 |

| Productivity 4 [PR 4] | Annual turnover per person employed in the transport and storage sector | Eurostat, table SBS_NA_1A_SE_R [39] | Thousand Euros |

| Capital non-IT [K1] | Non-IT capital, i.e., expenditure on non-IT infrastructure investments as those listed for the Kit variable above. | Eurostat, table NAMA_10_NFA_ST [38] Cross-classification tables of fixed assets for the transport and storage sector by non-IT assets | Chain linked volumes (2015), in million Euros |

| Capital IT [K2] | IT capital, i.e., expenditure on IT infrastructure investments as those listed for the Iit variable above. | Eurostat, table NAMA_10_NFA_ST [38] Cross-classification of fixed assets for the transport and storage sector by IT asset | Chain linked volumes (2015), in million Euros |

| Labor 1 [L1] | Annual number of persons employed in the transport and storage sector | Eurostat, table STS_SELB [41] | Index, 2015 = 100 |

| Labor 2 [L2] | Annual number of persons employed by sex, age, and economic activity (transport and storage sector) | Eurostat, table LFSA_EGAN2 [42] | Thousands of employed persons |

| Labor 3 [L3] | Annual total employment for the transport and storage sector (National accounts employment data by industry) | Eurostat, table NAMA_10_A64_E [43] | Thousands of persons |

| Labor 4 [L4] | Annual persons employed in the transport and storage sector | Eurostat, table SBS_NA_1A_SE_R2 [39] | Number of persons employed |

4. Results

- The R2 values are comfortably high indicating high levels of correlation between the variables selected (for reasons of economy of space, Table 2 shows only the results from the most “successful” runs and not of all the runs made which were more than 25).

- The sums of the β values are very close to 1, indicating that all equations are close to homogeneity, i.e., of degree 1 (constant returns to scale). This is a very welcome result indicating stability and robustness in the estimated production frontier models.

- All β parameters are significant at the 5% level. A reduction in the level of significance might result in the invalidation of a few runs, but this does not invalidate the methodology presented or its basic results.

- The sensitivity of the results to the “u” values was also examined. This seems to be quite high because the PE values are directly proportional (inverse proportional, but still “proportional”) to the “u” values. This gives high importance to the method of estimating the “u” values from the (v-u) standard error estimate of each regression.

- As already pointed out, the values of the coefficients β represent the corresponding elasticities of the respective variable relevant to the sector’s output. This is quite a useful result from the specific formulation selected for the production frontier model in the form of Equation (4). For example, (with reference to the results of Test Run 1, the first line of Table 2), the values of the β coefficients indicate that the elasticity of, e.g., non-IT capital (K1), with respect to the output of the transport sector (i.e., its annual turnover value) is 0.556. This means that for a 10% increase in the non-IT capital used, there will be a 5.56% increase in the sector’s output. Additionally, in the same line, one can see that the β value for IT capital is 0.160, indicating that for a 10% increase in IT capital, there will be a 1.6% increase in the sector’s output.

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| LIST OF ABBREVIATIONS | |

| BV | Business Value |

| SV | Sector Value |

| CD | The Cobb–Douglas mathematical formulation for the calculation of productive efficiency |

| EUROSTAT | The EU’s Statistical Authority |

| IS | Information Systems |

| IT | Information Technology |

| IT/BV | The business value of IT at firm-level |

| IT/SV | The business value of IT at sector-level |

| PE | Productive Efficiency |

| PF | Production Frontier |

| SPF | Stochastic Production Frontier |

References

- Giannopoulos, A. Defining IT Business Value Under Conditions of Economic Uncertainty. J. Adv. Manag. Sci. Inf. Syst. 2017, 3, 36–48. [Google Scholar] [CrossRef]

- Devaraj, S.; Kohli, R. Information technology payoff in the health-care industry: A longitudinal study. J. Manag. Inf. Syst. 2000, 16, 41–68. [Google Scholar] [CrossRef]

- Alpar, P.; Kim, M. A Microeconomic Approach to the Measurement of Information Technology Value. J. Manag. Inf. Syst. 1990, 7, 55–69. Available online: https://www.jstor.org/stable/40397946 (accessed on 21 February 2023). [CrossRef]

- Dewan, S.; Michael, S.; Min, C. Firm characteristics and investments in information technology: Scale and scope effects. Inf. Syst. Res. 1998, 9, 219–232. [Google Scholar] [CrossRef]

- Giannopoulos, A.G. Quantifying the role of IT in the ITS sector. In Proceedings of the IEEE 23rd Intelligent Transportation Systems Conference ITSC 2020, Rhodes, Greece, 20–23 September 2020. [Google Scholar]

- Melville, N.; Kraemer, K.; Gurbaxani, V. Information technology and organizational performance: An integrative model of IT business value. MIS Q. 2004, 28, 283–322. [Google Scholar] [CrossRef]

- Shu, W.S.; Lee, S. Beyond productivity—Productivity and the three types of efficiencies of information technology industries. Inf. Softw. Technol. 2003, 45, 513–524. [Google Scholar] [CrossRef]

- Soh, C.; Markus, M. How IT creates business value: A process theory synthesis. In Proceedings of the 16th International Conference on Information Systems, Amsterdam, The Netherlands, 10–13 December 1995; pp. 29–41. [Google Scholar]

- Dupeyras, A.; MacCallum, N. Indicators for Measuring Competitiveness in Tourism: A Guidance Document; OECD Tourism Papers, No. 2013/02; OECD Publishing: Paris, France, 2013. [Google Scholar] [CrossRef]

- Borgström, B.; Gammelgaard, B.; Bruun, P. Competitiveness in Road Transport: The Market Liberalized Haulier. In Proceedings of the 11th European Research Seminar on Logistics and SCM. ERS 2016, Vienna, Austria, 12–13 May 2013. [Google Scholar]

- Lee, S.; Xiang, J.Y.; Kim, J.K. Information technology and productivity: Empirical evidence from the Chinese electronics industry. Inf. Manag. 2011, 48, 79–87. [Google Scholar] [CrossRef]

- Wade, M.; Hulland, J. The Resource-Based View and Information Systems Research: Review, Extension, and Suggestions for Future Research. MIS Q. 2004, 28, 107. [Google Scholar] [CrossRef]

- Giannopoulos, A.G. Exploitation of IT Research Results and the Creation of Innovation in the Context of Collaborative Transport R&D Projects. Ph.D. Thesis, Athens University of Economics and Business, Athens, Greece, 2019. [Google Scholar]

- Gurbaxani, V.; Whang, S. The impact of information systems on organizations and markets. Commun. ACM 1991, 34, 59–73. [Google Scholar] [CrossRef]

- Belleflamme, P. Oligopolistic competition, IT use for product differentiation and the productivity paradox. Int. J. Ind. Organ. 2001, 19, 227–248. [Google Scholar] [CrossRef]

- Bharadwaj, A.S. A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investigation. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Mukhopadhyay, T.; Kekre, S.; Kalathur, S. Business Value of Information Technology: A Study of Electronic Data Interchange. MIS Q. 1995, 19, 137–156. Available online: https://www.jstor.org/stable/249685 (accessed on 1 November 2021). [CrossRef]

- Tam, K. The impact of information technology investments on firm performance and evaluation: Evidence from newly industrialized economies. Inf. Syst. Res. 1998, 9, 85–98. [Google Scholar] [CrossRef]

- Ahn, S.C.; Lee, Y.H.; Schmidt, P. Stochastic frontier models with multiple time-varying individual effects. J. Product. Anal. 2007, 27, 1–12. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hitt, L.M. Computing productivity: Firm-level evidence. Rev. Econ. Stat. 2003, 84, 793–808. [Google Scholar] [CrossRef]

- Mitra, S.; Chaya, A.K. Analyzing Cost-Effectiveness of Organizations: The Impact of Information Technology Spending. J. Manag. Inf. Syst. 1996, 13, 29–57. [Google Scholar] [CrossRef]

- Mooney, J.; Gurbaxani, V.; Kraemer, K. A process oriented framework for assessing the business value of information technology. In Proceedings of the 16th International Conference on Information Systems, Amsterdam, The Netherlands, 10–13 December 1995; pp. 17–27. [Google Scholar] [CrossRef]

- Tyrrell, T.; Paris, C.M.; Biaett, V. A Quantified Triple Bottom Line for Tourism. J. Travel Res. 2013, 52, 279–293. [Google Scholar] [CrossRef]

- Brynjolfsson, E. The Contribution of Information Technology to Consumer Welfare. Inf. Syst. Res. 1996, 7, 281–300. [Google Scholar] [CrossRef]

- Hitt, L.M.; Brynjolfsson, E. Productivity, business profitability, and consumer surplus: Three different measures of information technology value. MIS Q. 1996, 20, 121–142. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hitt, L.M. Paradox lost? Firm-level evidence on the returns to information systems spending. Manag. Sci. 1996, 42, 541–558. [Google Scholar] [CrossRef]

- Shao, B.B.M.; Lin, W.T. Technical efficiency analysis of information technology investments: A two-stage empirical investigation. Inf. Manag. 2002, 39, 391–401. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hitt, L.M. Beyond computation: Information technology, organizational transformation and business performance. J. Econ. Perspect. 2000, 14, 23–48. [Google Scholar] [CrossRef]

- Barua, A.; Kriebel, C.; Mukhopadhyay, T. An economic analysis of strategic information technology investments. MIS Q. 1991, 15, 313–331. [Google Scholar] [CrossRef]

- Baker, J.; Song, J.; Jones, D. Refining the IT business value model: Evidence from a longitudinal investigation of healthcare firms. In Proceedings of the International Conference on Information Systems, ICIS 2008, Paris, France, 14–17 December 2008; Available online: https://aisel.aisnet.org/icis2008/137/ (accessed on 1 October 2021).

- Brynjolfsson, E. The productivity paradox of information technology. Commun. ACM 1993, 36, 67–77. [Google Scholar] [CrossRef]

- Lin, W.T.; Shao, B.B.M. Assessing the input effect on productive efficiency in production systems: The value of information technology capital. Int. J. Prod. Res. 2006, 44, 1799–1819. [Google Scholar] [CrossRef]

- Lin, W.T. The business value of information technology as measured by technical efficiency: Evidence from country-level data. Decis. Support Syst. 2009, 46, 865–874. [Google Scholar] [CrossRef]

- Chen, Y.H.; Lin, W.T. Analyzing the relationships between information technology, inputs substitution and national characteristics based on CES stochastic frontier production models. Int. J. Prod. Econ. 2009, 120, 552–569. [Google Scholar] [CrossRef]

- Jondrow, J.; Lovell, K.; Materov, I.; Schmidt, P. On the estimation of technical inefficiency in the stochastic frontier production function model. J. Econom. 1982, 19, 233–238. [Google Scholar] [CrossRef]

- Belotti, F.; Ilardi, G. Consistent inference in fixed-effects stochastic frontier models. J. Econom. 2018, 202, 161–177. [Google Scholar] [CrossRef]

- Eurostat. Structural Business Statistics (SBS), Reference Metadata in Euro SDMX Metadata Structure (ESMS). Available online: https://ec.europa.eu/eurostat/cache/metadata/en/sbs_esms.htm (accessed on 1 February 2023).

- Eurostat. Cross-Classification of Fixed Assets by Industry and by Asset (Stocks) Nama_10_nfa_st Table. Available online: https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_NFA_ST$DV_647/default/table?lang=en&category=isoc.isoc_se (accessed on 1 February 2023).

- Eurostat. Annual Detailed Enterprise Statistics for Services (NACE Rev.2 H-N and S95), sbs_na_1a_se_r2 Table. Available online: https://ec.europa.eu/eurostat/databrowser/view/SBS_NA_1A_SE_R2/default/table?lang=en (accessed on 1 February 2023).

- Eurostat. Turnover in Services—Annual Data, Table TS_SETU_A. Available online: https://ec.europa.eu/eurostat/databrowser/view/STS_SETU_A__custom_4919922/default/table?lang=en (accessed on 1 February 2023).

- Eurostat. Labour Input in Services—Annual Data, Table STS_SELB. Available online: https://ec.europa.eu/eurostat/databrowser/view/STS_SELB_A__custom_4919932/default/table?lang=en (accessed on 1 February 2023).

- Eurostat. Employment by Sex, Age and Economic Activity (from 2008 onwards, NACE Rev. 2)—1000, Table LFSA_EGAN2. Available online: https://ec.europa.eu/eurostat/databrowser/view/LFSA_EGAN2/default/table?lang=en (accessed on 1 February 2023).

- Eurostat. National Accounts Aggregates by Industry (up to NACE A*64), Table NAMA_10_A64_E. Available online: https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_A64/default/table?lang=en (accessed on 1 February 2023).

- Aral, S.; Weill, P. IT Assets, Organizational Capabilities, and Firm Performance: How Resource Allocations and Organizational Differences Explain Performance Variation. Organ. Sci. 2007, 18, 763–780. [Google Scholar] [CrossRef]

- Cavallaro, F.; Nocera, S. Are transport policies and economic appraisal tools aligned in evaluating road externalities? Transp. Res. Part D Transp. Environ. 2022, 106, 103266. [Google Scholar] [CrossRef]

| Test Run 1 (PR1 vs. K1, L2, K2) | β1 * | β2 * | β3 * | Sum of β ** | Std Error (v-u) | R2 | u | PE () |

| With IT | 0.556 | 0.233 | 0.160 | 0.948 | 0.4490 | 0.893 | 0.1796 | 0.8356 |

| Without IT | 0.663 | 0.272 | - | 0.935 | 0.4603 | 0.887 | 0.2394 | 0.7871 |

| Test Run 1: % Contribution of IT *** | 6.2% | |||||||

| Test Run 2 (PR1 vs. K1, L3, K2) | β1 * | β2 * | β3 * | Sum of β ** | Std Error (v-u) | R2 | u | PE () |

| With IT | 0.418 | 0.428 | 0.159 | 1.005 | 0.4180 | 0.909 | 0.1672 | 0.8460 |

| Without IT | 0.511 | 0.470 | - | 0.994 | 0.4305 | 0.903 | 0.2152 | 0.8063 |

| Test Run 2: % Contribution of IT *** | 4.9% | |||||||

| Test Run 3 (PR1 vs. K1, L4, K2) | β1 * | β2 * | β3 * | Sum of β ** | Std Error (v-u) | R2 | u | PE () |

| With IT | 0.426 | 0.469 | 0.108 | 1.004 | 0.4129 | 0.910 | 0.1652 | 0.8477 |

| Without IT | 0.488 | 0.511 | - | 0.999 | 0.4179 | 0.907 | 0.2090 | 0.8114 |

| Test Run 3: % Contribution of IT *** | 4.5% | |||||||

| Test Run 4 (PR2 vs. K1, L3, K2) | β1 * | β2 * | β3 * | Sum of β ** | Std Error (v-u) | R2 | u | PE () |

| With IT | 0.502 | 0.351 | 0.177 | 1.031 | 0.3850 | 0.927 | 0.1540 | 0.8573 |

| Without IT | 0.620 | 0.398 | - | 1.018 | 0.4021 | 0.920 | 0.2011 | 0.8179 |

| Test Run 4: % Contribution of IT *** | 4.8% | |||||||

| Test Run 5 (PR2 vs. K1, L4, K2) | β1 * | β2 * | β3 * | Sum of β ** | Std Error (v-u) | R2 | u | PE () |

| With IT | 0.529 | 0.355 | 0.146 | 1.031 | 0.3798 | 0.929 | 0.1519 | 0.8590 |

| Without IT | 0.613 | 0.412 | - | 1.025 | 0.3908 | 0.925 | 0.1954 | 0.8225 |

| Test Run 5: % Contribution of IT *** | 4.4% | |||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Giannopoulos, A.G.; Moschovou, T.P. Estimating the Value of Information Technology in the Productivity of the Transport Sector. Future Transp. 2023, 3, 601-614. https://doi.org/10.3390/futuretransp3020035

Giannopoulos AG, Moschovou TP. Estimating the Value of Information Technology in the Productivity of the Transport Sector. Future Transportation. 2023; 3(2):601-614. https://doi.org/10.3390/futuretransp3020035

Chicago/Turabian StyleGiannopoulos, Athanasios G., and Tatiana P. Moschovou. 2023. "Estimating the Value of Information Technology in the Productivity of the Transport Sector" Future Transportation 3, no. 2: 601-614. https://doi.org/10.3390/futuretransp3020035

APA StyleGiannopoulos, A. G., & Moschovou, T. P. (2023). Estimating the Value of Information Technology in the Productivity of the Transport Sector. Future Transportation, 3(2), 601-614. https://doi.org/10.3390/futuretransp3020035