1. Introduction

Applications of EVT in the analysis of risky events are diverse, such as finance, insurance, material resistance, quality control, telecommunications, sports, environment, hydrology, biology, and seismology, among others.

The occurrence of extreme observations can have serious consequences, e.g., high water levels in floods, a vast area burned in wildfires, and losses in stock indexes in financial market crashes, among others. Sometimes, the occurrence of extreme values for one variable can contaminate other variables. Typical examples are the financial markets where the fall of one index leads to falls in others as well. Correlation is a measure of dependence between two variables widely used in applications. Although it works well to measure the association between two variables in the central part of the data, it fails to assess dependence within the tails. For instance, in a bivariate Normal with correlation

, if we are far enough in the tail, extreme values seem to occur independently at each margin, regardless of how high a correlation we choose [

1].

Extremal dependence in a random pair

is typically based on the chance for obtaining large values of both variables. It is helpful to remove the influence of marginal aspects by transforming the marginals to a common distribution function (df), e.g.,

and

, both of which are standard uniform where

and

are the marginal df of

X and

Y, respectively, and considered continuous. Therefore, differences in distributions are solely due to dependence aspects. As

and

are on a common scale, events of the form

and

, for large values of

u, are equally extreme events for each variable, both with their probability approaching zero as

. The tail dependence coefficient (TDC) measures the conditional probability of one variable being extreme, given that the other is extreme too:

Observe that the exact independence corresponds to

, since

, as

, whilst perfect dependence means

. Indeed, we say that

X and

Y are tail independent if

, and tail dependent if

. A positive

means a strong dependence persisting to the limit. A null

comprehends exact independence, but also a weak dependence that gradually vanishes as the limit is approached. Such residual dependency can be captured through the rate of convergence of

towards zero; more precisely, through the asymptotic tail independent coefficient of Ledford and Tawn

[

2], given by

where

is a slowly varying function, i.e.,

, as

,

[

3]. If

= 1 and

,

, the random variables (rvs) are asymptotically dependent. On the other hand, if

or

=1 and

, then

and the rv are asymptotically independent with degree

. The case

means near-independence; in particular, exact independence if

. We can also state that

corresponds to a positive association, in the sense that the probability of both rvs exceeding

u occurs more frequently than under exact independence, whereas in

, the probability of both rvs exceeding

u occur less frequently than under exact independence and, thus, the rvs are negatively associated. Inference on

allows us to distinguish the type of tail (in)dependence:

means tail dependence, whilst

means the presence of a residual tail dependence. According to [

2], assuming independence and ignoring

can lead to misspecified joint extremes estimations, while considering the dependence between rvs, when a residual dependence in fact occurs, may result in an overestimation.

Observe that

where

and

are standard Pareto. Considering rv

and

, by (

1) we can state that

and we say that

T has a regularly varying tail with index

. In EVT, this means that

corresponds to the tail index of

T, the primary measure in EVT inference. There are many estimation methods in the literature for the tail index. For a survey, see, e.g., [

4]. A well-known tail index estimator is the Hill [

5]. Given a sample

, consider

where

,

, are the rvs exceeding the threshold

. In the Hill estimator,

corresponds to the

up order statistics. In EVT, we can also estimate the tail index through a modeling approach. A common technique is to consider the exceedance values above a high threshold of data, and apply a Generalized Pareto Distribution (GPD) according to the Pickands–Balkema–De Haan theorem [

6,

7], known as the

Peaks Over Threshold (POT) approach (see, e.g., [

4] for more details). Here, we apply the POT method on rv

T in order to estimate

, and denote this estimator as

.

Based on (

1), we can rewrite

and, thus, we can estimate

by taking the empirical counterpart of (

3), which we denote as

. More precisely,

Note that, in practice, the margins

and

are usually unknown, and we can estimate by the empirical df. This is the approach followed for estimators

,

and

. Observe also that the standard uniform rvs,

and

,

, have

r-order statistics Beta(

) distributed. Thus, replacing the marginal empirical df in (

4) with Beta(

) df, we have the fourth estimator, which we denote as

. Further details on Beta marginals estimation can be seen in [

8].

In

Section 2, we analyze the referred estimators through simulation and compare their performance. An application to real data illustrates the methods in

Section 3.

2. Estimation of : A Simulation Study

In our study, we consider different models with different values of , as follows, where we use copula notation, :

Bivariate Ali–Mikhail–Haq distribution, where

, with

(

) (see, e.g., [

9]), denoted AMH;

Bivariate Frank distribution, where

, with

(

) (see, e.g., [

9]), denoted Frank;

Bivariate Normal distribution with

(

) (see, e.g., [

10]), denoted BNormal;

Bivariate extreme value distribution with a Logistic dependence function,

,

, with

(

) (see, e.g., [

2]), denoted Logistic.

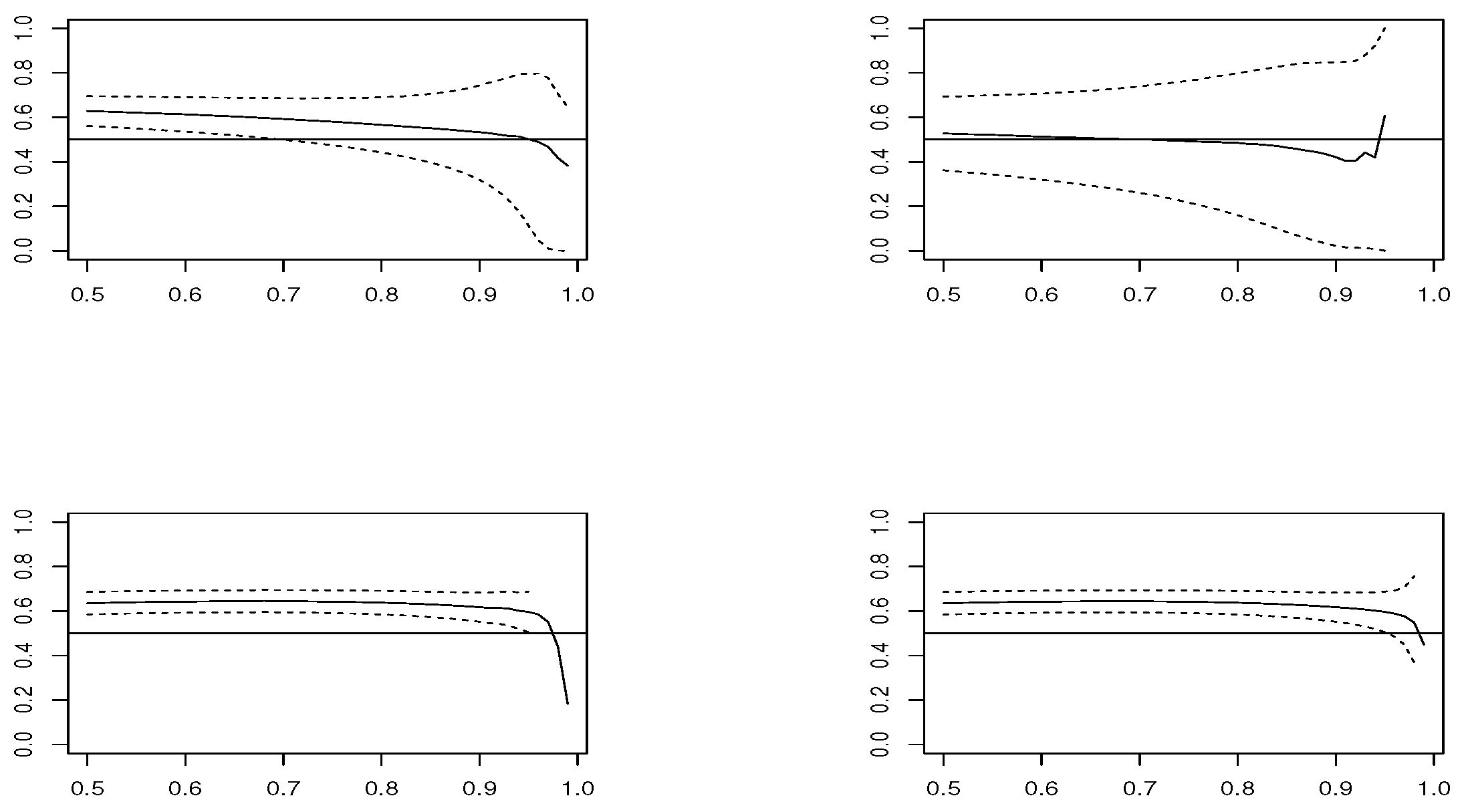

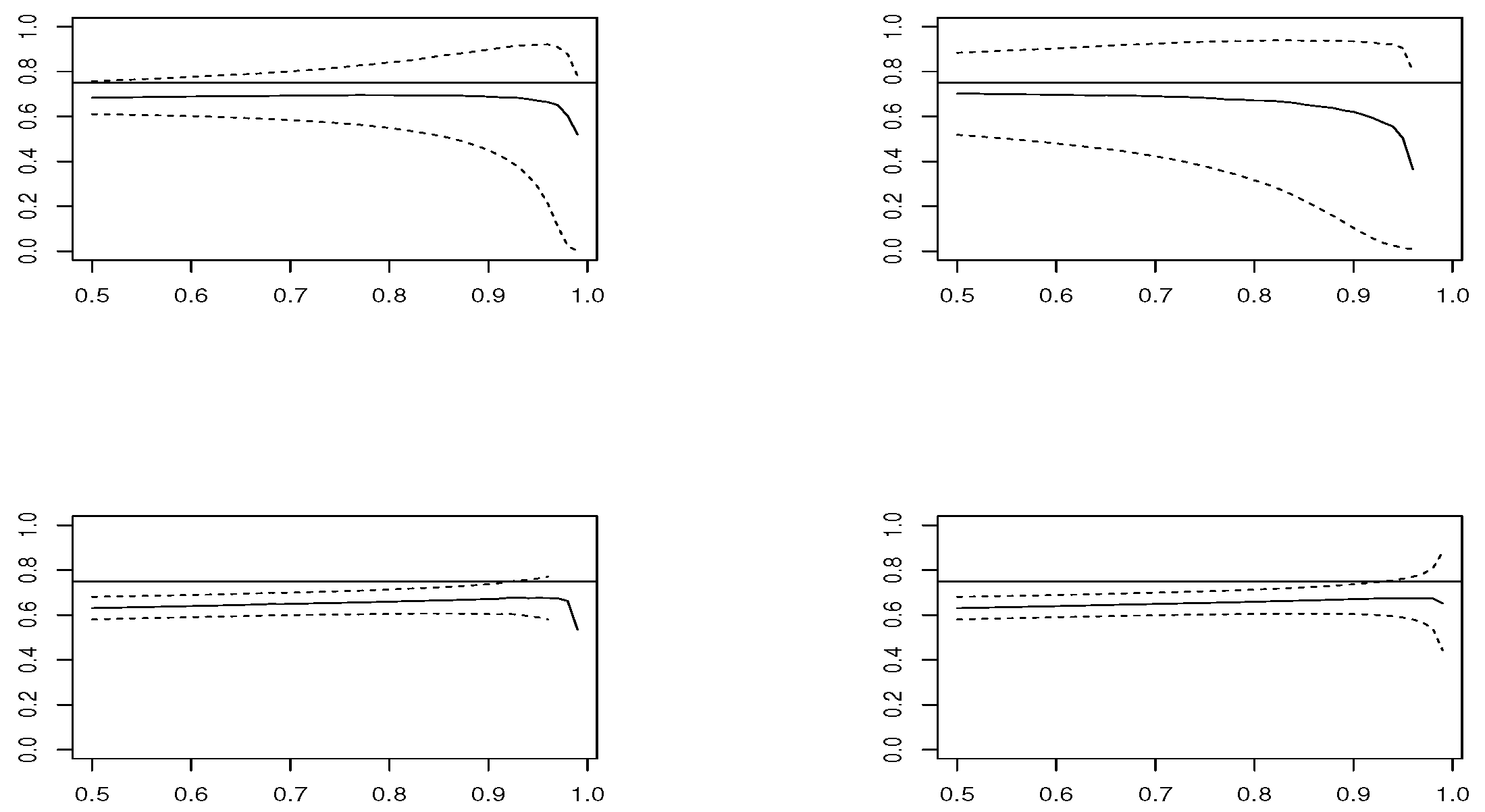

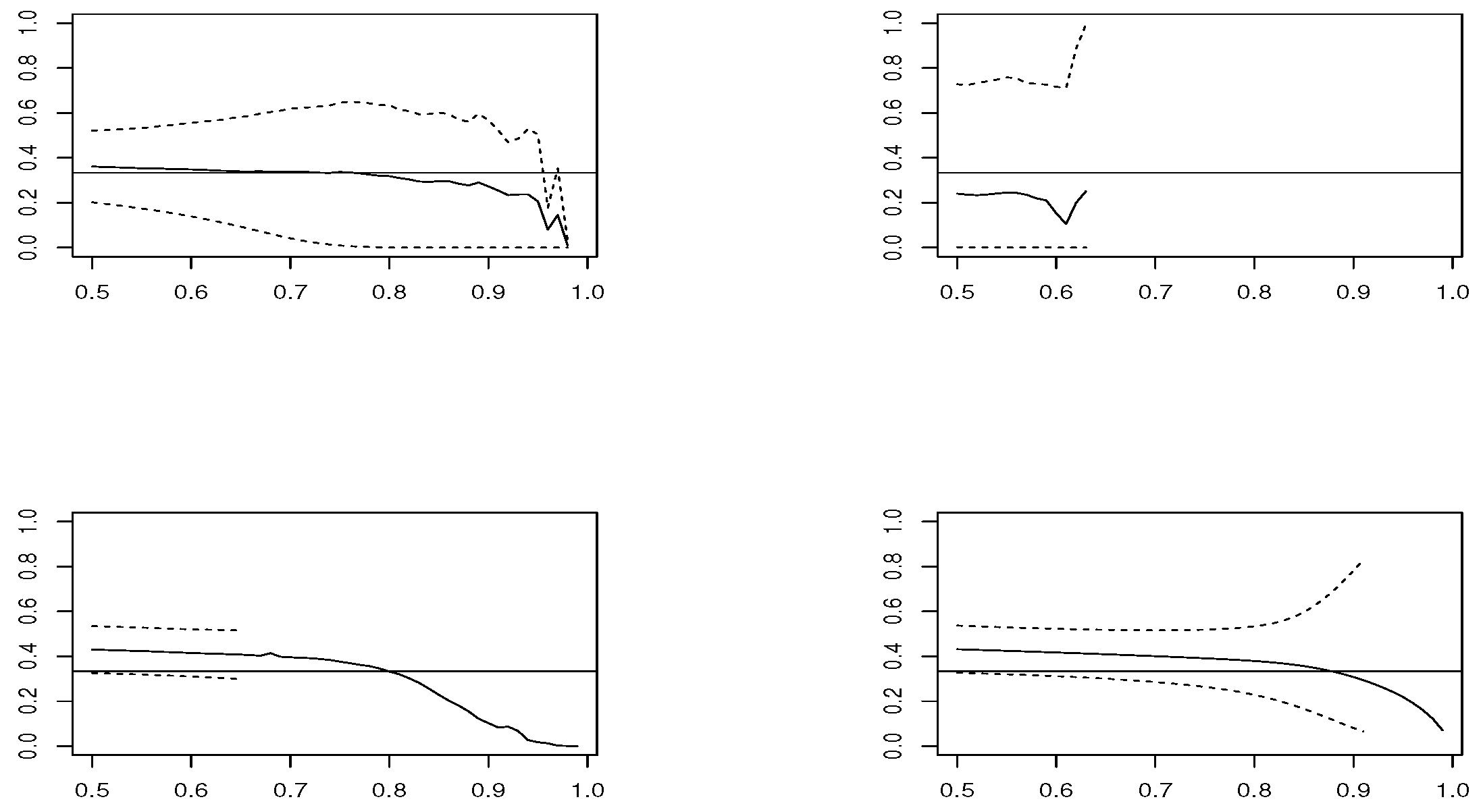

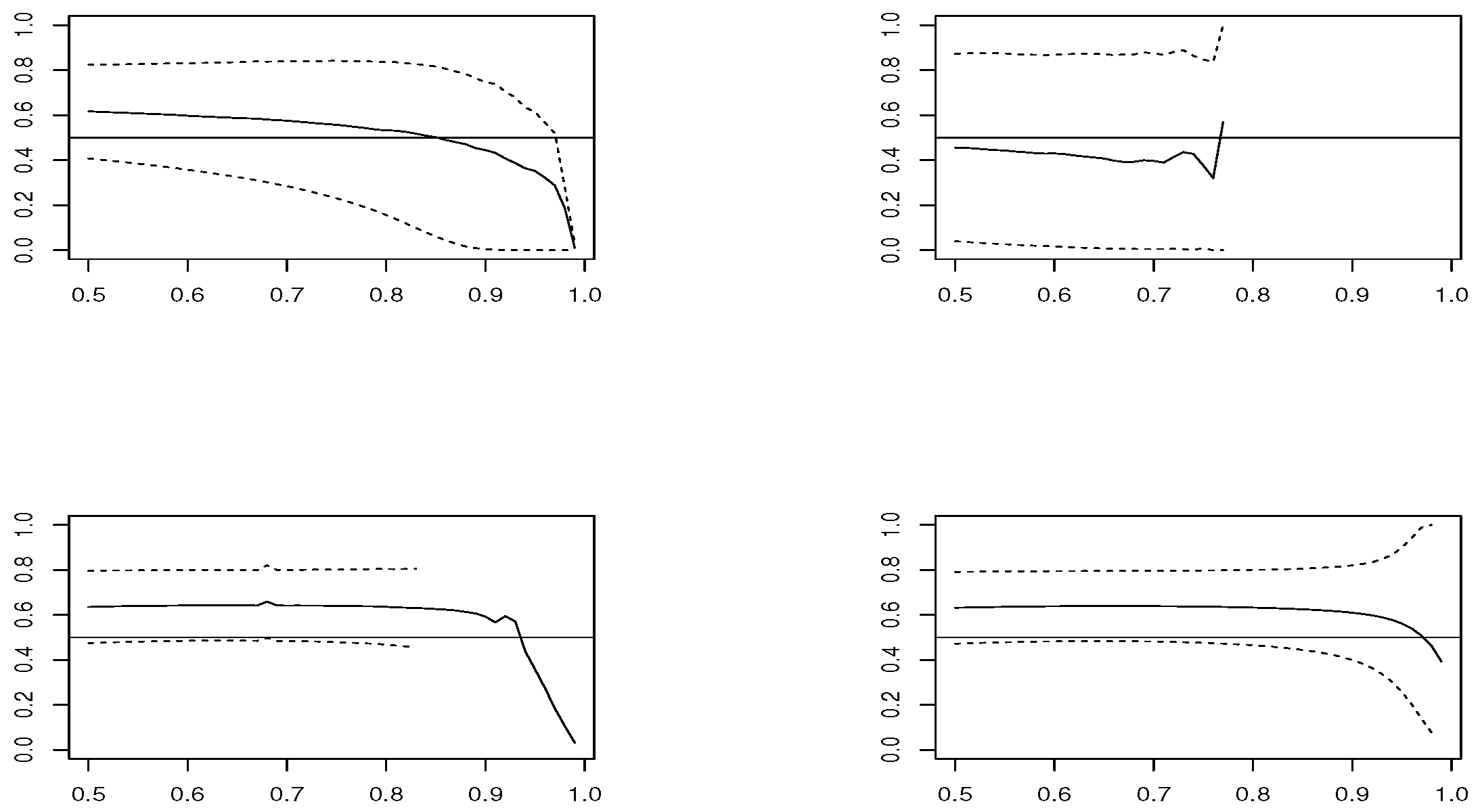

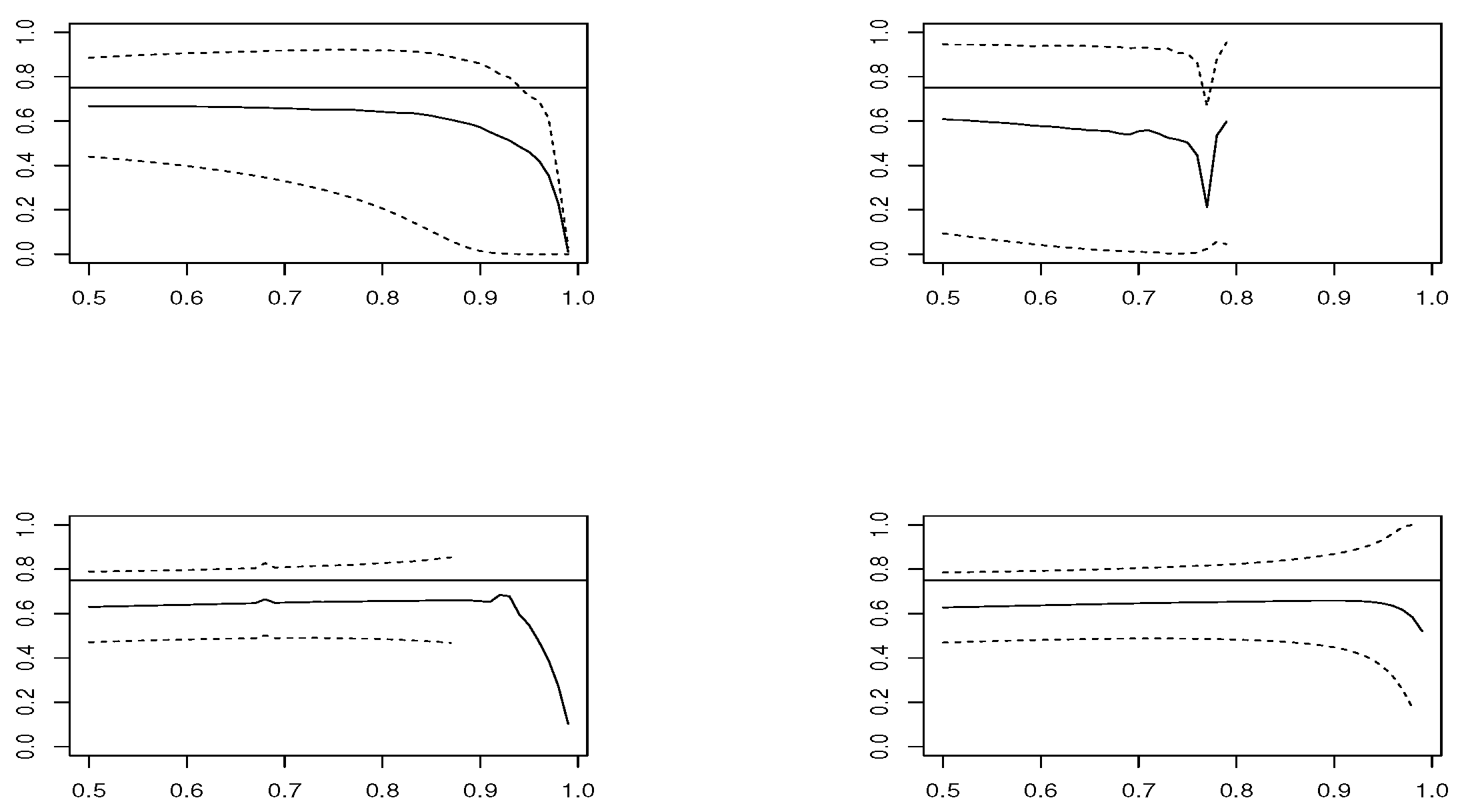

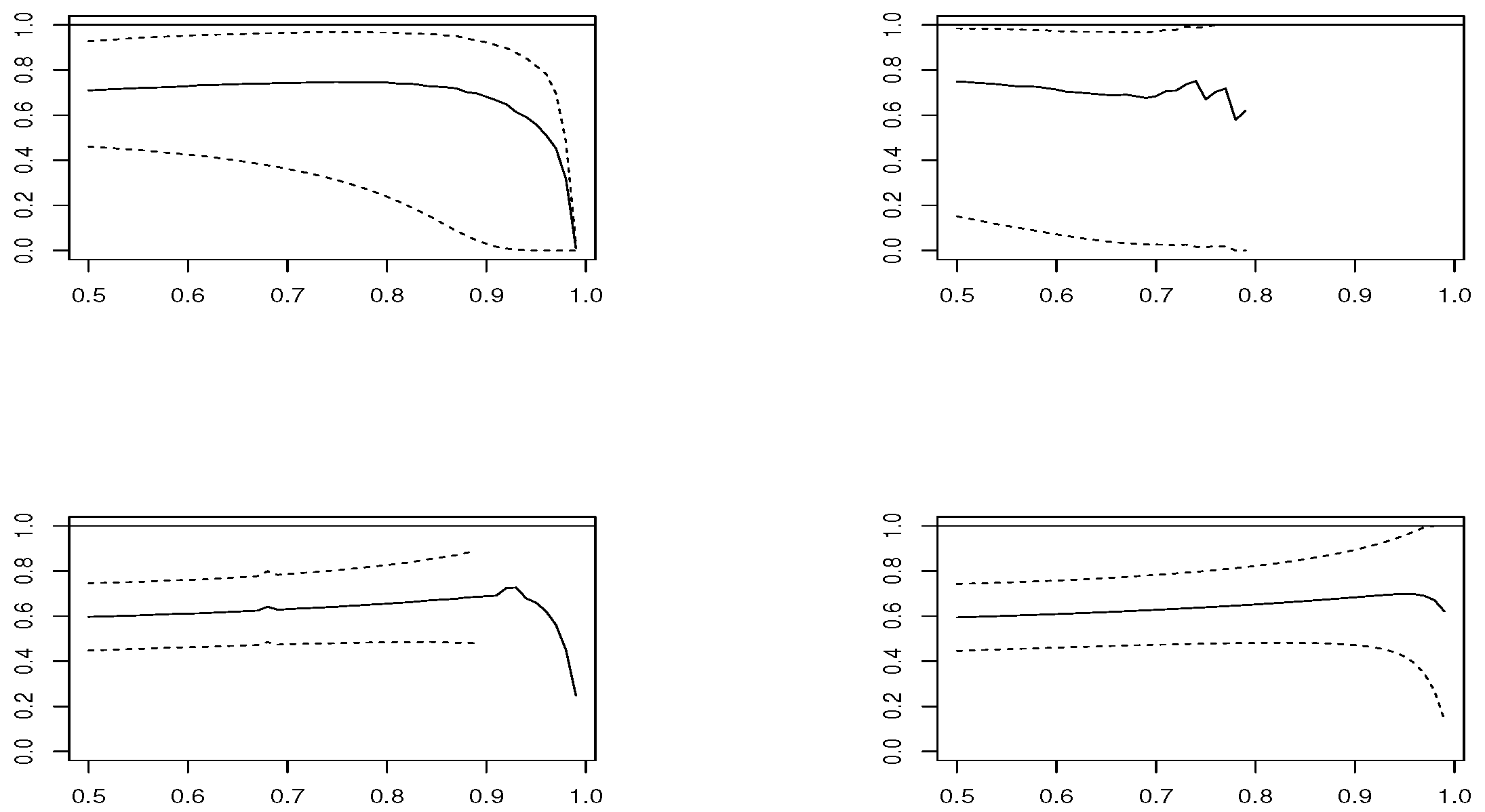

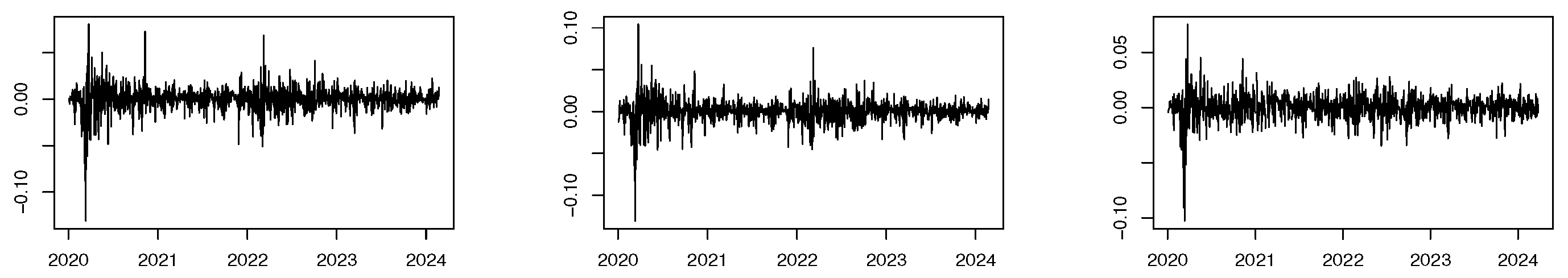

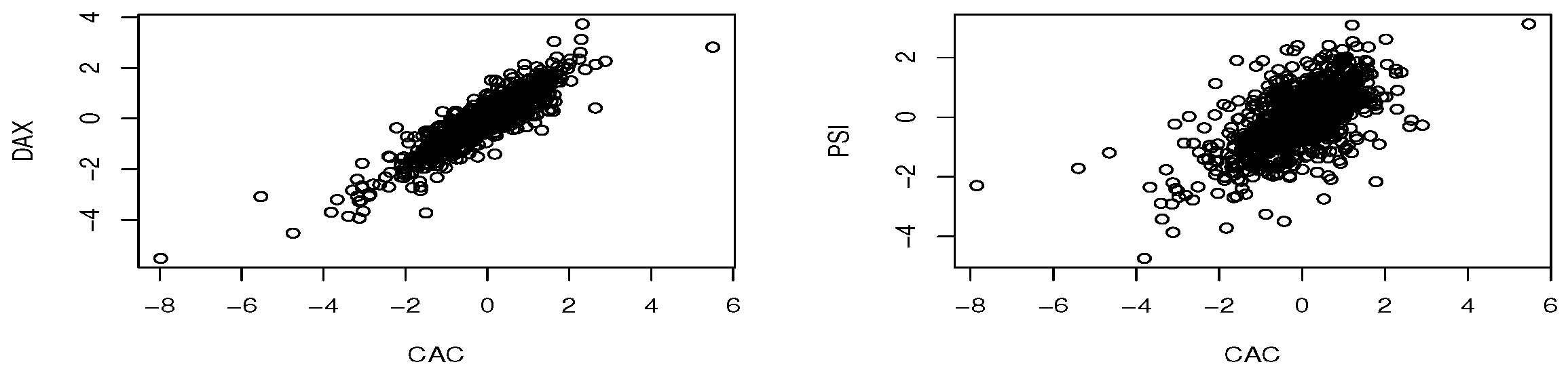

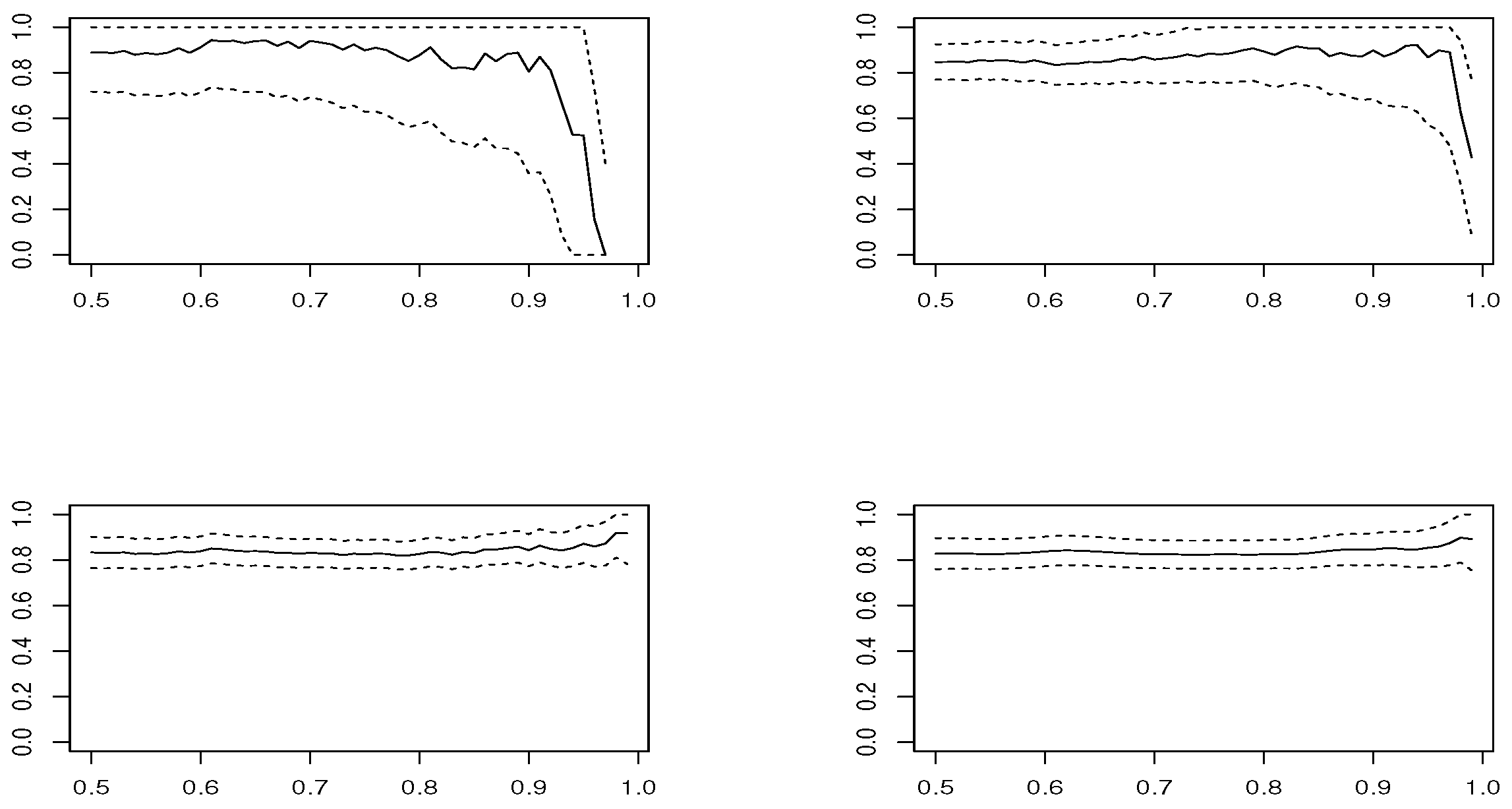

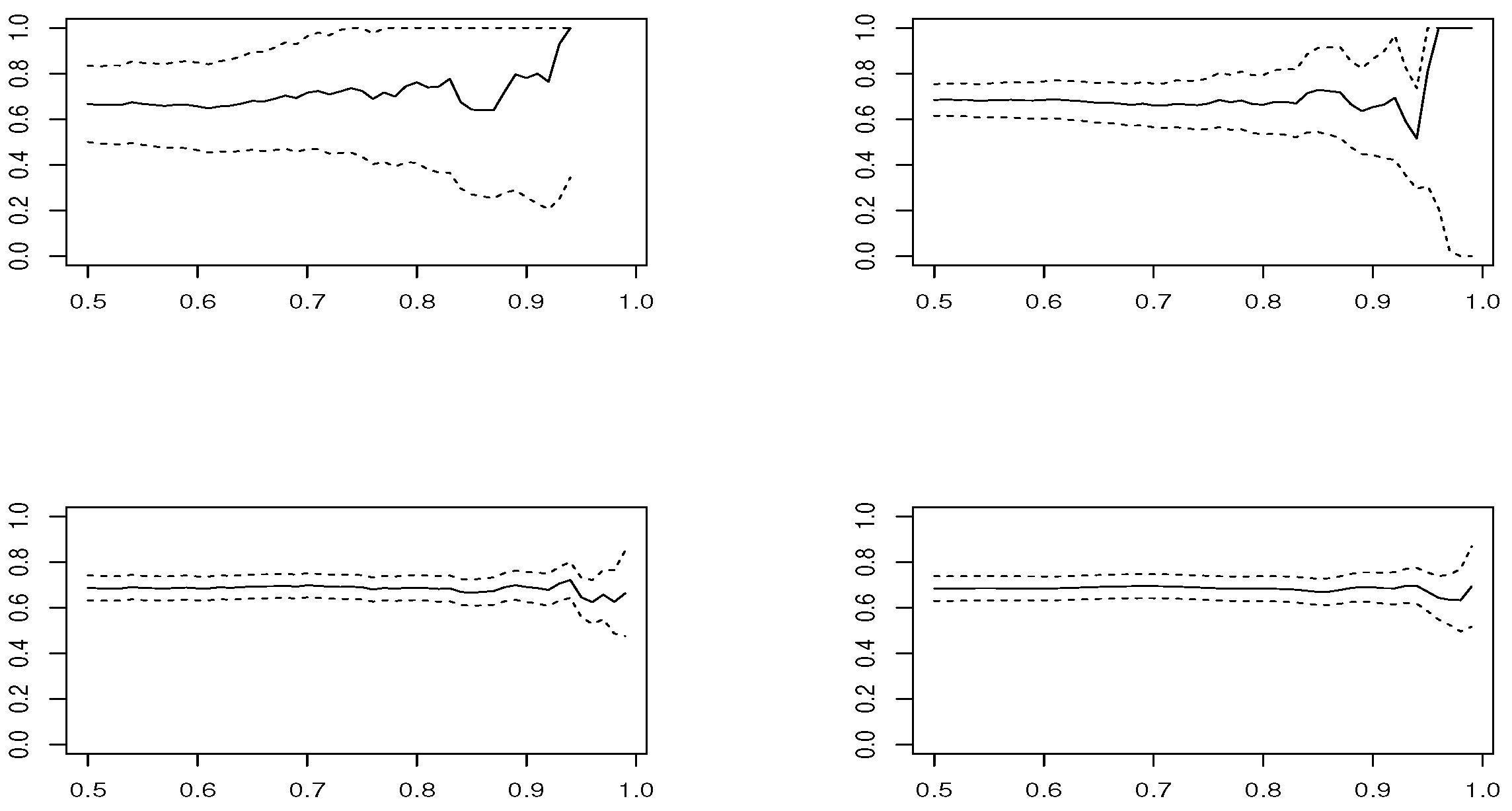

We simulate 1000 replicas of each model, with size

and

. We compute estimators

,

,

and

for thresholds

u corresponding to percentiles

. The estimation is conducted using package mev [

11] within statistical software R 2020 [

12]. We derive the sample mean of estimates in each threshold

u along with the Wald 95% confidence interval, which are plotted in

Figure 1,

Figure 2,

Figure 3 and

Figure 4, in the case of samples with size

, and

Figure 5,

Figure 6,

Figure 7 and

Figure 8 for

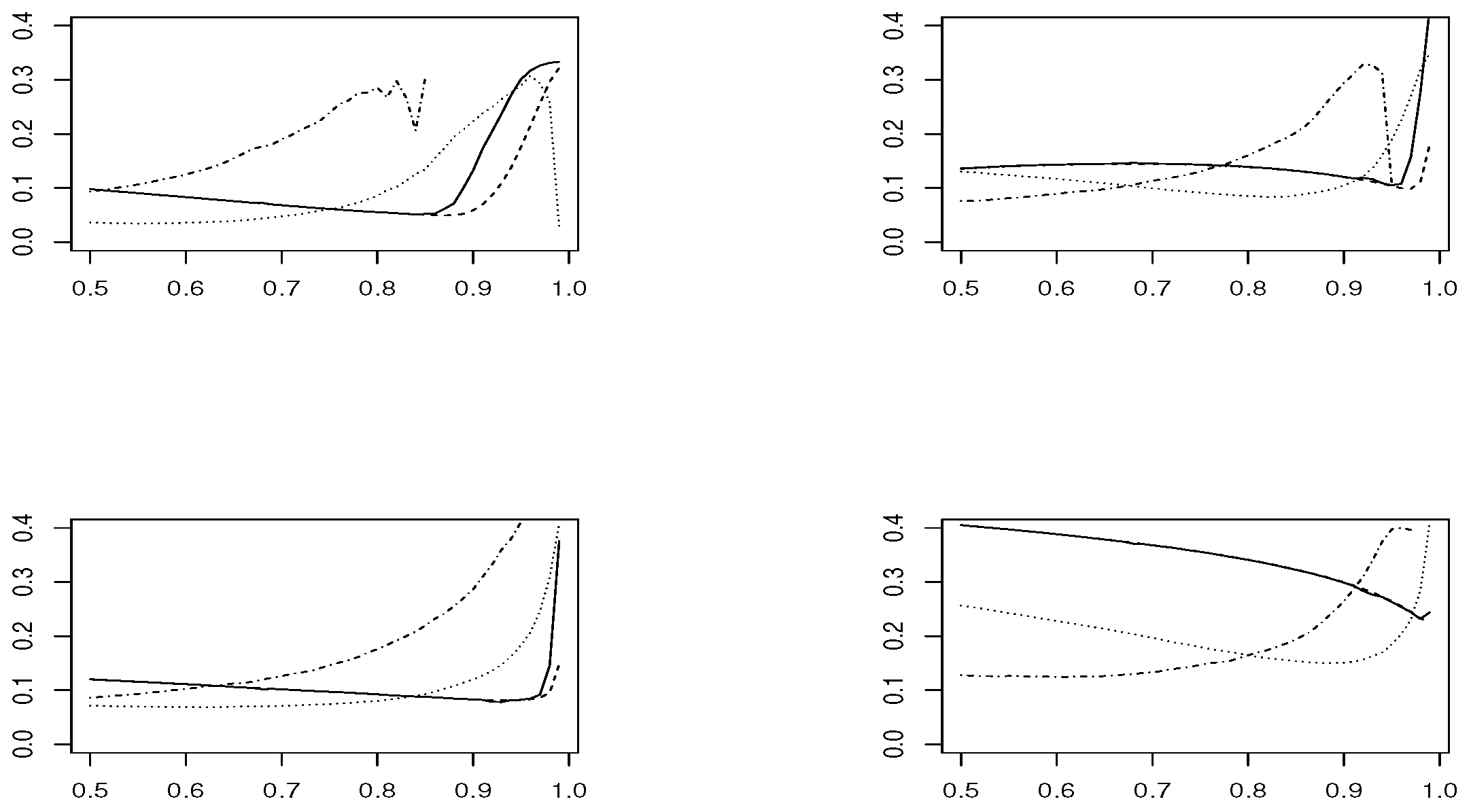

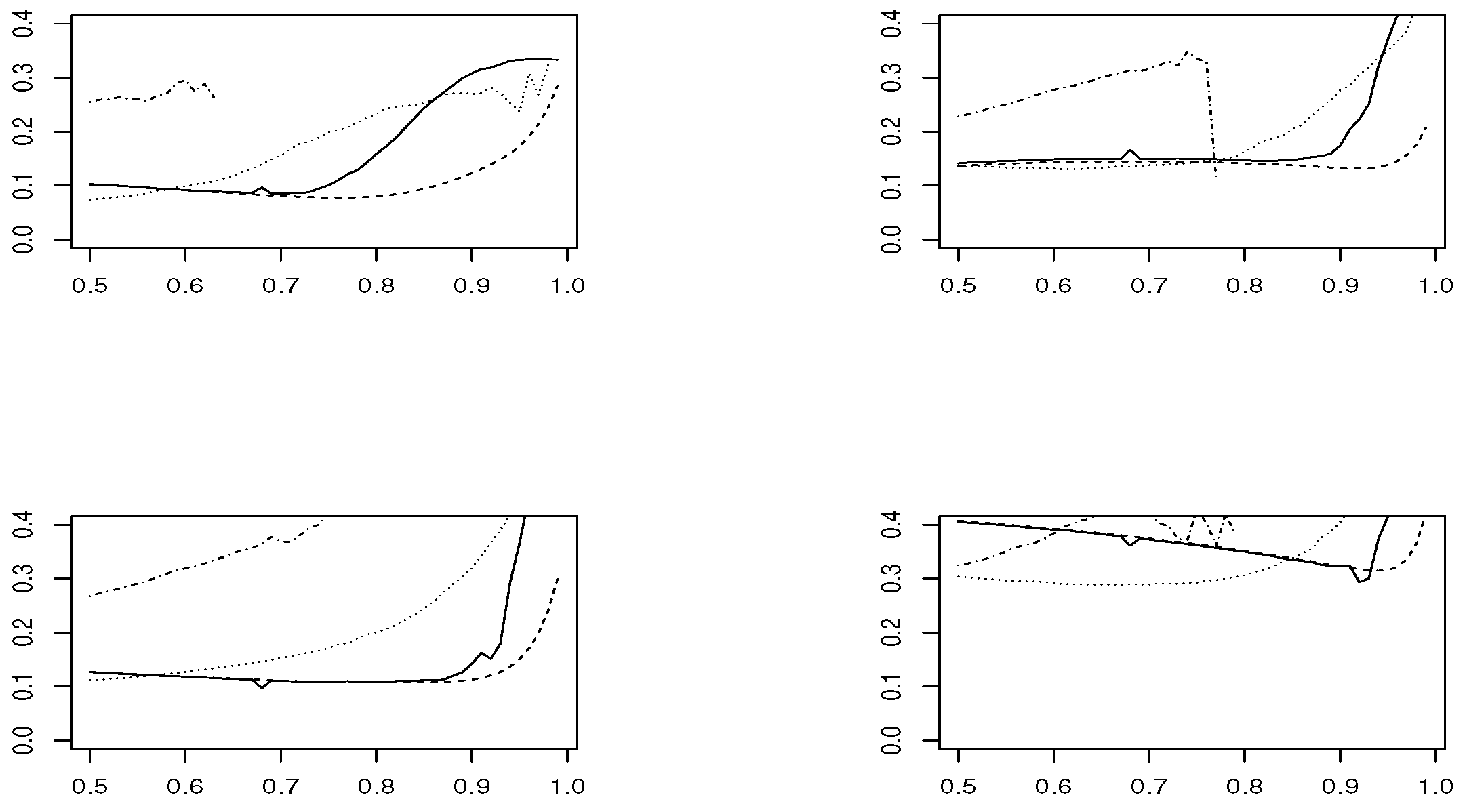

. We also calculate the root mean squared error (RMSE) in each threshold

u, available in

Figure 9 and

Figure 10, for sample sizes

and

, respectively. The

estimator is based on modeling threshold exceedances through the GPD model and, therefore, fails to be applied at very high thresholds, where the number of observations is small.

In the case , and looking at the estimated means, estimators and have the best performance. However, concerning the RMSE, presents the worst performance, except in the Logistic model, where and are the best choices and and are not recommended. In smaller sample size , the confidence intervals become larger and the results are less precise. The RMSE grows slightly for all estimators, except for , where it clearly increases. The low performance of all estimators is in the Logistic model, where corresponds to a boundary value.