1. Introduction

The creative economy includes the processes involved in producing, sharing, and using goods and services that depend on creativity, cultural understanding, entrepreneurship, and intellectual property as essential factors for economic value. This is situated at the intersection of cultural expression, economic productivity, and technological progress; the creative economy has experienced significant structural changes mainly driven by the proliferation of General Purpose Technologies (GPTs), such as mobile telecommunications, broadband networks, artificial intelligence (AI), and digital platforms [

1]. These technologies have transformed content creation and sharing, resulting in decentralised, platform-based economic systems that enable creators to generate income via global intermediaries such as YouTube, TikTok, and Spotify [

2]. Although developed nations predominantly drive the conversation around creative industries, emerging evidence indicates that Sub-Saharan Africa is increasingly integrating into the global digital creative scene [

3]. The merging of mobile-first distribution, casual creative production, and digitally connected platforms has broadened prospects for African creators, especially in semi-urban and underprivileged areas, by reducing entry barriers and improving access to audiences locally and globally.

In the African context, South Africa stands out as a fascinating example. The Cultural and Creative Industries (CCIs) Masterplan recognises the nation’s creative sectors, such as music, film, digital content, and fashion, which are crucial to gross domestic product (GDP), job creation, entrepreneurship, and social unity. According to the author [

4], the global creative economy contributes nearly 3% to world GDP, while in South Africa, cultural and creative industries account for approximately 3–4% of GDP and provide employment to more than one million people, particularly among youth and women. Conversely, in 2012, the creative industries in the United Kingdom accounted for 5.2% of GDP and produced 1.68 million jobs, according to [

5], demonstrating the sector’s potential as a catalyst for growth and employment. Despite these challenges, South Africa continues to face systemic obstacles. Author [

6] indicated that in 2017, the internet penetration rate in the country was 53%, the highest of seven African nations surveyed, but considerably lower compared to sixteen Global South economies, underlining ongoing digital divides that hinder the sector’s growth. These spaces also serve as essential sites for cultural identity and economic empowerment, especially for historically underrepresented groups such as women and youth [

7]. The untapped potential of South Africa’s creative economy remains underutilised due to persistent structural barriers. Factors such as uneven development of digital infrastructure, especially between urban areas and rural or township regions, as well as institutional shortcomings in intellectual property (IP) protection, innovation funding, entrepreneurship support, and sector coordination, all limit the formalisation and growth of creative businesses.

Although there is an increasing policy focus, academic research on the structural factors influencing the performance of the creative economy in South Africa remains quite limited. Moreover, while patent applications and AI-driven innovations are increasingly recognised as indicators of technological advancement and national innovation capacity in studies such as [

8,

9], their specific influence on the development of Africa’s creative sectors and entrepreneurial prospects remains insufficiently assessed. A significant lack of econometric research is evident in exploring the relationship among ICT investment, entrepreneurship dynamics, digital services trade, innovation activities, and outcomes in the creative sector in African settings

This knowledge gap is further worsened at the regional level, where the creative economy, despite its rhetorical prominence in development discourse, is often underfunded, informally structured, and inconsistently measured. Major obstacles such as weak IP enforcement, fragmented entrepreneurial financing climates, insufficient regional collaboration, and the absence of dependable sector-specific data continually impede its ability to function as a growth catalyst [

3]. Despite the sector’s significant potential for fostering inclusive post-industrial growth, scaling creative entrepreneurship, and reducing youth unemployment throughout Africa, its macroeconomic impact still largely remains underreported, fragmented, and mostly outside formal national statistics.

To address these gaps, this research employs a quantitative time-series approach with the Autoregressive Distributed Lag (ARDL) model to examine both short-term and long-term connections between innovation capacity (PAT), digital trade infrastructure (SERVEXP), sectoral development (CC), and intellectual property commercialisation (IP_RECV). The analysis addresses two key research questions: (1) How do innovation and digital infrastructure influence the commercialisation of creative outputs? (2) What are the short- and long-run impacts of creative sector growth on intellectual property revenues within South Africa’s creative economy? This framework guarantees a solid theoretical foundation and empirical accuracy in connecting the dynamics of innovation and entrepreneurship to the performance of the creative economy.

This research broadens discussions in global creative economy studies [

10,

11,

12] by situating South Africa’s digital transformation within the context of cultural value chains and creative cluster models. In contrast to research conducted in developed nations, where creative sectors are integrated into established innovation systems, African creative economies function amidst a blend of informality, scattered intellectual property rights, and inconsistent infrastructure growth. Connecting ARDL-based evidence to these theoretical discussions, the results extend beyond a mere technical analysis and aid in re-conceptualising how innovation and infrastructure support creative entrepreneurship in middle-income African settings. This study contributes three distinct perspectives to the literature on the creative economy and entrepreneurship. It initially offers a broad time-series evaluation of the relationship between digital trade integration and sectoral maturity concerning the commercialisation of intellectual property within an African middle-income setting. Additionally, it connects macro indicators (such as patent numbers, digital services trade metrics, and industry composition) to entrepreneurial processes, market entry, knowledge connections (relationships among creators, investors, and platforms), and participation gaps, thus transforming overall results into insights pertinent to creative entrepreneurs and policymakers. Third, due to measurement difficulties related to creative sector activity, the paper outlines alternative proxies and estimation methods, sharing these openly so that readers can assess the strength of our findings.

2. Literature Review

2.1. Digital Transformation in Creative Economies

Digital transformation is altering creative economies globally, forced by technological progress in distribution channels, connectivity, and content creation. Author [

3] highlights that digital platforms and technologies currently support the global creative economy, allowing content creators to reach broader markets while presenting new monetisation difficulties. Author [

12] illustrates how streaming services and platform economies, such as YouTube and Netflix, have transformed the media industries, generating both opportunities and gatekeeping challenges for local content creators. The COVID-19 pandemic accelerated the adoption of digital technologies in creative industries, resulting in changes in consumption habits and the expansion of virtual interactions enhanced by augmented and virtual reality [

13]. Companies adopting platform strategies and digital innovations are excelling compared to traditional entities that resist change [

14]. Nonetheless, issues regarding insufficient infrastructure, digital competencies, and access persist, particularly in lower-income countries [

15]. Recent studies support these conclusions, indicating that Africa’s digital evolution relies more on the incorporation of AI, the export of creative content, and the alignment of human capital [

16,

17].

In Africa, digital technologies offer a route for economic diversification and growth; however, progress varies significantly. Mobile-first adoption frameworks are prevalent, with advancements extending to the finance, health, and education sectors [

17,

18]. In the creative sectors, digitalisation is clear in advertising, fashion, and music production [

7]. Yet, obstacles like the urban–rural digital gap, infrastructure shortcomings, and cybersecurity issues impede comprehensive transformation within the industry [

19]. To address these challenges, it is advised that African decision-makers adopt holistic digital strategies focusing on infrastructure, policy reforms, and the improvement of digital competencies [

18]. Recent comparative studies have demonstrated that countries focusing on inclusive digital infrastructure achieve faster growth in the creative sector and greater resilience against market disruptions [

20].

In South Africa, digital transformation has been integrated into national development strategies to promote inclusive growth. Government initiatives seek to boost productivity, assist SMEs, and encourage diversity in the cultural and creative sectors (CCIs) [

21,

22,

23]. Productivity improvements are evident, particularly since the COVID-19 pandemic; however, governance fragmentation and ongoing digital access obstacles continue to hinder transformation initiatives [

22]. As a result, enhancing infrastructure and ensuring synchronised policy execution continue to be key focuses for unleashing the potential of South Africa’s digital creative economy.

2.2. Role of AI, ICT, and Innovation in Sub-Saharan Africa

AI and ICT are progressively acknowledged as essential technologies for socio-economic progress in Sub-Saharan Africa (SSA). Author [

24] highlights that progress in ICT is crucial for economic growth in low-income areas, as mobile technologies can tackle connectivity gaps where conventional infrastructure is inadequate. Nonetheless, the widespread implementation of AI is limited by infrastructure shortcomings, elevated deployment costs, and unclear regulations [

17,

18]. To harness AI’s transformative potential, it is essential to have extensive digital policies, continuous investment in connectivity, and the cultivation of human capital [

25]. This study emphasises AI and ICT applications in creative sectors, particularly in digital content, animation, gaming, and music production, where these technologies have a significant impact on entrepreneurial trajectories and innovation outcomes.

2.3. Patents as Innovation Proxies

The role of patents as measures of innovation remains a subject of discussion. Key research, such as that conducted by Author [

26], endorses the use of patent tallies as indicators of innovative performance, which mirror the intensity of R&D and the availability of a skilled workforce. Nonetheless, patents solely document formal, codified innovations, frequently overlooking informal and non-technological innovations prevalent in developing economies. Author [

27] contends that patent applications in industries like pharmaceuticals exhibit a low correlation with market results, whereas author [

28] discovers that other variables, such as market reactions to new products or trademarks, might more effectively reflect innovation in specific sectors. Author [

29], stated that innovation variables based on patents may mainly indicate urban, formal-sector innovation, neglecting the rural and informal innovations common in Sub-Saharan Africa

While patents act as a formal indication of innovation, they capture merely a limited segment of participation in the creative sector. Casual innovation, including design alterations, cultural reinterpretations, and unregistered artistic creations, constitutes a substantial part of Africa’s creative economy [

30]. Similarly, the incorporation of ICT and AI is not an isolated element but rather engages with cultural value networks and creative centres, influencing methods of production, distribution, and monetisation [

10]. Acknowledging these links is essential for understanding how digital and non-digital innovations collectively impact outcomes in creative entrepreneurship.

2.4. Identified Gaps in the Literature

Although studies on digitalisation and innovation in Africa have increased, many gaps remain. To begin with, econometric studies that measure the structural influence of ICT and innovation factors on creative industry outcomes are limited in African settings. Most of the current research emphasises qualitative evaluations, restricting empirical generalisation. Secondly, detailed data on digital infrastructure, including factors like mobile network availability, internet access percentages, and device usage, is frequently absent or unreliable, hindering thorough modelling initiatives [

31]. Likewise, formal innovation metrics, such as patents, might not fully capture creative results generated by informal sectors.

Finally, the relationships between AI-driven infrastructure, platform economies, and creative industry production in Sub-Saharan Africa remain insufficiently examined. Addressing these empirical gaps through robust modelling can support data-informed policymaking and promote innovative economic growth in Africa.

2.5. Entrepreneurial Activity in Creative Economies

According to [

2], entrepreneurial endeavours are the primary force behind the creative economy, linking concepts from social sciences, humanities, and the arts with sustainable business and innovation. In a country like South Africa, entrepreneurship is often characterised by small, micro, and informal enterprises that operate with limited financial resources yet make significant contributions to job creation and cultural development [

32].

South African graduates exhibit low motivation for entrepreneurship due to challenges associated with crime, the economy, support networks, skill sets, risks, and access to funding [

33]. In the creative sector, entrepreneurship is present in music production, digital start-ups, creative centres in townships, and fashion design companies.

However, elevated levels of informality frequently restrict access to financing, protection of intellectual property, and markets for exports [

34]. Additionally, within the African context, entrepreneurship is closely tied to structural factors, including the development of human capital, access to markets, and institutional frameworks [

35].

Consequently, the creative economy must be evaluated not just by ICT and innovation but should also recognise entrepreneurship as the channel through which creative outputs generate social and economic value.

2.6. Linking the Empirical Approach to Creative Economy and Entrepreneurship Theory

The creative economy is based on the notion that value is generated by converting cultural and intellectual assets into sellable products and services via innovation, abilities, and connections. The entrepreneurship theory considers this process to involve identifying opportunities, mobilising resources, and capturing value. In this research, the empirical variables are associated with these theoretical processes.

Patents and associated indicators signify the formalisation of inventive concepts and the safeguarding of intellectual assets, aligned with innovation and opportunity identification phases. Exports from the cultural and creative industries, in conjunction with formal jobs in these areas, represent the effective commercialisation and market integration of creative products, reflecting entrepreneurship theory’s value appropriation and growth elements [

4].

Exports of ICT and digital services embody the channels and processes that facilitate the arrival of creative outputs in markets, aligning with entrepreneurship theory’s commercialisation and scaling phases. Additionally, investing in creative industries and developing human capital demonstrates the mobilisation of resources and the nurturing of skills vital for creative production and entrepreneurial achievement within these vibrant sectors [

36].

Creative sector capacity indicators demonstrate the institutional and infrastructural elements that affect entrepreneurial ecosystems, aligning with the resource-mobilisation component of the theory. These components help clarify how creative entrepreneurship can promote regional innovation, job creation, and general economic expansion within vibrant urban environments [

37,

38].

The research aligns with the author′s [

39] multi-level perspective (MLP) on innovation and diffusion, which views socio-technical transformation as the result of interactions between niche innovations, existing institutional regimes, and broader socio-economic contexts. This framework enables an understanding of South Africa’s creative economy as a dynamic socio-technical system where creative entrepreneurship thrives through the interplay of cultural institutions, market dynamics, and digital infrastructures. This viewpoint suggests innovative entrepreneurship in developing economies is not merely about technology adoption. Still, it embodies a systemic change propelled by institutional adjustment and the spread of innovation throughout societal tiers. This conceptual integration offers interpretive richness that surpasses standard ARDL-based results and enhances the analytical connection between the econometric indicators and wider innovation theories.

This theoretical alignment also provides the foundation for subsequent empirical analysis, in which creative economy indicators are employed to explore these theoretical relationships within South Africa’s macroeconomic context. This study combines entrepreneurship theory with extensive econometric analysis to address persistent theoretical and empirical gaps in the creative economic literature. The analysis links theoretical concepts, such as innovation diffusion, ecosystem capability, and market access, to quantifiable macro indicators, thereby bridging the gap between creative economy theories and measurable empirical outcomes. This method addresses a significant drawback in previous research: converting theoretical frameworks of creative industry dynamics into strong, policy-relevant econometric data applicable to the Sub-Saharan environment.

3. Methodology

3.1. Study Area and Contextual Justification

Before detailing the methodological specifics, it is essential to note that this study employs a quantitative, time-series framework to link theoretical understandings of innovation and entrepreneurship with quantifiable economic outcomes. The study examines South Africa, a middle-income nation characterised by structural diversity, a relatively developed digital and intellectual property (IP) system, and a burgeoning creative sector that is gaining economic significance. South Africa’s creative economy functions within a changing institutional framework where formal innovation indicators (like patents) exist alongside informal and symbolic expressions of creativity, thus providing a pertinent example for exploring the interaction between innovation systems and entrepreneurial ecosystems. This contextual choice facilitates a detailed comprehension of how digital trade integration, sector maturity, and innovation results impact intellectual property commercialisation within a Sub-Saharan African context.

The Autoregressive Distributed Lag (ARDL) model was chosen because it successfully identifies both short-term and long-term relationships among mixed-order variables that are integrated at levels I(0) and I(1), which are typical of data structures in emerging economies. Significantly, ARDL is empirically confirmed for time-series studies with small samples, providing consistent and efficient estimates of long-term parameters without extensive datasets [

40]. Current studies by the author [

41], who adjusted bounds for limited samples, along with the use by authors [

42,

43], showcase the model’s strength and dependability for datasets with fewer than thirty yearly observations, especially in African macroeconomic scenarios. Further supported by authors [

44,

45,

46], the ARDL framework alleviates the over-parameterisation issues typical of multivariate cointegration models, such as VAR or VECM, thereby preserving estimation efficiency with shorter time series.

Therefore, the choice of ARDL in this study is theoretically and empirically supported. It ensures that the central questions of the study, examining how innovation, digital trade infrastructure, and creative sector maturity influence the commercialisation of intellectual property, are evaluated within a robust and methodologically appropriate econometric framework tailored to South Africa’s existing data and institutional environment. This study focuses on South Africa, a middle-income nation leader in cultural creation and investment in digital infrastructure. According to the Cultural and Creative Industries (CCI) Masterplan, South Africa’s creative sectors, including music, film, animation, and fashion, are crucial for promoting youth employment, cultural diplomacy, and diversification in a post-industrial context. The nation also possesses relatively sophisticated intellectual property institutions and digital trade systems in comparison to several of its regional counterparts.

Despite these benefits, South Africa still faces systemic inequalities in digital access, an uneven distribution of creative funding, and disjointed institutional support for innovation and IP monetisation. These obstacles render the nation an intriguing and significant example for examining the connections between innovation systems, sectoral investments, and creative economy results within an African framework.

Figure 1 displays a geographical representation of South Africa as the primary study region within the broader Sub-Saharan African creative economy framework, highlighting the national backdrop in which creative sector operations and intellectual property development occur.

3.2. Data Description and Variable Specification

This study utilises annual time-series data spanning 2000 to 2023, emphasising the changing dynamics between financing, innovation, digital infrastructure, and sector growth in relation to the commercialisation results of intellectual property in South Africa. The data is obtained from various international and national entities, including the World Bank, WIPO, UNESCO, and South Africa’s Department of Sport, Arts and Culture.

3.2.1. Dependent Variable

3.2.2. Independent Variables

PAT: Patents were selected as the innovation variable.

- ○

Purpose: Due to their provision of standardised, globally comparable information and ability to reflect the formal knowledge output codification [

26].

- ○

Limitations: Although alternative indicators, such as trademarks, copyrights, or design registrations, may more accurately capture creative sector activity, the availability of longitudinal data for these variables is limited in South Africa. Consequently, patents are a viable indicator of innovation capability, with limitations clearly recognised.

SERVEXP: The proportion of computer, communications, and various commercial services within total service exports, reflecting the robustness and accessibility of South Africa’s digital framework and its incorporation into international ICT commerce.

- ○

Purpose: This metric illustrates the supportive factors for digital content distribution and international IP dealings.

- ○

Limitation: for SERVEXP is that it represents international ICT trade integration instead of domestic access or penetration. This suggests that although SERVEXP is effective in measuring export-focused digital infrastructure, it may not fully account for variations in internal access, particularly in rural and township areas.

FUND: Investments from both public and private sectors in cultural and creative industries.

- ○

Purpose: the financial basis for the growth and expansion of creative businesses. This encompasses budget distributions, private equity investments, and cultural funding grants.

CC: The percentage of cultural and creative industries contributing to the national GDP, functioning as a control variable.

- ○

Purpose: It demonstrates the development and integration of the creative industry within the broader economy and offers a framework for understanding the impact of innovation and financial support systems.

3.2.3. Theoretical Mapping of Variables

Assessing creative entrepreneurship and the commercialisation of the creative sector on a macro level is challenging due to the prevalence of informal activities, reliance on copyright, and unconventional business models. Therefore, traditional innovation variables are not completely represented [

37]. To tackle this, we employ a theory-guided method for proxy selection. Every empirical indicator is selected as it aligns with a mechanism in the creative value chain (creation → protection → distribution → monetisation) as defined in the theory of creative economy and entrepreneurship [

47,

48].

Intellectual Property Receipts (IP_RECV): Designed to record the actual monetisation of intangible assets through international receipts. IP receipts represent licensing, royalty, and various payments, indicating the value capture phase in creative economy models. This measure represents the effective conversion of creative work into concrete financial gains, a vital component of entrepreneurial achievement in the creative sectors [

49].

Patents (PAT): Indicate formalised, documented knowledge results. Innovation economics frequently uses patent applications to measure inventive activity [

50].

- ○

Limitation: Patents do not completely encompass design, copyright-driven, or informal creative results [

51]

Digital Services Exposure (SERVEXP): This proxy reflects a nation’s involvement with global digital commerce networks and platforms. Empirical research [

52] indicates that digital economy/digital service exports are linked to the expansion of the creative industry, as digital platforms facilitate easier cross-border distribution for creators.

- ○

This is frequently indicated by per capita fixed broadband subscriptions and internet connectivity, representing the foundation for innovation [

49,

53].

Creative Capacity or Sector Composition (CC): Reflects structural maturity: employment in creative industries, presence of institutions, infrastructure, or the organisational capacity to support formal creative entrepreneurship. Literature on creative industries emphasises that a mature creative ecosystem (including institutions, policy frameworks, and human capital) enhances the ability to protect, formalise and monetise creative outputs [

54].

3.2.4. Synthesis and Limitations

Patents were chosen as the leading indicator of innovation due to the availability of data and its consistency over time; nonetheless, other metrics, such as trademarks, design rights, and copyright royalties, may be more relevant to specific sectors [

55]. SERVEXP, representing ICT services exports, is viewed as a measure of the structural integration of South Africa’s digital economy into international markets, indirectly influencing local creative entrepreneurship prospects. However, it does not entirely reflect internal access to ICT, a constraint recognised in

Section 5. Based on the CCI Masterplan, FUND combines public and private cultural expenditures; however, its assessment is limited by inconsistent reporting from year to year. Despite these constraints, the collective variables provide a comprehensive macro-level perspective on innovation, infrastructure, and funding dynamics.

3.2.5. Data Description and Variable Specification

This study employs yearly time-series data from 2000 to 2023, highlighting the evolving relationships among financing, innovation, digital infrastructure, and sector growth related to the commercialisation of intellectual property in South Africa. Information was gathered from global and national organisations, such as the World Bank, WIPO, UNESCO, and South Africa′s Department of Sport, Arts, and Culture.

Table 1 provides a summary of the study′s variables, their descriptions, and the sources of data.

3.3. Econometric Approach

To examine both the short-run and long-run relationships between structural components and IP commercialisation outcomes, the Autoregressive Distributed Lag (ARDL) bounds testing approach, as described by authors [

40], was employed. ARDL models are appropriate for:

Small datasets (in this instance, 24 annual observations),

Variables showing a combination of integration orders (I (0) and I (1)),

Simultaneous evaluation of both short- and long-run relationships.

3.3.1. Unit Root Testing

Stationarity was assessed using the Augmented Dickey–Fuller (ADF) test:

PAT was found stationary at level [I (0)],

IP_RECV, SERVEXP, FUND, and CC were stationary after first differencing [I (1)].

ARDL is specifically suited to handle such mixed integration scenarios [

43].

3.3.2. Lag Length Selection

The appropriate lag structure was determined using:

Akaike Information Criterion (AIC),

Schwarz Bayesian Criterion (SBC/SC),

Hannan-Quinn Criterion (HQC).

All criteria supported a lag length of 1, balancing model complexity with explanatory power.

3.3.3. ARDL Bounds Testing for Cointegration

The bounds testing method evaluated if a long-term relationship exists between IP_RECV (IP receipts) and its influencing factors. The F-statistics were evaluated against critical limits established by the author [

40]:

F-statistic exceeds Upper Bound → Long-term cointegration validated.

This research verified cointegration, demonstrating stable long-term relationships among funding, innovation, digital trade, sectoral composition, and IP commercialisation results. Considering the emphasis on digitalisation, funding, and innovation within Africa′s creative economy, ARDL offers a suitable methodological framework for examining dynamic interactions [

56].

All econometric estimations and diagnostic assessments were performed with EViews 12.

3.4. ARDL Model Specification

The general model is specified as:

where

Δ denotes first-differenced variables (short-run relationships);

α is the intercept.

∑βiΔXi, represents short-run coefficients of explanatory variables (ΔPAT, ΔSERVEXP, ΔCC, etc.);

λECTt−1 is the error correction term (ECT) coefficient, indicating the speed of adjustment toward equilibrium;

εt is the white noise error term.

The ECT captures the proportion of disequilibrium corrected in each period, indicating system stability.

3.5. Model Justification

ARDL was selected due to:

Appropriateness for limited datasets containing yearly macroeconomic information;

Capability to manage variables of various orders;

Concurrent assessment of immediate and enduring effects;

Effectiveness of the bounds testing method for assessing cointegration [

40,

43]. Given the focus on digitalisation, financing, and innovation in Africa’s creative economy, ARDL provides an appropriate methodological framework for analysing dynamic interactions [

56].

3.6. Post-Estimation Diagnostics

The confirmation of robustness and model adequacy was achieved through:

Breusch–Godfrey LM Test (to detect autocorrelation);

Breusch–Pagan–Godfrey test (to check for heteroskedasticity);

Jarque–Bera Test (to assess residual normality);

CUSUM and CUSUMSQ Tests (for assessing structural stability).

Every test confirmed the model’s reliability and stability, guaranteeing efficient and impartial coefficient estimates [

57].

Robustness and Alternative Specifications

Because no single macro indicator perfectly captures creative entrepreneurship, the study assesses the consistency of results through alternative specifications and diagnostic checks. Where data availability allows, additional estimations are performed using alternate proxies (for example, trademark or design counts as complements to patents) and by comparing results across related model forms. Diagnostic tests are conducted to check for autocorrelation, heteroskedasticity, and model stability [

58].

4. Results and Interpretation

This part presents a comprehensive overview of the empirical results derived from the ARDL model, examining both the long-term and short-term impacts of innovation capacity (PAT), digital trade infrastructure (SERVEXP), and creative economy advancement (CC) on intellectual property commercialisation (IP_RECV) in South Africa. The analysis is positioned within global creative economy research, the literature concerning innovation frameworks, and structural transformations in African economies.

4.1. Graphical Representation of Key Variables

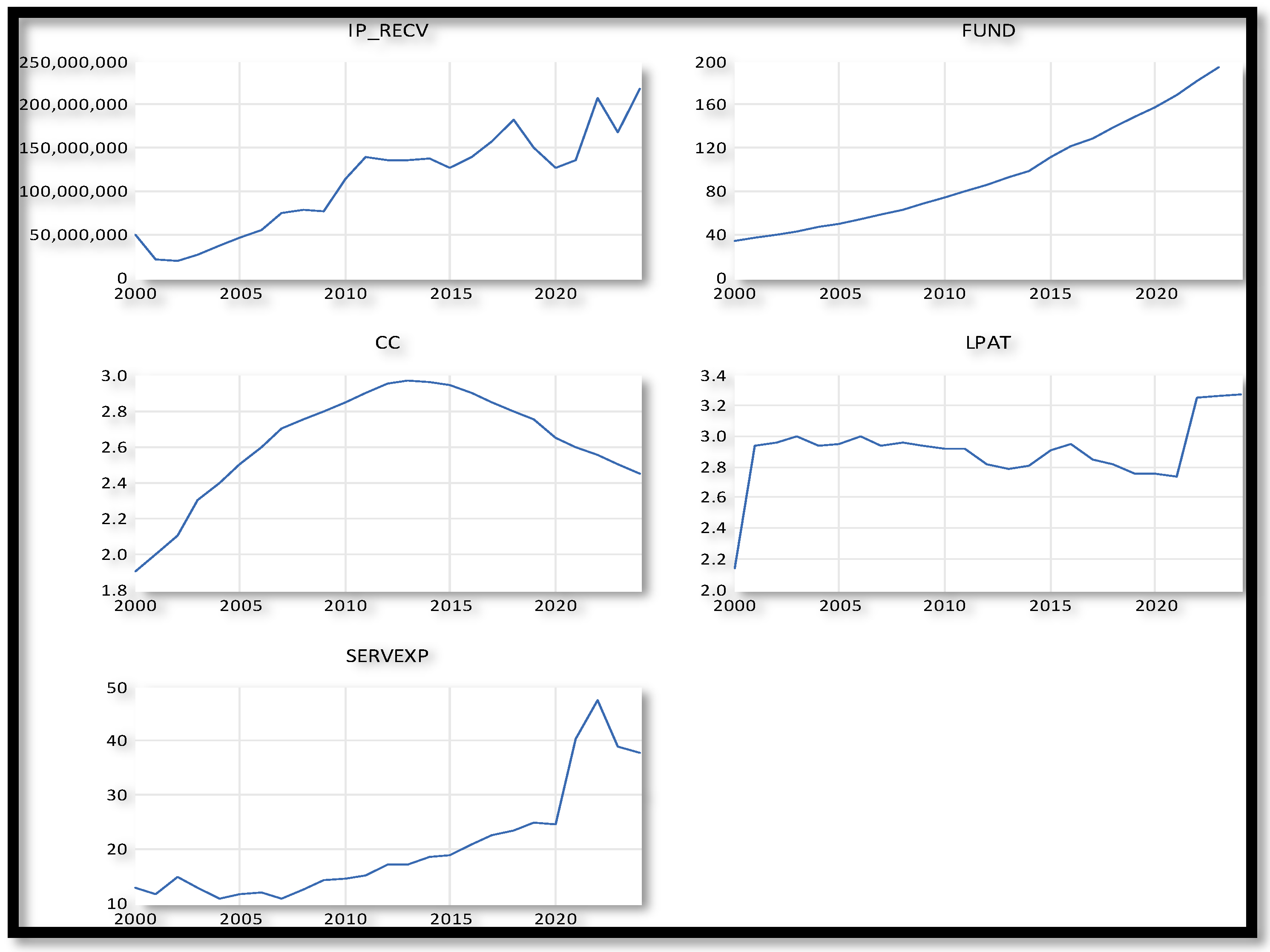

Figure 2 shows the time-series paths of IP_RECV, PAT, SERVEXP, FUND, and CC from 2000 to 2023. These charts, produced from raw data in EViews, illustrate the structural changes and volatility trends that guide the following econometric analysis. For example, IP_RECV shows a significant variation associated with global demand cycles, whereas PAT stays stable with slight increases in recent years. SERVEXP shows a gradual rise, aligning with South Africa’s deepening engagement in ICT-related commerce, while FUND and CC present trends indicating the difficulties of stable assessment and policy backing.

4.2. Unit Root and Stationarity Test

Stationarity was tested using the Augmented Dickey–Fuller (ADF) method. The results are summarised below:

Interpretation:

Table 2 shows that the ADF findings indicate a mixed integration order: LPAT is stationary at level [I(0)], whereas IP_RECV, FUND, CC, and SERVEXP are stationary following first differencing [I(1)]. This situation justifies the application of the ARDL bounds testing approach, according to the author [

40], allowing for the incorporation of I (0) and I (1) variables in one model, while excluding I (2).

4.3. Lag Length Selection Criteria

The optimal lag selection was performed using several criteria, all of which indicated lag 1 as the most efficient model specification.

Interpretation:

Table 3 shows that choosing lag 1 guarantees a concise model that captures key short-term dynamics and prevents overfitting. This is especially relevant in macroeconomic time series with small samples, commonly found in Sub-Saharan African economies.

4.4. ARDL Cointegration Bounds Test

The cointegration was tested using the ARDL bounds approach. The computed F-statistics significantly exceed the upper critical value.

Interpretation:

Table 4 shows the cointegration test results indicate a stable long-term equilibrium between intellectual property revenues (IP_RECV) and their factors (PAT, SERVEXP, and CC). This finding validates that innovation, digital commerce, and the advancement of the creative sector progress together over time, addressing the first research question regarding their combined impact on the South African creative economy. The F-statistic (5.878) exceeds the critical threshold at the 5% significance level, suggesting a long-term equilibrium relationship exists between IP_RECV and its predictors (LPAT, CC, and SERVEXP). This aligns with theoretical anticipations regarding the connection between innovation, digital trade, and results from the creative sector in influencing IP commercialisation [

2].

4.5. Long-Run and Short-Run Estimates

The ARDL long-run and short-run coefficients are summarised in

Table 5 below.

Interpretation:

Table 5 summarises the long-run and short-run coefficients of the ARDL. CC demonstrates a considerable and statistically significant positive effect, indicating that a thriving creative economy is essential for promoting the commercialisation of IP.

SERVEXP shows a notable positive impact, emphasising the significance of ICT trade infrastructure in leveraging creative resources.

LPAT shows slight significance, indicating that patent activity helps with IP commercialisation but may require additional institutional backing to be fully effective.

The error correction term (ECT) is significant and negative, with a value of −0.512, suggesting that about 51% of the imbalance is corrected annually and indicating moderate convergence towards the long-run trajectory.

The significant long-term impacts of SERVEXP and CC indicate that integration into digital trade and sectoral development is vital for IP commercialisation. The FUND variable was included initially; however, its inclusion violated important diagnostic tests, prompting its removal from the final specification. This result suggests that the measurement and consistency of financial data, instead of its irrelevance, could jeopardise its econometric reliability. Similarly, the limited effect of patents highlights structural flaws in South Africa’s innovation system, where formal intellectual property results may not adequately capture the dynamism of informal and non-technological creative activities. These findings indicate that wider structural factors, instead of individual indicators, have a more significant influence on determining commercialisation routes

4.6. Diagnostic Tests

The following diagnostic tests were performed to verify the statistical soundness of the model:

Interpretation:

All diagnostic tests shown in

Table 6 confirm that the model is statistically robust. There are no violations of classical assumptions, and the CUSUM test verifies that the model is structurally stable over time.

4.7. Summary of Findings

The development of the creative sector (CC) and digital trade infrastructure (SERVEXP) is identified as the most significant long-term indicator of South Africa’s ability to monetise intellectual property. The capacity for innovation (LPAT) has a positive yet marginally significant impact, suggesting that further policy support is needed to convert patents into economic outcomes. The error correction mechanism verifies long-term convergence, though at a gradual pace. All traditional diagnostic criteria are satisfied, reinforcing the internal validity of the estimated model. The error correction mechanism verifies long-term convergence, though at a gradual pace.

All traditional diagnostic criteria are satisfied, reinforcing the internal validity of the estimated model.

These results align with the broader body of literature on the structural foundations of creative economies, particularly in middle-income and emerging environments, where ICT infrastructure and innovation systems must develop in tandem to realise the value of intangible assets [

1,

3,

37].

4.8. Discussion

This section outlines the study’s findings in relation to established theories on innovation, entrepreneurship, and digital transformation. The discussion unfolds methodically, transitioning from innovative potential to ICT trade, industrial growth, obstacles to participation, and non-formal innovation activities. This method ensures a unified understanding that connects quantitative information to theoretical and policy perspectives. The study’s empirical findings emphasise the structural elements that promote and obstruct South Africa’s ability to commercialise intellectual property (IP) within its creative economy. The results contribute significantly to the existing literature by empirically confirming the effects of innovation capacity, ICT infrastructure, and sectoral growth on IP revenue, a subject that has been largely neglected in the African scenario [

37].

It is crucial to address the validity and interpretive significance of the macro-level indicators used to ensure that these empirical findings are understood within their theoretical and methodological framework. Although macro-level indicators, such as patents, ICT service exports, and intellectual property receipts, may not entirely reflect the intricate and often informal characteristics of creative activities, their combination offers a dependable and globally comparable framework for assessing the performance of the creative sector. These variables offer measurable insights into innovation capability, digital market integration, and value achievement —fundamental aspects of the creative economy and entrepreneurship theory. The study thus considers these proxies as structural indicators rather than exact measurements and enhances them with diagnostic assessments and various model specifications, as detailed in the Appendix. Together, these factors ensure that the empirical results are understood with an appropriate acknowledgement of the existing data’s advantages and constraints, while aligning with the theoretical foundations of the creative economy model [

3,

8]. It is essential to exercise caution when interpreting the ARDL results, even though they consistently indicate long-term relationships between innovation, ICT infrastructure, and the expansion of the creative sector. Instead of providing concrete proof of causality, the proxy indicators— patent activities, ICT service exports, and intellectual property earnings—serve as markers of systemic interaction. These associations suggest broad trends rather than specific microeconomic evidence due to the commonalities in the data and the presence of unregistered creative businesses that are not reflected in official statistics. As a result, the findings demonstrate crucial connections that need to be verified by organisational or regional data. Future research using panel or micro-survey techniques may be able to pinpoint the causal relationships more precisely, especially regarding the outcomes of creative entrepreneurship and digital innovation competencies.

4.8.1. Innovation and the Creation of Intangible Assets

The beneficial and slightly significant impact of patent activity (PAT) on IP revenues indicates the essential, albeit still emerging, role of innovation systems in South Africa’s creative economy. This corresponds with [

26], who viewed patents as indicators of technological advancement and knowledge creation. Although South Africa lags behind global innovation leaders in patent numbers, the noted correlation suggests that innovation results, particularly those related to digital content, AI applications, and cultural creation, are beginning to yield commercially viable IP outcomes [

8,

59]. This finding supports the authors′ [

60] claim that the creative economy is increasingly dependent on intangible assets, such as software, algorithms, and patents, which are essential to the value chains of the digital age. Nonetheless, the slight importance indicates restricted spillover effects, probably due to inadequate R&D infrastructure, ineffective IP enforcement, and shortcomings in innovation-to-market processes [

9]. The slight patent effect should not be interpreted as a deficiency in innovative capacity, but instead as an indication of systemic institutional barriers, such as ineffective IP enforcement and restricted innovation-to-market relations, that hinder creative innovation from being entirely captured in official IP indicators. Although innovation capability serves as a crucial base, its influence is enhanced by digital connectivity and trade, which create commercial pathways for monetising intellectual property.

4.8.2. ICT Trade Infrastructure as a Means for Commercialisation

The strong and statistically meaningful coefficient for SERVEXP (digital services exports) highlights the crucial importance of ICT infrastructure and trade integration in facilitating the monetisation of intellectual property. This validates worldwide empirical studies associating digital connectivity and export potential with IP-related income sources [

1,

61]. In contrast to standard ICT penetration metrics, SERVEXP reflects the structural capabilities for export, serving as a superior indicator of South Africa’s ability to monetise digital creative products on a large scale. These findings support the theoretical assertion that general-purpose technologies (GPTs) serve as both production tools and institutional frameworks, facilitating the creation of new markets, transaction methods, and global access for creative businesses [

1,

3].

4.8.3. Sectoral Development and Structural Facilitation

The primary long-term factor influencing IP receipts is the percentage of cultural and creative industries within CC. This supports the theory that the maturity of sectors and the integration within institutions are crucial prerequisites for the sustainable commercialisation of creative content. It supports author [

60], who claims that, as creative sectors establish formal institutional structures, such as IP registries, funding avenues, and export promotion systems, the monetisation of intangible assets becomes more feasible. Author [

3] noted that countries with larger contributions to the creative sector tend to have stronger creative IP portfolios, reinforcing the conclusions of this study. This structural benefit also poses a policy challenge: transnational platforms may acquire an unfair advantage as markets become formalised unless local intellectual property governance systems are improved [

62]. Nonetheless, growth in specific sectors is inadequate if disparities in participation and restricted digital access continue within creative communities.

4.8.4. Participation Disparities and Platform Accessibility

The weak short-term impacts noted for innovation and digital infrastructure suggest the presence of enduring structural delays, particularly in converting technological or policy investments into prompt market outcomes. This aligns with the findings of author [

63], who highlighted the “participatory divide,” where unequal access to digital creation resources and knowledge limits broader sectoral inclusion. The digital gap between urban and rural areas in South Africa, the low number of patents from small businesses, and the insufficient representation of marginalised creators in platform economies worsen these delays. Author [

64] also emphasises the significance of tackling digital participation via access and active involvement, particularly regarding short-form video platforms and decentralised monetisation avenues.

4.8.5. Innovation Spillovers and Systemic Limitations

Although patents have a positive impact, their marginal statistical significance indicates that patenting alone is inadequate for achieving commercial success. This corresponds to the knowledge coupling framework suggested by [

9], who contend that the commercialisation of innovation relies on interactions at the ecosystem level comprising finance, legal assistance, and network connections. Additionally, the lack of significance of GDP and urbanisation at the comprehensive model specification level supports the idea that macroeconomic growth does not ensure knowledge spillovers or enhancements in creative output. Authors [

43,

56] warn that in ARDL applications, structural impediments could invalidate the impacts of overall economic variables if specific interventions do not tackle micro-level dynamics. Creative communities, informal businesses, grassroots networks, patents, and formal funding significantly fuel innovations in South Africa. These performers often create economic and cultural value through unpatented methods, such as design reimagining, utilisation of indigenous knowledge, and collaborative creation in creative centres. Their absence from official datasets restricts econometric insight but highlights the need for supplementary qualitative and ethnographic methods in future studies [

30].

4.8.6. Informal Innovation

A limited, restricted impact of patents highlights institutional barriers to the commercialisation of IP and the widespread existence of unregistered innovation in South Africa. This suggests that creative entrepreneurship is abundant in innovation, manifesting itself through various forms rooted in cultural traditions, indigenous wisdom, and informal connections [

65]. Although infrequently captured in patent data, these types of innovation are essential for the operation of the creative economy. Acknowledging and assisting these informal methods needs policy instruments outside conventional IP protection, such as micro-grants, collective licensing arrangements, and backing for community-driven creative centres. Recognising both formal and informal innovation allows policymakers to create interventions that accurately represent the realities of South Africa’s creative sector.

4.8.7. Interpretive Cautions and Causal Limitations

Although the ARDL results consistently show long-term relationships between ICT infrastructure, innovation, and the growth of the creative sector, care should be taken when interpreting them. Instead of providing concrete proof of causality, the proxies patent activity, ICT service exports, and intellectual property receipts act as markers of systemic interaction. These associations reveal systemic trends rather than microeconomic evidence due to the communal nature of the data and the presence of unregulated creative enterprises that are not reflected in official statistics. As a result, the findings reveal crucial connections that require verification using regional or company-specific data. Future research using panel or micro-survey techniques may be able to pinpoint causal relationships more precisely, especially regarding the outcomes of creative entrepreneurship and digital innovation skills.

In conclusion, the relationships identified in the empirical investigation can be understood through the perspective of entrepreneurship and creative economy theory. Variables serve as substitutes for market access, and industry maturity appears crucial for the monetisation of creative products, as they represent avenues such as digital platforms, export links, and production capabilities by which creators connect with consumers and licensees. This highlights the importance of strong entrepreneurial ecosystems, which encompass access to funding, government support, and market growth, in fostering practical entrepreneurship in the creative sectors [

66]. Measures related to innovation, such as patent numbers, can indirectly aid commercialisation by indicating formal knowledge production, but their economic effects depend on the broader entrepreneurial environment. Access to financing, management skills, and institutional backing for utilising intellectual property are essential elements that influence whether creative and innovative results translate into tangible income. Nonetheless, the influence of these elements on entrepreneurial activities and economic development remains limited by an inadequate supportive environment, especially in situations such as South Africa, where entrepreneurial ecosystems encounter considerable obstacles [

67].

The results strengthen fundamental concepts of the creative economy and entrepreneurship theory. The positive connection between exports of digital services and earnings from intellectual property reinforces the notion that market access infrastructure allows creators to profit from intangible assets. The impact of sector maturity underscores the importance of entrepreneurial ecosystems in transforming innovation into economic value. In the meantime, the relatively limited role of patents emphasises that formal innovation alone does not ensure successful commercialisation without additional financial and institutional backing. These findings suggest that the econometric results capture genuine entrepreneurial activities rather than merely descriptive statistical correlations.

5. Policy Recommendations and Conclusions

Building from the empirical results and theoretical frameworks discussed previously, this study proposes the following strategic policy measures to improve inclusive and sustainable IP commercialisation within South Africa’s emerging creative economy:

5.1. Policy Recommendations

5.1.1. Enhance the Innovation–Commercialisation Framework

Considering the persistent, albeit limited, importance of patent activity, South Africa should enhance the connection between innovation and commercialisation within the creative economy.

Implement tax benefits and expedited IP registration services for creative SMEs to lower patenting and copyright safeguarding obstacles.

Create public–private partnerships (PPPs) to finance the commercialisation of patents, designs, and copyrighted materials, focusing on township start-ups and businesses.

Enhance regional innovation hubs in underprivileged areas to promote patent applications, knowledge sharing, and partnerships.

Create IP training initiatives for SMEs to improve knowledge of IP asset management and licensing procedures [

9,

60]

Drawing on [

39] framework for innovation diffusion, prioritise policy development towards systemic collaboration between market systems, institutional structures, and technological niches to support the transition of creative entrepreneurship from stand-alone initiatives into continuous innovation paths. This suggests that creative start-ups should connect with financial institutions, community innovation hubs, and online marketplaces to promote the spread of technological and cultural innovations throughout the economy.

These measures would strengthen South Africa’s broader innovation ecosystem by incorporating creative businesses into established knowledge and commercialisation pathways, thereby enhancing the nation’s ability to produce and profit from intellectual property over the long term.

5.1.2. Enhance Digital Infrastructure and Digital Commerce Competence

The significant impact of SERVEXP highlights the need for resilient ICT services and their integration into global digital commerce.

Provide financial support for broadband access in creative township hubs via specific vouchers and enhance community Wi-Fi projects in underserved regions.

Allocate funds for cloud infrastructure and budget-friendly hosting services to facilitate scalable content creation and dissemination.

Offer specialised assistance to digital export promotion entities that help creative SMEs prepare for platforms and facilitate global distribution.

Ensure creators have affordable access to fast internet. This aligns with worldwide findings that highlight the importance of fair digital trade frameworks for sustainable growth in the creative economy [

3,

61].

5.1.3. Address the Participatory Divide by Enhancing Skills and Access to Platforms

Reducing the disparities in digital engagement is essential for inclusive development.

Offer micro-grants to informal creative entrepreneurs to assist them in formalising their operations and obtaining IP protection.

Incorporate digital entrepreneurship and creative economy courses into TVET and higher education programs, targeting youth, women, and individuals with disabilities.

Create decentralised creative innovation hubs that provide studio facilities, training, and mentorship in rural and township areas [

63].

Demand that global platforms modify algorithms and revenue-sharing frameworks to ensure fair monetisation and exposure for creators in South Africa [

64].

5.1.4. Govern Digital Platform Economies to Safeguard Local IP Creators

With global platforms controlling revenue in the creative economy, South Africa needs more robust governance systems.

Establish platform-specific agreements that require transparency in royalty allocation and data accessibility for local creators.

Create a national digital content marketplace to lessen dependence on foreign platforms and enhance the visibility of domestic intellectual property.

Establish governance frameworks independent of platforms to safeguard creator rights irrespective of the monetisation method [

3].

5.1.5. Promote AI-Enabled Creative Clusters

Patent trends emphasise AI as a vital driver for innovative creativity.

Create interdisciplinary AI–creative centres where artists, tech professionals, and legal specialists work together on content creation and rights administration.

Assist AI-powered solutions for small and medium enterprises and solo creators, facilitating scalable creation, customisation, and content dissemination [

8].

Create AI education initiatives led by public–private partnerships focused on the arts, including infrastructure enhancements for digital archives, digitising cultural heritage, and labs for creative content.

5.2. Conclusions

The ARDL analysis empirically demonstrates that digital trade infrastructure (SERVEXP) and sectoral development (CC) have substantial and statistically significant impacts on intellectual property revenues. In contrast, innovation capacity (PAT) contributes positively but less significantly. These findings suggest that structural facilitators, particularly ICT integration and the development of a creative ecosystem, have a more direct impact on commercialisation results than just the innovation inputs themselves. Through ARDL-based empirical analysis, this study has demonstrated that structural factors such as digital trade infrastructure, industry maturity, entrepreneurship, and innovation initiatives substantially influence the commercialisation of intellectual property within South Africa’s creative economy. While long-term impacts were statistically significant for SERVEXP and CC, patent activity seemed supportive. However, it was not sufficiently independent, highlighting the fragmented nature of South Africa’s innovation-to-commercialisation and entrepreneurship pipeline. Policy frameworks should evolve beyond disjointed methods by incorporating innovation ecosystems, entrepreneurship assistance, digital infrastructure, and participatory inclusion into a unified creative economy strategy. Investment must focus on ICT infrastructure and establishing favourable conditions for inclusive value creation and entrepreneurship—covering platform regulation, enhancing digital skills, encouraging R&D, backing creative start-ups, and promoting innovation clusters. Future research should analyse company-level and platform-specific information to identify differences in entrepreneurial revenue strategies and evaluate the impact of policy measures. Comparative studies throughout Sub-Saharan Africa could help identify scalable, equitable, and culturally relevant models for fostering creative entrepreneurship and developing sustainable digital economies in the region.

5.3. Limitations and Future Research

While the research offers important perspectives on the structural factors affecting South Africa’s creative economy, certain limitations should be recognised. Firstly, the analysis is based on secondary time-series data consisting solely of twenty-four annual observations, which limit the extent of statistical inference and might not entirely reflect the dynamic and informal entrepreneurial activities prevalent in the sector.

Secondly, the dependent variable, total earnings from intellectual property, includes non-creative elements like pharmaceutical patents and industrial methods, which may exaggerate the impact of creative industries on the assessed results. Third, the patent application aspect does not include informal or non-technological innovations vital to numerous African creative sectors, especially those based on indigenous knowledge and cultural representation. Fourth, the FUND and CC variables originate from frameworks like the Cultural and Creative Industries Masterplan, and any inconsistencies or anomalies in policy execution and reporting may affect the comparability of measurements across different periods.

These limitations were alleviated by employing stringent econometric methods, such as unit root tests, cointegration analysis, and diagnostic testing using innovation proxies (PAT), service export indicators (SERVEXP), and sectoral contributions (CC), to yield a thorough structural perspective. However, it is crucial to highlight that the proxies utilised patent numbers, ICT service exports, and intellectual property revenues act as structural approximations of innovation and entrepreneurship rather than exact indicators of micro-level entrepreneurial outcomes. Due to the limited availability of extensive macro-level indicators, these proxies provide a reliable empirical basis for comparative time-series research. However, it is acknowledged that they fail to accurately capture informal or community-oriented creative endeavours, which constitute a significant segment of South Africa’s creative economy.

As a result, the econometric results outlined in this research should be viewed as suggestive correlations rather than direct causal relationships. Subsequent studies should enhance macro-level econometric findings with firm-specific or platform-oriented data to accurately reflect entrepreneurial tactics, revenue models, and value chain involvement. Comparative studies among Sub-Saharan African economies might shed light on institutional impacts and variations between countries. In contrast, qualitative case studies focused on creative entrepreneurs would offer a deeper understanding of the informal, adaptive, and non-technological innovations shaping the region’s creative economy.