Abstract

Supercritical fluid extraction (SFE) is a green methodology that allows the solvent to be easily removed by simply reducing the system’s pressure or temperature. An interesting compound to be separated through SFE is the clove’s essential oil, which contains 75.5% (m/m) of eugenol and shows many food and biomedical applications, such as antibacterial and antifungal activities, and use as an antioxidant or anti-inflammatory, and for asthma and allergy relief. Herein, we simulated the operation of a SFE plant with two 400 L-extractors using CO2 and performed the economic analysis based on real purchase costs from large-scale exportation suppliers. Our results show that this is not only a process that results in minimum harmless emissions, consuming low amounts of utilities, but is also an investment with excellent economic indicators, which is viable even if there are increases of 56% on clove’s purchase costs. A fixed capital expenditure (CAPEX) of USD 347,000 is required, leading to a high net present value (NPV) of USD 8,600,000 after the project’s lifetime (40 years), with a payback of 18.67 years and internal rate of return (IRR) of 7.29%.

1. Introduction

A supercritical fluid is a compound under conditions of temperature (T) and pressure (P) beyond its critical point (Tc, Pc), so that the liquid and vapor phases are indistinguishable [1]. Supercritical fluid extraction technology (SFE) presents remarkable advantages over traditional extraction techniques; it allows the solvent to be easily removed by simply reducing the system’s pressure or temperature, results in enhanced energetic efficiency, may proceed with minimal or even no amount of organic co-solvents, and results in minimum quantities of residues. Nowadays, it is employed to separate compounds from coffee, tea, and hop; these are extracted from solid matrices, and the supercritical fluid is used to solubilize the desired materials while filling the vessel [2]. The solvent flows inside the extractor, swelling its fixed bed and facilitating the mass transfer. In a second step, the pressure is reduced, with a consequent decrease of both the density of the solvent and of the solubility of the extracted compound, allowing for their easy separation. Finally, the solid residue (usually biomass) is removed from the extractor. One of the most-used solvents for SFE is CO2, which presents low toxicity and reactivity; is nonflammable; presents moderate Tc, Pc, and purchase costs; and results in no solvent residues in the equipment [3]. In turn, a relevant compound that may be separated through SFE is the essential oil from clove (Eugenia caryophyllata), composed of eugenol (75.5% in mass), eugenyl acetate (11.0%), trans-caryophyllene (12.1%), and α-humulene (1.4%). It presents antibacterial and antifungal activities and may be used as an antioxidant or anti-inflammatory, and for asthma and allergy relief [3]. In Brazil, its annual production is estimated at 6000 ton/year, with 5000 ton/year destined for exportation. However, there is still a need for technical and economic feasibility studies covering large-scale extraction plants (400 L-extractors) [4]; therefore, we used the SuperPro Designer 10 (Intelligen) to simulate an industry working with two extractors. We also collected real purchase data from large-scale exporters of clove and its essential oil compounds, and from suppliers of pressurized CO2 [5,6,7,8,9,10], and input this information into the simulator’s database. Finally, we applied the Weighted Average Capital Cost (WACC) methodology to calculate the main investment indicators of the industrial SFE plant and to evaluate the viability of the process for the purchase costs of different types of clove.

2. Simulation and Technical-Economic Model

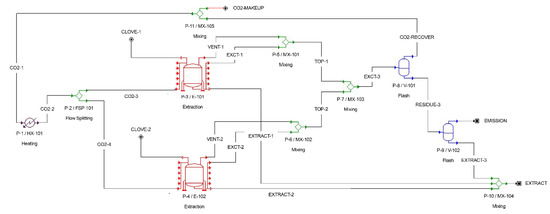

We developed the simulation diagram shown on Figure 1. Two 400 L-extractors are charged with solid clove and then pressurized with CO2. Two flash drums complete the system and allow the recovery of the oil compounds. We registered the following prices from large-scale exporters: 25.73 USD/kg (eugenol), 32.51 USD/kg (eugenyl acetate), 12.19 USD/kg (trans-caryophyllene), and 14.19 USD/kg (α-humulene) [6,7,8,9]. Subsequently, we created a mixture (“clove oil”) containing the abovementioned mass fractions [3], and finally we created a second mixture (“solid clove”), comprised of “Biomass” (a solid from the database that represents the average information collected for different vegetable materials) and clove oil. Once the manufactures’ guarantee an oil degree from 15 to 20% (m/m), the mean value of this range (17.5%) was taken as the mass fraction of oil in this semi-solid mixture. The purchase cost, in turn, was defined as 0.64 USD/kg of dry clove [5]. The software does not provide an equipment model for SFE, so the extractor must be created from simpler equipment already present. For that, we created two extractors (E-101 and E-102) from batch stocking drums and added the following discrete unit operations: opening of the tank and charging with solid dry clove (“Pull In”); transferring of CO2 from the previous streamlines (“Transfer In”); heating of the tank to the operation temperature (“Heat”); pressurization with the supercritical fluid (“Pressurize”); SFE (“Extract”); and discharging of a light phase mainly composed of CO2 and residual oil, a heavy phase enriched in oil, and the solid biomass that sedimented. The SFE cycle has a duration of 210 min and must proceed at 150 bar and 40 °C [11]. Manufactures already provide the gas under this pressure and at 15 °C, eliminating the pressurization costs. For the minimum purchase of 100 cylinders (10L-cylinders, fabricated in accordance with ISO 9809-1:2019), the purchase cost is USD 40/cylinder [10]. Under 150 bar and 40 °C, the rate of mass of solvent per mass of solid feed (S/F ratio) in SFE must at least satisfy S/F ≥ 2. For S/F = 6.6 (ideal ratio), the yield, Y—defined as the ratio between the oil mass extracted and the maximum mass that could be extracted if infinitely high times and solvent amounts were given (i.e., extracted mass per total amount of oil in the dry clove)—is 90%. Moreover, under these conditions of P, T, and S/F, the maximum fraction of CO2 that may remain on the heavy phase at the exit of the extractor is 2.2% of the total gas. This value was taken as the mass split to the bottom phase, simulating the worst conditions. For P ≥ 9 MPa, only ~0.20% of the extracted oil mass remains in the light phase at the exit of the extractor, so this percent was taken as the mass split of oil to the upper phase [4,11]. To keep the S/F = 6.6, we defined that the entrance of solid material in the 400 L-extractors should be directly proportional to that empirically verified for a 1 L-process [11], so they are charged with 228 kg of solid clove and are submitted to 429.94 kg CO2/h. After the extraction, the light phases are directed to an adiabatic flash drum for separating the CO2 from the extracted compounds. At this stage, we reduced P to 80.64 bar (40 °C), because this condition allows the formation of a vapor phase comprised of only CO2 (molar fraction of 0.997 ≈ 1) in equilibrium with a liquid phase containing a molar fraction of 0.6916 of CO2 [3]. Then, a second adiabatic flash drum under atmospheric pressure (1.013 bar) fully separates the remaining gases from the oil phase. A heat-exchanger that guarantees the gases flow into the extractors at 40 °C and a CO2 make-up entrance stream to compensate gas losses in the flash drums complete the simulation. We also limited the useful volumes to 90% of the total volume of each set of equipment.

Figure 1.

Simulation diagram developed in the SuperPro Designer 10 simulation interface.

The plant cost estimates were performed according to Turton’s method, in which Equation (1) is frequently applied; FCi represents the fixed capital that must be expensed for acquiring a given equipment, Ai is the capacity of the equipment in “i”-scale, and n is a cost exponent that ranges from 0.26 to 1.33, depending on the class of equipment, and represents the economy of scale of the plant. Because many pieces of Chemical and Food Engineering equipment present n ≈ 0.6, this value is frequently used for the estimative (six-tenths rule). The plant’s Direct Fixed Capital (DFC, or Capital Expenditure, CAPEX) is estimated based on the Total Equipment Purchase Cost (PC). The PC is calculated as the sum of the purchase costs of all equipment (estimated with Equation (1)) with the costs related to equipment that are unlisted in the project, but which are relevant to real plant operation. The cost of unlisted equipment is estimated as 20% of the listed equipment costs. After that, it is possible to estimate the project’s Direct Cost (DC) as the sum of PC costs with costs of process piping (estimated as 35% of PC), instrumentation (40% of PC), insulation (3% of PC), electrical facilities (10% of PC), buildings (45% of PC), yard improvements (15% of PC), auxiliary facilities (40% of PC), and installation of listed and unlisted equipment (50% of PC). Other important estimates are the project’s Indirect Costs (IC), which are the total of the engineering costs (25% of DC) and the construction costs (35% of DC), and the Other Costs (OC), calculated as the sum of the contractor’s fee costs (5% of the sum DC + IC) and the project’s contingency budget (10% of the sum DC + IC). The DFC if finally given by the sum DFC = CAPEX = DC + IC + OC. Additionally, the Facility-Dependent Costs (FDC) are estimated as the sum of maintenance; depreciation; and miscellaneous costs, which are comprised of insurance costs (estimated as 1% of DFC), local taxes (estimated as 2% of DFC), and factory expenses (5% of DFC). Other estimates performed are: laboratory quality control and quality assurance costs (15% of total costs related to the payment of factory operators), additional electricity (15% of the calculated electricity cost), and electrical power for unlisted equipment (5% of the calculated electricity cost) [12].

The evaluation of the investment feasibility involves the calculation of economic indicators; the Net Present Value (NPV) represents the real value of the general investment result after a defined period of time, which we took as the project’s lifetime of 40 years. The NPV is calculated through Equation (2), where j is the rate of return or discount rate (minimum interest rate that makes one investment attractive) and n is the number of periods, in years. Basically, a higher NPV implies a better investment because it directly represents the wealth generated. We also estimated a depreciation rate of 20% per year, which was linearly adjusted to the basic cash flow, and defined the rate of return as Brazil’s basic interest rate, which is 2.30% per year. The economic analysis was performed in accordance with the Weighted Average Capital Cost (WACC) methodology for evaluating the annual free cash flow (FCF) of the plant, which consists of evaluating the contribution of the debt costs (interest on the amount) and the return demanded by the shareholders for performing an investment (capital cost). A given investment is considered feasible if it results in a return superior to the debt and capital costs. For a total of 330 working days per year, the Operational Expenditure (OPEX) of the project was considered constant and equals to the sum of costs of acquisition of raw materials, labor costs, utilities costs (cooling water, water steam, and electricity costs), and laboratory quality control and quality assurance costs. The plant construction period was defined as 30 months, whereas the plant start-up period was 4 months, which are the standard of the SuperPro Designer 10 database. Therefore, operational profits are obtained only after the initial 34 months, but we considered that the OPEX is incident from the first year. The main project parameters we applied to the economic analysis are summarized in Table 1. Another important economic indicator is the “Earnings Before Interest, Taxes, Depreciation and Amortization” (EBITDA), which considers the net revenue discounted from the value expended on the production, stocking, and commercialization. The WACC methodology discounts the depreciation effects from the EBITDA, and only cash flow expenses are considered for the discount of income tax, reducing the total amount of interest paid. We applied a standard income tax rate of 34% per year with no tax benefits. Finally, the annual net working capital necessary was considered constant and was estimated as 5% of the initial fixed capital investment [12].

Table 1.

Main project operation parameters applied to the analysis.

3. Simulation Results and Economic Feasibility Analysis

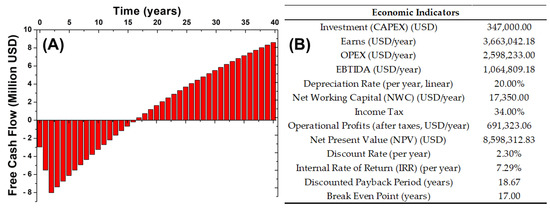

The simulation results indicated that virtually all of the CO2 can be recycled, leading to an almost null annual cost related to the purchase of this raw material. However, this is only an ideal situation, and the stocking of this gas is necessary for different reasons: our hypothesis was that the gas was supplied in cylinders under 150 bar, which is necessary for eliminating the costs of purchasing and operating a compressor, and it is necessary to have stocked gas for moments of stopping, maintenance, and start-up of the plant, as well as for compensating losses from non-idealities not covered by the project. We then considered an annual minimum purchase allowed by the suppliers of 100 cylinders of 10 L under 150 bar, corresponding to 4000 USD/year [10]. The equipment estimates, in turn, were performed for equipment fabricated in carbon steel (CS), or in stainless steel SS316 (only the two extractors). The free cash flow and the economic indicators are shown in Figure 2. We calculated that ~64.4% of the OPEX correspond to labor-dependent costs. Once we hypothesized that the plant must work with three operators, we estimated that extra investment in automation could drop the labor-dependent costs ~597,200.00 USD/year if there was only one operator directly working, a reduction of ~41.4% of the annual operating costs. It can also be noticed that the payback period (the time necessary for the investment to pay itself) is slightly superior to the breakeven point (when the free cash flow reaches zero): 18.67 years for the payback against 17 years for the breakeven. This is a consequence of defining an initial period for construction and start-up where we considered the OPEX was already present. On the other hand, the payback period is lower than half of the project’s lifetime (40 years), and the operational profits after taxes are substantial (691,323.06 USD/year). The consequence is a high internal rate of return (IRR) of 7.29% per year. The IRR is the discount rate that a cash flow must present so that NPV is equal to zero, so greater differences between the IRR and the minimum rate of return (2.30%/year) make an investment more attractive. The NPV also confirms that the investment has an outstanding capacity of generating wealth: the investment of USD 347,000 is converted into a NPV of USD ~8,600,000.00 after lifetime. Finally, it is important to verify the effect of different purchase prices on the economic indicators when agricultural commodities (such as clove) are highly influenced by oscillations of the international markets. Therefore, we calculated the NPVs and the correspondent breakeven points for purchase costs of dry clove ranging from 0.05 to 1.12 USD/kg, verifying a linear decrease of the NPV with the clove’s price: NPV (in USD) = −1,771,750,000,000.00 × (clove’s purchase cost, in USD/kg) + 1,993,750,000,000.00, adjusted R2 ≈ 1, and a linear increase of the breakeven point until 0.70 USD/kg of clove, when its rate of grown suffers a substantial enhancement. If the NPV is higher than the CAPEX investment (i.e., the operating effectively generates wealth), and if the breakeven point is not better than 75% of the project’s lifetime, then the process is viable for clove costs until 1.00 USD/kg, an increase of 56.25% of its cost. In this limit situation (1.00 USD/kg), the NPV = USD 2,220,018.89, and the breakeven occurs at 30 years.

Figure 2.

(A) 40-years free cash flow; (B) main financial indicators of the SFE plant of Figure 1.

Enormous amounts of biomass (793,749.29 kg/year) are produced as residues. The average heat of combustion of the other three vegetable species belonging to the same family as clove (Myrtaceae), which are present in Brazilian flora, is 18.25 MJ/kg for the dry biomasses [18,19], and typically 25% of this energy is effectively available for use [20]. Therefore, the produced biomass represents a potential for the generation of 3.62 × 106 MJ/year, which could be applied to the generation of water steam for use on the heat exchanger or for the generation of electricity in turbines, reducing the OPEX of the plant, or it could constitute a new source of revenue. Indeed, there is a growing market for the acquisition of wood pellets and for their use as energy source; by the end of 2019, the United Kingdom (UK) biomass boiler market reached ~16,500 commercial and industrial systems (systems with capacity above 200 kW), and 12,700 domestic boilers installed and in operation. By April 2020, the UK imported 896,000 tons of wood pellets from six major countries (44,000 ton came from Brazil), an increase of 39.3% in relation to the 643,000 tons in April 2019 [21,22]. There is not a single supplier dominating the whole international market, representing an opportunity for new players.

4. Conclusions

The analysis and simulations show that the investment in an industrial plant for the supercritical extraction of clove’s essential oil compounds with CO2 is very attractive. This oil presents many relevant food and biomedical applications, including antibacterial and antifungal activities, and use as antioxidant or anti-inflammatory, and for asthma and allergy relief. The SFE is not only a green process, but it also presents excellent investment indicators. The expenditure of USD 347,000 is converted into a NPV of USD 8,600,000 after the project lifetime, with a payback of 18.67 years, and the process is viable even if clove’s purchase cost is increased by up to 56.25%.

Author Contributions

All authors had equal contribution. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by São Paulo Research Foundation (FAPESP) under grant 2019/22554-4, CNPq and Capes (Finance Code—001).

Data Availability Statement

Data from the economic simulations, data tables and spreadsheets used in this research are publicly available on Sciforum.net (https://sciforum.net/paper/view/10778 (accessed on 1 March 2022)); and on Research Gate (https://www.researchgate.net/publication/354309542_Supercritical_Extraction_of_Essential_Oils_from_Dry_Clove_a_Technical_and_Economic_Viability_Study_of_a_Simulated_Industrial_Plant (accessed on 1 March 2022)). For the simulation files using the SuperPro Designer 10 simulator, please contact the authors through the email or through their Research Gate or LinkedIn (https://www.linkedin.com/in/marco-c%C3%A9sar-prado-soares-16a187113/ (accessed on 1 March 2022)) profiles.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Doane-Weideman, T.; Liescheskii, P. Analytical Supercritical Fluid Extraction for Food Applications. In Oil Extraction and Analysis; AOCS Publishing: Urbana, IL, USA, 2004. [Google Scholar]

- Zacchi, P.; Pietsch, A.; Voges, S.; Ambrogi, A.; Eggers, R.; Jaeger, P. Concepts of phase separation in supercritical processing. Chem. Eng. Process. Process Intensif. 2006, 45, 728–733. [Google Scholar] [CrossRef]

- Souza, A.T.; Corazza, M.L.; Cardozo-Filho, L.; Guirardello, R.; Meireles, M.A.A. Phase Equilibrium Measurements for the System Clove (Eugenia caryophyllus) Oil + CO2. Chem. Eng. Data 2004, 49, 352–356. [Google Scholar] [CrossRef]

- Takeuchi, T.M.; Leal, P.F.; Favareto, R.; Cardozo-Filho, L.; Corazza, M.L.; Rosa, P.T.V.; Meireles, M.A.A. Study of the phase equilibrium formed inside the flash tank used at the separation step of a supercritical fluid extraction unit. J. Supercrit. Fluids 2008, 43, 447–459. [Google Scholar] [CrossRef]

- Brown Whole Dry Cloves. Available online: https://www.indiamart.com/proddetail/clove-22530339073.html (accessed on 1 November 2020).

- Yellow Eugenol USP Extract Feed Grade. Available online: https://www.indiamart.com/proddetail/eugenol-usp-extract-feed-grade-3760659988.html (accessed on 24 October 2020).

- Natural Aroma Liquid Eugenol Acetate. Available online: https://www.indiamart.com/proddetail/eugenol-acetate-8336104997.html?pos=1&kwd=eugenil+acetate (accessed on 24 October 2020).

- Natural Aroma Liquid Caryophyllene Acetate. Available online: https://www.indiamart.com/proddetail/caryophyllene-acetate-6309471897.html?pos=5&kwd=caryophyllene (accessed on 24 October 2020).

- Alpha Humulene. Available online: https://www.indiamart.com/proddetail/alpha-humulene-6309461933.html?pos=1&kwd=alpha+humolene (accessed on 24 October 2020).

- 10L Seamless Steel Portable CO2 Carbon Dioxide Gas Cylinder. Available online: https://yacylinder.en.made-in-china.com/product/ISbJDRuVgjUp/China-10L-Seamless-Steel-Portable-CO2-Carbon-Dioxide-Gas-Cylinder.html (accessed on 1 November 2020).

- Zabot, G.L.; Moraes, M.N.; Petenate, A.J.; Meireles, M.A.A. Influence of the bed geometry on the kinetics of the extraction of clove bud oil with supercritical CO2. J. Supercrit. Fluids 2014, 93, 56–66. [Google Scholar] [CrossRef]

- Turton, R.; Bailie, R.C.; Whiting, W.B.; Shaeiwitz, J.A.; Bhattacharyya, D. Analysis, Synthesis and Design of Chemical Processes, 4th ed.; Pearson: London, UK, 2012. [Google Scholar]

- Canabarro, N.I.; Veggi, P.C.; Vardanega, R.; Mazutti, M.A.; Ferreira, M.C. Techno-economic evaluation and mathematical modeling of supercritical CO2 extraction from Eugenia uniflora L. leaves. J. Appl. Res. Med. Aromat. Plants 2020, 18, 100261. [Google Scholar]

- Hatami, T.; Johner, J.C.F.; Zabot, G.L.; Meireles, M.A.A. Supercritical fluid extraction assisted by cold pressing from clove buds: Extraction performance, volatile oil composition, and economic evaluation. J. Supercrit. Fluids 2019, 144, 39–47. [Google Scholar] [CrossRef]

- Johner, J.C.F.; Hatami, T.; Carvalho, P.I.N.; Meireles, M.A.A. Impact of Grinding Procedure on the Yield and Quality of the Extract from Clove Buds Using Supercritical Fluid Extraction. Open Food Sci. J. 2018, 10, 1–7. [Google Scholar] [CrossRef][Green Version]

- Ochoa, S.; Durango-Zuleta, M.M.; Osorio-Tobón, J.F. Techno-economic evaluation of the extraction of anthocyanins from purple yam (Dioscorea alata) using ultrasound-assisted extraction and conventional extraction processes. Food Bioprod. Process. 2020, 122, 111–123. [Google Scholar] [CrossRef]

- Viganó, J.; Zabot, G.L.; Martínez, J. Supercritical fluid and pressurized liquid extractions of phytonutrients from passion fruit by-products: Economic evaluation of sequential multi-stage and single-stage processes. J. Supercrit. Fluids 2017, 122, 88–98. [Google Scholar] [CrossRef]

- Vale, A.T.; Felfili, J.M. Dry biomass distribution in a cerrado sensu stricto site in Brazil central. Rev. Árvore 2005, 29, 661–669. [Google Scholar] [CrossRef]

- Yu, D.; Chen, M.; Wei, Y.; Niu, S.; Xue, F. An assessment on co-combustion characteristics of Chinese lignite and eucalyptus bark with TG–MS technique. Powder Technol. 2016, 294, 463–471. [Google Scholar] [CrossRef]

- Al-Hamamre, Z.; Saidan, M.; Hararah, M.; Rawajfeh, K.; Alkhasawneh, H.E.; Al-Shannag, M. Wastes and biomass materials as sustainable-renewable energy resources for Jordan. Renew. Sustain. Energy Rev. 2017, 67, 295–314. [Google Scholar]

- Aldridge, J. UK Wood Pellet Imports Hit Record April High. Available online: https://www.argusmedia.com/en/news/2118063-uk-wood-pellet-imports-hit-record-april-high (accessed on 23 November 2020).

- Harrison, N. UK Wood Pellet Market: Past, Present and Future. Available online: http://biomassmagazine.com/articles/16876/uk-wood-pellet-market-past-present-and-future (accessed on 23 November 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).