Abstract

Crises and disruptive events over new technologies like artificial intelligence, have transformed supply chains management. This literature review proposes a conceptual framework to identify the relevance of digitalization and artificial intelligence for decision-making through S&OP. Selected articles use mathematical models to resolve conflicts between objectives related to value parameters (revenue, cost, cash, asset and sustainability) and optimize planning. Half of the articles integrate computational intelligence, but do not directly address the use of AI in S&OP. One promising stream is the S&OP process as study object where artificial and generative intelligence will play a key role in collective and collaborative intelligence.

1. Introduction

The development of recent crises, such as COVID 19 and the Near East conflict, and disruptive technologies with digitalization and artificial Intelligence (AI) have transformed supply chain management and business in general. This had its effect on the (re)definition of performance and decision-making processes. Many terms have thus succeeded in describing this business posture renewal and found a strategic combination: flexibility, agility, demand-driven, data-driven, real time measure and decision-making and above all resilience. To understand how this renewal affects the management of the supply chain and the performance management, we have conducted a structured review of the scientific literature. Companies try to respond in time to any business opportunity or to react to a risk or hazard in supply chain (SC) operations. This is achievable if the steering process of the desired future, sales and operations planning (S&OP), integrates this agility and resilience. It is in companies’ full interest to define a new set of indicators to reflect the potential of the current business context transformed by the new game changer digitalization combined with artificial intelligence.

Authors of systematic reviews on S&OP have studied an integrative vision of the S&OP process [1], different effects and performances of S&OP practices [2], and the coordination mechanisms allowing for vertical and horizontal integration of plans through the S&OP process [3]. Ref. [4] identifies contextual conditions in relation to the implementation and deployment of the S&OP process. Ref. [5] compares S&OP process practices between process and discrete manufacturing industries. Other authors [6,7,8] have also developed literature reviews about the purpose, deployment and contributions of S&OP. Ref. [9] has worked on empirical and theoretical perspectives in the S&OP process. They identify three main research streams: S&OP and performance, the implementation of the S&OP process and the contextualization of S&OP design. The present study also refers to the theory of contingency: the S&OP purpose and deployment depend largely on the context and business strategy.

These reviews mentioned above explain in different ways the S&OP planning and its contribution to the development of the company’s performance. However, they do not give sufficient information on the management of this performance. Our interest is to study, through the S&OP process, the contribution of the scientific literature to understand the integration of supply chain management in performance management, specifically in ex-ante and ex-post decisions to thrive in the era of digitalization and artificial intelligence within a VUCA world (volatile, uncertain, complex and ambiguous). For that, we have conducted a review of literature from 2015 to date to answer two questions related to the S&OP process:

- What planning and ex-ante decisions (objectives and actions plan) are determined as part of the company’s strategy related to an extended supply chain?

- How does an ex-post evaluation of effectiveness, efficiency and relevance influences SC operating model and business model?

2. Research Framework

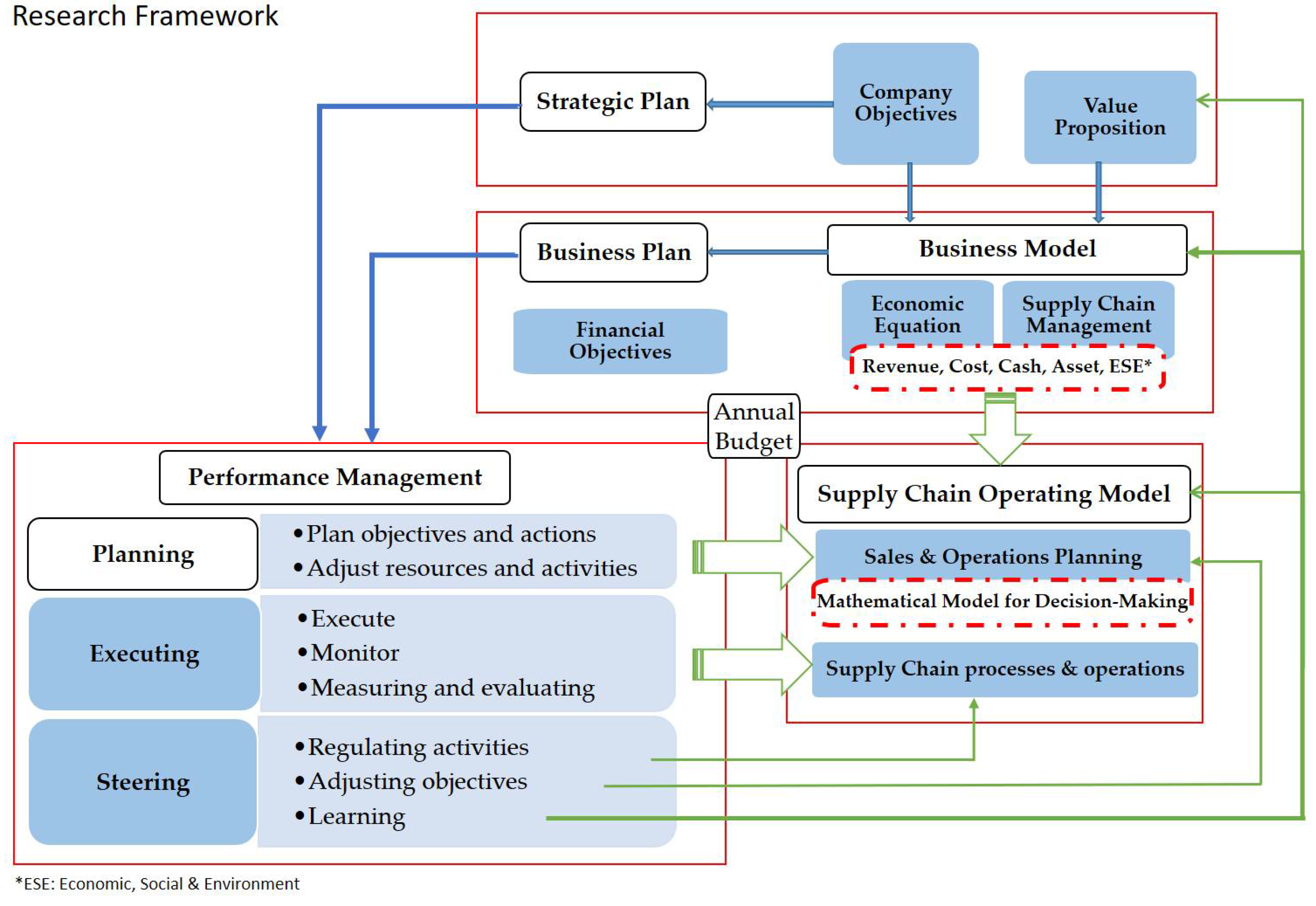

Flow management in the supply chain requires on the one hand, the integration of the internal actors of the company (marketing, finance, operations) as well as the external actors (partnership or transactional relations). On the other hand, leading these actors with different individual objectives towards an overall objective within the supply chain. To lead the alignment of different players we firstly need a performance model that defines and frames the flow that satisfies a supply chain management (SCM)-balanced value. Secondly we need a decision-making model to manage this flow. The link between the two models is the concept of value: the first model defines and identifies the value created, while the second model is built around the «optimized» sharing of this created value.

Not everything is decided in the S&OP process but it is the level where all business decisions are articulated. Activating the learning loop is therefore vital to stimulate the desired growth and sustainability. Learning begins with an assessment of the causes and effects of actions planned and executed in relation to strategic objectives. Then a check of the hypotheses’ accuracy previously defined during planning is conducted. This allows for assessing the relevance of the operating model, hence a business model specifically for route-to-market and value proposition. The proposed conceptual research framework for this literature review is based on the concept of value in steering and decision-making through S&OP (Figure 1).

Figure 1.

Proposed research framework for literature review.

3. Literature Review Methodology

We adapted Denyer’s method for “Systematic Review” in order to perform this scientific research with rigor in a formal way [10]: formulation of research questions (Section 1), location of scientific studies, selection and evaluation of studies (Section 3), analysis and synthesis and finally reporting and use of results (Section 4 and Section 5). According to this method, we develop a conceptual research framework (Section 2) to define a protocol and a codification of the results from the review.

The literature review was carried out using two scientific databases: Science Direct and Scopus. Search strings were built with three main keywords groups. The first group concerns the planning or management activities through the S&OP business process. The second group deals with performance management and decision-making. The third group focuses on SCM with a fourth subgroup, which takes up the following qualifications: «flexibility», «agility» and «resilience» then «digitalization» and «artificial intelligence». To respect the search method in each database, the exploitation of the search chain was relaxed firstly without using the fourth subgroup and secondly by maintaining the exact formulation «Sales and Operations Planning». Our concern is the S&OP process not just the planning. Under these conditions, we found 90 scientific references: 73 in Scopus and 17 in Science Direct.

According to the selection criteria, eleven publications integrate S&OP, SCM, performance management and decision-making supported by a mathematical model (Table 1).

Table 1.

Selection criteria for articles and studies retained for this research.

4. Findings, Analysis, and Discussion

With the current outcome of digitalization and artificial intelligence, companies and large groups seek to first assess their impacts on the entire supply chain. They develop a proof of concept (POC) and use cases to assess how transformation is undergone within both the value creation model (business model) and the delivery model (operating model). We propose using our research framework in an analytical way based on four axes: business context, multi-objective optimization and value parameters, ex-ante planning with S&OP decision-making and ex-post decision from the performance management.

4.1. Answer to the First and Second Question

The five-value equation parameters (revenue, cost, cash, asset and sustainability) are prioritized according to the company’s strategy. In this study we present the prioritization using a combination from one to five noted in the same order above. Zero indicates parameters have to be controlled within limits. The prioritization we propose is based on the content and case studies presented in each article. The ex-ante actions of the S&OP decision-making models in the articles are reported in the decision variables, and after a content analysis combined with previous findings, we determine the ex-post actions and their scopes operating model or business model (Table 2). For the ex-post actions, we consider all articles, regardless of their actual applications in practice.

Table 2.

Ex-Ante and Ex-Post Decisions.

- Abay et al., 2024 [12] (2,3,1,0,0)

This article prioritizes cash, revenue, and then cost. The S&OP process is used to manage the business (Ethiopian Automotive Industry). Authors develop transaction collaboration with customers and suppliers to ensure business growth and use a discrete event simulation for uncertain parameters to identify an extended dynamic multi-objective supply chain. Strategy planning consists of saturating assembly-to-stock capabilities following the forecast and negotiating assembly-to-order with customers and suppliers. Given difficulties in foreign currency availability, negotiation with customers and suppliers is set off as a process in the operating model and collaboration is integrated into the economic/cash equation in the business model. It is clear that macroeconomic conditions influence the formulation of decision-making at the S&OP level.

- Kim et al., 2023 [13] (1,2,0,3,0)

In this article, the goal of the electronic company is to improve supply chain resilience to ensure customer satisfaction and business continuity in case of a crisis. This article prioritizes income then the cost followed by the asset. Authors use a two-stage mixed integer linear programming (MILP) model for a multi-objective decision-making in S&OP. Firstly, they saturate their own facilities through planning under constraints using available stocks to ensure efficiency. Secondly, they evaluate choices between using a single versus several suppliers to satisfy the rest of the demand by optimizing profit and lead-time. Profit is used here instead of income because prices are changing. The prioritization of value parameters is not directly included as such in the model of the S&OP decision-making process. Resilience is based on collaboration thus this ex post decision is brought to the level of the business model in a kind of partnerships or alliance with suppliers.

- Suemitsu et al., 2024 [14] (1,2,0,3,0)

This article prioritizes revenue, cost, and then assets. The Japan Electronic Company deals with distribution planning as a specific S&OP. It faces challenges with the development of e-commerce, which has led to a reduction in delivery batches. The assigned objective is to satisfy all demand. Decision-making is a three-phase model. The first phase is a MILP optimization to define the ideal inventory level and distribution quantities. The second and third phases are simulation optimization phases to define the business rules. The second phase use a MILP model to define the inventory rules at the beginning in relation to the ideal quantities. If the simulation of the distribution in the third phase detects a stock shortage, the ideal quantities are updated and the rules are then recalculated by the model of the second phase. Both phases take place recursively until the stock shortage does not occur in the distribution simulation phase. For the operating model at the distribution stage, inventory management rules are about defining the order-up-to-level for each product while minimizing total cost of transport and storage that vary over time.

- Pereira et al., 2022b [15] (2,3,0,1,0)

This article prioritizes the asset. The income is in the second place then the cost. To manage a supply chain (electric cable manufacturer) with a wide variety of products and maintain the level of lead time, ref. [15] presents an S&OP with a hybrid MTS/MTO strategy planning. In this case, the main function of the multi-objective optimization model is revenue-based. They develop a two-stage decision-making process based first on a mixed-integer programming (MIP) model and on an elaborated matrix with the different possible MTS and MTO strategies. They use ε-constraints method to define different Pareto-optimal solutions with the management mix choice in a hybrid MTS/MTO and tradeoff between cost minimization and customer service level. The prioritization of value parameters influences the configuration of the supply chain design through the choice of the strategy planning. Therefore, strategy planning is set, at the business model level, as a key process.

- Albrecht & Steinrücke, 2020 [16] (1,2,0,3,0)

In this article, S&OP decision-making is a planning–scheduling process to make a sales plan over the course of a few days for a global photovoltaic group in Germany. This article prioritizes income, cost, and then the asset. Authors take advantage of the “healthy” complexity of the multiple-products: possible use of two alternative production processes, products modularity, and a market for semi-finished products. This flexibility is critical due to the challenging agreements with resellers in regard of continuous decline in sales prices.

Authors develop a two-stage multi-objective MILP model for S&OP, covering the entire extended supply chain. They used a multi-step heuristic with relax-and-fix decomposition methods, and they chose the satisfied result to last a half-day computation. The steering concerned the extended supply chain with various players. Therefore, the S&OP becomes key process in the business model.

- Aiassi et al., 2020 and Lim et al., 2017 [17,18] (1,2,3,0,0)

These articles study similar situations and prioritize revenue, cost, and then cash. In [18], the S&OP is based on coordination and responsiveness to satisfy consumers under industrial constraints. The authors of [17] consider, in addition, unreliable suppliers. They evaluate two stock management strategies: production flexibility and safety stock. Then develop a simulation–optimization approach with a built-to-order strategy–planning process to find a balanced compromise between the cost of logistics and the level of customer experience. They use a multi-objective simulation optimization method with ε-constraints. The authors of [17,18], faced with an uncertain environment and volatile demand, defined dynamic governance rules, in particular inventory management versus desired flexibility at the level of the operating model.

- Taşkın et al., 2015 [11] (1,2,0,3,0)

This article prioritizes income, cost, and then assets. To satisfy its customers, the supply chain offers a wide variety of products with different configurations. The strategic rule is to satisfy all orders. The objective function is based on cost because of “Price based competition in the market”. Decision-making is a mathematical programming model based on MILP where users can interact with the model and relax some constraints to resolve infeasibility. The designed mathematical model supports the specific S&OP process integrated with Vestel Electronic Company’s ERP (Enterprise Resource Planning). In this case, the S&OP process is a business model’s key process.

- Nemati & Alavidoost, 2019 and Nemati et al., 2017 [19,20] (2,1,0,3,0)

These articles prioritize the cost, the income, and then the asset. In the Dairy Industry, multi-site supply chain structures with are very developed, which is crucial to monitor the end-to-end cost. Demand variety makes the supply chain even more complex with a wide range of product families. In this case, there are two main functions of the multi-objective optimization model. A function that aims to minimize the overall cost of the supply chain from supply to delivery. Then a second objective function to maximize the customer satisfaction. Hence, the maximum possible income. The resolution approach in the S&OP decision-making process depends on the complexity of the end-to-end supply chain structure.

In [20], the authors investigate the benefits of using the S&OP process in a Dairy Company in Iran. For this, they develop three MIP models for three S&OP configurations covering the scope of this process. In [19], the authors use an interactive fuzzy programming approach to develop three Fuzzy MILP models for three S&OP configurations. Both studies demonstrate the superiority of S&OP–integrated model planning over all others. S&OP is a key process for setting the supply chain configuration that has an economic advantage.

- Anand Jayakumar et al., 2016 [21] (2,1,3,0,0)

This article prioritizes cost, followed by income and cash. In this case study, the SME for gardening tools and items has restricted assets, and all its operational capacity depends on the human resources (HR) engaged in the production campaigns. The aggregated demand is established with the resellers, which gives it more reliability. A two-level collaboration allows abroad activities and generates revenue with profitability. The objective function is based on profit optimization because selling prices fluctuate over the planning period. A simple and insightful S&OP, with promotional and discount scenarios to prepare the entire sales season, uses efficient optimization tools like LINGO for planning–scheduling. This business collaboration is a critical key process in the business model.

4.2. Discussion and Synthesis

4.2.1. The First Axis: Business and Context Study

The article-related sectors are, respectively, automotive (three articles), electronics (four articles), electrical (one article), tools & equipment (one article), and fast-moving consumer goods (FMCGs) (two articles). All these sectors use the S&OP process as a business decision-making process not only to balance supply and demand but also to align the SCM with the strategy. Referring to the Industry clock-speed (IC) [22], represented by product innovation and life cycle, six articles in our research base are in the fast IC (6 to 24 months), and the other five articles are in the medium IC (3 to 15 years). Solemnly, no article is in the slow IC (over 10 years). Companies seek to create value by prioritizing product innovation, customer satisfaction, or operations efficiency as a backbone strategy [23]. That sets the tone for digitalization and AI solutions. Digitalization is essential for business connectivity with customers, suppliers, and environment. This digital connectivity has to be articulated with the industry clock-speed. This is directly stated only in the electronics articles.

4.2.2. The Second Axis: Value Parameters Trade Offs

Value parameters tradeoffs are a mandatory business choice [23]. This is to clarify the value equation for creating and sharing value. In the 11 articles, revenue and cost are represented in all combinations; assets and cash are represented, respectively, seven and four times. Six articles give priority to revenue while three articles prioritize the cost, and a single article prioritizes cash. The asset is present in seven combinations but six times in position 3. Just one article mentions sustainability in the decision-making process [13]. Different value parameters’ prioritizations involves different value models to assess performance. Hence, there are specific learning developments (ex-post decisions) for each case in the articles.

Even if a project is relevant, effective and efficient, top-management is concerned with profitability. Thus, it is essential to link project value to the company’s strategy through the five value parameters. The research framework with the tow loops for effectiveness, with efficiency and value creation is an enabler for the exploration and exploitation of the potential of the new game changer. Incorporating digitalization and artificial intelligence in S&OP or other processes needs a consistent budget (e.g., IoT technology, end-to-end visibility, computing and storage capacity, data and cloud service, etc.); the Return on Investment (ROI) is required. More importantly, once the link is identified we have the ability to track the value created by the project versus the development of the business and the strategy. We avoid relying on the success of a solution for an old business situation.

4.2.3. The Third Axis: Decision-Making Model

In decision-making, the resolution approach is adapted according to the availability of data versus modeling. Mixed integer linear programming (MILP) is used in seven out of eleven articles as the main optimization approach. The simulation is used once. However, it is more successful when coupled with an optimization model to formulate the simulation-optimization approach in three articles. In these articles, optimization methods use mathematical planning models but five studies have directly used computational intelligence.

In the decision-making model, the value parameters are objectives and constraints to be respected (e.g., satisfaction of all demand to generate income), decision variables to be defined (e.g., management rules involving the minimum cost), or else the ex-ante execution with respect to strategic prioritization (e.g., in first–use company’s structures). Based on the analysis of all these eleven articles, we find that the prioritization of the value parameters and supply chain complexity influences the S&OP decision-making model. The structure and configuration choice of the mathematical solving approach for multi-objective optimization depends on the company’s operating need and decision maker preferences versus business context and strategy.

To identify the use of artificial intelligence in S&OP process steps we have to restrict searches to «areas related to S&OP activities» and «SCM planning». The authors of [24,25] specify, respectively, that machine learning (ML) is used in S&OP activities and in the SCM. In addition, the artificial neural network (ANN) is the most used technique for supervised learning. The ML is used in demand and sales forecasting, production planning, and then inventory management. Generative artificial intelligence (Gen AI) is also promising for S&OP process development [26]. Above all, it allows for using unstructured data and facilitates access and interactivity with different interfaces.

4.2.4. The Fourth Axis: Performance Management

The references studied focus on the internal impacts of operations and, in a few cases, on the external ones through the value chain. Almost all articles related the benefits of optimized planning to cost and customer satisfaction. Production and distribution planning, quantity and lead time are the most important ex-ante decisions followed closely by the stock level. The backlog is a decision to ensure the smoothing of production, but it is mainly used to accept latest orders instead of rejecting them to avoid customer dissatisfaction.

Ten out of eleven articles do not refer to operating or business models. No articles address the consequences of decisions arising after executing planning, namely, regulation and feedback on operating and business models. The link between the business model and/or the operating model and the choice of the optimization method is essential to resolve conflicts between value parameters. “AI is often too logical to robustly solve problems that have not been well-posed” [27]. To prevent such a misadventure, our conceptual framework, the basis of this research, constitutes a reflective diagram enabling analytical thinking. It is an original articulated way to link the choice of digitalization projects and artificial intelligence solutions and other projects with the company’s performance according to its strategy on time scales. Moreover, it allows for tracking levers for performance and value created through business and operating models.

4.2.5. S&OP: Digitalization and AI to Leverage Collective Intelligence

During the S&OP process phase meetings, various actors decide on the numbers, scenarios, and action protocols to achieve an integrated business reconciliation. These decisions are made in relation to options subject to events in different modalities (e.g., market restriction: low, moderate, strong). Therefore, decision-making needs collective intelligence. In the research chain of scientific articles, covered by this literature review, no article deals with artificial intelligence as an enabler of S&OP process deployment. It neither facilitates its progress as a process nor addresses conflicting actors’ perceptions in order to bring them close to the “one set numbers”. In addition, no article extends to the value network and competitors. To fill this gap, it is essential to develop an artificial intelligence-based model for collective intelligence in S&OP over the extended SC.

One of the main principles of SCM is collaboration. When developed with different value network players, it allows companies to reconfigure SC according to an event or a new business situation. Digitalization for sensing coupled with AI for rationality and optimization, will enable choosing, between alternative objectives within constraints and with respect to value parameters prioritization. Acquiring this ability to choose on time is a requirement for agility and resilience. In the S&OP decision-making process, it consists of an interactive approach with “HR Inside” to resolve multi-objective optimization planning and balance supply and demand considering partners and competitors. Our research framework can provide consistency to decision-maker preferences (e.g., classification of objectives) information and inputs. Otherwise, HR interaction styles may lead to a weak solution. As a lever, AI allows for variance reduction in the supply chain subsystem. It enhances prediction’ accuracy in demand forecast, supply chain operations’ reliability, and suppliers’ capability. As an enabler, computational intelligence worthily combine searching and learning to develop the Pareto optimal solutions set. Through the four articulated axes in the research framework, collaboration, agility, and resilience can be intelligible. Then, with the concept of value we can express them in the mathematical model using value parameter trade-offs.

5. Conclusions and Future Research

This scientific literature review aims to help identify and indicate the relevant link, through the S&OP decision-making process, between business management and digitalization projects with artificial intelligence solutions. They are project lever and enabler. Analytical reasoning is needed to link mathematical models with the five value parameters prioritized on time scales according to the company’s strategy. The conceptual framework offers a foundation to integrate, at the same time, the business context and strategy, value parameters tradeoffs, multi-objective decision-making model and performance management. One can use it for different value assessments, specifically to quantify the ROI and track the impact and the relevance of a new activity or investment. This is crucial for projects that intend to develop collaboration and resilience within value creation.

Articles do not directly address the use of artificial intelligence in the S&OP process, but practically half of these articles use computational intelligence. Simulation–optimization models that have AI as a driver and integrate the interactions of actors and the environment will represent the most interesting direction for future research. The way of combining approaches is promising. Based on simulation–optimization models and multi-agent systems in particular, it will be possible to (re)configure the decision-making model. Digitalization with AI will enable us to develop in time, “design, plan & operate”, which is a requirement for agility and resilience. Certainly, this study has limitations. The one that is more restrictive is the small number of articles forming the research base on the use of digitization and artificial intelligence in the S&OP process. The construction of other research chains through the articulation of the components of the proposed research framework is a research perspective. A promising opportunity is the study of the sales & operations planning process where digitalization and artificial intelligence play a key role in collective and collaborative intelligence.

Author Contributions

Conceptualization, R.O.; methodology, R.O.; validation, R.O.; formal analysis, R.O.; investigation, R.O.; writing—original draft preparation, R.O.; writing—review and editing, N.E.H.; visualization, R.O.; supervision, N.E.H.; project administration, R.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Tavares Thomé, A.M.; Scavarda, L.F.; Fernandez, N.S.; Scavarda, A.J. Sales and operations planning: A research synthesis. Int. J. Prod. Econ. 2012, 138, 1–13. [Google Scholar] [CrossRef]

- Thomé, A.M.T.; Sousa, R.S.; Scavarda Do Carmo, L.F.R.R. The impact of sales and operations planning practices on manufacturing operational performance. Int. J. Prod. Res. 2014, 52, 2108–2121. [Google Scholar] [CrossRef]

- Tuomikangas, N.; Kaipia, R. A coordination framework for sales and operations planning (S&OP): Synthesis from the literature. Int. J. Prod. Econ. 2014, 154, 243–262. [Google Scholar] [CrossRef]

- Kristensen, J.; Jonsson, P. Context-based sales and operations planning (S&OP) research: A literature review and future agenda. IJPDLM 2018, 48, 19–46. [Google Scholar] [CrossRef]

- Noroozi, S.; Wikner, J. Sales and operations planning in the process industry: A literature review. Int. J. Prod. Econ. 2017, 188, 139–155. [Google Scholar] [CrossRef]

- Nabil, L.; El Barkany, A.; El Khalfi, A. Sales and Operations Planning (S&OP) Concepts and Models under Constraints: Literature Review. JERA 2018, 34, 171–188. [Google Scholar] [CrossRef]

- Goh, S.H.; Eldridge, S. Sales and Operations Planning: The effect of coordination mechanisms on supply chain performance. Int. J. Prod. Econ. 2019, 214, 80–94. [Google Scholar] [CrossRef]

- Ni, D.; Xiao, Z.; Lim, M.K. A systematic review of the research trends of machine learning in supply chain management. Int. J. Mach. Learn. Cyber. 2020, 11, 1463–1482. [Google Scholar] [CrossRef]

- Kreuter, T.; Scavarda, L.F.; Thomé, A.M.T.; Hellingrath, B.; Seeling, M.X. Empirical and theoretical perspectives in sales and operations planning. Rev. Manag. Sci. 2022, 16, 319–354. [Google Scholar] [CrossRef]

- Denyer, D.; Tranfield, D. Producing a systematic review. In The Sage Handbook of Organizational Research Methods; Sage Publications Ltd.: Thousand Oaks, CA, USA, 2009; pp. 671–689. ISBN 978-1-4129-3118-2. [Google Scholar]

- Taşkın, Z.C.; Ağralı, S.; Ünal, A.T.; Belada, V.; Gökten-Yılmaz, F. Mathematical Programming-Based Sales and Operations Planning at Vestel Electronics. Interfaces 2015, 45, 325–340. [Google Scholar] [CrossRef]

- Abay, Y.; Kaihara, T.; Kokuryo, D. A Discrete-Event Simulation Study of Multi-Objective Sales and Operation Planning Under Demand Uncertainty: A Case of the Ethiopian Automotive Industry. IJAT 2024, 18, 135–145. [Google Scholar] [CrossRef]

- Kim, C.-K.; Lee, C.; Kim, D.; Cha, H.; Cheong, T. Enhancing Supply Chain Efficiency: A Two-Stage Model for Evaluating Multiple Sourcing and Extra Procurement Strategy Optimization. Sustainability 2023, 15, 16122. [Google Scholar] [CrossRef]

- Suemitsu, I.; Miyashita, N.; Hosoda, J.; Shimazu, Y.; Nishikawa, T.; Izui, K. Integration of sales, inventory, and transportation resource planning by dynamic-demand joint replenishment problem with time-varying costs. Comput. Ind. Eng. 2024, 188, 109922. [Google Scholar] [CrossRef]

- Pereira, D.F.; Oliveira, J.F.; Carravilla, M.A. Merging make-to-stock/make-to-order decisions into sales and operations planning: A multi-objective approach. Omega 2022, 107, 102561. [Google Scholar] [CrossRef]

- Albrecht, W.; Steinrücke, M. Continuous-time scheduling of production, distribution and sales in photovoltaic supply chains with declining prices. Flex. Serv. Manuf. J. 2020, 32, 629–667. [Google Scholar] [CrossRef]

- Aiassi, R.; Sajadi, S.M.; Hadji-Molana, S.M.; Zamani-Babgohari, A. Designing a stochastic multi-objective simulation-based optimization model for sales and operations planning in built-to-order environment with uncertain distant outsourcing. Simul. Model. Pract. Theory 2020, 104, 102103. [Google Scholar] [CrossRef]

- Lim, L.L.; Alpan, G.; Penz, B. A simulation-optimization approach for sales and operations planning in build-to-order industries with distant sourcing: Focus on the automotive industry. Comput. Ind. Eng. 2017, 112, 469–482. [Google Scholar] [CrossRef]

- Nemati, Y.; Alavidoost, M.H. A fuzzy bi-objective MILP approach to integrate sales, production, distribution and procurement planning in a FMCG supply chain. Soft Comput. 2019, 23, 4871–4890. [Google Scholar] [CrossRef]

- Nemati, Y.; Madhoshi, M.; Ghadikolaei, A.S. The effect of Sales and Operations Planning (S&OP) on supply chain’s total performance: A case study in an Iranian dairy company. Comput. Chem. Eng. 2017, 104, 323–338. [Google Scholar] [CrossRef]

- Anand Jayakumar, A.; Krishnaraj, C.; Kasthuri Raj, S.R. LINGO based revenue maximization using aggregate planning. ARPN J. Eng. Appl. Sci. 2016, 11, 6075–6081. [Google Scholar]

- Fine, C.H. Clockspeed: Winning Industry Control in the Age of Temporary Advantage; Perseus Books: Reading, MA, USA, 1998; ISBN 978-0-7382-0153-5. [Google Scholar]

- Treacy, M.; Wiersema, F.; Le Séac’h, M. L’exigence du choix: Trois disciplines de valeur pour dominer ses marchés. In Marketing, 2nd ed.; Village Mondial: Paris, France, 2002; ISBN 978-2-84211-171-7. [Google Scholar]

- Ohlson, N.-E.; Riveiro, M.; Bäckstrand, J. Identification of Tasks to Be Supported by Machine Learning to Reduce Sales & Operations Planning Challenges in an Engineer-to-Order Context; Ng, A.H.C., Syberfeldt, D., Högberg, D., Holm, M., Eds.; IOS Press: Amsterdam, The Netherlands, 2022; pp. 39–49. [Google Scholar]

- Mahraz, M.; Benabbou, L.; Berrado, A. Machine Learning in Supply Chain Management: A Systematic Literature Review. IJSOM 2022, 9, 398–416. [Google Scholar] [CrossRef]

- Jackson, I.; Ivanov, D.; Dolgui, A.; Namdar, J. Generative artificial intelligence in supply chain and operations management: A capability-based fra. Int. J. Prod. Res. 2024, 62, 1–26. [Google Scholar] [CrossRef]

- Hanne, T.; Dornberger, R. Computational Intelligence in Logistics and Supply Chain Management; International Series in Operations Research & Management Science; Springer International Publishing: Cham, Switzerland, 2017; Volume 244, ISBN 978-3-319-40720-3. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).