1. Introduction

Purpose of the paper. Our foremost goal is to offer a concise, non-specialist coverage of economic growth and its contribution to transforming the world. How better to tell its story than through the lens of the world’s first growing economy?

Economic growth signalled the end of a long and largely stagnant existence, in which wars and monarchs came and went, but life was largely unchanged generation to generation. Before economic growth, the vast majority of the world’s population lived in extreme poverty. Their diets were extremely limited (as such, nutrition was poor), living conditions were dire, disease was widespread and modern medicine did not exist. With economic growth came the dawn of modernity. Despite the millennia that humans have inhabited the planet, sustained economic growth has only been present since around 1650—less than four centuries ago. Rapid sustained growth, such that average incomes increase on a generational basis, first occurred in Britain around 1760 with the Industrial Revolution. In the time since growth began, humankind has progressed from a limited subsistence agricultural existence to a world at our fingertips. Technology has become increasingly more capable of executing more complex tasks at a faster rate. The structure of society and our way of life has been crafted by the defiant advances of economic growth.

Britain’s experience with economic growth has been a rocky path of tremendous highs and despairing lows, but, despite crises and shifts in industry, growth has rolled with the punches. Our work presents an analysis of growth and crisis in the UK, surveying key ideas from academic literature in an engaging and informative manner, accessible to readers with or without a background in Economics. (Note that the UK did not exist before 1801, the modern classification of the UK did not exist until 1922. As such, where the UK is mentioned in this paper, it refers to the definition of the United Kingdom when the event in discussion took place. ‘Britain’ is a collective term to denote the entity of Britain. It encompasses all nations classified as the UK or Britain during the period in question and represents the political, military or geographical entity depending on the context.)

Our series of four essays studies defining events in Britain’s past relationship with growth, whilst engaging with pertinent contemporary debates surrounding its future. We explore the drivers of growth, the restructuring effects of crisis on productivity and employment, and the socioeconomic impacts of restricted access to the growing economy. We hope that our work provides context and depth for modern discussions, enabling readers to evaluate growth and crisis in a new light and to inform their perspectives on future growth.

This first essay in a series of four will investigate how Britain led the way in breaking out of the Malthusian Trap—a futile cycle of population and progress governed by the produce of land. We will begin by exploring the persistence of subsistence living which was experienced by much of the population prior to industrialisation, before assessing the structural changes that enabled the conditions for economic growth to occur. This will include the significance of institutions to enable growth, the role of technological change and demographic shifts towards urbanisation. We then cover the dominance of industrial might as the Industrial Revolution made Britain the world’s first industrial nation. We uncover force and slavery as facilitators of growth and investigate how Empire trade connections created networks across the world to facilitate British economic growth.

This essay is structured as follows.

Section 2 describes the long wait for the emergence of growth in Britain before 1650. Agriculture had hardly changed in centuries, and feudalism had trapped the economy through its inherent disincentive to innovate.

Section 3 describes Britain’s emergence from the Malthusian trap with increases in productivity during the period of 1650–1750. Growth emerged.

Section 4 highlights the process of specialisation and migration into urban areas, which eventually led to the industrial revolution that is covered in

Section 5. Sources for each subsection of these sections are collected at the end of this paper.

2. The Long Wait

Sustained economic growth did not emerge in Britain until about 1650. Not until the dawn of the Industrial Revolution (around 1760) did rapid growth enable improvements in standards of living within people’s lifetimes. This is quite a puzzle. During the Neolithic period, humans settled down, beginning practices of organised agriculture, domesticating livestock and, for the first time, storing resources. Yet growth did not follow—the main goal was to be self-sustained to avoid starvation and death. This section draws on the references [

1,

2,

3,

4,

5,

6,

7].

2.1. Caught in a Trap

Before the emergence of sustained economic growth, Britain saw little alteration in agricultural productivity throughout the latter half of the Middle Ages and the beginnings of the Early Modern Era. Productivity, hence output per worker, was limited by human capacity. Thus, income per capita was essentially determined by the size of the population. As a result, population growth presented the only opportunity to increase output.

Yet this posed a dilemma. On the one hand, there were limits to the availability of arable land for agricultural expansion, hence an increasing population meant less food to go around, reducing standards of living. On the other hand, a decline in population, such as the almost halving of the British population during the Black Death (1348–1350) meant standards of living, in terms of income per capita, increased. Over time, however, if the population was not replenished, output production would decrease due to reduced manpower until, again, there would only be sufficient food for the size of population at that time. It was a futile cycle with little progress.

The pre-industrial period witnessed transient periods of growth, increasing agricultural output. However, as a greater food supply can support a larger population, population size increased. Increases in productivity saw increases in population but not an increase in standards of living, as the agricultural output per head remained unchanged. Britain was confined by the ‘Malthusian Trap’. The nation could not sustain the output growth necessary to further increase the population without decreasing standards of living.

Gregory Clark’s ‘The Long March of History: Farm Wages, Population and Economic Growth, England 1209–1869’ demonstrates that a substantially civilised society, along with an organised market economy, fostering employment and wages, does not by itself create an environment for economic growth. Even with the emergence of paid employment as early as 1209, which allowed specialisation and removed the need to grow one’s own food, growth did not occur.

One can speculate that laws to regulate markets prevented growth through inhibiting free trade. However, already in Medieval Britain, the most significant British market, the one for grain, was, according to Gregory Clark, ‘both extensive and efficient as early as 1209’, and ‘England had an elaborate market economy at least 500 years before it had sustained economic growth.’ Until advancements in agricultural technology were made, British output was trapped by a period of ‘technological stasis’. To achieve growth, a population must move beyond manpower and land as the sole determinants of output.

2.2. Feudal Frustration

The trappings of feudalism restricted the innovation needed for developments in efficiency. Under feudalism, a lord’s land was divided into sections, which were cultivated by peasant farmers (‘serfs’). Serfs were obliged to relinquish a portion of their crop (‘dues’) to the lord, retaining the produce net of dues for their own consumption. They were not waged workers and, under the legal structure of the time, could not establish agricultural production to their own schedules or own the land. As such, they could not break free from forced labour and so had no power to increase their productivity through innovation.

There were other reasons too for the lack of any technological, labour-saving progress. Farmers doubled as military protection. Any lord who adopted a new technology would reduce the number of peasants and become vulnerable to a rival lord who would seize his land before he could benefit from the fruits of more efficient production. In this sense, lords were ‘playing chicken’ with each other—the first lord to move loses.

There are conflicting conclusions about the efficiency of the manorial agricultural system and the situation preceding the watershed moment of adopting new technologies. However, neoclassical institutional economists, and theorists with alternative perspectives, concur that the establishment of property rights provided the necessary conditions for the adoption of productive technologies, giving rise to the dawn of the revolution in agriculture. The emergence of property rights brought forth the development of institutional control of agricultural production. It gave both worker and lord assurance that neither would act to the detriment of the other, as this would void the social contracts imposed by the rights established by the institution.

Lords took complete ownership of the crop that their land produced, gaining revenue from its sale, which incentivised lords to maximise the profitability of their land and, hence, invest in more productive technologies. Peasants became employed by the lord and earnt a wage. The short-sighted ‘cat and mouse’ rivalries between lords were replaced by a new perception of earnings potential over time. Before, the short-term impact of another lord’s military might outweighed the future earnings of investing in new technology. The transition to a land-owner–paid-employment relationship between peasant and lord, along with enforceable ownership rights, shifted the lords’ preferences to favour increased future earnings. The breakdown of feudalism made way for the adoption of new technologies, increasing productivity of British agriculture, instigating growth. In the process, it brought about ‘the worker’ instead of the peasant bound by necessity, a concept vital to the transition to urban centres of industrial production.

3. Emergence of Growth

‘There is just one truly important event in the economic history of the world, the onset of economic growth. This is the one transformation that changed everything.’ (Max Roser)

In the mid-17th century, Britain began to experience a steady growth of income. By the mid-18th century, economic growth was skyrocketing. Where did growth come from? How did Britain transform from the agrarian Malthusian Trap to the world’s first industrial nation? This section draws on the references [

3,

4,

8,

9].

3.1. Early Growth

We have already seen that restricted innovation as a result of feudalism had stagnated growth potential for many generations. However, feudalism’s stranglehold on growth was in decline before its official end in 1660. Following the Great Famine (1315–1317) and the Black Death (1348–1350), a severe decline in the population diminished the control that lords could wield over peasants—there were too few peasants for the amount of land. As control became increasingly centralised around monarchy, the localised landowner–peasant relationship became less prevalent. Once agricultural practice was freed from manorial agriculture, technology could prevail. As such, it is not the case that Britain’s economy was trapped in stagnation up until the dawn of the Industrial Revolution.

In the pre-industrial period, Britain’s economy experienced an upturn in sustained growth for the first time around 1650, albeit at a slow rate of increase. Recent analysis of probate records, wills and apprenticeship records by Patrick Wallis, Justin Colson and David Chilosi suggests that England displayed an upturn in productivity in all the three sectors of the economy (agriculture, industry and services) from the 1630s to the turn of the 18th century. Employment migration out of agriculture, although not necessarily into cities, was evident from the first half of the 17th century. Wallis et al. credit this pre-Industrial Revolution period of growth in part to the foundations of the British economy: productive and organised agriculture, along with commercialisation, processing of foods for transportation around the country (such as cheese and bread) and rural-based proto-industry. Crucially, the transition into secondary employment (out of agriculture)—a demographic transition common to all nations who have since undergone industrialisation and experienced economic growth—had already begun. Britain’s economy had begun to show embryonic signs of growth even under the technological limitations of the time.

The early transition out of primary employment did not lead to urbanisation in large city areas. Recall that the early signs of British economic growth originated from a network of proto-industry and early commercialisation. An unusual occurrence. Britain had a peculiar early urban landscape, characterised by pockets of industry in many smaller urban areas formed from rural communities. How could this have occurred? By both avoiding rule of law and being protected by it, the 1500s–1600s enabled countryside industry and domestic trade links to develop throughout England to enable the economy to establish the roots necessary for the early throws of sustained economic growth. In the Tudor period, laws were implemented in an attempt to monopolise the economy under the monarch’s control. However, laws only covered existing industries.

To avoid legislation, people were motivated to diversify into new, uncharted industrial sectors. Why not form new sectors within existing towns? Some economic historians have suggested that the guilds who governed and enforced the rule of law were limited to towns. Moving into the countryside allowed early industrialists to ‘fly under the radar’ and escape the rule of law. Further, rural peacekeepers and law enforcers were unpaid and so had limited incentive to enforce the law. In addition, Clark suggests that the rise in small industrialised hubs could be accredited to unusually ‘safe’ rural areas. In the Middle Ages and pre-Industrial period, England’s countryside was largely protected from organised violence, removing the requirement for ‘cottage industries’ to join into large urban conglomerates for protection.

3.2. Rules of the Game

We have established that Britain’s economic markets were extensive for many centuries before the onset of growth. However, to transition from simple trading markets to a growing economy, a nation requires a missing piece of the jigsaw: institutions. It has been identified that to establish growth, a pre-industrial economy needs solid institutions and access to robust financial systems. Sheilagh Ogilvie and A. W. Carus state that ‘Historical evidence suggests strongly that, although markets are required for economies to grow, public-order institutions are necessary for markets to function’.

Despite perspectives in economic history, and amongst some economic theorists, that economic growth is purely the product of competing private interests vying for profit in a crowded market, historical records do not evidence a purely private role in the emergence, nor the maintenance of growth. Ogilvie and Carus argue that private-order institutions cannot alone forge economic growth. The essence of their discussion is that private and public institutions are not substitutes for one another, but, by operating as complementary entities, they can enable the conditions for sustained economic growth. In the latter half of the 1600s, the role of the state in Britain significantly altered.

The breakdown of feudalism culminated in the 1660 Tenures Abolition Act, accredited as the end of the Feudal Era. Less than thirty years later, Britain experienced the Glorious Revolution in 1688. In 1689, Parliament replaced the monarch as the ruling authority. Parliamentary sovereignty was established, usurping the principle of monarchical rule that sovereignty originated from birth. The landowner had been separated from the peasant worker, and national control had been separated from monarchy, disbanding monopolistic control over land, workers and society.

Many analyses of economic history have determined that the establishment of British institutional power, particularly the expansion of parliamentary powers in Britain after 1688, founded the necessary institutional makeup to enable the progress of the Industrial Revolution and rapid sustained economic growth. Following 1689, British economic institutions emerged to underpin the security of property rights, during a period described as the English Financial Revolution. As we have discussed, the establishment of property rights contributed to the breakdown of feudalism.

The Financial Revolution created structures with which to secure property rights, which once enforceable, well-defined and inclusive of all stakeholders, provided the guarantee required to push the time-focus of British investors further into the future. Prior to secure property rights, the fear of property loss in the short-term deterred investments that could be beneficial in the long-term. Institutions for securing property rights increased certainty in the short-term. With reduced fear that property, wealth and material goods would be lost in the short-term, capital markets could adopt the long-term dimension necessary for the investment in productive technologies.

Douglass C. North comments that the formation of The Bank of England in 1694, and development of new financial instruments, significantly reduced transaction costs, further incentivising landowners to invest. The synergy between private investments in innovative technology, and the security provided by institutional authority created a market where investments necessary to instigate rapid sustained economic growth were mutually beneficial—the nation could gain wealth and stability, improving international power and prominence, whilst private investors could ensure profit in the long term.

4. Soaring to New Heights

By the latter half of the 17th century, Britain had established well-functioning markets, financial institutions and new property rights, along with the formation of urban pockets of specialised small industry. The foundations necessary to spark rapid economic growth were established. However, by the early 18th century, according to Wallis et al., ‘diminishing returns had set in’. The largely agricultural and small proto-industry model had mostly reached its limit in producing productivity gains necessary for an increase in the rate of growth. Growth originates from a shift to more productive factor inputs of production. This section draws on the references [

1,

10,

11].

We saw in the ‘Long Wait’ (

Section 2) that Britain had experienced brief periods of sporadic growth prior to mechanisation, due to increases in population—the factor inputs (human workers) had become more productive by multiplying in number. However, to instigate continued growth, total factor productivity (the quantity of output gained from the production inputs) must constantly improve. Inefficiencies must be systematically ironed out, and technology must adapt to advance the output capacity of a worker. Simply increasing the number of workers cannot provide the efficiency gains and the ability to surpass human capability over a long time period.

Around the mid-1600s, productivity increases in agriculture were gathering pace. Developments in mechanisation had begun to transform the structure of work and life in Britain. Production was no longer restricted to the limited productivity of manpower—complementing human with machine revolutionised the output potential of workers. Mechanisation extended into traditional manufacturing, primarily textiles, and so cottage industry production was replaced by mass manufacturing.

Industry continued to gain efficiency throughout the pre-industrial and the Industrial Revolution period, accompanied by a mass transition from primary employment (agriculture) into secondary employment (manufacturing) and a demographic transition to urbanisation, as advancements in technology created redundant workers in rural areas. Employment migration into large urban areas coincided with major advances in manufacturing equipment and technology.

Agricultural mechanisation continued, whilst the scale of industrial production increased in newly-formed city-orientated urban hubs. Through labour specialisation and the production line, the productivity of an individual worker in the collective is increased, increasing the capacity for economic growth.

Due to rapid innovations in technology and employment migration necessary to provide a labour supply for city-based factories, Britain became the first nation to undergo industrialisation, with the Industrial Revolution beginning around 1760. The increasing use of mechanisation signalled the dawn of sustained rapid growth. As productivity per worker grew, population growth detached from output and standard of living. Britain was successfully escaping the Malthusian Trap.

4.1. Energy

Before the efficient conversion of energy (kinetic or heat) into mechanical energy, plant matter and the energy it contained was the source of livestock growth, human survival and the effort humans exerted to sustain minor industry and agriculture. During the Industrial Revolution, developments in technology enabled humans to break free from the production limitations imposed by photosynthesis.

The productivity gains in textiles from the Spinning Jenny increased with the water-wheel-powered ‘water frame’ and later the Spinning Mule. Deriving useful energy processes from the rotation of a wheel was an old invention. Think of the principles of a windmill used to operate a millstone grinding wheat into flour. The water wheel was established before the dawn of the Industrial Revolution.

The match made in heaven was the use of the water wheel to operate equipment for mass manufacturing and industrial processes, such as chopping wood. Supplementing human energy from plant matter with the mechanical energy provided to production machinery by the water wheel markedly increased the productivity of workers. With greater productivity came faster economic growth. However, in the 19th century, steam was a game changer for manufacturing and transport.

Releasing energy from fossil fuels was not a new idea. Coal gained traction in England in the 14th century, with usage becoming widespread during the Tudor times, mainly to heat homes. However, it was not until burning coal to heat water to create steam that people enabled the conversion of historical photosynthesis (i.e., the trapped plant energy in fossil fuels) into mechanical energy for industrial processes.

The steam engine eclipsed the dominance of the water wheel and economic growth continued its steep ascent. The steam engine could be located anywhere, was operable in any conditions and had substantial wide-ranging uses, creating a sudden acceleration in speed and efficiency across industry and society. The 1840s brought ‘Railway Mania’, as travel and distribution brought the far reaches of Britain closer to the cities through fast-paced transportation. For many, the rise of steam is the image synonymous with the power of British industry.

Adam Smith had previously dismissed the concept of sustained economic growth through production as a realistic occurrence, accrediting limits in agricultural land available and the trade-off between tradeable production (i.e., production of goods for sale) and the ability to produce sufficient foodstuffs for the British population to survive. Within the limits of technology at the time, this was an apt observation—Smith had understood that natural limits will impede human progress.

Akin to Smith’s rumination, by viewing fossil fuels as historical photosynthesis processes, the advent of steam power also spelled the beginnings of a process towards coal and fossil fuel depletion and of releasing sunk carbon. Smith’s assertion that nature’s limits will prevent humans forging growth in production at a point is not far removed from what is true in a long-run perspective.

4.2. A Will to Grow?

It was Adam Smith in his ‘Wealth of Nations’ that viewed increases in national wealth to be the result of the natural human instinct for material betterment. He believed that when left unregulated, the market would enable wealth of all people to grow to the extent that they could fully choose how to invest. He considered that choice would enable all individuals to fulfil their unending desire to increase their material status, and that this system would benefit all players in the economy, from rich to poor.

The idea that unregulated free markets act as the most efficient and mutually beneficial economic system has persisted as a staunch underpinning for many political economic perspectives on the organisation for an economy. However, although the theme of instinctive human will, even to the extent of a biological gravitation, for material wealth continued to permeate economic thought, it is no longer attributed to being the source of growth.

Although it is not unfounded that people want better for themselves, these ideas neglect the value people place on activities other than consumption, such as dedicating their time to others and volunteering, leisure time, hobbies and interests, and enjoying the company of friends and family.

Further, it is now widely acknowledged that, even with a personal drive for increased material wealth, the road to economic growth cannot begin without increases in productivity. A series of minor efficiency and technological improvements, interspersed with radical new inventions mean production methods leap forward. For many centuries, people would have possessed an innate ‘will to grow’; however, the British economy did not grow until advancements in productivity.

5. The Industrial Revolution

For many readers, the imagery associated with the Industrial Revolution will likely form a cultural depiction of the origins of British economic growth. It constituted a sustained period of continued evolution of technologies, improving the efficiency of industrial and mechanical processes, and changing the face of agriculture, manufacturing and working life. It was a major turning point in Britain’s economic story and paved the way for other nations to undergo industrialisation. This section draws on the references [

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25].

Increasing productivity and rapid industrialisation created unprecedented rates of economic growth. Not only did output per capita increase spectacularly, having broken away from the Malthusian Trap, productivity increases through technology enabled the economy to sustain dramatic rates of growth. As a result, standards of living (the average material welfare per head of population) climbed dramatically.

The era is attributed as the first time that people could witness significant changes in living conditions and wealth within a generation. Tony Wrigley observes that ’[e]ach generation came to have a confident expectation that they would be substantially better off than their parents or grandparents.’ When compared to the many centuries when human life depended on survival, the Industrial Revolution was a remarkable new dawn for human civilisation, transforming societal and economic structures, creating progress towards our modernity.

5.1. What Happened?

The Industrial Revolution was defined by two phases. In the First Phase (1760–c. 1830), industrialisation centred around urbanisation and the manufacture of textiles. Many workers still resided in rural areas, agriculture still maintained a level of prominence and work in factories was still evolving into specialised mass production. Innovation during the First Phase mostly improved upon older techniques to increase productivity through gaining efficiency with new technologies.

In the Second Phase, growth soared to record-breaking heights. Whilst there is some debate surrounding the precise dates of the Second Phase, it was characterised by resurgence of high-paced growth after a brief mid-19th century productivity slowdown. The foundations for major industrial dominance had been crystallised in the First Phase, and Britain’s innovative capacity exceeded all previous expectations. The Second Phase witnessed a wealth of revolutionary innovations, in which entirely new breakthroughs in technology emerged or usage of a particular technology transformed industry and the way of life. Specifically, this was the era of steel, chemicals and electricity.

Research, and the consolidation of scientific ideas with technical inventions, played pivotal roles in promoting marginal efficiency gains to increase productivity. Steam was the symbol of the Second Phase. The steam train and engineering, such as railways, bridges and tunnels, along with billowing mills, became archetypical images of ‘industrial Britain.’ It was in the Second Phase that industrialisation began to spread to other nations, such as the US and Germany, with innovations throughout the world, such as the usage of electricity for practical purposes and the invention of the telephone, the first automobiles, and, in the early 20th century, the aeroplane.

By the turn of of the 20th century, Britain was no longer unique in experiencing rapid sustained growth of productivity per worker, hence economic growth. The Second Phase of the Industrial Revolution took Britain through to the First World War, but many of its trademarks persisted as pivotal aspects of British industry until the mid-20th century. On a global scale, the end of the Second Phase can be defined as the mid-20th century, or later, encompassing the perfection of the assembly line and increasingly automated production lines during the latter half of the 20th century.

The industrialisation of textile manufacture was a key driving force of the first wave of the Industrial revolution (around 1760–1830) due to mechanised spinning. Between 1760 and 1830, the population of Manchester had grown from 17,000 to 180,000, with the expansion of textile mills, turning a small enclave of Britain into ‘Cottonopolis’—the world’s first industrial city and the home of industrial textile production.

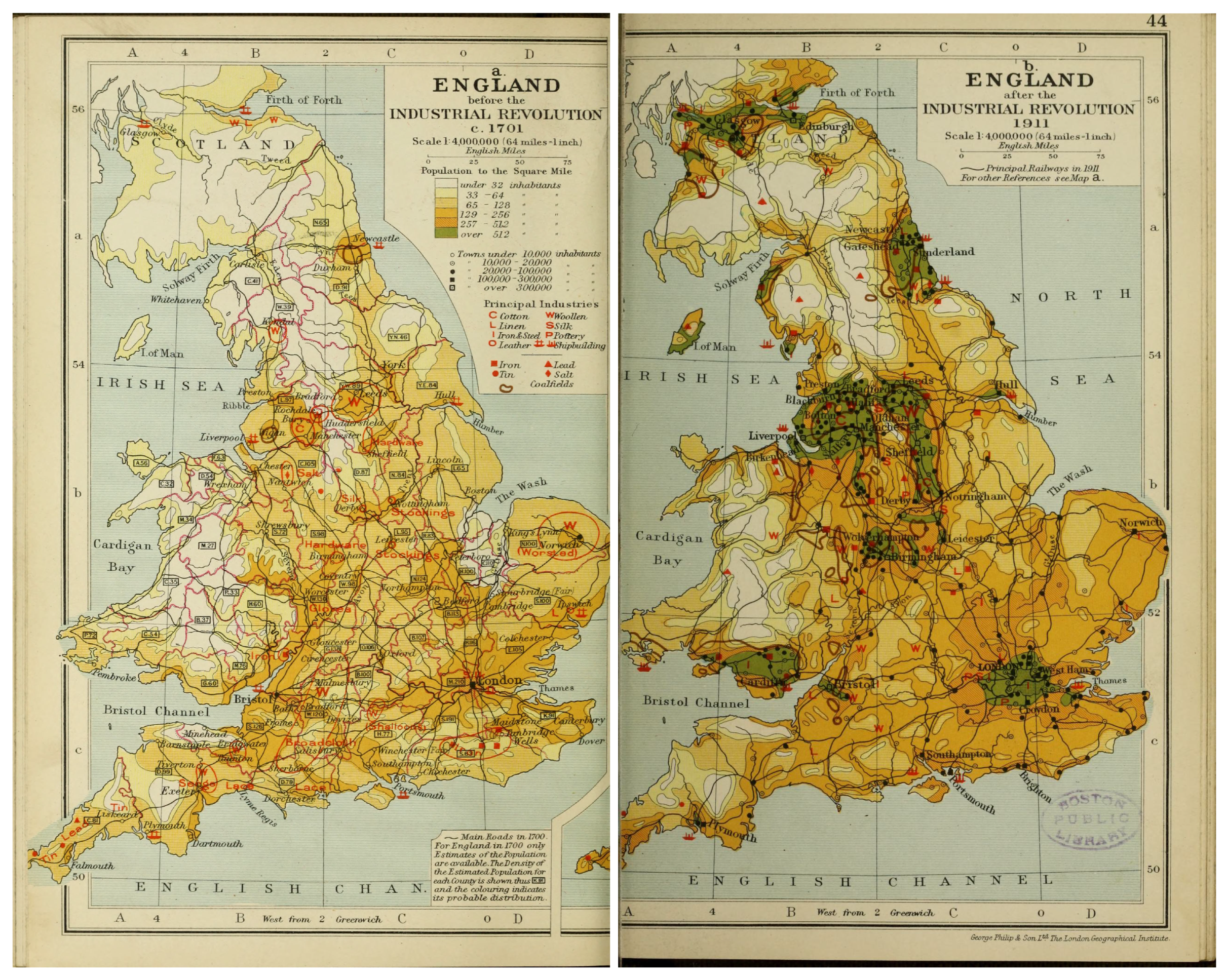

Figure 1 shows the change in population density by comparing the years 1701 (left) and 1911 (right). Population density increased dramatically in industrial hubs during the Industrial Revolution, i.e., urbanisation took hold.

By 1850, Manchester produced around 40% of the world’s cotton textile production. A similar pattern of population growth across resource-rich areas and those suitable for industrial production was witnessed in this period. Slate mines in Llanberis, North Wales, were said to ‘roof the world’, whilst Liverpool Docks facilitated 40% of world trade in the early 19th century.

Scotland also rose to become a textile powerhouse; mills in New Lanark, near Glasgow were some of the largest in the world. Scotland also grew to become a major supplier of coal as industrialisation progressed into steam. Wales became the ‘world’s first industrial society’, with industrial workers surpassing agricultural workers by 1851. South Wales was a key supplier of coal, supplying local smelting works to produce iron ore, and, due to its high-carbon content, Welsh coal was transported for use in industrial processes throughout the UK.

Sheffield, South Yorkshire became world-leading in the production of steel. Britain, particularly North of England, Scotland and Wales, had transformed into the industrial powerhouse of the world. The British Industrial Revolution spanned beyond factories and machines; the nation became the world leader in transportation and logistics.

Reacting to the mismatch between coal supply and factory demand and the slow transportation provided by ships around the coast, Britain embarked on a major canal building program, constructing 2000 miles of canal by 1815. The canals enabled Britain to transport raw materials and finished products across the nation. By the advent of steam, trains revolutionised cross-country travel, increasing productive potential, as trains could move goods to destinations across the country much faster than before. To benefit from the increased production output potential of new industrial processes, rapid demographic and population changes occurred, drawing vast portions of the rural population into rapidly urbanising areas.

The 1870s saw a reduction in fertility rates across Western Europe. Although reduced fertility is often associated with reductions in mortality rates, this was not the case in England, occurring 140 years after reductions in mortality rates. Reduced fertility rates led to a decline in population growth, which, in combination with the booming growth of industrial output contributing to GDP, made the English population comparatively richer per head, thus leading to an increase in GDP per capita.

Oded Galor accredits declining fertility rates to the increasing demand for human capital in the Second Phase of the Industrial Revolution. During the Second Phase, physical and manual tasks were largely overtaken by automation and mechanised industry, requiring mental skill executed by both men and women. As a result, schooling became more favourable, and there were more employment opportunities for women. Large families increased the costs of schooling and the opportunity cost of female unemployment.

5.2. A Global Monopoly

Aside from technological progress, how did Britain sustain such a radical and rapid transition into industrialisation? Just as areas of Britain had become intrinsically connected, Britain set about creating a global monopoly. Areas that later became fundamental to maintaining industrial might became the focus of British attention during exploration in the 15th and 16th centuries. Britain, like other European powers, began traversing the globe by sea to seek out trading partners.

Using power and waging conflict against opposing powers, the British establishment defeated other European powers in certain regions and, in doing so, laid claim to large sections of the world’s economy, using the areas of the world as extra fuel to grow the nation’s wealth during British industrialisation. Following the establishment of the East India Company in 1600 and its subsequent expansion for trade, during the 18th century, Britain tightened its grip on India, through war, forced treaties, annexations and alliances with local rulers. Major wars continued throughout the era of British industrialisation as Britain forced control over successive regions of India to secure easy access to resources for the future of British industry.

Between 1793 and 1813, British manufacturers campaigned against the East India Company, defeating its monopoly of Indian trade, making India an economic colony of the industrial might of Britain. Economic and land policies enforced by the British enabled economic control of Indian production for British industrialists’ benefit, regulating the nature of crops, including dedicating land to indigo production to be shipped to Britain to dye textiles.

The empire expanded the amount of different products Britain could produce (hence trade), the quantity of produce and the trade links to generate exchange. The trade, often forced, helped to sustain the productivity of Britain’s manufacturing, enabling Britain to trade material goods manufactured in Britain for production resources. Indian crafts and goods were heavily taxed on export, whilst the Indian market became flooded by British-made textiles, forcing many Indian semi-industrial workers back into agricultural work. By 1850, half of the world’s textiles and iron and two-thirds of the world’s coal originated in Britain. Britain had achieved market dominance in many areas of the globe and had become the foremost international power.

The increasing demand for sugar consumption in Britain, owing to the transition of sugar from an upper-class delicacy to a working-class staple during the Industrial Revolution, caused British sugar imports to skyrocket. Between 1710 and the early 1770s, records of sugar imports and population suggest that British per capita consumption of sugar rose 3.5-fold. As a result, maintaining the industrial productivity of Britain’s urban powerhouses meant the rapid increase in numbers of slaves sold to Caribbean plantations to increase sugar production for export.

Although some commentators attribute the rise in sugar consumption to ‘a change in tastes’, we cannot view this as one would comment on a modern-day ‘change in tastes’. One must add that ‘taste’ does not imply ‘fashion’. The uptake of sugar in working-class households likely originated from the necessity to sustain strenuous work, which drove demand for a diet that provided more energy. Further, North American plantations produced raw cotton to be shipped to Britain for use in textile production.

Not only did the British establishment increase wealth through increasing industrial production, they devised means to profit from other nations’ trade, further boosting national income. British companies established the Indian railways with a profit guaranteed by the British government, securing ownership by British private companies of the lease of the land on which the railway was built.

British companies owned the ships exporting beef from Ireland to the Caribbean. North America incurred trade deficits to Britain, meaning North America traded with the Caribbean to generate surplus, hence the Caribbean needed more slaves (which the British provided from West Africa, selling to the Caribbean at a profit). Britain acted as a production line for the world, importing cotton from plantations in North America, processing it into textiles and exporting worldwide.

Through trade and global expansion, Britain had risen to become the dominant global superpower. Industry—and producing more output—had become entwined into the mentality of gaining power. To continue extending power across the globe, Britain claimed more territories and waged wars to maintain market share, such as the Opium Wars with China to retain market dominance of opium grown in India.

5.3. Class and Economic Inequality

It is widely understood that the Industrial Revolution was the first time that standards of living increased within a generation’s lifetime. However, this is not to say everybody, or even the majority of the population, immediately experienced a higher quality of life as a result of economic growth. During the Industrial Revolution, the national wealth of Britain increased, and, with it, more individuals benefitted—the number of wealthy individuals increased as a result of opportunities to profit from new industries.

However, this came at the cost of the deprivation of the urban poor. Alexis de Tocqueville remarked in his writings on the conditions in Manchester in 1835: ‘From this foul drain, the greatest stream of human industry flows to fertilise the whole world. From this filthy sewer, pure gold flows.’ Despite greater wealth distribution as a consequence of the Industrial Revolution, the extra wealth was forged from the declined standards of living and health outcomes of those subjected to urban squalor.

Beyond the cities, many of the ground-breaking feats necessary to facilitate the rise to Industrial prominence entailed dangerous work. Many of those who built the canals and railways (‘navvies’) were Irish immigrants escaping the Potato Famine (1845–1852), arriving in Britain as unskilled workers at a time when industry was specialising in skilled work.

The dawn of rapid economic growth not only saw an increase in production, it forged more social and class disruption and division than before, rattling the rich-poor social structure of British life into a class ladder ranging from the affluence of the landed ‘old-money’ through the new money rich middle classes to the neglect of working people. Many of the political and philosophical thinkers of the 19th century journeyed to Britain’s industrial heartlands to chart the impact of extreme and sudden industrialisation on working communities, citing the deprivation impacting the health and living conditions of the urban poor.

Notably, the life expectancy in Manchester at the height of the industrialised 19th century was reported in 1845 to be 17, with modern estimates in the range of 25–32. It is important to acknowledge that modern estimates, such as constructions of historical GDP, are derived from archival materials only able to display a portion of the total picture of complete information from the period.

The political aspect of economic growth in the Industrial Revolution showed its head through the lobbying of the government by industrialists to maintain the conditions necessary for the rapid accumulation of wealth. The lobbying included the protection of their industries through import duties, the opening of new markets through political and/or military force (colonisation) and lobbying against ending child labour, passing labour protection laws, cutting work hours, introducing labour unions and raising wages. Economic growth came at the expense of human cost, controlling other nations’ trade and production, facilitating, and profiting from, the West African-Caribbean slave trade and controlling the working class in Britain.

6. Conclusions

Our world currently lives in the age of growth, a world that is drastically different from the conditions that existed for many millennia. Within the series of four independent essays, of which this is the first, we aim to go deeper than the surface of British economic history, identifying how the pursuit of growth has woven the fabric of British society—we hope we have done it justice and that it sparks new lines of interest and enquiry for our readers.

In the present essay, we explained how Britain broke out of the Malthusian Trap and highlighted the structural changes that enabled persistent economic growth. In the last chapter, we gave a concise coverage of the Industrial Revolution and detailed how the world’s first industrial nation used military force and slavery as facilitators of growth.

In the next essay, we examine crisis. Throughout the UK’s experience of growth, industry, employment and productivity have altered dramatically, and the drivers of growth have continually changed. As industrialisation has spread internationally, and economies have become increasingly interconnected and globalised, crises have begun to spread rapidly, and each crisis has left its mark. We will delve into some of the policy decisions, conjured in times of temporary crisis, which have left a legacy that persists to the modern day. This sets the scene to investigate the socioeconomic landscape that has emerged as a result of growth and crisis.