Abstract

Increased interest is demonstrated recently in the emergence of prosumer schemes for the residential sector on the basis of combined RES and storage configurations. Primarily, such schemes aim to increase energy autonomy for end users. Despite providing an alternative supply solution that may secure end users from volatile energy prices, RES–battery configurations also suggest costly and, in most cases, capital-intensive solutions. As such, exploring the generation of additional revenue through market participation is an exercise worth undertaking, noting at the same time that decongestion management services may also be provided to the local grid. In this context, the current study introduces an operational framework for the market participation of RES–battery prosumer schemes, seeking to determine the optimal balance between self-consumption and market integration. For that purpose, we use typical demand patterns and perform an extensive parametrical analysis concerning system size, spot price levels and degree of market integration in the context of the Greek electricity market, with our results indicating areas of optimum balance for the minimization of similar schemes’ levelized cost of electricity.

1. Introduction

Increased interest has been demonstrated recently in the emergence of prosumer schemes for the residential sector on the basis of combined RES and storage configurations [1,2]. Primarily, such schemes aim to increase energy autonomy for end users. Despite providing an alternative supply solution that may secure end users from volatile energy prices, RES–battery configurations also suggest costly and in most cases capital intensive solutions. As such, exploring the generation of additional revenue through market participation is an exercise worth undertaking, noting at the same time that decongestion management services may also be provided to the local grid. In this context, the current study introduces an operational framework for the market participation of RES–battery prosumer schemes, seeking to determine the optimal balance between self-consumption and market integration while focusing on the Greek region.

Over the past years, the impacts of the persisting energy crisis have affected electricity prices in an unprecedented way, with the local wholesale electricity market exhibiting significant vulnerabilities and exposure to price volatility. The latter has led to spot prices that, during the second half of 2022, even exceeded 500–600 €/MWh, with the annual average positioned at 280 €/MWh. This had a direct impact on retail prices as well, which, despite state subsidies, has led to increased levels of insecurity for end customers, as in the rest of Europe [3,4].

In response to the unfolding energy crisis in Europe, in May 2022 the European Commission launched the ambitious REPowerEU plan [5,6], aiming to put forward a bundle of initiatives regarding energy saving, clean energy production and energy supply diversification, and with a special focus, amongst other things, on the promotion of residential-scale PV solutions. Similar subsidy schemes recently emerged in Greece as well, paving the way for introducing not only PVs but also hybrid PV–battery schemes in the residential sector. With this in mind, we currently argue that for the roll-out of similar configurations, extra value needs to be extracted from their operation, which also implies the need for interfacing the local electricity market.

2. Materials and Methods

2.1. Problem Definition and Methods

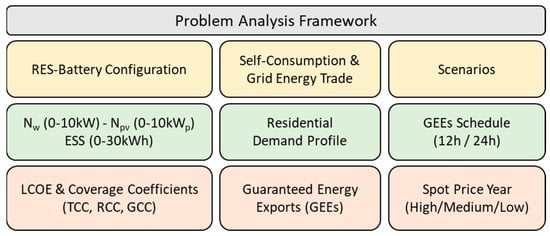

Acknowledging the above, the current study develops a computational framework for the evaluation of different prosumer schemes, capturing different RES–battery configurations (including both wind and solar power of residential scale) combined with practical market-integration strategies. For that purpose, we used a typical Greek household demand pattern and performed an extensive parametrical analysis concerning system size, spot price levels and degree of market integration. The schematic block of Figure 1 synopsizes the problem methodology, which, apart from the variation in system main variables (Nw: wind power; Npv: PV power; ESS: battery capacity), looks at the examination of different scenarios and the generation of energy and economic performance metrics, explained in Table 1 and Table 2, together with main parameters and assumptions.

Figure 1.

Schematic representation of the formulated problem.

Table 1.

Main, non-system parameters of the problem.

Table 2.

Main performance metrics of the problem.

Accordingly, the approach adopted for the examination of the problem is the brute force approach, which assumes study of all possible configurations within a given range of analysis, allowing in this way for the interpretation of emerging trends rather than for the designation of unique, optimum solutions. To that end, the span of solutions currently examined considers 0–10 kW variation in wind and PV power (1 kW step) and 0–30 kWh variation in battery capacity (2 kWh step, DoD of 80% and a moderate roundtrip efficiency of ~75%), which gathers a total of 1936 different configurations, together with examination of two different schedules for the day-ahead GEEs to the local grid, i.e., from 7 am to 18 pm (12 h) and for the entire 24 h period of each following day.

2.2. Input Data

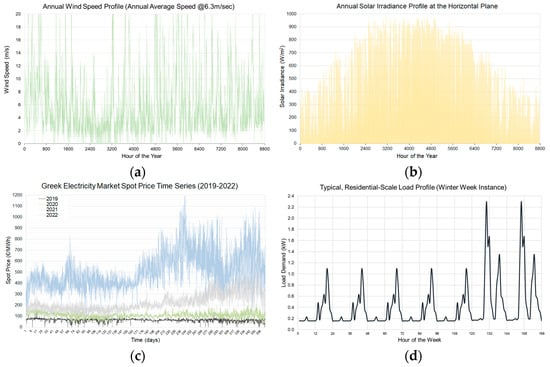

For the purpose of our analysis, we use hourly time series of a medium quality solar potential of ~1580 kWh/m2.a at the horizontal plane, and a medium quality wind potential, with an annual average wind speed of 6.3 m/s (see also Figure 2). At the same time, and in order to capture different market conditions, we select three out of the last four spot price years, i.e., the years 2019, 2021 and 2022, representative of a low (63 €/MWh), medium (116 €/MWh) and high (280 €/MWh) price environment, respectively (see also Figure 2c). Finally, concerning the typical load demand pattern (see also Figure 2d), we assume a residential end customer defined by a moderate annual consumption of 3.5 MWh and a peak demand of 2.7 kW.

Figure 2.

Wind speed (a) and solar irradiance (b) profiles; spot price time series (2019–2022) (c) and weekly load demand variation instance for the typical end consumer considered (d).

3. Results

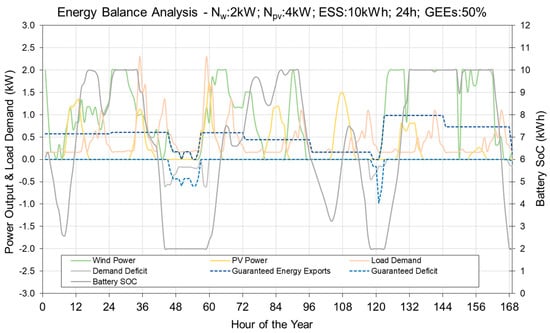

By applying the proposed methodology, we next proceed with the presentation of the results of the brute force approach currently adopted. Prior to that, in Figure 3, we provide an exemplary instance of energy balance analysis for a week-long period and for a representative RES–battery configuration, following a 24 h GEE trading schedule for the day-ahead. To that end, as one may note, the GEEs are re-estimated on a daily basis, depending on the anticipated RES production for the day-ahead, and is currently assumed to be covered in priority against self-consumption needs, first from the side of the RES component, and secondly from the battery component side. In the same context, the inability of the combined RES–battery system to serve the GEEs and self-consumption needs leads to the occurrence of deficits, which are on the one hand penalized (guaranteed energy) and on the other covered through grid electricity imports (self-consumption).

Figure 3.

Weekly instance of energy balance analysis for a representative configuration.

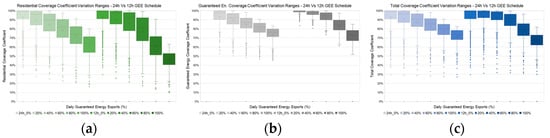

Accordingly, in the following set of figures (Figure 4, Figure 5, Figure 6 and Figure 7) we present the results of the brute force analysis for the entire range of configurations examined. In more detail, in Figure 4, the results of the RCC, GCC and TCC are provided, in relation to the variation in the GEE value (from 0% to 100%) and the two different selling schedules examined, i.e., the 24 h and the 12 h schedule. As one may see, an increase in GEEs leads, as expected, to a reduction in coverage coefficients, which is less intense in the case of the guaranteed energy coverage, since the latter is also served in priority. At the same time, 24 h schedules yield lower values for the majority of GEE values, for both GCC and RCC, with the overall values of the TCC found to range between ~65–100%.

Figure 4.

Variation ranges of RCC (a), GCC (b) and TCC (c) in relation to the variation in GEEs and examined GEE time schedules.

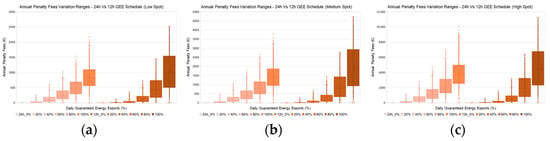

Figure 5.

Variation ranges of penalty fees for low (a), medium (b) and high (c) market prices in relation to the variation in GEEs and examined GEE time schedules.

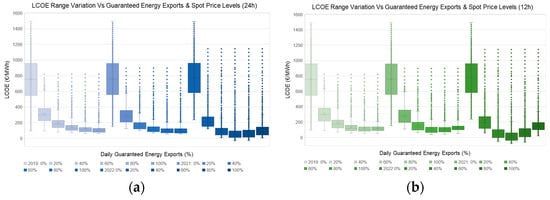

Figure 6.

Variation ranges of LCOE for the 24 h (a) and the 12 h (b) schedules in relation to the variation in GEE.

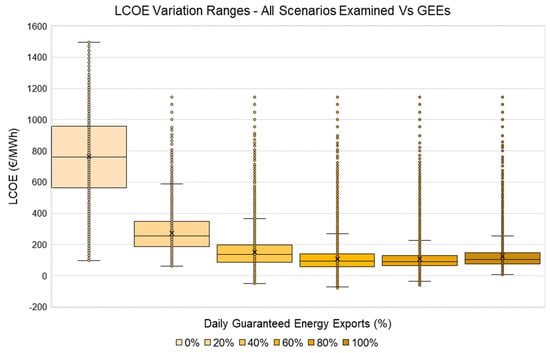

Figure 7.

Variation ranges of LCOE for all scenarios examined in relation to the variation in GEEs.

Following the presentation of energy results, in Figure 5 we provide annual penalty fees concerning the violation of GEE schedules, in relation to the three different market price environments represented by years 2019, 2021 and 2022 for the Greek electricity market. As anticipated, penalty fees are found to increase remarkably between 2019 and 2022, even exceeding 6 k€/year under the latter. At the same time, and owing to the fact that in the context of the 24 h schedule, lower prices may also be encountered in the course of the day, the 12 h schedule presents higher annual fees for GEEs in the range of 80–100%.

Integrating all cost components (the assumed values of investment costs correspond to 1500 €/kW for wind power, 750 €/kW for PV power and 700 €/kWh for the battery component, together with 10% of BoS and an annual maintenance coefficient of 3% over the system investment), we next present variation ranges of LCOE in Figure 6. The results are organized in relation to GEEs and the three price environments examined, in three sets of boxplots per different schedule. As can be concluded from the figures, there is an asymptotic trend of LCOE with the increase in GEEs for the years 2019 and 2021, that gradually leads to near zero LCOE values. This is indicative of the market environment effect, which for the year 2022, also leads to the designation of minimum LCOE values in the area of ~60% for GEEs. Moreover, it is important to note the difference between a system that is fully dedicated to the coverage of self-consumption (GEEs = 0%) and a system allowed to also interface with the market, while finally, negative LCOE values also appearing could be explained on the basis of windfall profits from the participation of prosumers in a high-price market environment.

Finally, in the last figure, Figure 7, we grouped together the results of all scenarios examined in the given study and again related them to the variation in GEEs. The resulting variation ranges of LCOE incorporate all three years of market prices, the entire set of configurations and both the 24 h and 12 h schedules. In this context, the given ranges may be considered as representative for a broad pool of prosumers and market conditions for the case of Greece. With this in mind, optimum solutions were found in the area of 80% for GEEs, which represents a conclusive finding of our research, with the option of market integration generating a significant reduction in LCOE, even for GEEs in the range of 20%.

4. Discussion and Conclusions

In the present study, we evaluated different prosumer schemes allowing for the increased coverage of both self-consumption needs and electricity market integration, using the Greek electricity market as an example. In this context, we developed a computational framework for the evaluation of different strategies and configurations and proceeded with the analysis of scenarios addressing variations in the main problem parameters, such as system size, price environment and dispatch schedules.

According to our findings, allowing market integration of RES–battery prosumers entails the generation of extra value for the given configurations, with the optimal degree of integration for the Greek electricity market and for a bundle of scenarios found in the area of 60% to 80% in terms of GEEs.

In addition, and following the analysis of results from the previous section, the value-adding impact of market integration for RES–battery prosumers was designated. Further work towards this direction shall also address the influence of different quality RES potential across Greek regions, combined with an extensive sensitivity analysis of the uncertainties determining cost components and main problem parameters.

Author Contributions

Conceptualization, D.Z.; methodology, K.C. and D.Z.; software, D.Z., K.C., K.K. and I.S.; formal analysis, D.Z. and K.K.; investigation, K.C. and K.K.; resources, K.C. and I.S.; data curation, K.C. and I.S.; writing—original draft preparation, D.Z. and I.S.; writing—review and editing, K.C. and K.K.; visualization, I.S. and K.C.; supervision, D.Z. and K.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research has appreciated funding from the University of West Attica.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Meteorological time series were retrieved from the database of the Soft Energy Applications & Environmental Protection Lab, maintaining own experimental data records and data made available from the Greek Public Power Corporation (Public Power Corporation. “Wind Speed Measurements for Greece: 1980–1985”, in PPC Editions, Athens, 1986). Electricity price data were made available from ENTSO-E Transparency Platform—Available online: https://transparency.entsoe.eu/ (accessed on 20 May 2023).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zheng, S.; Huang, G.; Lai, A.C.K. Techno-economic performance analysis of synergistic energy sharing strategies for grid-connected prosumers with distributed battery storages. Renew. Energy 2021, 178, 1261–1278. [Google Scholar] [CrossRef]

- Faraji, J.; Ketabi, A.; Hashemi-Dezaki, H. Optimization of the scheduling and operation of prosumers considering the loss of life costs of battery storage systems. J. Energy Storage 2020, 31, 101655. [Google Scholar] [CrossRef]

- Martin-Valmayor, M.A.; Gil-Alana, L.A.; Infante, J. Energy prices in Europe. Evidence of persistence across markets. Resour. Policy 2023, 82, 103546. [Google Scholar] [CrossRef]

- Hussain, S.A.; Razi, F.; Hewage, K.; Sadiq, R. The perspective of energy poverty and 1st energy crisis of green transition. Energy 2023, 275, 127487. [Google Scholar] [CrossRef]

- Parag, Y.; Fawcett, T.; Hampton, S.; Eyre, N. Energy saving in a hurry: A research agenda and guidelines to study European responses to the 2022–2023 energy crisis. Energy Res. Soc. Sci. 2023, 97, 102999. [Google Scholar] [CrossRef]

- Vezzoni, R. Green growth for whom, how and why? The REPowerEU Plan and the inconsistencies of European Union energy policy. Energy Res. Soc. Sci. 2023, 101, 103134. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).