1. Introduction

In the field of energy, in a scientific and technical sense, the term “aggregator” refers to a specific type of market entity or intermediary that combines (aggregates) multiple distributed energy resources. They can incorporate renewable energy producers (solar panels, wind turbines, etc.), energy storage systems (batteries, accumulators), managed consumers (flexible load, demand response), electric vehicles (EVs), small thermal power plants, and cogeneration.

Aggregators hold a key role in the integration of renewable energy sources. They optimise the transition to smart grids and decentralised energy systems and provide flexibility and stability. The main purpose of aggregators is to form unified virtual capacities (Virtual Power Plants, VPPs). They can effectively participate in energy markets or provide network services such as balancing, frequency regulation, and load management. Aggregators can lower overall energy costs by optimizing demand response strategies. That reduces the need for expensive peak power generation. Additionally, in addition to the cost reduction, there is another possible source of economic efficiency, and this is the generation of additional revenues.

The types of aggregators can be commercial—aimed at extracting maximum market profits from energy trading; technical—aimed at technical optimization, improving grid stability, and supporting the system operator; and integrated—performing both commercial and technical functions simultaneously.

1.1. Basic Economic Functions of Aggregators

Aggregators combine multiple small resources that individually could not participate effectively in the market and create a large, stable, manageable virtual power known as a Virtual Power Plant (VPP). They use complex optimization algorithms that define the best way to utilize resources according to market conditions and price and demand forecasts. They also create additional value by optimizing production and consumption, minimizing losses, and increasing plant uptime during the most profitable periods.

1.1.1. Cost Efficiency

Improving cost efficiency can also be viewed in terms of the role of aggregators as a tool for managing flexibility in electricity networks. By analysing [

1] how aggregators can facilitate electricity price flexibility through the development of demand-side management mechanisms, thereby reducing costs for consumers and improving the efficiency of the energy system.

1.1.2. Participations in the Energy Markets

The commercial strategy can be presented as a two-stage mathematical model [

2] for a renewable energy aggregator that exercises market power. The aim is to optimise the aggregator’s participation in electricity markets, taking into account various constraints and opportunities to maximise profit. In the residential and service sectors, the focus is on the operational and financial aspects of the business. Ideas are sought on how aggregators can effectively integrate decentralised energy resources and optimise the management of energy systems. Aggregators manage the flexibility of energy demand and supply, including the usage of technologies for monitoring and controlling the consumption. Financial models that aggregators can use include, for example, sharing savings with consumers or service fees. The importance of well-structured business models for the successful integration of aggregators into the energy system is highlighted. By effectively managing operational and financial aspects, aggregators can contribute to a more sustainable and efficient energy system.

There is another two-stage efficient aggregation model [

3]. In this model, a profit-maximising aggregator purchases electricity from distributed energy resources (DERs) and sells it on the wholesale market. The study shows that this model preserves full market efficiency, i.e., the social welfare achieved through the aggregation model is the same as with the direct participation of DERs in the wholesale market. The mathematical model is a two-stage model that serves to optimise the trading strategies of a renewable energy aggregator with market power. The model aims to determine the optimal strategy for the aggregator’s participation in both the energy market and the reserve market, considering the interaction between them and the possibility of influencing market prices.

1.2. Business Models and Analysis

1.2.1. Payments of Monthly Taxes and Energy as a Service (EASM) Model

An innovative business model [

4] proposes that consumers pay a monthly fee to aggregators to represent them and optimise their participation in multiple wholesale electricity markets. The aim is to improve cost efficiency through centralised management and optimization of consumers’ energy resources. Here, aggregators provide Energy-as-a-Service (EaaS) to prosumers, or consumers who both consume and produce electricity. In this model, prosumers pay a monthly fee to be represented by the aggregator in diverse wholesale electricity markets, with the goal to optimise their participation and maximising their benefits. In providing Energy as a Service (EaaS), aggregators take responsibility for managing the prosumers’ energy resources, including electricity generation, storage, and consumption. They optimise prosumers’ participation in electricity markets, aiming to increase revenues from the sale of excess energy and reduce consumption costs. Overall, the EaaS model provides a new perspective for the integration of prosumers into the energy system through aggregators. It offers benefits both for consumers, through lower costs and better energy management, and for the energy system as a whole, through increased flexibility and resilience.

A systematic assessment of the economic value of aggregators [

5] in power systems highlights aspects for improving cost efficiency by optimising participation in energy markets and providing additional services. Regulatory barriers and opportunities arise related to the activity of aggregators, including the need for clear rules and standards for the participation of decentralised resources in energy markets. The need to create a favourable regulatory environment that encourages innovation and competition is highlighted. The importance of well-structured business models for the successful integration of aggregators into the energy system is highlighted. By effectively managing operational and financial aspects, aggregators can contribute to a more sustainable and efficient energy system.

1.2.2. Optimal Bidding Strategy for Energy Storage Aggregators

The focus of this model is on the optimisation of bidding strategies of aggregators operating energy storage systems and their role in supporting community energy storage. Linear and quadratic optimisation models are used to simulate the behaviour of aggregators under different market conditions and supply and demand scenarios. This leads to a significant increase in aggregators’ revenues and improved efficiency of energy storage systems. This model [

6] explores the possible optimisation of the bidding strategy of an Energy Storage Aggregator (ESA) participating in the electricity market. The main objective is to maximise the revenue from the sale of stored energy by optimally determining the bids in the day-ahead market and other segments.

1.2.3. Aggregation of Flexibilities in Multiple Electricity Markets

This two-stage model allows renewable energy aggregators to develop optimal trading strategies, taking into consideration different market conditions and opportunities to exercise market power [

7] and examines how aggregators can optimise portfolios of flexible resources—such as electricity consumption, generation, and storage—by participating in different electricity markets. The goal is to increase the value of these resources through strategic participation in day-ahead, intraday, and balancing markets. A model is presented that allows aggregators to make decisions about participating in different markets, considering technical resource constraints and market conditions. Different scenarios are analysed, including participation in the day-ahead market, integrated participation in the intraday and balancing markets, and integrated participation in all markets. The model shows that combined participation in multiple markets can increase aggregators’ revenues and improve the efficiency of using flexible resources.

Examining the role of aggregators in bundling flexibilities and their participation in multiple electricity markets within the EU market design, in specific business cases, aggregators can increase profits through combined participation in the energy market, the balancing capacity market, and the ancillary services market. A model for optimal portfolio management in the context of the regulatory requirements of the markets is developed. Simulations with real market data demonstrate that aggregated resources such as batteries, electric vehicles, and heat pumps can significantly reduce balancing costs and increase participants’ revenues. The results show that optimizing the participation of aggregators in different markets leads to higher efficiency and sustainability of the electricity system.

2. Methodology: Case Study Analysis

When analysing the business models of aggregators in the residential and service sectors [

8], the focus should be on the operational and financial aspects of their activities to identify effective strategies for integrating flexibility from consumers into electricity markets.

The current research identifies a lack of research on battery energy storage (BESS) models; hence, the need to explore the possibilities of combining different business models with BESS participation to increase profitability. There is limited attention to internal balancing and intraday market participation. This can be compensated by developing strategies and models that optimise aggregators’ participation in these markets. There is a lack of integrated analysis of the financial relationships between aggregators and consumers. There is a need to develop models that consider both aggregators’ revenues and consumer incentives to ensure the sustainability of the business model.

Insufficient research on business models involving battery energy storage systems (BESS) needs to explore the possibilities of combining different business models involving BESS to increase profitability.

Here are the main business models that aggregators can approach for implementation:

2.1. Flexible Trade with Day-Ahead Market (DAM)

The first alternative is for the aggregator to manage the users’ assets (e.g., electrical appliances, electric vehicles, batteries) through home energy management systems (HEMS), with the aim of minimising costs in the DAM market.

The second alternative is for the users to manage their assets themselves in response to price signals, with the aim of reducing their own costs. Multi-market participation [

9] significantly increases aggregators’ revenues and improves the use of flexibility. Different technologies contribute different values—batteries, PV systems, heat pumps, and electric vehicles have their own specific added values. The optimal aggregation size has a minimum threshold above which the business model is sustainable and market relevant.

2.2. Intra-Day Market Trade (IDM) and Provision of Power Reserves

The aggregator updates its forecasts and trading positions in near real-time to reduce costs from imbalances. A probabilistic two-stage model for demand optimisation [

10] in day-ahead and intraday markets, including balance risks and volume and price forecasting, is proposed. The objective is to minimise the total trading costs over 24 h, given the constraints of batteries, PV, and flexible demand. A simulation of the Spanish electricity market for a full year is considered, demonstrating the greater efficiency of the probabilistic approach.

The aggregator uses assets such as electric vehicles and batteries to participate in reserve markets, generating revenue from providing services to keep the balance of the electricity system.

2.3. Internal Portfolio Balancing and Network Congestion Management

The aggregator manages consumption within its portfolio to minimise individual imbalances without directly participating in the markets.

The aggregator offers flexibility to distribution system operators (DSOs) to deal with congestion through mechanisms such as dynamic pricing and flexibility trading platforms.

3. Technology and Enhanced Grid Stability

How do aggregator technologies contribute to grid stability? Aggregators bring together multiple distributed energy resources (DERs)—such as photovoltaics, batteries, electric vehicles, and flexible loads—into a single platform that can participate in the energy market and provide services to maintain grid stability.

Digitalisation is a key factor for the efficient operation of aggregators and grid stability. Commelec is a framework for distributed and real-time management of electricity grids using explicit active/reactive power setpoints. It allows for better grid management with high penetration of distributed generation. Virtual Power Plants (VPPs) integrate multiple distributed energy resources, providing services such as frequency regulation and reserves, which contributes to grid stability.

3.1. Frequency Control

The issue of grid frequency stabilization using load control presents an innovative framework [

11] for load frequency control (LFC) based on aggregators to improve the response of the power system to frequency fluctuations. Aggregators gain multiple electricity consumers by coordinating their consumption to provide grid frequency stabilisation services. The proposed frequency control framework uses modelling and simulations to evaluate the effectiveness of aggregators in LFC, demonstrating their ability to improve the dynamic stability of the system. In conclusion, the use of aggregators in LFC leads to a faster system response to disturbances, reduced frequency deviations, and increased grid reliability. Aggregators are confirmed as key players in power system frequency management. By coordinating the consumption of multiple consumers, aggregators can provide valuable grid stabilisation services, contributing to a more resilient and reliable power system.

3.2. Integration of RES

The National Renewable Energy Laboratory (NREL) report, entitled “What Role Do Aggregators Play in the Security and Resilience of the Electric Power System?” [

12], examines how aggregators of distributed energy resources (DERs) can contribute to improving the security and resilience of the electric power system. In September 2020, the Federal Energy Regulatory Commission (FERC) approved an order that allows aggregators of DERs to participate in wholesale electricity markets. This opens opportunities for the broader use of DERs to maintain the security and resilience of the grid.

Aggregators combine multiple DERs, such as renewables and energy storage technologies, to provide services such as load management, reserves, and demand response. This increases the flexibility and resilience of the electric power system.

Of course, there are challenges. Despite the aggregators significance, there are barriers, such as technical, regulatory, and market constraints, that hinder their full integration into the electricity system. There is a need to develop policies and technologies that facilitate the participation of aggregators in markets and promote the use of DERs to improve grid security and resilience [

13]. However, the aggregators’ potential to transform the electricity system remains unequivocal, highlighting the need for joint efforts between regulators, operators, and market participants to overcome existing challenges.

3.3. Digital Energy Ecosystem

The document “Digital Energy Grid: A Vision for a Unified Energy Ecosystem” (2025), published by FIDE and the Beckn Open Collective, presents a conceptual framework [

12] for building an open, decentralised and interoperable energy infrastructure through the Beckn protocol and the Unified Energy Interface. The Digital Energy Grid (DEG) is a vision for a digital energy grid that connects producers, consumers, and intermediaries through open standards, enabling dynamic demand and supply of energy services. The Unified Energy Interface (UEI) is a protocol based on Beckn that provides a standard way for different actors in the energy sector to interact, facilitating the trading and management of energy services. The DEG promotes the creation of open energy grids, where different platforms and services can interact without the need for centralised intermediaries. The DEG defines different roles, including energy suppliers, consumers, aggregators, and network operators, with each actor being able to interact through standardised interfaces. Through the UEI, actors can publish, discover, and manage energy services, such as electric vehicle charging, load management, and energy trading.

The DEG aims to democratise access to energy services by reducing dependence on centralised systems and encouraging the participation of small and medium-sized suppliers. By optimising supply and demand, the DEG can contribute to more efficient use of resources and to decreasing CO2 emissions. The DEG’s open architecture creates opportunities for the development of new services and business models in the energy sector.

The DEG can be a vision for the further development of the energy sector, where there exist open standards and decentralised networks that make more efficient, sustainable, and affordable energy management. Trusting the Beckn protocol and the UEI interface, the DEG offers a framework for an innovative energy ecosystem.

4. Renewable Energy Integration

The integration of RES with the grid brings challenges connected to unpredictability and lack of stability of production. Aggregators have a critical importance in coping with these challenges by the integration of distributed energy resources (DERs) and providing flexibility for both producers and consumers.

Aggregators enhance the integration of RES through flexible demand management. They can balance fluctuations in RES production, for example, through demand response programs. By pooling multiple DERs, aggregators create VPPs that can participate in electricity markets and provide services to maintain grid stability. European energy policy is moving towards liberalisation of the European energy market and energy transition by facilitating the integration of diverse energy resources and introducing consumer participation to the energy market.

The synergy of battery energy storage systems (BESS) and batteries with aggregators is essential for grid stability and the increased usage of renewable energy sources (RES). Aggregators coordinate multiple distributed energy resources, including batteries, to assure services like frequency regulation, load balancing, and cost optimization, as well as a system that uses weather forecasts and load monitoring to prioritise battery charging, minimising degradation and increasing storage efficiency. The batteries used help balance supply and demand, providing grid flexibility and enabling greater penetration of RES.

In today’s world, the growing demand for energy sources less dependent on fossil fuels and meeting global efforts to address climate change have put photovoltaics and wind farms in the spotlight. Both technologies are examples of RES that not only offer a sustainable solution for electricity production and storage but also a role in the global fight against climate change.

The constant affirmation of the energy transition is not only related to the performance of specifically developed technologies or optimised energy costs. In the period of ultra-dynamic trend of solar generating capacities, more than ever it is necessary to observe two factors: the transmission and distribution networks condition and the building of storage systems. Most of the innovations in the energy sector are coming together to achieve this goal: digitalisation, decentralisation, electrification, etc. It is still a question whether these innovations will be fully developed and implemented.

Solar and wind energy are considered as key components of the energy mix of many countries in their energy transition towards a low-carbon economy and a sustainable energy system. Both technologies have significant advantages: lower operating costs in the long term, the opportunity of deployment in different geographical conditions, significant reduction of carbon footprint, etc. The possibility of decreasing the finance value of energy supply, along with innovations in technology and the reduction of component prices, makes these sources increasingly accessible to industrial, public, and individual users.

5. Proof of Concept Sustainability

To prove the concept that the energy transition is sustainable and successful under certain conditions, we should perform a good analysis of the required storage capacities, the choice of storage technologies, and their precise place in the energy structure. This comparative analysis of the net annual consumption and net RES generation in Bulgaria for the period 2022–2024 uses the methodology recommended in “Seasonal Energy Storage in a Renewable Energy System” [

14] and considers two scenarios of the contribution of solar and wind energy and their ratio in the state energy mix.

5.1. RES Energy Mix Distribution Scenarios

The first scenario is the current percentage ratio of 70% share of solar energy and 30% share of wind energy in the entire RES energy mix for the years from 2022 to 2024. The second scenario is with equal stakes of 50:50 of solar and wind energy in the energy mix. We restrict the reduction of solar energy generation due to limited indicators of electricity quality, insufficient storage capacity by the middle of the present year, and the chance of the energy infrastructure to cope with the transmission and distribution of enormous volumes of generated solar energy. Alternatively, the growth of wind energy will support untapped wind potential, both on land and at sea [

15]. The data used are from the National Statistical Institute, the Energy System Operator of the country.

5.2. Balance Between Generation and Storage

We inspect the net consumption of electricity and net generation of both RES sources.

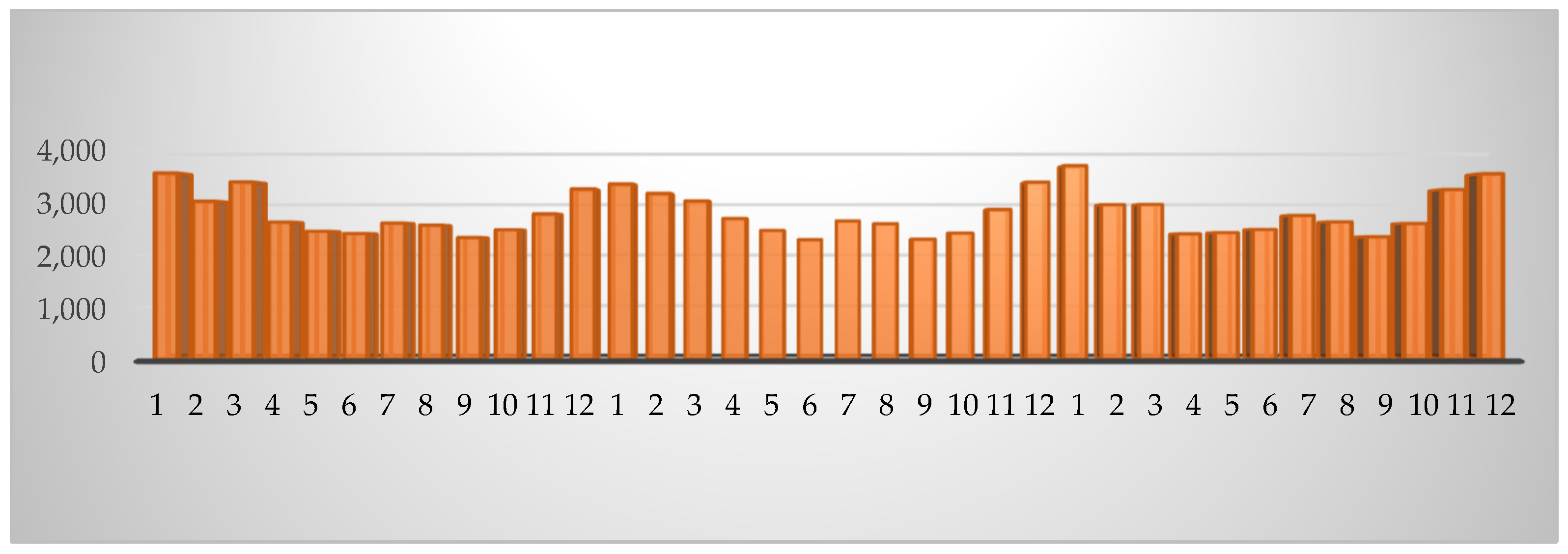

Figure 1 presents the country’s net consumption for a period of three years (2022–2024). We can clearly distinguish seasonality and cyclicality, which imply long-term seasonal storage.

The energy storage capacity [

15] needed to meet annual electricity demand (given that the electricity source is a compound of solar and wind) varies from 10% to 20% of the overall annual consumption. To analyse the dynamics of consumption and identify the influencing factors, we compare the monthly values. The analysis shows three typical periods with similar characteristics: the winter period (December, January, and February), summer (June, July, and August), as well as transitional (March, April, May, and September, October, and November) periods.

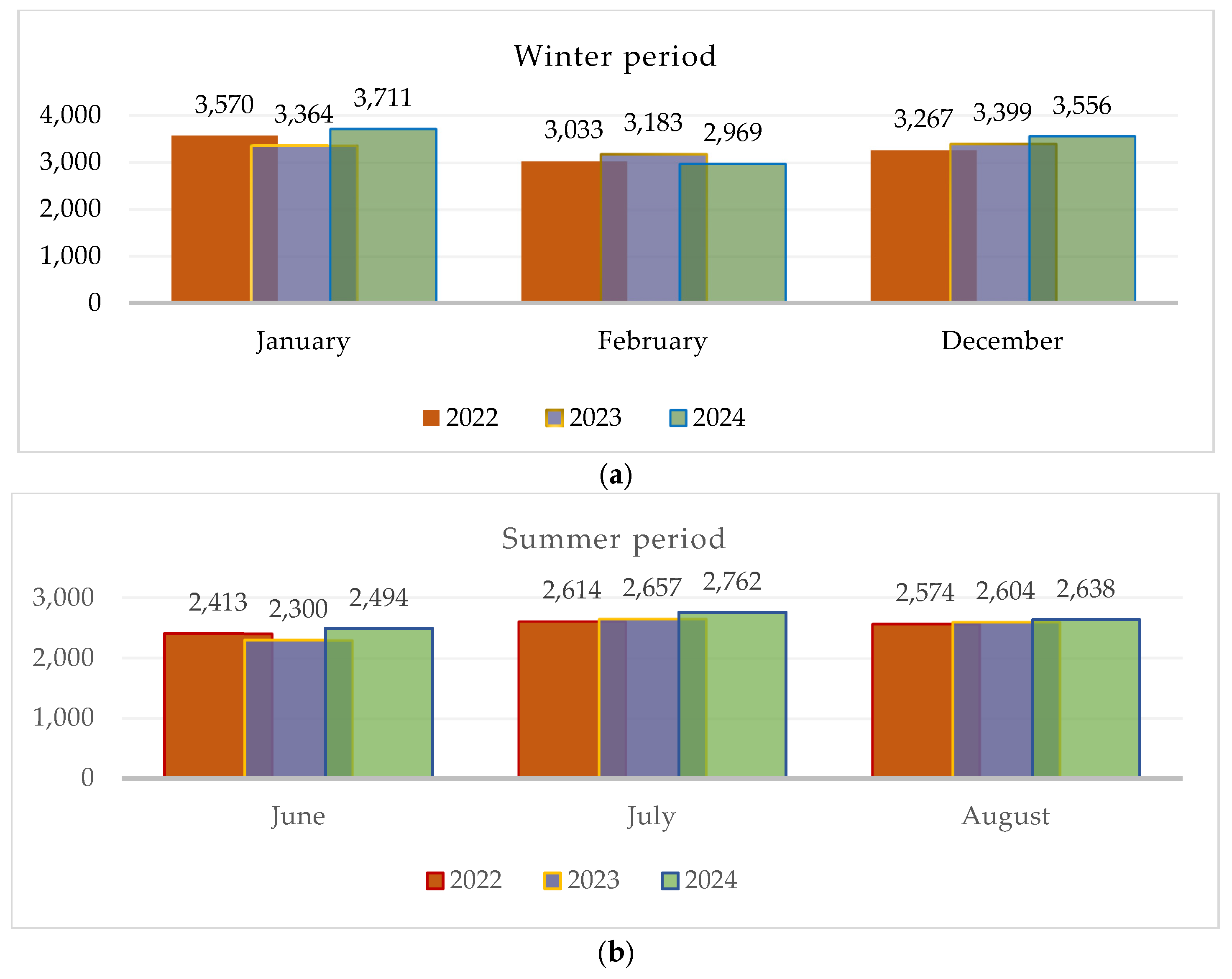

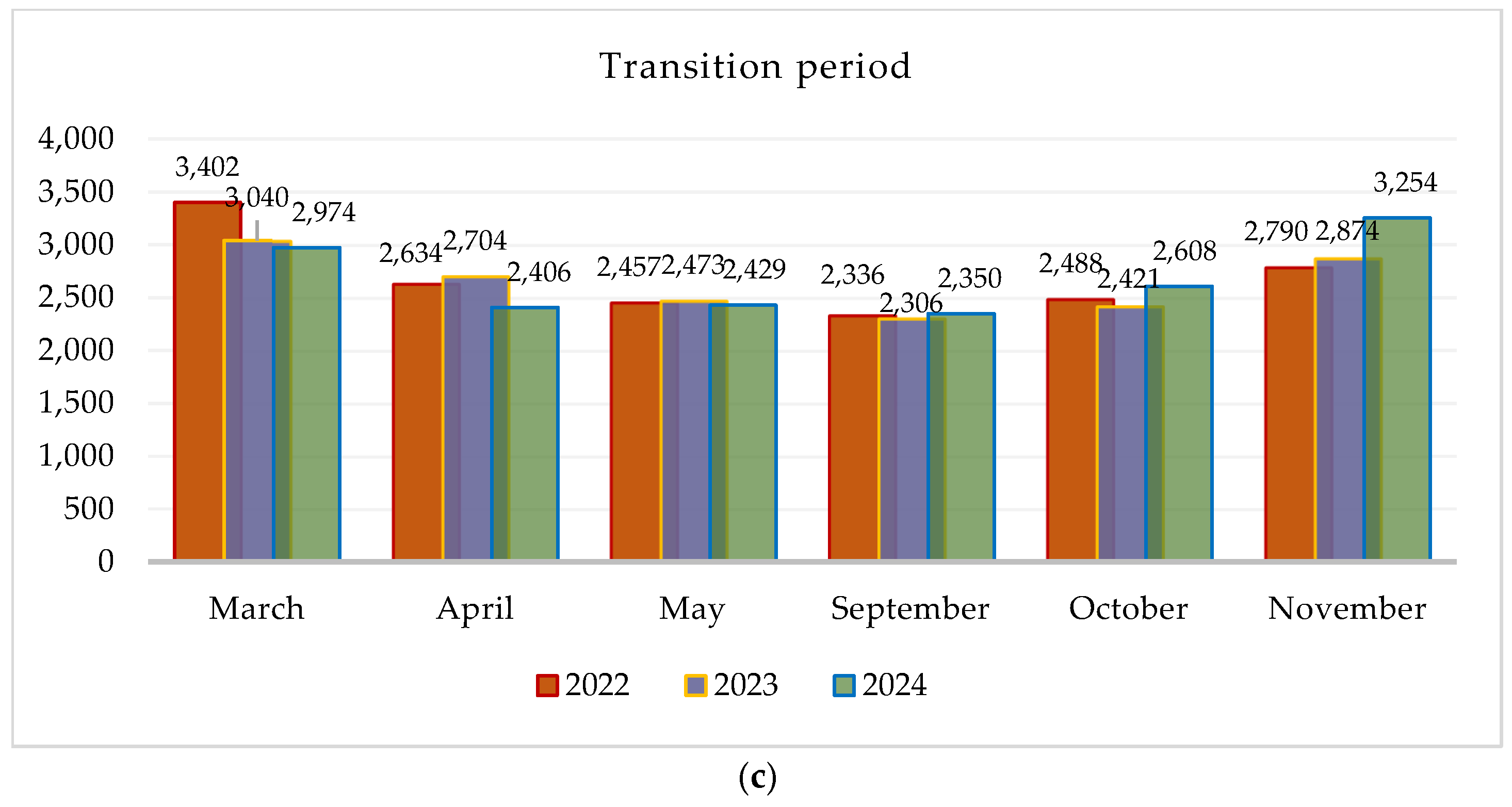

Figure 2a presents data on energy consumption during the winter period, when increased consumption is logically observed due to increased heating needs.

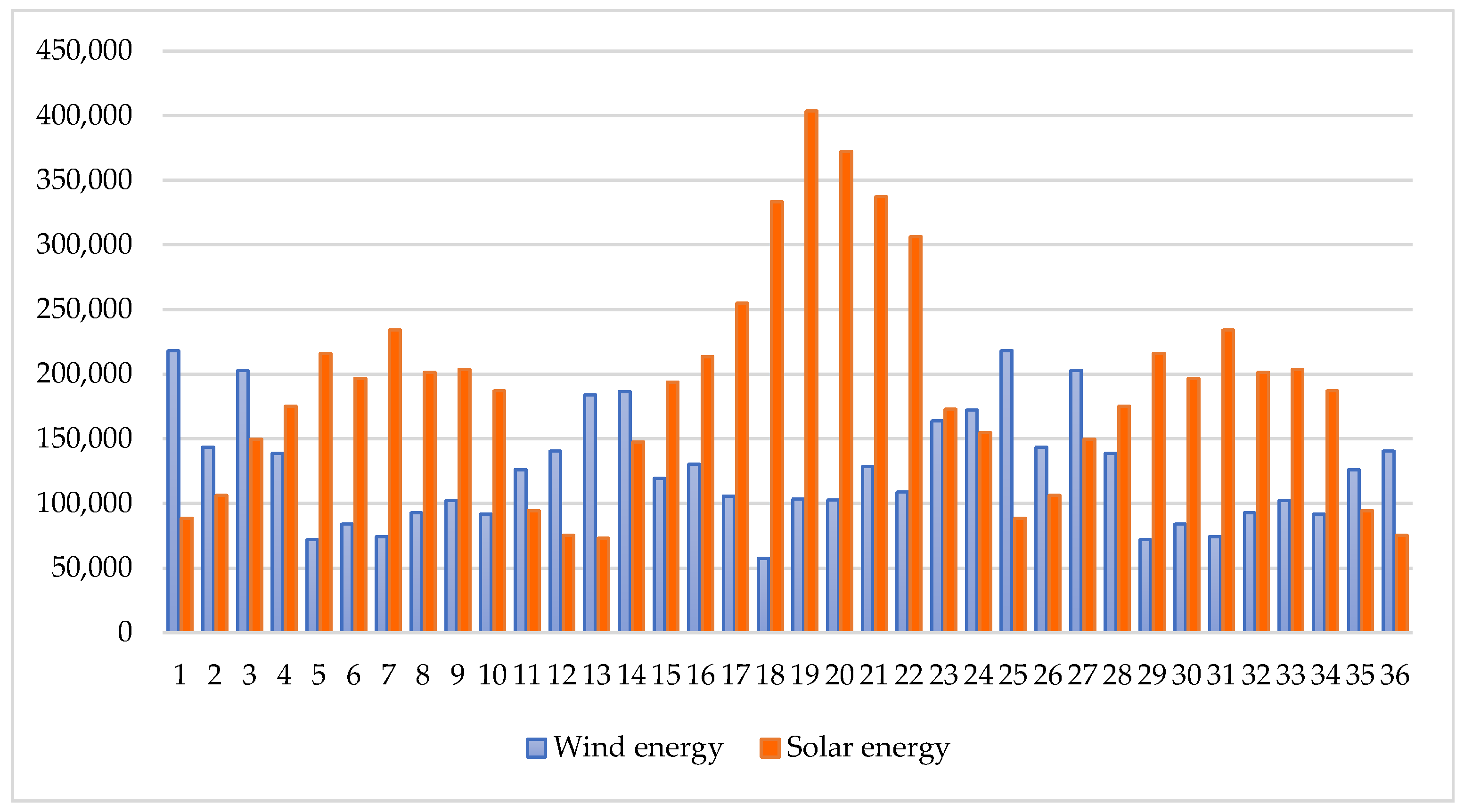

Solar generation is at low levels due to reduced solar radiation and short daylight. Wind energy in the winter months has a much higher share in the total energy mix, as per

Figure 3, and in the summer months, extremely high levels and a dominant share in the energy mix with the solar generation.

By observing seasonal changes in consumption and generation, we determine the required storage capacities for the two scenarios 70:30 (70% solar generation and 30% wind generation) and 50:50 (equal shares). The resulting calculations will show at what storage capacities energy sustainability will be achieved.

Table 1 summarises the data by month for the three years, as follows: A—Month of the considered year; B—Monthly electricity consumption, GWh; C—Monthly (as a percentage of annual) electricity consumption, %; D—Monthly generation of electrical energy from wind energy, GWh; F—Monthly energy generation (as a percentage of annual) from wind energy consumption, %; F—Monthly generation from wind energy, as an annual percentage; G—Percentage of energy storage required in case the entire volume is produced by wind energy, %; H—Monthly energy production from solar energy, GWh; I—Monthly electricity solar production as a percentage of annual, %; J—Percentage of energy storage required if the whole volume is generated in ration 50% wind and 50% solar energy or 70% solar and 30% wind, %; K—Percentage of energy storage demanded if the whole volume is generated by solar energy, %.

If energy conversion losses and subsequent storage are ignored, the required storage capacity is about 13% of the entire wind and solar generation,

Table 2.

In case of a predominant share of wind and solar generation in the electricity mix, for both scenarios, we apply the following equations:

The share of storage capacities for the characteristic periods is presented in

Table 3.

Table 4 presents a comparison of the data in percentages for storage capacities in the two scenarios (the needed energy storage capacity to meet energy demand for each year).

The concept that the “weak” months for solar generation are compensated by wind and a larger share of the electricity generated by RES can be stored is clearly confirmed. In addition, in the winter months, long-term storage capacities are smaller.

All this gives rise to two important conclusions:

Wind energy must be developed instead of the ultra-dynamic and uncontrolled growth of solar power plants;

If this policy is followed, storage capacities and the costs associated with their installation and maintenance will be smaller.

Indeed, Bulgaria also keeps a hidden reserve for offshore and/or onshore wind power plants, but there is no enterprise to support their development. Through the development of wind energy, the so-called grid parity would be achieved more quickly. Grid parity is the distribution of generating capacities in which the Levelized Cost of Electricity (LCOE) of any generating source becomes equal to the price of energy for consumers. The wind onshore potential for Bulgaria is about 60 TWh with investment costs of around 1500 EUR/kW and 3% O&M cost. Considering the current wholesale prices on the electricity markets, with the support of this concept, Bulgaria will offer a relatively low price for wind energy: 50–87 EUR/MWh.

6. Regulatory Impact

Aggregators are playing an increasingly important role [

6] in the context of the energy transition in Europe, especially following the adoption of new legislative frameworks. Aggregators bring together multiple Decentralised Energy Resources (DERs), such as renewables and energy storage technologies, and electricity system services. They act as intermediaries between consumers and markets, facilitating the participation of small producers and consumers in the energy market. European regulations, in particular the Electricity Market Directive and the Internal Electricity Market Regulation, recognise and promote the role of aggregators. These regulations encourage a wider participation of aggregators in the markets in providing flexibility and balancing services. Aggregators are most often faced with challenges such as a lack of standardised procedures, limited access to data, and the need to adapt existing market mechanisms. The need to develop increasingly clear regulatory guidelines, create standardised interfaces for data exchange, and encourage innovation in aggregators’ business models is confirmed.

7. Environmental Impact

Aggregators combine multiple small RES (solar panels, wind turbines), presenting them together on the market. In this way, they facilitate the balance of the electricity system. This leads to a more intensive penetration of variable RES and reduces dependence on fossil fuels [

15]. Through demand response programs, aggregators stimulate a shift in consumption to periods with lower carbon intensity (with stronger sunlight during the daylight hours). The need to include peak coal or gas plants is reduced. This directly reduces CO

2 emissions. Aggregators can shift investments in new baseload capacity by managing the load at peak times. This reduces construction and also indirectly has an environmental effect. Aggregators can utilise batteries and electric vehicles as distributed energy resources. Such management supports the storage of green energy and reduces losses associated with excess production and lack of consumption.

The environmental impact is not only positive. The more intensive use of batteries brings with it the use of resources such as lithium, cobalt, and other rare metals and creates recycling problems. The massive digitalisation required to manage aggregator platforms increases the risk of cyberattacks, which has an energy security component.

8. Conclusions

Aggregators are proving themselves to be key intermediaries in building smart, sustainable, and efficient energy systems. By implementing innovative business models and actively using energy storage and optimisation technologies, they provide valuable services for grid balance and stability. Practical results from the energy mix analysis show that a meaningful combination of solar and wind energy, assembled by appropriate storage capacities, can guarantee energy sustainability at meaningful costs. In the future, the success of the energy transition will depend on the development of standardised regulations and the active participation of aggregators in various energy markets. The analyses highlight the need to create a favourable regulatory environment that encourages innovation and removes barriers to the participation of aggregators in energy markets. In conclusion, policies supporting flexibility, energy storage, and digitalisation will be key to the successful integration of renewables and the sustainable development of the energy sector.

Author Contributions

Conceptualization, N.N., D.K. and V.Z.; methodology, N.N., D.K. and V.Z.; validation, D.K. and Z.D.; formal analysis, N.N., D.K. and V.Z.; investigation, D.K. and Z.D.; resources, N.N., D.K.; data curation, D.K. and Z.D.; writing—original draft preparation, N.N., D.K. and V.Z.; writing—review and editing, N.N. and D.K.; visualization, D.K. and Z.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the European Regional Development Fund within the OP “Research, Innovation and Digitalization Programme for Intelligent Transformation 2021-2027”, Project No. BG16RFPR002-1.014-0005 Center of competence “Smart Mechatronics, Eco- and Energy Saving Systems and Technologies”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| RES | Renewable Energy Sources |

| DERs | Distributed Energy Sources |

| EV | Electric Vehicles |

| VPP | Virtual Power Plants |

| EASM | Energy As a Service Model |

| EaaS | Energy as a Service |

| ESA | Energy Storage Aggregator |

| BESS | Battery Energy Storage |

| DAM | Day-Ahead Market |

| IDM | Intra-Day Market trade |

| DSOs | Distribution System Operators |

| LFC | Load Frequency Control |

| NREL | National Renewable Energy Laboratory |

| FERC | Federal Energy Regulatory Commission |

| DEG | Digital Energy Grid |

| UEI | Unified Energy Interface |

| LCOE | Levelized Cost of Electricity |

References

- Zvirgzdina, M.; Bogdanova, O.; Spiridonovs, J. Aggregator as cost optimization tool for energy demand. In Proceedings of the 17th International Scientific Conference Engineering for Rural Development (2018), Jelgava, Latvia, 23–25 May 2018. [Google Scholar]

- Dimitriadis, C.N.; Tsimopoulos, E.G.; Georfiadis, M.C. Co-optimized trading strategy of a renewable energy aggregator in electricity and green certificates markets. Renew. Energy Int. J. 2024, 236, 121444. [Google Scholar] [CrossRef]

- Gao, Z.; Alshehri, K.; Birge, J.R. Aggregating Distributed Energy Resources: Efficiency and Market Power. Manuf. Serv. Oper. Manag. 2021, 26, 1–56. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F. An energy-as-a-service business model for aggregators of prosumers. Appl. Energy 2023, 347, 121487. [Google Scholar] [CrossRef]

- Burger, S.; Chaves-Ávila, J.P.; Batlle, C.; Pérez-Arriag, I.J. A review of the value of aggregators in electricity systems. Renew. Sustain. Energy Rev. 2017, 77, 395–405. [Google Scholar] [CrossRef]

- Biggins, F.A.V.; Ejeh, J.O.; Brown, S. Going, Going, Gone: Optimising the bidding strategy for an energy storage aggregator and its value in supporting community energy storage. Energy Rep. 2022, 8, 10518–10532. [Google Scholar] [CrossRef]

- Schwabeneder, D.; Corinaldesi, C.; Lettner, G.; Auer, H. Business cases of aggregated flexibilities in multiple electricity markets in a European market design. Energy Convers. Manag. 2021, 230, 113783. [Google Scholar] [CrossRef]

- Okur, Ö.; Heijnen, P.; Lukszo, Z. Aggregator’s business models in residential and service sectors: A review of operational and financial aspects. Renew. Sustain. Energy Rev. 2021, 139, 110702. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Galego, P.; Munne, I. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 833. [Google Scholar] [CrossRef]

- Ayón, X.; Moreno, M.Á.; Usaola, J. Aggregators’ Optimal Bidding Strategy in Sequential Day-Ahead and Intraday Electricity Spot Markets. Energies 2017, 10, 450. [Google Scholar] [CrossRef]

- Reidenbach, B.; Harmsen, S.; Spencer, T. Digital Energy Grid A Vision for a Unified Energy Infrastructure. 2025. Available online: https://energy.becknprotocol.io/wp-content/uploads/2025/01/DIGITAL_fide-deg-paper-250212-v13-1.pdf (accessed on 22 August 2025).

- Matsuda-Dunn, R.; Leddy, L.; Hotchkiss, E.; Gautam, M.; Abdelmalak, M. What Role Do Aggregators Play in Power System Security and Resilience, NREL. In Proceedings of the 2023 Resilience Week, National Harbor, MD, USA, 27–30 November 2023. [Google Scholar]

- Kerscher, S.; Arboleya, P. The key role of aggregators in the energy transition under the latest European regulatory framework. Int. J. Electr. Power Energy Syst. 2022, 134, 107361. [Google Scholar] [CrossRef]

- Converse, A.O. Seasonal Energy Storage in a Renewable Energy System. Proc. IEEE 2012, 100, 401–409. [Google Scholar] [CrossRef]

- Pakere, I.; Gravelsins, A.; Bohvalovs, G.; Rozentale, L.; Blumberga, D. Will Aggregator Reduce Renewable Power Surpluses? A System Dynamics Approach for the Latvia Case Study. Energies 2021, 14, 7900. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).