Development of the Hydrogen Market and Local Green Hydrogen Offtake in Africa

Abstract

1. Introduction

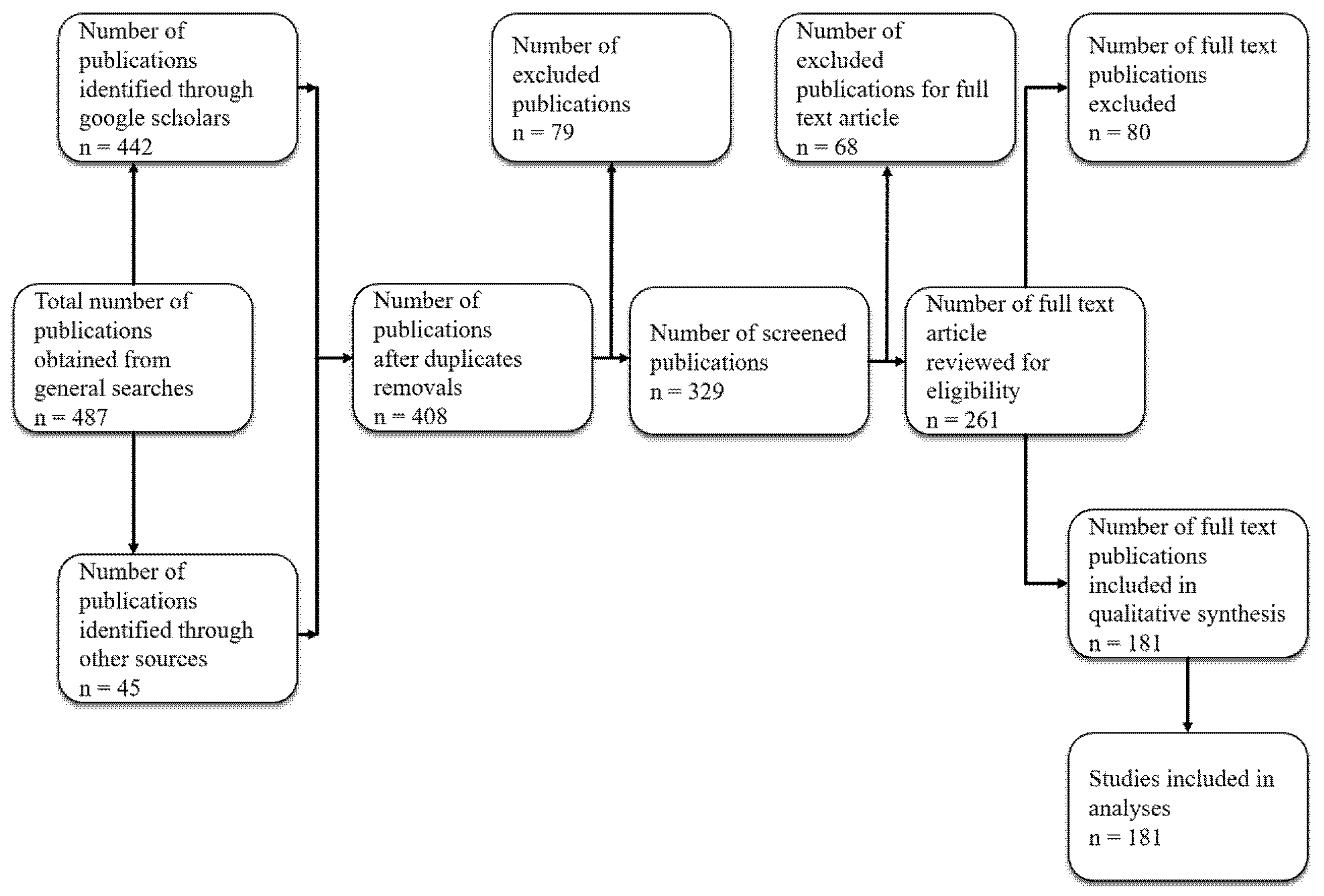

2. Research Methodology

3. Results and Discussion

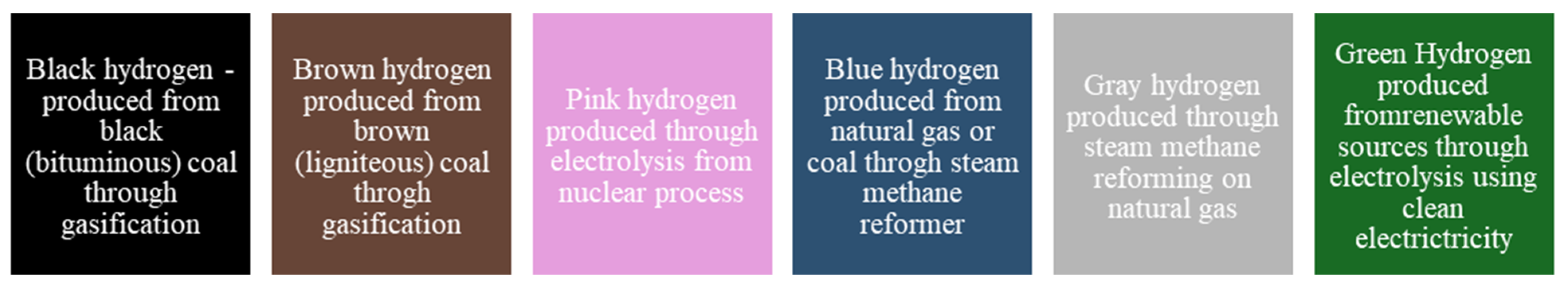

3.1. The Global Hydrogen Landscape

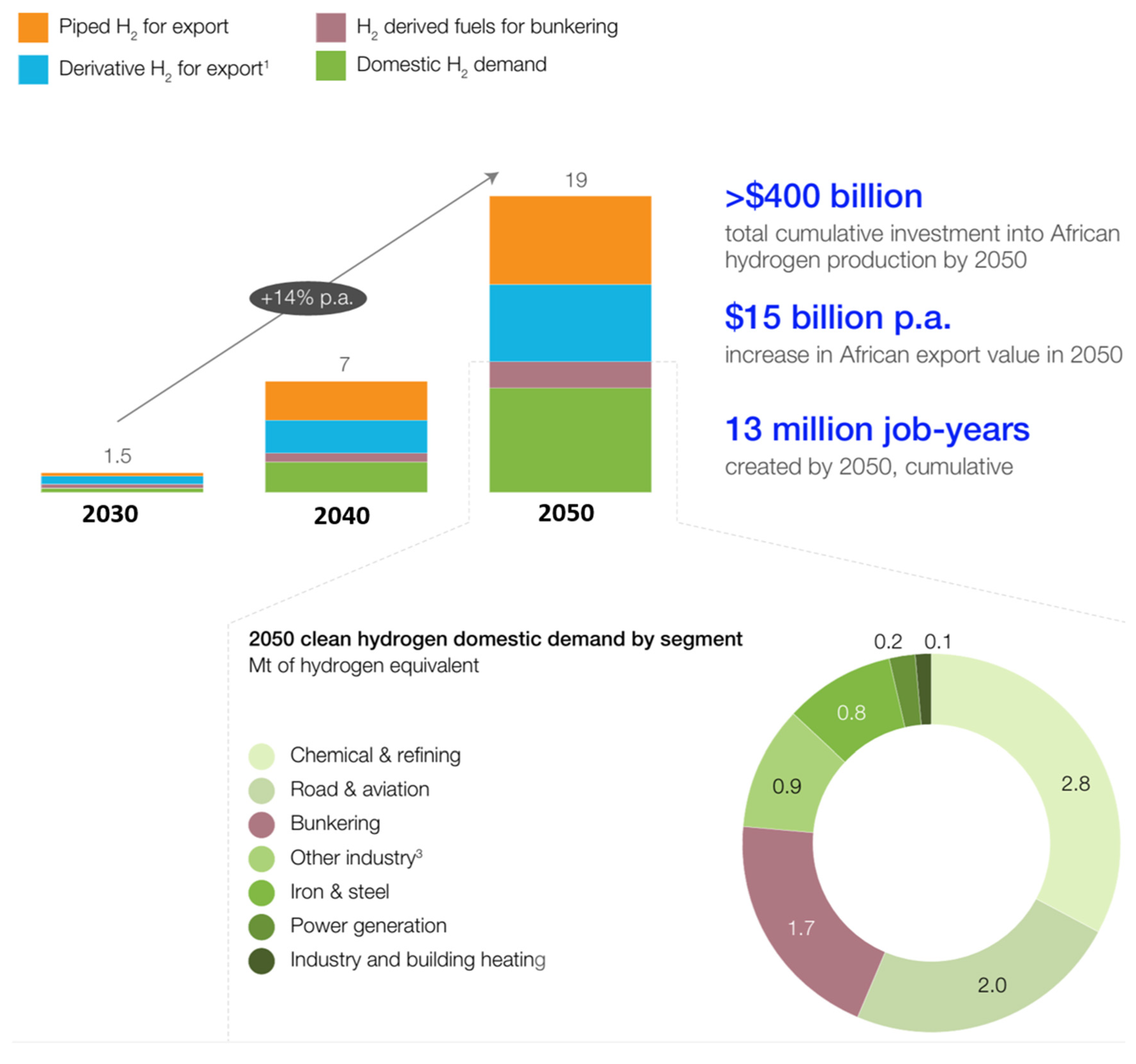

3.2. The Role and Challenges of Hydrogen in Africa’s Energy Transition

3.3. Strengthening the Policies and Regulatory Frameworks in Hydrogen Market Development

| Challenges | Descriptions | Opportunities for Policy Reforms |

|---|---|---|

| Energy Sector Regulations | Existing regulations in the energy sector often favor traditional fossil fuels, with minimal provisions for hydrogen. The regulatory frameworks are outdated and do not recognize hydrogen as a viable energy source [47]. | Integrating hydrogen as part of the energy mix in the energy sector regulations. |

| Defining hydrogen’s role in decarbonization strategies. | ||

| Establishing clear hydrogen standards for production, distribution, and use. | ||

| Land-Use Policies | Land-use restrictions and zoning laws hinder the establishment of hydrogen production and storage facilities. Hydrogen production, especially green hydrogen, requires significant land for renewable energy sources like solar and wind farms [48]. | Revising land-use policies to allow for the development of hydrogen-related infrastructure. |

| Implementing flexible zoning laws for hydrogen facilities in industrial zones. | ||

| Encouraging multi-use land policies that integrate renewable energy production with hydrogen generation. | ||

| Investment Barriers | High capital costs and long payback periods discourage private investment in hydrogen projects. Financial support mechanisms such as subsidies or tax incentives for hydrogen are either limited or non-existent [49]. | Offering investment incentives such as grants, subsidies, and tax credits for hydrogen projects. |

| Establishing public–private partnerships (PPPs) to lower risk for private investors. | ||

| Creating green financing mechanisms, including green bonds, specifically for hydrogen development. | ||

| Infrastructure | Limited infrastructure for hydrogen storage, transportation, and refueling stations, particularly in emerging markets. This slows the scaling up of hydrogen use across industries [50]. | Encouraging infrastructure investments through public funding and international collaboration. |

| Supporting the creation of hydrogen corridors for transportation and distribution. | ||

| Promoting research and development (R&D) in hydrogen storage and distribution technologies. | ||

| Safety and Environmental Regulations | Lack of harmonized safety standards and environmental regulations for hydrogen handling, storage, and transport increases risks and deters investment [51]. | Developing clear, global standards for hydrogen safety and environmental impact. |

| Harmonizing hydrogen safety regulations across jurisdictions to promote cross-border trade. | ||

| Permits and Licenses | Hydrogen projects face lengthy and complex permitting and licensing processes, leading to delays in development. Regulatory approvals for hydrogen-related infrastructure can take years [52,53]. | Streamlining permitting and licensing processes for hydrogen projects. |

| Implementing fast-tracked approval mechanisms for low-carbon energy projects, including hydrogen. | ||

| Fragmented Regulatory Landscape | Regulatory frameworks for hydrogen vary significantly between regions, creating barriers for cross-border trade and market integration. This lack of coordination complicates hydrogen market development [52,54]. | Promoting regional and international cooperation on hydrogen regulations. |

| Creating common regulatory frameworks and standards for cross-border hydrogen markets, particularly in Africa. |

3.4. Comparative Analysis of Best Global Practices

3.5. Developing a Green Hydrogen Offtake Strategy in Africa

3.5.1. Strategies for Local Green Hydrogen Offtake Development

3.5.2. Case Studies of Green Hydrogen Offtake Agreements

3.6. Policy Recommendations for Building a Hydrogen Economy

- Developing a Policy Framework That Is Both Consistent and Open to Change

- 2.

- Promotions of Financial Gain

- 3.

- Supply Chains and Civil Construction of Infrastructure

- 4.

- Enabling International Cooperation and Specifications for Standards

- 5.

- Stimulating Demand and Giving Encouragement to The Creation of New Markets

- 6.

- Fostering a Sustainable Social and Environmental Environment

- 7.

- Foster creativity, innovation, and technological advancement.

Refined Policy Recommendations Based on Differentiated National Contexts

3.7. Financing Mechanisms and International Support for the Hydrogen Development in Africa

| Financing Mechanism | Descriptions | Initiatives | Reference |

|---|---|---|---|

| Public–Private Partnerships (PPP) | Combines government and private sector funding for infrastructure projects, sharing risks and costs. PPPs are vital in scaling hydrogen infrastructure and production. | African Development Bank’s hydrogen projects through PPPs in Africa. HyNet Northwest (UK) receives government and private support. | [122,123,124] |

| International Funds | Dedicated funds to support hydrogen and clean energy development globally. Often target emerging economies to scale green hydrogen production and usage. | The Green Climate Fund (GCF) supports hydrogen projects in developing countries; the European Green Deal Fund for hydrogen development. | [119,125,126] |

| Green Bonds | Bonds are issued to fund projects that contribute to environmental sustainability, including renewable energy and hydrogen. | Iberdrola Green Bond for hydrogen development in Spain; European Investment Bank (EIB) issues green bonds for clean energy projects. | [127,128] |

| Carbon Markets | Allows the trading of carbon credits, offering a way to finance hydrogen projects through the reduction of carbon emissions. Hydrogen projects generate credits for trading. | The EU Emissions Trading System (EU ETS) supports hydrogen projects. California’s Low Carbon Fuel Standard (LCFS) integrates hydrogen. | [129,130,131] |

| International Development Loans | Low-interest loans provided by international financial institutions for clean energy and hydrogen development, targeting infrastructure growth in developing regions. | African Development Bank financing hydrogen development in Africa; World Bank loans for hydrogen infrastructure in Asia. | [38,132,133] |

| Private Equity and Venture Capital | Investments from private equity and venture capital firms into hydrogen technology companies, helping to scale production and innovation in hydrogen technologies. | Breakthrough Energy Ventures funds green hydrogen startups. HydrogenOne Capital focuses on hydrogen infrastructure investments. | [134,135] |

| Blended Finance | Uses a mix of concessional public finance with private finance to de-risk investments in hydrogen projects in emerging markets, attracting further private sector investments. | Climate Investment Funds (CIF) blended finance for clean hydrogen projects in Africa. AfDB leveraging blended finance for hydrogen. | [116,119] |

| Sovereign Wealth Funds | Government-owned investment funds finance hydrogen projects to diversify economies and transition to green energy. | Saudi Arabia’s Public Investment Fund (PIF) invests in NEOM’s green hydrogen project. | [136] |

| Risk Mitigation Measure | Description | Examples and Initiatives | Reference |

|---|---|---|---|

| Government Guarantees | Governments offer guarantees to reduce risks for investors, particularly in emerging technologies like hydrogen, by ensuring returns on investment or covering losses. | South Korea provides government-backed guarantees for hydrogen projects. Japan offers guarantees for hydrogen infrastructure development. | [137,138,139,140] |

| Regulatory Clarity | Clear and stable regulatory frameworks reduce uncertainties for investors by ensuring compliance standards, safety protocols, and long-term industry guidelines. | The European Union Hydrogen Strategy provides clear regulations for hydrogen production and trade. California’s regulatory framework for hydrogen vehicles. | [47,108,141,142] |

| Long-term Offtake Agreements | Contracts between hydrogen producers and buyers that secure long-term demand, providing predictable revenue streams and reducing market risks for investors. | NEOM Hydrogen Project has a 20-year offtake agreement with Air Products HyDeal Ambition focuses on long-term hydrogen supply contracts. | [143,144,145] |

| Price Support Mechanisms | Governments or organizations set minimum prices for hydrogen, ensuring producers a certain level of profitability and reducing the risk of price fluctuations. | Germany’s Contracts for Difference (CfD) for green hydrogen pricing The UK Hydrogen Business Model includes price support for hydrogen producers. | [146,147,148] |

| Insurance and Hedging Products | Specialized insurance products and financial instruments that protect investors from risks such as project delays, cost overruns, or market volatility. | Marsh McLennan offers hydrogen-specific insurance products. Zurich Insurance Group provides risk coverage for renewable energy projects. | [149,150,151] |

| Public–Private Co-investment | Governments co-invest alongside private investors, sharing risks and rewards in hydrogen projects, particularly in early-stage ventures. | HyNet Northwest (UK) is supported through co-investment from the government and private sector. The European Clean Hydrogen Alliance promotes co-investment. | [152] |

| Tax Incentives and Credits | Governments provide tax breaks, deductions, or credits to incentivize investment in hydrogen projects, reducing capital costs and improving returns. | US Hydrogen Production Tax Credit (PTC) under the Inflation Reduction Act | [153] |

| Grants and Subsidies | Direct financial support from governments to hydrogen developers, often provided during the early stages of project development to reduce upfront costs. | The European Union Horizon 2020 provides grants for hydrogen research and innovation Japan’s NEDO offers subsidies for hydrogen projects. | [154,155] |

| Blended Finance | Combining public and private financing in ways that reduce risk for private investors, especially for projects in emerging markets or new technologies like hydrogen. | The African Development Bank (AfDB) uses blended finance for hydrogen projects in Africa. The World Bank applies blended finance for clean energy projects. | [126,156,157] |

3.8. The Regional Roles and International Cooperation

3.9. Environmental and Social Impacts of Hydrogen Market Development

4. Conclusions

Study Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rohith, P.K.; Priolkar, J.; Kunkolienkar, G.R. Hydrogen: An innovative and alternative energy for the future. In Proceedings of the 2016 World Conference on Futuristic Trends in Research and Innovation for Social Welfare (Startup Conclave), Coimbatore, India, 29 February–1 March 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Rosen, M.A. The Prospects for Renewable Energy through Hydrogen Energy Systems. J. Power Energy Eng. 2015, 3, 373–377. [Google Scholar] [CrossRef]

- Ikpeka, P.M.; Ugwu, J.O. In situ hydrogen production from hydrocarbon reservoirs—Modelling study. RSC Adv. 2023, 13, 12100–12113. [Google Scholar] [CrossRef]

- Saleh, M.T. Hydrogen in Africa: Navigating the Continent’s Unique Energy Transition Landscape and Unsustainable Energy Supply Backbone. Adv. Sci. Technol. 2024, 142, 3–14. [Google Scholar] [CrossRef]

- Rosen, M.A.; Koohi-Fayegh, S. The prospects for hydrogen as an energy carrier: An overview of hydrogen energy and hydrogen energy systems. Energy Ecol. Environ. 2016, 1, 10–29. [Google Scholar] [CrossRef]

- Sigfusson, T.I. Pathways to hydrogen as an energy carrier. Philos. Trans. R. Soc. A 2007, 365, 1025–1042. [Google Scholar] [CrossRef] [PubMed]

- Paraschiv, S.; Paraschiv, L.S.; Serban, A. Global hydrogen production capacity for sustainable decarbonization and green transition in transport applications to mitigate climate change: A comprehensive overview. Manag. Environ. Qual. 2025; ahead-of-print. [Google Scholar] [CrossRef]

- AbouSeada, N.; Hatem, T.M. Climate action: Prospects of green hydrogen in Africa. Energy Rep. 2022, 8, 3873–3890. [Google Scholar] [CrossRef]

- Imasiku, K.; Farirai, F.; Olwoch, J.; Agbo, S.N. A policy review of green hydrogen economy in Southern Africa. Sustainability 2021, 13, 13240. [Google Scholar] [CrossRef]

- GHIC South Africa. Green Hydrogen Innovation Center. Available online: https://isa-ghic.org/countries/south-africa (accessed on 18 June 2025).

- Pinto, J.; Chege, K. Regulating Green and Low-Carbon Hydrogen in Africa: A Case Study of South Africa. Adv. Sci. Technol. 2024, 142, 15–24. [Google Scholar] [CrossRef]

- Ballo, A.; Valentin, K.K.; Korgo, B.; Ogunjobi, K.O.; Agbo, S.N.; Kone, D.; Savadogo, M. Law and Policy Review on Green Hydrogen Potential in ECOWAS Countries. Energies 2022, 15, 2304. [Google Scholar] [CrossRef]

- Lavrijssen, S.; Vitéz, B. Make hydrogen whilst the sun shines: How to turn the current momentum into a well-functioning hydrogen market? Carbon Clim. Law Rev. 2020, 14, 266–280. [Google Scholar] [CrossRef]

- Ocenic, E.-L. Harmonizing Hydrogen Colour Codes: Need for an Economic Policy Framework for a Global Hydrogen Market. Ovidius Univ. Ann. Econ. Sci. Ser. 2023, 23, 458–465. [Google Scholar] [CrossRef]

- Baumgart, M.; Lavrijssen, S. Exploring regulatory strategies for accelerating the development of sustainable hydrogen markets in the European Union. J. Energy Nat. Resour. Law 2024, 42, 137–166. [Google Scholar] [CrossRef]

- Koshikwinja, P.M.; Cavana, M.; Sechi, S.; Bochiellini, R.; Leone, P. Review of the hydrogen supply chain and use in Africa. Renew. Sustain. Energy Rev. 2025, 208, 115004. [Google Scholar] [CrossRef]

- Obanor, E.I.; Dirisu, J.O.; Kilanko, O.O.; Salawu, E.Y.; Ajayi, O.O. Progress in green hydrogen adoption in the African context. Front. Energy Res. 2024, 12, 1429118. [Google Scholar] [CrossRef]

- Agyekum, E.B. Is Africa ready for green hydrogen energy takeoff?—A multi-criteria analysis approach to the opportunities and barriers of hydrogen production on the continent. Int. J. Hydrogen Energy 2024, 49, 219–233. [Google Scholar] [CrossRef]

- Vechkinzova, E.; Steblyakova, L.P.; Roslyakova, N.; Omarova, B. Prospects for the Development of Hydrogen Energy: Overview of Global Trends and the Russian Market State. Energies 2022, 15, 8503. [Google Scholar] [CrossRef]

- Le, P.A.; Trung, V.D.; Nguyen, P.L.; Phung, T.V.B.; Natsuki, J.; Natsuki, T. The current status of hydrogen energy: An overview. RSC Adv. 2023, 13, 28262–28287. [Google Scholar] [CrossRef] [PubMed]

- Lebrouhi, B.E.; Djoupo, J.J.; Lamrani, B.; Benabdelaziz, K.; Kousksou, T. Global Hydrogen Development—A Technological and Geopolitical Overview. Int. J. Hydrogen Energy 2022, 47, 7016–7048. [Google Scholar] [CrossRef]

- Esily, R.R.; Chi, Y.; Ibrahiem, D.M.; Chen, Y. Hydrogen strategy in decarbonization era: Egypt as a case study. Int. J. Hydrogen Energy 2022, 47, 18629–18647. [Google Scholar] [CrossRef]

- Chapman, A.; Itaoka, K.; Farabi-Asl, H.; Fujii, Y.; Nakahara, M. Societal penetration of hydrogen into the future energy system: Impacts of policy, technology and carbon targets. Int. J. Hydrogen Energy 2020, 45, 3883–3898. [Google Scholar] [CrossRef]

- Pathak, P.K.; Yadav, A.K.; Padmanaban, S. Transition toward emission-free energy systems by 2050: Potential role of hydrogen. Int. J. Hydrogen Energy 2023, 48, 9921–9927. [Google Scholar] [CrossRef]

- Pleshivtseva, Y.; Derevyanov, M.; Pimenov, A.; Rapoport, A. Comparative analysis of global trends in low carbon hydrogen production towards the decarbonization pathway. Int. J. Hydrogen Energy 2023, 48, 32191–32240. [Google Scholar] [CrossRef]

- Cheon, K.; Kim, J. Hydrogen Economy in Major Countries: Policies of Promotion and Lessons Learnt from Them. J. Korean Soc. Miner. Energy Resour. Eng. 2020, 57, 629–639. [Google Scholar] [CrossRef]

- Prest, J.; Woodyatt, J.; Pettit, J. Comparing the Hydrogen Strategies of the EU, Germany, and Australia: Legal and Policy Issues; Oil, Gas & Energy Law Intelligence: Nootdorp, The Netherlands, 2021. [Google Scholar]

- Kar, S.K.; Sinha, A.S.; Bansal, R.; Shabani, B.; Harichandan, S. Overview of hydrogen economy in Australia. WIREs Energy Environ. 2022, 12, e457. [Google Scholar] [CrossRef]

- Reda, B.; Elzamar, A.A.; AlFazzani, S.; Ezzat, S.M. Green hydrogen as a source of renewable energy: A step towards sustainability, an overview. Environ. Dev. Sustain. 2024, 1–21. [Google Scholar] [CrossRef]

- Waegel, A.; Byrne, J.; Tobin, D.; Haney, B. Hydrogen Highways: Lessons on the Energy Technology-Policy Interface. Bull. Sci. Technol. Soc. 2006, 26, 288–298. [Google Scholar] [CrossRef]

- Reigstad, G.A.; Roussanaly, S.; Straus, J.; Anantharaman, R.; de Kler, R.; Akhurst, M.; Sunny, N.; Goldthorpe, W.; Avignon, L.; Pearce, J.; et al. Moving toward the low-carbon hydrogen economy: Experiences and key learnings from national case studies. Adv. Appl. Energy 2022, 8, 100108. [Google Scholar] [CrossRef]

- Komorowski, P.; Grzywacz, M. Green hydrogen in Africa: Opportunities and limitations. J. Manag. Financ. Sci. 2024, XVI, 61–79. [Google Scholar] [CrossRef]

- Nnabuife, S.G.; Quainoo, K.A.; Hamzat, A.K.; Darko, C.K.; Agyemang, C.K. Innovative Strategies for Combining Solar and Wind Energy with Green Hydrogen Systems. Appl. Sci. 2024, 14, 9771. [Google Scholar] [CrossRef]

- Winkler, C.; Heinrichs, H.; Ishmam, S.; Bayat, B.; Lahnaoui, A.; Agbo, S.; Sanchez, E.P.; Franzmann, D.; Oijeabou, N.; Koerner, C.; et al. Participatory mapping of local green hydrogen cost-potentials in Sub-Saharan Africa. Int. J. Hydrogen Energy 2025, 112, 289–321. [Google Scholar] [CrossRef]

- Agoundedemba, H.-G.; Kim, M.; Kim, C.K. Energy Status in Africa: Challenges, Progress and Sustainable Pathways. Energies 2023, 16, 7708. [Google Scholar] [CrossRef]

- Schwerhoff, M.; Sy, G. Developing Africa’s energy mix. Clim. Policy 2018, 19, 108–124. [Google Scholar] [CrossRef]

- Uzoagba, C.; Onwualu, P.A.; Okoroigwe, E.; Kadivar, M.; Oribu, W.S.; Adedeji, I.A. A Review of Biomass Valorization for Bioenergy and Rural Electricity Generation in Nigeria. Cureus J. Eng. 2024, 1–16. [Google Scholar] [CrossRef]

- Ayodele, T.R.; Munda, J.L. The potential role of green hydrogen production in the South Africa energy mix. J. Renew. Sustain. Energy 2019, 11, 044301. [Google Scholar] [CrossRef]

- Chirambo, D. The Climate Finance and Energy Investment Dilemma in Africa: Lacking amidst Plenty. J. Dev. Soc. 2014, 30, 415–440. [Google Scholar] [CrossRef]

- Zobaa, A.F.; Naidoo, P. Electric power development and trade, and power sector reform in Africa. In Proceedings of the 2006 IEEE Power Engineering Society General Meeting, Montreal, QC, Canada, 18–22 June 2006; p. 7. [Google Scholar] [CrossRef]

- Mukelabai, M.D.; Wijayantha, U.K.G.; Blanchard, R.E. Renewable hydrogen economy outlook in Africa. Renew. Sustain. Energy Rev. 2022, 167, 112705. [Google Scholar] [CrossRef]

- Fopah-Lele, A. Hydrogen technology in Sub-Saharan Africa: Prospects for Power Plants. E3S Web Conf. 2022, 354, 01001. [Google Scholar] [CrossRef]

- McKinsey & Company. Global Energy Perspective. Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-energy-perspective-2023 (accessed on 6 June 2025).

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH. Study on the Policy and Regulation Framework for the Build-Up of a Hydrogen Market in Nigeria. 2023. Available online: https://www.gfa-group.de/projects/Study_on_build-up_of_a_hydrogen_market_in_Nigeria_4023394.html (accessed on 18 June 2025).

- Okolocha, D.A.; Oghale, T.O.; Odili, A.M.; Ogagarue, D.O. Hydrogen a Key Solution to Nigeria Energy Poverty: A Case Study of a Pilot Project. In Proceedings of the SPE Nigeria Annual International Conference and Exhibition, Lagos, Nigeria, 31 July–2 August 2023. [Google Scholar]

- Sadik-Zada, E.R.; Gatto, A.; Schäfer, N. African green hydrogen uptake from the lens of African development and European energy security: A blessing or curse? Technol. Forecast. Soc. Chang. 2025, 215, 123974. [Google Scholar] [CrossRef]

- Bade, O.S.; Tomomewo, S.O. A review of governance strategies, policy measures, and regulatory framework for hydrogen energy in the United States. Int. J. Hydrogen Energy 2024, 78, 1363–1381. [Google Scholar] [CrossRef]

- Tonelli, D.; Rosa, L.; Gabrielli, P.; Parente, A.; Contino, F. Global land and water limits to electrolytic hydrogen production using wind and solar resources. Nat. Commun. 2023, 14, 5532. [Google Scholar] [CrossRef]

- Jimena, M.; Luna, L. Environmental Technology & International Affairs Hydrogen as a Potential Renewable and Secure Source for Energy Supply. Master’s Thesis, Dilomatische Akademie Wien, Vienna, Austria, 2019. [Google Scholar] [CrossRef]

- Pan, X.; Zhou, H.; Baimbetov, D.; Syrlybekkyzy, S.; Akhmetov, B.B.; Abbas, Q. Development Status and Future Prospects of Hydrogen Energy Technology: Production, Storage, and Cost Analysis. Adv. Energy Sustain. Res. 2025, 2400451. [Google Scholar] [CrossRef]

- Banet, C.; O’Brien, A. De-Risking the Hydrogen-CCS Value Chain Through Law. Eur. Energy Environ. Law Rev. 2021, 30, 24–41. [Google Scholar] [CrossRef]

- Andreasson, M.; Malin, L. Deliverable 2.2, 2.3—Regulatory Framework: Legal Challenges and Incentives for Developing Hydrogen Offshore; North Sea Energy: 2020; p. 82. Available online: https://pure.rug.nl/ws/portalfiles/portal/166622276/Deliverable_2.2_2.3_Legal_Challenges_and_Incentives_for_Developing_Hydrogen_Offshore.pdf (accessed on 6 June 2025).

- Jumaat, N.A.; Khalid, A.A. A comprehensive review of challenges, prospects, and future perspectives for hydrogen energy development in Malaysia. Int. J. Hydrogen Energy 2024, 55, 65–77. [Google Scholar] [CrossRef]

- Scheibe, R.; Alexander, P. Regulating the Future European Hydrogen Supply Industry: A Balancing Act Between Liberalization, Sustainability, and Security of Supply? The Oxford Institute for Energy Studies: Oxford, UK, 2023. [Google Scholar]

- Lu, X.; Krutoff, A.-C.; Wappler, M.; Fischer, A. Key influencing factors on hydrogen storage and transportation costs: A systematic literature review. Int. J. Hydrogen Energy 2025, 105, 308–325. [Google Scholar] [CrossRef]

- Shao, Y.; Yang, Z.; Yan, Y.; Yan, Y.; Israilova, F.; Khan, N.; Chang, L. Navigating Nigeria’s path to sustainable energy: Challenges, opportunities, and global insight. Energy Strateg. Rev. 2025, 59, 101707. [Google Scholar] [CrossRef]

- Gado, M.G.; Nasser, M.; Hassan, H. Potential of solar and wind-based green hydrogen production frameworks in African countries. Int. J. Hydrogen Energy 2024, 68, 520–536. [Google Scholar] [CrossRef]

- Kim, C.; Cho, S.H.; Cho, S.M.; Na, Y.; Kim, S.; Kim, D.K. Review of hydrogen infrastructure: The current status and roll-out strategyo Title. Int. J. Hydrogen Energy 2023, 48, 1701–1716. [Google Scholar] [CrossRef]

- Garvin, M.J.; Bosso, D. Assessing the Effectiveness of Infrastructure Public—Private Partnership Programs and Projects. Public Work. Manag. Policy 2008, 13, 162–178. [Google Scholar] [CrossRef]

- Mohtavipour, S.S.; Ghafouri, H.; Lasaki, R.A.; Rostami, S. Reliability contract in hydrogen networks: Another step towards sustainable transportation. Int. J. Hydrogen Energy 2024, 58, 341–350. [Google Scholar] [CrossRef]

- Scholten, D.J. Keeping an Eye on Reliability; 2012. Available online: https://repository.tudelft.nl/record/uuid:fd4c94f1-445c-4981-8700-ffcd1765f16f (accessed on 19 June 2025).

- Elgowainy, A.; Mintz, M.; Lee, U.; Stephens, T.; Sun, P.; Reddi, K.; Zhou, Y.; Zang, G.; Ruth, M.; Jadun, P.; et al. Assessment of Potential Future Demands for Hydrogen in the United States; Energy Systems Division, Argonne National Lab. (ANL): Argonne, IL, USA, 2020; pp. 1–80. [Google Scholar] [CrossRef]

- Genovese, M.; Schlüter, A.; Scionti, E.; Piraino, F.; Corigliano, O.; Fragiacomo, P. Power-to-hydrogen and hydrogen-to-X energy systems for the industry of the future in Europe. Int. J. Hydrogen Energy 2023, 48, 16545–16568. [Google Scholar] [CrossRef]

- Franco, A.; Rocca, M. Renewable Electricity and Green Hydrogen Integration for Decarbonization of ‘Hard-to-Abate’ Industrial Sectors. Electricity 2024, 5, 471–490. [Google Scholar] [CrossRef]

- Ikram, M.; Sadki, J.E. Resilient and sustainable green technology strategies: A study of Morocco’s path toward sustainable development. Sustain. Futures 2024, 8, 100327. [Google Scholar] [CrossRef]

- Lahnaoui, A.; Aniello, G.; Barberis, S.; Agbo, S.N.; Kuckshinrichs, W. Assessing the feasibility of a green hydrogen economy in selected African regions with composite indicators. Int. J. Hydrogen Energy 2025, 101, 1387–1405. [Google Scholar] [CrossRef]

- Müller, L.A.; Leonard, A.; Trotter, P.A.; Hirmer, S. Green hydrogen production and use in low- and middle-income countries: A least-cost geospatial modelling approach applied to Kenya. Appl. Energy 2023, 343, 121219. [Google Scholar] [CrossRef]

- Nnabuife, S.G.; Oko, E.; Kuang, B.; Bello, A.; Onwualu, A.P.; Oyagha, S.; Whidborne, J. The prospects of hydrogen in achieving net zero emissions by 2050: A critical review. Sustain. Chem. Clim. Action 2023, 2, 100024. [Google Scholar] [CrossRef]

- Ringel, M.; Stöckigt, G.; Shamon, H.; Vögele, S. Green hydrogen cooperation between Egypt and Europe: The perspective of locals in Suez and Port Said. Int. J. Hydrogen Energy 2024, 79, 1501–1510. [Google Scholar] [CrossRef]

- Serem, A. Kenya Has Potential to Become a Leading Green Hydrogen Exporter. The Standard. Available online: https://www.standardmedia.co.ke/health/health-science/article/2001475578/kenya-has-potential-to-become-a-leading-green-hydrogen-exporter (accessed on 6 June 2025).

- van der Gaast, W.; Begg, K.; Flamos, A. Promoting sustainable energy technology transfers to developing countries through the CDM. Appl. Energy 2009, 86, 230–236. [Google Scholar] [CrossRef]

- Bayssi, O.; Nabil, N.; Azaroual, M.; Bousselamti, L.; Boutammachte, N.; Rachidi, S.; Barberis, S. Green hydrogen landscape in North African countries: Strengths, challenges, and future prospects. Int. J. Hydrogen Energy 2024, 84, 822–839. [Google Scholar] [CrossRef]

- Rekik, S. Optimizing green hydrogen strategies in Tunisia: A combined SWOT-MCDM approach. Sci. Afr. 2024, 26, e02438. [Google Scholar] [CrossRef]

- Schrotenboer, A.H.; Veenstra, A.A.T.; Michiel, A.J.; Ursavas, E. A Green Hydrogen Energy System: Optimal control strategies for integrated hydrogen storage and power generation with wind energy. Renew. Sustain. Energy Rev. 2022, 168, 112744. [Google Scholar] [CrossRef]

- Schucan, T. Case Studies of Integrated Hydrogen Systems; 1999. Available online: https://digital.library.unt.edu/ark:/67531/metadc715026/ (accessed on 6 June 2025).

- Segawa, Y.; Endo, N.; Shimoda, E.; Yamane, T.; Maeda, T. Pilot-scale hydrogen energy utilization system demonstration: A case study of a commercial building with supply and utilization of off-site green hydrogen. Int. J. Hydrogen Energy 2024, 50, 26–36. [Google Scholar] [CrossRef]

- GAN. The Boegoebaai Port and Green Hydrogen Cluster. Global African Network. Available online: https://www.globalafricanetwork.com/south-africa/boegoebaai-port-and-green-hydrogen-cluster/ (accessed on 6 June 2025).

- Hyphen. Southern Corridor Development Initiative (SCDI) Namibian Green Hydrogen Project. Hyphen Hydrogen Energy (Pty) Ltd. Available online: https://hyphenafrica.com/the-hyphen-project/ (accessed on 6 June 2025).

- GH2. Morocco. Green Hydrogen Organisation. Available online: https://gh2.org/ (accessed on 6 June 2025).

- CWP. AMAN. CWP Global. Available online: https://www.oecd.org/content/dam/oecd/en/about/programmes/cefim/green-hydrogen/CWP-case-study.pdf/_jcr_content/renditions/original./CWP-case-study.pdf (accessed on 6 June 2025).

- Rezk, M.R.A.; Piccinetti, L.; Saleh, H.A.; Salem, N.; Mostafa, M.M.M.; Santoro, D.; El-Bary, A.A.; Sakr, M.M. Future scenarios of green hydrogen in the Mena countries: The Case of Egypt. Insights Reg. Dev. 2023, 5, 92–114. [Google Scholar] [CrossRef]

- Newswire, G. Fusion Fuel Announces HEVO Ammonia Morocco Project, Aims to Produce 183,000 Tons of Green Ammonia by 2026. Fusion Fuel Green PLC. Available online: https://www.globenewswire.com/news-release/2021/07/14/2263073/0/en/Fusion-Fuel-Announces-HEVO-Ammonia-Morocco-Project-Aims-to-Produce-183-000-Tons-of-Green-Ammonia-by-2026.html (accessed on 6 June 2025).

- Viljoen, N. Driving the Hydrogen Economy in South Africa. Anglo American. Available online: https://hydrogen.revolve.media/2022/case-studies/driving-the-hydrogen-economy-in-south-africa/ (accessed on 6 June 2025).

- Ammar, E.B.; Ammar, S. Green Hydrogen in Tunisia: A New Mechanism of Plunder and Exploitation. Transnational Institute (tni). Available online: https://www.cetri.be/Green-hydrogen-A-new-mechanism-of?lang=fr (accessed on 6 June 2025).

- IRENA. Global Hydrogen Trade to Meet the 1.5 °C Climate Goal: Part I—Trade Outlook for 2050 and Way Forward; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- Stautner, W.; Ansell, P.J.; Haran, K.S. CHEETA: An All-Electric Aircraft Takes Cryogenics and Superconductivity on Board: Combatting climate change. IEEE Electrif. Mag. 2022, 10, 34–42. [Google Scholar] [CrossRef]

- Curtis, A.J.; Mclellan, B.C. Potential Domestic Energy System Vulnerabilities from Major Exports of Green Hydrogen: A Case Study of Australia. Energies 2023, 16, 5881. [Google Scholar] [CrossRef]

- Wikipedia. Western Green Energy Hub. Wikipedia. Available online: https://en.wikipedia.org/wiki/Western_Green_Energy_Hub (accessed on 6 June 2025).

- Sadiq, M.; Alshehhi, R.J.; Urs, R.R.; Mayyas, A.T. Techno-economic analysis of Green-H2 @ Scale production. Renew. Energy 2023, 219, 119362. [Google Scholar] [CrossRef]

- NEOM. NEOM Green Hydrogen Company Completes Financial Close at a Total Investment Value of USD 8.4 Billion in the World’s Largest Carbon-Free Green Hydrogen Plant. Available online: https://www.neom.com/en-us/newsroom/neom-green-hydrogen-investment#:~:text=NEOM%2C%20Saudi%20Arabia%20%E2%80%93%2022%20May,facility%20at%20a%20total%20investment (accessed on 6 June 2025).

- Enerdata. JinkoSolar Will Supply 1 GW of Solar for the NEOM Hydrogen Project in Saudi Arabia. Enerdata. Available online: https://www.enerdata.net/publications/daily-energy-news/jinkosolar-will-supply-1-gw-solar-neom-hydrogen-project-saudi-arabia.html (accessed on 6 June 2025).

- Pivetta, D.; Armi, C.D.; Sandrin, P.; Bogar, M.; Taccani, R. The role of hydrogen as enabler of industrial port area decarbonization. Renew. Sustain. Energy Rev. 2024, 189, 113912. [Google Scholar] [CrossRef]

- Port, T.; Sea, N. Port of Rotterdam Developing Europe’s Hydrogen Hub; Port of Rotterdam: Europoort, The Netherlands, 2024; pp. 1–8. [Google Scholar]

- SCCS. Rotterdam Climate Initiative: Project Details. University of Edinburgh. Available online: https://www.geos.ed.ac.uk/sccs/project-info/1228 (accessed on 6 June 2025).

- Energy Networks Association. Gas Goes Green: Britain’s Hydrogen Network Plan Report; Energy Networks Association: London, UK, 2021. [Google Scholar]

- French, S. The Role of Zero and Low Carbon Hydrogen in Enabling the Energy Transition and the Path to Net Zero Greenhouse Gas Emissions zero future. Johns. Matthey Technol. Rev. 2020, 64, 357–370. [Google Scholar] [CrossRef]

- Nicolas, P. Technical, Environmental and Economic Analysis of Green Ammonia as an Energy Vector in Spain; Universitat Politècnica de Catalunya: Barcelona, Spain, 2022. [Google Scholar]

- Patiño, J.J.; Velásquez, C.; Ramirez, E.; Betancur, R.; Montoya, J.F.; Chica, E.; Romero-Gómez, P.; Kannan, A.M.; Ramírez, D.; Eusse, P.; et al. Eusse A Renewable Energy Sources for Green Hydrogen Generation in Colombia and Applicable Case of Studies. Energies 2023, 16, 7809. [Google Scholar] [CrossRef]

- Li, Y.; Shi, X.; Phoumin, H. A strategic roadmap for large-scale green hydrogen demonstration and commercialisation in China: A review and survey analysis. Int. J. Hydrogen Energy 2022, 47, 24592–24609. [Google Scholar] [CrossRef]

- Hancock, L.; Ralph, N. A framework for assessing fossil fuel ‘retrofit’ hydrogen exports: Security-justice implications of Australia’s coal-generated hydrogen exports to Japan. Energy 2021, 223, 119938. [Google Scholar] [CrossRef]

- Blomgren, A. Recycling petroleum related knowledge and resources: A case study of channels for knowledge transition and diversification in South West Norway. NORCE Nor. Res. Cent. 2021, 34, 1–22. [Google Scholar]

- De Tommasi, L.; Padraig, L. Towards the Integration of Flexible Green Hydrogen Demand and Production in Ireland: Opportunities, Barriers, and Recommendations. Energies 2023, 16, 352. [Google Scholar] [CrossRef]

- Andrews, C.J.; Weiner, S.A. Visions of a hydrogen future. IEEE Power Energy Mag. 2004, 2, 26–34. [Google Scholar] [CrossRef]

- Elmanakhly, F.; DaCosta, A.; Berry, B.; Stasko, R.; Fowler, M.; Wu, X.Y. Hydrogen economy transition plan: A case study on Ontario. AIMS Energy 2021, 9, 775–811. [Google Scholar] [CrossRef]

- Farrell, N. Policy design for green hydrogen. Renew. Sustain. Energy Rev. 2023, 178, 113216. [Google Scholar] [CrossRef]

- Chirosca, A.-M.; Rusu, E.; Minzu, V. Green Hydrogen—Production and Storage Methods: Current Status and Future Directions. Energies 2024, 17, 5820. [Google Scholar] [CrossRef]

- Ishaq, H.; Dincer, I.; Crawford, C. A review on hydrogen production and utilization: Challenges and opportunities. Int. J. Hydrogen Energy 2022, 47, 26238–26264. [Google Scholar] [CrossRef]

- Cheng, W.; Lee, S. How Green Are the National Hydrogen Strategies? Sustainability 2022, 14, 1930. [Google Scholar] [CrossRef]

- Shamoushaki, M.; Koh, S.C.L. Novel maturity scoring for hydrogen standards and economy in G20. Renew. Sustain. Energy Rev. 2025, 212, 115365. [Google Scholar] [CrossRef]

- Hou, W.; Pan, X.; Pu, Y.; Ma, R.; Saleem, A. Harnessing artificial intelligence for energy strategies: Advancing global economic policies and hydrogen production in the transition to a low-carbon economy. Energy Strateg. Rev. 2024, 56, 101568. [Google Scholar] [CrossRef]

- Chelvam, K.; Hanafiah, M.M.; Nawaz, R. National hydrogen strategies and other policies for promoting hydrogen economy. In Accelerating the Transition to a Hydrogen Economy; Elsevier: Amsterdam, The Netherlands, 2025; pp. 253–281. [Google Scholar] [CrossRef]

- Lee, Y.; Cho, M.H.; Lee, M.C.; Kim, Y.J. Policy agenda toward a hydrogen economy: Institutional and technological perspectives. Int. J. Hydrogen Energy 2024, 54, 1521–1531. [Google Scholar] [CrossRef]

- Klagge, B.; Walker, B.; Kalvelage, L.; Greiner, C. Governance of future-making: Green hydrogen in Namibia and South Africa. Geoforum 2025, 161, 104244. [Google Scholar] [CrossRef]

- Kim, J.W.; Boo, K.J.; Cho, J.H.; Moon, I. Key challenges in the development of an infrastructure for hydrogen production, delivery, storage and use. Adv. Hydrogen Prod. Storage Distrib. 2014, 1, 3–31. [Google Scholar] [CrossRef]

- Bandiri, S.Y.; Mensah, J.H.; Nbundé, N.S.; dos Santos, I.F.; Tiago Filho, G.L. Challenging the status quo: Hydrogen as a catalyst for energy development in Africa. Sustain. Energy Technol. Assess. 2024, 68, 103850. [Google Scholar] [CrossRef]

- Emenekwe, C.; Nnamani, U.; Stephen, A. Green Industrialization in Africa: Opportunities and Tensions in Africa-Europe Relations. Scoping Paper on Nigeria; Scoping Paper Nigeria; 2024. Available online: https://www.iddri.org/en/publications-and-events/report/green-industrialization-africa-opportunities-and-tensions-africa (accessed on 6 June 2025).

- Fasesin, K.; Oladinni, A.; Emezirinwune, M.U.; Oba-sulaiman, Z.; Abdulsalam, K.A. Renewable Energy in Developing Countries: Challenges, Opportunities, and Policy Recommendations for Innovative Funding. Adeleke Univ. J. Sci. 2024, 3, 120–129. [Google Scholar]

- Martins, F.P.; Almaraz, S.D.-L.; Botelho, A.B., Jr.; Azzaro-Pantel, C.; Parikh, P. Hydrogen and the sustainable development goals: Synergies and trade-offs. Renew. Sustain. Energy Rev. 2024, 204, 114796. [Google Scholar] [CrossRef]

- Visconti, G.; Ramirez, G.R.; Braly-Cartillier, I. Enhancing Access to Concessional Climate Finance Enhancing Access to Concessional Climate Finance; Inter-American Development Bank: Washington, DC, USA, 2024. [Google Scholar] [CrossRef]

- Agrawal, A. Risk Mitigation Strategies for Renewable Energy Project Financing. Strateg. Plan. Energy Environ. 2021, 32, 9–20. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Li, Y.; Rasoulinezhad, E.; Mortha, A.; Long, Y.; Lan, Y.; Zhang, Z.; Li, N.; Zhao, X.; Wang, Y. Green finance and the economic feasibility of hydrogen projects. Int. J. Hydrogen Energy 2022, 47, 24511–24522. [Google Scholar] [CrossRef]

- Schreiner, L.; Madlener, R.; Schreiner, L. A Green Alliance with the Black Continent: Requirements to Implement a Long-Run EU-Africa Hydrogen Economy via Public-Private Partnerships. FCN Work. Pap. 2022, 64. [Google Scholar] [CrossRef]

- Anyanwu, J.C. Public-Private Partnerships in the Nigerian Energy Sector: Banks’ Roles and Lessons of Experience; Nova Science Publishers, Inc.: Hauppauge, NY, USA, 2009. [Google Scholar]

- EET Fuels. UK’s Drive to Net Zero Leaps Forward as HyNet North West Awarded Substantial Funding. Essar Energy Transition (EET) Fuels. Available online: https://www.eetfuels.com/news/uk-s-drive-to-net-zero-leaps-forward-as-hynet-north-west-awarded-substantial-funding/ (accessed on 6 June 2025).

- European Union. A hydrogen strategy for a climate-neutral Europe. In Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; COM(2020), No. Document 52020DC0301; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Speer, B.; Wu, K. Assessment of Opportunities for Usaid to Deepen Climate Finance Support for Renewable Energy and Energy Efficiency in Developing Countries; U.S. Agency for International Development (USAID): Washington, DC, USA, 2021. [Google Scholar]

- BP. BP and Iberdrola Announce Final Investment Decision for Largest Green Hydrogen Plant in Spain. BP Press Release. Available online: https://www.bp.com/en/global/corporate/news-and-insights/press-releases/bp-and-iberdrola-announce-final-investment-decision-for-largest-green-hydrogen-plant-in-spain.html (accessed on 6 June 2025).

- European Investment Bank. France: EIB Invests €150 Million in EDF’s €3 Billion Green Bond Issue on 11 June 2024. European Investment Bank. Available online: https://europeansting.com/2024/06/17/france-eib-invests-e150-million-in-edfs-e3-billion-green-bond-issue-on-11-june-2024/ (accessed on 6 June 2025).

- Hydrogen Europe. ETS and CBAM—Implications for the Hydrogen Sector; Hydrogen Europe: Brussels, Belgium, 2022. [Google Scholar]

- Gregor Erbach. Revised EU Emissions Trading System; No. PE 754.575; EPRS|European Parliamentary Research Service: Brussels, Belgium, 2023. [Google Scholar]

- Fuelcell Energy. Renewable Hydrogen Included Under California LCFS. Biomass Magazine. Available online: https://biomassmagazine.com/articles/renewable-hydrogen-included-under-california-lcfs-12806 (accessed on 6 June 2025).

- Climate Investment Fund. Just Transition in a Renewable Energy Rich Environment—Potential Role of Green Hydrogen; African Development Bank Group: Abidjan, Côte d’Ivoire, 2022. [Google Scholar]

- World Bank. World Bank Proposes 10 GW Clean Hydrogen Initiative to Boost Adoption of Low-Carbon Energy. World Bank Group. Available online: https://www.worldbank.org/en/news/press-release/2023/11/17/world-bank-proposes-10-gw-clean-hydrogen-initiative-to-boost-adoption-of-low-carbon-energy (accessed on 21 March 2025).

- Wilson, A. Hydrogen Is Having a Moment; Breakthrough Energy: Kirkland, WA, USA, 2023. [Google Scholar]

- Strohm. HydrogenOne Capital Growth plc invests £8.4m (EUR 10m) in Netherlands-Based Hydrogen Pipeline Company Strohm. Strohm. Available online: https://strohm.eu/news/hydrogenone-capital-growth-plc-invests-84m-eur-10m-in-netherlands-based-hydrogen-pipeline-company-strohm (accessed on 25 March 2025).

- Dokso, A. Saudi Arabia’s Public Investment Fund Invests in Clean Hydrogen. H2 Energy News. Available online: https://energynews.biz/saudi-arabias-public-investment-fund-invests-in-clean-hydrogen/ (accessed on 25 March 2025).

- Cho, M.; Lee, Y.; Kim, Y.; Lee, M.C. Strategic Public Relations Policy for Accelerating Hydrogen Acceptance: Insights from an Expert Survey in South Korea. Energies 2024, 17, 4325. [Google Scholar] [CrossRef]

- Yun, M.; Jang, W.; Lim, J.; Yun, B. A study on a political system for the advance in green hydrogen technology: A South Korea case study. Energy. Sustain. Soc. 2023, 13, 43. [Google Scholar] [CrossRef]

- Osaki, Y.; Hughes, L. Japan: Putting Hydrogen at the Core of Its Decarbonization Strategy. Available online: https://www.rifs-potsdam.de/en/output/publications/2024/japan-putting-hydrogen-core-its-decarbonization-strategy (accessed on 5 May 2025).

- Shibata, Y.; Nian, V.; Bhandari, A.; Roychoudhury, J. Using hydrogen for decarbonization, industrial development, and energy security: Shared ambitions for Japan, ASEAN Member States, and India. In The Clean Hydrogen Economy and Saudi Arabia; Routledge: Oxfordshire, UK, 2024; pp. 329–373. [Google Scholar]

- Migliavacca, G.; Carlini, C.; Domenighini, P.; Zagano, C. Hydrogen: Prospects and Criticalities for Future Development and Analysis of Present EU and National Regulation Hydrogen: Prospects and Criticalities for Future Development and Analysis of Present EU. Preprint 2024. [Google Scholar] [CrossRef]

- Bade, S.O.; Tomomewo, O.S.; Meenakshisundaram, A.; Ferron, P.; Oni, B.A. Economic, social, and regulatory challenges of green hydrogen production and utilization in the US: A review. Int. J. Hydrogen Energy 2024, 49, 314–335. [Google Scholar] [CrossRef]

- Millison, D. Emerging Hydrogen Energy Technology and Global Momentum; ADB Sustainable Development Working Paper Series No. 96; Asian Development Bank: Metro Manila, Philippines, 2024. [Google Scholar]

- Braun, J.F.; van Wijk, A.; Westphal, K. Europe’s Hydrogen Pathways: Toward a Balanced Partnership with Saudi Arabia and the Gulf; Routledge: Oxfordshire, UK, 2024. [Google Scholar] [CrossRef]

- Escribano, G.; Urbasos, I. Spain’s Hydrogen Ambition: Between Reindustrialisation and Export-Led Energy Integration with the EU. In The Geopolitics of Hydrogen; Springer: Cham, Switzerland, 2024; Volume 1, pp. 131–146. [Google Scholar] [CrossRef]

- Geßner, D. Rethinking Renewable Energy Policies for Hydrogen—How the Intercept of Electricity and Hydrogen Markets Can Be Addressed; Würzburg Economic Papers: Würzburg, Germany, 2024. [Google Scholar] [CrossRef]

- Acharya, A. A Review of Emerging Revenue Models for Low-carbon Hydrogen Technologies. J. Sustain. Dev. 2024, 17, 1–15. [Google Scholar] [CrossRef]

- Schlecht, I.; Maurer, C.; Hirth, L. Financial contracts for differences: The problems with conventional CfDs in electricity markets and how forward contracts can help solve them. Energy Policy 2024, 186, 113981. [Google Scholar] [CrossRef]

- Marsh. Marsh Launches World’s First Insurance Facility for Green and Blue Hydrogen Project Risks. Available online: https://www.marsh.com/en-gb/about/media/worlds-first-insurance-facility-for-green-and-blue-hydrogen-project.html (accessed on 10 April 2025).

- Zurich Insurance Group. Zurich and Aon to Support Net-Zero Transition Through New Clean Hydrogen Insurance Facility. Available online: https://www.zurich.com/media/news-releases/2024/2024-0701-01 (accessed on 4 May 2025).

- Meral, H. The Role of Insurance in Promoting Clean Energy Transition. In Decision Making in Interdisciplinary Renewable Energy Projects. Contributions to Management Science; Dinçer, M., Yüksel, H., Deveci, S., Eds.; Springer: Cham, Switzerland, 2024; pp. 197–207. [Google Scholar] [CrossRef]

- Pultar, A.; Ferrier, J. Next Steps for Decarbonising UK Industry: IDRIC Policy Synthesis Report 2022; Industrial Decarbonisation Research and Innovation Centre: Edinburgh, UK, 2022; pp. 1–47. [Google Scholar] [CrossRef]

- Medlock, K.B., III; Hung, S.Y. Developing a Robust Hydrogen Market in Texas; Center for Energy Studies, Rice University’s Baker Institute: Houston, TX, USA, 2023. [Google Scholar]

- Behling, S.M.N.; Williams, M.C. Fuel cells and the hydrogen revolution: Analysis of a strategic plan in Japan. Econ. Anal. Policy 2015, 48, 204–221. [Google Scholar] [CrossRef]

- Delaval, B.; Rapson, T.; Sharma, R.; Hugh-Jones, W.; McClure, E.; Temminghoff, M.; Srinivasan, V. Hydrogen RD&D Collaboration Opportunities: Japan; CSIRO: Canberra, Australia, 2022. [Google Scholar]

- Panulo, B.; Van Staden, J. Understanding South African Development Finance Institutions to Promote Accountability; Bertha Centre: Cape Town, South Africa, 2022. [Google Scholar]

- Medinilla, A.; Sergejeff, K. Scaling Up African Clean Energy; ECDPM: Maastricht, The Netherlands, 2023. [Google Scholar]

- Mugwagwa, J. Multiple meanings, one objective: The case of biotechnology policy convergence in Africa. Asian Biotechnol. Dev. Rev. 2012, 14, 31–48. [Google Scholar]

- Yilma, K. The African Union and Digital Policies in Africa. Digit. Soc. 2023, 2, 16. [Google Scholar] [CrossRef]

- Knight, J. Higher education cooperation at the regional level. J. Int. Coop. Educ. 2024, 26, 101–115. [Google Scholar] [CrossRef]

- Chou, M.H.; Huisman, J.; Lorenzo, M.P. Regional cooperation in higher education. In Handbook of Regional Cooperation and Integration; Edward Elgar Publishing: Cheltenham, UK, 2024; pp. 266–288. [Google Scholar] [CrossRef]

- Ferreira-Snyman, M.P. The harmonisation of laws within the African Union and the viability of legal pluralism as an alternative. J. Contemp. Rom. Law 2010, 73, 608–628. [Google Scholar]

- Lee, J.K.; Dhar, S. Predicting potential challenges of regional hydrogen cooperation through a case study of the european union. Int. J. Renew. Energy Resour. 2023, 13, 1–13. [Google Scholar] [CrossRef]

- Popov, S.; Maksakova, D.; Baldynov, O.; Korneev, K. Hydrogen Energy: A New Dimension for the Energy Cooperation in the Northeast Asian Region. E3S Web Conf. 2020, 209, 05017. [Google Scholar] [CrossRef]

- Van De Graaf, T.; Overland, I.; Scholten, D.; Westphal, K. Energy Research & Social Science The new oil? The geopolitics and international governance of hydrogen. Energy Res. Soc. Sci. 2020, 70, 101667. [Google Scholar] [CrossRef]

- Cremonese, L.; Mbungu, G.K.; Quitzow, R. The sustainability of green hydrogen: An uncertain proposition. Int. J. Hydrogen Energy 2023, 48, 19422–19436. [Google Scholar] [CrossRef]

- Qin, Y.; Höglund-isaksson, L.; Byers, E.; Feng, K. Air Quality-Carbon-Water Synergies and Trade-offs in China’ s Natural Gas Industry. Nat. Sustain. 2018, 1, 505–511. [Google Scholar] [CrossRef]

- Kloss, C. Green Infrastructure for Urban Stormwater Management. In Low Impact Development for Urban Ecosystem and Habitat Protection; American Society of Civil Engineers: Reston, VA, USA, 2012; Volume 370/5. [Google Scholar] [CrossRef]

- Van Der Laan, M.; Jumman, A.; Perret, S.R. Environmental benefits of improved water and nitrogen management in irrigated sugarcane: A combined crop modelling and life cycle assessment approach. Environ. Sci. Agric. Food Sci. 2015, 64, 241–252. [Google Scholar]

- Millstein, D.; Macknick, J.; Nicholson, S.; Keyser, D.; Jeong, S.; Heath, G. GeoVision Analysis Supporting Task Force Report: Impacts—The Employment Opportunities, Water Impacts, Emission Reductions, and Air Quality Improvements of Achieving High Penetrations of Geothermal Power in the United States. Berkeley, CA and Golden, CO: Lawrence Berkeley National Laboratory and National Renewable Energy Laboratory. NREL/TP-6A20-71933. 2019. Available online: https://emp.lbl.gov/publications/geovision-analysis-impacts-task-force (accessed on 6 June 2025).

- Nnabuife, S.G.; Darko, C.K.; Obiako, P.C.; Kuang, B.; Sun, X.; Jenkins, K. A Comparative Analysis of Different Hydrogen Production Methods and Their Environmental Impact. Clean Technol. 2023, 5, 1344–1380. [Google Scholar] [CrossRef]

- Harper-Dorton, K.V.; Harper, S.J. Social and Environmental Justice and the Water-Energy Nexus: A Quest in Progress for Rural People. Contemp. Rural Soc. Work J. 2015, 7, 4. [Google Scholar]

- Ehimen, E.A.; Sandula, P.Y.; Robin, T.; Gamula, G.T. Improving Energy Access in Low-Income Sub-Saharan African Countries: A Case Study of Malawi. Energies 2023, 16, 3106. [Google Scholar] [CrossRef]

- Al Kez, D.; Foley, A.; Lowans, C.; Del Rio, D.F. Energy poverty assessment: Indicators and implications for developing and developed countries. Energy Convers. Manag. 2024, 307, 118324. [Google Scholar] [CrossRef]

- Ani, E.C.; Olajiga, O.K.; Sikhakane, Z.Q.; Olatunde, T.M. Renewable Energy Integration for Water Supply: A Comparative Review of African and U.S. Initiatives. Eng. Sci. Technol. J. 2024, 5, 1086–1096. [Google Scholar] [CrossRef]

- Joel, O.T.; Oguanobi, V.U. Leadership and management in high-growth environments: Effective strategies for the clean energy sector. Int. J. Manag. Entrep. Res. 2024, 6, 1423–1440. [Google Scholar] [CrossRef]

- Gebreslassie, M.G.; Bekele, G.; Bahta, S.T.; Mebrahtu, A.H.; Assefa, A.; Nurhussien, F.F.; Habtu, D.; Lake, A.; Broto, V.C.; Mulugetta, Y. Developing community energy systems to facilitate Ethiopia’s transition to sustainable energy. Energy Res. Soc. Sci. 2024, 117, 103713. [Google Scholar] [CrossRef]

- Speight, J.G.; Radovanovi, L. Biofuels: Future benefits and risks. ACTA Teh. CORVINIENSIS–Bull. Eng. 2015, 3, 1–5. [Google Scholar]

- Huda, N.; Beeson, M. Siting and co-location with hydrogen: What are the risks? Environ. Sci. Eng. 2021, 1–11. Available online: https://hysafe.info/uploads/papers/2021/71.pdf (accessed on 5 June 2025).

| Region | Key Policies | Financial Incentives | Market Structure | Notable Best Practice |

|---|---|---|---|---|

| EU | Green Deal, Hydrogen Strategy | Large-scale subsidies and funding calls | Liberalized, cross-border cooperation | Integrated EU Hydrogen Backbone |

| Japan | Basic Hydrogen Strategy | Direct government R&D funding | Public–private partnerships | Early commercialization focus |

| Australia | National Hydrogen Strategy | State and federal grants | Competitive, export-driven market | Federal-state coordination |

| Africa | Nascent national policies | Limited | Fragmented, emerging | Opportunity to integrate best practices |

| Case Study | Region/ Country | Description | Offtake Partners | Ref. |

|---|---|---|---|---|

| Boegoebaai Green Hydrogen Project | South Africa | A large-scale green hydrogen production facility powered by RE sources, primarily solar and wind. | Sasol and the Industrial Development Corporation (IDC) | [18,77] |

| Hyphen Hydrogen Energy Project | Namibia | The first large-scale green hydrogen production plant in Namibia, using wind and solar to produce green hydrogen. | Various European partners (incl. the German government) for export to Europe | [78] |

| Nigeria Hydrogen Policy Framework | Nigeria (West Africa) | A strategic national policy initiative focusing on local market development and hydrogen readiness, targeting industrial decarbonization. | National pilot stakeholders; regulatory framework in development | [44,68] |

| Morocco Green Hydrogen Alliance (MGHA) | Morocco | Initiative aimed at developing a national green hydrogen production strategy using the country’s vast renewable resources. | European Union partners and international corporations for hydrogen export | [32,79] |

| The AMAN Green Hydrogen Project | Mauritania | The massive renewable energy project is aimed at producing 10 million tons of green hydrogen annually for export. | CWP Global and European energy markets (offtake partners to be finalized) | [80] |

| Suez Green Hydrogen Project | Egypt | Focused on producing green hydrogen from solar and wind energy for use in local ammonia production and export. | Fertiglobe (Orascom), Scatec, and Egyptian Sovereign Fund | [81] |

| KenGen Green Hydrogen Pilot | Kenya | A pilot project to produce green hydrogen using geothermal energy from KenGen’s existing geothermal power plants. | Local industrial and transportation sectors (offtake partners in negotiation) | [70] |

| HEVO Ammonia Morocco Project | Morocco | A large-scale facility to produce green hydrogen for ammonia production, aiming to export ammonia globally. | Fusion Fuel and Vitol (for ammonia offtake) | [82] |

| Anglo American Green Hydrogen Initiative | South Africa | Green hydrogen production to power hydrogen fuel cell trucks for mining operations, reducing reliance on diesel. | Anglo American (internal offtake for mining operations) | [83] |

| Tunisia Green Hydrogen Strategy (National Program) | Tunisia | Developing green hydrogen infrastructure and capacity for local industrial use and potential export to Europe. | European Union partners (export offtake agreements being developed) | [84] |

| HyDeal Ambition | Europe (Spain, France) | A large-scale green hydrogen initiative aiming to deliver hydrogen at fossil fuel parity. Expected to supply 3.6 million tons of green hydrogen by 2030. | Industrial partners across Europe | [85,86] |

| Western Green Energy Hub (WGEH) | Australia | A proposed hub focused on producing green hydrogen for export to international markets, leveraging renewable energy. The project aims to produce up to 50 GW of energy. | Asian and European countries | [87,88] |

| NEOM Hydrogen Project | Saudi Arabia | A $5 billion project focused on producing green hydrogen for both local and international consumption. Expected to produce 650 tons of hydrogen daily from 2026. | ACWA Power, Air Products, NEOM | [89,90,91] |

| Port of Rotterdam Green Hydrogen Offtake | Netherlands | Green hydrogen produced at the Port of Rotterdam will be supplied to major industrial partners in Europe. The focus is on decarbonizing heavy industries. | BP, Shell, Uniper | [92,93,94] |

| HyNet Northwest | United Kingdom | A green hydrogen network focusing on decarbonizing industries in the Northwest of England. HyNet is expected to meet 80% of the region’s hydrogen demand by 2030. | UK industries | [95,96] |

| Green Hydrogen offtake agreement by Iberdrola | Spain | Iberdrola’s green hydrogen project in Puertollano will power fertilizers and ammonia production, with plans for further expansion into other industries. | Fertiberia | [97,98] |

| Asian Renewable Energy Hub (AREH) | Australia | This project aims to export green hydrogen to Southeast Asia, focusing on using abundant renewable resources in Australia to create a large green hydrogen export industry. | Japan, South Korea | [99] |

| Hydrogen Energy Supply Chain (HESC) | Australia—Japan | This pilot project exports liquid hydrogen from Australia to Japan, using coal gasification for hydrogen production, combined with carbon capture and storage (CCS). | Kawasaki Heavy Industries, J-Power | [100] |

| Hy2Gen Green Hydrogen Plant in Norway | Norway | Focused on providing green hydrogen to the maritime and logistics industries in Europe. Part of the European green hydrogen infrastructure expansion. | European maritime industries | [101] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Uzoagba, C.E.J.; Ikpeka, P.M.; Nnabuife, S.G.; Onwualu, P.A.; Ngasoh, F.O.; Kuang, B. Development of the Hydrogen Market and Local Green Hydrogen Offtake in Africa. Hydrogen 2025, 6, 43. https://doi.org/10.3390/hydrogen6030043

Uzoagba CEJ, Ikpeka PM, Nnabuife SG, Onwualu PA, Ngasoh FO, Kuang B. Development of the Hydrogen Market and Local Green Hydrogen Offtake in Africa. Hydrogen. 2025; 6(3):43. https://doi.org/10.3390/hydrogen6030043

Chicago/Turabian StyleUzoagba, Chidiebele E. J., Princewill M. Ikpeka, Somtochukwu Godfrey Nnabuife, Peter Azikiwe Onwualu, Fayen Odette Ngasoh, and Boyu Kuang. 2025. "Development of the Hydrogen Market and Local Green Hydrogen Offtake in Africa" Hydrogen 6, no. 3: 43. https://doi.org/10.3390/hydrogen6030043

APA StyleUzoagba, C. E. J., Ikpeka, P. M., Nnabuife, S. G., Onwualu, P. A., Ngasoh, F. O., & Kuang, B. (2025). Development of the Hydrogen Market and Local Green Hydrogen Offtake in Africa. Hydrogen, 6(3), 43. https://doi.org/10.3390/hydrogen6030043