Abstract

Mining (1) operations in remote areas (2) face significant challenges related to energy supply, high fuel costs, and limited infrastructure. This study investigates the potential for achieving energy independence (3) and resilience (4) in such environments through the integration of renewable energy sources (5) and battery–electric mining equipment. Using the “Studena Vrila” underground bauxite mine as a case study, a comprehensive techno-economic and environmental analysis was conducted across three development models. These models explore incremental scenarios of solar and wind energy adoption combined with electrification of mobile machinery. The methodology includes calculating levelized cost of energy (LCOE), return on investment (ROI), and greenhouse gas (GHG) reductions under each scenario. Results demonstrate that a full transition to RES and electric machinery can reduce diesel consumption by 100%, achieve annual savings of EUR 149,814, and cut GHG emissions by over 1.7 million kg CO2-eq. While initial capital costs are high, all models yield a positive Net Present Value (NPV), confirming long-term economic viability. This research provides a replicable framework for decarbonizing mining operations in off-grid and infrastructure-limited regions.

1. Introduction

The mining industry stands at a crossroads, driven by the need to enhance efficiency, improve sustainability and resilience, and comply with increasingly stringent environmental and safety standards. A critical factor in achieving energy independence and resilience, particularly given the remoteness of mining operations, whether underground or open-pit, is the availability of a reliable energy source that is entirely independent of the local infrastructure and market conditions (e.g., diesel fuel prices).

The public and investors demand concrete action from corporations to reduce greenhouse gas emissions in their operations. Mining companies face several challenges in reducing GHG emissions throughout the mining life cycle. These challenges include heavy reliance on fossil fuels and lack of access to a grid or low-carbon electricity in remote project locations [1].

A key area of focus is the selection of equipment used in underground and surface mining operations, particularly mobile machinery such as loaders, excavators, and haul trucks, which are essential for loading and transporting the extracted mineral resources. Equally important is the type of fuel or energy source powering this equipment, as the shift from conventional diesel-powered machines to low-emission or fully electric alternatives plays a crucial role in reducing the environmental footprint of mining activities and enhancing operational sustainability in remote areas.

Diesel-powered construction vehicles like excavators, wheel loaders, and dozers jointly emit an estimated 400 million tons of CO2 annually, accounting for around 1.1% of global carbon emissions. Excavators in the 10 t-plus category represent an enormous 46% of these emissions. The mining industry accounts for up to 7% of all greenhouse gas (GHG) emissions, so controlling emissions relating to transportation is particularly important [2].

Diesel, as a fossil fuel, is associated with significant greenhouse gas emissions, and its continued use is not aligned with the global mining industry’s efforts to achieve net-zero emissions by 2050 or even earlier.

Globally, leading mining companies have begun implementing ambitious decarbonization strategies that illustrate the feasibility and benefits of integrating renewable energy technologies. For example, Fortescue Metals Group (FMG) is actively pursuing zero-emissions mining through projects such as the deployment of Liebherr T 264 battery–electric haul trucks at its Christmas Creek operations in Australia, alongside a prototype hydrogen–electric haul truck powered by liquid hydrogen produced onsite [3,4]. Similarly, KGHM Polska Miedź has installed and expanded photovoltaic systems totaling nearly 50 MW across its copper mining facilities in Poland, aiming to cover 17% of its electricity demand from renewables [5].

At Rio Tinto’s Kennecott mine in Utah, a 5 MW solar plant completed in 2023 is reducing annual emissions by ~3000 tons of CO2-eq. An additional 25 MW plant has been approved, projected to eliminate over 21,000 tons of annual Scope 2 emissions once operational [6].

BHP, for instance, is procuring battery–electric locomotives to transport iron ore from its open-pit mines in Western Australia to the Port Hedland terminal. Given the topography of the rail route, the generation and storage of electricity during downhill braking of fully loaded trains and the potential for regenerative braking will also be explored. The introduction of battery–electric locomotives is expected to reduce annual greenhouse gas emissions by up to 30 percent [7].

The objectives of this research are as follows:

- To assess the technical and economic feasibility of achieving complete energy independence of mining facilities in remote areas through the implementation of integrated renewable energy systems, with a particular focus on solar photovoltaic energy and wind energy.

- To identify and evaluate the key challenges and limitations associated with the implementation of renewable energy sources and electric machinery in both underground and surface mining operations, and to propose strategies for overcoming these obstacles in order to ensure the sustainability and resilience of mining activities.

- To analyze the economic costs and long-term benefits of introducing solar energy and wind energy, and the potential savings and return on investment.

- To assess the environmental benefits, with an emphasis on reducing greenhouse gas emissions and the overall carbon footprint.

To achieve these objectives, a case study was analyzed: the potential integration of renewable energy sources at the Studena Vrila underground bauxite mine.

Literature Review

The integration of renewable energy sources (RESs) and electrified technologies into mining operations has become a focal point of sustainability research in recent years. Numerous studies have demonstrated the technical feasibility, economic benefits, and environmental impact reduction associated with renewable-powered mining systems, particularly in remote and off-grid areas.

Aydogdu et al. (2024) analyzed electrification and CO2 reduction pathways for copper mining haulage systems, highlighting that battery–electric trucks can reduce emissions by up to 85% over diesel fleets, especially when powered by RESs [1]. Igogo et al. (2021) provided a comprehensive overview of challenges and enabling mechanisms for integrating solar and wind energy into mining, emphasizing the importance of flexible load management and hybrid systems [8].

In a review by Alova (2018), the author identified successful RES adoption cases across the mining sector, including solar–diesel hybrids in Chilean copper mines and wind-powered gold mining in Canada, showing that even partial adoption of RESs can lead to substantial cost savings and improved social license to operate [9]. More recently, Kujundžić et al. (2025) examined the potential for solar and hydro in architectural stone quarries in the Balkans, underscoring regional relevance [7].

Despite progress, integration remains limited by infrastructure constraints, intermittent resource availability, and the capital cost of both RESs and electric machinery. Many studies suggest that hybrid models combining solar, wind, and battery energy storage systems supported by robust energy management systems offer the most practical path forward for decarbonizing mining in the near term.

These studies provide a crucial foundation for the present research, which builds on this body of work by applying a multi-model techno-economic and environmental framework to the Studena Vrila underground bauxite mine, with a focus on solar and wind integration with battery–electric LHD machines.

2. Materials and Methods

2.1. Methodological Framework

The research is based on a real-world example of an underground mining operation, specifically, the Studena Vrila (Rudnik Mesihovina d.o.o., Mesihovina 413, 80240 Tomislavgrad, Bosnia and Herzegovina) bauxite mine located in western Herzegovina. Technical data were collected on the existing machinery, energy consumption, climatic conditions, and current renewable energy capacities. The analysis was conducted in three models, aimed at evaluating the economic viability, technical feasibility, and environmental impact of the full integration of renewable energy sources into the mine’s energy system.

The methods employed in the study include:

- Technical analysis: Sizing of solar power systems based on local climatic data (e.g., average sunshine hours, seasonal variations in solar irradiance), as well as an assessment of wind energy potential.

- Economic evaluation: Calculation of the leveled cost of energy (LCOE), annual savings, return on investment (ROI), and Net Present Value (NPV) for different development scenarios.

- Environmental analysis: Estimation of greenhouse gas emissions using prescribed emission factors (e.g., 84.7 kg/GJ CO2-eq), and calculation of the mine’s carbon footprint before and after implementation of the proposed measures.

Input data were sourced from internal mine reports, technical specifications of equipment (e.g., LHD vehicles), records of fuel and electricity consumption, and data on the installed solar farm. An analytical calculation method was used based on established formulas and scenario modeling for the three development models.

The use of electric machinery in underground mining operations offers numerous advantages that can significantly enhance operational efficiency, reduce environmental impact, and improve worker safety. Key benefits include:

Reduced emissions of harmful gases;

- 1.

- Improved worker health and safety;

- 2.

- Energy efficiency;

- 3.

- Lower operating costs;

- 4.

- Sustainability and environmental compliance;

- 5.

- Increased productivity;

- 6.

- Compatibility with renewable energy integration.

Electric machines produce no exhaust emissions, which significantly improves air quality in confined underground environments. With lower emissions of harmful gases, less energy is required for ventilation, resulting in substantial cost savings. Furthermore, the reduction in pollutants—including diesel particulate matter and gases such as nitrogen oxides (NOx) and carbon monoxide (CO)—has a positive impact on the health and well-being of workers.

A key factor in underground metal ore mining is the cost of ventilation, which serves to remove heat and harmful combustion byproducts, ensuring a safe working environment. In order to reduce the costs and improve the working conditions of the crew, it is advisable to replace diesel engines with electric motors powered from the mains and batteries. Such a tendency is observed in many countries around the world, with Canada being the precursor [10]. This applies in particular to self-propelled mining machines, such as drilling and bolting rigs, LHD loaders, and haul trucks. It should be emphasized, however, that the user expects electrically driven machines to have the same parameters and functional properties as the ones powered by internal combustion engines. This is a serious challenge because battery power remains a new issue despite the fact that the electric drive is known and widely used in mining machines. In addition, it should be noted that the difficulty results mainly from the specific conditions of underground mining and related requirements [11].

Since electric machinery is generally quieter in operation compared to diesel-powered equipment, it contributes to reduced noise exposure, improved communication among workers, and enhanced overall workplace safety. Electricity is often less expensive than diesel fuel, leading to significant long-term cost savings. In addition, electric machines have fewer moving parts, which results in lower maintenance costs and reduced operational downtime.

Both internal combustion engines and electric motors have been known and success fully used for many years in stationary and mobile machines. However, electric motors do not consume oxygen and do not emit exhaust fumes, which has a positive effect on the environment and human health [12].

A reduced carbon footprint is a major advantage in achieving sustainability and ensuring compliance with increasingly stringent environmental regulations. Companies that adopt electric machinery can enhance their reputation as legislation continues to tighten restrictions on diesel emissions. The transition to electric equipment and renewable energy sources enables mining operations to proactively align with future regulatory requirements.

One of the greatest advantages of remote mining areas is the potential for integrating renewable energy systems on previously mined land or on sites scheduled for extraction in the near future. These systems can provide independent energy sources to power mining equipment and infrastructure, further enhancing the environmental performance of mining operations.

Since mines always expand deeper and grow larger in total size, the distance machines need to travel in mines increases all the time. The risk for accidents and air pollution will increase along with the growing size of the mine [13].

The implementation of electric machinery in underground mining brings a number of challenges that may affect operational efficiency, cost-effectiveness, and infrastructure requirements. The key limitations include:

- 1.

- High initial capital investment;

- 2.

- Battery limitations and charging time;

- 3.

- Power supply challenges;

- 4.

- Performance constraints;

- 5.

- Infrastructure and spatial requirements;

- 6.

- Safety risks;

- 7.

- Need for skilled workforce.

Electric mining equipment, particularly battery-powered machines, involves significant upfront costs, not only for vehicle procurement but also for the development of the required charging infrastructure. Unlike diesel-powered equipment, which can be refueled quickly, electric machines require a certain amount of downtime for recharging, potentially leading to delays and reduced productivity. While solutions such as fast charging and battery swapping are available, they still pose logistical challenges in confined underground environments.

A reliable power supply is a critical prerequisite, yet mines in remote areas often lack adequate access to the electrical grid. This necessitates substantial infrastructure investment, which can be a barrier to electrification. Furthermore, performance limitations in extreme underground conditions such as deep mining may result in lower operational efficiency compared to conventional diesel machinery. The limited specific energy of modern lithium-ion batteries requires compromise solutions between battery capacity, operation availability, and charging solution [14].

Spatial constraints in narrow and confined underground tunnels can complicate the installation of charging stations and the routing of electrical cabling. In addition, electric systems introduce specific safety risks, including short circuits and fire hazards, especially in humid or high-temperature environments. These conditions require the implementation of enhanced safety measures and monitoring systems.

Many mines, especially in developing economies and geographically dispersed and sparsely populated countries, may also suffer from energy infrastructure gaps and associated low-quality electricity supply. This may result in blackouts, load shedding, forced load curtailment, or no access to the state grid. In view of these challenges, mining companies often find themselves in competition for scarce energy resources with local communities, which gives rise to discontent and weakens their social license to operate [15].

The operation and maintenance of electric mining equipment require a skilled workforce. However, finding qualified technicians for the maintenance of electric vehicles can be particularly challenging in remote mining areas.

Despite the existence of a business case and policy drivers for integrating renewables in mining and a growing number of successfully delivered projects worldwide, a decisiveshift in the whole mining industry towards a low-emission business model is yet to takeplace. As a relatively new technology for mining companies, renewable energy may pose a number of operational and financial risks, coupled in some countries with policy-related factors, which may impede the accelerated uptake of green business practices throughout the industry. Furthermore, the energy transition of the mining sector needs to be accompanied by the increased electrification of operations and the growth in the renewable energy sector for the mining industry to partner with [9].

Despite these challenges, battery–electric machines are becoming an increasingly viable and resilient option as technology continues to evolve. Nevertheless, a successful transition from diesel-powered to electric equipment requires careful planning to address these limitations and ensure the long-term sustainability of mining operations.

In an effort to reduce the harmful environmental impact of fossil fuels, mining companies are actively seeking to integrate solar and wind energy into their technological processes, along with the adoption of hybrid and electric machinery. The use of renewable energy sources has proven to be economically viable and offers numerous environmental benefits.

2.2. Case Study: “Studena Vrila” Bauxite Mine

An example of renewable energy application through a solar farm can be found in a remote area of western Herzegovina, at the Studena Vrila underground bauxite mine.

The “Studena Vrila” area extends both east and west of the Posušje–Tomislavgrad main road, with a continuation toward the Vučipolje plateau to the east and bordering the Zagorje region to the west. Administratively, it belongs to the municipalities of Posušje and Tomislavgrad. Geomorphologically, this area is part of a moderately high mountainous region, with elevations ranging between 900 and 1150 m above sea level. The terrain is gently undulating, depending on the erosion resistance of individual lithological units, which vary in petrographic composition.

The bauxite-bearing area of Studena Vrila is composed of Upper Cretaceous limestones and Paleogene clastic deposits. From a structural–tectonic perspective, the area belongs to the Zavelim tectonic unit. Upper Cretaceous limestones dominate the southern and southwestern parts of the terrain, while in the central and northeastern parts, they are exposed through erosion beneath clastic cover. The oldest sediments in the wider Studena Vrila region are Cenomanian–Turonian limestones, which are found in the far southwestern part of the terrain, outside the immediate area of interest. These are reddish-gray limestones with interbeds of dolomite containing poorly preserved remains of chondrichthyan (cartilaginous fish) fossils.

Within the “Studena Vrila” area lies the “Okrugli Brijeg” mine, consisting of five ore bodies (L-9a, L-8, L-9b, L-19, and L-20), all connected by a common haulage and ventilation drift. Currently, mining operations are active in ore bodies L-9a and L-8. The sublevel caving method with immediate caving of ore and overburden is employed for bauxite extraction (as shown in Figure 1). In ore body L-9a, only one level is currently developed and operational, located at elevation K −890,4 m, where the extraction process is carried out through retreat mining from a developed drift. Over the past two years, 175 m of underground workings (drifts and crosscuts) have been developed on this level.

Figure 1.

LHD machine in the sublevel caving method.

The extraction process itself involves drilling and blasting of fan-patterned boreholes approximately 4 m in length. All ore extracted from this level is transported via conveyor belts to an external stockpile. Approximately 4000 tons of ore remain to be mined on this level. In ore body L-8, an estimated 300,000 tons of ore remain available for extraction [16].

Wheel loaders or LHD machines (Load, Haul, Dump machines) are front-loading trucks that transport the fragmented ore to ore chutes and account for a large part of the diesel consumed in mines today [17].

2.3. Data and Assumptions

The LHD machines used in the “Okrugli Brijeg” mine are primarily powered by fossil fuels, but there is a growing trend toward transitioning to hybrid and fully electric drivetrains (Table 1).

Table 1.

Machinery and equipment for underground mining operations in “Okrugli Brijeg”.

Among the machines listed in Table 1, the standout is an LHD loader with a rated power of 220 kW (Figure 2), powered by a lithium–ion battery with a capacity of 213 kWh. The basic technical specifications of this loader are presented in Table 2.

Figure 2.

Battery–electric underground loader (LHD) (R1700 XE).

Table 2.

Technical specifications of the battery–electric underground loader (LHD)—R1700 XE.

The primary motivation for introducing a battery–electric LHD loader was the volatility of diesel fuel prices, which represent one of the major recurring monthly expenses. Prior to the deployment of the battery–electric LHD, the average monthly diesel consumption amounted to approximately 4 tons. With the introduction of this loader, diesel consumption has been reduced by around 15%, currently amounting to approximately 3.4 tons per month.

In the near future, a full transition to battery–electric LHD loaders is planned at the “Okrugli Brijeg” underground mine, with the goal of replacing the existing diesel–electric machines and achieving energy independence and resilience to external influences. The first step toward this goal is to assess the feasibility of integrating a solar farm or wind turbines.

According to the World Bank’s estimates, meeting the objective of the Paris Agreement to limit global warming to 2 °C above pre-industrial levels would dramatically increase demand for certain minerals, such as aluminum, cobalt, iron, lead, lithium, manganese, and nickel. Solar and wind technologies are likely to double the demand for these minerals, while manufacturing batteries would increase it by more than 1000% [18].

The area designated for construction experiences variable wind conditions throughout the year. The windier season lasts approximately 5.7 months, from late October to mid-April, with average wind speeds exceeding 12.6 km/h. The windiest month is typically February, with average wind speeds of around 14.6 km/h. In contrast, the calmer season lasts about 6.3 months, from mid-April to late October, with the calmest month being June, when average wind speeds drop to around 10.1 km/h. These values fall within the range required for effective wind turbine operation, and due to the elevated terrain, further increases in wind speed and turbine efficiency are expected.

One of the main limitations of wind energy is its seasonal variability—wind speeds tend to decrease during the summer, which may result in reduced energy production during periods of peak electricity demand. In addition, wind farms require strong grid connectivity. If the transmission infrastructure in the area is insufficient, additional investment will be necessary. Furthermore, environmental impact assessments, community engagement, and land availability studies must be conducted before turbine installation.

To achieve the goal of complete transition to renewable energy sources—and thereby attain energy independence and resilience to external factors—it will be necessary to build a large-scale solar farm and a wind farm to enable sustainable extraction powered by renewable energy. The “Studena Vrila” area shows favorable conditions for solar energy production. Solar output varies throughout the year as follows:

- Summer: Average daily energy production per installed kilowatt (kW) of solar capacity reaches up to 7.27 kWh;

- Spring: Approximately 5.25 kWh per kW per day;

- Autumn: Around 3.41 kWh per kW per day;

- Winter: About 1.84 kWh per kW per day.

It is evident that wind power would play a greater role during the winter period, while solar energy would serve as the primary source of electricity during the summer months.

The limitations are similar to those of wind power systems: it is necessary to assess whether the existing electrical grid can accommodate additional solar capacity, and to conduct environmental impact assessments and consultations with local communities.

A 349 kW solar farm has already been constructed within the mining concession area. The next section will discuss the current state of energy systems, as well as future plans and developments aimed at achieving energy independence and resilience.

3. Results

Before a mining company starts considering the integration of solar or wind power into its energy mix, it is important to reach clarity on the levelized cost of energy of a specific mine—lifetime energy costs divided by total energy produced. The levelized cost may depend on a number of factors, such as investment, maintenance and fuel costs, and the overall energy production and life of the system. Capital and operating costs vary significantly, depending on the source of energy. For example, in comparison to fossil fuels, the development of a renewable energy plant involves high upfront capital costs, but relatively lower maintenance costs and zero fuel costs. At the same time, fossil fuel-based energy systems incur relatively higher operating costs, driven by volatile fuel prices, as discussed above, which are, however, spread over the whole lifetime of the asset [9].

The transition of a mine from a conventional model—characterized by predominant reliance on diesel fuel or hybrid grid systems—to the so-called “green mine” concept can be achieved through the gradual integration of renewable energy sources. Mining facilities in remote areas are particularly vulnerable due to their energy dependence, which reduces their resilience to market fluctuations. Therefore, in order to improve the sustainability and resilience of mining operations in such areas, the integration of renewable energy sources is essential. The expected outcomes of this transition are both economically and environmentally beneficial.

Based on the “Studena Vrila” case study, a model for achieving energy independence and resilience in a remote mining operation has been developed, divided into three models of renewable energy integration.

3.1. Model One Integration of Renewable Energy Based on the Current Mine Status

The analysis of renewable energy integration in Model One is based on the equipment presented in Table 1.

Currently, the underground bauxite mining operations at the “Studena Vrila” site are carried out using machines powered by various energy sources—including diesel fuel, electricity, and compressed air.

Within the mining concession area, a 349 kW solar farm has already been constructed (as shown in Table 3).

Table 3.

Main specifications of the existing solar farm in the area of the “Studena Vrila” underground mine.

Considering that the solar farm was built on land parcels owned by the mining concession holder, the total construction cost per installed kilowatt-hour amounts to EUR 1100.

The annual number of sunshine hours is approximately 1500 h. Accordingly, the currently installed solar farm can produce up to 523,500 kWh per year (Qann). Considering the electricity price on the domestic market of EUR 0.12/kWh (Cel), the total annual savings (Pel) can be calculated as shown in Equation (1):

where:

Pel = Qann × Cel, EUR

Pel = 523,500 × 0.12 = EUR 62,820

- Pel—Total annual electricity cost savings (EUR);

- Qann—Annual electricity production from the solar farm (kWh);

- Cel—Market price of electricity (EUR/kWh).

Since the selected LHD loader is fully powered by electricity from renewable energy sources, it is necessary to include fuel savings in the overall calculation, as shown in Equation (2). The initial investment for the battery–electric LHD loader (R1700 XE) amounted to EUR 300,000. The total investment is calculated in Equation (3). Diesel fuel consumption has decreased from 4 tons/month to 3.4 tons/month, resulting in a savings of 0.6 tons per month.

where:

Zm = Qdis × Cdis, EUR

- Zm—Total monthly savings, EUR;

- Zann—Total annual savings, EUR;

- Qdis—Monthly amount of saved diesel fuel, 0,6 t/m ~ 708 L/m;

- Cdis—Average market price of diesel fuel, 1.3 EUR/L.

Zm = 708 × 1.3 = 920 EUR

Zann = Zm × 12 = 920 × 12 = EUR 11,040

Total investment (I):

where:

I = Ilhd + Isf, EUR

- I—Total investment, EUR

- Ilhd—Price of LHD loader, EUR 300,000;

- Isf—Cost of the solar farm, EUR 383,900.

I = 300,000 + 383,900 = EUR 683,900

The total annual savings according to Equation (4) is EUR 73,680, and the ROI is shown in Equation (5).

Annual savings (P):

where:

P = Pel + Zann

- P—Total annual savings, EUR;

- Pel—Total annual savings on electric energy, EUR 62,820;

- Zann—Total annual savings on diesel fuel, EUR 11,040;

P = 62,820 + 11,040 = EUR 73,860

Return on investment (V):

where:

V = I/U

- V—Expected payback period;

- I—Total investment, EUR 683,900;

- P—Total annual savings, EUR 73,860.

V = 683,900/73,860 = 9.26 years

The Net Present Value (NPV) method takes into account the time value of money. The actual value of revenues and costs occurring over the project horizon—i.e., in a given year—must be converted to present value using a discount rate.

The analysis is conducted over a 25-year period (t = 25 years), with a discount rate of 5% (p = 5%). A discount rate of 5% was adopted, consistent with real-world usage in Southeast European mining evaluations (e.g., Serbia, where 5% is standard) [19]. It also aligns with effective discount rate ranges (3.5–4.5%) used for long-term energy and infrastructure investments in Central and Eastern European countries [20]. A 10-year replacement cycle is used for the LHD machine. The total adjusted investment is EUR 981,141 (EUR 383,900 for solar farm and EUR 597,241 for LHD purchase every 10 years), as shown in Equation (6).

where:

- NPV—Net Present Value;

- P—Expected cash inflow (cash flow) in period t;

- I—Total investment;

- t—Time of the observed period;

- p—Discount rate;

Savings through observed period ≈ EUR 1,041,320

NPV= 1,040,979 – 981,141 = EUR 59,838

A positive Net Present Value (NPV) indicates that the project is economically viable.

3.2. Model Two: Reduction in Diesel Consumption and Expansion of Renewable Energy Capacity

In the second model, the objective is to achieve a 50% reduction in monthly diesel fuel consumption, accompanied by investment in the wind farm of 70 kW (20% increase in electricity production) and the procurement of new battery–electric machinery (representing a 100% increase in equipment investment). A 30% increase in electricity consumption is also anticipated due to the shift in energy source.

The analysis of renewable energy integration in Model Two is based on updated data regarding the solar and wind farm and the newly acquired battery–electric equipment, as presented in Table 4.

Table 4.

Data on the solar farm and new equipment in the second model of renewable energy integration.

The results of renewable energy integration in the second model of development of the “Studena Vrila” mine will be reflected in economic gains in the form of specific savings (Table 5), which will ultimately contribute to an increase in the Net Present Value (NPV).

Table 5.

Results of renewable energy integration—second model (“Studena Vrila”).

3.3. Model Two: Full (100%) Integration of Renewable Energy in the Mine

The third model aims to reduce diesel fuel consumption to 0%, enabling a complete (100%) integration of renewable energy sources. This transition would make it possible for the mine to achieve full energy independence and operational resilience. The model includes the procurement of additional battery–electric machinery and scaling up the wind farm to fully meet annual electricity consumption needs. In this model, an investment in electricity storage is also integrated.

To determine the required capacity of the solar farm needed to meet annual electricity consumption (Qn = 726,887.2 kWh), the following Equation (7) is used:

where:

Pn = Qn/Nann, kW

- Pn—Required capacity of solar farm;

- Qn—Required annual electricity consumption, 726,887.2 kWh;

- Nann—Annual number of sunshine hours, 1500 h.

Pn = 726,887.2/1500 = 484.6 ≈ 485 kW

The results of the integration of renewable energy sources in the third model of development of the “Studena Vrila” mine will be reflected in economic benefits in the form of specific savings (Table 6), which will enable the mine’s independence and resilience.

Table 6.

Results of the integration of renewable energy sources in the third model of development of the “Studena Vrila” mine.

3.4. Summary Results of the Techno-Economic Analysis of Renewable Energy Source Integration in the Mine and Sensitivity Anallysis

Three different models (scenarios) of investment in a solar farm, wind farm, battery energy storage, and battery–electric machinery were analyzed, with the aim of optimizing costs and return on investment, and achieving the mine’s independence (sustainability) and resilience. Each model represents a project evolution with specific indicators, which allowed for the observation of changes affecting economic outcomes, depending on the share of energy produced (Table 7).

Table 7.

Summary of the techno-economic analysis results of renewable energy integration by models.

In Table 8, a sensitivity analysis is presented, showing how variations in key economic and technical parameters—such as diesel price, electricity cost, and investment in batteries and wind turbines—affect the Net Present Value (NPV) and return on investment (ROI) for the full renewable integration scenario (Model 3).

Table 8.

Sensitivity analysis of key parameters and impact of wind energy and battery storage on economic performance (Model 3 scenario).

3.5. Environmental Impact Achieved by Integrating Renewable Energy Sources in the Mine

The integration of renewable energy sources in mines results not only in economic benefits but also in a positive environmental impact, manifested as a reduction in greenhouse gas emissions, i.e., the carbon footprint.

The quantification of greenhouse gases is determined by calculations based on activity data, such as the amount of diesel fuel consumed, applying appropriate emission and conversion factors. All greenhouse gas emissions can be expressed as equivalent carbon dioxide emissions (CO2eq) since they originate from the same sources.

To account for the different impacts that individual gases have on the greenhouse effect, the emissions of each gas are multiplied by its global warming potential. This allows the total emissions to be summed and presented as equivalent carbon dioxide emissions (CO2eq) [21], according to the following Equations (8) and (9):

where:

Esp = Pdg × FE

- Esp—Greenhouse gas emissions, kg CO2eq;

- Pdg—Energy content of diesel, GJ;

- FE—Emission factor, 84,728,723 kg/GJ CO2eq [21].

Pdg = Qdis × qdis

- Qdis—Total mass of diesel fuel, kg;

- qdis—Specific energy content of diesel, 0.0431 GJ/kg.

According to Equations (8) and (9) and the data from Table 7, the reduction in the carbon footprint was determined for each model of renewable energy integration (Table 9).

Table 9.

Results of the carbon footprint analysis by models of renewable energy integration in the mine.

4. Discussion

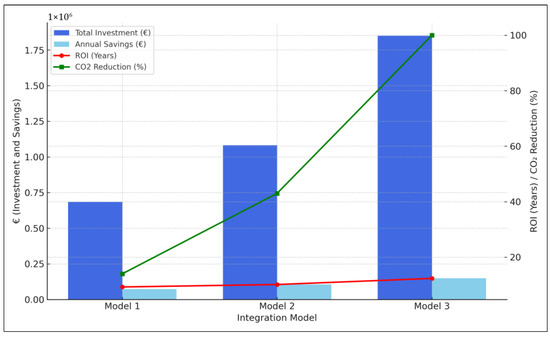

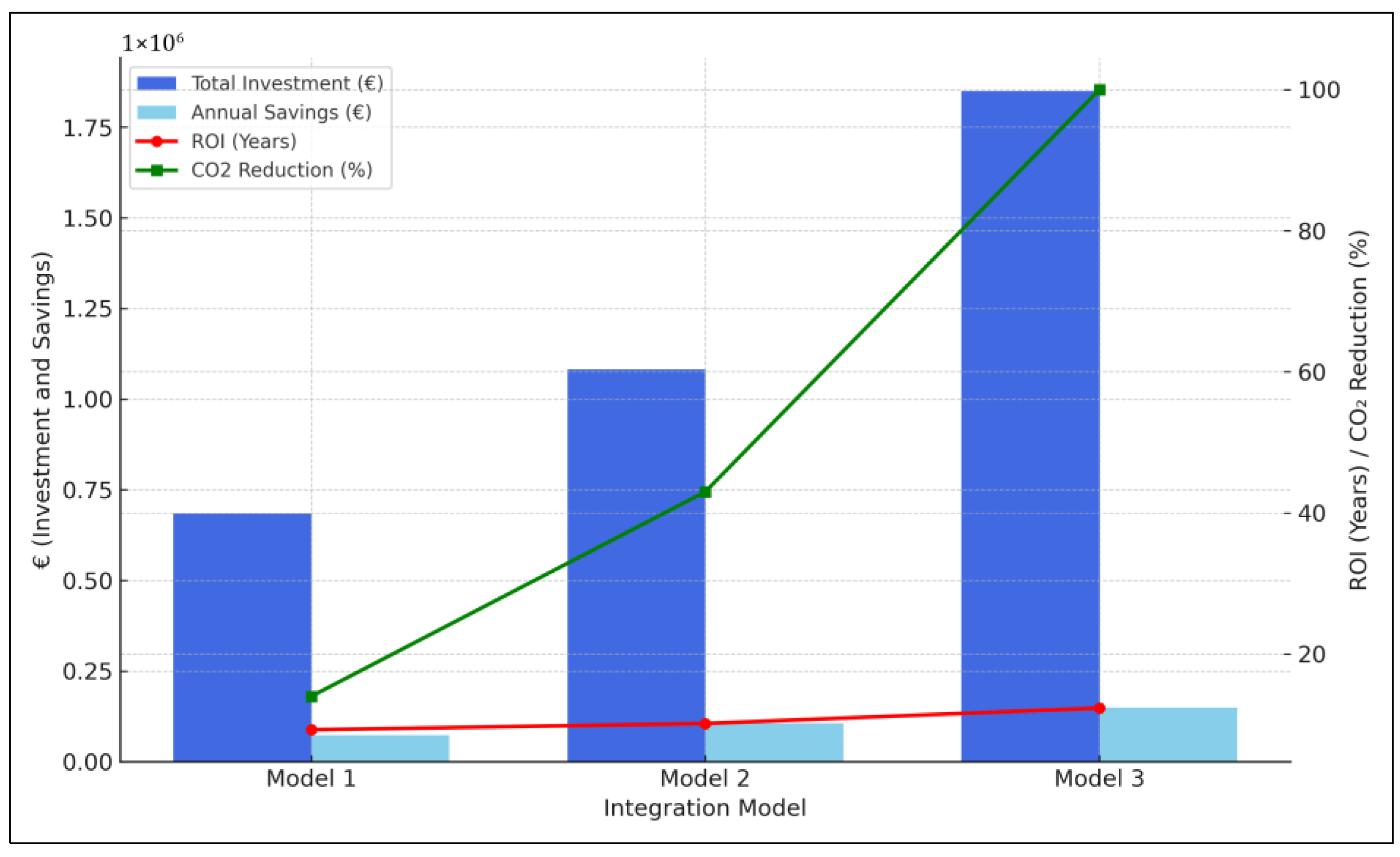

The results of the case study analysis are clearly presented through technological, economic, and environmental indicators, which are implemented in three models. Based on the presented results, several correlations can be identified, with the following standing out:

- Increased investment in battery–electric machinery and the solar/wind farm leads to greater overall annual savings.

- The integration of wind energy and battery storage systems proved essential for ensuring reliable energy supply, especially during periods of low solar irradiance. Wind turbines helped compensate for seasonal variability in solar output, while battery storage systems enabled effective load balancing and reduced curtailment of renewable electricity. While this requires a higher initial investment, it reduces long-term dependence on the external grid and maximizes savings, resulting in a more favorable payback period, as seen in Model 3 (Figure 3).

- Balancing investments: Although higher investment in battery–electric machines brings greater diesel savings due to the elimination of fuel consumption, it is critical to assess whether such an investment is justified considering the extended payback period. Despite the highest investment, Model 3 has a longer payback period than Model 1 but is improved compared to non-optimized Model 2 (Figure 3).

- Complete integration of renewable energy sources enables energy independence and resilience to external fuel price fluctuations, especially diesel.

Critical analysis and limitations:

- Financial viability: All scenarios yield a positive NPV, confirming long-term investment profitability. However, Model 3, despite the highest savings, has the longest payback period (12.34 years), indicating a need for financial incentives and subsidies.

- Technical challenges: Although conditions for solar and wind energy are favorable, seasonal variations and the need for energy storage remain significant challenges. Increasing the share of electricity consumption requires additional infrastructure (charging stations, battery storage).

- Operational challenges: Integration of electric machinery requires availability of skilled labor and staff training. Moreover, safety requirements and logistics in underground conditions need to be thoroughly addressed.

Figure 3.

Indicators of mine independence and resilience according to the degree of integration of renewable energy sources.

Figure 3.

Indicators of mine independence and resilience according to the degree of integration of renewable energy sources.

5. Conclusions

The integration of renewable energy sources, primarily solar photovoltaic systems and wind farms, along with the electrification of mining machinery such as LHD loaders, represents a key strategy for achieving energy independence and resilience in remote mining areas, while significantly contributing to the reduction of greenhouse gas emissions.

The analysis of three development models, including the optimization of the solar farm capacity to fully cover electricity demand, clearly demonstrates the financial viability of such investments.

Model 1, with the existing 349 kW solar farm and partial reduction in diesel consumption, already achieves substantial annual savings of EUR 73.860, with a payback period of 9.26 years. Transitioning to Model 2, which includes a 20% larger solar farm (419 kW) and doubled investment in machinery electrification with increased diesel savings (1.7 t/month), results in total annual savings rising to EUR 106,677.6. Despite a higher total investment of EUR 1,060,900, the payback period of 9.94 years indicates continued project profitability.

The most significant improvement comes with Model 3, where investment in machinery electrification increases to EUR 1,200,000, and the solar farm is sized at 485 kW to fully cover the annual electricity consumption of 726,887.2 kWh. Complete elimination of diesel consumption (saving 3.4 t/month), combined with covering all electricity needs, leads to total annual savings of EUR 149,813.7. Although the total investment in this model is the highest (EUR 1,733,500), optimizing the solar farm capacity results in a favorable payback period of approximately 11.57 years.

The analysis clearly demonstrates that despite high initial investments in battery–electric machinery and renewable energy infrastructure, long-term savings on fuel and electricity, combined with reduced operational costs and environmental benefits, make the project economically justified. The shift to electric machinery significantly improves air quality in underground spaces by reducing ventilation needs and decreases noise pollution, positively impacting worker health and safety.

The example of the “Studena Vrila” mine proves that energy transition in mining is not only technically feasible but also necessary to achieve net-zero emissions by 2050 and ensure long-term industry sustainability and competitiveness. Despite challenges such as high upfront costs, battery limitations, and infrastructure requirements, continuous technological development and careful planning can overcome them, making such projects a crucial step toward a greener and more resilient mining future.

Recommendations for further work:

- Introduce an Energy Management System (EMS) model with priorities for the use of renewable energy sources and storage.

- Conduct a broader sensitivity analysis on changes in energy prices.

- Consider the application of hydrogen systems or advanced battery solutions.

- Expand the study to multiple mines located in remote areas to generalize the methodology.

- Such an extension of the discussion provides a broader view of benefits, risks, and future development directions in the context of the mining industry’s energy transition.

Author Contributions

Conceptualization, J.K. and I.G.; methodology, J.K.; formal analysis, J.K.; investigation, J.K.; resources, I.G.; writing—original draft preparation, J.K.; writing—review and editing, I.G.; supervision, I.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data supporting the findings of this study are available from the corresponding author upon reasonable request.

Acknowledgments

The authors thank Rudnik Mesihovina d.o.o. for providing technical and operational data, and the Faculty of Mining, Geology and Petroleum Engineering for scientific support.

Conflicts of Interest

Josip Kronja is an employee of Rudist d.o.o. The paper reflects the views of the scientists and not the company.

References

- Aydogdu, K.; Duzgun, S.; Yaylaci, E.D.; Aranoglu, F. A Systems Engineering Approach to Decarbonizing Mining: Analyzing Electrification and CO2 Emission Reduction Scenarios for Copper Mining Haulage Systems. Sustainability 2024, 16, 6232. [Google Scholar] [CrossRef]

- Owen, W. Electrifying Mining Operations; Global Mining Review: Farnham, UK, 2022; Available online: https://www.globalminingreview.com/special-reports/01102022/electrifying-mining-operations/ (accessed on 7 June 2025).

- Gleeson, D. Fortescue Kicks Off Battery-Electric Truck Testing in the Pilbara; International Mining: Sevenoaks, UK, 2023; Available online: https://im-mining.com/2023/08/01/fortescue-kicks-off-battery-electric-truck-testing-in-the-pilbara/ (accessed on 26 July 2025).

- Webb, S. Fortescue, Liebherr Secure Orders for 100 Electric Mining Trucks, Forrest Says; Reuters: London, UK, 2024; Available online: https://www.reuters.com/business/autos-transportation/fortescue-liebherr-secure-orders-100-electric-mining-trucks-forrest-says-2024-09-27/ (accessed on 26 July 2025).

- Publicnow. KGHM Polska Mied? S A: With Permits to Build Its Own Photovoltaic Installations; MarketScreener: Annecy, France, 2023; Available online: https://www.marketscreener.com/quote/stock/KGHM-POLSKA-MIEDZ-1413331/news/KGHM-Polska-Mied-S-A-with-permits-to-build-its-own-photovoltaic-installations-45617704/ (accessed on 26 July 2025).

- Rio Tinto Approves New Solar Plant to Power Kennecott. Available online: https://www.riotinto.com/en/news/releases/2024/rio-tinto-approves-new-solar-plant-to-power-kennecott (accessed on 26 July 2025).

- Kujundžić, T.; Korman, T.; Purkić, R.; Perić, M. Mogućnost primjene obnovljivih izvora energije pri eksploataciji arhitektonsko-građevnog kamena. Klesarstvo Graditelj. 2025, 32, 100–114. [Google Scholar]

- Igogo, T.; Awuah-Offei, K.; Newman, A.; Lowder, T.; Engel-Cox, J. Integrating Renewable Energy into Mining Operations: Opportunities, Challenges, and Enabling Approaches. Appl. Energy 2021, 300, 117375. [Google Scholar] [CrossRef]

- Alova, G. Integrating Renewables in Mining: Review of Business Models and Policy Implications. OECD Dev. Policy Pap. 2018, 7. [Google Scholar] [CrossRef]

- Bołoz, Ł. Global Trends in the Development of Battery-Powered Underground Mining Machines. Multidiscip. Asp. Prod. Eng. 2021, 4, 178–189. [Google Scholar] [CrossRef]

- Kozłowski, A.; Bołoz, Ł. Design and Research on Power Systems and Algorithms for Controlling Electric Underground Mining Machines Powered by Batteries. Energies 2021, 14, 4060. [Google Scholar] [CrossRef]

- Fugiel, A.; Burchart-Korol, D.; Czaplicka-Kolarz, K.; Smoliński, A. Environmental Impact and Damage Categories Caused by Air Pollution Emissions from Mining and Quarrying Sectors of European Countries. J. Clean. Prod. 2017, 143, 159–168. [Google Scholar] [CrossRef]

- Johansson, B.; Johansson, J. ‘The New Attractive Mine’: 36 Research Areas for Attractive Workplaces in Future Deep Metal Mining. Int. J. Min. Miner. Eng. 2014, 5, 350. [Google Scholar] [CrossRef]

- Lajunen, A.; Suomela, J. Evaluation of Energy Storage System Requirements for Hybrid Mining Loader. IEEE Trans. Veh. Technol. 2012, 61, 3387–3393. [Google Scholar] [CrossRef]

- OECD. Economic Commission for Latin America and the Caribbean. In OECD Environmental Performance Reviews: Chile 2016; OECD Environmental Performance Reviews; OECD: Paris, France, 2016. [Google Scholar] [CrossRef]

- Radovac, D. Modeliranje Ležišta Boksita i Podzemnih Prostorija na Boksitonosnom Području Studena Vrila s Prijedlogom Razvoja Rudarskih Radova. Ph.D. Thesis, University of Zagreb, Zagreb, Croatia, 2024. [Google Scholar]

- Jäderblom, N. From Diesel to Battery Power in Underground Mines. Master’s Thesis, Luleå University of Technology, Luleå, Sweden, 2017. [Google Scholar]

- World Bank Group. The Growing Role of Minerals and Metals for a Low Carbon Future; World Bank: Washington, DC, USA, 2017. [Google Scholar] [CrossRef]

- Ovalle, A. Analysis of the Discount Rate for Mining Projects. In MassMin 2020: Proceedings of the Eighth International Conference & Exhibition on Mass Mining; University of Chile: Santiago, Chile, 2020; pp. 1048–1064. [Google Scholar] [CrossRef]

- Buła, R.; Foltyn-Zarychta, M. Declining Discount Rates for Energy Policy Investments in CEE EU Member Countries. Energies 2022, 16, 321. [Google Scholar] [CrossRef]

- Mingo; Antić; Galić, I. Vodič o Metodologiji Izračuna Faktora Emisija i Uklanjanja Stakleničkih Plinova. 2022. Available online: https://mingo.gov.hr/UserDocsImages/KLIMA/Vodic%20o%20metodologiji.pdf (accessed on 26 July 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).