1. Introduction

Infrastructure is the backbone of every society; it provides essential services, including energy, water, and transportation to meet the needs of growing populations. Infrastructure also is central to a country’s development, and research reveals that infrastructure can influence the achievement of up to 92% of the Sustainable Development Goals (SDG) targets [

1]. However, infrastructure can also have damaging impacts on society, not least in the case of climate change. Infrastructure, primarily through transport and buildings in cities, contributes to 75% of all global greenhouse gas emissions that are driving climate change [

2] and increases the magnitude and frequency of climate-related hazard events. Infrastructure is particularly susceptible to such hazards. When infrastructure is not resilient, it can disrupt the delivery of critical services and set back development gains that have been established over decades.

As the world deals with the impacts of climate change, infrastructure is a vital enabler of climate mitigation and adaptation for achieving the Paris Agreement. Climate mitigation is promoted by using low carbon technologies in infrastructure development and demand reduction. Similarly, ensuring that infrastructure is resilient to hazards, including green infrastructure for hazard protection, contributes to climate adaptation. With several countries signing the Paris Agreement, sustainable finance is a critical enabler to keep them on track to meet their Nationally Determined Contribution (NDC) targets.

In recent years, the emergence of climate and SDG-related finance from public and private investors such as the Green Climate Fund (GCF) and increased Official Development Assistance allocations to climate change and related sectors indicate a global recognition of the need for increased climate finance [

3]. Governments, however, face challenges in attracting this finance to meet their national objectives. Capacity constraints exist in developing bankable projects, identifying financiers, and meeting their financing criteria [

4].

Several tools and methodologies have been developed to support governments in overcoming financing barriers. Some of these tools aid the development of bankable projects through the provision of guidance resources for project preparation (Source [

5], Project Navigator [

6], and Sustainable Infrastructure Tool Navigator [

7]). These are relevant for governments with the technical know-how and financial ability to carry out the recommended feasibility studies for project preparation. Other tools focus on mapping out development financiers through retrospective financial reporting on aid allocation (Financial Tracking Service [

8], ODF for Infrastructure [

9]) and identifying financing opportunities through specific tenders and calls for proposals (Devex [

10]).

Existing tools have centered on the major global financiers and their investments in development projects without adequately elucidating how to access the available infrastructure financing or considering the diversity of different country contexts. Several tools also do not reference climate change impacts or progress towards the Paris Agreement beyond the inclusion of environmental and social impact assessments (ESIAs). In an attempt to fill this gap, the United Nations Office for Project Services, in collaboration with the University of Oxford, has developed the Sustainable Infrastructure Financing Tool (SIFT) to provide an intuitive and structured approach to identifying potential sources of financing for sustainable infrastructure. SIFT enables the development of an evidence-based strategy for financing national infrastructure pipelines and climate mitigation and adaptation plans.

The following sections outline the SIFT methodology and demonstrate its application to Saint Lucia, a small island developing nation with unique development challenges. First, the SIFT methodology is explained, including its underlying frameworks and datasets. This is then followed by the practical application in Saint Lucia and the study results. Conclusions are provided in the final section, highlighting the implications of the Saint Lucia study and the relevance of SIFT globally.

2. SIFT Methodology

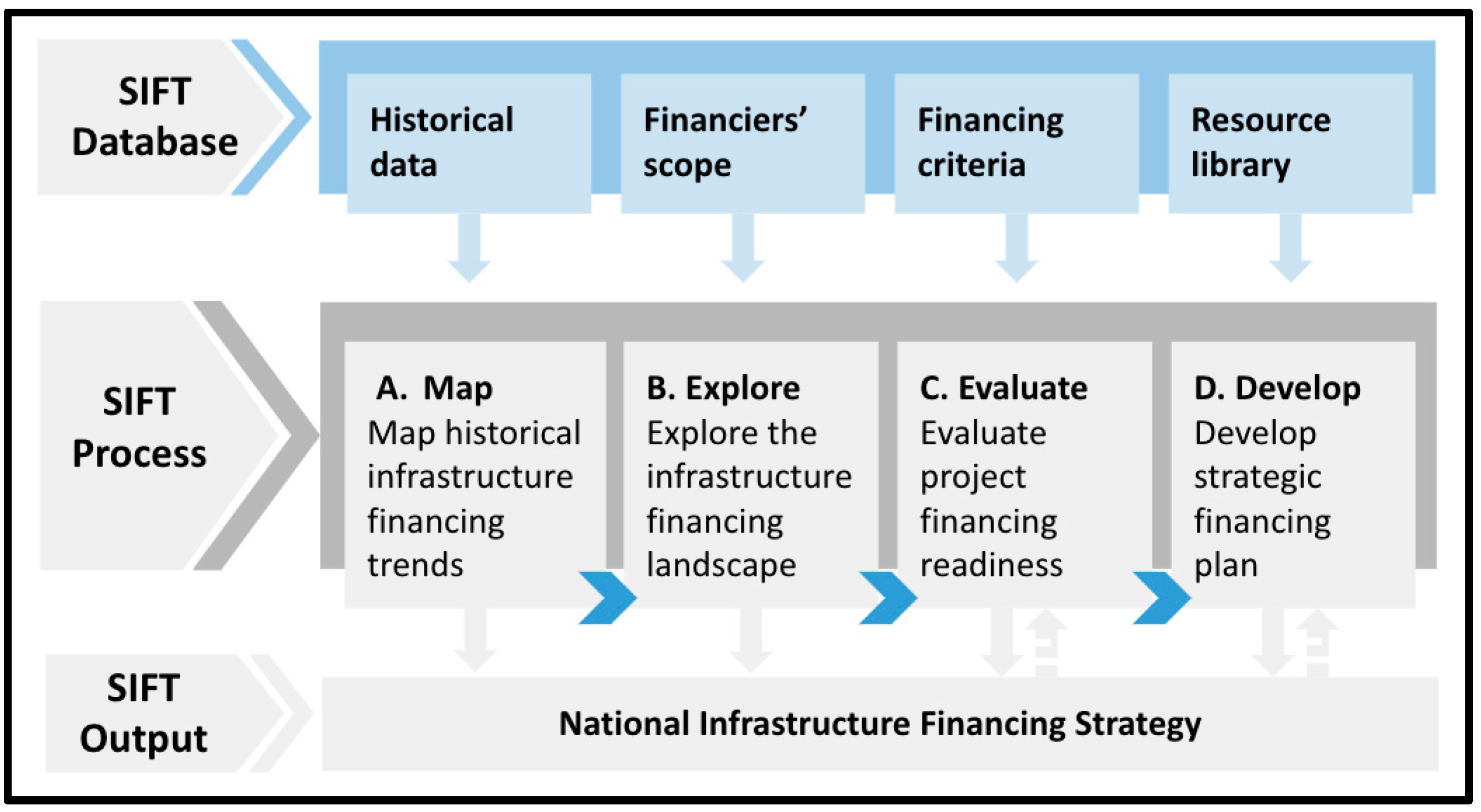

The SIFT methodological framework (

Figure 1) supports the systematic development of a National Infrastructure Financing Strategy (NIFS). Central to this framework is the SIFT process, which is underpinned by a large range of datasets within the SIFT database. The key components of the SIFT framework are described further in the following sub-sections.

2.1. SIFT Database

Data collection for the SIFT database involved consultation with national governments and a comprehensive desktop review of fund websites and documentation, including annual reports, sustainability reports, financial statements, policies, guidelines, and other relevant documentation. The datasets comprise the following:

Historical data: This captures macroeconomic data on Gross Domestic Product (GDP) and debt levels as well as budgetary data on infrastructure expenditure for the country of focus.

Financiers’ scope: This is a growing global dataset of 110 infrastructure funds containing detailed information on their (i) geographic coverage—237 countries; (ii) sectoral coverage—15 infrastructure sectors; (iii) financing mechanisms offered—7 mechanisms, and; (iv) project activities financed—financing available for project implementation, project preparation and enabling activities that build institutional capacity. There is additional data on thematic focus, blended finance options, co-financing requirements, and requirements for private sector involvement. Notably, about 50% of funds currently in SIFT primarily finance infrastructure for climate mitigation and adaptation, such as renewable energy, nature-based solutions, and climate resilience projects.

Financing criteria: This is a collection of 15 financing criteria used by funds to assess projects for financing. Financing criteria are categorized into five general criteria and ten sustainability criteria. The general criteria evaluate the projects’ technical and financial viability, while the sustainability criteria assess economic, social, and environmental benefits and alignment with the global agenda. Approximately 90% of funds require that projects demonstrate climate resilience measures and nearly 75% of funds highlight projects’ alignment with the Paris Agreement as a priority.

Resource library: This provides a comprehensive set of best-practice resources and actions to guide project preparation and address financing criteria.

2.2. SIFT Process

2.2.1. Step A: Map Historical Infrastructure Financing Trends

SIFT leverages historical country data to contextualize the financing landscape in-country and draw attention to overarching financing needs. Institutional structures and arrangements are also assessed to contextualize the enabling environment and understand the institutional capacity to develop and implement sustainable infrastructure projects. This step provides a foundation for the subsequent analysis and tailors the financing strategy to a country’s specific context and needs.

2.2.2. Step B: Explore the Infrastructure Financing Landscape

Data on financiers’ scope are analyzed to provide an overview of the infrastructure financing landscape of a country. In addition to mapping infrastructure financiers based on historical data and existing donor relationships, this step enables governments to understand the new potential financing opportunities available for their national infrastructure pipeline.

2.2.3. Step C: Evaluate Project Financing Readiness

An infrastructure project’s documentation is evaluated to assess its readiness for financing based on financing criteria used by funds. Through this assessment, the extent to which the project’s documentation addresses financing criteria is understood, highlighting areas of strength and improvement to better align with fund requirements.

2.2.4. Step D: Develop Strategic Financing Plan

SIFT identifies well-aligned funds for the government to focus on to finance specific projects in the national infrastructure pipeline. This analysis is based on the exploration of the financing landscape (step B) and the evaluation of a project’s financing readiness (step C), considering historical context, over-arching financing needs, and prior funding relationships (step A). The SIFT resource library is then used to inform project-specific strategic actions to address gaps in project financing readiness. An action plan is developed to guide an integrated approach for financing the national infrastructure pipeline. This holistic analysis enables governments to identify and explore opportunities for cross-ministerial collaboration for project preparation, capacity building, and fund engagement.

2.3. SIFT Output

In the form of a succinct report, the NIFS summarizes the findings from each step of the SIFT process and extracts insights to inform governments’ strategic decision-making for financing their infrastructure pipelines. Project factsheets that summarize crucial project information and highlight potential NDC and SDG impacts are developed for special focus projects in the NIFS, equipping governments to engage with sustainable infrastructure financiers. By highlighting specific funds that individual focus projects align with, the NIFS enables governments to identify financing opportunities for their infrastructure projects, including those which specifically tackle climate change.

The NIFS highlights opportunities to capitalize on the growing amount of financing for climate mitigation and adaptation to promote climate-resilient infrastructure development. Leveraging the SIFT resource library, the NIFS ensures current and future projects address financing criteria related to climate change. SIFT and the accompanying NIFS enable governments to strategically attract infrastructure financing to achieve their development targets.

3. Application for Saint Lucia

Like most Caribbean countries, certain challenges have limited sustainable development in Saint Lucia, including economic vulnerabilities due to its small size, import dependence, and tourism volatility, which the COVID-19 pandemic has exacerbated. The island is also highly vulnerable to climate hazards, as its geography leaves it especially exposed to the negative impacts of climate change [

11]. Its ability to address these challenges has made infrastructure a priority for the Government of Saint Lucia (GoSL), as stated in its Medium-term Development Strategy (MTDS) [

12] and the National Infrastructure Assessment (NIA) [

13]. The NIA delineates specific national infrastructure-related targets to further progress toward the Paris Agreement and the SDGs, including 35% renewable energy generation, 23% emissions reduction, and a 61% wastewater treatment rate by 2030. However, the MTDS reiterates that inadequate financial resources for infrastructure are barriers to meeting these targets, which are worsened by rising public debt and contraction of the GDP by 20% in 2020 due to COVID-19 [

14].

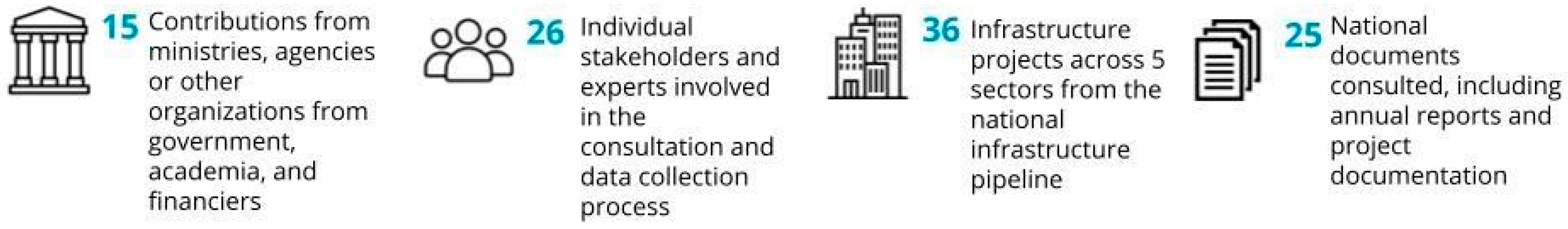

External support from the public and private financiers is key to unlocking the financial barriers to infrastructure development. There is a need for enhanced mechanisms to support GoSL to overcome knowledge gaps regarding the available sources of external financing and the resources required to access these funds. With the responsibility to understand and exploit financing opportunities, decision-makers lack adequate information to take strategic actions to attract funding for infrastructure. Given this, SIFT was applied in Saint Lucia to accelerate financing for the national infrastructure pipeline in alignment with the Paris Agreement and the SDGs and national development priorities. The Saint Lucia NIFS involved extensive stakeholder consultation across government ministries/agencies to facilitate data collection and guide the selection of focus projects across key infrastructure sectors (

Figure 2). Consultations with these stakeholders enabled critical evaluation of infrastructure projects at different stages and the intended timelines. Project documentation provided data to assess the projects’ readiness for financing. National documents were also reviewed to understand contextual issues and trends to develop practical approaches to access infrastructure finance. This holistic consultative process fostered cross-ministerial coordination to understand needs and capacities regarding infrastructure finance mobilization in Saint Lucia.

4. Results and Discussion

4.1. Historical Infrastructure Financing Trends

Following three years of decline in government spending on buildings and infrastructure, expenditure in Saint Lucia grew by 75% to XCD 210 million in the 2019/2020 fiscal year [

15]. In recent years, excluding uncategorized spending, transport, health, and disaster reduction have been the most financed sectors [

15]. Most infrastructure financing is through bonds; however, loans have increased steadily while grants have declined at a similar rate [

16]. This trend is in line with an increasing debt-to-GDP ratio, which reached 87% of GDP in 2020 [

14]. Growing debt levels, worsened by the global COVID-19 pandemic, make evident the need to explore alternative infrastructure financing options. Development banks and international organizations have been the largest external infrastructure financiers of GoSL in recent years [

15]. Amidst a growing market of private sector infrastructure investors, XCD 351 million of private sector finance has been invested in Saint Lucia through public-private partnerships (PPPs) since 1990, primarily in the energy sector [

17]. However, challenges such as small project sizes, constrained local PPP capacity, and hazard vulnerability have limited private investment in the country.

4.2. Saint Lucia’s Infrastructure Financing Landscape

SIFT identified 60 funds with the ability to finance infrastructure in Saint Lucia, of which 57% are currently not accessed by the Government of Saint Lucia. Identified funds include development banks, government development agencies, and development finance institutions. These newly identified funds can increase the pool of financiers in Saint Lucia, significantly expanding the potential for infrastructure development. The majority of the identified funds allocate financing to traditional sectors such as energy and transport while emerging sectors like climate infrastructure are gaining prominence.

Loans are the most readily available financing mechanism; however, grants and equity are also available, with 68% and 47% of funds offering them respectively. The availability of blended finance, equity investments, and guarantees draws attention to the opportunity for private sector participation in infrastructure financing through PPPs. Of the available funds, 85% provide financing for project implementation, while 70% finance enabling activities that build institutional capacity and 52% finance project preparation activities.

4.3. National Infrastructure Pipeline Readiness for Financing

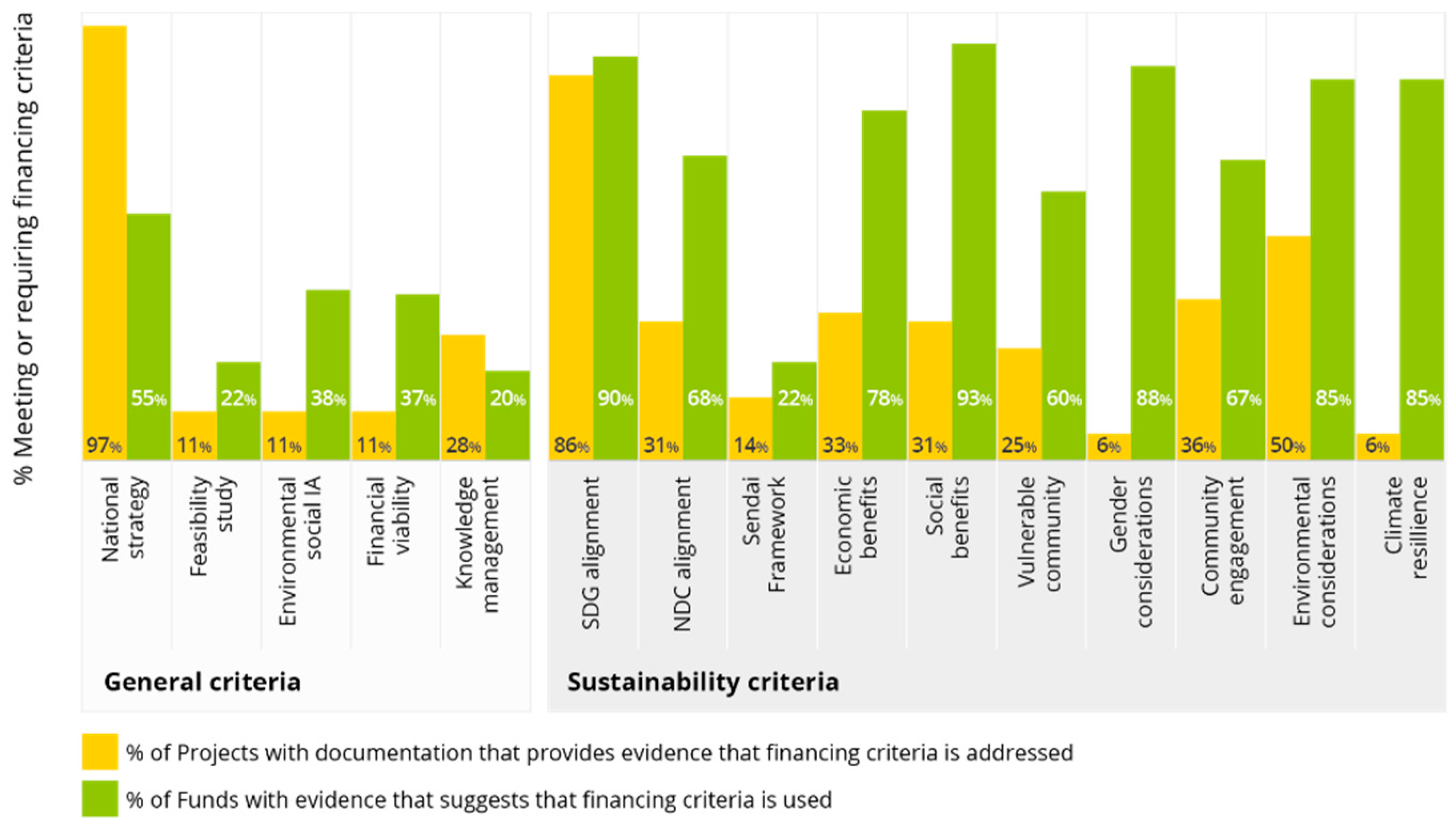

Thirty-six projects across energy, housing, water, wastewater, and solid waste sectors in Saint Lucia’s infrastructure project pipeline were assessed in the study. The project pipeline included proposal documentation with varying levels of financing readiness (

Figure 3). Areas of strength demonstrated by over 85% of projects included alignment with a national strategy and alignment with the SDGs. In contrast, areas for improvement included incorporating climate resilience measures and gender considerations (

Figure 4). Given their importance to financiers in Saint Lucia, these areas are critical to address as over 85% of available funds assess these criteria. Aligning projects with the Paris Agreement to meet the country’s NDC targets was also an area for improvement; only 31% of projects in the pipeline provided evidence in their documentation to suggest that this criterion is addressed. Gaps in general criteria, such as feasibility studies, impact assessments, and financial viability assessments were also highlighted as areas to strengthen to better attract private sector investment.

The assessment of Saint Lucia’s infrastructure pipeline provides a strong rationale for the government to allocate resources to the criteria most required by funds and areas to develop institutional capacity for project preparation. Climate resilience is one of such areas, as it is a criterion used by 85% of funds but incorporated into only 6% of pipeline projects based on the evidence found in proposal documentation (

Figure 4). This evaluation was crucial in selecting the focus projects for which specific financing opportunities were identified.

4.4. Strategic Financing Plan

An in-depth analysis was completed for six focus projects across the five sectors to identify, prioritize and exploit specific financing opportunities. The selection of focus projects was based on immediate government priorities, sectoral distribution, projects’ financing readiness, and implementation timelines. A project factsheet, fund-alignment assessment, and financing action plan were completed for each project.

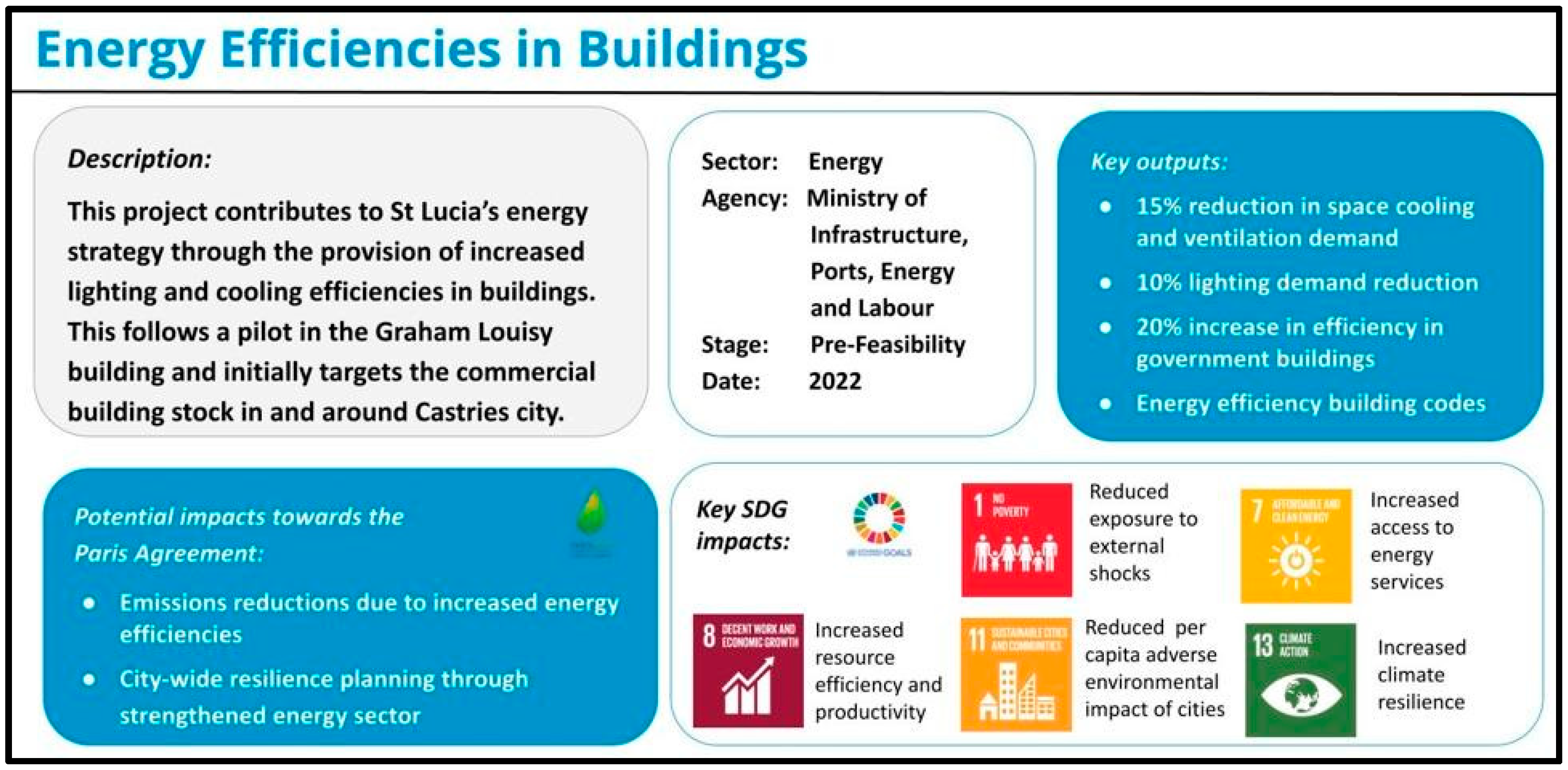

For this paper, the project on ‘Energy Efficiencies in Buildings’ is used as an example of the focus project analysis (

Figure 5). At the time of this study, the project’s documentation provided evidence that addressed 47% of the financing criteria, including alignment with a national strategy and the SDGs and demonstrating economic, social, and environmental benefits. Five funds were identified as strongly aligned with the project; 80% of these funds offer grants, 40% offer blended finance solutions to attract private sector investment, and 40% finance project preparation activities to further develop the project.

Overall, for the six focus projects, 23 of the 60 SIFT funds for Saint Lucia were identified as potential project financiers; GoSL has an established relationship with 14 of these funds. Opportunities for coordination and collaboration between ministries were identified for fund engagement, given that seven funds were highly aligned with multiple projects. To help ensure efficient use of capacity and resources, opportunities to group and package projects with similar timelines and sectors were identified for certain funds.

Of the 15 financing criteria, 11 were identified as areas of improvement for six focus projects (

Figure 6). Cross-ministerial collaboration can be leveraged to address gaps in the project documentation of focus projects and build capacity in project preparation to increase financing readiness and better align with funds. For example, all focus projects except one lacked alignment with the Paris Agreement, gender considerations, and climate resilience in their project documentation. A coordinated approach can be taken to identify and exploit available expertise within the government to incorporate these criteria in the focus projects and efficiently build capacity across the respective ministries.

The analysis culminated in a holistic 3-tier action roadmap creating a clear path to secure financing for the focus projects, further developing the national infrastructure pipeline, and ensuring a legacy of evidence-based decision-making for financing long-term infrastructure development.

5. Conclusions

This paper has shed light on the key role infrastructure plays in delivering on the Paris Agreement and the SDGs, and has drawn attention to the need for infrastructure finance mobilization to be rooted in evidence. Using the novel SIFT approach, governments are better able to channel limited resources towards preparing infrastructure projects that address the criteria of financiers and increase the likelihood of attracting much-needed finance, including for projects targeted at climate mitigation and adaptation. The application of SIFT in Saint Lucia produced a financing strategy that provides an integrated approach to infrastructure financing and fund engagement. The NIFS also promotes cross-ministerial coordination and collaboration to strengthen the government’s institutional capacity in project preparation and financing. This will yield both short- and long-term benefits and promote efficiency in financing the national infrastructure pipeline. Some limitations of the application in Saint Lucia include the unavailability of project data for some infrastructure sectors, notably transportation, which significantly influences meeting development targets. In addition, the SIFT database is currently under development; hence the financing opportunities highlighted for the country and focus projects are not exhaustive.

In this decade of action, SIFT is an innovative solution with great potential to help governments overcome challenges to infrastructure financing by building strategic partnerships with infrastructure financiers that prioritize positive economic, social and environmental impacts to achieve the Paris Agreement and the SDGs. SIFT is scalable and can be applied to various country contexts, including landlocked developing countries, small island developing states, and least developed countries to promote evidence-based infrastructure financing for climate action and the achievement of sustainable development.