1. Introduction

As the low-carbon economy becomes a popular economic development concept, and in some cases, a practical strategy, the need for decarbonizing economic sectors has been on the rise. At the industry level, a standard approach to decarbonization is to reduce the carbon footprint of a given sector’s energy inputs, commonly oil and natural gas. Fossil-based non-renewable energy is not only a source of fuel but also an important chemical input to many industries. In some sectors, such as agriculture, oil and natural gas play both the role of fuel (for machinery) and the role of chemical inputs (e.g., as fertilizers). When it comes to the decarbonization of the sector, policymakers and practitioners may find the dual role (energy carrier + chemical input) sophisticated. One motivation of this paper is to shed light on the dual role of LCIA. Decarbonizing fossil fuel and the transportation sector, overall, has been going on for at least two decades. However, decarbonizing chemical inputs sourced from oil and natural gas has been a relatively new and challenging proposal [

1]. The sophistication often comes from the fact that many of these chemical inputs do not physically contain carbon elements, and the final products are not necessarily combusted (to generate CO

2 emission) when applied. In this case, it is critical to examine the entire supply chain of the given chemical input as its production process (especially the upstream) may involve CO

2 emission (e.g., see [

2]). For example, many fertilizers are made of conventional natural gas with a significant carbon footprint. Hence, in a holistic view, decarbonizing an industrial sector involves not only reducing carbon emissions in final product uses but also cutting carbon emissions during the production processes and along the supply chain.

In recent years, the concept of clean energy has been significantly broadened. It no longer simply refers to the transition or transformation from non-renewable energy to renewable energy. It covers a wide range of energy forms that explicitly or implicitly incorporate a decarbonization process or a similar process of preventing harmful compounds from being released into the environment. This paper focuses on one such energy existence—ammonia (NH

3), which is both an important energy carrier (through hydrogen) and an important chemical material (e.g., for fertilizers and cleaning products). According to different sources, 80% to 90% of ammonia has been used for fertilizers in the agricultural sector in the United States (US). Hence, if one would decarbonize the supply chain of the food and agricultural sector, ammonia is a critical input to target. Given that there is no carbon in ammonia compounds, decarbonizing the use of ammonia needs to focus on the upstream of its production process and the supply chain (e.g., how hydrogen is produced). Note that hydrogen is a necessary input for making ammonia at the industrial scale, which is then reacted with nitrogen from the air [

3].

In today’s technology, steam methane reforming (SMR) is the common method used for ammonia production with fossil-based natural gas as the main feedstock. Its final product is commonly referred to as grey ammonia, where CO

2 emission occurs as part of the production process.

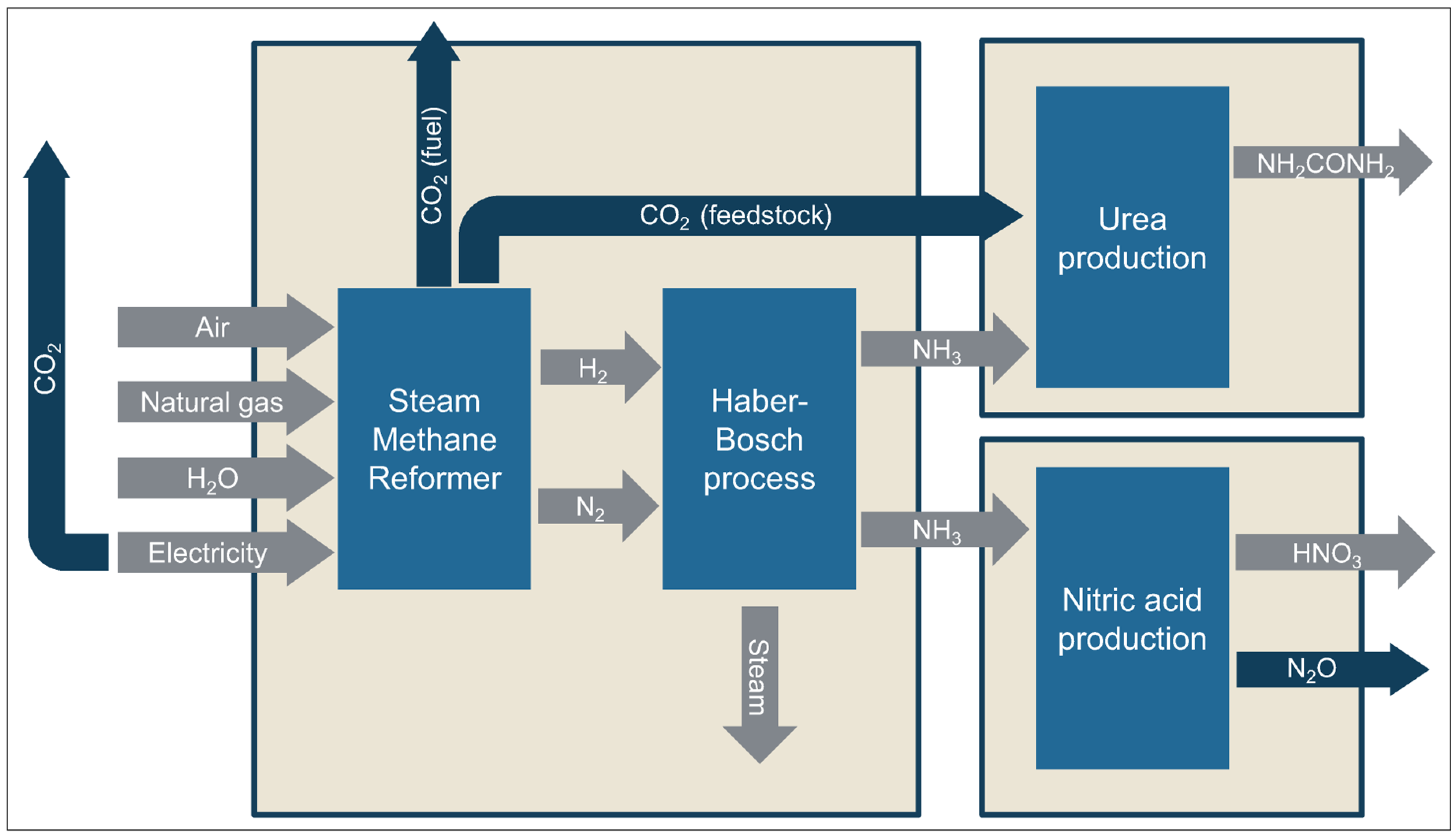

Figure 1 illustrates the conventional process of producing ammonia from natural gas. It is worth noting that some of the CO

2 emissions (CO

2—feedstock;

Figure 1) from the process can be separated and captured for beneficial uses, such as taking it as an input for the downstream urea production, which creates a significant value-added component. If the rest of the CO

2 emission (CO

2—fuel;

Figure 1) is captured and stored, then the system produces what is called blue ammonia. If the intermediate input hydrogen is instead made from a carbon-free process (e.g., electrolysis of water), then the final product becomes what is called green ammonia. Green ammonia is usually more expensive because of the electricity cost. The novelty of LCIA is something in between. It can be largely regarded as an augmented grey or blue ammonia production process with the CO

2 emission reduced or compensated (e.g., through market-based carbon credits). On one hand, the CO

2 emission reduction during the production process makes it a cleaner energy. On the other hand, using fossil-based natural gas as feedstock makes it cheaper than green ammonia made from water electrolysis. For example, some LCIA production methods incorporate CCS technologies to reduce CO

2 emissions from industrial processes or power plants [

4,

5]. Overall, LCIA combines the ideas of sustainability and affordability for industrial applications. The goal of this paper is two-fold. First, we will explore the market potential of LCIA in using it as both an energy source and a chemical input in various sectors. Second, we will discuss the role of policies in helping foster and develop markets for LCIA, in the broader context of a (low-carbon) hydrogen economy.

The growing but limited literature on LCIA has already highlighted its critical role in reducing greenhouse gas emissions and its potential to promote climate-smart farming practices (e.g., [

6]). For instance, innovations in fertilizer usage can mitigate the adverse effects of climate stress, with LCIA-based fertilizers offering a potential pathway to climate-resilient nutrient management. However, there has been little research on the marketability of LCIA and related products. The current market size of LCIA is modest, reflecting its early-stage development, limited production, and slow market diffusion compared to conventional ammonia. Nevertheless, market projections indicate significant growth potential for LCIA in the near term [

7]. Factors such as the increasing demand for sustainable agricultural inputs, supportive regulatory frameworks, technological advancements, and shifting consumer preferences are expected to drive its market growth. Regional market variations may also play a role, with emerging economies promising to increasingly adopt LCIA-related products due to expanding agricultural sectors and growing environmental concerns [

8,

9,

10]. To develop a robust market for LCIA in the US, two factors are critical. First, there needs to be substantial policy support to encourage technology developments to reduce the cost of LCIA-based products as the market grows. Second, the development of LCIA markets is expected to create an increasing demand for both CCS capacity and market-based carbon credits. Hence, some cross-industry market coordination (e.g., between the carbon credit market and the LCIA market) may need to be in place to grow the market for LCIA-based products organically.

Figure 1.

The conventional ammonia production process. Source: Adapted from DECHEMA, Germany [

11].

Figure 1.

The conventional ammonia production process. Source: Adapted from DECHEMA, Germany [

11].

To better understand the potential markets for LCIA, we conduct the following tasks in this paper. First, we analyze the value chain of LCIA and see how it is different from the value chain of conventional ammonia. One goal related to this task is to identify new value-added components to justify the relatively higher cost of LCIA-based products. Second, we explore the domestic market and the international market for LCIA, and the interactions between them through trade. Historically, the US economy heavily relied on imported ammonia. As the need for securing domestic supply chains and revitalizing regional economic development becomes more highlighted, the emerging LCIA markets provide an opportunity to strategically shift some ammonia production capacity from overseas to the US. This has important economic development implications for regions with abundant renewable energy resources and cheap natural gas supplies, for example, the Permian Basin and surrounding areas. Third, we initiate a discussion on the role of policy in growing markets for LCIA, which includes both federal-level and local-level efforts. While federal policies are pivotal in catalyzing industrial-level standardization and innovation (e.g., via tax credits and grant programs), local-level policy supports are often critical for the necessary infrastructure development and workforce growth. Lastly, we conclude by discussing several key challenges related to LCIA markets that future research should aim to tackle.

2. The Value Chain

The LCIA value chain adapts and expands from the conventional ammonia value chain. To understand any new value-added components, it is essential to grasp the mass flows of the production process.

Figure 2 illustrates the mass flows of producing fertilizers using natural gas as input and ammonia as the intermediate product, along with the value chains of two common nitrogen fertilizers. The estimates presented in

Figure 2 were derived using the GREET 2023 model (for more information about the model, please go to

https://www.energy.gov/eere/greet (accessed on 28 July 2024)). The Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies (GREET) model, developed by the Argonne National Laboratory, is a widely used tool for evaluating the energy and environmental impacts of various transportation fuels and advanced vehicle technologies. By employing this model, we were able to assess the energy consumption associated with the production of ammonia, urea, and ammonium nitrate. The GREET model provides comprehensive data and methodologies, ensuring that our calculations are grounded in rigorous and up-to-date scientific analyses. The estimates in

Figure 2 were based on the given relationships between natural gas, ammonia, urea, and ammonium nitrate prices and production rates. Specifically, it was established that 31 MMBtu of natural gas, priced at

$2 per MMBtu (assumption, but close to the actual market price at the time of this writing), is required to produce one ton of ammonia, resulting in an ammonia cost of

$62 per metric ton. Given the price of ammonia at

$400 per metric ton, the value of ammonia produced from

$1 worth of natural gas was determined to be approximately

$6.45. Urea requires 0.567 metric tons of ammonia per metric ton to make. The amount of urea produced and its value from

$1 worth of natural gas was calculated to be around

$9.38. Similarly, for ammonium nitrate, requiring 0.439 metric tons of ammonia per metric ton to make, its value from

$1 worth of natural gas was found to be approximately

$12.31.

The value chain of LCIA is similar to the conventional one. The overall value added comes from the decarbonization component or module. When an industrial or consumer product can be labeled green or clean due to the embedded low-carbon solution in its supply chain, there is usually a justifiable additional willingness to pay. Such a value added is the same as the willingness to pay for organic products [

12]. Otherwise, arguably, LCIA is identical to conventionally made ammonia in terms of product attributes. Nevertheless, LCIA can enable various marketing channels due to its environmental benefits and the associated virtue values, making it easier for adoption in other applications (beyond dominantly for fertilizers), for example, to be used as fuel in an engine [

13].

3. The Domestic Market

The US is one of the world’s leading producers and consumers of ammonia. About 60% of the total US ammonia production capacity is in Louisiana, Oklahoma, and Texas due to the availability of large reserves of natural gas that can be readily used as domestic feedstock as of 2023 [

14]. Despite being a leading producer of ammonia, the US is also among the top two importers of ammonia, along with India. The country imports over 2 million metric tons of ammonia annually [

15]. The US ammonia market appreciated significantly in recent years. According to the US EIA, between January 2020 and January 2022, ammonia prices went up almost five times from just over

$200 per metric ton to over

$1000 per metric ton, mimicking the movement in the domestic natural gas market [

16]. The COVID-19 pandemic certainly contributed to the market volatility. By January 2024, retail ammonia prices settled in the

$700–800 per metric ton range [

17]. From a broad energy market perspective, ammonia does not have an independent market. Its prices are heavily driven by demand and supply factors that connect directly to other energy markets (especially natural gas).

As mentioned in the

Section 1, most of the US domestic ammonia (80%+) is used for making fertilizers. According to the recent ammonia technology roadmap published by the International Energy Agency (IEA), around 70% of ammonia goes into fertilizers globally [

18]. In terms of specific fertilizer products made from ammonia, they range from urea, ammonium nitrate, calcium ammonium nitrate, monoammonium phosphate, diammonium phosphate, and urea ammonium nitrate to ammonium sulfate [

19] (p. 27). Ammonia can also be used as an antifungal agent on certain fruits and vegetables. Overall, ammonia is a critical agricultural production input. The critical role of ammonia in the agricultural sector implies that agricultural finance is sensitive to the price volatility of ammonia. Its high volatility is due to at least two factors. The first and fundamental factor is the linkage to the natural gas market. The latter is exposed to all the financial risks of the energy commodity market, which can quickly transfer to ammonia products. For example, the first three months of 2024 have seen a significant decline in ammonia prices in the North American and Asian markets. The continual declining trend is mostly driven by the easing natural gas cost and the lack of participation in the market (especially from China). The other important factor contributing to the price volatility of ammonia is more on the demand side—the elastic demand for fertilizers in the agricultural sector. For example, Williamson estimated that fertilizer price elasticities of demand among US farmers range from −1.67 to −1.87 (highly elastic) [

20].

Fertilizer is an expensive input for farmers and ranchers in many regions across the US, especially for those outside of the Midwest (the so-called Corn Belt). From an agronomic perspective, fertilizers work interactively with other inputs in crop production. When there is not enough soil moisture or water supply for irrigation, fertilization may not reach the desired outcomes in yield. Hence, farmers’ and ranchers’ fertilizer purchase decisions tend to be very sensitive to uncertainties in climatic conditions and other production inputs, including the future market conditions in the case of commercial crops. Despite all the uncertainties, the supply of ammonia is vital to the agricultural sector. According to the Association of American Plant Food Control Officials (AAPFCO), close to 12 million metric tons of fertilizer nitrogen was purchased in 2017 in the US. It is reasonable to expect most of them were used in crop production.

Figure 3 shows the state-level fertilizer expense in the US agricultural sector based on the most recent Census of Agriculture data. Because of the size of the demand, future ammonia and nitrogen fertilizer price trends are important for decision-making. It is also why policy support (elaborated later in this paper) is important for developing markets for LCIA-based products.

Additionally, due to the recent federal policy push on enhancing domestic supply chains of critical commodities to the US economy, including fertilizers, there will be a potential demand increase in ammonia. Considering the emerging demand for decarbonizing the economy, the market for LCIA could be sizable in the future, meeting the need for enhancing the domestic supply chain and decarbonization. The last piece of the puzzle is how all the enhancing domestic demand and supply connect to the international market.

4. The International Market

The global ammonia market is well-established, with significant production and consumption in North America, Europe, and Asia. The US is among the world’s leading producers and consumers of ammonia, with a significant production capacity concentrated in regions rich in natural gas reserves, such as the Permian Basin and the Gulf Coast. Global ammonia production was approximately 150 million metric tons in 2023, with a projected annual growth rate of around 5% over the next decade [

14,

18,

19,

21]. The primary demand driver is also the agricultural sector, where ammonia is a main ingredient in fertilizers and various industrial applications. The global ammonia market’s supply is dominated by regions with abundant natural gas resources, such as Russia, the Middle East, and the US. The conventional production process is highly energy-intensive and natural-gas-dependent (see

Figure 1), contributing to significant greenhouse gas emissions.

Globally, the LCIA market emerges as a distinct segment of the broader ammonia market. LCIA production relies either on green hydrogen, produced via electrolysis using renewable energy sources, or through integrating CCS technologies [

18,

19,

22]. As a result, key producers are likely to emerge in regions with abundant renewable energy resources and desired conditions for CO

2 geological storage. While LCIA is still a niche market globally, LCIA demand is projected to grow significantly as global decarbonization efforts intensify, reaching 20 million metric tons per year by 2030 [

18]. Due to the relatively high cost of renewable energy and carbon capture technology, there are still many hurdles to scaling up the LCIA market.

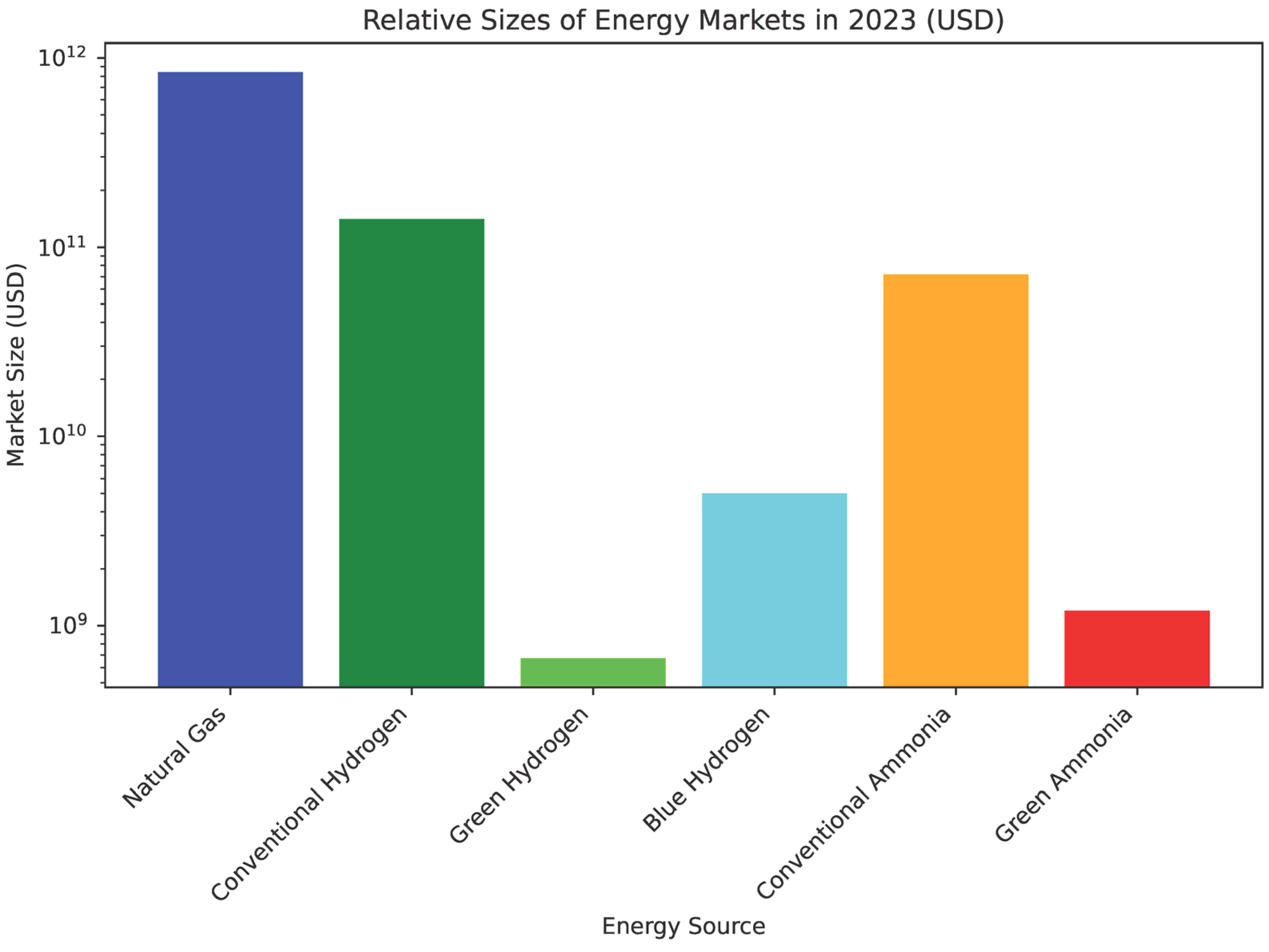

Figure 4 compares the global market size of natural gas, hydrogen, and ammonia (including conventional ammonia and LCIA) to illustrate the relatively small size of the emerging low-carbon market. However, with strong government policy support and growing investment interests from the private sector, the low-carbon market can grow substantially in the near future.

In Europe, the push towards decarbonization is driven by the European Union’s Green Deal and stringent carbon reduction targets [

27], including 4 million metric tons of ammonia as imported [

28]. In Asia, Japan’s commitment to LCIA is highlighted by the Basic Hydrogen Strategy that aims to position Japan as a leading hydrogen society by 2050, emphasizing green hydrogen and ammonia [

29], and the Fuel Ammonia Introduction Roadmap announced by the Ministry of Economy, Trade, and Industry (METI) in 2020, with a plan of importing 3 million metric tons of ammonia annually by 2030 and 30 million metric tons by 2050. South Korea’s Hydrogen Economy Roadmap, introduced in 2019, sets ambitious targets for hydrogen production, aiming for 5.3 million metric tons by 2040, with specific measures supporting green hydrogen and ammonia through subsidies and tax incentives [

30,

31].

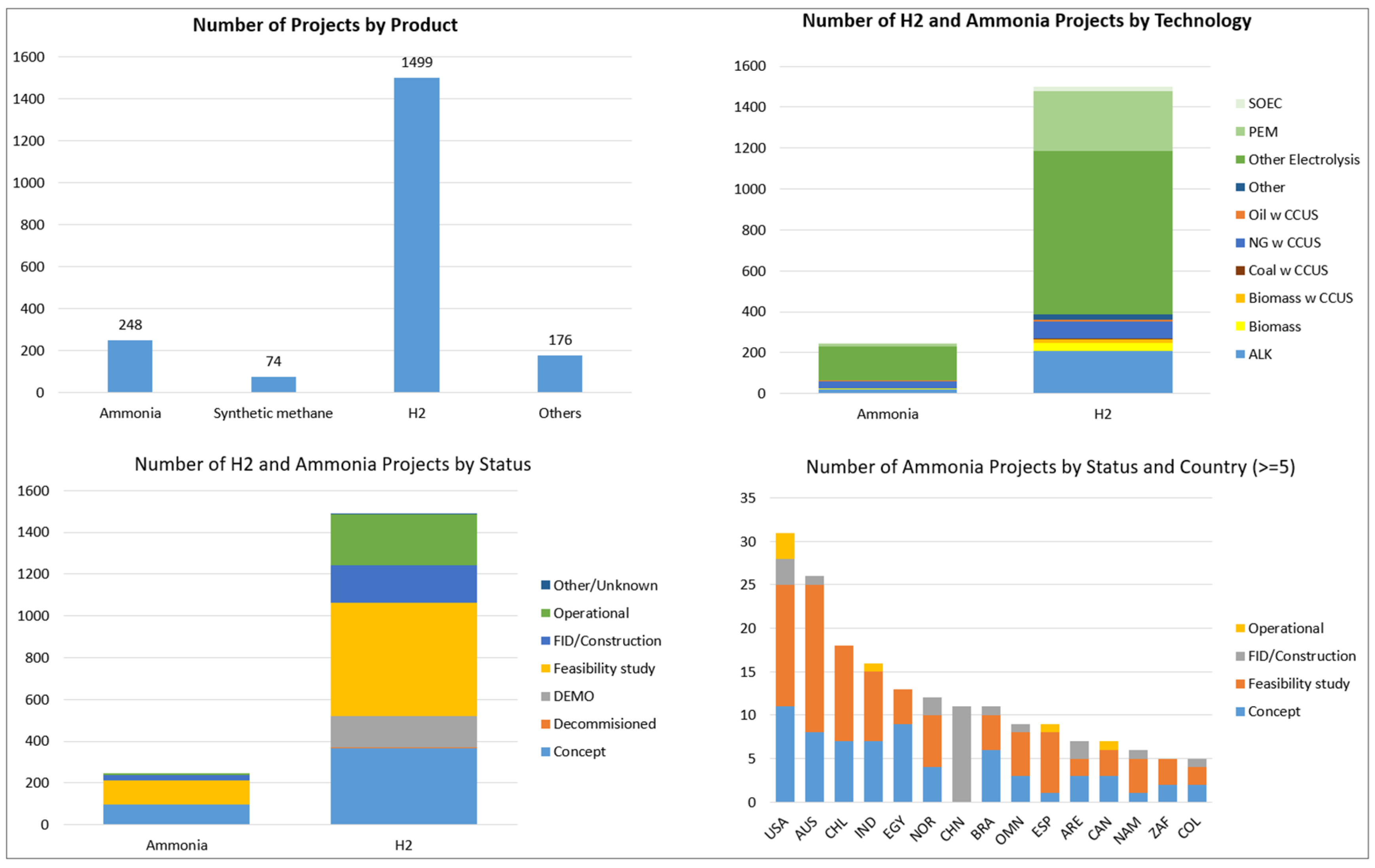

Figure 5 summarizes the global LCIA projects based on the IEA’s hydrogen production database (see the data at

https://www.iea.org/data-and-statistics/data-product/hydrogen-production-and-infrastructure-projects-database (accessed on 28 July 2024)). While fewer than hydrogen projects, ammonia projects still represent a significant portion of the capacity, including a growing interest in using ammonia as a hydrogen carrier. Most of these ammonia projects are associated with natural gas plus CCS, reflecting the current reliance on fossil fuels paired with carbon capture technologies. Countries like the US, Australia, and Norway are the forerunners of these ammonia projects. Future research should focus on exploring (1) how the emerging LCIA market will shape the global hydrogen economy, and (2) how the global hydrogen and ammonia trade relationships may evolve as the US enhances its domestic supply chains.

6. Concluding Remarks

This paper discusses the emerging market for low-carbon ammonia—an industrial material that serves as both an energy carrier and an essential chemical input in agricultural production, consumer goods, and industrial processes. It underscores the importance of an integrated approach to addressing the challenges posed by climate change to agriculture and energy systems. LCIA emerges as a pivotal solution, offering environmental and economic benefits across sectors. We argue that the development of a comprehensive LCIA value chain, supported by dedicated policy measures and broad stakeholder engagement, is critical for materializing the potential of LCIA in contributing to a sustainable and climate-resilient economy. To this end, we believe both local and federal policies could play indispensable roles and complement each other in areas such as infrastructure development, workforce development, and industrial standards and regulation.

Additionally, it is worth emphasizing that an LCIA market is intrinsically linked to other major markets, including natural gas, hydrogen, and agricultural commodities. Even though LCIA production has more diversified feedstock (e.g., natural gas, water, and biogas), natural gas remains relevant for blue hydrogen production, which is used in some LCIA production processes. In the fertilizer market, which is a primary consumer of ammonia, LCIA could capture a significant share driven by both forthcoming regulatory requirements and consumer preferences for sustainable agricultural practices. This creates a complex dynamic where the LCIA market intersects with traditional ammonia, hydrogen, and fertilizer markets, leading to a potential restructuring of market relationships and dynamics [

36,

37,

38]. The price differentials between conventional ammonia and LCIA will be a crucial factor influencing market adoption rates. Regions with stringent carbon pricing or subsidies for low-carbon technologies will see a faster adoption of LCIA, creating a more competitive market structure [

19]. Strategic policy support and technological advancement will be the key to unlocking the full potential of LCIA and achieving a sustainable low-carbon economy.